© 2022 Wells Fargo Bank, N.A. All rights reserved.

Investor Presentation

Spring 2022

Executive Summary

• Wells Fargo enhanced its engagement efforts and discussed key topics of interest to our investors, including potential

changes to our executive compensation program and enhancements to our disclosure.

• The Board’s composition and leadership is a result of our thoughtful refreshment, evaluation process, and succession

planning; we nominated three new independent directors in February who expand the Board’s diversity, perspectives,

and skills.

• Our continued focus on efficiency improvements and our ongoing work to put legacy issues behind us contributed to

significantly improved year-over-year financial results and execution on strategic priorities.

• The HRC closely studied and discussed shareholder feedback in evaluating potential changes to our executive

compensation program, ultimately approving several structural changes to our program and enhancements to our

disclosure; this included providing additional details on the performance assessment and enhancing the disclosure

around the HRC’s process for determining variable incentive compensation.

• Our long-term incentive plan aligns interests of plan participants with shareholders, facilitates retention, and rewards

performance over the long-term; approval of the plan will allow the Company to grant additional equity awards.

• Robust Board oversight and governance structures provide accountability for, and leadership over, Environmental,

Social, and Governance (ESG) and Diversity, Equity and Inclusion (DE&I) efforts.

• Our Board believes that its strong oversight over the areas of focus in the shareholder proposals on our ballot, coupled

with our existing policies, practices, reporting, and disclosures, effectively addresses the requests noted within each

proposal.

• Wells Fargo measures and manages risk as part of our business, including in connection with the products and services we

offer to our customers. Our top priority is to strengthen our Company by building the right risk and control

infrastructure.

2

Investor Engagement Program Overview

See Proxy, pages 3 to 5, for more

information on our investor

engagement program

Wells Fargo enhanced its engagement efforts and discussed key topics of interest to our investors, including potential

changes to our executive compensation program and enhancements to our disclosure.

Investor Engagement Following the 2021 Annual Meeting

Following the vote of 57% support on Say on Pay at the 2021 Annual Meeting, Wells

Fargo conducted a robust investor outreach program, focusing on potential changes to

our executive compensation program and enhancements to our disclosure in response to

shareholder feedback

Human Resources Committee Chair Ron Sargent participated in 10 meetings

Engagement included 16 investors who voted against Say on Pay, and 10 investors

with whom we did not engage prior to our 2021 Annual Meeting

Through the engagements, Wells Fargo received positive feedback on the proposed

structural changes and disclosure enhancements

Investors reacted favorably to Wells Fargo’s responsiveness to raised concerns with

the proposed structural changes to our program and disclosure enhancements

See Slide 6 for more details on the feedback we received from investors on our

executive compensation program and the actions taken in response

Wells Fargo also solicited feedback on the following topics: financial performance,

business and strategy, community engagement, Board oversight of risk and regulatory

matters, Board composition and Board diversity, Company performance and progress on

regulatory matters, ESG disclosures and practices, and DE&I goals and metrics

Post-2021 Annual Meeting

Engagement

(1)

47%

of total

outstanding

shares

Total Outreach

44%

of total

outstanding

shares

Total Engagement

30%

of total

outstanding

shares

HRC Chair Participation

(1) Represents approximate ownership of shares outstanding as of 31-Dec-2021.

3

Diverse and Experienced Board of Directors

See Proxy, pages 7 to 13, for full

biographies on our nominees and

page 17 for information on their

qualifications and experience

The Board’s composition and leadership is a result of our thoughtful refreshment, evaluation process and succession planning;

we nominated three new independent directors in February who expand the Board’s diversity, perspectives, and skills.

Charles W. Scharf

CEO and

President, Wells

Fargo & Company

Committees: None

Richard K. Davis

CEO and President,

Make-A-Wish

Foundation; retired

CEO, U.S. Bancorp

Committees: N/A

Richard B. Payne, Jr.

Retired Vice Chairman,

Wholesale Banking, U.S.

Bancorp

Committees: RC

Steven D. Black

Retired Co-CEO of

Bregal Investments;

former Vice Chairman,

JPMorgan Chase & Co.

Committees: FC*, HRC

Wayne M. Hewett

Senior Advisor,

Permira; Chairman,

DiversiTech

Corporation;

Chairman, Cambrex

Corporation

Committees: CRC,

GNC*, HRC, RC

Juan A. Pujadas

Retired Principal,

PricewaterhouseCoopers

LLP; former Vice

Chairman, Global Advisory

Services,PwC Intl.

Committees: FC, RC

Mark A. Chancy

Retired Vice Chairman

and Co-Chief Operating

Officer, SunTrust Banks,

Inc.

Committees: AC, RC

CeCelia “CeCe” Morken

Retired CEO and

President,

Headspace

Committees: N/A

Ronald L. Sargent

Retired Chairman and

CEO, Staples, Inc.

Committees: AC, GNC,HRC*

Celeste A. Clark

Principal, Abraham Clark

Consulting, LLC; retired Sr.

VP, Global Public Policy and

External Relations, and

Chief Sustainability Officer,

Kellogg Company

Committees: CRC*, GNC

Maria R. Morris

Retired Executive Vice

President and Head of

Global Employee Benefits

business, MetLife, Inc.

Committees: HRC, RC*

Suzanne M. Vautrinot

President, Kilovolt Consulting

Inc.; Major General and

Commander, U.S. Air Force

(retired)

Committees: CRC, RC

Theodore F. Craver, Jr.

Retired Chairman,

President, and CEO, Edison

International

Committees: AC*, FC,

GNC

Felicia F. Norwood

Executive Vice President

and President,

Government Business

Division, Anthem, Inc.

Committees: N/A

AC Audit Committee

CRC

Corporate Responsibility

Committee

FC Finance Committee

GNC

Governance and Nominating

Committee

HRC Human Resources Committee

RC

Risk Committee

* Committee Chair

New Director Nominee

Independent Chairman

Qualifications and Experience

of our Director Nominees

Board Diversity of our Director

Nominees

Commitment to Refreshment

Provides Fresh Perspectives

64% 93% 71% 29% 36% 3.5 100%

financial services

experience

risk management

experience

human capital

management

experience,

including

succession planning

racially / ethnically

diverse director

nominees

women director

nominees

average years of

current independent

director nominees

tenure**

of standing Board

committee chair

roles rotated since

2017

** Based on completed years of service from date first elected to Board. As of 14-Mar-2022.

4

Our Director Nominees

55

25

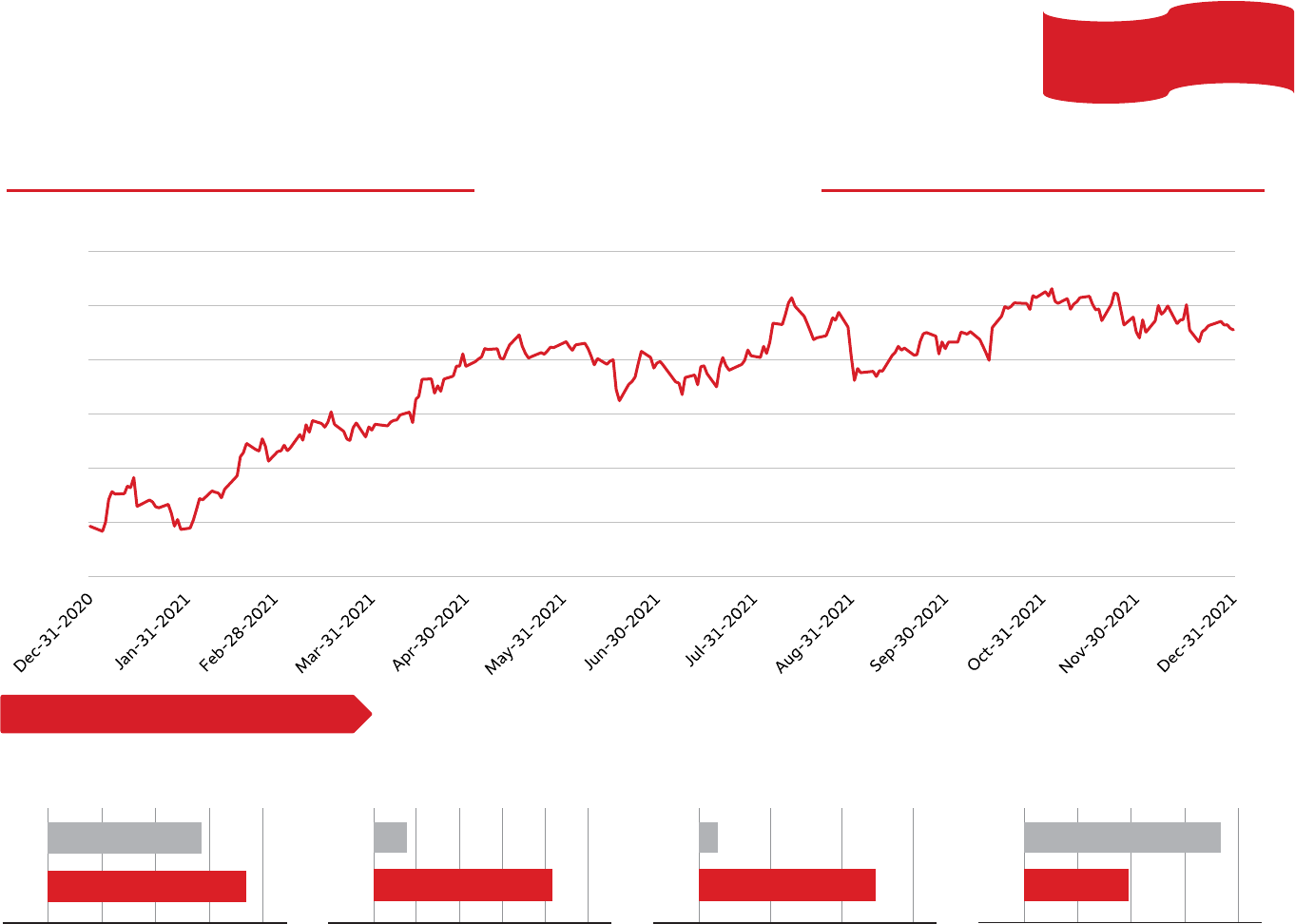

2021 Financial Performance Overview

See Proxy, page 74, for more

information on our 2021 financial

performance

Wells Fargo's execution on strategic priorities, including a continued focus on efficiency improvements, a recovering economy,

and our ongoing work to put legacy issues behind us contributed to significantly improved year-over-year financial results.

Total Shareholder Return

(1)

(USD)

30

35

40

45

50

+61%

Key 2021 Highlights

Total Revenue Net Income Diluted Earnings Per Efficiency Ratio

(2)

(billions) (billions)

Common Share

(lower % indicates greater efficiency)

$78.5

$74.3

2021

2020 2020

2021

$3.4

$21.5

2020

2021

$0.43

$4.95

2020

2021 69%

78%

(1) Total Shareholder Return reflects the closing price adjusted for cash dividends on the ex-dividend date; based on S&P Global Market Intelligence/S&P Capital IQ Pro data.

(2) The efficiency ratio is noninterest expense divided by total revenue (net interest income and noninterest income).

5

Responsive Compensation Changes

See Proxy, pages 63 to 87, for our

full Compensation Discussion and

Analysis

The HRC closely studied and discussed shareholder feedback in evaluating potential changes to the executive compensation

program, ultimately approving several structural changes to our program and enhancements to our disclosure.

What We Heard from Shareholders How We Responded Proxy Reference

Enhanced Disclosure

Goals: Preference for more disclosure

about the goals used to evaluate individual

NEO Performance

Enhanced description of the goals used to evaluate individual

NEO performance

Page 73 (see pages 77

to 78 for sample

application)

Performance Assessment: Preference for

more disclosure about the factors the HRC

considers in assessing performance

Provided additional detail on the performance assessment

process used by the HRC

Pages 72 to 73

Variable Incentive Process: Preference for

more disclosure about the process to

determine variable incentive compensation

Enhanced the disclosure around the HRC’s process for

determining variable incentive compensation, including

application of performance achievement levels

Page 73 (see page 78

for sample application)

Structural Changes

Pay Mix: Preference for a higher proportion

of performance-based long-term equity in

CEO pay mix

Increased the weight of Performance Shares in the CEO’s equity

mix to 65% with the remaining 35% in Restricted Share Rights

(RSRs) (previously, split 50% / 50%)

Page 70

Relative Performance Link: Preference for

inclusion of a relative measure in our

Performance Share design

Reintroduced relative Return on Tangible Common Equity

(ROTCE) performance in our Performance Share design,

weighted at 25% (previously, 100% absolute ROTCE)

Page 70

Performance Criteria: Focus on

maintaining rigorous performance criteria

Increased the target performance goal required for three year

average absolute ROTCE performance to achieve a target payout

or above

Page 70

Total Shareholder Return (TSR)

(1)

:

Preference for increased rigor of the TSR

structure

Re-evaluated the structure and rigor of TSR in the Performance

Share Award (PSA) program; payouts will be adjusted upward by

20% if our TSR is at or above the 75th percentile and will be

reduced by 20% if our TSR is below the 25th percentile, and there

will be no upward adjustment if our absolute TSR is negative

Page 70

(1) Refer to the 2022 Proxy Statement, Additional Notes, Note 1, on page 138 for a further discussion of TSR for the Performance Share Award program.

6

Total Variable Incentive Compensation Process

See Proxy, pages 72 to 73 for more

information on the performance

assessment and variable incentive

determination process

The performance assessment and variable incentive determination process aligns incentive compensation with performance

and prudent risk oversight.

Company

Goals

• The HRC selects financial and non-financial goals that closely align with the Company’s key value drivers,

strategic plan, and risk and control framework.

• For 2021, the HRC selected many of the same goals that were included in 2020, as well as additional goals that the

HRC believed increase alignment with the Company’s strategic focus areas.

Customer-Centric ESG (including DE&I

Risk, Regulatory, Talent and Technology and Operational

Financial Culture and and Community

& Control Leadership Innovation Excellence

Conduct Engagement)

Individual

Goals

• The HRC uses a disciplined approach in establishing goals that incentivize NEOs to deliver on strategic priorities.

• Goals are established at the beginning of each year, tailored to each NEO’s area of responsibility and reinforced

throughout the year. At the end of the year, results from the performance assessment against these goals are

tied directly to the NEO’s variable incentive compensation.

Risk, Regulatory, & Control Financial Talent, Leadership, & Culture / DE&I Strategy, Technology, & Innovation

Total Variable Incentive Compensation Process

(1)

The performance assessment also provides the HRC with the ability to reduce an individual NEO’s performance

achievement level to zero for failures in risk management, including misconduct.

(1) The total variable incentive compensation process for Functional NEOs weighs Company Performance at 50% and Individual Performance at 50%. The total variable

incentive compensation process for Line-of-Business NEOs weighs Company Performance at 30%, Line-of-Business Performance at 20%, and Individual Performance at 50%.

CEO

Total

Performance

Achievement

Variable

Incentive

Target

Total

Variable

Incentive

Compensation

Company Performance

Weighting Achievement

Individual Performance

Weighting Achievement

% $

65%

%

35%

%

$

7

-

Overview of the 2022 Long-Term Incentive Plan Proposal

See Proxy, pages 100 to 106, for

our full discussion on our 2022

Long Term Incentive Plan

Our long-term incentive plan aligns interests of plan participants with shareholders, facilitates retention, and rewards

performance over the long-term; approval of the plan will allow the Company to grant additional equity awards.

Prudent Share Request

Share Request • Asking for an additional 80M shares

(1)

Duration • Estimated to enable the Company to grant additional equity awards for ~3-4 years

Eligibility • Employees, directors, and certain former employees (with respect to certain compensation earned while

employed)

• For context, approximately 18,000 of our employees participated in 2021

Burn Rate

• Our three-year average annual gross burn rate for fiscal years 2019-2021 was 0.67%

Dilution •

•

Estimated total potential dilution of ~5.3%

We repurchased $14.5B of common stock in 2021 as part of a capital plan to repurchase ~$18B for the four

quarter period beginning Q3 2021 through Q2 2022

Shareholder-Aligned Plan Features & Practices

Plan Features

1-year minimum vesting for 95% of shares granted

$750,000 annual director compensation limit; $1.5M for Chair

Double-trigger change-in-control vesting provision

10-year max term for options and stock appreciation rights

No “evergreen” provision

No discounted options or reload options

No excise tax gross-up benefits

Prohibits the payment of dividends prior to vesting

Plan Practices

Stock Ownership Policy strengthens stock retention

requirements (see page 48 of Proxy)

Robust Clawback and Forfeiture Policy discourages unnecessary

or inappropriate risk taking (see page 84 of Proxy)

Low Historical Burn Rate & Total Potential Dilution

Metric

(2)

2019 2020 2021

Burn Rate 0.6% 0.6% 0.8%

Total Potential Dilution 7.2% 6.5% 5.3%

(1) If shareholders approve the 2022 LTIP, 132,439,684 shares will be issuable after its approval, minus twice the number of shares that are awarded under the LTICP

after February 7, 2022, including those awarded to non-employee directors on the date of the 2022 Annual Meeting. Any shares with respect to awards

currently outstanding under the LTICP that are forfeited, canceled, or settled in cash will also be made available for grant under the 2022 LTIP.

8

(2) See definitions on page 100 of the Proxy.

Robust Oversight of ESG Priorities

See our ESG Report for more

information on oversight of our

ESG and DE&I efforts

Robust Board oversight and governance structures provide accountability for, and leadership over, ESG and DE&I efforts.

Human Resources Committee

Oversees DE&I efforts and regularly engages

in DE&I discussions; the full Board receives

DE&I updates

Corporate Responsibility

Committee

Oversees our strategies, policies, and programs

on social and public responsibility, and

relationships and enterprise reputation with

external stakeholders on those matters

Our Board believes that its strong oversight over the areas

of focus in the shareholder proposals on our ballot

(outlined on slides 11-13), coupled with our existing

policies, practices, reporting, and disclosures, effectively

addresses the requests noted within each proposal

Board Oversight

Head of Diverse Segments,

Representation and Inclusion

Reports to the CEO; responsible for

advancing DE&I efforts in the marketplace

and the workplace

Chief Sustainability Officer

Responsible for driving enterprise ESG

programs, leading the progress towards our

enterprise climate initiatives, and establishing

the Institute for Sustainable Finance

Senior Leadership

Advisory Councils

(Established for all business lines

and functions)

Collaborate with senior leadership; focus on

workforce, marketplace, and advocacy

outcomes

ESG Disclosure Council

Provides senior-level accountability for ESG

reporting and disclosures, and considers

ways to address gaps and deficiencies

Provides insights and feedback from external sources; focused on deepening our

understanding of current and emerging ESG issues that are relevant to our stakeholders

External Stakeholder Advisory Council

Diversity, Equity, and Inclusion

Councils

9

Ongoing Focus on Risk Management Oversight

See Proxy, pages 31 to 34, and our

Environmental and Social Risk

Management Framework

We measure and manage risk as part of our business, including in connection with the products and services we offer to our

customers. Our top priority is to strengthen our Company by building an appropriate risk and control infrastructure.

Risk Oversight and Governance

In 2020, we announced an enhanced organizational structure to manage risk across the Company, including five line-of-

business chief risk officers reporting to our Chief Risk Officer (CRO), as well as a new Chief Compliance Officer and Chief

Operational Risk Officer

The Board carries out its risk oversight responsibilities directly and through its Committees. All Board Committees report

to the full Board about their activities, including risk oversight-related matters

The Risk Committee approves the Company’s Risk Management Framework and oversees its implementation. It also

monitors the Company’s adherence to its Risk Appetite and oversees the Independent Risk Management function

The Enterprise Risk & Control Committee (ERCC) is a management governance committee that governs the management

of all risk types; each principal line of business and enterprise function also has a risk and control committee with a

mandate that aligns with the ERCC

Three Lines of Defense Within our Risk Operating Model

The front line, composed of

business groups and certain

activities of enterprise functions

Independent Risk Management Internal Audit

This model creates necessary interaction, interdependencies, and ongoing engagement among the three lines of defense.

10

The Board Recommends a Vote AGAINST Each

Shareholder Proposal

See Proxy, pages 114 and 116 to

117, for full opposition statements

Shareholder

Proposal

Key Reasons Why the Request in the Shareholder

Proposal is Not Appropriate or Necessary

WFC Policies / Disclosures Already in Place that

Address These Topics

Policy for

Management

Pay Clawback

Authorization

Report on

Incentive-

Based

Compensation

and Risks of

Material Losses

• Our existing Clawback and Forfeiture Policy is

broader than the proposed policy in several ways.

• The proposed policy disregards individual

responsibility, which goes against our core

compensation principle of linking pay to

performance, and is inconsistent with practices of

our peers.

• Subjecting compensation to a risk of forfeiture

irrespective of personal responsibility and in a

manner inconsistent with market practice would

harm shareholder interests by hampering our ability

to attract and retain top talent.

• The requested report could provide confidential,

sensitive, and competitive information about our

incentive compensation practices in that it would

require us to disclose an extensive level of detail

regarding compensation for a large group of

employees.

• This information could facilitate recruitment of

employees by our competitors, and does not

meaningfully add to the substance of our disclosures.

• Our Clawback and Forfeiture Policy permits clawback

of equity-based compensation and certain cash

compensation and empowers the Company to hold

employees accountable for lesser triggers than

violations of law, which is the only trigger requested

by the proposal, including misconduct and risk

events.

• Our Clawback and Forfeiture Policy, stock ownership

requirements, and

Code of Ethics and Business

Conduct incentivize long-term performance while

discouraging excessive risk-taking.

• Our Incentive Compensation Risk Management

(ICRM) and performance management programs are

responsive to the incentive compensation risk

concerns raised in this proposal.

• Through our ICRM program, we identify and provide

for heightened oversight of employees in roles that

may be able, individually or as a group, to expose the

Company to material risk.

11

The Board Recommends a Vote AGAINST Each

Shareholder Proposal

See Proxy, pages 119 and 125 to

126, for full opposition statements

Shareholder

Proposal

Key Reasons Why the Request in the Shareholder

Proposal is Not Appropriate or Necessary

WFC Policies / Disclosures Already in Place that

Address These Topics

Racial and

• Our current practices to continue to enhance our

Gender Board

Board diversity and our robust disclosures in our

Diversity

proxy statement are responsive to the concerns

Report

raised in this proposal.

Conduct a

• We do not believe that performing a Racial Equity

Racial Equity

Audit ultimately serves the best interests of our

Audit

shareholders given our comprehensive approach to

DE&I, with continued oversight from our Board,

management accountability, and our robust DE&I

disclosures.

• Our director nomination process includes, as one of

its criteria, consideration of gender, race, and ethnic

diversity.

• 36% of our director nominees are women and 29%

are racially/ethnically diverse. Two of our new

independent director nominees enhance our Board’s

diversity.

• We provide robust disclosures of our commitment to

board diversity, including the process for recruiting

diverse candidates, and a matrix with Board

members’ self-identified gender, race, and ethnicity.

• We have significant and ongoing DE&I initiatives and

existing / planned future disclosures of our efforts.

• We added Diverse Segment Leader roles in each

customer-facing line of business, linked DE&I

outcomes to compensation, and launched a number

of initiatives to support communities of color and

address systemic economic inequities.

• We recently published our

Priority

Recommendations of the Wells Fargo Human Rights

Impact Assessment and Actions in Response report;

the HRIA was conducted by a third party to help us

gain better insights into where our stakeholders

perceive we have human rights impacts, and includes

a specific focus on DE&I.

• We expanded our

efforts to advance racial equity in

homeownership, committing to annually assess and

publicly disclose our progress. (See

News Release)

12

The Board Recommends a Vote AGAINST Each

Shareholder Proposal

See Proxy, pages 123, 121, and

127 to 128, for full opposition

statements

Shareholder

Proposal

Key Reasons Why the Request in the Shareholder

Proposal is Not Appropriate or Necessary

WFC Policies / Disclosures Already in Place that

Address These Topics

Climate

Change Policy

Report on

Respecting

Indigenous

Peoples’ Rights

• The scenario cited in the proposal assumes no new

• Wells Fargo set a goal of net-zero greenhouse gas

oil and gas developments required to attain net-zero;

emissions by 2050 and committed to setting interim

conditioning our financing on this assumption is an

emissions targets for the Oil & Gas and Power

ineffective and impractical way to manage lending

portfolios by the end of 2022. (See

News Release)

practices or further our net-zero goal.

• Adopting the requested policy would effectively

• Our target-setting, participation in financing the new

capabilities and resources of Oil & Gas companies,

preclude us from offering general purpose loans to

and investment in renewable solar and wind power

the Oil & Gas sector, an unreasonable approach

projects facilitates an orderly and balanced transition

based on current energy usage and the potential

away from high-emitting hydrocarbons.

negative impacts on the U.S. economy.

See also our recent announcement on joining the Net-Zero Banking Alliance

• Developing the report requested by the proposal

would be both time consuming and costly without

adding significant value to our shareholders.

• The requested report would require inappropriate

disclosure of proprietary business decisions, as well

as confidential information about customers.

• Providing the requested report does not ultimately

serve the best interests of our shareholders

• Our policies and procedures, including a robust due

diligence framework for analyzing transactions that

may impact an indigenous community, take into

account the responsibility of respecting the rights of

Indigenous Peoples in how we conduct business.

• Our

Indigenous Peoples Statement articulates our

commitment to treating all Indigenous Peoples with

dignity and respect, and to responsible financing

when our financing may impact their communities.

Charitable

• The Board believes that the disclosures currently in • We

provide robust disclosures of our charitable

Donations

place are fully responsive to the proposal.

contributions, including the process, approach, and

Disclosure

rationale for contributions, and information about

the grant application process; we also

provide access

to more detailed information of our donations.

13

Forward-Looking Statements and Website References

This document contains forward-looking statements. In addition, we may make forward-looking statements orally as part of our presentation.

Forward-looking statements can be identified by words such as “anticipates,” “intends,” “plans,” “seeks,” “believes,” “estimates,” “expects,” “target,”

“projects,” “outlook,” “forecast,” “will,” “may,” “could,” “should,” “can” and similar references to future periods. In particular, forward-looking

statements include, but are not limited to, statements we make about: (i) the future operating or financial performance of the Company, including our

outlook for future growth; (ii) our noninterest expense and efficiency ratio; (iii) future credit quality and performance, including our expectations

regarding future loan losses, our allowance for credit losses, and the economic scenarios considered to develop the allowance; (iv) our expectations

regarding net interest income and net interest margin; (v) loan growth or the reduction or mitigation of risk in our loan portfolios; (vi) future capital or

liquidity levels, ratios or targets; (vii) the performance of our mortgage business and any related exposures; (viii) the expected outcome and impact of

legal, regulatory and legislative developments, as well as our expectations regarding compliance therewith; (ix) future common stock dividends,

common share repurchases and other uses of capital; (x) our targeted range for return on assets, return on equity, and return on tangible common

equity; (xi) expectations regarding our effective income tax rate; (xii) the outcome of contingencies, such as legal proceedings; (xiii) environmental,

social and governance related goals or commitments; and (xiv) the Company’s plans, objectives and strategies. Forward-looking statements are not

based on historical facts but instead represent our current expectations and assumptions regarding our business, the economy and other future

conditions. Investors are urged to not unduly rely on forward-looking statements as actual results could differ materially from expectations. Forward-

looking statements speak only as of the date made, and we do not undertake to update them to reflect changes or events that occur after that date.

For more information about factors that could cause actual results to differ materially from expectations, refer to the “Forward-Looking Statements”

discussion in our most recent Quarterly Report on Form 10-Q, as well as to Wells Fargo’s other reports filed with the Securities and Exchange

Commission, including the discussion under “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2021.

Website references throughout this document are provided for convenience only, and the content on the referenced websites is not incorporated by

reference into this document. We assume no liability for any third-party content contained on the referenced websites.

14

Thank you

15