U.S. Department of Housing and Urban Development | Ofce of Policy Development and Research

Financing Lower-Priced Homes:

Small Mortgage Loans

Financing Lower-Priced Homes: Small Mortgage Loans

U.S. Department of Housing and Urban Development

Office of Policy Development and Research

October 2022

ii

Table of Contents

List of Exhibits .............................................................................................................................................. iii

Background on Small Mortgage Lending ...................................................................................................... 2

Details of Small Mortgage Lending ............................................................................................................... 7

Housing Stock ............................................................................................................................................ 7

Applications ............................................................................................................................................... 9

Underwriting ........................................................................................................................................... 12

Barriers to Lending on Lower-Priced Homes .............................................................................................. 15

Loan Costs ............................................................................................................................................... 15

Loan Performance ................................................................................................................................... 19

FHA Programs and Policies ......................................................................................................................... 20

TOTAL Mortgage Scorecard .................................................................................................................... 21

Minimum Property Requirements and Standards .................................................................................. 24

203(k) Rehabilitation Loans .................................................................................................................... 25

Title I Programs ....................................................................................................................................... 25

Policy Implications ...................................................................................................................................... 26

Conclusion ................................................................................................................................................... 27

References .................................................................................................................................................. 28

iii

List of Exhibits

Exhibit 1. Loan Originations under $70,000 .................................................................................................. 3

Exhibit 2: Loan Amount by House Value ....................................................................................................... 4

Exhibit 3. Small Mortgage Loans and Lower-Priced Homes to Minority Borrowers .................................... 5

Exhibit 4: Small Mortgage Loans and Lower-Priced Homes by Loan Type ................................................... 6

Exhibit 5: Lower Priced Share of Owner-Occupied Homes ........................................................................... 7

Exhibit 6: Physical Inadequacy ...................................................................................................................... 8

Exhibit 7: Tenure and Mortgage Status by House Value .............................................................................. 9

Exhibit 8: Small Mortgage Purchase Loan Applications .............................................................................. 10

Exhibit 9: Loan Applications per Owner-Occupied Unit by Property Value ................................................ 11

Exhibit 10: Distribution of Lower-Priced Housing Units and Loan Applications by Rural/Urban County ... 11

Exhibit 11. Majority of Lower-Priced Homes are not Financed with a Mortgage Loan .............................. 12

Exhibit 12: Denial Rate by Loan Purpose, Credit Score, and Property Value .............................................. 14

Exhibit 13: Reason for Denial by Loan Purpose and Property Value .......................................................... 15

Exhibit 14: Mortgage Annual Percentage Rate Spread by Property Value ................................................. 17

Exhibit 15: Mortgage Annual Percentage Rate Spread by Property Value and Loan Type ........................ 19

Exhibit 16: Mortgage Default Rate by Loan Purpose, Credit Score, and Property Value ........................... 20

Exhibit 17: Federal Housing Administration Underwriting and Endorsement ........................................... 22

Exhibit 18. Lender Approval Rate by AUS Result ........................................................................................ 23

Exhibit 19. Reason for Lender Denial by AUS Result .................................................................................. 24

Exhibit 20: Title I Loan Disbursements ........................................................................................................ 26

1

Financing Lower-Priced Homes: Small Mortgage Loans

The House of Representatives Committee Report, 116–452, accompanying the Departments of

Transportation, and Housing and Urban Development, and Related Agencies Appropriations Bill, 2021,

requests that the U.S. Department of Housing and Urban Development (HUD) review the Federal

Housing Administration’s (FHA’s) single-family mortgage insurance policies, practices, and products to

(1) identify barriers or impediments to supporting, facilitating, and making available mortgage insurance

for mortgage loans having an original principal obligation of $70,000 or less, (2) identify administrative

actions that HUD could take to remove barriers and impediments, and (3) describe the effect of such

actions on the solvency of the Mutual Mortgage Insurance Fund (MMI Fund).

1

This report is submitted in

response to that request.

Mortgage loans with an original principal obligation of $70,000 or less are a small portion of the

mortgage lending market, constituting less than 3.5 percent of home purchase originations in 2020.

Many of these low balance mortgage loans secure properties valued at more than $70,000; only 57

percent of small mortgage loan originations are for owner-occupied, lower-priced homes. Lower-priced

homes constitute a disproportionate share of the housing stock in rural areas of the Southeast, older

industrial areas in the Midwest, and urban areas throughout the South. Manufactured homes comprise

28 percent of homes valued under $100,000. Many of these homes are placed on land not owned by the

homeowner, which makes these homes personal property and not eligible for a traditional mortgage

loan.

FHA programs do not impose minimum loan amounts, nor do FHA’s policies intentionally discriminate

against small mortgage loans. FHA insurance exists for the explicit purpose of incentivizing lenders to

make loans they otherwise would not, to provide access to homeownership for qualified homebuyers in

communities throughout the country. FHA disproportionately insures loans for lower-priced homes

compared to the rest of the mortgage market. The report discusses FHA underwriting of small mortgage

loans and programs for financing property improvements and manufactured homes that are particularly

targeted to lower loan amounts.

A significant barrier to small mortgage lending is the fixed costs of loan origination and servicing, which

makes smaller loans less profitable to lenders, particularly given that mortgage loans on lower-priced

homes are associated with higher delinquency rates and a greater loss severity rate. Because limited

profitability appears to be a primary driver of low origination volume of small mortgage loans to owner-

occupant purchasers of lower-priced homes, increasing the number of these loans submitted for FHA

insurance endorsement may require either a reduction in origination and servicing costs or the provision

of additional lender or loan originator compensation sufficient to make small mortgage loans profitable

at levels acceptable to lenders. More information about how costs and regulatory limitations are

preventing lenders from making these loans will be required to develop a proposal for how these goals

might be achieved.

1

See House of Representatives Report 116–452, 134, https://www.congress.gov/116/crpt/hrpt452/CRPT-

116hrpt452.pdf.

2

Additionally, attempts to increase the origination volume of small mortgage loans insured by FHA must

be pursued in a way that is prudent for both FHA and borrowers to ensure sustainable homeownership.

Background on Small Mortgage Lending

HUD has been asked to look at the financing of mortgage loans in the amount of $70,000 or less. While

some people refer to such loans as “small dollar loans,” that term is more often used to refer to payday

loans or other consumer finance products not secured by homes. This report uses the term “small

mortgage loans.” Other researchers use higher cutoffs, such as $100,000 (see McCargo et al., 2018;

Zainulbhai et al., 2021). This report primarily focuses on loans of no more than $70,000, though some

data are on loans of up to $100,000.

To understand what is happening in the mortgage market with respect to smaller mortgages, it is

important to understand the overall context of small balance mortgage lending over time. As shown in

exhibit 1, the share of home loan originations for loan amounts under $70,000 has fallen sharply over

the last decade, from more than 11 percent of home purchase originations in 2011 to less than 3.5

percent in 2020, that is fewer than 900,000 loans out of over 25 million home purchase loans. The

change in the share under a nominal dollar threshold overstates the decline due to inflation. Moreover,

housing prices have increased faster than overall inflation, meaning fewer homes may be available to

purchase under $70,000. Adjusting for house price appreciation using the Federal Housing Finance

Agency’s house price index, small mortgage loans accounted for over 6 percent of originations in 2007,

declined to 3.5 percent by 2013, and have been relatively stable since then. Exhibit 1 includes a similar

chart of loan amounts among refinances. Although the shares are more volatile, much of the declining

trend in small mortgage loans can be explained by inflation in general and house price appreciation in

particular.

3

Exhibit 1. Loan Originations under $70,000

Purchase

Refinance

Source: Home Mortgage Disclosure Act

4

Substantial shares of small mortgage loans are for properties valued at more than $70,000. The typical

combined loan-to-value (LTV) ratio on mortgage loans of less than $70,000 between 2018 and 2020 was

64 percent—lower than the LTV ratio on larger mortgage loans (exhibit 2). Further, more than 10

percent of small mortgage loan borrowers did not intend to use the property as a principal dwelling.

These factors result in owner-occupied, lower-priced homes accounting for only about 57 percent of

small mortgage loan originations.

Exhibit 2: Loan Amount by House Value

Notes: First lien loan originations between 2018 and 2020, excluding reverse mortgages, home equity lines of credit, and

business loans. Approximately 3 percent of originations do not report a property value.

Source: Home Mortgage Disclosure Act

Loans for owner-occupied lower-priced homes are more likely to be for minority borrowers than small

mortgage loans, although both are less likely to be minority borrowers than the overall market (exhibit

3).

0

20

40

60

80

100

Under

$20,000

$30,000 $40,000 $50,000 $60,000 $70,000

Share of Loans (%)

Loan Amount

0

20

40

60

80

100

All

Property Va l ue

Missing

$300,000 or

More

$200,000 to

$299,999

$150,000 to

$199,999

$100,000 to

$149,999

Under $100,000

5

Exhibit 3. Small Mortgage Loans and Lower-Priced Homes to Minority Borrowers

Notes: First lien loan originations between 2018 and 2020, excluding reverse mortgages, home equity lines of credit, and

business loans. Small mortgage loans refer to loan amounts less than $70,000. Lower-priced homes refer to owner-occupied

homes worth less than $100,000.

Source: Home Mortgage Disclosure Act

Loans for owner-occupied lower-priced homes are more likely than small mortgage loans generally to be

insured by a government agency, particularly the Federal Housing Administration and the Rural Housing

Service (exhibit 4). In contrast, small mortgage loans are more likely to be conventional (that is, not

government-insured) than the overall market.

6

Exhibit 4: Small Mortgage Loans and Lower-Priced Homes by Loan Type

FHA = Federal Housing Administration. RHS = Rural Housing Service. VA = Veterans Affairs.

Notes: First lien loan originations between 2018 and 2020, excluding reverse mortgages, home equity lines of credit, and

business loans. Small mortgage loans refer to loan amounts less than $70,000. Lower-priced homes refer to owner-occupied

homes worth less than $100,000.

Source: Home Mortgage Disclosure Act

As previously reported in the Annual Report to Congress Regarding the Financial Status of the FHA

Mutual Mortgage Insurance Fund, FHA insured 33,871 small mortgage loans in Fiscal Year 2021, which

constituted 2.03 percent of its origination loan count. Because the Congressional request is focused on

FHA products, which generally are higher LTV products, the analysis focuses on loans for owner-

occupied lower-priced homes rather than all small mortgage loans. The following sections describe the

lower-priced housing stock, demand for credit, underwriting, costs, performance, as well as programs

and policies specific to FHA.

7

Details of Small Mortgage Lending

Housing Stock

One reason for relatively few small mortgage loans is the scarcity of lower-priced homes. Less than 19

percent of the owner-occupied housing stock in the United States is valued by homeowners at less than

$100,000, according to the 2019 American Community Survey.

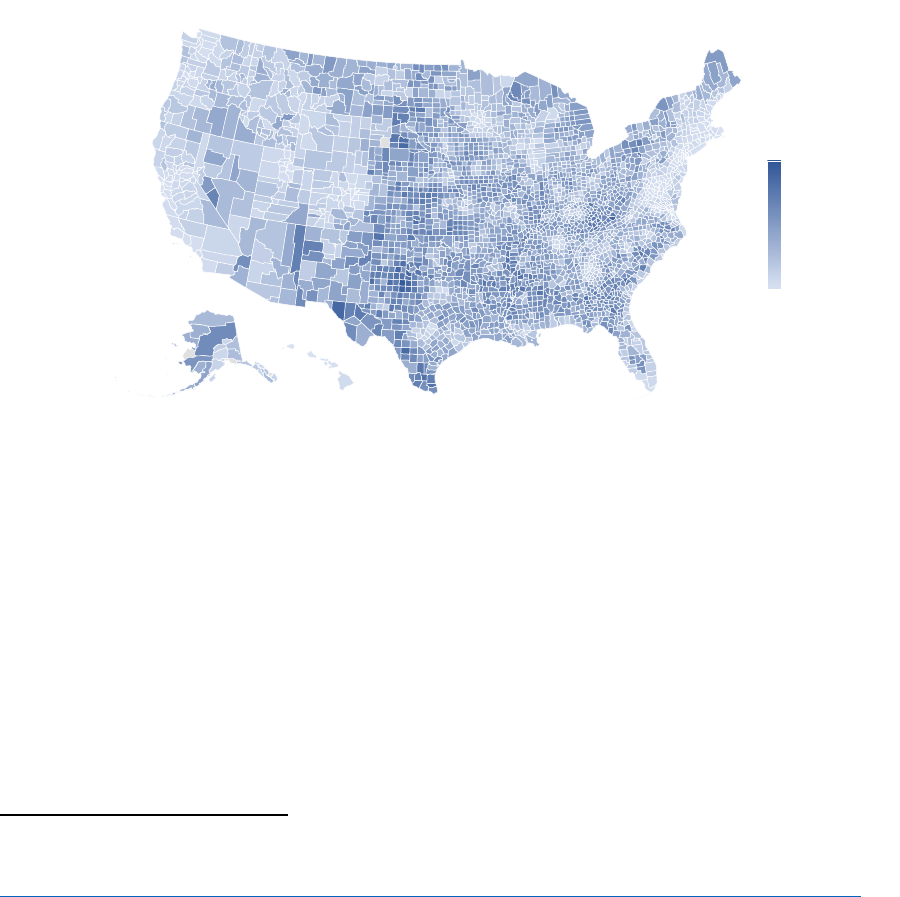

Lower-priced homes constitute a disproportionate share of the housing stock in rural areas of the

Southeast, Middle Appalachia, Texas, and the Great Plains (exhibit 5). Older industrial areas in the

Midwest and urban areas throughout the South often account for a larger share of all homes under

$100,000: Wayne County, Michigan (Detroit), accounts for the largest share of the nation’s lower-priced

homes at 1.3 percent, followed by Harris County, Texas (Houston), at 1.1 percent.

Exhibit 5: Lower Priced Share of Owner-Occupied Homes

Source: 2019 5-Year American Community Survey

The dark clusters in exhibit 5, with larger shares of lower-priced homes, indicate where housing markets

may have a greater need for small mortgage lending. McCargo et al. (2018) found “low-cost” counties

had more than twice the share of lower-priced home sales, 39 percent compared to 14 percent

nationally, in 2015. Of those sales, only 21 percent had traditional mortgage financing.

Lower-priced homes are less likely to meet the standard of “a decent home and a suitable living

environment,” the physical adequacy metric in the American Housing Survey.

2

Roughly 7.6 percent of

the owner-occupied lower price housing stock is considered physically inadequate, including 1.6 percent

that is severely inadequate, meaning lacking running water, having exposed wires or lacking electricity,

structural problems, etc. For comparison, less than 2.4 percent of the more expensive housing stock is

considered physically inadequate (exhibit 6). Maintenance, repairs, and improvements can account for

2

The physical adequacy metric in the American Housing Survey assesses the extent to which the housing stock met

the standard established by the Housing Act of 1949. See

https://www.census.gov/content/dam/Census/programs-surveys/ahs/publications/HousingAdequacy.pdf.

0

100

Below $100,000

Powered by Bing

© GeoNames, Microsoft, TomTom

8

considered physically inadequate (exhibit 6). Maintenance, repairs, and improvements can account for

roughly 18 percent of the cost of homeownership on average (Begley and Palim, 2022). Owners of

lower-priced homes may face even higher cost burdens if the property is lower-priced precisely because

it is in poor condition. At the same time, they may have difficulty obtaining financing given the condition

of the collateral. FHA requires properties to meet minimum property requirements and standards to be

eligible for mortgage insurance (see the section on Minimum Property Requirements and Standards

).

FHA also provides insurance for property improvement loans to rehabilitate, repair, and improve homes

(see the sections on 203(k) Rehabilitation Loans and Title I Programs under FHA Programs and Policies).

Exhibit 6: Physical Inadequacy

Note: Owner-occupied units only.

Source: 2019 American Housing Survey

Roughly two-thirds (68 percent) of owner-occupied homes valued under $100,000 are site-built single-

family homes. Manufactured homes account for a disproportionate share (28 percent), particularly of

the least expensive homes. It is important to note that 39 percent of those manufactured housing

homeowners (11 percent of all lower-priced owner-occupied homes) own only the housing unit and not

the underlying land. Because the house is owned as personal—not real—property, these households

cannot obtain a traditional mortgage loan; instead, they must purchase their home using personal

property loans. Personal property loans for manufactured homes have higher interest rates than

mortgages for manufactured homes (Goodman and Ganesh, 2018; Russell et al., 2021). Landowners may

still choose the more expensive financing option for manufactured homes if they do not want to

encumber the land, but they may also be steered into personal property loans by lenders and retailers

9

(UNC Center for Community Capital, 2019). See the sections on Underwriting and Title I Programs for

more information on financing manufactured homes.

In general, the share of homeowners with a mortgage loan increases with property value (exhibit 7).

Only 36 percent of lower-priced owner-occupied homes are mortgaged compared with 62 percent

among more expensive homes. For home purchases in 2019, the Urban Institute finds only 23 percent of

homes priced below $100,000 were financed with a mortgage compared with more than 73 percent of

more expensive homes (McCargo et al., 2020). This lower share represents both a lower demand for

credit and difficulties obtaining credit, which are discussed in the next two sections.

Exhibit 7: Tenure and Mortgage Status by House Value

Note: Owner-occupied units only.

Source: 2019 American Housing Survey

Applications

Purchase loan applications

3

for less than $70,000 in nominal terms declined from over 13 percent of all

loans in 2011 to 5 percent in 2020. Adjusting $70,000 for the decline in purchasing power over time,

however, shows a smaller decline in market share, and house prices have appreciated at a faster rate

than other goods and services over the past decade. Adjusting loan amounts using the Federal Housing

Finance Agency’s house price index shows virtually no change in the small loan share of the mortgage

market (exhibit 8). Small mortgage loans constitute a declining share of the mortgage market because

house prices have increased.

3

Applications are defined as those that received a credit decision and exclude withdrawn and incomplete

applications.

0

20

40

60

80

100

Share of Housing Units (%)

Property Value

0

20

40

60

80

100

All

Single-Family No Debt Single-Family With Debt

Manufactured Home With Land No Debt Manufactured Home With Land With Debt

Manufactured Home Unit Only No Debt Manufactured Home Unit Only With Debt

Other

10

Exhibit 8: Small Mortgage Purchase Loan Applications

CPI = Consumer Price Index. HPI = House Price Index.

Notes: First lien mortgage applications for purchase of owner-occupied properties. Applications are restricted to purchase

mortgages because they typically have higher LTV ratios and are therefore more correlated with property values. Property

value is not reported in HMDA until 2018. Loan amounts are adjusted to 2019 averages using the BLS CPI-U-RS price index and

FHFA monthly purchase-only house price index.

Sources: Home Mortgage Disclosure Act; Bureau of Labor Statistics; Federal Housing Finance Agency

The Urban Institute finds lower-priced homes have higher turnover rates than moderately priced homes

(McCargo et al., 2018). Yet lower-priced homes receive fewer mortgage applications per unit than more

expensive homes. Comparing mortgage applications (both purchase and refinance) with the number of

housing units by property value reveals lower-priced homes received roughly 58 purchase mortgage

applications and 32 loan originations per thousand housing units compared with nearly 125 applications

and 102 loan originations per thousand overall (exhibit 9). The lower origination rate among applications

for lower-priced homes is discussed in the Underwriting

section.

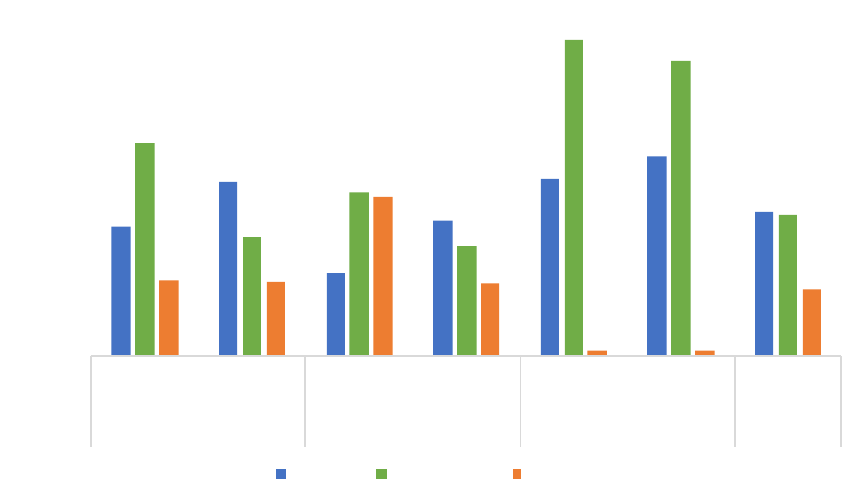

The lower demand for mortgage credit is disproportionately due to rural areas (exhibit 10). Urban

counties in metropolitan areas of a million people or more account for 31 percent of the lower-priced

owner-occupied housing stock but over 40 percent of loan applications and originations for lower-priced

homes. By contrast, non-metropolitan counties account for a similar share of the lower-priced housing

stock (32 percent) but only 23 percent of mortgage applications for lower-priced homes and 22 percent

of originations.

0

3

6

9

12

15

2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020

Share of Purchase Mortgage Applica�ons (%)

Under $70,000: Nominal CPI -Adjusted HPI-Adjusted

11

Exhibit 9: Loan Applications per Owner-Occupied Unit by Property Value

Note: First lien purchase mortgage and refinance applications for owner-occupied homes between 2018 and 2020, excluding

reverse mortgages, home equity lines of credit, and business loans.

Sources: 2019 5-Year American Community Survey; Home Mortgage Disclosure Act

Exhibit 10: Distribution of Lower-Priced Housing Units and Loan Applications by Rural/Urban County

Notes: First lien loan applications for owner-occupied homes under $70,000 (2019$) between 2018 and 2020, excluding reverse

mortgages, home equity lines of credit, and business loans. County definitions provided by the U.S. Department of Agriculture’s

2013 Rural-Urban Continuum Codes, aggregating non-metropolitan counties into metropolitan adjacent and not adjacent.

Sources: 2019 5-Year American Community Survey; Home Mortgage Disclosure Act; U.S. Department of Agriculture

Fewer mortgage applications for lower-priced homes may also reflect the prevalence of cash

purchasers, both investors and homebuyers. Cash transactions, which can be completed much more

0

20

40

60

80

100

120

140

Average Annual

Per Thousand Housing Units

Property Value

0

20

40

60

80

100

120

140

All

0

20

40

60

80

100

Owner-Occupi ed

Housing Units

Mortgage

Share of Lower -Priced Housing Units and

Mortgage (%)

Non-Metropolitan

Not Adjacent

Metropolitan Adjacent

Metropolitan Area

Less than 250,000

250,000 to 1 million

Ove r 1 million people

Originations Applications

Applications

Originations

Applications

Applications

Counties

Counties

12

quickly and create fewer risks for sellers, may hinder lower wealth households from purchasing. As

shown in exhibit 11, over three-quarters of homes valued at less than $100,000 were purchased without

using a traditional mortgage loan, although the data do not identify the specific mechanism used for

those purchases. Some may have been purchased using alternative financing mechanisms, which

include seller-financed mortgage loans, lease to purchase agreements, and land contracts. Alternative

financing methods can be riskier for purchasers as the seller/owner may continue to hold title;

uncertainties around who pays for taxes, insurance and maintenance can create challenges; and some

consumer protections around fees, interest rates and disclosures may not apply (The Pew Charitable

Trusts, 2021). Canavan, Roche, and Siegel (2022) found that approximately seven million homeowners

are currently using alternative financing, which they define to include personal property loans financing

manufactured housing. Of the survey respondents, 34 percent of Hispanic borrowers, 23 percent of

Black borrowers, and 19 percent of non-Hispanic White borrowers had used an alternative financing

arrangement.

Exhibit 11

. Majority of Lower-Priced Homes are not Financed with a Mortgage Loan

Source: Zainulbhai et al., 2021, Figure 7

Underwriting

Not only are there relatively fewer mortgage loan applications for lower-priced homes, but applications

for lower-priced homes are also more likely to be denied (exhibit 12). Nearly 40 percent of loan

applications for lower-priced homes were denied between 2018 and 2020, compared with fewer than

13 percent of applications for more expensive homes. The likelihood of denial is strongly impacted by

borrower credit score, particularly at specific thresholds like 580 and 620. However, the denial rates for

mortgages for lower-priced homes are still higher than for mortgage applications for higher-priced

homes even when borrowers have similar credit scores.

13

Credit history is more likely to be cited as the reason for denial among applications for lower-priced

homes, whereas debt-to-income (DTI) ratio is less likely to be cited as the reason (exhibit 13).

Insufficiency of collateral is also a more common reason for refinance mortgage denials for lower-priced

homes. Denial rates for mortgage loans are presented separately from denial rates on personal property

loans for the purchase of manufactured homes, given the difference in risk of lending without land as

collateral. Purchase price does not seem to make a substantial difference in denial rates for personal

property loans for manufactured homes.

14

Exhibit 12: Denial Rate by Loan Purpose, Credit Score, and Property Value

Purchase Mortgages

Refinance Mortgages

Purchase Manufactured Housing Personal Property Loans

Notes: First lien loan applications for owner-occupied homes between 2018 and 2020, excluding reverse mortgages, home

equity lines of credit, and business loans. Personal property loans identified as loans for manufactured housing units only.

Source: Home Mortgage Disclosure Act

0

20

40

60

80

100

500 540 580 620 660 700 740 780 820

Denial Rate (%)

Credit Score

0

20

40

60

80

100

500 540 580 620 660 700 740 780 820

Denial Rate (%)

Credit Score

0

20

40

60

80

100

500 540 580 620 660 700 740 780 820

Denial Rate (%)

Credit Score

Property Va l ue: Under $100,000 $100,000 or More

15

Exhibit 13: Reason for Denial by Loan Purpose and Property Value

DTI = debt-to-income. MH = manufactured housing.

Notes: Denied first lien loan applications for owner-occupied homes between 2018 and 2020, excluding reverse mortgages,

home equity lines of credit, and business loans. Personal property loans identified as loans for manufactured housing units only.

Reasons for denial are not mutually exclusive.

Source: Home Mortgage Disclosure Act

Barriers to Lending on Lower-Priced Homes

As discussed above, lower-priced homes are a small portion of the housing market, yet these homes

serve an important role in enabling households with less wealth and lower incomes to obtain

homeownership. This section looks at barriers to lending for these homes.

Loan Costs

One of the main reasons lenders do not make as many small mortgage loans is because the fixed costs

of origination and servicing do not change based on the size of the loan. Loan origination costs paid by

the borrower cover various closing costs, such as origination charges, title insurance, settlement

charges, and taxes (Mota and Palim, 2021). Some of these costs are proportional to the loan amount or

property value; many are fixed and invariable, making them regressive. Consequently, although the

typical loan costs for a 30-year mortgage loan were lower for a lower-priced home than a higher-priced

home between 2018 and 2020 ($3,145 versus $4,236), the costs constituted a higher amount relative to

loan amount (4.5 percent versus 1.7 percent). Servicing also involves fixed and variable expenses,

creating a similar regressive pattern in interest rates.

Both loan origination and servicing costs per loan have risen over time (Freddie Mac, 2021; Goodman,

2014). Technology may help lower loan production and servicing costs. Freddie Mac (2021) finds lenders

that more heavily used its automated technology had origination costs per loan roughly 22 percent

0

10

20

30

40

50

60

70

Under

$100,000

$100,000 or

More

Under

$100,000

$100,000 or

More

Under

$100,000

$100,000 or

More

Purcha s e Mortga ge Mortgage Purchase MH Personal All

Share of Denied (%)

DTI

Credi t Hi s tory Collateral

Ratio

Refinance

Applications

16

($2,200) lower than lenders still relying on manual processes. However, small mortgage loans will

generally be less profitable than larger loans given the regressive nature of fixed costs.

The annual percentage rate (APR), which is the effective interest rate a borrower pays, combines the

interest rate with upfront costs. As a result of these origination costs, the median APR for 30-year

mortgage loans on lower-priced homes between 2018 and 2020 was 107 basis points over the average

prime offer rate, compared with 26 basis points above prime for more expensive homes (exhibit 14).

17

Exhibit 14: Mortgage Annual Percentage Rate Spread by Property Value

Total Loan

Costs

Share of Loan Amount

(%)

Interest Rate

Spread (%)

APR

Spread (%)

APR = annual percentage rate.

Notes: 30-year first lien mortgage originations for owner-occupied homes between 2018 and 2020, excluding personal property

loans for manufactured housing, reverse mortgages, home equity lines of credit, and business loans. Boxes show median and

inter-quartile ranges.

Source: Home Mortgage Disclosure Act

The Qualified Mortgage (QM) standard was instituted by the Consumer Financial Protection Bureau to

provide lenders protection from liability under the Ability to Repay rule created by the Dodd-Frank Wall

Street Reform and Consumer Protection Act of 2010. The QM standard limits the amount a lender can

-0.50

0.00

0.50

1.00

1.50

2.00

Under $20,000

$30,000

$40,000

$50,000

$60,000

$70,000

$80,000

$90,000

$100,000

All

APR Spread

Property Value

$0

$2,000

$4,000

$6,000

$8,000

0

2

4

6

8

-0.3

0.0

0.3

0.6

0.9

-0.6

0.0

0.6

1.2

1.8

18

charge in points and fees but establishes a tiered structure for small mortgage loans.

4

Upfront points

and fees cannot exceed 3 percent of the loan amount for mortgages of $114,877 or more but can be as

high as 8 percent for loan amounts less than $14,356. Similarly, the APR is limited to 2.25 percentage

points above the average prime offer rate for mortgages of $114,877 or more but can be as high as 6.5

percentage points over prime for mortgages under $68,908 and manufactured home loans under

$114,847.

5

More research is needed on whether these limits are disproportionately binding on small

mortgage loans, hindering profitable lending opportunities, and whether the current standard

appropriately balances profitability and consumer protection.

FHA limits upfront mortgage points and fees (but not including mortgage insurance premiums) to the

maximums adopted by the Consumer Financial Protection Bureau’s Qualified Mortgages standard.

6

In

addition, Section 203(u) of the National Housing Act prohibits lenders from varying FHA mortgage costs,

including interest rates and origination fees, by more than 2 percent within a metropolitan area.

7

These

limits on points, fees, and “tiered pricing” are intended to protect consumers. FHA-insured 30-year

mortgages exhibit higher APRs than conventional loans, but also less variation by loan amount (exhibit

15). These pricing limits may hinder the ability of lenders to profitably originate small mortgage loans.

4

See 12 CFR 1026.43(e)(3).

5

Truth in Lending (Regulation Z) Annual Threshold Adjustments (Credit Cards, HOEPA, and Qualified Mortgages),

86 FR 60357, effective January 1, 2022.

6

Loans with an annual percentage rate less than the sum of the average prime offer rate, annual mortgage

insurance premium, and 1.15 percentage points have safe harbor from the ability-to-pay requirements of the

Truth in Lending Act (TILA), while more expensive loans have a rebuttable presumption.

7

See 12 U.S.C. 1709(u), 24 CFR §202.12, and Section II.A.6.a.x(D) of the FHA Single Family Housing Policy Handbook

4000.1 (HB 4000.1). Mortgage charge rate is the amount of mortgage charges for a mortgage loan expressed as a

percentage of the initial principal amount of the loan.

19

Exhibit 15: Mortgage Annual Percentage Rate Spread by Property Value and Loan Type

APR = annual percentage rate. FHA = Federal Housing Administration.

Notes: 30-year first lien mortgage originations for owner-occupied homes between 2018 and 2020, excluding personal property

loans for manufactured housing, reverse mortgages, home equity lines of credit, and business loans. Boxes show median and

inter-quartile range.

Source: Home Mortgage Disclosure Act

Restrictions on loan officer compensation that limit compensation to comparable percentages of the

loan amount also may serve as a disincentive to loan officer participation in small mortgage lending by

diminishing the return per loan for origination of small mortgage loans compared to larger loans.

Courchane and Ross (2019), in reviewing recent regulatory changes, recommend a greater allowance for

higher broker compensation for smaller mortgage loans and in thinner markets to increase minority

access to credit.

Loan Performance

Overall, mortgage loans on lower-priced homes are associated with higher delinquency rates. Among all

mortgage loans originated between 2015 and 2017 for the purchase of owner-occupied homes, 3.0

percent of buyers of lower-priced homes experienced a 90-day delinquency within 2 years, compared

with 1.6 percent of buyers of more expensive homes. The comparable rates among refinances were 3.2

percent and 0.9 percent, respectively (exhibit 16). Controlling for credit score partially explains the

differences, but mortgages, particularly refinances, for lower-priced homes remain higher risk. The

Urban Institute also finds the loss severity rate is consistently higher on smaller loan amounts. This may

be due to the fixed costs of servicing distressed loans and managing the foreclosure process in weaker

housing markets in which many lower-priced homes are located (McCargo and Strochak, 2019).

-0.5

0.0

0.5

1.0

1.5

2.0

Under $100,000 $100,000 or More Under $100,000 $100,000 or More

FHA

APR Spread

Conventional

20

Exhibit 16: Mortgage Default Rate by Loan Purpose, Credit Score, and Property Value

Purchase

Refinance

Notes: First lien mortgages opened between 2015 and 2017 for owner-occupied homes. Mortgage default is defined as a 90-

day delinquency within 24 months of opening the tradeline.

Source: National Mortgage Database

FHA Programs and Policies

FHA programs do not impose minimum loan amounts, nor do FHA’s policies intentionally discriminate

against small mortgage loans. FHA insurance exists for the explicit purpose of incentivizing lenders to

make loans they otherwise would not make to provide access to homeownership for qualified

homebuyers in communities throughout the country. As noted, FHA disproportionately insures loans for

0

5

10

15

20

25

500 540 580 620 660 700 740 780 820

Defa ul t Rate (%)

Credit Score

0

5

10

15

20

25

500 540 580 620 660 700 740 780 820

Defa ul t Rate (%)

Credit Score

Property Va l ue: Under $100,000 $100,000 or More

21

lower-priced homes compared to the rest of the mortgage market (see exhibit 4). Under 12 USC

1709(b), FHA cannot insure loan amounts above certain limits. FHA mortgage policies do not directly

address small mortgage loans or lending for lower-priced homes, but may indirectly impact such lending

through underwriting, pricing, and collateral requirements. FHA also has loan insurance programs for

financing property improvements and manufactured homes that are particularly targeted to lower loan

amounts.

TOTAL Mortgage Scorecard

Most applications for mortgages insured under FHA’s standard 203(b) program are evaluated by its

Technology Open to Approved Lenders (TOTAL) Mortgage Scorecard. The scorecard is an algorithm used

by approved automated underwriting systems, although it refers higher risk mortgage applications to

manual underwriting. Lenders have been required to use the TOTAL Scorecard for most FHA mortgage

applications since 2008.

Overall, applications to purchase or refinance properties under $100,000 are less likely to be credit-

approved by TOTAL; roughly two-thirds (67 percent) of applications for lower-priced homes last scored

between 2018 and 2020 were approved, compared with 84 percent of more expensive homes (exhibit

17). Restricting applications to those with case numbers, which requires an application for a specific

property,

8

increases the overall approval rates and reduces the disparity to 85 percent and 92 percent,

respectively. Plotting the approval rates by credit score reveals that applications for lower-priced homes

are less likely to be approved when the borrower has a credit score of less than 700 but more likely to

be approved among borrowers with higher credit scores.

Some applications approved by TOTAL do not result in a loan being originated. Conditional on being

credit-approved, only 77 percent of cases for lower-priced homes were endorsed compared with over

84 percent of cases for more expensive homes. This disparity persists across all borrower credit scores.

Additionally, cases not approved by TOTAL are not necessarily denied. They may be referred for manual

underwriting, which adds to the lender’s cost and perceived risk, creating another deterrent to

originating small mortgage loans.

8

Potential homebuyers may request a pre-approval before a property is identified to indicate they can obtain

credit.

22

Exhibit 17: Federal Housing Administration Underwriting and Endorsement

TOTAL Accept Rate

Endorsement Rate

TOTAL = Technology Open to Approved Lenders.

Note: Dotted lines indicate TOTAL accept rates given case number assignment.

Source: FHA administrative data

The pattern reflected in exhibit 17 is consistent with the broader lending market. Looking at the lender

credit decision conditional on the automated underwriting system (AUS) result across all lenders, only

85 percent of applications under $70,000 approved by an AUS are approved by the lender compared to

93 percent of approved applications of $70,000 or more (see exhibit 18). Applications for $70,000 or

more are relatively more likely to be denied due to the debt burden (see exhibit 19). In other words,

0

20

40

60

80

100

500 540 580 620 660 700 740 780 820

TOTAL Accept Ra te (%)

Credit Score

0

20

40

60

80

100

500 540 580 620 660 700 740 780 820

Endors ement Rate Gi ven TOTAL Accept (%)

Credit Score

Property Va l ue: Under $100,000 $100,000 or More

23

small mortgage applications referred by an AUS are relatively more likely to be denied due to credit

history, while small mortgage applications approved by an AUS are relatively more likely to be denied

due to collateral.

Exhibit 18. Lender Approval Rate by AUS Result

AUS = automated underwriting system.

Notes: Applications for first lien closed-end forward residential mortgage originations only (excludes subordinate liens,

reverse mortgages, home equity lines of credit, business loans, and chattel manufactured housing loans). “Approve” defined

as codes “Approve/Eligible,” “Accept,” or “Eligible.” “AUS Refer” defined as codes “Refer/Eligible,” “Refer with Caution,”

“Caution,” or “Refer.” All other codes are defined as ineligible. Applications reported as both accepted and referred (in

different fields) are defined as ambiguous.

Source: 2018–2020 Home Mortgage Disclosure Act

24

Exhibit 19. Reason for Lender Denial by AUS Result

DTI = debt-to-income.

Notes: Applications for first lien closed-end forward residential mortgage originations only (excludes subordinate liens,

reverse mortgages, home equity lines of credit, business loans, and chattel manufactured housing loans). AUS approved

defined as codes “Approve/Eligible,” “Accept,” or “Eligible.” AUS refer defined as codes “Refer/Eligible,” “Refer with

Caution,” “Caution,” or “Refer.” All other codes are defined as ineligible. Applications reported as both accepted and

referred (in different fields) are defined as ambiguous. Reason for denial is not a required field and lenders can select

multiple, not mutually exclusive reasons.

Source: 2018–2020 Home Mortgage Disclosure Act

The analyses above show that smaller loans are more likely to be denied than larger loans. While some

of the differences can be attributed to debt burden, credit history, or collateral, not all of the differences

can be. These differences may be attributable to other impediments, such as the lower return on

production for smaller mortgages, that may limit access to credit.

Minimum Property Requirements and Standards

FHA recommends but does not require property inspections; however, it does require appraisers to

determine whether properties meet minimum property requirements and standards, including legal

requirements, land use, externalities, site conditions, and property characteristics. Repairs may be

required to maintain the safety, security, and soundness of the property, preserve the marketability of

the property, and protect the health and safety of the occupants.

9

As noted in exhibit 6, the lower-priced housing stock disproportionately suffers from plumbing,

electrical, structural, and other physical inadequacies. Consequently, these homes may be less likely to

meet FHA’s minimum property requirements. This additional appraisal requirement may hinder the

9

See 24 CFR Subpart S and Section II.D.3 of HB 4000.1.

25

ability of borrowers relying on FHA insurance to compete with other homebuyers (Goodman and

Ratcliffe, 2021). FHA offers loan insurance to finance property improvements that may help improve the

quality of the lower-priced housing stock (see next sections on 203(k) Loans and Title I Programs).

Minimum property requirements are a consumer protection intended to ensure FHA borrowers have a

safe and healthy living environment. Moreover, property standards reduce the likelihood of borrowers

having to face large, unexpected home repairs that might result in financial distress and mortgage

delinquency. For homeowners purchasing a lower-priced home, significant repairs may exceed their

available reserves, rendering homeownership unsustainable. FHA’s minimum property requirements,

therefore, are important to homeownership retention for low- and moderate-income households.

203(k) Rehabilitation Loans

FHA provides insurance for mortgages designed to rehabilitate properties that fall below FHA’s

Minimum Property Requirements to adequate condition. FHA’s Handbook states, “A Property that is not

eligible for a 203(b) Mortgage due to health and safety or security issues may be eligible under 203(k) if

the rehabilitation or repair work performed will correct such issues.”

The amount owners may borrow is based on either the “as is” appraised value plus financeable repair

costs and fees or the appraised value after improvement.

10

Roughly a quarter of 203(k) loans originated

between 2018 and 2020 were for lower-priced homes (6,322 out of 25,205 cases). Financed repairs

increased the appraised value of these properties by nearly 83 percent, proportionately greater than the

increase among more expensive properties (33 percent).

Title I Programs

In addition to home mortgage insurance financed through the Mutual Mortgage Insurance Fund,

including 203(k) loans, FHA offers other loan insurance programs under Title I of the National Housing

Act that are particularly targeted to lower loan amounts.

FHA offers smaller property improvement loans through Title I to substantially protect or improve the

basic livability or utility of a property. No appraisal is required and there is no minimum required

investment or maximum loan-to-value (LTV) ratio, so lower-priced homes should not be at a

disadvantage in qualifying for improvement financing. Unsecured property improvement loans are

limited to $7,500. Secured improvement loans are limited to $25,000 for a single-family home and up to

$60,000 for multifamily homes.

As noted, manufactured housing accounts for a disproportionate share of the lower-priced housing

stock. Title I manufactured home loans are available to purchase or refinance manufactured homes with

or without owning the underlying land. Loans are limited to $69,678 for a manufactured housing unit or

$92,904 for both the unit and lot.

Both Title I programs have declined in volume substantially over the last several years (exhibit 20). A

frequent complaint is that the loan limits have not increased with rising costs, which again points to the

10

See Section II.A.8.a.ix – x of HB 4000.1. for maximum mortgage amounts for purchase or refinance using 203(k).

26

decreasing purchasing power of small mortgage loans as a primary reason for their declining market

share.

Exhibit 20: Title I Loan Disbursements

Source: FHA administrative data

The Government Sponsored Enterprises have proposed pilot programs to securitize personal property

loans on manufactured homes (Fannie Mae, 2021; Freddie Mac, 2020). Currently, however, they levy

higher fees on manufactured home mortgages; for example, Fannie Mae charges a 50-basis point

upfront charge to purchase mortgages on manufactured homes. Private mortgage insurance can add

another 18 to 60 basis points to the monthly cost. Given the importance of manufactured housing to the

affordable stock, consideration of sustainable financing options for these homes is also needed.

Policy Implications

Borrower ability to access mortgage credit for lower-priced homes is a critical question for FHA, when so

many borrowers—especially borrowers of color and low- and moderate-income borrowers—are locked

out of the homeownership market and/or are receiving non-mortgage-based credit that is higher-priced

and in some cases dangerous. It is also a matter of geographic fairness, as this issue affects certain areas

of the country and rural markets far more strongly than others.

Given the run-up in home prices over the past several years, however, it is likely that policies addressing

this issue will need to target beyond either the $70,000 or $100,000 price point. More research is

needed to ascertain a breakpoint that is more in line with today’s market.

Because limited profitability appears to be a primary driver of low origination volume of small mortgage

loans to owner-occupant purchasers of lower-priced homes, increasing the number of these loans

submitted for FHA insurance endorsement may require either a reduction in origination and servicing

0

1,000

2,000

3,000

4,000

5,000

6,000

7,000

8,000

2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021

Disbusrements

Property Improvement Manufactured Home

27

costs or the provision of additional lender or loan originator compensation sufficient to make small

mortgage loans profitable at levels acceptable to lenders. More information about how costs and

regulatory limitations are preventing lenders from making these loans will be required to develop a

proposal for how these goals might be achieved.

Additionally, attempts to increase the origination volume of small mortgage loans insured by FHA must

be pursued in a way that is prudent for both FHA and borrowers. Since mortgage loans for lower-priced

homes experience higher delinquency rates than loans for higher priced homes, FHA would need to

consider adjusting credit underwriting requirements to ensure that borrowers are not placed in

mortgage loans that are unsustainable. Likewise, reducing or eliminating FHA’s minimum property

requirements could put low- and moderate-income homeowners into homes with safety or health

violations and may also put them at risk of losing their homes due to expensive home repairs not

identified prior to purchase and for which they do not possess adequate reserves.

Consideration also needs to be given to the ways the secondary market can play a role, particularly to

incentivize or subsidize small mortgage lending. For example, pooling small mortgage loans could make

it more economically advantageous for small lenders, such as Community Development Financial

Institutions (CDFIs).

Conclusion

Ensuring equal access to credit for borrowers seeking to purchase lower-priced homes is a critical issue

for the populations that FHA has historically served. FHA offers several programs that serve borrowers

seeking lower-priced homes, and it is possible that these programs can be improved and made more

easily usable. However, it is unlikely that these programs can overcome the basic math problem faced

by lenders in profitably originating and servicing small mortgage loans. Currently, pilots by lenders and

researchers are underway to explore mechanisms for increasing profitability and decreasing risk (see,

McCargo et al., 2020). FHA will continue to examine the ways in which it can better support small

mortgage lending, including engaging in ongoing communication with lenders and other stakeholders

and exploring potential demonstration programs to test innovative concepts aimed at meeting the

challenges presented in this report.

28

References

Begley, Jaclene, and Mark Palim. 2022. “Mortgage Costs as a Share of Housing Costs—Placing the Cost of

Credit in Broader Context.” Fannie Mae Working Paper.

https://www.fanniemae.com/media/43026/display.

Canavan, Ryan, Tara Roche, and Rachel Siegel. 2022. Millions of Americans Have Used Risky Financing

Arrangements to Buy Homes. The Pew Charitable Trusts. https://www.pewtrusts.org/-

/media/assets/2022/05/millionsofamericanshaveusedriskyfinancing_brief.pdf.

Courchane, Marsha J., and Stephen L. Ross. 2019. “Evidence and Actions on Mortgage Market

Disparities: Research, Fair Lending Enforcement, and Consumer Protection,” Housing Policy Debate 29

(5): 769–794. https://www.tandfonline.com/doi/full/10.1080/10511482.2018.1524446.

Fannie Mae. 2021. Duty to Serve Underserved Markets Plan for the Manufactured Housing Market.

https://www.fhfa.gov/PolicyProgramsResearch/Programs/Documents/FannieMaeDTSPlan_2018-

2021.pdf.

Freddie Mac. 2020. Duty to Serve Underserved Markets Plan.

https://sf.freddiemac.com/content/_assets/resources/pdf/marketing-materials/freddie-mac-

underserved-markets-plan-2018-2021.pdf.

Freddie Mac. 2021. Cost to Originate Study: How Digital Offerings Impact Loan Production Costs.

https://sf.freddiemac.com/content/_assets/resources/pdf/report/cost-to-originate.pdf.

Goodman, Laurie. 2014. Servicing Is an Underappreciated Constraint on Credit Access. Washington, DC:

Urban Institute. https://www.urban.org/sites/defaul

t/files/publication/33451/2000049-servicing-is-an-

underappreciated-constraint-on-credit-access.pdf.

Goodman, Laurie, and Bhargavi Ganesh. 2018. Challenges to Obtaining Manufactured Home Financing.

Washington, DC: Urban Institute.

https://www.urban.org/sites/default/files/publication/98687/challenges_to_obtaining_manufactured_

home_financing_0.pdf.

Goodman, Laurie, and Janneke Ratcliffe. 2021. The Tight Housing Market Boxes Out Government-Insured

Borrowers, Widening Homeownership Gaps. Washington, DC: Urban Institute.

https://www.urban.org/urban-wire

/tight-housing-market-boxes-out-government-insured-borrowers-

widening-homeownership-gaps.

McCargo, Alanna, Bing Bai, Taz George, and Sarah Strochak. 2018. Small-Dollar Mortgages for Single-

Family Residential Properties. Washington, DC: Urban Institute.

https://www.urban.org/research/publication/small-dolla

r-mortgages-single-family-residential-

properties.

McCargo, Alanna, and Sarah Strochak. 2019. Small-Dollar Mortgages: A Loan Performance Analysis.

Washington, DC: Urban Institute. https://www.urban.org/research/publication/small-dolla

r-mortgages-

loan-performance-analysis.

29

McCargo, Alanna, Linna Zhu, Sarah Strochak, and Rita Ballesteros. 2020. The MicroMortgage

Marketplace Demonstration Project. Washington, DC: Urban Institute.

https://www.urban.org/research/publication/micromortgage-marketplace-demonstration-project.

Mota, Nuno, and Mark Palim. 2021. Barriers to Entry: Closing Costs for First-Time and Low-Income

Homebuyers. Fannie Mae. https://www.fanniemae.com/media/42286/display.

Russell, Jessica, Nora O’Reilly, Karl Schneider, Nicolas Melton, Nick Schwartz, and Sam Leitner. 2021.

Manufactured Housing Finance: New Insights from the Home Mortgage Disclosure Act Data. Consumer

Financial Protection Bureau. https://files.consumerfinance.gov/f/documents/cfpb_manufactured-

housing-finance-new-insights-hmda_report_2021-05.pdf.

The Pew Charitable Trusts. 2021. New Research Project to Explore the World of Small Home Loans.

https://www.pewtrusts.org/en/research-an

d-analysis/articles/2021/04/29/new-research-project-to-

explore-the-world-of-small-home-loans.

The University of North Carolina at Chapel Hill (UNC) Center for Community Capital. 2019. The Loan

Shopping Experiences of Manufactured Homeowners: Survey Report. Freddie Mac.

https://sf.freddiemac.com/resources/manufactured-homeo

wners-survey-and-report-on-loan-shopping-

experiences.

Zainulbhai, Sabiha, Zachary D. Blizard, Craig J. Richardson, and Yuliya Panfil, 2021. The Lending Hole at

the Bottom of the Homeownership Market: Why Millions of Families Can’t Get Small Dollar Loans. New

America.

https://www.newamerica.org/future-land-ho

using/reports/the-lending-hole-at-the-bottom-

of-the-homeownership-market/.

U.S. Department of Housing and Urban Development

Office of Policy Development and Research

Washington, DC 20410-6000

October 2022