CONSUMER FINANCIAL PROTECTION BUREAU | MAY 2020

OMB CONTROL NO. 3170-0008

Home Mortgage

Disclosure (Regulation C)

Small Entity Compliance Guide

1 HOME MORTGAGE DISCLOSURE (REGULATION C) VERSION 5.0

Version Log

The Bureau updates this guide on a periodic basis. Below is a version log noting the history of

this document and its updates:

Date Version Summary of Changes

May 26, 2020 5 Updates to incorporate the content of the 2020 HMDA Thresholds

Final Rule issued on April 16, 2020, including:

• Institutional coverage and the uniform loan-vo lume threshold for

closed-end mortgage loans and open-end lines of credit

(Sections 2.1, 3.1, and 9.1)

• Tran sactional coverage for clo sed -end mortgage loans and

open-end lines of credit (Sections 2.2, 4.1.1, 4.1.2, and 9.1)

Updates to incorporate the

Bureau’s Statement on Supervisory and

Enforcement Practices Regarding Quarterly Reporting Under the

Home Mortgage Disclosure Act (Sections 2.6, and 6.2)

Miscellaneous administrative changes in various sections.

January 23, 2020 4.0 Updates to incorporate the content of the final rule issued on October 10,

2019, including:

• Effective date (Section 2)

• Institutional coverage for open -end lines o f credit (Sectio ns 2.1,

3.1, 3.1.1, 3.1.2, 9.1)

• Transactional coverage for open-end lines of credit (Sections

2.2, 4.1.2, 4.3, 4.3.2)

• Partial exemptions (Sections 4.3, 4.3.1, 8.5)

• Non-universal loan identifier (Sections 5.2)

Information about the Bureau’s policy guidance on disclosure of loan-

level HMDA data (Section 2.7).

Deletes text related to 2017 institutional coverage because it is no longer

in effect (Section 2.1, 2.3, 2.5, 5.1.1, 9.1).

Deletes text regarding the collection of race, ethnicity, and sex for

applications taken in 2017 (Section 2.3, 5.1).

2 HOME MORTGAGE DISCLOSURE (REGULATION C) VERSION 5.0

Deletes text related to Appendix A of Regulation C because it was

removed from Reg ulation C in 2019 (Section 2.5).

Miscellaneous administrative changes in various sections.

October 2018 3.0 Updates to reflect Section 104(a) of the Economic Growth, Regulatory

Relief, and Consumer Protection Act (2018 Act) and the interpretive and

procedural rule issued on August 31, 2018 (2018 HMDA Rule), including:

• General information about Section 104(a) of the 2018 Act and

the 2018 HMDA Rule (Section 1)

• Key changes and effective date of Section 104(a) of the 2018

Act (Sectio ns 2.1, 2.3, and 4.3)

• Institutions eligible to rely upon the partial exemptions

created by Section 104(a) of the 2018 Act (Section 4.3.1)

• Loan-volume thresholds for the partial exemptions (Section

4.3.2)

• Collecting, recording, and reporting data points if a partial

exemption applies (Sections 4.3.3)

• Reporting a non-universal loan identifier if a partial exemption

applies (Section 5.2)

• Reporting other data points affected by the partial exemptions

(Sections 5.4, 5.9, 5.11, 5.12, 5.16, 5.17, and 5.19 through

5.30)

Additional information about which transactions a financial institution

must count when d etermining if a loan-volume threshold has been met

(Section 4.1.2).

Revisions to the portion of the table describing the loan amount reported

for a counteroffer for an amount different from the amount for which the

applicant applied, if the applicant did not accept or failed to respond.

Also, revisions to the portion of the same table describing the loan

amount reported for an Application that was denied, closed for

incompleteness, or withdrawn (Section 5.8).

Miscellaneous administrative changes in various sections.

October 2017 2.0 Updates to incorporate the content of the final rule issued on August

24, 2017, including changes and clarification regarding:

• Institutional coverage and the uniform loan-vo lume threshold for

open-end lines of credit (Sections 2.1, 3.2, and 9.1)

• Transactional coverage for open-end lines o f credit (Sections

2.2, 4.1.2, and 9.1)

3 HOME MORTGAGE DISCLOSURE (REGULATION C) VERSION 5.0

• Collection and reporting of applicant information (Sections 2.4,

5.1, 9.2.1, and Attachment A)

• ,Effective date of enforcement provisions for larger volume

reporters (Sections 2.8 and 7)

• Whether certain installment sales contracts are extensions of

credit for purposes of th e HMDA Rule (Section 4.1.1.1)

• An exclusion from coverage for certain preliminary transactions

that consolidate new funds into a New Yo rk CEMA (Sectio n s

4.1.1.1. and 4.1.2)

• What co nstitutes a loan secured by a multifamily dwelling under

the HMDA Rule (Sections 4.1.1.2)

• The exclusion from coverage for temporary finan cing (Section

4.1.2)

• Including certain distributions from retirement and other asset

accounts when reporting income (Section 5.1.2)

• Reporting the ULI and use of check digit tool provided by the

Bureau (Section 5.2)

• Reporting loan purpose (Section 5.7)

• Reporting p roperty address and location when certain

information is unknown or unavailable (Section 5.12)

• Reporting census tract using the geocoding tool provided by the

Bureau (Sections 5.12 an d 7)

• Reporting CLTV when th e calculation includes property other

than the Identified Prop erty (Section 5.21)

• Reporting credit score when there are multiple scores or

multiple applicants (Sectio n 5.22)

• Securitizers an d automated underwriting systems (Section 5.23)

• Reporting interest rate, rate spread, and certain other data

points when revised or corrected disclosures are provided

(Sections 5.24, 5.26, and 5.28)

• Reporting the introductory rate (Section 5.25)

• Reporting rate spread, including for applications that are

approved but not accepted (Section 5.26)

• Reporting mortgage loan originator identifier for certain

purchased covered loans (Section 5.30)

• Reporting action taken if there is a counteroffer (Attachment B)

Also, makes miscellaneous administrative changes to various sections

December 2015 1.0 Original Document

4 HOME MORTGAGE DISCLOSURE (REGULATION C) VERSION 5.0

Table of contents

Table of contents ..............................................................................................................4

1. Introduction ................................................................................................................8

1.1 Purpose of this guide.................................................................................. 9

1.2 Additional implementation resources..................................................... 10

2. Key changes and effective dates ..........................................................................11

2.1 Institutional coverage ...............................................................................12

2.2 Transactional coverage .............................................................................13

2.3 Required data points.................................................................................15

2.4 Collection and reporting of applicant information................................. 16

2.5 Annual reporting ...................................................................................... 16

2.6 Quarterly reporting ...................................................................................17

2.7 Disclosure requirements.......................................................................... 18

2.8 Enforcement provisions for larger-volume reporters ............................ 19

3. Institutional coverage .............................................................................................20

3.1 Institutional coverage on or after January 1, 2018 ................................. 20

3.2 Exempt institutions.................................................................................. 24

4. Transactional coverage ..........................................................................................25

4.1 Covered loans ........................................................................................... 25

4.2 Reportable activity ................................................................................... 36

4.3 Partial exemptions ................................................................................... 42

5. Reportable data ........................................................................................................50

5 HOME MORTGAGE DISCLOSURE (REGULATION C) VERSION 5.0

5.1 Applicant information ............................................................................. 50

5.2 Universal loan identifier (ULI) or non-universal loan identifier ........... 58

5.3 Application date ....................................................................................... 61

5.4 Application channel ................................................................................. 62

5.5 Preapproval request ................................................................................. 63

5.6 Loan type .................................................................................................. 63

5.7 Loan purpose............................................................................................64

5.8 Loan amount ............................................................................................ 67

5.9 Loan te rm .................................................................................................68

5.10 Action taken and date ..............................................................................69

5.11 Reasons for denial....................................................................................69

5.12 Property address and property location...................................................71

5.13 Construction method ............................................................................... 73

5.14 Occupancy type ........................................................................................ 74

5.15 Lie n status ................................................................................................ 75

5.16 Manufactured home information ............................................................ 76

5.17 Property value .......................................................................................... 77

5.18 Total units ................................................................................................ 78

5.19 Multifamily affordable units.................................................................... 79

5.20 Debt-to-income ratio ...............................................................................80

5.21 Combined loan-to-value .......................................................................... 81

5.22 Credit score information.......................................................................... 83

5.23 Automated underwriting system information ........................................ 85

5.24 Interest rate ..............................................................................................88

5.25 Introductory rate period .......................................................................... 91

5.26 Rate spread............................................................................................... 92

6 HOME MORTGAGE DISCLOSURE (REGULATION C) VERSION 5.0

5.27 Non-amortizing features.......................................................................... 97

5.28 Data points for certain loans subject to Regulation Z ............................98

5.29 Transaction indicators ........................................................................... 102

5.30 Mortgage loan originator identifier....................................................... 103

5.31 Type of purchaser................................................................................... 104

6. Recording and reporting ......................................................................................107

6.1 Re cording ............................................................................................... 107

6.2 Reporting................................................................................................ 108

6.3 Disclosure of data.................................................................................... 110

7. Enforcement provisions .......................................................................................113

8. Mergers and acquisitions .....................................................................................114

8.1 Determining coverage ............................................................................. 114

8.2 Reporting responsibility for calendar year of merger or acquisition .... 114

8.3 Changes to appropriate Federal agency or TIN ..................................... 115

8.4 Determining quarterly reporting coverage ............................................ 116

8.5 Applicability of partial exemptions under the 2018 Act after a merger or

acquisition ............................................................................................... 117

9. Practical implementation and compliance considerations.............................119

9.1 Identifying affected institutions, products, departments, and staff ..... 119

9.2 Implementation and compliance management support activities .......123

Attachment A: ...............................................................................................................126

Attachment B: ...............................................................................................................126

7 HOME MORTGAGE DISCLOSURE (REGULATION C) VERSION 5.0

Action taken chart........................................................................................... 126

Attachment C: ...............................................................................................................132

Sample notices .................................................................................................132

PAPERWORK REDUCTION ACT

According to the Paperwork Reduction Act of 1995, an agency may not conduct or sponsor, and,

notwithstanding any other provision of law, a person is not required to respond to a collection of

information unless it displays a valid OMB control number. The OMB control number for this

collection is 3170-0008. It expires on November 30, 2022. The information collections created

by the Final Rule published October 28, 2015 at 80 FR 66127 will not become effective until

either three years from the date of publication of the rule or 2020 in the case of certain

information collections. The time required to complete this information collection is estimated

to average between 161 hours and 9,000 hours per response depending on the size of the

institution. The obligation to respond to this collection of information is mandatory per the

Home Mortgage Disclosure Act, 12 U.S.C. 2801-2810, as implemented by the Bureau’s

Regulation C, 12 CFR part 1003. Comments regarding this collection of information, including

the estimated response time, suggestions for improving the usefulness of the information, or

suggestions for reducing the burden to respond to this collection should be submitted to the

Bureau of Consumer Financial Protection (Attention: PRA Office), 1700 G Street NW,

Washington, DC 20552, or by email to PRA@cfpb.gov. The other agencies collecting

information under this regulation maintain OMB control numbers for their collections as

follows: Office of the Comptroller of the Currency (1557–0159), the Federal Deposit Insurance

Corporation (3064–0046), the Federal Reserve System (7100–0247), the Department of

Housing and Urban Development (2502–0529), and the National Credit Union Administration

(3133–0166).

8 HOME MORTGAGE DISCLOSURE (REGULATION C) VERSION 5.0

1. Introduction

The Home Mortgage Disclosure Act (HMDA), which Congress enacted in 1975, requires certain

financial institutions to collect, record, report, and disclose information about their mortgage

lending activity. Regulation C implements HMDA and sets out specific requirements for the

collection, recording, reporting, and disclosure of mortgage lending information. The data-

related requirements in HMDA and Regulation C serve three primary purposes: (1) to help

determine whether financial institutions are serving their communities’ housing needs; (2) to

assist public officials in distributing public investment to attract private investment; and (3) to

assist in identifying potential discriminatory lending patterns and enforcing antidiscrimination

statutes.

The Dodd-Frank Wall Street Reform and Consumer Protection Act (Dodd-Frank Act)

transferred rulemaking authority for HMDA to the Bureau of Consumer Financial Protection

(Bureau), effective July 2011. It also amended HMDA to require financial institutions to report

new data points and authorized the Bureau to require financial institutions to collect, record,

and report additional information. On August 29, 2014, the Bureau published

proposed

amendments to Regulation C to implement the Dodd-Frank Act changes and to make additional

changes. The Bureau carefully reviewed and considered the comments it received on its

proposed amendments. On October 15, 2015, the Bureau issued a final rule (2015 HMDA Rule)

amending Regulation C. The

2015 HMDA Rule was published in the Federal Register on

October 28, 2015. On August 24, 2017, the Bureau issued a final rule (2017 HMDA Rule) f urther

amending Regulation C to make technical corrections and to clarify and amend certain

requirements adopted by the 2015 HMDA Rule. The

2017 HMDA Rule was published in the

Federal Register on September 13, 2017. On May 24, 2018, the President signed the Economic

Growth, Regulatory Relief, and Consumer Protection Act (2018 Act) into law. Effective May 24,

2018, Section 104(a) of the 2018 Act created partial exemptions from some of HMDA’s

requirements for certain covered institutions. On August 31, 2018, the Bureau issued an

interpretive and procedural rule (2018 HMDA Rule) to implement and clarify Section 104(a) of

the 2018 Act. The

2018 HMDA Rule was published in the Federal Register on September 7,

2018. On October 10, 2019, the Bureau issued a final rule (2019 Rule) to extend until January 1,

2022 the current temporary loan-volume threshold for reporting data about open-end lines of

credit and incorporate the 2018 HMDA Rule into Regulation C and implement further the 2018

Act. The

2019 HMDA Rule was published in the Federal Register on October 29, 2019. On

9 HOME MORTGAGE DISCLOSURE (REGULATION C) VERSION 5.0

April 16, 2020, the Bureau issued a final rule (2020 HMDA Thresholds Rule) amending

Regulation C’s institutional and transactional coverage thresholds for closed-end mortgage

loans and open-end lines of credit. The 2020 HMDA Thresholds Rule was published in the

Federal Register on May 12, 2020. In this guide, the 2015 HMDA Rule, 2017 HMDA Rule, 2018

HMDA Rule, 2019 HMDA Rule, and 2020 HMDA Thresholds Rule are collectively referred to as

the HMDA Rule.

Certain terms that are defined in Regulation C are capitalized in this guide for ease of reference.

The definitions for these terms are found in 12 CFR 1003.2.

1.1 Purpose of this guide

The purpose of this guide is to provide an easy-to-use summary of Regulation C to highlight

information that financial institutions and those that work with them might find helpful when

implementing the HMDA Rule.

This guide meets the requirements of Section 212 of the Small Business Regulatory Enforcement

Fairness Act of 1996, which requires the Bureau to issue a small entity compliance guide to help

small entities comply with new regulations. Larger entities may also find this guide useful.

This is a Compliance Aid issued by the Consumer Financial Protection Bureau. The Bureau

published a Policy Statement on Compliance Aids, available at

https://www.consumerfinance.gov/policy-compliance/rulemaking/final-rules/policy-

statement-compliance-aids/, that explains the Bureau’s approach to Compliance Aids.

Regulation C, the 2015 HMDA Rule, the 2017 HMDA Rule, the 2018 HMDA Rule, the 2019

HMDA Rule, the 2020 HMDA Thresholds Rule, and the Official Interpretations (also known as

the commentary) are the definitive sources of information regarding their requirements. The

2015 HMDA Rule, the 2017 HMDA Rule, the 2018 HMDA Rule, the 2019 HMDA Rule, and the

2020 HMDA Thresholds Rule are available at

http://www.consumerfinance.gov/regulatory-

implementation/hmda/.

The focus of this guide is Regulation C and the HMDA Rule. Except when specifically needed to

explain a provision of amended Regulation C, this guide does not discuss other Federal or State

laws that may apply to mortgage lending.

10 HOME MORTGAGE DISCLOSURE (REGULATION C) VERSION 5.0

This guide has examples to illustrate some portions of the HMDA Rule. The examples do not

include all possible factual situations that could illustrate a particular provision, trigger a

particular obligation, or satisfy a particular requirement. Even though an example may identify

a fictitious financial institution as, for example, “Ficus Bank” or “Ficus Mortgage Company,” the

provision or obligation being illustrated in the example may apply to all financial institutions,

including both depository and nondepository financial institutions.

Sometimes this guide will distinguish between the requirements of the HMDA Rule and the

requirements of Regulation C as they apply before a specific part of the HMDA Rule goes into

effect. When making these distinctions, the guide generally refers to the requirements of

Regulation C as they apply before a specific part of the HMDA Rule goes into effect as “current

Regulation C.” However, it should be understood that this means the requirements of

Regulation C as they are before the specific part of the HMDA Rule being discussed goes into

effect, not Regulation C as of any specific date (such as the date the guide is being read).

1.2 Additional implementation resources

Additional resources to help institutions understand and comply with the HMDA Rule are

available on the Bureau’s website at http://www.consumerfinance.gov/regulatory-

implementation/hmda/. These resources include a list of frequently asked questions and

answers on particular topics to assist in understanding and complying with HMDA and

Regulation C.

A person who has a specific regulatory interpretation question about the HMDA Rule after

reviewing these materials may submit the question on the Bureau’s website at

https://reginquiries.consumerfinance.gov/

. Bureau staff provide only informal responses to

regulatory inquiries, and the responses do not constitute official interpretations or legal advice.

Generally, Bureau staff is not able to respond to specific inquiries the same business day or

within a particular requested timeframe. Actual response times will vary based on the number

of questions Bureau staff is handling and the amount of research needed to respond to a specific

question.

Technical questions about the HMDA Platform, or the publication of HMDA data

should be directed to hmdahelp@cfpb.gov

.

11 HOME MORTGAGE DISCLOSURE (REGULATION C) VERSION 5.0

2. Key changes and effective

dates

The HMDA Rule changes: (1) the types of financial institutions that are subject to Regulation C;

(2) the types of transactions that are subject to Regulation C; (3) the data that financial

institutions are required to collect, record, and report; and (4) the processes for reporting and

disclosing HMDA data.

Most provisions of the HMDA Rule took effect on January 1, 2018 and apply to data collected in

2018 and reported in 2019 or later years. The partial exemptions created by the 2018 Act

became effective when the Act was signed into law on May 24, 2018. Further implementation of

the 2018 Act, such as the application of partial exemptions after a merger or acquisition, is

effective January 1, 2020. Certain changes regarding reporting and changes to the enforcement

provisions regarding good faith efforts are effective January 1, 2019. The new quarterly

reporting requirement and changes to the enforcement provisions for larger-volume reporters

are effective January 1, 2020. Additionally, there are institutional and transactional coverage

changes for closed-end mortgage loans that are effective July 1, 2020 and open-end lines of

credit that are effective January 1, 2022.

1

This section summarizes these key changes and provides the effective date for each key change.

For more detailed information on the HMDA Rule’s specific requirements, see Sections 3

through 8.

1

On April 16, 2020, the Bureau issued the 2020 HMDA Thresholds Rule adjusting Regulation C’s institutional and

transactional coverage thresholds for closed-end mortgage l oans and open-end lines of credit. Effective July 1,

2020, the final rule permanently raises the closed-end coverage threshold from 25 to 100 closed-end mortgage

loans in each of the two preceding calendar years. Effective January 1, 2022, when the temporary threshold of 500

open-end lines of credit expires, the final rule sets the permanent open-end threshold at 200 open-end lines of

credit in each of the two preceding calendar years.

12 HOME MORTGAGE DISCLOSURE (REGULATION C) VERSION 5.0

2.1 Institutional coverage

Effective January 1, 2018, for changes to institutional coverage; effective July 1, 2020, for a

change to the loan-volume threshold for covered closed-end mortgage loans; effective January

1, 2022, for a change to the loan-volume threshold for open-end lines of credit

Effective January 1, 2018, the HMDA Rule

adopts a uniform loan-volume threshold

for all financial institutions. As described

below, the loan-volume threshold for

closed-end mortgage loans and open-end

lines of credit adjusts over three effective

dates. First, from January 1, 2018, through

June 30, 2020, a financial institution is not

subject to Regulation C unless it originated

at least 25 covered closed-end mortgage

loans in each of the two preceding calendar

years or at least 500 covered open-end

lines of credit in each of the two preceding

calendar years, and it meets other

applicable coverage requirements. Second,

from July 1, 2020 through December 31,

2021, a financial institution is not subject

to Regulation C unless it originated at least

100 covered closed-end mortgage loans in

each of the two preceding calendar years or

at least 500 covered open-end lines of

credit in each of the two preceding calendar

years, and it meets other applicable

coverage requirements. Third, effective

January 1, 2022, a financial institution is

not subject to Regulation C unless it

originated at least 100 covered closed-end

mortgage loans in each of the two

preceding calendar years or at least 200

The 2018 Act added partial exemptions to

HMDA. As discussed in Section 4.3, certain

financial institutions are eligible for these

partial exemptions from some of the HMDA

Rule’s data collection and reporting

requirements. Among other things, in order

to be eligible for a partial exemption, a

financial institution must be either an

insured depository institution as defined in

Section 3 of the Federal Deposit Insurance

Act or an insured credit union as defined in

Section 101 of the Federal Credit Union Act.

As discussed in Section 4.3, an insured

depository institution with a less than

satisfactory Community Reinvestment Act

examination history is not eligible for a

partial exemption.

A financial institution that was subject to

HMDA’s closed-end requirements as of

January 1, 2020, but is no longer subject to

HMDA’s closed-end requirements as of July

1, 2020, because it originated fewer than 100

closed-end mortgage loans during 2018 or

2019, may stop collecting, recording, and

reporting HMDA data as of July 1, 2020.

Such an institution may report voluntarily

HMDA data on closed-end mortgage loans

from 2020 as long as the institution reports

data for the full calendar year 2020.

13 HOME MORTGAGE DISCLOSURE (REGULATION C) VERSION 5.0

covered open-end lines of credit in each of the two preceding calendar years, and it meets other

applicable coverage requirements.

For depository financial institution coverage, the HMDA Rule maintains Regulation C’s asset-

size threshold, location test, federally related test, and loan activity test. For nondepository

financial institutions, the HMDA Rule retains the location test.

For more information regarding which financial institutions are subject to the HMDA Rule, see

Section 3 and the HMDA Institutional Coverage Charts

.

2.2 Transactional coverage

Effective January 1, 2018 for data collected on or after January 1, 2018 (to be reported in or

after 2019); effective July 1, 2020 for data collected on or after July 1, 2020 for a change to the

exclusion for closed-end mortgage loans; effective January 1, 2022 for data collected on or

after January 1, 2022 (to be reported in or after 2023) for a change to the exclusion for open-

end lines of credit.

The HMDA Rule modifies the types of transactions that are subject to Regulation C and

generally adopts a dwelling-secured standard for transactional coverage.

Beginning on January 1, 2018, Regulation C generally applies to consumer-purpose, closed-end

loans and open-end lines of credit that are secured by a dwelling. 12 CFR 1003.2(d), (e), and (o).

A home improvement loan is not subject to Regulation C unless it is secured by a dwelling.

Beginning on January 1, 2018, Regulation C applies to business-purpose, closed-end loans and

open-end lines of credit that are dwelling-secured and are home purchase loans, home

improvement loans, or refinancings. 12 CFR 1003.3(c)(10). For business-purpose transactions,

the HMDA Rule creates a dwelling-secured standard and maintains current Regulation C’s

purpose test.

The HMDA Rule retains existing categories of excluded transactions, clarifies some categories of

excluded transactions, and expands the existing exclusion for agricultural-purpose transactions.

12 CFR 1003.3(c). It also adds new categories of excluded transactions that are designed to

work in tandem with the HMDA Rule’s other changes. For example, from January 1, 2018

through June 30, 2020, closed-end mortgage loans are excluded transactions for a financial

14 HOME MORTGAGE DISCLOSURE (REGULATION C) VERSION 5.0

institution that did not originate 25 or more of them in each of the two preceding calendar years.

Effective July 1, 2020, closed-end mortgage loans are excluded transactions for a financial

institution that did not originate 100 or more of them in each of the two preceding calendar

years. Similarly, open-end lines of credit are excluded transactions for a financial institution

that did not originate a certain number of them in each of the two preceding calendar years.

For 2018, 2019, 2020, and 2021, open-end lines of credit are excluded transactions for a

financial institution that did not originate at least 500 of them in each of the two preceding

calendar years. Effective January 1, 2022, open-end lines of credit are excluded transactions for

a financial institution that did not originate at least 200 of them in each of the two preceding

calendar years.

2

The HMDA Rule expands the types of

preapproval requests that are reported, but

also excludes requests regarding some types

of loans from the scope of reportable

preapproval requests. Under the HMDA

Rule, reporting of preapproval requests that

are approved but not accepted is required

instead of optional. However, under the

HMDA Rule, preapproval requests

regarding home purchase loans to be

secured by multifamily dwellings,

preapproval requests for open-end lines of credit, and preapproval requests for reverse

mortgages are not reportable.

For more information regarding the transactions that are subject to the HMDA Rule, see Section

4 and the HMDA Transactional Coverage Chart.

2

A financial institution may collect, record, report, and disclose information, as described in §§ 1003.4 and 1003.5,

for a closed-end mortgage loan excluded under § 1002.3(c)(11) or an open-end line of credit excluded under

§ 1002.3(c)(12) as though it were a covered loan, provided that the financial institution complies with such

requirements for all applications for closed-end mortgage loans or open-end lines of credit that it receives,

originates, and purchases that otherwise would have been covered loans during the calendar year during which final

action is taken on the excluded closed-end mortgage loan or open-end line of credit.

The 2018 Act created two partial exemptions:

one for closed-end mortgage loans and one

for open-end lines of credit. Transactions

that are subject to the HMDA Rule and are

covered by a partial exemption are still

subject to some of the HMDA Rule’s

requirements, and certain data points must

be collected, recorded, and reported for such

transactions. For more information on the

partial exemptions, see Section 4.3.

15 HOME MORTGAGE DISCLOSURE (REGULATION C) VERSION 5.0

2.3 Required data points

Effective January 1, 2018 and applicable to data reported in or after 2019; partial exemptions

effective May 24, 2018 and applicable for collection, recording, and reporting of data on or

after May 24, 2018.

The HMDA Rule adds the data points specified in the Dodd-Frank Act as well as data points that

the Bureau determined will assist in carrying out HMDA’s purposes. For example, the HMDA

Rule adds new data points for age, credit score, automated underwriting information, debt-to-

income ratio, unique loan identifier, property value, application channel, points and fees,

borrower-paid origination charges, discount points, lender credits, loan term, prepayment

penalty, and identification of other loan features. 12 CFR 1003.4(a). The HMDA Rule also

modifies some existing data points.

Effective May 24, 2018, the 2018 Act created partial exemptions that permit certain financial

institutions to exclude 26 data points when collecting, recording, and reporting HMDA data for

certain transactions. If a partial exemption applies to a covered transaction, an insured

depository institution or insured credit union may, but is not required to, collect, record, and

report these 26 data points. However, the insured depository institution or insured credit union

must collect, record, and report the remaining 22 data points as required by the HMDA Rule

and otherwise comply with the HMDA Rule for such covered transactions.

Generally, a financial institution collects, records, and reports the new and modified data points

under the HMDA Rule for applications on which final action is taken on or after January 1,

2018. However, if a partial exemption applies, an insured depository institution or insured

credit union is not required to collect, record, or report many of these data points as discussed in

Section 4.3.3.

A financial institution collects, records, and reports the new and modified data points, to the

extent that they apply to purchased loans, for purchases of covered loans that occur on or after

January 1, 2018.

For more information regarding the data points that must be reported under the HMDA Rule,

see Section 5. For more information on the data points that must be reported if a partial

exemption applies to a covered transaction, see Section 4.3.3.

16 HOME MORTGAGE DISCLOSURE (REGULATION C) VERSION 5.0

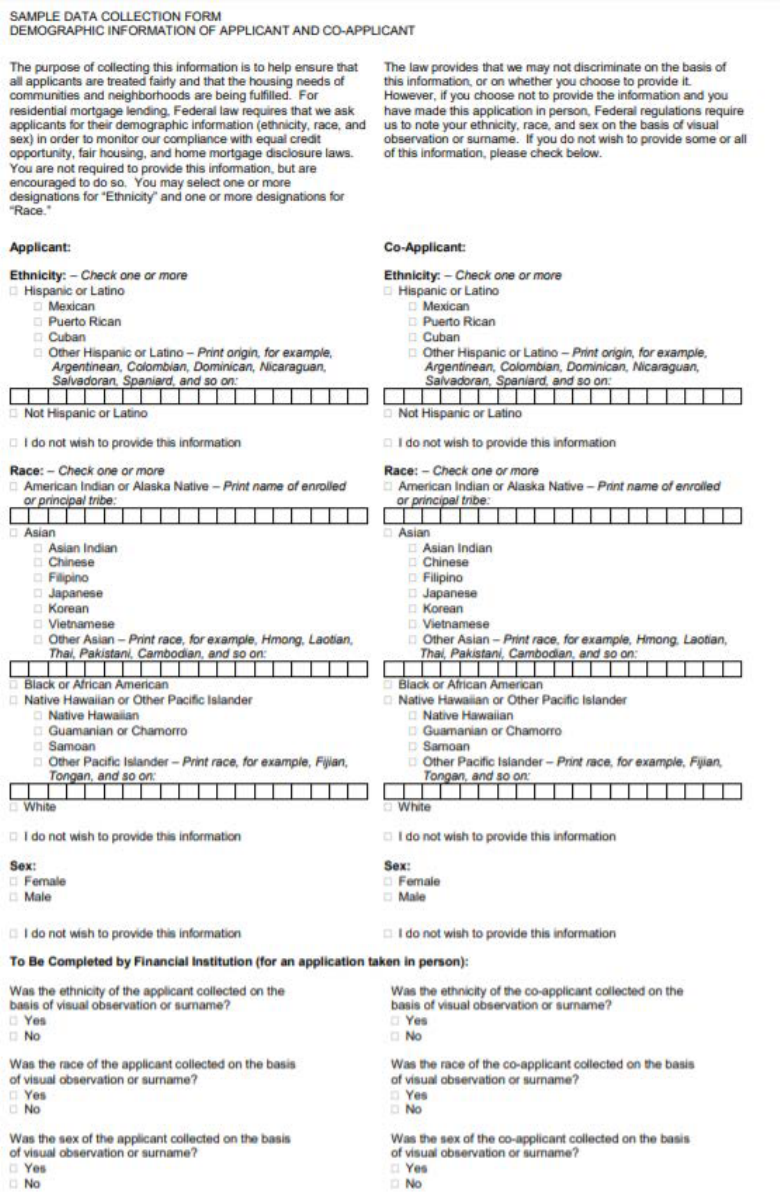

2.4 Collection and reporting of applicant

information

Effective January 1, 2018 for data collected in or after 2018 (to be reported in or after 2019)

For data collected in or after 2018, the HMDA Rule amends the requirements for collection and

reporting of information regarding an applicant’s or borrower’s ethnicity, race, and sex.

First, the HMDA Rule adds a requirement to report how the institution collected the

information about the applicant’s or borrower’s ethnicity, race, and sex. A financial institution

reports whether or not it collected the information on the basis of visual observation or

surname. 12 CFR 1003.4(a)(10)(i). Financial institutions are required to collect information

about an applicant’s ethnicity, race, and sex on the basis of visual observation or surname when

an applicant chooses not to provide the information for an application taken in person.

Second, financial institutions must permit applicants to self-identify using disaggregated ethnic

and racial subcategories and must report disaggregated information applicants provide.

However, the HMDA Rule does not require or permit financial institutions to use the

disaggregated subcategories when identifying the applicant’s ethnicity and race based on visual

observation or surname. The HMDA Rule includes a new sample data collection form in

appendix B that provides the required aggregated categories and disaggregated subcategories

for ethnicity and race. Appendix B to Part 1003.

For more information regarding the collection and reporting of applicant information under the

HMDA Rule, see Section 5.1.

2.5 Annual reporting

Effective January 1, 2019 for changes requiring electronic submission of HMDA data in 2019

and later years

The HMDA Rule retains the requirement that a financial institution submit its HMDA data to its

appropriate Federal agency by March 1 following the calendar year for which it collected the

data, but requires electronic submission of the data.

17 HOME MORTGAGE DISCLOSURE (REGULATION C) VERSION 5.0

The Bureau developed a new web-based tool for electronically submitting HMDA data. Financial

institutions are required to submit data electronically using the web-based tool beginning in

2018 for data collected in 2017. For more information on the submission tool, see

http://ffiec.cfpb.gov/.

Beginning in 2019, financial institutions are required to submit the new dataset electronically in

accordance with the HMDA Rule, using the new web-based submission tool and revised

procedures available at http://ffiec.cfpb.gov/.

For more information regarding annual reporting under the HMDA Rule, see Section 6.2.1.

2.6 Quarterly reporting

Effective January 1, 2020 for data collected and reported in or after 2020

The HMDA Rule imposes a new quarterly reporting requirement for larger-volume reporters.

In addition to their annual data submission, these larger-volume reporters will also

electronically submit their HMDA data for each of the first three quarters of the year on a

quarterly basis beginning in 2020. 12 CFR 1003.5(a)(1)(ii).

As of March 26, 2020, and until further notice, the Bureau does not intend to cite in an

examination or initiate an enforcement action against any institution for failure to report its

HMDA data quarterly. At a later date, the Bureau will provide information as to how and when

it expects institutions under its jurisdiction to resume quarterly HMDA data submissions.

Entities should continue collecting and recording HMDA data in anticipation of making annual

data submissions. Entities may continue making quarterly HMDA data submissions even

though the Bureau does not intend to cite or take any actions against them if they do not do so.

See the Bureau’s

Statement on Supervisory and Enforcement Practices Regarding Quarterly

Reporting Under the Home Mortgage Disclosure Act for more information.

For more information regarding quarterly reporting under the HMDA Rule, see Section 6.2.2.

18 HOME MORTGAGE DISCLOSURE (REGULATION C) VERSION 5.0

2.7 Disclosure requirements

Effective January 1, 2018 for data collected on or after January 1, 2017 (to be reported in or

after 2018)

The HMDA Rule replaces Regulation C’s requirements to provide a disclosure statement and

modified LAR

3

to the public upon request with new requirements to provide notices that the

institution’s disclosure statement and modified LAR are available on the Bureau’s website.

12 CFR 1003.5(b)(2) and (c).

The HMDA Rule also modifies the content of the posting required under Regulation C.

The HMDA Rule includes sample language that financial institutions can use to provide notice

that the institution’s HMDA data are available on the Bureau’s website and to comply with the

posting requirement. These revised disclosure requirements are effective January 1, 2018 and

apply to data collected on or after January 1, 2017 and reported in or after 2018.

The Bureau’s policy guidance on the disclosure of loan-level HMDA data

4

notes that for HMDA

data collected by Financial Institutions in or after 2018 and made available to the public

beginning in 2019, the Bureau intends to modify the public loan-level data to exclude certain

fields and reduce the precision of most of the values reported for certain data fields.

For more information regarding the disclosure requirements under the HMDA Rule,

see Section 6.3.

3

HMDA requires a financial institution to make available to the public, upon request, “loan application register

information” in the form required under Regulation C, and requires the Bureau to determine if deletions from the

information are appropriate to protect applicants’ and borrowers’ privacy interests or to protect financial

institutions from liability under privacy laws. 12 USC 304(j). Prior to being disclosed to the public, LARs must be

modified to remove loan application register information that the Bureau determines should be deleted.

4

See Disclosure of Loan-Level HMDA Data, 84 FR 649 (Jan. 31, 2019)

19 HOME MORTGAGE DISCLOSURE (REGULATION C) VERSION 5.0

2.8 Enforcement provisions for larger-

volume reporters

Effective January 1, 2020

The HMDA Rule provides that inaccuracies or omissions in quarterly reporting are not

violations of HMDA or Regulation C if the financial institution makes a good-faith effort to

report quarterly data timely, fully, and accurately, and then corrects or completes the data prior

to its annual submission. 12 CFR 1003.6(c)(2). For more information regarding the

enforcement provisions of the HMDA Rule, see Section 7.

20 HOME MORTGAGE DISCLOSURE (REGULATION C) VERSION 5.0

3. Institutional coverage

An institution is required to comply with Regulation C only if it is a “financial institution” as that

term is defined in Regulation C.

3.1 Institutional coverage on or after

January 1, 2018

An institution uses two definitions, which are outlined below, as coverage tests to determine

whether it is a financial institution that is required to comply with Regulation C, on or after

January 1, 2018.

These coverage tests include loan-volume thresholds for closed-end mortgage loans and for

open-end lines of credit. For closed-end mortgage loans, the HMDA Rule includes a lower

threshold that is effective from January 1, 2018, through July 1, 2020. Similarly, for open-end

lines of credit, the HMDA Rule includes both a temporary higher threshold that is effective

January 1, 2018 and a lower threshold that takes effect January 1, 2022. These thresholds are

discussed in more detail below.

Although the HMDA Rule is the definitive source regarding the institutional coverage criteria,

an institution may also find the Bureau’s HMDA Institutional Coverage Charts

helpful when it is

determining whether it is subject to Regulation C, on or after January 1, 2018.

Throughout the remainder of this guide, an institution that meets the criteria set forth in the

HMDA Rule’s definition of depository financial institution is referred to as a Depository

Financial Institution, and an institution that meets the criteria set forth in the HMDA Rule’s

definition of nondepository financial institution is referred to as a Nondepository Financial

Institution. The capitalized term Financial Institution refers to an institution that is either a

Depository Financial Institution or a Nondepository Financial Institution and that is an

institution that is subject to HMDA Rule.

21 HOME MORTGAGE DISCLOSURE (REGULATION C) VERSION 5.0

3.1.1 Depository financial institutions

Under the HMDA Rule, effective January 1, 2018, a bank, savings association, or credit union is

a Depository Financial Institution, a Financial Institution, and subject to Regulation C if it meets

ALL

5

of the following:

1. Asset-Size Threshold. On the preceding December 31, the bank, savings association, or

credit union had assets in excess of the asset-size threshold published annually in the

Federal Register and posted on the Bureau’s website. The phrase “preceding December 31”

refers to the December 31 immediately preceding the current calendar year. For example, in

2018, the preceding December 31 is December 31, 2017. 12 CFR 1003.2(g)(1)(i).

2. Location Test. On the preceding December 31, the bank, savings association, or credit

union had a home or Branch Office located in an MSA. 12 CFR 1003.2(g)(1)(ii).

For purposes of this location test, a Branch Office for a bank, savings association, or credit

union is an office: (a) of the bank, savings association, or credit union (b) that is considered

a branch by the institution’s Federal or State supervisory agency. For purposes of the

HMDA Rule, an automated teller machine or other free-standing electronic terminal is not a

Branch Office regardless of whether the supervisory agency would consider it a branch.

12 CFR 1003.2(c)(1). A Branch Office of a credit union is any office where member accounts

are established or loans are made, whether or not an agency has approved the office as a

branch. Comment 2(c)(1)-1.

3. Loan Activity Test. During the preceding calendar year, the bank, savings association, or

credit union originated at least one Home Purchase Loan or Refinancing of a Home

Purchase Loan secured by a first lien on a one-to-four-unit Dwelling.

12 CFR 1003.2(g)(1)(iii).

For more information on whether a loan is secured by a Dwelling, is a Home Purchase Loan,

or is a Refinancing of a Home Purchase Loan, see Sections 4.1.1.2 and 5.7.

4. Federally Related Test. The bank, savings association, or credit union:

a. Is federally insured; or

5

When determining whether it meets these criteria on or after January 1, 2018, a bank, savings association, or credit

union relies on the definitions in the HMDA Rule.

22 HOME MORTGAGE DISCLOSURE (REGULATION C) VERSION 5.0

b. Is federally regulated; or

c. Originated at least one Home Purchase Loan or Refinancing of a Home Purchase Loan

that was secured by a first lien on a one-to-four-unit Dwelling and also (i) was insured,

guaranteed or supplemented by a Federal agency or (ii) was intended for sale to Fannie

Mae or Freddie Mac. 12 CFR 1003.2(g)(1)(iv).

5. Loan-Volume Thresholds. The bank, savings association, or credit union meets or

exceeds either the loan-volume threshold for Closed-End Mortgage Loans or the loan-

volume threshold for Open-End Lines of Credit in each of the two preceding calendar years.

Effective January 1, 2018 through June 30, 2020, the loan-volume threshold for Closed-End

Mortgage Loans is 25 Closed-End Mortgage Loans, and effective July 1, 2020, the loan-

volume threshold for Closed-End Mortgage Loans is 100 Closed-End Mortgage Loans.

Effective January 1, 2018 through December 31, 2021, the loan-volume threshold for Open-

End Lines of Credit is 500 Open-End Lines of Credit, and effective January 1, 2022, the

loan-volume threshold for Open-End Lines of Credit is 200 Open-End Lines of Credit.

When the bank, savings association, or credit union determines whether it meets these loan-

volume thresholds, it does not count transactions excluded by 12 CFR 1003.3(c)(1) through (10)

and (13). 12 CFR 1003.2(g)(1)(v). These Excluded Transactions are discussed below in Section

4.1.2 in paragraphs 1 through 10 and in paragraph 13. For more information on Closed-End

Mortgage Loans, Open-End Lines of Credit, and Excluded Transactions, see Section 4.1.

When determining if it meets the loan-volume thresholds, a bank, savings association, or credit

union only counts Closed-End Mortgage Loans and Open-End Lines of Credit that it originated.

Only one institution is deemed to have originated a specific Closed-End Mortgage Loan or

Open-End Line of Credit under the HMDA Rule, even if two or more institutions are involved in

the origination process. Only the institution that is deemed to have originated the transaction

under the HMDA Rule counts it for purposes of the loan-volume threshold. Comments 2(g)-5;

see also comments 4(a)-2 through -4. For more information on how to determine whether an

institution is deemed to have originated a transaction under the HMDA Rule, see Section 4.2.3.

The HMDA Rule also includes a separate test to ensure that Financial Institutions that meet

only the Closed-End Mortgage Loan threshold are not required to report their Open-End Lines

of Credit, and that Financial Institutions that meet only the Open-End Line of Credit threshold

are not required to report their Closed-End Mortgage Loans. 12 CFR 1003.3(c)(11) and

(12). For more information, see Section 4.1.2.

23 HOME MORTGAGE DISCLOSURE (REGULATION C) VERSION 5.0

3.1.2 Nondepository financial institutions

Under the HMDA Rule, effective January 1, 2018, a for-profit mortgage-lending institution

(other than a bank, savings association, or credit union) is a Nondepository Financial

Institution, a Financial Institution, and subject to Regulation C if it meets BOTH

6

of the

following:

1. Location Test. The mortgage-lending institution had a home or Branch Office in an MSA

on the preceding December 31. The phrase “preceding December 31” refers to the December

31 immediately preceding the current calendar year. For example, in 2018, the preceding

December 31 is December 31, 2017. 12 CFR 1003.2(g)(2)(i).

For purposes of this location test, a Branch Office of a for-profit mortgage-lending

institution is: (a) any one of the institution’s offices (b) at which the institution takes from

the public Applications for Covered Loans. A mortgage-lending institution is also deemed to

have a Branch Office in an MSA if, in the preceding calendar year, it received Applications

for, originated, or purchased five or more Covered Loans related to property located in that

MSA. 12 CFR 1003.2(c)(2). For more information on Applications and Covered Loans, see

Section 4.

2. Loan-Volume Thresholds. The mortgage-lending institution meets or exceeds either the

Closed-End Mortgage Loan loan-volume threshold or the Open-End Line of Credit loan-

volume threshold in each of the two preceding calendar years. Effective January 1, 2018,

through June 30, 2020, the loan-volume threshold for Closed-End Mortgage Loans is 25

Closed-End Mortgage Loans, and effective July 1, 2020, the loan-volume threshold for

Closed-End Mortgage Loans is 100 Closed-End Mortgage Loans. Effective January 1, 2018

through December 31, 2021, the loan-volume threshold for Open-End Lines of Credit is 500

Open-End Lines of Credit, and effective January 1, 2022, the loan-volume threshold for

Open-End Lines of Credit is 200 Open-End Lines of Credit.

.

When an institution determines whether it meets the loan-volume thresholds, it does not count

transactions excluded by 12 CFR 1003.3(c)(1) through (10) and (13). 12 CFR 1003.2(g)(2)(ii).

These Excluded Transactions are discussed below in Section 4.1.2 in paragraphs 1 through 10

6

When determining whether it meets these criteria on or after January 1, 2018, a mortgage-lending institution relies

on the definitions in the HMDA Rule.

24 HOME MORTGAGE DISCLOSURE (REGULATION C) VERSION 5.0

and paragraph 13. For more information on Closed-End Mortgage Loans, Open-End Lines of

Credit, and Excluded Transactions, see Section 4.1.

When determining if it meets the loan-volume thresholds, a mortgage-lending institution only

counts Closed-End Mortgage Loans and Open-End Lines of Credit that it originated. Only one

institution is deemed to have originated a specific Closed-End Mortgage Loan or Open-End Line

of Credit under the HMDA Rule, even if two or more institutions are involved in the origination

process. Only the institution that is deemed to have originated the transaction under the HMDA

Rule counts it for purposes of the loan-volume threshold. Comment 2(g)-5. See also comments

4(a)-2 through -4. For more information on how to determine whether an institution is deemed

to have originated a transaction under the HMDA Rule, see Section 4.2.3. The HMDA Rule also

includes a separate test to ensure that Financial Institutions that meet only the Closed-End

Mortgage Loan threshold are not required to report their Open-End Lines of Credit, and that

Financial Institutions that meet only the Open-End Line of Credit threshold are not required to

report their Closed-End Mortgage Loans. 12 CFR 1003.3(c)(11) and (12). For more information,

see Section 4.1.2.

3.2 Exempt institutions

Regulation C provides that Financial Institutions may apply for an exemption from coverage,

and the HMDA Rule does not change this provision. Specifically, the Bureau may exempt a

State-chartered or State-licensed Financial Institution if the Bureau determines that the

Financial Institution is subject to a State disclosure law that contains requirements substantially

similar to those imposed by Regulation C and adequate enforcement provisions. Any State-

licensed or State-chartered Financial Institution or association of such institutions may apply to

the Bureau for an exemption. An exempt institution shall submit the data required by State law

to its State supervisory agency. 12 CFR 1003.3(a). A Financial Institution that loses its

exemption must comply with Regulation C beginning with the calendar year following the year

for which it last reported data under the State disclosure law. 12 CFR 1003.3(b).

25 HOME MORTGAGE DISCLOSURE (REGULATION C) VERSION 5.0

4. Transactional coverage

A Financial Institution is required to collect, record, and report information only for

transactions that are subject to Regulation C. Effective January 1, 2018, the HMDA Rule

changes the types of transactions that are subject to Regulation C. This guide uses the

capitalized term Covered Loan to refer to a loan or line of credit that is subject to Regulation C,

effective January 1, 2018. As of that date, a Financial Institution is required to collect, record,

and report information only for a transaction that involves a Covered Loan, such as the

origination or purchase of a Covered Loan.

A Financial Institution can use Section 4.1 of this guide, below, for assistance in determining

whether a transaction involves a Covered Loan.

After a Financial Institution has determined that a transaction involves a Covered Loan, it can

use Section 4.2 for assistance in determining whether the HMDA Rule requires it to collect,

record, and report information related to the transaction. A Financial Institution can use

Section 4.3 to help it determine if a transaction that involves a Covered Loan is partially exempt

from some of the HMDA Rule’s requirements for collecting, recording, and reporting

information.

4.1 Covered loans

A Covered Loan can be either a Closed-End Mortgage Loan or an Open-End Line of Credit (see

Section 4.1.1), but an Excluded Transaction cannot be a Covered Loan (see Section 4.1.2).

12 CFR 1003.2(e).

To determine if a transaction is subject to amended Regulation C, effective January 1, 2018, a

Financial Institution should first determine whether the loan or line of credit involved in the

transaction is either a Closed-End Mortgage Loan or an Open-End Line of Credit. See Section

4.1.1. If the loan or line of credit is neither a Closed-End Mortgage Loan nor an Open-End Line

of Credit, the transaction does not involve a Covered Loan, and the Financial Institution is not

required to report the transaction. If the loan or line of credit is either a Closed-End Mortgage

Loan or an Open-End Line of Credit, the Financial Institution must determine if the Closed-End

Mortgage Loan or Open-End Line of Credit is an Excluded Transaction. See Section 4.1.2. If the

26 HOME MORTGAGE DISCLOSURE (REGULATION C) VERSION 5.0

Closed-End Mortgage Loan or an Open-End Line of Credit is an Excluded Transaction, it is not a

Covered Loan, and the Financial Institution is not required to report the transaction. If the loan

or line of credit is a Closed-End Mortgage Loan or an Open-End Line of Credit and is not an

Excluded Transaction, the Financial Institution may be required to report information related to

the transaction. See Sections 4.2 and 4.3.

4.1.1 Closed-end mortgage loans and open-end lines of

credit

A Closed-End Mortgage Loan is:

1. An extension of credit;

2. Secured by a lien on a Dwelling; and

3. Not an Open-End Line of Credit. 12 CFR 1003.2(d).

An Open-End Line of Credit is:

1. An extension of credit;

2. Secured by a lien on a Dwelling; and

3. An open-end credit plan for which:

a. The lender reasonably contemplates repeated transactions;

b. The lender may impose a finance charge from time-to-time on an outstanding unpaid

balance; and

c. The amount of credit that may be extended to the borrower during the term of the plan

(up to any limit set by the lender) is generally made available to the extent that any

outstanding balance is repaid. 12 CFR 1003.2(o); 12 CFR 1026.2(a)(20).

27 HOME MORTGAGE DISCLOSURE (REGULATION C) VERSION 5.0

Financial Institutions may rely on Regulation Z, 12 CFR 1026.2(a)(20),

7

and its official

commentary when determining whether a transaction is extended under a plan for which the

lender reasonably contemplates repeated transactions, the lender may impose a finance charge

from time-to-time on an outstanding unpaid balance, and the amount of credit that may be

extended to the borrower during the term of the plan is generally made available to the extent

that any outstanding balance is repaid.

A business-purpose transaction that is exempt from Regulation Z but is otherwise open-end

credit under Regulation Z, 12 CFR 1026.2(a)(20), would be an Open-End Line of Credit under

the HMDA Rule if it is an extension of credit secured by a lien on a Dwelling and is not an

Excluded Transaction. Comment 2(o)-1.

4.1.1.1 Extension of credit

A closed-end loan or open-end line of credit is not a Closed-End Mortgage Loan or an Open-End

Line of Credit under the HMDA Rule unless it involves an extension of credit. Depending on the

facts and circumstances, some transactions completed pursuant to installment sales contracts,

such as some land contracts, may not be Closed-End Mortgage Loans because no credit is

extended. Comment 2(d)-2. Individual draws on an Open-End Line of Credit are not separate

extensions of credit. Comment 2(o)-2.

Under the HMDA Rule, an “extension of credit” generally requires a new debt obligation.

Comment 2(d)-2. Thus, for example, a loan modification where the existing debt obligation is

not satisfied and replaced is not generally a Covered Loan (i.e., Closed-End Mortgage Loan or

Open-End Line of Credit) under the HMDA Rule. Except as described below, if a transaction

modifies, renews, extends, or amends the terms of an existing debt obligation, but the existing

debt obligation is not satisfied and replaced, the transaction is not a Covered Loan. It is

important to note that the HMDA Rule defines the phrase “extension of credit” differently than

Regulation B, 12 CFR part 1002.

8

Comment 2(d)-2 and 2(o)-2.

The HMDA Rule provides two narrow exceptions to the requirement that an “extension of

credit” involve a new debt obligation. The exceptions are designed to capture transactions that

7

Regulation Z, 12 CFR part 1026, implements the Truth in Lending Act.

8

Regulation B, 12 CFR part 1002, implements the Equal Credit Opportunity Act.

28 HOME MORTGAGE DISCLOSURE (REGULATION C) VERSION 5.0

the Bureau believes are substantially similar to new debt obligations and should be treated as

such.

First, the HMDA Rule maintains Regulation C’s coverage of loan assumptions, even if no new

debt obligation is created. A loan assumption is a transaction in which a Financial Institution

enters into a written agreement accepting a new borrower in place of an existing borrower as the

obligor on an existing debt obligation. The HMDA Rule clarifies that, under Regulation C,

assumptions include successor-in-interest transactions in which an individual succeeds the

prior owner as the property owner and then assumes the existing debt secured by the property.

Assumptions are extensions of credit under the HMDA Rule even if the new borrower merely

assumes the existing debt obligation and no new debt obligation is created. Comment 2(d)-2.i.

Second, the HMDA Rule provides that a transaction completed pursuant to a New York State

consolidation, extension, and modification agreement and classified as a supplemental

mortgage under New York Tax Law Section 255, such that the borrower owes reduced or no

mortgage recording taxes, (New York CEMA) is an extension of credit under the HMDA Rule.

However, the HMDA Rule also provides that certain transactions providing new funds that are

consolidated into a New York CEMA are excluded from the HMDA reporting requirements.

Comment 2(d)-2.ii. See Section 4.1.2 for additional information on the exclusion for certain

transactions consolidated into a New York CEMA.

4.1.1.2 Secured by a lien on a dwelling

A loan is not a Closed-End Mortgage Loan and a line of credit is not an Open-End Line of Credit

unless it is secured by a lien on a Dwelling.

A Dwelling is a residential structure. There is no requirement that the structure be attached to

real property or that it be the applicant’s or borrower’s residence. Examples of Dwellings

include:

1. Principal residences;

2. Second homes and vacation homes;

3. Investment properties;

4. Residential structures attached to real property;

5. Detached residential structures;

29 HOME MORTGAGE DISCLOSURE (REGULATION C) VERSION 5.0

6. Individual condominium and cooperative units;

7. Manufactured Homes

9

or other factory-built homes; and

8. Multifamily residential structures or communities, such as apartment buildings,

condominium complexes, cooperative

buildings or housing complexes, and

Manufactured Home communities.

12 CFR 1003.2(f); comments 2(f)-1

and -2.

A Dwelling is not limited to a structure

that has four or fewer units and includes a

Multifamily Dwelling, which is a Dwelling

that contains five or more individual

dwelling units. A Multifamily Dwelling

includes a Manufactured Home

community.

A loan related to a Manufactured Home community is secured by a Dwelling even if it is not

secured by any individual Manufactured Homes, but is secured only by the land that constitutes

9

A Manufactured Home is a residential structure that satisfies the definition of “manufactured home” in the U.S.

Department of Housing and Urban Development’s (HUD’s) regulations, 24 CFR 3280.2, for establishing

manufactured home construction and safety standards. 12 CFR 1003.2(l). A modular home or factory-b uil t home

that does not meet HUD’s regulations is not a Manufactured Home under the HMDA Rule. A Manufactured Home

will generally bear a HUD Certification Label and data plate noting compliance with the Federal standards.

Comment 2(l)-2.

A loan is not secured by a Multifamily

Dwelling for purposes of the HMDA Rule

merely because it is secured by five or more

individual units. In order for a loan to be

secured by a Multifamily Dwelling, the

Dwelling must contain five or more

individual units. See comment 2(n)-3 for

examples of when a loan is and is not secured

by a Multifamily Dwelling.

Examples: A landlord obtains a closed-end mortgage loan from a Financial Institution

and uses the proceeds to improve five separate Dwellings, each with one individual unit,

located in different parts of a town. The loan is secured by the five separate Dwellings,

but is not secured by a Multifamily Dwelling.

An investor obtains a closed-end mortgage loan from a Financial Institution and uses the

proceeds to purchase ten individual condominium units in a 100-unit condominium

complex. The loan is secured by the ten individual units, but not by the entire

condominium complex. The loan is secured by the ten separate Dwellings, but is not

secured by a Multifamily Dwelling.

30 HOME MORTGAGE DISCLOSURE (REGULATION C) VERSION 5.0

the Manufactured Home community. However, a loan related to a multifamily residential

structure or community other than a Manufactured Home community is not secured by a

Dwelling unless it is secured by one or more individual dwelling units. For example, a loan that

is secured only by the common areas of a condominium complex or only by an assignment of

rents from an apartment building is not secured by a Dwelling. Comment 2(f)-2.

The following are not Dwellings:

1. Recreational vehicles, such as boats, campers, travel trailers, or park model recreational

vehicles;

2. Houseboats, floating homes, or mobile homes constructed before June 15, 1976;

3. Transitory residences, such as hotels, hospitals, college dormitories, or recreational

vehicle parks; and

4. Structures originally designed as a Dwelling but used exclusively for commercial

purposes, such as a home converted to a daycare facility or professional office. Comment

2(f)-3.

A property that is used for both residential and commercial purposes, such as a building that has

apartment and retail units, is a Dwelling if the property’s primary use is residential. Comment

2(f)-4.

A property used for both long-term housing and to provide assisted living or supportive housing

services is a Dwelling. However, transitory residences used to provide such services are not

Dwellings. Properties used to provide medical care, such as skilled nursing, rehabilitation, or

long-term medical care, are not Dwellings. If a property is used for long-term housing, to

provide related services (such as assisted living) and to provide medical care, the property is a

Dwelling if its primary use is residential. Comment 2(f)-5.

A Financial Institution may use any reasonable standard to determine a property’s primary use,

such as square footage, income generated, or number of beds or units allocated for each use. It

may select the standard on a case-by-case basis. Comments 2(f)-4 and -5.

4.1.2 Excluded transactions

Regulation C does not apply to transactions that are specifically excluded from coverage.

12 CFR 1003.3(c). Therefore, an Excluded Transaction is not a Covered Loan. The HMDA Rule

31 HOME MORTGAGE DISCLOSURE (REGULATION C) VERSION 5.0

retains and clarifies existing categories of transactions that are excluded from coverage. It also

expands the existing exclusion for agricultural loans, and adds new categories of transactions

that are excluded from coverage. Effective January 1, 2018, the following are Excluded

Transactions:

1. A Closed-End Mortgage Loan or an Open-End Line of Credit that a Financial Institution

originates or purchases in a fiduciary capacity, such as a Closed-End Mortgage Loan or an

Open-End Line of Credit that a Financial Institution originates or purchases as a trustee.

12 CFR 1003.3(c)(1); comment 3(c)(1).

2. A Closed-End Mortgage Loan or an Open-End Line of Credit secured by a lien on

unimproved land. 12 CFR 1003.3(c)(2). Generally, a loan or line of credit must be secured

by a Dwelling to be a Covered Loan. The HMDA Rule also lists Closed-End Mortgage Loans

and Open-End Lines of Credit secured only by vacant or unimproved land as Excluded

Transactions. However, a loan or line of credit secured by a lien on unimproved land is

deemed to be secured by a Dwelling (and might not be excluded) if the Financial Institution

knows, based on information that it receives from the applicant or borrower at the time the

Application is received or the credit decision is made, that the proceeds of that loan or credit

line will be used within two years after closing or account opening to construct a Dwelling

on, or to purchase a Dwelling to be placed on, the land. Comment 3(c)(2)-1.

32 HOME MORTGAGE DISCLOSURE (REGULATION C) VERSION 5.0

3. A Closed-End Mortgage Loan or an Open-End Line of Credit that is temporary financing. A

transaction is excluded as temporary financing if it is designed to be replaced by separate

permanent financing extended to the same borrower at a later time. The separate

permanent financing may be extended by any lender (i.e., by either the lender that extended

the temporary financing or another lender). A construction-only loan or line of credit is

considered temporary financing and excluded under the HMDA Rule if the loan or line of

credit is extended to a person exclusively to construct a Dwelling for sale.

Comment 3(c)(3)-2.

4. The purchase of an interest in a pool of Closed-End Mortgage Loans or Open-End Lines of

Credit, such as mortgage-participation certificates, mortgage-backed securities, or real estate

mortgage investment conduits. 12 CFR 1003.3(c)(4); comment 3(c)(4)-1.

Examples: Ficus Bank extends a bridge or swing loan to finance a borrower’s down

payment for a home purchase. The borrower will pay off the bridge or swing loan with

funds from the sale of his or her existing home and obtain permanent financing from

Ficus Bank at that time. The bridge or swing loan is excluded as temporary financing.

Ficus Bank extends a construction loan to a borrower to finance construction of the

borrower’s Dwelling. The borrower will obtain a new extension of credit for permanent

financing of the Dwelling from either Ficus Bank or another lender. Ficus Bank renews

the construction loan several times before the borrower obtains a new extension of credit

from another lender for permanent financing. The construction loan is excluded as

temporary financing.

Ficus Bank extends a construction loan to a borrower to finance construction of the

borrower’s Dwelling. The construction loan will automatically convert to permanent

financing after the construction phase is complete. The construction loan is not

temporary financing because it is not designed to be “replaced by” separate permanent

financing.

Ficus Bank extends a nine-month loan to an investor, who uses the loan proceeds to

purchase a home, renovate it, and sell it before the loan term expires. The loan is not

temporary financing because it is not designed to be “replaced by” separate permanent

financing.

33 HOME MORTGAGE DISCLOSURE (REGULATION C) VERSION 5.0

5. The purchase solely of the right to service Closed-End Mortgage Loans or Open-End Lines of

Credit. 12 CFR 1003.3(c)(5).

6. The purchase of a Closed-End Mortgage Loan or an Open-End Line of Credit as part of a

merger or acquisition or as part of the acquisition of all of a Branch Office’s assets and

liabilities. 12 CFR 1003.3(c)(6); comment 3(c)(6)-1. For more information on mergers and

acquisitions under the HMDA Rule, see Section 8.

7. A Closed-End Mortgage Loan or an Open-End Line of Credit, or an Application for a Closed-

End Mortgage Loan or Open-End Line of Credit, for which the total dollar amount is less

than $500. 12 CFR 1003.3(c)(7).

8. The purchase of a partial interest in a Closed-End Mortgage Loan or an Open-End Line of

Credit. 12 CFR 1003.3(c)(8); comment 3(c)(8)-1.

9. A Closed-End Mortgage Loan or an Open-End Line of Credit if the proceeds are used

primarily for agricultural purposes or if the Closed-End Mortgage Loan or Open-End Line of

Credit is secured by a Dwelling that is located on real property that is used primarily for

agricultural purposes. 12 CFR 1003.3(c)(9); comment 3(c)(9)-1. The HMDA Rule directs

Financial Institutions to Regulation Z’s official commentary for guidance on what is an

agricultural purpose. Regulation Z’s official commentary states that agricultural purposes

include planting, propagating, nurturing, harvesting, catching, storing, exhibiting,

marketing, transporting, processing, or manufacturing food, beverages, flowers, trees,

livestock, poultry, bees, wildlife, fish or shellfish by a natural person engaged in farming,

fishing, or growing crops, flowers, trees, livestock, poultry, bees or wildlife. See comment

3(a)-8 in the official interpretations of Regulation Z, 12 CFR part 1026. A Financial

Institution may use any reasonable standard to determine the primary use of the property,

and may select the standard to apply on a case-by-case basis. Comment 3(c)(9)-1.

10. A Closed-End Mortgage Loan or an Open-End Line of Credit that is or will be made

primarily for business or commercial purposes, unless it is a Home Improvement Loan, a

Home Purchase Loan, or a Refinancing. 12 CFR 1003.3(c)(10). Not all transactions that are

primarily for a business purpose are Excluded Transactions. Thus, a Financial Institution

must collect, record, and report data for Dwelling-secured, business-purpose loans and lines

of credit that are Home Improvement Loans, Home Purchase Loans, or Refinancings if no

other exclusion applies. For more information on determining whether a loan or line of

credit is a Home Purchase Loan, Home Improvement Loan, or Refinancing, see Section 5.7.

The HMDA Rule provides that, if a Closed-End Mortgage Loan or an Open-End Line of

Credit is deemed to be primarily for a business, commercial, or organizational purposes

34 HOME MORTGAGE DISCLOSURE (REGULATION C) VERSION 5.0

under Regulation Z, 12 CFR 1026.3(a) and its official commentary, then the loan or line of

credit also is deemed to be primarily for a business or commercial purpose under the HMDA

Rule. Comment 3(c)(10)-2. For more information and examples of business-purpose or

commercial-purpose transactions that are Covered Loans, see comment 3(c)(10)-3 and -4.

11. A Closed-End Mortgage Loan if the Financial Institution originated fewer than the

applicable threshold forClosed-End Mortgage Loans in either of the two preceding calendar

years. 12 CFR 1003.3(c)(11); comment 3(c)(11)-1. Effective January 1, 2018 until June 30,

2020, the applicable threshold is 25 Closed-End Mortgage Loans, and effective July 1, 2020,

the applicable threshold is 100 Closed-End Mortgage Loans. A Financial Institution is not

required to collect, record, or report Closed-End Mortgage Loans if it originated fewer than

the applicable theshold in either of the two preceding calendar years. However, the