Comparison of Air Trac Management

related operational and economic

performance

U.S. - Europe

January 2024

This report is a joint publication of the Air Traffic Organization of the FAA (FAA-ATO System

Operations Services) and of the EUROCONTROL Aviation Intelligence Unit (AIU) on behalf of the

European Commission in the interest of the exchange of information.

It is prepared in application of Appendix 2 to Annex 1 of the Memorandum of Cooperation NAT-I-

9406A signed between the United States of America and the European Union on 13 December 2017

and managed by a joint European Commission-FAA Performance Analysis Review Committee

(PARC).

The objective is to make a factual high-level comparison of Air Traffic Management (ATM)

performance between the U.S. and Europe based on a set of comparable performance indicators,

developed jointly, and reviewed over time.

Rolf Tuchhardt

PARC Co-Chair, European Commission

Kevin Hanson

PARC Co-Chair, U.S., FAA

COPYRIGHT NOTICE AND DISCLAIMER

Every possible effort was made to ensure that the information and analysis contained in this document

are as accurate and complete as possible. Should you find any errors or inconsistencies we would be

grateful if you could bring them to our attention.

The document may be copied in whole or in part, provided that the copyright notice and disclaimer

are included and it is not used for commercial purposes (i.e. for financial gain). The information

contained in this document may not be modified without prior written permission from the Air Traffic

Organization System Operations Services or the European Commission.

The views expressed herein do not necessarily reflect the official views or policy of the FAA, the

European Commission or EUROCONTROL, which make no warranty, either implied or express, for the

information contained in this document, neither do they assume any legal liability or responsibility for

the accuracy, completeness or usefulness of this information.

© Air Traffic Organization System Operations Services (FAA-ATO)

© European Commission (EC)

© European Organisation for the Safety of Air Navigation (EUROCONTROL)

i EXECUTIVE SUMMARY

U.S. – Europe Comparison of ANS performance (Edition 2023)

EXECUTIVE SUMMARY

KEY MESSAGES

INTRODUCTION

• This report is the eighth in a series of

comparisons between the U.S. and Europe.

• The objective of the work conducted by the

U.S. Air Traffic Organization (FAA-ATO)

Office of Performance Analysis and the

EUROCONTROL Aviation Intelligence Unit

(AIU) is to compare, understand, and further

improve air traffic management (ATM)

performance in both systems.

• The report looks at the operational and

economic ATM performance in both systems

since the outbreak of the pandemic in 2020.

Where appropriate, it also follows up on

longer term trends and differences in ATM

performance between the U.S. and Europe,

identified in previous reports.

• Russia’s invasion of Ukraine in February 2022

and the unfolding effects of the war also

influenced the analyses in this report. While

most European traffic is not directly affected

by the resulting airspace closures, there are

substantial direct operational and economic

impacts on several States in the region.

• To ensure comparability based on a common

set of data sources with a sufficient level of

detail and coverage, the operational

comparison of Air Navigation Service (ANS)

performance was limited to flights to or from

the main 34 airports for IFR traffic in the U.S.

and in Europe which account for

approximately 68% and 65% of the controlled

flights in Europe and the U.S., respectively.

ORGANISATION OF ATM

• For the interpretation of the results, it is

useful to start with a summary of the

organization of ATM in the U.S. and in

Europe.

• While both systems are operated with similar

technology and operational concepts, a

significant distinguishing factor is that the

U.S. airspace is handled by a single air

navigation service provider (ANSP) while

Europe is managed by close to 40 different

service providers.

• In 2022, the U.S. controlled notably more

flights operating under instrumental flight

rules (IFR) with less controllers and less en-

route control centres.

• Despite the efforts of the Single European

Sky Initiative to reduce fragmentation and to

better organise European airspace according

to traffic flows rather than national

boundaries, many issues in Europe revolve

around the level of fragmentation and its

impact on ATM performance in terms of

operations and costs.

FLOW MANAGEMENT TECHNIQUES

• To minimize the effects of ATM-related

constraints, the U.S. and Europe use

comparable methodologies to balance

demand and capacity but both systems differ

notably in the timing (when) and the phase of

flight (where) air traffic flow management

(ATFM) measures are applied.

• In Europe, a lot of emphasis is put on strategic

planning and a large part of the demand/

capacity management measures are applied

months in advance. Unlike in the U.S. where

only 3 airports have schedule limitations,

traffic at major European airports is usually

ii EXECUTIVE SUMMARY

U.S. – Europe Comparison of ANS performance (Edition 2023)

already regulated (in terms of volume and

concentration) in the strategic phase through

an airport scheduling process.

• With no or very limited en-route spacing or

metering in Europe, the focus in Europe is on

anticipating demand/ capacity imbalances in

en-route centres or at airports and, if

necessary, to solve them by delaying aircraft

at the origin airports on the ground

(allocation of ATFM take-off slots).

• In the U.S., the emphasis is more on the

tactical traffic management in the gate-to-

gate phase to maximize system and airport

throughput under prevailing conditions on

the day of operations. The approach

is supported by the en-route function and less

en-route capacity constraints than in Europe.

This enables delay to be absorbed through

path stretching in the en-route airspace

and to achieve the metering required by

TMAs and airports.

• Hence, many issues in the U.S. appear to be

attributable to the effects of capacity

variation between most favourable and least

favourable conditions at airports, with

demand levels near visual airport capacity

and self-controlled by airlines.

• The way imbalances between capacity and

demand are managed along the trajectory of

a flight has an impact on airspace users

(predictability, fuel burn), the utilisation of

capacity (en-route, airport), and the

environment (additional CO2 emissions).

• Both systems try to optimize the use of

available capacity in a safe and efficient

manner.

• The comparison of performance based on a

set of harmonised indicators provides

insights for a more holistic assessment of

ATM in both regions, including the

identification of future research areas.

TRAFFIC

• In terms of controlled traffic, there was a

notable decoupling between the U.S. and

Europe as of 2003.

• While traffic continued to increase in Europe,

the U.S. experienced a decline until 2016,

after which traffic began to rise again until the

onset of the pandemic in March 2020.

• Between 2003 and 2019, traffic in Europe

grew by +31% (+2.5 million flights) while

flights in the U.S. CONUS area decreased

by -7% (-1.2 million flights) during the same

period.

• In 2003, the U.S. managed more than twice

the traffic of Europe. However, by 2019, this

margin had diminished to approximately 50%

more flights in the U.S.

• Following the outbreak of the COVID-19

pandemic in the first quarter of 2020, traffic

on both sides of the Atlantic dropped

dramatically. Compared to 2019, traffic in the

U.S. decreased in 2020 by -33% with Europe

showing an even higher drop of -56% vs 2019.

• After passing the low point in April 2020,

traffic in the U.S. increased continuously

whereas in Europe traffic remained at a low

level until summer 2021 when it began to

recover again. In 2022, traffic in the U.S. was

still -6.7% below 2019 levels while in Europe

traffic remained -16.9% below 2019 levels.

• The notable difference in the initial traffic

reduction and in the recovery paths can be

attributed primarily to the predominantly

domestic traffic in the U.S. (80% of flights),

which rebounded more quickly than the

largely intra-European traffic which was

subject to a multitude of national travel

restrictions.

Average daily IFR flights (2022)

Avg. per day change vs 2019

40,514

23,758

US (CONUS)

Europe

-6.7%

-16.9%

iii EXECUTIVE SUMMARY

U.S. – Europe Comparison of ANS performance (Edition 2023)

PUNCTUALITY

• “Punctuality” is a widely used industry

standard to measure the service quality of air

transport. It is expressed as the percentage of

flights arriving (or departing) within 15

minutes of their published schedule time.

• In 2019, 80.1% of flights in the U.S. arrived

within 15 minutes of their scheduled time,

compared to 76.5% in Europe.

• As the pandemic began in early 2020, both

systems experienced an uptick in punctuality

due to the decrease in traffic. In 2020, nearly

90% of flights at U.S. airports arrived at their

destinations within 15 minutes of their

scheduled time, compared to 87% in Europe.

• As traffic began to rebound, punctuality

levels began to deteriorate again on both

sides of the Atlantic. In the U.S., arrival

punctuality consistently worsened from 2020

through mid-2023, falling below the levels

observed in 2019. Meanwhile, in Europe,

arrival punctuality initially experienced a

moderate decline in 2021 but then reached its

all-time lowest point in the summer of 2022.

• Despite European traffic levels remaining

notably below those of 2019, it became

evident that several service providers were ill-

prepared to scale up their operations to meet

the rapidly increasing demand. The subpar

performance in Europe did not stem from a

single area (such as airports, airlines, or air

traffic control) but rather resulted from

deficiencies across multiple actors, primarily

associated with staff shortages.

• While punctuality provides valuable first

insights, the involvement of many different

stakeholders and the inclusion of time buffers

in airline schedules limit the analysis from an

air traffic management point of view.

OPERATIONAL ANS PERFORMANCE

• The analysis of ATM-related operational

performance aims to better understand and

quantify constraints imposed on airspace

users through the application of air traffic

flow measures and therefore focuses more

on the efficiency of operations by phase of

flight, compared to an (unconstrained)

theoretical optimum.

• It is worth noting that a certain level of flight

inefficiency is necessary or even desirable

for a system to be run efficiently without

underutilization of available resources

(capacity efficiency).

• Hence, the theoretical optimum cannot be

achieved at system level when operational

trade-offs, environmental or political

restrictions, or other performance affecting

factors such as weather conditions are

considered.

• The goal should be to minimize overall

direct (fuel, etc.) and strategic (schedule

buffer, etc.) costs and the impact on

environment whilst maximizing the

utilization of available capacity.

ANS-RELATED DEPARTURE RESTRICTIONS

(ATFM/EDCT DELAYS)

• Both the U.S. and Europe report ATM-

related delay imposed on departing flights

at the gate (ATFM/EDCT delays).

• In 2022 both regions show an improvement

compared to 2019. However, the

ATFM/EDCT delay per flight in Europe was

more than twice as high as in the U.S., with

fundamental differences in underlying

drivers and the constraining locations.

• It is worth pointing out that 2018 and 2019

were particularly bad years with

Arrival punctuality - flights to/from main 34 airports (2022)

% of arrivals delayed by less than 15 minutes

Arrival punctuality (%) change vs 2019

(percentage points)

78.5%

70.9%

US

(CONUS)

Europe

-1.6%

-5.6%

ATFM/EDCT delay per flight (2022)

flights to/from main 34 airports within region

Only delays >= 15 mins are included

Avg. min per flight change vs 2019

1.0

2.2

US (CONUS)

Europe

-1.0

-0.2

iv EXECUTIVE SUMMARY

U.S. – Europe Comparison of ANS performance (Edition 2023)

exceptionally high ATFM delays in Europe

after a continuous degradation of

performance since 2013, mainly because of

growing en-route capacity constraints.

• In the U.S. most ATFM/EDCT delays in 2022

were due to airports (66%) while in Europe

most delays (75%) were attributed to en-

route facilities.

• By far the main reason for delays in the U.S.

in 2022 was adverse weather (76%) with a

high share originating from airports.

• In Europe, the main causes in 2022 were

ATC capacity/staffing related constraints

(44%), followed by adverse weather (29%)

and “Other” reasons (mainly due to ATC

system upgrades and the war in Ukraine).

TAXI-OUT EFFICIENCY

• Following the COVID-19 related traffic

reduction, additional taxi-out time in the

U.S. initially showed a substantial reduction

but increased again in line with the traffic

recovery and ultimately reached a level

comparable to the pre-pandemic period.

• In Europe, a similar trend was observed.

However, in line with the slower traffic

recovery, average additional taxi out time

remained low until 2022 when it started to

increase again to almost reach pre-

pandemic levels.

• In 2022, taxi-out efficiency was still better

than in 2019 on both sides of the Atlantic.

• Nonetheless, average additional taxi-out

time in the U.S. is roughly twice the

additional taxi-out time in Europe. This

disparity primarily arises from differences in

flow control policies, with the U.S. adopting

a more tactical approach, and the absence

of scheduling caps at most U.S. airports.

HORIZONTAL EN-ROUTE FLIGHT EFFICIENCY

• Overall, the level of horizontal en-route

flight inefficiency in both regions was at

similar levels in 2022 with a slightly better

performance in the U.S.

• The significant decrease in traffic following

the COVID-19 outbreak briefly led to a

temporary improvement of horizontal en-

route flight efficiency in both Europe and

the U.S. Nevertheless, as traffic began to

recover, flight efficiency deteriorated again,

returning to pre-pandemic levels on both

sides of the Atlantic.

• Between 2019 and 2022, horizontal en-

route flight inefficiency in the U.S. slightly

reduced, while it increased in Europe during

the same period, partly because of the

impact of the war in Ukraine.

FLIGHT EFFICIENCY WITHIN THE LAST 100NM

• Prior to the pandemic, Europe had a

significantly higher average additional time

within the last 100 nautical miles, which was

notably influenced by London Heathrow as

a distinct outlier.

• With traffic levels in Europe still notably

lower in 2022, the level of inefficiency due to

airborne holding and metering was similar in

both regions.

• Compared to 2019, both the U.S. and

Europe show an improved performance in

2022, albeit at lower traffic levels at most

airports.

Additional taxi out time (2022)

departures from the main 34 airports

Avg. min per departure change vs 2019

6.3

2.9

US (CONUS)

Europe

-0.8

-0.8

Horizontal en-route flight inefficiency (2022)

flights to and from the main 34 airports

route extension (%) change vs 2019

(percentage points)

3.0%

3.3%

US (CONUS)

Europe

-0.11%

0.15%

Additional time within the last 100 NM (2022)

arrivals at the main 34 airports

Avg. min per arrival change vs 2019

2.22

2.35

US (CONUS)

Europe

-0.3

-0.8

v EXECUTIVE SUMMARY

U.S. – Europe Comparison of ANS performance (Edition 2023)

ANS-RELATED PERFORMANCE – Overview

• As there are many trade-offs between flight

phases, the aggregation of the results

enables a high-level comparison of the

theoretical maximum “benefit pool”

actionable by ATM in both systems.

• It is important to emphasize that the

"benefit pool" is based on a theoretical

optimum which, due to inherent necessary

(safety) or desired (capacity) limitations, is

not achievable at system level.

• Overall, the relative distribution of the ATM-

related inefficiencies associated with the

different phases of flight is consistent with

the differences in flow management

strategies described throughout the report.

• In Europe ATM-related departure delays

(ATFM/EDCT) at the gate are much more

frequently used than in the U.S., which leads

to a higher average delay and a higher share

of traffic affected. Consequently, flights in

Europe are 5 times more likely to be held at

the gate than in the U.S. because of en-

route capacity constraints.

• In the U.S. the additional taxi-out time is

twice as high as in Europe, mainly because

of the more tactical focus to maximise

throughput under prevailing conditions on

the day of operations.

• Overall, the total benefit pool in 2022 was

higher in the U.S. than in Europe, but with

traffic levels in the U.S. notably closer to

pre-pandemic levels.

• To get a more complete picture of ANS

performance in each region, there is a need

to also consider capacity utilization

together with the observed “benefit pool”.

ANS COST-EFFICIENCY

• Between 2011 and 2019 traffic grew

considerably in both the SES States

(+19.3%) and in the U.S. (+8.7%); even so,

the U.S. still controlled 84% more flight-

hours than SES States in 2019. In the

meantime, the ATM/CNS provision costs for

the ANSPs in the SES States increased

slightly (+2.1%), while the U.S. FAA-ATO

reduced its cost-base by -11.2% primarily

reflecting a decrease in total support costs,

partly due to a change in accounting

methodology. Consequently, the ATM/CNS

provision costs per flight-hour reduced

considerably for both the SES States

(-14.4%) and the U.S. (-18.4%) over this

period.

• Cost-efficiency metrics in both the SES

States and the U.S. were significantly

impacted by the sharp decline in flight hours

controlled brought about by the

implementation of stringent travel

restrictions aimed at mitigating the spread

of COVID-19.

• The influence of the COVID-19 pandemic on

the total number of IFR flight-hours logged

in 2021 had a notably more pronounced

effect on the SES States, where there was a

decrease of -44.6% compared to 2019, as

opposed to the U.S., which saw a decrease

of -19.9% compared to 2019.

• Both the SES States and the U.S.

implemented cost-containment measures

reducing the ATM/CNS provision costs

between 2019 and 2021 by -7.0% and -1.8%

respectively.

• The total ATM/CNS provision costs per

flight-hour experienced a significant rise on

both sides of the Atlantic after the onset of

the COVID-19 pandemic in 2020. However,

in the U.S., the increase was notably less

pronounced than in the SES States, with a

difference of +22.6% compared to +67.9%,

respectively. This contrast can be mainly

Theoretical maximum benefit pool actionable by ATM (2022)

Avg. min change vs 2019 Avg. min change vs 2019

1.0

6.3

2.3

2.2

11.8

ATFM/EDCT delay

per flight

Add. taxi out time

per departure

Horizonal en-route

flight inefficiency

Terminal area

inefficiency

Benefit pool

-1.0

-0.8

-0.1

-0.3

-2.2

2.2

2.9

2.5

2.4

10.0

-0.2

-0.8

0.1

-0.8

-1.6

U.S. (CONUS)

Europe

vi EXECUTIVE SUMMARY

U.S. – Europe Comparison of ANS performance (Edition 2023)

attributed to the considerably smaller

reduction in traffic in the U.S.

• In 2021, the total ATM/CNS provision costs

in the U.S. were 47% higher than those in

the SES States, but it's important to note

that the U.S. also managed more than

double the number of IFR flight-hours

compared to the SES States. This was

achieved with approximately 10.2% fewer

ATCOs in OPS (FTE) than in the SES States,

who worked, on average, longer than their

European counterparts.

• As a result, the average U.S. ATCO was

some 1.5 times more productive (in terms of

IFR flight-hours controlled per ATCO-hour

on duty) than the controllers in the SES

States.

EMERGING THEMES

• The findings in this report continue to

demonstrate that it is practical to examine

two different aviation systems and develop

key performance indicators using

harmonized procedures.

• This common approach allows both groups

to examine the essential questions on the

extent performance differences are driven

by policy, ATM operating strategies, or

prevailing organisational, meteorological

and/or economic conditions.

• Given the key elements affecting

performance in the two systems, further

work in the following areas could provide

useful insights for performance

improvement in both systems.

ANS OPERATIONAL PERFORMANCE

• Magnitude and Effect of Traffic Flow

Initiatives: More work is needed to

determine how to minimize the impact of

flow measures on airspace users and the

environment in each flight phase while

maximizing the use of scarce airport and en-

route capacity.

• Quantify capacity utilization: A better

understanding of tactical capacities at

airports but also in en-route centres would

strengthen the comparison and enable a

more complete assessment of flow

management together with capacity

utilization.

• Factors affecting en-route flight efficiency:

Future reports could provide some initial

evaluations of those factors impacting en-

route flight efficiency in each region (trade-

offs, special use airspace, TMA entry points,

weather impact, etc.).

• Vertical flight efficiency: More work is

required to improve the assessment of

vertical flight efficiency that can be

attributed to ATM in the comparison report,

and to develop commonly agreed indicators

for the measurement of those inefficiencies.

ANS COST-EFFICIENCY

• Improve staffing comparisons: Get a deeper

understanding of the role of the FAA

“developmental” and Certified Professional

Controllers In-Training (CPC-ITs) vs. a

European equivalent may be necessary to

advance other measures, such as cost based

or productivity measures. Furthermore, a

better understanding of working

arrangements in each region (rostering

practices, contractual working hours,

overtime, leave, training) would be

beneficial in future comparison reports.

• Support cost analysis: In view of the large

share in the total ATM/CNS costs (70%+), it

would be useful to better understand the

main support cost drivers in the U.S. and in

Europe, including a better understanding of

the treatment of facilities and equipment as

part of the total operating costs in each

region to ensure an accurate comparison in

this cost category.

U.S. – Europe Comparison of ANS performance (Edition 2023)

CONTENTS

Executive Summary

1 Introduction & Context .............................................................................................. 1

1.1 Report scope....................................................................................................... 2

1.2 Organisation of ATM in the U.S. and in Europe ............................................... 3

2 Traffic characteristics in the U.S. and in Europe ...................................................... 8

2.1 Air traffic evolution in the U.S. and in Europe ................................................. 8

2.2 Air traffic density .............................................................................................. 10

2.3 Seasonal variability .......................................................................................... 11

2.4 Aircraft mix ....................................................................................................... 12

2.5 Operations at the main 34 airports ................................................................ 13

3 Comparison of operational ANS performance ....................................................... 14

3.1 Introduction and background.......................................................................... 14

3.2 Approach........................................................................................................... 14

3.3 On-time performance (OTP) ............................................................................ 15

3.4 ANS- related operational performance .......................................................... 17

3.5 Conclusions - operational ANS performance ................................................. 28

4 Comparison of ANS cost-efficiency trends (2011-21)............................................ 31

4.1 Introduction and background.......................................................................... 31

4.2 Scope, methodology and influencing factors ................................................. 32

4.3 Long-term overview ......................................................................................... 36

4.4 Comparison of ANS cost-efficiency & Productivity ........................................ 38

4.5 Conclusions - ANS cost-efficiency comparison .............................................. 45

5 Emerging themes for future research .................................................................... 49

6 References ................................................................................................................ 51

ANNEX 1 – Operational data sources .............................................................................. 53

ANNEX 2 – Operations at the main 34 airports .............................................................. 55

Operations at the main 34 airports in the U.S. .......................................................... 55

Operations at the main 34 airports in Europe............................................................ 56

ANNEX 3 – European ANSPs included in the comparison .............................................. 57

ANNEX 4 – Methodology - economic comparison ......................................................... 58

6.1 Definitions of key data ..................................................................................... 58

6.2 Inflation, exchange rates and ppp data .......................................................... 58

ANNEX 5 – Summary of key cost-efficiency data............................................................ 59

1 INTRODUCTION & CONTEXT

U.S. – Europe Comparison of ANS performance (Edition 2023)

1 Introduction & Context

This report is the eighth in a series of joint comparisons between the U.S. and Europe [1] [2]. It

represents the fifth edition under the Memorandum of Cooperation (NAT-I-9406A) between the

United States and the European Union (EU). The work is managed by the joint Performance Analysis

Review Committee (PARC) under the Memorandum.

Building on commonly agreed metrics from the previous operational [1] and cost-efficiency [2]

comparison reports, the objective of the joint work conducted by the U.S. Air Traffic Organization

(FAA-ATO)

1

and EUROCONTROL on behalf of the PARC is to compare, understand, and further

improve air traffic management (ATM) performance in both systems.

The outbreak of the COVID-19 pandemic in early 2020 resulted in an unprecedented reduction of air

traffic around the globe - with significant effects on the entire aviation industry. Air Navigation

Services (ANS) had to adjust operationally and economically as quickly as possible to the reduced

demand, whilst ensuring a safe and reliable service to those flights still operating. A first evaluation of

the economic and operational impact of the COVID-19 outbreak on the two ATM systems in the U.S.

and in Europe was provided in a special report in December 2021 [3].

As shown in this special report in 2021, the impact of the pandemic on air traffic was notably different

in the U.S. and in Europe due to differences in market composition. The analysis showed that

international traffic was much more affected because of the various measures implemented by

governments to fight the pandemic. Hence, the impact on air traffic in the U.S. was notably lower

because of the large domestic market share (80%) in comparison to Europe (30%).

The recovery phase also showed different patterns. While in the U.S. traffic recovered continuously

after the outbreak of the pandemic in March 2020, in Europe recovery was generally slower but with

notably high growth rates in summer.

This report looks at the operational and economic ATM performance in both systems since the

outbreak of the pandemic in 2020. Where appropriate, it also follows up on longer term trends and

differences in ATM performance between the U.S. and Europe identified in previous reports.

Russia’s invasion of Ukraine in February 2022 and the unfolding effects of the war also influenced the

analyses in this report.

The closure of Ukraine’s airspace to commercial traffic was amplified by reciprocal airspace bans for

Russian and many Western operators. This resulted in a cut of many important east-west airways

between Europe and Asia for many Western carriers.

While most of the European traffic is not directly affected

by the airspace closures, flights originating in Europe or

Eastern Asia that previously travelled through Russian

airspace need to divert, which adds travel time and fuel

burn and in turn lowers flight efficiency. Additionally,

there is a direct operational and economic impact on the

adjacent Air Navigation Service Providers (ANSPs).

To allow for consistency in time series analyses, Ukraine

was removed from the scope of the analyses in this report.

1

The U.S. Air Traffic Organization (ATO) is the operational arm of the FAA, which applies business-like practices to

the delivery of air traffic services.

Figure 1-1: Impact of Ukraine war on air traffic

INTRODUCTION & CONTEXT 2

U.S. – Europe Comparison of ANS performance (Edition 2023)

1.1 REPORT SCOPE

To ensure the comparability of ATM performance, the analysis scope in this report was influenced by

the need to identify a common set of data sources with a sufficient level of detail and coverage (see

Annex I for more information on data sources).

GEOGRAPHICAL SCOPE

Unless otherwise indicated, “U.S.” refers to ANS provided by the United States of America in the 48

contiguous States located on the North American continent south of the border with Canada plus the

District of Columbia, but excluding Alaska, Hawaii and Oceanic areas (U.S. CONUS).

Unless stated otherwise, for the purpose of this report, “Europe” is defined as the geographical area

where ANS are provided by the EU Member States plus those States outside the EU that are members

of EUROCONTROL, excluding Oceanic areas, Georgia, the Canary Islands and Ukraine

2

.

The overview of the traffic characteristics in the U.S. and in Europe in Chapter 2 includes all airports

and all IFR traffic. The more detailed operational analyses of ATM-related operational performance

by phase of flight in Chapter 3 are limited to flights to or from the main 34 airports for IFR traffic in

both the U.S. and in Europe

3

. A list of the airports included in this report can be found in Annex II.

Figure 1-2: Geographical scope of the comparison in the report (2023)

In the economic comparison in Chapter 4, “Europe” corresponds to the 36 ANSPs

4

included in the ATM

cost-effectiveness (ACE) benchmarking exercise (see Annex III for the full list of ANSPs).

The “U.S.” refers to the 48 contiguous States located on the North American continent south of the

border with Canada (U.S. CONUS) plus activity for Alaska, Hawaii, Puerto Rico, and Guam.

TEMPORAL SCOPE

The analyses in this report focus mainly on the period between 2018-2022 to contrast the

performance of 2022 versus the performance before the pandemic and during the recovery phase.

Where useful, comparisons over longer time periods are provided to track trends over time already

highlighted in previous reports.

2

Different from previous years, Ukraine was excluded from this report following Russia’s invasion in February 2022

and the subsequent closure of airspace to commercial traffic.

3

Although they are within the main 34 airports in terms of traffic in Europe, Istanbul (SAW), Antalya (AYT) and

Manchester (MAN) airports were not included in the analysis due to data availability issues.

4

While the latest ACE Benchmarking report [9] includes 38 ANSPs, Sakaeronavigacija, the Georgian ANSP, and

BHANSA, the ANSP of Bosnia and Herzegovina, only started to provide data for the years 2015 and 2019

respectively and are therefore excluded from the analysis presented in this report.

20 U.S. CONUS Air Route Traffic Control Centers (ARTCCs)

vs. 58 European Area Control Centres (ACCs)

34 Airports tracked

for each region

3 INTRODUCTION & CONTEXT

U.S. – Europe Comparison of ANS performance (Edition 2023)

1.2 ORGANISATION OF ATM IN THE U.S. AND IN EUROPE

For the interpretation of the results in this report, it is useful to start with a high-level summary of the

organisation of ATM in the U.S. and in Europe.

The key difference between both regions is that the European ATM system is composed of many

individual Air Navigation Service Providers (ANSP) with different working arrangements and cost

structures whereas the U.S. system is operated by a single ANSP using the same tools and equipment,

communication processes and a common set of rules and procedures.

Both the U.S. and Europe have established system-wide, centralized traffic management facilities

(the ATCSCC

5

and the NM

6

respectively) to manage the ATFM processes at strategic, pre-tactical and

tactical level and to ensure that traffic flows do not exceed what can be safely handled by Air Traffic

Control (ATC) units while trying to optimize the use of available capacity. The delivery of ATC capacity

and the fine-tuning of traffic flows is the responsibility of en-route, terminal and airport ATC facilities.

As far as traffic management issues are concerned, there is a clear hierarchy in the U.S. Terminal

Radar Approach Control (TRACON) units’ work through the overlying ARTCC which coordinate

directly with the ATCSCC in Virginia. The ATCSCC has final approval authority for all national Traffic

Management Initiatives (TMIs) in the U.S. and is also responsible for resolving inter-facility issues.

This puts the ATCSCC in a much stronger position with more active involvement of tactically

managing traffic on the day of operations than is the case in Europe.

In Europe, although Air Traffic Flow Management (ATFM) and Airspace Management (ASM) are

coordinated centrally by the NM, at the ATC level the European system is more fragmented, and the

provision of ANS is still largely organized by State boundaries.

The NM monitors the traffic situation and proposes flow measures which are coordinated through a

Collaborative Decision Making (CDM) process with the local authority. Usually the local Flow

Management Positions (FMP), embedded in Area Control Centers (ACCs) to coordinate the air traffic

flow management, requests the NM to implement flow measures.

The Single European Sky (SES) initiative of the European Union (EU) aims at reducing the effects of

fragmentation. It provides the framework for the creation of additional capacity and for improved

efficiency and interoperability of the ATM system in Europe. The second legislative package, adopted

in 2009, foresees, inter alia, for the European NM a more proactive role in ATFM, ATC capacity

enhancement, airspace structure development and the support to the deployment of technological

improvements across the ATM network. Additionally, it made legal provision for an EU wide

performance scheme for ANS starting in 2012. The European Commission subsequently made a new

reform proposal SES2+ to further improve and advance the Single European Sky. This legislative

proposal is currently negotiated between the co-legislators (European parliament and council).

The SES performance scheme places focus on planning and accountability for performance, binding

target setting (Safety, Cost-Efficiency, Capacity and Environment), monitoring, incentives and

corrective actions at both European and national levels. It is coupled with a charging regime replacing

“full cost recovery” by a system of “determined costs” and risk sharing set at the same time as

performance targets [4].

Part of the SES initiative also includes the modernisation of the European system as part of the SESAR

programme. This comprises research and development of novel operational concepts and technical

enablers. The programme received funding from the European Union and is implemented through

Common Projects.

5

Air Traffic Control System Command Center (ATCSCC) in Warrenton, Virginia.

6

Network Manager (NM) in Brussels, Belgium.

INTRODUCTION & CONTEXT 4

U.S. – Europe Comparison of ANS performance (Edition 2023)

Table 1-1 provides a high-level overview of ATM key system figures in the U.S. and in Europe. While

the total surface of airspace analyzed in this report is similar for Europe and the U.S., the number of

physical ATC facilities differs notably in both ANS systems.

The U.S. has one ANSP and the U.S. CONUS is served by 20 Air Route Traffic Control Centers (ARTCC)

supplemented by 26 stand-alone TRACONs providing services to multiple airports (total: 46 facilities).

In addition, the U.S. has 134 Approach Control Facilities combined with Tower services.

The ATM system in Europe is more fragmented and operates with more physical facilities than the

U.S. The European region comprises 36 ANSPs (and a similar number of different regulators), 58 Area

Control Centers (ACC)

7

and 19 stand-alone Approach Control (APP) units (total: 77 facilities).

However, the U.S. controls notably more flights operating under Instrument Flight Rules (IFR) with

fewer Air Traffic Controllers (ATCOs) and fewer en-route and terminal facilities (total: 46 facilities).

Year 2021/22

U.S.

8

Europe

9

U.S. vs. Europe

Geographic Area (million km

2

)

10.4

10.6

Controlled flights 2022 (IFR) (million)

14.8

8.7

≈ +70%

Share of General Aviation (IFR flights)

19%

4.4%

Nr. of civil en-route Air Navigation Service Providers

1

36

Number of en-route facilities

20

10

58

Number of stand-alone APP/TRACON units

26

11

19

Number of APP units collocated with en-route or TWR fac.

134

250

Number of airports with ATC services

517

12

374

Of which are slot controlled

3

13

> 100

14

Number of Air Traffic Controllers (ATCOs in OPS), in FTEs (2021)

11 784

15

16 552

≈ -29%

Number of OJT/developmental ATCOs, in FTEs (2021)

2 260

1 079

Total ATCOs in OPS plus OJT/developmental, in FTEs (2021)

14 430

17 631

≈ -18%

Total staff, in FTEs (2021)

31 681

50 945

≈ -38%

Table 1-1: U.S. –Europe ATM key system figures at a glance (2021/22)

Using the definition employed by the ACE and CANSO benchmarking reports which excludes those

designated as “on-the-job training” in Europe or as a “developmental” at the FAA, the U.S. operated

with some 29% less full-time ATCOs than Europe in 2021. However, the gap narrows notably when

developmental and Certified Professional Controllers in Training (CPC-ITs) on the U.S. side and On-

the-Job trainees in Europe are also considered.

A further difference between the U.S. and Europe is the share of general aviation traffic which

accounts for 19% and 4.4% of total traffic respectively.

7

For Europe, a 59

th

en-route centre is located in the Canaries, outside of the geographical scope of the study. In the

U.S., 3 additional en-route centres are operated by the FAA, outside of the U.S. CONUS.

8

Area refers to CONUS only. Centre count and staff numbers refer to the NAS excluding Oceanic.

9

Area, staff and facility numbers refer to EUROCONTROL States, excluding Georgia, Ukraine, Canary Islands and

Oceanic areas. European staff and facility numbers refer to 2021 which is the latest year available.

10

20 en-route centers (ARTCCs) are in the U.S. CONUS, 3 are outside.

11

26 stand-alone TRACONs are in the U.S. CONUS, 1 is outside (Alaska).

12

Total of 514 facilities of which 264 are FAA staffed and 250 federal contract towers. European airports as included

in the ACE benchmarking report.

13

IATA Level 3: JFK. In addition, restrictions exist at DCA and LGA based on Federal and local rules. IATA Level 2:

ORD, LAX, EWR, SFO. IATA Level 2 for international terminals only: MCO, SEA

14

IATA Level 2: ±70. IATA Level 3: ±100.

15

This value reflects the CANSO reporting definition of a fully trained ATCO in OPS and includes supervisors. It is

different than the total controller count from the FAA Controller Workforce Plan which does not include

supervisors. The number of ATCOs in OPS does not include 1 400 controllers reported for contract towers. The

number of ATCOs in OPS including Oceanic is 11 958.

5 INTRODUCTION & CONTEXT

U.S. – Europe Comparison of ANS performance (Edition 2023)

To improve comparability, the analysis of operational ANS performance in Chapter 3 is limited to IFR

flights either originating from or arriving to the main 34 airports in each region. Notwithstanding the

large number of airports in each region, only a relatively small number of airports account for the main

share of traffic. The main 34 airports account for approximately 68% and 65% of the controlled flights

in Europe and the U.S., respectively. The traffic mix of this sample is more comparable as this removes

a large share of the smaller piston and turboprop aircraft (see also analysis in Figure 2-6 on page 12).

A further significant difference worth pointing out is the low number of airports with schedule or slot

limitations in the U.S. compared to Europe, where most of the airports are slot-coordinated.

1.2.1 FLOW MANAGEMENT TECHNIQUES

To minimize the effects of ATM-related constraints, the U.S. and Europe use a comparable

methodology to balance demand and capacity

16

. This is accomplished through the application of an

“ATFM planning and management” process, which is a collaborative, interactive capacity and airspace

planning process, where airport operators, ANSPs, Airspace Users (AUs), military authorities, and

other stakeholders work together to improve the performance of the ATM system.

This CDM process allows AUs to optimize their participation in the ATM system while mitigating the

impact of constraints on airspace and airport capacity. It also allows for the full realization of the

benefits of improved integration of airspace design, airspace management and air traffic flow

management (ATFM). The process contains several equally important phases: ATM planning, ATFM

execution (strategic, pre-tactical, tactical) including the fine tuning of traffic flows by ATC through

Traffic Management Initiatives (TMIs).

Figure 1-3 provides an overview of the key players involved and the most common ATFM techniques.

The two ATFM systems differ notably in the timing (when) and the phase of flight (where) ATFM

measures are applied.

In Europe, a lot of emphasis is put on strategic planning and a large part of the demand/capacity

management measures are applied months in advance. Traffic at major airports is usually regulated

(in terms of volume and concentration) in the strategic phase through the airport capacity declaration

16

In line with the guidance in ICAO Doc 9971 (Manual on Collaborative Air Traffic Flow Management).

Figure 1-3: Organization of ATFM (Overview)

Tactical

DEP. RESTRICTIONS

(GROUND HOLDING)

ROUTING,

SEQUENCING, SPEED

CONTROL, HOLDING

AIRBORNE HOLDING

(CIRCULAR, LINEAR),

VECTORING

EN ROUTE

ORIGIN

AIRPORT

DESTINATION

AIRPORT

AIRPORT SCHEDULING

(DEPARTURE SLOT)

STRATEGIC

AIRPORT SCHEDULING

(ARRIVAL SLOT)

STRATEGIC

TAKE-OFF

APPROACH

Tower

control

En route

Area control

Terminal

control

LOCAL ATC

UNITS

LANDING

TAXI-IN

TAXI-OUT

Ground

control

ATFM

MEASURES

FLIGHT

PHASE

Tower

Ground

US (CONUS)

EUROPE

Air Route Traffic

Control Center

(ARTCC):

20

Area Control

Centre

(ACC):

58

Terminal Radar

Approach Control

(TRACONs):

Stand-alone: 26

Collocated: 134

Approach Control

units

(APPs):

Stand-alone: 16

Collocated: 263

Airports with

ATC services

NETWORK (ATFM)

US

EUROPE

Air traffic

Control

System

Command

Center

(ATCSCC)

located in

Warrenton,

Virginia.

Eurocontrol

Network

Operations

Centre

(NMOC),

located in

Brussels,

Belgium

(formerly -

CFMU).

INTRODUCTION & CONTEXT 6

U.S. – Europe Comparison of ANS performance (Edition 2023)

process, and the subsequent allocation of airport landing and departure slots to aircraft operators

months before the actual day of operation. Airports are usually designated as ‘coordinated’ when the

airport capacity is insufficient to fulfil airlines’ demand during peak hours. The subsequent airport

scheduling process aims at matching airline demand with airport capacity several months before the

actual day of operations to avoid frequent and significant excess of demand on the day of operations.

The declared airport capacity takes account of airport infrastructure limitations and environmental

constraints and is decided by the coordination committee and/or by the respective States themselves.

It represents an agreed compromise between the maximization of airport infrastructure utilization

and the quality of service considered as locally acceptable.

In addition, demand in Europe is managed in pre-tactical phases (allocation of ATFM take-off slots).

The European system operates airport streaming on a local and distributed basis with the NM mainly

protecting the en-route segments from overload.

In the U.S., the emphasis is on the tactical traffic management in the gate-to-gate phase to maximize

system and airport throughput under prevailing conditions on the day of operations. Very few airports

in the U.S. have schedule limitations. The operations are based on real time capacity forecasts

provided by local ATC. Demand levels are self‐controlled by airlines and adapted depending on the

expected cost of delays and the expected value of operating additional flights. The few schedule

constrained airports in the U.S. are typically served by a wide range of (international) carriers and are

in high density areas at the U.S. East and West coast.

With more emphasis on the tactical phase, the U.S. system appears to be more geared towards

maximizing airport throughput according to the available capacity on the day of operations. The

approach is supported by the en-route function and less en-route capacity constraints than in Europe.

This enables to absorb path stretching in the en-route airspace and to achieve the metering required

by TMAs and airports.

The comparison of operational performance has the potential to provide interesting insights from a

fuel efficiency point of view as Europe applies more delay at the gate. However, as both systems try

to optimize the use of available capacity, this needs to be put in context for a more complete picture.

Departure restrictions (ground holdings): In the U.S., Ground Delay Programs (GDP) or Airspace Flow

Programs (AFP) are mostly used in case of severe capacity restrictions at airports or en-route when

less constraining measures, such as Time-Based Metering or Miles in Trail (MIT) are not sufficient. The

Air Traffic Command Center (ATCSCC) applies Estimated Departure Clearance Times (EDCT) to delay

flights prior to departure. Aircraft must depart within +/‐ 5 minutes of their EDCT to be in compliance

with the GDP. Most of these delays are taken at the gate. A ground stop (GS) is an extreme measure

in air traffic management where arrivals to a specific airport are temporarily postponed. The number

of departure airports included in the scope of the ground stop can vary based on the severity of the

event and international flights are excluded from these programs.

In Europe when traffic demand is anticipated to exceed the available capacity in en-route ACCs or at

airports, ATC units may call for “ATFM regulations”. Aircraft subject to ATFM regulations are held at

the departure airport according to “ATFM slots” allocated by the European Network Manager. The

ATFM delay of a given flight is attributed to the most constraining ATC unit, either en-route (en-route

ATFM delay) or airport (airport ATFM delay). The NM was initially created in the 1990s to manage the

lack of en-route capacity of a fragmented ATC system. Different from the U.S., the departure window

is wider in Europe and ATFM regulated aircraft must depart within ‐5/+10 minutes of their assigned

ATFM slot to be in compliance.

7 INTRODUCTION & CONTEXT

U.S. – Europe Comparison of ANS performance (Edition 2023)

En-route flow management (airborne): In the U.S. sequencing programs are used to achieve specified

spacing between aircraft using distance (miles) or time (minutes). The most known is called miles in

trail (MIT). It describes the number of miles required between aircraft departing from or arriving to an

airport, over a fix, navaid, at an altitude, through a sector, or on a specific air route. MIT is used to

apportion traffic into a manageable flow, as well as to provide space for additional traffic (merging or

departing) to enter the flow. En-route caused restrictions are small compared to airport driven flow

restrictions in the U.S.

MIT restrictions are commonly employed in the U.S., where the responsibility for maintaining a traffic

flow at or below the restricted level can be transmitted upstream, sometimes resulting in restrictions

even at the departure airport. Consequently, MIT restrictions can ultimately impact aircraft on the

ground. When an aircraft is preparing for take-off from an airport to join a traffic flow under an active

MIT restriction, it requires specific clearance for take-off. ATC releases the aircraft only when it can

seamlessly integrate into the sequenced flow. These delays, managed by the Traffic Management

System (TMS), primarily occur during the taxi-out phase, with limited impact at the gate.

The measures have a considerable effect on the workload of ATCOs by optimizing the use of the

available spacing in terms of MIT and, where necessary, modify up‐stream constraints thus

contributing significantly to reduce the complexity of the traffic sequences. The U.S. is more and more

transitioning to Time-Based Metering (TBM) due to gained spacing efficiencies. TBM allows individual

flights to be spaced as needed as compared to spacing all flights with standard distance-based miles

in trail.

There is currently no or very limited en-route spacing or metering in Europe. When sequencing tools

and procedures are developed locally, their application generally stops at the State boundary.

Speed control can also be used to adjust transit times. Aircraft are slowed down or sped up to adjust

the time at which the aircraft arrive in a specific airspace or at an airport.

Arrival flow management (airborne): In both the U.S. and the European system, the terminal area

around a congested airport is used to absorb delay and to keep pressure on the runways to ensure the

maximum use of available capacity. Traffic management Initiatives (TMIs) generally recognize

maximizing the airport throughput as paramount.

With Time Based Metering (TBM) systems in U.S. control facilities, delay absorption in the terminal

area is focused on keeping pressure on the runways without overloading the terminal area. Combined

with MIT initiatives, delays can be propagated further upstream at more fuel-efficient altitudes, if

necessary. However, holding is more manageable at lower altitudes where aircraft can hold with a

smaller radius to their holding pattern. Altitude has different effects on the fuel burn, depending on

the airframe/engine combination. Generally speaking, the higher the hold altitude the lower the fuel

flow.

TRAFFIC CHARACTERISTICS IN THE U.S. AND IN EUROPE 8

U.S. – Europe Comparison of ANS performance (Edition 2023)

2 Traffic characteristics in the U.S. and in Europe

This section provides some key air traffic characteristics of the ATM system in the U.S. and in Europe

to provide some background information and to ensure comparability of traffic samples.

2.1 AIR TRAFFIC EVOLUTION IN THE U.S. AND IN EUROPE

Figure 2-1 shows the evolution of IFR traffic in the U.S. and in Europe between 2003 and 2022. The

U.S. CONUS airspace is slightly smaller than the European airspace, but the U.S. controlled in 2022

notably more IFR flights with considerably less en-route facilities.

Historic trend (pre-COVID-19):

In 2003, the number of IFR flights in the U.S. CONUS area was more than twice the traffic in Europe.

As of 2004, a notable decoupling in terms of traffic evolution is visible with traffic in Europe continuing

to grow while U.S. traffic started to decline to reach its lowest level in 2016, before increasing again

until the start of the COVID-19 pandemic in early 2020. The effect of the economic crisis starting in

2008 is clearly visible on both sides of the Atlantic. Overall, traffic in Europe grew by +30.9% (+2.5

million flights) between 2003 and 2019 while flights in the U.S. CONUS area declined by -7.1% (-1.2

million flights) during the same period.

Figure 2-1: Evolution of IFR traffic in the U.S. CONUS area and in Europe (yearly)

COVID-19 pandemic:

Shortly after the World Health Organization (WHO) declared COVID-19 a pandemic in mid-March

2020, air traffic dropped dramatically on both sides of the Atlantic because of the travel restrictions

imposed by many countries to fight the pandemic. Consequently, in 2020, there was a -33% reduction

in U.S. traffic compared to 2019, equivalent to some 5.3 million less flights. Meanwhile, European air

traffic experienced an even more substantial decline, with a -56% reduction in 2020 compared to

2019, resulting in 5.9 million fewer flights.

-

4

8

12

16

20

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

2018

2019

2020

2021

2022

Millions

Evolution of IFR flights in the U.S. CONUS area and in Europe

US (CONUS) Europe

-7.5%

-6.6%

COVID-19

-33.3%

-56.2%

114%

higher

64%

higher

52%

higher

71%

higher

Global

financial

crisis

40

60

80

100

120

140

Index (2003)

3.2%

11.9%

2019 vs. 2011 (%)

-7.1%

30.9%

US (CONUS)

Europe

2019 vs. 2003 (%)

-6.7%

-16.9%

2022 vs. 2019 (%)

9 TRAFFIC CHARACTERISTICS IN THE U.S. AND IN EUROPE

U.S. – Europe Comparison of ANS performance (Edition 2023)

The annual figures hide to some extent the full dynamics of the COVID-19 crisis. The analysis in Figure

2-2 shows the evolution of the 7-day moving average of daily flights in the U.S. CONUS area and in

Europe between 2019 and 2023 (up to end July).

Figure 2-2: Evolution of IFR traffic in the U.S. CONUS area and in Europe (2019-2023)

A first interesting observation is the notably higher seasonal variation in Europe compared to U.S in

2019 which was not affected by the pandemic (top left in Figure 2-2). Flight counts in Europe show a

clear increase in summer (+15% vs average), mainly because of notably increased holiday traffic to

destinations in southern Europe. In the U.S., the seasonal variation is more moderate and skewed by

the high summer traffic in northern states offsetting the high winter/spring traffic in the south.

Following the shock in March 2020, the 7-day average reached its lowest point in Europe in mid-April

2020 when traffic was 91% below the level of 2019. In the U.S., the lowest point was also in mid-April

when traffic was 68% below the comparable traffic level in 2019.

After passing the low point in April 2020, traffic in the U.S. increased continuously whereas in Europe

traffic declined again after an initial surge in summer 2020 and remained at a low level until summer

2021. Despite substantial growth in the second half of 2021, traffic recovery in Europe in 2021 reached

only just above half the level of 2019. As for 2022, European traffic continued its rebound from the

impact of the COVID-19 pandemic, reaching approximately 83% of the 2019 traffic level, while in the

U.S., traffic levels in 2022 rebounded even further, achieving 93% of the 2019 levels.

As highlighted in the special report published on the impact of the COVID-19 pandemic on the U.S.

and European ANS systems [3], the notably higher traffic reduction in Europe was mainly linked to

the differences between the U.S. and Europe in terms of market composition and the timing and

severity of the measures implemented to fight the COVID-19 pandemic.

Domestic traffic was less affected than international traffic on both sides of the Atlantic. However,

the domestic market share in the U.S. is above 80% whereas in Europe domestic flights within States

only account for approximately 30% of all flights. Hence, the high share of international or cross-

border traffic in Europe affected by travel restrictions implemented by European States clearly played

a role in the higher initial traffic reduction in 2020 but was also a factor for the slower recovery rate

observed from 2020 onwards.

0

10

20

30

40

50

01-01-2019

01-04-2019

01-07-2019

01-10-2019

01-01-2020

01-04-2020

01-07-2020

01-10-2020

01-01-2021

01-04-2021

01-07-2021

01-10-2021

01-01-2022

01-04-2022

01-07-2022

01-10-2022

01-01-2023

01-04-2023

01-07-2023

Avg. daily flights

(thousands)

Europe (7 day trailing average)

U.S. CONUS (7 day trailing average)

Evolution of flights in the U.S CONUS area and in Europe

(7 day trailing average)

-91%

-68%

-100%

-80%

-60%

-40%

-20%

0%

20%

Compared to 2019

TRAFFIC CHARACTERISTICS IN THE U.S. AND IN EUROPE 10

U.S. – Europe Comparison of ANS performance (Edition 2023)

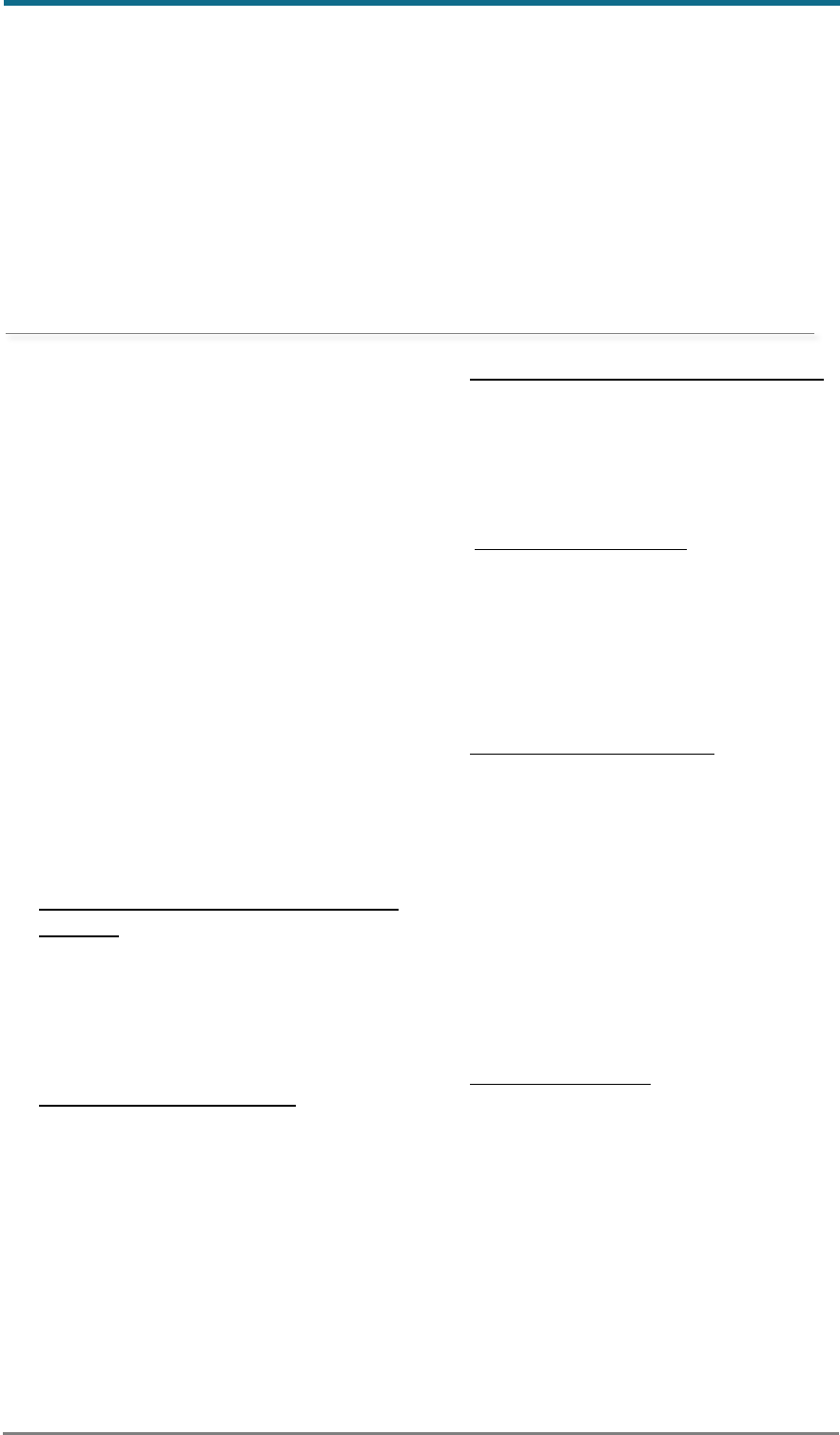

The recovery from the pandemic was not equally distributed among the network, as illustrated in the

map in Figure 2-3.

Figure 2-3: Evolution of IFR traffic in the U.S. and in Europe (2022 vs. 2019)

Europe shows a contrasted picture with wide variations between 2022 and 2019. This is partly due to

differences in COVID-19 recovery patterns but also due to changes in traffic flows because of the war

in Ukraine. Because of a substantial recovery of holiday traffic, typical holiday destinations in southern

Europe generally showed a better recovery in 2022 with some states such as Albania and Greece even

exceeding 2019 traffic levels.

The impact of the Ukraine war and the airspace closures issued by Western countries and Russia

affected traffic flows and overflights in several countries. Some Nordic States have lost substantial

traffic, whereas States south of Ukraine show higher traffic levels from flights circumnavigating

around closed airspace.

The U.S. is a more homogenous and mature market with a large share of domestic traffic which shows

a different behavior. The most noticeable shift in the U.S. is the increase in traffic over pre-pandemic

levels in the southeast. The major international airports in the northeast were slower to recover.

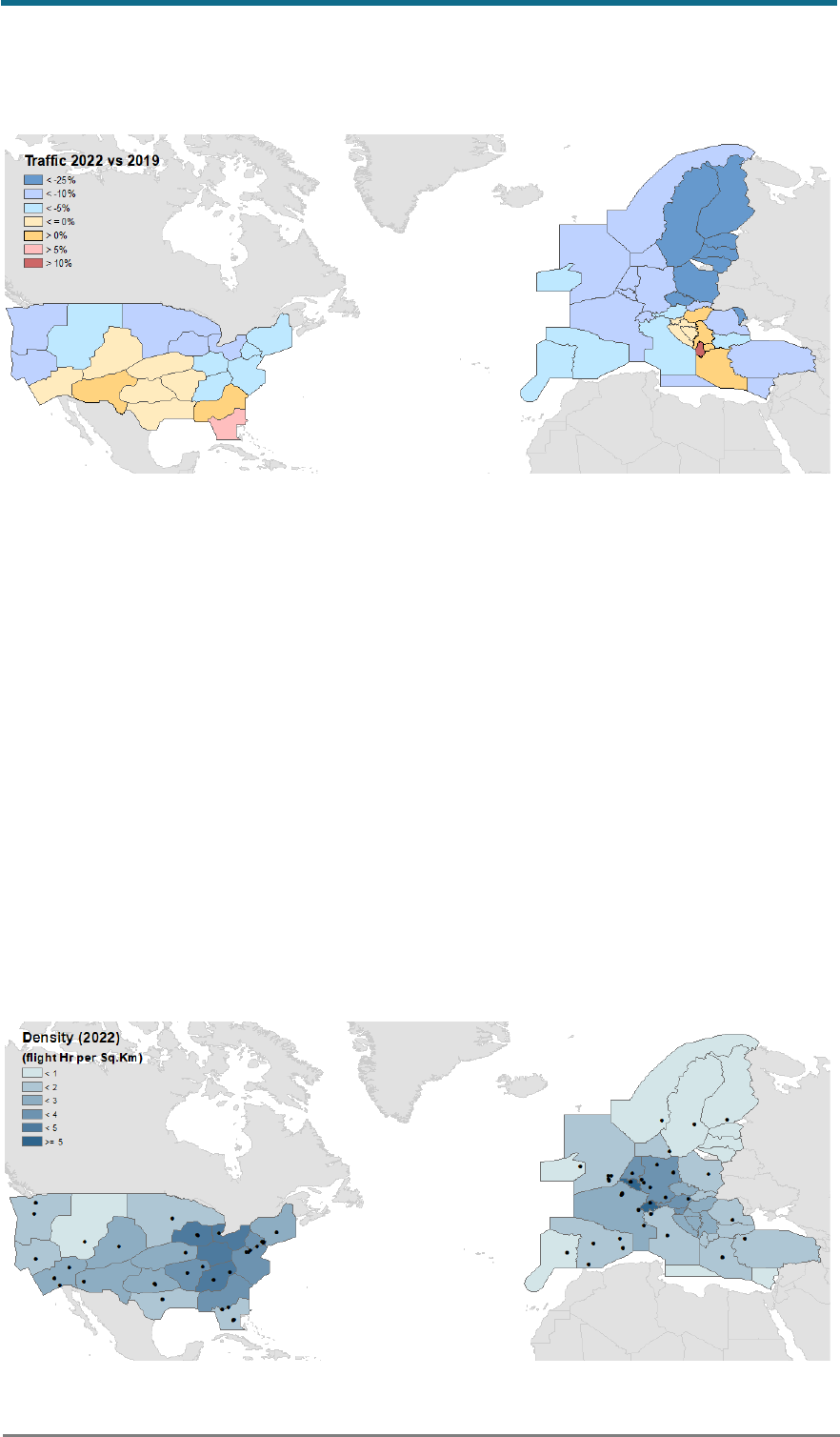

2.2 AIR TRAFFIC DENSITY

Figure 2-4 shows the traffic density in the U.S. and in Europe measured in annual flight-hours per

square kilometer for all altitudes in 2022. For Europe, the map is shown at Flight Information Region

(FIR) level because the display by en-route center would hide the centers in lower airspace.

Figure 2-4: Traffic density in the U.S. and in Europe (2022)

11 TRAFFIC CHARACTERISTICS IN THE U.S. AND IN EUROPE

U.S. – Europe Comparison of ANS performance (Edition 2023)

In Europe, the “core area” comprising the Benelux States, Northeast France, Germany, and

Switzerland is the densest and most complex airspace. The area includes major European hubs, and

it is also the crossing point between traffic from Northern Europe to the Southwest and traffic from

Central Europe to the West.

Similarly in the U.S., the centrally located centers of Cleveland (ZOB), Chicago (ZAU), Indianapolis

(ZID), and Atlanta (ZTL) have flight hour densities of more than twice the CONUS-wide average. The

New York Centre (ZNY) appears less dense due to the inclusion of a portion of coastal/oceanic

airspace. If this portion was excluded, ZNY would be the center with the highest density in the U.S.

In contrast to Europe where high-volume airports are concentrated in the center of the region, many

of the high-volume airports in the U.S. are located on the coasts or edges of the study region creating

a greater percentage of longer haul flights, especially when only flights within the CONUS area are

considered. The airborne trajectory on these transcontinental flights may be more affected by the

influences of wind and convective weather.

2.3 SEASONAL VARIABILITY

Seasonality and variability of air traffic demand can be a factor affecting ATM performance. If traffic

is highly variable, resources may be underutilized during off-peak times but scarce at peak times.

Figure 2-5 compares the seasonal variability (relative difference in traffic levels with respect to the

yearly averages) in the U.S. and in Europe for 2022.

Figure 2-5: Seasonal traffic variability in the U.S. and in Europe (2022)

As was the case before the pandemic, a very high level of seasonal variation in Europe is observed for

the holiday destinations in Southern Europe where a comparatively low number of flights in winter

contrast sharply with high demand in summer. Additionally, the shift of traffic flows following the

outbreak of the war in Ukraine in February 2022 contributed to the variation of traffic in certain areas

adjacent to the region.

In the U.S., the overall seasonality is skewed by the high summer traffic in northern en-route centers

(Boston, Chicago, and Minneapolis) offsetting the high winter/spring traffic of southern centers

(Miami and Jacksonville).

TRAFFIC CHARACTERISTICS IN THE U.S. AND IN EUROPE 12

U.S. – Europe Comparison of ANS performance (Edition 2023)

2.4 AIRCRAFT MIX

As shown in Table 1-1, the share of general aviation is notably higher in the U.S. and, although outside

the scope of this study, the U.S. also handles notably more Visual Flight Rules (VFR) traffic.

Figure 2-6 shows the

distribution of physical aircraft

classes for all flights and at the

main 34 airports in each region.

If all traffic is considered, the

U.S. shows a notably higher

share of smaller piston and

turboprop aircraft.

Even though the average

aircraft size is still notably

smaller in the U.S., the samples

are more comparable when only

flights to and from the 34 main

airports are considered.

The higher share of larger

aircraft in Europe is also

confirmed by the evolution of

the average number of seats per

scheduled passenger flight in

Figure 2-7. For 2022, the

average number of seats per

scheduled flight is +26% (+34

seats) higher in Europe for

traffic to or from the main 34

airports.

The noticeable variation in aircraft size between the two regions is connected to the distinct

approaches adopted by airlines, influenced by factors such as demand, market competition, and other

considerations. A growing number of European low-cost carriers opt for a high-density, one-class

seating arrangement, in contrast to the typical two-class configuration favored by U.S. carriers.

Furthermore, given the limited number of slot-restricted airports in the U.S., airlines have the

flexibility to increase service frequency by employing smaller aircraft, which helps them capture a

larger market share and cater to high-yield business travelers.

In contrast to Europe, where the average number of seats per flight consistently rose between 2008

and 2022, the United States experienced a more modest growth rate in the number of seats per

aircraft during the same period. However, this suggests the potential to accommodate more

passengers with relatively minor increases in operations. The substantial increase in average seat

numbers in the U.S. since 2013 can be primarily attributed to industry consolidation, resulting in fewer

flight frequencies but the utilization of larger aircraft. Additionally, the significant upswing in the U.S.

from 2014 to 2015 can be traced to alterations in airlines' regional fleets, which included a sharp

reduction in 45-50 seat jets in favor of larger 65-75 seat aircraft on select routes.

Figure 2-6: Comparison by physical aircraft class (2022)

0%

20%

40%

60%

80%

100%

U.S. EUR U.S. EUR

Comparison by physical aircraft class (2022)

Jet Heavy (>136t)

Jet Large (50t<>136t) +757

Jet Medium (7t<>50t)

Jet Light (<7t)

Turboprop

Piston

Other

All flights

Traffic to OR from

34 main airports

Figure 2-7: Average seats per scheduled flight (2008-2023)

102

103

106

112

114

119

121

135

99

102

105

112

114

119

121

135

90

100

110

120

130

140

150

160

170

180

2008

2010

2012

2014

2016

2018

2020

2022

Avg. seats per IFR flight

Scheduled Services (Main 34)

Scheduled Services (All)

Domestic U.S. (CONUS)

128

135

140

144

151

156

158

163

124

132

138

143

149

153

155

161

90

100

110

120

130

140

150

160

170

180

2008

2010

2012

2014

2016

2018

2020

2022

Avg. seats per IFR flight

Scheduled Services (Main 34)

Scheduled Services (All)

Intra-European

13 TRAFFIC CHARACTERISTICS IN THE U.S. AND IN EUROPE

U.S. – Europe Comparison of ANS performance (Edition 2023)

2.5 OPERATIONS AT THE MAIN 34 AIRPORTS

Figure 2-8 shows the average daily IFR departures at the main 34 airports

17

in the U.S. and in Europe.

The average number of daily IFR departures is considerably higher in the U.S., compared to Europe.

On both sides of the Atlantic, the highest decrease compared to 2019 is observed in April 2020. At the

34 main U.S. airports, departures in April 2020 were -69% lower than in April 2019. In Europe, the

decrease in April 2020 was with 91% notably higher at the main 34 airports.

As mentioned before, the notably lower decrease in the U.S. is linked to the stronger domestic market

in the U.S. which was less affected than international traffic. U.S. hubs with stronger international

traffic (e.g. Atlanta, Chicago, and San Francisco) were subject to a higher traffic reduction within the

U.S. during the pandemic.

Figure 2-8: Evolution of IFR traffic at the main 34 airports

.

17

Prior to the transfer of operations to the New Istanbul airport on 06 April 2019, traffic at Istanbul Ataturk airport

has been included. Before the transfer of traffic to Berlin Brandenburg airport in October 2020, traffic at Berlin Tegel

airport has been considered in the analysis.

The analysis relates only to IFR flights. Some airports – especially in the U.S. – have a significant share of additional

VFR traffic which has not been considered in the analysis.

Average daily IFR departures at the main 34 airports

297

578

570

561

523

521

482

388

386

302

298

291

290

289

284

282

280

278

277

272

256

241

239

233

222

213

198

192

191

185

182

162

161

141

139

0 500 1000

Europe - M34

Istanbul (IST)

Amsterdam (AMS)

Paris (CDG)

Frankfurt (FRA)

London (LHR)

Madrid (MAD)

Barcelona (BCN)

Munich (MUC)

Palma (PMI)

London (LGW)

Rome (FCO)

Dublin (DUB)

Zurich (ZRH)

Athens (ATH)

Oslo (OSL)

Vienna (VIE)

Lisbon (LIS)

Copenhagen (CPH)

Paris (ORY)

Milan (MXP)

London (STN)

Brussels (BRU)

Stockholm (ARN)

Berlin (BER)

Geneva (GVA)

Warsaw (WAW)

Dusseldorf (DUS)

Malaga (AGP)

Nice (NCE)

Helsinki (HEL)

Cologne (CGN)

London (LTN)

Hamburg (HAM)

Bucharest (OTP)

Avg. daily IFR departures

2022

-20%

1%

-18%

-19%

-26%

-20%

-17%

-18%

-32%

1%

-24%

-31%

-11%

-22%

-6%

-18%

-27%

-8%

-23%

-10%

-20%

-11%

-24%

-27%

-43%

-13%

-25%

-38%

-1%

-7%

-32%

-16%

-16%

-31%

-17%

-400 -200 0 200

Change

2022 vs 2019

0

100

200

300

400

500

600

JAN

APR

JUL

OCT

JAN

APR

JUL

OCT

JAN

APR

JUL

OCT

JAN

APR

JUL

OCT

JAN

APR

JUL

2019 2020 2021 2022 2023

-91% vs.

April 2019

MAIN 34 AIRPORTS - EUROPE

0

100

200

300

400

500

600

JAN

APR

JUL

OCT

JAN

APR

JUL

OCT

JAN

APR

JUL

OCT

JAN

APR

JUL

OCT

JAN

APR

JUL

2019 2020 2021 2022 2023

-69% vs.

April 2019

MAIN 34 AIRPORTS - U.S. (CONUS)

487

982

963

892

834

756

673

638

617

598

555

545

542

542

512

494

481

475

421

403

401

387

383

370

368

326

306

296

287

281

281

277

240

231

212

0 500 1000

US (conus) - M34

Atlanta (ATL)

Chicago (ORD)

Dallas (DFW)

Denver (DEN)

Los Angeles (LAX)

Charlotte (CLT)

Las Vegas (LAS)

Miami (MIA)

New York (JFK)

Phoenix (PHX)

Seattle (SEA)

Houston (IAH)

Newark (EWR)

Boston (BOS)

Orlando (MCO)

New York (LGA)

San Francisco (SFO)

Minneapolis (MSP)

Salt Lake City (SLC)

Washington (DCA)

Detroit (DTW)

Philadelphia (PHL)

Ft. Lauderdale (FLL)

Washington (IAD)

Nashville (BNA)

Dallas Love (DAL)

Baltimore (BWI)

Memphis (MEM)

San Diego (SAN)

Chicago (MDW)

Tampa (TPA)

Houston (HOU)

Portland (PDX)

St. Louis (STL)

Avg. daily IFR departures

2022

-12%

-20%

-23%

-9%

-4%

-20%

-14%

3%

9%

-3%

-5%

-11%

-17%

-10%

-12%

0%

-5%

-23%

-24%

-5%

0%

-29%

-28%

-15%

-12%

8%

0%

-17%

-7%

-10%

-9%

-2%

-6%

-27%

-19%

-400 -200 0 200

Change

2022 vs 2019

COMPARISON OF OPERATIONAL ANS PERFORMANCE 14

U.S. – Europe Comparison of ANS performance (Edition 2023)

3 Comparison of operational ANS performance

3.1 INTRODUCTION AND BACKGROUND

This chapter evaluates ANS operational performance in the U.S. and in Europe, based on commonly

agreed indicators used in international benchmarking studies and in the ICAO Global Air Navigation

Plan (GANP) context [1]. More information about the GANP indicators is available online on the GANP

Portal – KPI Overview.

To ensure comparability based on a common set of data sources with a sufficient level of detail and

coverage, the operational comparison of ANS performance was limited to flights to or from the main

34 airports for IFR traffic in the U.S. and in Europe which account for approximately 68% and 65% of

the controlled flights in Europe and the U.S., respectively. As shown in the previous section, those

samples are more comparable in terms of traffic as it removes a large share of the smaller aircraft