2BDoD 7000.14-R Financial Management Regulation Volume 7B, Chapter 3

* April 2015

3-1

VOLUME 7B, CHAPTER 3: “GROSS PAY COMPUTATION”

SUMMARY OF MAJOR CHANGES

All changes are denoted by blue font.

Substantive revisions are denoted by an asterisk (*) symbol preceding the

section, paragraph, table, or figure that includes the revision.

Unless otherwise noted, chapters referenced are contained in this volume.

Hyperlinks are denoted by bold, italic, blue, and underlined font.

The previous version dated March 2013 is archived.

PARAGRAPH

EXPLANATION OF CHANGE/REVISION

PURPOSE

All

Updated references, hyperlinks and format to comply with

current administrative instructions.

Revision

0301

Added the General Overview, Authoritative Guidance.

Addition

2BDoD 7000.14-R Financial Management Regulation Volume 7B, Chapter 3

* April 2015

3-2

Table of Contents

VOLUME 7B, CHAPTER 3: “GROSS PAY COMPUTATION” ................................................ 1

*0301 GENERAL .................................................................................................................. 4

030101. Overview .............................................................................................................. 4

030102. Authoritative Guidance ........................................................................................ 4

0302 BASIC COMPUTATION .............................................................................................. 4

030201. Overview .............................................................................................................. 4

030202. Disability Retirement (Table 3-1, Rules 1 and 2) ................................................ 6

030203. Voluntary Retirement (Table 3-1, Rules 3 through 8) ......................................... 7

030204. Mandatory Retirement (Table 3-1, Rules 9 through 12) ...................................... 9

030205. Non-Regular Service Retirement (Table 3-1, Rule 13) ....................................... 9

030206. Fleet Reserve and Fleet Marine Corps Reserve (FR/FMCR) Transfer (Table 3-1,

Rule 14) 10

030207. Historical Pay Computations.............................................................................. 11

030208. Service Credit Rounding of Months .................................................................. 12

030209. Rounding Retired Pay ........................................................................................ 13

030210. Special Computations for Career Status Bonus with Reduced Retirement

(CSB/REDUX) ..................................................................................................................... 14

030211. Temporary Early Retirement Authority (TERA) ............................................... 14

030212. Exception to High-36 Month Retired Pay Computation for Members Retired

Following a Disciplinary Reduction in Grade........................................................................ 16

0303 APPLICATION OF SAVED PAY .............................................................................. 17

030301. Career Compensation Act, Effective October 1, 1949 ....................................... 17

030302. Military Pay Act, Effective June 1, 1958 ........................................................... 18

030303. Military Pay Act, Effective October 1, 1967 ..................................................... 18

0304 TOWER AMENDMENT ............................................................................................. 19

030401. Basic Provisions ................................................................................................. 19

030402. Earlier Computation Dates ................................................................................. 20

030403. Computation at the Time of Retirement or Transfer to the FR/FMCR .............. 20

0305 SPECIAL PROVISIONS ............................................................................................. 21

030501. Entitlement Under More Than One Pay Formula .............................................. 21

030502. Commissioned Officer With More Than Four Years of Active Enlisted and/or

Warrant Officer Service ......................................................................................................... 21

030503. Commissioned Officer Serving in a Special Position ........................................ 21

030504. Officer in Grade O-9 or O-10............................................................................. 22

030505. Enlisted Member Serving in a Special Position ................................................. 23

030506. Heroism Pay ....................................................................................................... 23

2BDoD 7000.14-R Financial Management Regulation Volume 7B, Chapter 3

* April 2015

3-3

Table of Contents (Continued)

030507. Computation Under the Uniformed Services Pay Act, October 2, 1963 ........... 23

030508. Computation Under the Military Pay Act, May 20, 1958 .................................. 24

030509. Retired Pay Base for Officers Retired in General or Flag Officer Grades ......... 24

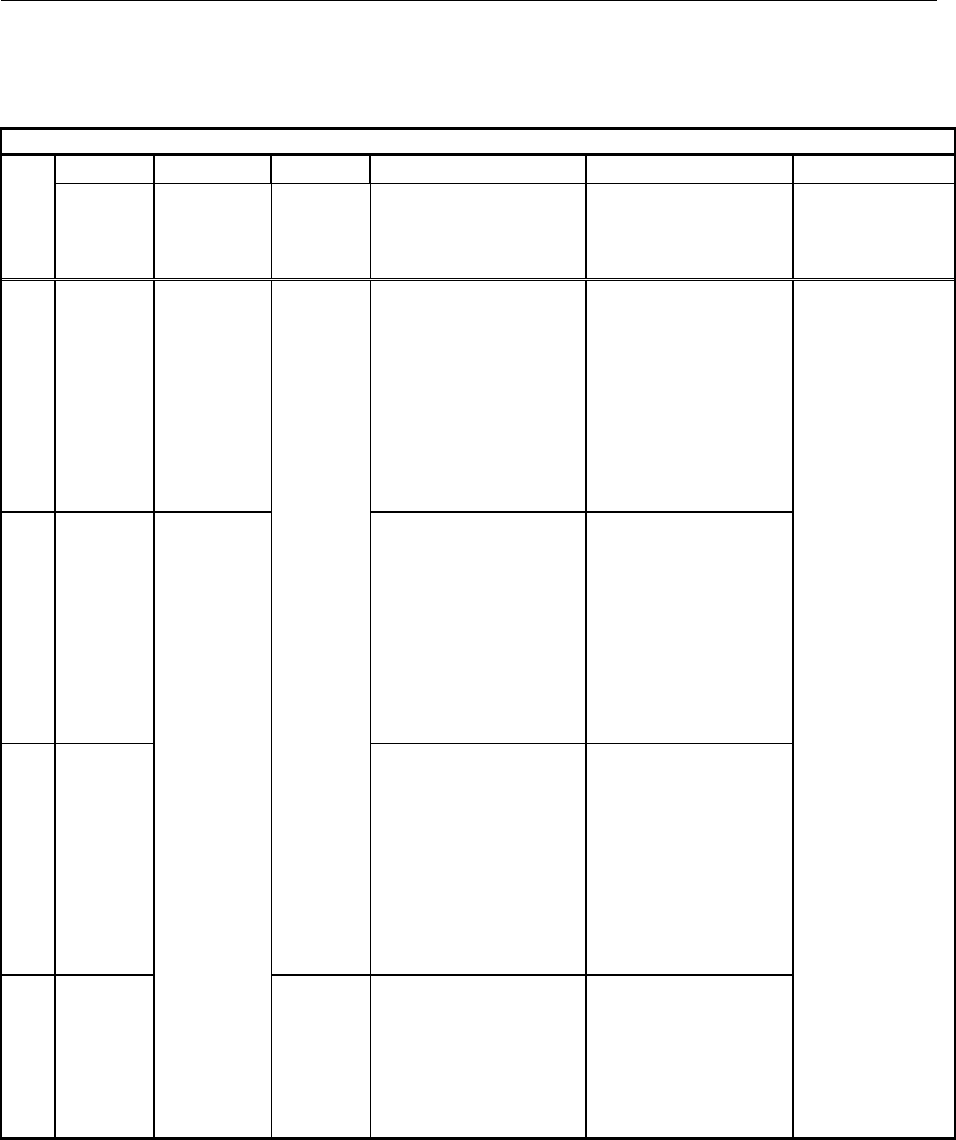

Table 3-1. Computation of Retired Pay .................................................................................... 25

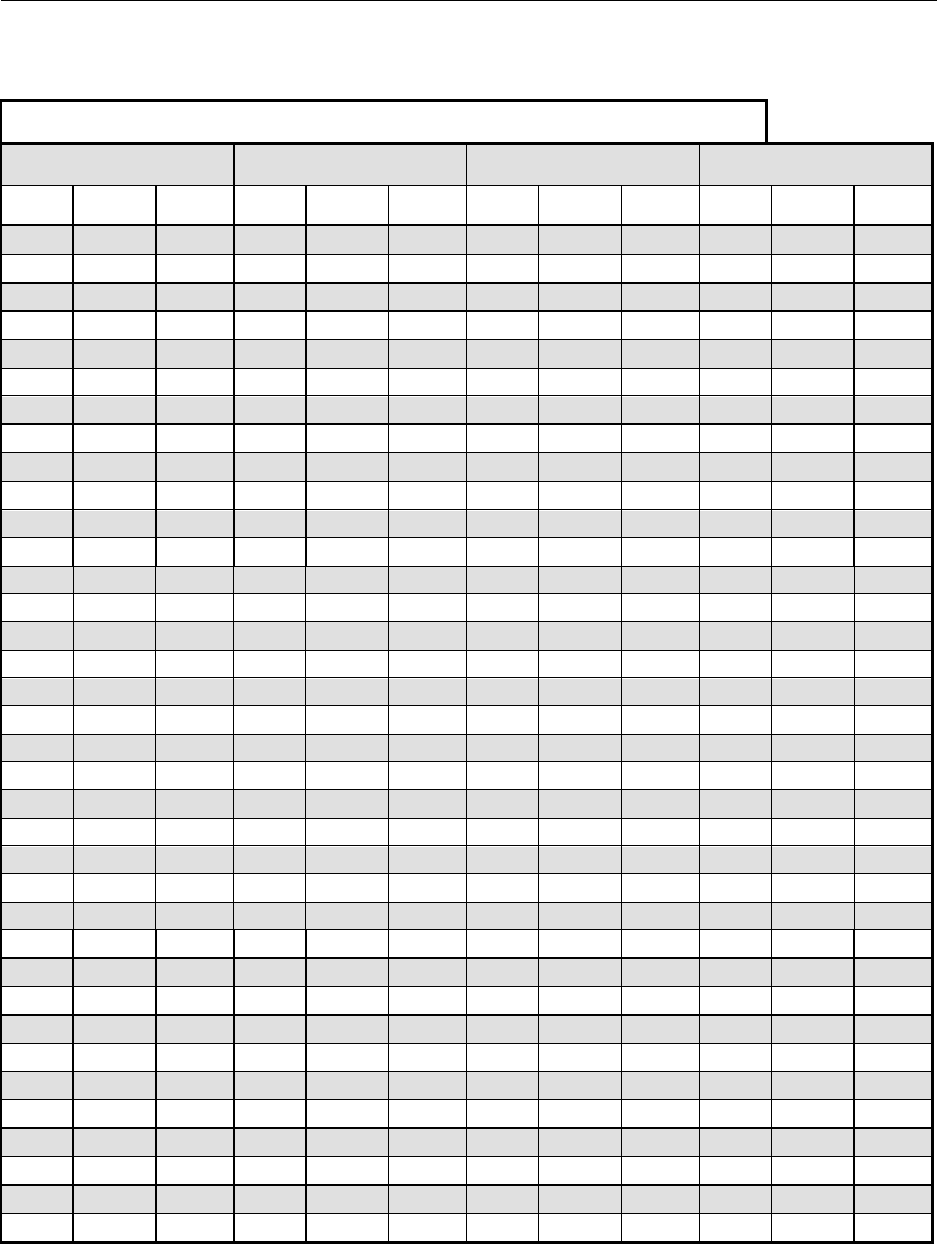

Table 3-2. Historical Pay Computations – Fleet Reserve and Fleet Marine Corps Reserve .... 29

Table 3-3. Pre-1982 Retirement Percentage Multiple Conversions ......................................... 32

Table 3-4. Post-1981 Retirement Percentage Multiplier Conversions ..................................... 33

Table 3-5. Reduction Factors Applicable to Temporary Early Retirement Authority ............. 37

BIBLIOGRAPHY ..................................................................................................................... 38

2BDoD 7000.14-R Financial Management Regulation Volume 7B, Chapter 3

* April 2015

3-4

CHAPTER 3

GROSS PAY COMPUTATION

*0301 GENERAL

030101. Overview

This chapter provides the standard way of computing basic retired pay, which includes

Application of Saved Pay, Tower Amendment, and Special Provisions.

030102. Authoritative Guidance

The bibliography at the end of this chapter lists the authoritative references.

0302 BASIC COMPUTATION

030201. Overview

In most cases, retired or retainer pay is the product of multiplying the retired pay base by

the years of service multiplier. In some military disability retirement cases, retired pay is the

product of multiplying the retired pay base by the percentage of disability determined by the

military service.

A. Retired Pay Base. The retired pay base is determined by using the

active-duty basic pay entitlement of the member.

1. Pre-September 8, 1980 Member. For individuals who first became

members before September 8, 1980, the retired or retainer pay base is the basic pay of the

member on the day before retirement. See paragraphs 030202 through 030206 for exceptions.

2. Post-September 7, 1980 Member. For individuals who first

became members after September 7, 1980, the retired or retainer pay base is the average of the

highest 36-months of basic pay received.

a. The retired pay base for a member with 36 or more months

of active service is the average monthly basic pay the member received over their highest

earning 36-months. In the case of a Reserve component member, this is the total amount of

basic pay to which the member was entitled during the member’s high 36-months or to which the

member would have been entitled if the member had served on “active-duty” during the entire

period of the member or former member’s high 36-months. Only months during which the

individual was a member of a uniformed service may be used. Starting with the highest rate of

pay, add together the monthly basic pay amounts until the total number of months equals 36-

months. Divide the total pay derived from the sum of months by 36, and round to the nearest

cent to obtain the retired pay base applicable to the member. Any lost time the member had is

not to be included in the computation.

2BDoD 7000.14-R Financial Management Regulation Volume 7B, Chapter 3

* April 2015

3-5

b. The retired pay base for a member with less than

36-months of active service is the member’s basic pay for the entire period of the member’s

active service added together divided by the number of months (including any fractions thereof)

of the member’s active service. In the case of a Reserve component member, this is the total

amount of basic pay to which the member was entitled or to which the member would have been

entitled if the member had served on active-duty during the entire period before being retired.

Divide the total pay by the total time expressed as months and days, count days that are less than

30 as 1/30th of a month. Round the result to the nearest cent.

c. A full month served counts as 1-month regardless of any

interruption by a pay rate change and regardless of the number of days in that month. Service for

an entire calendar month at a single rate of basic pay counts as 1-month under that rate of basic

pay, regardless of the number of days in the month, i.e., 28, 29, 30, or 31-days. For a calendar

month that has multiple rates of basic pay, compute service for an entire calendar month, for the

number of days paid at each rate. For example, if a member has a longevity pay increase

effective February 11, the old rate is applicable for 10-days and the new rate is applicable for 20-

days (regardless of leap year). If a month has 31-days, ignore the 31

st

. For example, if the

member has a longevity pay increase effective August 11, the old rate is applicable for 10-days

and the new rate is applicable for 20-days. The 30-day months are allocated in a straightforward

manner.

d. When a member serves less than a full month, count only

the number of days actually paid so that each total of 30-days equals one month. If a member

serves less than a full month and one or more rates of basic pay apply, compute each rate as

applicable for the number of days paid the member at the particular rate. For example, assume

the member had a break in service and returned to active-duty on February 8, but has a longevity

increase effective February 11. When a member serves through the end of February, consider

the month to have 30 days. This member receives 3-days at one rate and 20-days at the new rate

or 23-days of pay.

Example: A member receives monthly basic pay of $17,658.30 over 14-months and

11-days:

$17,658.30 $17,658.30

14-months + 11-days = 14.36667 = $1,229.12 Retired Pay Base

$1,229.12 Retired Pay Base

x % Retired Pay Multiplier

= $x,xxx.xx Retired Pay Rounded

3. An individual is considered to have first become a member of a

Uniformed Service when that individual, on or after September 8, 1980, is first appointed or

enlisted in the Uniformed Services. A member who first enlists before September 8, 1980 under

the delayed entry program; in a Reserve Component as part of the Senior Reserve Officers’

Training Corps (ROTC) or ROTC Financial Assistance programs; as a student at the Uniformed

2BDoD 7000.14-R Financial Management Regulation Volume 7B, Chapter 3

* April 2015

3-6

Services University of Health Sciences; or as a participant in the Armed Forces Health

Professions Scholarship Program, is considered to have first become a member before

September 8, 1980.

4. When it is to the member’s advantage, a saved pay rate under the

provisions of the Tower Amendment may be used to compute retired pay. See paragraph 030303

for eligibility. The Tower Amendment authorizes the use of the basic pay rates in effect on the

day before the effective date of the rates of monthly basic pay on which the member’s retired pay

would otherwise be based.

B. Retired Pay Multiplier

1. In computing retired or retainer pay, other than for disability or

non-regular service retirement, the retired pay or retainer pay multiplier is the product of two and

one-half percent and the member’s years of creditable service. The term “years of creditable

service” means the number of years of service that are creditable to a member in computing the

member’s retired or retainer pay, including credit for each full month of service in addition to

full years of service. See Chapter 1, section 0103 for determining creditable years of service for

computing retired pay.

2. The retired pay or retainer pay multiplier for a post-July 1986

member who has accepted the Career Status Bonus (CSB) and who retires with less than 30

years of creditable service is reduced at the time of retirement, if under age 62. See

paragraph 030210 and Chapter 8, paragraph 080215 for the restoring of retired pay at age 62.

3. If retired before January 1, 2007, the retired pay or retainer pay

multiplier is limited to 75 percent for a member with more than 30-years of creditable service. If

retired after December 31, 2006, for other than disability, there is no restriction on the retired pay

multiplier.

030202. Disability Retirement (Table 3-1, Rules 1 and 2)

A. The retired pay base pay for a disability retirement is determined as

follows:

1. For a member who entered service before September 8, 1980, the

retired pay base is the monthly basic pay of the grade or rank in which the member was serving

when placed on the Temporary Disability Retired List (TDRL) or the highest temporary grade or

rank in which the member served satisfactorily or to which the member was entitled on the day

before retirement or placement on the TDRL, whichever is the higher.

2. For a member who entered service after September 7, 1980, the

retired pay base is determined as prescribed in subparagraph 030201.A.

B. The retired pay multiplier for a disability retirement is determined as

follows:

2BDoD 7000.14-R Financial Management Regulation Volume 7B, Chapter 3

* April 2015

3-7

1. A member permanently retired for disability receives retired pay

that is equal to the retired pay base under Table 3-1, Rule 1, multiplied by the member’s election

of either:

a. Two and one-half percent times the years of service

credited for percentage purposes, except as provided in subparagraph c; or,

b. Percentage of disability, not to exceed 75-percent, on date

retired.

c. For a member with 30 or more years of service, retiring on

or before January 7, 2011, the retired pay multiplier may not exceed 75-percent. The retired pay

multiplier is not limited for members with 30 or more years of service who retire on or after

January 8, 2011.

2. A member placed on the TDRL receives retired pay that is equal to

the retired pay base under Table 3-1, Rule 2, multiplied by the member’s election of either:

a. Two and one-half percent times the years of service

credited for percentage purposes; or,

b. Percentage of disability, not to exceed 75-percent, on the

date when his or her name was placed on the TDRL.

3. If neither multiplier above is at least 50-percent, a minimum of 50-

percent of the retired pay base shall be paid while the member is on the TDRL.

4. For a member placed on the TDRL on or before January 7, 2011,

the retired pay multiplier may not exceed 75-percent. The retired pay multiplier is not limited

for members with 30 or more years of service who retire on or after January 8, 2011.

C. If a member is retired for disability and is eligible under another provision

of law, follow the rule in Table 3-1 applicable to the section of law that is more advantageous to

the member.

D. Since disability retired pay is not computed using a retired pay multiplier

that is determined under Title 10, United States Code (U.S.C.) section 1409, an adjustment

under paragraph 030210 is unnecessary.

030203. Voluntary Retirement (Table 3-1, Rules 3 through 8)

A. The retired or retainer pay base pay for a voluntary retirement is

determined as follows:

1. For a member who entered service before September 8, 1980, the

retired or retainer pay base is the monthly basic pay rate applicable on the date of the member’s

2BDoD 7000.14-R Financial Management Regulation Volume 7B, Chapter 3

* April 2015

3-8

retirement for the grade or rank in which the member was retired or to which the member is

advanced on the retired list. Compute the retired pay base as shown in Table 3-1, Rules 3

through 8, subject to subparagraphs a through d.

a. A Reserve enlisted member, who is retired in the highest

enlisted grade satisfactorily held on active-duty (or in which the member served on full-time

National Guard duty satisfactorily) after being administratively reduced in grade not as the result

of the member’s misconduct, may use the basic pay rate of the retired grade.

b. For Army and Air Force Reserve enlisted personnel, the

basic pay applicable on the member’s date of retirement for the retired grade is the retired pay

base, in lieu of the retired pay base under 10 U.S.C. 1406(c) or (e).

c. For Navy and Marine Corps Reserve enlisted personnel

transferred to the Fleet Reserve/Fleet Marine Corps Reserve (FR/FMCR) in the highest grade

satisfactorily held on active-duty after being administratively reduced in grade not as the result of

the member’s misconduct, use the basic pay rate of the grade in which the member transferred

for the retired or retainer pay base. This provision applies to the member who entered a

Uniformed Service before September 8, 1980 and who retired (or transferred to the FR/FMCR)

after September 30, 1996.

d. For warrant officers, compute the retired pay base on the

monthly basic pay to which the member would be entitled if serving on active-duty in the retired

grade on the day before retirement. If the member, however, is entitled to a higher rate of pay

using any other warrant officer grade satisfactorily held by the member on active-duty, retired

pay may be computed using the basic pay for that warrant officer grade.

2. For a member who entered service after September 7, 1980, the

retired pay base is determined as prescribed in subparagraphs 030201.A.2.a and b.

a. An Army or Air Force enlisted member with less than

30-years of service who is retired under 10 U.S.C. 3914 or 8914

will have the retired pay base

computed using only the rates of basic pay for months of active-duty as an enlisted member.

b. A Navy and Marine Corps enlisted member who is

transferred to the FR/FMCR in accordance with 10 U.S.C. 6330 will have the retired pay base

computed using only the rates of basic pay for months of active-duty as an enlisted member.

B. The retired or retainer pay multiplier for a voluntary retirement is

determined in accordance with subparagraph 030201.B.

1. For service credited for percentage purposes of enlisted members, see

Chapter 1, subparagraph 010302

2. For service credited for percentage purposes of commissioned

officers, see Chapter 1, subparagraph 010303.

2BDoD 7000.14-R Financial Management Regulation Volume 7B, Chapter 3

* April 2015

3-9

3. For service credited for percentage purposes of warrant officers, see

Chapter 1, subparagraph 010304.

4. The retired pay multiplier for a member who enters a Uniformed

Service after July 31, 1986, and who has accepted the CSB, is determined under subparagraph

030201.B.2.

5. See paragraph 030111 for retired pay computation for a member

retired under the Temporary Early Retirement Authority (TERA).

C. Retired or retainer pay may be increased by 10 percent of retired pay for

extraordinary heroism in the line of duty. See paragraph 030406.

030204. Mandatory Retirement (Table 3-1, Rules 9 through 12)

A. The retired pay base pay for a mandatory retirement is determined as

follows:

1. For a member who entered service before September 8, 1980, the

retired pay base is the basic pay rate of member’s grade that is applicable on member’s date of

retirement. Do not use the grade of brigadier general if the member was a permanent professor

at a military academy and was conferred such a title upon retirement. If a warrant officer is

entitled to a higher rate of pay using any other warrant officer grade satisfactorily held by the

member on active-duty, retired pay may be computed using the basic pay for that warrant officer

grade.

2. For a member who entered service after September 7, 1980, the

retired pay base is determined as prescribed in subparagraph 030201.A.

B. The retired pay multiplier for a mandatory retirement is determined in

accordance with subparagraph 030201.B.

1. For service credited for percentage purposes of Army and Air

Force retirees, see Chapter 1, subparagraph 010305.A.

2. For service credited for percentage purposes of Navy and Marine

Corps retirees, see Chapter 1, subparagraph 010305.B.

3. The retired pay multiplier for a member who enters a Uniformed

Service after July 31, 1986, and who has accepted the CSB, is determined under subparagraph

030201.B.2.

030205. Non-Regular Service Retirement (Table 3-1, Rule 13)

A. The retired pay base pay for a non-regular retirement is determined as

follows:

2BDoD 7000.14-R Financial Management Regulation Volume 7B, Chapter 3

* April 2015

3-10

1. For a member who entered service before September 8, 1980, the

retired pay base is the monthly basic pay at the rate applicable on the date when retired pay is

granted, of the highest grade held satisfactorily at any time in the Armed Forces.

2. For a member who entered service after September 7, 1980, the

retired pay base is determined as prescribed in subparagraph 030201.A. The high 36-months of

such a member are the 36-months for which the pay was the highest, whether or not consecutive,

out of all the months before the member became entitled to retired pay or would have become

entitled to retired pay. This will be the 36-months immediately preceding receipt of retired pay

even though the member may not have been in an active status during such time. However, only

months during which the individual was a member of a uniformed service may be used for this

purpose.

B. The retired pay multiplier for a non-regular retirement is determined by

multiplying two and one-half percent times the years of service credited for percentage purposes.

See Chapter 1; subparagraph 010407 for service credited for percentage purposes. (Pursuant to

10 U.S.C. 12733, the formula for converting retirement points into percentage years is total

number of retirement points divided by 360. Carry the result to three decimal places; round to

two decimal places. Example: 4,735 retirement points divided by 360 equals 13.152-years or

13.15-years for percentage purposes.)

030206. Fleet Reserve and Fleet Marine Corps Reserve (FR/FMCR) Transfer

(Table 3-1, Rule 14)

A member transferred to the FR/FMCR is entitled, when not on active-duty, to retainer

pay computed by multiplying the retainer pay base times two and one-half percent times the

years of service credited for percentage purposes. In lieu of the retainer pay base computed in

accordance with 10 U.S.C. 1406(d), a Reserve enlisted member may use the monthly basic pay

for the highest enlisted grade in which the member served satisfactorily, as determined by the

Secretary of the Navy. This provision applies to an individual who first became a member of the

Uniformed Service before September 8, 1980, and who at the time of transfer is serving on

active-duty in a grade lower than the highest enlisted grade held by the member while on active-

duty not as a result of the member’s misconduct.

A. Pre-September 8, 1980 Member. The retainer pay base is the basic pay

that the member received at the time of transfer to the FR/FMCR. The retainer pay base is

multiplied by two and one-half percent times the number of years of active service (as adjusted

in subparagraph 030201.A) in the Armed Forces.

B. Post-September 7, 1980 Member. The retainer pay base is the person’s

high-three average. The high-three average is the total amount of monthly basic pay for the

highest 36-months of member’s active service, whether or not consecutive, divided by 36. When

a member is transferred to the FR/FMCR with less than 30-years of service, the high-36 average

is computed using only rates of basic pay applicable to months of active-duty as an enlisted

member.

2BDoD 7000.14-R Financial Management Regulation Volume 7B, Chapter 3

* April 2015

3-11

030207. Historical Pay Computations

A. The laws that governed the computation of retainer pay for a member

transferred to the FR/FMCR from its inception in 1916 through June 30, 1938 are of no value

since assimilated in the Naval Reserve Act of 1938, effective July 1, 1938. Therefore, the earlier

computations are not included in this Regulation since they were restated effective July 1, 1938.

See Table 3-2 for the pay computations.

B. A member transferred to the FR/FMCR was administratively placed in a

class to differentiate between laws and conditions governing the computation of these pay

entitlements. The following classes are applicable to these members:

COMPONENT

CODE

APPLICABLE TO

FR

FMCR

F-4c

1-b

Member who is in the Naval service on July 1, 1925 and

later transferred to the FR/FMCR after completion of

16-years but less than 20-years of active service.

FR

FMCR

F-4d

1-c

Member who was in the Naval service on July 1, 1925

and later transferred to the FR/FMCR after completion

of 20-years but less than 30-years of active service.

FR

FMCR

F-5

H-1

Member who first enlisted in the Naval service after

July 1,

1925, and later transferred to the FR/FMCR

before August 10, 1946, after completion of 20-years

but less than 30-years of active service.

FR

FMCR

F-6

1-d

Member who first enlisted in the Naval service after

July 1, 1925, and later transferred to

the FR/FMCR on

or after August 10, 1946, after completion of 20-years

but less than 30-years of active service.

C. Longevity is the length of service performed by each member.

1. Before October 1, 1949, longevity pay was a significant factor in

computing retainer pay. Certain pay laws contained provisions for computing longevity pay.

Such pay was based on the length of service. During this period, base pay and longevity fitted

into the framework of pay formulas to arrive at retainer pay. The computation for the longevity

pay changed several times before being superseded by basic pay. The various computations and

the periods applicable are:

a. Until May 31, 1942, for Navy members, the computation

was 10-percent of base pay for the first increment of 4-years of Naval service, plus 5-percent of

base pay for each 4-year increment thereafter, not to exceed 16-years, or 25-percent.

2BDoD 7000.14-R Financial Management Regulation Volume 7B, Chapter 3

* April 2015

3-12

Example: Member served 18-years; on transfer to the Fleet Reserve, the longevity pay

credit computed:

1. 10-percent – 4-years

2. 5-percent – 4-years

3. 5-percent – 4-years

4. 5-percent – 4-years

5. 0-percent – 4-years

b. From June 1, 1942 to September 30, 1949, the computation

was 5-percent of base pay for each 3-years of service up to 30-years, maximum of 50-percent.

2. On October 1, 1949, when basic pay became an important factor,

longevity pay was not computed separately but was included in the rate of basic pay.

a. A member who transferred to the FR/FMCR on or after

October 1, 1949 was required to elect the formula under which their pay would be computed.

The two formulas were the fractional (under which a member would receive one third or one half

of base pay) and the percentage (two and one-half percent times years of active Federal service

times basic pay). Such election was indicated on the authorization for transfer to the Fleet

Reserve.

b. Under Public Law 1028, effective August 10, 1956, a

member who transfers to the FR/FMCR receives retainer pay computed on the formula included

in the codification of the military pay laws under Title 10 U.S.C.. The prior computations were

still in effect for the members to whom they applied. A member who enters a Uniformed Service

before September 8, 1980 receives retainer pay computed under this formula.

c. A member who enters the Uniformed Service after

September 7, 1980 receives retainer pay under the formula codified in 1956, except the retainer

pay base is used instead of a monthly basic pay rate.

030208. Service Credit Rounding of Months

For percentage purposes in computing retired or retainer pay:

A. A member who retired before January 1, 1982 receives credit for any

fractional part of a year that is 6-months or more as an additional year. Disregard any portion of

a year that is less than 6-months. See Table 3-3. This applies to any member who, before

January 1, 1982:

1. Applied for retirement;

2BDoD 7000.14-R Financial Management Regulation Volume 7B, Chapter 3

* April 2015

3-13

2. Applied for transfer to the FR/FMCR;

3. Was being processed for retirement under the provisions of

10 U.S.C. Chapter 61; or

4. Was on the TDRL and thereafter retired under the provisions of

10 U.S.C. 1210(c) or (d).

B. Unless covered by subparagraph 030201.A, a member who became

entitled to retired or retainer pay January 1, 1982 through September 30, 1983, inclusive,

received credit on a month-by-month basis for each full month served of 6-months or more.

Disregard any fraction of a year less than 6-months. See Table 3-3.

C. A member who became entitled to retired or retainer pay on or after

October 1, 1983 receives credit for each full month served. Disregard less than full months. See

Table 3-4.

NOTE: If a member retires October 1, 1983 or later and the member is entitled to retired pay

under 10 U.S.C. 1401a(f) using a hypothetical retirement date which is before January 1, 1982,

service credit of 6-months or more was rounded to a full year; however, funding limitations each

fiscal year prohibited payment for months in excess of whole months actually served until

permanent codification was effective July 1, 1986.

D. In calculating the percentage factor under subparagraphs 030208.B or C,

round the percent to the nearest 1/100 of one percentage point. For example, 20-years, 7-months

(20.58-years) time’s 2.5-percent equals 51.45-percent. See Table 3-4. This rounding method

will also be used if the member is entitled to retired pay computed under the saved pay provision

in paragraph 030203 or under 10 U.S.C. 1401a(f) in section 0303.

030209. Rounding Retired Pay

Under Public Law 98-94, the 1984 DoD Authorization Act, monthly retired or retainer

pay entitlement is rounded as initially computed and as subsequently adjusted.

A. Effective October 1, 1983, the initial computation of gross retired pay, if

not a multiple of $1, round down to the next lower multiple of $1. All further reductions,

deductions, withholdings, and allotments are made from this rounded figure. When retired pay is

subsequently increased under 10 U.S.C. 1401a by cost-of-living adjustments, the retired or

retainer pay, if not a multiple of $1, is rounded down to the next lower multiple of $1.

B. The retired or retainer pay for a member already retired on

September 30, 1983 was not rounded until the next cost-of-living adjustment, December 1, 1984.

The retired or retainer pay, if not a multiple of $1, was rounded to the next lower multiple of $1.

The same rounding procedure applies to all subsequent cost-of-living adjustments.

2BDoD 7000.14-R Financial Management Regulation Volume 7B, Chapter 3

* April 2015

3-14

030210. Special Computations for Career Status Bonus with Reduced Retirement

(CSB/REDUX)

A. The retired pay or retainer pay multiplier of members who elected the

CSB with REDUX retirement will be reduced one percentage point for each full year of

creditable service less than 30 and 1/12th of one percent for each full month of creditable service

less than a full year.

B. Effective on the first day of the month following the member’s 62nd

birthday, the retired pay of members who elected the CSB with REDUX will be recomputed to

equal the amount of retired pay to which the member would have been entitled on that date if the

member had not taken the CSB with REDUX retirement and had no reduction in their multiplier

or COLA (see Chapter 8, paragraph 080315). Following the restoration discussed in the

preceding sentence, the annual COLA reduction will continue to be applied to the member’s

retired pay each year throughout the member’s retirement.

C. Members who elected the CSB/REDUX retirement and accepted early

retirement under the TERA program will have their retired pay recomputed as discussed in

subparagraph 030210.A; however, they will be subject to the TERA reduction factor from Table

3-5 for the entirety of their retirement with no restoration of that reduction at age 62 or at any

other time.

030211. Temporary Early Retirement Authority (TERA)

The Secretary of Defense was provided a temporary additional force management tool

under TERA legislation with which to affect the drawdown of military forces from

October 23, 1992 through September 1, 2002. That legislation was amended to reinstate certain

TERA provisions for the period beginning December 31, 2011 and ending on

December 31, 2018. The basic TERA retired pay entitlement for members of the Army, Navy,

Marine Corps and Air Force will be computed as described in this paragraph.

A. Computation of Retired Pay. The amount of retired pay otherwise

prescribed for a retiring member using years of creditable service, high-36 monthly average basic

pay and a 2½ retired pay percentage factor is multiplied by the applicable reduction factor from

Table 3-5. The resulting reduced amount of retired pay, if not a multiple of $1, round to the next

lower multiple of $1. This rounded amount is the initial gross monthly retired pay entitlement.

B. Reduction Factor. To determine the appropriate reduction factor from

Table 3-5, take the difference between 240-months (20-year career) and the number of months of

active service as of the date of the member’s retirement or transfer to the Fleet Reserve or Fleet

Marine Corps Reserve under TERA.

1. Any portion of a month of active service in excess of a whole

month is rounded up to the next whole month. For example, total active service of 15-years,

7-months, and 13-days round up to 15-years, 8-months. The reduction factor based on 15-years

and 8-months is computed as: (15 × 12) + 8 = 188-months and the applicable reduction factor

2BDoD 7000.14-R Financial Management Regulation Volume 7B, Chapter 3

* April 2015

3-15

corresponds to the Table 3-5 entry for 240 less 188 or 52-months. The applicable reduction

factor for 52-months from Table 3-5 is .95667.

NOTE: In computing the retired pay, disregard the 13-days in excess of 187-months of service,

retired pay is based on 187-months. The rounding up is applied only to determine the TERA

reduction factor.

2. As an example, the retired pay for a member retired under TERA

as an E-7, with 15-years, 7-months, 13-days of creditable service and a high 36-monthly average

basic pay of $3,783.50 would be computed as follows:

RPB - Retired Pay Base (i.e. high 36 monthly average basic pay)

AS - Active Service (in months)

MO - Months in a year

RPF - Retired Pay Percentage Factor

TRF - TERA Reduction Factor (Table 3-5)

RPB × ((AS ÷ MO) × RPF) × TRF =

$3,783.50 × ((187 ÷ 12) × .025) × .95667 =

$3,783.50 × (15.5833 ×.025) × .95667 =

$3,783.50 × .3896 × .95667 =

$1,410.18

(Since this is not a multiple of $1, round down to $1,410.00.)

* C. TERA Computation Modified for Career Status Bonus (CSB)/Reduced

Retirement (REDUX). The basic TERA retired pay entitlement must be modified if a member

has elected to receive a CSB and is subject to the REDUX retirement plan. In such case, the

normal retired pay multiplier shall first be reduced by one twelfth of one percentage point for

each month that the member’s creditable service is less than 30-years (360-months) under the

REDUX computation before the application of the TERA reduction factor from Table 3-5.

Using the example in 030211.B.2, the TERA retired pay for a member who has elected to

receive a CSB would be computed as follows:

RPB - Retired Pay Base

360 - 30-Years (360-months)

AS - Active Service (in months)

MO - Months in a year

RPF - Retired Pay Percentage Factor

RRF - REDUX Reduction Factor (1%)

TRF - TERA Reduction Factor (Table 3-5)

RPB × ((AS ÷ MO) × RPF) – (((360 – AS) ÷ MO) ×RRF)) × TRF =

$3,783.50 × ((187 ÷ 12) × .025) – (((360 – 187) ÷ 12) × .01)) × .95667 =

$3,783.50 × ((15.5833 ×.025) – ((173 ÷ 12) × .01)) × .95667 =

2BDoD 7000.14-R Financial Management Regulation Volume 7B, Chapter 3

* April 2015

3-16

$3,783.50 × (.3896 – (14.42 × .01)) × .95667 =

$3,783.50 × (.3896 – .1442) × .95667 =

$3,783.50 × .2454 × .95667 =

$888.24

(Since this is not a multiple of $1, round down to $888.00.)

The amount determined in 030211.C will be increased by annual Cost of Living Allowances

(COLA) as determined for other members who have elected the CSB and REDUX retirement.

The result is COLA is reduced by one percentage whenever the standard military retirement

COLA is greater than one percent and the same COLA whenever the standard is one percent or

less.

D. Unlike the prior TERA eligibility period from 1992 through 2002, under

the new TERA authority members may not earn additional credit for purposes of re-computing

retired pay for any employment by a public service or community service organization.

E. Persons retired under the TERA provisions have all the same entitlement

rights, privileges and responsibilities of participation in the Survivor Benefit Plan (SBP), as

retired members of their respective branch of service.

1. Full coverage under SBP means coverage on the amount of retired

pay computed in subparagraph 030211.A which is the initial computation of TERA retired pay

as reduced by the applicable reduction factor from Table 3-5.

2. For a CSB/REDUX member, the base amount for full SBP

coverage is the amount computed using the TERA formula in 030111.A including the reduction

from Table 3-5. The SBP full base amount for a CSB recipient does not include the REDUX

retirement reduction in subparagraph 030211.C. If the member elects a reduced base amount,

with spouse concurrence, at the time of retirement, even if based on the REDUX re-computation

in subparagraph 030210.C, no increase will be made in that base amount as a result of the re-

computation at age 62 other than an increase to restore the elected base amount to what it would

have been in effect had full COLAs been in effect. No increase will be made in that base amount

as a result of the re-computation at age 62 for the restoration of the retired pay multiplier.

030212. Exception to High-36 Month Retired Pay Computation for Members

Retired Following a Disciplinary Reduction in Grade

Members or former members who entered the Uniformed Services on or after

September 8, 1980 will have their retired pay base computed using the high 36-month average,

except for the members described as follows, whose retired pay base is based on the final basic

pay of the grade prescribed in title 10 U.S.C. 1406, rather than the highest 36-month average of

basic pay.

A. Affected Members. A member or former member subject to the above

exception is one who, by reason of conduct occurring after October 30, 2000:

2BDoD 7000.14-R Financial Management Regulation Volume 7B, Chapter 3

* April 2015

3-17

1. In the case of an enlisted member retired or transferred to the

FR/FMCR, is reduced in grade as a result of court-martial sentence, nonjudicial punishment, or

an administrative action, unless the member was subsequently promoted to a higher enlisted

grade or appointed to a commissioned or warrant grade, in which case see subparagraph

030212.B.

2. In the case of an officer, is retired in a grade lower than the highest

grade in which the officer served by reason of denial of a determination or certification under

10 U.S.C. 1370 that the officer served on active-duty satisfactorily in that grade. This

determination is to be applied only in those circumstances where such determination is the result

of conduct occurring after October 30, 2000. Conduct, for the purposes of this provision shall

not include failure to complete the time necessary for certification under 10 U.S.C. 1370, absent

any other conduct bearing on such certification.

B. Special Rule for Enlisted Members. In the case of an enlisted member

retired within 3 years after having been reduced in grade as prescribed in

subparagraph 030212.A.1, and who was not subsequently promoted to a higher enlisted grade (or

appointed to a warrant or commissioned grade), the retired pay base will be computed using the

final basic pay rather than the high 36-month average. If, however, the member is subsequently

promoted to a higher enlisted grade (or appointed to a warrant or commissioned grade), the

member’s retired pay will be computed using a high 36-month average computation. The

computation will use the final 36-months of basic pay, except for the months in which the

member served in a grade higher than the grade in which retired. The basic pay for such months

shall be the rates that would have applied to the member at that time if serving in the grade in

which retired.

Examples:

1. An E-7 is reduced to E-5 and retired as E-5. This member comes

under subparagraph 030212A.1., with retired pay base computed under the pre-September 1980

system, which is final pay rules using the pay of an E-5.

2. An E-7 is reduced to E-5 two years before retirement, is promoted

1-year later to E-6 and retired as an E-6. This member uses the “Special Rule” and computes a

high 36 as specified in subparagraph 030211.B rather than using the final pay of an E-6. In

computing the high 36-average, it would include 12-months as an E-7, 12-months as an E-5, and

12-months as an E-6. The “Special Rule” requires that the time as an E-7 will be replaced in the

high 36 formula with pay rates of an E-6.

0303 APPLICATION OF SAVED PAY

030301. Career Compensation Act, Effective October 1, 1949

A. An officer retired for disability before October 1, 1949 who failed to elect

within a 5-year period to receive pay under the 1949 Act, or who did not qualify for pay under

2BDoD 7000.14-R Financial Management Regulation Volume 7B, Chapter 3

* April 2015

3-18

the 1949 Act, continued to receive pay under laws in effect before October 1, 1949, computed at

75-percent of the basic pay of the grade authorized.

B. A member who, on October 1, 1949, was a hospital patient and who,

before January 1, 1951, retired for disability as the result of the disease or injury for which

hospitalized could elect to receive retired pay:

1. Computed under laws in effect on September 30, 1949 at

75-percent of the basic pay of the grade authorized; or

2. Computed under section 402(d) of Public Law 81-351.

C. A member who, on October 1, 1949, was receiving or was entitled to

receive retired pay under any provision of law was authorized to continue the entitlement to

receive the pay to which entitled under the laws in effect on September 30, 1949.

030302. Military Pay Act, Effective June 1, 1958

A. A member who retired or transferred to the FR/FMCR on or after

June 1, 1958 and before April 1, 1963, and who was receiving active-duty basic pay under the

April 1, 1955, saved pay rates, continued to receive pay computed under the 1955 rates, based

upon service credited for basic pay purposes as of June 1, 1958.

B. A member who retired or transferred to the FR/FMCR on June 1, 1958

was entitled to pay computed on the June 1, 1958 active-duty basic pay rates, or on the

April 1, 1955 active-duty basic pay rates plus 6-percent, whichever was greater.

C. A member retired or transferred to the FR/FMCR after June 1, 1958, who

was receiving active-duty saved pay, was entitled to retired pay computed on the April 1, 1955

active-duty basic pay rates, but was not entitled to the additional 6 percent increase.

030303. Military Pay Act, Effective October 1, 1967

A. With respect to a member entitled to retired pay computed under this

paragraph, the retired or retainer pay may not be less than it would have been if the member had

become entitled to that pay based on the same basic pay grade, years of service for basic pay and

percentage purposes, and percent of disability (if any) on the day before the effective date of the

rates of monthly basic pay on which retired or retainer pay is based. Such members receive pay:

1. Computed under the current basic pay rates in effect on the date of

retirement or transfer, or

2. Computed under the rates of basic pay in effect immediately before

the current rates, whichever is greater.

2BDoD 7000.14-R Financial Management Regulation Volume 7B, Chapter 3

* April 2015

3-19

B. The above computations were, in some instances, subject to the provisions

of the Uniform Retirement Date Act. For application of this Act, see Chapter 1, paragraph

010502.

C. The “1-year look-back” provision codified at 10 U.S.C. 1401a(e) was

repealed by section 921 of the DoD Authorization Act, Fiscal Year 1984. Under the provisions

of that repeal, this paragraph now applies only to:

1. A member retired or transferred to the FR/FMCR October 1, 1967,

through September 24, 1983, inclusive; and

2. A member eligible for retirement or transfer on or before

September 24, 1983, provided the member retires or transfers on or before September 24, 1986.

If the member retires or transfers after September 24, 1986, the retired or retainer pay may not be

less than it would have had the member actually retired or transferred on September 23, 1986.

0304 TOWER AMENDMENT

030401. Basic Provisions

A. A member, who retires or transfers to the FR/FMCR on or after

January 1, 1971, and who fully qualifies for retirement on a date earlier than the actual retirement

date, receives the most favorable rate of pay as though the member had actually retired or been

transferred on the earlier date:

1. After becoming retirement-eligible on or after January 1, 1971 (see

Chapter 1, section 0102),

2. Based upon the grade and the service creditable on the earlier

computation date. (For retirements on or after October 5, 1994, the grade used in the

computation cannot be higher than the grade in which the member is retired.),

3. Using the rate of basic pay applicable to the member on the earlier

computation date in determining the retired pay base, or

4. Subject to the provisions of paragraph 030303.

B. A member, who retired or transferred to the FR/FMCR before

October 7, 1975, the effective date of the Tower Amendment, is entitled to pay adjusted from

October 7, 1975. No adjustment is authorized under the provisions of the amendment for any

period before October 7, 1975.

C. A member who retired between October 1, 1988 and October 4, 1994 and

who is reduced in grade under sentence of court-martial after initially becoming eligible for

retired pay is not entitled to computation on a grade higher than the grade in which retired.

2BDoD 7000.14-R Financial Management Regulation Volume 7B, Chapter 3

* April 2015

3-20

D. See subparagraph 030503.A for provision concerning an officer who

served in a special position as Chairman or Vice Chairman of the Joint Chiefs of Staff or as a

Chief of Service.

E. See paragraph 030505 for the provision concerning an enlisted member

who served in a special position as a senior enlisted member.

030402. Earlier Computation Dates

A. Predetermined earlier computation dates are established for uniformity in

computing the pay of a member who qualifies under 10 U.S.C. 1401a(f), and the Tower

Amendment, as amended. Generally, the day immediately preceding an active-duty basic pay

rate change is the earlier date of voluntary retirement eligibility, unless the computation is more

favorable based on the first day of the month preceding an active-duty basic pay rate change.

B. A member of the FR/FMCR may transfer on any intermediate day of a

month. Therefore, the earlier computation date for this member is the day before new active-

duty basic pay rates are effective.

C. A warrant officer retired under provisions of 10 U.S.C. 1293 (see

Table 3-1, rule 3), on the effective date of a change in the active-duty pay rates, receives retired

pay computed by using the rate of basic pay in effect on the day before the date of retirement.

Thus, the earlier retirement eligibility date under 10 U.S.C. 1401a(f) computation would be

one year earlier with retired pay based upon rates in effect on the day before the earlier eligibility

date. If the member is entitled to use the saved pay rate under paragraph 030203, the rate in

effect immediately prior to the rate in effect on the day before the earlier retirement eligibility

date is used.

030403. Computation at the Time of Retirement or Transfer to the FR/FMCR

A. A member receives the most favorable retired pay, as adjusted by

applicable cost-of-living adjustments, computed by using:

1. The active-duty basic pay rate applicable on the actual retirement

or transfer date, or

2. One prior active-duty basic pay rate at the same grade and service

applicable on the actual retirement or transfer date if the provisions of paragraph 030203 apply.

3. Any active-duty basic pay rate in effect on or after

January 1, 1971, at the grade and service credited on the earlier computation date, if retirement-

eligible on the earlier date. After this rule is used, apply subparagraph 030403.A.2 without

further loss of grade and service.

B. A member retiring for disability who is eligible for voluntary retirement or

transfer to the FR/FMCR on an earlier date may have gross retired pay entitlement computed in

2BDoD 7000.14-R Financial Management Regulation Volume 7B, Chapter 3

* April 2015

3-21

accordance with the provisions of 10 U.S.C. 1401a(f) when more favorable; however, the basic

pay rate applicable for an earlier retirement date under this condition for gross pay computation

cannot be used for computing pay based upon the disability rating. The rate of pay based upon

degree of disability may be calculated only on the basic pay rate applicable under subparagraph

030403.A.1 or A.2 (if applicable).

0305 SPECIAL PROVISIONS

030501. Entitlement Under More Than One Pay Formula

A member who is entitled to pay computed under more than one pay formula or

provision of law is entitled to be paid under the formula that is most favorable.

030502. Commissioned Officer With More Than Four Years of Active Enlisted

and/or Warrant Officer Service

A member, who at the time of retirement, is in pay grade O1E, O2E, or O3E, having

served more than 4-years of active-duty as an enlisted member and/or warrant officer, receives

pay computed on the special basic pay rate that is authorized.

030503. Commissioned Officer Serving in a Special Position

A. Joint Chief of Staff and Chief of Service. An officer who serves as

Chairman or Vice Chairman of the Joint Chiefs of Staff or as a Chief of the Service may receive

retired pay which is computed on the highest rate of basic pay applicable to the member while

serving in the special position, if that rate is higher than the rate otherwise authorized as a retired

pay base for a member who first became a member before September 8, 1980. Except as

provided in paragraph 030509, effective January 1, 2007, the rate of basic pay cannot exceed

Level II of the Executive Schedule. The term “Chief of Service” refers to one of the following:

1. Chief of Staff of the Army,

2. Chief of Naval Operations,

3. Chief of Staff of the Air Force,

4. Commandant of the Marine Corps, or

5. Commandant of the Coast Guard.

NOTE: The member may not use the rate of the special position for computation of retired pay

if, during or after serving in the special position, and by the member’s conduct after

October 16, 1998, the officer is not certified as having served satisfactorily in the grade of

general or admiral while serving in that position.

2BDoD 7000.14-R Financial Management Regulation Volume 7B, Chapter 3

* April 2015

3-22

B. Special Rule for Computation of Retired Pay Base for Commanders of

Combatant Commands. An officer who serves as a Commander of a Unified or Specified

Combatant Command may receive retired pay that is computed on the highest rate of basic pay

applicable to the member while serving in that position. The member may not use the rate of the

special position for computation of retired pay if, during or after serving in the special position

and by the member’s conduct after October 16, 1998, the officer is not certified as having served

satisfactorily in the grade of general or admiral while serving in that position. Effective

January 1, 2007, the rate of basic pay cannot exceed Level II of the Executive Schedule. This

special rule shall apply with respect to officers who first become entitled to retired pay on or

after November 23, 2004.

030504. Officer in Grade O-9 or O-10

A. An officer who served in grade O-9 or O-10 for not less than 3-years is

entitled to retired pay based on that grade if the Secretary of Defense certifies in writing to the

President and the Congress that the officer served on active-duty satisfactorily. The 3-year

requirement may be reduced to not less than 2-years for retirements effective during a specified

period (see Chapter 1, subparagraph 010501E.5). The 3-year time-in-grade requirement may not

be reduced or waived if the officer is under investigation for alleged misconduct or while an

adverse personnel action is pending against the officer for alleged misconduct.

B. An officer who served in grade O-9 or O-10 for a period of less than

3-years before retirement will have retired pay based on the next lower grade, unless a waiver of

the time in grade requirement has been granted by the appropriate authority. The granting of the

waiver will affect only the pay computation for the date of retirement. Computations for earlier

dates on which eligible to retire must be based on the next lower grade.

C. Section 601(e) of Public Law 106-65, October 5, 1999, provides that

retired pay be recomputed effective January 1, 2000 for certain members who retired during the

period April 30, 1999 through December 31, 1999. As a result, the retired pay of members’

grade 0-9 with over 26-years of service and 0-10s with over 16-years of service will be

recomputed. The new rates will be for months beginning on or after January 1, 2000 and will be

computed as if the Level II limit had applied at the time of a qualified member’s retirement. No

increased amount is payable for any period before January 1, 2000 as a result of this provision.

Retired pay rates for affected members should be recomputed as though the following rates of

basic pay had been applicable at the time of retirement:

0-9 Over 26-years of service: $9,528.00

0-10 Over 16-years of service: $9,528.00

0-10 Over 18-years of service: $9,528.00

0-10 Over 20-years of service: $10,167.00

0-10 Over 22-years of service: $10,167.00

0-10 Over 24-years of service: $10,167.00

0-10 Over 26-years of service: $10,491.60

2BDoD 7000.14-R Financial Management Regulation Volume 7B, Chapter 3

* April 2015

3-23

030505. Enlisted Member Serving in a Special Position

The senior enlisted member of an Armed Force may receive retired pay, which is

computed on the highest rate of basic pay applicable to the member while serving in that special

position, if that rate is higher than the rate otherwise authorized as a retired pay base for a

member who first became a member before September 8, 1980. The term “senior enlisted

member” refers to one of the following:

A. Sergeant Major of the Army,

B. Master Chief Petty Officer of the Navy,

C. Chief Master Sergeant of the Air Force,

D. Sergeant Major of the Marine Corps, or

E. Master Chief Petty Officer of the Coast Guard.

NOTE: The member may not use the rate of the special position for computation of retired pay

if, during or after serving in the special position, and by member’s conduct after

October 16, 1998, the member is reduced in grade by court-martial, nonjudicial punishment, or

other administrative process.

030506. Heroism Pay

An enlisted member retired after 20-years of service, to include an enlisted member

retired due to disability, may be entitled to an additional 10-percent retired pay for extraordinary

heroism, if authorized. See Chapter 1, Section 0108.

030507. Computation Under the Uniformed Services Pay Act, October 2, 1963

A. Beginning October 1, 1963, a member retired between October 1, 1949

and May 31, 1958, including a member retired before October 1, 1949, receiving pay under the

1949 Act, received the greater of:

1. An increase of 5-percent in the retired pay to which entitled on

September 30, 1963; or

2. Pay computed on the basic pay rates established under the

June 1, 1958 Act without a 5-percent increase.

B. Beginning October 1, 1963, a member retired for service before

October 1, 1949 and being paid under laws in effect on September 30, 1949 receives the greater

of:

2BDoD 7000.14-R Financial Management Regulation Volume 7B, Chapter 3

* April 2015

3-24

1. An increase of 5-percent in the retired pay to which entitled on

September 30, 1963; or

2. Pay recomputed on the basic pay rates established by the Military

Pay Act of 1958 without a 5-percent increase, based on actual active service creditable.

030508. Computation Under the Military Pay Act, May 20, 1958

A. A member who first became entitled to retired pay on June 1, 1958 was

authorized to receive pay computed on the new June 1, 1958 basic pay rates or on the

April 1, 1955 active-duty basic pay rates plus 6-percent, whichever is greater.

B. A member retired after June 1, 1958 who was receiving active-duty saved

pay was entitled to retired pay computed on the April 1, 1955 active-duty basic pay rate, but was

not entitled to the additional 6-percent increase.

C. The basic pay rate used in the computation of pay was increased by

increments of $200 for generals and admirals and $100 for lieutenant generals and vice admirals

before the 6-percent increase on June 1, 1958 for a retired officer who:

1. Served in that grade for at least 180-days, and

2. Was entitled to retired pay on the day before the effective date of

the Military Pay Act of 1958.

030509. Retired Pay Base for Officers Retired in General or Flag Officer Grades

A. The retired pay base of a general or flag officer who retires after

September 30, 2006 will not be restricted by the requirement in 37 U.S.C. 203 (a)(2) to reduce

basic pay in excess of Level II of the Executive Schedule.

B. The retired pay base shall be determined using the rate of basic pay for

such period provided by law, rather than such rate as reduced.

2BDoD 7000.14-R Financial Management Regulation Volume 7B, Chapter 3

* April 2015

3-25

Table 3-1. Computation of Retired Pay

COMPUTATION OF RETIRED PAY

R

U

L

E

A

B

C

D

E

F

G

A

member

of the

who is

under

provision

s of 10

U.S.C.

receives the

retired pay

base

multiplied by

plus

minus (note

8)

1

Armed

Forces

retired for

disability

1201

1204

computed

under

10 U.S.C.

1406(b) or

1407

(note 1)

the percentage of

disability

assigned, not to

exceed

75-percent or

2.5-percent times

the years of

service credited

for percentage

purposes, except

for a member

retiring on or

before

January 7, 2011,

the multiplier is

limited to

75-percent

(note 3)

2

1202

1205

the amount

necessary to

increase the

product of

columns D

and E to

50-percent of

retired pay

base

3

voluntarily

retired

1293

the retired pay

multiplier from

10 U.S.C. 1409

for the years of

service credited

for percentage

purposes

(note 3)

excess over

75-percent of

retired pay

base upon

which

computation

is based if

member

retires before

January 1,

2007

(note 6)

4

Army or

Air

Force

3914

3917

8914

8917

computed

under

10 U.S.C.

1406(c) -

for Army,

1406(e) -

for Air Force

or 1407

(notes 1

and 10)

10-percent of

the product

of

Columns D

and E, if

applicable

(note 2)

5

3911

3918

3920

3924

8911

8918

8920

8924

6

Navy or

Marine

Corps

6321

6323

computed

under

10 U.S.C.

1406(d) or

1407

(note 1)

2BDoD 7000.14-R Financial Management Regulation Volume 7B, Chapter 3

* April 2015

3-26

Table 3-1. Computation of Retired Pay (Continued)

COMPUTATION OF RETIRED PAY

R

U

L

E

A

B

C

D

E

F

G

A

member

of

who is

under

provision

s of 10

U.S.C.

receives the

retired pay

base

multiplied by

plus

minus/add

(note 8)

7

Navy or

Marine

Corps

voluntarily

retired

6322

6326

computed

under

10 U.S.C.

1406(d) or

1407

(note 1)

retired pay

multiplier from

10 U.S.C. 1409

for years of

service credited

for percentage

purposes

(note 3)

10-percent of

columns D

and E if

applicable

(note 2)

excess over

75-percent of

retired pay

base upon

which

computation

is based, if

the member

retired before

January 1,

2007

(note 6)

8

6327

50- percent

(note 5)

9

Armed

Forces

Involuntari

ly retired

580

633

634

635

636

1251

1263

1305

(note 9)

computed

under

10 U.S.C.

1406(b) or

1407

(note 1)

retired pay

multiplier from

10 U.S.C. 1409

for years of

service credited

for percentage

purposes

(note 3)

excess over

75-percent of

retired pay

base upon

which

computation

is based, if

the member

retired before

January 1,

2007

(note 6)

10

Army

3920

3921

(note 6)

computed

under

10 U.S.C.

1406(c) or

1407

(note 1)

11

Navy or

Marine

Corps

6371

6383,

(note 6)

computed

under

10 U.S.C.

1406(d) or

1407

(note 1)

12

Air

Force

8920

8921

(note 6)

computed

under

10 U.S.C.

1406(e) or

1407

(note 1)

retired pay

multiplier for the

years of service

credited for

percentage

purposes

(note 3)

2BDoD 7000.14-R Financial Management Regulation Volume 7B, Chapter 3

* April 2015

3-27

Table 3-1. Computation of Retired Pay (Continued)

COMPUTATION OF RETIRED PAY

R

U

L

E

A

B

C

D

E

F

G

A

member

of

who is

under

provision

s of 10

U.S.C.

receives the

retired pay

base

multiplied by

plus

minus/add

(note 8)

13

Armed

Forces,

Reserve,

or

National

Guard

Reservist

(meets age

and

service

require-

ment)

12731

computed

under

10 U.S.C.

1406(b) (2)

or 1407

(note 1)

2.5-percent times

the years of

service credited

for percentage

purposes

(notes 3 and 4)

10-percent of

the product

of columns

D and E

(note 2)

excess over

75-percent of

retired pay

base upon

which

computation

is based if

member

retired before

January 1,

2007

(note 6)

14

Navy or

Marine

Corps

transferred

to the

FR/FMCR

6330

computed

under

10 U.S.C.

1406(d) or

1407

(notes 1

and 7)

the retainer pay

multiplier for the

years of service

credited for

percentage

purposes

(note 3)

NOTES:

1. For applicable active-duty basic pay rate, see sections 0304 and 0305 and paragraphs 010502 and 030301.

For a person who first became a member of a uniformed service after September 7, 1980, use the high 36-month

average. For exception to high 36-months retired pay computation for members retired following a disciplinary

reduction in grade, refer to paragraph 030212.

2. Enlisted members credited with an act of extraordinary heroism in the line of duty. For Army and Air

Force enlisted members, the total retired pay to include the 10-percent increase, may not exceed the maximum pay

of 75-percent. For Navy and Marine Corps enlisted members, the total maximum retired pay is 75-percent plus the

10-percent increase. Members with more than 30-years of creditable service should also have retired pay computed

without the 10-percent add-on and awarded the higher of the two calculations. All members who retire under the

provisions of 10 U.S.C. 12731

with credit for extraordinary heroism are restricted to a maximum pay of 75-percent.

3. See Chapter 1 of this volume for service creditable for percentage purposes:

Voluntary retirement:

Paragraph 010402—Enlisted members

Paragraph 010403—Commissioned Officers

Paragraph 010404—Warrant Officers

Disability retirement:

Paragraph 010406

Mandatory retirement:

Subparagraph 010405.A—Army and Air Force

Subparagraph 010405.B—Navy and Marine Corps

Reservist age and service retirement:

Paragraph 010407

4. Total number of retirement points divided by 360. Carry the resultant figure to three decimal places, round

to two decimal places. EXAMPLE: 4735 retirement points divided by 360 = 13.152 or 13.15-years of service for

percentage purposes (for the section 12731 retiree only) to be multiplied by 2-1/2-percent.

5. Members retired under 10 U.S.C. 6327

are authorized to receive retired pay at 50 percent of the active-duty

basic pay of their grade when not on active-duty. This provision applies only to persons who were members of the

Naval Reserve or Marine Corps Reserve on January 1, 1953. The provisions of 10 U.S.C. 6327 terminated on

January 1, 1973. However, termination of the section did not affect any accrued rights to retired pay.

6. For members who retired on or after January 1, 2007, the retired pay multiplier is the sum of 75-percent for

30-years of service plus 2-1/2-percent for every year over 30-years.

2BDoD 7000.14-R Financial Management Regulation Volume 7B, Chapter 3

* April 2015

3-28

Table 3-1. Computation of Retired Pay (Continued)

NOTES

7. In lieu of the retainer pay base computed under 10 U.S.C. 1406(d), a Reserve enlisted member may be

entitled to retainer pay computed by using the monthly basic pay for the highest enlisted grade in which the member

served satisfactorily, as determined by the Secretary of the Navy. This provision applies to an individual who first

became a member of the Uniformed Service before September 8, 1980 and who, at the time of transfer, is serving on

active-duty in a grade lower than the highest enlisted grade held by the member while on active-duty not as a result

of the member’s own misconduct.

8. If a member was initially retired on or after October 1, 1983, the amount computed, if not a multiple of $1,

shall be rounded to the next lower multiple of $1. Any future adjustments to such pay must be made on the rounded

figure. Retired pay of members retired on September 30, 1983 will not be rounded until there is an adjustment

under 10 U.S.C. 1401a; then, and with each subsequent adjustment, the amount as adjusted, if not a multiple of $1,

shall be rounded to the next lower multiple of $1. The rounded amount becomes the member’s entitlement and any

future adjustments shall be based on this rounded entitlement.

9. Section 564 repealed by Public Law 102-190, December 5, 1991. Section 1255 repealed by Public

Law 90-130, November 8, 1967. An officer who was on active-duty on September 15, 1981 and who is retired

under Section 1251 is entitled to retired pay of at least 50-percent of the basic pay upon which the retired pay is

based.

10. For a Reserve enlisted member retired under 10 U.S.C. section 3914 or 8914 after September 30, 1996, the

retired pay base is the monthly basic pay of the member’s retired grade (based on rates applicable on date of

member’s retirement) in lieu of the retired pay base under 10 U.S.C. 1406(e).

2BDoD 7000.14-R Financial Management Regulation Volume 7B, Chapter 3

* April 2015

3-29

Table 3-2. Historical Pay Computations – Fleet Reserve and Fleet Marine Corps Reserve

HISTORICAL PAY COMPUTATIONS – FLEET RESERVE AND FLEET MARINE CORPS RESERVE

R

U

L

E

A

B

C

D

E

F

If

member

retires

in class

during

period

with

years of

service

at least

then pay computation

formula is

plus

and

applicable

law is

1

F-4c

1-b

pre-1938 to

May 31,

1942

16; less

than 20

1/3 x base pay rating in

which transferred

(note 1)

longevity pay

(25-percent

maximum),

extraordinary heroism

(10-percent)

52 Stat 1179,

section 203,

34 U.S.C. 854b.

2

F-4d

1-c

20; less

than 30

1/2 x base pay rating in

which transferred

(note 1)

longevity pay

(25-percent

maximum),

extraordinary heroism

(10-percent), or

good conduct

(10-percent)

3

F-5

H-1

52 Stat 1179,

section 204,

34 U.S.C. 854c.

4

F-4c

1-b

June 1,

1942 to

August 9,

1946

16; less

than 20

1/3 x base pay rating in

which transferred

(note 1)

longevity pay

(50-percent

maximum),

extraordinary heroism

(10-percent)

56 Stat 359,

Public Law 607,

June 6, 1942.

5

F-4d

1-c

20; less

than 30

1/2 x base pay rating in

which transferred

(note 1)

longevity pay

(50-percent

maximum), extraordi-

nary heroism

(10-percent), or

good conduct

(10-percent)

6

F-5, H-1

7

F-4c

1-b

August 10,

1946 to

September

30, 1949

16; less

than 20

(note 2)

1/3 x base pay rating in

which transferred

(notes 1 or 2)

longevity pay

(50-percent

maximum),

extraordinary heroism

(10-percent)

60 Stat 993,

Public Law 720,

August 10, 1946.

8

F-4d

1-c

20; less

than 30

1/2 x base pay rating in

which transferred

(note 2)

longevity pay

(50-percent

maximum),

extraordinary heroism

(10-percent), or

good conduct

(10-percent)

9

F-6

(note 3)

1-d

20

1/2 x base pay rating in

which transferred

(note 1) or

2.5-percent x years of

active federal service

multiplied by base pay

of rating in which

transferred (note 2)

longevity pay

(75-percent

maximum),

extraordinary heroism

(10-percent)

2BDoD 7000.14-R Financial Management Regulation Volume 7B, Chapter 3

* April 2015

3-30

Table 3-2. Historical Pay Computations – Fleet Reserve and Fleet Marine Corps Reserve

(Continued)

HISTORICAL PAY COMPUTATIONS – FLEET RESERVE AND FLEET MARINE CORPS RESERVE

R

U

L

E

A

B

C

D

E

F

If

member

retires

in class

during

period

with

years of

service

at least

then pay computation

formula is

plus

and

applicable

law is

10

all

classes

transferred

before

October 1,

1949,

effective

on October

1, 1949

at least

20

pay received on

9/30/49 (saved pay)

or

2.5-percent x years of

active service =

percent; percent x basic

pay of highest federally

recognized rating

satisfactorily held

(note 4)

Public Law 351,

81st Congress,

October 1, 1949.

11

F-4c

1-b

on or after

October 1,

1949

1/3 x basic pay

receiving at transfer

(note 5)

or

2.5-percent x years of

active federal service =

percent; percent x basic

pay of rating in which

transferred

(notes 6 and 8)

extraordinary heroism

(10-percent)

12

F-4d

1-c

1/2 x basic pay

receiving at transfer

(note 5)

or

2.5-percent x years of

active federal service =

percent; percent x basic

pay of rating in which

transferred

(notes 6 and 8)

extraordinary heroism

(10-percent),

or good conduct

(10-percent)

13

F-6

1-d

1/2 x basic pay

receiving at transfer

(note 5)

or

2.5-percent x years of

active federal service =

percent;

extraordinary heroism

(10-percent)