Form #459-467 (4/11/2024) SL3 IIM code: 22163

Page 1 of 9

• You can either ll out this application online or ll out a hard copy. If you choose a hard copy, please print clearly

with dark ink. Both online and hard copy methods require member hand sign and date in signature and notary areas.

• Your signature, and your spouse’s signature if married, must be notarized on page two of the application. PERS

sta can notarize applications at a Retirement Application Assistance Session (RAAS).

• Do not cross out, modify, or alter the application in any way — this could void your application.

• Please provide your personal email address. Conrmation and follow up letters are sent via email whenever possible.

• Depending on your choices, you may need to complete additional forms. For example, if you choose a direct

deposit for your installments, you must complete the Authorization Agreement for Automatic Deposits form. We

have provided links to the additional forms where appropriate. Contact PERS Member Services if you are reading

a paper version of these instructions and need additional support.

• PERS must know your exact date of birth to calculate your retirement benet. If you choose a survivorship

option, PERS must also know your beneciary’s date of birth. You will nd a list of acceptable verication of age

documents on page 3.

• Please use your full legal name to complete and sign forms. If submitting a driver’s license or passport as your age

verication document, your name on the application and age verication document should match. If your legal

name is not reected on your driver’s license or passport, complete the application using your current legal name

and provide proof of legal name change (marriage certicate, court document, etc.).

Oregon Public Service Retirement Plan (OPSRP) Pension

and Individual Account Program (IAP) Retirement Application

You will receive your first pension benefit payment within 92 days of your effective retirement date. Your

IAP benefit payment is normally paid within 120 days.

• You must be eligible to retire. Visit the Benefit Component Comparison page on PERS website.

• To retire at the early or normal retirement age for a police ocer or reghter, your last 60 months of retirement

credit prior to being eligible for P&F normal age or earliest age retirement must be classied as P&F.

• You must separate from employment with all PERS-participating employers before your eective retirement date.

• If your account is divorce-related, retirement option and beneciary restrictions may apply.

• Your application is not eective until PERS accepts it. PERS will mail or email you a letter conrming receipt of

your application and may request additional items required for application acceptance.

• When you retire from your OPSRP Pension, you must also retire from your IAP. Complete this entire application

to retire from both programs.

• If you have a Tier One/Tier Two Loss of Membership (LOM) account, consider applying for it now to avoid

retirement benet processing delays. To apply for the LOM account payout, complete either the

Loss of Membership Refund Application or a Tier One/Tier Two Member Account Withdrawal Application and

submit it before or with your retirement application.

11410 SW 68th Parkway, Tigard OR 97223

Mailing Address – PO Box 23700, Tigard OR 97281-3700

Toll free – 888-320-7377 Fax – 503-598-0561

Website – https://oregon.gov/pers

General retirement information

General information on lling out the application

Form #459-467 (4/11/2024) SL3 IIM code: 22163

Page 2 of 9

• The tax forms you will need to complete may be impacted by your elections so please pay close attention to

which tax forms you are including with your application.

• Include your name and Social Security number (SSN) or PERS ID at the top of every page and on any

documents submitted with your application. Providing your SSN is mandatory, and PERS is authorized to

request it under Internal Revenue code provisions. It will be used primarily to comply with mandatory IRS

reporting. However, PERS may also use it internally for conrmation purposes or recovery of overpaid funds.

(If you do not want it used for these purposes, enclose a written statement to that eect with your retirement

application.)

• Mail, fax, or deliver your completed application with accompanying forms and required documents to PERS.

Keep a copy for your records.

Forms and documents normally needed to receive benets

• Oregon Public Service Retirement Plan (OPSRP) Pension and Individual Account Program (IAP)

Retirement Application

• Verication of your age

• Verication of your beneciary’s age if you select a survivorship option

o (Full-survivorship, Full-survivorship Increase, Half-survivorship, Half-survivorship Increase)

• Verication of legal name change if your current legal name diers from the name on le with PERS

• Authorization Agreement for Automatic Deposit form (optional)

• W-4P form for federal and state tax withholding

• W-4R IAP Lump Sum Withholding form if you select the IAP one-time lump-sum option or a ve-year

installment and are not requesting a 100% rollover

• IAP Direct Transfer Rollover Acceptance form if you select the IAP one-time lump-sum option or a ve-year

installment and elect to roll all or a portion of your benet to another deferred compensation or eligible employer plan

(3/28/2022)

Page 3 of 9

Acceptable documentation to verify date of birth

Photocopies of birth-date documents and, if applicable, beneficiary birth-date documents are required before

benefits are paid. We will not accept documents that are incomplete, appear to be altered, or are difficult to

read. If your documents are not accepted, you will need to submit new photocopies. Please include your

PERS ID or Social Security number on all documents submitted, including beneficiary documents.

If it is impossible for you to furnish the proof required in Group 1 or 2, write to PERS with a full explanation.

Since the documents submitted cannot be returned, we suggest using photocopies. If it is illegal to copy a

document, bring it in, and PERS will verify the birth information.

Be sure to put the PERS member’s Social Security number on all documents so they are properly recorded.

**A compliant REAL ID will have a picture of a star, or a star cutout in the upper right-hand corner of the card. In lieu of REAL IDs, some states also have issued

“enhanced” driver’s licenses, driver’s permits, or ID cards. Enhanced cards are REAL ID compliant and will bear an American ag emblem and the word “enhanced”

on the front of the card.

Group 1

If one item in this group is furnished showing birth dates, no

further evidence of age is needed.

Any ONE of these:

Group 2

Two items in this group from different sources are sufficient if

age or birth date is shown.

Any TWO of these:

Example: One child’s birth certificate and one driver’s license

• Copy of Oregon driver’s license or ID card if issued on or

after February 4, 2008 (current or expired)

• Copy of REAL ID driver’s license, driver’s permit, or ID

card issued by any state** (current or expired)

• Birth verification issued by state, county, or country

(documents issued by foreign governments in a language

other than English need to include a translation into

English certified by a notary public, public agency, or

other public official)

• American Indian Reservation Age Verification

• Infant baptism certificate

• Hospital birth certificate (if signed by attending

physician or issued by state)

• Passport (current or expired)

• School-age record

• Naturalization or citizenship papers

• Family Bible record (if this record is furnished, include the

following information certified by a notary public or other

public official: copy of all family record entries in the Bible

referring to applicant and parents, brothers, and sisters;

Bible publication date or apparent age of Bible; when birth

date was entered and by whom)

• A notarized affidavit by an older, immediate family

member in a position to know the birth date (e.g., father,

mother, etc.)

• Certificate of military record

• Marriage record (record must show your age or date of

birth at time of marriage)

• Any other state’s driver’s license or ID card. (must be

current)

• County voter registration (must show your age or date of

birth; do not send in your precinct card)

• Copy of child’s birth certificate if it shows age of parents

• Social Security record (record must be displayed on

an estimate of benefits or screen print from the Social

Security office; document must be dated within

last 12 months)

• Military ID (military record DD214)

• Concealed weapons permit

Form #459-467 (4/11/2024) SL3 IIM code: 22163

Page 4 of 9

Section B: Effective retirement date (required)

Enter the month and year you want to begin your retirement. Retirements always begin on the first of the month, so you

only need to enter the month and the year.

Your eective retirement date can be no sooner than either the rst day of the month following the last day you worked

(or were on qualifying paid leave) or the rst of the month following the month PERS receives your retirement

application, whichever is later. Examples: If your last day worked is May 5, 2022, your retirement date can be no earlier than

June 1, 2022. If your last day worked was May 6, 2022, but PERS does not receive your application until June 6, 2022, your

retirement date can be no earlier than July 1, 2022.

Section A: Applicant information (required)

Fill in this section completely.

Provide your Social Security number (SSN) and your PERS ID. If you do not know your PERS ID, leave the PERS ID

box blank; however, providing your SSN is mandatory. Your application will be delayed if SSN is missing.

Enter your date of birth in the area provided. You must also present document(s) to verify your age. You will find a list

of acceptable verification of age documents on page 3 of these instructions.

Provide your personal email address. Confirmation and follow up letters are sent via email whenever possible.

Step-by-step instructions for lling out your retirement application

If you are retiring as a Police and Firefighter (P&F) member, make sure to refer to your

OPSRP Pension Program and Individual Account Program Pre-Retirement Guide for special rules.

Please note the following restrictions:

• To change or establish a new retirement date, you must submit a new retirement application and any additional

required forms. PERS must receive these, as required by law, before the issue date of your rst benet payment.

• To change your option after your retirement date you must submit a new, signed and notarized retirement

application requesting a later retirement date. PERS must receive the new application before the issue date of

your rst benet payment.

• To cancel your retirement application, PERS must receive a written and signed cancellation request before the

issue date of your rst benet payment. This request can be faxed to 503-598-0561, mailed to P.O. Box 23700,

Tigard, OR 97281-3700, or delivered to PERS at 11410 SW 68th Parkway, Tigard, OR 97223.

Section C: U.S. Citizenship (required)

PERS must know your citizenship for tax purposes. Check the appropriate box.

• Check I am a U.S. citizen or resident noncitizen if you are a U.S. citizen or a resident noncitizen.

— If you are a United States citizen living outside of the United States, you will be required to complete IRS

form W-9 and are not allowed to claim exempt from United States federal income tax withholding. The

W-9 is available in the Forms section of the PERS website.

• Check I am a nonresident noncitizen if you are a nonresident noncitizen and complete IRS form W-8BEN:

Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding. This form is available in the

Forms section of the PERS website.

By signing Section F you are acknowledging that you have read and you understand the limitations of working for a

PERS-participating employer after retirement.

Work After Retirement Information for OPSRP Retirees.

If you return to employment with a PERS-participating employer in the state of Oregon after retirement, Oregon statutes

impose certain limitations on that employment. Compliance with the statutory limitations is your responsibility. If

you exceed the work-hour limitations, you will be accountable. Exceeding the limitations may lead to your retirement

benets being canceled and you being invoiced for any overpaid benets.

Section D: Working after retirement acknowledgment (required)

Form #459-467 (4/11/2024) SL3 IIM code: 22163

Page 5 of 9

Section E: Acknowledgement of Receipt of Federal Tax Information Disclosure (required)

The IRS requires PERS to notify you of the tax consequences of taking a distribution by providing the

Federal Tax Information Disclosure.

By signing Section F you are acknowledging that you have received and read the Federal Tax Information Disclosure.

You have 30 days to review your distribution options and the associated tax consequences. PERS will not process your

payment until the 30-day period has passed unless you check the box to waive your right to this 30-day period. If you

check the waiver box, PERS will process your distribution as soon as possible.

If PERS is unable to process your distribution within 180 days from the signature date in Section F, the IRS requires us to

provide the Federal Tax Information Disclosure again, and you will need to complete a new Acknowledgement of Receipt

of Federal Tax Information Disclosure form. We will contact you if this happens.

Section G: Retirement options (required)

Section F: Member signature (required)

You must sign and date in Section F to acknowledge the statements in Sections D and E and declare the information you

have provided on this page is true to the best of your knowledge and belief.

Notice: Senate Bill 1049, passed by the Oregon Legislature in 2019, lifted most restrictions on working after retirement

for calendar years 2020 through 2024. As a result of House Bill 2296, passed by the Oregon Legislature in 2023, these

rules will now continue through December 31, 2034. During these years, most PERS retirees who retire at “normal”

retirement age may return to work for a PERS-participating employer and still collect their PERS retirement benets with

no limitations imposed by PERS. Your employer may have other limitations on your work hours.

Find more information on the PERS website, including owcharts, to see if you can work unlimited hours while

continuing to receive your pension benet.

Early retiree PERS Work-After-Retirement limitations

If you retire early, follow these guidelines to continue to receive your PERS benets if you go back to work for

one or more public employer(s) in Oregon:

• Make sure you have a complete break from any PERS-participating employment for at least six full months after

your retirement date, before returning to work, if you want to work unlimited hours.

• If you do not have a six-month break, as an OPSRP early retiree, you may work less than 600 hours in a

calendar year as a retiree. More details about these limitations can be found on the PERS website.

Social Security limitations

If you are receiving Social Security benets and have not reached “full retirement age” (FRA) under Social Security, the

Social Security Administration and PERS have additional limitations on your employment. If you have not reached FRA,

you may need to limit your hours to stay within the income allowed under the annual Social Security income limits. For

details, go to the Social Security website.

Important: We highly recommend you read and understand “Section A: OPSRP Pension Program - Part One: Retirement

Options and Part Two: Other Things to Know” your OPSRP Pension Program and Individual Account Program Pre-

Retirement Guide before lling out this section.

Any corrections, alterations, or omissions in this section may require a new application to be submitted which could cause

a delay processing your benets.

Select only ONE of the ve options listed.

See your OPSRP Pension Program and Individual Account Program Pre-Retirement Guide for information regarding

registered domestic partners.

You can change your option by submitting a new, signed and notarized retirement application up to your eective

retirement date. The option choice becomes irrevocable on your eective retirement date. To change your eective

retirement date see instructions in Section B.

Small Benet Cash Out (SBCO) information – Some members may receive an estimate or letter stating their monthly

OPSRP pension unreduced single life benet will be less than $200 a month and they will receive a SBCO. Although a

SBCO may be paid in lieu of a monthly pension benet, the SBCO is not a selectable benet option. All retiring members

must chose a valid option in Section G and complete the beneciary designation in Section H.

Form #459-467 (4/11/2024) SL3 IIM code: 22163

Page 6 of 9

Section H: OPSRP beneciary designation (required)

Any corrections, alterations, or omissions in this section may require a new application to be submitted which could cause

a delay processing your benets.

All members should name a beneciary in this section. If you selected a survivorship option you are required to

complete this section.

• You may only name one beneciary and it must be a person.

• You must provide your beneciary’s legal name, date of birth, and the beneciary’s relationship to you. Your

application will be returned if information is missing. This could delay your benet payment.

• PERS also requests that you provide your beneciary’s Social Security number. This can be an important tool in

identifying and locating your beneciary after your passing.

The designation becomes eective on your eective retirement date.

If you elect the Single Life Option and die on or after your eective retirement date, but before PERS has distributed your rst

payment, the beneciary named in Section H will receive a one-time payment of your accrued, but unpaid retirement benets.

You can change your beneciary up to your eective retirement date by submitting a new, signed and notarized

retirement application. See your OPSRP Pension Program and Individual Account Program Pre-Retirement Guide for more

information. Your beneciary becomes irrevocable on your eective retirement date. To change your eective retirement date

see instructions in Section B.

Section I: Verication of Age (required)

Check the boxes to indicate you are submitting age documentation for yourself and for your beneciary if you selected a

survivorship option.

A list of acceptable verication of age documents is on page 3 of these instructions. Illegible verication of age documents

routinely cause benet delays. Please provide legible documentation.

Section J: Member declaration and Spousal consent – notarized signatures (required)

Do not complete any part of this section until you are with the notary. Any corrections, alterations, or omissions in

this section may require a new application to be submitted which could cause a delay processing your benets. Notary

stamp must be legible.

Member:

• You must select one of the marital status boxes to indicate your marital status as of your eective retirement date.

• Your signature and date must be notarized.

• Your signature date and the notary’s signature date must be the same date.

Member’s Spouse (if member is married):

• Your signature and date must be notarized to indicate your spousal consent of the option and beneficiary

selected by the member.

• Your signature date and the notary’s signature date must be the same date.

Failure of a married member to obtain valid spousal consent in this section will result in a mandatory default to a

Half-survivorship Option with your spouse as your beneciary.

Form #459-467 (4/11/2024) SL3 IIM code: 22163

Page 7 of 9

You must choose one option in Section K to select your IAP distribution.

Be aware that all IAP distributions except those automatically deposited to your bank account and those rolled over to the

Oregon Savings Growth Plan (OSGP) will be mailed directly to the address listed in Section A of your application. In the

case of a rollover, your nancial institution will be the payee on the check. Requests for rollovers to the Oregon Savings

Growth Plan (OSGP) are automatically transferred from your IAP account into your OSGP account. You must be a current

OSGP participant to roll over your installment(s) to OSGP.

Distribution option details:

• One-time lump-sum distribution or ve-year installment distribution (rollover eligible)

In a one-time lump-sum distribution of your entire IAP account, or in the case of the ve-year installment

distribution, you may elect to have all or a portion of the distribution rolled over. These rollover-eligible

distributions can be paid directly to you or rolled over to an IRA, eligible employer plan, or deferred

compensation plan. It can also be split as a combination payment, including an amount rolled over, and the

remainder issued in a payment directly to you. The minimum pre-distribution account balance required for the

rollover portion in a combination split/roll distribution is $500.

If you choose a one-time lump-sum distribution or a ve-year installment distribution, you must also complete

Section L. And you must also ll out the W-4R – IAP Lump Sum Withholding form if you are not rolling over

100% of your distribution.

• 10-, 15-, 20-year, and Anticipated Life-Span Option installment distribution

The 10-, 15-, 20-year, and Anticipated Life-Span Option installment distribution options are not rollover eligible.

You may choose to receive installment payments by a direct deposit into your bank account or by a check mailed

directly to you. You must also ll out the W-4P tax withholding form.

Frequency details for installment distribution options:

• Five-, 10-, 15-, 20-year, and Anticipated Life-Span Option installment distribution

All options other than the one-time lump-sum distribution receive installment payments. Because you will receive

installments you must also choose a monthly, quarterly, or annual distribution frequency.

Select your preferred frequency directly below your elected installment distribution.

Once your distribution has begun, your payment will be equal to the current market value of your account divided by the

number of payments left for the balance of the distribution. Because the market uctuates daily, each distribution may be

dierent based on the current market value of your account. If your account reaches a zero balance, your distribution stops,

regardless of the number of payments left for the option chosen.

If you elect an installment option, you must designate a beneciary by completing Section M.

If you decide you no longer wish to receive an installment distribution, you can make a one-time decision to cash out your

IAP account. Once the account is distributed as a cash-out, it is not reversible and will close your PERS IAP account.

Membership in PERS is retained with an IAP cash-out at retirement; should you return to qualifying employment, you will

not need to serve a six-month waiting period.

If you decide to cash out and the distribution of your remaining account balance is greater than $200, the distribution is

rollover-eligible and will be taxed accordingly.

If you decide to cash out, are under the age of 59½, and are not rolling over these funds, the IRS may assess a 10% early

withdrawal penalty.

If you have any questions regarding tax laws, you may want to consult with a qualied tax professional or the IRS.

Section K: IAP distribution option

Form #459-467 (4/11/2024) SL3 IIM code: 22163

Page 8 of 9

Section L: IAP payment distribution

ONLY complete this section if you selected one-time lump-sum or a five-year installment. (Box #1 or #2 in Section

K) Indicate whether or not to roll over any portion of your distribution into a traditional IRA, Roth IRA, or another

deferred compensation or eligible employer plan.

Check box 1 if you want your IAP distribution to go directly to you. Please fill out the Direct Deposit form to have

your distribution deposited into your bank account. You will be taxed on your distribution, complete the

W-4R IAP Lump Sum Withholding form. Selecting box 1 completes Section L.

Check box 2 if you want to roll over your IAP distribution.

Fill in the information in 2a to indicate the specific percentage or dollar amount to be rolled over. If you roll over

less than 100% of your benet, complete the W-4R IAP Lump Sum Withholding form.

Fill in the information in 2b and 2c.

• Check one of the boxes under 2b to indicate whether the distribution(s) will be going to the Oregon Savings

Growth Plan (OSGP), a traditional IRA, Roth IRA, or another deferred compensation or eligible employer plan.

• In box 2c, provide the name of your nancial institution or employer plan for your rollover payment. The rollover

check will be made payable to the institution or plan you provide in this box. If you are uncertain to whom the check

should be payable, please consult with your nancial institution or employer plan prior to completing this section.

Note: All IAP rollover checks other than to OSGP will be mailed to you with the nancial institution or employer plan as

the payee. You must be a current OSGP participant to roll over your distribution(s) to OSGP.

If you are rolling over funds to another deferred compensation or employer plan other than OSGP, you must have an

authorized representative of the plan complete the IAP Direct Transfer Rollover Acceptance form.

Section M: IAP beneciary designation

All members with an IAP should complete this section to designate a beneciary or beneciaries for the IAP. The

designation becomes eective on your eective retirement date. This designation applies if you select a one-time lump

sum and die on or after your eective retirement date but before your benet is distributed or if you select an installment

option and die anytime on or after your eective retirement date.

Check the appropriate box to use the standard beneciary designation or to name specic beneciaries.

If you choose the standard designation, do not name any specic person. Instead, your beneciary selection follows the order

described in law.

The standard designation directs PERS to pay benets in the order listed below:

1) Your spouse, if legally married at the time of death. If not married, then to

2) Your child* or children in equal shares. If any of your children are deceased, their portion is equally divided between

their children who are alive at the time of your death. If all of your children predecease you, the benet will be awarded

to your grandchildren living at the time of your death, in equal shares. If no children or grandchildren survive you, then to

3) Your mother and father in equal shares, or to the survivor. If neither survives you, then to

4) Your brothers and sisters in equal shares, and the share of any brother or sister who does not survive you, to their

children living at the time of your death in equal shares. If none of your brothers or sisters survive you, to the children

of your brothers and sisters living at the time of your death in equal shares. If neither your siblings nor their children

survive you, then to

5) Your estate

*Natural born and adopted children are considered “children” even if you selected the standard designation before or after

their adoption or birth. If your children are adopted by someone else, they are not considered your “children” under the

standard designation. If you wish to name the adopted-out children as your beneciary, use the specic designation part

of this form.

Form #459-467 (4/11/2024) SL3 IIM code: 22163

Page 9 of 9

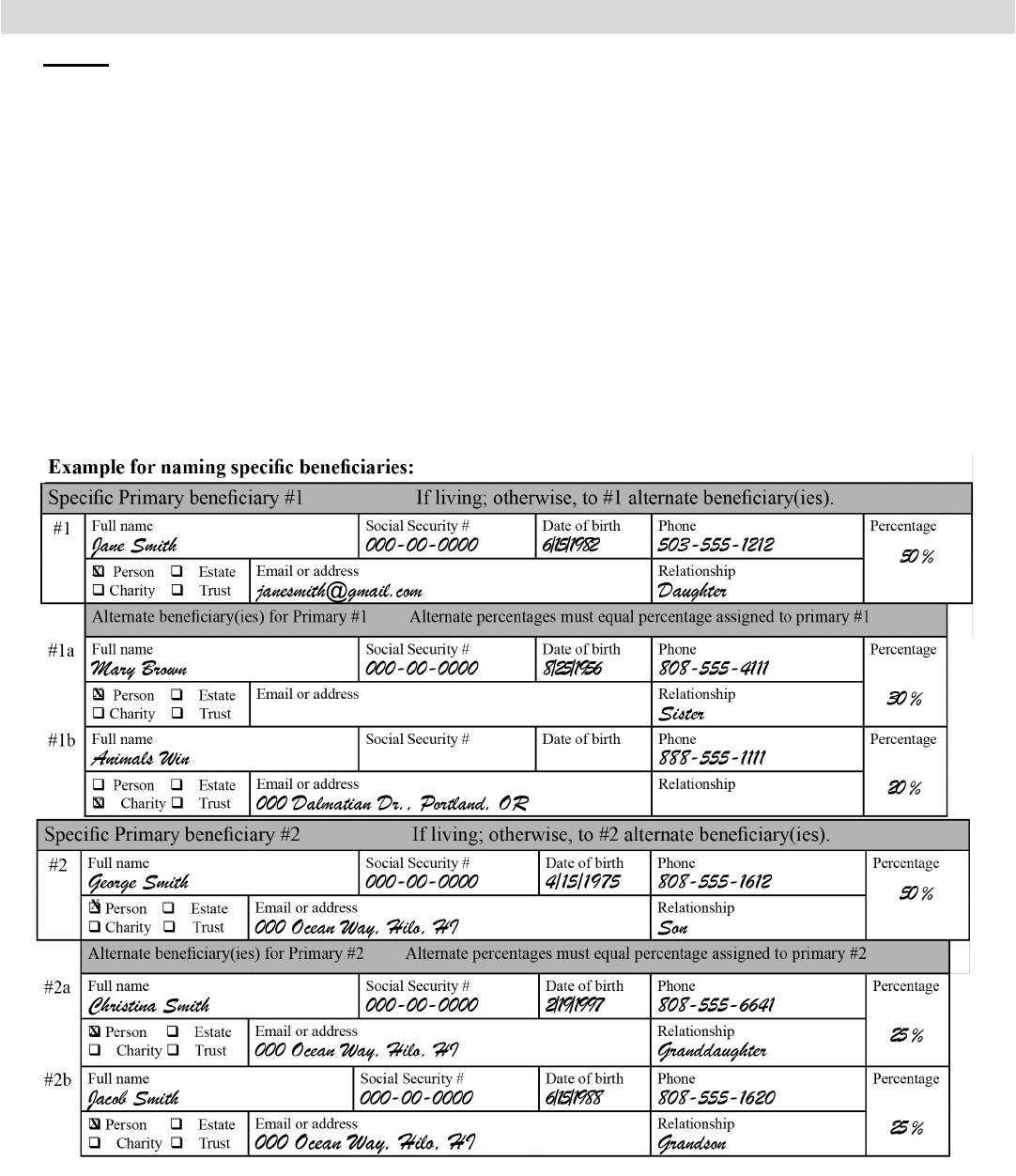

The specific designation allows you to name specific persons, charities, trusts, or your estate.

Providing requested information assists in locating your beneficiary.

If you need to add more beneficiaries, attach an additional sheet of paper that includes all the same information listed in

the table for each beneficiary. Include your name and SSN at the top of each additional sheet.

● The percentages assigned to primary beneciaries must total 100%.

● If you do not assign percentages, the beneciaries on that level (primaries or alternates under each specic

primary) will share equally.

● You can name one or more alternate beneciaries for each of your primary beneciaries. The alternates will

receive the primary beneciary’s share if the primary beneciary predeceases you. Note: The percentage you

designate for the alternates must equal the percentage you assigned to the primary beneciary. (E.g., if you

designate 50% to primary beneciary #1 and have two alternates for that beneciary, the percentages for the two

alternates must total 50%.)

● If you name your estate as a beneciary, you may not provide an alternate beneciary for your estate.

Section M: IAP beneciary designation (continued)

The percentages of #1 and #2 primary beneciaries add up to 100% (50+50=100)

The percentages of #1a and #1b alternate beneciaries add up to the #1 primary’s percentage (30+20=50)

The percentages of #2a and #2b alternate beneciaries add up to the #2 primary’s percentage (25+25=50)

You must sign and date Section M. The beneciary designation is not valid unless signed. Your signature is required for

both the Standard and Specic designations.

11410 SW 68th Parkway, Tigard OR 97223

Mailing Address – PO Box 23700, Tigard OR 97281-3700

Toll free – 888-320-7377 fax – 503-598-0561

Website – http://oregon.gov/pers

Section A: Applicant information

Section C: U.S. Citizenship (You are required to select one box below)

Section F: Member signature (Required)

First name MI Last name PERS ID (optional)

Mailing address (street or PO box) Social Security number (Required)*

City State ZIP code Country Date of birth (mm/dd/yyyy)

Home phone number Work phone number Cell phone number Personal Email

Section E: Acknowledgement of Receipt of Federal Tax Information Disclosure

Section B: Eective retirement date

Oregon Public Service Retirement Plan (OPSRP) Pension

and Individual Account Program (IAP) Retirement Application

*Providing your Social Security number (SSN) is mandatory, and PERS is authorized to request it under provisions of the Internal Revenue code. It will primarily be used to

comply with mandatory IRS reporting. It could also be used for conrmation purposes or recovery of overpaid funds

.

In compliance with the Americans with Disabilities Act, PERS will provide h

elp filling out this form upon request. You may request help by calling toll free 888-320-7377 or TTY 503-603-7766.

Form #459-467 (4/11/2024) SL3 IIM code: 22163 Page 1 of 4

My PERS retirement date is the rst day of:

PERS must receive your application

before this month and year.

_______________________ _____________________

Month Year

q

I am a U.S. citizen or resident noncitizen.

q

I am a nonresident noncitizen, and I have completed and included my IRS W-8BEN form.

By signing in Section F, I acknowledge that I have received and read the PERS document entitled Working After

Retirement Information for OPSRP Retirees.

Section D: Working after retirement acknowledgment

By signing in Section F, I acknowledge that I have received and read the Federal Tax Information Disclosure.

q

I waive my right to the 30-day period for reviewing the Federal Tax Information Disclosure. (optional)

I hereby declare that all statements on this page are true to the best of my knowledge and belief.

Applicant’s signature (Required for benet processing) Date

Form #459-467 (4/11/2024) SL3 IIM code: 22163 Page 2 of 4

1 q Single Life Option

2

q Full-survivorship Option

3

q Full-survivorship Increase Option

4

q Half-survivorship Option

5

q Half-survivorship Increase Option

First name (required) MI Last name (required) Social Security number (required)

All members should name an OPSRP beneciary

in Section H below.

The Section H beneciary designation becomes eective on

your retirement date.

You may only name one person.

If you elect the Single Life Option, the only benet payable to

your beneciary would be any retirement benet accrued after

your retirement date but not yet paid to you.

NO ALTERATIONS OR CORRECTIONS ARE ALLOWED ON THIS PAGE

Section G: Retirement options (Required - Select only ONE of the 5 options below)

Beneciary’s full name (Required) Beneciary’s SSN (Requested)

Beneciary’s date of birth (mm/dd/yyyy) (Required) Beneciary’s relationship to you (Required)

Section H: OPSRP beneciary designation (Required)

Section I: Verication of Age (Required) – see instructions for acceptable documentation

q

I am submitting acceptable verication of age to PERS with my retirement application to verify my date of birth.

q

I selected a survivorship option (#2 - #5 above) and am submitting my beneciary’s verication of age to PERS.

Section J: Member declaration and Spousal consent – notarized signatures (Required)

Do not complete any portion of this section until you are with the notary.

Member and spouse (if married) must sign in the presence of a notary.

Member declaration of marital status (Required)

q

As of my eective retirement date, I am married.

q

As of my eective retirement date, I am single.

Spousal consent (Required if married)

By my notarized signature below, I consent to the

option and beneciary my spouse selected.

Applicant’s signature Date Spouse’s signature Date

Notary Public Notary Public

State of County of State of County of

Applicant name Spouse name

Signed before me on this date Signed before me on this date

By (notary’s signature) By (notary’s signature)

Form #459-467 (4/11/2024) SL3 IIM code: 22163 Page 3 of 4

Section K: IAP distribution election

Section L: IAP payment distribution

Note: All IAP rollover checks other than to the OSGP will be mailed to you with the nancial institution as the payee.

First name (required) MI Last name (required) Social Security number (required)

Select only one from the six choices below and follow instructions based on your selection.

1.

q

One-time lump-sum distribution (rollover eligible). Complete Section L.

Fill out the W-4R – IAP Lump Sum Withholding form if you are not rolling over 100% of your distribution.

--------------------------------------------------------------------------------------------------------------

2.

q

Five-year installment distribution (rollover eligible).

Select frequency:

q

Monthly

q

Quarterly

q

Annually Complete Section L.

Fill out the W-4R – IAP Lump Sum Withholding form if you are not rolling over 100% of your distribution.

--------------------------------------------------------------------------------------------------------------

3.

q

10-year installment distribution – (not rollover eligible). Fill out a W-4P tax withholding form.

Select frequency:

q

Monthly

q

Quarterly

q

Annually Skip Section L.

--------------------------------------------------------------------------------------------------------------

4.

q

15-year installment distribution – (not rollover eligible). Fill out a W-4P tax withholding form.

Select frequency:

q

Monthly

q

Quarterly

q

Annually Skip Section L.

--------------------------------------------------------------------------------------------------------------

5.

q

20-year installment distribution – (not rollover eligible). Fill out a W-4P tax withholding form.

Select frequency:

q

Monthly

q

Quarterly

q

Annually Skip Section L.

--------------------------------------------------------------------------------------------------------------

6.

q

Anticipated Life-Span Option installments – (not rollover eligible). Fill out a W-4P tax withholding form.

Select frequency:

q

Monthly

q

Quarterly

q

Annually Skip Section L.

This Section is not for all members

Only complete this section if you selected one-time lump-sum (#1) or a ve-year installment (#2) in Section K.

1.

q

Do not roll over. Send distribution(s) directly to me, or direct deposit to my bank account. Continue to Section M.

2.

q

Roll over my distribution(s).

Subsections 2a, 2b, and 2c must be completed. Complete one line only under each 2a and 2b.

2a. Roll over __________________ % of my distribution, or

Roll over $ _________________ of my distribution.

2b. Roll to:

q

Traditional IRA.

q

Roth IRA.

q

Oregon Savings Growth Plan (OSGP).

You must be a current OSGP participant to roll over your installment(s) to OSGP.

q

Another deferred compensation or employer plan.

You must have an authorized representative of the plan complete the IAP Direct Transfer

Rollover Acceptance form and submit it with your application if you check this box.

2c. List the name of your nancial institution or employer plan name for your rollover below.

Rollover check should be made payable to:

Form #459-467 (4/11/2024) SL3 IIM code: 22163 Page 4 of 4

Applicant’s signature (Required for Section M: IAP beneciary designation)

Date

First name (required) MI Last name (required) Social Security number (required)

Section M: IAP beneciary designation (Required - Select only one Standard or Specic)

I understand this beneciary designation becomes eective upon my eective retirement date.

q

STANDARD - I elect to use the Standard beneciary designation. Do not complete table below.

q

SPECIFIC - I elect to use the Specic beneciary designation. Complete the table below.

Return completed application, additional forms and documents to PERS at PO Box 23700, Tigard OR 97281-3700, or fax to 503-598-0561.

q

Check this box if you want PERS to apply the following: If any of the named primary beneciaries predecease

me and I have not named an alternate beneciary, I want the portion of my benet that was designated to that

beneciary shared equally among the remaining primary beneciaries living at my death.

Specic Primary beneciary #1

If living; otherwise, to #1 alternate beneciary(ies).

#1

Full name Social Security # Date of birth Phone Percentage

q

Person

q

C h a r i t y

q

Estate

q

T r u s t

Email or address Relationship

Alternate beneciary(ies) for Primary #1 Alternate percentages must equal percentage assigned to primary #1

#1a

Full name Social Security # Date of birth Phone Percentage

q

Person

q

Charity

q

Estate

q

Trust

Email or address Relationship

#1b

Full name Social Security # Date of birth Phone Percentage

q

Person

q

C h a r i t y

q

Estate

q

T r u s t

Email or address Relationship

Specic Primary beneciary #2 If living; otherwise, to #2 alternate beneciary(ies).

#2

Full name Social Security # Date of birth Phone Percentage

q

Person

q

C h a r i t y

q

Estate

q

T r u s t

Email or address Relationship

Alternate beneciary(ies) for Primary #2 Alternate percentages must equal percentage assigned to primary #2

#2a

Full name Social Security # Date of birth Phone Percentage

q

Person

q

C h a r i t y

q

Estate

q

T r u s t

Email or address Relationship

#2b

Full name Social Security # Date of birth Phone Percentage

q

Person

q

C h a r i t y

q

Estate

q

T r u s t

Email or address Relationship

Print Form

Clear Fields