October 19, 2012 1:00 PM 11922

ANDRA GHENT, PH.D.

W.P. CAREY SCHOOL OF BUSINESS

ARIZONA STATE UNIVERSITY

research institute for housing america SPECIAL REPORT

THE HISTORICAL ORIGINS

OF AMERICA’S MORTGAGE LAWS

11922

research institute for housing america SPECIAL REPORT

THE HISTORICAL ORIGINS OF

AMERICA’S MORTGAGE LAWS

ANDRA GHENT

Assistant Professor of Real Estate

Department of Finance

W.P. Carey School of Business

Arizona State University

The Historical Origins of America’s Mortgage Laws iii

© Research Institute for Housing America October 2012. All rights reserved.

Research Institute for Housing America

B T

Chair

Teresa Bryce, Esq.

Radian Group Inc.

E.J. Burke

Vice Chairman, Mortgage Bankers Association

Key Bank

Trisha Hobson

Citi

Gleb Nechayev

CBRE

E. Michael Rosser, CMB

United Guaranty Corporation

Dena Yocom

IMortgage

S

Jay Brinkmann, Ph.D.

Trustee, Research Institute for Housing America

Senior Vice President, Research and Business Development

Chief Economist

Mortgage Bankers Association

Michael Fratantoni, Ph.D.

Executive Director, Research Institute for Housing America

Vice President, Research and Economics

Mortgage Bankers Association

iv The Historical Origins of America’s Mortgage Laws

© Research Institute for Housing America October 2012. All rights reserved.

The author would like to thank Loan Marsanico for the excellent research assistance.

ACKNOWLEDGEMENT

The Historical Origins of America’s Mortgage Laws v

© Research Institute for Housing America October 2012. All rights reserved.

Executive Summary . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .7

Introduction . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .9

Mortgages and Foreclosures in America Today . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

The English Origins of American Mortgages . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17

Title versus Lien Theory . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 21

The Development of Foreclosure Procedures . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 27

Redemption Rights. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .33

Restrictions on Deficiency Judgments and the One Action Rule . . . . . . . . . . . . . . . . . . . . . . . . . . . . 37

Conclusions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 43

References . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 45

Author Biography . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 49

TABLE OF CONTENTS

vi The Historical Origins of America’s Mortgage Laws

© Research Institute for Housing America October 2012. All rights reserved.

Tables and Charts

Table 1: Dominant Legal Theory of Mortgages in the Various U.S. States over Time. . . . . . . . . . . . . . . . . .22

Table 2: Pairwise Correlations Between Title Theory States, Usury Laws and State Age . . . . . . . . . . . . . . . . 23

Table 3: Marginal Effects from Probit Estimation on Title versus Lien Theory . . . . . . . . . . . . . . . . . . . . .25

Table 4: Availability of Non-judicial Foreclosure in the Various States over Time . . . . . . . . . . . . . . . . . . . 29

Figure 1: Availability of Non-judicial Foreclosure, 1863. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .31

Table 5: Redemption Periods in Usual Non-agricultural Residential Foreclosure Procedure . . . . . . . . . . . . . . 34

Table 6: Foreclosure Rates for Urban and Farm Mortgages during the Great Depression. . . . . . . . . . . . . . . .41

Table 7: Marginal Effects from Probit Estimation on Deficiency Judgment Bans . . . . . . . . . . . . . . . . . . . . 42

The Historical Origins of America’s Mortgage Laws 1

© Research Institute for Housing America October 2012. All rights reserved.

U.S. states vary dramatically in their mortgage laws. The laws across states differ in the legal theory

underlying the mortgage contract and in how they balance the rights of creditors with those of

borrowers. Moreover, the differences across states arose relatively early in America’s history. In a

popular 19th century American treatise on mortgage law, Jones (1879, ch. 30) observes

An examination of the statutes of the several states in relation to the foreclosure of

mortgages can hardly fail to surprise one at the great diversity of systems in use, and at

the difference in detail between those which are based on the same general principles.

Despite at least four distinct attempts over the last century to create a uniform mortgage code, mortgages

today continue to be governed by a very diverse set of state laws.

To better understand the variation in foreclosure laws across states, this paper traces the history

of mortgage laws in the United States. The paper is largely descriptive but, to the extent possible,

I try to explain why the laws differ across U.S. states. I document when states enacted the various

statutes that now govern real estate security instruments (i.e., mortgages or deeds of trust) therein. I

explore the historical forces that led states to follow either title or lien theory, or to adopt a nonjudicial

foreclosure procedure, that led to differences in redemption periods across states and that led some

to restrict deficiency judgments.

I find that older states are much more likely to have adopted title theory, which governed English

mortgages. Under title theory, the lender has formal ownership of the mortgaged property for the

duration of the mortgage while, under lien theory, the borrower legally owns the property during the

term of the mortgage. Younger states, founded after independence from Great Britain and thus less

likely to have precedents based solely on English law, may have felt freer to deviate from it. There

is some tentative evidence for the role of title theory in circumventing usury laws. Most states that

followed title theory in the late nineteenth century continued to follow some version of it in the late

twentieth century.

EXECUTIVE SUMMARY

2 The Historical Origins of America’s Mortgage Laws

© Research Institute for Housing America October 2012. All rights reserved.

There is a much less obvious pattern in foreclosure procedure and redemption rights, the rights some

states afford borrowers to redeem the property during a specified period of time before or after the

foreclosure sale if the borrower pays off the entire mortgage balance. The procedure that lenders must

follow to foreclose on a mortgage is determined very early in states’ histories, typically before the U.S.

Civil War. The validity of power-of-sale clauses and deeds of trust is mostly determined by case law

and there do not seem to be clear economic reasons for why states adopted different procedures for

the remedies they offer lenders. There has been a tendency among states since the 1930s to shorten

or reduce redemption periods.

Finally, restrictions on deficiency judgments on residential mortgages arose during the Great Depression.

In a deficiency judgment the lender recovers the debt by pursuing the borrower personally if the

property securing the mortgage is not worth enough to cover the debt owed. Many states tried to

enact similar laws regarding deficiency judgments with varying degrees of success, but in some the

courts ruled that the law was unconstitutional while in others the law was upheld. States that had

higher farm foreclosure rates were more likely to attempt to prohibit deficiency judgments but there

is no evidence that the foreclosure rate on urban mortgages affected the likelihood that a state would

enact a sweeping anti-deficiency statute.

In summary, there do not seem to be clear economic reasons for the different patterns of development

in America’s mortgage laws. With the exception of anti-deficiency statutes, mortgage laws seem to be

the outcome of path-dependent quirks in the wording of various proposed statutes and decisions of

individual judges. Rather than responses to differences in economic circumstances, mortgage laws

are extremely slow to change. While slow adjustment of laws is perhaps necessary to maintain the

integrity of the rule of law in a common law legal system, the result is a diverse set of laws that seem

poorly suited to a mortgage market that is increasingly integrated across state borders.

The Historical Origins of America’s Mortgage Laws 3

© Research Institute for Housing America October 2012. All rights reserved.

U.S. states differ dramatically in their mortgage laws. The laws across states differ in the legal theory

underlying the mortgage contract and in how they balance the rights of creditors with those of

borrowers. Moreover, the differences across states arose relatively early in America’s history. In a

popular 19th century American treatise on mortgage law, Jones (1879, ch. 30) observes

An examination of the statutes of the several states in relation to the foreclosure of

mortgages can hardly fail to surprise one at the great diversity of systems in use, and at

the difference in detail between those which are based on the same general principles.

Despite at least four distinct attempts over the years to create a uniform mortgage code,

1

mortgages

today continue to be governed by a very diverse set of state laws.

Differences in mortgage laws have real consequences. For example, foreclosure is much slower in

states that require a judge’s approval for a foreclosure (“judicial” foreclosure). Delay in foreclosure

may increase the number of foreclosures by extending the free-rent period (see Ambrose, Buttimer,

and Capone [1997]). Mian, Sufi, and Trebbi (2011) argue instead that judicial foreclosure decreases

the number of foreclosures. Even if judicial foreclosure affects only the timing of foreclosure, rather

than affecting whether foreclosure occurs as Gerardi, Lambie-Hanson, and Willen (2011) argue, a

prolonged foreclosure process may delay recovery in the housing market by preventing adjustment.

Pence (2006) shows that differences in state foreclosure laws affect loan size. Ghent and Kudlyak

(2011) show that state laws that restrict deficiency judgments increase the risk of foreclosure.

To better understand the variation in foreclosure laws across states, this paper traces the history of

mortgage laws in the U.S. The paper is largely descriptive but, to the extent possible, I try to explain

why the laws differ across the states. I document when they enacted the various statutes that now

1 Durfee and Doddridge (1925) and Pomeroy (1926) discuss at length the provisions of a Uniform Mortgage Act. This act does not ever

seem to have been passed. Reeve (1938) argues for the need to enact a Uniform Real Estate Mortgage Act. That act too does not seem

to have become law. Bernhardt (1992) discusses the provisions of the Uniform Land Security Interest Act of 1985 which has yet to be

adopted by any state. Nelson and Whitman (2004) analyze the Uniform Nonjudicial Foreclosure Act of 2002 and argue for its adoption

at the Federal level.

INTRODUCTION

4 The Historical Origins of America’s Mortgage Laws

© Research Institute for Housing America October 2012. All rights reserved.

govern real estate security instruments (i.e., mortgages and deeds of trusts) therein. I explore the

historical forces that led them to follow either title or lien theory, or to adopt a nonjudicial foreclosure

procedure, that led to differences in the time period the borrower has to redeem the property either

before or after foreclosure (redemption periods), and that led some states to restrict the lender’s right

to deficiency judgments.

I find that older states are much more likely to have adopted title theory as the basis for the law with

some tentative evidence for the role of title theory in circumventing usury laws. Most states that

followed title theory in the late nineteenth century continued to follow some version of it in the late

twentieth century.

There is a much less obvious pattern in foreclosure procedure and redemption rights. The procedure

that lenders must follow to foreclose on a mortgage is determined very early in states’ histories,

typically before the U.S. Civil War. The validity of power-of-sale clauses and deeds of trust is mostly

determined by case law and there do not seem to be clear economic reasons for why states adopted

different procedures for the remedies they offer lenders. It is thus likely safe to treat differences in

state mortgage laws as exogenous which may provide economists with a useful instrument for studying

the effect of differences in creditor rights (see, for example, Pence [2006] and Mian, Sufi, and Trebbi

[2011]). Differences in redemption rights also change little across time and do not seem to follow any

obvious geographic or economic pattern, although there has been a tendency among states since the

late 1930s to reduce or eliminate redemption periods.

Laws such as the One Action Rule that exist in some Western states, which in practice requires the

lender to exhaust the collateral before he can sue on the promissory note, seem to have arisen largely

out of historical accident and misinterpretation of a New York legal precedent (see Guidotti [1943]), a

precedent that never actually became law in New York, than for any fundamental economic reasons.

Finally, restrictions on deficiency judgments arose during the Great Depression. What is perhaps

surprising is that many states tried to enact similar laws regarding deficiency judgments but in

some states the higher courts ruled that the law was unconstitutional while in other states the law

was upheld as constitutional. What may have seemed like relatively minor differences in wording of

laws permanently altered the balance of rights between debtors and creditors. States that had higher

farm foreclosure rates were more likely to attempt to prohibit deficiency judgments, but there is no

evidence that the foreclosure rate on urban mortgages affected the likelihood that a state enacted an

anti-deficiency statute.

The Historical Origins of America’s Mortgage Laws 5

© Research Institute for Housing America October 2012. All rights reserved.

In summary, there do not seem to be clear economic reasons for the different patterns of development

in America’s mortgage laws. With the exception of anti-deficiency statutes, mortgage laws seem to be

the outcome of path-dependent quirks in the wording of various proposed statutes and decisions of

individual judges. Rather than responses to differences in economic circumstances, mortgage laws

are extremely slow to change.

The next section of the paper describes the nature of mortgage contracts and foreclosure processes

in the U.S. and defines some basic terminology that we will use throughout the paper. Section 3

discusses the origins of mortgages in America to better explain the developments in mortgage laws

early in America’s history. Section 4 explores why some states retained the title theory of mortgages

while others adopted lien theory. Section 5 explores the development of the procedure the lender

must use to foreclose on the borrower. Section 6 summarizes the history of redemption rights in the

various states. Section 7 explores the history of the right of the creditor to a deficiency judgment in

the various states. Section 8 offers some concluding remarks.

The Historical Origins of America’s Mortgage Laws 7

© Research Institute for Housing America October 2012. All rights reserved.

In the United States, what is commonly termed a mortgage actually consists of two legal documents.

The mortgage itself merely provides the lender with a lien on the property or, in a title theory state, the

ownership of the property until the borrower has paid off the debt. The specific terms under which

the borrower must repay the loan are contained in the promissory note. The borrower is known in

legal terms as the mortgagor and the lender is referred to as the mortgagee.

The legal theory underlying real estate security instruments differs from state to state. The main

division is between title theory and lien theory. If a state follows title theory, the lender retains title

to the property until such time as the borrower pays off the mortgage. That is, the lender is the legal

owner of the property for the duration of the mortgage. Under the contrasting theory, lien theory,

the borrower owns the property during the duration of the mortgage and the lender’s interest in the

property is limited to situations in which the borrower defaults on the mortgage. While the distinction

between title and lien theory no longer has any substantial effect on the balance of power between

borrower and creditor, different legal theories nevertheless require different mortgage documents,

adding to the paperwork burden of national lenders.

States also differ in whether the standard real estate security instrument is a mortgage or a deed of

trust although the term mortgage is used to refer to both instruments in everyday usage. In most

states, the standard way to finance a property is with a mortgage. However, in some states the standard

instrument is a deed of trust wherein the legal title to the property is entrusted to a third party known

as the trustee. Unlike a mortgage, where there are only two parties, there are three parties in a deed-

of-trust transaction. In a deed-of-trust state, the trustee sells the property if the borrower defaults.

In states that follow the lien theory of mortgages, the equitable title nevertheless remains with the

borrower. The main reason some states use a deed of trust rather than a mortgage is because, as we

discuss in greater detail below, when lenders began including power-of-sale clauses into mortgages,

some judges viewed it as improper for the lender himself to be able to sell the property.

MORTGAGES AND

FORECLOSURES IN

AMERICA TODAY

8 The Historical Origins of America’s Mortgage Laws

© Research Institute for Housing America October 2012. All rights reserved.

When a borrower becomes delinquent on their mortgage, there are two main factors that affect the

speed with which the lender can take possession of the property. First, some states require the lender

to go to court and receive a judge’s approval to foreclose. This is known as judicial foreclosure. In

other states, the lender may sell the property himself if the mortgage contains a power-of-sale clause

or, if a deed of trust is the standard real estate finance instrument, the trustee is obliged to sell the

property on the lender’s behalf. States that allow the lender to sell the property without a judge’s

approval are known as nonjudicial foreclosure states. Even in nonjudicial states, however, the lender

usually can pursue judicial foreclosure if he chooses. Given the higher transaction costs and time

to foreclose associated with judicial foreclosure, however, lenders usually foreclose nonjudicially if

state law permits it without any additional burdens. Lenders in an otherwise nonjudicial state might

choose to use judicial foreclosure if there is a problem with the title to the property. Some states also

require the lender to pursue judicial foreclosure if the lender wants to obtain a deficiency judgment

as we discuss later in this section. Finally, some states that technically permit nonjudicial foreclosure

give the borrower greater redemption rights under nonjudicial foreclosure or impose other burdens on

lenders if they foreclose nonjudicially such that lenders more commonly choose judicial foreclosure.

The second main factor that affects the speed with which a lender can foreclose is redemption rights. A

redemption right is the right of the borrower to redeem the property by paying off the entire balance of

the mortgage. A redemption period is a period during which the borrower has redemption rights. If the

redemption period precedes the foreclosure sale, the right of the borrower to redeem during that time

is known as an equitable redemption right. Such a right might take the form of requiring the lender to

wait, say, six months after the first serious delinquency before it can foreclose. In practice, most states

have some equitable redemption period that arises because of long notification and advertisement

requirements, although some might not necessarily term these waiting times equitable redemption

periods. Many states also allow the borrower some time period after the foreclosure sale to redeem

the property. The borrower’s right to redeem the property for some specified number of months after

the foreclosure sale is known as a statutory redemption right. Because statutory redemption rights

cloud the title of the property for prospective buyers at the foreclosure auction, they are arguably more

problematic for lenders than equitable redemption rights. As we discuss in greater detail below, the

distinction between equitable and statutory redemption rights likely arose from differences between

courts of law and courts of equity and states’ subsequent deference to one of the two types of courts.

The Historical Origins of America’s Mortgage Laws 9

© Research Institute for Housing America October 2012. All rights reserved.

Finally, some states have laws that restrict the rights of lenders to pursue a residential borrower

personally to recover the debt owed to the lender. For example, suppose a borrower defaults on a

mortgage of $300,000 and the fair market value of the property is only $200,000. The borrower still

owes the lender $100,000 after the lender seizes the property. To recover the $100,000, the lender in

most states can get a deficiency judgment which will enable the lender to seize any other assets the

borrower has and garnish the borrower’s wages. In some states, the lender automatically receives a

deficiency judgment if the property is not adequate to cover the debt owed to the lender, but in most

states the lender must file a lawsuit to get a deficiency judgment. A mortgage where the lender can

get a deficiency judgment is generally known as a recourse mortgage. If there is not a specific clause

in the promissory note that makes the mortgage non-recourse, a clause known as an exculpatory

clause, the mortgage is recourse unless state law overrides it. Exculpatory clauses are not generally

used in U.S. residential mortgages, although they are common in commercial mortgages. States that

have sweeping anti-deficiency statutes that effectively make mortgages non-recourse are known as

non-recourse states.

Ghent and Kudlyak (2011) empirically examine the effect of recourse on residential mortgage default.

Despite deficiency judgments being rare in the United States and the United States having very generous

personal bankruptcy laws relative to other industrialized countries, Ghent and Kudlyak (2011) find

that recourse substantially affects the borrower’s propensity to default in response to negative equity.

Their findings indicate that the mere possibility of recourse is enough to deter many households

from default which explains the rarity of deficiency judgments. Ghent and Kudlyak (2011) also find

that borrowers that default in non-recourse states are more likely to be strategic defaulters in the

sense of defaulting in a way that is inconsistent with liquidity constraints being the primary cause

of default. Furthermore, they show that borrowers in recourse states are more likely to default in a

lender-friendly manner, such as a short sale, because of the borrower’s weaker negotiating position

in recourse states.

10 The Historical Origins of America’s Mortgage Laws

© Research Institute for Housing America October 2012. All rights reserved.

The Historical Origins of America’s Mortgage Laws 11

© Research Institute for Housing America October 2012. All rights reserved.

To understand U.S. mortgage laws, it is necessary to understand their history. Our story starts in

medieval England where mortgages followed the strict title theory of mortgage law. The structure

of early English mortgages in turn derived from Anglo-Saxon mortgages (Jones [1878]).

2

In medieval

England, the most common form of mortgage consisted of the lender receiving the rents and profits

from the land to satisfy the debt. This prevented the contract from being seen as one in which the

borrower was paying interest per se to the lender, thus ensuring that the contract was not usurious

(Glaeser and Scheinkman [1998]). Until the early 16th century, all lending at interest was forbidden,

although occasional exceptions were made for money lending by Jews to gentiles (Temin and Voth

[2008]). As a result, it was crucial that the mortgage contract be structured in such a way that the

contract not violate usury laws (most mortgage transactions were unlikely to have occurred between

Jews and gentiles).

The mortgage contract evolved into a “conditional conveyance” (Jones [1878]) in the sense of the

property conveying to the borrower only upon satisfaction of the debt, rather than merely the property

serving as collateral in the event the borrower failed to make timely interest and principal payments.

This structure further differentiated the contract from an interest-bearing loan. The advantage of

title theory in medieval England was that the payment of rents and profits on land that the lender

had title to prevented the lender from being in violation of usury laws.

Before the early 17th century, the lender’s rights were likely sweeping. The borrower was legally

little more than an option holder. The lender had the right to enter the property at will and often the

borrower did not even retain the right to use the land during the period of the contract. The borrower

could not lease the property (Williams [1866]). After the contractual date of repayment had passed, the

lender’s ownership of the property became absolute rather than conditional. If the lender was using

2 Jones (1878) reports that Roman law also had the concept of a collateralized debt under which the lender retained possession of

the property until the debt was satisfied (the pignus or pawn) and a debt in which the borrower retained possession of the property

with the property merely serving as collateral should the borrower violate the provisions of the debt contract (the hypotheca or

hypothecation). Roman law does not seem to have distinguished between real property and chattel mortgages. Chaplin (1890) notes

that some version of a mortgage existed in the law of all civilized societies of which we have knowledge.

THE ENGLISH ORIGINS OF

AMERICAN MORTGAGES

12 The Historical Origins of America’s Mortgage Laws

© Research Institute for Housing America October 2012. All rights reserved.

the property, no lawsuit to make the title absolute was required on the part of the lender (Chaplin

[1890]). If the lender was not the user of the property, early on (certainly in the 12th and 13th centuries),

the lender had to bring suit in a court of law to eject the borrower. A shift occurred at some point

after the mid-13th century wherein, if the borrower was using the property, the onus shifted to the

borrower to provide proof of repayment of the debt in order to reclaim the property (Chaplin [1890]).

The lender did not need to sell the property upon evicting the borrower, and a borrower evicted from

the property would lose the entire estate (Williams [1866]) regardless of the amount of the debt that

remained unpaid. The property may have been worth many times the debt owed and yet the borrower

forfeited the entire property if he did not pay the full sum on the date stipulated. Given the nature of

such a contract, the lender often had an incentive to try to claim non-payment of the debt to secure

the property for himself, particularly given the large parcel sizes that characterized English realty

at the time.

In the early 17th century, the English mortgage underwent a seismic shift with the introduction of

the concept of the equity of redemption by English equity courts.

3

The equity of redemption principle

meant that, despite not having made payment on the date stipulated in the mortgage, the borrower

could regain his property by paying all principal, interest and fees due on the debt at some time after

the expiration of the contract. The equity of redemption principle marked a revolution in law insofar

as it abrogated private contracts. Under the equity of redemption, the borrower could not be deprived

of the right to his estate regardless of whether he voluntarily entered into a contract that would strip

him of his estate if he could not pay the debt (Jones [1878]). Since there was no concept of foreclosure

at this time, the term equity of redemption is also now used in the U.S. to refer to any redemption

rights the borrower has before the foreclosure sale.

The equity of redemption principle still allowed the lender to evict the borrower. However, it required

the lender to keep a strict account of the rents and profits he received from the property. Once the

rents and profits sufficed to cover the principle, interest and fees (such as late fees) due on the debt,

the lender had to convey the property back to the borrower unconditionally (Williams [1866]). It does

not seem coincidental that the equity of redemption evolved so soon after the relaxation of English

usury laws, since the equity of redemption is predicated on the lender having the right to a fixed

amount of income from the property (i.e., interest) and not having an equity interest in the property.

3 Courts of equity (also known as courts of chancery or simply chanceries) existed to prevent the strict letter of the law from acting too

harshly upon subjects. Effectively, the legal concept of equity is the idea that there is a set of principles that might not be explicit in

rules of law but that most human beings agree to as a matter of basic ethics or natural law. Chancellors used discretion in these courts

far more than in courts of law. In contrast to courts of law, courts of chancery admitted verbal (parol) evidence regarding the conditions

under which the mortgage contract was agreed to. Although the concept of equity of redemption was not formally recognized in

English courts of law, Chaplin (1890) cites evidence from as early as the 12th and 13th centuries that courts of law exercised some

equitable interpretation of mortgages.

The Historical Origins of America’s Mortgage Laws 13

© Research Institute for Housing America October 2012. All rights reserved.

Early in the history of the equity of redemption, there seems to have been no limitation on the timeframe

during which the borrower could redeem his property (Jones [1878]). Rights of redemption could be

used to pay debts and were passed on to the borrower’s heirs (Crabb [1846]). Gradually, limitations on

the equity of redemption developed. By 1846, Crabb (1846) suggests that the borrower had no more

than 20 years to redeem after the lender had taken possession. Kent (1830) similarly notes that, in

the absence of a foreclosure, the equitable right of redemption lasted decades in many U.S. states.

Eventually, the lender could petition a court of equity to set a date by which the borrower had to

repay the principle, interest and fees. If the borrower had not completed payment by that date, he

would forever lose his right to redeem the property and the conveyance to the lender would become

unconditional (Williams [1866]). Such an end was known as foreclosure. It is important to note that,

since the equitable right of redemption was a creation of a court of equity, rather than a court of law,

the lender had to bring such suit in a court of equity. Courts thus had wide leeway in determining under

what conditions a foreclosure could proceed. Getting a foreclosure was far from a routine procedure.

Such was the condition of the mortgage when it came to America. Until the early 19th century, it

seems the mortgage in the American states followed the same legal theory (title) and procedure as

the United Kingdom. As early as the 1860s, however, sizable differences had developed between the

U.S. states with regard to the legal theory they followed and the remedies available to the lender.

It is to these differences we now turn.

14 The Historical Origins of America’s Mortgage Laws

© Research Institute for Housing America October 2012. All rights reserved.

The Historical Origins of America’s Mortgage Laws 15

© Research Institute for Housing America October 2012. All rights reserved.

In 1878, the British Empire continued to follow the title theory of mortgages (Jones [1878]). By that

date, however, only half of U.S. states and territories followed it. Jones attributes the lien theory of

mortgages to the eighteenth century English barrister, Lord Mansfield. New York State led the way;

as early as 1828, New York was a lien-theory state. As a young state, California tried to emulate New

York in its civil code (see, for example, Guidotti [1943]) which may explain why it chose lien theory

at an early date. Many younger Western states chose to follow California law, leading to a somewhat

greater likelihood of lien theory among the Western states.

As of 1878, the description of state mortgage laws by Jones (1878) permits the theory underlying mortgage

laws in the U.S. states (some of which were then territories) to be loosely classified according to Table

1.

4

Such classifications are not absolute: for example, many title-theory states’ statutes explicitly stated

that the lender was not the owner of the property despite having title for the duration of the mortgage.

For comparison, the table also presents the legal theory underlying mortgages in each state in 1957

from Prather (1957) and in 1995 from Geis (1995). Despite more than a century having passed, most

states that followed title theory in 1878 retained some vestige of it in 1995. Of the 21 states that followed

title theory in 1878, only Arkansas, Florida, Kentucky and West Virginia were considered lien-theory

states by 1995. The comparison shows how persistent foundations can be in a legal system based on

case law. At present, however, whether a state follows title or lien theory has few, if any, practical

implications, since most states’ statutes are more explicit about the various rights and responsibilities

of each party to the mortgage transaction. Nevertheless, legal theory requires different documents

and forms for lien- and title-theory states even if all other aspects of the laws were identical.

Why did states differ in whether they followed title or lien theory? One possibility is that title theory

made it easier to get around usury laws. In general, a transaction in which the borrower received less

for the loan than the principal he had to repay often would not have been considered in violation of

4 Jones (1878) in fact uses the classification “mortgage of common law” vs. “mortgage of equity”.

TITLE VERSUS LIEN THEORY

16 The Historical Origins of America’s Mortgage Laws

© Research Institute for Housing America October 2012. All rights reserved.

usury laws (Holmes [1892]). For example, suppose a lender and borrower wanted to agree to a loan of

$1,000 at 10 percent interest for three years, but that the usury law in the borrower’s state capped the

rate of interest at 6 percent. How could the transaction be structured? If the lender simply provided the

borrower with $900, rather than the $1,000, and subsequently charged payments of 6% × $1,000 = $60

per year, the result would be an annual yield of 10 percent. This transaction is much less specious if it

is legally treated as a sale of the property from the borrower to the lender for the price of $900 with

the agreement on the part of the borrower to repurchase the property at a price of $1,000. Usury laws

generally made no attempt to restrict the prices at which real estate could transact (Holmes [1892]).

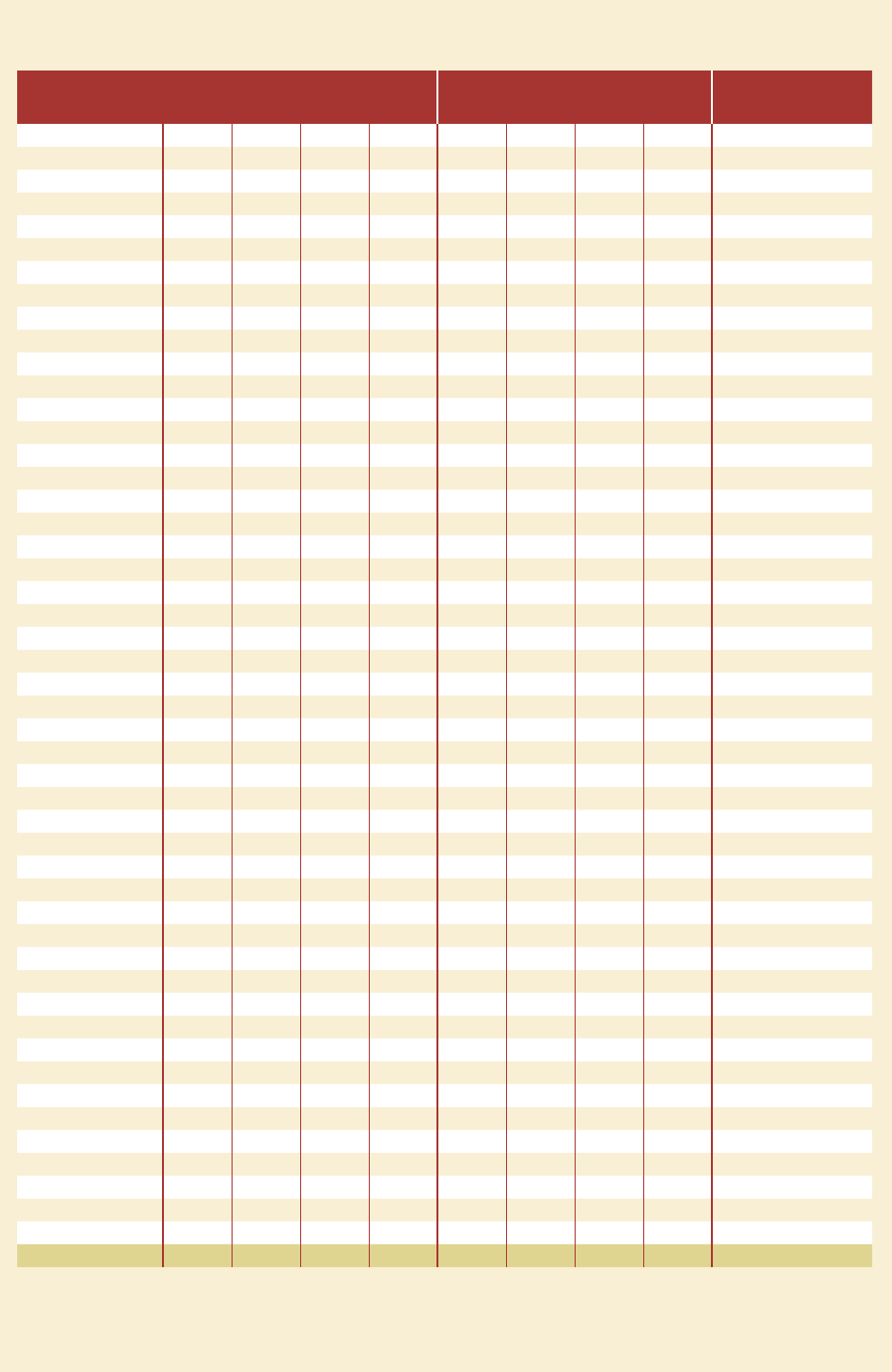

Table 1

Dominant Legal Theory of Mortgages in the Various U.S. States over Time

State 1879 1957 1995 State 1879 1957 1995

Alabama Title Title Title

Montana

(Montana Territory)

No Data Lien Lien

Alaska No Data No Data Lien Nebraska Lien Lien Lien

Arizona

(Arizona Territory)

Lien Lien Lien Nevada Lien Lien Lien

Arkansas Title Intermediate Lien New Hampshire Title Title Title

California Lien Lien Lien New Jersey Title Intermediate Intermediate

Colorado Lien Lien Lien New Mexico No Data Lien Lien

Connecticut Title Intermediate Title New York Lien Lien Lien

Delaware Lien Intermediate Lien North Carolina Title Intermediate Intermediate

District of Columbia No Data Intermediate No Data

North Dakota

(Dakota Territory)

No Data Lien Lien

Florida Title Lien Lien Ohio Title Intermediate Intermediate

Georgia Lien Title Lien

Oklahoma

(Indian Territory)

No Data Lien Lien

Idaho No Data Lien Lien Oregon Lien Lien Lien

Illinois Title Intermediate Intermediate Pennsylvania Title Title Intermediate

Indiana Lien Lien Lien Rhode Island Title Title Title

Iowa Lien Lien Lien South Carolina Lien Lien Lien

Kansas Lien Lien Lien

South Dakota

(Dakota Territory)

No Data Lien Lien

Kentucky Title Lien Lien Tennessee Title Title Title

Louisiana Lien Lien Lien Texas Lien Lien Lien

Maine Title Title Title Utah Lien Lien Lien

Maryland Title Title Intermediate Vermont Title Intermediate Intermediate

Massachusetts Title Intermediate Intermediate Virginia Title Intermediate Title

Michigan Lien Lien Lien Washington No Data Lien Lien

Minnesota Title Lien Lien West Virginia Title Intermediate Lien

Mississippi Title Intermediate Intermediate Wisconsin Lien Lien Lien

Missouri Lien Intermediate Lien Wyoming No Data Lien Lien

The Historical Origins of America’s Mortgage Laws 17

© Research Institute for Housing America October 2012. All rights reserved.

Table 2 further investigates the factors that may have led to a state following title or lien theory for the

40 states and territories for which we know whether the state followed the title or the lien theory of

mortgages in 1878. The usury laws I use to construct the variables in Table 2 are those in place at the

earliest time known and are taken from Holmes (1892). The first measure in Table 2, usury, takes a

value of one if there was a usury law on the books that restricted the maximum rate of interest lenders

could charge and for which there was a penalty for violation. The second measure, usurypenalty, is a

measure of how severe the penalty for violating the usury law was. I construct this measure using the

same weighting system as Benmelech and Moskowitz (2010). The final measure, maxrate, measures

the maximum rate a lender and borrower could agree to under the usury laws.

In Illinois and Wisconsin, the usury laws for banks differed from those for other lenders. For these

states, the decision of whether to use the usury law for banks or the one for other lenders depended

on whether or not banks were the dominant mortgage lenders in these states before the Civil War.

There is scant and conflicting evidence on the role of banks as mortgage lenders in the U.S. states

before the Civil War.

5

5 Dewey and Chaddock (1911, p. 160), for example, assert that “[a]s a rule, banks made loans on real estate.” Often, mortgage lending

resulted from a requirement that, to receive a charter, a certain portion of a bank’s lending had to be to agricultural interests. Lending

to agricultural interests would have been primarily mortgage loans. Dewey and Chaddock (1911) go on to describe extensive mortgage

lending by banks in Massachusetts and New York in the 1820s, as well as in Florida, Louisiana, Mississippi and South Carolina at least

since the 1830s. In the Southern states, banks were often set up explicitly for the purpose of lending on real estate or slaves (Dewey and

Chaddock [1911] and Helderman [1980]). Gouge (1833, p. 118) also cites evidence on the role of banks in encouraging land speculation in

ante-bellum America.

At some point between the mid-1830s and the panic of 1857, mortgages fell out of fashion among banks and their regulators. In 1848,

New York lowered the maximum loan to value from 50 percent to 40 percent for mortgages included as assets for the purposes of note

issuance (Helderman [1980], p. 22). The fall of mortgages from grace might have resulted from the experience of Michigan with free

banking. Michigan’s free banking law of 1838, like New York’s, explicitly permitted mortgages be included as assets for the purposes

of issuing notes. Unfortunately, the mortgages in Michigan were made on land that proved not to be very valuable; see Dwyer (1996).

Certainly, by 1858, the New York banks were not involved in mortgage lending on a large scale (Gibbons [1859]) as a result of their

negative experience with earlier mortgage lending.

Grada and White (2003) suggest that mutual savings banks also provided mortgage credit. It is unclear whether such mortgage credit

was for purchase of property or whether property was pledged as security for commercial loans.

Table 2

Pairwise Correlations Between Title Theory States, Usury Laws and State Age

Title_1878 Usury UsuryPenalty MaxRate Original13 EarlyState LateState

Title_1878 1

Usury 0.33** 1

UsuryPenalty 0.27* 0.62*** 1

MaxRate -0.42*** -0.80*** -0.56*** 1

Original13 0.27* 0.45*** 0.66*** -0.46*** 1

EarlyState 0.16 0.22 -0.08 -0.40** -0.48*** 1

LateState -0.42*** -0.66*** -0.58*** 0.85*** -0.51*** -0.51*** 1

***, **, * denote significance at 1%, 5% and 10%. Title_1878 takes a value of 1 if the state mortgage laws followed title theory as of 1878,

0 otherwise. Usury takes a value of 1 if the state had a usury law on the books at the earliest time known. UsuryPenalty is a measure of

the severity of the usury penalty. MaxRate is the maximum rate that could be charged under the earliest usury laws. Original 13 takes a

value of 1 if the state is one of the original 13 colonies; EarlyState takes a value of 1 if the state is not one of the original 13 colonies but

became a state before 1840; LateState takes a value of 1 if the state or territory was not a state as of 1840.

18 The Historical Origins of America’s Mortgage Laws

© Research Institute for Housing America October 2012. All rights reserved.

The evidence Stickle (2011) finds for Ohio is likely the most relevant evidence for Wisconsin and

Illinois. Stickle (2011) documents that the Ohio Life Insurance and Trust Company was the first

trans-Appalachian institutional provider of mortgage credit in the 1830s and 1840s. Stickle (2011)’s

finding thus suggests that institutional mortgage credit was rare in Wisconsin and Illinois at the

time many of the Western states adopted their foreclosure procedure. The Ohio Life Insurance and

Trust Company was also the first company Stickle finds to have facilitated flows of capital from the

savings-rich East to the frontier states (personal correspondence with Mark Stickle, Feb. 29th, 2012).

As part of his dissertation work, Stickle examined by hand many mortgage documents in several

counties throughout Ohio. He finds little evidence of institutional mortgage lending before the 1840s.

Based on the evidence Stickle uncovers for Ohio, I use the usury laws that apply to non-bank lenders

for Illinois and Wisconsin. Nevertheless, the results are quite similar when the usury law applied to

banks is used in the analysis instead.

The correlations in Table 2 suggest that states without usury laws, or with less restrictive usury laws,

are much more likely to have adopted the lien theory of mortgages. Of course, all states were relaxing

usury laws throughout the 19th century (see, for example, Rockoff [2003]) such that the correlation

between the usury laws and title theory may merely be capturing the fact that younger states were

more likely to adopt lien theory. Thus, Table 2 also looks at the correlation between the age of the

state and whether it followed title theory in 1878. I classify states into three age categories: one of the

original 13 colonies (original13), states that received statehood after independence but before 1840

(earlystate) and states or territories that were not states until after 1840.

The original 13 colonies were much more likely to follow title theory than younger states. Of the states

incorporated after 1840, only Florida, Minnesota and West Virginia followed title theory. Usury laws

were much more common, and stringent, in older than in younger states perhaps because older states

were founded as British colonies, and states that followed those states’ legal precedents adopted

British laws on usury.

Despite the sample size of just 40 states and territories, I attempt to disentangle the role of the age

of the state and usury laws using probit estimation. Table 3 reports the increase in the probability of

a state following title theory in response to changes in the independent variables when measured at

the means of the independent variables. The results reveal that states that had usury laws were 36

percent more to follow title theory in their mortgage laws. Similarly, the original 13 colonies were 47

percent more likely and the early states that were not among the 13 colonies 41 percent more likely

to follow title theory. However, when controlling for the age of the state and the existence of a usury

law simultaneously, only whether the state is one of the original 13 colonies is a significant predictor

of whether the state follows title theory, and the effect is significant only at the 10 percent level. The

lack of significance is likely due to the very small sample.

The Historical Origins of America’s Mortgage Laws 19

© Research Institute for Housing America October 2012. All rights reserved.

The results in Columns 9 and 10 of Table 3, in which the maximum interest rate allowable and the

age of the state are simultaneously controlled for in the subset of states that had a usury law, are the

most supportive of the view that usury laws influenced whether or not a state adopted title or lien

theory. However, the coefficient on the maximum rate is only significant at the 10 percent level and

the sample size is just 28 observations.

We can conclude by saying that older states with more restrictive usury laws were more likely to adopt

title theory. There is some evidence, although not conclusive, that usury laws had an independent

effect on whether the state followed title theory.

Table 3

Marginal Eects from Probit Estimation on Title vs. Lien Theory

(1) (2) (3) (4) (5) (6) (7) (8) (9) (10)

Usury 0.36** 0.29 0.10

UsuryPenalty 0.09*

MaxRate -12.19* -13.04* -11.69*

Original13 0.28* 0.47** 0.17 0.42* -0.03

EarlyState 0.41** 0.36 -0.15

Year of Statehood -0.008*** -0.003

Pseudo R-squared 8% 5% 21% 5% 14% 17% 9% 14% 22% 22%

No. obs. 40 40 28 40 40 40 40 40 28 28

Notes: 1) Dependent variable takes a value of 1 if state follows title theory in 1879. 2) See notes to Table 2 for variable definitions.

20 The Historical Origins of America’s Mortgage Laws

© Research Institute for Housing America October 2012. All rights reserved.

When mortgages came to America, foreclosure was a judicial process. The shift in some states toward

nonjudicial foreclosure, or a different judicial foreclosure practice, evolved as a result of attempts by

the lender to reduce or eliminate the equity of redemption that had evolved in the British court system.

The equitable right of redemption had become quite a nuisance for lenders by the time mortgages

became commonplace in early America. Tefft (1937) amasses evidence that, in British chancery courts,

the lenders had to petition to foreclose on the borrower’s redemption rights, and the courts were

usually quite generous to borrowers. Rather than being a strict and rapid procedure, it took lenders

several months and sometimes years to get English chancellors to agree to a foreclosure. The English

chancellors entertained entreaties for leniency from borrowers for several months. Any suggestion that

the lender acted improperly or that the borrower would soon come upon funds to repay him, would

often prevent the lender from getting a foreclosure. Even after the lender succeeded in obtaining a

decree of foreclosure, the English borrower typically was given six months more to redeem the property

(what would now be known as a statutory redemption period). English Chancellors would often grant

extensions to the statutory redemption period upon a reasonable request from the borrower.

Certain U.S. states lacked chancery courts altogether. Skilton (1943) reports that some states, such

as Pennsylvania, developed the writ of scire facias as a rapid foreclosure alternative. Although scire

facias is a judicial procedure, its rapidity and summary nature makes it a relatively creditor-friendly

procedure. It differs from other forms of judicial foreclosure in that the onus is on the borrower to

provide a reason why the lender should not be able to foreclose. In the 18th and 19th centuries scire

facias was adopted by Pennsylvania and Delaware. The figures Russell and Bridewell (1938) present

on the cost and time it took in the 1930s to foreclose in Delaware and Pennsylvania support the idea

that this is an expedient if not an inexpensive procedure. In Delaware, the scire facias procedure

seems to have been adopted to avoid chancery courts rather than because of the absence of chancery

courts. Ohio and Illinois also adopted versions of scire facias although it was no longer in use in either

state by the end of the 19th century.

As a result of the difficulties in obtaining a strict foreclosure, at some point in the 18th century, British

lenders began asking the courts to agree to a sale in lieu of foreclosure. A sale-in-lieu of foreclosure

ensured that the borrower would receive any value of the property in excess of that required to pay off

the debt, such that the borrower did not forfeit his estate altogether. In the absence of well-developed

land and financial markets with small parcel sizes, it is likely that many borrowers had positive equity

such that a sale-in-lieu of foreclosure likely seemed fairer to the borrower. In Britain, the lender was

not permitted to bid on the property at the sale-in-lieu of foreclosure which ensured that the borrower

received fair market value for the property (Tefft [1937]). The success of sales-in-lieu of foreclosure

eventually led to the insertion of power-of-sale clauses into many mortgages to further encourage

Chancellors to grant a sale-in-lieu of redemption.

The Historical Origins of America’s Mortgage Laws 21

© Research Institute for Housing America October 2012. All rights reserved.

American states rapidly embraced the concept of a foreclosure sale rather than a strict foreclosure.

Early on, a foreclosure sale still necessitated the approval of a judiciary. Gradually, however, courts

came to respect power-of-sale clauses and trust deeds in many states. A landmark U.S. Supreme

Court ruling in Newman vs. Jackson (1827) favored a power-of-sale clause in regulating a dispute in

the Georgetown neighborhood of Washington, D.C. and set a precedent for other states. The validity

of the power-of-sale clause or trust deed often met with legal challenges prior to their widespread

acceptance. Despite the 1827 US Supreme Court precedent of Newman vs. Jackson, it took decades for

many states to rule that power of sale foreclosure was valid or to begin using mortgages with power

of sale. However, by 1863, lenders were able to foreclose by a nonjudicial foreclosure procedure in

many states (J.F.D. [1863]). In some states, courts ruled that the lender himself could not conduct the

sale which led to the adoption of the deed of trust, wherein a third party sells the property, as the

standard real estate security instrument.

Table 4 summarizes the procedure in which lenders could foreclose in 1863, 1879, 1904, 1937, 1957 and

2008. The sources of information are J.F.D. (1863), Jones (1879, 1904, 1915, 1928), Russell and Bridewell

(1938), Skilton (1943) and Prather (1957), in the cases cited in the above, and the National Mortgage

Servicer’s Reference Directory (2008). The similarities between the laws in the different periods

are striking. Of the 37 states for which we have data from 1863, only 11 changed their foreclosure

proceeding substantially between 1863 and 2008. The pattern is similar for states for which the data

start later in the 19th century.

THE DEVELOPMENT OF

FORECLOSURE PROCEDURES

22 The Historical Origins of America’s Mortgage Laws

© Research Institute for Housing America October 2012. All rights reserved.

Focusing first on the changes between 1863 and 1937, four states changed their stance on nonjudicial

foreclosure substantially. In 1863, J.F.D. makes no mention of Georgia or New Hampshire in his discussion

of power-of-sale provisions and trust deeds; by 1937, power-of-sale foreclosure had become standard

in both states. In 1863, the validity of power-of-sale provisions in Illinois seemed to be finally settled

after several court proceedings questioning it; in 1879, foreclosure again became a judicial procedure

in Illinois. While a nonjudicial foreclosure procedure was available in South Carolina as of 1857, J.F.D.

states that they were not “in familiar use.” By 1904, Jones (1904) finds that trust deeds seem to be in

common use. It is unclear when South Carolina eliminated the possibility of nonjudicial foreclosure.

Of the states that adopted power-of-sale foreclosure or a deed of trust later than 1863, likely owing to

a late statehood date rather than legal reasons, Arizona, New Jersey and North Dakota had reversed

course by 1938. I have been unable to ascertain the exact date of or the reason for Arizona’s change

in foreclosure law. North Dakota banned foreclosure by advertisement, a nonjudicial foreclosure

procedure also in use in Maine, in 1933 (Vogel [1984]) as part of wide-ranging farm foreclosure relief

during the Great Depression.

Focusing on the changes between 1937 and 2008, Wisconsin abandoned its usual practice of foreclosing

nonjudicially. The reason seems to have been that bankruptcy judges set aside nonjudicial foreclosure

sales as improper conveyances. The solution to this problem was to use exclusively nonjudicial foreclosure

methods; see Handzlik (1984). It is unclear why New York abandoned nonjudicial foreclosure.

What is perhaps most remarkable about the adoption of power of sale, or the lack thereof, is how

early it occurs in the development of financial markets. For example, case law in California validates

power-of-sale foreclosure in 1851, although Weber (2006) reports that there are no banks at all in

California before at least 1860. New York makes power-of-sale foreclosure legal by statute before

there is a bank in the state.

What motivated states to adopt more creditor-friendly or more debtor-friendly foreclosure procedures?

Figure 1 maps the states that had adopted power of sale or deeds of trust by 1863. There is no obvious

geographical pattern. There is also no significant correlation between either the state’s age or whether

the state follows the title theory of mortgages or the lien theory of mortgages and whether it allows

nonjudicial foreclosure as of 1863.

The Historical Origins of America’s Mortgage Laws 23

© Research Institute for Housing America October 2012. All rights reserved.

Table 4

Availability of Non-judicial Foreclosure in the Various States Over Time

State 1863 1879 1904 1928 1938 1957 2008

Alabama Usual, 1830 Usual Usual Usual Usual Usual Usual

Alaska No data No data No data No data No data No data Usual

Arizona

(Arizona Territory)

No data No data

Available,

1887

Available Unavailable Unavailable Usual

Arkansas

Available,

1848

Available Available Available Available

Available,

rare

Usual

California Usual, 1852 Available Available Available Usual Usual Usual

Colorado No data Available Usual Usual Usual Usual Usual

Connecticut Unavailable Unavailable Unavailable Unavailable Unavailable Unavailable Unavailable

Delaware

Scire facias

(Judicial),

1827

Scire facias Scire facias Scire facias Scire facias Scire facias Scire facias

District of Columbia

Available,

1827

Usual Usual Usual Usual Usual Usual

Florida Unavailable Unavailable Unavailable Unavailable Unavailable Unavailable Unavailable

Georgia Unavailable

Available,

1867

Available Available Usual Usual Usual

Idaho No data No data

Explicitly

Unavailable,

1898

Unavailable Unavailable Usual Usual

Illinois

Available,

1846

Available

Unavailable,

1879

Unavailable Unavailable Unavailable Unavailable

Indiana

Unavailable

by statute,

1852 (avail-

able at some

point before)

Unavailable Unavailable Unavailable Unavailable Unavailable Unavailable

Iowa

Unavailable

by statute,

1861 (avail-

able at some

point before)

Unavailable Unavailable Unavailable Unavailable Unavailable

Unavailable

without

mortgagor's

consent

Kansas Unavailable Unavailable Unavailable Unavailable Unavailable Unavailable Unavailable

Kentucky

Unavailable

by statute,

1820

Unavailable Unavailable Unavailable Unavailable Unavailable Unavailable

Louisiana Unavailable Unavailable Unavailable Unavailable Unavailable Unavailable Unavailable

Maine

Foreclosure

by Adver-

tisement

(Non-Judi-

cial), 1821

Foreclosure

by Advert.

Foreclosure

by Advert.

Foreclosure

by Advert.

Foreclosure

by Advert.

Foreclosure

by Advert.

Foreclosure

by Advert.

Maryland

Available,

1859

Available Available Available Usual Usual Usual

Massachusetts

Available,

1826

Usual Usual Usual Usual Usual Usual

Michigan Usual, 1838 Usual Usual Usual Usual Usual Usual

Minnesota

Available,

1860

Available Usual Usual Usual Usual Usual

Mississippi Usual, 1838 Usual Usual Usual Usual Usual Usual

Missouri Usual, 1840 Usual Usual Usual Usual Usual Usual

24 The Historical Origins of America’s Mortgage Laws

© Research Institute for Housing America October 2012. All rights reserved.

Table 4

Availability of Non-judicial Foreclosure in the Various States Over Time

State 1863 1879 1904 1928 1938 1957 2008

Montana

(Montana Territory)

No data

Available,

1872

Available Available Available

Available,

not usual

Usual

Nebraska No data Unavailable Unavailable Unavailable Unavailable Unavailable

Available

(if Deed of

Trust)

Nevada No data

Available

(without

foreclosure),

rare, 1876

Available

(without

foreclosure),

rare

Available,

not in use

Available

Available,

not usual

Usual

New Hampshire Unavailable

Available,

1874, rare

Available Available Usual Usual Usual

New Jersey Unavailable

Available,

1867, rare

Available

Available,

rare

Unavailable Unavailable Unavailable

New Mexico No data No data No data No data Unavailable Unavailable

Available

only for

Deeds of

Trust origi-

nated 2006

or later

New York

Usual, 1774

by statute

Available Available Available Available

Available,

Rare

Available,

Rare

North Carolina Usual, 1830 Usual Usual Usual Usual Usual Usual

North Dakota

(Dakota Territory)

No data

Available,

1877

Available Available

Unavailable,

1933

Unavailable Unavailable

Ohio

Available,

1850

Available,

rare

Available,

rare

Available,

rare

Available

Available,

Rare

Unavailable

Oklahoma

(Indian Territory)

Avail-

able, 1848

(followed

Arkansas

law)

Available Available Available Available

Available,

Rare

Available if

POS clause

inserted

(1986), rare

Oregon Unavailable Unavailable Unavailable Unavailable Unavailable Unavailable

Usual, 1961

Deed of

Trust Statute

Pennsylvania

Scire facias

(Judicial),

1705

Scire facias Scire facias Scire facias Scire facias Scire facias Scire facias

Rhode Island

Available,

1856

Usual Usual Usual Usual Usual Usual

South Carolina

Available,

1857

Available Usual Usual Unavailable Unavailable Unavailable

South Dakota (Dakota

Territory)

No data

Available,

1877

Available Available Usual Usual

Technically

Available,

rare due to

Title dicul-

ties

Tennessee

Available,

1818

Available Available Available Usual Usual Usual

Texas Usual, 1849 Usual Usual Usual Usual Usual Usual

Utah No data No data No data Unavailable Unavailable Unavailable Usual

Vermont Unavailable Unavailable Unavailable Usual Unavailable Unavailable

Available,

very rare

Virginia Usual, 1842 Usual Usual Usual Usual Usual Usual

Washington No data No data No data Unavailable Unavailable Unavailable Usual

West Virginia Usual, 1842 Usual Usual Usual Usual Usual Usual

Wisconsin Usual, 1850 Usual Usual Available Available

Available,

not usual

Unavailable

Wyoming No data No data

Available,

1899

Available Available Usual Usual

The Historical Origins of America’s Mortgage Laws 25

© Research Institute for Housing America October 2012. All rights reserved.

It must be kept in mind that in most cases the validity of power of sale and deeds of trust was determined

in case law rather than by statute. As a result, it was usually the decision of a single judge that ended

up determining the process. For example, despite the national Supreme Court precedent in 1827,

Justice J. Kellogg of the Supreme Court of Vermont judge declared that a power-of-sale clause was

not generally valid in Wing v. Cooper (1864). Justice Kellogg’s reasoning was as follows:

A power of sale given by a mortgage deed is not an ordinary power, and as between the

mortgagor and mortgagee, it should be strictly construed. In this state, it is in practice

unusual if not unknown. We have no statute regulating its exercise, and a sale under it

might be made without the concurrence of the mortgagor, and even without notice to

him. It is too important a power to rest upon implication and local reasoning, and ought

not, as we think, to be recognized in any case unless it is conveyed by an express grant

and in clear and explicit terms.

While this ruling did not exactly forbid power-of-sale clauses, which would have been inconsistent

with the national precedent, the interpretation of the ruling banned them for all practical purposes.

The ruling seems to have been interpreted as requiring the lender to get the borrower’s permission to

use his power of sale after default which is usually even more difficult than getting a judge’s approval.

It seems likely that the other states that did not adopt power-of-sale foreclosure failed to do so for

similarly idiosyncratic reasons.

While there may be theories that can explain why some judges decided nonjudicial foreclosure was

acceptable while others ruled against it, the reasons do not seem closely correlated with the state’s

economic development. Nevertheless, nonjudicial foreclosure was a major victory for creditor rights.

Figure 1

Availability of Non-Judicial Foreclosure, 1863

Available

Unavailable

No Data

26 The Historical Origins of America’s Mortgage Laws

© Research Institute for Housing America October 2012. All rights reserved.

The Historical Origins of America’s Mortgage Laws 27

© Research Institute for Housing America October 2012. All rights reserved.

REDEMPTION RIGHTS

As foreclosure by sale grew, many states permitted the borrower a statutory right of redemption

wherein the borrower could regain possession of the property after a foreclosure sale by repaying the

principal, interest and fees. Some states allowed the borrower two years or more while others afforded

the borrower no grace period. In some cases, attempts by states to provide for a redemption period

were deemed unconstitutional by the courts, such as the attempt by Missouri to allow borrowers a

30-month redemption period (Skilton [1943]). Baker, Miceli, and Sirmans (2008) summarize the rights

of redemption afforded to the borrower in the various states and some of the changes over time.

Table 5 summarizes the changes in the rights of redemption over time. Changes in the redemption

periods are in bold with the date of the change noted in parentheses when known. A question mark

indicates uncertainty of the date of the change. Although there are more changes to redemption rights

over time than to the standard foreclosure procedure lenders must follow, there is a surprising amount

of persistence in redemption periods highlighting the importance of early institutional developments.

More than half of all states did not change their policy on redemption periods substantially between

the first available date for which we have data, typically the U.S. Civil War, and 1938. Since 1938 there

have been more changes with the tendency being towards reducing the redemption period. Between

1938 and 1957, Arkansas, Idaho and Tennessee eliminated their redemption periods while, over the

same period, only Florida increased its redemption period. It seems possible that the difference in

Florida’s redemption period relates to how Prather (1957) records the redemption period rather than

an actual change in the redemption period. There were no other changes in redemption periods

between 1938 and 1957.

Between 1957 and 2008, a total of 21 states reduced or eliminated their redemption periods. Only

Connecticut increased the redemption period by inserting a three-month equitable right of redemption.

It seems more likely to be institutional inertia than any other factor that has led many states to retain

their rights of redemption from the 19th century.

28 The Historical Origins of America’s Mortgage Laws

© Research Institute for Housing America October 2012. All rights reserved.

Table 5

Redemption Periods in Usual Non-Agricultural Residential Foreclosure Procedure

State 1879 1904 1915 1928 1938 1957 2008

Alabama 24 (1841) 24 24 24 24 24 12

Alaska No Data 4 (1900) 2 4 No Data No Data 12

Arizona

(Arizona Territory)

6 (1877) 6 6 6 6 6 0

Arkansas 12 (1879) 12 12 12 12 0 0

California 6 (1851) 6 6 6 0 0 0

Colorado 6 (1879) 6 6 6 6 6 6

Connecticut 0 0 0 0 0 0 3

Delaware 0 0 0 0 0 0 0

District of Columbia No Data

0 (None

mentioned)

No Data No Data No Data 0 0

Florida 0 0 0 0 0 2 0

Georgia 0 0 0 0 0 0 0

Idaho No Data 0 0 0 No Data 0 0

Illinois 6 (1864) 12 (1895) 12 12 12 0 0

Indiana 12 (1825) 12 12 12 12 12 3

Iowa 12 (1861) 12 12 12 12 12 3

Kansas 12 (1873) 12 12 12 12 12 6

Kentucky 0 0 0 18 (1923) 18 18 3

Louisiana 0 0 0 0 0 0 0

Maine 12 (1871) 12 12 12 12 12 3 (1975)

Maryland 0 0 0 0 0 0 0

Massachusetts 0 0 0 0 0 0 0

Michigan 12 (1844) 6 (1899?) 12 12 12 12 6

Minnesota 12 (1858) 12 12 12 12 12 6 (1967)

Mississippi 0 0 0 0 0 0 0

Missouri 0

12 (1899?)

if power of

sale used

12 12 12 12 12

Montana (Montana

Territory)

6 (1867) 12 (1895) 12 12 12 12 4

Nebraska 9 (1859) 9 9 9 9 9 0

Nevada 6 (1861) 6 6 6 12 12 0

New Hampshire 0 0 0 0 0 0 0

New Jersey 0 0 0 0 0 0 0

New Mexico No data

12 (1889 or

1897)

9 (1909) 9 9

9 (3 if

expressly

waived in

mortgage

instrument,

1957)

1 (1964)

The Historical Origins of America’s Mortgage Laws 29

© Research Institute for Housing America October 2012. All rights reserved.

Table 5

Redemption Periods in Usual Non-Agricultural Residential Foreclosure Procedure

State 1879 1904 1915 1928 1938 1957 2008

New York 0 (1838) 0 0 0 0 0 0

North Carolina 0 0 0 0 0 0 0

North Dakota

(Dakota Territory)

12 (1877) 12 12 12 12 12

2 (shortened

from 6 in

1981)

Ohio 0 0 0 0 0 0 0

Oklahoma

(Indian Territory)

No data 12 (1889) 12 No data 6 6

6 (waived if

foreclosure

with ap-

praisal)

Oregon 2 (1872) 2 4 4 12 12 4

Pennsylvania 0 (1879) 0 0 0 0 0 0

Rhode Island 0 (1857) 0 0 0 0 0 0

South Carolina 0 0 0 0 0 0 0

South Dakota (Dakota

Territory)

12 (1877) 12 12 12 12 12 6

Tennessee 24 (1820) 24 24 24 24

0 (24 but

waived in

most secu-

rity instru-

ments)

0

Texas 0 0 0 0 0 0 0

Utah 6 (1870) 6 6 6 6 6 3

Vermont 12 (1827) 12 12 12 12 12 6

Virginia 0 0 0 0 0 0 0

Washington 6 (1869) 12 (1886) 12 12 12 12

12 (8 if so

stated in

mortgage

and right to

a deficiency

judgment is

waived)

West Virginia 0 0 0 0 0 0 0

Wisconsin 24 (1849)

12 (1889) if

foreclosure

by advertise-

ment, 0 by

action

12 if fore-

closure by

advertise-

ment, 0 by

action

12 if fore-

closure by

advertise-

ment, 0 by

action

12 12 6 (1978)

Wyoming No data 6 (1895) 6 6 6 6 3

Note: 1) Table provides redemption period for foreclosure under the most common circumstances (e.g., right to a deficiency judgment

waived) for residential security instruments. 2) Includes both statutory and equitable periods (e.g., mandatory waiting period before

foreclosure sale) of right of redemption. 3) Period rounded to nearest month. 4) Changes in the redemption period are in bold with the

date of the change noted in parentheses when known. 5) A question mark indicates uncertainty of the date of the change.

30 The Historical Origins of America’s Mortgage Laws

© Research Institute for Housing America October 2012. All rights reserved.

The Historical Origins of America’s Mortgage Laws 31

© Research Institute for Housing America October 2012. All rights reserved.

RESTRICTIONS ON

DEFICIENCY JUDGMENTS

AND THE ONE ACTION RULE

Until the Great Depression, there were few restrictions on deficiency judgments. As of 1879, in most

states and territories the lender was free to pursue “all his remedies concurrently or successively”

(Jones [1879], Ch. 27). By that time, it had become standard for an American mortgage to consist of

both a note and the mortgage itself such that the lender could both sue on the note and seize the

property (Jones [1879], Ch. 27), often simultaneously. Only in California and Colorado did the lender

have only one remedy (Jones [1879], Ch. 30), what is now known as the “One Action” rule, and only

in California could the lender take an action precluding him from the right to a deficiency judgment.

In Minnesota and Nevada the borrower had to exhaust the property before suing on the note (Jones

[1879], Ch. 27), which is somewhat similar in effect to the One Action rule. In Dakota Territory, Indiana,

Iowa, Michigan, Nebraska, New York and Washington Territory, the lender could not simultaneously

sue on the promissory note and file a lawsuit for foreclosure; the lender could pursue actions in the

sequence of his choice, however.

Over time, many Western states gradually adopted the One Action rule. The One Action rule seems

to originate in California around 1860 (Guidotti [1943]) but at the time was not meant to provide

any restriction on deficiency judgments per se. Guidotti (1943) suggests that it arose as a mistake

in interpreting the New York code that California was trying to emulate. New York, however, does

not now have nor ever had a One Action rule. At the time California was trying to use New York as

a template for many of its codes of civil practice; in turn, many Western states used California as a

template. That in practice One Action rules came to make it more difficult to collect a deficiency owes

largely to the combination of One Action laws with subsequently enacted anti-deficiency statutes.

By 1911, at least six Western states (California, Colorado, Idaho, Montana, Nevada and Utah) had some

version of the One Action law on their books (Milliner [1991] and Jones [1879]). All of these states being

young, Western states that started out with little legal foundation of their own, it is almost certain

that these states enacted One Action rules because they developed their codes of civil procedures

from California’s.

32 The Historical Origins of America’s Mortgage Laws

© Research Institute for Housing America October 2012. All rights reserved.

Unlike their British counterparts, American lenders could bid at a sale in lieu of foreclosure. Often,

they were the only bidders and bid far less than the value of the debt or the fair market value of the

property, leaving borrowers liable for the deficiency. Since foreclosure by sale had become the standard

procedure, with the lender often the only bidder, this left open the possibility that the borrower would

both lose both his property and owe a substantial deficiency judgment in excess of his true debt if

the lender bid less than the debt. Vaughan (1940) details several cases of lenders bidding amounts

far lower than the fair market value of the property. Starting with Connecticut (Jones [1879]), states

gradually modified their statutes to ensure that the borrower received fair credit for the market value

of the property.

If a state did not already have a “fair market value” provision with respect to deficiency judgments,

it likely did by the end of the Great Depression. During 1933-1935, Alabama, Idaho, Michigan, New

Jersey, New York, Pennsylvania, South Carolina and Texas all modified their statutes to include a

fair market value provision (Poteat [1938]).

6

In most cases, fair market value restrictions were deemed

constitutional when challenged. However, New Jersey, Pennsylvania and South Carolina’s restrictions

were declared unconstitutional however. In the case of New Jersey, this was likely because the act

also included several other procedural requirements on deficiency judgments such that courts may

have determined that the law would have been a de facto violation of the contract clause of the U.S.