American Economic Review 2016, 106(10): 2982–3028

http://dx.doi.org/10.1257/aer.20151052

2982

* Hurst: Booth School of Business, University of Chicago, 5807 S. Woodlawn Ave., Chicago, IL 60637 (e-mail:

Chicago, IL 60637 (e-mail: [email protected]); Seru: Booth School of Business, University of Chicago, 5807

University of Chicago, 5807 S. Woodlawn Ave., Chicago, IL 60637 (e-mail: joseph.va[email protected]). We

thank Sumit Agarwal, Heitor Almeida, Tom Davidoff, John Driscoll, Matthew Kahn, Arvind Krishnamurthy, John

Leahy, Tomasz Piskorski, Stijn Van Nieuwerburgh, Monika Piazzesi, David Scharfstein, Johannes Stroebel, Adi

Sunderam, Francesco Trebbi, and seminar participants at Berkeley Haas, Einaudi Institute, Federal Reserve Board,

HEC, Indian School of Business, Kellogg, MIT, National University of Singapore, NBER Monetary Economics

Program Meeting, Ohio State, NBER Summer Institute, Chicago Fed, Rutgers, Stanford, Toronto, UBC, UCLA,

University of Chicago Booth, University of Chicago Harris, University of Illinois, University of Michigan, Wharton,

the FRIC 2014 conference on nancial frictions, and the NBER conference on Financing Housing Capital for help-

ful comments and suggestions.

†

Go to http://dx.doi.org/10.1257/aer.20151052 to visit the article page for additional materials and author

disclosure statement(s).

Regional Redistribution through

the US Mortgage Market

†

By E H, B J. K, A S, J V*

Regional shocks are an important feature of the US economy.

Households’ ability to self-insure against these shocks depends on

how they affect local interest rates. In the United States, most bor-

rowing occurs through the mortgage market and is inuenced by the

presence of government-sponsored enterprises (GSE). We establish

that despite large regional variation in predictable default risk, GSE

mortgage rates for otherwise identical loans do not vary spatially.

In contrast, the private market does set interest rates which vary

with local risk. We use a spatial model of collateralized borrowing to

show that the national interest rate policy substantially affects wel-

fare by redistributing resources across regions. (JEL E32, E43, G21,

G28, L32, R11, R31)

The Great Recession has led to wide disparities in economic activity across regions

within the United States. The extent to which households can borrow to self-insure

against these regional shocks depends crucially on the interest rate and how it var-

ies with regional economic conditions. Theoretical models typically assume that

regions within a monetary union share a common risk-adjusted interest rate.

1

Yet,

there are no papers—of which we are aware—testing whether risk-adjusted interest

rates are equated across regions within a monetary union like the United States.

In this paper, we use data on mortgage loans, which represent the bulk of household

borrowing, to document two new facts. First, risk-adjusted rates are not equalized

1

The theoretical literature that assumes a constant risk-adjusted (or risk-free) interest rate across regions is

extensive. Recent papers making this assumption in the macroeconomics, monetary union, and public nance liter-

atures include: Lustig and Van Nieuwerburgh (2005); Farhi and Werning (2014); Nakamura and Steinsson (2014);

Yagan (2016); Zidar (2015); and Beraja, Hurst, and Ospina (2016).

2983

Hurst et al.: regional redistribution

Vol. 106 no. 10

across locations within the US monetary union: despite large regional variation in

ex ante predictable default risk, there is no regional variation in mortgage contract

rates for loans securitized by government-sponsored enterprises (GSE). Since GSEs

securitize most of the loans in the US mortgage market, this constant contract rate

in the face of variation in predictable default risk implies that the majority of bor-

rowers face risk-adjusted rates which do vary with their locations. Second, this lack

of risk-based pricing does not occur because this risk cannot be observed ex ante: we

show that otherwise similar non-GSE loans that are securitized in the private market

increase (decrease) mortgage rates when ex ante local default risk rises (falls).

If mortgage rates do not respond to local economic shocks that increase ex ante

default risk, then individuals in those regions face lower borrowing costs than they

otherwise would if default risk was priced into interest rates. This reduction in bor-

rowing costs may in turn offset some of the negative local economic shock that

increased default risk in the rst place. Conversely, individuals in regions with

low default risk will face higher borrowing costs than if this low default risk was

priced into interest rates. Thus, the constant interest rate policy followed by the

GSEs results in state-contingent regional transfers. While the rst half of our paper

concentrates on documenting the constant interest rate policy, the second half of the

paper quanties the size and welfare consequences of these implicit transfers.

Our paper unfolds in three parts. We begin by using detailed loan-level data secu-

ritized by the GSEs to show that local characteristics systematically predict future

local loan default even after controlling for other observable borrower and loan

characteristics. For example, there is medium-run persistence in local default prob-

abilities: conditional on borrower and loan characteristics, regions that experienced

higher default rates yesterday are more likely to experience higher default rates

tomorrow. These ndings hold throughout the entire 2000s and are not limited to the

period surrounding the 2008 recession. Despite this nding, we further document

that interest rates on loans securitized by the GSEs do not vary at all with this pre-

dictable default risk. These patterns hold across different time periods and are robust

to many different specications to predict local mortgage default rates. The results

are striking. Even though the GSEs charge different interest rates to borrowers who

take on greater leverage (i.e., have higher loan-to-value (LTV) ratios) or who are

less credit-worthy (i.e., have lower FICO scores), they do not charge higher rates

to borrowers in regions with declining economic conditions even though they are

much more likely to eventually default. Additionally, we show that local mortgage

rates for loans securitized by the GSEs do not vary with other dimensions that could

also induce local adjustment for risk, such as local mortgage recourse laws, local

bankruptcy laws, or local lender concentration.

In the second part of the paper, we then provide an assessment of the extent to

which GSE interest rates should vary spatially, given the large spatial variation in

default risk. To do this, we exploit loan-level data containing loans securitized by pri-

vate agencies. To facilitate comparisons, we focus on a set of loans which we refer to

as “prime jumbo” loans. The GSEs are only allowed to securitize loans smaller than

some threshold size, known as the conforming loan limit. Our prime jumbo loans

are larger than those made by the GSEs but comparable on many other dimensions

(in particular, FICO score and LTV ratio). Unlike the interest rate on GSE loans, we

document that the interest rate on prime jumbo loans rises dramatically with ex ante

2984

THE AMERICAN ECONOMIC REVIEW

OCTObER 2016

local predicted default risk. Thus, although there is no regional risk-based pricing in

the government-backed GSE market, the private market does set interest rates based

in part on regional risk factors. This result shows that local risk factors are ex ante

observable by lenders.

Employing a variety of techniques, including a regression discontinuity approach

around the conforming limit threshold, we construct counterfactual estimates of the

extent to which GSE mortgage rates should have varied across regions within the

United States. In particular, we construct these estimates during both the early 2000s

and during the Great Recession, assuming that the GSEs priced local risk similarly

to the private market. These results are robust to controlling for many potential con-

founding factors, including the possibility that prepayment propensities or points

and fees vary spatially. We also document that loan amounts for GSE and prime

jumbo borrowers do not respond differentially to ex ante predictable default. This

suggests that, relative to the private market, the GSE market does not compensate

for the lack of spatial variation in mortgage rates by reducing the amount of credit

extended.

We explore a number of explanations for why the relationship between mortgage

rates and predictable default differs in the GSE and private markets. We conclude

that political pressure is the most reasonable explanation for the patterns we observe.

The GSEs face a great deal of political scrutiny: we provide evidence showing that

multiple times during the past decade the GSEs tried to implement space-based

policies but that these efforts were abandoned after backlash from Congress, real-

tors, and community groups that objected to GSEs using different standards across

regions.

2

The fact that risk-adjusted mortgage rates are not equalized across regions implies

that resources are redistributed across regions through the mortgage market. In the

nal part of the paper, we quantify the economic impact of the transfers induced by

the GSEs’ constant interest rate policy. We begin with a simple back-of-the-envelope

exercise that “ marks-to-market” the interest rate on GSE-securitized loans origi-

nated during the Great Recession. More precisely, for each loan, we calculate the

difference between the actual mortgage payment we observe under the GSE constant

interest rate policy and the counterfactual mortgage payment if GSE interest rates

instead priced local predicted default like the private market. Summing up these

wedges over all loans originated during the Great Recession implies a total redistri-

bution of $14.5 billion in mortgage payments across regions during the 2007–2009

period. While this calculation already suggests an important redistributive role for

the constant interest rate policy, it does not fully account for the total effects of the

policy. In particular, it ignores: (i) equilibrium effects of the GSE policy on local

income and house prices; (ii) equilibrium effects associated with households adjust-

ing their housing and mortgage behavior in response to changes in the GSE pricing

rule; and (iii) the effect of the policy on loans originated outside of the 2007–2009

period.

2

This lack of local variation in pricing rules appears in many pricing decisions for the US government. For

example, the US Postal Service charges the same at rate for all rst-class mail regardless of the distance traveled.

Finkelstein and Poterba (2014) also nd that political economy considerations can explain why UK insurance pro-

viders price nationally despite the presence of local drivers of mortality risk.

2985

Hurst et al.: regional redistribution

Vol. 106 no. 10

In order to provide a more complete account of the welfare consequences of the

constant interest rate policy, we build a structural model suitable for counterfactual

analysis. This spatial model of collateralized borrowing has households that face

region-specic shocks to house prices and labor earnings as well as purely idiosyn-

cratic labor earnings risk. Individuals in the model can choose whether to own a

home or to rent, in addition to choosing nondurable consumption and liquid savings

over their life cycle. Owner-occupied housing is subject to xed adjustment costs

but serves as collateral against which individuals can borrow to smooth nondurable

consumption. In addition, changes in interest rates have effects on local house prices

and income.

We use this model to assess the welfare consequences of the GSEs’ constant

interest rate policy. In particular, we ask what would happen if the GSEs maintained

their role in the mortgage market but simply allowed interest rates to vary with local

default risk as in the private market.

3

Within the model, we compare two scenarios,

one in which a common interest rate applies to all regions and one in which interest

rates respond to the local default risk within each region. We use the empirical work

in the rst part of the paper to discipline the counterfactual interest rate policy in

which rates respond to local default risk.

In our benchmark calibration, designed to match the regional variation observed

during the Great Recession, the GSEs’ pricing policy generates a present value

effect roughly equivalent to a one-time $1,000 per-household tax on a region with a

two-standard-deviation increase in regional activity (i.e., decline in predicted local

mortgage default) and generates a one-time subsidy of $900 for a region with a

two-standard-deviation decrease in regional activity (i.e., increase in predicted local

mortgage default). This one-time net transfer of $1,900 per household from regions

with two-standard-deviation positive shocks to those with two-standard-deviation

negative shocks is larger than the per-household tax rebate checks paid by the US

government during the 2001 and 2008 recessions. Thus, our results suggest that

the magnitude of redistribution induced by the GSEs through the mortgage mar-

ket is economically meaningful and compares in size to transfer policies that have

received vastly more attention.

Rather than focusing on the model’s implications for particular regions during

the Great Recession, we can also add up the total transfers across all regions. Under

our baseline calibration, our model implies that about $47 billion is transferred via

the mortgage market from regions receiving better than average economic shocks to

regions receiving worse than average economic shocks. The model-implied transfers

are higher than our estimated back-of-the-envelope transfers, in large part because

the model allows for the constant interest rate policy to provide an additional benet

to local economic activity by boosting local income and house prices.

We also show that this large average transfer across regions hides substantial

heterogeneity in the effects within regions since not all households have equal mort-

gage exposure. In particular, our model implies that the GSE pricing policy has a

much larger effect on middle-aged households than on young households because

3

To be clear, we are not evaluating the consequences of eliminating GSEs and are instead considering a simple

change in their interest rate policy. Eliminating GSEs would have many important effects on housing markets, as

described in Elenev, Landvoigt, and Van Nieuwerburgh (2016).

2986

THE AMERICAN ECONOMIC REVIEW

OCTObER 2016

the young mostly choose to rent and are thus less sensitive to the local mortgage

rate. Similarly, the implied transfer is largest for middle-income households within

each region, as the poorest households do not own houses and the richest households

have little mortgage debt. Thus, the GSE constant interest rate policy has the great-

est effects on the middle class.

Our work relates to a number of existing literatures. First, there is a small body of

work that studies the extent to which risk is shared across US states through credit

markets. For example, Asdrubali, Sorensen, and Yosha (1996) examine risk sharing

across US states and suggest that credit markets smooth about 23 percent of regional

shocks. In that paper, the key mechanism is general borrowing and lending across

regions. Lustig and Van Nieuwerburgh (2010) directly explore the role of housing

equity in supporting regional risk sharing. As housing equity increases, households

are better able to borrow. The increased ability to borrow relaxes local liquidity

constraints, allowing local residents to better insure themselves against local shocks.

Lustig and Van Nieuwerburgh nd that the extent of regional risk sharing varies with

the state of the aggregate housing market. Our paper complements these ndings by

highlighting a direct mechanism by which the credit market serves to insure regional

shocks. This mechanism, as far as we can tell, is a novel addition to the regional

risk-sharing literature.

4

Additionally, our paper speaks to how local shocks are mitigated within monetary

and scal unions. This question has gained considerable attention in recent years as

large disparities in regional outcomes have occurred within both the United States

and Europe. There is a large literature arguing that an integrated tax and transfer

system together with easy factor mobility can help mitigate local shocks.

5

Most

papers exploring regional variation in economic conditions impose constant interest

rates across regions. Since these models typically do not include default risk, this

should be interpreted as imposing a common risk-adjusted rate. Our work suggests

that institutional features—such as the political pressure faced by GSEs—may lead

to violations of this assumption. The bulk of US household borrowing occurs in

mortgages securitized by GSEs. We show that loans securitized by the GSEs exhibit

contract rate equalization across regions, but that default risk varies substantially

across these same regions. This implies that the risk-adjusted rate on these loans

varies substantially. This in turn leads to quantitatively important transfers across

regions that occur in state-contingent ways.

4

More broadly, our work contributes to the growing literature emphasizing that housing nance has import-

ant implications for the US economy. Recent papers in this literature include Agarwal et al. (2012); Di Maggio,

Kermani, and Ramcharan (2015); Keys et al. (2014); Lustig and Van Nieuwerburgh (2005); Mian, Su, and Trebbi

(2015); Mian, Rao, and Su (2013); Mayer, Pence, and Sherlund (2009); Piazzesi, Schneider, and Tuzel (2007);

and Scharfstein and Sunderam (2013).

5

See, for example, Farhi and Werning (2012) and the citations within. Additionally, Sala-i-Martin and Sachs

(1991) and Asdrubali, Sorenson, and Yosha (1996) explore the role of an integrated scal system in smoothing

income across US states. For a classic example of the importance of factor mobility, see Blanchard and Katz (1992).

Recent examples include Farhi and Werning (2014); Charles, Hurst, and Notowidigdo (2016); and Yagan (2016).

Also see Feyrer and Sacerdote (2011) for arguments that the integrated tax and transfer system as well as the ease

of factor mobility are reasons for the long-run stability of the monetary union across US states.

2987

Hurst et al.: regional redistribution

Vol. 106 no. 10

I. Background

Most mortgages in the United States are sold to a secondary market after origi-

nation, rather than staying on lenders’ balance sheets. For example, from 2004 to

2006, about 80 percent of all mortgages were securitized (Keys et al. 2013). Loans

meeting the underwriting standards of Fannie Mae and Freddie Mac are consid-

ered “conventional,” and thus eligible for purchase by these government-sponsored

enterprises (GSE). These loans are purchased, packaged, and insured against loss

of principal and interest in the resulting mortgage-backed securities. As a premium,

lenders pay a “guarantee fee” on each loan, which could potentially vary with fea-

tures of the borrower (FICO score) or loan ( loan-to-value ratio). The interest rate

charged on mortgages sold to the GSEs thus reects the guarantee fee, additional

guidelines imposed by the GSEs, and any other charges that could potentially vary

with regional risk.

The alternative secondary market for mortgages is known as the non-agency or

private mortgage-backed security (MBS) market. In this market, loans that do not

meet the standards of the GSEs are purchased, bundled, and sold to investors in the

form of securities. These investors do not receive any guarantees against losses of

principal or interest on the loans underlying the securities. That is, while investors

in GSE securities are insulated from default risk, investors in the private market

must accurately price both the risk of default and the risk of early prepayment. The

interest rate charged on mortgages sold through the private market thus reects the

guidelines imposed by investors, as well as other charges that could potentially vary

with regional risk.

Prior to 2004, roughly 80 percent of the securitized mortgage market was securi-

tized by the GSEs (Fannie Mae, Freddie Mac, and Ginnie Mae). The private market

securitized all other loans. The private market includes jumbo mortgages (loans that

exceed the conventional mortgage size limits), subprime mortgages (loans for bor-

rowers with poor credit histories), and Alt-A mortgages (loans for borrowers who

provide less than full documentation). During the 2004–2006 period, the share of

loans securitized by the private market grew at the expense of those loans securi-

tized by the GSEs. However, by late 2007, the private secondary mortgage market

dried up, and essentially all securitization of mortgages since that time has been

conducted by the GSEs.

Why do the GSEs dominate the conventional mortgage market? Researchers

have estimated that the government’s implicit guarantee to keep Fannie and

Freddie solvent reduces the GSEs’ cost of funds relative to the private market.

Estimates suggest that mortgage rates for conventional mortgages are 20 to 40

basis points lower than mortgage rates for otherwise similar jumbo mortgages

(see, for example, Sherlund 2008). This difference is attributed to both the implicit

guarantee and the scale of the GSE market.

6

This cost differential makes it dif-

cult for the private market to undo any potential mispricing by the GSEs. In

particular, if political constraints prevent the GSEs from raising interest rates in

declining markets and lowering interest rates in relatively strong markets, the cost

6

For a recent discussion of this literature, see Sherlund (2008).

2988

THE AMERICAN ECONOMIC REVIEW

OCTObER 2016

differential prevents private markets from competing with lower interest rates in

relatively stronger markets. However, this cost differential does provide a bound

on the potential mispricing of local risk.

Finally, it is worth discussing who ultimately holds these securities and bears the

risk of the mispricing. Although institutional investors may hold both GSE-backed

and private mortgage-backed securities, only the private securities face default

risk. In contrast, the GSEs guarantee the principal and interest payments of their

mortgage-backed securities. Thus, the GSEs directly bear the risk of mispricing.

From the investors’ perspective, they only face the risk of early prepayment in

GSE-backed mortgage securities. When the GSEs were publicly traded, their share-

holders also bore the risk that the GSE pricing model was not accurate. After the

housing bust caused the GSEs to be put into government conservatorship, losses

were ultimately borne by taxpayers. In sum, the costs from failing to price local

default risk are rst borne directly by the GSEs, who fully insure securities holders

against default risk, and then indirectly by taxpayers, who implicitly provide a gov-

ernment backstop.

II. Data

We use two main data sources for our empirical work. The rst includes a

sample of loans securitized by either Fannie Mae or Freddie Mac. Due to issues

related to data coverage and comparability, we do not analyze loans securitized

by Ginnie Mae. The second includes a sample of jumbo loans securitized by the

private market.

A. Fannie Mae/Freddie Mac Sample

Our primary data sources are Fannie Mae’s Single Family Loan Performance

Data and Freddie Mac’s Single Family Loan-Level Dataset. The population of

both datasets includes a subset of the 30-year, fully amortizing, full documen-

tation, single-family, conventional xed-rate mortgages acquired by the GSEs

between 1999 and 2012. The data include both borrower and loan informa-

tion at the time of origination as well as data on the loan’s performance. With

respect to information at the time of origination, the data includes the borrow-

er’s credit (FICO) score, the date of origination, the loan size, the loan size

relative to the house value (LTV ratio), whether the loan is originated for pur-

chase or renancing, the three-digit zip code of the property, and the interest rate

on the mortgage. The loan performance data are provided monthly and include

information on the loan’s age, the number of months to maturity, the outstanding

mortgage balance, whether the loan is delinquent, the number of months delin-

quent, and whether the loan is prepaid. There is a unique loan identier code in

the datasets that allows a loan to be tracked from inception through its subsequent

performance.

When creating our analysis le, we pool data from both the Fannie Mae and

Freddie Mac datasets. In doing so, we are exploring the spatial variation in interest

rates for conventional loans that are securitized by either GSE. Finally, within our

analysis sample, we include loans associated with both new-purchase mortgages

2989

Hurst et al.: regional redistribution

Vol. 106 no. 10

and renancing.

7

In total, our sample includes roughly 13 million loans that were

originated during the 2001–2006 period and another roughly 5 million loans that

were originated during the 2007–2009 period.

B. Prime Jumbo Sample

Our second primary data source is the Loan Performance database, which con-

tains loan-level origination and performance data on the near-universe of mortgage

loans sold through the private secondary market during the housing boom. Within

the Loan Performance database, we focus only on what we term xed-rate “prime

jumbo” mortgages. As noted above, loans securitized by the private market include

both subprime and Alt-A mortgages as well as mortgages that are larger than the

conforming loan limit.

Specically, we want to create a set of mortgages securitized by the private mar-

ket that is as similar as possible to the mortgages in the Fannie/Freddie pool. To do

that, our prime jumbo mortgages: (i) have an origination value that is between the

conforming mortgage limit and two times the conforming mortgage limit in the year

of origination; (ii) have a xed interest rate; (iii) have an LTV ratio at origination

of less than 100 percent; (iv) have a FICO score at origination of 620 or higher;

(v) provide full documentation at the time of origination; and (vi) were originated

between 2001 and 2006.

8

The 2006 end date is necessitated by the fact that the pri-

vate market effectively disappeared in 2007.

In essence, our prime jumbo loans are designed to be similar to the Fannie/

Freddie loans in all respects except that the origination value of the loan is slightly

higher. As with GSE mortgages, we include originations for both new purchases

and renancings. Finally, we restrict the sample to include only observations where

there are at least ve loan originations in an MSA and quarter-of-year cell. Our unit

of analysis for exploring spatial variation in mortgage rates is at the MSA level.

This restriction ensures that there will be a minimum amount of loans for each

MSA-quarter cell. In total, our prime jumbo sample includes 70,327 loans origi-

nated during the 2001–2006 period.

C. Additional Sample Restrictions

Table 1 provides descriptive statistics for both our GSE sample (column 1) and

our prime jumbo sample (column 4) during the 2001–2006 period without any fur-

ther restrictions on the GSE sample. A few things are of note about the GSE sample

relative to the prime jumbo sample. First, borrower quality looks higher in the GSE

sample despite our initial restrictions on the prime jumbo sample. In the full GSE

sample, the average FICO score of borrowers is 728. The comparable number in

the prime jumbo sample is only 656. Second, the GSE data covers 374 distinct

7

The results are unchanged if we analyze Fannie Mae and Freddie Mac loans separately, or if we exclude re-

nance loans. The Data Appendix discusses additional sample restrictions. In particular, we include only mortgages

that have a FICO score at origination of at least 620 (the bulk of GSE data), were originated between January 2001

and December 2009, and were originated within one of our included MSAs.

8

The conforming limit was raised from $275,000 to $417,000 between 2001 and 2006. This period predates the

FHFA policy to vary loan limits regionally based on “high cost” areas, which began in 2008.

2990

THE AMERICAN ECONOMIC REVIEW

OCTObER 2016

metropolitan statistical areas (MSAs). However, prime jumbo loans are only in 106

distinct MSAs (where at least ve loans that meet our denition were originated

during a quarter). This is not surprising given that the origination amount on a prime

jumbo loan has to exceed a relatively large value. For many MSAs, it is rare for a

property to transact above the conforming loan limit. As average property values in

an MSA increase, the probability that loans exceed the conforming loan threshold

also increases.

To further facilitate comparison between the GSE data and the prime jumbo data,

we make two additional sets of restrictions to the GSE data. First, we restrict the

GSE data to include only loans for the 106 MSAs where we have at least 5 obser-

vations of prime jumbo data. This ensures that the MSA-quarter coverage between

the two samples is identical. The restriction reduces the sample size of GSE loans

from 13.1 million loans to 8.1 million loans. Descriptive statistics for this sample are

shown in column 2 of Table 1. This restriction does not alter the borrower-quality

comparisons at all: it is still the case that the MSA-matched GSE sample had higher

FICO scores than the prime jumbo sample.

Our second set of restrictions is more substantial. Here we restrict the GSE sample

to match the prime jumbo sample along two additional dimensions. First, we restrict

the sample so that the sample sizes match exactly. This is important given that when

we measure the variability of interest rates and default rates across MSAs, we want

to ensure we have similar power within the two samples. Second, we restrict the

T 1—D S

2001–2006 2007–2009

GSE

all

GSE

restricted

MSAs

GSE

matched

sample

Prime

jumbo

GSE

all

GSE

restricted

MSAs

Number of loans 13,110,212 8,052,967 70,327 70,327 4,861,259 3,677,984

Median FICO 728 727 658 656 756 757

Median LTV 0.78 0.75 0.79 0.80 0.76 0.75

MSAs covered 374 106 106 106 374 106

Mean interest rate (%)

6.25 6.22 6.33 6.66 5.65 5.63

Mean 2-yr. delinquency rate (%)

1.6 1.4 3.0 2.1 3.8 4.0

Cross-MSA SD of interest rates

Unconditional (percentage points)

0.544 0.557 0.578 0.657 0.627 0.623

Conditional (percentage points)

0.076 0.072 0.086 0.165 0.070 0.064

Cross-MSA SD of delinquency rates

Unconditional (percentage points)

1.5 1.2 3.2 2.7 4.0 4.3

Conditional (percentage points)

1.3 1.1 2.8 2.5 2.9 2.9

Notes: This table provides summary statistics for the samples of GSE and non-GSE (prime jumbo) loans. The

different columns refer to different samples and different time periods, with the rst four columns referring to

loans originated between 2001 and 2006, and the last two columns featuring loans originated between 2007 and

2009 (after the non-GSE market ceased large-scale operation). The rst column uses all loans in our sample orig-

inated by the GSEs, the Restricted MSA sample uses only those MSAs with prime jumbo loans present (during

2001 to 2006), and the GSE Matched Sample restricts to these 106 MSAs and matches the distribution of FICO

scores and LTV ratios in the non-GSE sample. Conditional measure of standard deviation removes year × quarter

xed effects and semiparametric controls for FICO and LTV interacted with year × quarter xed effects. See

text for details.

2991

Hurst et al.: regional redistribution

Vol. 106 no. 10

GSE sample so that it replicates the FICO and LTV distributions of the prime jumbo

sample. As a result, the distribution of borrower quality as measured by FICO scores

and LTV ratios will not differ between the two samples.

9

We refer to this sample

as the “matched” GSE sample where the matching occurs on MSA-quarter, FICO

score, LTV ratio, and sample size. For each prime jumbo loan we “draw” a similar

loan from the GSE sample. Descriptive statistics for the matched GSE sample are

shown in column 3 of Table 1. Given the matching procedure, it is not surprising that

the median FICO variation, median LTV variation, and the MSA coverage match

exactly with the prime jumbo sample. This matched GSE sample will be our main

analysis sample going forward.

Table 1 also shows the average interest rate on the loans within each sample.

Consistent with the literature, the unconditional interest rate on GSE loans during

this period was about 33 basis points lower than the rate on prime jumbo loans

(6.33 percent versus 6.66 percent). Throughout the paper, 60+ days delinquent

will be our primary measure of default. Table 1 measures the fraction of loans that

became 60+ days delinquent at some point during the two years after origination.

Unconditionally, 3.0 percent of the GSE loans in the matched sample become delin-

quent in the two years after origination, while only 2.1 percent of the prime jumbo

loans become delinquent. As we show below, conditioning on the date of origination

and focusing on loans originated around the conforming limit cutoff, the ex post

delinquency measures are nearly identical between the two samples.

D. Controlling for Borrower and Loan Characteristics

Throughout the paper, we want to examine spatial variation in mortgage rates

and show how this variation correlates with spatial variation in predicted future

mortgage default rates in each of our samples. Interest rates and delinquency rates

could potentially differ spatially just because borrower or loan characteristics, such

as FICO score or date of origination, vary spatially. For example, borrowers with

lower credit scores empirically face higher interest rates and are more likely to later

default. If borrower credit-worthiness varies spatially, this could explain some spa-

tial variation in observed mortgage rates and default rates. Of course, matching the

two samples on FICO scores and LTV ratios mitigates some of this concern. What

we are after, however, is whether interest rates and the predictable component of

default rates vary spatially after conditioning on borrower and loan characteristics.

A borrower with a given credit score and LTV ratio may be more likely to default

in one region relative to another because overall economic conditions differ across

regions. We want to know whether a given borrower would pay a higher interest

rate when taking out an otherwise identical loan in a high risk rather than a low risk

location.

9

All of these sample restrictions were made to ease comparison of the two samples. However, given that all of

our estimation procedures also include controls for observable loan and borrower characteristics, the matching did

not make much difference. In many of our tables, we show the results with and without restricting the samples to be

similar in size and FICO/LTV distributions. The results are nearly identical across the specications. See the online

Appendix for details of the exact selection criteria for our main sample to facilitate replication of our results. In

online Appendix Table A-1, we show that the matching criteria resulted in both the mean and distribution of FICO

and LTV being similar between the GSE and prime jumbo sample.

2992

THE AMERICAN ECONOMIC REVIEW

OCTObER 2016

To formally explore these patterns, we purge the variation in mortgage rates and

subsequent delinquency rates of spatial differences in borrower and loan charac-

teristics. To do so, we rst estimate the following equations using our loan-level

microdata:

r

ikt

j

= α

0

j

+ α

1

j

X

it

+ α

2

j

D

t

+ α

3

j

D

t

⋅ X

it

+ η

ikt

j

y

ikt

j

= φ

0

j

+ φ

1

j

X

it

+ φ

2

j

D

t

+ φ

3

j

D

t

⋅ X

it

+ ν

ikt

j

,

where r

ikt

j

is the loan-level mortgage rate for a loan made to borrower i , in MSA k ,

during period t , and y

ikt

j

is an indicator variable for whether the loan made by bor-

rower i , in MSA k , during period t , defaulted at some point during the subsequent

24 months. X

it

is a set of control variables for borrower i in period t . Sample j refers

to whether we use individuals from the GSE sample or the private jumbo sample.

We run these regressions separately using data from each of our two samples. D

t

is a

vector of time dummies based on the quarter of origination. The borrower/loan con-

trols include detailed FICO and LTV controls. Specically, all regressions include

quadratics in FICO and LTV, and each of these terms is fully interacted with quarter

of origination dummies. The goal of these specications is to recover η

ikt

j

and ν

ikt

j

,

the residual mortgage rate and residual ex post delinquency rate, respectively, for

borrower i in MSA k during time t for loans in sample j after controlling for bor-

rower/loan characteristics and time xed effects.

Once we have the residuals from the regressions above with the full set of con-

trols, we compute location specic average mortgage rates, R

kt

j

, and location spe-

cic average ex post default rates, Y

kt

j

. We do this separately for each time period

and for each sample. Specically,

R

kt

j

=

1

_

N

kt

j

∑

i=1

N

kt

j

η

ikt

j

Y

kt

j

=

1

_

N

kt

j

∑

i=1

N

kt

j

ν

ikt

j

,

where N

kt

j

is the number of loans in the MSA k during period t within each sample.

Formally, R

kt

j

( Y

kt

j

) will be the average mortgage rate residual ( ex post delinquency

residual) in an MSA for loans originated during a given period for a given sample.

The bottom rows of Table 1 show the standard deviation of unconditional and

conditional mortgage rates and delinquency rates across the MSAs for our matched

GSE sample and our prime jumbo sample originated during 2001–2006. The

cross-MSA variation in interest rates is reduced dramatically once we condition on

borrower, loan, and time controls. Additionally, the conditional cross-MSA stan-

dard deviation of mortgage rates is twice as high in the prime jumbo sample as in

the matched GSE sample, while the conditional cross-MSA standard deviation of

delinquency rates is similar in the two samples. As a starting point, this shows that

there is more cross-MSA variation in mortgage rates in privately securitized loans

than in GSE loans.

2993

Hurst et al.: regional redistribution

Vol. 106 no. 10

III. Local Mortgage Rates and Predictable Local Default Risk

In this section, we document our key empirical facts. As we will illustrate, GSE

mortgage rates do not vary at all with measures of local default risk, while prime

jumbo rates do vary with this risk.

A. A Metric for Local Economic Activity

In order to examine whether mortgage rates vary with local economic condi-

tions, we need to dene measures of local economic activity observable to lenders

that could potentially be used in their pricing decisions. Our primary measure of

local economic activity is the lagged delinquency rate on loans securitized within

each sample. Specically, within each MSA k in period t , we measure the fraction

of loans originated during the prior two-year period that defaulted at some time

between their origination and period t − 1 . Because our time unit of analysis is

1 quarter, our lagged delinquency measure is the fraction of all loans originated

between 9 quarters prior and 1 quarter prior that became 60 days delinquent by

the current quarter. We refer to this measure as E

k, t−1

j

, where E

k, t−1

denotes lagged

economic activity in location k prior to the current period. We index this measure

by j because we could measure lagged defaults either in the GSE sample or in the

prime jumbo sample. We use lagged delinquency as our primary measure of local

economic activity both because it is a summary statistic for many economic factors

that could predict future default (e.g., weak local labor markets, declining house

prices) and because it is easily observable by lenders.

10

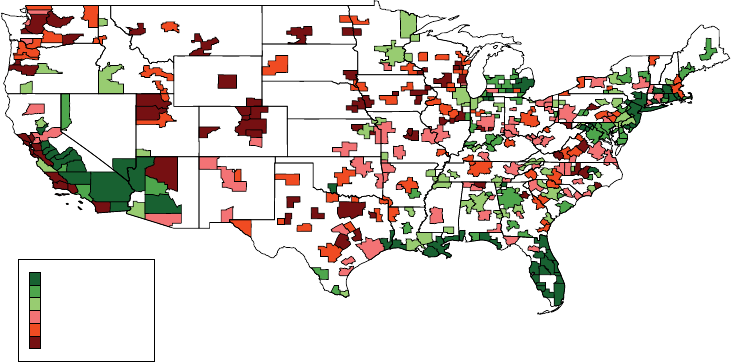

To present the data, panel A of Figure 1 shows a simple scatter plot of local mort-

gage rates residuals for the GSE loans, R

kt

GSE

, in the full GSE sample against lagged

local GSE default rates, E

k, t−1

GSE

, during the 2001–2006 period. Panel B presents the

same result for the GSE sample matched on the distribution of FICO scores and LTV

ratios. The matched GSE sample, as discussed above, only includes 106 MSAs,

while the full sample includes 374 MSAs. Panel C analogously shows the scatter

plot of local mortgage rates residuals for the prime jumbo loans, R

kt

jumbo

, against

lagged local GSE default rates, E

k, t−1

GSE

, during the same time period. Each observa-

tion in the gures is an MSA-quarter pair.

Panels A and B show that there is no relationship between lagged local

GSE default rates and average local mortgage rates in either the full GSE sam-

ple or in the matched GSE sample. Columns 1 and 3 of Table 2 summarize the

regression line of the scatter plots in panels A and B, respectively. Focusing

on the results from column 3 of Table 2, a one-percentage-point increase in

lagged GSE default is associated with a (statistically insignicant) increase

in local GSE mortgage rates of only 3.5 basis points (i.e., from 6.000 to

10

We also used both the lagged local unemployment and lagged housing price growth as measures of local

economic activity. Results were generally similar. The one difference was that lagged local house price growth

during the early 2000s negatively predicted local mortgage default, while lagged local house price growth during

the mid-2000s positively predicted local mortgage default. The latter result was driven by the fact that local house

price growth during the mid-2000s predicted local house price declines during the late 2000s, and households are

more likely to default when house prices decline.

2994

THE AMERICAN ECONOMIC REVIEW

OCTObER 2016

−0.5

−0.25

0

0.25

0.5

0.75

1

Interest rate residual

0 1 2 3 4 5

Lagged default rate Lagged default rate

Panel A. GSE loans

0 0.5 1 1.5 2 2.5

Panel B. GSE loans matched on FICO and LTV

MSA-Quarter observation Linear t

−0.5

−0.25

0

0.25

0.5

0.75

1

Interest rate residual

Lagged default rate

0 0.5 1 1.5 2 2.5

−0.5

−0.25

0

0.25

0.5

0.75

1

Interest rate residual

Panel C. Non-GSE loans

F 1. R I R L L D, 2001–2006

Notes: This gure shows the relationship between residualized interest rates and residualized lagged MSA-level

default of loans originated within the last two years for three samples. Panel A presents the relationship in the GSE

market for all 374 available MSAs. Panel B restricts the GSE loans to the 106 MSAs where non-GSE loans are pres-

ent, and matched based on the FICO and LTV distributions of non-GSE loans for comparability. Panel C shows the

relationship in the non-GSE loan market. The adjusted residual removes year × quarter xed effects and semipara-

metric controls for FICO and LTV interacted with year × quarter xed effects.

T 2—R C MSA I R L GSE D R

2001–2006 2007–2009

GSE

all

(1)

GSE

restricted

MSAs

(2)

GSE

matched

sample

(3)

Prime

jumbo

(4)

GSE

all

(5)

GSE

restricted

MSAs

(6)

Coefcient on lagged GSE default rate 0.16 2.40 3.54 30.55 1.12 1.09

(0.29) (2.84) (2.75) (2.49) (0.23) (0.27)

Implied basis point change in mortgage:

rate to a two-standard-deviation change

in lagged GSE default

0.28 1.78 2.56 20.77 3.18 3.27

Observations 13,109,968 8,052,967 70,327 70,327 4,861,218 3,677,984

Notes: This table shows the coefcient from a regression of conditional MSA interest rates during a given quarter on

lagged GSE default rates. The different columns refer to different samples and different time periods for which the

conditional MSA interest rates and lagged default rates are based. The different sample denitions are discussed in

the notes to Table 1. The implied change in interest rate to a two standard deviation change in lagged GSE default is

simply the coefcient times the standard deviation of lagged GSE default across the MSAs in the relevant sample.

Standard errors in parentheses clustered at the MSA level. See text for details.

2995

Hurst et al.: regional redistribution

Vol. 106 no. 10

6.035).

11

Using the standard deviation of lagged GSE default across MSAs (0.36 per-

centage points) implies that a two-standard-deviation increase in lagged defaults is

associated with only a 2.5 basis-point increase in local GSE mortgage rates. Even

adjusting for the standard error of the estimate, this is essentially a precise zero. As

seen from comparing the rst three columns of Table 2, there is no economically

meaningful or statistically signicant relationship between lagged GSE default and

GSE mortgage rates regardless of the sample used for the GSE data. Finally, col-

umns 5 and 6 show that the 2001–2006 patterns persisted through the 2007–2009

period. During the Great Recession, there was also no economically meaningful

relationship between lagged local mortgage default and local mortgage rates in the

GSE market.

The pattern in panel C of Figure 1 is in stark contrast to those in panels A

and B. Panel C shows that there is a strong positive correlation between lagged

GSE default rates and local interest rates for prime jumbo loans. MSAs that had

larger GSE defaults in the prior year originate loans with higher interest rates con-

ditional on borrower and loan characteristics. Column 4 of Table 2 shows that a

one-percentage-point increase in lagged local GSE default rates was associated with

a 31-basis-point increase in local prime jumbo mortgage rates. This coefcient is

10 times larger than the effect on GSE mortgage rates and is highly statistically

signicant. Importantly, the strong response of interest rates to lagged default in

the prime jumbo market shows that this information is available and exploitable by

lenders. That is, the lack of risk-based pricing by GSEs cannot arise because this

risk was ex ante unobservable.

B. Relationship between Predicted Default and Mortgage Rates

The previous subsection showed the relationship between lagged economic con-

ditions and current mortgage rates. What lenders are presumably interested in is

how past economic conditions translate into future default risk. In this subsection,

we assess the extent to which lagged local economic conditions predict subsequent

actual default. We then assess the cross-region relationship between predicted

default and mortgage rates for both the GSE and prime jumbo samples.

We refer to predicted local default for loans in each sample j , in each location k ,

during each time period t , as Y

ˆ

kt

j

. We calculate three measures of predicted default.

Our rst and primary measure predicts the relationship between future default and

lagged default conditional on borrower and loan characteristics. In particular, we

run the following regression on both the GSE and prime jumbo samples using data

from 2001–2006:

y

ikt

j

= θ

0

j

+ θ

1

j

X

it

+ θ

2

j

D

t

+ θ

3

j

D

t

⋅ X

it

+ λ

j

E

k, t−1

GSE

+ ν

ikt

j

,

where y

ikt

j

, X

it

, D

t

, and E

k, t−1

GSE

are dened above. The goal of this regression is to use

the underlying microdata to see whether lagged GSE default rates predict subsequent

11

When tting a line through the scatter plot or running regressions, we weight each observation by the number

of loans originated during the MSA-quarter. As a result, larger MSAs with more loans are weighted more when

tting the line. All results in the paper are weighted in a similar manner.

2996

THE AMERICAN ECONOMIC REVIEW

OCTObER 2016

mortgage default (conditional on loan and borrower observables). We use the lagged

GSE default rate for both samples so that we capture the response of actual default

rates in the two samples to the same underlying economic conditions. The primary

coefcient of interest is λ

j

, which we can use to dene our rst measure of predicted

local mortgage default:

Y

ˆ

kt

j

= λ

j

E

k, t−1

GSE

.

For both samples, λ

j

is large and statistically signicant, showing that lagged GSE

default rates have signicant predictive power for future default rates in both the

GSE and prime jumbo samples. In particular, for the GSE market, the coefcient

is 1.71 (standard error = 0.24, F-stat = 50.5), while for the non-GSE market, the

coefcient is 2.55 (standard error = 0.31, F-stat = 68.1).

12

For robustness, we also

explore two additional measures of predicted local default. The rst we refer to as

our “random walk” forecast such that

Y

ˆ

kt

j

= E

k, t−1

j

.

This specication implies that the best forecast of today’s loan default rate is yester-

day’s default rate. Notice, for each sample, the lagged default rate is sample specic.

This differs from the rst predicted default measure where both the future default

rates of loans in the GSE sample and the prime jumbo sample depended on the

lagged GSE default rate. This allows for lagged default rates on the prime jumbo

sample to have better predictive properties for loans in the prime jumbo sample than

would lagged GSE default rate. As was the case with the previous results, lagged

prime jumbo default rates were highly predictive of future prime jumbo default

rates.

Second, we examine a “perfect foresight” prediction of future default such that

Y

ˆ

kt

j

= Y

k, t

j

.

This perfect foresight specication implies that lenders’ best prediction of future

default in a given sample in a given location (conditional on observables) is the

actual future default rate (which we label Y

k, t

j

in the specication above).

To examine whether the mortgage rates on GSE loans and the mortgage rates on

prime jumbo loans respond similarly to predicted local default, we estimate the fol-

lowing equation separately for each sample during the 2001–2006 period:

r

ikt

j

= ω

0

j

+ ω

1

j

X

it

+ ω

2

j

D

t

+ ω

3

j

D

t

⋅ X

it

+ β

j

Y

ˆ

kt

j

+ η

ist

j

.

The regression is nearly identical to the ones above explaining mortgage rate vari-

ation aside from the addition of the predicted default variable. The coefcients of

12

One may wonder if the relationship between lagged GSE default and future default is an artifact of the period

we studied. We explored this possibility by rerunning the relationship above for various subperiods of our data. For

example, within the GSE sample, λ

j

was large, statistically signicant, and of similar order of magnitude during the

2001–2003 period, the 2004–2006 period, and the 2007–2009 period. In all three subperiods, lagged GSE default

positively and signicantly predicted future default rates within each loan type.

2997

Hurst et al.: regional redistribution

Vol. 106 no. 10

interest are β

GSE

and β

jumbo

(estimated from separate regressions on the GSE data

and prime jumbo data, respectively).

13

Column 1 of Table 3 shows our estimates

of β

GSE

for our three predicted default measures, while the second column shows

our estimates of β

jumbo

. Columns 3 and 4 show the difference between the coef-

cients ( β

jumbo

− β

GSE

) as well as the p-value of the difference.

In all cases, mortgage rates in the prime jumbo market respond much more to

predicted default than do mortgage rates in the GSE sample. That is, these regres-

sions show that the greater response of jumbo mortgage rates to lagged economic

conditions is not driven by greater sensitivity of actual default to these conditions.

Furthermore, it is not just that jumbo rates are more responsive than GSE rates: our

regression shows that GSE interest rates do not respond in any meaningful way to

predicted default. A one-percentage-point increase in local predicted default only

raises local GSE mortgage rates by two basis points, an effect that is statistically

indistinguishable from zero.

14

Again, the strong response of jumbo mortgage rates

13

To address concerns related to statistical inference with generated regressors, every estimate reported in the

paper that relies on predicted defaults uses bootstrapped standard errors (500 repetitions, clustered at the MSA

level).

14

It is important to note that because the measures of predicted default are in different units, the coefcients

cannot be directly compared across rows within a given column. In the next section, we will show that all three of

the lagged default specications yield similar differential variations in interest rates between the two samples once

scaled appropriately by the underlying variation in the predicted default metric.

T 3—R C MSA I R MSA P D,

2001–2006

Base

specication

Regression

discontinuity

specication

Predictive default measure

GSE

matched

sample

(1)

Prime

jumbo

sample

(2)

Difference

in

coefcients

(3)

p-value of

difference

(4)

RD

coefcient

(5)

Predicted default using lagged local 2.10 12.04 9.94

<0.001

13.48

GSE default

(1.78) (1.68) (4.56)

Lagged default (random walk)

3.56 12.60 9.04

<0.001

13.04

(2.76) (3.16) (4.57)

Actual default (perfect foresight)

0.26 2.12 1.86

<0.001

2.06

(0.14) (0.40) (0.44)

Observations 70,327 70,327 70,327

Time, FICO, and LTV controls included Yes Ye s Yes

Notes: This table presents coefcients from regressions of conditional MSA interest rates on three measures of pre-

dictive default: lagged default rates, actual default rates, and predicted default rates. Lagged default is measured

within-sample depending on GSE or non-GSE loans. Predicted default rates are constructed using lagged GSE

default rates. The sample of GSE loans is restricted to the 106 MSAs where non-GSE loans are present during the

time period 2001–2006 and matches the distribution of FICO scores and LTV ratios in the non-GSE sample. The

different sample denitions are discussed in the notes to Table 1. The rst two columns show the separate OLS esti-

mates, columns 3 and 4 test for differences, while column 5 shows the “regression discontinuity” estimates shown

in Figure 3, using bins that are each 20 percent of the loan amount distribution between $0 and twice the conform-

ing loan limit. Standard errors in parentheses clustered at the MSA level. Standard errors for results relying on pre-

dicted default are bootstrapped (500 repetitions, clustered at MSA level) to account for the generated regressor. See

text for details.

2998

THE AMERICAN ECONOMIC REVIEW

OCTObER 2016

to our measures of predicted default implies that these objects have predictive power

and can be meaningfully acted upon by actual lenders.

We can also explore the differential responsiveness of local mortgage rates to

measures of local predicted default using a regression discontinuity approach to

estimate ( β

jumbo

− β

GSE

) around the conforming loan threshold. Specically, we

estimate

r

ikt

j

= δ

0

+ δ

1

X

it

+ δ

2

D

t

+ δ

3

D

t

⋅ X

it

+ ( δ

̃

1

X

it

+ δ

̃

2

D

t

+ δ

̃

3

D

t

⋅ X

it

) D

it

jumbo

+ δ

4

Bi n

it

+ βBi n

it

⋅ Y

ˆ

kt

j

+ η

ist

j

.

For this regression, we pool the prime jumbo sample and the matched GSE sample

for the years 2001–2006. D

jumbo

is a dummy variable indicating that the loan is

from the prime jumbo sample, and our specication allows the responsiveness of

mortgage rates to observables (FICO, LTV) and time effects to differ across the two

samples.

The key additions to this specication are the variables Bi n

it

and Bi n

it

⋅ Y

ˆ

kt

j

. For

each loan, we compute a metric of the mortgage size relative to the conforming loan

threshold. Loans above the conforming threshold will have a metric that ranges from

1 to 2 (given the prime jumbo sample includes only loans that were originated up

to two times the conforming limit). These loans will all be from the prime jumbo

sample. Loans below the conforming threshold will have a metric between 0 and 1.

The variable Bi n

it

is an indicator variable for the extent to which the loan size differs

from the conforming threshold. Specically, the Bi n

it

variable is dened in 0.2 unit

intervals of the ratio of the loan size to the conforming loan limit (e.g., 0.8–1, 1–1.2,

1.2–1.4, etc.). For example, loans in the 1–1.2 bin have an origination value that is

between the conforming limit and 20 percent greater than the conforming limit. The

regression includes dummy variables for all ten bin values and allows the respon-

siveness of local interest rates to our measures of local predicted default to differ

across the bins. As noted above, we created our matched GSE sample so that it has a

similar distribution of loan sizes below the conforming threshold as the prime jumbo

sample has above this threshold. This ensures that there are similar numbers of loans

in each symmetric bin to the left and right of the threshold.

Selection is a potential concern for any such regression discontinuity approach,

and we address it in a number of ways. More specically, the concern is that loans

just above the threshold may be similar on observables but might differ on unobserv-

ables that affect their propensity to default. This type of selection would not be sur-

prising given the large nancial benet in terms of lower average interest rates for

GSE loans relative to prime jumbo loans. As a result, better borrowers may migrate

to the GSE sample by choosing to put up more equity and take out a loan smaller

than the conforming threshold. We explore these issues in Figure 2: panels A and B

show that there is no discrete change in FICO scores or LTV ratios, so observable

characteristics do not change across the conforming threshold. This is not surprising

given that the samples were matched on exactly these measures.

Panel C of Figure 2 explores whether there is selection on unobservables at the

conforming threshold. It does so by comparing the default rates of the GSE loans

right below the threshold with the default rates for the prime jumbo loans right

2999

Hurst et al.: regional redistribution

Vol. 106 no. 10

above the threshold. If there was selection, one would imagine that better borrow-

ers (on unobservables) put up more cash so that they secure a loan lower than the

conforming threshold. Panel C shows that there is a very slight increase in default

probabilities for prime jumbo loans in the rst bin above the conforming threshold

relative to the rst bin below the threshold (differential actual default probability

= 0.004 with a standard error of 0.001). Although the difference in actual default

rates is small, it does appear that some selection is taking place. However, the sec-

ond bin above the threshold shows no differential default probability relative to the

GSE loans just below the threshold. The differential default probability between

GSE loans close to the conforming limit and loans in the second bin above the

threshold is close to 0.001 with a standard error of 0.001. Similar results hold for the

550

600

650

700

750

800

Average FICO score

0–0.2

0.2–0.4

0.4–0.6

0.6–0.8

0.8–1.0

1.0–1.2

1.2–1.4

1.4–1.6

1.6–1.8

1.8–2.0

0–0.2

0.2–0.4

0.4–0.6

0.6–0.8

0.8–1.0

1.0–1.2

1.2–1.4

1.4–1.6

1.6–1.8

1.8–2.0

0–0.2

0.2–0.4

0.4–0.6

0.6–0.8

0.8–1.0

1.0–1.2

1.2–1.4

1.4–1.6

1.6–1.8

1.8–2.0

Loan size as fraction of conforming threshold

Loan size as fraction of conforming threshold

Loan size as fraction of conforming threshold

Panel A. Average FICO score

30

40

50

60

70

80

90

Average LTV Ratio

Panel B. Average LTV ratio

−0.05

−0.01

0.03

0.07

Average residualized default

Panel C. Average default rate

F 2. A FICO S, LTV R, D R, L A, 2001–2006

Notes: Panel A: the average FICO credit score; panel B: the average LTV ratio; and panel C: the average residu-

alized default rate in each loan amount bin around the conforming loan limit. Residualized default rate removes

year × quarter xed effects and semiparametric controls for FICO and LTV interacted with year × quarter xed

effects. To the left of the limit (values ≤ 1), loans are insured and securitized by the GSEs. To the right of the limit

(values ≥ 1), loans are securitized by the private non-GSE market. The GSE sample is restricted to the MSAs where

non-GSE loans are present, and matched based on the FICO and LTV distributions of non-GSE loans for compa-

rability. Each point in each gure is an average for a loan amount bin representing 10 percent of the loan amount

distribution from $0 to twice the conforming loan limit. 95 percent condence intervals are represented by dashed

lines. See text for details.

3000

THE AMERICAN ECONOMIC REVIEW

OCTObER 2016

third, fourth, and fth bins above the threshold. Thus, although there may be a small

amount of selection occurring within the rst bin above the threshold, there does not

seem to be any evidence of selection in the other bins that is correlated with actual

loan performance.

15

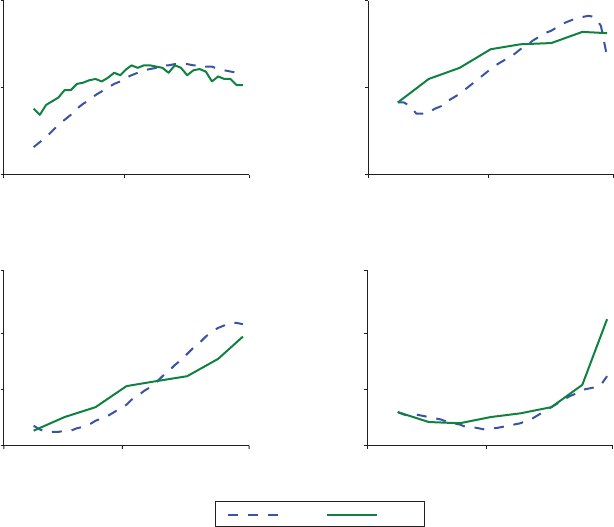

Figure 3 shows our estimates of β for each of the ten bins using our three default

measures. The results are, again, striking. The responsiveness of local mortgage rates

to local predicted default rates is essentially zero for all bins below the conforming

15

Given that the second bin has a loan value that is, on average, between $40,000 and $80,000 above the thresh-

old, it is challenging for most households buying a $500,000 home to substantially reduce the loan balance so that

it could be securitized by the GSEs.

Panel C. Actual (realized) default

−

5

0

5

10

15

20

Regression coefcient

Regression coefcient

Regression coefcient

Panel A. Predicted default

−

10

0

10

20

30

40

Panel B. Lagged default

−

1

0

1

2

3

4

0–0.2

0.2–0.4

0.4–0.6

0.6–0.8

0.8–1.0

1.0–1.2

1.2–1.4

1.4–1.6

1.6–1.8

1.8–2.0

Loan size as fraction of conforming threshold

0–0.2

0.2–0.4

0.4–0.6

0.6–0.8

0.8–1.0

1.0–1.2

1.2–1.4

1.4–1.6

1.6–1.8

1.8–2.0

Loan size as fraction of conforming threshold

0–0.2

0.2–0.4

0.4–0.6

0.6–0.8

0.8–1.0

1.0–1.2

1.2–1.4

1.4–1.6

1.6–1.8

1.8–2.0

Loan size as fraction of conforming threshold

F 3. R I R T M D, 2001–2006

Notes: This gure shows the relationship between residualized interest rates and default rates in each loan amount

bin around the conforming loan limit. Adjusted residual removes year × quarter xed effects and semiparametric

controls for FICO and LTV interacted with year × quarter xed effects. To the left of the limit (values ≤ 1), loans

are insured and securitized by the GSEs. To the right of the limit (values ≥ 1), loans are securitized by the private

non-GSE market. The GSE sample is restricted to the MSAs where non-GSE loans are present, and matched based

on the FICO and LTV distributions of non-GSE loans for comparability. Each point in each figure is a regression

coefficient for a loan amount bin representing 10 percent of the loan amount distribution from $0 to twice the con-

forming loan limit. 95 percent confidence intervals based on standard errors clustered at MSA level are represented

by dashed lines. Standard errors for results relying on predicted default are bootstrapped (500 repetitions, clustered

at MSA level). See text for details.

3001

Hurst et al.: regional redistribution

Vol. 106 no. 10

threshold, regardless of our denition of predicted default. However, for the bins

directly above the conforming thresholds, there is a strong positive relationship

between local default probabilities and local mortgage rates. The estimated respon-

siveness is nearly identical in the second, third, and fourth bins above the threshold.

The results, combined with the actual default analysis in panel C of Figure 2, show

that the pricing behavior of mortgages with respect to local default risk changes

discretely between the GSE and prime jumbo samples. Column 5 of Table 3 shows

our regression discontinuity (RD) estimates of the differences in responsiveness for

our three measures of predicted default. Our RD estimates are very similar to the

regression-based estimates shown in column 3 of Table 3.

C. How Much Should GSE Loan Rates Have Varied with Predictable Default?

In this subsection, we construct a counterfactual of how much GSE interest rates

should have varied across regions if local risk was priced similarly to the prime

jumbo sample. Table 4 shows the standard deviation of predicted default for our

three default measures. The rst and second columns examine the standard devia-

tion of predicted default for our matched GSE sample and our prime jumbo sample

during the 2001–2006 period. The last column examines predicted default measures

for a sample of GSE loans restricted to the same MSAs as the prime jumbo loans,

but during the 2007–2009 instead of the 2001–2006 period.

Table 5 is our key counterfactual table. Given the standard deviation of predicted

default rates (shown in Table 4), Table 5 computes how much GSE interest rates

should have varied across regions in response to a two-standard-deviation change

in predicted default. We use our baseline RD coefcients (column 5 of Table 3)

to perform the counterfactual. Table 5, therefore, computes the counterfactual by

multiplying our estimate of ( β

jumbo

− β

GSE

) by two times the relevant standard devi-

ation of predicted default. Our preferred estimates (row 1 of Table 5, which uses

the regression measure of predicted default) suggest that a two-standard-deviation

shock to predicted default should have resulted in a 16-basis-point variation in GSE

T 4—S D P D

2001–2006 2007–2009

Predicted default measure

GSE

matched

sample

Prime

jumbo

sample

GSE

restricted

MSAs

Predicted default using lagged local GSE default 0.006 0.009 0.011

Lagged default (random walk)

0.004 0.005 0.015

Actual default (perfect foresight)

0.030 0.027 0.043

Notes: This table presents the standard deviation of each measure of predicted default for each sample used in the

analysis, GSE loans and non-GSE loans originated between 2001 and 2006, and GSE loans originated between

2007 and 2009. The GSE sample during the 2001–2006 period is restricted to the MSAs where non-GSE loans are

present and matched on the FICO and LTV distributions of the non-GSE sample for better comparability. The GSE

sample during the 2007–2009 period is restricted to the MSAs where non-GSE loans were present during the period

2001–2006. See text for details of sample construction.

3002

THE AMERICAN ECONOMIC REVIEW

OCTObER 2016

mortgage rates across regions during the 2001–2006 period and a 30-basis-point

variation in GSE mortgage rates across regions during the 2007–2009 period. The

difference between the two periods results from the fact that the variation in pre-

dicted default across regions was much higher during the 2007–2009 period.

The other specications of lagged default give roughly similar estimates. In our

modeling section below, we are particularly interested in measuring the extent of

resource transfers due to the GSEs’ constant interest rate policy during the Great

Recession because regional risk was particularly important during this time period.

With this goal in mind, we choose parameters so that a two-standard-deviation

shock to local economic activity across regions would generate a 25-basis-point

movement in mortgage rates across regions if the GSEs abandoned their constant

interest rate policy and allowed mortgage rates to adjust to local default risk as in

the private market. Given our counterfactual estimates for the other predicted default

measures shown in Table 5, we examine the robustness of our model results when a

two-standard-deviation shock causes a 15-basis-point or a 35-basis-point movement

in mortgage rates across regions.

In sections that follow, we will assess the consequences of the GSE constant

interest rate policy. We use a simple back of the envelope calculation as well as

more formal structural model that accounts for endogenous household decisions

in response to interest rate changes and feedback of interest rate policy to local

house prices and income. The broad conclusion that emerges from either of these

approaches is that the constant interest rate policy induces large and meaningful

transfers across regions.

D. Robustness and Extensions

Before turning to a formal welfare analysis of the constant interest rate policy, we

rst briey discuss the robustness of our empirical results along a number of dimen-

sions. As a summary, none of the robustness specications we explored altered our

conclusions either qualitatively or quantitatively. In the online Appendix we describe

these robustness exercises in much greater detail.

Aside from default risk, the biggest risk lenders face is prepayment risk. If pre-

payment risk differs dramatically between GSE loans and prime jumbo loans in a

way that is correlated with local default risk, the lack of variation in GSE mortgage

T 5—P C T-S-D C-MSA

V GSE I R

Predicted default measure 2001–2006 2007–2009

Predicted default using lagged local GSE default 0.162 0.297

Lagged default (random walk)

0.104 0.391

Actual default (perfect foresight)

0.124 0.177

Notes: This table presents the interest rate response to a two-standard-deviation change in each

predicted default measure for two time periods, 2001–2006 and 2007–2009. These values are

obtained by multiplying the values in Table 3, column 5 with two times the standard deviations

found in Table 4 for GSE loans.

3003

Hurst et al.: regional redistribution

Vol. 106 no. 10

rates with local default risk may not be surprising. In our data, we can track pre-

payments and thus create a measure of predicted local prepayment risk (in ways

similar to our creation of local default risk). The online Appendix discusses exactly

how we compute the measures of local prepayment risk. We nd that predicted pre-

payment rates, conditional on loan and borrower observables, are very similar for

GSE and prime jumbo loans. For example, using our RD approach, predicted annual

prepayment rates were only 1 percentage point lower for prime jumbo loans above

the conforming threshold than for GSE loans below the threshold (19 percent ver-

sus 20 percent). What matters is whether predicted prepayments are differentially

correlated with predicted default rates across the two samples in a way that undoes

the results documented above. To explore this, we added predicted prepayment rates

as an additional control to all our main empirical specications. Table 6 shows one

such specication. Column 1 of Table 6 redisplays our estimate from column 5 of

Table 3 (row 1). We do this to facilitate comparison across our robustness speci-

cations. Column 2 shows our RD estimates when we add the measure of predicted

prepayments as an additional control. Notice that controlling for predicted prepay-

ment risk does not change the RD estimates in any meaningful way. Again, this is

not surprising given the fact that conditional prepayment probabilities barely differ