Memorandum to the Board of Directors

Taxi Upfront Fare Pilot – Second Quarter Report

To: SFMTA Board of Directors

Amanda Eaken, Chair

Stephanie Cajina, Vice Chair

Steve Heminger, Director

Dominica Henderson, Director

Fiona Hinze, Director

Lydia So, Director

Manny Yekutiel, Director

Through: Jeffrey Tumlin

Director of Transportation

From: Kate Toran

Director of Taxis, Access & Mobility Services

Date: September 13, 2023

Subject: Taxi Upfront Fare Pilot – Second Quarter Report

The San Francisco Municipal Transportation Agency (SFMTA) is providing quarterly updates to

the SFMTA Board and other key stakeholders regarding the implementation of the Taxi Upfront

Fare Pilot (Pilot). The first quarter report of the Pilot provides a summary of the program and its

policy goals, as well as an analysis of key metrics identified during the first full quarter (Q1),

December 2022 through

February 2023.

This is the second quarter (Q2) report tracking progress in meeting policy goals covering March

2023 through May 2023. The quarterly reports are intended to help the SFMTA assess the

impact of the Pilot, understand whether the Pilot is on track to meet key policy goals and to

provide transparency to the public regarding key findings throughout the Pilot.

BRIEF SUMMARY

for

Page 2 of 22

The Pilot allows taxi customers to book a ride through a Taxi E-Hail App (app) and pay the

upfront fare in advance of the trip or book a trip through the app and pay the fare at the end of

the trip. The Pilot also allows Taxi E-Hail App providers to dispatch trips that originate with third-

party entities (e.g., entities that do not receive permits issued by the SFMTA), which may offer

upfront fares that are not based on Taximeter rates.

The Upfront Fare Pilot allows two types of trips:

1. Taxi Pilot Trips have the following characteristics:

originate with a customer requesting a ride through a Taxi E-Hail App

driver is dispatched by a Taxi E-Hail App

ride is provided by a permitted San Francisco taxi driver in a permitted San Francisco

taxi vehicle

upfront fare payment is based on the estimated Taximeter amount

2. Third-Party Pilot Trips have the following characteristics:

originates with a customer requesting a ride through a third-party entity (Third-Party

Provider)

ride is transferred to a Taxi E-Hail App

driver is dispatched by a Taxi E-Hail App

ride is provided by a permitted San Francisco taxi driver in a permitted San Francisco

taxi vehicle

upfront fare is not required to be based on the estimated Taximeter amount

In the first half of the Pilot term, Flywheel Technologies was the only company providing Pilot

trips and Uber was the only approved third party entity. Yellow Cab is still working to achieve

compliance with the data requirements and has not yet participated in the Pilot.

SUMMARY OF KEY TAKEAWAYS DURING THE FIRST HALF

OF THE PILOT

This section provides a summary of key takeaways during the first two quarters of the Pilot. A

more extensive analysis of each Pilot goal and associated metrics is provided later in this report.

A quick snapshot of key data points during the first two quarters of the Pilot shows the following:

52,473 total number of Pilot trips provided

o 10,834 Pilot trips provided in Q1

Page 3 of 22

o 41,639 Pilot trips provided in Q2

o Third-Party Trips comprise 85% of the total Pilot trips provided and Taxi Pilot

Trips comprise 15%

o Pilot trips comprised 2.1% of total Taxi trips in Q1

o Pilot trips comprised 7.3% of total Taxi trips in Q2

o App-based trip requests account for 11.7% of all hail types in Q2

Total taxi trips stayed relatively constant as compared to the same period during the

prior year

o Total taxi trips increased 9.4% in Q1 as compared to the same period during the

prior year, but decreased 7% during Q2 as compared to the same period during

the prior year

o Total taxi trips for the first half of the Pilot overall remained fairly constant, with a

slight increase of 0.11%

A total of 378 drivers participated in the Pilot, notably increasing 37% from Q1 to Q2

o Active taxi drivers increased by 10.3% as compared to the number of active

drivers over the same six-month period from the previous year

o Drivers who service Third-Party Pilot trips earn on average 23.8% more in

monthly fare revenue than drivers who do not service those types of trips

o Drivers who provide Third-Party Pilot Trips earn an average of $1,430 per month

from those trips alone, and it increased 60% from Q1 ($1,093) to Q2 ($1,767)

o Flywheel Color Scheme experienced the biggest increase in active drivers in Q2

of the Pilot as compared to the same period during the prior year:

Flywheel Taxi = 45.5% increase (from 222 to 323)

Yellow Cab = 2.3% increase (from 400 to 409)

San Francisco Taxicab = 26.4% increase (from 121 to 153)

An analysis of the geographic distribution of Third-Party Pilot Trips indicates that these

trips are helping to extend the density of taxi pick-ups to outer neighborhoods in San

Francisco that have historically been underserved by the taxi industry

The relative proportion of paratransit taxi trips to all taxi trips before and during the first

half of the Pilot term has remained fairly consistent and there has not been an increase

in paratransit taxi complaints attributed to the Pilot.

METHODOLOGY AND ASSUMPTIONS

The metrics discussed below are analyzed based on a set of methods and assumptions applied

to the collection, validation, and analysis of taxi industry data.

The main source of the data presented in this report is the data reported by the taxi industry. As

required by the Transportation Code, all taxi companies permitted to operate in the City and

County of San Francisco transmit digital records of their fleet’s activity to SFMTA in real time

through the SFMTA Taxi Application Programming Interface (API), which is the software

interface that allows the SFMTA to receive data securely from the taxi industry. Prior to

Page 4 of 22

launching the Pilot program, SFMTA updated its specifications for the Taxi API data by requiring

the submission of the types of data necessary for tracking the Pilot’s performance, such as

upfront or metered fare payment method and the trip application origin (Taxi E-Hail or Third-

Party). For Third-Party Trips, the relevant data is transmitted to SFMTA on a bi-weekly basis by

Flywheel, currently the only taxi company permitted to service the trips — the SFMTA does not

receive any data directly from third-party entities.

As the SFMTA receives data from the industry, the Data Analytics team applies automated and

manual validation procedures to check the quality of the data in each record received. The

validation process has identified numerous data quality issues since the start of the Pilot, such

as regular taxi trip records mislabeled as Taxi Pilot Trips and inaccurate meter fare estimations

for Pilot trips. When an issue is identified through the validation process, the Data Analytics

Team conducts an independent investigation and then collaborates with industry partners to

identify a solution. SFMTA hosts regular technical troubleshooting sessions with each of the

participating taxi companies individually to address data quality issues in a timely fashion. The

data presented in this report has been vetted by the Data Analytics Team and is therefore

reliable and accurate to the best of our knowledge. However, since this is a new program that

involves significant technical updates and challenges, the validation process is ongoing, and all

industry data remains subject to future corrections and updates.

Based on the validated industry data, SFMTA tracks key metrics to measure the actual impact

of the Pilot on the industry based on the goals of the program. To measure that impact, the

metrics compare the data received since the start of the Pilot to historical data from before the

Pilot began. The historical data has undergone a similar validation process, and also remains

subject to future corrections and updates. The Data Analytics Team primarily uses year-over-

year comparisons to account for strong seasonality in the taxi industry but relies on short-term

baseline comparisons to a period immediately preceding the pilot if deficiencies in the long-term

historical data make it necessary. For example, the taxi industry did not consistently report how

a passenger requested a trip (i.e. hail type) prior to October 2022. Therefore, when analyzing

hail type during the Pilot, due to historical deficiencies, October 2022 is used as the baseline

period for comparison purposes.

Staff has also analyzed the Q2 data as compared to Q1 data, understanding that the seasonal

differences between those two quarters impact results, but that the analyses are still important

to understand trends over the course of the Pilot term.

In addition, SFMTA acknowledges that the impact of the Pilot on the industry may be

confounded by other contextual factors such as the easing of COVID-era restrictions or other

SFMTA efforts to benefit the industry like increasing the taxi meter rate. We take these factors

Page 5 of 22

into account and do not intend to claim that the industry trends discussed below are solely the

result of the Pilot.

PILOT GOALS AND METRICS

Goals: Desired Outcomes

The SFMTA has established six main goals for the Pilot:

1. Improve taxi customer service by:

Offering upfront fare estimates and bookings through Taxi E-Hail Apps

Relieving meter anxiety for customers by providing price certainty for taxi trips

Allowing customers to price shop for similar on-demand services

2. Increase taxi trips

3. Maintain a consistent level of service for traditional taxi trips, including Paratransit taxi trips

4. Increase taxi drivers’ fare revenue

5. Increase the number of permitted taxi drivers offering service to the public

6. Ensure that Taxi Pilot Trip fares closely match the Taximeter rates

Metrics: Measuring Success

The SFMTA requires Pilot participants to submit various types of data, including Taxi Pilot Trips

and Third-Party Pilot Trips, driver fare income, and other relevant datasets to help measure the

success of the Pilot in meeting the stated goals. Staff may also use the data to identify potential

areas for improvement, assess participant compliance, and to update program criteria and

processes. Some metrics do not have a specific numeric target, but rather, describe the data

that will be collected. Since the Pilot is novel, there may be multiple variables associated with an

enumerated metric, showcasing the importance of identifying associations or trends within the

Pilot and the data itself. The metrics have been slightly revised from the original policy memo

establishing the Pilot as described below and may be further updated during the Pilot term,

depending on staff assessment and key stakeholder feedback.

Goal 1: Improve customer service

Metric 1A: Track the total number of Pilot trips

The total number of Pilot trips is a proxy for customer satisfaction. Staff tracks the number of

Taxi Pilot Trips as compared to the number of Third-Party Pilot Trips. This metric has changed

slightly from the policy memo that established the Pilot. Staff updated the original metric,

“Increase E-Hail App Trips by 10%,” because not all Taxi E-Hail App providers are participating

Page 6 of 22

in the Pilot and the intent of this metric is to track satisfaction with the Pilot. Therefore, the

metric was updated to track the total number of Pilot trips, which provides a more targeted proxy

measure of customer satisfaction.

Metric 1B: Complaints

The SFMTA tracks the number of complaints by taxi drivers and customers regarding Pilot trips.

Staff also tracks the total number of complaints, comparing the number received prior to the

Pilot’s launch and the number received during the Pilot term.

QUARTER 2 RESULTS FOR GOAL 1

Metric 1A: Total Number of Pilot Trips

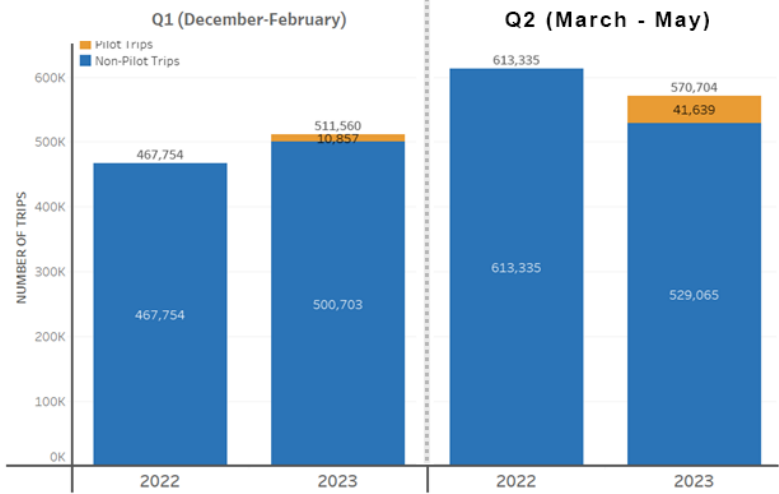

Altogether there were 41,639 total Pilot trips in Q2 - 15% (6,315) were Taxi Pilot Trips and 85%

(35,324) were Third-Party Trips. Total Pilot trips nearly quadrupled in Q2 as compared to Q1, as

shown in Figure 1 below. Due to the seasonal variation in Q2 as compared to Q1, staff expected

an overall increase in Pilot trips in Q2. This is because typically, the winter months of Q1 have

less demand for trips than the spring months of Q2. But even considering seasonal variation,

the ramp up in Third-Party Trips in Q2 is particularly notable. The more gradual increase of the

Taxi Pilot Trips and the smaller proportion as compared to Third-Party Trips during Q2 reflects

Flywheel’s slower than anticipated roll-out of Taxi Pilot Trips. During the first half of the Pilot

launch, Flywheel Technologies worked to ensure that the data integration for Third-Party Pilot

Trips was functioning properly, and that the data stream provided to the SFMTA properly

tracked the required data fields.

Page 7 of 22

Figure 1: Total Pilot Trips during Q1 and Q2

Metric 1B: Complaints

The SFMTA tracks the number of complaints by taxi drivers and customers regarding Pilot trips,

as well as the overall number of complaints to monitor potential impacts on service delivery.

Staff pays particular attention to complaints about response times. Most complaints are filed

through 311, but SFMTA staff also receive and investigate complaints that are filed through

email, over the phone and in person at the Taxi Window at 1 South Van Ness.

As with other Pilot metrics, to account for potential impacts due to seasonality, SFMTA

compared complaints during the Pilot period to the same timeframe from the prior year, along

with comparisons from Q1 to Q2. Additionally, to account for the difference in total taxi trips,

staff analyzed complaints per 1,000 trips to provide a more accurate comparison.

Table 1: Taxi Complaints per 1,000 Trips during Q1 and Q2 compared to the same period from the

previous year

Before Pilot

(Dec 2021 – Feb

2022)

Q1 of Pilot

(Dec 2022 – Feb

2023)

Before Pilot

(March-May 2022)

Q2 of Pilot

(March – May 2023)

Average

0.07

0.08

0.12

0.08

With an average of 0.08 complaints per 1,000 trips, taxi complaints in Q2 are lower than

complaints during the same three-month period from the prior year (0.12 complaints per 1,000

taxi trips). Q2 of the Pilot shows the same rate of complaints from Q1.

Page 8 of 22

Staff also separately analyzed complaints regarding taxi driver response times, and per Table 2

below, there was a marginal change during Q2 as compared to the same period from the prior

year and as compared to Q1.

Table 2: Taxi Driver Response Time Complaints per 1,000 Trips during Q1 and Q2 compared to the same

period from the previous year

Before Pilot

(Dec 2021 – Feb

2022)

Q1 of Pilot

(Dec 2022 – Feb

2023)

Before Pilot

(March-May 2022)

Q2 of Pilot

(March – May 2023)

Average

0.04

0.05

0.01

0.01

SFMTA is also tracking paratransit taxi complaints, paying particular attention to complaints

received about response times, which would indicate paratransit taxi customers are waiting

longer for taxi trips. During the first two quarters of the Pilot, there were no complaints filed

about paratransit taxi response time and there were overall fewer complaints about paratransit

taxi trips per1,000 trips when compared to the same period from the year prior, as indicated in

Table 3 below.

Table 3: Paratransit Taxi Complaints per 1,000 Trips during Q1 and Q2 compared to the same period

from the previous year

Before Pilot

(Dec 2021 – Feb

2022)

Q1 of Pilot

(Dec 2022 – Feb

2023)

Before Pilot

(March -May 2022)

Q2 of Pilot

(March – May 2023)

Average

0.14

0.12

0.01

0.01

In general, SFMTA has not seen a significant change in the rate of complaints during either

quarter of the Pilot. It is unlikely that the Pilot impacted the number or type of complaints for taxi

trips or paratransit taxi trips during both quarters as a multitude of possible factors could explain

any increase or decrease in complaints, and Pilot trips are still a small percentage of overall taxi

trips. But this is still an important metric to track.

Goal 2: Increase taxi trips

Metric 2A: Increase total taxi trips by 10%

Page 9 of 22

The SFMTA tracks the total number of taxi trips provided during the Pilot term and compares it

to the total number of taxi trips provided prior to the Pilot, with a goal of increasing total taxi trips

by 10%.

Page 10 of 22

QUARTER 2 RESULTS FOR GOAL 2

Increasing the total number of taxi trips is a key goal for the SFMTA, particularly since the

number of taxi trips significantly declined after TNCs began operations in San Francisco. There

were further taxi trip reductions during the pandemic, which severely impacted taxi trip demand,

reducing trip volumes by 70% on average SFMTA. SFMTA views an increase in the total

number of taxi trips as indicative of the Pilot’s positive impact on the taxi industry and future

growth. The total number of taxi trips includes all taxi trips in the SF market, including all Pilot

trips (Taxi Pilot Trips and Third-Party Pilot Trips) and non-Pilot taxi trips. To account for strong

seasonality in the industry, a year-over-year comparison provides a more “apples to apples”

comparison of the change in taxi trips, although staff also has analyzed the total taxi trips in Q2

of the Pilot as compared to Q1. Comparing Q2 to Q1 helps provide a picture of the change in

trips during the Pilot term, with the caveat that that some of the fluctuation can be attributed to

seasonality. Staff also acknowledge that other contextual factors, in addition to the Pilot, may

influence the change in total taxi trips.

Total taxi trips during Q2 of the Pilot were 7% lower than the total taxi trips provided during the

same period of the prior year, decreasing from 613,335 to 570,704 as shown in Figure 2 below.

This decrease contrasts with the 9.4% increase in trips during Q1 of the Pilot, which is also

displayed below in Figure 2 for comparison purposes. It is not clear to staff how to account for

this decrease in total taxi trips during Q2 and we will continue to monitor trip trends, as well as

continue to review and validate the historical and current data. As noted in the Methodology

section, the SFMTA relies on the taxi industry to provide data, which is then reviewed and

validated by the Data Analytics Team. There have been instances of missing or misreported

data, which the SFMTA has worked with the taxi industry to correct. This continues to be an

ongoing process and staff will continue to review and update data and subsequent reporting as

needed.

Figure 2: Total Taxi Trips during Q1 and Q2 compared to the same periods from the previous

year

Page 11 of 22

Total taxi trips experienced an 11.6% increase from Q1 to Q2 of the Pilot. This is comprised of

an increase in both non-Pilot and Pilot trips. Staff is providing this view of the data to show the

change in trips during the Pilot term, acknowledging that an increase in trips from the winter

months to the spring months is to be expected, due to higher demand in the taxi industry during

the spring months. The relative proportion of Pilot trips as compared to total taxi trips increased

from 2.1% in Q1 of the Pilot to 7.3% in Q2.

Total taxi trips during the first half of the Pilot (1,082,241) as compared to the same period for

the prior year (1,080,889) remained fairly constant, with a slight increase of 0.11%. The

SFMTA’s goal of a 10% increase in total taxi trips has not yet been met and staff will continue to

work to understand confounding factors that may play a role in the trip trends.

Goal 3: Maintain a consistent level of service for traditional taxi trips,

including Paratransit taxi trips

Metric 3A: Taxi trips by hail type

The SFMTA assesses the impacts, if any, of Third-Party Pilot Trips on traditional taxi trips,

including street hails and phone dispatch trips, by analyzing the distribution of trips by hail type

before and during the Pilot term.

Metric 3B: Paratransit taxi trips

Page 12 of 22

Staff analyzes the relative proportion of paratransit taxi trips to all taxi trips before and during the

Pilot term to help assess potential impacts of the Pilot.

QUARTER 2 RESULTS FOR GOAL 3

Metric 3A: Taxi Trips by Hail Type

SFMTA is tracking the distribution of trips by hail type as a measure of the Pilot’s impact on

customer service in the industry, particularly on the level of service for traditional taxi trips. Hail

type refers to the method used by the customer to request a ride. There are three main methods

for hailing a taxi in San Francisco: street trips are those hailed by hand on the street; dispatch

trips are those hailed through a phone call or website; and e-hail trips are those hailed through

one of the three approved Taxi E-Hail Apps. Street and dispatch trips are both considered

traditional taxi service trips that many customers continue to rely on. E-hail is a relatively new

option that makes it easier for customers to hail a nearby taxi on their smart phones without the

need to flag the vehicle down in the street or speak with a phone dispatch operator. In addition,

the Pilot has introduced a fourth method for hailing taxis through apps operated by third-party

entities that have partnered with one of the taxi companies authorized to offer Third-Party Pilot

Trips. Due to deficiencies in the historical data on hail type from last year, SFMTA is unable to

make a year-over-year comparison of trip distribution by hail type. Instead, we measure change

by comparing the distribution during the Pilot to the last full month before the Pilot began

(October 2022).

During Q2 of the Pilot, there was a significant increase in the proportion of Third-Party Pilot Trip

hails. The relative proportion of Third-Party Trip hails increased from 1.8% in Q1 to 6.2% in Q2.

Figure 3 below displays the distribution of trips by hail type during Q1 and Q2 of the Pilot

compared to the baseline distribution.

Figure 3: Taxi Trips by Hail Type

Page 13 of 22

Although Third-Pilot Party Trip hails account for a small proportion of total taxi hails when

compared to street or dispatch hails, the growth in that hail type from Q1 to Q2 is notable.

Traditional methods of hailing a taxi—by street and phone dispatch—saw a slight decline in their

percentage of the total; however, app-based methods of requesting a trip — by e-hail and Third-

Party applications—increased by a combined proportion of 11.7%.

Metric 3B: Paratransit Taxi Trips

SFMTA is tracking the proportion of paratransit taxi trips of total taxi trips as a measure of the

Pilot’s impact on the paratransit taxi service. To measure change in paratransit taxi service over

time and account for industry seasonality staff compare paratransit taxi trips as a percentage of

all taxi trips during the Pilot to a six-month baseline period before the Pilot began (May-October

2020).

During Q2 of the Pilot, paratransit taxi trips accounted for 11.8% of all taxi trips (67,581 out of

570,704). This represents a slight decrease from the Q1 value of 12.6%, yet a higher portion

overall from the baseline percentage of 11.6% from the six months preceding the Pilot. Figure 4

below displays the paratransit trip percentage during Q1 and Q2 of the Pilot compared to the

baseline period.

Figure 4: Paratransit Taxi Trips as a Proportion of Total Taxi Trips

Page 14 of 22

The proportion of paratransit trips as compared to total taxi trips remained largely consistent

throughout the periods both before and after the start of the Pilot. The consistency indicates that

the Pilot has not had a significant impact on the level of service provided to paratransit taxi

customers during Q1 and Q2, as measured by trip levels. This is an expected outcome given

the small number of Pilot trips during these periods. Additionally, there are other factors that

may impact changes in paratransit taxi trip demand and usage that are not attributable to the

Pilot. For example, and spike in Covid may decrease paratransit taxi demand during a given

period. SFMTA will continue to monitor the level of paratransit taxi trips.

Goal 4: Increase taxi driver fare revenue

Metric 4A: Increase taxi driver fare revenue by 10%

SFMTA monitors driver fare revenue to understand the Pilot’s impact on driver income. Fare

revenue is the base amount charged to the customer for a trip, excluding tip, airport fees,

baggage fees, out-of-town fees, tolls, and any other associated fees. These additional customer

costs are not reported to SFMTA consistently enough to generate reliable data, and therefore

are not included in our analysis. Fare revenue also excludes any calculation of color scheme or

other operational fees, such as those charged by the app provider or Third-Party Pilot app.*

Calculating net driver income would require an in-depth analysis of taxi driver costs, which may

be a future project for staff to undertake but is not included as part of the Pilot metrics.

Although fare revenue is not equivalent to the final amount received by the driver, it is the most

reliable indicator of driver revenue available to SFMTA given current data reporting protocols.

To account for industry seasonality, SFMTA measured the change in fare revenue during Q2 of

the Pilot by comparing it to the same period last year. SFMTA also tracks the amount of fare

revenue that drivers earned from Pilot trips compared to non-Pilot trips.

QUARTER 2 RESULTS FOR GOAL 4

During Q2 of the Pilot, the average monthly fare revenue per driver was $5,766, which

represents a 2.6% increase compared to the same period from the prior year ($5,620), as

shown in Figure 5 below. This is lower than expected, particularly when considering the

taximeter rates increased by about 18% in November 2022, but is attributed to the decrease in

overall taxi trips during Q2 of the Pilot.

Figure 5 also shows the average monthly fare revenue per driver, broken out into revenue from

Pilot trips and revenue from non-Pilot trips for Q1 and Q2 of the Pilot term as compared to the

same periods from the prior year.

Page 15 of 22

*

Note: Third-party apps report the weighted average fee amount they charge to drivers

monthly. During Q2 of the pilot, the average fee charged to drivers by Third-Party apps was

approximately 10.2% of the fare charged to the customer during Q2 of the Pilot.

Figure 5: Taxi Driver Average Monthly Fare Revenue during Q1 and Q2 compared to the same periods

from the previous year

Average driver fare revenue increased to nearly 14.9% during the first half of the Pilot term as

compared to the same six-month period of the prior year. This increase tracks with the taximeter

rate increase and cannot be attributed solely to the Pilot.

The average monthly fare revenue per driver during Q2 increased 12.3% as compared to Q1

($5,138), and the revenue from Third-Party Trips alone increased 60.2% from Q1 ($1,103) to

Q2 ($1,767). As noted above, comparing Q1 data to Q2 must include a caveat regarding

seasonality – more taxi trips are typically provided during the spring months than the winter –

but this comparison indicates that the Third-Party Pilot Trips provide drivers with the opportunity

to increase their earnings, if they choose to service those trips.

Page 16 of 22

During Q2, drivers who provided Third-Party Pilot Trips earned $6,949 in average monthly fare

revenue, of which 25.4% ($1,767) came from just Third-Party Trips. Revenue for drivers who did

not provide Third-Party Pilot Trips was $5,615 on average for Q2. Therefore, drivers who

provided Third-Party Pilot Trips earned on average 23.8% more in overall monthly fare revenue

than drivers who did not provide Third-Party Trips. Comparing average driver revenue from Q1

to Q2 shows an 18.32% increase for drivers who provide Third-Party Trips. Earning solely from

Third-Party Trips increased 60.20% from Q1 ($1,103) to Q2 ($1,767).

Figure 6: Comparison of Revenue during Q1 and Q2 for Drivers that Provide Third-Party Pilot Trips and

Drivers that do not Provide Third-Party Trips

As noted in the Q1 report, some taxi industry members have expressed concerns to the SFMTA

regarding the fee charged to drivers by Uber for the Third-Party Trips. As with Uber’s passenger

fares, the driver fees are dynamic, and this has been an area of concern for the taxi industry,

because the payment structure for the taxi industry is not dynamic. As noted above, the

monthly weighted average fee charged to drivers during Q2 was 10.2% of the customer fare.

This fee is similar to the 13.5% fee that Flywheel Technologies charges drivers. To provide taxi

drivers with full transparency regarding their potential earnings for servicing a Third-Party Pilot

Trip, taxi drivers are able to see the pick-up and drop-off locations and the amount they will earn

Page 17 of 22

for that trip prior to accepting the trip. The taxi driver can then make an informed decision about

servicing each specific trip.

Goal 5: Increase the number of taxi drivers

Metric 5A: Increase the number of active taxi drivers in service

Active drivers in service are defined as drivers who have provided at least one trip during the

period of analysis (in this case, during Q2 of the Pilot). Tracking the number of active drivers in

service helps SFMTA assess whether more drivers are actively working during the Pilot term as

compared to prior. While there are many factors external to the Pilot that may impact this metric,

it is important for SFMTA to track this metric as one measure of the Pilot’s success.

Metric 5B: Increase the number of new taxi drivers

The SFMTA tracks the number of taxi drivers, assessing for an increase in the total driver pool.

As the agency anticipates an increasing number of trips due to the Pilot, the number of drivers

willing to conduct trips can help determine the impact that the pricing system has on drivers.

Additionally, if trip demand increases, the market response should be a corresponding increase

in the number of drivers. An increase in the number of drivers may be a result of the

opportunities to increase driver revenue, however, national labor issues and other factors

outside of the SFMTA’s sphere of influence could also be contributing factors to driver pool

supply limitations. Therefore, there is not a specific target for this metric, but changes in the

number of drivers during the Pilot will be tracked.

QUARTER 2 RESULTS FOR GOAL 5

Metric 5A: Increase the number of active taxi drivers

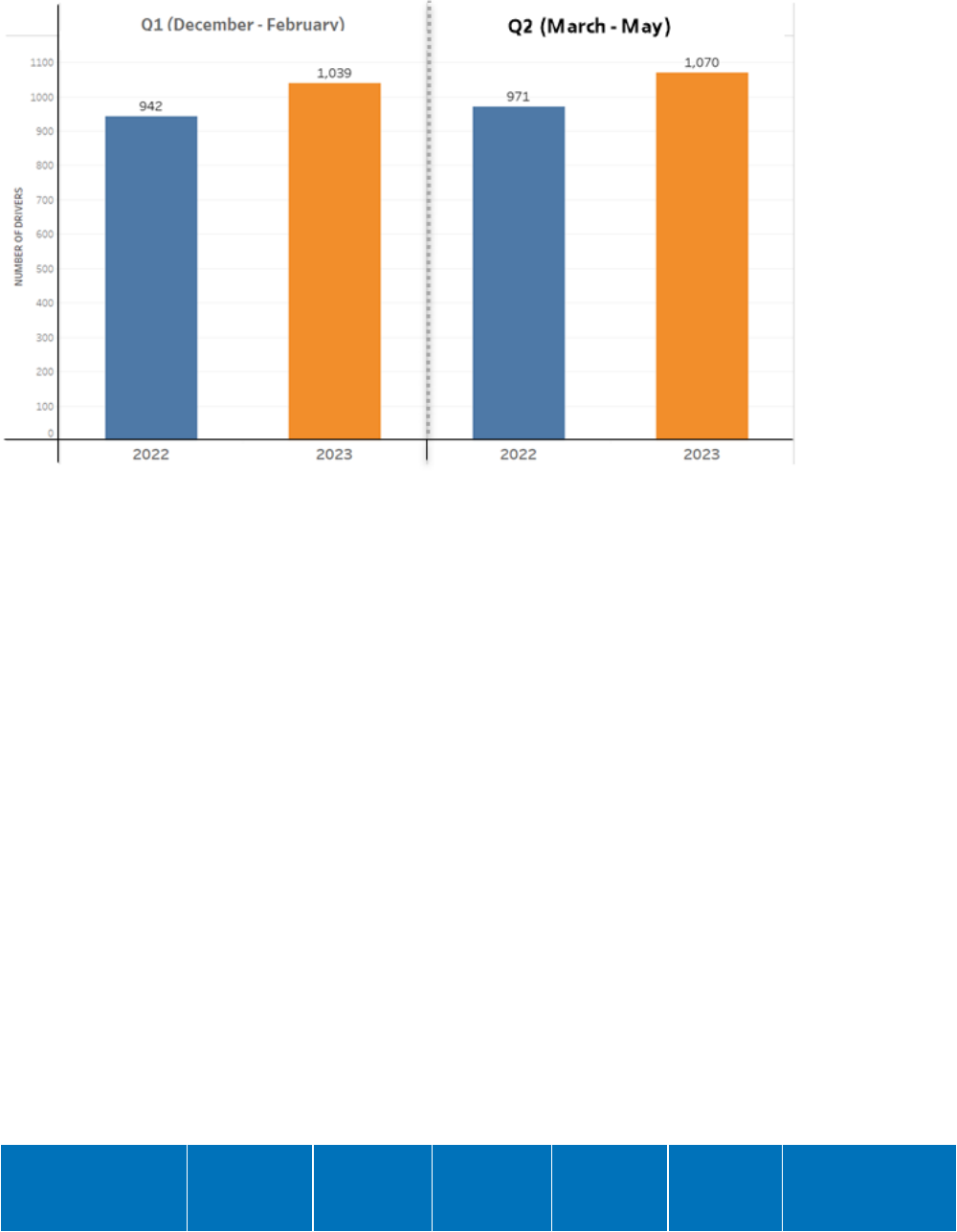

The total number of active drivers during Q2 of the Pilot was 1,070, a 10.30% increase from the

number of active drivers over the same three-month period during the previous year (971).

Additionally, the number of active drivers who serviced Pilot trips increased by 37% from Q1 of

the Pilot Program (276) to Q2 (378). Figure 7 below shows the number of active drivers per

month during Q2 of the Pilot as compared to the same period for the prior year and the same

analysis for Q1 for comparative purposes.

Figure 7: Number of Active Drivers per Month during Q1 and Q2 compared to the same periods from the

previous year

Page 18 of 22

The fact that more than a quarter of active drivers have participated in the Pilot during Q2

indicates that the Pilot may be a factor in the 10.30% year-over-year growth in total active

drivers. Nevertheless, we acknowledge that other factors, such as the easing of pandemic-era

restrictions, may also have played a role in this increase.

In an effort to understand the impact of the Pilot on the active driver trends and based on taxi

industry feedback, the SFMTA analyzed the changes in active drivers at the three largest color

schemes – Flywheel, Yellow Cab and SF Taxi. Flywheel is the only color scheme of those three

that participates in the Pilot. During Q2, Flywheel Color Scheme experienced the biggest increase

in active drivers as compared to the same period during the prior year:

Flywheel Taxi = 45.5% increase (from 222 to 323)

Yellow Cab = 2.3% increase (from 400 to 409)

San Francisco Taxicab = 26.4% increase (from 121 to 153)

Metric 5B: Increase the number of new taxi drivers

The number of new taxi drivers has increased year over year, per Table 4 below. The number of

new taxi drivers entering the industry increased dramatically in calendar year 2022, and the

trend continues through the first 8 months of 2023.

Table 4: New Taxi Drivers by Calendar Year

Year

2018

2019

2020

2021

2022

2023

(YTD through

August)

Page 19 of 22

New Taxi

Drivers

43

33

23

22

135

153

An analysis of new taxi drivers during Q2 of the Pilot as compared with the same period during

the prior year also shows a significant increase in new drivers entering the SF taxi industry.

Table5: New Taxi Drivers during Q1 and Q2 compared to the same periods from previous year

Before Pilot

(Dec 2021 – Feb

2022)

Q1 of Pilot

(Dec 2022 – Feb

2023)

Before Pilot

(March -May 2022)

Q2 of Pilot

(March – May 2023)

1

22

5

24

6

19

2

16

4

24

11

12

Average

4

22

6

17

Goal 6: Ensure that Taxi Pilot Trip fares closely match the Taximeter

rates

Metric 6A: Taxi Pilot Trip fares should be within 10% of the Taximeter rate on average

The SFMTA assesses how closely the Taxi Pilot Trip fares match the estimated Taximeter rate

for those trips. On average, Taxi Pilot Trip fares should be within a 10% range of the Taximeter.

Third-Party Pilot Trips are not required to adhere to Taximeter rates, but SFMTA will track how

those fares compare to Taximeter rates on average, for informational purposes.

QUARTER 2 RESULTS FOR GOAL 6

Metric 6A: Taxi Pilot Trip Fare within 10% of the Taximeter rate

on average

During Q2 of the Pilot, the average upfront fare ($14.22) was 4.1% below the estimated average

Taximeter fare ($14.83), which is calculated by the SFMTA. This indicates that the Taxi Pilot

fares are within the allowable range of 10%.

Page 20 of 22

Figure 8 below shows the daily variation in the average fare for Taxi Pilot Trips compared to the

average estimated meter fare during Q2 of the Pilot.

Figure 8: Average Taxi Pilot Fares Compared to the Taximeter Rate during Q2

The SFMTA is not able to report on the average Third-Party Pilot fare rate as compared to the

estimated Taximeter rate during Q2 due to data quality issues. The Data Analytics Team has

worked with Flywheel to address these issues, and staff expects to be able to report on this data

point in subsequent reports. Because there is not a specific fare requirement for Third-Party

Pilot trips, this has not impacted our ability to report on Pilot metrics.

GEOGRAPHIC EXPANSION OF SERVICE

Although it is not an official metric of the Pilot, the SFMTA is tracking the geographic expansion

of taxi service within the city as a measure of the Pilot’s impact on customer service in the city.

The SFMTA uses trip pick-up and drop off locations to determine the geographic distribution of

taxi service. The SFMTA measured the expansion of service by comparing the geographic

distribution of pick-up locations for Third-Party Pilot trips with non-Pilot taxi trips.

Figure 9: Spatial Distribution of Trip Pick-Up Locations during Q2

Page 21 of 22

Taxi Trips (excluding Third-Party Trips)

Third-Party Trips

The spatial comparison in Figure 9 shows that the Pilot continues to help expand the

geographic distribution of taxi service to outer neighborhoods where taxi service has historically

been sparse, however remains concentrated in the downtown area. The heat map for taxi trips

only (not including Third-Party Pilot Trips) highlights the concentration of taxi service in the

downtown area and at the airport. By contrast, the heat map for Third-Party Pilot Trips displays

a much more even geographic distribution, with a similar trend of increasing service to outer

neighborhoods in addition to the downtown area.

Page 22 of 22

CONCLUSION

The Pilot continues to show promise as it continued to ramp up from Q1 to Q2. The Q2 results

show more active drivers at Flywheel color scheme, it shows a significant increase in Third-

Party Pilot Trips and a more gradual increase in Taxi Pilot Trips, and it shows that drivers that

provide Third-Party Pilot Trips earn more money on average than drivers who do not service

those trips.

The Pilot continues to require an extensive amount of data validation and analysis, and the taxi

outreach meetings provide a very valuable forum for the taxi industry to provide the SFMTA with

feedback about the Pilot overall and the specific metrics.

Due to the promising results during the first two quarters of the Pilot, staff anticipates requesting

the SFMTA Board to extend the Pilot term to allow more time for the service to more fully ramp

up and for more industry participation, and to allow more time for the Pilot to potentially achieve

success in meeting the SFMTA’s policy goals.