Cotimissioners -

Blue Sheet No. 20050574

Agenda Item Summary

1. ACTION REQUESTED/PURPOSE:

Authorize the Division of County Lands to make binding offer to property

owner in the amount of $534,000 for Parcel 107, Church Road Widening Project No. 0919 (Hendry County),

pursuant to the Purchase Agreement, and authorize the Division of County Lands to handle and accept all

documentation necessary to complete transaction,

2. WHAT ACTION ACCOMPLISHES:

Makes binding offer to property owner

3. MANAGEMENT RECOMMENDATION:

Management recommends Board approve the Action Requested

4. Departmental

Category: 6 ah3

1 5. Meeting

6. Agenda:

/

Date:&$,~/:~~~

7. Requirement/Purpose:

(specify) 1 8. Request Initiated:

Lee County Board Of Countv

!

Interest to Acquire: Fee

!

kopertv Details:

Owner:

Felda Ridge Grove Partnership, a Florida General Partnership

Address: 2105

Church Road, Felda, Florida (Hendry County)

STRAP No.:

I-24-45.28.AOO-0001 .OOOO

!

‘urchase Details:

Purchase Price: $534,000

Costs to Close: $10,000

!

Qwraisal Information:

Company:

Hanson Real Estate Advisors, Inc.

Appraised Value: $493,700

staff Recommendation:

Staff is of the opinion that the purchase prices increase of $40,300 (8.1%) above the

appraised value, can be justified considering the costs associated with condemnation proceedings, cure items

calue/cost estimates, estimated between $40,000 and $60,000. Staff recommends the Board approve the action

equested.

w: 200919-40102.506110

btachments:

Purchase and Sale Agreement, In-House Title Search, Appraisal Data, Location Map

Budget Services Budget Services

County

Manaaer1P.W.

Attorney

rl

-Denied

-Other

S:\POOL\CHURCHRD\BS\107doci PRE May 9, 2005

This document prepared by

Lee County

County Lands Division

Project: Church Road Extension, Project No. 0919

STRAP Nos.: l-24-45-28-AOO-0001.0000

Parcel No. 107

BOARD OF COUNTY COMMISSIONERS

LEE COUNTY

AGREEMENT FOR PURCHASE AND SALE OF REAL ESTATE

IN LIEU OF CONDEMNATION PROCEEDINGS

THIS AGREEMENT for purchase and sale of real property is made this

day of

, 2001 by and between Felda Ridge Groves

Partnership,

a Florida General Partnership,hereinafter referred to as

SELLER, whose address

isPost Office Box 979, Oakland, Florida, 34760-

1416, and Lee County,

a political subdivision of the State of Florida,

hereinafter referred to as BUYER.

WITNESSETH:

1. AGREEMENT TO PURCHASE AND TO SELL: SELLER agrees

to

sell and

BUYER

agrees to purchase, subject to the terms and conditions set forth

below,

a parcel of land consisting of 4.99* acres more or less, and

located in

Hendry County, Florida,

and being more particularly

described in "Exhibit A"

attached hereto and made a part hereof,

hereinafter called "the Property." This property is being acquired for

the

Church Road Extension Project, hereinafter called

"the

Project",

with the SELLER'S understanding that the property, if not voluntarily

sold, would have been condemned by BUYER through the exercise of its

eminent domain powers.

2.

PURCHASE PRICE AND TIME OF PAYMENT:

The total purchase

price("Purchase Price") will

beFive Hundred Thirty Eight Thousand and

no/100 Dollars ($534,000.00) ,

payable at closing by County warrant.

The Purchase Price is mutually agreeable to both the SELLER and BUYER

and represents the voluntary sale and purchase of the property in lieu

of BUYER'S condemnation. The Purchase Price is inclusive of costs to

cure and improvements.

Agreement for Purchase and Sale of Real Estate

Page 2 of 6

3. EVIDENCE OF TITLE: BUYER will obtain at

Buyer's expense an

American Land Title Association Form B Title Commitment and provide

title insurance Owner's Policy in the amount of$534,000, from a title

company acceptable to BUYER. The commitment will be accompanied by one

copy of all documents that constitute exceptions to the title

commitment. The commitment will also show title to be good and

marketable with legal access, subject only to real estate taxes for the

current year, zoning and use restrictions imposed by governmental

authority, and restrictions and easements common to the area.

4. CONDITION OF PROPERTY; RISK OF LOSS:

BUYER has inspected the

Property and, except as is otherwise provided herein, accepts the

Property in the condition inspected.

Any loss and/or damage to the

Property occurring between the date of this offer and the date of

closing or date of possession by BUYER, whichever occurs first, will

be at SELLER'S sole risk and expense.

However, BUYER may accept the

damaged property and deduct from the purchase price any expenses

required to repair the damage, or BUYER may cancel this Agreement

without obligation.

5. SELLER'S

INSTRUMENTS AND EXPENSES: SELLER will pay for and

provide:

(a) A statutory warranty deed,

and an affidavit regarding

liens, possession,

and withholding under FIRPTA in a

form sufficient to allow "gap" coverage by title

insurance;

(b)

utility services up to, but not including the date of

closing;

(c) taxes or assessments for which a bill has been rendered

on or before the date of closing;

id) payment of partial release of mortgage fees, if any;

(e) SELLER'S attorney fees, if any.

6.

BUYER'S INSTRUMENTS AND EXPENSES: BUYER will pay for:

(a) Recording fee for deed;

(b) survey, (if desired by BUYER).

Agreement for Purchase and Sale of Real Estate

Page 3 of 6

7. TAXES:

SELLER will be charged for Real Estate taxes and personal

property taxes (if applicable) up to, but not including the date of

closing.

This voluntary sale and purchase is considered by Florida law

to be exempt from the payment of Documentary Stamp Taxes because this

transaction was made under the threat of an eminent domain proceeding

by the BUYER.

8.

DEFECTS IN TITLE AND LEGAL ACCESS:

Prior to closing, BUYER will

have a reasonable

time

to examine the title and documents establishing

legal access to the property. Title shall be delivered to the BUYER

free and clear of any and all liens, encumbrances and/or leases

currently existing on the property. If title or legal access is found

to be defective, BUYER will notify SELLER in writing of the defects and

SELLER will make a prompt and diligent effort to correct such defects.

If SELLER fails to make corrections within 60 days after notice, BUYER

may elect to accept the Property in its existing condition with an

appropriate reduction to the purchase price, or

may

terminate this

Agreement without obligation.

9. SURVEY:

BUYER may order the Property surveyed at BUYER's expense.

SELLER agrees to provide access to the Property for such survey to be

performed. If the survey shows a discrepancy in the size or dimensions

of the Property,

or shows encroachments onto the Property or that

improvements located on the Property encroach onto adjacent lands, or

if the survey identifies violations of recorded covenants and/or

covenants of this Agreement, upon notice to the SELLER, the BUYER may

elect to treat such discrepancies, violations and/or encroachments as

a title defect.

10. ENVIRONMENTAL AUDIT:

BUYER

may

perform or have performed, at

BUYER's expense,

an environmental audit of the Property.

If the audit

identifies environmental problems unacceptable to the BUYER, BUYER may

elect to accept the Property in its existing condition with an

appropriate abatement to the purchase price or BUYER may terminate this

Agreement without obligation.

Agreement for Purchase and Sale of Real Estate

Page 4 of 6

11. ABSENCE OF ENVIRONMENTAL LIABILITIES: The SELLER warrants and

represents that the Property is free from hazardous materials and does

not constitute an environmental hazard under any federal, state or

local law or regulation.

No hazardous,

toxic or polluting substances

have been released or disposed of on the Property in violation of any

applicable law or regulation. The SELLER further warrants that there

is no evidence that hazardous, toxic or polluting substances are

contained on or emitting from the property in violation of applicable

law or regulation. There are no surface impoundments, waste piles,

land fills,

injection wells, underground storage areas, or other

man-made facilities that have or

may

have accommodated hazardous

materials. There is no proceeding or inquiry by any governmental

agency with respect to production,

disposal or storage on the property

of any hazardous

materials,

or of any activity that could have produced

hazardous materials or toxic effects on humans, flora or fauna. There

are no buried, partially buried, or above-ground tanks, storage

vessels, drums or containers located on the Property. There is no

evidence of release of hazardous

materials

onto or into the Property.

The SELLER also warrants that there have been no requests from any

governmental authority or other party for information, notices of

claim,

demand letters or other notification that there is any potential

for responsibility with respect to any investigation or clean-up of

hazardous substance releases on the property. All warranties described

herein will survive the closing of this transaction.

In the event the SELLER breaches the warranties as to environmental

liability, SELLER agrees to indemnify and hold the BUYER harmless from

all fines, penalties, assessments, costs and reasonable attorneys' fees

resulting from contamination and remediation of the property.

12. TIME AND BINDING AGREEMENT: Time is of the essence for closing

this transaction. The BUYER's written acceptance of this offer will

constitute an Agreement for the purchase and sale of the Property and

will bind the parties,

their successors and assigns. In the event the

BUYER abandons this project after execution of this Agreement, but

before closing,

BUYER

may

terminate this Agreement without obligation.

13. DATE AND LOCATION OF CLOSING: The closing of this transaction

will be held at the office of the insuring title company on or before

S:\POOL\CWURCHRD\PA\Felda Ridge Gioves.wpd-pre May !I,2005

Agreement for Purchase and Sale of Real Estate

Page 5 of 6

90 days from the date this Agreement is made.

The time and location

of closing may be changed by

mutual

agreement of the parties.

14. ATTORNEYS' FEES: The prevailing party in any litigation concerning

this Agreement will be entitled to recover reasonable attorneys' fees

and costs.

15. REAL ESTATE BROKERS: SELLER hereby agrees to indemnify and hold

the BUYER harmless from and against any

claims

by a

real estate

broker

claiming by or through SELLER.

16. POSSESSION: SELLER warrants that there are no parties in

possession other than SELLER unless otherwise stated herein.

SELLER

agrees to deliver possession of Property to BUYER at time of closing

unless otherwise stated herein free of all encumbrances and any leases

that may be outstanding on the property.

17. TYPEWRITTEN/HANDWRITTEN PROVISIONS:

Typewritten and handwritten

provisions inserted herein or attached hereto as addenda, and initialed

by all parties,

will control all printed provisions in conflict

therewith.

18. FENCING: Fencing is not included within the purchase price.

Any

fencing that is removed will be replaced as part of the roadway

construction contract.

19. SPECIAL CONDITIONS:

Any and all special conditions will be

attached to this Agreement and signed by all parties to this Agreement.

Agreement for Purchase and Sale of Real Estate

Page 6 of 6

WITNESSES: SELLER: Felda Ridge Groves Partnership,

a Florida General Partnership

By:

(Date)

(Please print 01 type name)

Its General Partner

BUYER:

CHARLIE GREEN, CLERK

LEE COUNTY, FLORIDA, BY ITS

BOARD OF COUNTY COMMISSIONERS

BY:

BY:

DEPUTY CLERK (DATE)

CHAIRMAN OR VICE CHAIRMAN

APPROVED AS TO LEGAL FORM

AND SUFFICIENCY

COUNTY ATTORNEY (DATE)

Exhibit “A”

SECTION 24, TOWNSHIP 45 SOUTH, RANGE 28 EAST,

HENDRY COUNTY, FLORIDA

PARCEL 107

A PARCEL OF LAND LYING IN SECTION 24, TOWNSHIP 45 SOUTH, RANGE 28

EAST, HENDRY COUNTY, FLORIDA; BEING MORE PARTICULARLY DESCRIBED AS

FOLLOWS:

THE NORTH 42 FEET OF SAID SECTION 24, LYING WITHIN THOSE LANDS

DESCRIBED IN OFFICIAL RECORD BOOK 497, PAGE 1397, PUBLIC RECORDS

OF HENDRY COUNTY, FLORIDA.

SAID LANDS CONTAINING 4.99 ACRES MORE OR LESS

MS IS ND’

Exhibit “Apg

Page AOf 2

~~CT~ON 24, TOWNSHIP 45 SOUTH, RANGE 28 EAS

HENDRY COUNTY, FLORIDA

LEGEND:

SECTION 13

ORB 343. PG.80: CO’W SLOUGH, INC.

ORB 447, PG.304: LEE COUNTY

ORB 290. PG,920; WILLlAM D. ROBERTS

INGRESS, EGRESS AND

“TiLlTY EASEMENT

FELDA GROVES PARTNERSHIP

SOUTH 60’. SECTION 13

ORB 476, PG.1830

NORTH LlNE OF SECTION 24

PROPOSED SOUTHERLY

RlGHT OF WAY LINE

42.00’ (R/W TAKE)

ORB 46,. PG.436: LEE COUNTY

ELECTRlC COOPERATIVE. INC.

16’ WlDE ELECTRIC&L EASEMENT

FELDA RIDGE

GROVES PARTNERSHIP

ORB 440. PG.413

TAKE ACREAGE = 4.99 ACRES+

SECTION 24

(NOT TO SCALE)

SOUTH LINE SECTION 24

R/W = RIGHT OF WAY

ORB = OFFICIAL RECORD BOOK

PG. = PAGE

TO: Linda K. Fleming, CLS &/

Property Acquisition Agent

FROM: Terry Green

Guardian Title

STRAP: I-24-45-28AOO-0001.0000

OUTSIDE TITLE SEARCH

Department of Public Works

County Lands

Page 1 of 1

Search No. 215238

-

DATE: July 30, 1998

/

PARCEL : 9

PROJECT: Church Road Extension

This search covers the period of time from December 30, 1957 at 8:00 a.m. to June 12, 1998 at 500 p.m.

Subject Property: The Northerly 100 feet of Section 24, Township 45 South, Range 28 East, Hendry County,

Florida.

Title to the subject property is vested in the following:

Felda Ridge Grove Partnership, a Florida General Partnership

By that certain instrument dated October 11, 1989, recorded October 11, 1989, in Official Record Book 440,

Page 413, Public Records of Hendry County, Florida.

Subject to:

1.

Title to oil, gas and mineral rights and leases on subject property is specifically omitted from this report.

2.

Easements as recited in Official Recyd Book 440, Page 413, Public Records of Hendry, County, Florida

and also recordedJin Official Record Book 320, Page 82, Official Record BooM62, Page 277, and Official

Record Book 331, Page 406, Public Records of Hendry, County, Florida.

3. Mortgage executed by Felda Ridge Groves Partnership in favor of MBL Life Assurance Corporation,

dated November 21,1994, recorded November 28, 1994 in Official Record Book 516, Page 1914, Public

Records of Hendry County, Florida.

4. U.C.C. between Felda Ridge Groves Partnership and MBL Life Assurance Corporation, recorded

November 28, 1994 in Official Record Book 516, Page 1932, filed in the Public Records of Hendry County,

Florida.

5. Easement to Lee County Electric Cooperative, Inc., recorded in Official Record Book 461, Page 436,

Public Records of Hendry County, Florida.

STRAP No. I-24-45-28AOO-0001 .OOOO

1997 Taxes: Paid December 3. 1997 in the amount of $29,990.98

Back Taxes: None

Garbage: None

Assessments: None

The Division of County Lands makes no guarantees nor warranty as to the accuracy of this report.

H:IPOOLlCHuRCHRDinnEiZIS23BTSWPD-fsw

‘COMPLETESUMMARYAPPRAISAL

RJZPORTNO.O~-0505.107

Project: Church Road Extension Project

Project No.: 919

Parcel No.: 107

Owner: Felda Ridge Groves Partnership,

A Florida General Partnership

County: Hendry County, Florida

PREPAREDFOR

Robert G. Clemens

Acquisition Program Manager

Lee County Division of County Lands

P. 0. Box 398

Fort Myers, Florida 33901

DATEOFTHE~PORT

March 23,2005

EFFECTIVEDATEOFTHEAPPRAISAL

December 3,2004

(Date of Last Inspection)

PREPAREDBY

Hanson Real Estate Advisors, Inc.

2233

Second Street

Fort Myers, FL 33901-3051

HANSON REAL ESTATE ADVISORS, INC.

Real Estate Valuation and Counseling

March 23, 2005

Robert G. Clemens _’

Acquisition Program Manager

Lee County Division of County Lands

P. 0. Box 398

Fort Myers, Florida 33902

Re:

Complete Summary Appraisal Report No. 04-05-05.107

Project:

Church Road Extension Project

Project No.: 919

Parcel No.: 107

Owner:

Felda Ridge Groves Partnership, A Florida General Partnership

county:

Hendry County, Florida

Dear Mr. Clemens:

Pursuant to your request, an inspection and analysis has been made of the above referenced

property, which is legally described in the attached appraisal report. The purpose of the report is

to estimate the market value of those property rights to be acquired, together with all diminution

in value to the remaining~ land (if any) which can be attributed to the use of or activity upon land

which has been proposed for acquisition.

As of January 1, 2005, the Appraisal Standards Board of the Appraisal Foundation approved

revisions and modifications of the Departure Provision, and Standards Rules 2 and 3 and the

Definition Section of the Uniform Standards of Professional Appraisal Practice (USPAP). In

compliance with Standards Rule 2-2(b), the appraisers are communicating to the reader that this

report is considered a Complete Summary Appraisal Report, one of the three reporting options

allowed under this Standards Rule.

The subject property, containing 621.90 acres of gross land area, is located in the unincorporated

Felda market area of western Hendry County, Florida.

The property is proposed to be the subject

of a partial acquisition by Lee County, consisting of 4.99 acres of gross land area to be acquired

in fee simple interest for the construction of the Church Road Extension. The project, designated

as Project No. 919, is proposed to run easterly from South Church Road and the Lee County

Solid Waste Facility, along the northerly edge of the subject property, to State Route 29.

The parent tract is an improved citrus grove situated along an unnamed private, east-west grove

road, approximately two miles west of SR-29 and about 1% miles northwest of Felda, in

southwestern Hendry County, Florida. The 621.90-acre parent tract consists of all of Section 24,

Twp 45 South, Range 28 East. The property has approximately 5,179 feet of Frontage along the

subject’s privately-owned limestone grove roadway. The roadway provides legal access from

2233 Second Street * Fort Myers, FL 33901-3051 * Phone (239) 3344430 * Fax (239) 334-0403 * www.hrea.com

I

I

I

I

I

I

I

I

II

u

I

u

I

I

I

I

I

!

I;

Page 2

Robert G. Clemens

March 23,2005

the northeast and northwest comers of the property, over and across lands owned by others to

SR-29 to the east and: to South Church Road to the west.

The partially-paved roadway is

proposed to be developed as the Church Road Extension roadway. The public utilities to the

subject are limited to telephone and electrical service. The property is zoned A-2 (General

Agricultural) and is situated within the Agricultural land use designation (a maximum density of

1 du./5 ac.) on the Future Land Use Map (FLUM) of the Hendry County Comprehensive Plan.

The parcel is identified in the Hendry County Property Appraiser’s office as Folio 1-24-45-28-

AOO-00001.0000.

According to owner-provided materials, the 621.90 acre parent tract is improved with a 5.0 to

14.0-year old, mature citrus grove of Valencia and Hamlin orange trees on Swingle and Carrizo

rootstock with 548.78 grove acres, and 486.13 (net) tree acres, indicating a grove utilization ratio

of 89%. The tree spacing is 12’ x 22’ on double-row beds for both fruit varieties, indicating a tree

density of 165 trees per acre.

Grove irrigation is by micro-jet on poly-tubing. Grove

improvements include 6 wells with diesel engines; 2 throw-out pumps with diesel engines; a

61.90-acre reservoir, and one spray gate (canker station). The property has all applicable South

Florida Water Management District (SFWMD) permits in place as of the date of appraisal.

The

grove appears to be in good condition. The highest and best use of the property has been

estimated to be for continued use for agricultural purposes as a citrus grove.

The proposed fee simple partial acquisition area consists of 4.99 acres and is identified as Project

Parcel 107. Parcel 107 is a rectangular, narrow, 42.0 foot x 5,179 foot-wide strip of land along

the entire northerly boundary of the parent tract. The partial acquisition is proposed for the

construction of a paved roadway in connection with the construction of the Church Road

Extension Project. Improvements observed within the fee simple partial acquisition area include

the subject’s east-west internal roadway.

The remainder property, containing 616.91 acres of gross land area, is a rectangular-shaped tract

with a northerly property line measuring an estimated 5,179 feet along the southerly right-of-way

of the constructed Church Road Extension roadway.

The impact of the proposed partial

acquisition of the subject property, results in a loss of the owner’s main grove roadway and the

elimination of the site’s roadway access point. With these features eliminated, and in order to

restore the grove to economic viability, the appraisers are relying upon an engineer who is

proposing a cure which includes restoration/reconstruction of the grove’s roadway system and

reestablishment of the grove irrigation/seepage, and drainage system in the northerly 85 feet of

the remainder property. The appraisers have considered the proposed cure and cost estimates

provided by the County’s engineer.

The fnnction of the appraisal is understood to be for use as a basis of value for purposes of

estimating the amount due the owner as a result of the proposed partial acquisition.

Page 3

Robert Clemens,

March 23,2005

This letter of transmittal precedes the full narrative appraisal report, further describing the

property and contalning,,the reasoning and most pertinent data leading to the final value

estimates. Your attention is directed to the “General Assumptions”, “General Limiting

Conditions”, and “Certificate of Appraisal”, which are considered usual for this type of

assignment, These items have been included in the report addendum.

By reason of our investigation and analysis, data contained in this report and our experience in

the real estate appraisal profession, it is our opinion that the total amount due the property owner

as a result of the recent acquisition, as of December 3,2004, the Date of Last Inspection, is:

l

Value of Part Proposed To Be Acquired:

l

Land To be Acquired:

l

Improvements To Be Acquired:

Subtotal (Part To Be Acquired):

l

Severance Damages:

* Net Cost To Cure:

$ 15,000

161,600

$176,600

-O-

317.100

AMOUNT DUF! OWNER:

$493.700

The reasonable market exposure term for the parent tract and the remainder property after

severance at this value estimate, is estimated to be 9 to 12 months.

Respectfully submitted,

%

b

Woodward

anson, MAI, CRE, CCIM

St. Cert. Gen. Rl3A RZ 1003

St. Cert. Gen. REA RZ 2248

I

I

I

I

I

I

I

I

I

I

3

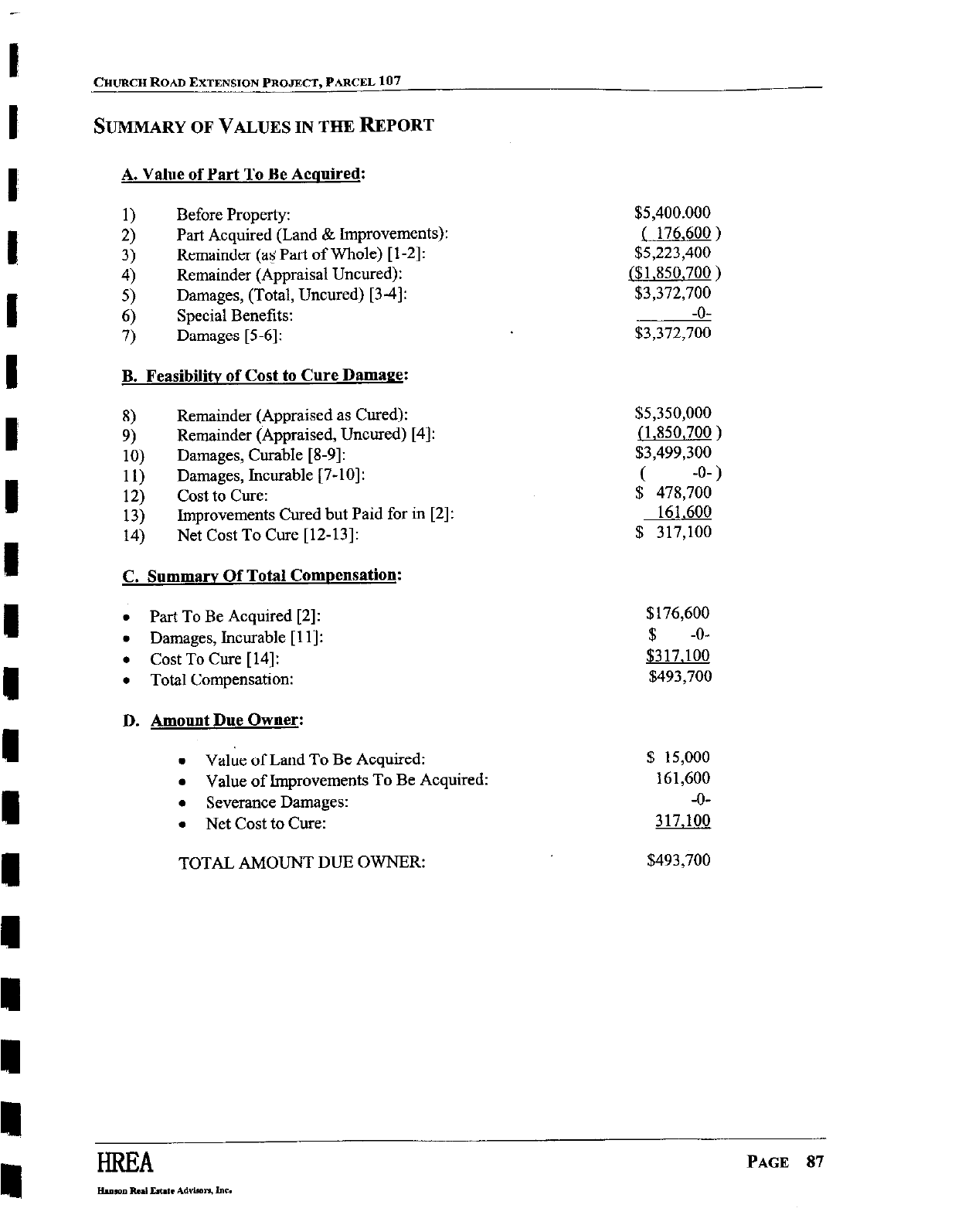

CHURCHROADEXTENSIONPROJECT,PARCEL

107

SUMMARY OF

VALUES

IN THE

REPORT

A. Value of Part To Be Acquired:

1)

Before Property:

2)

Part Acquired (Land & Improvements):

3)

Remainder (a$ Part of Whole) [l-2]:

4)

Remainder (Appraisal Uncured):

5)

Damages, (Total, Uncured) [3-4]:

6)

Special Benefits:

7)

Damages [5-61:

B. Feasibilitv of Cost to Cure Damaee:

8)

Remainder (Appraised as Cured):

9)

Remainder (Appraised, Uncured) [4]:

10)

Damages, Curable [8-91:

11)

Damages, Incurable [7-lo]:

12)

Cost to Cure:

13)

Improvements Cured but Paid for in [2]:

14)

Net Cost To Cure [12-131:

C. Summarv Of Total Compensation:

. Part To Be Acquired [2]:

. Damages, Incurable [l 11:

l

Cost To Care [14]:

l

Total Compensation:

D. Amount Due Owner:

l

Value of Land To Be Acquired:

.

Value of Improvements To Be Acquired:

. Severance Damages:

l

Net Cost to Cure:

TOTAL AMOUNT DUE OWNER:

$5,400.000

( 176.600 )

$5,223,400

~$1,850.700 )

$3,372,700

-O-

$3,372,700

$5,350,000

(1,850,700 )

$3,499,300

(

-o- )

$ 478,700

161.600

$ 317,100

$176,600

$$317.1:;

$493,700

$ 15,000

161,600

-o-

317.100

$493,700

CE~RCEROA~EXTENSIONPROJECT,PARCEL 107

AREA MAP

-

--

i

^ f - -

5 Year Sales History

Parcel No. 107

Church Road Widening Project, No. 0919

NO SALES IN THE LAST 5 YEARS

L:\POOL\CHURCHRD\BS\Histi07.wDd