Instructions to Form ITR-2 (AY 2020-21)

Page 1 of 103

Instructions for filling out FORM ITR-2

These instructions are guidelines for filling the particulars in Income-tax Return Form-2 for the

Assessment Year 2020-21 relating to the Financial Year 2019-20. In case of any doubt, please refer to

relevant provisions of the Income-tax Act, 1961 and the Income-tax Rules, 1962.

1. Assessment Year for which this Return Form is applicable

This Return Form is applicable for assessment year 2020-21 only, i.e., it relates to income earned

in Financial Year 2019-20.

2. Who is eligible to use this Return Form?

This Return Form is to be used by an individual or a Hindu Undivided Family (HUF) who is not eligible

to file Form ITR-1 (Sahaj) and who is not having any income under the head “Profits or gains of business

or profession”.

3. Who is not eligible to use this Return Form?

This Return Form should not be used by an individual whose total income for the Assessment Year

2020-21 includes Income under the head “Profits or Gains of Business or Profession”.

4. Manner of filing and verification of this Return Form

This Return Form can be filed with the Income-tax Department electronically on the e-filing web

portal of Income-tax Department (www.incometaxindiaefiling.gov.in) and verified in any one of the

following manner –

(i) digitally signing the verification part, or

(ii) authenticating by way of electronic verification code (EVC), or

(iii) Aadhaar OTP

(iv) by sending duly signed paper Form ITR-V – Income Tax Return Verification Form by post to

CPC at the following address –

“Centralized Processing Centre,

Income Tax Department,

Bengaluru— 560500,

Karnataka”.

The Form ITR-V – Income Tax Return Verification Form should reach within 120 days from the date

of e-filing the return.

The confirmation of the receipt of ITR-V at Centralized Processing Centre will be sent to the assessee

on e-mail ID registered in the e-filing account.

5. Filling out the ITR V-Income Tax Return Verification Form

Where the Return Form is furnished in the manner mentioned at 4(iv), the assessee should print

out Form ITR-V-Income Tax Return Verification Form. ITR-V-Income Tax Return Verification Form, duly

signed by the assessee, has to be sent by ordinary post or speed post only to Centralized Processing

Centre, Income Tax Department, Bengaluru–560500 (Karnataka)

6. Obligation to file return

Every individual or HUF whose total income before allowing deductions under Chapter VI-A of the

Instructions to Form ITR-2 (AY 2020-21)

Page 2 of 103

Income-tax Act, exceeds the maximum amount which is not chargeable to income tax is obligated to

furnish his return of income. The claim of deduction(s) under Chapter VI-A is to be mentioned in Part C of

this Return Form. The maximum amount not chargeable to income-tax for Assessment Year 2020-21, in

case of different categories of individuals and HUF is as under:-

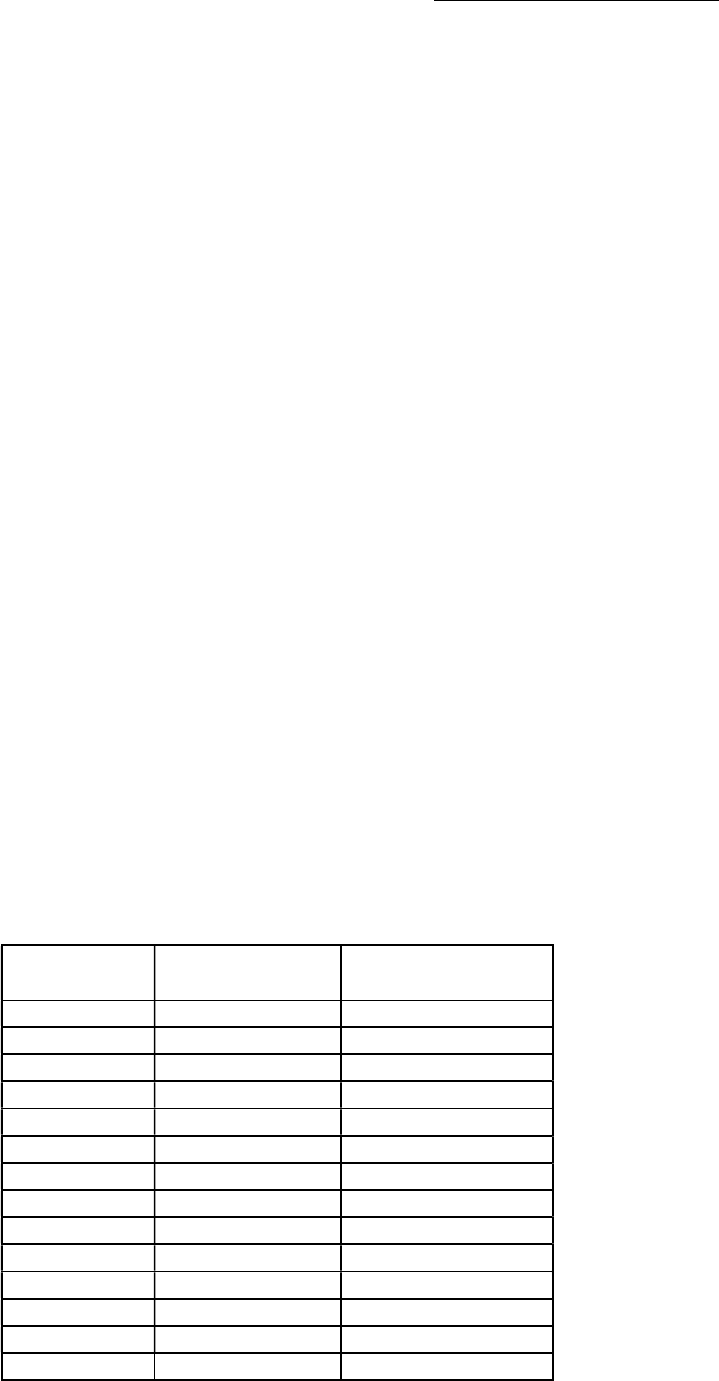

S. No.

Category Amount (in Rs.)

i. In case of an individual who is below the age of 60 years or a

Hindu Undivided Family (HUF)

2,50,000

ii.

In case of an individual, being resident in India, who is of the age of

60 years or more at any time during the financial year 2018-19

but

below the age of 80 years.

3,00,000

iii.

In case of an individual, being resident in India, who is of the age of

80 years or more at any time during the financial year 2018-19.

5,00,000

If a person whose total income before allowing deductions under Chapter VI-A of the Income-tax Act or

deduction for capital gains (section 54 to 54GB), does not exceeds the maximum amount which is not

chargeable to income-tax but fulfils one or more conditions mentioned below is obligated to furnish his

return of income. In case of any doubt, please refer to relevant provisions of the Income-tax Act.

a) Deposit of amount or aggregates of amount exceeding Rs 1 crore in one or more current accounts;

b) Incurred expenditure of an amount or aggregate of amount exceeding Rs. 2 lakhs for travel to a

foreign country for yourself or any other person;

c) Incurred expenditure of amount or aggregate of amount exceeding Rs. 1 lakh on consumption of

electricity.

Item by Item Instructions to fill up the Return Form

Part-A – General Information

Field Name Instruction

PERSONAL INFORMATION

First Name Enter the First Name as per PAN card

Middle Name Enter the Middle Name as per PAN card

Last Name Enter the Last Name as per PAN card

PAN Enter the PAN as in PAN card

Flat/ Door/ Block No. Enter the Flat or House Number

Name of Premises/ Building /

Village

Enter the name of the Premises or Building or Apartment or Village

Status Please tick the applicable check box, indicating the status under

which the return is being filed-

(a) Individual

(b) Hindu Undivided Family (HUF)

Road/ Street/Post Office Enter the name of the Post office or Road or Street in which the

house is situated

Date of Birth Enter the Date of Birth as per the PAN card

Area/ Locality

Enter the name of area or locality in whic

h the house is situated

Aadhaar Number (12 digits) /

Aadhaar Enrolment Id (28 digits)

Enter the Aadhaar Number (12 digits) as mentioned in Aadhaar

Card. In case Aadhaar number has been applied for but not yet

allotted, please enter the Aadhaar Enrolment number (28 digits).

Instructions to Form ITR-2 (AY 2020-21)

Page 3 of 103

Town/ City/ District Enter the name of town or City or District in which the house is

situated

State Select the name of State from the dropdown

Country Select the name of Country from the dropdown.

PIN Code/ Zip Code Enter the PIN Code/ Zip Code of the Post Office

Residential/ Office Phone

Number with STD code/ Mobile

No.1

Enter the residential or office landline number with STD code, or

enter PAN holder’s mobile number. This will be used for official

communication with the PAN holder.

Mobile No.2 Enter the mobile number of PAN holder or that of any other person,

as an alternative number for communication.

Email Address (Self) Enter the PAN holder’s email address. This will be used for official

communication with the PAN holder.

Email Address-2 Enter the Email Address of PAN holder or any other person, as an

alternative email address for communication.

FILING STATUS

Filed u/s Please tick the applicable check box, indicating the section under

which the return is being filed –

(a) If filed voluntarily on or before the due date, tick ‘139(1)’

(b) If filed voluntarily after the due date, tick ‘139(4)’

(c) If this is a revised return, tick ‘139(5)’

(d) If this is a modified return, filed in accordance with an Advanced

Pricing Agreement (APA), tick ‘92CD’

(e) If filed in pursuance to an order u/s 119(2)(b) condoning the

delay, tick ‘119(2)(b)’

If revised/ defective/ modified

then enter Receipt No. and Date

of filing original return

If this is a revised return, or a

return being filed in response to notice

under section 139(9), or a modified return filed in accordance with

an APA, please enter the acknowledgement number and date of

filing of the original return.

Or Filed in response to notice

u/s

In case the return is being filed in response to a statutory notice,

please tick the applicable check box -

(a) If filed in response to a notice u/s 139(9), tick ‘139(9)’

(b) If filed in response to notice u/s 142(1), tick ‘142(1)’

(c) If filed in response to notice u/s 148, tick ‘148’

(d) If filed in response to notice u/s 153A, tick ‘153A’

(e) If filed in response to notice u/s 153C, tick ‘153C’.

If filed in response to notice/

order, please enter Unique

Number/ Document

Identification Number & Date of

such Notice or Order

In case the return is being filed in response to a statutory notice, or

in pursuance to an order under section 119(2)(b) condoning the

delay, or in accordance with an APA u/s 92CD, please enter the

unique number/ Document Identification Number and date of the

relevant statutory notice, or the date of condonation order or the

date on which the Advanced Pricing Agreement was entered (as

applicable).

Are you filing return of income

under Seventh proviso to section

139(1) but otherwise not

required to furnish return of

income? - (Tick) Yes No

If yes, please furnish following

information

In case the return is being filed if any one or all of the below

conditions are applicable although the total income before allowing

deductions under Chapter VI-A of the Income-tax Act or deduction

for capital gains (section 54 to 54GB) or exempt long term capital

gains (section 10(38)), does not exceeds the maximum amount

which is not chargeable to income-tax, tick ‘Yes’:

Deposit of amount or aggregates of amount exceeding Rs 1 crore in

one or more current accounts;

Instructions to Form ITR-2 (AY 2020-21)

Page 4 of 103

[Note: To be filled only if a

person is not required to furnish

a return of income under section

139(1) but filing return of

income due to fulfilling one or

more conditions mentioned in

the seventh proviso to section

139(1)]

Incurred expenditure of an amount or aggregate of amount

exceeding Rs. 2 lakhs for travel to a foreign country for yourself or

any other person;

Incurred expenditure of amount or aggregate of amount exceeding

Rs. 1 lakh on consumption of electricity.

Select ‘No’ if total income before allowing deductions under

Chapter VI-A of the Income-tax Act or deduction for capital gains

(section 54 to 54GB) or exempt long term capital gains (section

10(38)), exceeds the maximum amount which is not chargeable to

income-tax.

Have you deposited amount or

aggregate of amounts exceeding

Rs. 1 Crore in one or more

current account during the

previous year? (Yes/No)

Please tick ‘Yes’ in case an amount / aggregate amount exceeding

Rs.1 Crores is deposited in one or more current account during the

period 1 April 2019 to 31 March 2020, else tick ‘No’

Please enter amount / aggregate amount deposited if ‘Yes’ is

ticked.

Have you incurred expenditure

of an amount or aggregate of

amount exceeding Rs. 2 lakhs for

travel to a foreign country for

yourself or for any other person?

(Yes/ No)

Please tick ‘Yes’ if expenditure incurred of an amount/ aggregate

amount exceeding 2 lakhs for travel to a foreign country for self or

for any other person, else tick ‘No’

Please enter amount/ aggregate amount of expenditure if ‘Yes’ is

ticked.

Have you incurred expenditure

of amount or aggregate of

amount exceeding Rs. 1 lakh on

consumption of electricity

during the previous year?

(Yes/No)

Please tick ‘Yes’ if expenditure incurred of an amount/ aggregate

amount exceeding Rs.1 lakh on consumption of electricity during

the period 1 April 2019 to 31 March 2020, else tick ‘No’.

Please enter amount/ aggregate amount of expenditure if ‘Yes’ is

ticked

Residential Status in India (for

individuals)

(Tick applicable option)

If you are an individual, please specify your residential status in the

given list:

A. Resident.

B. Resident but not Ordinarily resident (RNOR)

C. Non-resident

In case you are a resident/RNOR, please also indicate the basis for

claiming status of resident/RNOR by checking the applicable box

against these categories.

In case you are a non-resident, please specify the jurisdiction of

residence during the previous year and your Taxpayer Identification

Number (TIN) in that jurisdiction.

In case you are a non-resident, but a citizen of India or person of

Indian origin, please specify the total number of days for which you

stayed in India during the previous year, and during the four

preceding years.

Instructions to Form ITR-2 (AY 2020-21)

Page 5 of 103

In case TIN has not been allotted in the jurisdiction of residence, the

passport number should be mentioned instead of TIN. Name of the

country in which the passport was issued should be mentioned in

the column “jurisdiction of residence”.

Residential Status in India (for

HUF)

(Tick applicable option)

If you are a HUF, please specify your residential status by ticking the

applicable checkbox:

Resident.

Resident but not Ordinarily resident (RNOR)

Non-resident

Do you want to claim the benefit

u/s 115H

(Applicable in case of Resident)

If you were NRI in earlier years, but are a resident in India for this

year, please specify whether you want to claim benefit of special

provisions under Chapter XII-A in respect of investment income

from any foreign exchange asset, by ticking the applicable

checkbox:

Yes

No

Are you governed by Portuguese

Civil Code as per section 5A?

If you are governed by the system of community of property under

the Portuguese Civil Code 1860, please tick ‘Yes’ and fill up the

information necessary for apportionment of income between

husband and wife in Schedule 5A. Else, tick ‘No’.

Whether this return is being filed

by a Representative Assessee

Please tick the applicable check box. In case the return is being filed

by a representative assessee, please furnish the following

information:-

(a) Name of the Representative

(b) Capacity of the Representative (select from drop down list)

(c) Address of the Representative

(d) PAN/ Aadhaar No. of the Representative

Whether you were Director in a

company at any time during the

previous year?

If you are an individual and were Director in a company at any time

during the previous year, please tick ‘Yes’ and provide information

about name, type & PAN of the company, your DIN and indicate

whether, or not, shares of the company are listed on a recognised

stock exchange.

Else, tick ‘No’.

Please note that furnishing of PAN and DIN is not mandatory in case

of a foreign company.

a) In case you are a director of a Foreign Company which does

not have PAN. You should choose “foreign company” in the

drop-down provided for “type of company”. In such case,

PAN is not mandatory. However, PAN should be mentioned,

if such foreign company has been allotted a PAN.

b) A non-resident taxpayer who is Director only in a foreign

company, which does not have any income received in

India, or accruing or arising in India, should answer the

relevant question in the negative, whereupon he would not

be required to disclose details of such foreign company.

c) A non-resident taxpayer, who is Director in a domestic

company and also in a foreign company, which does not

have any income received in India, or accruing or arising in

India, should answer the relevant question in the

affirmative, and provide details of directorship in the

domestic company only.

Instructions to Form ITR-2 (AY 2020-21)

Page 6 of 103

d) A resident taxpayer is required to disclose details of

directorship in any company, including foreign company, in

the relevant column.

Whether you have held unlisted

equity shares at any time during

the previous year?

If you have held investment in any unlisted equity shares at any time

during the previous year, please tick ‘Yes’ and furnish information

about name, type & PAN of company, opening balance, shares

acquired/ transferred during the year and closing balance, in the

given table.

Else, tick ‘No’.

a) If you have held shares of a company during the previous

year, which are listed in a recognized stock exchange

outside India. You may select “No” here and you are not

required to report the requisite details here

b) In case have held equity shares of a company which were

previously listed in a recognised stock exchange but

delisted subsequently, and became unlisted. In such cases

PAN of the company may be furnished if it is available. In

case PAN of delisted company cannot be obtained, you may

enter a default value in place of PAN, as “NNNNN0000N”.

c) In case unlisted equity shares are acquired or transferred

by way of gift, will, amalgamation, merger, demerger, or

bonus issue etc., In such cases You may enter zero or the

appropriate value against “cost of acquisition” or “sale

consideration” in such cases. Please note that the details of

unlisted equity shares held during the year are required

only for the purpose of reporting. The quantitative details

entered in this column are not relevant for the purpose of

computation of total income or tax liability

d) Even in case where you have held shares in an unlisted

foreign company which has been duly reported in the

Schedule FA. You are required to report the same again in

this clause.

e) Even in case where you have held unlisted equity shares as

stock-in-trade of business during the previous year you are

required to report the same in this clause.

f) In case you are holding equity shares of a Co-operative Bank

or Credit Societies, which are unlisted, only the details of

equity shareholding in any entity which is registered under

the Companies Act, and is not listed on any recognised

stock exchange, is only required to be reported.

Schedule S- Details of Income from Salary

Instructions to Form ITR-2 (AY 2020-21)

Page 7 of 103

Field Name Instruction

Name of employer Enter the name of the Employer.

Nature of Employ

er

In case of individuals, please tick the applicable check box

-

(a) If you are a Central Government Employee, tick 'Central

Government'

(b) If you are a State Government Employee, tick 'State

Government'

(c) If you are an employee of Public Sector Enterprise (whether

Central or State Government), tick 'Public Sector Undertaking'

(d) If you are drawing pension, tick 'Pensioners'

(e) If you are an employee of Private Sector concern, tick

'Others'

TAN of Employer

(mandatory if tax is deducted)

Please enter the Tax deduction Account Number (TAN) of the

Employer as mentioned in Form-16.

Address of employer

Please enter the complete address of the employer including

name of town or city, State and Pin code/Zip code. The name of

State has to be selected from the drop down list.

Town/City

State

Pin code/ Zip code

1 Gross Salary This is an auto-populated field representing aggregate of the

amounts entered at fields (1a), (1b) and (1c) below.

1a Salary as per section 17(1) Please select the type of salary payments from the given list and

enter the amount. In case more than one type of salary payment

has been received during the year, please report each type of

payment as separate line item.

List of types of salary payment :-

1. Basic Salary

2. Dearness Allowance (DA)

3. Conveyance Allowance

4. House Rent Allowance (HRA)

5. Leave Travel Allowance (LTA)

6. Children Education Allowance (CEA)

7.

7. Other Allowance

8. The Contribution made by the employer towards pension

scheme as referred under section 80CCD

9. Amount deemed to be income under rule 6 of Part-A of Fourth

Schedule

10. Amount deemed to be income under rule 11(4) of Part-A of

Fourth Schedule

11. Annuity or pension

12. Commuted Pension

13. Gratuity

14. Fees/ commission

15. Advance of salary

16. Leave Encashment

17. Others (please enter the details in the text box)

1b Value of perquisites as per

section 17(2)

Please select the type of perquisites from the given list and enter

the value thereof. In case more than one type of perquisite has

been received during the year, please report each type of

perquisite as separate line item.

Instructions to Form ITR-2 (AY 2020-21)

Page 8 of 103

List of types of perquisite:-

1. Accommodation

2. Cars / Other Automotive

3. Sweeper, gardener, watchman or personal attendant

4. Gas, electricity, water

5. Interest free or concessional loans

6. Holiday expenses

7. Free or concessional travel

8. Free meals

9. Free education

10. Gifts, vouchers, etc.

11. Credit card expenses

12. Club expenses

13. Use of movable assets by employees

14. Transfer of assets to employee

15. Value of any other benefit/ amenity/ service/ privilege

16. Stock options (non-qualified options)

17. Tax paid by employer on non-monetary perquisite

18. Other benefits or amenities (please enter the details in a

separate text box).

1c Profits in lieu of salary as

per section 17(3)

Please select the nature of profits in lieu of salary from the given

list and enter the value thereof. In case more than one profit in

lieu of salary has been received during the year, please report

each as a separate line item.

List of types of profits in lieu of salary:-

1. Any compensation due or received by an assessee from an

employer or former employer in connection with the

termination of his employment or modification thereto.

2. Any payment due or received by an assessee from an

employer or former employer, or from a provident or other fund,

sum received under Keyman Insurance Policy, including bonus

on such policy.

3. Any amount due or received by an assessee from any person

before joining any employment with that person, or after

cessation of his employment with that person.

4. Any other (please enter the details in a separate text box).

In case you are employed with more than one employer during the year, please provide details of

Gross Salary at column (1), as also break-up thereof at columns (1a), (1b) and (1c), separately for each

employer, by adding multiple rows as necessary.

2 Total Gross Salary Please enter the aggregate amount of gross salary received from

all employers during the year.

3

Less allowances to the

extent exempt u/s 10

(Note: Ensure that it is

included in Total Gross

salary in (2) above )

Please select the

allowances from the drop down (

as per list

) and

enter the amount which is exempt. In case multiple allowances

are claimed as exempt, please enter details of each allowance as

separate line item.

List of allowances:-

Sec 10(5)- Travel concession/assistance received

Sec 10(6)- Remuneration received as an official, by whatever

name called, of an Embassy, High Commission etc.

Instructions to Form ITR-2 (AY 2020-21)

Page 9 of 103

Sec 10(7)- Allowances or perquisites paid or allowed as such

outside India by the Government to a citizen of India for

rendering services outside India

Sec 10(10)- Death–cum-retirement gratuity received

Sec 10(10A)- Commuted value of pension received

Sec 10(10AA)

-

Earned leave encashment

on retirement

Note: If category of employer is other than "Central or State

Government" deduction u/s. 10(10AA) shall be restricted to Rs.

3 Lakh

Sec 10(10B) First proviso-Compensation limit notified by CG in

the Official Gazette

Sec 10(10B) Second proviso-Compensation under scheme

approved by the Central Government

Sec 10(10C)- Amount received on voluntary retirement or

termination of service

Sec 10(10CC)- Tax paid by employer on non-monetary perquisite

Sec 10(13A)- Allowance to meet expenditure incurred on house

rent

Sec 10(14)(i)- Allowances or benefits, not in the nature of

perquisite, specifically granted and incurred in the performance

of the duties of an office or employment

Sec10(14)(ii)-Allowances or benefits not in a nature of perquisite

specifically granted in performance of duties of office or

employment.

Any Other - In case of any other allowances enter the details in a

text box provided.

4 Net Salary (2 – 3) This is an auto-populated field representing the net amount,

after deducting the exempt allowances [3] from the Gross Salary

[2].

5

Deductions u/s 16 (5a + 5b

+ 5c)

This is an auto

-

populated field representing aggregate of the

amounts entered at fields (5a), (5b) and (5c) below.

5a Standard Deduction u/s

16(ia)

This is an auto-populated field as lower of 4 (Net Salary) or Rs.

50,000.

5b Entertainment allowance

u/s 16(ii)

Please enter the amount of Entertainment allowance admissible

as deduction u/s 16(ii) (as per Part B of Form 16)

5c Professional tax u/s 16(iii) Please enter the amount of Professional tax paid which is

admissible as deduction u/s 16(iii) (as per Part B of Form 16)

6 Income chargeable under

the Head ‘Salaries’ (4 - 5)

This is an auto-populated field representing the net amount,

after claiming deductions under section 16 [5] against the Net

Salary [4].

Schedule HP- Details of Income from House Property

Please indicate ownership of the house property, income from which is being reported in this

Schedule, by selecting from the list in the drop down menu – Self/Minor/Spouse/Others

Field Name Instruction

Address of property

Please enter the complete address of the property including

name of town or city, State, Country and Pin code/Zip code. The

name of State and Country has to be selected from the drop

down list.

Town/City

State

Country

Instructions to Form ITR-2 (AY 2020-21)

Page 10 of 103

Pin code/ Zip code

Owner of the property Please select the owner of the property from the dropdown

menu:

Self

Minor

Spouse

Others

Is the property co-owned Please state whether the property is co-owned by you along with

other owners by ticking the applicable checkbox -

Yes

No

Your percentage of share in the

Property

If yes, please specify your percentage share in the property in the

given box.

Name of Co-owners If yes, please specify the name, PAN/ Aadhaar No. and respective

percentage shares of other co-owners of the property. Please

add rows as necessary.

PAN/ Aadhaar No. of Co-

owner(s)

Percentage share of the co-

owners in property

Type of House property Please tick the applicable check box, indicating the usage of the

house property during the previous year-

(a) If the house property consist of a house, or part of a house,

which is self-occupied, or treated as self-occupied u/s 23(2), tick

‘Self-Occupied’

(b) If the house property, or part thereof, was actually let out

during whole or part of the year, tick ‘Let Out’

(c) If the house property, or part thereof, is deemed to be let out

u/s 23(4), tick ‘Deemed Let Out’.

Name(s) of Tenant If the property was actually let out during the year or part of the

year, please mention name, PAN/ Aadhaar No. and TAN of the

tenant(s). Furnishing of PAN/ Aadhaar No. of tenant is

mandatory if tax has been deducted at source u/s 194-IB.

Furnishing of TAN of tenant is mandatory if tax has been

deducted at source u/s 194-I.

PAN/ Aadhaar No. of Tenant(s)

PAN/TAN/ Aadhaar No. of

Tenant(s)

1a Gross rent received/

receivable/ letable value

during the year

If the house property is actually let out, please enter the amount

of actual rent received or receivable in respect of the property

during the year. Otherwise, enter the amount for which the

property might reasonably be expected to let during the year.

1b The amount of rent which

cannot be realised

Please enter the amount of rent, out of the Gross rent

receivable, which cannot be realised by the owner and has

become irrecoverable. [Please refer Rule 4 and Explanation

below sub-section (1) of section 23]

1c Tax paid to local

authorities

Please enter the amount of tax on house property which has

been actually paid during the year, to local authorities such as

municipal taxes paid etc.

1d Total (1b + 1c) This is an auto-populated field representing the aggregate of

unrealised rent [1b] and taxes paid to local authorities [1c].

1e Annual Value (1a–1d) This is an auto-populated field representing the amount of Gross

rent [1a] as reduced by amounts deductible therefrom for

computing annual value [1d]. In case of self-occupied property,

this field shall be taken as ‘Nil’.

Instructions to Form ITR-2 (AY 2020-21)

Page 11 of 103

1f Annual value of the

property owned

Please compute the annual value of the share of property which

is owned by you, by multiplying the annual value arrived at

column (1e) with your percentage share in the property.

1g 30% of 1f Please enter 30% of Annual Value of your share of your property.

1h Interest payable on

borrowed capital

In case the property has been acquired/ constructed/ repaired/

renewed/ reconstructed with borrowed capital, please enter the

actual amount of interest payable on such borrowed capital.

In case the house property is ‘self-occupied’ as per provisions of

section 23(2), the amount of interest payable on borrowed

capital shall be restricted to Rs. 2 lakh or 30 thousand, as the case

may be.

1i

Total (1g + 1h)

This is an auto

-

populated field representing the aggregate

of

amounts deductible u/s 24 under the head ‘house property’,

namely, 30% of annual value [1g] and interest payable on

borrowed capital [1h].

1j Arrears/Unrealized Rent

received during the year

Less 30%

In case arrears of rent have been received, or unrealised rent has

been realised subsequently from a tenant in respect of the house

property, during the year, please enter the amount of

arrears/unrealized rent so received, after reducing a sum equal

to 30% of the arrears/unrealised rent.

1k Income from house

property 1 (1f-1i+1j)

This is an auto-populated field representing the net income from

house property which is computed as annual value [1f] as

reduced by total amounts deductible u/s 24 [1i] and as increased

by arrears of rent etc. [1j]

Please fill up all the details above separately for each property owned or co-owned by you during the

year income from which is assessable under the head ‘house property’ and compute net income from

each house property separately.

2 Income from house

property 2 (2f-2i+2j)

This represents income from house property-2 which is

computed in a similar manner as given at item No. 1 above.

3

Pass through income

/

loss, if any

The details of pass through income

/ loss

from business trust or

investment fund as per section 115UA or 115UB are required to

be reported separately in Schedule PTI.

If any amount of pass through income/ loss reported therein is

of the nature of house property income, the same has to be

reported at this column in the Schedule HP for including the

same in head-wise computation.

4 Income under the head

“Income from house

property”

This is an auto-populated field representing the aggregate of net

incomes from all house properties owned during the year [1k +

2k + .........] and also the pass through income/ loss of the nature

of house property [3].

Schedule CG – Capital Gains

Capital gains arising from sale/transfer of different types of capital assets have been segregated. In

a case where capital gains arises from sale or transfer of more than one capital asset, which are of same

type, please make a consolidated computation of capital gains in respect of all such capital assets of same

type except for following:

a. In case of Long Term/ Short Term Capital Gain arising on sale of Immovable property i.e A1 and B1

where capital gains are required to be computed separately for each property, and

b. In case of long term capital gains (LTCG) arising on sale of equity shares in a company or unit of equity

Instructions to Form ITR-2 (AY 2020-21)

Page 12 of 103

oriented fund or unit of business trust on which STT is paid, computation of capital gains should be

made as per item No. B4 or item No. B7. Please note that separate computation of capital gains

should be made for each scrip or units of mutual fund sold during the year as per Schedule 112A and

115AD(1)(b)(iii) proviso. The net capital gains arising on sale of individual scrips should be aggregated

and will be auto populated to B4a and B7a of Schedule CG. Thereafter, tax shall be charged at a flat

rate of 10% in Schedule SI on the aggregate LTCG, as reduced by Rupees One lakh, for the purpose of

tax computation.

Part A of this Schedule provides for computation of short-term capital gains (STCG) from sale of

different types of capital assets. Out of this, item No. A3 and A4 are applicable only for non-residents.

Part B of this Schedule provides for computation of long-term capital gains (LTCG) from sale of

different types of capital assets. Out of this, item No. B5, B6, B7 and B8 are applicable only for non-

residents.

STCG/LTCG on sale of immovable property, if any, should be reported at item No. A1/B1. It is

mandatory to disclose the details of immovable property, name and PAN/ Aadhaar No. of the buyer etc.

as per the given table. These details should be furnished separately for each immovable property

transferred during the year.

a) If you have sold land and building. Quoting of PAN of buyer is mandatory only if tax is deducted

under section 194-IA or is mentioned in the documents.

b) If you are a resident and have sold land and building situated outside India. The details of

property and name of buyer should invariably be mentioned. However, quoting of PAN of buyer

is mandatory only if tax is deducted under section 194-IA or is mentioned in the documents.

The details of pass through income/loss from business trust or investment fund as per section

115UA or 115UB are required to be reported separately in Schedule PTI. In case any amount of pass

through income reported therein is of the nature of short-term capital gain, the same has to be reported

at item No. A7 of this Schedule. Further, in case any amount of pass through income reported therein is

of the nature of long-term capital gain, the same has to be reported at item No. B11 of this Schedule.

Amount of STCG/ LTCG on assets referred in A1-A7/ B1- B11 which is chargeable at special rates or

not chargeable to tax in India in accordance with the relevant article of Double Taxation Avoidance

Agreement (DTAA) of India with another country, if any, should be reported at item no. A8/ B12.

In the given table, please report the amount of income at column (2) and furnish other relevant

details sought in the table such as relevant article of DTAA at column (5), treaty rate at Column (6), rate

as per Income Tax Act at Column (9) and the applicable rate, which is lower of the two rates, at Column

(10). Please report whether Tax Residency Certificate (TRC) is obtained from the country of residence in

Column (7). This column is applicable only in case of Non-Residents. Please note, if TRC Flag is ‘No’, income

will be chargeable as per the applicable rates specified in Part A/B.

Part C of this Schedule computes the total of short-term capital gain (item No. A9) and long-term

capital gain (item No. B13). In case the total amount of long-term capital gain at item No. B13 is a loss

figure, the same shall not be allowed to be set off against short-term capital gains. In such a case, the

figure at item No. B13 should be taken as ‘Nil’ and only the figure of item No. A9 should be taken as item

C.

Deductions can be claimed in respect of capital gains subject to fulfillment of prescribed conditions

under sections 54 or 54B or 54EC or 54F or 54GB or 115F. Deductions under sections 54 or 54EC or 54F

or 54GB or 115F are available only against long-term capital gains. In case any deduction is claimed against

any type of capital gains, the details of such claim have to be furnished as per part D of this Schedule.

Instructions to Form ITR-2 (AY 2020-21)

Page 13 of 103

Part E of this Schedule provides for intra-head set off of current year capital losses with current year

capital gains. The Schedule separates different category of capital gains (long-term and short-term) into

different baskets according to rate at which the same is chargeable to tax. The applicable rate implies the

rate of tax at which the normal income of the assessee is otherwise taxable. The DTAA rate refers to the

special rate at which the short-term capital gains or long-term capital gains is chargeable to tax in

accordance with the relevant article of the Double Taxation Avoidance Agreement (DTAA) of India with

another country.

The figures in column 1 list out the categories of capital gains against which capital losses of the

current year can be set off. Similarly figures in row ‘i' provides for different categories of capital losses of

the current year which can be set off against capital gains in column 1. The figures in row ‘i' and column

‘1’ are derived from addition of figures computed at relevant items of Schedule CG as indicated. Thus,

(A2e*+A3a*+A7a*) is addition of short-term capital gains reported at items Nos. A2e, A3a and A7a as

reduced by the amount of short-term capital gains not chargeable to tax or chargeable to tax at DTAA

rates which is included therein. Further, if (A2e* + A3a* + A7a*) represents a negative figure it should be

filled in cell ‘2i’ and if it is a positive figure it should be filled in cell ‘1ii’. The assessee may set off the

capital loss of row ‘i' with any category of capital gains in column ‘1’ except that the long-term capital loss

can only be adjusted with any long-term capital gains only. The amount of capital loss set off has to be

entered into in the relevant rows of columns 2 to 8. The capital gains of current year remaining after intra-

head set off is computed in column 9, which is then taken to Schedule CYLA for computing inter-head set

off of current year losses. The remaining capital loss of current year is computed in row (x) which is taken

to Schedule CFL for reporting of losses to be carried forward to future years.

In Part F of this Schedule, please report the quarter-wise details of accrual or receipt of incomes

under the head ‘capital gains’ as per the table given.

The details of accrual or receipt have to be furnished separately for short-term capital gains (STCG)

taxable at different rates and long-term capital gains (LTCG) taxable at different rates, for all quarters.

The amounts of STCG and LTCG, in respect of which a quarter-wise break-up is required to be furnished,

should be taken as computed in column 3 of Schedule BFLA, i.e. capital gains remaining after set-off of

current year losses and brought forward losses.

For computing long-term capital gain, cost of acquisition and cost of improvement may be indexed,

if required, on the basis of following cost inflation index notified by the Central Government for this

purpose.

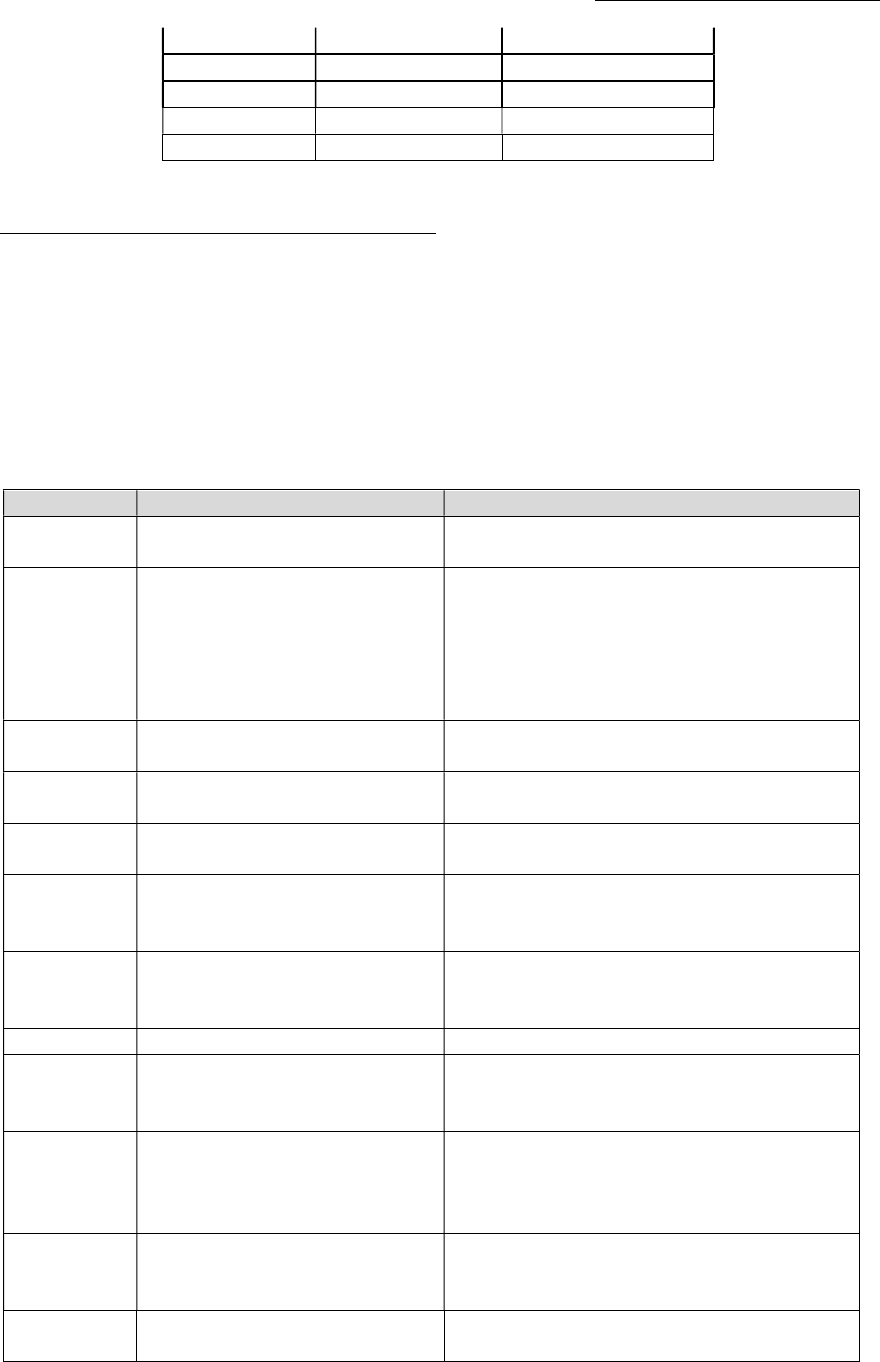

S. No.

Financial Year

Cost Inflation

Index

1.

2001-02 100

2.

2002

-

03

105

3.

2003-04 109

4.

2004-05 113

5.

2005-06 117

6.

2006-07 122

7.

2007-08 129

8.

2008-09 137

9.

2009-10 148

10. 2010-11 167

11. 2011-12 184

12. 2012-13 200

13. 2013-14 220

14. 2014-15 240

Instructions to Form ITR-2 (AY 2020-21)

Page 14 of 103

15. 2015-16 254

16. 2016-17 264

17. 2017-18 272

18. 2018-19 280

19. 2019-20 289

Schedule 112A & Schedule 115AD(1)(b)(iii)-Proviso

In Schedule 112-A - please enter the scrip wise/unit wise detail of sale of equity shares of a company,

units of an equity-oriented fund, or a unit of a business trust on which STT is paid under section

112A.This schedule is applicable for both residents & Non-residents

In Schedule 115AD(1)(b)(iii) proviso - please enter the scrip wise/unit wise detail of sale of equity shares

of a company, units of an equity-oriented fund, or a unit of a business trust on which STT is paid under

section 112A read with section 115AD(1)(b)(iii)-proviso. This schedule is applicable for Foreign

Institutional Investors (FII)

Field No.

Field Name

Instruction

1 S. No Please enter the serial no.

The row can be added was required

2 ISIN Code Enter the International Securities

Identification Number (ISIN code) in the text

box.

Note: In case the security or share does not

have an ISIN Code, then use

“INNOTAVAILAB” as ISIN Code.

3 Name of the Share/Unit Please enter the name of share/unit in the

given box

4 No. of Shares/Units Enter the number of shares/units sold in the

given box.

5 Sale-price per Share/Unit Please enter the sale price per share/unit in

the given box.

6 Full value consideration (Total

Sale Value 4*5)

This field will be auto populated as No of

shares/units (4) multiply with sale price per

unit (5)

7 Cost of acquisition without

indexation

The Cost of acquisition without indexation

will be auto populated as higher of Column

8 or Column 9

8

Cost of

acquisition

Enter the amount in the text box.

9 If the long-term capital asset

was acquired before

01.02.2018, lower of 11 & 6

This field will be auto populated as the lower

of Column 11 & Column 6

10 Fair Market Value per

share/unit as on 31st

January,2018

Enter the fair Market Value per share/unit

as on 31st January,2018 in the text box.

If shares/units are acquired after 31 January

2018 then please mention zero.

11

Total Fair Market Value of

capital asset as per Section

55(2) (ac)- (4*10)

This

field will be auto

-

populated as the value

of Column 4 multiplied with Column 10.

12 Expenditure wholly and

exclusively in connection with

Enter the amount of expenditure wholly and

exclusively in connection with transfer in

Instructions to Form ITR-2 (AY 2020-21)

Page 15 of 103

transfer the given box.

13 Total deductions (7+12) This field will be auto populated as the sum

of Column7+ Column 12

14 Long term capital Gain Balance

(6–13)

Item B4 of LTCG Schedule of CG

This field will be auto-populated as the value

at column 6- Value at Column 13.

Item B7 of LTCG Schedule CG

Total of each column These fields should auto populate as sum of

columns 6, 7, 8, 9, 11, 12, 13 and 14

Schedule-OS - Income from other sources

S. No.

Field Name Instruction

1 Gross income chargeable to tax at

normal applicable rates

Please enter the gross amount of income from other

sources which are chargeable to tax at normal

applicable rates. This is an auto-populated field

representing the aggregate of figures reported at

column 1a, 1b, 1c, 1d and 1e below.

1a Dividends, Gross [not exempt u/s

10(34) and 10(35)]

Please enter the amount of gross dividend income

which is chargeable to tax at normal applicable

rates.

1b Interest, Gross Please enter the gross amount of interest income

which is chargeable to tax at normal applicable

rates. Please indicate break-up of interest income

from separate sources such as interest from savings

bank account, interest on deposits with banks, post

office or co-operative society, interest on income-

tax refund, any pass through income/ loss in the

nature of interest or any other interest income.

1c

Rental income from machinery, plants,

buildings etc., Gross

Please enter the gross amount of rental income

from

letting of machinery, plants, furniture or buildings

belonging to assessee which is chargeable under the

head ‘income from other sources’ under sections

56(2)(ii) or 56(2)(iii).

1d Income of the nature referred to in

section 56(2)(x) which is chargeable to

tax

Please enter the total amount of income of the

nature referred to in section 56(2)(x) which is

chargeable to tax at normal applicable rates. This is

an auto-populated field representing the aggregate

of figures reported at column di, dii, diii, div and dv

below.

1di Aggregate value of sum of money

received without consideration

Please enter the aggregate value of any sum of

money received without consideration, in case the

aggregate value exceeds Rs. 50,000/-.

1dii

In case immovable property is received

without consideration, stamp duty value

of property

Please enter the

stamp duty value of property

received without consideration, in case the stamp

duty value exceeds Rs. 50,000/-.

1diii In case immovable property is received

for inadequate consideration, stamp

duty value of property in excess of such

consideration

Please enter the stamp duty value of property in

excess of consideration, in case the stamp duty value

exceeds the consideration by more than Rs. 50,000/-

or 5% of the consideration, whichever is higher.

Instructions to Form ITR-2 (AY 2020-21)

Page 16 of 103

1div In case any other property is received

without consideration, fair market value

of property

Please enter the aggregate Fair Market Value (FMV)

of the property received without consideration, in

case FMV exceeds Rs. 50,000/-.

1dv In case any other property is received for

inadequate consideration, fair market

value of property in excess of such

consideration

Please enter the aggregate Fair Market Value (FMV)

of the property in excess of the consideration, in

case the FMV exceeds the consideration by more

than Rs. 50,000/-.

1e Any other income (please specify

nature)

Please enter any other income chargeable under the

head ‘income from other sources’, at normal rates.

If any other income is in the nature of Family

Pension, mention the amount in the field provided.

For others, please specify nature and amount of such

income.

2 Income chargeable at special rates (2a+

2b+ 2c+ 2d + 2e+2f elements relating to

S.No. 1)

Please enter the gross amount of income from other

sources which is chargeable to tax at special rates

such as winning from lotteries, income chargeable

u/s 115BBE etc. This is an auto-populated field

representing the aggregate of figures reported at

column 2a, 2b, 2c, 2d, 2e and 2f below. Please note,

for Non-residents elements relating to S.No. 1 will be

added only if TRC Flag is Y at Column No. 7 of S.No.

2f.

Please ensure that these incomes are also reported

in Schedule SI (Income chargeable to tax at special

rates) for proper computation of tax liability.

2a Winnings from lotteries, crossword

puzzles etc. chargeable u/s 115BB

Please report in this column, any income by way of

winnings from any lottery or crossword puzzle or

race including horse race or card game and other

game of any sort or gambling or betting of any form

or nature which is chargeable at special rates u/s

115BB.

2b Income chargeable u/s 115BBE (bi + bii

+ biii + biv+ bv + bvi)

Please report in this column, aggregate of incomes

of the nature referred to in section 115BBE which

are chargeable at special rates as prescribed therein.

This is an auto-populated field representing the

aggregate of figures reported at columns 2bi, 2bii,

2biii, 2biv, 2bv and 2bvi below.

2bi Cash credits u/s 68 Please report in this column any sum in the nature

of unexplained cash credit, deemed as income of the

year u/s 68.

2bii Unexplained investments u/s 69 Please report in this column any unexplained

investment which is not recorded in the books of

accounts, deemed as income of the year u/s 69.

2biii Unexplained money etc. u/s 69A Please report in this column any unexplained

money, bullion, jewellery or other valuable article

which is not recorded in the books of accounts,

deemed as income of the year u/s 69A.

2biv Undisclosed investments etc. u/s 69B Please report in this column any unexplained

investment or any bullion, jewellery or other

valuable article which is not fully recorded in the

books of accounts, deemed as income of the year

u/s 69B.

Instructions to Form ITR-2 (AY 2020-21)

Page 17 of 103

2bv Unexplained expenditure etc. u/s 69C Please report in this column, any unexplained

expenditure or part thereof, deemed as income of

the year u/s 69C.

2bvi Amount borrowed or repaid on hundi

u/s 69D

Please report in this column any amount borrowed

on a hundi, or any repayment being due on a hundi,

otherwise than through an a/c payee cheque drawn

on a bank, deemed as income of the year u/s 69D.

2c Accumulated balance of recognized

provident fund taxable u/s 111

In case any accumulated balance of a recognised

provident fund is to be included in total income of

the year, owing to the provisions of rule 8 of part A

of the Fourth Schedule not being applicable, tax has

to be computed year-wise as prescribed in rule 9. In

such a case, please furnish the details of income

benefit and tax benefit for each of the assessment

years concerned.

2d Any other income chargeable at special

rate (total of di to dxviii)

Please report in this column any other income under

the head ‘income from other sources’ which is

chargeable to tax at special rates. Please select the

nature of income from drop down menu and enter

the amount. In case of more than one type of

income, please report each income as a separate line

item. Please ensure that these incomes are also

reported in Schedule SI (Income chargeable to tax at

special rates) for proper computation of tax liability.

List of types of income chargeable at

special rate

(i) Dividends received by non-resident (not being

company) or foreign company chargeable u/s

115A(1)(a)(i)

(ii)

Interest received from Government or Indian

concern on foreign currency debts chargeable

u/s 115A(1)(a)(ii)

(iii) Interest received from Infrastructure Debt

Fund chargeable u/s 115A(1)(a)(iia)

(iv) Interest referred to in section 194LC -

chargeable u/s 115A(1)(a)(iiaa)

(v) Interest referred to in section 194LD -

chargeable u/s 115A(1)(a)(iiab)

(vi) Distributed income being interest referred to

in section 194LBA - chargeable u/s

115A(1)(a)(iiac)

(vii) Income from units of UTI or other Mutual

Funds specified in section 10(23D), purchased

in Foreign Currency - chargeable u/s

115A(1)(a)(iii)

(viii)

Income from royalty or fees for technical

services received from Government or Indian

concern - chargeable u/s 115A(1)(b)(A) &

115A(1)(b)(B)

(ix) Income by way of interest or dividends from

bonds or GDRs purchased in foreign currency

by non-residents - chargeable u/s 115AC

(x) Income by way of dividends from GDRs

purchased in foreign currency by residents -

chargeable u/s 115ACA

Instructions to Form ITR-2 (AY 2020-21)

Page 18 of 103

(xi) Income (other than dividend) received by an

FII in respect of securities (other than units

referred to in section 115AB) - chargeable u/s

115AD(1)(i)

(xii) Income by way of interest received by an FII on

bonds or Government securities referred to in

section 194LD – chargeable as per proviso to

section 115AD(1)(i)

(xiii) Tax on non-residents sportsmen or sports

associations chargeable u/s 115BBA

(xiv) Anonymous Donations in certain cases

chargeable u/s 115BBC

(xv) Income by way of dividend received by

specified assessee, being resident, from

domestic company exceeding rupees ten lakh

chargeable u/s 115BBDA

(xvi)

Income by way of royalty from patent

developed and registered in India - chargeable

u/s 115BBF

(xvii) Income by way of transfer of carbon credits -

chargeable u/s 115BBG

(xviii) Investment Income of a Non-Resident Indian -

chargeable u/s 115E

(xix)

2e

Pass through income in the nature of

income from other sources chargeable

at special rates

The details of pass through income from business

trust or investment fund as per section 115UA or

115UB are required to be reported separately in

Schedule PTI.

If any amount of pass through income reported in

Schedule PTI is of the nature of income from other

sources, the same has to be reported at this column

in the Schedule OS for including the same in head-

wise computation.

Please select the nature of pass through income

from drop down menu and enter the amount. In

case of more than one type of pass through income,

please report each income as a separate line item.

List of types of pass through income

chargeable at special rates

PTI-115A(1)(a)(i)- Dividends interest and income

from units purchase in foreign currency

PTI-115A(1)(a)(ii)- Interest received from

govt/Indian Concerns received in Foreign Currency

PTI-115A(1) (a)(iia) -Interest from Infrastructure

Debt Fund

PTI-115A(1) (a)(iiaa) -Interest as per Sec. 194LC

PTI-115A(1) (a)(iiab) -Interest as per Sec. 194LD

PTI-115A(1) (a)(iiac) -Interest as per Sec. 194LBA

PTI

-

115A(1) (a)(iii)

-

Income received in respect of

units of UTI purchased in foreign currency

Instructions to Form ITR-2 (AY 2020-21)

Page 19 of 103

PTI-115A(1)(b)(A)- Income from royalty & technical

services

PTI

-

115A(1)(b)(B) Income from royalty & technical

services

PTI

-

115AC(1)(a & b)

-

Income from bonds or GDR

purchased in foreign currency - non-resident

PTI-115ACA(1)(a) - Income from GDR purchased in

foreign currency -resident

PTI-115AD(1)(i) -Income received by an FII in respect

of securities (other than units as per Sec 115AB)

PTI-115AD(1)(i) -Income received by an FII in respect

of bonds or government securities as per Sec 194LD

PTI-115BBA - Income of non-residents sportsmen or

sports associations

PTI-115BBC - Anonymous donations

PTI-115BBDA - Dividend Income from domestic

company exceeding 10 Lakh

PTI-115BBF - Income from patent

PTI-115BBG - Income from transfer of carbon credits

PTI-115E(a) - Investment income

PTI

-

115BB

-

Winnings from lotteries, crossword

puzzles etc.

PTI

-

115BBE

-

Income under section 68, 69, 69A, 69B,

69C or 69D

2f Amount included in 1 and 2 above,

which is chargeable at special rates in

India as per DTAA (total of column (2) of

table below)

Please report in this column any income under the

head ‘income from other sources’ which is

chargeable at special rates in accordance with the

relevant article of the Double Taxation Avoidance

Agreement (DTAA) of India with another country.

This field will be an auto-populated field

representing total of Column 2 (Amount of Income)

of the given table. For Non-Residents total of fields

of Column 2 will be computed only if TRC Flag is Yes.

In the given table, please report the amount of

income at column (2) and furnish other relevant

details sought in the table such as relevant article of

DTAA at column (5), treaty rate at column (6), rate

as per Income-tax Act at column (9) and the

applicable rate, which is lower of the two rates, at

column (10). Please report whether Tax Residency

Certificate (TRC) is obtained from the country of

residence in Column No. 7. This column is applicable

in case of Non-Residents only.

Please note, if TRC Flag is No then income will be

chargeable to tax as per the applicable rates

specified for such income.

3 Deductions under section 57:- (other

than those relating to income

chargeable at special rates under 2a, 2b

& 2d)

Any claim of deduction u/s 57 relating to income

under the head ‘income from other sources’

chargeable at normal applicable rates should be

mentioned here.

Deduction under column Family Pension will be

available only if income is offered in column 1e

Instructions to Form ITR-2 (AY 2020-21)

Page 20 of 103

Deduction under column “depreciation” will be

available only if income is offered in column 1c

4 Amounts not deductible u/s 58 Any amount which is not deductible in computing

income chargeable under the head ‘income from

other sources’ by virtue of section 58 should be

reported in this column. In case any expenditure or

deduction is claimed u/s 57 but the whole or part

thereof becomes inadmissible as per section 58, the

same should also be reported here.

5

Profits chargeable to tax u/s 59

Any profit which is chargeable to tax under the head

‘income from other sources’ by virtue of section 59

read with section 41 should be reported in this

column.

6 Net Income from other sources

chargeable at normal applicable rates (1

– 3 + 4 + 5- 2f relating to 1) (If negative

take the figure to 3i of Schedule CYLA)

Please enter the net amount of income under the

head ‘income from other sources’ which is

chargeable to tax at normal applicable rates.

This is an auto-populated field representing the

gross income from other sources chargeable at

normal rates [item 1] as reduced by deductions u/s

57 [item 3] & income chargeable at special rates

specified in item 2f (related to item 1) and as

increased by amounts not deductible u/s 58 [item 4]

and profits chargeable to tax u/s 59 [item 5].

7 Income from other sources (other than

from owning race horses)(2+6) (enter 6

as nil, if negative)

Please enter the aggregate of incomes chargeable

under the head ‘income from other sources’,

excluding the income from activity of owning and

maintaining race horses.

This is an auto-populated field representing the

aggregate of income chargeable at special rates

[item 2] and net income chargeable at normal

applicable rates [item 6].

8

Income from the activity of owning and

maintaining race horses

Please report in this column net income from the

activity of owning and maintaining race horses.

Please furnish break-up in terms of gross receipts at

item 8a, deductions in relation to such activity at

item 8b, amounts not deductible as per section 58

relating to this activity at item 8c, profit chargeable

to tax as per section 59 relating to this activity at

item 8d and compute the net income at item 8e

accordingly.

In case the net income computed at item 8e is

negative, take this figure to item 6xi of Schedule CFL

for carry forward of loss from the activity of owning

and maintaining race horses to future years.

9 Income under the head “Income from

other sources” (7+8e) (take 8e as nil if

negative)

Please compute in this column the aggregate income

chargeable under head ‘income from other sources’.

This is an auto-populated field representing the

aggregate of income from other sources (other than

from owning and maintaining race horses)

Instructions to Form ITR-2 (AY 2020-21)

Page 21 of 103

computed at item 7 and net income from the activity

of owning and maintaining race horses computed at

item 8e.

10 Information about accrual/receipt of

income from Other Sources

Please report the period-wise details of accrual or

receipt of incomes under the head ‘income from

other sources’ in the table given at this column.

The details have to be furnished separately for

dividend income of the nature referred to in section

115BBDA and any income by way of winnings from

lotteries, crossword puzzles, races, games,

gambling, betting etc. referred to in section 2(24)(ix)

Schedule-CYLA - Details of Income after set-off of current year losses

If the net result of computation under the head ‘income from house property’, and ‘income from

other sources chargeable at normal applicable rates’ is a loss figure, please fill up the figure of loss in the

first row under the respective head. Please note that loss from activity of owning and maintaining horse

races and loss from long term or short term capital gain cannot be set off against income under other

heads for the current year.

The positive income computed under various heads of income for the current year should be

mentioned in column (1) in the relevant row for the respective head. Short-term capital gains or long-

term capital gains chargeable to tax at various rates should be mentioned in separate rows as indicated

in the Schedule.

The losses mentioned in row (i) can be set off against positive incomes mentioned under other

heads in column (1) in accordance with the provisions of section 71.

In a case where loss is computed under the head “income from house property”, such loss can be

set off against income under any other head only to the extent it does not exceed rupees two lakh.

The amount of current year loss which is set off against the income computed under other heads

should be entered into in columns 2 and 3, in the relevant rows.

In column (4), please mention the net income remaining after set off of current year losses, under

the respective heads of income, in the relevant rows.

In row (xiii), please mention the total of current year losses set off out of the columns (2) and (3).

In row (xiv), please mention the remaining loss under various heads i.e. house property loss at

column (2) and loss from other sources at column (3).

The unabsorbed losses allowed to be carried forward out of this should be taken to Schedule CFL

for carry forward to future years.

Schedule-BFLA- Details of Income after Set off of Brought Forward Losses of earlier years

The positive income remaining after set off of current year losses, as per Schedule CYLA, under

various heads of income for the current year should be mentioned in column (1) in the relevant row for

the respective head. The net positive short-term capital gains or long-term capital gains chargeable to

tax at various rates should be mentioned in separate rows as indicated in the Schedule.

In column (2), the amount of loss brought forward from earlier years which can be set off against

Instructions to Form ITR-2 (AY 2020-21)

Page 22 of 103

various heads of income should be entered in the relevant row. Brought forward short-term capital loss

can be set off against any item of short-term or long-term capital gains. However, brought forward long-

term capital loss can only be set off against an item of long-term capital gains. Brought forward loss from

activity of owning and maintaining horse races can be set off only against positive income from the same

activity during the current year.

In column (3), please mention the net positive income of current year remaining after set off of

brought forward losses under various heads of income in the relevant rows. The head-wise total of

column (3) should be captured in row (xiii) thereof which should be the figure of Gross Total Income (GTI)

of the year.

The aggregate of brought forward losses under various heads set-off against positive income of the

current year should be mentioned in row (xii) of column (2).

Schedule-CFL - Details of Losses to be carried forward to future years

Please enter the assessment year-wise details of losses brought forward from earlier years in the

first eight rows [row (i) to row (viii)] under various heads of income at respective columns [column (3) to

column (6)].

The column no 3, 4 & 5 are further divided into 3 columns. Please enter the pass through loss distributed

by business trust and investment fund to its unit holders as per provisions of 115UB.

The aggregate amount of brought forward losses under various heads of income should be

mentioned in row (ix).

In row (x), please enter the amount of brought forward losses under various heads set off against

income of current year in the respective columns. The head-wise figures of set off of brought forward

loss should be taken from column (2) of Schedule BFLA.

In row (xi), please enter the amount of remaining losses of current year under various heads in the

respective column. The head-wise figures of remaining current year losses should be taken from the

relevant cell of Schedule CYLA, Schedule CG and Schedule OS as indicated below:

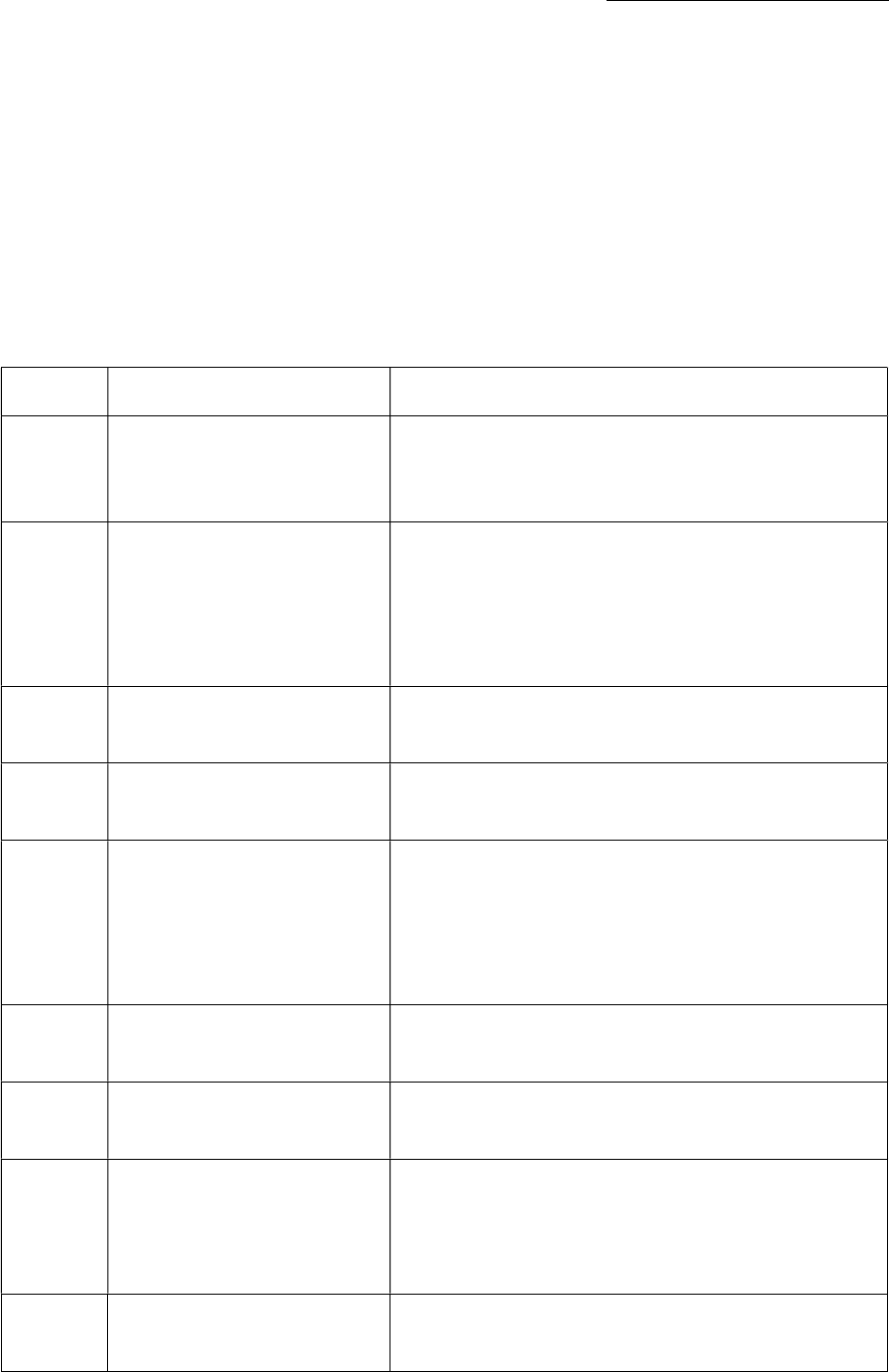

Sr.

No.

The fields in row no. xi “2020-21(Current year losses)” Source of Auto-population

1 House property loss (3c) (2xiv of schedule CYLA)

2 Short-term capital loss (4c) (2x+3x+4x+5x) of item E of

schedule CG

3 Long-term capital loss (5c) (6x+7x+8x) of item E of

schedule CG

4 Loss from owning and maintaining race horses (6) (8e of schedule OS, if –ve)

In row (xii), please enter the amount of aggregate loss under various heads to be carried forward

to future years in the respective column.

The losses under the head “house property”, or ‘capital gains’, are allowed to be carried forward

for 8 assessment years. However, loss from the activity of owning and maintaining race horses can be

carried forward only for 4 assessment years.

Schedule-VIA - Deductions under Chapter VI-A

In this part, please provide the details of deduction claimed under various provisions of Chapter VI-A during the

year.

Instructions to Form ITR-2 (AY 2020-21)

Page 23 of 103

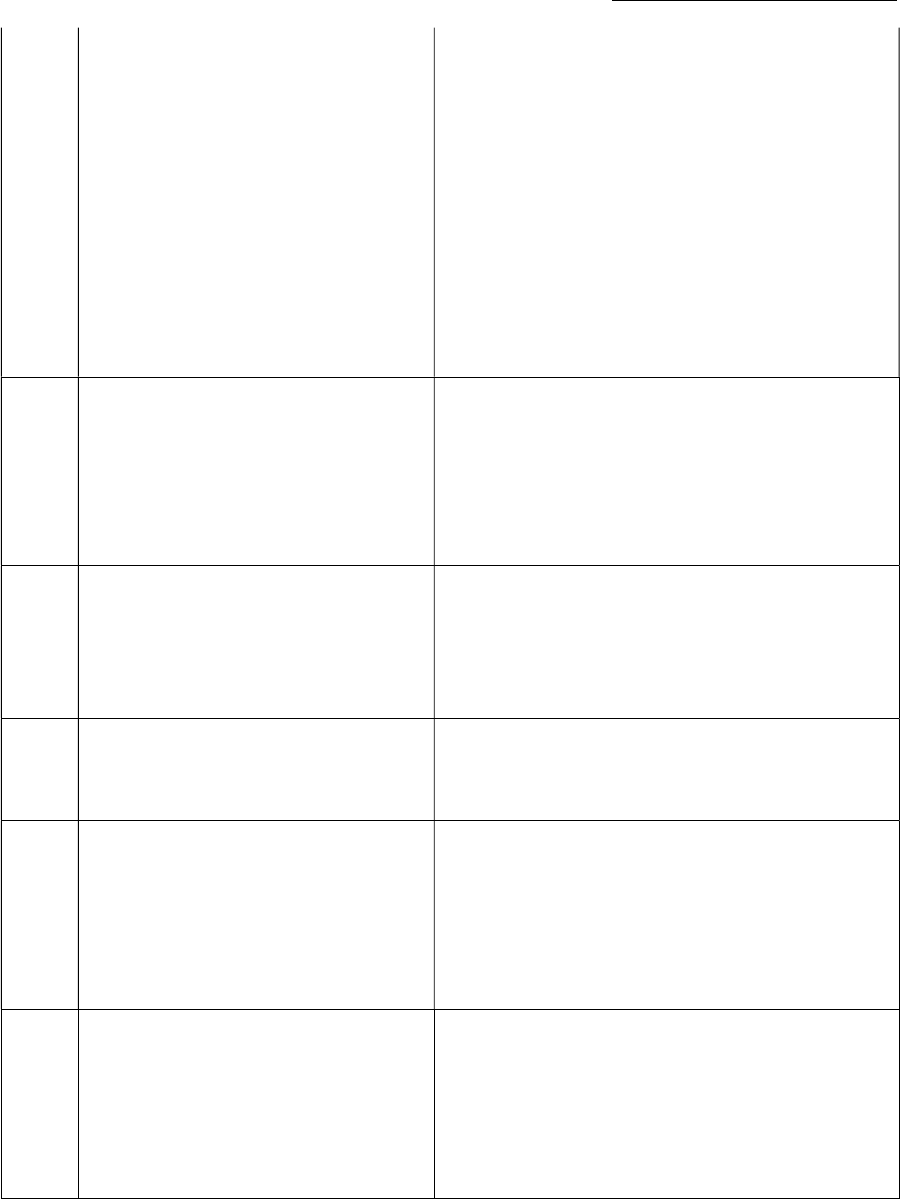

Table 1. Part B- Deduction in respect of certain payments

Column

No.

Section Nature of

deduction

Instruction

Whether, you have made any investment/

deposit/ payments between 01.04.2020 to

30.06.2020

#

for the purpose of claiming any

deduction under Part B of Chapter VIA? (If yes,

please fill S.No. "A" of Schedule DI)

Tick Yes No

Please indicate

whether, you have made any investment/

deposit/ payments between 01.04.2020 to 30.06.2020

#

for

the purpose of claiming any deduction under Part B of

Chapter VI-A by ticking the applicable checkbox

Yes

No

If yes is selected, please ensure that relevant details are

mentioned at S. No. “A" of schedule DI

# - Time-limit relaxed to 31.07.2020 as per The Taxation and

Other Laws (Relaxation and Amendment of Certain Provisions)

Act, 2020

1a

80C

Deduction in

respect of life

insurance

premia, deferred

annuity,

contributions to

provident fund,

subscription to

certain equity

shares or

debentures, etc.

Please enter the amount paid or deposited towards life

insurance premium, contribution to any Provident Fund set up

by the Government, employees contribution to a recognised

Provident Fund or an approved superannuation fund,

contribution to deferred annuity plan, subscription to National

Savings Certificates, tuition fees, payment or repayment of

amounts borrowed for purposes of purchase/ construction of

a residential house, and other similar payments/ investments

which are eligible for deduction under section 80C of the

Income-tax Act.

The aggregate amount of deductions admissible u/s 80C,

80CCC and 80CCD(1) shall be restricted to maximum limit of

Rs.1,50,000.

1b 80CCC Deduction in

respect of

contribution to

certain Pension

Funds

Please enter the amount paid towards any annuity plan of LIC

or any other insurer for receiving pension from the pension

fund, which is eligible for deduction under section 80CCC.

The aggregate amount of deductions admissible u/s 80C,

80CCC and 80CCD(1) shall be restricted to maximum limit of

Rs. 1,50,000.

1c

80CCD(1)

Deduction in

respect of

contribution to

pension scheme

of Central

Government

Please enter the total amount paid or deposited during the

year, in your account under a pension scheme notified by the

Central Government, which is eligible for deduction under sub-

section (1) of section 80CCD.

The deduction u/s 80CCD(1) is restricted to upper limit of 10%

of salary, in the case of an employee, and 20% of gross total

income, in any other case.

The aggregate amount of deductions admissible u/s 80C,

80CCC and 80CCD(1) shall be further restricted to maximum

limit of Rs. 1,50,000.

1d 80CCD(1B) Deduction in

respect of

contribution to

Please enter the amount paid or deposited during the year, in

your account under a pension scheme notified by the Central

Instructions to Form ITR-2 (AY 2020-21)

Page 24 of 103

pension scheme

of Central

Government

Government, which is eligible for deduction under sub-section

(1B) of section 80CCD.

The amount eligible under this sub-section is subject to a

maximum limit of Rs. 50,000 and further condition that no

claim should have been made under sub-section (1) in respect

of the same amount.

1e

80CCD(2)

Deduction in

respect of

contribution of

employer to

pension scheme

of Central

Government

Please enter the amount of employer’s contribution paid

during the year to your account under a pension scheme

notified by the Central Government, which is eligible for

deduction under sub-section (2) of section 80CCD.

The amount eligible is subject to maximum limit of 10% of

salary in case the nature of employer selected is other than

Central Government.

In case the nature of employer selected is Central

Government, the amount eligible is subject to maximum limit

of 14% of Salary.

1f 80D Deduction in

respect of health

insurance premia

This field will be auto-populated from schedule 80D. Please fill

schedule 80D for claiming the deduction.

1g 80DD Deduction in

respect of

maintenance

including medical

treatment of a

dependent who

is a person with

disability

Please enter the details of expenditure actually incurred for

medical treatment, training and rehabilitation of a dependent

person with disability by selecting the appropriate options

from the drop down.

1. Dependent person with disability

2. Dependent person with severe disability

The amount eligible for deduction is subject to maximum limit

of ₹ 75,000, in case of dependent person with disability, and ₹

1,25,000 in case of dependent person with severe disability.

Instructions to Form ITR-2 (AY 2020-21)

Page 25 of 103

1h 80DDB Deduction in

respect of

medical

treatment etc.

Please enter the details of expenditure actually incurred on

medical treatment of specified diseases for self, dependent or

a member of HUF. Please select the appropriate options from

the drop down menu and enter relevant amount.

1. Self or Dependent

2. Senior Citizen – Self or Dependent

The amount eligible for deduction is subject to a maximum

limit of ₹ 40,000 during the year. However, in case of senior

citizen the applicable limit is ₹1,00,000.

1i 80E Deduction in

respect of

interest on loan

taken for higher

education

Please enter the amount paid during the year by way of

interest on loan taken from any financial institution or

approved charitable institution for the purpose of pursuing

higher education of self or relative which is eligible for

deduction u/s 80E.

1j 80EE Deduction in

respect of

interest on loan

taken for

residential house

property

Please enter the amount paid during the year by way of

interest on loan taken from any financial institution for the

purposes of acquisition of a residential property, which is

eligible for deduction u/ 80EE.

The amount eligible for deduction is subject to a maximum

limit of ₹ 50,000 during the year and further conditions

specified in sub-section (3) of section 80EE.

1k 80EEA Deduction in

respect of

interest on loan

taken for certain

house property

Please enter the amount paid during the year by way of

interest on loan taken from any financial institution during

the period 1 April 2019 to 31 March 2020 for the purpose of

acquisition of a residential house property, which is eligible

for deduction u/s 80EEA.

The amount eligible for deduction is subject to maximum

limit of ₹150,000 paid during the year and further conditions

specified in sub-section (3) of section 80EEA.

In case deduction u/s 80EE is claimed, deduction u/s 80EEA

shall not be allowed.

1l 80EEB Deduction in

respect of

purchase of

electric vehicle.

Please enter the amount paid during the year by way of

interest on loan taken for purchase of electric vehicle from

any financial institution during the period 1 April 2019 to 31

March 2023 which is eligible for deduction u/s 80EEB.

The amount eligible for deduction is subject to maximum

limit of ₹150,000 paid during the year.

1m 80G Deduction in

respect of

donations to

certain funds,

charitable

institutions, etc.

Please enter the amount of donations made during the year to

charitable institutions or specified funds. Please fill up details

of donations in Schedule 80G.

Please note that no deduction shall be allowed under this

section in respect of donation of any sum exceeding Rs.

2,000/- unless such donation is paid by any mode other than

cash.

Instructions to Form ITR-2 (AY 2020-21)

Page 26 of 103

1n 80GG Deduction in

respect of rents

paid

Please enter the amount paid during the year towards rent in

respect of any furnished/ unfurnished residential

accommodation, in excess of 10% of total income, which is

eligible for deduction u/s 80GG.

The amount eligible for deduction is subject to a maximum

limit of ₹ 60,000 during the year and further conditions

specified therein.

1o 80GGA Deduction in

respect of

donation for

scientific

research or rural

development

Please enter the amount of donations made during the year to

research association, university, college or other institution for

scientific research or programme of rural development etc.,

which is eligible for deduction u/s 80GGA.