ARR for FY 2023-24 and Retail Supply Tariff Order for FY 2023-24

Madhya Pradesh Electricity Regulatory Commission Page 1

MADHYA PRADESH ELECTRICITY REGULATORY COMMISSION

5

th

Floor, Metro Plaza, Bittan Market, Bhopal - 462 016

Petition No. 84/2022

PRESENT:

S.P.S. Parihar, Chairman

Gopal Srivastava, Member (Law)

IN THE MATTER OF:

Determination of Aggregate Revenue Requirement (ARR) and Retail Supply

Tariff for FY 2023-24 based on the ARR & Tariff Petition filed by the Distribution

Licensees namely Madhya Pradesh Poorv Kshetra Vidyut Vitaran Company

Limited (East DISCOM), Madhya Pradesh Paschim Kshetra Vidyut Vitaran

Company Limited (West DISCOM), Madhya Pradesh Madhya Kshetra Vidyut

Vitaran Company Limited (Central DISCOM), and M.P. Power Management

Company Limited (MPPMCL).

AGGREGATE REVENUE REQUIREMENT AND RETAIL

SUPPLY TARIFF ORDER FOR FY 2023-24

ARR for FY 2023-24 and Retail Supply Tariff Order for FY 2023-24

Madhya Pradesh Electricity Regulatory Commission Page 2

Table of Contents

A1: ORDER……………………………………………………………………………………10

A2: AGGREGATE REVENUE REQUIREMENT FOR PETITIONERS………………..19

Sales Forecast ................................................................................................................................. 19

Energy Balance ............................................................................................................................... 22

Assessment of Energy Availability ............................................................................................... 24

Assessment of Power Purchase Cost ............................................................................................ 38

Renewable Purchase Obligation (RPO) ....................................................................................... 60

Management of Surplus Energy ................................................................................................... 63

Inter-State Transmission Charges ................................................................................................ 66

Intra-State Transmission Charges and SLDC Charges ............................................................. 67

MPPMCL Costs: Details and DISCOM-wise Allocation ........................................................... 69

Summary of Power Purchase Cost ............................................................................................... 71

Capital Expenditure Plans/ Capitalization of Assets .................................................................. 72

Operations and Maintenance Expenses ....................................................................................... 75

Depreciation .................................................................................................................................... 82

Interest and Finance Charges ....................................................................................................... 85

Interest on Working Capital ......................................................................................................... 90

Interest on Consumer Security Deposit ....................................................................................... 93

Return on Equity (RoE) ................................................................................................................ 94

Bad and doubtful debts ................................................................................................................. 97

Other Income .................................................................................................................................. 98

Differential Bulk Supply Tariff (DBST) .................................................................................... 100

Revenue from Existing and Admitted Tariffs and Gap/Surplus ............................................. 107

A3: WHEELING CHARGES, CROSS SUBSIDY SURCHARGE AND ADDITIONAL

SURCHARGE…………………………………………………………………………………...111

Determination of Wheeling Cost ................................................................................................ 111

Determination of Cross-Subsidy Surcharge .............................................................................. 115

Determination of Additional Surcharge .................................................................................... 120

A4: GREEN ENERGY TARIFF……………………………………………………………122

A5: FUEL AND POWER PURCHASE ADJUSTMENT SURCHARGE……………….138

A6: RETAIL TARIFF DESIGN ……………………………………………………………144

Legal Position ............................................................................................................................... 144

Commission’s Approach to Tariff Determination .................................................................... 144

Linkage to Average Cost of Supply ............................................................................................ 144

A7: COMPLIANCE OF DIRECTIVES ISSUED IN TARIFF ORDER FOR FY 2022-

23…………………………………………………………………………………………………149

ARR for FY 2023-24 and Retail Supply Tariff Order for FY 2023-24

Madhya Pradesh Electricity Regulatory Commission Page 3

A8: PUBLIC SUGGESTIONS AND COMMENTS ON LICENSEES’ PETITIONS…..164

Annexure-1 (List of Stakeholders) ............................................................................................. 194

Annexure-2 (Tariff Schedules for Low Tension Consumers) .................................................. 199

Annexure-3 (Tariff Schedules for High Tension Consumers) ................................................. 225

ARR for FY 2023-24 and Retail Supply Tariff Order for FY 2023-24

Madhya Pradesh Electricity Regulatory Commission Page 4

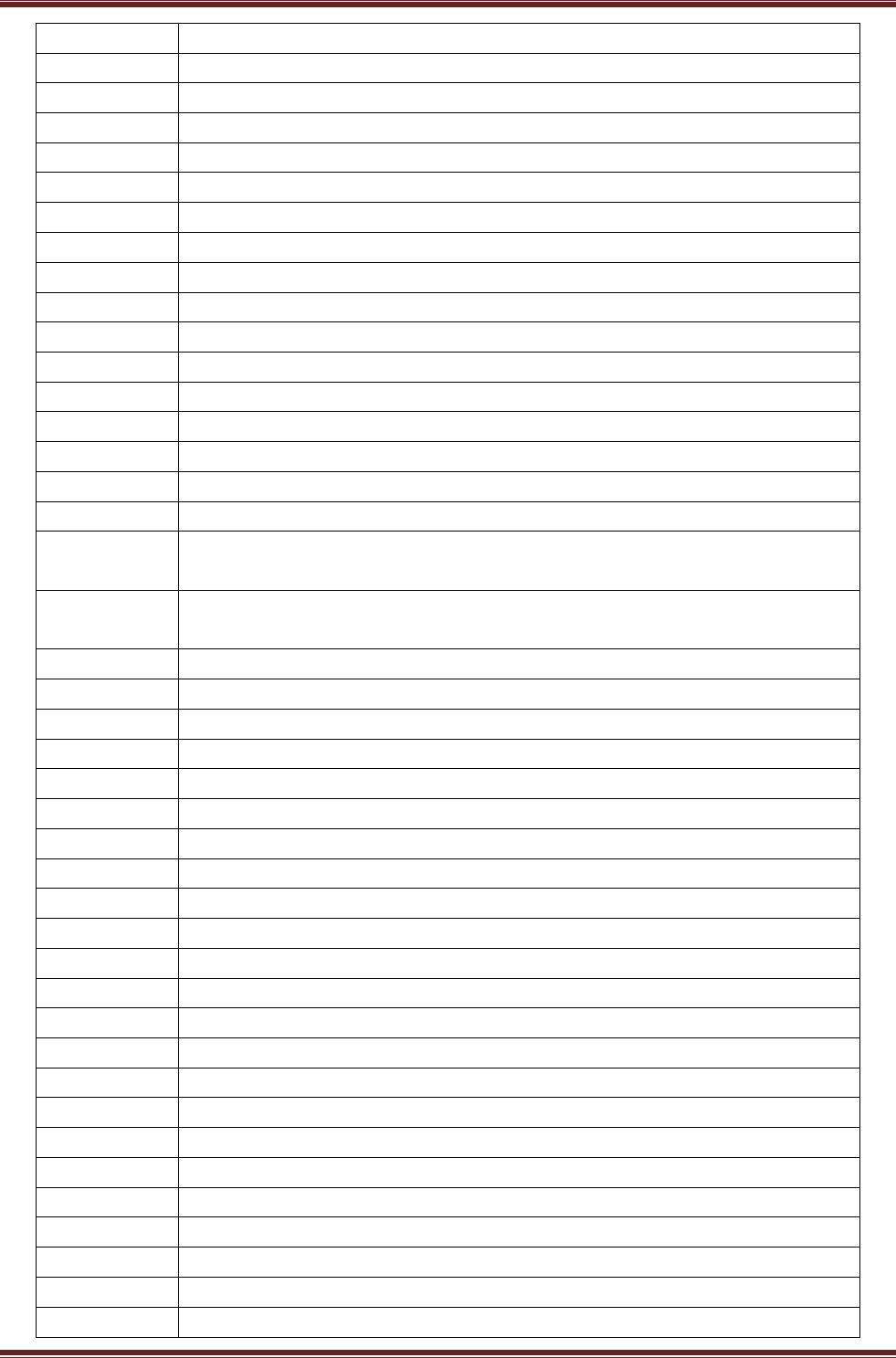

List of Tables

Table 1 : List of Newspapers- Public Notice published by the Petitioners ......................................... 11

Table 2 : Summary of Tariff proposal for FY 2023-24 as submitted by Petitioners (Rs. Crore) ........ 11

Table 3: Status of meterisation of un-metered rural domestic consumers ........................................... 12

Table 4: Status of meterisation of agricultural DTRs .......................................................................... 13

Table 5: Distribution Loss Trajectory specified in the Regulations .................................................... 13

Table 6: Actual Distribution Loss for FY 2021-22 .............................................................................. 14

Table 7: ARR admitted by the Commission for FY 2023-24 (Rs. Crore) ........................................... 15

Table 8: ARR admitted and Revenue at Existing/Approved Tariff for FY 2023-24 (Rs. Crore) ........ 16

Table 9: Category wise sales projected by Petitioners for FY 2023-24 (MU) .................................... 20

Table 10: Category wise sales admitted by the Commission for State for FY 2023-24 (MUs) .......... 21

Table 11: Energy Requirement proposed by Petitioners for FY 2023-24 (MU) ................................. 23

Table 12: Loss targets as per Regulations (in %) ................................................................................ 23

Table 13: Energy requirement admitted by the Commission for FY 2023-24 .................................... 24

Table 14: Upcoming Stations and Technical Parameters .................................................................... 25

Table 15: Allocated stations submitted by the Petitioners for FY 2023-24 ......................................... 26

Table 16: Power Plant Wise backing down considered by the Petitioners for FY 2023-24 (MU) ...... 29

Table 17: Total Availability of Energy submitted by the Petitioners for FY 2023-24 (MU) .............. 31

Table 18: Allocation of Generating Station considered by the Commission for FY 2023-24 ............ 32

Table 19 : Month wise energy availability projection for FY 2023-24 (MU) ..................................... 36

Table 20 : Fixed cost and Energy charges of MPPMCL allocated stations as submitted by the

……..Petitioners for FY 2023-24 ................................................................................................ 38

Table 21 : MOD for FY 2023-24 as submitted by the Petitioners ....................................................... 44

Table 22 : Fixed cost and Energy cost as Claimed by Petitioners for FY 2023-24 (Rs. Crore) .......... 46

Table 23: Basis of Fixed and Energy charges for the generating stations for FY 2023-24 ................. 51

Table 24: MOD on allocated generating stations for FY 2023-24 ...................................................... 56

Table 25 : Fixed and Energy Charges of all generating stations admitted for FY 2023-24 ................ 58

Table 26: Renewable Purchase Obligation and Cost as submitted by the Petitioners for FY 2023-24

...................................................................................................................................................... 60

Table 27: Renewable Purchase Obligation and Cost as computed by the Commission for FY 2023-24

...................................................................................................................................................... 61

Table 28: RE power purchase cost for RPO compliance for FY 2023-24 ........................................... 62

Table 29: Management of Surplus Energy as submitted by Petitioners .............................................. 64

Table 30: Surplus Energy information for last 3 years as submitted by Petitioners ............................ 65

Table 31 : Details of saving in power purchase cost through sale of Surplus energy ......................... 66

Table 32: Inter-State Transmission Charges claimed for FY 2023-24 (Rs. Crore) ............................. 67

Table 33: Inter-State Transmission Charges admitted for FY 2023-24 (Rs. Crore) ............................ 67

Table 34: Intra-State Transmission Charges and SLDC charges claimed for FY 2023-24 (Rs. Crore)

...................................................................................................................................................... 67

Table 35 : Intra-State Transmission Charges including SLDC Charges admitted for FY 2023-24

…….(Rs.Crore) ............................................................................................................................ 68

Table 36: MPPMCL Cost claimed for FY 2023-24 (Rs. Crore) .......................................................... 69

Table 37: MPPMCL Costs/ Income admitted by the Commission for FY 2023-24 (Rs. Crore) ........ 70

Table 38: Power Purchase Cost as filed by Petitioners for FY 2023-24 (Rs. Crore) .......................... 71

Table 39 : Total Power Purchase cost admitted for FY 2023-24 (Rs. Crore) ...................................... 71

Table 40: Capital Expenditure Plan for FY 2023-24 (Rs. Crore) ........................................................ 74

Table 41 : DISCOM-wise proposed capitalization and bifurcation of CWIP (Rs. Crore) .................. 74

ARR for FY 2023-24 and Retail Supply Tariff Order for FY 2023-24

Madhya Pradesh Electricity Regulatory Commission Page 5

Table 42: Projected Asset Capitalization considered by the Commission for FY 2023-24 (Rs. Crore)

...................................................................................................................................................... 75

Table 43: Escalation Rate for FY 2021-22 and FY 2022-23 (%) ....................................................... 76

Table 44: Dearness Allowance Considered (%) .................................................................................. 77

Table 45: Additional OPEX submitted by the Petitioners (Rs Crore) ................................................. 78

Table 46: O&M Expenses Claimed by the Petitioners for FY 2023-24 (Rs. Crore) .......................... 78

Table 47: Escalation Rate admitted for FY 2021-22 and FY 2022-23 (%) ........................................ 80

Table 48: Operation and Maintenance Expenses admitted for FY 2023-24 (Rs. Crore) ..................... 81

Table 49: Depreciation claimed for FY 2023-24 (Rs. Crore) .............................................................. 82

Table 50: Depreciation admitted for FY 2023-24 (Rs. Crore) ............................................................. 85

Table 51: Interest on Project Loan claimed for FY 2023-24 (Rs. Crore) ............................................ 86

Table 52: Interest and finance charges admitted for FY 2023-24 (Rs. Crore) .................................... 89

Table 53: Interest on Working Capital claimed for 2023-24 (Rs Crore) ............................................. 90

Table 54: Interest on Working Capital admitted by the Commission (Rs. Crore) .............................. 92

Table 55: Interest on Consumer Security Deposit claimed by the Petitioners for FY 2023-24 (Rs.

……Crore) ................................................................................................................................... 93

Table 56: Interest on Consumer Security Deposit (CSD) admitted for FY 2023-24 (Rs. Crore) ........ 94

Table 57: Return on Equity Claimed by the Petitioners for FY 2023-24 (Rs. Crore) ......................... 94

Table 58: Return on Equity admitted for FY 2023-24 (Rs. Crore) ...................................................... 97

Table 59: Provision for Bad and Doubtful Debts Claimed for FY 2023-24 (Rs Crore) ...................... 97

Table 60: Other Income and Non-Tariff Income for FY 2023-24 (Rs Crore) ..................................... 99

Table 61: Total actual other income as per true-up orders (Rs Crore) .............................................. 100

Table 62: Other Income admitted for FY 2023-24 (Rs. Crore) ......................................................... 100

Table 63: DBST submitted by the Petitioners for FY 2023-24 (Rs Crore) ....................................... 101

Table 64: Differential Bulk Supply Tariff Admitted by the Commission for FY 2023-24 (Rs Crore)

.................................................................................................................................................... 102

Table 65: Aggregate Revenue Requirement (ARR) admitted for State for FY 2023-24 (Rs Crore) 103

Table 66: Admitted ARR for Wheeling Business for FY 2023-24 (Rs. Crore) ................................ 105

Table 67: Admitted ARR for Supply Business for FY 2023-24 (Rs. Crore) ..................................... 106

Table 68: Revenue at Existing and proposed Tariff submitted by Petitioner for FY 2023-24 (Rs.

……Crore) ................................................................................................................................. 107

Table 69: Gap/Surplus for FY 2023-24 as submitted by the Petitioner ............................................. 109

Table 70: Revenue including Rebate/ Incentives at Existing and Admitted Tariffs for FY 2023-24

……(Rs. Crore) .......................................................................................................................... 109

Table 71: Final ARR and Revenue from existing tariffs for FY 2023-24 (Rs Crore) ....................... 110

Table 72: Final ARR and Revenue from admitted tariffs for FY 2023-24 (Rs Crore) ...................... 110

Table 73 : Wheeling Charges submitted by the Petitioners for FY 2023-24 ..................................... 111

Table 74 : Voltage level-wise Cost Break-up of Sub transmission & Distribution Lines ................. 113

Table 75: Voltage level-wise cost of Transformer ........................................................................... 113

Table 76 : Identification of value of network at different each voltage level (Rs. Crore) ................. 113

Table 77 : Identification of network expenses (wheeling cost) at different voltage levels ............... 113

Table 78 : Sales at different voltage levels ........................................................................................ 114

Table 79 : Allocation of wheeling cost over Distribution System Users at 33 kV ............................ 114

Table 80 : Allocation of wheeling cost over Distribution System Users at 11 kV ............................ 114

Table 81 : Wheeling Charges at different Voltage levels .................................................................. 115

Table 82 : Weighted average cost of power purchase by the Licensee including cost of meeting the

…….Renewable Purchase Obligation ....................................................................................... 116

Table 83 : Voltage-wise losses .......................................................................................................... 117

Table 84 : Transmission Charges ....................................................................................................... 117

Table 85: Average Billing Rate (ABR) for FY 2023-24 at approved tariff (Rs./kWh) ..................... 117

Table 86 : Illustration of Computation of Cost for Cross Subsidy Surcharge (Rs. per unit) ............. 118

Table 87: Category wise Cross Subsidy Surcharge as per above Illustration (Rs. Per unit) ............. 118

ARR for FY 2023-24 and Retail Supply Tariff Order for FY 2023-24

Madhya Pradesh Electricity Regulatory Commission Page 6

Table 88 : Computation of Additional Surcharge Submitted by the Petitioners for FY 2023-24 ..... 120

Table 89 : Determination of Additional Surcharge for FY 2023-24 ................................................. 121

Table 90 : Green Energy Tariff proposed by the Petitioners for FY 2023-24 ................................... 122

Table 91 : Proposed Green Energy Tariff for RPO compliance of an entity FY 2023-24 ................ 128

Table 92 : Proposal for Green Energy Tariff for FY 2023-24 ........................................................... 129

Table 93 : Green Energy Charges ( for the consumers who wish to procure RE Power for the purpose

……..of reducing their carbon footprint and seeking Certification to this effect) approved by the

……..Commission for FY 2023-24 ........................................................................................... 131

Table 94 : Effective Cost of Pooled Power Purchase of RE sources ................................................. 133

Table 95 : Computation of Incremental Green Energy Charges for consumers for FY 2023-24 ...... 135

Table 96 : Green Energy Charges for FY 2023-24 ............................................................................ 136

Table 97 : Computation of voltage-wise cost of supply for the State for FY 2023-24...................... 145

Table 98: Cross-subsidy based on voltage-wise cost of supply for FY 2023-24 for the State ......... 146

Table 99: Comparison of tariff v/s overall average cost of supply ................................................... 147

Table 100 : List of Newspapers- Public Notice published by Petitioner ........................................... 164

Table 101 : Public Suggestions/Comments on the Petition ............................................................... 164

ARR for FY 2023-24 and Retail Supply Tariff Order for FY 2023-24

Madhya Pradesh Electricity Regulatory Commission Page 7

List of Abbreviations

A&G

Administrative and General Expenses

AB Cable

Aerial Bunched Cable

APTEL

Appellate Tribunal for Electricity

ARR

Aggregate Revenue Requirement

AS

Additional Surcharge

AT&C

Aggregate Technical and Commercial

ATPS

Amarkantak Thermal Power Station

BPSA

Bulk Power Supply Agreement

CAGR

Compounded Annual Growth Rate

CEA

Central Electrical Authority

CERC

Central Electricity Regulatory Commission

CFA

Cash Financial Assistance

CGS

Central Generating Station

CHPS

Chambal Hydro Power Scheme

COD

Commercial Date of Operation

CUF

Capacity Utilisation Factor

CPP

Captive Power Plants

CSD

Consumer Security Deposit

CSS

Cross Subsidy Surcharge

CTPS

Chandrapur Thermal Power Station

CWIP

Capital Works in Progress

DA

Dearness Allowance

DBST

Differential Bulk Supply Tariff

DISCOM

Distribution Company

DSM

Deviation Settlement Mechanism

DTR

Distribution Transformer

DVC

Damodar Valley Corporation

EHT

Extra High Tension

ER

Eastern Region

FPPAS

Fuel and Power Purchase Adjustment Surcharge

FCA

Fuel Cost Adjustment

FY

Financial Year

GFA

Gross Fixed Asset

GoI

Government of India

GoMP

Government of Madhya Pradesh

GPP

Gas Power Plant

GST

Goods and Services Tax

HP

Horse Power

HPS

Hydro Power Station

HT

High Tension

IDC

Interest During Construction

ARR for FY 2023-24 and Retail Supply Tariff Order for FY 2023-24

Madhya Pradesh Electricity Regulatory Commission Page 8

IEX

Indian Energy Exchange

IND-AS

Indian Accounting Standards

ISPS

Indira Sagar Power Station

IPDS

Integrated Power Development Scheme

IPP

Independent Power Producer

KAPS

Kakrapar Atomic Power Station

kV

kilo Volt

kVA

kilo Volt Ampere

kVAh

kilo Volt Ampere hour

kW

kilo Watt

kWh

kilo Watt hour

LED

Light Emitting Diode

LT

Low Tension

MD

Maximum Demand

MOD

Merit Order Despatch

MP

Madhya Pradesh

MPERC

Madhya Pradesh Electricity Regulatory Commission

MPPGCL or

MP Genco

Madhya Pradesh Power Generating Company Limited

MPPMCL or

MP Transco

MP Power Management Company Limited

MPPTCL

Madhya Pradesh Power Transmission Company Limited

MPSEB

Madhya Pradesh State Electricity Board

MTPS

Mejia Thermal Power Plant

MU

Million Unit

MVA

Mega Volt Ampere

MW

Mega Watt

MYT

Multi-Year Tariff

NHDC

Narmada Hydroelectric Development Corporation

NPS

New Pension Scheme

NTPC

NTPC Limited

O&M

Operation & Maintenance

OA

Open Access

OHP

Omkareshwar Hydro Project

PAF

Plant Availability Factor

PF

Provident Fund

PGCIL

Power Grid Corporation of India Ltd.

PLF

Plant Load Factor

PoC

Point of Connection

PPA

Power Purchase Agreement

PPCA

Power Purchase Cost Adjustment

PTR

Power Transformer

PWW

Public Water Works

PXIL

Power Exchange India Limited

ARR for FY 2023-24 and Retail Supply Tariff Order for FY 2023-24

Madhya Pradesh Electricity Regulatory Commission Page 9

R&M

Repair & Maintenance

RBI

Reserve Bank of India

RSD

Reserve Shut Down

RDSS

Revamped Distribution Sector Scheme

RGGVY

Rajiv Gandhi Grameen Vidyutikaran Yojana

RoE

Return on Equity

RPO

Renewable Purchase Obligation

SAC

State Advisory Committee

SBI

State Bank of India

SEZ

Special Economic Zone

SGTPS

Sanjay Gandhi Thermal Power Station

SLDC

State Load Despatch Centre

SSP

Sardar Sarovar Project

STPS

Super Thermal Power Station

TAPS

Tarapur Atomic Power Station

TBT

Terminal Benefit Trust

TMM

Technical Minimum

ToD

Time of Day

TPS

Thermal Power Station

TP

Tariff Policy

UDAY

Ujwal DISCOM Assurance Yojana

UMPP

Ultra Mega Power Plant

UI

Unscheduled Interchange

VAT

Value Added Tax

WR

Western Region

WRPC

Western Regional Power Committee

ARR for FY 2023-24 and Retail Supply Tariff Order for FY 2023-24

Madhya Pradesh Electricity Regulatory Commission Page 10

A1: ORDER

(Passed on this 28

th

Day of March, 2023)

1.1 This order is in response to the Petition No. 84 of 2022 jointly filed by Madhya Pradesh Poorv

Kshetra Vidyut Vitaran Company Limited, Jabalpur, Madhya Pradesh Paschim Kshetra

Vidyut Vitaran Company Limited, Indore, and Madhya Pradesh Madhya Kshetra Vidyut

Vitaran Company Limited, Bhopal (hereinafter individually referred to as East DISCOM,

West DISCOM and Central DISCOM, respectively, and collectively referred to as DISCOMs

or Distribution Licensees or Licensees or the Petitioners), and MP Power Management

Company Limited, Jabalpur (hereinafter referred as the MPPMCL or collectively with

DISCOMs referred to as the Petitioners) before Madhya Pradesh Electricity Regulatory

Commission (hereinafter referred to as MPERC or the Commission). This Petition has been

filed under the provisions of “Madhya Pradesh Electricity Regulatory Commission (Terms

and Conditions for Determination of Tariff for Supply and Wheeling of Electricity and

Methods and Principles for Fixation of Charges) Regulations, 2021 and amendments thereof

{RG-35(III) of 2021}” {hereinafter referred to as the MYT Regulations, 2021 or

Regulations}.

1.2 The Petitioners jointly filed a Petition bearing Petition No. 84 of 2022 on 30

th

November,

2022. The motion hearing on the Petition was held by the Commission on 06

th

December,

2022, vide which the Commission admitted the Petition and directed the Petitioners to submit

draft public notice for approval of the Commission.

1.3 The Commission vide letter dated 22

nd

December, 2022 sought clarification/ information to

fill data gaps, based on the scrutiny of the Petition. Thereafter, the Commission vide letter

dated 28

th

December, 2022 received communications from Petitioners for extension of time

by 15 days for submission of additional information and reply to fill data gaps. The

Commission vide letter dated 03

rd

January, 2023 allowed 7 days additional time for furnishing

the additional information to fill data gaps.

1.4 The Petitioners submitted the consolidated response to fill data gaps by way of clarifications

and additional information vide letter dated 13

th

January, 2023. The Petitioners furnished

another submission vide letter dated 28

th

February, 2023 relating to Metro Rail Tariff,

Wheeling Charges, Peak ToD Slots and Green Energy Tariff.

1.5 The Commission vide letter dated 21

st

December, 2022, directed the Petitioners to publish the

public notice as approved by the Commission in Hindi and English in the prominent

newspapers of the State for inviting objections /comments/suggestions from the stakeholders

on the subject Petition (Petition No. 84 of 2022) by 16

th

January, 2023. Accordingly, the

Petitioners published the public notice in the following newspapers as shown in the table

below:

ARR for FY 2023-24 and Retail Supply Tariff Order for FY 2023-24

Madhya Pradesh Electricity Regulatory Commission Page 11

Table 1 : List of Newspapers- Public Notice published by the Petitioners

Newspaper

Language

Dainik Bhaskar, Jabalpur

Hindi

Dainik Bhaskar, Sagar

Hindi

Deshbandhu, Satna

Hindi

Hitvada, Jabalpur

English

Nai Duniya, Indore

Hindi

Times of India, Indore

English

Peoples Samachar, Bhopal

Hindi

Dainik Bhaskar, Bhopal

Hindi

Navbharat, Gwalior

Hindi

Raj Express, Gwalior

Hindi

Times of India, Bhopal

English

1.6 In response to public notice, the Commission received 132 comments (East DISCOM: 44

Nos., West DISCOM: 63 Nos., Central DISCOM: 25 Nos.) from different stakeholders. The

Commission scheduled Public Hearings on 23

rd

January, 2023 for East DISCOM, 24

th

January, 2023 for West DISCOM and 25

th

January, 2023 for Central DISCOM through video

conferencing and heard the objections/comments/suggestions of stakeholders.

1.7 Details of objections/suggestions/comments received and response thereon from the

Petitioners alongwith views of the Commission are given in Chapter ‘A8: Public Objections/

suggestions and Comments on Petition’ of this order.

Disclaimer for Rounding

1.8 In this Order certain numbers as a whole, upto several decimal places have been rounded up

or down. Therefore, there may be discrepancies between the totals of the individual numbers

shown in the tables upto 2 decimal places and numbers given in the corresponding analyses

in the text of this order.

Snapshot of Petition

1.9 The Petitioners through instant Petition have submitted the Revised ARR for FY 2023-24 and

tariff proposal for FY 2023-24. The Petitioners have prayed to approve the net ARR of Rs

49,530 Crore and the revenue gap of Rs. 1,537 Crore for FY 2023-24 and to recover the same

through a tariff hike of 3.20%. Summary of the Tariff proposal as submitted by the Petitioners

for FY 2023-24 is as follows:

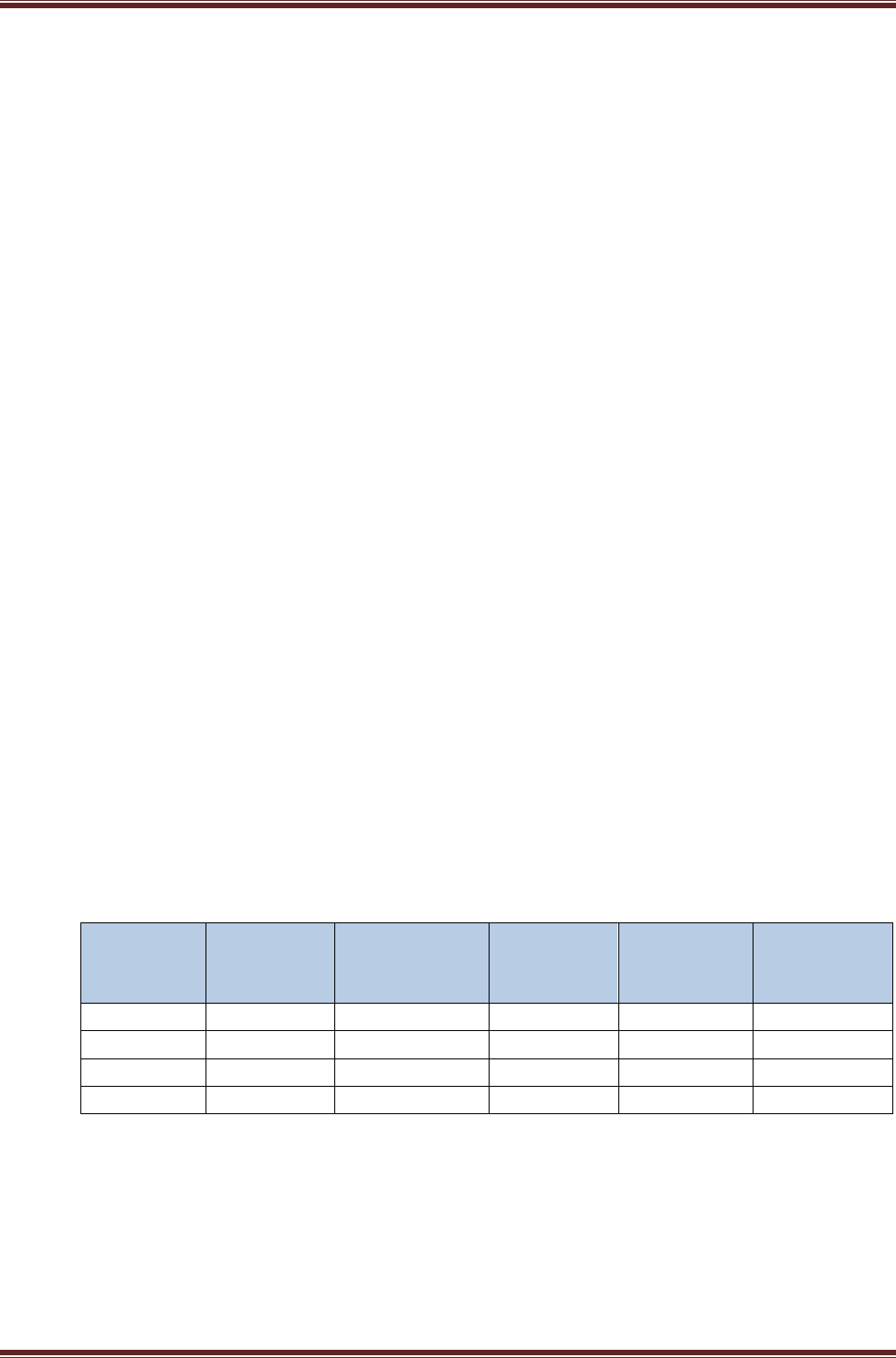

Table 2 : Summary of Tariff proposal for FY 2023-24 as submitted by Petitioners (Rs. Crore)

Particulars

East

DISCOM

West

DISCOM

Central

DISCOM

State

Aggregate Revenue Requirement

13,820.73

19,328.69

16,380.40

49,529.81

Revenue from sale of power as per

existing tariff

13,395.46

18,726.88

15,869.98

47,992.32

Revenue Gap for FY 2023-24

425.26

601.81

510.42

1,537.49

ARR for FY 2023-24 and Retail Supply Tariff Order for FY 2023-24

Madhya Pradesh Electricity Regulatory Commission Page 12

State Advisory Committee

1.10 The Commission convened a meeting of State Advisory Committee (SAC) on 30

th

January,

2023 through video conferencing. SAC members provided valuable suggestions on the instant

Retail Tariff Petition including suggestions pertaining to sales projections, treatment of

surplus energy, concept of green energy tariff, terms and conditions of tariff, etc. The

Commission has taken due cognisance of these issues while determining the ARR and Tariff

for FY 2023-24.

Energy Accounting, Meterisation and technical & commercial loss reduction

1.11 The Commission has been emphasising the importance of energy accounting and meterisation

from time to time separately and through previous Tariff Orders. Need for proper Energy

Accounting and Energy Audit at various levels such as sub-stations, distribution feeders and

distribution transformers as well as at the consumer end was also impressed upon the

DISCOMs so as to provide reliable data about the actual level of technical and commercial

losses. DISCOMs were directed to prepare and implement appropriate loss reduction

strategies and schemes. Meterisation at various levels of the distribution network such as

Feeder/ DTR and consumer metering is of prime importance to identify high loss areas and

to take action to curb losses. The DISCOMs have achieved 100% meterisation of the domestic

connections in urban area but the progress in DTR and consumer metering in rural areas is

not satisfactory. There appears to be substantial progress with regard to Feeder meterisation,

while meterisation of agricultural DTRs remains neglected by DISCOMs. With regard to

individual un-metered domestic connections in rural areas, West DISCOM has almost

completed the meterisation, whereas, East and Central DISCOMs have unmetered Domestic

Rural connections upto the level of 8.41% and 13.61%, respectively. For East and Central

DISCOMs, the Commission has taken a serious note on the poor progress of meterisation in

this category and is of the opinion that concerted efforts need to be made to account for the

energy at all stages including the Rural Domestic connections. The first step to do so is to

meterise all the remaining connections. The energy accounting needs to be carried out on a

system driven approach on regular basis. The Commission has also observed that there are

number of existing Feeder meters, which are lying defective and need prompt replacements.

The status as per periodic reports submitted by DISCOMs with regard to meterisation of un-

metered rural domestic connections and agricultural predominant DTRs up to December,

2022 is given below:

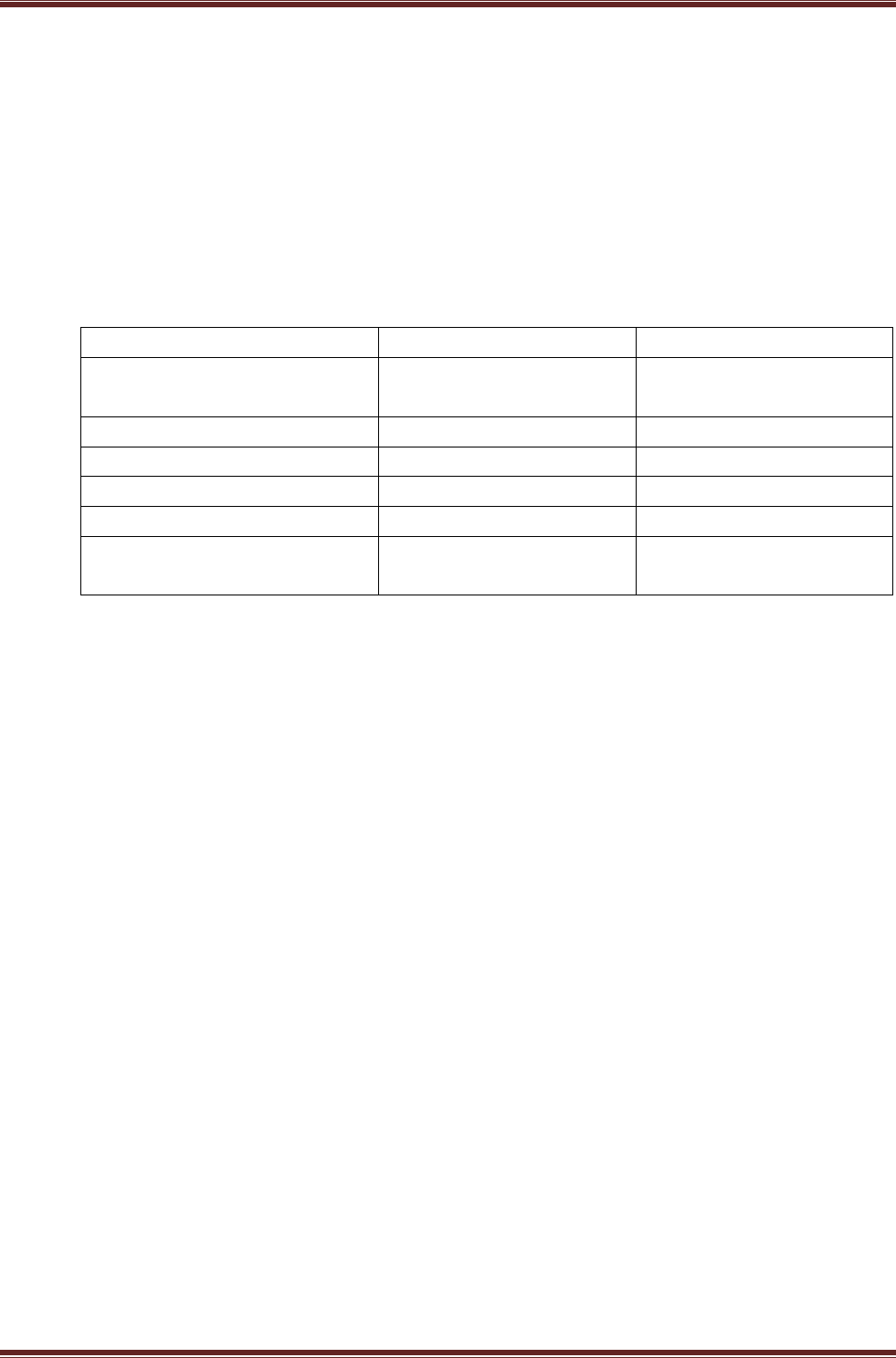

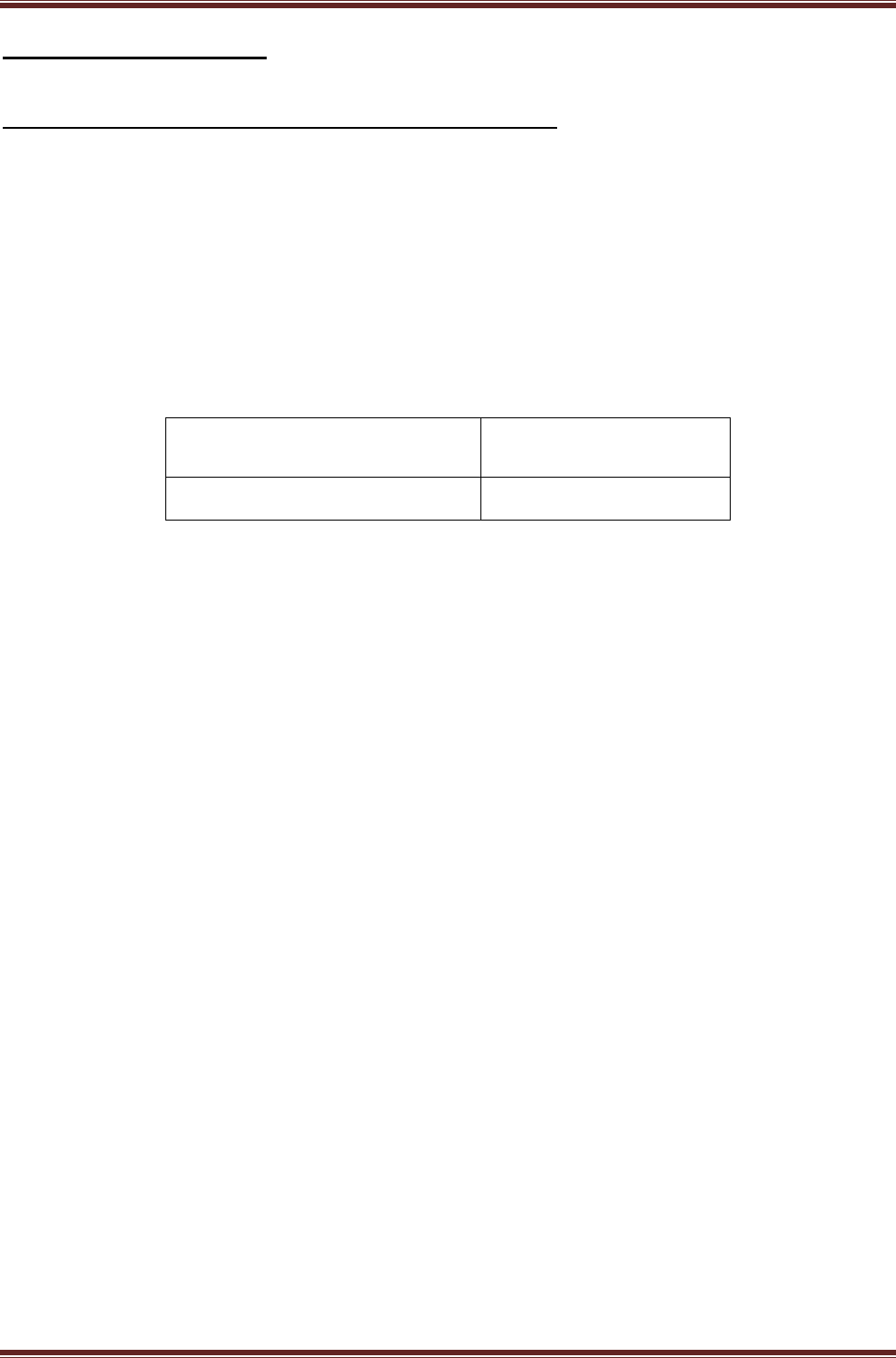

Table 3: Status of meterisation of un-metered rural domestic consumers

DISCOM

Domestic Rural

Total no. of

connections

No. of un-metered

connections

Percentage (%)

Un-metered

East DISCOM

33,43,261

2,81,139

8.41%

West DISCOM

23,03,806

22,123

0.96%

Central DISCOM

20,29,150

2,76,244

13.61%

State

76,76,217

5,79,506

7.55%

ARR for FY 2023-24 and Retail Supply Tariff Order for FY 2023-24

Madhya Pradesh Electricity Regulatory Commission Page 13

Table 4: Status of meterisation of agricultural DTRs

DISCOMs

Agricultural DTR

Total no. of Pre-

Dominant

Agricultural DTRs

No. of DTRs

provided with

meters

Percentage (%) of

DTRs provided

with meters

East DISCOM

1,11,890

11,909

10.64%

West DISCOM

1,95,584

36,231

18.52%

Central DISCOM

2,86,057

64,139

22.42%

State

5,93,531

1,12,279

18.92%

1.12 The Commission would like to emphasize that the directive for meterisation of agriculture

predominant DTRs is an interim arrangement till meters on all individual agriculture

connections are provided. The Commission is of the firm view that all consumers should be

metered individually. The present regime of billing on benchmark consumption to either

domestic or agriculture consumers provides no incentive for energy saving by the consumers

and it makes accounting of actual losses impossible. The Commission has noted that the rate

of meterisation of Agriculture DTRs is extremely slow and it needs to be enhanced. Without

proper metering system in place, it is not possible to assess the demand and to perform energy

audit of the agriculture consumers. The Commission, therefore, directed the DISCOMs to

expedite feeder meterisation including replacement of defective meters and DTR meterisation

on priority basis. There is also a need to segregate Technical and Commercial losses.

1.13 The purpose of providing meters on agriculture DTRs is to assess the consumption of flat rate

agriculture consumers and perform energy audit in order to have a proper data on Distribution

losses. The Commission desires that the DISCOMs should perform energy audit on the

agriculture DTRs where the meters have already been installed. DISCOMs are also identified

as designated consumers under Perform, Achieve and Trade (PAT) scheme within the

framework of Energy Conservation Act, 2001. DISCOMs are required to conduct energy

audit as per Bureau of Energy Efficiency (BEE) (Manner and Intervals for Conduct of Energy

Audit in Electricity Distribution Companies) Regulations, 2021. It is expected that East and

Central DISCOMs will also take all measures to comply with energy audit requirements laid

down under the Energy Conservation Act, 2001.

1.14 In the earlier Tariff Orders, the Commission had directed the Petitioners to make concerted

efforts to reduce the distribution losses in line with the loss trajectory specified by the

Commission. The Commission has provided sufficient time to the DISCOMs and specified

the loss reduction trajectory with achievable targets. The loss reduction trajectory specified

in the MYT Regulations, 2021 for the period from FY 2022-23 to FY 2026-27 is given in the

following table:

Table 5: Distribution Loss Trajectory specified in the Regulations

DISCOMs

FY 2022-23

FY 2023-24

FY 2024-25

FY 2025-26

FY 2026-27

East DISCOM

15.75%

15.50%

15.25%

15.00%

14.75%

West DISCOM

14.75%

14.50%

14.25%

14.00%

13.75%

Central DISCOM

16.75%

16.50%

16.25%

16.00%

15.75%

ARR for FY 2023-24 and Retail Supply Tariff Order for FY 2023-24

Madhya Pradesh Electricity Regulatory Commission Page 14

1.15 Against the aforesaid targets, the actual loss level for FY 2021-22 reported by the DISCOMs

in the Tariff Petition is as follows:

Table 6: Actual Distribution Loss for FY 2021-22

DISCOMs

FY 2021-22

East DISCOM

27.40%

West DISCOM

11.61%

Central DISCOM

24.67%

1.16 The Commission appreciates the performance of West DISCOM for achieving lower

Distribution losses in comparison with the loss trajectory specified by the Commission. On

the other hand, it is observed that the loss levels in other two DISCOMs are much higher than

the loss trajectory specified and needs immediate corrective steps. The stakeholders, in their

objections, have also pointed out and shown concern over the high loss level of the DISCOMs.

It has been submitted by stakeholders that the higher loss level is adversely affecting the

financial viability of DISCOMs as well as services to be delivered to their consumers. The

Commission has allowed only normative losses in the Tariff Order, so that consumers are not

burdened on account of the inefficiencies of the Distribution Licensees.

1.17 In order to bail out the DISCOMs from high debt and to ensure financial turnaround of the

DISCOMs, the Government of India had launched Ujwal DISCOM Assurance Yojana

(UDAY). Madhya Pradesh also participated in the UDAY scheme and committed to reduce

AT&C losses as per prescribed targets in a time bound manner. The Commission had admitted

the capital investment schemes of the DISCOMs in the past years for reduction of losses. The

Government of India is also providing financial and technological support to the DISCOMs

through various schemes. However, it appears that the Central and East DISCOMs are lacking

in implementation of these schemes resulting in failure to reduce the distribution losses to

desired levels.

1.18 One of the reasons for high losses is unmetered connections and improper energy accounting.

Large number of unmetered connections and stopped/defective meters with slow pace of

replacement is resulting in lower billing efficiency. Inadequate energy audit system at feeders

as well as DTR level is not allowing to fix the accountability and hence, system is running as

usual. In the last Tariff Order, the Commission had directed the DISCOMs to install meters

on the remaining unmetered predominant agricultural DTRs for proper energy accounting and

for recording consumption by the agricultural pumps. However, the progress in this regard is

still far from satisfactory. The East and Central DISCOMs also need to focus on meterisation

of rural unmetered Domestic connections. The Commission would like to draw attention of

the State Government in this regard and emphasizes the need to implement a concrete program

to achieve the targeted loss level in a time bound manner for making the DISCOMs financially

viable.

1.19 The Commission has noted that the Government of India has launched Revamped Distribution

Sector Scheme (RDSS) with an objective of improving quality, reliability and affordability of

Power Supply to consumers through a financially sustainable and operationally efficient

distribution sector. The scheme has targeted to reduce AT&C losses to pan-India levels of 12-

ARR for FY 2023-24 and Retail Supply Tariff Order for FY 2023-24

Madhya Pradesh Electricity Regulatory Commission Page 15

15% and to reduce ACS & ARR gap to zero by FY 2024-25. This scheme is reforms based

and result linked. DISCOMs of the State are participating in the scheme and committed to

reduce AT&C losses as per prescribed targets under the approved Scheme for Madhya

Pradesh in a time bound manner. The Commission has admitted the capital investment plan

under RDSS and directed the Petitioners that outcome of the capital investment under RDSS

be monitored closely and that envisaged results through capital investment are met in a timely

manner.

Aggregate Revenue Requirement of DISCOMs

1.20 The Commission has determined the revised ARR and Retail Supply Tariff for FY 2023-24

for the DISCOMs in this order as shown below in the table:

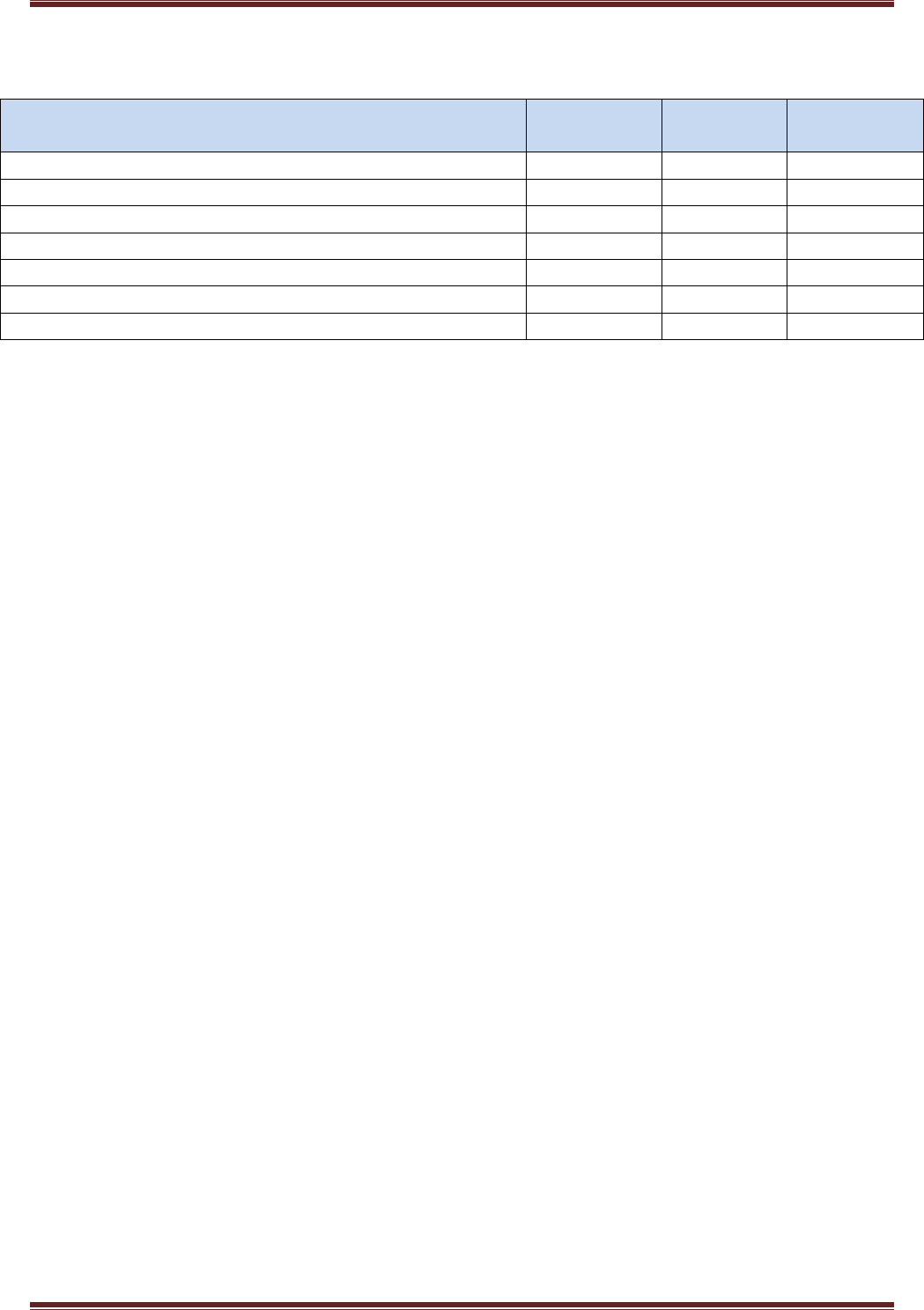

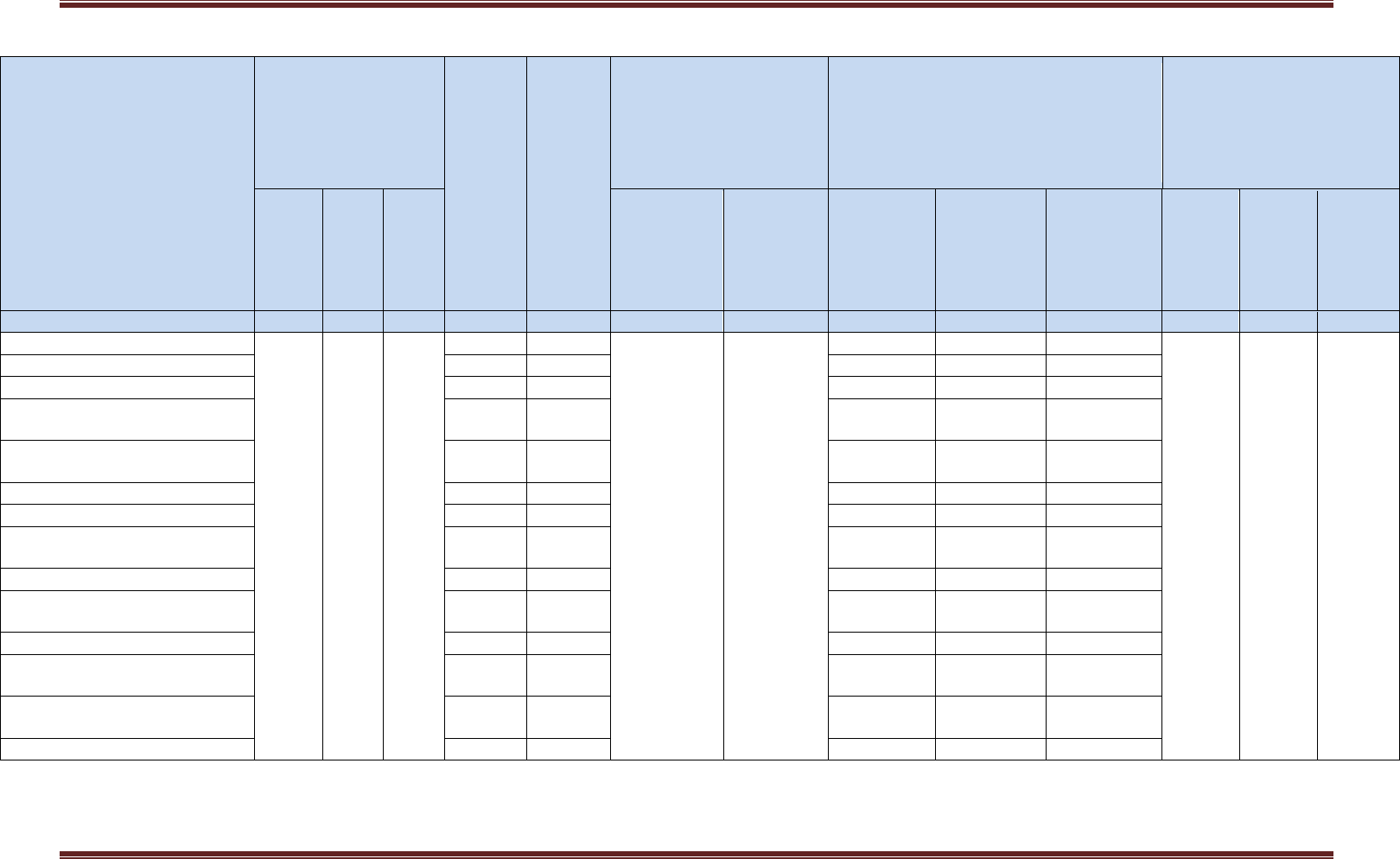

Table 7: ARR admitted by the Commission for FY 2023-24 (Rs. Crore)

Particulars

East DISCOM

West DISCOM

Central DISCOM

State

Claimed

Admitted

Claimed

Admitted

Claimed

Admitted

Claimed

Admitted

Power Purchase Cost including

Inter-State Transmission Charges

7,694.38

9,163.32

16,855.22

14,743.63

10,472.32

11,737.90

35,021.92

35,644.84

Intra-State Transmission

including SLDC Charges

1,288.68

1,290.73

1,543.98

1,544.05

1,502.35

1,504.67

4,335.01

4,339.45

O&M Expenses

1,907.31

1,875.67

1,812.03

1,744.43

1,801.31

1,828.55

5,520.64

5,448.66

Depreciation

295.86

241.02

345.77

141.99

395.36

276.97

1,036.98

659.98

Interest & Finance Charges

On Project Loans

281.95

281.10

145.45

148.94

348.39

366.90

775.78

796.95

On Working Capital Loans

78.28

68.43

17.15

10.58

39.51

57.81

134.95

136.81

On Consumer Security Deposit

53.19

42.83

68.29

85.25

58.26

59.09

179.73

187.17

Return on Equity

234.51

231.54

174.91

172.41

277.25

270.16

686.67

674.11

Bad & Doubtful Debts

2.00

0.00

2.00

0.00

2.00

0.00

6.00

0.00

Total Expenses Admitted

11,836.16

13,194.64

20,964.78

18,591.27

14,896.74

16,102.06

47,697.68

47,887.97

Less: Other income and Non-

Tariff Income

186.01

132.98

202.80

147.66

183.31

142.65

572.12

423.29

Total ARR Admitted

11,650.15

13,061.66

20,761.98

18,443.60

14,713.43

15,959.42

47,125.57

47,464.68

Revenue at Existing Tariff

13,395.46

13,265.45

18,726.88

18,731.47

15,869.98

16,200.87

47,992.32

48,197.80

Revenue Gap/(Surplus) at

Existing Tariff

(1,745.32)

(203.79)

2,035.11

(287.87)

(1,156.54)

(241.45)

(866.76)

(733.12)

1.21 From above, it can be observed that the Commission has admitted standalone ARR (excluding

true up of previous years) of Rs. 47,464.68 Crore for FY 2023-24 against the Petitioners claim

of Rs. 47,125.57 Crore. The Commission in approval of ARR has undertaken thorough review

of the Petitioners submission and has admitted only the prudent expenses in accordance with

the provision of the MYT Regulations, 2021 and amendments thereof. Instead of considering

actual loss level, the Commission allowed ARR on normative loss level specified by the

Commission, so that inefficiency of the Distribution Licensee is not passed on to the

Consumers. The revenue for FY 2023-24 at existing tariff is Rs. 48,197.80 Crore.

Accordingly, on standalone basis for FY 2023-24, the DISCOMs are in revenue surplus of

Rs. 733.12 Crore. The Commission has recently approved following True Ups Order for

MPPGCL, MPPTCL and DISCOMs as follows:

ARR for FY 2023-24 and Retail Supply Tariff Order for FY 2023-24

Madhya Pradesh Electricity Regulatory Commission Page 16

(i) Revenue Gap of Rs. 1,648.21 Crore in True Up of ARR of FY 2021-22 of DISCOMs

approved vide order dated 20

th

March, 2023.

(ii) Revenue Gap of Rs.762.11 Crore in True Up of ARR of FY 2021-22 of MP Power

Transmission Company Ltd. approved vide order dated 07

th

March, 2023.

(iii)Revenue Surplus of Rs. 1,026.52 Crore in True Up of ARR of FY 2020-21 of MP

Genco approved vide order dated 30

th

December, 2022.

1.22 These true-up amounts (Surplus/Gap) have been admitted by the Commission after carrying

out due diligence and the same needs to be considered while approving ARR and tariff for

FY 2023-24 to enable recovery of the same for DISCOMs. Therefore, considering the above

true ups, the revenue gap at existing tariff for FY 2023-24 works out as Rs.794.87 Crore. In

order to allow recovery of the same, the Commission in this Order has allowed a tariff hike

of 1.65% against the Petitioners claim of 3.20%.

1.23 The ARR admitted for the DISCOMs for FY 2023-24, Revenue at Existing Tariff and

Proposed/Admitted Tariff is shown in the following table:

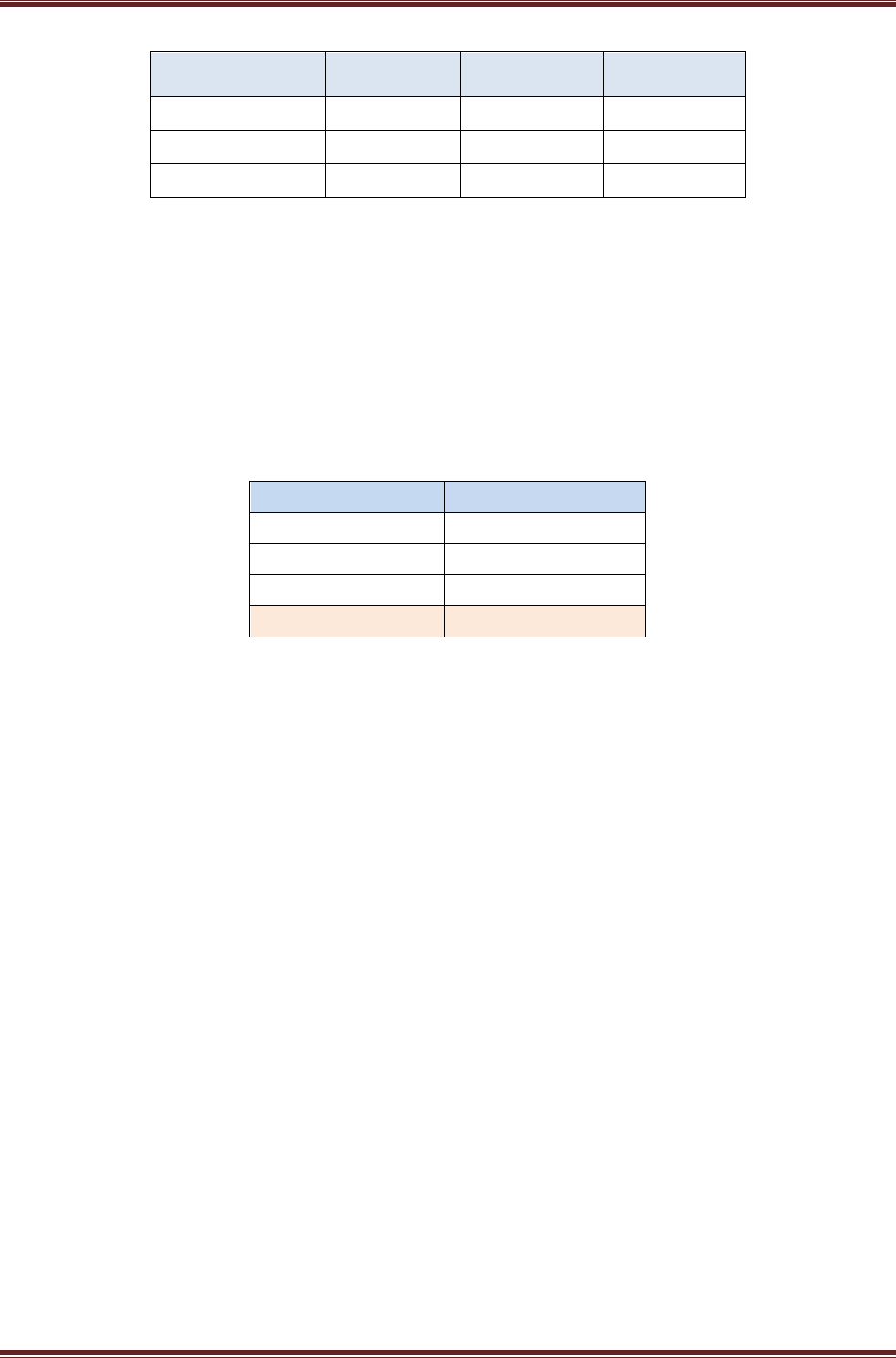

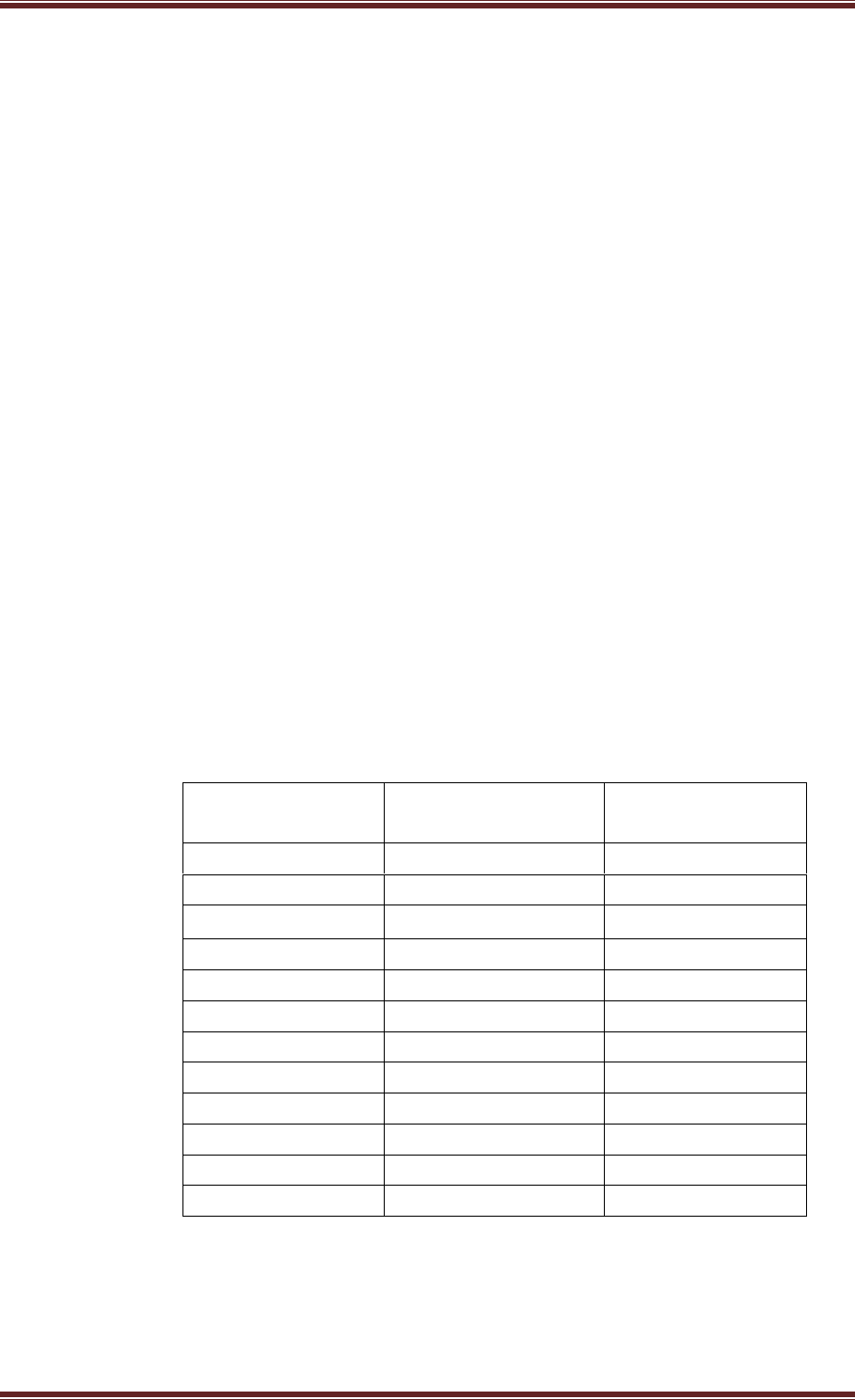

Table 8: ARR admitted and Revenue at Existing/Approved Tariff for FY 2023-24 (Rs. Crore)

Particulars

East DISCOM

West DISCOM

Central DISCOM

State

Claimed

Admitted

Claimed

Admitted

Claimed

Admitted

Claimed

Admitted

Total ARR (excluding True-up)

11,650.15

13,061.66

20,761.98

18,443.60

14,713.43

15,959.42

47,125.57

47,464.68

Revenue Gap of MP Transco

True-up of FY 2020-21

72.98

72.98

22.25

22.25

48.96

48.96

144.19

144.19

Revenue Surplus of MP Genco

True-up of FY 2020-21

(338.61)

(342.17)

(338.61)

(342.17)

(338.61)

(342.17)

(1,015.83)

(1,026.52)

Revenue Gap of MP DISCOMs

True-up of FY 2021-22

2,436.21

455.58

(1,116.94)

635.80

1,956.61

556.83

3,275.88

1,648.21

Revenue Gap of MP Transco

True-up of FY 2021-22

-

232.50

-

284.08

-

245.53

-

762.11

Total ARR (including True-up)

13,820.73

13,480.54

19,328.69

19,043.56

16,380.39

16,468.57

49,529.81

48,992.66

Revenue at Existing Tariff

13,395.46

13,265.45

18,726.88

18,731.47

15,869.98

16,200.87

47,992.32

48,197.80

Revenue Gap at Existing Tariff

425.26

215.09

601.81

312.09

510.42

267.69

1,537.49

794.87

Revenue at Proposed Tariff

13,820.73

13,480.54

19,328.69

19,043.56

16,380.39

16,468.57

49,529.81

48,992.66

Revenue Gap/(Surplus) at

Proposed Tariff

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

1.24 The Commission would like to highlight here that the utmost care is taken by the Commission

while approving the ARR, Retail Tariff, so that inefficiency of the DISCOMs is not passed

onto the consumers of the State. It is notable that in true up of FY 2021-22, the Petitioner had

claimed revenue gap of Rs. 3,275.88 Crore. However, the Commission after exercising

prudence check of the said claim and considering the stakeholders observations has admitted

revenue gap of Rs. 1,648.21 Crore, thereby disallowing expenses towards inefficiency of the

DISCOMs.

1.25 The Licensees are directed to keep in view the provision of relevant Regulations and ensure

compliance with performance criteria. They are also encouraged to avail incentives in terms

of R&M expenses and Return on Equity, which are available for better performance for

improving consumer services.

1.26 In case of grant of tariff subsidy by the State Government for consumers, action as mandated

ARR for FY 2023-24 and Retail Supply Tariff Order for FY 2023-24

Madhya Pradesh Electricity Regulatory Commission Page 17

under Section 65 of the Electricity Act, 2003 shall be ensured by all concerned and such

consumers shall be billed accordingly by the Distribution Licensees.

1.27 The Commission through 1

st

Amendment to MYT Regulations, 2021 has specified

mechanism for recovery of Fuel and Power Purchase Adjustment Surcharge (FPPAS) on

monthly basis so that uncontrollable costs on account of variations in the fuel and power

purchase charges are adjusted/recovered timely in accordance with the provisions of the

Electricity Act, 2003.

1.28 The Commission has made suitable provisions to fulfil the Renewable Purchase Obligations

(RPO) in the ARR of the DISCOMs as per relevant Regulations. The Petitioners are directed

to fulfil their RPOs accordingly.

1.29 The Commission in this order has determined the Green Energy Charges for consumers

availing Green Energy from Distribution Licensee only for the purpose of reducing their

carbon footprint and seeking Certification to this effect. Besides, Tariff has been determined

for Green Energy for consumers availing Green Energy from Distribution Licensee as per

MPERC (Co-generation and generation of electricity from Renewable sources of energy)

Regulations, 2021 and amendments thereof.

1.30 In compliance to directives given in the Judgment by Hon’ble APTEL, the Commission has

determined the ratio of Average Billing Rate to the Voltage-wise Cost of Supply (VCoS) for

various consumer categories based on the proposals submitted by the DISCOMs. It may be

mentioned here that the data/ information for working out the VCoS needs to be further

validated to get a fair and correct picture. In absence of requisite data the VCoS vis-a-vis cross

subsidy percentage worked out in this Tariff Order is only indicative in nature.

Implementation of the Order

1.31 The Distribution Licensees must take immediate steps to implement this order after giving

seven (7) days Public Notice in prominent newspapers having State wide circulation, in

accordance with Regulation 1.30 of MPERC (Details to be furnished and fee payable by

licensee or generating company for determination of tariff and manner of making application)

Regulations, 2004, as amended from time to time. The tariff determined by this order shall

take effect only after seven (7) days from the date of such publication and bills shall be issued

accordingly. The tariff determined by this order shall be applicable until amended or modified

by an order of this Commission.

1.32 The detailed order provides for the grounds and reasons of determining the ARR, discusses

the functional and financial performance of three DISCOMs and includes a section dealing

with the status report on compliance of the Commission’s Directives as well as responses of

the Distribution Licensees thereto along with the Commission’s observations on the

suggestions/objections/comments received from various stakeholders on ARR and Tariff

proposal. The Commission directs the Petitioners that this order be implemented along with

directions given and conditions mentioned in the detailed order and in the tariff schedules

annexed with (Annexure-2 and Annexure-3) this order. It is further ordered that the DISCOMs

ARR for FY 2023-24 and Retail Supply Tariff Order for FY 2023-24

Madhya Pradesh Electricity Regulatory Commission Page 18

are permitted to issue bills to the consumers in accordance with the provisions of this Tariff

Order and applicable Regulations.

Sd/-

Sd/-

(Gopal Srivastava)

(S.P.S. Parihar)

Member (Law)

Chairman

Date: 28

th

March, 2023

Place: Bhopal

ARR for FY 2023-24 and Retail Supply Tariff Order for FY 2023-24

Madhya Pradesh Electricity Regulatory Commission Page 19

A2: AGGREGATE REVENUE REQUIREMENT FOR PETITIONERS

Sales Forecast

Sales forecast as submitted by the Petitioners

2.1 For projection of sales for FY 2023-24, the Petitioners have considered the past growth trends

for each consumer category as historical trend method has proved to be reasonably accurate

and well accepted method for estimating the load, number of consumers and energy

consumption. Further, submitted that as per Regulation 25.1 of MYT Regulations, 2021

category wise and slab wise sales are to be determined based on the actual/audited data of the

preceding three years. However, the preceding three years include COVID-19 year as well.

Hence, in order to normalize the abnormal effect of COVID-19 on sales projections, the

Petitioners have taken preceding five years data, i.e., form FY 2017-18 to FY 2021-22 and

the sales data of FY 2022-23 up to the month of August 2022.

2.2 Accordingly, category and slab wise actual data of the sale of electricity, number of

consumers, connected / contracted load, etc. as per the annual R-15 statement corresponding

to said period are taken and Compounded Annual Growth Rates (CAGR) of sales have been

computed from the past sales for each category and sub-category. The approach being

followed by the Petitioners is as follows:-

(a) Analyse 5-year, 4-year, 3-year and 2-year CAGRs and Year-on-Year growth rate in

Number of Consumers, Sales and Demand of each category and its sub-categories in

respect of Urban & Rural consumers separately

(b) After analysis of the data, appropriate / reasonable growth rates have been assumed for

future consumer forecasts from the past CAGRs of the Category/Sub-category by the

three DISCOMs.

(c) During the analysis, if an abnormal growth rate (high or low), relative to the current

trend is observed, then the same is normalized for the purpose of projection for ensuing

year.

(d) In cases where the past data shows a declining trend, a nil growth has been considered.

(e) The growth rate assumed is then applied on sales per consumer / sales per kW and

connected load while forecasting the connected load, number of consumers and sales

in each category/sub-category.

2.3 Further, the Petitioners submitted that they have considered the specific consumption, i.e.,

consumption per consumer and / or consumption per unit load which is the basic forecasting

variable and is widely used in load and energy sales forecasting. The basic intent in using this

model is that the specific consumption per consumer and / or consumption per unit load

captures the trends and variations in the usage of electricity over a growth cycle more

ARR for FY 2023-24 and Retail Supply Tariff Order for FY 2023-24

Madhya Pradesh Electricity Regulatory Commission Page 20

precisely. Further, this method has also been recommended by the CEA.

2.4 Details of the category-wise sales as projected by the Petitioners, is given in the table as

follows:

Table 9: Category wise sales projected by Petitioners for FY 2023-24 (MU)

Particulars

East

DISCOM

West

DISCOM

Central

DISCOM

State

LV-1: Domestic

6,043

6,328

6,599

18,970

LV-2: Non-Domestic

1,281

1,332

1,285

3,897

LV-3: Public Water Works & Street Light

409

536

457

1,402

LV-4 LT Industries

568

792

339

1,699

LV 5: Agriculture and Allied Activities

7,339

11,600

9,755

28,694

LV 6: E-Vehicle/ E-Rickshaws Charging Stations

0.13

0.16

0.18

0.47

LT Total

15,640

20,587

18,435

54,662

HV-1: Railway Traction

55.32

-

55.32

110.64

HV-2: Coal Mines

483

-

23

506

HV-3.1: Industrial

2,788

5,422

3,966

12,176

HV-3.2: Non-Industries

308

548

444

1,300

HV-4: Seasonal & Non-Seasonal

9

10

2

21

HV-5: Irrigation, Public Water Works and Other

than Agricultural

250

1,244

330

1,149

HV-6: Bulk Residential Users

237

32

155

1823

HV-7: Synchronization and Start-Up Power

1

24

3

28

HV 8: E-Vehicle/ E-Rickshaws Charging Stations

2

17

3

23

HT Total

4,133

7,297

4,982

16,412

Total Sales for State

19,773

27,884

23,417

71,074

Note :- As per Additional Submission made by the Petitioners Sales to Metro Rail is projected as 16

MU which has been considered by the Commission.

Commission’s Analysis on Sales forecast

2.5 The Commission has observed that the Petitioners have relied on the actual data pertaining to

FY 2017-18 to FY 2022-23 (up to August) for projection of number of consumers, connected

load and sales for FY 2023-24. In order to project number of consumers, connected load and

sales for FY 2023-24, the Commission has found it appropriate to consider last five years data

from FY 2016-17 to FY 2021-22 and FY 2022-23 (up to December).

2.6 Based on the actual data, the Commission has also computed projected connected load per

consumer and sales per unit load (kW) and / or demand (kVA) and sales per consumer.

2.7 Approach adopted by the Commission, for projection of number of consumers, connected

load and sales is as follows:

• Number of Consumers, Connected load / Contract Demand for FY 2023-24 have been

projected based on the analysis of corresponding data of last 5 years and considering

ARR for FY 2023-24 and Retail Supply Tariff Order for FY 2023-24

Madhya Pradesh Electricity Regulatory Commission Page 21

the appropriate CAGR.

• In order to have more realistic projections, the Commission has re-assessed the Sales

for FY 2022-23 considering 9 months actual data i.e April to December, 2022 and

estimated the sales for January to March, 2023 by considering the proportion of actual

energy sales in last 3 months (Jan – Mar 2022) with respect to actual energy sales

during first nine months of FY 2021-22 (April 2021 to December 2021). Using this

average proportion of sales, the Commission has extrapolated the actual energy sales

till the month of December 2022 for the full year to assess the revised estimated energy

sales for FY 2022-23. Thereafter, the Commission analysed category wise, sub-

category wise 5-Year CAGR, 4 Years CAGR, 3 Years CAGR, 2 Years CAGR and

Year-on-Year growth rate, compared the same with the growth rates considered by

the Petitioners for projections and considered appropriate growth rates for projection

of sales for FY 2023-24.

• For Categories LV-6 and HV-8 (Electric Vehicle and Charging Stations), wherein any

peculiar trend in growth rates has not been observed, the number of consumers,

connected load and sales have been projected as per Petitioners’ submission.

• For HV-1 (Railway Traction) and HV-9 (Metro Rail), Number of consumers,

connected load and sales have been considered as proposed by the Petitioners.

2.8 Based on above approach, the sales admitted for FY 2023-24 by the Commission is as follows:

Table 10: Category wise sales admitted by the Commission for State for FY 2023-24 (MUs)

Consumer Categories

East

DISCOM

West

DISCOM

Central

DISCOM

State

LV-1: Domestic

6,185.65

6,579.53

6,605.67

19,370.86

LV-2: Non-Domestic

1,177.36

1,446.49

1,351.83

3,975.68

LV-3: Public Water Works & Street Light

407.09

571.27

489.12

1,467.48

LV-4 LT Industries

483.94

772.88

364.88

1,621.70

LV 5: Agriculture and Allied Activities

7,285.47

11,566.55

10,125.32

28,977.33

LV 6: E-Vehicle/ E-Rickshaws Charging Stations

0.13

0.16

0.18

0.47

LT Total

15,539.63

20,936.88

18,937.00

55,413.51

HV-1: Railway Traction

55.32

0.00

55.32

110.64

HV-2: Coal Mines

489.51

0.00

21.52

511.03

HV-3.1: Industrial

2,869.15

3,836.44

3,303.60

10,009.19

HV-3.2: non-Industrial

318.47

485.98

416.51

1,220.96

HV-3.3: shopping malls

9.17

58.05

43.74

110.96

HV-3.4: Power Intensive Industries

98.89

1,547.50

803.32

2,449.72

HV-3: HT Industrial, Non-Industrial and

shopping malls

3,295.69

5,927.97

4,567.17

13,790.82

HV-4: Seasonal & Non-Seasonal

9.54

8.32

0.90

18.75

HV-5: Irrigation, Public Water Works and Other

than Agricultural

212.68

1,208.69

344.26

1,765.63

HV-6: Bulk Residential Users

249.72

39.83

157.58

447.13

ARR for FY 2023-24 and Retail Supply Tariff Order for FY 2023-24

Madhya Pradesh Electricity Regulatory Commission Page 22

Consumer Categories

East

DISCOM

West

DISCOM

Central

DISCOM

State

HV-7: Synchronization/ Start-Up Power

3.70

31.19

5.44

40.33

HV 8: E-Vehicle/ E-Rickshaws Charging Stations

2.10

17.27

3.35

22.71

HV-9: Metro Rail

0.00

8.09

7.81

15.90

HT Total

4,318.25

7,241.35

5,163.35

16,722.95

Total Sales for State (LT + HT)

19,857.89

28,178.23

24,100.35

72,136.47

Energy Balance

Petitioners’ Submission

2.9 The Petitioners submitted that for projecting the energy requirement for FY 2023-24, annual

sales have been converted into monthly sales using the sales profile actually observed in the

past five years including FY 2021-22 for each DISCOM.

2.10 Further, the Petitioners submitted that the Commission in the MYT Regulations, 2021 has

specified normative distribution loss levels for the MYT period from FY 2022-23 to FY 2026-

27. Whereas the actual losses for East, West and Central DSICOM for FY 2021-22 stands at

27.40%, 11.61% and 24.67%, respectively. However, for the instant Petition, the Petitioners

have considered normative Distribution Losses only as per MYT Regulations, 2021 for the

computation of Energy Requirement. The annual distribution loss trajectory is converted into

monthly loss trajectory based on the standard deviations of monthly losses from the

cumulative annual losses during the past 5 years. In this method, the actual monthly loss levels

and the cumulative annual losses of the DISCOMs for the past years are taken and standard

deviation of loss levels of each month from the cumulative annual average has been

calculated. The monthly standard deviations are then used to calculate the monthly loss levels

using the annual Distribution loss level trajectory specified by the Commission in MYT

Regulations, 2021.

2.11 The Intra-State Transmission Losses of 2.63% for FY 2021-22 as reported by MPPTCL to

MPPMCL have been considered for FY 2023-24. Further, Inter -State Transmission Losses

have been computed as per Regulation 10 of CERC (Sharing of Inter State Transmission

Charges and Losses) Regulations, 2020 in which it is specified that Inter-State transmission

(ISTS) losses shall be calculated on all India average basis for each week. The ISTS losses

for FY 2021-22 were 3.42%, on the same basis the Petitioners have considered 3.47% ISTS

losses for power stations under the Western, Northern & Eastern Region. which is based on

last 52 weeks moving average losses (17

th

October 2021 – 23

rd

October 2022) for FY 2023-

24.

2.12 Based on the above, the Petitioners have projected energy requirement for FY 2023-24 by

grossing up the projected sales by normative distribution losses and projected transmission

losses, as shown in the table below:

ARR for FY 2023-24 and Retail Supply Tariff Order for FY 2023-24

Madhya Pradesh Electricity Regulatory Commission Page 23

Table 11: Energy Requirement proposed by Petitioners for FY 2023-24 (MU)

Particulars

Unit

East

DISCOM

West

DISCOM

Central

DISCOM

State

LT

MU

15,640

20,587

18,434

54,662

HT

MU

4,133

7,297

4,982

16,412

Sales

MU

19,773

27,884

23,417

71,074

Distribution loss

%

15.50%

14.50%

16.50%

15.95%

Distribution loss

MU

3,615

5,215

4,655

13,485

Energy Requirement at DISCOM

Boundary

MU

23,388

33,099

28,071

84,559

Intra-State Transmission Losses

%

2.63%

2.63%

2.63%

2.63%

Intra-State Transmission Losses

MU

632

894

758

2,284

Energy Requirement at State Boundary

MU

24,020

33,993

28,829

86,843

Inter-State Transmission Losses

MU

419

592

503

1,513

Ex-Bus Energy Requirement

MU

24,439

34,585

29,332

88,356

Commission’s Analysis

2.13 For arriving at the total quantum of energy requirement, the Commission has considered

annual sales grossed up by specified loss levels as per the calculations shown in subsequent

paragraphs/ tables. Further, to compute the monthly energy requirement for FY 2023-24,

monthly sales profile which is based on the actual sales profile of last five years, as submitted

by the Petitioners, has been considered.

2.14 The distribution loss level trajectory as specified for FY 2023-24 in the MYT Regulations,

2021 is given in the table below:

Table 12: Loss targets as per Regulations (in %)

DISCOMs

FY 2023-24

East

15.50%

West

14.50%

Central

16.50%

2.15 The Commission has considered the distribution losses as specified in the MYT Regulations,

2021 for projecting the energy requirement for FY 2023-24. The Commission has not

considered any deviation in the monthly losses as proposed by the Petitioner and has

considered the normative losses as specified in the MYT Regulations, 2021 for every month.

2.16 Further, the Commission has considered the Inter-State transmission losses as per monthly

actual PGCIL losses on all India Average basis considering the weekly losses for the period

of 6

th

February, 2022 to 30

th

January 2023 (52-weeks data).

2.17 Intra-State transmission losses have been considered as per actual losses for FY 2021-22 i.e.,

2.63% as submitted by MPPTCL in their annual report of regulatory compliance for FY 2021-

22.

ARR for FY 2023-24 and Retail Supply Tariff Order for FY 2023-24

Madhya Pradesh Electricity Regulatory Commission Page 24

2.18 The energy balance / Energy requirement computed based on admitted sales and normative

losses for FY 2023-24, is shown in the following tables:

Table 13: Energy requirement admitted by the Commission for FY 2023-24

Particular

East

DISCOM

West

DISCOM

Central

DISCOM

State

Total Sales (MU)

19,857.89

28,178.23

24,100.35

72,136.47

Distribution loss (%)

15.50%

14.50%

16.50%

15.45%

Distribution loss (MU)

3,642.57

4,778.76

4,762.34

13,183.68

Input at T-D interface (MU)

23,500.46

32,956.99

28,862.69

85,320.15

Intra State Transmission loss (%)

2.63%

2.63%

2.63%

2.63%

Intra State Transmission loss (MU)

634.76

890.18

779.59

2,304.53

Input at G-T interface (MU)

24,135.22

33,847.18

29,642.29

87,624.68

Inter State Transmission Losses (MU)

639.74

907.79

776.41

2,323.94

Power Purchase Requirement for

FY 2023-24 (MU)

24,774.95

34,754.96

30,418.70

89,948.62

Assessment of Energy Availability

Petitioners’ Submission

2.19 The Petitioners have assessed availability of energy for the State, on the following basis:

(a) Existing long-term allocated generation capacity of MP

(b) New generation capacity additions during FY 2023-24 for MPPGCL, Central Sector,

Joint venture and by Private players awarded through competitive bidding.

(c) Allocation of generation capacity to MP from various Central Generating Stations.

2.20 Further, the petitioners in their additional submission to fill data gaps stated that Petitioners

have considered following approach for forecast of Energy Availability: -

(a) New generation capacity additions during FY 2023-24 have been considered as per

Power Purchase Agreement.

(b) Allocation of Power to the State of MP, from Central Generating Stations is as per

Regional Power Committees and communication held with their concerned offices.

(c) The details of chosen Plant Availability Factor (PAF) and Capacity Utilisation Factor

(CUF) for various plants are as indicated below:

(i) PAF of MP GENCO Thermal plants have been considered on the basis of past

pattern.

(ii) PAF of Central Generating Stations have been considered as 85% for coal based

Thermal Power Plants and 60% for Gas based Thermal Power Plants.

(iii) PAF of IPPs has also been considered as 85%, except for BLA power, for which

it has been considered at 75%.

(iv) CUF of Solar plants has been considered as 20% and that of Non Solar

ARR for FY 2023-24 and Retail Supply Tariff Order for FY 2023-24

Madhya Pradesh Electricity Regulatory Commission Page 25

renewable energy plants has been considered as 19%.

(v) CUF of new renewable sources is considered as mentioned in PPAs.

(vi) PAF of all new thermal power plants has been considered as 85%.

(vii) Predicting hydel availability is quite difficult, which totally depends on the

rainfall. Accordingly, a suitable multiplying factor to Design Energy is assumed

on the basis of actual availability during past three to five years data.

(viii) RPO has been considered as per MPERC's Regulations.

(ix) COD of new thermal units has been considered as intimated by concerned

developers.

2.21 Allocation of power to MP from Central Generating Stations is as per Western Regional

Power Committee letter No. WRPC/Comml-I/6/Alloc/2022/10680 dated 13

th

October,2022

and from Eastern Region NTPC Kahalgaon-2 as per GoI MoP letter no. 5/31/2006 dated 21

st

February, 2007 and from Northern Region as per Northern Regional Power Committee letter

no. NRPC/OPR/103/02/2022 dated 14

th

October 2022 and communication held with their

concerned offices. Allocation from MP Genco and other sources have been considered based

on inputs provided and latest updates from their concerned offices.

2.22 MPPMCL has already decided to foreclose the PPAs with DVC for 400 MW (MTPS & CTPS)

and 100 MW (DTPS) w.e.f. 01

st

March, 2018 & 15

th

May, 2017, respectively. Hence, no

power is being scheduled from these stations after the said date. However, since September,

2020, power on STOA basis is being scheduled from 100 MW DVC (DTPS) through LOI

dated 10

th

July, 2020. Similarly, LOI for 200 MW from DVC (CTPS) on STOA basis has also

been issued on 10

th

July, 2020. Thus, costs of these plants have also been considered while

calculating the power purchase cost for FY 2023-24.

2.23 During FY 2021-22, power from Essar, BLA and Sugen Torrent Generating Stations has been

scheduled following MoD whereas in the Tariff Order for FY 2022-23, the Commission had

not considered availability and the cost thereon from these plants. The power purchase

expenditure incurred on these plants will be submitted before the Commission in the true up

of FY 2022-23. For FY 2022-23 to FY 2026-27, the availability from these plants has been

considered as the PPAs with these plants remain in force.

2.24 New Central and State Generating Stations scheduled to commence generation during FY

2023-24 are as follows:

Table 14: Upcoming Stations and Technical Parameters

Sr. No.

Particulars

Capacity

(MW)

MP’s Share

Energy

Availability

(MU)

CoD

(%)

(MW)

1

NHPC Lower Subanshiri HEP

8x250

5%

104

73

September-2023

(Unit-1 & 2)

December-2023

(Unit-3 & 4)

2.25 Following table shows allocated capacity from existing stations as well as the new capacity

additions, which are expected to become operational during the FY 2023-24:

ARR for FY 2023-24 and Retail Supply Tariff Order for FY 2023-24

Madhya Pradesh Electricity Regulatory Commission Page 26

Table 15: Allocated stations submitted by the Petitioners for FY 2023-24

Sr.

No.

Source

Plant Capacity

(MW)

MP's Share

in %

MP's Share

in MW

1

Amarkantak TPS Ph-III

210

100%

210

2

Satpura TPS Ph-II & III

830

100%

830

3

Satpura TPS Ph-IV

500

100%

500

4

SGTPS Ph-I & II

840

100%

840

5

SGTPS Ph-III

500

100%

500

6

Shri Singaji STPS Phase-I

1,200

100%

1,200

7

Shri Singaji STPS Phase-II

1,320

100%

1,320

A

Total (MP Genco Thermal-MP Share)

5,400

5,400

8

Rani Awanti Bai Sagar, Bargi HPS

90

100%

90

9

Bansagar Ph I HPS (Tons)

315

100%

315

10

Bansagar Ph-II HPS (Silpara)

30

100%

30

11

Bansagar Ph-III HPS (Deolond)

60

100%

60

12

Bansagar Ph-IV HPS (Jhinna)

20

100%

20

13

Birsinghpur HPS

20

100%

20

14

Madikheda HPS

60

100%

60

15

Rajghat HPS

45

60%

27

16

Gandhisagar HPS

115

50%

58

17

Ranapratap Sagar HPS

172

50%

86

18

Jawahar Sagar HPS

99

50%

50

19

Pench HPS

160

67%

107

B

Total (MP Genco Hydel)

1,186

922

20

NHDC Indira Sagar HPS

1,000

100%

1,000

21

NHDC Omkareshwar HPS

520

100%

520

22

NVDA Sardar Sarovar HPS

1,450

57%

827

23

Rihand HPS

300

15%

45

24

Matatila HPS

31

33%

10

25

SJVN Rampur HPS

412

31%

128

26

SJVN Jhakri HPS

1,500

0%

2

27

Tehri HPS

1,000

0%

2

28

Koteshwar HPP

400

0%

1

29

NHPC Parbati III

520

0%

1

30

NHPC Chamera II

300

0%

1

31

NHPC Chamera III

231

0%

1

32

NHPC Dulhasti

390

0%

1

33

NHPC Dhauliganga

280

0%

1

34

NHPC Sewa II

120

0%

0

35

NHPC Uri II

240

0%

1

36

NHPC Kishanganga

330

0%

1

37

NTPC Koldam HPP I

800

0%

1

38

NTPC Singrauli Small HPP

8

0%

0

39

NHPC Lower Subansiri HEP (Unit-1 to Unit-8)

2,000

5%

100

C