mortgagesolutions.net

FIRST TIME HOME BUYER’S

GUIDE TO FINANCING

mortgagesolutions.net

FIRST TIME HOME BUYER’S

GUIDE TO FINANCING

CONTENTS

OVERVIEW

Purchasing your first home involves a lot more than finding a place to hang your hat. It involves long-term commitments, a sizeable

investment, and great rewards. You will no longer write rent checks to pay off your landlord’s mortgage. Instead, you will make monthly

payments on your own mortgage – and you will gain valuable equity in the process.

Your home is likely to be one of the largest purchases you ever make, and few of us are able to simply write a check to cover the bill.

The job of a mortgage lender is to provide financing to make the purchase possible. The job of a good mortgage lender is to ensure that

the loan provided is sensible—that it can be manageably paid back by the borrower over time.

The goal of this guide is to make you an educated and confident home buyer. The guide

• explains the need for pre-approval and the pre-approval process,

• provides an overview of some common financing options,

• explains factors affecting pre-approval and loan qualification, and

• lists some of the documents needed when applying for a loan.

THE MORTGAGE SOLUTIONS FINANCIAL MISSION

Mortgage Solutions Financial strongly believes every client should be served with integrity, dignity, and respect. Without compromise,

Mortgage Solutions Financial is committed to providing loans that are in the best interest of our clients, not our bottom line. We will

continue to educate the community by empowering our clients to make responsible and informed fiscal decisions that result in greater

financial peace of mind.

Overview/Mortgage Solutions Financial Mission ..................................... 2

Get the Loan First: Pre-Approval ............................................................. 3

What is FICO? ......................................................................................... 4

Immediate Cash Requirements .............................................................. 5

Loan Options .......................................................................................... 6

Dos and Don’ts for Successful Financing .............................................. 7

Application Checklist .............................................................................. 8

mortgagesolutions.net

GET THE LOAN FIRST: PRE-APPROVAL

Why Obtain Pre-Approval?

Common sense dictates that we should know what we can afford before we start shopping, and the home-buying is no different. For

this reason, it is wise to get pre-approved for a loan before house-hunting.

Even if you think you know how much you can afford or the loan amount you will qualify for, solid numbers from a mortgage expert

ensure a smoother process.

House hunting is exciting but can result in disappointment if buyers set their hearts on a property that is out of financial reach.

Pre-approval gives you more clout in the eyes of realtors and sellers.

There is no cost or commitment for pre-approval. Pre-approval is a straightforward process. Lenders base their determinations on a

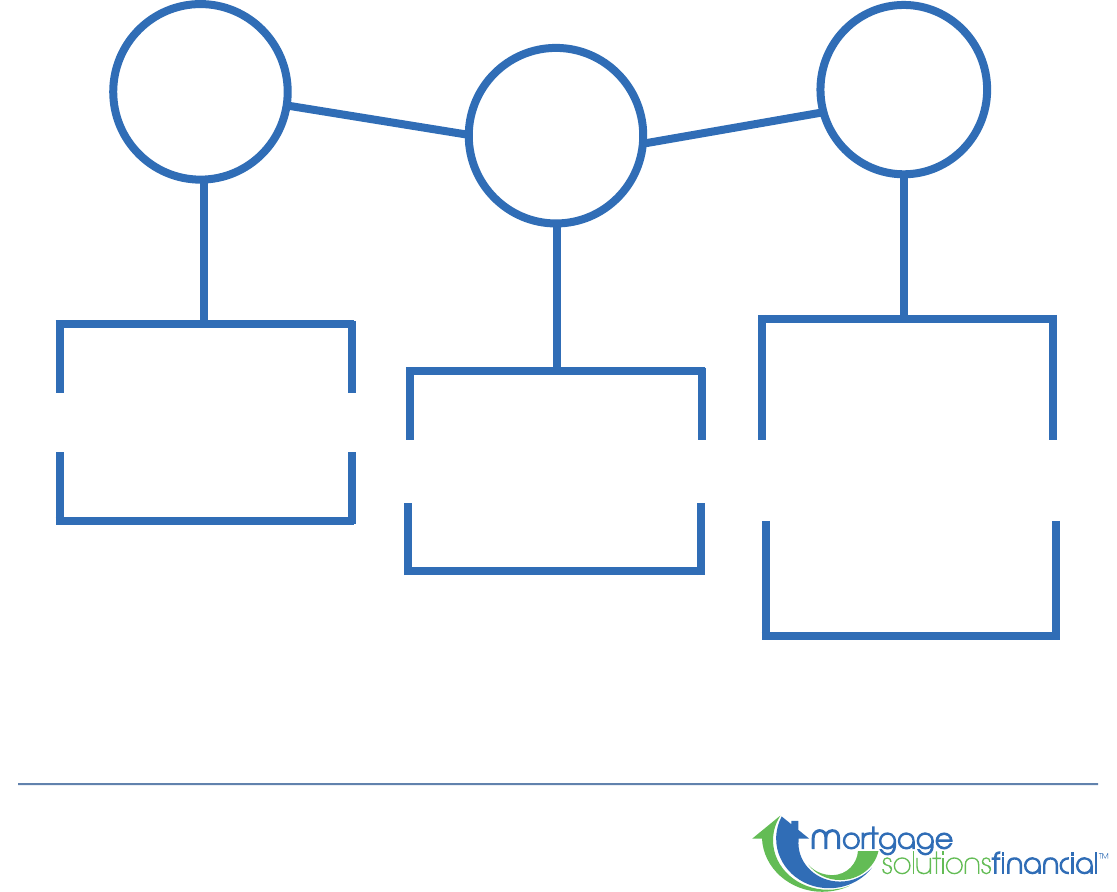

number of factors, including:

NOTE: Pre-approval is a necessary and valuable first step; however, you will complete a more detailed application later in the process to

become fully qualified for a loan.

Income

&

Assets

Debts

&

Liabilities

Credit History

&

FICO Score

Lenders also weigh your current

debts and liabilities in light of

other qualifying factors in order

to determine loan eligibility and

repayment ability.

Lenders assess your income

amount and stability to

determine your eligibility for a

loan and your ability to make

monthly payments.

Lenders examine your credit

history and FICO score to assess

how well you have handled debt

in the past. Your FICO score

may vary somewhat from one

reporting agency to the next;

don’t be surprised if you check

your score and the numbers are

different from those of the lender.

WHAT IS FICO?

FICO is an acronym for the Fair Isaac Corporation. A primary function of FICO is to provide

lenders with credit scores that help indicate a borrower’s credit risk. Though the precise

formula for scoring has not been made public, it is based on length of credit history, types of

credit usage, new credit, existing credit debts, and payment history.

There may be loan options for borrowers with flawed credit histories or lower-than-ideal FICO scores. However, if your credit history is

not in great shape, working to repair it—before attempting to finance a mortgage—may be strategic.

Ultimately, consulting with a mortgage expert will give you the best idea of your options in light of your FICO score.

mortgagesolutions.net

How can I determine how much my mortgage could be?

Use our free mortgage calculator.

Calculating a mortgage can be a complex process. Know the numbers without all the head scratching. Visit the Resources section of the

Mortgage Solutions Financial website at www.mortgagesolutions.net to access a mortgage calculator. This free, zero-commitment tool

and many other resources offered on the site will help guide you through the financing process. These tools provide general information;

work with a Mortgage Solutions Financial expert to get actual numbers.

www.mortgagesolutions.net

IMMEDIATE CASH REQUIREMENTS

Although some mortgage options require zero money down,

most require cash on hand for the down payment, closing

costs, and mortgage/lender fees.

Down Payment

Any money you put toward your down payment will reduce the principal amount of the loan, therefore lowering your monthly payments

and possibly your interest rates.

You may be required to make a down payment that equals a specific percentage of your home’s purchase price. The percentage

required may be dictated in part by factors—such as your FICO score, income, assets, and debts—that are considered during the

qualification process. The type of loan you seek will also affect the amount of the required down payment.

As a general rule of thumb, mortgages obtained with less than 20% down will require the purchase of PMI, or Private Mortgage

Insurance. PMI, which serves as a safeguard for lenders, will be figured into your monthly payments.

Where you obtain your down payment may also have bearing on your approval and interest rates. For example, money received as a gift

from a family member is perfectly acceptable, but money from your personal savings account presents a lower risk to the lender.

Closing Costs and Mortgage/Lender Fees

At the time of closing, certain fees and closing costs should be expected, though they vary, depending on a range of factors. Costs and

fees can be confusing, but your Mortgage Solutions Financial expert will explain any charges and answer all of your questions.

Occasionally, lenders will omit certain fees or sellers will agree to cover portions of the costs. However, closing costs and fees typically

range from 3%–5% of the total mortgage amount. Charges may include:

• General Loan Fees

• Insurance

• Taxes

• Title Charges

• Government Recording Charges

• Application Fees

mortgagesolutions.net

LOAN OPTIONS

Speaking with a professional is the best way to determine which loan is the best fit for you

and your family. This section outlines only a few of the most common loan options available.

USDA

Loans

The U.S. Department of Agriculture’s Guaranteed Rural Housing Program is designed

to help low or moderate income families acquire home loans within designated rural

areas. 100% financing is available for eligible USDA loan applicants.

VA

Loans

The VA Loan program is designed to assist the brave servicemen and servicewomen

of the U.S. Armed Forces. Military veterans and their spouses may benefit from the

special terms of these loans, such as relaxed credit score requirements and 100%

financing.

FHA

Loans

FHA loans may offer significant benefits to qualified borrowers. The flexible guidelines

allow relaxed credit score requirements and the possibility for a borrower to qualify

quickly following a bankruptcy. The standard FHA purchase loan requires only a 3.5%

down payment, and in many cases the down payment may be gifted.

Adjustable

Rate

Mortgages

Adjustable rate mortgages offer variable interest rates that may change over time

according to benchmarks set prior to closing. As a result, your monthly payment may

change over time.

Fixed Rate

Mortgages

With a fixed rate mortgage your interest rate stays the same throughout the course of

the loan’s maturity. Your total payment toward interest and principal will not change

from month to month.

{

{

www.mortgagesolutions.net

DOS AND DON’TS

FOR SUCCESSFUL FINANCING

With guidance from a Mortgage Solutions Financial mortgage specialist, the financing

process is usually relatively straightforward. The guidelines below highlight some of the basic

“Dos and Don’ts” that can expedite the process and help to ensure a successful transaction. It

is important to continue following these guidelines even after preapproval.

DO crunch ALL of your numbers and clearly define your goals.

Your Mortgage Solutions Financial mortgage specialist will strive to make the financing process as stress-free as

possible for you. However, you must perform your own due diligence—carefully considering ALL your financial

details— to ensure that your decisions are financially sound for you and your family.

DO be prepared.

Gathering the appropriate information before the financing process begins can significantly streamline the

transaction. The checklist on the next page presents some of the documentation that may be required, but

please bear in mind that different loan programs may call for different forms of verification.

DON’T change jobs or start your own business during the financing process.

It is essential that your employment status is the same at final verification as when you fill out the initial

application. Mortgage Solutions Financial supports the entrepreneurial spirit, but now is not a good time to

change jobs or quit your job to start your own business.

DON’T make any large purchases that require a credit check during the

process.

Credit checks can negatively affect your credit score. For this reason, large purchases such as vehicles and

furniture—anything that may result in a credit check—should be avoided during the financing process.

DON’T guesstimate when filling out your application.

From pre-approval through final verification, ensure that all the information provided to your mortgage specialist

and lender is as accurate as possible. The fewer surprises the better!

mortgagesolutions.net

APPLICATION CHECKLIST

Though additional information may be necessary, this checklist provides an overview of the verification documents lenders use to deter-

mine loan qualification. Ask a Mortgage Solutions Financial mortgage specialist for additional information.

Income Information:

Pay stubs for the last 30 days.

Names and addresses of all employers for the last two years.

W2 forms and Federal Income Tax Returns for the last two years.

Verification of other income, such as dividends, rental income, child support, alimony, or Social Security and disability

payments.

Asset Information:

Savings accounts.

Checking accounts.

401(k) accounts.

IRA accounts.

Investment records.

Additional Documentation:

Social Security number.

Names, phone numbers, and addresses of all involved parties.

Getting Started

Mortgage Solutions Financial is here to help.

Over the course of nearly two decades, Mortgage Solutions Financial has helped over 40,000 families purchase the homes of their

dreams and reach their financial goals. We are here to serve you and guide you through the financing process every step of the way. Our

mortgage specialists are dedicated to answering your questions and finding the best options available for you and your family, seven

days a week.

Give us a call at (877) 899-3614 today, or visit us online at www.mortgagesolutions.net to schedule a free,

no-commitment consultation.

Complete your free loan application today.

Mortgage Solutions Financial offers a free online loan application at www.mortgagesolutions.net. You can fill out the application at your

own pace. You can even begin the application, save your work, and return at a later time to complete the forms.

Equal Housing Lender ©2018 Mortgage Solutions of Colorado, LLC, dba Mortgage Solutions Financial NMLS #61602, headquartered at 5455 N Union Blvd, Colorado Springs, CO

80918, 719-447-0325. AL 21883; AR 104413; AZ Mortgage Banker License BK-0928346; Licensed by the Department of Corporations Under CA Residential Mortgage Lending Act

License 4130456 and under CA Finance Lender Law License 603H857; CO Mortgage Company Registration; CT ML-61602; DC Mortgage Lender License MLB61602; DE Licensed by

The Commissioner 20424: exp. 12/31/18; FL MLD902; GA 37525; IA MBK-2013-0042; ID MBL-7290; IL MB.6760816, Illinois Residential Mortgage Licensee; IN 17441 and 17442; KS

MC.0001684, Kansas Licensed Mortgage Company; KY MC83187; LA Residential Mortgage Lending License; MD 19702; MI FR0018740 and SR0018741; MN MO-61602; MO 17-1769;

MS 60602 Licensed by the Mississippi Dept of Banking & Consumer Finance; MT 61602; NC L-157264; ND MB102837; NE 2000; New Jersey Mortgage Lender License, Licensed by the NJ Department

of Banking ; NM 2464; NV 4668 and 4399; OH MBMB.850123.000; OK ML010480; OR ML-4912; PA 43167 Licensed by the Pennsylvania Dept of Banking and Securities; Rhode Island Licensed Lender

20122869LL; SC MLS-61602; SD ML.05086; TN 109443; TX SML Mortgage Banker Registration and SML Residential Mortgage Loan Servicer Registration; WA CL-61602; WI 61602BA and 61602BR; WV

ML-32877; WY MBL1022.