Version 2.0

September 2019

Visa Contactless and Card Present

PSD2 SCA:

A Guide to Implementation

September 2019

Version 2.0

9 September 2019

2

Contents

Important Information ............................................................................................................ 3

Using the Document ................................................................................................................ 4

1 The requirements of PSD2 Strong Customer Authentication ...................................... 7

1.2 Exemptions ............................................................................................................................................. 8

2 Visa’s PSD2 Contactless Solutions ................................................................................. 10

2.1 The Visa contactless solutions...................................................................................................... 10

2.2 The Visa Card Based Solution ....................................................................................................... 10

2.3 Issuer Host Based Solution ............................................................................................................ 14

2.4 Authentication and Authorization Message Codes ............................................................. 17

2.5 Solutions for the application of SCA .......................................................................................... 18

2.6 Transactions at Unattended Terminals ..................................................................................... 19

2.7 Stand in Processing – STIP ............................................................................................................. 19

3 Guidelines for applying the exemptions and implementing Visa’s solutions .......... 21

3.1 Selecting the optimum solution. ................................................................................................. 21

3.2 Implementing the Card Based Solution .................................................................................. 22

3.3 Implementing the Issuer Host Based Solution ..................................................................... 24

3.4 Optimising application of the contactless exemption ........................................................ 26

3.5 Liability and disputes ....................................................................................................................... 26

3.6 Practical guidelines on applying the transport and parking exemption ...................... 26

3.7 Practical guidelines for supporting non-card payment devices ...................................... 26

3.8 Education of Merchants and Consumers ................................................................................. 26

4 Planning for PSD2 - what you need to do .................................................................... 28

4.1 Issuer planning checklist ................................................................................................................ 28

4.2 Acquirer planning checklist ........................................................................................................... 29

4.3 Merchant planning checklist ......................................................................................................... 29

5 FAQ ................................................................................................................................... 31

6 Bibliography .................................................................................................................... 37

7 Glossary ............................................................................................................................ 40

A Appendices ...................................................................................................................... 42

A.1 Appendix 1 Visa EEA Countries .................................................................................................... 42

Version 2.0

9 September 2019

3

Important Information

© 2019 Visa. All Rights Reserved.

The trademarks, logos, trade names and service marks, whether registered or unregistered

(collectively the “Trademarks”) are Trademarks owned by Visa. All other trademarks not

attributed to Visa are the property of their respective owners.

Disclaimer: Case studies, comparisons, statistics, research and recommendations are provided

“AS IS” and intended for informational purposes only and should not be relied upon for

operational, marketing, legal, technical, tax, financial or other advice.

As a new regulatory framework in an evolving ecosystem, the requirements for SCA still need

to be refined for some use cases. This paper represents Visa’s evolving thinking, but it should

not be taken as a definitive position or considered as legal advice, and it is subject to change

in light of competent authorities’ guidance and clarifications. Visa reserves the right to revise

this guide pending further regulatory developments. We encourage clients to contact Visa if

they experience challenges due to conflicting guidance from local regulators. Where it makes

sense, Visa will proactively engage with regulators to try and resolve such issues.

This guide is also not intended to ensure or guarantee compliance with regulatory

requirements. Payment Service Providers are encouraged to seek the advice of a competent

professional where such advice is required.

This document is not part of the Visa Rules. In the event of any conflict between any content

in this document, any document referenced herein, any exhibit to this document, or any

communications concerning this document, and any content in the Visa Rules, the Visa Rules

shall govern and control.

References to liability protection, when used in this context throughout this guide, refer to

protection from fraud-related chargeback liability under the Visa Rules.

Note on Terminology: the term “Card Present” is used throughout this guide when referring

to any electronic transaction that involves a physical payment terminal and a payment card

account. This includes:

• Contact and contactless transactions

• Transactions made using cards and payment devices including mobile phones, wearables

etc. that are associated with a card payment account

• Transactions at attended and unattended terminals.

Version 2.0

9 September 2019

4

Using the Document

This guide forms part of a set of Visa guidance documents that are relevant to the

implementation of Strong Customer Authentication under PSD2. The guide is written for

business, technology and payments managers responsible for the planning and

implementation of PSD2 compliance policies and solutions within Issuers, Acquirers,

merchants, gateways and vendors. It aims to provide readers with guidance to support

business, process and infrastructure policy decisions needed to plan for the implementation

of SCA. It is supported by more detailed implementation guides and other documents that are

listed in the bibliography in section 6.

This guide covers card present and contactless payments initiated from Issuer provided

payment credentials including cards, Issuer provided contactless wearables and mobile single

Issuer wallets. The term card is used throughout this document to refer to the Issuer provided

contactless payment credential regardless of form factor. Some solutions presented in this

guide are only applicable to cards supporting both contact and contactless payments and

these are clearly indicated by the text.

Whilst some of the principles covered in this guide are relevant, this guide does not cover

Issuer payment credentials enabled by a third party such as tokenised mobile multi-Issuer

wallets and third party provided tokenised wearables where consumer authentication is

performed by the third party on behalf of the Issuer.

The guide is structured as follows:

Section

Title

Description

1

The requirements

of PSD2 Strong

Customer

Authentication

A high-level summary of the requirements for SCA and the

exemptions relevant to card present and contactless transactions as

defined in the PSD2 Regulation and the RTS and Visa’s

interpretation of the requirements and exemptions

2

Visa’s PSD2

Contactless

Solutions

This section details the tools and services Visa is making available to

merchants, Issuers and Acquirers to optimise the application of SCA

and allowable exemptions, specifically; the Card Based and Issuer

Host Based Solutions. The section also covers unattended terminals

and STIP.

3

Guidelines for

applying the

exemptions and

implementing

Visa’s solutions

Providing information and guidance to help clients to select and

effectively implement the most appropriate solutions.

Version 2.0

9 September 2019

5

Section

Title

Description

4

Planning for

PSD2

– what you need

to do

Providing checklists for merchants, Acquirers and Issuers,

highlighting the actions they need to take to ensure they are ready

for PSD2 SCA, in September 2019.

5

FAQs

Common questions and answers regarding the application of PSD2

SCA to card present and contactless transactions

6

Bibliography

A list of key additional reference documents.

7

Glossary

A glossary of technical terms used in the guide

A1

Appendices

Additional technical detail supporting the main text.

Each section, and subsection, has been highlighted to show its relevancy to each client

stakeholder group. The icons used throughout this document are as follows:

Important Note:

This document provides guidance on the practical application of SCA in a PSD2

environment. Clients should note that this guide should not be taken as legal advice

and the following take precedence over content in this guide:

• Interpretations of the regulation and guidance provided by local competent

authorities

• Visa core rules

• Technical information and guidance published in EMVCo specs and Visa

Implementation guides listed in the bibliography

Visa recognises that clients have choices and may wish to use alternative approaches,

tools and services to those referred to in this guide.

Audience

This guide is intended for anyone involved in the processing of card present and contactless

EMV (cEMV) transactions in the Visa Europe region. This may include:

Version 2.0

9 September 2019

6

• Issuers, Merchants and their Acquirers and third-party agents and vendors looking for

guidance on implementing point of sale SCA solutions.

• Issuers seeking to ensure that they accurately recognise transactions that are in and out of

scope of SCA so they can maintain security without their cardholder’s experience being

unnecessarily disrupted.

Who to contact

For further information on any of the topics covered in this guide, Clients in the Visa Europe

region may contact their Visa Representative or email customersupport@visa.com.

Merchants and gateways should contact their Visa Acquirer.

Feedback

We welcome feedback from readers on ways in which future editions of the guide could be

improved. Please send any comments or requests for clarifications to

PSD2questions@visa.com

Version 2.0

9 September 2019

7

1 The requirements of PSD2

Strong Customer Authentication

This section provides a brief summary of Visa’s interpretation of the PSD2 Strong Customer

Authentication (SCA) requirements in the context of card present and contactless transactions.

PSD2 requires that SCA is applied to all electronic payments - including proximity, remote and

m-payments - within the European Economic Area (EEA). The SCA mandate is complemented

by some limited exemptions that aim to support a frictionless customer experience when a

transaction risk is low. In addition, some transaction types are out of scope of SCA.

The specific rules on SCA come into force on 14th September 2019.

For a more detailed definition and discussion of these and other requirements, please refer to

the Visa paper “Preparing for PSD2 SCA” November 2018. Clients should also refer to guidance

produced by national competent authorities when considering their compliance policies.

1.1 The application of SCA and use of factors

Regulated Payment Service Providers (PSPs) are responsible for the application of SCA and of

the exemptions. In the case of card payments, these PSPs are Issuers (the payer’s PSP) and

Acquirers (the payee’s PSP). SCA requires that the payer is authenticated by a PSP through at

least two factors, each of which must be from a different category. These are summarised in

Table 1.

Table 1: Strong Customer Authentication Factors

Category

Description

Example

Knowledge

Something only the payer knows

A password or PIN

Possession

Something only the payer has

A preregistered mobile phone or card

Inherence

Something the payer is

A biometric (facial recognition, fingerprint,

voice recognition, behavioural biometric)

Factors must be independent such that if one factor is compromised the reliability of the other

factor is not compromised.

1

For card present one factor is always possession evidenced by the

cryptogram. The other may be a knowledge or inherence factor, typically one of the example

1

For more information on the application of factors please refer to Section 2.2 of the Visa paper

“Preparing for PSD2 SCA” November 2018.

Version 2.0

9 September 2019

8

factors shown in Table 1, depending on the type and form factor of the payment credential

used.

1.2 Exemptions

The main exemptions to the application of SCA relevant to Visa card present and contactless

transactions are summarised below. It should be noted that not all exemptions are available

to all PSPs. For more detail on how to practically apply the exemptions please refer to section

3.

1.2.1 Contactless payments at point of sale

SCA is not required for contactless payments at point of sale subject to the following

conditions:

• The value of the transaction must not exceed €50; and either

• The cumulative monetary amount of consecutive contactless transactions without

application of SCA must not exceed €150 (or the local currency equivalent for non-Euro

Zone markets); or

• The number of consecutive contactless transactions since the last application of SCA must

not exceed five.

Once the limit for the monetary amount or number of transactions without the application of

SCA exceeds the selected limit, SCA must be applied and the count is reset to zero. The

cumulative monetary amount and number of transaction limit is counted on the basis of

transactions where this particular exemption was applied (i.e. not transactions where a

different exemption was applied to avoid applying SCA).

Issuers can select whether to apply the transaction count or cumulative monetary amount limit.

Visa recommends the cumulative monetary amount based approach to minimise the impact

on customer experience.

2

Visa’s view is that contactless limits should be applied at device/token level rather than account

level.

3

1.2.2 Unattended transport and parking terminals

Article 12 of the SCA RTS states that PSPs shall be allowed not to apply SCA, subject to

compliance with the general authentication requirements laid down in Article 2

4

, where the

payer initiates an electronic payment transaction at an unattended payment terminal for the

purpose of paying a transport fare or a parking fee.

1.3 Out of scope transactions

The following transaction types are out of scope of SCA:

2

For more information see Question 12 in the FAQ in Section 5

3

For more information see Question 10 in the FAQ in Section 5

4

Article 2 states that PSPs shall have transaction monitoring mechanism in place to detect unauthorised

or fraudulent payments that take into account a defined set of minimum risk-based factors.

Version 2.0

9 September 2019

9

Mail Order/Telephone Order (MOTO)

One leg out - It may not be possible to apply SCA to a transaction where either the Issuer

or Acquirer is located outside the EEA

5

. However, SCA should still be applied on a “best

efforts” basis.

Anonymous transactions - Transactions through anonymous payment instruments are

not subject to the SCA mandate, for example anonymous prepaid cards.

These transactions are out of scope regardless of whether they are remote or card present.

5

Refer to Appendix A.1 for a list of EEA countries

Version 2.0

9 September 2019

10

2 Visa’s PSD2 Contactless

Solutions

2.1 The Visa contactless solutions

Visa is offering two distinct primary solutions to enable Issuers to apply the contactless

exemption for card present transactions and to apply SCA when it is required by the regulation.

Each of the solutions offers slightly different benefits and implementing each solution implies

different considerations. Issuers can select one or more of the solutions based upon their

individual requirements. This section provides a summary of each solution along with guidance

to Issuers on the points they should consider when deciding whether to adopt each option.

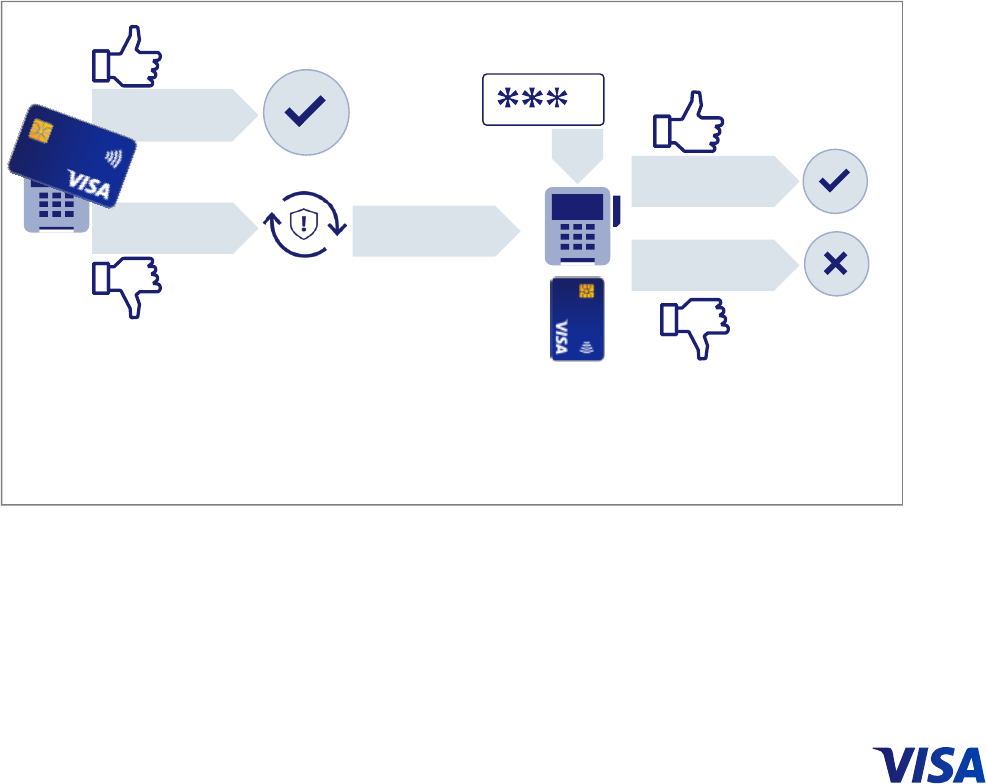

The primary solutions are summarised in Fig. 1 and described in more detail in sections 2.2

and 2.3 .

Fig. 1: Summary of the Visa Solutions

In addition to these two primary solutions, Visa is introducing new authorization message

response codes. Stand In Processing (STIP) is also important to the application of PSD2 SCA

and exemptions in a card present environment. These are covered, along with a summary of

SCA options in sections2.4, 2.5 and 2.7.

2.2 The Visa Card Based Solution

2.2.1 Introduction to the Card Based Solution

The solution works on the basis of incorporating the logic required to track transaction count

or cumulative monetary amount within the chip on the card. The solution is based on the Visa

Contactless Payment Specification Version 2.2 Updates List 3 (VCPS2.2.3) specification whose

The Card Based

Solution

Allows an issuer to

solve for PSD2 SCA

requirements via their

card base alone,

without requiring any

host modifications

Issuer

The Issuer Host

Based Solution

Allows an issuer to

solve for PSD2 SCA

requirements without

modifying their card

base, using new logic in

the authorization

process

The Visa Based

Solution

Could allow an issuer to

solve for PSD2 SCA

without modifying their

card base or host

systems, leveraging

unique Visa processing

capabilities

Version 2.0

9 September 2019

11

key features are described below. It allows all of the logic required for application of the

contactless payments exemption and of SCA, when required, to be executed in the card chip

without the need to contact the Issuer host. The solution requires no upgrade to merchant

terminals or Issuer host systems.

2.2.2 The VCPS 2.2.3 chip specification

2.2.2.1 Velocity parameters

The Visa Contactless Payment Specification Version 2.2 Updates List 3 (VCPS2.2.3) introduces

two new velocity parameters to assist Issuers in meeting the requirements of the PSD2

regulation and to provide further risk management controls. These parameters are:

1. Consecutive Transaction Counter – No CVM (CTC-NC) – “The Counter”: This

parameter counts the number of consecutive transactions performed since the last

successful CVM. It supports application of the transaction count limit.

2. Cumulative Total Transaction Amount – No CVM (CTTA-NC)- “The Accumulator”:

This parameter accumulates the total transaction amount spent on the card since the

last successful CVM. It supports the application of the cumulative monetary amount

limit.

An Issuer will decide which parameter it wishes to use as the basis for applying SCA. Guidance

on selection of the parameter is given in section 3.4.1

2.2.2.2 Country list and currency parameters

In addition, the specification also supports the following parameters:

3. Cardholder verification country list: Issuers are required to define the cardholder

verification country list. The specification allows configuration of up to 40 countries.

This is required for both CTC-NC and CTTA-NC to determine whether the card is within

scope of the requirement to apply SCA.

4. Currency conversion: The specification allows configuration of up to 20 currencies

along with the exchange rate. This is only required if using CTTA-NC. The conversion

rate used for determining whether SCA needs to be applied is not the same as the

conversion rate used during clearing and settlement transactions. The rate used is a

decision for Issuers – see section 3.2.5 below.

The specification also supports no CVM based Card Risk Management. This applies to:

• Transactions in scope of SCA checks (i.e. within the EEA country list defined)

• Both online and offline transactions without SCA

When the parameter limit that the Issuer has selected for the application of SCA (either 5

consecutive transactions or a cumulative limit of €150) is breached, a transaction will require

application of Cardholder Verification Method (CVM).

2.2.2.3 Chip and signature support

The specification also has a configurable parameter for signature to allow for circumstances

where an Issuer offers Chip and signature for the application of CVM, for example where it is

offered to certain customers for inclusivity (for more details see FAQs Section 5 item 6 below)

or in markets where it may be allowable. This parameter can be set by the Issuer during card

Version 2.0

9 September 2019

12

personalisation. Where the parameter is set, the counter or accumulator will be reset for

contact chip and signature transactions as well for Chip and PIN.

2.2.3 How the Card Based Solution works

The transaction counter and amount parameters allow the chip on the card to:

• Track and a mass cumulative monetary amount and number of consecutive contactless

transactions against the limits for transactions within the European Economic Area (EEA)

• Convert between multiple currencies for transactions that are within Europe, but outside

the domestic currency of the issuing country

• Recognise when the pre-set transaction count or cumulative monetary amount threshold

is reached and trigger the terminal to request a Chip and PIN transaction to authenticate

the customer

• Reset the counters to zero when SCA has successfully been applied through CVM, either

as a result of the pre-set contactless limit being reached or another PIN authenticated

transaction taking place, such as a higher value Chip and PIN transaction on an ATM

withdrawal

The process of incrementing and resetting the counters and accumulators on the card is

referred to as Card Risk Management.

The transaction flow is illustrated in Fig 2 below.

Fig. 2: The Card Based Solution transaction flow

2.2.3.1 Incrementing the parameters

The transaction counter or accumulator is only incremented when a contactless transaction

carried out without CVM is authorised and approved, either online or offline. This takes place

via the contactless interface.

The counter and accumulator are not incremented when a transaction is declined, nor are they

incremented when a zero-value transaction is carried out. This means that transactions

$

SCA parameter

in Breach

SCA parameter

not in Breach

SCA required

Continue

Request CVM &

Switch Interface

Enter PIN

PIN OK

PIN not OK

SCA requirements

are met

Parameter is reset

SCA requirement

not met

1

$

NO CVM (SCA) Parameters can only

be reset during a successful contact

transaction with CVM

Version 2.0

9 September 2019

13

processed through the mass transit model can be exempted. In this case, a contactless

transaction performed at a qualifying unattended ticket gate or parking terminal has no effect

on the counter or accumulator for a zero value transaction.

2.2.3.2 Resetting the transaction count and cumulative monetary amount parameters

• Any successful Chip and PIN transaction will reset the counters

• If the counters are breached, the transaction will switch interfaces and a successful

transaction will reset the counters.

2.2.3.3 The transaction flow process

When a contactless transaction is attempted, the card chip checks the current status of the

counter or accumulator No CVM parameters. If completing the transaction will not breach the

transaction count or cumulative monetary amount limit, the transaction can be completed as

a normal contactless transaction. If the limit will be breached, CVM needs to be applied.

Assuming a dual interface terminal, the transaction will continue, or switch interface as follows:

• In the case of an offline PIN transaction, if the card supports it, the terminal will switch to

the contact interface and the application of CVM resets the counter and accumulator

parameters to zero

• Contact transactions performed at terminals without a PIN entry capability will be sent

online to the Issuer and if CVM is not applied, the parameters will not be reset.

For contactless transactions the contactless card specification does not permit this, so the

transaction will be declined by the card, unless the terminal has contact capability. Note a

transaction processed through the Mass Transit Model will not decline.

2.2.4 Benefits and considerations

The card-based solution offers the following benefits:

• The customer experience is as friction free as possible

• Merchant terminals are unaffected and do not need to be upgraded

• No changes need to be made to the Issuer host system

• No changes need to be made to Acquirer systems

• The solution is able to exclude exempt transactions including unattended transit terminals

operating under the Visa Unattended Mass Transit Framework

However, implementation of the card-based solution requires that cards based on VCPS2.2.3

or higher are reissued to all customers.

2.2.5 When Issuers should consider adopting the solution

The Card Based Solution works well in offline PIN markets as follows:

• The solution works in markets with offline PIN support, where Issuers and cards are used

to switching interfaces to Chip and PIN.

• The solution works best for offline PIN support, but could be used for online PIN markets,

with consideration to customer experience.

Version 2.0

9 September 2019

14

2.3 Issuer Host Based Solution

2.3.1 Introduction to the Issuer Host Based Solution

The Issuer Host Based Solution works by executing the logic required to track transaction

count or cumulative monetary amount within the Issuer’s host system rather than on the card

chip. It therefore works for existing cards with no need to reissue and also works for mobiles

and wearables. The solution is fully online, based on a contactless zero floor limit and provides

the Issuer with the ability to adjust the parameter thresholds as required.

2.3.2 How the solution works

The solution utilises new authorization response codes to request SCA when needed. The

transaction flow is summarised in Fig. 3 below:

Fig. 3: The Issuer Host Based Solution transaction flow

When a customer initiates a contactless transaction, the transaction is sent online to the Issuer

for Authorization.

Transaction sent

for authorization

Customer

Enters PIN

Approved

Declined

Host SCA

parameter

is reset

Host SCA

parameter

is not reset

SCA parameter

in Breach

SCA parameter

not in Breach

SCA required

Approved

1

$

Acquirer Issuer

Amount below CVL

$

VISA

Transaction

with PIN

Response

code

(issuer

supports

Online PIN)

Response

code

(issuer

does not

support

Online PIN)

TIG v1.5

Terninal

Enter

PIN

Insert

card

AcquirerIssuer

VISA

Online PIN

not

supported

Online PIN

supported

Online authorization

Online

authorization

Version 2.0

9 September 2019

15

The Issuer tracks the number of transactions and the cumulative monetary amount with no

cardholder verification based on receiving transaction authorization requests. The Issuer resets

the counts every time a transaction with cardholder verification is performed (contact chip with

offline or online PIN, contactless with online PIN or CD-CVM). When the Issuer host detects

that the pre-set transaction count or cumulative monetary amount threshold has been

reached, it returns the appropriate response code back to the merchant terminal.

The Issuer can respond with one of two new response codes depending on whether the Issuer

supports online PIN:

• Response code 1A is used to switch interface to contact for offline PIN

• Response code 70 is used for online PIN

This is determined by which market the Issuer is in.

See section 2.4.1 for more information on the response codes. So long as the terminal is

compliant with Terminal Implementation Guidelines v1.5 (TIG V1.5), it will recognise the code

and prompt the customer to authenticate the transaction.

In markets that do support online PIN as a CVM, the cardholder, mobile and wearable user will

just be invited to enter their PIN into the terminal. The Issuer has the choice to use Response

code 70 or 1A, but Visa strongly recommends Issuers use Response code 70, as the customer

experience is better.

In markets that don’t support online PIN as a CVM, the customer will be invited to insert their

card to complete the payment using Chip and PIN. Once the customer has entered the PIN,

the terminal returns the authorization message with the PIN to the Issuer for approval. Once

the PIN is verified, and if the transaction is approved, the host based counter or amount

accumulator resets to zero.

If the transaction is declined, the host SCA parameter is not reset.

2.3.3 Benefits and considerations

The Issuer Host Based Solution offers the following benefits:

• The customer experience is as friction free as possible

• There is no need for card reissuance – the system works with existing cards

• Exempt transactions at unattended transport or parking terminals can be readily supported

• It can improve credit and fraud risk as all in scope transactions are authorised online

• There is no requirement for the customer to either double tap or insert and enter PIN in

on-line PIN supported countries

However, the implementation of the Issuer Host Based Solution requires:

• Issuer host authorization systems to be changed to:

• Manage the SCA cumulative transaction count or cumulative monetary amount

accumulator parameters

• Support the new response codes to request the application of SCA when the selected

parameter has been breached

Version 2.0

9 September 2019

16

• All in scope transactions need to be authorized online, requiring a zero floor limit across

Europe. This will be implemented in October 2019.

• There is an additional authorization processing overhead for the Issuer for transactions

that require SCA, but this can be minimised by selecting to use the cumulative monetary

amount parameter rather than the transaction count.

• That PoS Terminals are TIG V1.5 compliant to ensure that the new response code is

recognised. If a terminal is not upgraded, it will not recognise the response codes sent

when SCA is required and the transaction will be declined.

• All Acquirers must support the new Response codes.

• Acquirers and merchants will need to cooperate in terminal upgrade programmes, to

minimise potential declines and minimise friction in the customer experience.

2.3.4 Consumer experience considerations

The following table summarises how the customer experience of the Host Based Solution

differs under different payment device and Online PIN vs. Offline PIN scenarios.

Table 2: Summary of Issuer Host Based customer SCA experience

Payment Device/

Environment –

Contactless

Code

used

Online PIN environment –

Consumer experience

Offline PIN environment –

Consumer experience

Card – Online PIN

supported over

contactless

70

Requests PIN

Changes interface to Chip

Card – No Online

PIN over

contactless

1A

Changes interface to Chip

Changes interface to Chip

Card – Chip &

signature

1A

Changes interface to Chip

Changes interface to Chip

Mobile - Online

PIN supported by

Issuer AND device

70

Request PIN

N/A

Mobile – Non

online PIN

supported by

Issuer OR device

1A

Ask to tap again with CDCVM

required

Ask to tap again with CDCVM

required

Wearable with

online PIN

70 & 1A

Requests PIN

Decline

Version 2.0

9 September 2019

17

The TIG 1.5 terminal specification does allow the Issuer Host Based Solution to be used for a

transaction initiated by a mobile device that does not support online PIN as a CVM method,

however it should be noted that if the customer taps again without applying CDVCM the

terminal will ask for the device to be tapped again and the customer may experience a “loop”

of repeated requests to re tap.

2.3.5 When Issuers should consider adopting the solution

The Issuer Host Based Solution works well in:

• Online PIN markets

• Markets operating zero floor limits

2.4 Authentication and Authorization Message Codes

2.4.1 SCA Required Response Codes

SCA may be required if the applicable monetary amount or number of transactions limit has

been exceeded.

The requirement to apply SCA will be communicated to the terminal by way of an appropriate

response code as follows:

1. Response code 1A in Field 39 – a new response code that will be available to

Issuers to indicate that the transaction cannot be approved until SCA is applied.

a. Issuers may respond with 1A for both e-commerce and card present

contactless point of sale (POS) transactions

b. For contactless transactions, response code 1A should be used for offline

PIN. The terminal will then switch interfaces to contact and request an

offline PIN

c. Issuers should not use response code 1A for One Leg Out transactions

2. Response code 70 in Field 39 should be used effective 3 June 2019, code 70 (PIN

data required) that will allow Issuers that support online PINs to request SCA.

a. The cardholder will then be prompted at the point-of-sale (POS) terminal

to enter their PIN if the POS device supports online PIN.

b. Response code 70 will result in the prior transaction, which triggered the

response code, being resubmitted to the Issuer along with an online PIN.

c. A POS device in an offline PIN country will treat a Response code 70 as a

Response code 1A and will switch interface.

Version 2.0

9 September 2019

18

3. Response codes 70 is optional from 3 June 2019 and mandatory from 18 October

2019 for Acquirers (alongside 1A). Issuers are mandated to adopt the response

code 1A for remote electronic transactions from 18 October 2019.

2.4.2 Terminal support of Response Codes

The Visa Europe Contactless Terminal Implementation Guide Version 1.5 (TIG V1.5) requires

that the terminal is able to respond to the response code and display the appropriate

cardholder prompt message

6

.

2.5 Solutions for the application of SCA

The reader may, after the contactless tap and on receipt of the appropriate response code (see

section 2.4.1 above), prompt the consumer to undergo SCA. In that case, specific instructions

detailing the SCA action required by the POS system are displayed.

Depending on the outcome of the SCA logic, the reader may display a prompt for the

cardholder to insert their card in the chip reader, the cardholder may be prompted to enter

their PIN, or the cardholder may be prompted to tap their device again, depending on whether

the Issuer supports online PIN or not, as per the screens shown in Fig. 5 below.

Fig. 5: Example cardholder prompts

2.5.1 Mobile and wearable authentication

For Visa contactless transactions conducted with a consumer device, such as a mobile phone,

the reader may prompt the consumer to follow the instructions on the display of their device,

for example when a consumer is required to enter a passcode into their mobile device.

2.5.2 Transaction Declines

If SCA has been requested by the Issuer and the POS system is not able to carry out the SCA,

it should decline the transaction and present the cardholder with a “Not Authorised” message.

6

For more details, please refer to the TIG V1.5 or above

Please

insert card

Please enter

your PIN

Present device

again

Version 2.0

9 September 2019

19

2.6 Transactions at Unattended Terminals

Transactions undertaken at unattended transit and parking terminals, to which the unattended

transit and parking terminals exemption applies, will be handled by the Visa contactless

solutions as follows:

• Under the Card Based Solution, the card will not add to the No CVM count if it sees a zero

amount transaction.

• Under the Issuer Host Based Solution, the transactions will be identified by the MCC

codes.

Where the terminal does not have PIN entry capability and the unattended transit and parking

terminal exemption does not apply and the SCA limit parameter is breached, there is the

chance that some transactions may be declined.

2.7 Stand in Processing – STIP

Stand-in processing (STIP) occurs when Visa acts as a backup processor that approves or

declines authorizations on behalf of an Issuer. The VisaNet Integrated Payment (V.I.P.) System

determines when a transaction is eligible for STIP based on Issuer availability or participation

in various Visa on-behalf-of services. When a transaction is routed to STIP, a series of Issuer-

defined parameters and activity limits are used to determine how the transaction should be

processed.

2.7.1 Strong Customer Authentication Parameters for STIP

7

To ensure that STIP transactions support the PSD2 requirement to support Strong Customer

Authentication (SCA), effective with the April 2019 Business Enhancements release, new

SCA STIP parameters will be available for Issuers in the European Economic Area (EEA) in the

following scenarios for contactless transactions:

Additional configuration options will be provided for PSD2 SCA STIP for contactless

transactions, namely:

• Does the issuing BIN want to decline all unauthenticated contactless transactions in STIP

when the Issuer is unavailable?

• An authenticated contactless (F22.1=07/91) transaction is one where:

o Offline PIN validation has been successfully performed or

o Consumer device cardholder verification method (CDCVM) or

o Online PIN is present in the request and can be validated by the V.I.P. System in STIP

The default value for the question above will be ‘No’, i.e. an unauthenticated contactless

transaction will not be declined in STIP due to lack of SCA. Issuers that choose to participate

in the SCA STIP options must submit the SCA Client Implementation Questionnaire (CIQ) to

specify their SCA parameters for STIP. The questionnaire will be available to download from

the Europe CIQ Forms page at Visa Online shortly.

Note:

7

These requirements are defined in VBN: Changes to Stand-In Processing to Support Strong Customer

Authentication Under PSD2 18

th

April 2019

Version 2.0

9 September 2019

20

Issuers can define the response code to be used in SCA STIP in answer to the question above:

• Declined with Response Code 05—Do Not Honour

• Response Code 70: To be used by Issuers from markets supporting online and offline PIN

(and therefore online PIN at contactless)

• Response Code 1A: To be used by Issuers from offline PIN markets

• Approved with Response Code 00 (Note: This is the default if the Issuer does not use the

STIP option as listed above.)

2.7.2 Scope of SCA / PSD2 for STIP Transactions

PSD2 requires that SCA be performed on transactions where both the Acquirer and Issuer are

located in the EEA

8

. Issuers can define certain exemptions

9

to be used in SCA STIP.

SCA STIP is not required to be performed for Contactless transactions at an unattended

terminal with the following merchant category codes (MCCs) for the purpose of paying a

transport fare or a parking fee:

Transit and Parking MCCs

• MCC 4111—Local and Suburban Commuter Passenger Transportation, Including Ferries

• MCC 4112—Passenger Railways

• MCC 4131—Bus Lines

• MCC 4784—Tolls and Bridge Fees

• MCC 7523—Parking Lots, Parking Meters and Garages

8

For a list of countries see Appendix A.1

9

For more detail see section 1.2

Version 2.0

9 September 2019

21

3 Guidelines for applying the

exemptions and implementing Visa’s

solutions

3.1 Selecting the optimum solution.

The solution that Issuers select will depend upon a number of factors including the market(s)

they are operating in and the practical balance between the potential need to re-issue cards

and upgrade merchant terminal and Issuer authorization host systems.

Each of the two solutions and the considerations to take into account is summarised in Table

3 below:

Table 3 Summary of the Visa solutions and considerations

Card Based Solution

Issuer Host Based Solution

Benefits

• Apply SCA and exemptions for

plastic cards in all market conditions

in Europe.

• No additional transaction

processing. Card determines need

for, and triggers, SCA (e.g. PIN)

capture

• Can also improve Issuer control of

credit and fraud risk

• Apply SCA and exemptions

without requiring re-issuance of

card plastics. Existing cards work

as usual.

• Precise method of accounting for

exempted transactions (e.g.

unattended transport and

parking).

• Can improve Issuer control of

credit and fraud risk.

• Exchange rates can be applied

dynamically

Considerations

• Card re-issuance can be expensive,

especially within PSD2 timeframe

• If parameters are breached, the

solution always switches

transactions to Chip & PIN to

capture SCA

• As such, this may hinder growth of

contactless

• Not suitable for mobile or

wearables

• Requires Issuer host changes (new

parameters and Response Codes)

• Results in additional transaction

processing where SCA is required

Dependencies

• Requires card re-issuance based on

VCPS 2.2.3 or higher

• Requires all transactions to be

processed online (e.g. zero floor

limit)

• Requires terminals to comply with

TIG 1.5 to process new RC

Issuer

Version 2.0

9 September 2019

22

• Requires Issuer to support new

host-based parameters and

Response Codes

Issuers may consider adopting more than one solution for PSD2 compliance.

3.2 Implementing the Card Based Solution

3.2.1 Customer experience considerations

Issuers should understand the impact on the customer experience of switching to Chip and

PIN when SCA is required. In markets supporting Online PIN, a change of interface is required

under the Card Based Solution when SCA limit parameters are breached. It should also be

noted that under the card based solution, the counters cannot be reset without using a contact

interface.

3.2.2 Card reissuance

The most significant policy decision for Issuers considering implementing the Card Based

Solution is the need for card reissuance. Visa recommends that:

• Issuers consider the opinions of local competent authorities in determining their card

replacement strategy

• Issuers work with their card vendors ensure that all contactless cards issued after 14

th

September 2019 are based on VCPS 2.2.3 or higher

• Issuers may wish to consider forced reissuance where appropriate, especially for regular

contactless card user customers

Visa is working with regulators to ensure that they are aware of the challenges and

disadvantages of large scale forced card reissuance and to promote acceptance of pragmatic

card replacement strategies that aim to minimise disruption to customers and fraud risk.

Issuers should take their own legal advice and understand the view of their local competent

authorities before finalising their strategy.

Visa’s position is that the cumulative counts or amounts requirements should apply, where

applicable, to cards issued after the SCA rules enter into force, i.e. 14 September 2019, and

that for existing cards in circulation, Issuers should have a card replacement programme in

place to achieve compliance with the regulation over a reasonable time period. Issuers should

work with their regulators on a smooth glide path. For further details, please refer to our

“Preparing for PSD2 SCA” guidance issued in November 2018.

3.2.3 Setting personalisation criteria

Personalisation is managed through the VPA. Visa encourages Issuers to use the simplified

profile selection approach within the VPA to take advantage of the predefined best practice

personalisation settings and reduce the complexity of card set up for SCA. Refer to the

Contactless Best Practice Risk Guide for further details.

The Issuer can set the options at card personalisation, to receive values of the on-card SCA

parameters in the authorization request message, the Issuer then has the option to use this

information in the authorization process.

Version 2.0

9 September 2019

23

3.2.4 Selection of the Velocity Parameters and resetting of counters

The Issuer may select whether to use the consecutive transaction counter parameter or the

cumulative monetary amount parameter as the basis for triggering the application of SCA.

Issuers may also set the value for which SCA is applied when the parameter is breached. This

may be lower than the values defined by the PSD2 SCA RTS (5 consecutive transactions or a

cumulative monetary amount of €150 since the last application of SCA), if the Issuer wishes to

adopt a more cautious risk strategy.

Visa recommends that Issuers adopt the cumulative monetary amount parameter to minimise

the impact of the application of SCA on the customer experience.

Issuers should note that for the Card Based Solution, when the limit is breached, the counter

will only be reset if the contact interface is used. Going online and using the contactless

interface will not reset the counter.

3.2.5 Setting currency conversion rate parameters

For the Card Based Solution, the conversion rate used is set at personalisation and therefore

the rates used will be an approximation of the actual exchange rates at any point in time.

The rate used is a decision for Issuers. Issuers should check the policy of local competent

authorities before determining which conversion rates should be used. Refer to the Contactless

Best Practice Risk Guide for further details on setting the parameter.

It is possible to update currency conversion parameters via scripting, at the Issuer’s discretion.

3.2.6 Contact and contactless interface selection and support of Chip and Signature

Parameters need to be set to ensure selection of the correct interface for application of SCA

and resetting of counters. The card needs to be configured to switch to the contact interface

in order to reset the counter when a PIN is entered correctly.

The VCPS 2.2.3 specification has a configurable parameter for signature to allow for

circumstances where an Issuer offers Chip and signature for the application of CVM. Where

the parameter is set, the counter or accumulator will be reset for contact chip and signature

transactions as well for Chip and PIN. Please note that the counter will not be reset if the

contactless interface is used.

Refer to the Contactless Best Practice Risk Guide for further details on setting these

parameters.

3.2.7 Unattended terminals and application of the unattended transit terminals exemption

Issuers need to be aware that under the Card Based Solution:

• When the card is used at an unattended transit or parking terminal and the SCA parameter

is breached:

• If the transaction is zero value, the counter will not be incremented and SCA will not

be requested.

• The card will attempt to switch interface

• If the terminal is unable to switch interface, then the transaction will be declined.

Version 2.0

9 September 2019

24

3.2.8 Availability of the solution

The VCPS 2.2.3 specification governing the solution was published in December 2018 and is

now available. The Applet VSDC 2.9.1 required for producing the cards and the testing tools

are available.

Visa expects to have products available for use by Issuers from May 2019.

VPA which is used for defining personalisation profiles and simplified profile selection will be

updated for SCA related usage from May 2019

Issuers are encouraged to contact their card vendors for further updates.

3.2.9 Certification

Standard processes will apply for the certification of new VCPS 2.2.3 compliant cards. Visa is

making tools available for Issuers to self-certify according to their own timescales. Issuers

should contact the Visa Client Implementation team to initiate a certification project. Issuers

who do not yet have Client Implementation Team contact should contact Visa customer

services.

3.3 Implementing the Issuer Host Based Solution

3.3.1 Availability of the Solution

3.3.1.1 New Response Codes

The Response Code 1A is available in the VisaNet Integrated Payment (V.I.P) System as of April

2019. Acquirers and Issuers must be able to process this code (for remote as well as card

present transactions) by October 2019. Processing of the code is optional from April 2019.

Response code 70 is effective from 3 June 2019.

Acquirers are Mandated to support response codes 1A and 70 across the EEA from October

2019. Issuers are mandated to support response code 1A for remote electronic transactions

from October 2019

3.3.1.2 Contactless Terminal Requirements and Implementation Guide

The Contactless Terminal Implementation Guide version 1.5 (TIG 1.5) that defines the

requirements on terminal to support the new response codes is available as of February 2019.

Acquirers & Merchants are already able to upgrade their terminals to ensure they comply

3.3.2 Use of the new response codes in field 39

3.3.2.1 Response code 1A

Response code 1A should be used by Issuers from offline PIN countries

3.3.2.2 Response code 70

Response code 70 should be used by Issuers from online PIN countries

The response code used is determined by whether the Issuer supports online PIN, not whether

the transaction is undertaken in an online or off-line PIN market. The TIG 1.5 compliant

terminal will respond appropriately.

Version 2.0

9 September 2019

25

Issuers should note that when using a Response code 70 to request CVM, the second

authentication request submitted after CVM is applied will have the same chip data as the first,

along with the CVM data (the PIN) and the transaction should not be declined.

3.3.2.3 Implementation of the response codes

The new response codes will be implemented through the standard scheme changes process.

Further detailed information on the response codes and their implementation is provided in

the appropriate Visa technical letters

10

.

3.3.3 Reliance on terminal upgrades

The Issuer Host Based Solution requires that all terminals are upgraded to comply with the TIG

1.5 specification. Acquirers and Merchants should ensure that terminals are upgraded in time,

as transactions from non-compliant terminals that require SCA to be applied due to breaching

of the cumulative velocity limit will be declined.

3.3.4 Use of the Issuer Host Based Solution outside the EEA

Issuers should not use these Response codes for transactions outside the EAA as they are likely

to lead to declines.

3.3.5 Other Issuer implementation considerations

3.3.5.1 Not all transactions will be online

The Issuer Host Based Solution requires transactions to come online for authorization. While

zero floor limits will apply on all countries from October 2019, not all transactions will come

online. For example:

• Deferred authorization

• Merchant stand-in

• Some low value and transit

transactions will be authorized offline.

3.3.5.2 ATC checking processes

Where ATC checking processes are used a part of Risk management they need to be reviewed

as:

• Transactions may be received out of sequence

• Two identical transactions may be received with the same chip data. The second

transaction should include the PIN block and should not be declined as a duplicated

transaction due to ATC checking rules.

3.3.5.3 Use of the Issuer Host Based Solution for Mobile and wearables

Issuers should also avoid using response code 1A for transactions initiated from wearable

devices.

10

Further details on Response Code 1A are provided in Global Technical Letter and Implementation

Guides published October 2018: and April 2019 and July 2019 VisaNet Business Enhancements

published March 2019. Details on response code 70 are included in Global Technical Letter and

Implementation Guide Version 1 Published April 2019.

Version 2.0

9 September 2019

26

For mobile, and wearables, the terminal will need to use the Form Factor Indicator (FFI) to flag

to the Issuer that the device is a mobile or wearable.

3.3.6 Terminal upgrade and certification process

Upgrading terminal software in line with the latest version of the TIG will constitute a

significant change to the payment functionality. This will necessitate retesting of the terminal

according to Visa’s standard terminal testing processes. For the contactless interface this

means testing with a VpTT (Visa payWave Test Tool) and submitting reports on the CCRT (Chip

Compliance Reporting Tool) on VOL. No retesting of the contact interface should be necessary.

Queries relating to terminal testing should be addressed to: [email protected]om.

3.4 Optimising application of the contactless exemption

3.4.1 How to select which cumulative limit to apply (preference for value-based approach)

Visa recommends that Issuers use the cumulative amount-based limit rather than the count

based limit as this will minimise the frequency with which SCA needs to be applied and

minimise impact on customer experience.

In the case that the Issuer is using the host-based solution, selection of the cumulative

monetary amount limit also reduces the authorization processing overhead.

3.5 Liability and disputes

There are no changes to liability for card present transactions as a result of PSD2.

3.6 Practical guidelines on applying the transport and parking exemption

Transport and parking transactions are identified from the following MCC codes:

• 4111 (Local and Suburban Commuter Passenger Transportation, including Ferries)

• 4112 (Passenger Railways)

• 4131 (Bus Lines)

• 4784 (Tolls and Bridge Fees)

• 7523 (Parking Lots, Parking Meters and Garages)

3.7 Practical guidelines for supporting non-card payment devices

When using a device (e.g. paying via a mobile phone or wearable device), Visa’s view is that

two-factors of authentication can be captured through Possession using the token cryptogram

(requires prior device linking), and either Inherence using a biometric or Knowledge using a

passcode, or online PIN (for markets that offer this functionality). This applies to all mobiles

and wearables with a linked mobile application.

3.8 Education of Merchants and Consumers

Visa recommends that:

Version 2.0

9 September 2019

27

• Issuers put in place communications programmes to educate customers about the changes

they can expect to the contactless transaction experience as a result of the PSD2

requirements for SCA and the reasons for these changes being implemented.

• Acquirers put in place communications programmes to educate merchants about the

changes their customers will experience to the contactless transaction experience, so that

they can effectively manage the transaction when CVM is requested for a contactless

transaction.

Version 2.0

9 September 2019

28

4 Planning for PSD2 - what you

need to do

Visa clients, merchants and other stakeholders need to plan and prepare for the application of

SCA.

This section summarises the key decisions and actions that need to be taken by each

stakeholder group and identifies the sections of the guide that provide more detailed

guidance:

4.1 Issuer planning checklist

Issuers should ensure they have a contactless PSD2 SCA plan in place that covers at least the

following critical decisions and actions:

Table 4 Issuer planning checklist

Solution Selection

1.1

Select Visa solution to for managing

the contactless exemption and

application of SCA

• Review each of Visa solutions available and the benefits and

considerations and guidance provided in this guide

• Consider which solution or combination of solutions is the

best fit for your market and for your portfolio

•

1.2

Develop a plan for implementation

of the solution(s)

This should include as appropriate:

• Timings for implementation

• Issuer host upgrades

• Card procurement (VCPS2.23 complaint)

• Card reissuance

•

For more details see below

Card Based Solution Implementation (if applicable)

2.1

Contact your vendor for

information on the availability of

the VCPS2.2.3 compliant cards

• Your vendor should be able to advise on timescales

• Put a certification project in place

2.2

Develop a plan for reissuance

• Which portfolios the Card Based Solution will apply to

• Whether you are going to reissue based on the natural card

replacement cycle or an adopt an accelerated programme

Issuer Host Based Solution Implementation (if applicable)

3.1

Ensure that the new response codes

will be supported in time

• Issuers will need to support Response code 1A for offline PIN

markets and 70 for online PIN markets

3.2

Scope and plan the required

changes to the host authorization

• Evaluate solutions and decide on whether to utilise this

solution

Version 2.0

9 September 2019

29

system to support the counter and

accumulator parameter logic

• Build counts in Host systems

• Review impacts of Article 12 in counts – Transit and Parking

Customer Communications

5.1

Develop a customer

communications plan

• Customers will need to be made aware that their contactless

experience will change and why that is the case

4.2 Acquirer planning checklist

Acquirers should ensure they have a contactless PSD2-SCA plan in place that covers at least

the following critical decisions and actions:

Infrastructure upgrade

1.1

Develop a plan for upgrading

terminal estate to TIG 1.5

• Issuers in many markets will adopt the Issuer Host Based

Solution that requires terminal upgrade

• Terminals in your own estate and those managed by ISVs,

merchants and other third parties will need to be upgraded

• Ensure that a certification project is in place

1.2

Ensure the new response codes are

supported

• All Issuers and Acquirers need to support the new

response codes (1A and 70) by Oct 2019

• Terminal retesting with VpTT will be needed.

Merchant Communication

2.1

Develop a plan to prepare

merchants for PSD2 and the

application of SCA to contactless

transactions

This should cover

• The need and plans for terminal upgrades

• The changes to the customer experience so that staff can

be trained to deal with issues appropriately

4.3 Merchant planning checklist

Merchants should ensure they have a contactless PSD2-SCA plan in place that covers at least

the following critical decisions and actions:

Merchants with Acquirer owned terminal estate

1.1

Familiarise yourself with the PSD2

requirement

• Read the relevant sections of this guide to understanding

of the changes to card present and contactless transaction

authentication that will take place to ensure compliance

with PSD2

1.2

Contact your Acquirer for details

on whether and when terminal

upgrades will take place.

Version 2.0

9 September 2019

30

Merchants with owned payment terminal estate

2.1

Identify whether you will need to

update your terminals to TIG 1.5

• Merchants in markets where Issuers are adopting the Host

Based solution who own their terminals will need to ensure

these terminals are updated to TIG 1.5 by Sept 2019

2.2

Develop a plan for terminal

upgrades

• Work with your vendor to develop an upgrade and

certification plan

All Merchants

2.1

Train staff

Staff will need to be aware that customers making contactless

transactions will be challenged to authenticate themselves on

amore regular basis than to date. Staff should understand and

be able to explain to customers why this is and that it is not due

to a problem with the customer’s card, the payment terminal or

processing systems.

Version 2.0

9 September 2019

31

5 FAQ

Question

Answer

1

What is the impact of PSD2 SCA

regulation on contactless?

New regulatory requirements on Strong Customer

Authentication (SCA) will make two-factor authentication

a key requirement for the provision of electronic payment

services.

The new requirements are outlined in the final Regulatory

Technical Standards (RTS) on Strong Customer

Authentication and secure communications (published 27

November 2017), hereinafter “PSD2 SCA”, which will apply

from 14 September 2019

11

.

2

What is Strong Customer

Authentication?

Strong Customer Authentication (SCA) means an

authentication based on the use of two or more elements

categorised as:

• Knowledge (something only the user knows),

• Possession (something only the user possesses), and

• Inherence (something only the user is),

that are independent, in that the breach of one does not

compromise the reliability of the other(s).

3

When does SCA apply?

Strong Customer Authentication should be applied each

time a payer accesses its payment account online, initiates

an electronic payment transaction, or carries out an action

through a remote channel which may imply a risk of

payment fraud or other abuses.

There are certain exceptions detailed in Chapter III of the

RTS. The ones most relevant to card present transactions

are:

• Article 11 – Contactless Payments at Point of Sale

• Article 12 – Unattended terminals for transport fares

and parking fees.

In addition, some transactions are out of scope of the SCA

requirements. For more information refer to section 1 of

this guide

11

For further information, please refer to “Preparing for PSD2 SCA”, November 2018.

Version 2.0

9 September 2019

32

Question

Answer

4

Do PSD2 SCA requirements

apply to cards that are issued

outside of the EEA (when

purchasing in the EEA)? Does

this requirement apply when

EEA cardholders make purchases

where the Acquirer is outside

the EEA?

• A transaction from an EEA (the European Economic

Area) issued card at an EEA acquired terminal is

considered a “two-legged” transaction – and this is

in-scope of the PSD2 regulation.

• However, a transaction from an EEA issued card at a

terminal acquired outside the EEA is considered a

“one-legged” transaction – the EBA expects SCA to

be applied on a ‘best-effort’ basis.

• Also, a transaction from a non-EEA issued card at an

EEA acquired terminal is considered a “one-legged”

transaction –the EBA expects SCA to be applied on a

‘best-effort’ basis.

5

What countries does this apply

to?

PSD2 legislation will apply to all countries within the

European Economic Area.

6

Are Chip and Signature

transactions compliant with

PSD2 SCA?

Chip and paper-based signature is not an alternative to

Chip & PIN for the purposes of SCA and should only be

used for financial inclusion purposes, subject to local

competent authorities’ views.

Visa will process transactions that are authenticated using

Chip and signature, but the decision on whether to

authorize these transactions should be made by the Issuer

based on their risk strategy.

7

Are Magnetic Stripe and

Signature transactions compliant

with PSD2 SCA?

Magnetic stripe transactions are not compliant with SCA

according to the EBA, even as a fall-back.

8

Is there a time limit regarding

the 5 consecutive transactions or

€150 cumulative contactless

spend limits?

No. There is no time period.

9

Do all cards need to be

compliant from 14th September

2019 or can we issue rollout on

a replacement cycle only?

This is a matter for Issuers. However, Visa’s position is that

the cumulative counts or amounts requirements should

apply, where applicable, to cards issued after the SCA rules

enter into force, i.e. 14 September 2019, and that for

existing cards in circulation, Issuers should have a card

replacement programme in place to achieve compliance

with the regulation over a reasonable time period. Issuers

should work with their regulators on a smooth glide path.

For further details, please refer to our “Preparing for PSD2

SCA” guidance issued in November 2018.

Version 2.0

9 September 2019

33

Question

Answer

10

Do the cumulative number of

transactions and transaction

amount limits apply to the

Payment Account or Payment

Device?

Visa’s view is that contactless limits should be applied at

device/token level rather than account level. If the limits

were to be managed at the account level, this would not

adequately take into account that the same payment card

can be used as a plastic card or it can be registered in one

or more digital/mobile wallet(s) and/or devices (e.g.

smartwatches and wristbands). The application of the

limits at account level implies that performing SCA on any

device would reset the counter/accumulator. This would

have the effect of allowing lost or stolen devices to be used

if the owner is not aware of the loss and continues to use

other devices and perform SCA.

11

Has an updated contactless risk

guide been produced?

Yes, “Contactless Best Practice Risk Guide” issued in

September 2018.

Please contact your Account Executive for further details.

12

Does Visa recommend a value

based or volume based count?

Visa recommends the value based approach to minimise

the impact on customer experience. This recommendation

reflects the fact that in markets with high levels of

contactless usage, consumers now view contactless as a

highly convenient way of making low value payments and

often make multiple transactions in the course of a day.

Fraud rates on contactless transactions are also very low,

typically less than 2 basis points. Enforcing SCA via PIN

entry every five transactions will be disruptive and

inconvenient for consumers and will offer little benefit in

terms of fraud reduction. Issuers may choose which metric

to apply and SCA must be applied as soon as the selected

metric is breached.

13

Does PSD2/SCA have any

implications on liability?

PSD2 sets out regulatory liability rules. The current Visa

rules around liability and disputes remain in place.

14

What solutions has Visa

developed to support

compliance with PDS2 SCA

requirements?

Visa has designed the following solutions to provide

choice for our clients in achieving compliance with PSD2

SCA requirements:

• Card Based Solution - allows an Issuer to apply SCA

or exemptions via their card base alone;

• Issuer Host Based Solution - allows an Issuer to apply

SCA or exemptions without modifying their card

base, using new logic in the authorization process;

and

Version 2.0

9 September 2019

34

Question

Answer

These solutions have been developed to allow for

authentication whilst providing minimum friction to the

customer at the point of sale. All with the goal of

maintaining the positive customer experience millions of

cardholders expect from contactless payments.

For more information see Section 2 of this guide

15

What are the new Parameters

being introduced into the new

card specification?

Visa Contactless Payment specification (v2.2.3) has

introduced two new parameters namely

• CTC- NC – A counter which counts the number of

consecutive contactless transactions performed

without CVM

• CTTA – NC – An accumulator that accumulates the

amount of contactless transaction without CVM.

16

How does the card handle

different currencies?

The card can be personalised for 40 countries and 20

different currencies. The exchange rate is set at the time of

the personalisation of the card.

17

When will the Card Based

Solution be ready?

Updated “Visa Contactless Payment Specification”, (v2.2

updates list 3) has been issued. The new applet (v2.9.1) has

been developed, testing tools are being developed and

will be available in spring 2019.

18

Does the Card Based Solution

reflect Article 12 re the Transit

transactions?

Any transaction that is processed with a zero value, such

as transactions processed through the Mass Transit model,

for example at London’s tube gates, will not count towards

the accumulator.

19

When will the Host Based

Solution be available?

The “Contactless Terminal Requirements and

Implementation Guide”, version 1.5, and authorization

messages to request for SCA, was published in February

2019. The general principal is that the Issuer counts the

PSD2 SCA parameters in their own host. Once the SCA

threshold is breached they can issue a response code that

will indicate to the terminal that they wish to step up

authentication (e.g. request a PIN transaction).

For further information, please refer to Technical

Guidelines.

20

What is Visa’s view on Non Card

Form Factors?

There is no general exemption from non-card form factors

that do not support SCA. Behavioural biometrics may offer

one way to support SCA. Transactions from non-card

Version 2.0

9 September 2019

35

Question

Answer

form-factors, such as wearable devices, based on the Visa

Contactless Payment Specification (VCPS), where CDCVM

is not supported by the device, may also be able to

perform SCA if the device and terminal support Online PIN.

21

Will STIP provide additional

configuration to cater for PSD2

SCA?

Additional configuration options will be provided for PSD2

SCA STIP for contactless transactions, namely:

• Does the issuing BIN want to decline all

unauthenticated contactless transactions in STIP when

the Issuer is unavailable?

• Issuers can define the response code to be used in SCA

STIP in answer to the question above:

• Declined with Response Code 05—Do Not Honor

• Response Code 70: To be used by Issuers from

markets supporting online and offline PIN (and

therefore online PIN at contactless)

• Response Code 1A: To be used by Issuers from

offline PIN markets

• Approved with Response Code 00 (Note: This is

the default if the Issuer does not use the STIP

option as listed above.)

• SCA STIP is not required to be performed for

Contactless transactions at an unattended terminal

with defined merchant category codes (MCCs) for the

purpose of paying a transport fare or a parking fee

For more information please refer to section 2.7.

22

Can the solutions for contactless

and PSD2 SCA be combined?

The two solutions (Card Based and Issuer Host Based) can

be combined in some cases to create additional value,

and/or used in concert with other Visa services, such as

Stand-In Processing (STIP), for example:

• Issuers opting for a Card Based Solution may also

implement Issuer Host Based accumulators which

could operate in concert;

• Regardless of the solution opted for, Issuers may

choose to implement Visa Stand-In Processing.

23

If an Issuer chooses to go with

the Card Based Solution, does it

have to ensure that all card

portfolios are upgraded and

reissued by September 2019?

This is a matter for Issuers. However, Visa’s position is that

the cumulative transaction count or monetary amounts

requirements should apply, where applicable, to cards

issued after the SCA rules enter into force, i.e. 14

September 2019, and that for existing cards in circulation,

Issuers should have a card replacement programme in

place to achieve compliance with the regulation over a

reasonable time period. Issuers should work with their

regulators on a smooth glide path. For further details,

Version 2.0

9 September 2019

36

Question

Answer

please refer to our “Preparing for PSD2 SCA” guidance

issued in November 2018.

24

Will support be given to

Acquirers to update terminals to

TIG 1.5?