*Persons with disabilities who plan to attend this meeting and would like to request auxiliary aids or services are requested to contact the District's office at (713) 942-0500 at least three business days prior to the meeting so that the appropriate arrangements can be

made. The Board will conduct an in-person meeting at its physical meeting location. As an accommodation during the current levels of transmission during this COVID-19 virus epidemic emergency, the Board is making available a Zoom teleconference and/or

videoconference option for members of the public to participate and to address the Board. Members of the Board may participate by videoconference in accordance with requirements of the Texas Open Meetings Act, provided a quorum of the Board meets in person.

Pursuant to V.T.C.A Government Code, Chapter 551, as amended, the Board of Directors may convene in closed session to receive advice from legal counsel and discuss matters relating to pending or contemplated litigation, personnel matters, gifts and donations,

real estate transactions, the deployment, or specific occasions for the implementation of, security personnel or devices and or economic development negotiations.

5445 Almeda Rd., Suite 503, Houston, Texas 77004

713-942-0500 (T) • 713-942-9882 (F) • info@houstonse.org (E)

TO: THE BOARD OF DIRECTORS OF THE GREATER SOUTHEAST MANAGEMENT DISTRICT AND TO ALL

OTHER INTERESTED PARTIES

Notice is hereby, given that the Board of Directors of the Greater Southeast Management District (the "District") will hold a regular

meeting, open to the public on Wednesday, March 9, 2022, at 12:00 p.m. at Palm Center, 5330 Griggs Road, Houston, Texas

77021 and via Zoom at the following link:: https://us06web.zoom.us/j/86322216225 dial 1-346-248-7799 and Meeting ID: 863 2221

6225 and Access Code: 658301. For an electronic copy of agenda documents, please refer to the following link:

https://houstonse.org/about/agenda-minutes-2/. The Board of Directors of the District will (i) consider, present, and discuss orders,

resolutions, or motions; (ii) adopt, approve and ratify such orders, resolutions or motions; and (iii) take other actions as may be

necessary, convenient or desirable, with respect to the following matters:

AGENDA

12:00 P.M.

12:05 P.M.

12:06 P.M.

12:08 P.M.

1. Call to Order

2. Public Comments

3. Approve Minutes from Previous Board of Directors’ Meeting

4. Receive Interim General Manager's Status Report on Administrative Services and Program Services

5. Receive Tax Assessor Collection Report: Equi-Tax, Inc.’s Assessment Collection Report for the period ended

February 28, 2022

12:10 P.M. 6. Receive Perdue, Brandon, Fielder, Collins & Mott LLP’s Lawsuit & Arbitration and Delinquent Commercial Assessed Tax

Collection Report for the period ended February 28, 2022

12:13 P.M. 7. Receive Budget & Finance Committee Report:

i. Receive Balance Sheet with Previous Month Comparison as of January 31, 2022

ii. Receive Profit & Loss with Previous Month and YTD Comparison as of January 31, 2022

iii. Approve Payment of Recurring and Non-Recurring Expenses for the period ending January 31, 2022

iv. Approve a Lease Agreement with Abdullatif & Company LLC at 5445 Almeda Rd, Suite 503, Houston, Tx

12:16 P.M. 8. Receive Governance Committee Report

i. Board of Directors Retreat Date and Time

ii. Board of Directors Attendance Policy

iii. Nomination of Officers for the Board of Directors

12:20 P.M. 9. Receive Personnel Committee Report:

i. Consider approval of job announcement and proposed search process for the position of Executive Director

ii. Authorize Hawes Hill & Associates LLP to serve as search process support designee for the Personnel Committee

12:24 P.M. 10. Receive District Services and Improvements Reports and Take Actions, if necessary, related to the following:

a. Enhanced Public Safety Services

b. Environmental, Urban Design & Visual Improvement Services

c. Transportation & Local Mobility Services

d. Marketing, Public Relations & Perception Enhancement Services

A scope of work, contract extension and a not-to-exceed amount for the Connect the Dots to provide Professional

Services for the Marketing, Public Relations and Perception Enhancement Services Program

e. Business & Economic Development Services

12:30 P.M.

11. Next Meeting Date: Wednesday, April 13, 2022, at 12:00 p.m.

12. Adjournment

__

/s/ Jerry Davis

__________________________

Interim General Manager, Hawes Hill & Associates LLP

GREATER SOUTHEAST MANAGEMENT DISTRICT

MINUTES OF A MEETING OF THE BOARD OF DIRECTORS

FEBRUARY 9, 2022

I. CALL TO ORDER

A regular meeting of the Board of Directors, of the Greater Southeast Management District (“District”) was held on

Wednesday, February 9, 2022, at 12:00 p.m. at Bracewell LLP, 711 Louisiana Street, Suite 2300, Houston, Texas 77002, and

via WebEx. The roll was called of the duly appointed members of The Board of Directors, to-wit:

Position #

Board Members

Position #

Board Members

1

Alan D. Bergeron

10

Cydonii Miles

2

Sharone Mayberry

11

Zinetta A. Burney

3

Jonathan Howard

12

Chris Hageney

4

Hexser J. Holliday II

13

Dr. Teddy A. McDavid

5

Charic Daniels Jellins

14

Brian G. Smith

6

Sadie Rucker

15

Dr. Abdul Muhammad

7

Rickey Jimenez

16

Karen Carter Richards

8

Abbey Roberson

17

Janice Sibley-Reid

9

Vacant

It was determined that all members of the Board of Directors were present except for Director Janice Sibley-Reid, Karen

Richards, Charic Daniels Jellins, Zinetta A. Burney and Sadie Rucker. Those in attendance were Clark Lord, Abbey Roberson,

Oletha Miller Jacobs, Jerry Davis and those attending virtually were Jonathan Howard, Chris Hageney, Nicole Knight, Dr. Misael

Obregon, Kendall Thompson, Maratha Failing, Michael Mauer, Nahab Fahnbulleh, Theola Petteway, Zachery Martin, Kathy

Hall, Mariana Raschke, Sgt. Frank Gans, Kelyn Allen and Jim Webb.

Chair Brian Smith called the meeting to order at 12:01 p.m.

II. PUBLIC COMMENTS

Chair Brian Smith turned to the receipt of public comments. Director Teddy McDavid, on behalf of the Old Spanish

Trail Community Partnership, shared information on the Shred Day on February 12, 2022, at Holman Street Baptist Church.

Director Smith gave a tribute to Texas State Representative Garnet Fredrick Coleman on behalf Black History month.

Representative Garnet F. Coleman has served the people of District 147 in the Texas House of Representatives continuously

since 1991.

III. APPROVE OF THE MINUTES

Chair Brian Smith called for the approval of the minutes of the Board of Directors meeting on January 12, 2022.

Upon motion duly made by Director Sharone Mayberry and seconded by Director Hexser Holliday II, approval of such minutes

were approved.

IV. INTERIM GENERAL MANAGERS REPORT

The Board of Directors received the Interim General Manager’s Status Report on Administrative Services and Programs

Services for period ending February 9, 2022, as presented by Jerry Davis, Interim General Manager.

V. TAX ASSESSOR COLLECTION REPORT

Chair Brian Smith called for the Tax Assessor Collection Report for the period ending January 31, 2022. The Board of

Directors received the Assessment Collection Report as presented by Oletha Miller Jacobs, Interim Managing Director of District

Administrative Services and Improvements..

Page | 2

VI. BUDGET & FINANCE COMMITTEE REPORT

Director Cydonii Miles stated the Budget and Finance Committee met on Tuesday, February 8, 2022, and provided a brief update.

The Board of Directors received the Budget and Finance Committee report as presented by Director Cydonii Miles.

a. The Board of Directors received the Compilation Report for period ending December 31, 2021, and the

Quarterly Investment Report for the period ending December 31, 2021;

b. The Board of Directors received the Balance Sheet with Previous Month Comparison as of December 31, 2021

c. The Board of Directors received the Profit & Loss with Previous Month and YTD Comparison as of December

31, 2021;

d. Upon a motion made by Director Teddy McDavid and seconded by Director Hexser Holliday II, the Board of

Directors approved the recurring and non-recurring expenses for the period ending December 31, 2021;

e. Upon a motion made by Director Teddy McDavid and seconded by Director Hexser Holliday II, the Board of

Directors approved an engagement letter from George Baugh III Certified Public Accountant for FY 2021

Auditing Services and a not-to-exceed amount of $11,800.00 non-single Audit and the single Audit $13,800.00,

additional out-of-pocket expense $500;

f. Upon a motion made by Director Teddy McDavid and seconded by Director Chris Hageney, the Board of

Directors approved a scope of work and a not-to-exceed amount for Bratton & Associates, PLLC to provide

Professional Legal Counseling and Advisement Services, with noted corrections/updates. Director Brian Smith

and Hexser Holliday II abstained.

g. Outstanding Contracts/Agreements. No Action Taken.

VII. PERSONNEL COMMITTEE REPORT

Director Alan Bergeron stated the Personnel committee met on Friday, February 4, 2022, and requested Hawes Hill to provide

an organizational chart and the District’s office situation needs to be rectified to avoid any personnel conflicts. The Board of

Directors received the Personnel Committee report as presented by Director Alan Bergeron.

VIII. GOVERNANCE COMMITTEE REPORT

Director Teddy McDavid chaired the Governance Committee meeting in Director Janice Sibley Reid’s absence. Director Teddy

McDavid stated the Governance Committee met on Monday, February 7, 2022. The committee discussed Board positions &

term limits, Board Attendance Policy, and the slate of directors’ positions 1-17 submitted to the City Council for approval. Clark

Lord, Legal Counsel provided a brief update on Open Meetings Act regarding Board Attendance. Chair Brian Smith appointed

Director Muhammad to lead the FY 2022 Board of Directors Retreat. The Board of Directors welcome Abbey Roberson, she

was appointed by the Board on December 8, 2021. The Board of Directors received the Governance Committee report as

presented by Director Teddy McDavid.

IX. DISTRICT SERVICES AND IMPROVEMENTS

The Board of Directors received the monthly District Services and Improvements for Enhanced Public Safety; Environmental,

Urban Design & Visual Improvement Services; Transportation & Local Mobility Services; Business & Economic Development

Services; Marketing, Public Relations & Perception Enhancement Services and Environmental, Urban Design & Visual

Improvement Services for the period ending February 9, 2022, as presented by Nicole Knight, Interim Program Manager.

a. Upon a motion made by Director Teddy McDavid and seconded by Director Hexser Holliday. II, the Board of

Directors approved to renew Annual Public Agency Membership with Urban Land Institute (“ULI”) for Board

Chair and two (2) associate members and to add one (1) additional associate membership for Business &

Economic Development Chair for a not-to-exceed amount of $1,000.00;

b. Local Hazard Mitigation Plans Program Grant (LHMPP) the $25,000,000 Local Hazard Mitigation Plans

Program (LHMPP) assists eligible entities through providing grants to develop or update local hazard mitigation

plans, or to provide cost share for hazard mitigation planning activities funded through other federal sources.

CDBG-MIT funds administered by HUD, and implemented through the Texas General Land Office fund these

Page | 3

planning activities, and the Hazard Mitigation Plan development and approval oversight is administered by

FEMA and implemented through the Texas Division of Emergency Management. Grant awards will range from

$20,000 - $100,000. No Local Match Requirement. No Action Taken; and

c. A scope of work, contract extension and a not-to-exceed amount $10,800.00 for the Connect the Dots to provide

Professional Services for the Marketing, Public Relations and Perception Enhancement Services Program for

the period beginning of February 9, 2022 and ending May 9, 2022. Item was tabled.

X. FUTURE MEETING

The next regular meeting of the Board of Directors of the Greater Southeast Management District is expected to be held on

Wednesday, March 9, 2022, at 12:00 p.m.

XI. ADJOURNMENT

Chair Smith adjourned the regular meeting of the Board of Directors of the Greater Southeast Management District at 1:26 p.m.

______________________________

Janice Sibley-Reid, Board Secretary

.

INTERIM GENERAL MANAGER’S REPORT

EQUI-TAX, INC.’S TAX ASSESSOR

COLLECTION REPORT

PERDUE, BRANDON, FIELDER, COLLINS & MOTT LLP’S

LAWSUIT & ARBITRATION AND DELINQUENT

COMMERCIAL ASSESSED TAX COLLECTION REPORT

Greater Southeast Management District

Lawsuit and Arbitration Status Summary as of 2/11/2022

Jur 944

Summary

For Years 2005-2022, for the period of May 2009 through February 11, 2022

Settled

9,124,461,604 Original value of Settled accounts as of 2/11/2022

1,309 Number of Settled accounts as of 2/11/2022

851,998,065

Reduction in value of Settled accounts

9.34% Average % reduction in value of Settled accounts

Unsettled

2,406,565,389 Original value of Unsettled accounts as of 2/11/2022

245

Number of Unsettled accounts as of 2/11/2022

.115 Assessment rate per $100 valuation

$258,420

Estimated* reduction in assessment on

245 Unsettled accounts,

based on 9.34% average

*Estimated because of "capped levies."

F:\Company Info\Lawsuits\Lawsuit Status\Greater SE Mgmt Dist_944_LTS-Feb11 2022.xlsx

Revised 2 March 2022

prepared by: Equi-Tax Inc.

281.444.4866

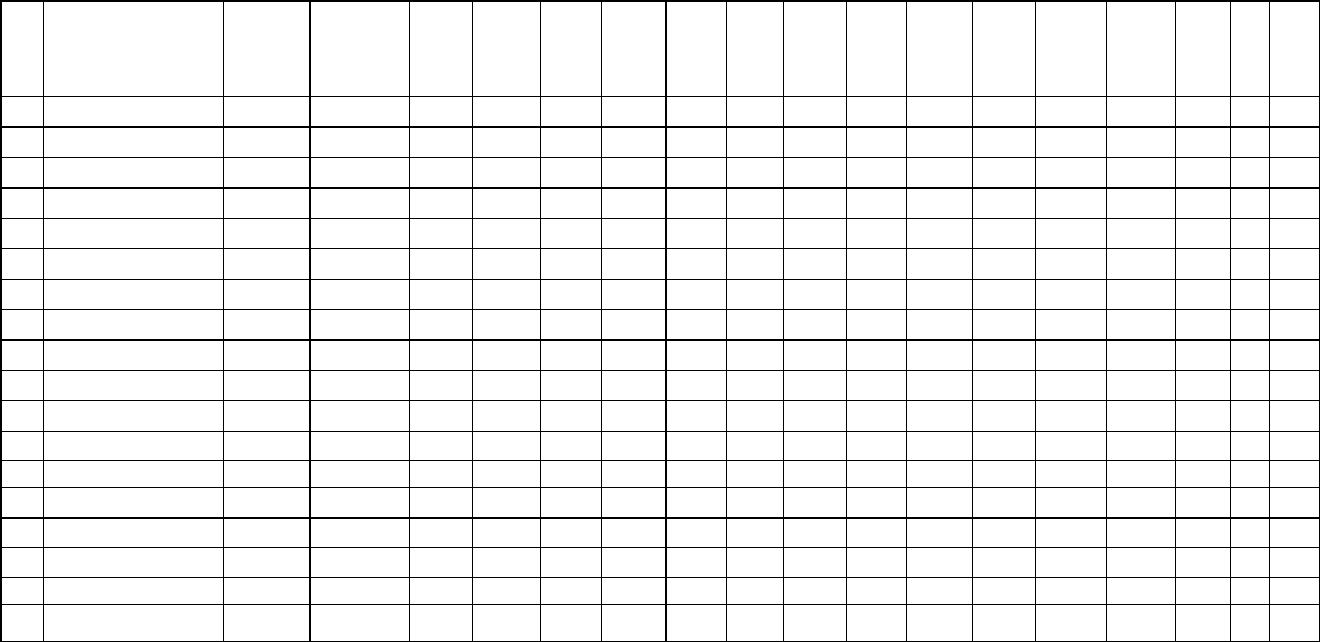

Greater Southeast Management District

Lawsuit and Arbitration Status Detail as of 2/11/2022

Jur 944

Tax Year CAD Account No. Owner Name ARB Hearing Value

Assessment

Collected

Cause Number

Date Received

from HCAD

Settled Value

Reduction in

Value

%

Reduction

in Value

Reduction in

Assessment

%

Reduction

in

Assessment

Date

Designation

Form Sent to

Owner

Date Refund

Notice Sent to

Bkpr

Tax Year 2005

Tax Year 2017

Settled

Tax Year 2017 061-098-000-0003 Safya LLC 1,130,040 No change 2017-74444 11/17/2021 1,130,040 0 0.00% $0.00 0.00% NA NA

Tax Year 2017 061-116-000-0003 Abdullatif & Co LLC 3,525,810 No change 2017-74444 11/17/2021 3,525,810 0 0.00% $0.00 0.00% NA NA

856,688,205 82,487,823

100

Unsettled

Tax Year 2017 131-026-001-0001 BSD Ltd 13,462,500 2017-69223

Tax Year 2017 041-031-017-0020 Greenview Village Inc 1,130,852 2017-69999

Tax Year 2017 127-087-001-0001 Saroj Inc 1,644,869 2017-70693

Tax Year 2017 002-146-000-0008 Cohen Jay H 329,140 2017-71235

Tax Year 2017 061-126-033-0020 Beason Clyde R & Linda 2,554,544 2017-84721

Tax Year 2017

Total Unsettled Accounts, original value 19,121,905

Tax Year 2017

Total

Unsettled Accounts, number of accounts

5

Tax Year 2018

Settled

Tax Year 2018 010-016-000-0007 Ardmore Inv Corp Inc 1,971,326 $2,267.02 2018-67033 12/7/2021 1,820,000 151,326 7.68% $174.02 7.68% 12/27/2021 2/2/2022

Tax Year 2018 042-176-000-0003 2ML Real Estate Interest Inc 3,434,610 2018-70742 3,174,116

Tax Year 2018 134-385-001-0001 NB Vue Mac Dst 31,016,116 2018-72434 29,000,000

834,335,477 97,683,667

121

Unsettled

Tax Year 2018 002-146-000-0008 Cohen Jay H 330,502 2018-64151

Tax Year 2018 061-159-000-0013 L&L Properties 231,139 2018-65197 Received

Tax Year 2018 128-029-001-0001 Pegram Samuel B 943,115 2018-67137

Tax Year 2018 128-029-001-0002 Pegram Samuel B 580,350 2018-67137

Tax Year 2018 130-553-001-0001 OTM Partners LP 2,078,775 2018-67666

Tax Year 2018 131-504-001-0001 Ektara Property Inc 1,076,716 2018-67697

Tax Year 2018 019-158-000-0007 Doan Loan T / Nguyen Tung T 665,400 2018-71892

Tax Year 2018 042-066-000-0016 2004 Binz Management Inc 645,000 2018-71902

Tax Year 2018 010-019-000-0017 Hurt Real Estate Holdings of Texas 2,616,284 2018-72422

Tax Year 2018 061-126-033-0020 Beason Clyde R & Linda 2,391,000 2018-73774

Tax Year 2018 127-087-001-0001 Saroj Inc 1,667,759 2018-74184

Tax Year 2018 045-064-000-0245 Trejo, Roberto and Lozano, Araceli 257,167 2018-75394

Tax Year 2018 010-010-000-0023 PM Dixie LLC 802,616 2018-75722

Tax Year 2018 061-168-034-0007 Cohen Howard M Trustee 728,700 2018-77269

Tax Year 2018

Total Unsettled Accounts, original value 15,014,523

F:\Company Info\Lawsuits\Lawsuit Status\Greater SE Mgmt Dist_944_LTS-Feb11 2022.xlsx

Revised 2 March 2022

page 1 of 11

prepared by: Equi-Tax Inc.

281.444.4866

Greater Southeast Management District

Lawsuit and Arbitration Status Detail as of 2/11/2022

Jur 944

Tax Year CAD Account No. Owner Name ARB Hearing Value

Assessment

Collected

Cause Number

Date Received

from HCAD

Settled Value

Reduction in

Value

%

Reduction

in Value

Reduction in

Assessment

%

Reduction

in

Assessment

Date

Designation

Form Sent to

Owner

Date Refund

Notice Sent to

Bkpr

Tax Year 2018

Total

Unsettled Accounts, number of accounts

14

Tax Year 2019

Settled

Tax Year 2019 019-293-000-0006 Houstons This Is It Restaurant 949,098 capped 2019-67769 12/7/2021 875,000 74,098 na na na Capped na

Tax Year 2019 010-016-000-0007 Ardmore Inv Corp Inc 1,971,500 $2,267.22 2019-68118 11/17/2021 1,840,000 131,500 6.67% $151.22 6.67% 11/22/2021 1/6/2022

Tax Year 2019 002-146-000-0003 Levin Credit Shelter Trust 140,625 2018-77599 132,200 8,425 5.99%

Tax Year 2019 019-203-001-0009 Cohen Jay H 112,500 2018-77599 93,750 18,750 16.67%

Tax Year 2019 010-018-000-0001 TMC Grand Blvd Investors LLC 7,288,410 $7,683.19 2019-68457 2/2/2022 6,568,044 720,366 9.88% $129.94 1.69% 2/16/2022 3/3/2022

Tax Year 2019 010-018-000-0010 TMC Grand Blvd Investors LLC 4,425,266 $5,089.06 2019-68457 2/2/2022 4,296,375 128,891 2.91% $148.23 2.91% 2/16/2022 3/3/2022

Tax Year 2019 010-018-000-0031 TMC Grand Blvd Investors LLC 135,581 no change 2019-68457 12/7/2021 135,581 0 0.00% $0.00 0.00% na na

Tax Year 2019 057-095-000-0012

Tax Year 2019 057-095-000-0026

Tax Year 2019 137-873-001-0001 3509 Elgin LLC 23,961,913 2019-64637 21,400,000

Tax Year 2019 119-245-001-0001 2ML Real Estate Interests Inc 38,320,000 2019-70058 35,750,000

Tax Year 2019 120-141-001-0001 2ML Real Estate Interests Inc 43,643,430 2019-70058 43,250,000

Tax Year 2019 129-490-001-0001 National Village Holding Ltd 2,704,918 2019-90587 2,450,000

863,666,710 85,097,364

123

Unsettled

Tax Year 2019 061-159-000-0013 L&L Properties 281,639 2018-65197 Received

Tax Year 2019 135-306-001-0003 L&L Properties 3,950,000 2019-52343

Tax Year 2019 135-306-001-0002 AC Campus Vue Student Housing LLC 42,830,595 2019-52560

Tax Year 2019 123-118-001-0001 7227 Fannin Management 3,156,809 2019-56273

Tax Year 2019 121-425-000-0001 DMG Houston LLC 17,902,549 2019-65272

Tax Year 2019 137-368-001-0001 Breckenridge Group Houston Texas 44,552,945 2019-65903

Tax Year 2019 137-368-001-0002 Breckenridge Group Houston Texas 1,449,320 2019-65903

Tax Year 2019 002-146-000-0008 Cohen Jay H 330,775 2019-66353

Tax Year 2019 025-003-025-0011 Shipra Enterprise Inc 525,060 2019-68299

Tax Year 2019 025-005-030-0001 Shipra Enterprise Inc 1,162,500 2019-68299

Tax Year 2019 025-005-030-0004 Shipra Enterprise Inc 1,612,820 2019-68299

Tax Year 2019 025-005-030-0005 Shipra Enterprise Inc 360,120 2019-68299

Tax Year 2019 025-007-035-0009 Shipra Enterprise Inc 690,800 2019-68299

Tax Year 2019 019-293-000-0004 Malone Family Trrust 1,164,000 2019-73154

Tax Year 2019 033-255-004-0001 Excelsior Land Co Inc 8,120,793 2019-73619

Tax Year 2019 138-196-001-0001 Excelsior Land Co Inc 3,045,795 2019-73619

Tax Year 2019 124-826-001-0001 Nulrana Investments LLC 3,760,500 2019-73695

Tax Year 2019 042-176-000-0003 2ML Real Estate Interests Inc 3,754,058 2019-73710

Tax Year 2019

Total Unsettled Accounts, original value 138,651,078

Tax Year 2019

Total

Unsettled Accounts, number of accounts

18

F:\Company Info\Lawsuits\Lawsuit Status\Greater SE Mgmt Dist_944_LTS-Feb11 2022.xlsx

Revised 2 March 2022

page 2 of 11

prepared by: Equi-Tax Inc.

281.444.4866

Greater Southeast Management District

Lawsuit and Arbitration Status Detail as of 2/11/2022

Jur 944

Tax Year CAD Account No. Owner Name ARB Hearing Value

Assessment

Collected

Cause Number

Date Received

from HCAD

Settled Value

Reduction in

Value

%

Reduction

in Value

Reduction in

Assessment

%

Reduction

in

Assessment

Date

Designation

Form Sent to

Owner

Date Refund

Notice Sent to

Bkpr

Tax Year 2020

Settled

Tax Year 2020 019-253-000-0001 Hou Properties Inc 685,000 $787.75 101-20-002260 11/1/2021 300,000 385,000 56.20% $442.75 56.20% 11/3/2021 12/1/2021

Tax Year 2020 033-267-000-0002 Texas Healthcare Portfolio II Dst 8,237,907 $9,473.59 2020-69537 11/1/2021 7,700,000 537,907 6.53% $618.59 6.53% 11/3/2021 12/1/2021

Tax Year 2020 010-019-000-0020 Star Properties LLC 5,000,000 $5,750.00 2020-58415 12/7/2021 4,750,000 250,000 5.00% $287.50 5.00% Received 2/2/2022

Tax Year 2020 046-036-004-0027 Levey Group Fund 20 LLC 1,253,676 $1,441.73 2020-69155 12/7/2021 1,150,000 103,676 8.27% $119.23 8.27% 12/27/2021 2/2/2022

Tax Year 2020 045-064-000-0080 TV Prop LLC 691,914 $795.70 2020-75095 11/17/2021 600,000 91,914 13.28% $105.70 13.28% 11/22/2021 1/6/2022

Tax Year 2020 045-064-000-0105 Romeo & Rebecca LLC 1,391,687 $1,600.44 2020-75095 11/17/2021 1,200,000 191,687 13.77% $220.44 13.77% 11/22/2021 1/6/2022

Tax Year 2020 041-007-028-0007 Hou Holdings Inc 663,021 101-20-002261 500,949 162,072 24.44%

Tax Year 2020 041-007-008-0001 RMF Inc 3,480,041 101-20-002373 2,740,258 739,783 21.26%

Tax Year 2020 041-031-034-0185 MRG Inc 3,247,117 101-20-002436 2,590,247 656,870 20.23%

Tax Year 2020 019-253-000-0005 Wang Properties LLC 982,000 101-20-003559 750,000 232,000 23.63%

Tax Year 2020 061-121-000-0024 Taylor Raymond 513,010 101-20-003607 385,000 128,010 24.95%

Tax Year 2020 133-017-001-0001 UH Hammond Scott LP 477,900 101-20-003685 445,850 32,050 6.71%

Tax Year 2020 002-164-000-0003 IM ME Holdings LLC 1,130,154 $1,299.68 101-20-003771 12/7/2021 1,014,863 115,291 10.20% $132.59 10.20% 25.25(b) 1/6/2022

Tax Year 2020 019-307-000-0012 Arbor Capital LLC 328,468 101-20-003951 285,000 43,468 13.23%

Tax Year 2020 019-264-000-0002 2400 Napoleon LLC 746,480 101-20-003969 575,000 171,480 22.97%

Tax Year 2020 061-094-000-0030 Arbor Capital LLC 690,440 101-20-003970 430,000 260,440 37.72%

Tax Year 2020 150-019-001-0001 TMC Grand Blvd Land Company LLC 15,167,715 $17,442.87 2019-68457 2/2/2022 13,924,780 1,242,935 8.19% $1,426.37 8.18% 2/16/2022 3/3/2022

Tax Year 2020 150-019-001-0002 TMC Grand Apts # 1 LLC 4,175,220 No change 2019-68457 12/7/2021 4,175,220 0 0.00% $0.00 0.00% NA NA

Tax Year 2020 120-269-000-0001 7009 Almeda Road LLC 48,947,805 $56,289.98 2020-47453 2/2/2022 42,140,000 6,807,805 13.91% $7,828.98 13.91% 2/16/2022 3/3/2022

Tax Year 2020 139-452-000-0001 Houston 5110 Griggs Road Retail LLC 1,896,039 $2,180.44 2020-65419 12/7/2021 1,850,000 46,039 2.43% $52.94 2.43% 12/27/2021 2/2/2022

Tax Year 2020 139-452-000-0002

Houston 5110 Griggs Road Residential LP

11,032,100 $12,686.92 2020-65419 12/7/2021 9,550,000 1,482,100 13.43% $1,704.42 13.43% 12/27/2021 2/2/2022

Tax Year 2020 002-164-000-0001 East End Warehouses LLC 892,031 $1,025.84 2020-75873 12/7/2021 820,000 72,031 8.07% $82.84 8.08% 12/27/2021 2/2/2022

Tax Year 2020 132-586-001-0001 Simi Investment Company Ltd 1,024,455 $1,178.12 2020-81617 11/17/2021 900,000 124,455 12.15% $143.12 12.15% Received 12/1/2021

Tax Year 2020 045-064-000-0354 6045 Scott Street Inc 1,384,587 2020-48384 1,204,161

Tax Year 2020 010-006-000-0020 2ML Real Estate Interest Inc 7,798,441 2020-54008 6,179,143

Tax Year 2020 134-395-001-0001

CRP MM Hermann Park Plaza Owner LP

33,747,003 2020-57152 31,000,000

Tax Year 2020 134-495-001-0001 2400 SMW LP 5,649,375 2020-58957 5,500,000

Tax Year 2020 039-163-000-0001 HTA Park Plaza LLC 50,680,000 2020-59901 45,500,000

Tax Year 2020 118-787-001-0001 Yellowstone Boulevard LLC 8,217,677 2020-72240 7,400,000

Tax Year 2020 010-018-000-0011 Bulldog Enterprises LLC 1,347,613 2020-79349 1,260,000

1,460,950,808 126,311,429

117

Unsettled

Tax Year 2020 061-159-000-0013 L&L Properties 273,410 2018-65197

Tax Year 2020 135-306-001-0003

AC Campus Vue Senior Apartments LLC

5,568,606 2019-52343

Tax Year 2020 135-306-001-0002 AC Campus Vue Student Housing LLC 44,755,009 2019-52560

Tax Year 2020 123-118-001-0001 7227 Fannin Management 3,758,523 2019-56273

Tax Year 2020 134-752-001-0001 McRef Premier LLC 49,817,989 2020-46251

Tax Year 2020 010-155-000-0001 Lemings LLC 68,058 2020-47222

F:\Company Info\Lawsuits\Lawsuit Status\Greater SE Mgmt Dist_944_LTS-Feb11 2022.xlsx

Revised 2 March 2022

page 3 of 11

prepared by: Equi-Tax Inc.

281.444.4866

Greater Southeast Management District

Lawsuit and Arbitration Status Detail as of 2/11/2022

Jur 944

Tax Year CAD Account No. Owner Name ARB Hearing Value

Assessment

Collected

Cause Number

Date Received

from HCAD

Settled Value

Reduction in

Value

%

Reduction

in Value

Reduction in

Assessment

%

Reduction

in

Assessment

Date

Designation

Form Sent to

Owner

Date Refund

Notice Sent to

Bkpr

Tax Year 2020 010-155-000-0003 Lemings LLC 563,957 2020-47222

Tax Year 2020 010-155-000-0004 Lemings LLC 75,000 2020-47222

Tax Year 2020 022-170-000-0003 Sometimes LLC 75,000 2020-47222

Tax Year 2020 037-211-000-0001 Lemings LLC 60,000 2020-47222

Tax Year 2020 037-211-000-0002 Lemings LLC 420,222 2020-47222

Tax Year 2020 037-211-000-0003 Lemings LLC 75,000 2020-47222

Tax Year 2020 061-117-000-0001 Cacophony LLC 723,649 2020-47222

Tax Year 2020 133-025-001-0001 Balcor Parc Binz I LLC 22,210,000 2020-53040

Tax Year 2020 137-368-001-0001 Breckenridge Group Houston TX LLC 68,576,145 2020-53262

Tax Year 2020 137-368-001-0002 Breckenridge Group Houston TX LLC 2,173,980 2020-53262

Tax Year 2020 139-726-001-0001 MacGregor Grocery LLC 25,377,502 2020-54920

Tax Year 2020 134-385-001-0001 NB Vue Mac Dst 36,593,609 2020-56601

Tax Year 2020 130-782-001-0001 Mekdessi Fouad 1,181,446 2020-58134

Tax Year 2020 130-782-001-0002 Mekdessi Fouad 3,371,243 2020-58134

Tax Year 2020 061-126-033-0020 Beason Clyde R & Linda 3,313,937 2020-58654

Tax Year 2020 120-141-001-0001 2ML Real Estate Interest Inc 42,970,812 2020-59935

Tax Year 2020 137-873-001-0001 3509 Elgin LLC 35,760,719 2020-60421

Tax Year 2020 042-196-000-0037 Sri Janma Bhumi Interests LLC 30,032,193 2020-62205

Tax Year 2020 042-196-000-0030 Americus OST LLC 12,401,445 2020-62840

Tax Year 2020 042-196-000-0030 Americus OST LLC 12,401,445 2020-62841

Tax Year 2020 061-168-034-0018 Toast & Bananas LLC 260,352 2020-64611

Tax Year 2020 091-222-000-0002 Depends LLC 3,254,779 2020-64611

Tax Year 2020 122-987-001-0001 St Del Rio Holdings LP 10,605,820 2020-64734

Tax Year 2020 123-237-001-0001 St Del Rio Holdings LP 12,450,309 2020-64734

Tax Year 2020 058-192-000-0013 Reichek Robert 203,881 2020-65248

Tax Year 2020 033-255-004-0001 Excelsior Land Co Inc 6,601,093 2020-65892

Tax Year 2020 025-024-054-0002 Hampstead MD Hou LP 9,161,831 2020-66221

Tax Year 2020 039-178-002-0001 Stone J S Dr 2,312,787 2020-66673

Tax Year 2020 134-749-001-0002 1699 HPR LLC 67,413,038 2020-66915

Tax Year 2020 137-275-001-0001 Zhejiang Blossom Tourism 21,557,976 2020-67155

Tax Year 2020 019-308-000-0010 BS Gambhir LLC 754,100 2020-68735

Tax Year 2020 046-036-004-0003 PRJ Enterprises Ltd 3,071,995 2020-70107

Tax Year 2020 061-098-000-0003 Safya LLC 1,130,040 2020-71683

Tax Year 2020 025-003-025-0011 Shipra Enterprise Inc 525,060 2020-75133

Tax Year 2020 025-005-030-0001 Shipra Enterprise Inc 1,162,500 2020-75133

Tax Year 2020 025-005-030-0004 Shipra Enterprise Inc 1,485,276 2020-75133

Tax Year 2020 025-005-030-0005 Shipra Enterprise Inc 360,120 2020-75133

Tax Year 2020 025-007-035-0004 Akshay Investment Corporation 569,213 2020-75133

Tax Year 2020 025-007-035-0009 Shipra Enterprise Inc 656,656 2020-75133

Tax Year 2020 025-007-035-0013 Shipra Enterprise Inc 300,000 2020-75133

Tax Year 2020 019-293-000-0006 Houstons This Is It Restaurant 868,625 2020-75202

Tax Year 2020 131-504-001-0001 Ektara Property Inc 1,089,500 2020-75452

Tax Year 2020 033-248-006-0001 Aron Hertzel 1,636,080 2020-76281

F:\Company Info\Lawsuits\Lawsuit Status\Greater SE Mgmt Dist_944_LTS-Feb11 2022.xlsx

Revised 2 March 2022

page 4 of 11

prepared by: Equi-Tax Inc.

281.444.4866

Greater Southeast Management District

Lawsuit and Arbitration Status Detail as of 2/11/2022

Jur 944

Tax Year CAD Account No. Owner Name ARB Hearing Value

Assessment

Collected

Cause Number

Date Received

from HCAD

Settled Value

Reduction in

Value

%

Reduction

in Value

Reduction in

Assessment

%

Reduction

in

Assessment

Date

Designation

Form Sent to

Owner

Date Refund

Notice Sent to

Bkpr

Tax Year 2020 042-176-000-0184 S Loop East Ph I LLC 892,224 2020-78008

Tax Year 2020 010-006-000-0026 2ML Real Estate Interest Inc 191,320 2020-78163

Tax Year 2020 061-129-039-0009 Glasmic Ltd 1,826,922 2020-79352

Tax Year 2020 137-029-001-0001 Chelsea Museum District LLC 1,424,940 2021-00970

Tax Year 2020 121-425-000-0001 DMG Houston LLC 18,568,363 2021-03601

Tax Year 2020 124-826-001-0001 Nulrana Investments LLC 3,586,828 2021-14019

Tax Year 2020

Total Unsettled Accounts, original value 576,520,527

Tax Year 2020

Total

Unsettled Accounts, number of accounts

55

F:\Company Info\Lawsuits\Lawsuit Status\Greater SE Mgmt Dist_944_LTS-Feb11 2022.xlsx

Revised 2 March 2022

page 5 of 11

prepared by: Equi-Tax Inc.

281.444.4866

Greater Southeast Management District

Lawsuit and Arbitration Status Detail as of 2/11/2022

Jur 944

Tax Year CAD Account No. Owner Name ARB Hearing Value

Assessment

Collected

Cause Number

Date Received

from HCAD

Settled Value

Reduction in

Value

%

Reduction

in Value

Reduction in

Assessment

%

Reduction

in

Assessment

Date

Designation

Form Sent to

Owner

Date Refund

Notice Sent to

Bkpr

Tax Year 2021

Settled

Tax Year 2021 041-007-033-0028 KS Investments Inc 1,498,016 $0.00 101-21-000226 11/1/2021 1,190,000 308,016 20.56% $0.00 0.00% NA NA

Tax Year 2021 033-240-041-0004 Electra Properties LLC 3,494,196 $0.00 101-21-000227 11/1/2021 3,000,000 494,196 14.14% $0.00 0.00% NA NA

Tax Year 2021 133-247-001-0001 Trieu Family Inc 1,207,026 101-21-000556 1,125,000 82,026 6.80%

Tax Year 2021 135-010-001-0001 24 Seven Entrepreneurs LLC 1,941,530 No change 101-21-000735 11/17/2021 1,941,530 0 0.00% $0.00 0.00% NA NA

Tax Year 2021 019-253-000-0001 Hou Properties Inc 885,182 101-21-000856 376,000 509,182 57.52%

Tax Year 2021 019-253-000-0003 Hou Properties Inc 935,000 101-21-000857 376,000 559,000 59.79%

Tax Year 2021 019-163-000-0004 Sita Properties LLC 735,000 101-21-001537 567,000 168,000 22.86%

Tax Year 2021 019-012-000-0020 KS Houston Development 1,126,922 No change 101-21-001045 12/7/2021 1,126,922 0 0.00% $0.00 0.00% NA NA

Tax Year 2021 033-266-000-0009 OS Crawford LLC 903,500 No change 101-21-001049 12/7/2021 903,500 0 0.00% $0.00 0.00% NA NA

Tax Year 2021 033-248-001-0001 Second Almeda LP 2,470,241 No change 101-21-002233 12/7/2021 2,470,241 0 0.00% $0.00 0.00% NA NA

Tax Year 2021 120-269-000-0001 7009 Almeda Road LLC 48,007,734 $48,461.00 2021-55224 2/2/2022 42,140,000 5,867,734 12.22% $0.00 0.00%

Tax Year 2021 019-307-000-0012 Arbor Capital LLC 335,073 No change 101-21-001782 335,073 NA NA

Tax Year 2021 057-154-000-0031 Twelve Canfield Place LLC 2,912,736 101-21-001785 2,600,000

Tax Year 2021 010-018-000-0015 Ardmore Professional Center LLC 2,576,942 No change 101-21-001787 2,576,942 NA NA

Tax Year 2021 041-007-028-0007 DKT Interests LLC 663,021 101-21-002078 500,000

Tax Year 2021 041-031-034-0185 MRG Inc 3,374,061 101-21-002517 2,800,000

Tax Year 2021 041-007-008-0001 RMF Inc 2,993,373 101-21-002518 2,770,129

Tax Year 2021 063-167-004-0004 RMS Properties 1,200,794 101-21-002519 1,000,000

Tax Year 2021 041-007-033-0004 South Loop Business Park LLC 3,292,929 101-21-002776 2,900,000

Tax Year 2021 025-024-049-0001 SBH Realty Investments LLC 1,491,709 101-21-002787 1,270,000

Tax Year 2021 042-066-000-0126 5400 Almeda LLC 1,311,257 101-21-003521 1,150,000

Tax Year 2021 042-176-000-0185 Ranger H TX LP 6,262,072 2021-51152 5,600,000 Received

Tax Year 2021 131-026-001-0001 BSD Ltd 17,047,252 2021-51162 16,100,000

Tax Year 2021 121-475-001-0001 Proguard Mini Storage Ltd 7,745,749 2021-51450 7,100,000

Tax Year 2021 039-163-000-0001 HTA Park Plaza LLC 50,855,133 2021-52918 45,300,000

Tax Year 2021 022-165-000-0003 Wholesale Electric Supply 3,852,602 101-21-003106 3,440,000

Tax Year 2021 129-928-001-0001 Wholesale Electric Supply 4,231,013 101-21-003106 3,800,000

Tax Year 2021 052-145-001-0001 Gigglin Marlin Divers Inc 1,016,050 No change 101-21-003259 1,016,050 NA NA

Tax Year 2021 061-136-059-0044 River Oaks at MLK LLC 1,133,080 101-21-003309 1,050,000

Tax Year 2021 061-118-000-0009 NPN Realty LLC 974,925 101-21-004021 920,925

Tax Year 2021 130-683-001-0001 Palmetto Partners Ardmore LP 3,385,135 101-21-004230 2,647,175

Tax Year 2021 050-289-004-0003 Highveld Properties LLC 438,712 101-21-004396 397,750

Tax Year 2021 050-289-004-0004 Highveld Properties LLC 592,042 101-21-004396 527,250

183,904,609 7,988,154

36

Unsettled

Tax Year 2021 042-066-000-0180 Fiesta a Uno Ltd Ptnrsh 1,653,790 101-21-002809 Received

Tax Year 2021 061-121-000-0024 Taylor Raymond 531,197 101-21-003600

Tax Year 2021 019-264-000-0002 2400 Napoleon LLC 757,930 101-21-003601

F:\Company Info\Lawsuits\Lawsuit Status\Greater SE Mgmt Dist_944_LTS-Feb11 2022.xlsx

Revised 2 March 2022

page 6 of 11

prepared by: Equi-Tax Inc.

281.444.4866

Greater Southeast Management District

Lawsuit and Arbitration Status Detail as of 2/11/2022

Jur 944

Tax Year CAD Account No. Owner Name ARB Hearing Value

Assessment

Collected

Cause Number

Date Received

from HCAD

Settled Value

Reduction in

Value

%

Reduction

in Value

Reduction in

Assessment

%

Reduction

in

Assessment

Date

Designation

Form Sent to

Owner

Date Refund

Notice Sent to

Bkpr

Tax Year 2021 061-094-000-0030 Arbor Capital LLC 736,315 101-21-003602

Tax Year 2021 019-058-000-0018 Houston Rehab of Houston LLC 230,281 101-21-003637

Tax Year 2021 019-058-000-0022 Houston Rehab of Houston LLC 291,585 101-21-003637

Tax Year 2021 019-058-000-0039 Houston Rehab of Houston LLC 301,232 101-21-003637

Tax Year 2021 002-127-000-0013 Drexler Clyde 587,000 101-21-003765

Tax Year 2021 002-127-000-0009 Drexler Clyde 1,367,833 101-21-003779

Tax Year 2021 002-127-000-0015 Drexler Clyde 443,867 101-21-003779

Tax Year 2021 002-127-000-0016 Drexler Clyde 227,629 101-21-003779

Tax Year 2021 064-005-000-0004 Keyser Deborah 1,134,090 101-21-003862 Received

Tax Year 2021 019-061-000-0001 Dow Joseph 1,080,000 101-21-003900

Tax Year 2021 039-164-000-0001 Lurie Apts LLC 1,407,996 101-21-004064

Tax Year 2021 039-164-000-0007 Lurie Apts LLC 637,241 101-21-004064

Tax Year 2021 039-164-000-0009 Lurie Apts LLC 662,191 101-21-004064

Tax Year 2021 039-164-000-0020 Lurie Apts LLC 1,244,187 101-21-004064

Tax Year 2021 052-138-000-0004 Laurie Apts LP 702,840 101-21-004079

Tax Year 2021 046-122-000-0075 Good Land II Corp 572,181 101-21-004121

Tax Year 2021 033-236-021-0001 Chardmore Inc 734,400 101-21-004214

Tax Year 2021 003-022-000-0010 Harmouche Omar 225,400 101-21-004273

Tax Year 2021 129-903-001-0001 Luxurway Museum Park LLC 1,275,040 101-21-004465

Tax Year 2021 121-508-001-0001 Tabestan LLC 484,770 101-21-004583

Tax Year 2021 033-271-000-0010 MMSYK LP 1,130,606 101-21-004746

Tax Year 2021 041-007-031-0075 Southern Dental Properties Inc 389,334 101-21-004855

Tax Year 2021 061-159-000-0013 L&L Properties 291,180 2018-65197

Tax Year 2021 010-155-000-0001 Lemings LLC 71,640 2020-47222

Tax Year 2021 010-155-000-0022 Lemings LLC 183,570 2020-47222

Tax Year 2021 010-155-000-0003 Lemings LLC 562,339 2020-47222

Tax Year 2021 010-155-000-0004 Lemings LLC 75,000 2020-47222

Tax Year 2021 022-170-000-0003 Sometimes LLC 75,000 2020-47222

Tax Year 2021 037-211-000-0001 Lemings LLC 60,000 2020-47222

Tax Year 2021 037-211-000-0002 Lemings LLC 420,222 2020-47222

Tax Year 2021 037-211-000-0003 Lemings LLC 75,000 2020-47222

Tax Year 2021 037-211-000-0009 Lemings LLC 30,000 2020-47222

Tax Year 2021 061-117-000-0001 Cacophony LLC 740,493 2020-47222

Tax Year 2021 130-782-001-0001 Mekdessi Fouad 1,687,780 2020-58134

Tax Year 2021 130-782-001-0002 Mekdessi Fouad 3,409,980 2020-58134

Tax Year 2021 061-168-034-0018 Toast & Bananas LLC 315,797 2020-64611

Tax Year 2021 091-222-000-0002 Depends LLC 3,258,021 2020-64611

Tax Year 2021 058-192-000-0013 Reichek Robert 258,321 2020-65248

Tax Year 2021 025-024-054-0002 Hampstead MD Hou LP 8,868,705 2020-66221

Tax Year 2021 134-749-001-0002 1699 HPR LLC 65,551,519 2020-66915

Tax Year 2021 019-308-000-0010 BS Gambhir LLC 930,740 2020-68735

Tax Year 2021 033-248-006-0001 Aron Hertzel 1,972,167 2020-76281

Tax Year 2021 044-097-000-0018 Marriott Corporation 34,360,900 2021-43986

F:\Company Info\Lawsuits\Lawsuit Status\Greater SE Mgmt Dist_944_LTS-Feb11 2022.xlsx

Revised 2 March 2022

page 7 of 11

prepared by: Equi-Tax Inc.

281.444.4866

Greater Southeast Management District

Lawsuit and Arbitration Status Detail as of 2/11/2022

Jur 944

Tax Year CAD Account No. Owner Name ARB Hearing Value

Assessment

Collected

Cause Number

Date Received

from HCAD

Settled Value

Reduction in

Value

%

Reduction

in Value

Reduction in

Assessment

%

Reduction

in

Assessment

Date

Designation

Form Sent to

Owner

Date Refund

Notice Sent to

Bkpr

Tax Year 2021 135-306-001-0002 AC Campus Vue Student Housing LLC 45,828,301 2021-45663

Tax Year 2021 042-066-000-0084 Cole WG houston TX LP 4,690,972 2021-47327

Tax Year 2021 129-562-001-0001 NNN Houston TX Owner Lp 3,251,118 2021-47327

Tax Year 2021 123-118-001-0001 7227 Fannin Management 3,164,993 2021-47575

Tax Year 2021 039-174-000-0003 BMEF Plaza Limited Partnership 42,019,217 2021-48205

Tax Year 2021 133-890-001-0001 CPUS Elan Med LP 56,638,183 2021-48490

Tax Year 2021 041-007-016-0183 Autozone Inc 484,482 2021-48663

Tax Year 2021 124-826-001-0001 Nulrana Investments LLC 3,131,030 2021-49231

Tax Year 2021 010-014-000-0006 Greenbriar Holding Houston 6,340,924 2021-49585

Tax Year 2021 134-752-001-0001 McRef Premier LLC 44,358,467 2021-50479

Tax Year 2021 128-687-001-0001 Broadstone Med Center LP 49,983,695 2021-50559

Tax Year 2021 135-881-001-0001 Din Sers Millennium Cambridge 101,204,571 2021-51180

Tax Year 2021 134-752-001-0001 McRef Premier LLC 44,358,467 2021-51284

Tax Year 2021 044-097-000-0062 Medical Towers Sub LLC 32,423,217 2021-52220

Tax Year 2021 128-687-001-0002 CPT/AR OST II Owner LP 48,568,158 2021-52522

Tax Year 2021 137-368-001-0001 Breckenridge Group Houston TX LLC 66,910,682 2021-52871

Tax Year 2021 137-368-001-0002 Breckenridge Group Houston TX LLC 2,173,980 2021-52871

Tax Year 2021 033-255-004-0001 Excelsior Land Co Inc 6,214,962 2021-52891

Tax Year 2021 138-196-001-0001 Excelsior Land Co Inc 28,732,271 2021-52892

Tax Year 2021 121-176-001-0001 Comcapp Cityside LLC 25,526,319 2021-53228

Tax Year 2021 130-102-000-0002 PR III THCPR Mosaic Owner LP 2,952,353 2021-53622

Tax Year 2021 130-102-000-0003 PR III THCPR Mosaic Owner LP 88,747,623 2021-53622

Tax Year 2021 130-102-000-0004 PR III THCPR Mosaic Owner LP 1,963,435 2021-53622

Tax Year 2021 045-064-000-0015 OST Scott Ren LLC 10,367,250 2021-53823

Tax Year 2021 010-017-000-0001 Cube HHF LP 7,820,956 2021-54138

Tax Year 2021 033-278-001-0001 HH Southmore LLC 88,992,250 2021-54966

Tax Year 2021 039-166-000-0001 Houston - PPH LLC 12,146,176 2021-55121

Tax Year 2021 150-245-001-0001 Houston - PPH LLC 17,478,950 2021-55121

Tax Year 2021 130-477-001-0001 HGIT 5353 Fannin LP 63,563,252 2021-55211

Tax Year 2021 139-726-001-0001 MacGregor Grocery LLC 26,013,682 2021-55990

Tax Year 2021 019-010-000-0010 Alsco Inc 2,094,120 2021-56058

Tax Year 2021 139-068-001-0001 Alsco Inc 3,215,296 2021-56058

Tax Year 2021 139-649-001-0001 Tower 5040 LLC 38,226,109 2021-56379

Tax Year 2021 010-006-000-0020 2ML Real Estate Interest Inc 11,395,375 2021-56781

Tax Year 2021 025-003-025-0011 Shipra Enterprise Inc 612,570 2021-56820

Tax Year 2021 025-005-030-0001 Shipra Enterprise Inc 1,356,250 2021-56820

Tax Year 2021 025-005-030-0004 Shipra Enterprise Inc 1,705,742 2021-56820

Tax Year 2021 025-005-030-0005 Shipra Enterprise Inc 420,140 2021-56820

Tax Year 2021 025-007-035-0004 Akshay Investment Corporation 665,315 2021-56820

Tax Year 2021 025-007-035-0009 Shipra Enterprise Inc 765,919 2021-56820

Tax Year 2021 025-007-035-0013 Shipra Enterprise Inc 350,000 2021-56820

Tax Year 2021 045-064-000-0155 3922 OST LLC 1,742,619 2021-57018

Tax Year 2021 150-019-001-0001 TMC Grand Blvd Land Company LLC 14,757,881 2021-58050

F:\Company Info\Lawsuits\Lawsuit Status\Greater SE Mgmt Dist_944_LTS-Feb11 2022.xlsx

Revised 2 March 2022

page 8 of 11

prepared by: Equi-Tax Inc.

281.444.4866

Greater Southeast Management District

Lawsuit and Arbitration Status Detail as of 2/11/2022

Jur 944

Tax Year CAD Account No. Owner Name ARB Hearing Value

Assessment

Collected

Cause Number

Date Received

from HCAD

Settled Value

Reduction in

Value

%

Reduction

in Value

Reduction in

Assessment

%

Reduction

in

Assessment

Date

Designation

Form Sent to

Owner

Date Refund

Notice Sent to

Bkpr

Tax Year 2021 044-097-000-0075 Ventas Realty Ltd Prtnrshp 13,005,000 2021-58082

Tax Year 2021 069-049-000-0035 2ML Real Estate Interest Inc 2,282,650 2021-58159

Tax Year 2021 119-245-001-0001 2ML Real Estate Interest Inc 47,186,494 2021-58159

Tax Year 2021 120-141-001-0001 2ML Real Estate Interest Inc 38,877,300 2021-58159

Tax Year 2021 072-059-003-0001 Medical Center Hospitality LLC 3,972,694 2021-58204

Tax Year 2021 033-267-000-0002 Texas Healthcare Portfolio II DST 8,312,600 2021-58429

Tax Year 2021 041-007-015-0077 WSSA Houston VA LLC 2,071,308 2021-58491

Tax Year 2021 117-013-000-0001 Versailles Property Owner LLC 27,350,066 2021-58533

Tax Year 2021 127-318-001-0001 Amalfi Holdco LP 76,030,857 2021-58757

Tax Year 2021 133-025-001-0001 Balcor Parc Binz I LLC 21,782,676 2021-59440

Tax Year 2021 131-653-001-0001 FKM Partnership 4,231,580 2021-60489

Tax Year 2021 134-385-001-0001 NB Vue Mac Dst 33,354,813 2021-60521

Tax Year 2021 041-007-031-0066 Royal Palms Housing LLC 4,136,827 2021-60669

Tax Year 2021 045-064-000-0354 6045 Scott Street Inc 1,428,735 2021-60901

Tax Year 2021 042-196-000-0037 Sri Janma Bhumi Interests LLC 29,906,896 2021-61191

Tax Year 2021 135-306-001-0003

AC Campus Vue Senior Apartments LLC

5,712,141 2021-61509

Tax Year 2021 117-879-001-0002 Irolo Villas LLC 1,309,315 2021-61735

Tax Year 2021 042-196-000-0042 Amelang Partners Inc 2,620,800 2021-62039

Tax Year 2021 061-129-039-0009 Glasmic Ltd 2,162,639 2021-62379

Tax Year 2021 061-125-000-0024 Camden Hotels Inc 1,137,069 2021-62392

Tax Year 2021 130-553-001-0001 Kapoor Menta LLC 1,996,933 2021-62935

Tax Year 2021 129-490-001-0001 National Village Holdings 2,640,084 2021-63039

Tax Year 2021 010-016-000-0007 Ardmore Inv Corp Inc 2,169,661 2021-64049

Tax Year 2021 039-178-002-0001 Stone J S Dr 2,359,100 2021-64180

Tax Year 2021 010-019-000-0017

Hurt Real Estate Holdings of Texas Ltd

2,897,254 2021-64302

Tax Year 2021 042-176-000-0197 S Loop East PH II LLC 1,759,135 2021-64734

Tax Year 2021 045-064-000-0364 STRR Investments LLC 536,484 2021-65003

Tax Year 2021 042-176-000-0001 Agellan Commercial REIT US LP 5,704,003 2021-65298

Tax Year 2021 042-066-000-0013 Norvin Almeda LP 10,757,355 2021-65389

Tax Year 2021 010-018-000-0011 Bulldog Enterprises LLC 1,361,440 2021-65447

Tax Year 2021 046-036-004-0027 Levey Group Fund 20 LLC 1,253,676 2021-65849

Tax Year 2021 010-005-000-0039 AGI Gehring LLC 1,707,440 2021-66397

Tax Year 2021 139-452-000-0001 Houston 5110 Griggs Road Retail LLC 2,082,441 2021-66527

Tax Year 2021 139-452-000-0002

Houston 5110 Griggs Road Residential LP

11,191,450 2021-66527

Tax Year 2021 069-028-004-0006 Allstate BK Real Estate Holdings Ltd 1,186,740 2021-66976

Tax Year 2021 138-998-001-0001 Global New Millennium Partners Ltd 4,309,882 2021-66976

Tax Year 2021 061-126-033-0017 Seed of Abraham 2,628,755 2021-67031

Tax Year 2021 061-126-033-0020 Success Financial Investment 3,632,998 2021-67032

Tax Year 2021 010-015-000-0014 WFD Holdings Inc 4,669,033 2021-67227

Tax Year 2021 137-275-001-0001

Zhejiang Blossom Tourism Group Houston LLC

43,119,310 2021-67976

Tax Year 2021 061-098-000-0003 Safya LLC 1,726,450 2021-68676

Tax Year 2021 067-089-004-0040 2ML Real Estate Interest Inc 324,915 2021-69167

Tax Year 2021 041-007-015-0020

WRI AEW Lone Star Retail Portfolio LLC

785,783 2021-70143

F:\Company Info\Lawsuits\Lawsuit Status\Greater SE Mgmt Dist_944_LTS-Feb11 2022.xlsx

Revised 2 March 2022

page 9 of 11

prepared by: Equi-Tax Inc.

281.444.4866

Greater Southeast Management District

Lawsuit and Arbitration Status Detail as of 2/11/2022

Jur 944

Tax Year CAD Account No. Owner Name ARB Hearing Value

Assessment

Collected

Cause Number

Date Received

from HCAD

Settled Value

Reduction in

Value

%

Reduction

in Value

Reduction in

Assessment

%

Reduction

in

Assessment

Date

Designation

Form Sent to

Owner

Date Refund

Notice Sent to

Bkpr

Tax Year 2021 041-007-015-0021

WRI AEW Lone Star Retail Portfolio LLC

2,849,039 2021-70143

Tax Year 2021 041-007-015-0036

WRI AEW Lone Star Retail Portfolio LLC

395,818 2021-70143

Tax Year 2021 041-007-016-0012 Weingarten Realty Investor U031-001 389,828 2021-70143

Tax Year 2021 041-007-016-0018

WRI AEW Lone Star Retail Portfolio LLC

2,271,227 2021-70143

Tax Year 2021 019-293-000-0006 Houston This is it Resturant 1,009,125 2021-72315

Tax Year 2021 019-276-000-0016 Alief Petroleum Inc 1,240,010 2021-72574

Tax Year 2021 122-022-001-0001 Houston Griggs Rd LLC 586,863 2021-72618

Tax Year 2021 045-064-000-0080 TV Prop LLC 747,103 2021-74130

Tax Year 2021 045-064-000-0105 Romeo & Rebecca LLC 1,310,027 2021-74130

Tax Year 2021 137-873-002-0001 3509 Elgin LLC 42,258,666 2021-74354

Tax Year 2021 046-036-000-0120 Jml Apartments LLC 900,680 2021-75897

Tax Year 2021 010-006-000-0026 2ML Real Estate Interest Inc 191,320 2021-78561

Tax Year 2021 041-031-033-0009 3620 Southmore LLC 1,896,327 2021-78575

Tax Year 2021 100-353-000-0004 5751 Blythewood Street Trust 1,052,967 2021-78626

Tax Year 2021 010-017-000-0013 Almeda Office LLC 1,798,463 2021-78638

Tax Year 2021 131-504-001-0001 Ektara Property LLC 1,119,368 2021-80042

Tax Year 2021 061-098-000-0001 Safya LLC 1,019,887 2021-83532

Tax Year 2021 041-007-008-0055 Marquee Realty 370,800 2022-01235

Tax Year 2021 046-122-000-0040 Energy Flow Systems 914,628 2022-03180

Tax Year 2021 033-266-000-0020 Neff Mark R 872,792 2022-03215

Tax Year 2021 042-176-000-0184 S Loop East PH I LLC 1,025,055 2022-03371

Tax Year 2021

Total Unsettled Accounts, original value 1,657,257,356

Tax Year 2021

Total

Unsettled Accounts, number of accounts

153

F:\Company Info\Lawsuits\Lawsuit Status\Greater SE Mgmt Dist_944_LTS-Feb11 2022.xlsx

Revised 2 March 2022

page 10 of 11

prepared by: Equi-Tax Inc.

281.444.4866

Greater Southeast Management District

Lawsuit and Arbitration Status Detail as of 2/11/2022

Jur 944

Tax Year CAD Account No. Owner Name ARB Hearing Value

Assessment

Collected

Cause Number

Date Received

from HCAD

Settled Value

Reduction in

Value

%

Reduction

in Value

Reduction in

Assessment

%

Reduction

in

Assessment

Date

Designation

Form Sent to

Owner

Date Refund

Notice Sent to

Bkpr

Cumulative

Settled

Cumulative Grand Total Settled Accounts, original value 9,124,461,604 851,998,065

Cumulative Grand Total Settled Accounts, number of accounts 1,309

Unsettled

Cumulative Grand Total Unsettled Accounts, original value 2,406,565,389

Cumulative Grand Total

Unsettled Accounts, number of accounts

245

Color Legend

Light Gray Settled previously

Yellow Settled as of this report

White Unsettled

Pink Unsettled and new since previous report

Abbreviations

NA

Not applicable

x

Previous to implementation of Designation Form

DELQ

Refund was not issued -- Reduction in

assessment was applied to the account,

and account still has a balance due.

BASA

Billed at settled amount -- Account had

not been billed for this tax year before the

lawsuit was settled; so account was

adjusted (if needed) and billed at the

settled amount.

NYB

Not yet billed

25.25b

Settled under Tax Code 25.25b; refund

processed

F:\Company Info\Lawsuits\Lawsuit Status\Greater SE Mgmt Dist_944_LTS-Feb11 2022.xlsx

Revised 2 March 2022

page 11 of 11

prepared by: Equi-Tax Inc.

281.444.4866

BUDGET AND FINANCE

Jan 31, 22 Dec 31, 21 $ Change % Change

ASSETS

Current Assets

Checking/Savings

TexPool FTA

413,610 413,596 13 0%

Wells Fargo-FTA

155,170 55,238 99,932 181%

Operating Accounts

Chase-Overpayment TaxPayers

14,878 29,981 (15,103) (50)%

Chase Operating Account

95,120 86,029 9,092 11%

Wells Fargo-Tax Assessor

2,493,356 575,652 1,917,704 333%

Total Operating Accounts

2,603,354 691,662 1,911,693 276%

Investment Accounts

TexPool

2,403,629 2,623,129 (219,500) (8)%

Unity National Bank

16,003 16,003 0 0%

AmegyBank Of Texas

3,156 3,156 0 0%

Total Investment Accounts

2,422,789 2,642,288 (219,500) (8)%

Total Checking/Savings

5,594,922 3,802,785 1,792,138 47%

Accounts Receivable

Receivable-TIRZ OST/Palm CtrLiv

0 43,000 (43,000) (100)%

Receivable-TIRZ SuppleAgreemnt

9,944 23,082 (13,139) (57)%

Receivable FTA Grant Reimburse

(0) 99,319 (99,319) (100)%

Receivable-TIRZ EPS Reimb Grant

19,998 47,121 (27,123) (58)%

1200 · Accounts Receivable

0 100,000 (100,000) (100)%

Total Accounts Receivable

29,942 312,522 (282,581) (90)%

Other Current Assets

Prepaid Expenses

2,987 3,734 (747) (20)%

Accounts Receivable-Assessments

Receivable Assessment-2021

1,228,260 2,743,495 (1,515,235) (55)%

Receivable Assessment-2020

164,030 166,762 (2,732) (2)%

Receivable Assessment-2019

82,034 83,120 (1,086) (1)%

Receivable Assessment-2018

16,270 16,728 (458) (3)%

Receivable Assessment-2017

8,375 8,740 (365) (4)%

Receivable Assessment-2016

3,402 3,519 (117) (3)%

Receivable Assessment-2015

2,719 2,836 (117) (4)%

Receivable Assessment-2014

7,862 7,978 (116) (2)%

Receivable Assessment-2013

5,946 5,946 0 0%

Receivable Assessment-2012

5,145 5,145 0 0%

Receivable Assessment-2011

4,513 4,513 0 0%

Receivable Assessment-2010

6,638 6,638 0 0%

Receivable Assessment-2009

8,824 8,824 0 0%

Receivable Assessment-2008

5,519 5,519 0 0%

Receivable Assessment-2007

294 294 0 0%

Receivable Assessment-2006

190 190 0 0%

Receivable Assessment-2005

308 308 0 0%

Receivable Assesmt 2004 & Prior

601 601 0 0%

Total Accounts Receivable-Assessme...

1,550,930 3,071,157 (1,520,227) (50)%

Total Other Current Assets

1,553,917 3,074,891 (1,520,974) (50)%

Total Current Assets

7,178,781 7,190,198 (11,417) (0)%

Fixed Assets

Computer Equipment

13,925 13,925 0 0%

Copier

3,600 3,600 0 0%

Accumulated Depreciation

(16,644) (16,583) (61) (0)%

Total Fixed Assets

881 942 (61) (7)%

TOTAL ASSETS 7,179,662 7,191,140 (11,478) (0)%

LIABILITIES & EQUITY

Greater Southeast Management District

Balance Sheet with Previous Month Comparison

As of January 31, 2022

Jan 31, 22 Dec 31, 21 $ Change % Change

Liabilities

Current Liabilities

Accounts Payable

8010 · Accounts Payable

143,469 310,725 (167,255) (54)%

Total Accounts Payable

143,469 310,725 (167,255) (54)%

Other Current Liabilities

Amount Due Parkwood Civic Grant

4,350 4,350 0 0%

Deposits in Transit

399,226 41,944 357,282 852%

Overpayment-Due to Taxpayers

32,254 50,149 (17,895) (36)%

Deferred Revenue

1,704,685 3,224,912 (1,520,227) (47)%

Total Other Current Liabilities

2,140,514 3,321,355 (1,180,840) (36)%

Total Current Liabilities

2,283,984 3,632,079 (1,348,096) (37)%

Total Liabilities

2,283,984 3,632,079 (1,348,096) (37)%

Equity

6010 · Assigned Surplus

3,559,060 2,232,594 1,326,467 59%

Net Income

1,336,618 1,326,467 10,151 1%

Total Equity

4,895,678 3,559,060 1,336,618 38%

TOTAL LIABILITIES & EQUITY 7,179,662 7,191,140 (11,478) (0)%

Greater Southeast Management District

Balance Sheet with Previous Month Comparison

As of January 31, 2022

Page 2

Jan 22 Dec 21 $ Change % Change

Ordinary Income/Expense

Income

4032 · Grant Revenue Fed RailroadGrant

613 154,556 (153,943) (100)%

4056 · Supplemental Agrmnt shared scvs

4,327 860 3,468 403%

4065 · Grant Revenue METRO

0 100,000 (100,000) (100)%

4060 · Enhanced Public Safety Revenue

9,982 (276) 10,258 3,712%

4057 · Income (Other)

4,327 0 4,327 100%

4010 · Tax Assessment Revenue

1,520,227 508,760 1,011,467 199%

4020 · Tax Assessor Other Revenue

3,017 1,526 1,492 98%

4050 · Interest Income

92 105 (13) (12)%

Total Income

1,542,585 765,531 777,054 102%

Gross Profit

1,542,585 765,531 777,054 102%

Expense

1000 · District Administration

District Management

1015 · Management & Administrative Svc

2015 · Professional Services

Auditing Services

0 10,980 (10,980) (100)%

2015-2 · Legal Services

3,105 7,696 (4,591) (60)%

2015-1b · Accounting Services

1,300 1,300 0 0%

2015-5 · Assessment Management Services

4,480 2,641 1,839 70%

Total 2015 · Professional Services

8,885 22,617 (13,733) (61)%

2015-9 · Administrative Management Svcs

13,000 (53,605) 66,605 124%

2006 · ADP Fees

335 79 256 323%

1015-8 · Admin Reclass

(19,888) (20,895) 1,007 5%

1015-5 · Employee Health Benefits

3,469 2,483 986 40%

1015-2 · ADP Employer Taxes

3,376 1,444 1,932 134%

1015-4 · Salaries

34,892 18,873 16,019 85%

Total 1015 · Management & Administrative Svc

44,068 (29,003) 73,072 252%

2000 · Office Expense

1005 · Insurance

747 747 0 0%

2015-12 · Computer/Website Consultant

1,120 370 750 203%

2030-22 · Depreciation Expense

61 61 0 0%

2025-22 · Office Rent/Storage Unit Rent

2,930 226 2,704 1,197%

2020-22 · Telephone

520 1,001 (481) (48)%

2005 · Bank Charges

30 91 (61) (67)%

2035 · Meeting Expense

2035-1 · BOD Meeting Expense & Retreat

189 221 (32) (14)%

Total 2035 · Meeting Expense

189 221 (32) (14)%

Total 2000 · Office Expense

5,597 2,717 2,880 106%

Total District Management

49,665 (26,287) 75,952 289%

Total 1000 · District Administration

49,665 (26,287) 75,952 289%

3000 · District Svcs & Improvements

3005 · Transporation & Local Mobility

3005-40 · Management of T&LM

Legal

124 0 124 100%

Greater Southeast Management District

Profit & Loss with Previous Month Comparison

For the Period Ended January 2022

Jan 22 Dec 21 $ Change % Change

Program & Project Personnel

Salaries & Benefits

4,472 5,954 (1,482) (25)%

Total Program & Project Personnel

4,472 5,954 (1,482) (25)%

Total 3005-40 · Management of T&LM

4,596 5,954 (1,358) (23)%

3005-20 · Planning Coordinatioin Fund Dev

3005-21 · TGC - Fund DevelopPlanCoordInti

6,922 4,394 2,528 58%

Total 3005-20 · Planning Coordinatioin Fund Dev

6,922 4,394 2,528 58%

3005-13 · Multi-Modal Trans Develop

3005-08 · FederalRailRoadGrant

0 613 (613) (100)%

3005-09 · FederalRailRoadGrantLocalMatch

0 307 (307) (100)%

3005-10 · HoustonBikeShareProject

0 (40,370) 40,370 100%

3005-38 · Custom Bus Shelters

(242) (2,641) 2,400 91%

Total 3005-13 · Multi-Modal Trans Develop

(242) (42,091) 41,850 99%

Total 3005 · Transporation & Local Mobility

11,276 (31,743) 43,019 136%

3010 · Environ, Urban, Design & Visual

3010-60 · Management of EUD&VI

Legal

0 495 (495) (100)%

Program & Project Personnel

Salaries & Benefits

4,472 5,954 (1,482) (25)%

Total Program & Project Personnel

4,472 5,954 (1,482) (25)%

Total 3010-60 · Management of EUD&VI

4,472 6,449 (1,977) (31)%

3010-50 · Right-Of-Way Maint/Median Enh

3010-19 · UrbanCommunityGardenMaint/Mkt

800 800 0 0%

3010-21 · LandscapingIrrigationTrash/Debr

42,974 33,410 9,564 29%

3010-29 · Bus Shelter Maintenance

2,500 2,500 0 0%

3010-31 · Water for Street Enhancements

513 831 (319) (38)%

3010-30 · Waste Removal/Management

514 509 4 1%

3010-57 · LandscapeMaint/HardscapeRepairs

18,540 8,105 10,435 129%

Total 3010-50 · Right-Of-Way Maint/Median Enh

65,840 46,156 19,684 43%

3010-20 · Graffiti Abatement Program

1,360 1,360 0 0%

Total 3010 · Environ, Urban, Design & Visual

71,672 53,965 17,708 33%

3015 · Enhanced Pub. Safety Svcs

3015-40 · Management of EPSS

Meeting & Office Expense

436 166 270 163%

Program & Project Personnel

Salaries & Benefits

2,851 2,861 (9) (0)%

Total Program & Project Personnel

2,851 2,861 (9) (0)%

Total 3015-40 · Management of EPSS

3,287 3,026 261 9%

Greater Southeast Management District

Profit & Loss with Previous Month Comparison

For the Period Ended January 2022

Page 2

Jan 22 Dec 21 $ Change % Change

3015-20 · EPS Program

3015-22 · Bike Patrol Coordinator

3,000 3,000 0 0%

3015-23 · Bike/Motorcycle Patrol

9,395 9,116 279 3%

3015-21 · Constables

49,579 49,578 1 0%

Total 3015-20 · EPS Program

61,974 61,694 280 1%

Total 3015 · Enhanced Pub. Safety Svcs

65,261 64,721 541 1%

3020 · Business & Economic Development

3020-40 · Management of B&ED

Program & Project Personnel

Salaries & Benefits

2,851 3,222 (370) (12)%

Total Program & Project Personnel

2,851 3,222 (370) (12)%

Total 3020-40 · Management of B&ED

2,851 3,222 (370) (12)%

Total 3020 · Business & Economic Development

2,851 3,222 (370) (12)%

3025 · Marketing, Public Relations/Per

3025-50 · Management of MPR&PE

Program & Project Personnel

Salaries & Benefits

5,241 2,905 2,336 80%

Total Program & Project Personnel

5,241 2,905 2,336 80%

Total 3025-50 · Management of MPR&PE

5,241 2,905 2,336 80%

3025-40 · Public Relations Program

0 3,632 (3,632) (100)%

Total 3025 · Marketing, Public Relations/Per

5,241 6,537 (1,296) (20)%

Total 3000 · District Svcs & Improvements

156,302 96,701 59,601 62%

Total Expense

205,967 70,414 135,553 193%

Net Ordinary Income

1,336,618 695,117 641,501 92%

Net Income 1,336,618 695,117 641,501 92%

Greater Southeast Management District

Profit & Loss with Previous Month Comparison

For the Period Ended January 2022

Page 3

Greater Southeast Management District

Recurring and Non-Recurring

As of January 31, 2022

Date Name Memo Amount

01/24/2022 ADP Payroll Fees ADMIN: Payroll Processing Fees for 1/31/22 93.20$

01/31/2022 ADP Payroll Fees ADMIN: Payroll Processing Fees for 1/31/22 88.56$

01/18/2022 ADP Payroll Fees ADMIN: Payroll Processing Fees for 12/31/21 W-2 & 1099 processing fees 153.55$

01/31/2022 Bracewell LLP ADMIN: Legal Services for January 31, 2022 3,105.00$

01/31/2022 Bracewell LLP ADMIN: BOD refreshments 1/11/22 189.44$

01/25/2022 Comcast Business Phone & Internet ADMIN: Business Phone & Internet Services for 1/30/2022 to 2/28/2022 342.34$

01/15/2022 Comcast Business VoiceEdge ADMIN: Business VoiceEdge Services for 1/15/2022 to 2/14/2022 292.57$

01/15/2022 Comcast Business VoiceEdge ADMIN: Business VoiceEdge Services for 12/15/2021 to 1/14/2022 288.96$

01/25/2022 CompuSolutionX ADMIN: Monthly computer add'l consulting services for January 2022 750.00$

01/01/2022 CompuSolutionX ADMIN: Monthly computer consulting services for January 2022 370.00$

01/01/2022 Equi-Tax, Inc. ADMIN: Assessment Collection Monthly fee for January 2022 2,640.94$

01/01/2022 Hawes Hill & Associates LLP ADMIN: Monthly Professional Consulting & Administration Fee & Reimbursements for December 2021 6,500.00$

01/01/2022 Hawes Hill & Associates LLP ADMIN: Monthly Professional Consulting & Administration Fee & Reimbursements for January 2022 6,500.00$

01/31/2022 McConnell & Jones, LLP ADMIN: Accounting/Bookkeeper Services for January 2022 1,300.00$

01/01/2022 OST/Almeda Corridors Redevelopment Aut. ADMIN: Sub-Lease Rent for January 2022 1,352.03$

01/01/2022 OST/Almeda Corridors Redevelopment Aut. ADMIN: Sub-Lease Rent Property Taxes FY 2021 1,352.03$

01/31/2022 Perdue, Brandon, Fielder, Collins, & Mott ADMIN: Professional Services Rendered in Collections for 11/24/2021-12/29/2021 824.55$

01/01/2022 Proguard Self Storage Houston ADMIN: Storage Unit Rent Unit 4144 - January 2022 226.00$

01/31/2022 TML ADMIN: Insurance expense (Multi-Coverage Policies 6/01/21 - 6/30/22) for January 2022 746.82$

01/01/2022 TSG Reporting, Inc. ADMIN: Public Hearing to Consider the Advisability of Supplementing the Assessment Roll - Novemb... 1,014.15$

28,130.14$

01/31/2022 Administrative Expense T&LM: Salaries and benefits for the period of 1/1/2022 to 1/31/2022 4,471.94$

01/31/2022 The Goodman Corporation T&LM: Pursuit of Funding/Program Coord Planning & Fund Development Svcs FTA- January 2022 6,921.89$

01/31/2022 Bracewell LLP T&LM: Agreement with MCMD 123.75$

11,517.58$

01/31/2022 Administrative Expense EUD&VI: Salaries and benefits for the period of 1/1/2022 to 1/31/2022 4,471.84$

01/06/2022 Terry Garner EUD&VI: Community Garden Facilitator Services at Palm Center Community Garden - Jan 2022 800.00$

01/31/2022 Flores Quality Services EUD&VI: District Maintenance Services Other Maintenance Svcs for January 2022 9,564.07$

01/31/2022 Flores Quality Services EUD&VI: Monthly District Maintenance Services for January 2022 33,410.13$

01/31/2022 Flores Quality Services EUD&VI: District Maintenance Services for 25 Metro Bus Shelters for January 2022 2,500.00$

01/31/2022 Flores Quality Services EUD&VI: District Maintenance Services Other Sevices Irrigation repairs for January 2022 590.00$

01/31/2022 Flores Quality Services EUD&VI: District Maintenance Services Other Sevices Mulch for January 2022 15,250.00$

01/20/2022 City of Houston Water Department EUD&VI: Water charges for period 11/08/2021 to 12/05/2021- 2201 Blodgett 309.94$

01/20/2022 City of Houston Water Department EUD&VI: Water charges for period 11/08/2021 to 12/05/2021- 6192 Main 6.25$

01/20/2022 City of Houston Water Department EUD&VI: Water charges for period 11/08/2021 to 12/05/2021 - 2022 Blodgett 6.25$

01/20/2022 City of Houston Water Department EUD&VI: Water charges for period 11/08/2021 to 12/05/2021 - 2300 Tuam 6.25$

01/20/2022 City of Houston Water Department EUD&VI: Water charges for period 11/08/2021 to 12/05/2021 - 2333 Southmore Blvd -$

01/20/2022 City of Houston Water Department EUD&VI: Water charges for period 11/08/2021 to 12/05/2021 - 2824 Blodgett 18.80$

01/20/2022 City of Houston Water Department EUD&VI: Water charges for period 11/08/2021 to 12/05/2021 - 3018 Dowling 6.25$

01/20/2022 City of Houston Water Department EUD&VI: Water charges for period 11/08/2021 to 12/05/2021 - 3093 Blodgett 118.80$

DISTRICT ADMINISTRATION

TRANSPORATION & LOCAL MOBILITY SERVICES

Greater Southeast Management District

Recurring and Non-Recurring

As of January 31, 2022

Date Name Memo Amount

01/20/2022 City of Houston Water Department EUD&VI: Water charges for period 11/08/2021 to 12/05/2021 - 4002 Griggs 18.80$

01/20/2022 City of Houston Water Department EUD&VI: Water charges for period 11/08/2021 to 12/05/2021 - 4003 Griggs 8.80$

01/20/2022 City of Houston Water Department EUD&VI: Water charges for period 11/08/2021 to 12/05/2021 - 6032 Main 6.25$

01/20/2022 City of Houston Water Department EUD&VI: Water charges for period 11/08/2021 to 12/05/2021 - 6215 Main 6.25$

01/01/2022 Waste Connections of TX, LLC EUD&VI: Waste Removal Services for January 2022 239.52$

01/01/2022 Waste Connections of TX, LLC EUD&VI: Waste Removal Services for January 2022 274.02$

01/06/2022 Southern Concrete Raising EUD&VI: Emergency Sidewalk Repairs for 4000 Griggs Rd, Houston, Tx 77021 2,000.00$

01/07/2022 Southern Concrete Raising EUD&VI: Emergency Sidewalk Repairs for 5101 Almeda Rd, Houston, Tx 77004 700.00$

01/06/2022 East End District EUD&VI: Grafitti Abatement Services for January 2022 1,360.00$

71,672.22$

01/31/2022 Administrative Expense EPS: Salaries and benefits for the period of 1/1/2022 to 1/31/2022 3,723.47$

01/31/2022 Franklin Gans, Jr. EPS: Coordinator fee for January 2022 3,000.00$

01/31/2022 Joe Fleming EPS: Bike/Motorcycle Patrol for January 2022 1,872.00$

01/31/2022 Ernest McNichols EPS: Bike/Motorcycle Patrol for January 2022 1,287.00$

01/31/2022 Fitzgerald Plummer EPS: Bike/Motorcycle Patrol for January 2022 1,404.00$

01/31/2022 Aldrin Sampson EPS: Bike/Motorcycle Patrol for January 2022 1,232.00$

01/31/2022 Keith Seafous EPS: Bike/Motorcycle Patrol for January 2022 1,135.75$

01/31/2022 Mark Andrus EPS: Bike/Motorcycle Patrol for January 2022 1,232.00$

01/31/2022 Cory Cloud EPS: Bike/Motorcycle Patrol for January 2022 1,232.00$

01/08/2022 Harris County Treasurer EPS: Constables February 2022 49,579.00$

65,697.22$

01/31/2022 Administrative Expense B&ED: Salaries and benefits for the period of 1/1/2022 to 1/31/2022 2,851.49$

2,851.49$

01/31/2022 Administrative Expense MPR&PE: Salaries and benefits for the period of 1/1/2022 to 1/31/2022 5,241.22$

5,241.22$

185,109.87$

TOTAL RECURRING EXPENSE FOR THE PERIOD ENDING JANUARY 31, 2022

ENVIRONMENTAL, URBAN, DESIGN & VISUAL IMPROVEMENT SERVICES

ENHANCED PUBLIC SAFETY SERVICES

BUSINESS & ECONOMIC DEVELOPMENT SERVICES

MARKETING, PUBLIC RELATIONS & PERCEPTION ENHANCEMENT SERVICES

Lease Concerning: Greater Southeast Management District – 5445 Almeda #503.

Initialed for Identification by: Tenant _____ _____ Landlord _____ _____

COMMERCIAL LEASE

1. PARTIES: The parties to this lease are:

Tenant: Greater Southeast Management District ; and

Landlord: Abdullatif & Company LLC,

2. LEASED PREMISES:

A. Landlord leases to Tenant the following described real property, knows as the "Leased Premises,"

along with all its improvements:

(1) Multiple-Tenant Property: Suite or Unit Number 503 containing approximately 1265 square feet of

net rentable area in the John B. Coleman Professional Building at 5445 Almeda in Houston, TX in

Harris County is legally described as LTS 1 THRU 7 BLK 23 RIVERSIDE TERRACE SEC 3.

B. Leased Premises Definitions:

(1) "Property° means the building or complex in which the Leased Premises are located, inclusive of

any common areas, drives, parking areas, and walks; and

(2) the parties agree that the rentable area of the Leased Premises may not equal the actual or usable

area within the Leased Premises and may include an allocation of common areas in the Property.

3. TERM:

A. Term: The term of this lease is_6__ months and _0__ days, commencing on:

April 1, 2022 ______________________( Commencement Date) and ending on

September 30, 2022 _______________ (Expiration Date).

Lease shall continue on a month-to-month basis after September 30, 2022 until December

31, 2022.

Delay of Occupancy: Inapplicable.

B. Unless the parties agree otherwise, Tenant is responsible for obtaining a certificate of occupancy

for the Leased Premises if required by a governmental body.

4. RENT AND EXPENSES:

A. Base Monthly Rent: On or before the first day of each month during this lease, Tenant will pay

Landlord base monthly rent as described as follows:

from

April 1, 2022

To: September 30, 2022

$2,002.00

B. First Full Month's Rent: The first full base monthly rent is due upon execution.

Lease Concerning: Greater Southeast Management District – 5445 Almeda #503.

Initialed for Identification by: Tenant _____ _____ Landlord _____ _____

C. Prorated Rent: If the Commencement Date is on a day other than the first day of a month, Tenant

will pay Landlord as prorated rent, an amount equal to the base monthly rent calculated by the

following fraction: the number of days from the Commencement Date to the first day of the following

month divided by the number of days in the month in which this lease commences. The prorated

rent will be due on or before the first day of the 2

nd

month, in which a payment is due, according

to the lease.

D. Additional Rent: In addition to the base monthly rent and prorated rent, Tenant will pay Landlord

all other amounts, as provided by this lease.

All amounts payable under the applicable addenda are deemed to be "rent" for the purposes of

this lease.

E. Place of Payment: Tenant will remit all amounts due Landlord under this lease to the following

person at the place stated or to such other person or place as Landlord may later designate in

writing:

Name: BUILDING MANAGER- PAYABLE TO ABDULLATIF & COMPANY

Address: 4900 Fournace Place, Suite 600, Bellaire, TX 77401

F. Method of Payment: Tenant must pay all rent timely without demand, deduction, or offset, except

as permitted by law or this lease. If Tenant fails to timely pay any amounts due under this lease or

if any check of Tenant is returned to Landlord by the institution on which it was drawn, Landlord

after providing written notice to Tenant may require Tenant to pay subsequent amounts that become

due under this lease in certified funds. This paragraph does not limit Landlord from seeking other

remedies under this Lease for Tenant's failure to make timely payments with good funds.

G Late Charges: If Landlord does not actually receive a rent payment at the designated place of

payment within 5 days after the date it is due, Landlord shall give Tenant notice of same and Tenant

will pay Landlord a late charge equal to 5% of the amount due if Payment not received by the 10

th

of the Month.; However, Landlord shall be required to give Tenant notice under the terms of this

provision only once during the term of this Lease. In this paragraph, the mailbox is not the agent

for receipt for Landlord. The late charge is a cost associated with the collection of rent and

Landlord's acceptance of a late charge does not waive Landlord's right to exercise remedies under

Paragraph 20.

H. Returned Checks: Tenant will pay $50.00 for each check Tenant tenders to Landlord which is

returned by the institution on which it is drawn for any reason, plus any late charges until Landlord

receives payment.

5. SECURITY DEPOSIT:

A. Upon execution of this lease, Tenant will pay $0.00 to Landlord as a security deposit.

B. Landlord may apply the security deposit to any amounts owed by Tenant under this lease. If

Landlord applies any part of the security deposit during any time this lease is in effect to amounts

owed by Tenant, Tenant must, within 10 days after receipt of notice from Landlord, restore the

security deposit to the amount stated.

Lease Concerning: Greater Southeast Management District – 5445 Almeda #503.

Initialed for Identification by: Tenant _____ _____ Landlord _____ _____

C. After Tenant surrenders the Leased Premises to Landlord and provides Landlord written notice of

Tenant's forwarding address, Landlord will, not later than the time required by §93.005, Texas

Property Code, refund the security deposit less any amounts applied toward amounts owed by

Tenant or other charges authorized by this lease. The parties agree that Landlord acts in good

faith if Landlord accounts for the security deposit within the time stated.

6. TAXES:

Tenant shall pay a monthly proportionate share of all real property taxes applicable to the Leased

Premises for the number of months of occupancy. Landlord shall remit to tenant a copy of all tax

statements for the Leased Premises for each year in question within (30) days of receipt. Tenant's

proportionate share of the premises shall be determined by dividing the square footage of the Leased

Premises by the total net rentable square footage for the building. The Net rentable building square

footage is 40000 sq ft. Tenant share is 3.1%.

7. UTILITIES:

A. The party designated below will pay for the following utility charges to the Leased Premises and

any connection charges for the utilities. (Check all that apply.)

Tenant

Landlord

N/A

(1)

Water

❑

✓

❑