This PDF is a selection from an out-of-print volume from the National

Bureau of Economic Research

Volume Title: Explorations in Economic Research, Volume 3,

number 1

Volume Author/Editor: NBER

Volume Publisher: NBER

Volume URL: http://www.nber.org/books/gort76-1

Publication Date: 1976

Chapter Title: Housing Demand in the Short Run: An Analysis

of Polytomous Choice

Chapter Author: John M. Quigley

Chapter URL: http://www.nber.org/chapters/c9079

Chapter pages in book: (p. 76 - 102)

I

JOHN M. QUIGLEY

National Bureau of Economic Research

and Yale University

Housing Demand in the Short

Run:

An Analysis of Polytomous

Choice

ABSTRACT:

In this paper the author presents a model of household

choice among types of residential housing that incorporates intramet-

ropolitan variations in housing prices arising from variations in work

site location. Under suitable assumptions, the prices that households

face in choosing among alternative types of residential housing are

deduced. ¶ The empirical analysis suggests that consumers are re-

sponsive to the systematic variation in these prices in their choices

among housing types in a metropolitan area. A model relating house-

hold choices among some 18 types of residential housing to intrarnet-

ropolitan price variation is estimated by maximum likelihood methods

using conditional logit analysis. The results of the analysis, which is

conducted separately for some

O stratifications of households by

income and family size, provide strong evidence of the importance of

these intrametropolitan variations in

relative

prices in motivating

choice among alternative types of residential housing.

NOTE: A previous version of this paper was presented at the winter meetings of the Econometric Societ

New York, December 1973. I am grateful to Bill Apgar. Jim Ohis, and William Weaton for helpful criticise

of an earlier draft, and to Wallace Campbell, Walter Fisher, and Philip Klutznick of the Board reading

committee for their comments on the final version of the paper.

76

rch

sity

old

et-

ork

olds

are

re-

ces

use-

met-

ocis

h is

by

e of

(I ng

ciey,

ticism

ading

77

F-

Housing Demand in the Short Run

Existing empirical studies of the demand for housing,

usually based on

aggregate cross-section data, ignore (Or

assume away) several crucial

features of the urban housing market. First, these studies

measure housing

consumption in a single dimension, rental

payments (Or housing values),

despite the obvious heterogeneity of the housing

stock. Secondly, these

studies either ignore housing prices completely

in focussing on the

income-expenditure relation, or they rely

upon crude measurements of

'average" housing prices in an entire metropolitan

area.'

The few analyses of the demand for housing based

upon micro units, i.e.

individual households and dwelling units, have established,

not surpris-

ingly, that specified types of housing

consumers demand particular com-

ponents of housing services. However, these recent studies have

only

analyzed the effect of housing prices upon household demand

under the

implicit assumption that components of housing services

may be pur-

chased quite independently of one another.2

Theoretical analyses of residential location and the demand

for housing

stress the importance of the work trip in determining the spatial location of

housing consumption and the quantity of "housing services" demanded,

Yet with very few exceptions, these theories ignore the existence of durable

and differentiated stocks of residential housing. These theoretical analyses

in effect assume that the urban area will be built de

novo during any

period of analysis.

Neglect of the heterogeneity of housing in both residential location and

housing demand studies is clearly justified in certain situations, notably in

the analysis of comparative statistics when the central focus of the investi-

gation is upon the long-run equilibrium of the entire market for "housing

services." Since in the long run housing can be converted or built anew at

any site, the convenient notion of undifferentiated "housing services,"

measured by total monthly expenditures, is appropriate in analyses of both

consumer demand and choice of location.

Yet it is equally clear that dwelling units emitting the same quantities of

"housing services," as measured by contract rent or monthly expendi-

tures, are often viewed as utterly distinct by both housing suppliers and

demanders. Indeed, both producers and consumers may view them as

much less similar than other units which differ substantially in price. The

substantial costs of transforming the characteristics of existing units implies

that housing units of various types may barn substantial locational quasi-

rents for long periods of time.

Indeed, the first attempts to incorporate distinct components of housing

services explicitly into consumer demand theory have already been under-

taken by Sweeney. In his insightful theoretical analysis, Sweeney defines a

"hierarchy" of housing commodities and derives the equilibrium condi-

tions for a market characterized by discrete housing types that can be

John M. Quigley

ranked identically by all consumers from the "most

preferred" to the "least

preferred" type. Sweeney also investigates changes in the

demand for all

housing types in response to a change in the price of any

single type. In

concentrating upon the "hierarchical" nature of the housing

commodity,

however, Sweeney ignores the spatial aspects of the housing market.

The polycentric nature of employment locations in real urban areas and

the importance of the work trip in determining both residential location

and the choice of housing type greatly complicate the problem. The

durability and fixity of residential housing suggests that households face

differing effective prices for the same types of housing depending upon

their work place locations, at least as long as transport is not costless.

This paper extends the theoretical analysis of the demand for housing to

incorporate the spatial dimension (and thus the residential location deci-

sion), as well as the choice of housing type. In particular, we address the

choice of housing type and residential location in a metropolitan area

which may have several work places. In this short-run analysis, the spatial

distributions of the stocks of various types of housing are given. Although

the monocentric assumption of traditional residential location models is

abandoned, the analysis relies upon the primary insight of residential

location theorythe willingness of consumers to substitute transport costs,

specifically work trip commuting costs, for housing prices in choosing

residential locations. The theoretical model indicates how choices among

housing are related to systematic variations in the relative prices faced by

households for the same types of residential housing. The model indicates

that these prices, in turn are heavily dependent on the interaction of work

place location, the spatial distribution of the stock of housing, and the

characteristics of the urban transport network.

The model is estimated empirically, by conditional logit analysis, based

upon the actual choices made by a sample of some 3,000 renter house-

holds in the Pittsburgh metropolitan area. The results provide rather

powerful predictors of the housing choices made by the sample of relocat-

ing households; yet the results are not necessarily consistent with the

notion of equilibrium in the housing market as a whole. In particular, the

results are generally consistent with the possibility, at given prices, of

excess demand or excess supply of particular types of housing at certain

locations.

In choosing a dwelling unit, households jointly purchase

a wide variety

of attributes at a particular location. Considerable effort

has already been

expended by researchers to isolate those attributes of the

housing "bundle"

that command prices in the market. Without

loss of generality, we can

classify units into housing "types"

or collections of attributes. Each housing

type is defined at specified values of the vector of attributes

that command

market prices. The set of mutually exclusive housing

types represents all

ast

all

In

ity,

t.

and

tion

The

face

pon

less.

ley

70

Housing Demand in the Short Run

possible choices that may be made by any housing

consumer. We assume

that each consumer will choose one (and only one) residence

from the set.

During any given period only a small fraction of urban

households

become "movers" and actively search for

new residences in the urban

area. Typically these households include:

1.

additional workers induced to the urban

area;

2.

new households formed during the period;

3.

those whose preferences for housing attributes have

changed;

4.

those for whom the relative prices of housing

types have changed

appreciably.

g to

deci-

Since preferences for particular configurations of housing

are strongly

s the

related to family size, composition, and age as well

as family income, the

area

third category includes movers induced by life-cycle changes in house-

atial

holds. For reasons discussed below, the fourth category includes

house-

ough

holds whose work place has changed as well as those with unchanged

els is

work places who face changes :n relative prices. However, since moving

ential

within the urban area imposes economic and other costs

upon households,

costs,

we may suppose that for households with unchanged preferences and

sing

work places, appreciable changes in relative prices will be required

to

mong

induce intrametropolitan mobility.

ed by

In any period each household making a residential choice gathers

icates

information on the spatial locations of each type of housing and

on the

work

market prices of housing types at these locations. Since alternative spatial

d the

locations impose costs upon the household, each household similarly

gathers information on the accessibility costs associated with different sites.

based

These accessibility costs will reflect the out-of-pocket costs and the oppor-

tunity costs of the time expended in commuting and in travelling to other

points.

ouse-

rather

locat-

For an individual household, the choice of the best, or "optimal"

location, for any particular type of housing is straightforward, at least in

th the

principle. For each possible location the household adds the accessibility

ar, the

costs to the housing price schedule and calculates the total cost of

es, of

consuming that type of housing at that location. The site at which this total

ertain

cost is a minimum is the optimal location for consuming the partcular type

of residential housing.

variety

The household's ultimate choice among housing types is systematically

y been

related to this cost minimizing calculus. After calculating the optimal (i.e.

undle"

the minimum cost) location for each type of residential housing, the

e can

household chooses among locationally subscripted housing types on the

ousing

basis of its preferences for the underlying housing characteristics and the

rnand

relative costs (or effective prices) of the alternatives. Note that the total cost

ents all

I

S

80

John M. Quigley

of each housing type at its minimum priced location is

the relevant price in

considering the choice among housing types.

If, as the assumption of

residential location theory suggests, work trips are the most iniportant

component of accessibility costs, the effective price

facing different house-

holds for consuming a particular type of housing varies with the place-

ment of their work sites relative to concentrations of the available stock. If

travel time is related to alternative wages, the price will also vary for

households with different wages

In a city where work places and incomes are not identical and where

durable and heterogeneous residential structures exist, our theory suggests

that consumers' choices among housing types will be dependent upon

these relative prices.

For simplicity assume that each household entering the housing market

possesses perfect information about housing prices and the spatial distribu-

tion of housing units; that is, assume that each moving household knows

the surface of prices and housing stock densities in the urban area for every

housing type.

For most households, the single most important component of the

accessibility costs of any site is commuting expenditures. For example,

studies of household trip-making behavior indicate that work trips alone

account for 40-45 percent of total trips and account for more than twice as

many trips as any other class. In addition work trips are, on average, longer

than other types of trips, so their share of accessibility costs is much larger

than their share of total trips. Finally, work trips are typically made

on a

regular basis to particular sites and most other trips are made to diverse

destinations. It has been found, for example, that "the [accessibility] costs

to any single point [other than work place] are almost always trivial."6 In

contrast, journey-to-work costs are typically incurred to reach a particular

destination and their magnitude is substantial. These factors

suggest that

work trip costs are a good approximation to total accessibility

costs. In

particular, we will assume that households have

an inelastic demand for

trips to the work site and that all other trips

are made to ubiquitous and

substitutable destinations. This assumption is fairly

common in models of

residential location.

In contrast, however, to traditional residential location theory,

we do not

assume that all households have the same work place. We recognize the

polycentric nature of urban areas by assuming instead

that locating house-

holds have known and fixed work places.

Under these assumptions the household

can calculate the total cost of

consuming each type of housing at each location. By

searching for the

minimum, the household can discover the optimal

site and its associated

cost for each type of housing. As noted previously the

optimal site and the

cost associated with it will vary with work place

and wages or incomes.

e-

If

the

le,

ne

as

ger

ger

na

rse

osts

In

ular

that

In

for

and

s of

y

n

nt

or

re

sts

et

U-

ws

ery

not

the

use-

:t of

the

ated

the

es.

81

Housing Demand in the Short Run

(1)

= mm

= mm [R, -s-

Definitions for the variables appear in the following

list:

R1,

is the contract price (monthly rent) of housing

type i at residential site

m.

Tjm

is the (monthly) cost of work trips between work

place I and residence site

m for workers with income y.

P,,1

is the total (monthly) cost of housing type i

at location m for workers of

income y with work site j.

is the effective or minimum (monthly)

price of consuming housing type

I

for workers with income y and work site

j.

131ii,

I = 1, 2,

. . .

, I

identifies housing types;

m = 1, 2, . .

, M identifies residence sites

j = 1, 2.....I identifies work sites;

y =1, 2.....Y identifies incomes.

Households with given work places,

I. and income, y, face

a budget

constraint of the form

y = P2z + P

where z is the amount of other (nonhousing, nontransport) goods

con-

sumed at price P, and P41 is defined in equation 1 (with the work place

and income subscripts suppressed) as the cost of consuming housing

type i

at its minimum priced location.

For each of the I discrete types of residential housing

we define X. as the

vector of their underlying characteristics (x11, x21,

. . .

, x,), i = 1, 2, . .

, I.

Households are assumed to value the underlying

characteristics of the

housing types as well as other goods

z, i.e., they have utility functions of

the form,

U(X,z)

Since each locating household occupies but

a single housing unit, each

household makes one choice out of the

range of discrete housing bundles,

in addition to its choices of other (nonhousing,

nontransport) goods. For a

household of given income, knowledge of the housing

type consumed and

its effective price determines the

amount of other goods that may be

purchased. Thus for given incomes, each housing bundle and

its price

represent a complete choice over all goods, i.e., the mixed direct-indirect

utility function

(4) V(X1,P)

L

82

John M. Quigley

represents the budget-constrained level of utility derived by a household

with income y living in housing type i. The consumer's problem is to select

the housing type i which yields the highest level of utility.

Preferences for particular underlying characteristics defining housing

types depends upon certain attributes of the households, notably family

size and composition, or "life cycle" attributes. If we consider households

with common incomes, y, and life cycle attributes a, utility maximization

implies that housing type i

will be chosen if

U

(X,, P) > Up,, (Xi, P) for all j i

Since some of the influences upon consumer tastes are unobserved even

if households are stratified by income and household attributes,

the

deviations of individual preferences from the average of the socioeconomic

group (y, a) may be summarized in a stochastic component.8

U,,,, (Xi, P) = W,,a (X1, P) + Eva

where

represents the preferences of the "representative" consumer,

and EVa summarizes the influences

upon preferences of all factors which

are unobserved.

Thus if the preference functions

are interpreted as having a stochastic

component, the probability (pva,) that a particular household

of class (y.. a)

will choose housing type i

over all other types depends on the probability

that the utility of housing typei exceeds the

utility of each other type

j, i.e.

P,,aa = prob [Uya (Xi, P') > U,,a (K,, P)] for all I

I.

and

prob [Eyaj

Eval < W,,,, (K1, P)

t'',,,, (K,, P)] for all j

i

Equation 8 indicates that the

probability of choosing

any particular

housing type depends

on the vector of housing characteristics of a/I

housing types and their total

costs and on a vector of stochastic elements.

If

the vector of stochastic

terms follows some known distribution,

it

is

possible to derive an explicit formula

for p.

In particular, as McFadden has

dernonstrated,

if e, and

are statistically

independent with the reciprocal

exponential distribution

prob(

Zj)eZ.

then

1

prob(1 -

Z1) =

=

+ e'

eZi

1

uigley

ehold

select

Using

holds

zation

s,

j,

i.e.

n, it

83

Housing Demand in the Short Run

and

e'

v,

(11)

=

amily

In equation lithe probability of choosing any particular housing

type i

depends on the attributes and prices of each of the available

types. The

sum of the probabilities over the I housing types is

1 and the probability of

choosing any single type will lie between 0 and 1. In short,

equation 11

even

represents a well-behaved probability function. From equation ii, the

the

odds of choosing i over alternative j may be expressed

nomic

as

-

P

w

(

P)

Pya

-

(li,

,. P)

or

su mer,

which

log

= Wi,,, (X,P) W.,, (X,P)

chastic

Equation 13 implies that the choice between any two housing types is

s (y, a)

independent of the characteristics of the other housing types. Since, by

ability

definition, the set of housing types represents the entire range of choice,

an

individual's ranking of all possible housing types is completely determined

by a series of paired comparisons. This property, the so-called "indepen-

dence of irrelevant alternatives," implies that if those characteristics which

define housing types are chosen correctly, the analysis can be generalized

to address the probability of choosing "new" types of housing (i.e.,

combination, of housing characteristics which may not be observed in a

rticular

given sample).

of all

The logic of equation 11

also implies a separability property in the

erits. If

choice of housing characteristics. Even if housing characteristics are only

is

available in discrete bundles or types, for any given price vector a

household's probability of choosing specified levels of two characteristics

istically

can be decomposed into an independent marginal and a conditional

probability.

In the empirical analysis that follows, it will be assumed that W is

linear in

its parameters.'0 In this case,

W,,,, (X1, P) = b,,,, , +

P

the statistical model is a multinomial generalization of the logit model

often applied to situations involving binary choice, and the parameters can

similarly be estimated by maximum likelihood methods. In addition,

if

84

John M. Quiglev

preferences can be approximated by any

function linear in its parameters

McFadden has shown that the likelihood

function is concave, implying that

iterative estimation procedures converge upon

the unique maximum likeli-

hood estimator of the b parameters.'1

Equations 13 and 14 imply the

multinomial

logistic model to be

estimated separately for each stratification of income

and socioeconomic

characteristics (y, a).

(15)

log (p1/p,) = b, (x,, - x,) +

. .

.

+ b,,

(x,,, - x,,) + b,1 (P'

P)

Empirical estimates of the demand for housing types and individual

housing characteristics are obtained by using information from a large-

scale home interview survey conducted in 1967 in the Pittsburgh Met-

ropolitan Area.'2 The empirical analysis uses price and housing stock

information gathered on some 25,000 dwelling units to analyze the

housing choices made by approximately 3,000 rental households who

made location decisions within the seven year period 1960-1967.

The central hypothesis is that the multiplicity of work places interacts

with the location of durable stocks of differentiated housing types to create

systematic variation in the relative prices of housing types that confront

households in the urban area. These systematic variations in relative prices

are derived from variations in journey-to-work costs, and by hypothesis

they affect households' choices among housing types or housing configura-

tions.

Besides testing this hypothesis in some detail, the analysis allows empiri.

cal testing of several other hypotheses concerning housing market be-

havior. These hypotheses are developed following the definitions of the

particular variables used in the analysis. The operational definitions of the

types of residential housing, their component characteristics, and the

calculation of the effective prices facing each household are first discussed

in turn.

THE TYPES OF RESIDENTIAL HOUSING

As previous analyses have stressed, payment for housing

services includes

payments for a wide variety of qualitative and quantitative attributes of

residential structures, In defining discrete housing

types, or combinations

of these underlying attributes, theoretical

considerations suggest two rough

guidelines. On the supply side, the existence

of discrete housing types or

submarkets implies that it must be costly

to transform housing units among

submarkets. On the demand side, housing

units within any submarket must

be viewed as (virtually) identical, but

housing units in different submarkets

must be viewed as separate and distinct

entities.

y

SI

at

e

ic

al

et-

ck

he

ho

cts

ate

nt

es

S's

ra-

In-

be-

the

the

the

sed

des

of

ons

gh

s or

ong

ust

kets

85

Housing Demand in the Short Run

Both the empirical and theoretical literature

suggest that households

of

differing income and family size will choose

units of varying

residential

density (or lot size) and varying interior

size. In addition,

the qualitative

characteristics of residential Structures

are valued by households.

Based upon these considerations and

available sample

information 18

types or submarkets of rental housing

are defined by proxies for

residential

density, quality, and interior size. Residential

density (or effective

lot size) is

proxied by structure type, which is

reported in three

categories; single

detached units, common-wall units

(including row and

duplex houses),

and multifamily (apartment) units.

The age of the dwelling unit is used

as a proxy for housing

quality and

obsolescence.

Units are classified into

two categories: those

built before

1930 and those built after 1930. The cutoff

year for defining age

categories

was chosen from considerations of sample size with

respect to the data

source. It should also be noted that there

was relatively little

new residen-

tial construction in the Pittsburgh

metropolitan area during the

period

1930-1 945.

Although it would have been preferable

to use floor space in describing

interior size, the only available information

in the sample is the number

of

bedrooms in each dwelling unit. Interior

size is thus proxied by the

number

of bedrooms in the unit, reported in

three categories:

less than two

bedrooms, two bedrooms, and three

or more bedrooms.

The types of rental housing

are thus described by 1 8 combinations:

three

structure types by two quality levels by three

interior size

measures.

The Effective Prices of Housing

Types

For each of the 18 types of residential

housing, the surface of

contract

prices (monthly rents) is estimated by

the average price in each of

50

locations (zones) in the metropolitan

area. The available stock of each type

01 housing is similarly described

by the number of units in each

zone.

Calculations made by households of the

costs of commuting to work are

facilitated by reference to

a set of 330 work sites (zones) and 130 residence

sites (zones).

Thus from equation 1 the

surface representing the total cost of

consum-

ing housing of type i

is

(16)

P,,, = R1,. +

where

= 1, 18

housing types

= 1, 330 work places

m = 1, 130 residence places

m' = 1, 50

residence places

y = 1, Y

incomes

To estimate the monthly cost of work trips we make two strong assump.

tions. First, we assume that households are free to choose the number of

hours they work; secondly, we assume that workers neither value the act of

traveling nor the intrinsic characteristics of travel modes. These assump.

tions imply that the time spent traveling is valued at the (marginal) wage

rate and that the choice of mode is made solely on the basis of time and

money costs.

Thus for an individual with (marginal) wage w, the monthly transpon

costs (TC) from fixed work place Ito residence place m will be equal to

the minimum of the cost of a single trip on public transit (TP,) or the

cost

of a trip by private auto (T%,) multiplied by the number of work trips

per

month (N);

i.e.,

T,

= N mm (TP,, TA)

The cost of trips by public transit is composed of out-of-pocket fares

(F)

and time costs. Let T'm be the elapsed time by public transit between

work

place j and residence site in.

TPjmw

'jm + Tm Wp

Similarly the cost of trips by private auto includes the out-of-pocket

cost of

fuel and maintenance'4 (expressed as E dollars

per minute), the cost of

parking at the destination (expressed

as half the costs of all day parking at

the work site, C) and the costs of time (where

Tm is the interzonal travel

time for an auto trip):

T,

L + T

(E + w)

The total expenditure required to

consume housing type i at any residential

location m may be computed

as

P

= R.,

mm

t(F,

+ Tm wy),

+ T,, [E + wJ)}

Figures

1

and 2 illustrate schematically

the spatial

distribution of

monthly contract prices and the

cumulative distribution of total housing

costs for a particular housing

type facing a particular worker. Figure 1

maps the surface of contract

prices R._, for a particular housing type in the

analysis area. As the schematic

is drawn, darker shades correspond to

higher monthly

rents for this type of housing

at different spatial locations.

Figure 1 in effect

presents the average monthly

rents of a particular housing

type in 50 zones in the

metropolitan area. Although the price

pattern

reveals some tendency for

prices to decline with distance from the Central

Business District (CBD), the

surface is characterized by

irregular peaks and

valleys and by

conspicuous "holes" where the

type of housing is simply

unavailable. Figure 2 plots

the ordered distribution

of the total costs of

p.

of

of

p-

)rt

to

st

er

k

of

of

at

el

of

Is.

al

id

ly

Jf

FIGURE 1

Schematic of the

Surface of

Monthly Rents for

New Two

Bedroom CommonWaIl

Units in the

tan Study

Pittsburgh Metropoli..

}''))lIlll)))lIII7,I)),)

I))

Ill)

Z:

I

ISJ5S7fl7)5.)777

III

2s.j

111fl7,721;.,,71,

7&1

''7F7Ell..e,...p.._,.

'77t7212,l7,.,. 272717)77)

..............

-.7227777.77)7 22272Il2717)

)177flhyj21

22!772777771)j27)777777

111717 11"11p,l, 7')&)I,7

,'''77 2

777) lZ!7Ifl77,177j,7,,

7,2,

(II)

'''')llII2j)pr,,pr.

1,1)7)17

tf7V,.7,,,,,777

£S,u,,,,,,,, )II)27J),2

7))

I'll,,..

37I)If)f/p7qf.

17772

llhllil7ul 771)

27)77

21222

7)777777,

171711

(tIft S'7I2,j

217771)I77271,,))

1522,1..,).

772 7l717!277711!lrj7)j2)777)7171.,

I

flIfl,,i

Ufl7,'

117)772222,7,

I II

7727717)57)

12 27277 Z27)z7, 777 l)77

2)

III

))))))

77211277)12111

III))))

!7)Z7/277))777)777)7777)

fl)

7'!) l)))))fl))

77

.................................................

7lflflfl)fl,

I

2)27)))

)fl)flflflJflflj,

I)lI;)t7f7rfe,.

ll)I7fl));)))fl)1111

7,7277).

2lI))))))))))j,,

l)')!l))l)))))),

Zl)2777flfl777.

2272777..

'Ffrf.,l

II))III)), 11)1)211)112)21)1)51)1)1

2227)

77'7)) 1)111111)1111)271111121

''22:1'.SIl77(f.,-,

ff771) IIl)lI))IIlI III 1)) 222))

lIIllll)i)iij,,,,,,j,,,

l))))));))

II)))

111)2)2)1)1)

7'1175

llIl)flI,7, 111177777)

I II))J)))j),p) I) 1I)1)))ll)li,

II

II III) I) I))

II Ill II

consuming this type of housing

faced by an individual

with wage rate of

$7,000 employed in the CBD.

The figure was plotted

by applying equation

20, using the three travel

matrices, Firn, T,22, and T,,2

(130 x 330), and the

vector of parking costs C3 (1

x 330) aggregated from the

1 967 Pittsburgh

survey.

If households possessed

perfect information, the

optimal residential

location for this type of housing

for the individual

represented in Figure 2

and its effective price

to him would be the actual

minimum of the

cumulative price distribution,

$122 on the diagram.

Because housing market

information is costly and because

the indi-

vidual estimates of

total housing costs

are subject to measurement error,

the empirical analysis

does not rely

upon the single minimum total price

as

an estimate of the effective housing

price facing an individual. Instead the

average total price of the lowest

five percent of the stock of each housing

type is used to estimate

the effective price minimum. Figure

2 illustrates

this computation

and shows an estimated minimum

price of $128.

In addition

to these price estimates,

a variable measuring the total

number of units of each

housing type available in the metropolitan

area is

$

a

FIGURE 2

Ordered Distribution of Total Cost of Consuming New

Tø

Bedroom Common-Wall Units Facing a Household

in the CBD With an Annual Income of $7,000

P,ykm

250

225

200

175

*

plik

125

100-

0

0

10

20

30

40

50

60

70

80

Per cent of the housing Stock

included. This additional

measure is used to proxy for the information

available to consumers about the location

and prices of alternative housing

types.

The Complete Model and

Some Additional Hypotheses

As stated and developed

in previous sections, the model

to be estimated in

this section

is the multinornial logistic.

For each cross-classification of

income and family size, the

logarithmic odds of the choice between any

two types of residential housing

is a linear function of the attributes of each

housing type (in this

case proxies for residential density, interior size,

quality, and availdbility

in the metropolitan area and the eftective price Ot

each housing type

(which may

vary for particular households). From

equation 15, the specific

model is:

I

Housing Demand in the Short Run

89

log (pr/p,) = b1 (CW1

- CW3) + b2 (APT1 - APT) + b3 (BR

- BR)

+ b.1(ACF

GEJ) ± b5 (P

- P) -f b (ST1 -

i)

where

CW is a dummy variable with

a value of I

if j

is a common-wall unit

APT1 is a dummy variable with

a value of

I

if

i

is an apartment unit

BR1

is the number of bedrooms in

type I

AGEI is a dummy variable with

a value of 1

if I was built before

1930

P

is the effective monthly cost of

consuming housing type i

and

ST,

is the number of units of housing of

type i

in the sample

The parameters of equation 21

are estimated separately for each

of 30

combinations of income and family size. Equation

21, together with the

error term assumption in equation 9, define the likelihood

function (L)

whose logarithm is:

log L = -

jD1r log{

(CWkT - CW1r)

r=1 t=I

k=i

+ .

+ b6 (STkr

ST1r)jJ

where

R

is the sample size for each

stratification of income and family

size

and r

1, 2.....R is the index of

observations, and

Dir is a dummy variable with

a value of 1

if the rth household chooses

housing type I.

Maximum likelihood estimates of the

parameters of equation 22 are

obtained by an iterative

process.

If this model of housing choice is

appropriate, several hypotheses about the signs and

magnitudes of the

estimated parameters can be addressed.

First, from equation 11 the own-

price elasticity of choice

among housing types is

N1, = Pb5(1

- pi)

and the cross-price elasticity is

N. = Pb5p

To insure a negative own-price elasticity

and a positive cross-price elastic-

ity, the estimate of b, should be

negative for each stratification of income

and family size.

We should also

expect the parameter b4 to be negative since, ceteris

paribus, households prefer higher quality

dwelling units, that is, holding

structure type and size constant, housing

types indexed by quality form a

"commodity hierarchy." Similarly, holding

structure type and quality

e

90

John M. Quiley

constant, housing types indexed by size

form a "commodity hierarchy";

thus we expect the estimate of b

to he positive. The coefficient of the

housing stock term, b6, should be positive, since households can obtain

more information, at the same

search cost, for housing types in greater

supply.

Holding income constant, we should expect that larger families demand

larger units and more exterior space. Thus for larger families with the same

income we should expect that the estimate of b3 will be larger than for

small families. Similarly, the estimates for b, and b2 should be smaller in

magnitude (or more negative) for larger families than for smaller famjlips

Holding family size constant, we expect that higher incomes are as-

sociated with greater consumption of higher quality, larger units with more

exterior space. Thus for the same family size we expect that the estimate of

b3 will be larger for the higher income households than for lower income

households. Similarly, the estimates of b1, b2 and b4 should be more

negative for higher income households than for lower income households.

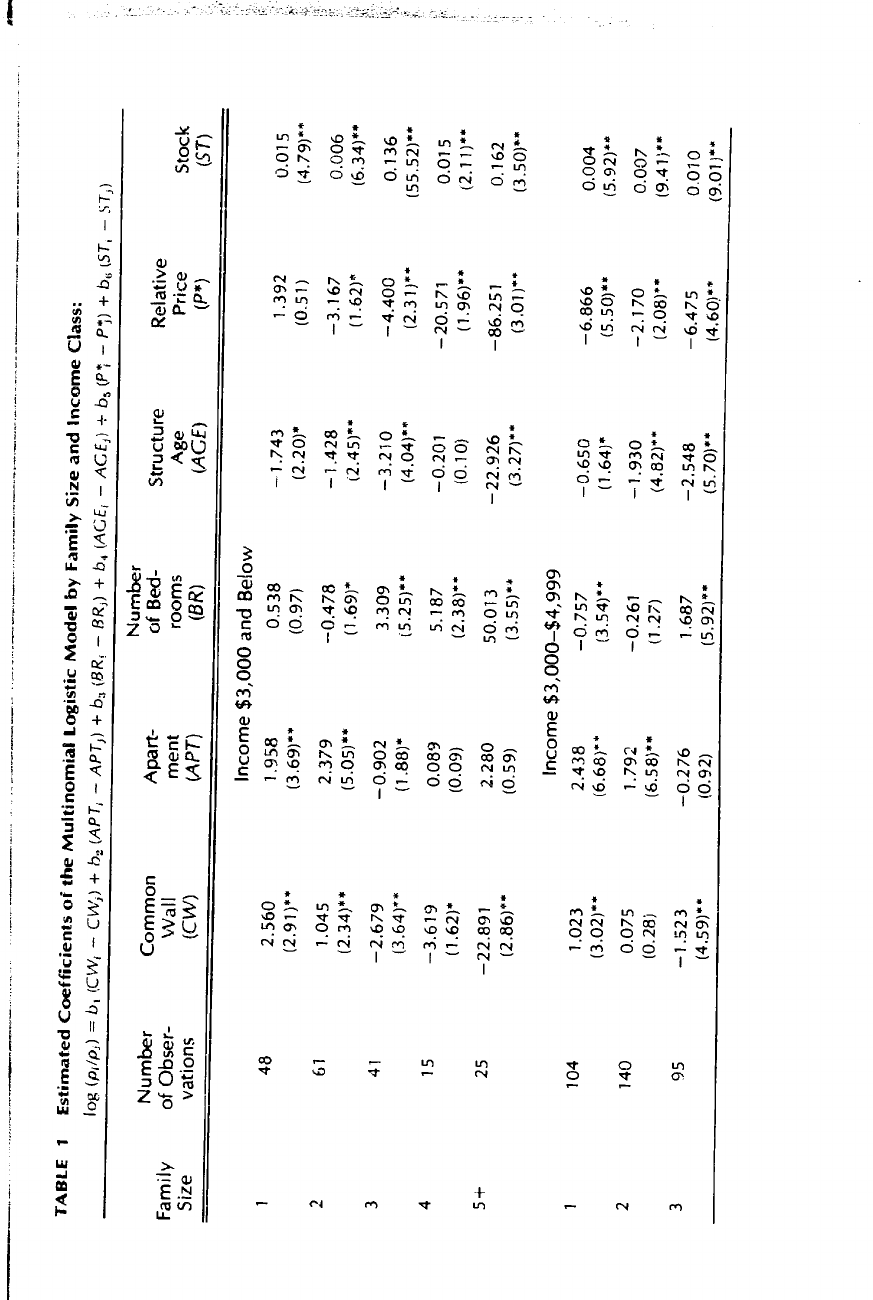

Table

presents the coefficients of the multinornial

logistic model,

1

estimated by the maximum likelihood method, for each of thirty combina-

tions of income and family size. The model is estimated separately for each

of five family sizes (corresponding to households of 1, 2, 3, 4, and 5

or

more members) for each of six income classes (corresponding to annual

incomes of less than $3,000$4,999, $5,000$6,999, $7,000$9,999,

$10,000$14,999, and $15,000 or more).

For each household in the sample, the total cost was calculated for each

of the 18 types of residential housing at each possible location by using

equation 20 and the mid-points of the income classes to derive hourly

wage estimate w;'5 the minimum total cost (P) including housing and

transport cost, was estimated for each housing type by calculating the

average price of the cheapest 5 percent of the stock for each household.

One type of residential housing was chosen as a numeraire; the prices

facing each household are relative to this numeraire.'6

For each of the 30 nonlinear regressions, the results reported in Table 1

were obtained by specifying a convergency criterion of .01. In most cases

five or six iterations were required. For each set of results the sample size is

noted and the asymptotic t ratios of the coefficients

appear in parentheses.

In 26 of the 30 equations the relative price coefficient has the antici-

pated sign; the estimated coefficient exceeds its standard

error

in 22

equations and it appears highly significant in 16 stratifications. The

ratios

of the relative price coefficients

are substantially lower for the two higher

income groups. For renter households earning between $10,000 and

$15,000 a year, three of the estimates

coefficients are significant at about

the .05 level and the other

two are insignificant. For renter households

earning more than $15,000 a year,

none of the price coefficients are

significant.

TABLE 1

Estimated Coefficients of the Multinomial

Logistic Model by Family Size and Income Class:

log (p,/p.) = b1 (CW1 - CVv) + h2 (APT1

- APT,) + b3 (BR - BR,) + b4 (ACE1 - ACE,) + b (P

- P) + b6 (STe - ST,)

Number

Number

Common

Apart-

of Bed-

Structure

Relative

Family

of Obser-

Wall

ment

rooms

Age

Price

Stock

Size

vations

(CW)

(APT)

(BR)

(ACE)

(P*)

(ST)

Income $3,000 and Below

48

2.560

1 .958

0.538

-1.743

1.392

0.0 15

(2.91)**

(3.69)**

(0.97) (2.20)*

(4,79)**

(0.51)

61

1 .045

2.379

-0.478

-1.428

-3.167

0.006

(2.34)**

(5.05)

(1 .69)*

(2.45)**

(1.62)

(6,34)**

3

41

-2.679

-0.902

3.309

-3.2 10

-4.400

0.136

(3.64)**

(1 .88)*

(5.25)**

(4.04)*

(2 .3 1) ** (55.52)**

4

15

-3.619

0.089

5.187

-0.201

-20.571

0.015

(1 .62)*

(0.09)

(2,38)**

(0.10)

(1.96)*

(2.1 1)**

5+

25

-22.89 1

2.280

50.0 13

-22.926

-86.251

0.162

(2.86)*

(0.59)

(3,55)**

(3 .2 7)**

(3,01)**

(3.50)*

Income $3,000-$4,999

1

1.023

104

2.438

-0.757

-0.650

-6.866

(3.02)**

(6.68)*

0.004

(3.54)

(1.64)

(5.50)**

(5.92)*

2

140

0.075

1.792

-0.261

-1.930

-2.170

0.007

(0.28)

(6.58)**

(1.27)

(4.82)

(2.08)**

(9.41)'

95

-1.523

-0.276

1,687

3

-2,548

-6.475

(459)*

0.010

(0.92)

(5.92)**

(5.70)**

(4.60)

(9.01)

0

'-fl. Saa*a

TABLE 1

(continued)

Number

Number

Common

Apart-

of Bed-

Structure

Relative

Family

of Obser-

Wall

ment

rooms

Age

Price

Stock

Size

vations

(CW)

(APT)

(BR)

(AGE)

(P1)

(ST)

4

88

-1,054

-0,810

1.770

0.455

-6.364

0.006

(3.00)1*

(2.40)1*

(5.20)"

(1 .20)

(3.87)"

(593)**

5+

87

-1.278

-1.930

3.282

-0.247

-3.998

0.010

(3.72)"

(4.34)1*

(8.91)1*

(0.67)

(2.90)"

(9.15)"

Income $5,000-$6,999

1

91

0.150

2.564

-1.222

-3.049

-1.888

0,009

(0.31)

(5.50)1*

(3.21)"

(4.26)"

(1.20)

(654)1*

2

223

0.291

0.874

-0.223

-0.223

-2.906

0.003

(1.65)*

(4.29)1*

(5.1 3)1*

(1.25)

(3.98)"

(7.79)"

3

224

-1.500

-0.849

2.020

-2.383

-4.465

0.010

(7.06)"

(445)1

(10.92)1*

(9.03)1*

(5.87)"

(14.89)"

4

194

-2.693

-0.903

3.823

-2.738

-4.140

0.014

(10.1 2)"

(4.23)1*

(13 .54)1 *

(8.86)"

(4.91)"

(14.16)"

5+

223

-1.591

-2.0 13

3.170

-0.893

-6.116

0.008

(753)1*

(7.32)1*

(13.46)1*

(3,89)**

(6.61)"

(12.16)**

Income $7,000.-$9,999

79

0.664

1

1.561

-0.586

-3.179

-0.491

0.006

(1.55)

(3.73)

(2.39)

(6.11)"

(0.44)

(5,54)1

C,.

2

228

0.196

0.350

0.479

-1.881

-1.403

0.006

(0.87)

(1 .65)*

(339)**

(7.81 )

(2.26)"

(11.67)"

3

218

-1.242

-0.490

2.272

-2.955

-3.490

0.010

(543)**

(2.37)"

(11 .92)*

(10.95)**

(495)**

(14.24)"

4

166

-2.340

-0.616

4.193

-4.304

-3.565

0.015

(9.1 8)**

(1 .85)**

(11 .70)**

(354)**

(9.63)"

(12.50)"

5+

173

-2.096

-1.561

4.159

-0.750

-5.035

0.009

(8.46)**

(5,1 7)**

(1 2.12)**

(3.00)"

(4.90)**

(11.82)"

Income $1 0,000-s 14,999

24

-'1.267

-1.736

0.493

1

-4.651

1.105

0.020

(0.92)

(1.16)

(0.68)

(2.92)"

(0.22)

(3.44)"

2

153

-0.108

0.391

0.060

-1.503

-1.262

0.003

(0.40)

(1.51)

(0.44)

(6.46)"

(1 .83)*

(6.59)"

3

83

-0.640

-0.284

1.368

-1.051

-1.711

0.004

(1 99)*

(0.82)

(5.72)"

(3.25)"

(1 .81)

(5.52)"

4

56

-2.566

2.134

7.477

-6.366

-2.031

0.023

(4.63)"

(2.72)"

(6.89)"

(5.49)"

(1.10)

(6.94)"

5+

67

-2.511

-3.769

4.743

-2.674

-3.348

0.010

(5.78)"

(4.40)"

(7.39)"

(4,99)"

(1 .76)

(6.20)"

Income $15,000 and Above

17

-19.346

-10.694

1.256

-3.686

-3.321

0.040

(0.03)

(0.02)

(0.01)

(0.01)

(0.00)

(0.03)

TABLE 1

(concluded)

Number

Number

Common

Apart-

Family

of Obser-

of Bed-

Structure

Relative

Wall

ment

rooms

Age

Size

vations

(CW)

Price

Stock

(APT)

(BR)

(AGE)

(P*)

(ST)

2

50

-1.656

-0.230

1.926

-3.534

0.084

0.011

(2.31)**

(0.47)

(4.28)**

(5.48)"

(0.06)

(5,68)**

3

24

-3.605

1.531

3.466

-0.093

-1.572

(345)**

0.000

(1.15)

(4.21)"

(0.11)

(0.63)

(0.00)

4

14

-2.324

-1.390

3.347

-3.446

-2.458

0.012

(2.1 0)*t

(1.32)

(3.3Ø)*

(2.46)

(0.79)

(2.77)"

5+

10

-0.251

9.609

13 .027

-0.867

2.343

0.002

(0.13)

(0.09)

(0.12)

(0.50)

(0.21)

(0.31)

NOTE:

Asymptotic t ratios in parentheses.

"indcates coefficient different from

zero at .01

level,

indicates coefficient different from

zero at .05 level.

95

Housing Demand in the Short Run

The patterns of significance

suggest that the choices of

housing types for

the overwhelming proportion of rental

households (i.e. those

lower and

middle income rental households that,

for this sample,

comprise 85

percent of the rental market), are strongly

influenced by relative

prices. The

table also suggests a clear pattern in the

magnitude of the relative

price

coefficients for families of different sizes.

Within each income

class, the

magnitude of the price coefficient

increases with family

size. larger

families with greater demands for

necessities are more

responsive to

relative prices in their choices

among housing types.

The estimated coefficient of the

structure age variable has the

anticipated

sign in 29 of the 30 equations and is

highly Significant

in 22 of the

stratifications. Again, the t ratios

suggest that renters in the highest

income

class are least Sensitive to structure

age, but there does not

seem to be a

strong pattern in the magnitudes of the

estimated coefficients

across

income classes and family sizes.

The coefficients of the number of

bedrooffis indicate

a systematic pattern

across income classes and family sizes. The

coefficients are statistically

significant with the correct sign in 1 9 of

the stratifications. For

each of the

six income classes, the magnitude of

the coefficient

on the bedroom

variable increases with family size.

There is also a tendency

for the

coefficient to increase with income level

for a given family size.

The coefficient of the variable for

commonwall units is statistically

significant

in 20 of the 30 equations; the coefficient

of the variable

representing apartment units is significant in 15

stratifications. The pattern

of coefficients suggests, ceteris paribus, that

single detached units are

preferred to either of these types of families

with three or more members.

Holding family size constant, the coefficients

also indicate that single

detached rental units

are preferred by those of higher incomes.

In general, the model performs less well for

renters of the highest income

class, those earning

more than $15,000 a year. In part, this may be a

reflection of the smaller sample sizes for

households in this category.

However, the results may also

suggest that the definitions of the housing

types are inadequate to model the behavior

of the highest income group;

the aspects of housing which

motivate the residential location and housing

choices of the highest income households

are not well represented by only

18 types of residential housing.

Tables 2 and 3 illustrate the differences

in housing consumption attribut-

able, ceteris paribus,

to variations in the socioeconomic characteristics of

households. The tables indicate the predicted

probabilities of consuming

several housing characteristics

using the coefficients of Table 1 and assum-

ing each household

in the metropolitan area faced the same effective

housing prices (P). These

probability estimates may be interpreted as

those observed under

the monocentric or equilibrium assumptions of the

Predicted Probabilities of Housing Type Choice, p,1,,

TAULE 2

for Selected Incomes Across Family Sizes:

=

where

I'J =

h,,

!i

,

Family Size

1

Type of Dwelling

2

4

Income $3000 -$4,999

Common-'alI units

.11 .11

.39

.69

Apartments

.84 .82

.38

.27

.06

Single detached

.04 .07

.25

.34

.25

One bedroom

.78 .79

.35

.12

.o

Two bedrooms .20 .20

.53

.42

.48

Three bedrooms .02 .01

.12

.46

.49

Income $5,000-$6,999

Common-wall units

.03 .22

.54

.52

.52

Apartments

.94

.60

.23

.11

.oa

Single detached

.02

.17

.24

.37

.40

One bedroom

.95

.66

.23

.10

.03

Two bedrooms

.05

.28

.33

.61

.61

Three bedrooms

.00

.06

.16

.29

.64

classical theory. If all households were employed at

a single work site they

would, of course, face identical effective prices for the

same type of

residentia! housing.17 The probability estimates

were obtained by substitu-

tion into equations 11 and 14 and by then forming the marginal totals.

Table 2 illustrates the probabilities for two income classes

over the five

family size categories. The table indicates that,

as family size increases,

households are less likely to choose multifamily

units and are more likely

to choose common-wall units and single detached

units, For income levels

of $3,000 to $5,000, the probability

of choosing apartment dwellings

declines from .84 for

one-person households to .06 for five-person house-

holds; the probability of choosing

common-wall units increases from .1 Ito

.69. Similarly the probability of choosing

single detached units increases

from .04 to .25

as family size increases from one to five members.

For a higher level of income, the

table indicates (hat larger family sizes

also systematically choose less

dense housing configurations. In contrast to

the lower income

group, households earning between $5,000 to $7,000

have higher probabilities

of consuming larger effective lot sizes at each

TABLE 3

Predicted Probabilities

of Housing

Type Choice,

p,

for Selected Family

Sizes Across

Income Classes.

where

W11,(X1, P) =

b,,1

+

I

Less than $3,000-

$5,000-

7 flflfl-

TypeolDwelling

$3,000

$4999

$6,g9

$9,999

$14,999 $15,000+

Three-person Families

Common-wall units

.54

37

54

.36

Apartments .01

.24

.38

.23

.23

.32

Singledetached

.21

.82

.25

.24

.18

.32

One bedroom

.18

.18

.35

.23

.18

iwo bedrooms

.00

.64

.53

.61

.62

.39

Threebedrooms

.18

.03

.12

.16

.20

.47

Five-or-more-person Families

Common-wall units

1.00

.69

.52

.46

.49

Apartments

.37

.00

.06

.08

.13

Singledetachd

.00

.25

.02

.13

.40

.41

.49

.50

Onebedroom

1.00

.03

.03

.01

.00

.00

Two bedrooms

.00

.48

.33

.24

.19

Three bedrooms

.00

.49

.64

.03

.75

.80

.97

family size. Holding

family size constant,

higher income households

systematically choose less dense

types of residential housing.

Within each income

class, Table 2 indicates that

increased family size is

associated with the choice of

housing types with larger

interior sizes (as

measured by numbers of bedrooms).

However, the comparison for the

two

income classes reveals that

at the same family size, higher

income house-

holds are generally

more likely to choose two and three bedroom

units

than lower income

households.

Table 3 illustrates the

differences in housing consumption

across the six

income classes for

two stratifications of family size. The

table indicates that

for three-person

families, the probabilities of

consuming units with larger

interiors are very similar

for households earning less than

$7,000 a year.

(The predicted

average numbers of bedrooms

are 2.0, 1.8, 1.9 and 2.0,

respectively for the lowest four

income classes.) Only for the two highest

income classes, where

the predicted average number of bedrooms

in-

creases to 2.3 and 3.0

respectively, does higher income increase the

likelihood of choosing

housing types with larger interior sizes.

rev

mc

cho

cbs

with

sjn1i

unit

there

fli

98

JohnM. Quigley

In contrast, for larger families the probability of choosing larger

Units

increases systematicafly with income level. As income rises from

$3,000 to

$15,000 a year the probability of choosing a three bedroom unit

increases

from .00 to .97. The predicted average number of bedrooms

for the sir

income classes are 1.0, 2.5, 2.6, 2.7, 2.8, and 3.0

respectively.

For smaller families, the differences in the predicted

Probability of

choosing different structure types do not vary systematically

with income.

For larger families, however, the estimates in Table 3

suggest that increases

in income are associated with higher probabilities of

choosing single

detached units. The predicted probability of choosing

single detached

units

increases from .00 to .50 as family income rises from $3,000

to $15,000

a

year.

As has been emphasized throughout this discussion, the

variation in the

effective prices (Pt) facing different households

arises from the interaction

of contract housing prices and the accessibility

costs to the specific work

sites of different households. Within the sample,

substantial variation

exists

in the effective prices facing otherwise identical

households. By way of

illustration, Figure 3 presents the frequency

distribution of the effective

prices (P*) facing households of

a single income class for two housing

types. The figure indicates the effective prices

relative to the

numeraire

used in the empirical analysis. The

variation

in the prices faced by

individual households arises because

the spatial location of the

minimum

price and its magnitude varies with work

site, the transport network,

and

the surface of contract prices.

To indicate the importance of these

price differences in affecting

the

choice of housing types,

we have used the equations estimated

in Table 1

to calculate the predicted probabilities

of choice among the housing

types

for otherwise identical

households which are employed

at four specific

work places iii the

metropolitan area. One of these work

sites is located in

the heart of the Pittsburgh

CBD; a second is located iii

the inner city, east

of the CBD; a third is

located on the outskirts

of the central city, and

a

fourth is located in the

suburbs east of Pittsburgh.

Table 4 presents the

predicted probabilities of choice

for households of the

same income and

family size who face

the effective prices

calculated for these four work

sites. The predicted

probabilities of choice for

four-person households

earning between $5,000

to $7,000 a year and employed

at the four work

sites are presented

in the first section of

Table 4. The predicted prob-

abilities for a five-person

household earning income

in the same range and

employed at the

same locations are presented

in the second section. In the

third section of the

table the probabilities

predicted for a five-person

household of a lower

income class

are indicated.

The table clearly

shows the differences

in the consumption of housing

attributes which arise from

the variations in

relative prices. For households

FIGURE 3

Frequency Distribution of

Relative Prices for

Two lypes

of Housing Facing

Households Earning

Less Than $3,000

a Year

25

Effective price of old,

I bedroom common

wall units

20

Effective price of old,

r---i3 bedroom common wall units

-

II

I

r_-h

I_______

o

L___

0.6 07

.8

0.9

1.0

I

U

1.2

1.3

1.4

1.5

Relative price, P

NOTE:

Both prices are relative to the effective price of

new one bedroom, common-

wall units.

earning between $5,000 to $7,000

a year, the probability of choosing

apartments declines systematically for four-person households

whose work

place is more distant from the Central Business

District. Similarly, the

probability of choosing single detached housing

types increases systemati-

cally for tour-person households with less central

work places. For five-

person households. The same regular pattern of structure-type choices

is

revealed for the four work places. For larger

households at the same

income, however, those employed

at noncentral places are more likely to

choose larger effective lot sizes than

smaller households.

For five-person households of

a lower income class, the probability of

choosing single detached housing increases with less

central employment

locations, but the probabilities

are substantially lower than for households

with larger incomes. The probability of choosing

common-wall units

similarly declines at noncentral employment

sites, hut the probabilities are

uniformly higher than for households with larger incomes.

Even at the same family size, variations in the effective prices affect

households' choices of the interior size of units. For four-person families,

there is a small but

systematic increase in the probability of choosing

housing types with

more bedrooms at less central work sites. For five-

person households of both income classes this tendency is more pro-

nounced.

TABLE 4

Predicted Probabilities of Housing Type Choice,

for Otherwise Identical Households at Four Work Sites

Work Places

Inner

Central

Type of Dwelling

CBD

City

City

Suburbs

Four-person Families--Income $5000-$6

999

Common-wall units

.51

.54

.50

.42

Apartments

.40

.29

.19

.11

Single detached

.09

.17

.30

47

Onebedroom

.16

.13

.13

.14

Two bedrooms

.63

.63

.61

Three bedrooms

.21

.23

.26

.28

Five-person Families-Income

$5,000-$6 999

Common-wall units

.58

.51

.36

.19

Apartments

.28

.15

.07

.02

Single detached

.15

.33

.53

78

One bedroom

.05

.05

.06

.07

Two l)edrooms

.46

.43

.37

.33

Three bedrooms

.49

.53

.57

.60

Five-person Families-Income

$3,000-$4,999

Common-wall units

.74

.69

.60

Apartments

.14

.10

.06

.48

.04

Single detached

.i 2

.21

.33

.48

One bedroom

.57

.04

.05

.06

Two bedrooms

.39

.55

.52

.47

Three bedrooms

.09

.41

.43

.47

Table 4 clearly shows how

variations in the intrametropolitan

costs of

configurations of residential housing

affect households' choices

of consum-

ing several attributes of

the residential housing

"bundle".

The theory of the housing

market and the

computation of the effective

prices of housing units used

in the empirical analysis

suggest that these

price variations arise because:

existing housing units

are costly to transform

and the spatial distribution

of housing types changes

slowly in response to

market forces; households

employed at different sites face

different acces-

sibility costs to the

available supplies of durable

housing units. By neglect-

ing these considerations

many analyses of household location

and de-

mand for "housing" have

overlooked a crucial link

in understanding why

households choose

particular spatial locations

and why households choose

components of the bund!e of housing

services.

101

Housing Demand in the Short Run

NOTES

Aggregate studies whi&h neglect housing prices

in focusing

on uic.ome expenditures

include: Margaret Reid, Housing and Income

(Chicago: Universits

of Chicago Press

1962); Alan R. \'\'inger, 'Housing and Income,"

pp. 226-232. Muth's study includes an index of

Western Economic

Journal June 1968,

construction costs (tli

across cities, and de Leeuw's intercity analysis

Boeckh index)

uses the Bureau of Labor

Stjjk-5

city-worker budget to provide an

average price for a

'standard" bundle of housing

services. See Richard F. Moth, "The Demand for

Non-farm Housing," in

The Demand

for Durable Goods, Arnold C. Harberger,

ed. (Chicago: University

of Chicago Press,

1962); Frank do Leeuw and Nkanta F. Ekanern,

"The Demand for

Housing: A Reviexx' of

the Cross-Section Evidence," Review of

Economics and Statistics,

February 1971,

pp.

1-10.

See Mah!on R. Siraszheim, "Estimation of the

Demand for Urban Housing

Services from

Household Interview Dat,i," Revieis of

Economics and Statistics

February i

pp.

1-8; Mahlon R. Straszheim, An Econometric

Analysis of the Urban Housing

Market

(New York: National Bureau of Economic

Research, 1975); John F,

Kain and John M.

Quiglev, Housing Markets ann Racial

Discrimination: A MicIOcConornic

Analysis (New

York: National Bureau of Economic Research,

1975); John M. Quigey,

"Racial Dis-

crinhination and the Housing Consumption

of Black Households," in

Patterns of Racial

Ljiscrirriin,stion

Vol.

1: Housing, George M. Von

Furstenberg ed. (Lexington,

Mass.:

D.C. Heath, 1974); A. Thomas King,

"Households in Housing Markets' The

Demand for

Housing Components" (College Park, Md.:

Bureau of Business and

Economic Research,

University of Maryland, 1973).

The classic references include: Richard F.

Muth, Cities and Horning (Chicago:

Univer-

sity

of Chicago

Press,

1969); Lowdon Wingo,

Transportation and Urban Land

(Washington, DC,: Resources for the Future,

1961); William Alonso, Location and

Land

Use (Cambridge: Harvard University Press,

1964).

James L. Ssveeney, "Quality, Commodity,

Hierarchies, and Housing Markets," Stanford

University, Department of Engineering.Economic

Systems, mimeographed, October

1972.

These estimates of the implicit prices of housing

attributes are derived from Lancaster's

analysis of hedonic goods. See Kelvin

J.

Lancaster, "A New Approach to Consumer

Theory," Journal of Political Economy,

April 1966, PP

132-156; Sherwin Rosen,

"Hedonic Prices and Implicit Markets: Product

Differentiation in Pure Competition,"

Journal of Political Economy, January/February

1974, pp. 34-55. For a recent survey of

this literatwe as related to housing markets

see Michael J. Ball, "Recent Empirical Work

on the Determinants of Relative House Prices," Urban

Studies, June 1973, PF) 213-233.

John F. Kain, "The Journey

to Woik as a Determinant of Residential Location," Papers

and Proceedings of the Regional Science

Association

1962, pp. 137-161.

7.

It may he that the! types of residential

housing form a "hierarchy" in the sense defined

by Sweeney, i.e. that

(NI)

UX11, z0) > U(X, z0)

tor all coilsurners. More generally,

since x is multidimensional, it is likely that only some

housing types are strictly hierarchical.

For example, it the components of x include

"housing quality" and "size," it

may be true that all consumers prefer higher quality to

lower quality units and larger dwelling

units to smaller units; consumers may have

mixed preferences, however, regarding the

tradeoff between larger, lower quality units

and smaller, higher quality

units.

a

I

'5

.5'

102

Iohn M. Quiglc'y

ft

H. Bluch arid 1. Marschak, ''Randwii Ordeiines and Stodistiu 11

Rvsponc"

(ontribut,n

to Probabtht', and Stati.stiis,

I. 01km. ed. (St,inlnrd: Stanford

University

Press, 1960).

Daniel McFadden. 'The Revealed Preferences of

,i Government Bureaucracy" 1'echq.

cal Report W. 17, Institute of International Studies, University of

California_Berkrlt.s

November 1968; Charles River Associates, "A Disaggregated

Behavioral Model of

Urban Travel Demand," Report CRA-156-2, March 1972; Daniel

McFadden "Conch.

tional LogO Analysis of Qualitative Choice Behavior,'' in Frontiers

in F(oflorne(rjCs

Zaremka, ed. (New York: Academic Press, 1974).

p.

Although this assumption (as well as (he assumed

error term distribution in equation 9)

is made solely in the interest of tractability, it is not quite

as restrictive as it may appear,

since a wide variety of functional forms may, in principle, be

accommodated by dummy

variabies ad piecewise linear approximations.

11

McFadden, 1968 (sec note 9).

Details concerning the survey instruments and the underlying

data may be found in John

M. Quigley, "Residential Location with Multiple Workplaces

and a IIeterugenc'ous

Housing Stock," Discussion Paper Numbe, 80, Program

on Regirniat ,mrt Urban

Economics, Harvard U niversity, September 1972.

For evidence on the relationship between housing

age and "objective nhc'asur'

of

housing quality," see John F. lOin and John M.

Quigley, "Evaluating the Quality of the

Residential Environment" Lnvironrrrent and P!annin,

Vol. 2, 1970,

p. 21-32

Cost estimates were obtained from John B.

Lansing aiid G. Hendricks, "How

People

Perceive the Cost of the Journey to Work," No.

197, Highway Research Board, 1967,

Pp. 44-55.

For the six income classes the (assumed) midpoints

and the associated hourly

wages

(based upon a 40 hour week for 50 weeks

per year) are:

income class

)

income mid-point

hourly wagss (Wy)

$

0-2,999

$ 2,500

$1.25

3,000-4,999

4,000

2.00

5,000-6999

6,000

3.00

7,000-9,999

4.24

10,000-14,999

t2,500

6.25

15,000-

17,500

8.75

Although the methodology

can be briefly stated, the calculation of the

effective prices

involved estimating the entire surface

of total housing costs lacing each

household for

each type of housing and

"scanning" each surface to find the

average price of the

cheapest fise percent of the stock of

each type. For each household,

its work place and

income class thence

an estimate of its wage rate)

are sufficient to calculate the

accessibility cost of each residential

location. Knowledge of this

cost plus the estimate of

contract prices at each residential location

for each housing type allowed

a surface of

total housing Costs to be defined

for each type of housing. For

each type of housing, the

prices and the number of

units at each residential location

were scanned to estimate the

average total cost of the cheapest five

percent of the stock when viewed from the work

place of each household

at its wage rate. The price of

one bedroom common.wall units

built after 1930

was used as the numerajre

Alternatively, if several work

places existed and the markets

for each type of residential

housing were in equilibrium,

differences in the effective prices

facing similar households

could arise only if

wages for identical labor inputs

varied by ss'ork place.