Direct

Workshop Training Guide

Morningstar Direct

Morningstar Direct December 2017

© 2017 Morningstar. All Rights Reserved.

Copyright © 2017 Morningstar, Inc. All rights reserved.

Microsoft and Excel are either registered trademarks or trademarks of Microsoft Corporation in the United States

and/or other countries

The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied

or distributed; (3) is not warranted to be accurate, complete or timely; and (4) does not constitute advice of any kind.

Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this

information. Any statements that are nonfactual in nature constitute opinions only, are subject to change without

notice, and may not be consistent across Morningstar. Past performance is no guarantee of future results

Contents

Morningstar Direct December 2017 3

© 2017 Morningstar. All Rights Reserved.

Contents

Class Overview . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

Reviewing Stock Sector Performance . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

Overview . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

Scenario. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

Solution . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

Exercise 1: Creating a workbook template in Presentation Studio . . . . . . . . . . . . . . . . . . 7

Exercise 2: Adding the Markets Periodic Chart to the template . . . . . . . . . . . . . . . . . . . . 9

Exercise 3: Modifying the Markets Periodic Chart . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

Exercise 4: Adding a header to the report . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

Exercise 5: Adding a name to the header. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14

Exercise 6: Adding a dynamic date to the header . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15

Exercise 7: Generating and saving the report template. . . . . . . . . . . . . . . . . . . . . . . . . . 17

Exercise 8: Saving the stock sector indexes to a list . . . . . . . . . . . . . . . . . . . . . . . . . . . . 19

Evaluating Asset Flow Data in Morningstar Direct. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 23

Overview . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 23

Scenario. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 23

Solution . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 23

Exercise 9: Search for funds with high exposure to the Energy sector . . . . . . . . . . . . . . 24

Exercise 10: Saving funds to a list . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 27

Exercise 11: Examining the asset flows for under-performing funds . . . . . . . . . . . . . . . . 28

Exercise 12: Adding context to the fund flow data . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 30

Identifying Funds with Consistent Top Performance . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 34

Overview . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 34

What is involved in creating a performance report? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 35

Scenario. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 36

Solution . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 36

Exercise 13: Searching for the cheapest share class of a fund . . . . . . . . . . . . . . . . . . . . . 37

Exercise 14: Create a search by criteria in Performance Reporting. . . . . . . . . . . . . . . . . . 39

Exercise 15: Change the settings for the group . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 41

Exercise 16: Set the values for the Time Periods tab . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 45

Exercise 17: Set the values for Data Points and Ranks . . . . . . . . . . . . . . . . . . . . . . . . . . . 46

Exercise 18: Select options from the Supplementary Columns window . . . . . . . . . . . . . . 49

Exercise 19: Rename a data column. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 51

Exercise 20: Save the performance report . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 52

Exercise 21: Calculate the performance report . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 53

Exercise 22: Apply conditional formatting to a performance report . . . . . . . . . . . . . . . . . 54

Exercise 23: Apply conditional formatting to the Morningstar Analyst Rating. . . . . . . . . 55

Exercise 24: Generate a Scorecard for a set of investments . . . . . . . . . . . . . . . . . . . . . . . 59

Exercise 25: Add a summary column for various scores . . . . . . . . . . . . . . . . . . . . . . . . . . 62

Exercise 26: Save investments to a list. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 64

Using Portfolio Attribution to Understand Performance. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 65

Overview . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 65

Scenario. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 65

Solution . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 65

Exercise 27: Opening a list in Portfolio Analysis. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 66

Exercise 28: Viewing attribution data in Portfolio Analysis . . . . . . . . . . . . . . . . . . . . . . . . 67

Exercise 29: Adjusting the benchmark for attribution analysis . . . . . . . . . . . . . . . . . . . . . 68

Contents

4 Morningstar Direct December 2017

© 2017 Morningstar. All Rights Reserved.

Exercise 30: Adjusting the time period reflected in a workspace . . . . . . . . . . . . . . . . . . . 69

Exercise 31: Moving to Analysis mode . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 71

Exercise 32: Displaying the Attribution workspace template . . . . . . . . . . . . . . . . . . . . . . 72

Exercise 33: Changing the time period for a template. . . . . . . . . . . . . . . . . . . . . . . . . . . . 73

Exercise 34: Displaying the Attribution Detail table. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 74

Exercise 35: Changing the time period for the Attribution Detail table . . . . . . . . . . . . . . 75

Exercise 36: Exploring the worst stock selection for the fund . . . . . . . . . . . . . . . . . . . . . . 76

Finding Sustainable Investments in Morningstar Direct Cloud . . . . . . . . . . . . . . . . . . . . . . . . 78

Overview . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 78

Scenario. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 78

Solution . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 78

Exercise 37: Accessing Morningstar research on sustainability . . . . . . . . . . . . . . . . . . . . 78

Exercise 38: Create a screen for sustainable investments. . . . . . . . . . . . . . . . . . . . . . . . . 80

Exercise 39: Save the screen and its investments to a list. . . . . . . . . . . . . . . . . . . . . . . . . 88

Managing a Portfolio in Morningstar Direct . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 91

Overview . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 91

Scenario. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 91

Solution . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 91

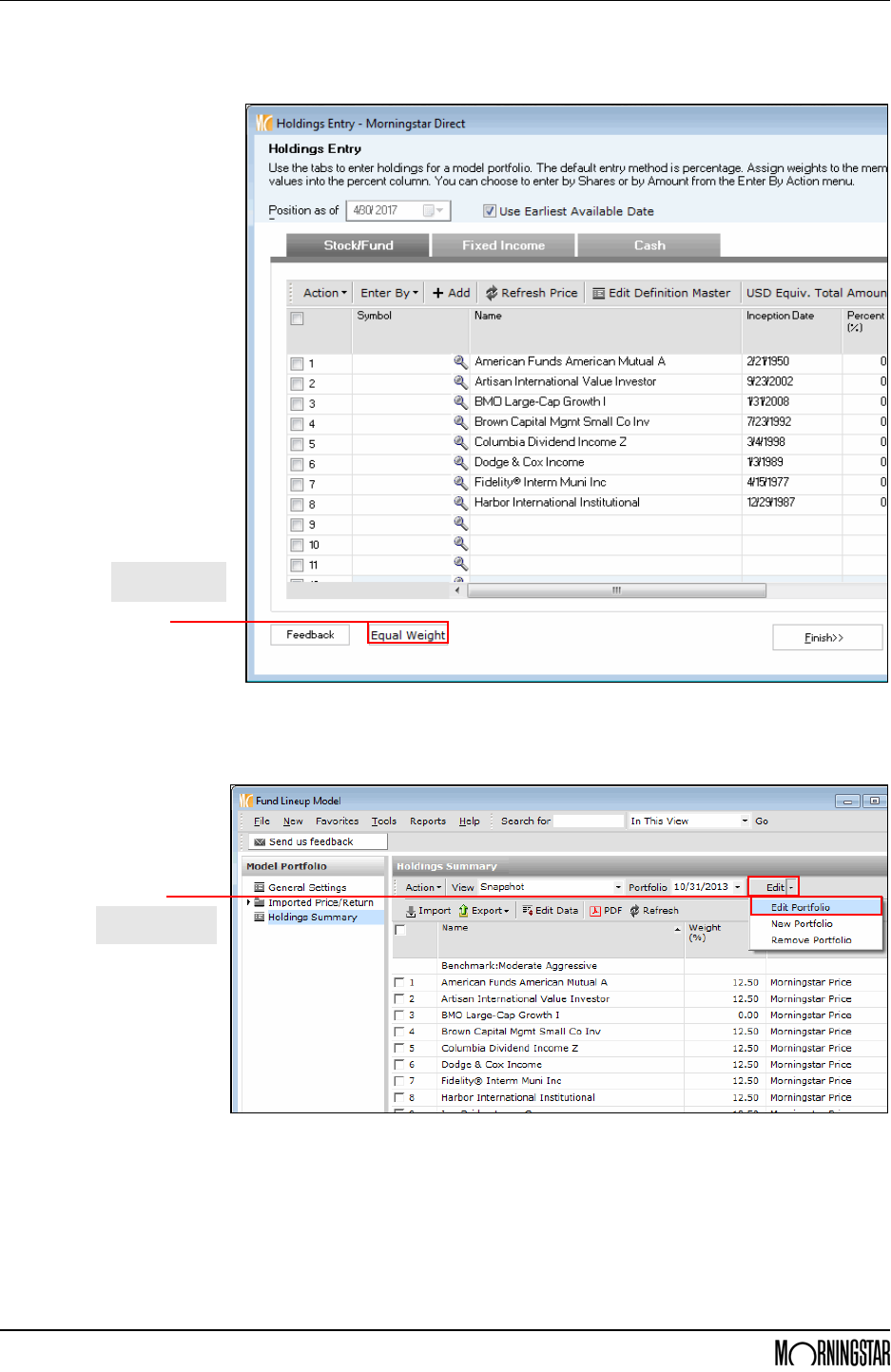

Exercise 40: Importing a model portfolio from Microsoft Excel . . . . . . . . . . . . . . . . . . . . . 91

Exercise 41: Adjusting a portfolio’s settings for Performance Reporting . . . . . . . . . . . . . 94

Exercise 42: Creating a custom benchmark . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 95

Exercise 43: Selecting and allocating the weightings for a custom benchmark. . . . . . . . 98

Exercise 44: Assigning a custom benchmark to a model portfolio . . . . . . . . . . . . . . . . . 100

Exercise 45: Adding a holding to a portfolio for comparison . . . . . . . . . . . . . . . . . . . . . . 102

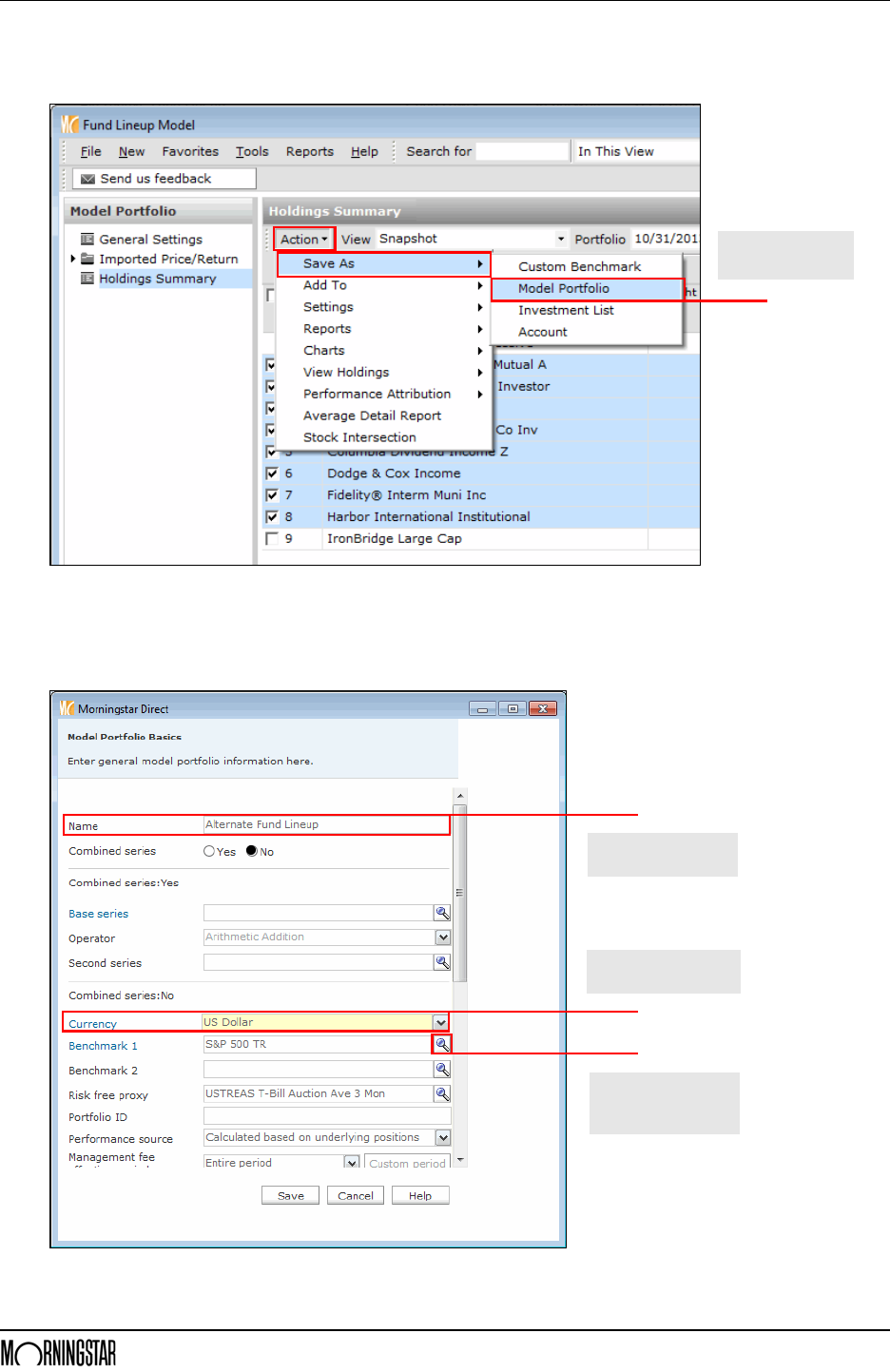

Exercise 46: Creating a new model portfolio from an existing model portfolio. . . . . . . . 104

Using Presentation Studio to Compare Model Portfolios . . . . . . . . . . . . . . . . . . . . . . . . . . . . 110

Overview . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 110

Scenario. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 110

Solution . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 110

Exercise 47: Create a template from scratch . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 111

Exercise 48: Add the pages for the report template. . . . . . . . . . . . . . . . . . . . . . . . . . . . . 114

Exercise 49: Save the Presentation Studio template and report . . . . . . . . . . . . . . . . . . . 114

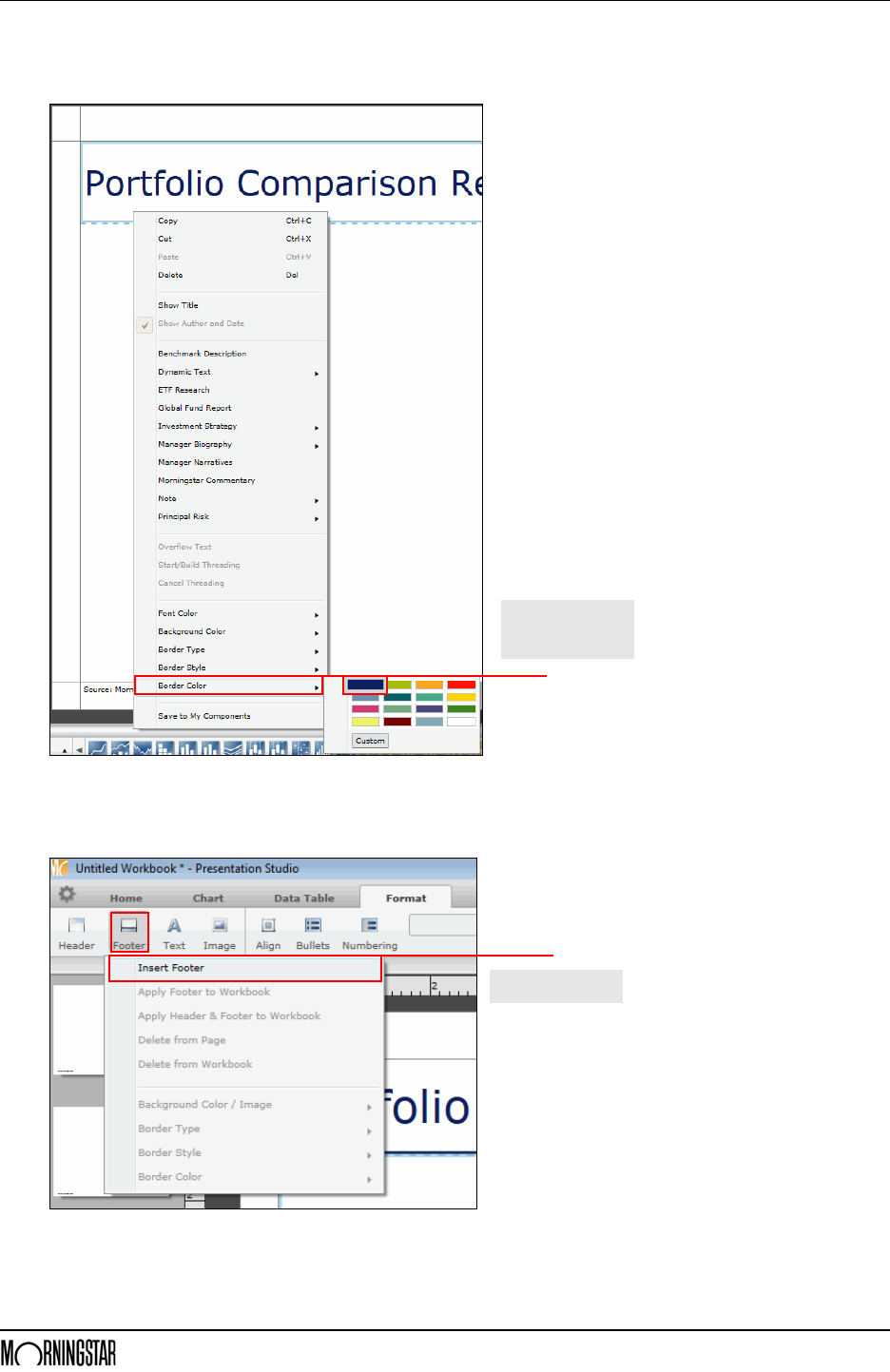

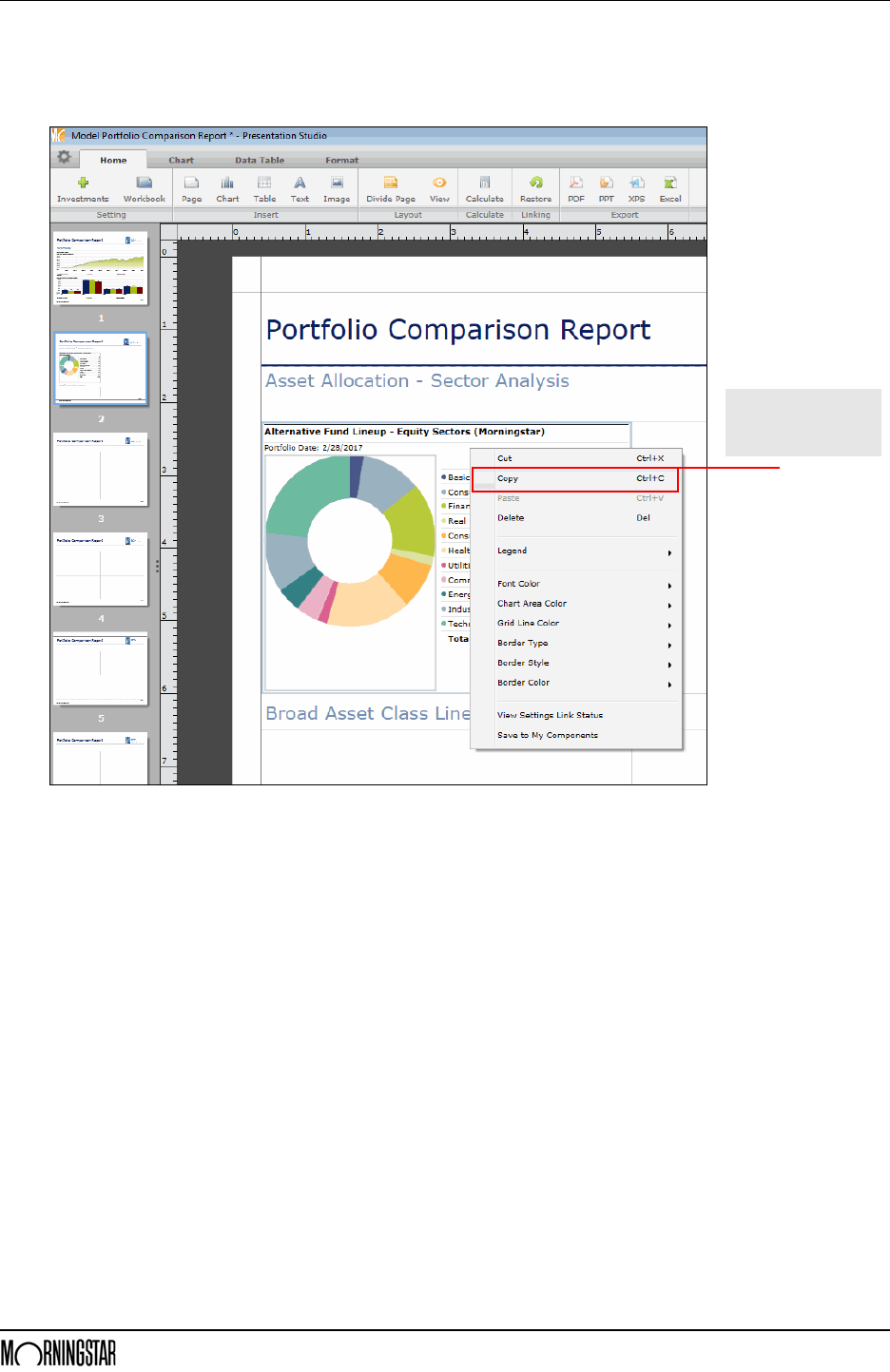

Exercise 50: Insert and design the report header and footer . . . . . . . . . . . . . . . . . . . . . 116

Exercise 51: Divide the first page to hold three components . . . . . . . . . . . . . . . . . . . . . 124

Exercise 52: Divide the second page to hold six components . . . . . . . . . . . . . . . . . . . . . 126

Exercise 53: Divide the third page to hold five components . . . . . . . . . . . . . . . . . . . . . . 128

Exercise 54: Duplicate the layout of the third page for the fourth page . . . . . . . . . . . . . 129

Exercise 55: Divide the fifth page to hold four components . . . . . . . . . . . . . . . . . . . . . . 130

Exercise 56: Divide the sixth page to hold three components. . . . . . . . . . . . . . . . . . . . . 131

Exercise 57: Add the label to the first page . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 132

Exercise 58: Add the components to the first page . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 134

Exercise 59: Add the labels to the second page. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 138

Exercise 60: Add the components to the second page . . . . . . . . . . . . . . . . . . . . . . . . . . 142

Exercise 61: Add the label to the third page . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 149

Exercise 62: Add the components to the third page . . . . . . . . . . . . . . . . . . . . . . . . . . . . 151

Exercise 63: Add the label to the fourth page . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 158

Exercise 64: Add the components to the fourth page . . . . . . . . . . . . . . . . . . . . . . . . . . . 159

Exercise 65: Add the label to the fifth page . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 163

Exercise 66: Add the components to the fifth page. . . . . . . . . . . . . . . . . . . . . . . . . . . . . 164

Exercise 67: Add the label to the last page . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 166

Exercise 68: Add the components to the last page . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 167

Morningstar Direct December 2017 5

© 2017 Morningstar. All Rights Reserved.

Viewing the Market through

the Lens of Morningstar Direct

SM

Class OverviewIn this workshop, you will learn how to leverage some of the key features in

Morningstar Direct

SM

in the following lessons:

g Reviewing stock sector performance

g Evaluating asset flow data in Morningstar Direct

g Identifying funds with consistent top performance

g Using portfolio attribution to understand performance

g Managing a portfolio in Morningstar Direct

g Using Presentation Studio to compare model portfolios

In this workshop, you will

work in several Morningstar

Direct modules

Overview Reviewing Stock Sector Performance

6 Morningstar Direct December 2017

© 2017 Morningstar. All Rights Reserved.

Reviewing Stock Sector Performance

Overview You can sometimes find and present the same information in Morningstar Direct in

more than one way. How you deliver the information is both a matter of choice, and the

skills you have with the software. This scenario allows you to find the same set of data

multiple ways, as well as present it in more than one fashion.

Scenario As part of a review of fund flow data, your manager has asked you to identify how the

various Morningstar stock sectors have performed during the trailing one-year period.

Your manager, however, did not specify whether this information should be presented

graphically, or as a set of data.

Solution In Presentation Studio, you will illustrate stock sector performance by creating a

workbook template and including the Markets Periodic Table. You will need to

customize it to show the Morningstar Stock Sectors and only the trailing one-year

time

period.

In the event your manager prefers to see this information as a data set, you will also

use the Workspace module to create a list of indexes tied to the stock sectors, and save

the list in a view showing returns data.

Data presented via

a report may be

more easily

understood than

seeing it in a grid view

Reviewing Stock Sector Performance Exercise 1: Creating a workbook template in Presentation Studio

Morningstar Direct December 2017 7

© 2017 Morningstar. All Rights Reserved.

E x e r c i s e 1 : C r e a t i n g

a workbook template

in Presentation Studio

You need to know how the various Morningstar stock sectors have performed over the

past year,

and show this as a ranking. First, you must decide what will represent the

stock sectors. In Morningstar Direct, no such item as “Stock Sector

returns” exists

natively. Instead, you need find a set of indexes that tracks these

sectors.

The Presentation Studio module has a component that allows you to display sector

index data. You could create either a Workbook or Factsheet template to display this

report; you will have to decide which version of the report you think looks better. The

following instructions guide you through the process of creating a workbook template

to show the trailing one-year performance for the Morningstar stock sectors.

To create a Presentation Studio workbook template, do the following:

1. If a Presentation Studio template is open, close it.

2. From the left navigation pane, select the Presentation Studio module.

3. Click the Workbook icon. The Create New Workbook dialog box opens.

4. The option for New Workbook should be selected. Click OK. The Investments: Settings

dialog box opens.

To click the Workbook

icon, you must first

select the Presentation

Studio module

This option should be

selected automatically

Exercise 1: Creating a workbook template in Presentation Studio Reviewing Stock Sector Performance

8 Morningstar Direct December 2017

© 2017 Morningstar. All Rights Reserved.

5. Click +Add. The Find Investments dialog box opens.

6. From the Find By drop-down field, select Ticker.

7. In the search field, type SLADX, then click Go. Selected American Shares D appears in

the Available Records list.

8. To select the fund, double-click its name (Selected American Shares D). Selected

American Shares D appears in the Selected Records list.

Click +Add to add

investments to a report

When you double-click

a fund name in the

Available Records list,

it appears here (the

Selected Records list)

Be sure to select Ticker

from this drop-down field

before entering a ticker in

the search field

Reviewing Stock Sector Performance Exercise 2: Adding the Markets Periodic Chart to the template

Morningstar Direct December 2017 9

© 2017 Morningstar. All Rights Reserved.

9. Click OK to close the Find Investments dialog box.

10. Click OK to close the Investments: Settings dialog box. The workbook template opens in

a new window.

Exercise 2: Adding

the Markets Periodic

Chart to the template

Now that the blank report template has been created, you can add a component to

depict the stock sectors’ performance. Do the following:

1. If the Home tab at the top of the Presentation Studio window is not selected, select it.

2. From the toolbar, from the Chart drop-down field, select Markets. A set of Markets

charts opens to the right.

3. Drag the Markets Periodic Table to a blank space in the template.

Note the

highlighted selections

Exercise 3: Modifying the Markets Periodic Chart Reviewing Stock Sector Performance

10 Morningstar Direct December 2017

© 2017 Morningstar. All Rights Reserved.

Exercise 3: Modifying the

Markets Periodic Chart

By default, the Markets Periodic Chart shows the performance of four different

US-equity-based indexes for the trailing five-year period. You need to do the following:

g select a different set of indexes, and

g change the time period being to the trailing one-year period.

To accomplish these tasks, do the following:

1. In the bottom-left corner of the Presentation Studio window, click Chart Settings. The

Chart Settings window opens.

2. From the Index Group drop-down field, select Morningstar US Sector Indexes. The

component shown in the template updates to reflect this selection.

Chart Settings is at the

bottom of the Presentation

Studio window

Reviewing Stock Sector Performance Exercise 3: Modifying the Markets Periodic Chart

Morningstar Direct December 2017 11

© 2017 Morningstar. All Rights Reserved.

3. Click Chart Settings again, and this time click the Setup button in the Time Period field.

The Time Period Setup dialog box opens.

4. Because you want to depict only one time period on the chart, start by removing all

time

periods. Near the bottom of the Time Period Setup dialog box, click the Remove

All

button.

Click this button to change

the time period being

reflected on the chart

You do not need to select the time

periods when you remove them by

clicking Remove All

Exercise 3: Modifying the Markets Periodic Chart Reviewing Stock Sector Performance

12 Morningstar Direct December 2017

© 2017 Morningstar. All Rights Reserved.

5. From the Start Date drop-down field, select 1 Year Ago. The End Date should still

display Last

Month End.

6. To the right of the Number of Columns field, click Add Column(s).

7. Click OK. The Time Period Setup dialog box closes. In the template, the Markets Periodic

Table component updates to reflect this choice.

Note the

highlighted selections

Reviewing Stock Sector Performance Exercise 4: Adding a header to the report

Morningstar Direct December 2017 13

© 2017 Morningstar. All Rights Reserved.

Exercise 4: Adding a

header to the report

The report now reflects both the data and the time period you want. You could

generate a PDF from here and send it to your manager, but a header at the top of the

report would help someone who wasn’t involved in creating it understand what the

report is depicting.

To add a header to the report, do the following:

1. At the top of the Presentation Studio window, select the Format tab.

2. From the toolbar, from the Header drop-down field, select Insert Header. A header is

inserted at the top of the page.

3. From the toolbar, from the View drop-down field, select Snap to Grid to turn on

this

feature.

4. Use your mouse to drag the bottom border of the header so the header takes up just

1.00 inch of space.

Be sure to select the correct

tab in order to insert a

header on the report

Snap to Grid makes it

easier to resize and align

components on a page

The location of th header’s bottom border

is shown on the left (vertical) ruler

Exercise 5: Adding a name to the header Reviewing Stock Sector Performance

14 Morningstar Direct December 2017

© 2017 Morningstar. All Rights Reserved.

E x e r c i s e 5 : A d d i n g

a name to the header

To add a report name to the header, do the following:

1. From the toolbar, from the Divide Page drop-down field, select the Two Cell option with

the vertical divider. The header area now has two cells. You will place the report title in

the left cell, and the time period in the right cell.

2. If header cell on the left is not selected, select it. From the toolbar, from the Text

drop-down field, select Custom Text.

Select this option

to divide the

header into two

side-by-side cells

This option

allows you to

enter a title for

the report

Reviewing Stock Sector Performance Exercise 6: Adding a dynamic date to the header

Morningstar Direct December 2017 15

© 2017 Morningstar. All Rights Reserved.

3. Double-click the left header cell and type Morningstar Stock Sector Returns.

4. Select the text you just typed by pressing <CTRL>+<A>. The text is now highlighted.

5. From the toolbar, from the Font Size drop-down field, select 24.

Exercise 6: Adding a

dynamic date

to the header

When entering a time period in the header, if you use a dynamic date here rather than

manually typing the date, the report can be updated without you having to manually

change the date.

To enter a time period for the report without having to manually type the date, do

the

following:

1. Select the header cell to the right of the report title cell.

2. From the toolbar, from the Text drop-down field, select Dynamic Text…Time Period.

The time period for the template is entered in the cell. Note, however, that this is not the

same date being depicted in the component.

Use this

field to

enlarge the

text on the

header

Use this selection to enter

the time period being

reflected in the header

Exercise 6: Adding a dynamic date to the header Reviewing Stock Sector Performance

16 Morningstar Direct December 2017

© 2017 Morningstar. All Rights Reserved.

3. To change the date in the header, select the Home tab at the top of the Presentation

Studio window.

4. Click the Workbook icon. The Workbook Settings: Data window opens.

5. The Data tab should be selected. From the Start Date drop-down field, select

1

Year Ago.

6. Click OK. The Workbook Settings: Data window and the time period date in the header

updates to reflect your choices.

7. Click the date in the right header cell. It changes to display [Time Period].

8. Select the date by pressing <CTRL>+<A>. [Time Period] is now highlighted.

9. Select the Format tab, then from the Font Size drop-down field, select 24.

10. Click outside the cell to see the date displayed in the cell.

Use this field to

change the date

being depicted

in the header

Reviewing Stock Sector Performance Exercise 7: Generating and saving the report template

Morningstar Direct December 2017 17

© 2017 Morningstar. All Rights Reserved.

Exercise 7: Generating

and saving

the report template

When you save a Presentation Studio template, you have the following choices:

g You can save your work as a template. This method allows you to re-use the

template for any investment(s) you want in the future. A report based on a

template does not reflect the investment(s) you selected at the time you created

the template. The downside to saving a Presentation Studio file as a template is

that you will always have to select an investment when opening the file. This will

add some extra clicks to the process of editing the report.

g You can save your work as a report. The file will open much faster because the

system already knows what investment(s) should be associated with the report.

The downside to saving your Presentation Studio file as a report is that if you do

want to change the investments being depicted on the report, you will have to

manually select them.

To see this file as a PDF and save it as a report, do the following:

1. From the toolbar at the top of the Presentation Studio window, from the PDF drop-down

field, select Full Report.

2. From the toolbar at the top of the Presentation Studio window, from the gear drop-down

field, select Save. The Presentation Studio dialog box opens.

This option

immediately

generates a PDF

of the report

Use this option to

save the report

Exercise 7: Generating and saving the report template Reviewing Stock Sector Performance

18 Morningstar Direct December 2017

© 2017 Morningstar. All Rights Reserved.

3. In the Workbook Name field, type Morningstar Stock Sector Returns.

4. Click Save.

5. Close the Presentation Studio window.

Enter the name for

the report here

Reviewing Stock Sector Performance Exercise 8: Saving the stock sector indexes to a list

Morningstar Direct December 2017 19

© 2017 Morningstar. All Rights Reserved.

E x e r c i s e 8 : S a v i n g t h e

stock sector

indexes to a list

The Presentation Studio report is a great asset for depicting the performance of stock

sectors over the past year, but it is possible your manager will ask to see the information

as a list, instead of the graphic representation you created in Presentation Studio.

In order to make the stock sector data available as a list, you will use the Workspace

module. You first have to find the correct indexes, select them, and then save them to a

list. Do the following:

1. In the left navigation pane, select the Workspace module, click the Search Criteria

folder to expand it, then select the My Search Criteria page.

2. From the toolbar above the grid, from the New drop-down field, select

Advanced

Search…Market Index. The search by criteria dialog box opens.

Use the highlighted

selections to begin

building your search

Exercise 8: Saving the stock sector indexes to a list Reviewing Stock Sector Performance

20 Morningstar Direct December 2017

© 2017 Morningstar. All Rights Reserved.

3. Create a search with the following criteria:

Note: Selecting the Alphabetically button in the lower-left corner of the dialog box can help

find the criteria more quickly.

4. After entering the criteria, operators, and values, click OK.

5. From the header row at the top of the grid view, click the checkbox to the left of the

Name column. All rows from the search should now be selected.

6. Uncheck the box next to the following indexes:

7. Confirm all the following rows (11 in total) are still selected:

Rel Field Name Operator Value

-- Series Name = Morningstar US Sector

And Return Type = Total Return

And Base Currency = US Dollar

Select this

option to

look for

criteria

by name

g Morningstar US Bas Mat & Energy TR USD g Morningstar US Energy Capped TR USD

g Morningstar US Commun Svc Capped TR USD g Morningstar US Fin Svc & RE TR USD

g Morningstar US Cyclcl Sup Sec TR USD g Morningstar US Snstve Sup Sec TR USD, and

g Morningstar US Dfnsve Sup Sec TR USD g Morningstar US Tech & Commun Svc TR USD.

g Morningstar US Basic Materials TR USD g Morningstar US Healthcare TR USD

g Morningstar US Commun Svc TR USD g Morningstar US Industrials TR USD

g Morningstar US Consumr Cyclcl TR USD g Morningstar US Real Estate TR USD

g Morningstar US Consumr Dfnsve TR USD g Morningstar US Technology TR USD, and

g Morningstar US Energy TR USD g Morningstar US Utilities TR USD.

g Morningstar US Financial Services TR USD g

Reviewing Stock Sector Performance Exercise 8: Saving the stock sector indexes to a list

Morningstar Direct December 2017 21

© 2017 Morningstar. All Rights Reserved.

8. From the toolbar above the grid view, from the Action drop-down field, select

Save

As…Investment List. The Save As dialog box opens.

9. In the Name field, type Morningstar Stock Sectors, then click OK.

Use the highlighted

selections to save

your search as a list

You can confirm the

number of selected

rows at the bottom of

the window

Enter the name for

the list here

Exercise 8: Saving the stock sector indexes to a list Reviewing Stock Sector Performance

22 Morningstar Direct December 2017

© 2017 Morningstar. All Rights Reserved.

10. From the View drop-down field, select Returns (Month End). You can scroll right to see

the values in the Total Return 1 Yr (Mo-End) USD column.

11. From the toolbar above the grid view, click the Save icon. (Saving ensures that the next

time the list is opened, the Returns view is displayed by default.)

Change the data being

depicted to this view

Use this icon to make

this layout the default

option each time this

list is opened

Evaluating Asset Flow Data in Morningstar Direct Overview

Morningstar Direct December 2017 23

© 2017 Morningstar. All Rights Reserved.

Evaluating Asset Flow Data in Morningstar Direct

OverviewThe Asset Flows module in Morningstar Direct uses data from the SEC N-SAR form, as

well as estimated data (provided by fund families to Morningstar) to understand

changes in asset levels at the fund, category, strategy (active vs. passive), and firm

levels. Not only can you see which items have net inflows vs. outflows, but you can

also evaluate the size of the change relative to a fund itself, and measure investment

trends as individuals and institutions adjust to market conditions.

ScenarioYour manager is interested in learning about the impact to asset flows over the past

year for non-sector-specific funds with significant exposure to the Energy sector. If a

fund has a meaningful allocation to energy stocks and has underperformed in its

category, did it also see large outflows as a consequence?

SolutionYou will use the Workspace and Asset Flows modules to find the funds most likely to

have been affected by their exposure to the Energy sector, and what the impact has

been on the asset flows of those funds.

The Asset Flows

module allows you

to monitor money

moving into and

out of funds

Exercise 9: Search for funds with high exposure to the Energy sector Evaluating Asset Flow Data in Morningstar Direct

24 Morningstar Direct December 2017

© 2017 Morningstar. All Rights Reserved.

E x e r c i s e 9 : S e a r c h f o r

funds with high exposure

to the Energy sector

To evaluate funds with meaningful exposure to the Energy sector that

also

underperformed in their category, you will search for funds that meet the

following

criteria:

g They were in the bottom quartile of their category during the past year, and

g They had meaningful exposure to the Real Estate sector during that time.

(Additionally, you will exclude funds in certain energy-related categories, because

these funds would be expected to under-perform due to high exposure to this sector.)

Do the following:

1. In the left navigation pane, be sure the Workspace module is selected.

2. Click the Search Criteria folder to expand it, then select My Search Criteria.

3. From the toolbar above the grid view, from the New drop-down field, select

Advanced

Search…Open End Fund. The Search Criteria dialog box opens.

Use this page to create

an advanced search

Use these options

to begin the search

Evaluating Asset Flow Data in Morningstar Direct Exercise 9: Search for funds with high exposure to the Energy sector

Morningstar Direct December 2017 25

© 2017 Morningstar. All Rights Reserved.

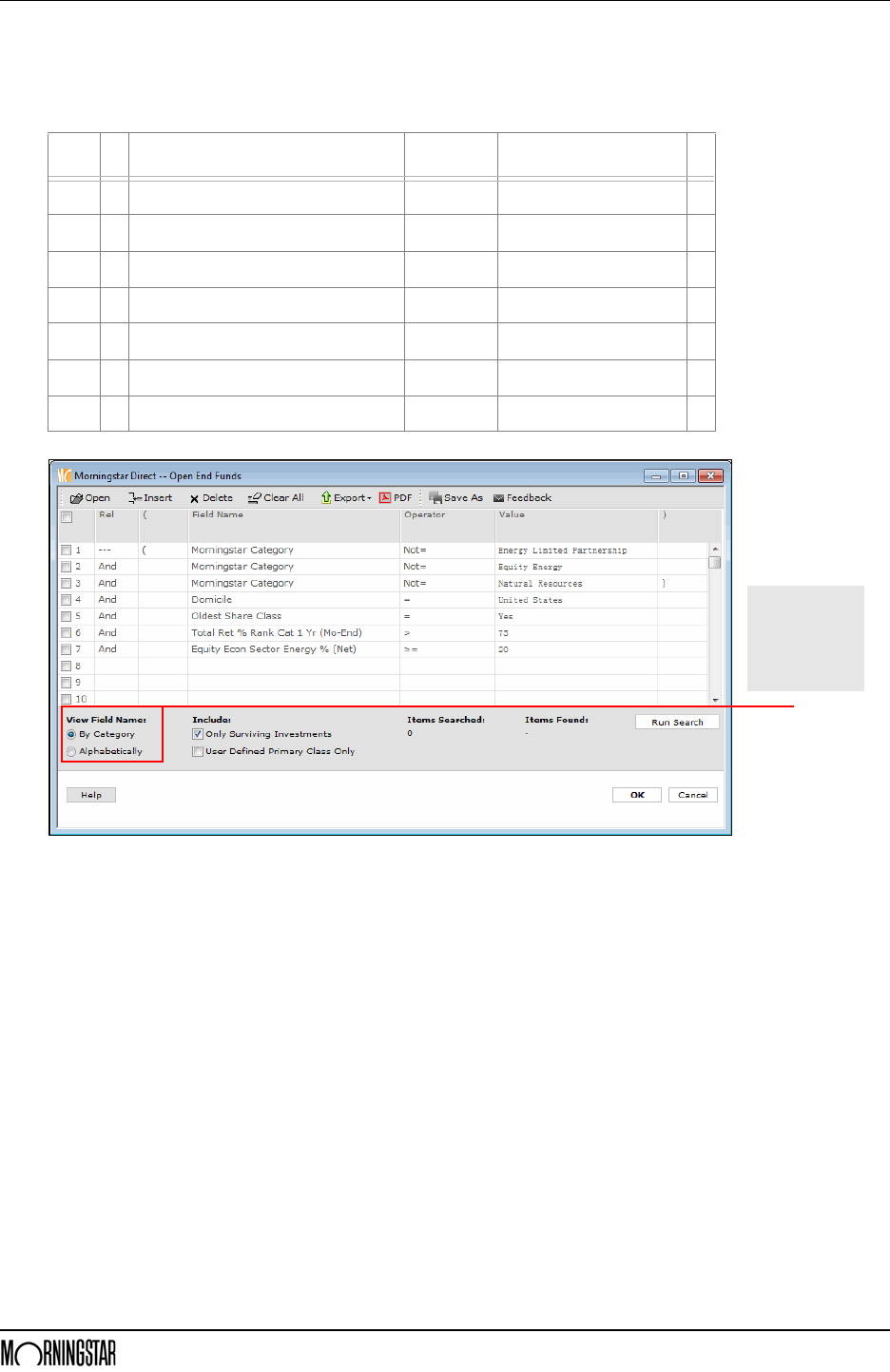

4. Create a search with the following criteria:

Note: Selecting the option button for Alphabetically in the bottom-left corner can help speed

the search for various field names.

Rel ( Field Name Operator Value )

-- ( Morningstar Category Not= Energy Limited Partnership

And Morningstar Category Not= Equity Energy

And Morningstar Category Not= Natural Resources )

And Domicile = United States

And Oldest Share Class = Yes

And Total Ret % Rank Cat 1 Yr (Mo-End) > 75

And Equity Econ Sector Energy % (Net) >= 20

If you cannot find

the criteria by

category, select

the Alphabetically

option to look for

them by name

Exercise 9: Search for funds with high exposure to the Energy sector Evaluating Asset Flow Data in Morningstar Direct

26 Morningstar Direct December 2017

© 2017 Morningstar. All Rights Reserved.

5. To save the search, from the toolbar near the top of the dialog box, click Save As. The

Save As dialog box opens.

6. In the Name field, type Energy.

7. Click OK. The Save As dialog box closes.

8. Click OK again to close the Search dialog box and see your results.

Enter the name

for the search here

Click this icon

to save a search

Evaluating Asset Flow Data in Morningstar Direct Exercise 10: Saving funds to a list

Morningstar Direct December 2017 27

© 2017 Morningstar. All Rights Reserved.

Exercise 10: Saving

funds to a list

Now that the search has revealed the funds with a significant exposure to the Real

Estate sector that underperformed in their category, you can save these items to a list.

With the funds saved as a list, you can see them in the Asset Flows module; you cannot

open a saved search from Workspace in the Asset Flows module.

Do the following:

1. You should be looking at the results of your search in the Workspace module. To select

all rows, click the box in the column header at the left. All rows are now selected.

2. From the Action drop-down field, select Save As…Investment List. The Save As dialog

box

opens.

3. In the Name field, type Energy Exposure.

4. Click OK.

5. When prompted to save your changes, click No. (This step simply ties the current data

columns to the rows you’ve saved in your list.)

Check this box to

select all rows

Select the

highlighted options

Exercise 11: Examining the asset flows for under-performing funds Evaluating Asset Flow Data in Morningstar Direct

28 Morningstar Direct December 2017

© 2017 Morningstar. All Rights Reserved.

Exercise 11: Examining

the asset flows for

under-performing funds

Once you know the funds whose asset flows you want to evaluate, you can move to

the Asset Flows module and begin the investigation.

Do the following:

1. From the left navigation pane, select the Asset Flows module. The Market Summary tab

at the top is selected by default.

2. At the top of the Asset Flows pane, select the Workspace tab.

3. In the Saved Actions area, select the Inv. List tab.

4. Click the Energy Exposure list. A new window opens.

Select this tab in

the Asset Flows pane

Be sure to

select this tab

Evaluating Asset Flow Data in Morningstar Direct Exercise 11: Examining the asset flows for under-performing funds

Morningstar Direct December 2017 29

© 2017 Morningstar. All Rights Reserved.

5. Click the 1-Yr column header to sort from best to worst.

6. Click the 1-Yr column header again, to sort from worst to best.

7. To see the percentage of the fund’s assets represented by this inflow or outflow, click

the Organic

Growth Rate (TTM) column header to sort from best to worst.

8. To sort from worst to best, click the Organic Growth Rate (TTM) column header again.

Note the correct way

to sort this column

Exercise 12: Adding context to the fund flow data Evaluating Asset Flow Data in Morningstar Direct

30 Morningstar Direct December 2017

© 2017 Morningstar. All Rights Reserved.

Exercise 12: Adding

context to the

fund flow data

The fund with the largest outflow over the past year belonged to the Large Growth

category. How do its outflows compare to other funds in this category? To see the

outflows from a Morningstar Category, do the following:

1. Select the Market Summary tab at the top of the page.

2. Scroll down until you see the grouping for Morningstar Categories.

3. In the Morningstar Categories section, click Large Growth. A new window opens.

Click once on this category

Be sure this

tab is selected

Evaluating Asset Flow Data in Morningstar Direct Exercise 12: Adding context to the fund flow data

Morningstar Direct December 2017 31

© 2017 Morningstar. All Rights Reserved.

4. In the left pane, click Funds.

5. Be sure the Sub-view field reads Estimated Net Flow…Estimated Net Flow (Current).

6. Click the 1-Yr column header to sort from best to worst.

7. Click the 1-Yr column header again, to sort from worst to best. How does the fund with

the largest outflows here compare to the fund from Exercise 11?

Note: In this view, funds are rolled up, and not broken out by share classes as when you were

looking at funds from the list you saved.

8. Close any Asset Flow windows that are open.

If needed, select

this option from

the drop-down field

Be sure this

page is selected

Be sure to sort the data

by the correct column

Be sure to move

to the second page

Exercise 12: Adding context to the fund flow data Evaluating Asset Flow Data in Morningstar Direct

32 Morningstar Direct December 2017

© 2017 Morningstar. All Rights Reserved.

To see how the outflows from this Large Growth fund compare to that of others at its

fund family, do the

following:

1. With the Market Summary tab selected, scroll to the top so you can see the Fund

Families grouping.

2. Click Fidelity Investments. A new window opens.

3. In the left pane, click Funds.

Click this name to

open a new window

Be sure the correct

section displayed

Be sure to

select this page

Evaluating Asset Flow Data in Morningstar Direct Exercise 12: Adding context to the fund flow data

Morningstar Direct December 2017 33

© 2017 Morningstar. All Rights Reserved.

4. From the Sub-view drop-down field in the upper-right corner of the dialog box, be sure

Estimated Net Flow…Estimated Net Flow (Current) is selected.

5. Click the 1-Yr column header to sort from best to worst.

6. Click the 1-Yr column header again, to sort from worst to best. Where is the Large

Growth fund you saw earlier in this exercise?

7. Close any Asset Flow windows that are open.

Note the options

selected here

Overview Identifying Funds with Consistent Top Performance

34 Morningstar Direct December 2017

© 2017 Morningstar. All Rights Reserved.

Identifying Funds with Consistent Top Performance

Overview The Morningstar Rating for a fund is a starting point for evaluating a fund’s

risk-adjusted performance, but it is also important to consider the consistency of a

fund’s performance over time so you understand whether investors can rely on regular

out-performance from the management team.

A performance report, which shows rows of investments and columns of data about

those investments, allows you to show your manager the information being sought

about funds with consistent performance. The Performance Reporting module in

Morningstar Direct not only displays return and category rank data from multiple time

periods more easily than in other parts of the application, but also allows you to use

tools such as grouping, conditional formatting, and a scorecard to calculate results and

present data in an easy-to-understand format.

In this sample

performance report,

you can see

both conditional

formatting and

score columns

Identifying Funds with Consistent Top Performance What is involved in creating a performance report?

Morningstar Direct December 2017 35

© 2017 Morningstar. All Rights Reserved.

What is involved

in

creating a

performance

report?

Creating a performance report consists of the following steps:

1. Select the investments for the report.

2. Decide how the investments will be grouped together, what the investments on the

report should be compared to, and select comparison and calculation benchmarks for

the investments on the report.

3. Choose the time periods (trailing 1-year, rolling window, etc.) to display, and data points

(Return, Category Rank) to display in each time period.

4. Choose supplementary information you want to include outside of the time periods.

5. Apply conditional formatting to call out important information.

6. Use a scorecard to calculate results over time.

Scenario Identifying Funds with Consistent Top Performance

36 Morningstar Direct December 2017

© 2017 Morningstar. All Rights Reserved.

Scenario Your manager wants to understand the consistency of Large Growth open-end funds.

Which of the funds have had truly reliable performance during the past five years?

Your manager wants to you to produce a report identifying consistent Large Growth

funds. Each fund must meet the following criteria:

g still open to new investors

g an above-average Sharpe Ratio for the trailing five-year period when compared to

their category peers

g an expense ratio below the category average

g a Downside Capture Ratio for the five-year period below 100, and

g only the cheapest share class of a fund should be considered.

The report should show returns and category ranks for rolling three-year periods,

starting from five years ago through the most recent month end.

In the following exercises, a fund will be considered a consistent top performer if it has

appeared in the top quarter of its category during all of the 25 time periods being

considered. If a fund has a Morningstar Analyst Rating, your manager wants to see

that, but funds are not required to have an analyst rating in order to be considered a

top performer. Finally, the Sharpe Ratio should also be shown, but only for the most

recent three-year period.

Solution In this performance report, you will search for the investments to consider, then

configure the performance report to retrieve the proper time periods and data points.

Conditional formatting will be used to highlight both funds appearing in the top

quartile for each time period, and the Morningstar Analyst Rating (where available).

Finally, a scorecard will be employed to determine whether funds have consistently

appeared in the top quartile of their respective Morningstar Category.

Identifying Funds with Consistent Top Performance Exercise 13: Searching for the cheapest share class of a fund

Morningstar Direct December 2017 37

© 2017 Morningstar. All Rights Reserved.

Exercise 13: Searching

for the cheapest

share class of a fund

When creating an advanced search to find only one instance of a fund (rather than

seeing all share classes of a fund), you have a number of options, including looking for

the following:

g the oldest share class of a fund

g a specific share class for a fund, such as the A share, or

g the least expensive share class for a fund.

Before conducting an advanced search to look for the cheapest share class for a fund,

you need to set the proper user preference to allow for this. Do the following:

1. From the menu bar at the top of the Morningstar Direct window, select

File…Set

User Preferences. The Set User Preferences window opens.

Select this option

from the File menu

Exercise 13: Searching for the cheapest share class of a fund Identifying Funds with Consistent Top Performance

38 Morningstar Direct December 2017

© 2017 Morningstar. All Rights Reserved.

2. Select the User Defined Primary tab.

3. Select the row for Annual Report Net Expense Ratio, then click the move to top

button. (The move to top button displays two up arrows.) This ensures this criterion takes

precedence when conducting a search.

4. Be sure the word Lowest appears in the Choose column.

5. Click OK. In the next exercise, you will learn to leverage this setting.

Use this button to

move the selected

item to the top of the list

Be sure to select this tab

Identifying Funds with Consistent Top Performance Exercise 14: Create a search by criteria in Performance Reporting

Morningstar Direct December 2017 39

© 2017 Morningstar. All Rights Reserved.

Exercise 14: Create

a search by criteria in

Performance Reporting

The first step in identifying consistently top performing large cap funds is to search for

those open-end funds that meet the following criteria:

g an expense ratio below the category average

g still open to new investors

g an above-average Sharpe Ratio for the trailing five-year period, when compared to

their category peers, and

g a Downside Capture Ratio below 100 for the five-year period.

To create a search by criteria in the Performance Reporting module, do the following:

1. In Morningstar Direct, select the Performance Reporting tab. The Folders page should

be selected by default.

2. From the toolbar above the grid view, click New. The Select Investments dialog box

opens.

3. Select the option for Search Criteria. Be sure the Open End Funds option is selected

from the drop-down field.

4. Click OK. The Search Criteria dialog box opens.

Click this icon to create a

new performance report

Be sure to select this

option to find

investments based on the

parameters you choose

Be sure this option is selected

to find investments based on

the parameters you choose

Exercise 14: Create a search by criteria in Performance Reporting Identifying Funds with Consistent Top Performance

40 Morningstar Direct December 2017

© 2017 Morningstar. All Rights Reserved.

5. Set your criteria as shown in the following table:

Note: At the bottom of the Search Criteria dialog box, be sure to check the checkbox for

User Defined Primary Class Only.

6. Click OK. The Group Settings window opens.

Rel ( Field Name Operator Value )

-- Morningstar Category = US Large Growth

And Annual Report Net Expense Ratio < CAT AVG

And Closed to New Inv Not= Yes

And Sharpe Ratio 5 Yr (Mo-End) > CAT AVG

And Downside Capture Ratio 5 Yr (Mo-End) < 100

And Inception Date <= 10/1/2012

Be sure your search

reflects the inputs

shown here

When looking for

criteria in the Field

Name column, it

helps to have the

Alphabetically option

selected, so you can

see all criteria at once

Be sure to check

this box as well

Identifying Funds with Consistent Top Performance Exercise 15: Change the settings for the group

Morningstar Direct December 2017 41

© 2017 Morningstar. All Rights Reserved.

Exercise 15: Change

the settings for the group

By default, when examining the performance of selected funds in a performance

report, Morningstar Direct compares the funds to each other, rather than all of the

funds in the appropriate Morningstar Category. In this section, you will learn how to

change the peer group for a set of funds.

In a performance report, it is also important to use a relevant benchmark for both the

performance comparison and performance calculations. You can also decide whether

to display only one comparison benchmark (rather than the default two benchmarks).

To change these settings for a performance report, do the following:

1. In the Peer Group column for row 1, click the Peer Group icon. The Peer Group dialog

box

opens.

2. Select the Morningstar Category option.

3. Click OK to close the dialog box.

Click this icon to change the

peer group for the report

This option allows you to

compare the funds from

your search to all other

funds in their category

Exercise 15: Change the settings for the group Identifying Funds with Consistent Top Performance

42 Morningstar Direct December 2017

© 2017 Morningstar. All Rights Reserved.

4. In row 1, from the Display Benchmark 1 drop-down field, select

Morningstar

Category Index.

5. To see what the benchmarks are for each category, from the toolbar, click

Show

Benchmarks.

6. From the toolbar, click Report Settings. The Report Settings dialog box opens. From

here, the second display benchmark can be hidden.

Select this option to assign an

index to the category in the

performance report

This icon allows you to see

the name of each index that

will appear on the report

Use this icon to display just

one comparison benchmark

on the performance report

Identifying Funds with Consistent Top Performance Exercise 15: Change the settings for the group

Morningstar Direct December 2017 43

© 2017 Morningstar. All Rights Reserved.

7. Uncheck the Show display benchmark 2 checkbox.

8. Click OK to close the Report Settings dialog box.

Uncheck this box to

ensure only one

benchmark appears on

the performance report

Exercise 15: Change the settings for the group Identifying Funds with Consistent Top Performance

44 Morningstar Direct December 2017

© 2017 Morningstar. All Rights Reserved.

9. Next, you need to ensure the proper benchmark is used for calculating the data on

the

performance report. From the Calculation Benchmark drop-down field, select

Display

Benchmark 1. This allows you to use the same benchmark for both display

and

calculation. It also ensures a peer-appropriate index is being used for

calculation

purposes.

10. Click OK. The Select Column dialog box opens.

11. Make sure the option for User Defined is selected, then click OK. The Performance

Column Setup window opens.

Note the selection

from this

drop-down field

This option should be

selected by default

Identifying Funds with Consistent Top Performance Exercise 16: Set the values for the Time Periods tab

Morningstar Direct December 2017 45

© 2017 Morningstar. All Rights Reserved.

Exercise 16: Set

the values for

the Time Periods tab

To see if this set of funds has had consistent performance over a set of rolling

three-year periods starting from five years ago, do the following:

1. In the Performance Column Setup, select the Rolling window option.

2. From the Start Date field, select Enter Date, and select the first day of the current month

from five years ago.

3. From the End Date field, select Last Month End.

4. From the Window size drop-down field, select 3 years.

5. From the Moving step drop-down field, select 1 month. The Number of columns field

should read 25.

6. Click Add Columns. The time periods for the report are added to the Selected Time

Periods area.

Note: Do not click OK yet; the Data Points and Ranks tabs still need to be addressed.

Be sure to select this

option for Time Periods

Be sure to select the correct

values for Window size and

Moving step

Note the values for the

Start Date and End Date fields

Exercise 17: Set the values for Data Points and Ranks Identifying Funds with Consistent Top Performance

46 Morningstar Direct December 2017

© 2017 Morningstar. All Rights Reserved.

Exercise 17: Set

the values for

Data Points and Ranks

Remember that your manager requested to see not only the return for each time

period, but also the Sharpe Ratio for only the most recent time period. To set the

values

for the two remaining tabs in the Performance Column Setup window, do

the

following:

1. Select the Data Points tab, and ensure Return is displayed in the Selected Data

Points

list.

Be sure to select

the correct tab

The Return data

point is included

automatically in a

performance report

Identifying Funds with Consistent Top Performance Exercise 17: Set the values for Data Points and Ranks

Morningstar Direct December 2017 47

© 2017 Morningstar. All Rights Reserved.

2. To see the Sharpe Ratio value for the funds, but only for the most recent time period, at the

bottom of the window, uncheck the Apply

add/remove to all time periods checkbox.

3. From the Time Period drop-down field at the top of the window, scroll down to select

the

most recent time period.

4. In the Data Points list, scroll down until you see the Sharpe Ratio data point, then

double-click Sharpe Ratio to add it to the Selected Data Points area.

Be sure to select

the latest time period

Double-click this data point

This box must be

unchecked to ensure the

data point is added only to

the time period you select

at the top

Exercise 17: Set the values for Data Points and Ranks Identifying Funds with Consistent Top Performance

48 Morningstar Direct December 2017

© 2017 Morningstar. All Rights Reserved.

5. Select the Ranks tab, and ensure only Peer group percentile is selected in the Selected

Rank Columns list.

6. In the Selected Rank Columns list, double-click Peer group percentile. The

Display

Setting dialog box opens.

7. In the Display Name field, type Peer group %.

8. Click OK to close the Display Setting dialog box.

9. Click OK to close the Performance Column Setup window. The Supplementary Columns

window opens.

Be sure to select

the correct tab

Only this field is

selected by default on

this tab

Type the new name

for the Display

Setting here

Identifying Funds with Consistent Top Performance Exercise 18: Select options from the Supplementary Columns window

Morningstar Direct December 2017 49

© 2017 Morningstar. All Rights Reserved.

Exercise 18: Select

options from

the Supplementary

Columns window

In addition to seeing the name of a fund on the performance report, it will also be

useful to include the fund’s ticker symbol. Also, your manager asked to see a

Morningstar Analyst Rating if one is assigned to the fund. To include a fund’s ticker

symbol and Analyst Rating on the performance report, do the following:

1. On the Supplementary tab, in the Available Supplementary Columns list, double-click

Ticker to move it to the Selected Supplementary Columns list.

2. In the Selected Supplementary Columns list, select Ticker and click the up arrow to

move it above Name.

Note the position of the

two selected columns

Exercise 18: Select options from the Supplementary Columns window Identifying Funds with Consistent Top Performance

50 Morningstar Direct December 2017

© 2017 Morningstar. All Rights Reserved.

3. Scroll down in the Available Supplementary Columns list, and double-click

Morningstar Analyst Rating.

4. Click OK to close the Supplementary Columns window. The performance report is now

ready to be saved and calculated.

Be sure to double-click the

Morningstar Analyst Rating,

and not the Morningstar Rating

Identifying Funds with Consistent Top Performance Exercise 19: Rename a data column

Morningstar Direct December 2017 51

© 2017 Morningstar. All Rights Reserved.

Exercise 19: Rename

a data column

Only the most recent time period has the correct label for the Peer group percentile

column; the others were not renamed to Peer group %. To correct this for all other time

periods at once, do the following:

1. From the toolbar above the grid, from the Edit drop-down field, select Manage

Columns. The Manage Columns dialog

box opens.

2. Scroll down to the row where Peer group % is shown.

3. Hover your mouse over the Peer group % cell.

4. Click Apply change to all.

Note: You could also click in a row to manually rename “Peer group percentile” to

“Peer group %,” but this would take much more effort.

5. Click OK to close the Manage Columns dialog box.

Select this option from the

Edit drop-down field

When you hover your mouse

over this area, you will be

able to click this option

Exercise 20: Save the performance report Identifying Funds with Consistent Top Performance

52 Morningstar Direct December 2017

© 2017 Morningstar. All Rights Reserved.

Exercise 20: Save the

performance report

Now that the parameters for the report are set, the last step before calculating it is to

save it.

To save the performance report, do the following:

1. From the toolbar above the spreadsheet grid, click Save. The Save Report dialog

box

opens.

2. In the Name field, type Consistent Large Growth Funds.

3. Click OK. The Save Report dialog box closes.

This icon allows you to save

your work when creating

a performance report

Note the name you

should enter for this report

Identifying Funds with Consistent Top Performance Exercise 21: Calculate the performance report

Morningstar Direct December 2017 53

© 2017 Morningstar. All Rights Reserved.

Exercise 21: Calculate

the performance report

To calculate the report, do the following:

1. From the toolbar above the grid view, click Calculate. During the calculation, the Folders

page is displayed.

2. When the Report Calculation Complete message opens, click Yes to view the report. The

spreadsheet grid is now filled with data.

This icon allows you

to generate a

performance report

Note the data now

available in the report

Exercise 22: Apply conditional formatting to a performance report Identifying Funds with Consistent Top Performance

54 Morningstar Direct December 2017

© 2017 Morningstar. All Rights Reserved.

Exercise 22: Apply

conditional formatting

to a performance report

The information in the performance report is great, but it is also a bit difficult to read

without some additional formatting. The conditional formatting feature in the

Performance Reporting module allows you to color each row, cell, or column to aid the

interpretation of the data.

In this exercise, you will apply a color to the Peer group % column to call out the times

when each fund was in the top quartile of its category. To apply conditional formatting

to a performance report, do the following:

1. From the toolbar above the grid view, from the Tools drop-down field, select

Conditional

Format…Conditional Formatting. The Conditional Formatting Rules dialog

box opens.

2. From the Field Name drop-down field, expand the All Time Periods option and select

Return : Peer group %.

Select this

option to

highlight

information on

the report

Be sure to select the

correct option here

Identifying Funds with Consistent Top Performance Exercise 23: Apply conditional formatting to the Morningstar Analyst Rating

Morningstar Direct December 2017 55

© 2017 Morningstar. All Rights Reserved.

3. From the Operator drop-down field, select <=.

4. In the Value field, type 25.

5. From the Cell Color drop-down field, select green in the upper-right corner.

6. Be sure the box for Column Only is checked.

7. Click Preview to ensure the rule is working as expected.

8. Click OK. The Conditional Formatting Rules dialog box closes.

Exercise 23: Apply

conditional formatting

to the Morningstar

Analyst Rating

In addition to highlighting funds when they appeared in the top quartile, you can also

apply conditional formatting to the Morningstar Analyst Rating column, to help these

values stand out. Do the following:

1. From the toolbar above the grid view, from the Tools drop-down field, select

Conditional

Format…Conditional Formatting. The Conditional Formatting Rules

dialog

box opens.

2. Click Add Rule. Rule 2 now appears.

Note all of the highlighted

values for this first rule

Click this button to add

another formatting rule

Exercise 23: Apply conditional formatting to the Morningstar Analyst Rating Identifying Funds with Consistent Top Performance

56 Morningstar Direct December 2017

© 2017 Morningstar. All Rights Reserved.

3. From the Field Name drop-down field, select Morningstar Analyst Rating.

4. The Operator field should show =.

5. From the Value field, select Gold.

6. From the Cell Color drop-down field, click Custom. The Custom Color dialog box opens.

7. Set the following values:

g Red = 250

g Green = 164

g Blue = 29

8. Click OK.

9. Be sure the Column Only box is checked.

Note the values

for this rule

Use this button

to customize

the color

for these cells

Be sure your values

match those shown here

Identifying Funds with Consistent Top Performance Exercise 23: Apply conditional formatting to the Morningstar Analyst Rating

Morningstar Direct December 2017 57

© 2017 Morningstar. All Rights Reserved.

10. To help you create multiple conditional formatting rules for the same column, you can

use the Clone Rule icon. From the Rule 2 heading bar, click the Clone Rule icon. Rule 3

now appears. The Field Name, Operator, and Value fields are populated automatically

based on the rule you cloned.

11. In the Rule 3 section, from the Value drop-down field, select Silver.

12. From the Cell Color drop-down field, click Custom. The Custom Color dialog box opens.

Be sure to click

the Clone Rule icon

for the correct rule

Be sure to change

the value for this field

Exercise 23: Apply conditional formatting to the Morningstar Analyst Rating Identifying Funds with Consistent Top Performance

58 Morningstar Direct December 2017

© 2017 Morningstar. All Rights Reserved.

13. Set the following values:

g Red = 139

g Green = 155

g Blue = 151

14. Click OK to close the Custom Color dialog box.

15. In the Conditional Formatting Rules dialog box, on the Rule 3 heading bar, click the

Clone Rule icon. Rule 4 now appears.

16. In the for Rule 4 section, from the Value drop-down field, select Bronze.

17. From the Cell Color drop-down field, select Custom. The Custom Color dialog box opens.

18. Set the following values:

g Red = 200

g Green = 116

g Blue = 90

19. Click OK to close the Custom Color dialog box.

20. Click OK to close the Conditional Formatting Rules dialog box.

Be sure your values

match those shown here

Be sure your values

match those shown here

Identifying Funds with Consistent Top Performance Exercise 24: Generate a Scorecard for a set of investments

Morningstar Direct December 2017 59

© 2017 Morningstar. All Rights Reserved.

Exercise 24: Generate

a Scorecard for a

set of investments

Conditional formatting is helpful, but it still is not clear which funds have actually

performed consistently well. Remember, your manager stated that to be considered a

top performer, a fund had to be in the top quartile at least 75% of the time over these

time periods. This calculation can be done with the Scorecard feature. A new column

will be added to each time period, as well as to the right side of the report for the Total

Score of each fund across these time periods.

In this instance, each time a fund appears in the top quartile of its category for a time

period, it will be given a score of one point. If it is not in the top quartile, it will not

receive any points. Once you add a scorecard to a performance report, you will need to

recalculate the report.

To create a Scorecard for this set of investments, do the following:

1. From the toolbar above the grid view, from the Edit drop-down field, select Scorecard.

The Investment Scorecard dialog box opens.

2. In the Scoring Type area, select the Custom Scoring option.

Note: When the Performance Reporting warning message opens related to all formatting

being lost, click Yes.

3. In the Performance Factors area, click Add Score. The Custom Score Setting dialog

box

opens.

Select this option from the

Edit icon’s drop-down field

Use this icon to

create your

custom scorecard

Be sure to select

this option to

create your own

scoring rules

Exercise 24: Generate a Scorecard for a set of investments Identifying Funds with Consistent Top Performance

60 Morningstar Direct December 2017

© 2017 Morningstar. All Rights Reserved.

4. The Time Period field should read All Time Periods. From the Data Point/Rank Selected

drop-down field, select Return: Peer group %.

5. In row 1, enter the following values:

6. Click OK to close the Custom Score Setting dialog box.

7. Click OK to close the Investment Scorecard dialog box.

8. From the toolbar above the spreadsheet grid, click Calculate.

Operator Value1 Score Display

<= 25 1 1

Note the

highlighted values

for this rule

Because the parameters of

the report have changed,

you need to recalculate it

Identifying Funds with Consistent Top Performance Exercise 24: Generate a Scorecard for a set of investments

Morningstar Direct December 2017 61

© 2017 Morningstar. All Rights Reserved.

9. When the confirmation message opens, click Yes to view the report.

10. To see only the scores, from the toolbar above the grid view, from the View drop-down

field, select Score Columns. Note

the new Total Score column on the far right side.

Select this option

to see only the

score columns for

the report

The Total Score

column has

been added to

the report

Exercise 25: Add a summary column for various scores Identifying Funds with Consistent Top Performance

62 Morningstar Direct December 2017

© 2017 Morningstar. All Rights Reserved.

Exercise 25: Add a

summary column

for various scores

The information in the score columns is useful, but it would be nice to summarize the

scores, and then analyze the funds. How many have been truly consistent over all 25

time periods? Do the following:

1. From the toolbar above the spreadsheet grid, from the Edit drop-down field, select

Scorecard. The Investment Scorecard window opens.

2. From the toolbar in the Performance Factors section, click Add Score. The Custom Score

Setting dialog box opens.

As before, use this

option to create a

scorecard column

Click this button to

create an additional

score column

Identifying Funds with Consistent Top Performance Exercise 25: Add a summary column for various scores

Morningstar Direct December 2017 63

© 2017 Morningstar. All Rights Reserved.

3. From the Time Period drop-down field, select Score. The Data Point/Rank Selected

drop-down field should show Total Score.

4. In row 1 under Default Display, enter the following values:

5. Click Insert Rule to create the following rule:

6. Click OK to close the Custom Score Setting dialog box.

7. Click OK to close the Investment Scorecard window.

8. From the toolbar above the grid view, click Calculate.

9. When the confirmation message opens, click Yes to view the report.

10. Scroll to the right and double-click the Total Score column header to sort the content

of this column.

Operator Value1 Display

= 25 Consistent Performer

Operator Value1 Display

<25Do Not Consider

Select this option to

summarize the

scores on the report

Exercise 26: Save investments to a list Identifying Funds with Consistent Top Performance

64 Morningstar Direct December 2017

© 2017 Morningstar. All Rights Reserved.

Exercise 26: Save

investments to a list

Now that you know which funds should be considered consistent top performers, you

can do further analysis on the portfolio of each one. The first step is to save these items

to a list. Do the following:

1. For each fund in the Large Growth category marked as a Consistent Top Performer in the

Total Score column, click the checkbox to the left of its row number

2. From the toolbar, from the Save drop-down field, select Save as Investment List. The

Save As dialog box opens.

3. In the Name field, type Large Growth Consistent Performers.

4. Click OK.

You have now successfully generated a Performance Report, and saved the securities

to a list for further analysis. To conduct that analysis, you will use the Portfolio Analysis

module, which is covered in the next section.

Be sure to select

the correct option

to save these

items to an

investment list

Using Portfolio Attribution to Understand Performance Overview

Morningstar Direct December 2017 65

© 2017 Morningstar. All Rights Reserved.

Using Portfolio Attribution to Understand Performance

OverviewNow that you have a list of funds to examine, you can begin to explore how they have

achieved their success, particularly in the past year. Can the funds’ success be credited

to an overexposure to Financial Services and Technology, or being underexposed to

Energy and Real Estate? Maybe both? The Portfolio Analysis module in Morningstar

Direct allows you to conduct this type of attribution exploration.

ScenarioYour manager has asked you to investigate the Large Growth Consistent Performers list

you saved from the performance report you created. Which fund has the highest active

return? What investment decisions can account for this? Did the manager make any

missteps in selecting different stocks or sector investments?

SolutionThe steps to accomplish your assignment are as follows:

1. Use the Portfolio Analysis tool in Morningstar Direct Cloud to analyze the funds on the

list you saved in Performance Reporting.

2. Display the Attribution worksheet on the dashboard view, then drill down on a specific

fund to conduct further attribution analysis.

3. Select, configure, and navigate through the Attribution workspace to investigate the fund

and provide insightful analysis to your manager on the fund’s return over the past year.

A report created in

Performance Reporting

can be analyzed in

Portfolio Analysis

Exercise 27: Opening a list in Portfolio Analysis Using Portfolio Attribution to Understand Performance

66 Morningstar Direct December 2017

© 2017 Morningstar. All Rights Reserved.

Exercise 27: Opening a

list in Portfolio Analysis

Rather than manually re-creating the list of funds in Portfolio Analysis, you can simply

recall the list you saved.

Do the following:

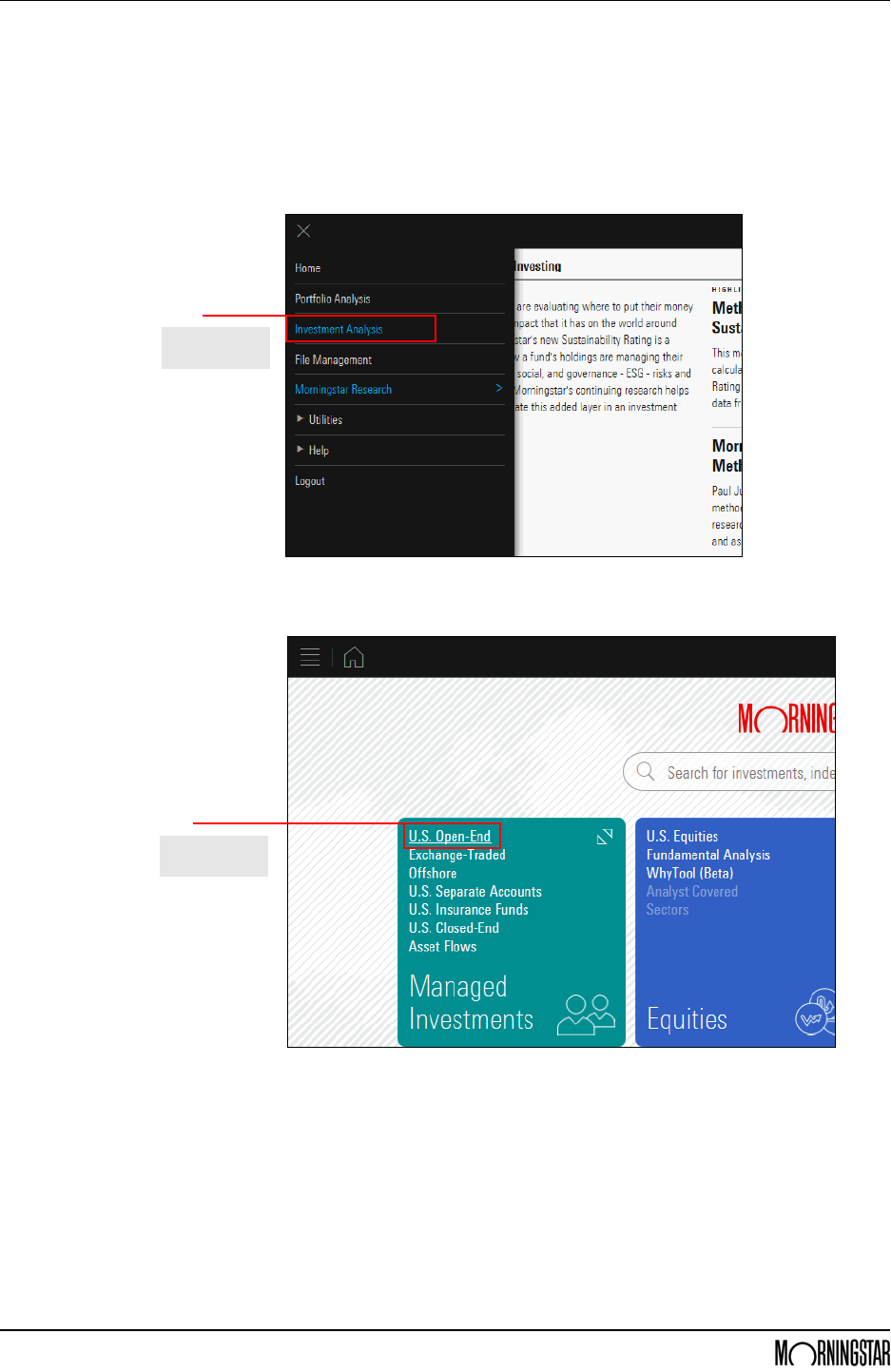

1. Log in to Morningstar Direct Cloud at http://direct.morningstar.com, using the same

credentials you use to log in to the desktop version of Morningstar Direct.

2. On the Portfolio tile, click Monitoring. The dashboard mode of the Portfolio Analysis

tool

opens.

Note: You may be asked to log in again. If necessary, close the Release Notes window once

the Portfolio Analysis tool opens

.

3. From the Investment List drop-down field in the upper-left corner of the screen, select

Investment Lists…Large Growth Consistent Performers. The funds from the list

automatically show in the dashboard.

Select this link to access

the Portfolio Analysis tool

Select the list from the

correct section of

this drop-down field

Using Portfolio Attribution to Understand Performance Exercise 28: Viewing attribution data in Portfolio Analysis

Morningstar Direct December 2017 67

© 2017 Morningstar. All Rights Reserved.

Exercise 28: Viewing

attribution data in

Portfolio Analysis

Now you need to ensure the Attribution workspace is displaying these funds. To see

the attribution analysis for this list of funds, do the following:

1. From the toolbar at the top of the window, from the Column Set drop-down field, select

Open. The Open dialog box opens.

2. In the Morningstar Column Sets list, select Attribution.

3. Click Open. The attribution data points now show in the dashboard.

This option

allows you to

open an existing

set of columns

Be sure to select the correct

option under Morningstar

Column Sets

Exercise 29: Adjusting the benchmark for attribution analysis Using Portfolio Attribution to Understand Performance

68 Morningstar Direct December 2017

© 2017 Morningstar. All Rights Reserved.

Exercise 29: Adjusting

the benchmark for

attribution analysis

One of the keys to conducting Attribution Analysis is to ensure you are using a

comparison benchmark for which you have constituent rights to see the holdings for

the index. If you do not have the rights to see constituent data for an index, the

Attribution data points cannot be calculated for the funds you are reviewing. You can

address this issue the following ways:

g Work with your Morningstar Client Service Consultant to enable those indexes for

which you do have constituent rights in

Morningstar Direct so you can see this

data in the Portfolio Analysis module (and elsewhere, such as Presentation

Studio).

g Use an ETF proxy instead of an index for attribution analysis, or

g Use a Morningstar Index as the comparison benchmark when conducting

attribution analysis. Because you are a Morningstar Direct subscriber, you

automatically have constituent rights to all Morningstar Indexes.

To use the Morningstar index for each fund, do the following:

1. In the header row at the top of the grid view, check the checkbox at the far left. This

selects all rows in the list.

2. From the Benchmark drop-down field for row 1, select Morningstar Index. The

workspace recalculates all rows.

Click this checkbox to

select all rows

Select this option from

the drop-down field

Using Portfolio Attribution to Understand Performance Exercise 30: Adjusting the time period reflected in a workspace

Morningstar Direct December 2017 69