Consumer Packaged Goods Practice

How COVID-19 is

changing the world

of beauty

The beauty industry has been resilient in the past. Could this

crisis have a different outcome?

May 2020

© ??????/Getty Images

by Emily Gerstell, Sophie Marchessou, Jennifer Schmidt, and Emma Spagnuolo

The global beauty industry (comprising skin care,

color cosmetics, hair care, fragrances, and personal

care) has been shocked by the COVID19 crisis.

First-quarter sales have been weak, and there have

been widespread store closures.

The industry has responded positively to the crisis,

with brands switching their manufacturing to

produce hand sanitizers and cleaning agents and

offering free beauty services for frontline response

workers. At the same time, the industry’s leaders

have a responsibility to do their best to ensure that

their companies survive. The global beauty industry

generates $500 billion in sales a year and accounts

for millions of jobs, directly and indirectly. Lives

come first, but livelihoods also matter.

This article examines the likely effects of

COVID19 on the beauty industry over the next

three to six months. Then it explores how the crisis

could fundamentally change the industry in the

long term—and how retailers, strategic players,

and investors can adapt. In many cases, it draws

from the results of a McKinsey Global Consumer

Sentiment Survey that took place in early April.

The short-term outlook for the

beauty industry

Beauty may be in the eye of the beholder, but there

is little debate when it comes to the long-term

attractiveness of the global beauty industry. Not

only has it grown steadily, it has created generations

of loyal consumers. During the 2008 financial crisis,

spending in the industry only fell slightly and fully

bounced back by 2010 (Exhibit 1).

Even though the economic magnitude of the

COVID19 pandemic on brands and retailers will be

far greater than any recession, there are signs that

the beauty industry may once again prove relatively

resilient. In China, the industry’s February sales fell

up to 80 percent compared with 2019. In March,

the year-on-year decline was 20 percent—a rapid

rebound under the circumstances. In a variety

of markets, consumers report they intend to

spend less on beauty products in the near term

(largely driven by declines in spending on color

cosmetics) but more than they will in other

discretionary categories, such as footwear and

clothing (Exhibit 2). Noting the uptick in lipstick

sales seen during the 2001 recession, Leonard

Lauder of the cosmetics company coined the term

“lipstick index” to describe this phenomenon. The

principle is that people see lipstick as an affordable

luxury, and sales therefore tend to stay strong, even

in times of duress.

McKinsey has explored nine scenarios for the

economy over the next few years, based on

epidemiological trends and the effectiveness of

economic-policy decisions. Based on the scenarios

most expected by global executives and current

trends, we estimate global beauty-industry

revenues could fall 20 to 30 percent in 2020. In the

United States, if there is a COVID19 recurrence

later in the year, the decline could be as much as

35 percent (Exhibit 3).

We looked at the beauty industry’s recovery against

each scenario, considering two key factors: where

and how beauty products are being sold and what is

being purchased.

Where and how beauty products are being sold

In most major beauty-industry markets, in-store

shopping accounted for up to 85 percent of beauty-

product purchases prior to the COVID19 crisis, with

some variation by subcategory. Even online-savvy

American millennials and Gen Zers (those born

between 1980 and 1996) made close to 60 percent

of their purchases in stores (Exhibit 4). With

the closure of premium beauty-product outlets

because of COVID19, approximately 30 percent

of the beauty-industry market was shut down.

Some of these stores will never open again, and

new openings will likely be delayed for at least

a year.

2 How COVID-19 is changing the world of beauty

Exhibit 1

GES 2020

COVID Beauty

Exhibit 1 of 5

The global beauty-industry market has been consistently resilient.

Note: Figures may not sum to listed totals, because of rounding.

1

Includes bath, hair-care, men’s shaving, oral-care, shower, and adults’ sun-care products; deodorants; and depilatories.

Source: Euromonitor

Global beauty-industry retail sales, $ billion

2005

134

37

28

267

68

141

38

30

281

+5.0% +3.2% +4.1% +4.6%

72

148

40

32

297

77

154

42

33

309

81

159

43

33

319

84

165

44

35

332

88

174

46

37

349

92

182

49

38

367

97

190

51

40

383

102

198

54

42

400

106

205

58

43

418

111

211

63

45

436

117

218

67

47

455

123

227

70

49

477

132

236

72

51

500

140

2006 2007 2008 2009 2010 2011 2012 2013 2014 2016 2017 20182015 2019

Personal-care

products

1

Skin-care

products

Color cosmetics

Fragrances

1

Priya Rao, “How Sephora is incubating the ‘next guard’ online,” Glossy, April 14, 2020, glossy.co.

Here are several ways beauty-product sales

are changing:

— Increased online sales are not offsetting the

decline in in-store sales. Some beauty-product

brands and retailers with inventory and shipment

operations ready to scale up are reporting

e-commerce sales twice as high as their pre-

COVID19 levels. Overall, we think 20 to 30

percent growth will be more typical. Sephora’s US

online sales are reportedly up 30 percent versus

2019,

1

as were Amazon’s beauty-product sales

for the four-week period ending April 11. In China,

McKinsey research has seen online revenues for

beauty-industry players rise 20 to 30 percent

during the outbreak. These figures are in line with

what beauty-product consumers are reporting in

McKinsey COVID19 Consumer Pulse Surveys.

— Beauty-product sales at essential retailers

are down. While brick-and-mortar drugstores

and mass-market and grocery stores remain

open, their customer traffic and revenues have

plummeted. The Boots UK drugstore chain

reported its overall sales fell by two-thirds

between March 25 and April 3, 2020, with

beauty-product revenues contributing to the

decline. Surveyed UK consumers say they expect

to spend around 50 percent less on beauty

products than usual in the next two weeks.

3How COVID-19 is changing the world of beauty

— China shows the return to in-store shopping

could be slow and differentiated. Despite

store reopenings in China starting the week of

March 13 and reports of “revenge spending,”

sales have not fully bounced back. As of mid-

April, 90 percent of drugstores, supermarkets,

beauty-product specialty retailers, and

department stores in China had reopened.

However, depending on the sector and type

of store, traffic remains down 9 to 43 percent

compared with pre-COVID19 levels. Mall-based

stores have proven slower to recover. Even after

reopening, around 60 percent of large malls

in China report a 30 to 70 percent decrease in

sales, year on year, in the first quarter of 2020.

— Retailers and brands are turning to promotions

to bring in consumers and clear inventory. In an

uncharacteristic move, several prestige brands

are offering discounts online of up to 40 percent,

competing with specialty beauty-product

and department stores to capture promotion-

oriented consumers. Promotions also help move

unsold seasonal inventory. As beauty-product

brick-and-mortar stores reopen, we expect

to see more promotions aimed at reclaiming

customer foot traffic.

Which beauty products are being purchased

Given the realities of working from home, physical

distancing, and mask wearing, it has become much

less important to wear makeup and fragrance.

For prestige brands, we see 55 and 75 percent

declines in cosmetic and fragrance purchasing,

respectively, versus a year ago. When consumers

do return to work, many will continue to wear masks,

further slowing makeup’s recovery. One possible

exception is above-the-mask treatments. In China,

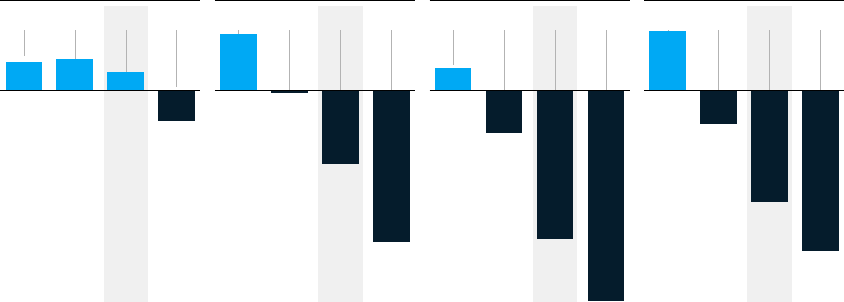

Exhibit 2

GES 2020

COVID Beauty

Exhibit 2 of 5

Global consumers intend to spend less on beauty products, but other categories

could fare even worse.

1

Net intent calculated by subtracting % of respondents stating they expect to decrease spend from % of respondents stating they expect

to increase spend. Question: Over the next 2 weeks, do you expect that you will spend more, about the same, or less money on these

categories than usual?

Source: McKinsey COVID-19 Consumer Pulse Surveys, results sampled and weighted to match general population aged ≥18 years:

Apr 15–19, 2020, in China (including Hubei province) (n = 1,896); Apr 17–19, 2020, in Japan (n = 600); Apr 18–19, 2020, in UK (n = 1,005);

Apr 20–26, 2020, in US (n = 1,484)

Expected spend per category over next 2 weeks compared with usual,

net intent

1

A

A Groceries B Personal-care products C Skin-care products/makeup D Apparel

B C D A B C D A B C D A

China Japan UK US

B C D

9

10

6

–10

–1

18

–24

–14

–11

–49

7

–48

–68

19

–36

–52

4 How COVID-19 is changing the world of beauty

Alibaba reported eye-cosmetic sales increased

150 percent, month over month, during the week of

February 18, 2020.

2

By contrast, skin-care, hair-care, and bath-and-

body products appear to be benefiting from

self-care and pampering trends. NPD, which

tracks consumer spending and point-of-sale data,

recorded that sales of luxury hand soap in France

were up 800 percent the week of March 16, 2020,

as the country went into lockdown.

3

Zalando,

Europe’s largest fashion and lifestyle e-commerce

marketplace, reported a boom in pampering and

self-care beauty categories, including candles,

aromatherapy, and detox products; sales of skin-,

nail-, and hair-care products were up 300 percent,

year on year.

4

That is consistent with results from

Amazon, for which most makeup sales in the United

States are showing slight declines, compared with

the same month in 2019, while sales for nail-care

products (218 percent), hair coloring (172 percent),

and bath-and-body products (65 percent) are way

up (Exhibit 5).

Another notable trend is the rise of do-it-yourself

(DIY) beauty care. Many beauty salons have closed,

and even in places where they have not, consumers

are forgoing services because of concerns about

close physical contact. In addition, many consumers

will likely face economic difficulties after the

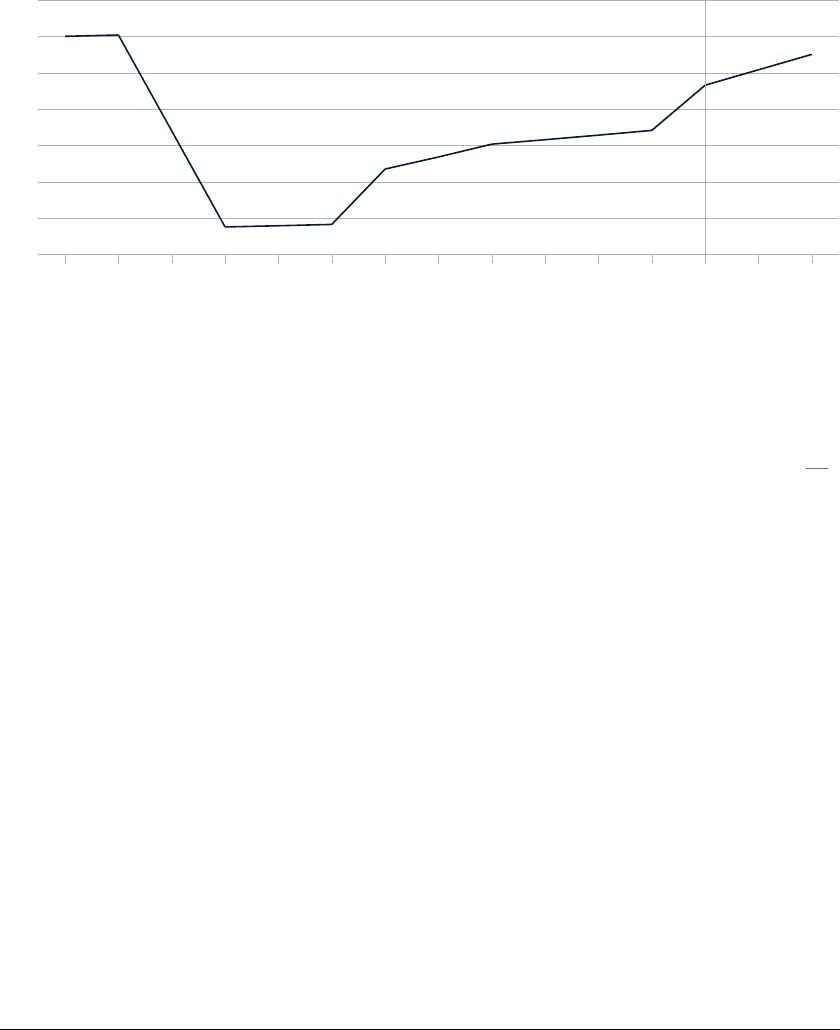

Exhibit 3

GES 2020

COVID Beauty

Exhibit 3 of 5

If there is a COVID-19 recurrence later this year, US beauty-industry revenue

could fall by as much as 35 percent.

1

Estimate based on McKinsey economic-impact scenario A1 (virus recurrence).

Source: Daxue Consulting; Earnest Research; National Electronic Disease Surveillance System Base System; “Safeguarding our lives and

our livelihoods: The imperative of our time,” Mar 2020, McKinsey.com; McKinsey COVID-19 US Consumer Pulse Survey, Mar 16–17, 2020;

McKinsey analysis

Monthly beauty-product sales compared with 2019,

%

1

–60

–50

–40

–30

–20

–10

0

10

Jan Feb Mar Apr May June July Aug Sept Oct Nov Dec Jan

2020 2021

Feb Mar

–25 to –35% ~50% 8–20 weeks Q1 2022

change year over year drop in peak sales

year over year

of store closures

(with rolling openings)

before return to

precrisis level

2

Christine Chou, “Huda Beauty catches the eyes of Chines consumers,” Alizila, March 30, 2020, alizila.com.

3

“Confinement: Mauvaise passe pour les produits de beauté haut de gamme ... à deux exceptions près [in French],” Fashion Network,

April 10, 2020, fr.fashionetwork.com.

4

“What Zalando customers are buying as they’re asked to stay home,” Zalando, April 16, 2020, corporate.zalando.com.

5

How COVID-19 is changing the world of beauty

COVID19 crisis, given the loss of jobs and savings.

In McKinsey’s survey of UK consumers, 66 percent

believe their finances will be affected for at least

two months because of COVID19, and 36 percent

say they are cutting back on spending.

As a result, DIY hair coloring, nail care, and care in

other beauty categories are finding new customers.

In the United States, Nielsen reported rises in the

sales of hair dye and hair clippers by 23 and 166

percent, respectively, in the first week of April 2020

versus a year ago.

5

Sales of Madison Reed at-home

hair-coloring kits rose tenfold from mid-March to

mid-April.

6

In the United Kingdom, online sales of

prestige-brand nail polish have seen double-digit

growth every week since lockdown began in March.

This surge in DIY nail care has some speculating

that the current crisis’s lipstick effect has an added

dimension—the “nail-polish effect.”

7

The long-term impact of COVID-19

on the beauty industry

Some changes resulting from the COVID19 crisis

are likely to be permanent. Here are three areas in

which the pandemic could alter the beauty industry

in fundamental ways:

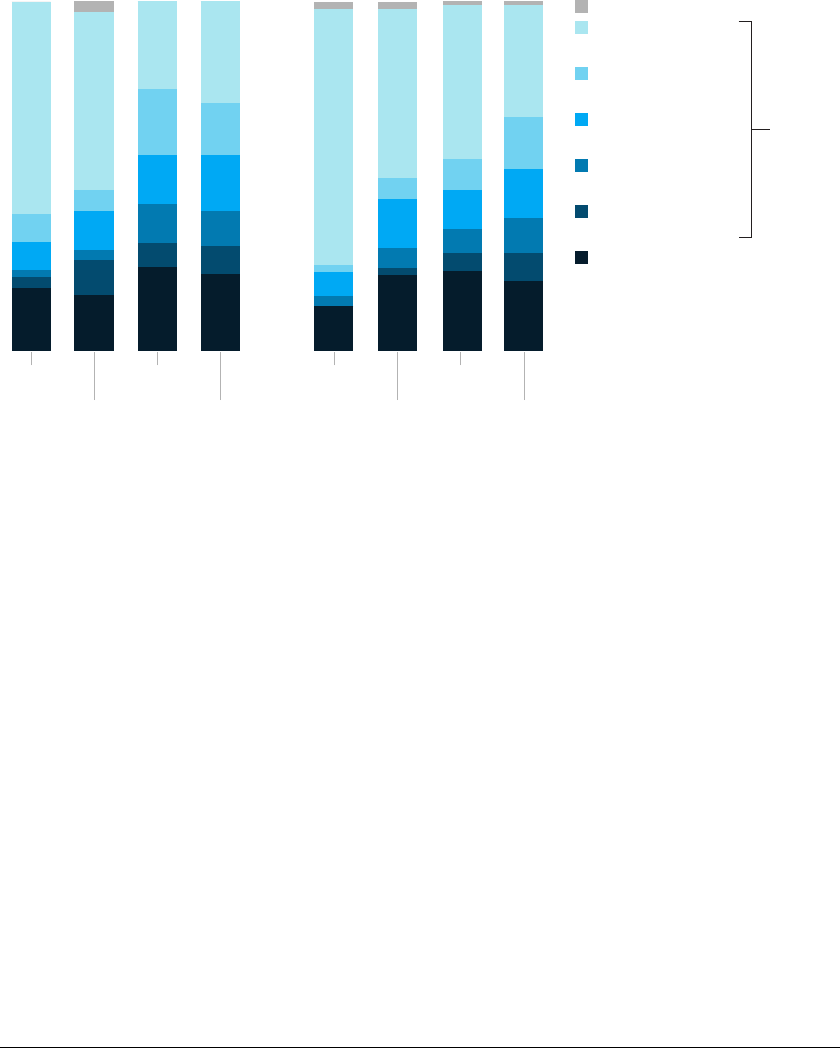

Exhibit 4

GES 2020

COVID Beauty

Exhibit 4 of 5

Some beauty-product sales are shifting online, but the store still has a critical

role to play.

Note: Figures may not sum to 100%, because of rounding.

1

Question: How do you purchase [cosmetics and skin-care products] most often? (n = 10,000).

Source: McKinsey New Age of the Consumer Generational Survey 2019

Shopping habits, by age group, % of respondents

1

Other

Baby

boomers

Millennials

Gen Xers Gen Zers

Baby

boomers

Cosmetics Skin-care products

Millennials

Gen Xers Gen Zers

Store

inuenced

Browse in store;

buy in store

Browse online;

buy in store

Browse in store and

online; buy in store

Browse in store and

online; buy online

Browse in store;

buy online

Browse online;

buy online

18

16

24

7

11

10

3

2

8

8

60

11

14

19

25

22

8

10

16

15

29

22

6

14

6

49

13

7

2

74

2 2 1 1

6

51

3

23

7

11

9

44

5

20

10

14

15

32

8

3

3

2

5

Alicia Wallace, “Walmart CEO says we’re in the ‘hair color’ phase of panic buying,” CNN Business, April 11, 2020, cnn.com.

6

Megan Cerullo, “Sales of hair-dye kits jump as stuck-at-home workers cut off from salons,” CBS News, March 27, 2020, cbsnews.com.

7

Sandra Halliday, “Nail care is the UK’s ‘lipstick effect’ in Covid-19 crisis, French brands benefit,” Fashion Network, April 8, 2020,

us.fashionnetwork.com.

6

How COVID-19 is changing the world of beauty

— Digital continues to rise. Pre-COVID19 trends

will likely accelerate, with direct-to-consumer

e-commerce, such as brands’ websites,

shoppable social-media platforms, and

marketplaces becoming more important. Across

the globe, consumers indicate they are likely to

increase their online engagement and spending.

Beauty-industry players will need to prioritize

digital channels to capture and convert the

attention of existing and new customers. On the

operations side, the use of artificial intelligence

for testing, discovery, and customization will

need to accelerate as concerns about safety and

hygiene fundamentally disrupt product testing

and in-person consultations.

— The pace of innovation accelerates. As the

COVID19 crisis has shown, the world can

change quickly, bringing substantial shifts in

demand. Sometimes, supply cannot catch up.

Even before the pandemic, brands were under

pressure to overhaul their product-innovation

pipelines, inspired by the ability of digital-native

direct-to-consumer brands to go from concept

to cupboard in less than a month. Now, the need

for speed is even greater. To achieve it, there

may be a greater role for contract manufacturers,

both to diversify (and thus reduce production

risks) and to serve as thought partners in

product innovation. There is also potential

for closer collaboration—among brands and

Exhibit 5

GES 2020

COVID Beauty

Exhibit 5 of 5

Do-it-yourself and self-care beauty products are growing quickly in the

United States.

Note: From Amazon results.

1

Includes fragrances and sun-care and tanning products.

Source: Stackline

Body wash, soap, and lotion

Estimated

year-to-date

sales, $ million

Average

price, $Beauty-product category

Average

price, %

Retail

sales, %

Year-over-year change, 2019–20,

4 weeks ending April 11

Retail sales,

$ million

Nail care

Hair care

Men’s grooming

Skin care

Hair coloring

Women’s hair removal

Eye makeup

Face makeup

Lip care and color

Beauty tools, devices, and accessories

Total beauty products

1

–6

172

44

37

33

28

27

17

9

1

–1

–2

N/A

–11

–12

6

–3

–12

–15

–14

–14

–21

–28

16

–7

28

65

218

27

56

20

172

53

5

–3

–15

16.60

N/A2,632

14.10

15.02

18.43

25.44

18.17

13.64

16.15

12.30

13.87

8.97

316

321

123

540

240

540

58

74

82

77

55

Do-it-yourself and

self-care products

7How COVID-19 is changing the world of beauty

retailers, in particular—through data sharing and

inventory pooling.

— M&A rises as multiples fall. With the COVID19

crisis causing significant damage to the balance

sheets of brands, retailers, and suppliers, many

companies will need to find new sources of

capital. At the same time, given the hits to

revenues and the global economy, multiples

could fall from precrisis levels, when some

brands were trading for more than eight times

revenue or 10 to 15 times earnings.

While the beauty industry may be in a relatively

stronger position than other consumer categories,

2020 will be one of the worst years it has ever

endured. We believe, however, that the industry

will remain attractive in the long run. The COVID19

crisis is likely to accelerate trends that were already

shaping the market, such as the rise of the global

middle class and the use of e-commerce, rather

than mark entirely new ground. Consumers across

the globe are showing by their actions that they still

find comfort in the simple pleasures of a “self-care

Sunday” or a swipe of lipstick before a Zoom meeting.

Even before the pandemic, the definition of

“beauty” was becoming more global, expansive, and

intertwined with individuals’ sense of well-being.

The COVID19 crisis is not likely to change these

trends—and in that, there is reason for hope.

Even before the pandemic, brands

were under pressure to overhaul their

product-innovation pipelines. Now, the

need for speed is even greater.

Designed by Global Editorial Services

Copyright © 2020 McKinsey & Company. All rights reserved.

Emily Gerstell and Emma Spagnuolo are associate partners in McKinsey’s New Jersey office, Sophie Marchessou is a

partner in the Paris office, and Jennifer Schmidt is a senior partner in the Minneapolis office.

The authors wish to thank Sara Hudson, Aimee Kim, Dale Kim, Sajal Kohli, Jessica Moulton, Kelsey Robinson, Tom Skiles, Kristi

Weaver, and Daniel Zipser for their contributions to this article.

8 How COVID-19 is changing the world of beauty