In this report

How do companies target

Millennials who no longer

trust traditional advertising?

How important are payment

options in India? Which

countries are most likely to

buy from foreign websites?

Where are consumers

willing to buy groceries

online? In this report we

answer these and other

questions that can help

inform an online strategy

that is more targeted,

effective and customer-

centric.

Foreword

Enabled by technology, the continued year over year growth in online shopping has

been fueled by a new generation of consumers who want greater convenience,

value and options. For consumer businesses, this trend poses both challenges and

significant opportunities.

Competition is no longer limited to local shops during business hours. Consumers

today are shopping all the time and everywhere; and in a truly global online

marketplace, products can easily be purchased from retailers and manufacturers

located anywhere in the world—or from those with no physical retail locations at all.

Consumer demand for richer experiences and greater convenience means that

retailers need to rethink their strategy, both online and in stores. Having the right

product mix is no longer sufficient to attract the new wave of consumers including

Millennials, who are entirely focused on one transaction—theirs. Creating an online

shopping experience enhanced by technology such as augmented and virtual reality

or 3D is becoming at least as important as providing convenient and personalized

ordering, payment and delivery options.

However, despite the rise of online shopping, ecommerce still makes up a relatively

small percentage of total retail spending. Retailers’ brick and mortar strategies also

need to evolve to continue to draw customers into their stores, and to compete

with the online retailers opening their own physical outlets. Increasingly, we are

seeing innovative marketing strategies, as well as new technologies such as smart

shelves, robots, self-checkout, and interactive and virtual reality, being deployed in

stores as retailers strive to compete on all fronts.

Finding the ‘right’ strategy starts with one question: Given your brand promise,

where do you want to compete? Only once a company understands their goals,

customers and those customers’ needs can an appropriate strategy be designed.

And the key to a sustainable strategy is being able to understand and meet customer

needs both today and tomorrow, across geographies, and across generations.

In this report, we aim to raise and answer some questions about your company’s

approach to ecommerce. Our global research on online consumer behaviors,

preferences and attitudes can be leveraged by consumer companies seeking to

improve their approach towards winning and retaining customers online.

I hope you find this report interesting and insightful. I would like to thank the survey

respondents, company executives, and KPMG professionals who invested their

time and insights to make this study possible.

To learn more about this research, please visit kpmg.com/onlineconsumers or

contact a member of KPMG directly.

Sincerely,

Willy Kruh

Global Chair, Consumer Markets

KPMG International

©2017 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated.

2017 Global Online Consumer Report 1

Contents

What do consumers really want? ......................................................2

The dilemma .....................................................................................2

What 18,430 consumers told us .......................................................3

Online purchase behavior

...................................................................4

Online shopping as a rising trend ......................................................4

Product category trends....................................................................6

Rise of international trade and e-tailers.............................................8

Device preference trends ................................................................12

The path to purchase journey

...........................................................14

Stage 1 — Awareness: triggers and influencers ............................. 15

Stage 2 — Consideration: product and company research .............16

Stage 3 — Conversion: deciding where and when to buy ..............20

Stage 4 — Evaluation: experience and feedback ............................22

Cycle duration .................................................................................24

Understanding consumer attitudes and motivations

....................27

What’s driving the shift to online? ................................................... 27

Overcoming the hurdles to selling online........................................28

Winning the online consumer .........................................................29

Payment options need to be regionally tailored ..............................30

Building consumer trust ..................................................................33

Are experience and trust enough to earn consumer loyalty? .......... 34

How KPMG can help

.........................................................................35

About KPMG

......................................................................................36

Contact us

......................................................................................Back

©2017 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated.

2 2017 Global Online Consumer Report

What do

consumers

really want?

Advances in technology, logistics, payments and

trust — coupled with increasing internet and mobile

access and consumer demand for convenience —

have created a US$1.9 trillion global online shopping

arena, where millions of consumers no longer ‘go’

shopping, but literally ‘are’ shopping — at every

moment and everywhere.

A recent report by KPMG International

titled ‘Seeking customer centricity

through omni business models’

1

, looked

at how consumer and retail businesses

are transforming to adapt to the shift

from traditional shop-centric business

models to a new world where the

customer is increasingly at the center

of a perpetual shopping experience. In

this ‘customer-centric’ reality, retailers

need to be exceptionally sensitive

and responsive to when and where

their potential customers are making

purchase decisions (both consciously

and subconsciously) throughout their

‘always on’ shopping journey.

The dilemma

The burning question is, how can

consumer and retail companies achieve

this nirvana of consumer mindreading?

How can they identify and keep pace

with the behaviors and preferences of

customers today and tomorrow? How

can they ensure their online strategy

is acutely tailored to attract and win

the diverse and dynamic customer

segments they serve?

1

https://www.kpmg.com/cmsurvey

©2017 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated.

2017 Global Online Consumer Report 3

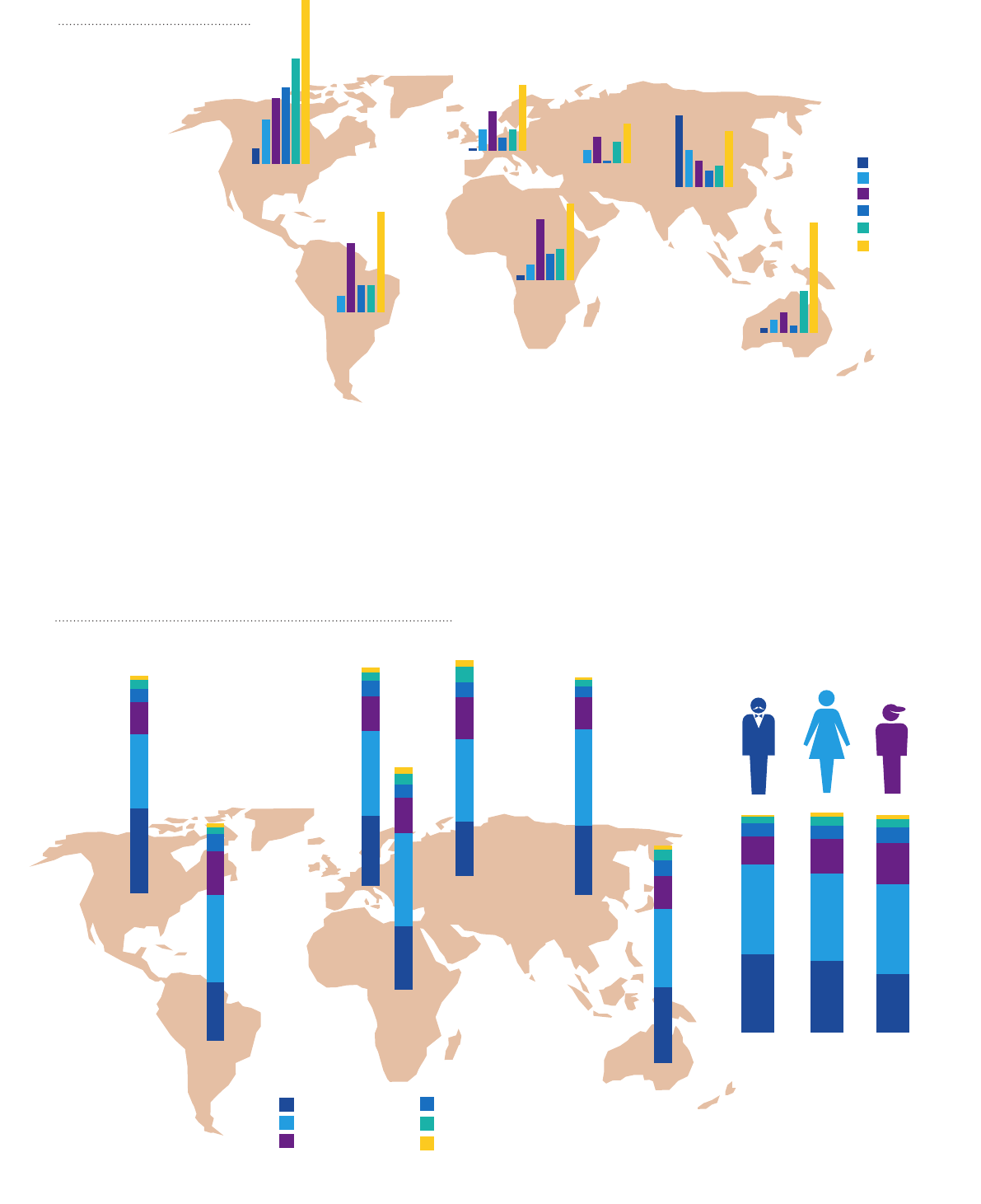

What 18,430 consumers told us

During 2016, KPMG conducted an

international study on consumer

behaviors and preferences related to

online shopping. The research was

largely based on an online survey of

18,430 consumers living in more than

50 countries. The respondents were

between the ages of 15 and 70, each

having purchased at least one consumer

product online in the past 12 months.

In addition to scrutinizing their online

shopping behaviors, preferences, and

decision processes, the study also

explored consumers’ plans for future

online purchases, factors affecting trust

and loyalty towards certain brands, and

their sentiments and attitudes towards

the companies that they do, or don’t,

choose to buy from.

The ultimate purpose of this research

was to provide consumer goods and

retail companies with the global and

local insights into the specific behaviors

and preferences of the customers

they want to target. By understanding

the uniqueness of different customer

segments, companies can tailor their

online strategies for maximum success.

The depth of the data collected for this

study makes it possible for companies

to analyze and forecast the behaviors

and preferences of their customers

by geography, generation (Millennials,

Generation X or Baby Boomers) and/

or product category. The number of

ways to filter and classify the data is

too copious to summarize in a single

report, so in the following sections

we provide an overview of the global

results, highlighting the most significant

or interesting trends and comparisons

among the major demographic groups

and product categories.

Executives interested in receiving more

detailed insights are invited to contact

KPMG to have a member of our team

filter and analyze the full set of data

according to your specific requirements

or target markets.

Baby Boomers

Born 1946-1965

Generation X

Born 1966-1981

Millennials

Born 1982-2001

©2017 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated.

4 2017 Global Online Consumer Report

Online

purchase

behavior

The digital age and rise of online

shopping have driven an unprecedented

business model shift for consumer

product manufacturers and retailers.

Many traditional consumer businesses

and new start-ups alike are moving

away from models that are shop-

centric or geographically-focused, to

ones that are customer-centric and

virtually borderless. To help inform

companies tackling this transformation,

KPMG International’s recent survey of

18,430 consumers provides a unique,

comprehensive index of consumer

online shopping behaviors and

sentiments across countries, products

and generations.

Online shopping as a

rising trend

The frequency of online purchases

varies considerably by geography.

Consumers in Asia, North America and

Western Europe are most likely to shop

online, while per capita online purchases

in Eastern Europe and Russia, Latin

America, and the Middle East and Africa

are less frequent (Figure 1.0).

A Generation X are the most

active online shoppers

Among the different age groups,

Generation X consumers (born between

1966 and 1981) made more online

purchases last year than any other age

group, averaging nearly 19 transactions

per year. Interestingly, despite the

common belief that the upswing in

online shopping is largely driven by

the younger and more ’tech-savvy‘

Millennials (born between 1982 and

2001), Generation X consumers in fact

made 20 percent more purchases last

year than their younger counterparts.

Stage of life and income levels are

certainly primary factors driving

both online and offline shopping,

and Generation X consumers, many

ofwhichare more established in

their careers and building homes

Survey respondents were

required to have purchased

at least one consumer

product online in the past

12 months.

“There is a little Millennial in each of us. A number

of Baby Boomers are starting to understand and

appreciate the technology that is out there. They’re also

trying to appreciate and experience the convenience of

buying online.”

— Mark Larson, Head of Consumer and Retail, KPMG in the US

©2017 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated.

2017 Global Online Consumer Report 5

0

5

10

15

20

25

19

9.2

18.4

11.9

22.1

16.1

11

North America

Latin America

Western Europe

Africa & Middle East

Eastern Europe & Russia

Asia

Australia & New Zealand

$203

$190

$173

Baby

Boomers

Generation X Millennials

and families, are likely buying more

consumer goods than the younger

Millennials overall. As Millennials

continue to enter the workforce and

adopt new lifestyle priorities, however,

their online shopping activity is

expected to surge and even far surpass

levels currently exhibited by older

generations.

Don’t underestimate

the Baby Boomers

Compared to the digital-first Millennial

generation, it is reasonable to presume

that Baby Boomers (born between

1946 and 1965) are less inclined to shop

online. However, the Baby Boomers

surveyed in fact shopped online

just as frequently as the Millennials.

Furthermore, the Baby Boomers on

average spent more per transaction

than either of the two other younger

generation groups (Figure 1.1). This

Figure 1.0

Average number of online

transactions (per person per year)

Figure 1.1

Average amount spent per

transaction (USD)

generation was more likely to buy

healthcare products, wine, household

goods and appliances, categories which

tend to have higher price points.

Men spend more online than

women

While men and women shopped with

about equal frequencies, on average,

the men spent more per transaction—

US$220 vs. US$151 for women—on

their most recent purchase. This can

largely be attributed to the fact that

the male consumers were more

likely to buy items in higher priced

categories such as luxury goods (55

percent of luxury transactions were

by men) or electronics (72 percent of

electronics transactions were by men),

while women were more likely to buy

in lower-priced categories such as

cosmetics or food.

15.1

18.6

15.6

Baby

Boomers

Generation X

Millennials

Source: Global Online Consumer

Report, KPMG International, 2017

Source: Global Online Consumer

Report, KPMG International, 2017

©2017 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated.

6 2017 Global Online Consumer Report

Top online

products by

geography

In most countries, media,

electronics, and apparel are

among the 5 products most

often purchased online.

Product category trends

The online shopping landscape is

gradually changing in terms of the

types of products being bought online.

Generally, consumers’ planned online

purchases indicated a year over year

increase for most product categories

(Figure 1.2). These results signal a

higher willingness to buy new product

categories online, particularly those

more traditionally sold in shops. For

example, greater options for shipping

and delivery have made it easier and

more common to buy bulkier products

online—including furniture, appliances

and even vehicles. Meanwhile, although

‘easier to ship’ products such as books,

music, electronics, accessories and

apparel remain the most popular online

categories, relative growth in these

segments is expected to be minimal.

In fact, we see a possible downward

trend for books and music, currently

the number one online category,

asMillennials purchase these items

online less often than the older

generations. It will be worth watching

this particular category over the

next few years to see if Millennials’

preference for streaming

2

vs buying

media continues to put downward

pressure on online sales of books and

music, since even as Millennials get

older this is one area where buying

habits are unlikely to change.

On the other hand, bigger items such

as household goods and appliances,

furniture, home décor and sporting

goods show some of the highest

growth potential. According to

respondents’ planned online purchases

for the coming year, online sales of

household goods and appliances are

expected to increase by 3.5 percentage

points, furniture and home décor by

4.3 points and sporting goods and

equipment by 4.4 points. Telecom

products and fragrances are categories

that are also expected to grow, by 4.5

and 2.8 percentage points respectively,

as are wine, liquor and art.

In general, growth categories tend to

be those which do not need trial and/or

where consumers can have relatively

more faith in product quality.

Books and

music

Electronics

Apparel

Apparel

2

https://www.purposegeneration.com/buzz/article/streaming-the-future-millennials-and-media

“Clearly, ecommerce has been growing globally

across many ‘usual suspect’ categories like apparel,

books, and music. But what we are now starting

to see, and where we expect more growth, is from

categories where showrooming often occurs, such as

mobile phones and laptops, as well as furniture and

decoration items. Even in the grocery retail market we

see opportunities. Very few retailers get their online

grocery model right, but when they do, it can be very

successful. Winning companies in this segment have

focused on Millennials and young professionals,

where the focus on prepared fresh meals has been a

growth driver.”

— Willy Kruh, Global Chair, Consumer Markets,

KPMG International

©2017 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated.

2017 Global Online Consumer Report 7

Apparel

53

0.5

(0.6)

1.0

3.5

(1.0)

2.3

1.4

1.7

0.8

4.3

4.4

2.0

4.5

2.2

54

47

47

40

41

36

39

40

39

34

36

33

34

29

31

30

31

26

31

26

30

27

29

23

27

25

27

Books/

Music

Growth in

% points

Electronics/computers/

peripherals

Apparel –

women

Household goods

and appliances

Accessories

Apparel –

men

Food/

groceries

Toys/games/

video games

Cosmetics/

skin care

Furniture/

home décor

Sporting goods/

equipment

Shoes –

women

Telecommunications/

phones

Shoes –

men

22

23

20

21

18

21

20

21

15

17

13

15

12

13

14

13

12

12

11

12

9

11

10

10

5

6

Apparel –

children

0.8

1.5

2.8

1.6

2.7

1.3

0.7

(1.0)

0.8

1.0

1.5

0.8

1.1

Bags/

leather goods

Perfume/

cologne

Pharmacy/

healthcare

Wine

Shoes –

children

Fine jewelry/

watches

Baby

products

Eyewear

Pet food

and supplies

Liquor

Beer

Artwork

Figure 1.2

Actual vs planned online purchases:

Last year vs next year

Percentage that purchased the

product in the past 12 months

Percentage planning to purchase

the product in the next 12 months

Wine

Australia and

Belgium

Accessories

US, Indonesia and

Turkey

Telecom products

and men’s

footwear

India, Russia, and

the UAE

Cosmetics

Asia-Pacific, Russia

and CEE

Pharmacy and

healthcare

products

Brazil and Greece

Household

goods

Africa and the

Middle East

Groceries

UK and China

Sporting goods

Finland

Children’s

clothing, toys

and games

France

The following products were

also among the top 5 in these

geographies:

Source: Global Online Consumer

Report, KPMG International, 2017

©2017 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated.

8 2017 Global Online Consumer Report

Generational trends —

a closer look

When looking at differences by age

group to spot trends, further analysis is

required to determine when an apparent

trend indicates sustainable future

behavior, versus when it is simply due to

a difference in age or income.

For example, contrary to the earlier

example suggesting that media sales

may continue to decline even as

Millennials mature, the interpretation of

this generation’s similar lower tendency

Figure 1.3

Expected category growth by

generation: Percentage point difference

between last year and next year

to buy a category such as household

goods (Figure 1.3) is different. In this

case, fewer household goods purchases

by younger age groups is more likely

due to the ‘age effect’ or ‘cohort effect’

3

,

where behaviors are tied to age or stage

of life rather than to lasting attitudes.

In fact, as Millennials grow older, the

potential for buying household goods

online is probably quite strong.

Artwork is a small category in terms

of the percentage of total consumers

buying it online, however this category’s

online sales seem to be growing quickly

among Millennials. As Millennials’

interest in art, comfort with buying

art online, and disposable incomes all

grow, we see this as another category

showing solid potential.

Rise of international trade and

e-tailers

Cross-border shopping is on the rise

globally, driving international retail trade.

As part of this study we looked at the level

and nature of online purchases made

outside consumers’ own countries.

1.1

1.5

Baby Boomers

Generation X

Millennials

Eyewear

–.7

.5

1.9

Fine

jewelry/

watches

–2.1

.9

2

Pharmacy

/healthcare

2.5

2.1

.6

Perfume/

cologne

1.8

3.1

3.1

Bags/

leather

goods

–.7

1.4

2.8

Furniture/

home décor

2.6

4.8

4.7

1.5

1

.3

.4

2.2

2.6

5.9

3.6

2

Cosmetics/

skin care

Shoes —

women

Household

goods and

applicances

.7

–.6

–2.2

Acces-

sories

1.6

.8

–.3

Books/

music

Artwork

3

https://en.onpage.org/wiki/Cohort_Analysis

“Much of the future growth in ecommerce will be millennial-driven. In 2 or 3 years,

Millennials are forecasted to be the largest demographic in North America. As

Millennials delay leaving their parents’ house and delay getting married, they spend their

money on other things. Brands like Uber and Apple, and the craft beer industry have all

to some degree been ignited by Millennials. Grocery spending, on the other hand, has

been eclipsed by restaurant spend. Millennials like to share meals with friends—it’s all

about shared experiences.”

— Willy Kruh, Global Chair, Consumer Markets, KPMG International

Source: Global Online Consumer

Report, KPMG International, 2017

©2017 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated.

2017 Global Online Consumer Report 9

0

10

20

30

40

50

14

44

15

43

21

35

50

North America

Latin America

Western Europe

Africa & Middle East

Eastern Europe & Russia

Asia

Australia & New Zealand

Figure 1.4

Percentage of online purchases

imported from other regions

Figure 1.4 shows the percentage of online

purchases that consumers made outside

their own region. North American and

European consumers made the fewest

international purchases,14 and 15

percent respectively of their total online

purchases—not surprising given the

maturity of these markets, where the most

popular products can already be sourced

domestically at competitive prices.

Asian consumers’ imports averaged 21

percent—although it varied significantly

by country. While Hong Kong, Singapore

and Vietnam had significant imports at

31, 43 and 55 percent, respectively, of

their online purchases, other countries

such as Indonesia, Japan and India each

imported only 12 percent or less of their

online buys outside Asia. China, with 20

percent imports from outside Asia, lay

somewhere in the middle.

In Australia and New Zealand, the

percentage of online purchases

imported from outside this region

was 35 percent, with 25 percent of

those imports from North America

and Europe. The geographically more

remote location of these countries is

likely one of the key drivers.

The bottom three regions in Figure 1.4

are the markets most likely to make

international purchases online. In

Eastern Europe and Russia, 43 percent

of all online purchases were imported,

mainly from Asia (15 percent), Western

Europe (13 percent) and North America

(8 percent). In Latin America, 44 percent

of online purchases were imported,

with nearly 60 percent of those imports

from North America. African and Middle

Eastern consumers were the most likely

to import consumer products bought

online (50 percent of purchases). This

is particularly true in the UAE, where

58 percent of online purchases were

imported—with 80 percent coming from

Asia, North America and Western Europe.

In many countries, the tendency to

buy internationally is highest among

Millennials. This could indicate potential

growth for cross-border online shopping

as consumers increasingly seek unique

or specialized products from other

countries. In the US, for example,

15percent of Millennials’ recent

purchases were imported, compared

to 9 percent for Generation X and just

3 percent for Baby Boomers. It will be

interesting to see how the new US

administration’s proposed focus on

domestic protectionism might affect

the trend for younger US consumers to

shop outside the country.

Source: Global Online Consumer

Report, KPMG International, 2017

©2017 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated.

10 2017 Global Online Consumer Report

Case study

10 2017 Global Online Consumer Report

Nespresso

Roger Staeheli, Country Manager, Hong Kong

Nespresso SA was

founded by Nestlé 30

years ago, to introduce

a revolutionary system

of coffee machines and

portioned encapsulated

coffee. Initially in 1986,

the company focused

on the corporate offices

market, and a few years

later expanded to selling

direct to consumers.

Today, Nespresso’s

450 retail boutiques

can be found in 64

countries throughout

the world. Nespresso’s

boutiques are an

important branding and

sales channel for the

company, although the

fastest-growing part of

their business in some

countries such as Hong

Kong, is online.

Nespresso’s omni-channel

evolution

Roger Staeheli, Nespresso’s Country

Manager for Hong Kong, explains that

Nespresso operates autonomously

from Nestlé, due to its unique direct-

to-consumer (B2C) model that requires

the company to have their own sales

channels. The company’s four B2C

channels include: retail boutiques, an

online boutique, coffee machine trade

points, and call centers called Customer

Relationship Centers, where more than

1,000 coffee specialists offer support to

Nespresso Club members.

Nespresso’s sales channel evolution

evolved in the opposite way than

that of many similar long-standing

retailers. After initially selling through

its Customer Relationship Centers,

Nespresso launched its Nespresso

website in 1996, began to take orders

online in 1998, and opened its first retail

boutique in 2000 in the city of Paris.

According to Staeheli, this progression

from online to retail shops was born

out of necessity, rather than choice.

“Thirty years ago, coffee that was sold

at retailers was instant coffee. So we

decided to retail our own products

ourselves. We first established the

call centers then evolved into different

channels from there.”

Staeheli says the goal today is to offer

a consistent experience to customers

across all channels, both offline and

online. “It’s about consistency in the

product, price and promotion.”

©2017 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated.

Integrated channels and

customer relationships

The company is very clear on the role

of each of its channels, he says. “Retail

is very much about delivering the brand

experience. Online is about Nespresso

‘anytime, anywhere’. Trade is focused on

machine sales and is a channel through

which we can recruit new members. The

Customer Relationship Center, which

used to be a transactional channel,

today is about building relationships.”

Typically, new customers that are initially

recruited through a Nespresso boutique,

then become online customers.

Subsequently, these customers are

regularly invited back into the boutique

or shop to try new coffee innovations

to enable Nespresso to engage directly

with them. Since in most cases,

customers are also members of the

Nespresso Club, the company is able

to gain a good understanding of their

individual customers’ behaviors and

preferences, therefore enabling them to

tailor their marketing campaigns or offer

customers personalized experiences.

Offline vs. online in Hong Kong

Despite the fast growth of Nespresso’s

online channel, Staeheli highlights the

two main challenges to ecommerce

in Hong Kong. “We want to offer our

online customers greater convenience,

but going out to the shops in Hong

Kong is already very convenient, since

most households are within five to ten

minutes of a mall. So to better serve

our online customers, we offer same-

day delivery during a certain period of

the day. The other challenge for Hong

Kong then becomes the high cost of

distribution.”

2017 Global Online Consumer Report 11

“ Overseas born Australians have been a contributing factor to ecommerce growth. In

cities like Sydney, Melbourne and Brisbane with large percentages of overseas born

nationals, consumers have always been comfortable buying goods online as it was

often the only way to get the products they liked.”

— Trent Duvall, Head of Consumer Markets, KPMG in Australia

E-tailers dominate the online

marketplace

The rising power of e-tailers such as

Taobao, Alibaba or Amazon, to name

a few, is apparent around the world.

Their dominance is particularly evident

in China and India—where over 80

percent of online purchases were

from e-tailers—as well as in Japan

(69 percent), Italy (68 percent) and

South Africa (65 percent). The share for

e-tailers in these countries is far above

the global average of 50 percent.

A trend of younger consumers being

less likely than Baby Boomers to buy

from e-tailers could indicate a future

slowdown in this platform’s growth.

Fifty-four percent of Baby Boomers,

who are less prone to shop around for

price and who prefer to buy from familiar

websites, made their most recent

purchase from an e-tailer, compared to

Millennials with e-tailer purchases at 48

percent. Conversely, Millennials were

30 percent more likely than the Baby

Boomers to buy directly from a retail

shop’s website (Figure 1.5).

Figure 1.5

Where most recent purchase was made (%)

An online-only retailer

0

20

40

60

80

100

120

0

20

40

60

80

100

120

Retailer’s website

Manufacturer or brand’s website

Other

5

8

10

5

11

34

12

10

33

5

7

18

42

46

5

11

10

11

43

45

16

29

51

28

56

45

70

36

6

13

27

54

7

10

34

50

6

10

35

48

Baby

Boomers

Generation X Millennials

6

13

27

54

7

10

34

50

6

10

35

48

Baby

Boomers

Generation X Millennials

North America

Latin America

Western Europe

Africa & Middle East

Eastern Europe & Russia

Asia

Australia & New Zealand

Source: Global Online Consumer

Report, KPMG International, 2017

©2017 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated.

12 2017 Global Online Consumer Report

Figure 1.6

Preferred device for shopping online (%)

0

20

40

60

80

100

120

0

20

40

60

80

100

120

29

29

6

6

59

6

5

60

24

7

6

63

71

5

6

18

59

5

10

27

48

19

8

25

54

5

8

33

North America

Latin America

Western Europe

Africa & Middle East

Eastern Europe & Russia

Asia

Australia & New Zealand

54

11

6

29

55

8

9

28

67

4

10

20

Laptop or PC

Smartphone

Tablet

No preference

Baby

Boomers

Generation X Millennials

or laptops, while 17 percent said they

preferred to use a mobile device and 27

percent had no preference (Figure 1.6).

Device preferences varied significantly

by region, with Asian consumers being

more than twice as likely (19 percent) as

the global average (8 percent) to shop

on a smart phone. This was particularly

Device preference trends

Despite the global proliferation of

mobile smart phones and tablets,

the majority of consumers still prefer

traditional desktop PCs or laptops when

shopping online. More than half (57

percent) of online purchasers globally

said they prefer to use desktop PCs

evident in China, where 26 percent

favored a mobile device. As expected,

Millennials were the generation most

likely to use a smartphone for shopping

(11 percent of recent purchases)

although 54 percent of them still used

a laptop or desktop PC for their most

recent online purchase.

“One of the reasons that China is so mobile-centric is because third-party payment

systems using mobile apps are widely accepted in China both online and in shops.

Chinese consumers are unique in their high confidence in third-party payment systems.

Another reason is the high penetration of smartphones—largely due to the number of

local manufacturers and competitive prices. Lastly, a lot of people have leapfrogged to

ecommerce because of the lack of shops or brands available to them. The smartphone

literally brings shops to rural consumers for the first time.”

— Jessie Qian, Head of Consumer Markets, KPMG in China

Source: Global Online Consumer

Report, KPMG International, 2017

©2017 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated.

2017 Global Online Consumer Report 13

Smart phones keep offline

shoppers connected

While mobile may not be the most

preferred online sales channel, over two-

thirds of the consumers said they had

used a smartphone for product research

while in a physical shop (Figure 1.7).

This was particularly common in

Singapore (83 percent), Brazil

(79 percent), CEE (78 percent) and the

US (77 percent), whiles many European

consumers are about 10 to 15 percent

less likely than average to look up

products online while out shopping.

Millennials in all regions were more

likely than their older counterparts to

look up information on a smartphone

while out shopping (77 percent).

However, even half of the oldest

generation of respondents said they

had checked their mobile devices while

in a shop.

What were consumers looking up?

Comparing prices was the main reason

for doing online research while out

shopping, followed by looking up

product information and checking online

reviews (Figure 1.8).

“Companies should be channel agnostic, meaning it does not matter if they start with

online or offline, what matters is that all channels are interlinked to give consumers the

convenience they need. Online plays a major part in the customer journey or ROPO

(research online, purchase offline). The most successful multi-channel companies

established their online channels as early as the late nineties, went on to establish ‘click

and collect’, eradicated silos across the entire organization and established a channel

agnostic incentive program so retail staff do not consider online as a separate business.”

— Paul Martin, UK Head of Retail, KPMG in the UK

50%

70%

77%

Baby

Boomers

Generation X Millennials

Figure 1.7

Percentage of consumers that have

used their smartphone to look up a

product while in a shop

Figure 1.8

Percentage of consumers that looked

up the following information about a

product while in a shop

Price comparison with

other retailers

65%

Product information/

specifcations

61%

Online

reviews

49%

Product options

(e.g. color, size, style, etc.)

35%

Store inventory/

availability

16%

Source: Global Online Consumer

Report, KPMG International, 2017

Source: Global Online Consumer

Report, KPMG International, 2017

©2017 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated.

14 2017 Global Online Consumer Report

The path to

purchase

journey

The ‘path to purchase’ is a traditional

shopping concept that has evolved

significantly over the past decade due

to the internet, digital innovation and

the subsequent rise of online shopping.

Although the digital revolution hasn’t

altered the fact that consumers

still experience the same stages of

awareness, consideration, conversion

and evaluation, the journey itself has

changed. Instead of a path to purchase

that is traditionally linear, it has

become more of a cycle or even a web.

Consumers move through and back and

forth between the stages, influenced

by a myriad of both offline and online

factors at every stage.

In order to investigate the drivers,

motivators and inhibitors affecting

consumers’ decisions during a typical

online transaction, a simplified cyclical

path to purchase model was used for

this study (Figure 2.0). Respondents

were asked to describe their behavior

during their most recent online

transaction at each of four stages:

Awareness

When they first became aware of or had

a desire for the product

Consideration

When they were researching the

product online or offline

Conversion

When they were deciding where and

when to buy the product

Evaluation

After they made the purchase

“To create loyalty with Millennials, brands need to first cover

the basics—that means top notch customer service and

quick, individualized responses, through the channels they

use such as social media and messaging. But beyond that,

brands need the right content strategy. They need to engage

Millennials with communications that are both entertaining

and informative. Elements of gamification or exclusivity can

work well. Some of the footwear brands that are popular

with Millennials use limited editions to create product and

brand buzz. Millennials will line up physically and digitally to

get their hands on these exclusive products.”

— Joel Benzimra, Global Advisory Lead for Consumer Markets,

KPMG International

©2017 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated.

2017 Global Online Consumer Report 15

In an online shop

16.7

30

Online: 59% Offline: 52%

1515

10

7

10

22

15

13

9

8

12

In an advertisement

In an online review

In a social media post or blog

In an email promotion

In an online article or magazine

In a physical shop

Talking with my friends

Talking with my family

I saw a friend with it

in a print magazine or newspaper

I saw it on TV or in a movie

Online shop

30%

Any online

channel: 59%

Any offline

channel: 52%

15%15%

10%

7%

10%

22%

15%

13%

9%

8%

12%

Online

advertisement

Online review

Social media post or blog

Email promotion

Online article or magazine

Physical shop

Talking to friends

Talking to family

Saw a friend with it

Print magazine or newspaper

On TV or in a movie

Stage 1 — Awareness:

triggers and influencers

When comparing the impact of

online versus offline touchpoints in

creating the first trigger moment, it is

interesting to observe that 52 percent

of consumers cited at least one offline

channel as a source of initial awareness,

and 59 percent cited one or more online

channels (Figure 2.1).

Using a multi-channel strategy

to create awareness

Retail websites or online shops were

the most common source of initial

product awareness, cited by nearly

a third of consumers, and online

advertisements were cited by 15

percent. At the same time, physical

shops were the second most popular

source of awareness, cited by

22 percent of consumers.

Ecommerce is clearly far from being

an online-only affair. Both online and

Figure 2.0

Simplified path to purchase

Stages of the online purchase journey

Figure 2.1

Channels where consumers saw the product before purchasing

offline channels are effective in creating

consumer awareness and demand,

especially when they are used together.

This is true for both corporate-controlled

channels (shops, websites, advertising),

as well as third-party sources of

information. After websites, shops or

online advertising, the most common

sources of product awareness were

online reviews (cited by 15 percent),

talking with friends (15 percent), social

media (13 percent) or seeing a friend

with it (12 percent).

Consideration:

product and

company

research

Conversion:

deciding where and

when to buy

Awareness:

triggers and

influencers

Evaluation:

experience

and

feedback

Awareness:

triggers and

influencers

1.

Conversion:

where and

when to buy

3.

Evaluation:

experience

and feedback

4.

Consideration:

product and

company research

2.

Source: Global Online Consumer

Report, KPMG International, 2017

©2017 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated.

16 2017 Global Online Consumer Report

Consumers’ increasing reliance on

peers or ambassadors means that

customers are among the most

influential promotional conduits for

companies. Both online and offline,

the frequency of peer opinions as

top awareness influencers highlights

the significance of creating brand

ambassadors and delivering a positive

customer experience.

Awareness triggers by

generation

Millennials are not only more likely than

the older generations to be influenced

by online sources such as social

media or peer reviews—they are also

more likely to be influenced by offline

channels. Millennials were 25 percent

more likely than Baby Boomers to have

seen their most recent purchase in a

shop, nearly 50 percent more likely

to have talked to a friend about it, and

more than twice as likely to say they

saw a friend with it (Figure 2.2).

Although Millennials are certainly digital

natives first, they are also at least as

active and influenced as their parents

are beyond the digital world.

Stage 2 — Consideration:

product and company

research

During the consideration stage, the

importance of online channels continues

to prevail, with the top two channels for

research being online reviews (cited by

55 percent of respondents) and company

websites (47 percent) (Figure 2.3).

Offline channels are also a significant

source of information, with 26 percent

of consumers saying they visited a

physical shop during the research stage

and 23 percent saying they spoke to

friends or family about the product.

Figure 2.2

Offline channels where consumers saw the

product before purchasing, by generation

Figure 2.3

Percentage of consumers using the following channels to

research products they bought online

Online search for reviews and

recommendations

Visited the

company website

Visited physical stores

to see, try or fit the product

Spoke with my friends

or family about it

23%

55%

47%

26%

18%

22%

24%

Baby Boomers

12%

13%

17%

8%

11%

17%

Physical shop Talking with friends Saw a friend with it

Generation X Millennials

Source: Global Online Consumer

Report, KPMG International, 2017

Source: Global Online Consumer

Report, KPMG International, 2017

©2017 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated.

2017 Global Online Consumer Report 17

Case study

Ryohin Keikaku (Muji)

Kenji Takeuchi — Executive Officer

©2017 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated.

Muji, founded in the

1980s, is a globally

renowned Japanese

retail brand selling more

than 7,000 household

goods, apparel and food

items. Their products

are sold both through

their online store, and in

over 700 shops around

the world—mainly in

Japan, as well as in over

26 other countries. As

an Executive Officer at

Ryohin Keikaku (RKJ),

Kenji Takeuchi is in charge

of Muji’s corporate

planning, finance and IT.

Japan business leads in

ecommerce

Ecommerce is a key part of Muji’s

business, although there is still

room for growth in their online sales,

especially outside of Japan. According

to Takeuchi-san, “In Japan, Muji’s online

transactions account for around 10

percent of total sales, whereas in other

countries it is lower; in Germany and

China for example, only about 4 percent

of sales come from online.”

Targeting different segments

Muji’s target market is not based solely

on demographics, but on market size

and respective consumer behaviors.

“We target customers who are

trend-conscious and are leading total

consumer spending in each region. For

example, Generation X are the main

target in Japan because they have a high

interest in shopping, and also have the

disposable income.”

In China, on the other hand, “Millennials

are the main target because we regard

them as the most up-to-date on trends

and they are highly engaged digitally”,

says Takeuchi-san. He also notes that,

“In Japan, where the retail market

is very mature, there are not many

differences between generations in

terms of online shopping. The only

difference Muji sees is that Millennials

contribute to information diffusion,

while Generation X consumers lead in

consumption.

Muji is a true omni-channel

retailer

Muji actively pursues synergies

between its offline and online channels,

and they have formal key performance

indicators (KPIs) in place that ensure

these synergies are maximized.

According to Takeuchi-san, “The number

of customers that visit our shops is a

KPI for our ecommerce division. One of

the objectives of that group is to direct

consumers shopping online to come

into our physical locations.”

In addition to online to offline, Takeuchi-

san discusses how their customers

also go from shopping offline to online.

“Furniture is a category that people

often prefer to shop for in person, so

they can see and touch the products.

However, the final purchase decision

may not be made until the consumer

goes home and is able to measure and

see if it will fit in their space. To allow

customers to then purchase the items

online, we ensure that they can be

easily ordered and quickly delivered.”

Communicating content instead

of specific products

Muji does not advertise their specific

products but instead relies on

consumers seeking new trends, styles,

and information. According to Takeuchi-

san, “Our advertising style is focused

on the communication of a concept.

We use our online asset ‘MUJI.net

community’ and online loyalty program

‘MUJI passport’ to communicate

concepts and provide information

that can be shared on Facebook or

Instagram, to entice consumers to visit

our website or stores.”

Muji uses its loyalty program to

encourage customers to provide

feedback and promote the company’s

products online. Members receive

‘MUJI Miles’ not only for making

purchases, but also for checking into

stores, posting product comments or

participating in other promotions.

Online community is a point of

differentiation

The MUJI.net community is considered

to be an area of differentiation for

Muji. The brand has developed a loyal

member base through this community,

with which they regularly communicate

regarding trends and products. Takeuchi-

san explains, “We provide interactive

content, and columns to publish our

views on social issues, and we engage

customers in product development by

asking for their ideas and opinions. This

contributes to building loyalty among

our customers.”

18 2017 Global Online Consumer Report

“Consumers are firmly in charge today and they are looking at personalization of services.

Today’s consumer is more similar to the 1920’s consumer with a personal relationship

with shopkeepers. Therefore, big data is important – retailers should understand

what individual consumers buy and what they do. They should cater to consumers as

individuals.”

— Paul Martin, UK Head of Retail, KPMG in the UK

Millennials are 50 percent more

likely than Baby Boomers to

visit a store

As in the awareness stage, Millennials

are more likely than both Generation X

and Baby Boomer consumers to use

offline channels during the consideration

stage. While online reviews and product

websites are most frequently consulted,

Millennials were also nearly 50 percent

more likely than Baby Boomers to

research a product by visiting a store or

talking to friends and family (Figure 2.4).

Trust in online reviews vs

company websites varies by

region

In Asia, Eastern Europe and Russia,

consumers seem to put a much heavier

reliance on online reviews vs corporate

websites than other regions (Figure

2.5). This comparatively lower trust

in corporate content can be a risk for

companies in these regions since they

lack control over messaging and product

information contained in consumer

reviews. In addition to having informative

websites, these companies need to pay

particular attention to ensuring that have

favorable reviews on social media and

other third party forums.

Factors driving final product

decisions

Overall, price or promotions (identified

by 27 percent of respondents) were

the factors most likely to influence

consumers’ decision regarding which

product or brand to buy online. After

price and promotions, product features

(23 percent) or brand reputation (22

percent) were also commonly identified

as the top considerations when making

a final product choice (Figure 2.6).

Product decision factors varied by

category. For fashion, food and

luxury items, brand reputation was a

particularly important consideration,

although price was still the top decision

factor (especially for luxury items, cited

by 33 percent). For cosmetics, however,

brand reputation and online reviews

were the leading considerations (27

and 21 percent respectively), and for

electronics, product features were most

important (25 percent), closely followed

by price, brand reputation and online

reviews (each cited by one-fifth of the

electronics buyers).

Figure 2.4

Channels used to research online purchases — by generation

Baby Boomers

Did online search for

reviews & recommendations

Visited the

company website

Online channels

Offline channels

Generation X

Millennials

52%

56%

56%

45%

48%

48%

Visited physical stores to see,

try or fit the product

Spoke with my friends or

family about it

20%

30%

26%

19%

27%

20%

Source: Global Online Consumer

Report, KPMG International, 2017

©2017 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated.

2017 Global Online Consumer Report 19

Did online search for

reviews & recommendations

Online channels

Offline channels

Visited the

company website

Visited physical stores to see,

try or fit the product

Spoke with friends or

family about it

42

44

52

32

25

55

49

28

20

55

50

22

22

50

48

22

19

49

53

20

16

66

42

3131

5

11

64

44

30

25

North America

Latin America

Western Europe

Africa & Middle East

Eastern Europe & Russia

Asia

Australia & New Zealand

Figure 2.5

Percentage of consumers using the following

channels to research online purchases — by region

Figure 2.6

Factors driving purchase decisions

27% Price/promotions

23% Product features

22% Brand

17% Online reviews

5% Newest trends

or arrivals

4% Peer influences/

recommendations

2% Complementary

products

Decision factors by region

Consumers in Australia, New Zealand,

Canada, France, Belgium and South

Africa were most likely to be influenced

by price or promotions. In these

countries, more than 38 percent of

consumers said price and promotions

were the factors that drove their most

recent product choice.

In Asia, on the other hand, brand was

typically more important than price,

particularly in China and India, where

brand reputation was cited twice

as often as price (31 percent vs 15

percent). Asian consumers, especially

in China, Japan, Hong Kong and India,

were also more likely than consumers

in any other country to base their final

product decision on online reviews

(Figure 2.7).

Figure 2.7

Factors driving purchase decisions — by region

Australia or

New Zealand

Price/promotions

Product features

Brand

Online reviews

Other

Asia North America Eastern Europe

or Russia

Latin AmericaWestern Europe Africa and

Middle East

19%

23%

24%

22%

12%

30%

25%

18%

16%

11%

29%

25%

24%

13%

9%

34%

17%

24%

16%

9%

9%

38%

19%

22%

12%

15%

27%

15%

26%

17%

13%

22%

29%

17%

19%

Source: Global Online Consumer

Report, KPMG International, 2017

Source: Global Online Consumer

Report, KPMG International, 2017

Source: Global Online Consumer

Report, KPMG International, 2017

©2017 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated.

20 2017 Global Online Consumer Report

Stage 3 — Conversion:

deciding where and

when to buy

In the conversion stage of the online

purchase journey, the consumer

exercises two decisions: where, and

when, to buy a product. In the online

shopping arena, however, successfully

engaging consumers during the first two

stages of the purchase journey far from

guarantees success in the third stage.

Informed online consumers will not

hesitate to glean their inspiration and

information from one or more sources,

only to buy from another. Understanding

the priorities of different types of

consumers during this critical stage

can give companies the advantage they

need to win the coveted final sale.

Deciding where to buy

As during the final product decision

stage, price remains as the most

common consideration when consumers

are deciding where to buy (Figure 2.8),

particularly in certain categories such

as electronics. Having a website that

consumers like and/or trust is also

important, especially in Asia, where

consumers said buying from a preferred

website was more important than price.

In developed nations such as North

America, Australia, New Zealand, and

Western Europe, stock availability

was a higher priority than in it was

for consumers in other countries,

particularly when buying fashion or

luxury items. Consumers buying fashion

items were also on average three times

more likely to choose a vendor based on

their returns policy.

Generally speaking, the decision factors

most often considered by consumers

choosing vendors were consistent

across age groups, although Millennials

were considerably more likely than the

older generations to choose a vendor

based on price than website preference

(Figure 2.9). This could partly be due to

Millennials’ lower disposable incomes,

or being relatively more online savvy

or comfortable with online shopping in

general.

Having a trusted website will always

be important, but even as Millennials’

incomes grow, competitive pricing

is expected to continue to rise in

importance during vendor selection.

Figure 2.8

Most important attributes when

deciding where to buy

Best

price

Preferred

website

Best delivery

options/price

Stock

availability

Peer

advice

Returns

policy

36%

30%

17%

14%

2%

1%

Figure 2.9

Top attributes when deciding where

to buy — by generation

Best pricePreferred website

Preferred

website

Best

price

Preferred

website

Best

price

32%

31%

35%

27%

Baby

Boomers

Generation X

Millennials

40%

33%

31%

27%

Baby

Boomers

Generation X

Millennials

33%

31%

27%

Source: Global Online Consumer

Report, KPMG International, 2017

Source: Global Online Consumer

Report, KPMG International, 2017

©2017 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated.

2017 Global Online Consumer Report 21

Case study

Grana

Luke Grana, CEO

Luke Grana is CEO

and Co-Founder of the

innovative online fashion

retailer, GRANA. He,

along with Pieter Paul

Wittgen (COO and Co-

Founder), have overseen

the company’s growth

from a small startup

just two years ago to

an international brand,

now shipping to twelve

countries. GRANA’s core

aim is to manufacture

and sell high-quality

clothing at affordable

prices, by cutting the

costs associated with

most traditional sales and

distribution channels.

Winning and creating loyal

online customers

GRANA’s ‘fun and cheeky’ social media

presence boosts rapport and in turn,

brand loyalty, with their customers. They

boast over 23,000 ‘likes’ on Facebook,

as well as over 24,000 followers on

Instagram. It is on these social media

platforms where they interact with their

core market of Millennials, in a way

that goes beyond just showcasing their

fashions.

Never having invested in traditional

advertising or promotion methods,

GRANA instead relies on social media,

digital campaigns and word-of-mouth

recommendations to build brand

awareness and drive online conversion.

To support their ecommerce platform,

GRANA has also created over twelve

pop-up stores in Australia, Hong Kong,

Singapore and the US, in addition to a

flagship showroom called ‘The Fitting

Room by GRANA’, located in Sheung

Wan, Hong Kong.

These physical locations serve a

dual purpose: they introduce the

brand to those who have not already

encountered it online, and they allow

both new and existing customers to

feel the fabrics and try on clothing to

find the right fit. Although The Fitting

Room and pop-ups carry no inventory,

the buying experience is easy for those

unaccustomed to online shopping, as

staff are at hand to help customers

order items online, on the spot, for

delivery to customers’ homes.

Returning customers comprise 50

percent of GRANA’s sales. Luke

attributes this loyalty to quality, pricing,

swift delivery and attention to customer

service—such as the personalized

handwritten thank you cards that are

included with each delivery, or the real-

time live chat option available on their

website.

Looking at the future

Initially, GRANA experienced most of

their sales in Hong Kong where it is still

strategically headquartered. However,

their highest growth market is now the

US. The company is planning to open

their next pop-up showroom experience

in New York City, in an effort to increase

their US customer base even further.

The startup also recently attracted

Alibaba’s Entrepreneur Fund as a new

investor, and with their support, GRANA

plans to enter the mainland China

market in 2017, complete with a Chinese

language website.

“We’re really excited to have investment

support from Alibaba, and we’re looking

forward to working closely with their

team to enter the mainland market,”

says Luke. “Chinese consumers have

already matured when it comes to the

adoption of online shopping, and we

see tremendous potential there in the

medium-to-long-term.”

©2017 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated.

22 2017 Global Online Consumer Report

0

9

18

27

36

45

0

5

10

15

20

25

30

35

43

35

32

30

26

22

14

North America

Latin America

Western Europe

Africa & Middle East

Eastern Europe & Russia

Asia

Australia & New Zealand

28

29

34

Baby

Boomers

Generation X Millennials

Stage 4 — Evaluation:

experience and feedback

In a circular or web path to purchase

model, the evaluation stage is at least

as important as, and inextricably linked

with, the awareness and consideration

stages. Positive customer experiences

are critical in generating loyalty and

repeat purchases, and in an era of social

media and increasingly trusted peer

reviews, voicing customer experiences

can significantly influence future

buying decisions—both positively and

negatively.

The rise of online feedback

Around 30 percent of online consumers

said they posted product feedback

online and, in Asia, consumers were

nearly 50 percent more likely than

average to post a review (Figure 2.10).

Consumers in the US, Turkey and Latin

America (Brazil to a lesser extent) were

also more likely than average to share

feedback online. On the other end of the

scale, consumers in Australia, Japan and

many Western European countries were

the least likely to post a review.

Younger consumers were more likely

to post a review online, a consumer

behavior trend that will likely continue

even as they get older. This means

that as the more vocal and digitally

engaged younger consumers comprise

an increasingly larger portion of the

consumer base, online feedback will

become a more frequent and influential

part of the marketing mix.

Reviews are generally

positive

A significant majority (92 percent) of

the reviews that consumers across all

age groups shared online were positive

(Figure 2.11). The growing tendency for

consumers to post positive reviews is

driven by many trends, including the

rise of social media, where consumers

subtly compete with their peers by

publicly sharing their latest purchases

and experiences; the rise of bloggers

whose business models are based

on providing product reviews that

drive affiliate clicks; and sellers who

proactively solicit ratings from happy

customers.

Figure 2.10

Percentage of respondents who

shared product feedback online

Figure 2.11

Type of feedback most recently

shared online

92% Positive

2% Negative

6% Neutral

Source: Global Online Consumer

Report, KPMG International, 2017

Source: Global Online Consumer

Report, KPMG International, 2017

©2017 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated.

2017 Global Online Consumer Report 23

“The older consumers are very concerned

about data privacy and hence trust in

the companies they buy from and share

information with is important. On the

other hand, younger consumers are

less concerned about privacy. As long as

they can gain a benefit from sharing their

information, they will do it. This trait will

become mainstream in the future.”

— Stephan Fetsch, Head of Retail, KPMG in

Germany

Figure 2.12

Sites where consumers shared

feedback (%)

47

31

18

17

12

11

11

10

9

4

3

3

21

Seller’s website

Facebook

Manufacturer or

brand website

WhatsApp

Instagram

Online forum

WeChat

Blogs

Twitter

YouTube

Snapchat

Pinterest

Other

47

31

18

17

12

11

11

10

10

9

4

3

3

21

Seller’s website

Facebook

Manufacturer or

brand website

WhatsApp

Instagram

Online forum

WeChat

Blogs

Twitter

YouTube

Snapchat

Pinterest

Other

mastered this approach, but most

brands have yet to fully do so.

Regionally, there is variation in the most

popular social media platforms (Figure

2.14). Although Facebook is the most

common platform in nearly all regions,

it is by far the preferred choice in

NorthAmerica and Australia. Instagram

and Twitter are predominantly North

American channels, and WhatsApp is

particularly popular in Hong Kong, India,

Africa, and Latin America. In China,

where many US-based social media

channels are not available, WeChat

dominates, although its use is virtually

exclusive to that country.

Increasing influence of

social media

Understanding where consumers are

posting feedback can help companies

become more proactively engaged in

monitoring, managing and fostering

positive online customer reviews.

Currently, consumers are most likely to

post directly to seller websites (Figure

2.12). Many popular online sellers have

feedback mechanisms built in to solicit

comments from customers shortly

after their purchase has been received.

By waiting a few days for unhappy

customers to register a complaint

or return a product, savvy sellers

can selectively reach out to those

customers who are likely satisfied and

willing to post a positive review.

Generational trends indicate an

increasing use of social media sites such

as Facebook, WhatsApp, Instagram,

blogs and Twitter for posting and

reviewing feedback (Figure 2.13).

The implication for companies is that

user-generated reviews are being

posted on sites that are increasingly

beyond their sphere of control or

influence. Companies will need to

actively integrate these social media

sites into their marketing and customer

strategies. Many digitally innovative

retailers and brands have already

Figure 2.13

Sites where consumers shared feedback (%) — by generation

Seller’s

website

43

49

46

25

29

34

22

18

17

3

9

18

4

9

11

12

10

11

16

16

17

6

10

12

13

10

10

3

3

5

1

2

5

1

3

4

Facebook

Manufacturer

or brand

website

Instagram Twitter Online

forum

WhatsApp Blogs WeChat YouTube Snapchat Pinterest

Baby Boomers

Generation X

Millennials

Source: Global Online Consumer

Report, KPMG International, 2017

Source: Global Online Consumer

Report, KPMG International, 2017

©2017 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated.

24 2017 Global Online Consumer Report

Figure 2.15

Length of purchase cycle by region and generation (%)

Cycle duration

Short decision cycles leave

little time to influence potential

customers

For the majority of online transactions,

the path from awareness to conversion

is very short—71 percent of consumers

surveyed made their purchase within

a week of awareness or desire. Nearly

one-third of the respondents said

they purchased the item on the same

day. This brief window for brands to

influence potential customers makes

it critical for them to understand what

drives consumer behavior and decisions

at every stage.

Although the survey results revealed