7020 Easy Wind Drive, Suite 200 • Austin, TX • T 512.320.0222 • F 512.320.0227 • CPPP.org

April 2015

It’s Time to Raise the Minimum Wage in Texas

Analysis of Who Would Benefit from a Minimum Wage Increase in Texas

Garrett Groves, gro[email protected], Jennifer Lee, [email protected],

and Katherine Strandberg, strandberg@cppp.org

Texans pride themselves on working hard and being self-sufficient. But too few workers and their

families earn enough to escape poverty. Texas ranks near the worst states for working families, with 38

percent earning less than $47,000 per year for a family of four.

1

If we want to live in a state where hard

work means real self-sufficiency, then we need to raise the minimum wage in Texas.

Several bills filed during the 84

th

Texas Legislative Session propose raising the state’s minimum wage to

$10.10 per hour in 2016. To help lawmakers and concerned Texans understand the impact of those

legislative proposals, the Center for Public Policy Priorities conducted new analysis to identify the Texans

who would benefit from raising the current federal minimum wage of $7.25 per hour to a new statewide

minimum wage of $10.10 per hour in 2016.

2

Key Finding:

Nearly 2.4 million Texans, or 1 in 4 for-profit and non-profit workers, would receive a pay increase

if the state adopted a minimum wage of $10.10 per hour in 2016.

3

Who Benefits from a Minimum Wage Increase?

Of the nearly 2.4 million Texans who would benefit from an increase in the state minimum wage to

$10.10 per hour in 2016:

4

Age: 60 percent are in their prime working years (25-54). Only 3.1 percent are teenagers between

the ages of 16-18.

Families with children: Nearly fifty percent live in households with children, and 14.7 percent of

all workers who benefit are single mothers.

Race and ethnicity: 1 in 3 are Non-Hispanic White, and over half are Hispanic or Latino, even

though they only make up a little more than a third of the for-profit and not-for-profit workforce.

Education level: 43 percent have at least some college education, and 15 percent have completed

a postsecondary degree.

Industry: Nearly half are concentrated in three industry sectors: the retail trades; accommodation

and food services; and the health care and social assistance industry. However, workers in nearly

every industry would benefit from an increase in the minimum wage.

Policy Recommendations:

The Center for Public Policy Priorities recommends that the 84

th

Texas Legislature:

● Raise the minimum wage to $10.10 per hour.

● Adjust the minimum wage annually by tying it to the consumer price index. The state should

also consider a clearly defined small business exemption from the new minimum wage that

protects workers as well as the state’s smallest employers.

● Repeal the state law that prohibits localities from setting wage standards.

● Encourage municipalities to create living wage standards for their own employees that are in

line with their cost of living.

Source: CPPP analysis of 1-year 2013 American Community Survey Public-Use Microdata Sample (PUMS) for Texas.

5

Minimum Wage Context

It’s tempting in Texas to believe that our thriving economy protects us from rising poverty and growing

inequality. It’s true that of the 5 million jobs created in the U.S. during the 21st century, more than 2

million were created here in Texas.

6

But it’s also true that the Texas economy relies on a larger share of minimum- and low-wage jobs than

most other states. There are 400,000 workers in Texas who make at or below the current federal

minimum wage of $7.25 per hour – more than any other state – and all of them need a raise.

7

Working

full-time at a minimum wage job provides $15,080 at the end of the year, an amount that is clearly

insufficient to support a family, yet alone a single working individual.

26.8%

40.8%

19.9%

40.2%

21.5%

43.1%

22.4%

19.7%

25.7%

0%

10%

20%

30%

40%

50%

Bexar

County

Cameron

County

Dallas

County

El Paso

County

Harris

County

Hidalgo

County

Tarrant

County

Travis

County

State

Average

Chart 1: Percent of For-Profit and Not-for-Profit Workforce to

Benefit from Minimum Wage Increase to $10.10 per Hour in 2016

Texas also has a higher share of working poor families than other states. In 2013, 38 percent of working

families in Texas earned less than twice the federal poverty rate, or $47,248 per year for a family of

four.

8

In total that’s almost 1.2 million Texas families who are making difficult choices about forgoing

necessities such as housing, food or transportation despite working hard to make a living.

Twenty-nine other states, including Arkansas, Ohio, Arizona, and West Virginia raised their minimum

wage above the federal minimum of $7.25 per hour.

9

Many municipalities across the country have done

the same, but not in Texas. While the cost of living varies greatly across Texas, state law currently

prohibits local regulation of wage standards with the exception of wages paid to government employees

or contractors.

10

In addition to raising the state minimum wage, removing the prohibition of local

minimum wage rates would give municipalities the flexibility to decide the right wage floor for their local

economies.

Growing evidence from leading economists indicates that higher minimum wage standards may have

positive economic effects on communities and a minimal or neutral effect on job growth. The issue is

also receiving growing private sector support. In addition to several large employers such as Wal-Mart,

Target, Starbucks and McDonalds all publicly committing to raising their minimum wage in 2015, a poll

of small businesses last year found that 61 percent of business owners support an increase to $10.10 per

hour, along with adjusting the minimum wage annually to keep pace with the cost of living.

11

Those business owners recognize that employees are also customers. As the cost of living rises faster

than wages do, workers become unable to spend enough to help drive economic activity. Businesses

also know that when workers are paid a higher wage, they are more likely to remain on the job,

reducing costs in hiring and training for new employees.

What It Means to Live on the Minimum Wage

According to the CPPP Family Budget Calculator, the federal minimum wage of $7.25 per hour does not

provide enough to cover an individual’s most basic living expenses in Texas. In fact, a worker in Houston

or Austin would need two full-time minimum wage jobs to cover the nearly $30,000 a year he or she

needs for food, housing, health care and transportation expenses. And the situation becomes even more

challenging for workers trying to support a family. A two parent family in Houston with two children

needs a combined full-time hourly income of $30.07, or $62,546 a year, in order to meet basic expenses

without room for savings of any kind.

12

The figures below show the hourly wages that are necessary for Texas families to meet basic living

expenses according to family size and location. These calculations assume that 1) all adults are full time

workers, 2) their employer(s) do not cover monthly health insurance premiums, and 3) they have no

emergency savings — which means that a simple car repair or significant illness could be financially

ruinous.

Table 1: Hourly Wages Needed to Meet Basic Living Expenses in Texas Cities

City

Single Person

1 Parent, 1 Child

2 Parents,

2 Children

2 People with

No Children

Austin

$14.09

$21.68

$31.51

$20.57

Brownsville

$11.78

$16.69

$25.06

$18.03

Dallas/Ft. Worth

$13.84

$20.83

$30.37

$20.44

El Paso

$11.60

$16.88

$23.89

$17.84

Houston

$14.05

$20.84

$30.07

$20.66

Lubbock

$12.15

$18.20

$26.34

$18.40

McAllen/Edinburg

$11.88

$17.28

$25.64

$18.10

San Antonio

$12.86

$20.21

$29.67

$19.75

Source: www.familybudgets.org. 2012 data, not adjusted for inflation to 2015.

Note: Hourly wage data for two-parent families is per household, not per person.

Recent Evidence Shows Raising the Minimum Wage Not Connected to Job Loss

In 2014 more than 600 economists, including seven Nobel Prize winners, sent a letter to Congress and

the president requesting a minimum wage increase to $10.10 per hour by 2016. They cited

developments in the research showing that a minimum-wage increase could stimulate the economy as

low-wage workers spend their additional earnings, raising demand and job growth.

One of the first case studies to challenge the assumption that an increase in wages results in businesses

employing fewer workers was published by David Card and Alan Krueger in 1993. They studied over 400

restaurants in the competitive fast food industry along the New Jersey and Pennsylvania state border

after a state minimum wage increase in New Jersey. They found that there was no evidence of reduced

employment in New Jersey or of a reduction in the number of establishments. In fact, their study

showed the exact opposite, that increasing the minimum wage led to an increase in employment.

13

Card and Krueger followed up their case study with a meta-analysis of over 30 long-term studies on the

effects of minimum wage increases in 1995. Again, they found that minimum wage increases did not

decrease employment.

14

That meta-analysis was updated by Hristos Doucouliagos and T.D. Stanley in

2008, and again by John Schmitt in 2013. Both analyses confirmed that there were little or no decreases

in employment with modest increases in the minimum wage.

15

There is some conflicting evidence on the impact of raising wages on the availability of jobs. A 2015

study by Jonathan Meer and Jeremy West at Texas A&M University found that while employers are not

likely to fire employees due to a minimum wage increase, they may be less likely to hire new employees

in the ensuing years.

16

After reviewing the existing research in 2014, the Congressional Budget Office

reported to the U.S. Congress that their best assessment of the effects of a national minimum wage

increase to $10.10 per hour would result in a 0.3 percent reduction in employment, or about 500,000

workers across the country, once fully implemented by the second half of 2016.

17

However, their

assessment also included a likely range from a negligible reduction in employment to a reduction of one

million workers.

The larger issue, however, is not simply determining the effect of a minimum wage increase on job

growth, but to understand if the benefits to low-wage workers outweigh the costs. And here there may

be greater consensus among researchers. In a 2013 survey of leading economists across the country, 34

percent stated that raising the minimum wage would make it harder for low-wage workers to find

employment, and 32 percent stated the opposite with 27 percent remaining undecided. But when the

same experts were asked if the benefits to low-skilled workers for raising the minimum wage

outweighed any adverse effects on employment, only 11 percent disagreed.

18

Best Practices and Policy Recommendations

As of 2015, the majority of U.S. states have some form of minimum wage policy that sets a wage

minimum, or floor, above the federal minimum. Each has tailored its wage laws to fit its own unique

economic needs. Some of the most common policies and practices are described below.

Consumer Price Index and Incremental Change

Of the 29 states and the District of Columbia that have a minimum wage above the federal floor of $7.25

per hour, 14 have tied increases in pay to the Consumer Price Index (CPI) to ensure that wages will keep

pace with increases in the cost of living. Tying the minimum wage to CPI also prevents the need for

repeated legislative efforts to raise the minimum wage floor as inflation erodes its value.

Six states are currently raising their minimum wages in annual increments, or stages. Based in part on

evidence that small increases in the minimum wage have little or no discernable effect on employment

numbers or consumer prices, we recommend moving toward a higher state minimum wage in annual

stages and indexing the final wage target to CPI once fully implemented.

Small Business Exemptions

Some policymakers have argued that raising the minimum wage may place an undue burden on very

small businesses that do not have large enough annual revenues to sufficiently cover new costs. The

federal Fair Labor Standards Act (FLSA), which sets the national minimum wage at $7.25, does not apply

to small businesses with annual gross revenue under $500,000 unless they engage in interstate

commerce or work for the federal, state or local government.

19

Eleven states also have an exemption

from higher minimum wages for small businesses. Six of those states define a small business by the

number of employees, with a range from 1 employee in Michigan to 10 employees in Florida. The other

five states define a small business by annual gross revenue, with a range from $150,000 in Ohio to

$500,000 in Minnesota and Arizona.

Minnesota’s small business exemption creates a separate wage floor for small businesses that is $1.50

less than the full minimum wage floor for larger businesses. This two-tiered system helps ensure small

businesses remain competitive while also boosting wages for their employees. As of August of 2014,

companies with annual gross revenue of more than $500,000 per year in Minnesota are classified as

large employers and pay $8.00 per hour, which will be increased to $9.00 in August and $9.50 the

following year. Small employers with gross annual revenue under $500,000 will be increased

incrementally from $6.50 to $7.25 per hour over the next few years. These minimum wage scales are

similar to those used by the federal government, but differ on two key issues: 1) they include tipped

workers, for whom the federal minimum is currently set at $2.13 per hour, and 2) they will be indexed

to the inflation rate as of 2018.

20

In order to protect the smallest businesses in Texas, we recommend a two-tiered minimum wage that

reduces the hourly minimum wage by $1.50 for small businesses with less than $500,000 of annual gross

revenue.

Local Control and Removing State Pre-emption Laws

A growing number of cities are setting their own minimum wages in response to rising costs of living in

their regions.

21

These local wage rates, which have been increasingly common since the first was

established in 2003, vary from $8.50 per hour in Bernalillo County, New Mexico, to $15 per hour in San

Francisco and Seattle.

Texas is one of 19 states with a law that prohibits cities from setting their own minimum wage

standards, effectively suppressing wages across the state. To view minimum wage fact sheets for Texas’

eight largest counties, visit bit.ly/MinWageTXblog.

Policy Recommendations

CPPP recommends that the 84

th

Texas Legislature:

● Raise the minimum wage to $10.10 per hour.

● Adjust the minimum wage annually by tying it to the consumer price index. The state should

also consider a clearly defined small business exemption from the new minimum wage that

protects workers as well as the state’s smallest employers.

● Repeal the state law that prohibits localities from setting wage standards.

● Encourage municipalities to create living wage standards for their own employees that are in

line with their cost of living.

Appendix A: Demographic Information

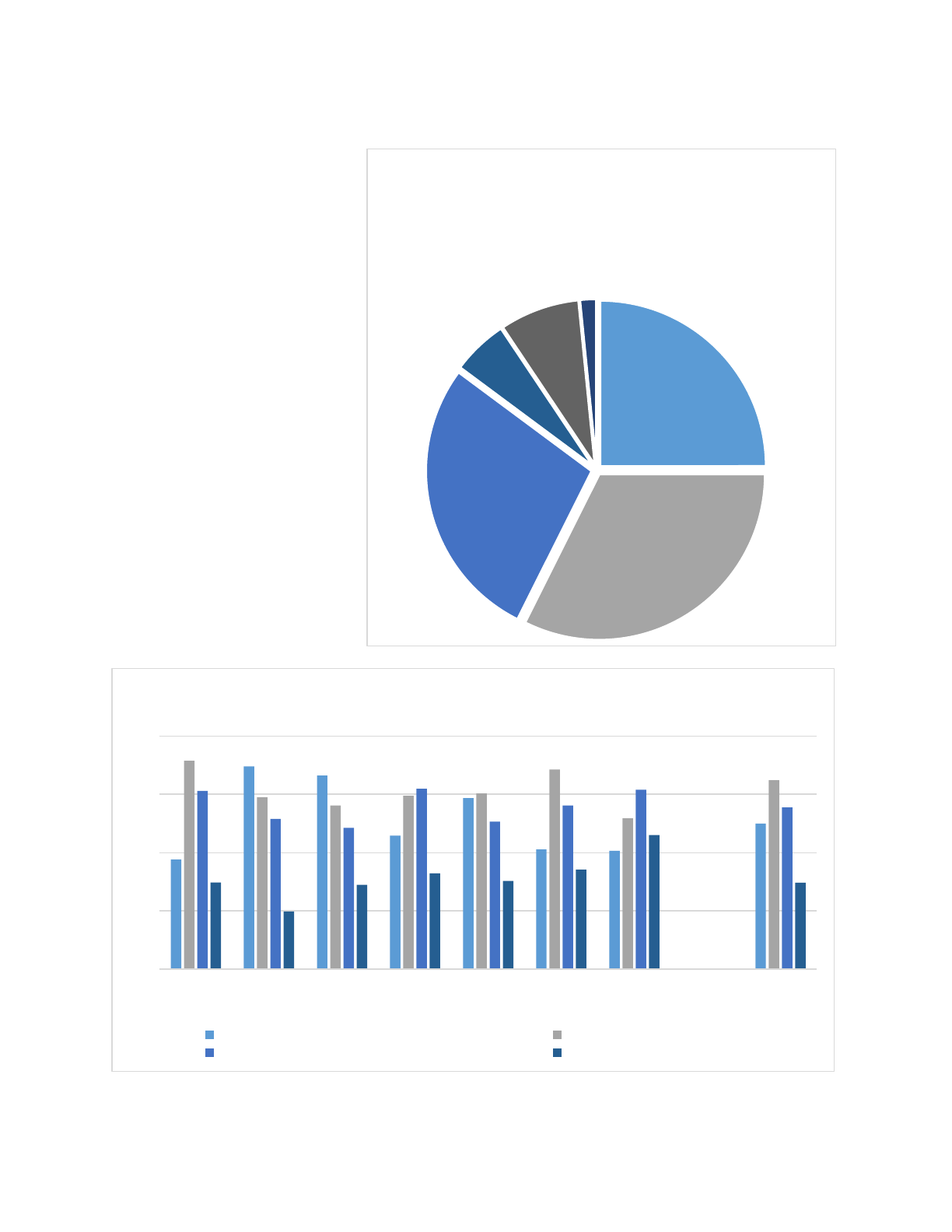

Age of Workers Who Benefit

There is a widely held assumption that

minimum wage jobs are filled with low

skilled young people, who with little

debt or family obligations can afford to

be paid the federal minimum wage.

However, seventy percent of all workers

who benefit in Texas from a minimum

wage increase are between the ages of

25 and 64, and only three percent of

workers affected by a minimum wage

increase are between the ages of 16-18.

Source: CPPP analysis of 1-year 2013 American Community Survey Public-Use Microdata Sample (PUMS) for Texas.

22

16-18

3%

19-24,

23.5%

25-34

26.0%

35-54

34.1%

55-64

9.5%

65+

3.9%

Chart 2: Age of Workers Who Benefit

Texas Average

0%

10%

20%

30%

40%

50%

Bexar

County

Dallas

County

Cameron &

Hidalgo

Counties

El Paso

County

Harris

County

Tarrant

County

Travis

County

Chart 3: Regional Focus - Age of Workers Who Benefit

By County

16-24 25-34 35-54

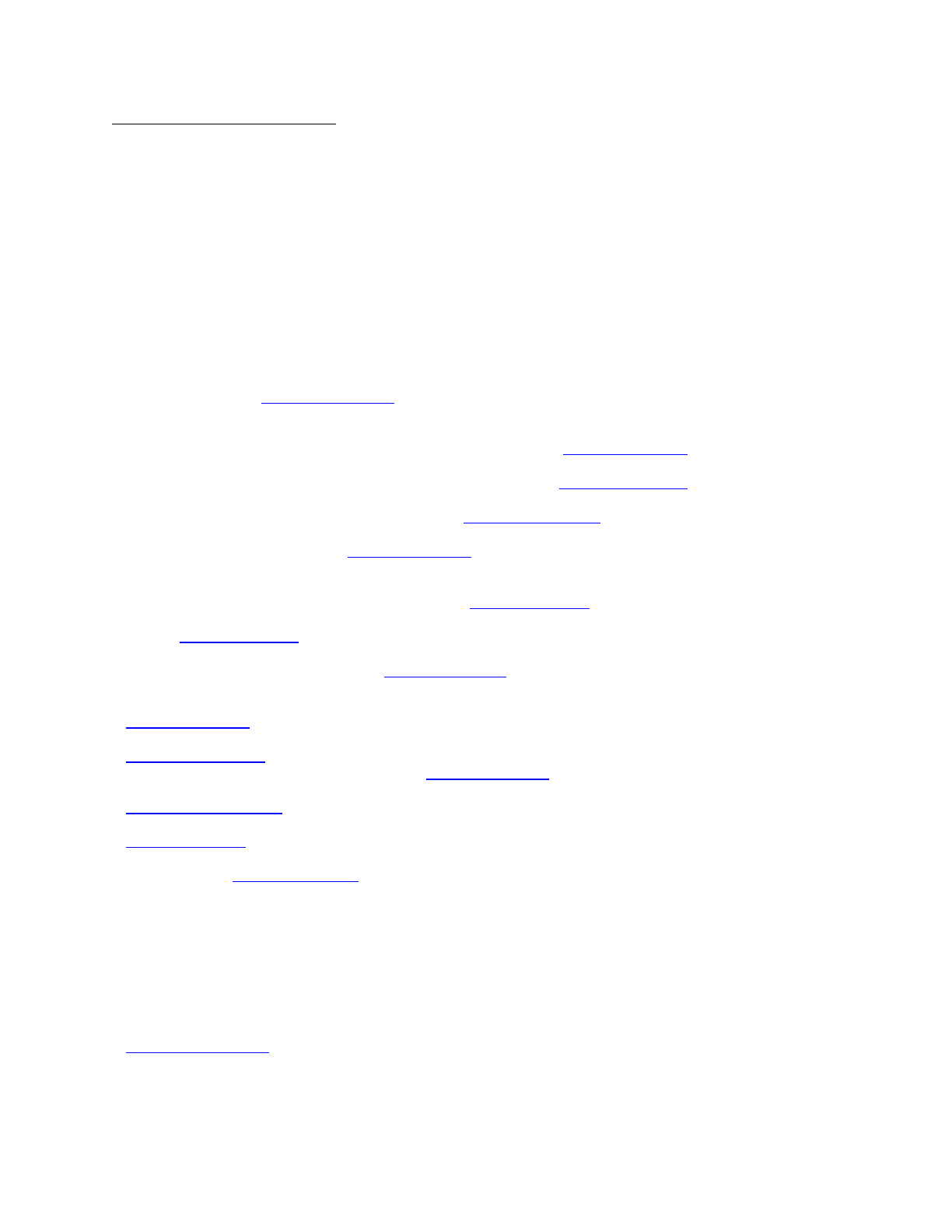

Workers Who Benefit with Children in the Home

Nearly 49 percent of workers who

benefit from a $10.10 minimum wage

have children at home. In fact, one in

five workers who benefit are single

parents. A total of 344,000 workers, or

14.7 percent of all workers who benefit

are single mothers, while another

102,000 or 4.3 percent, are single

fathers.

Source: CPPP analysis of 1-year 2013 American Community Survey Public-Use Microdata Sample (PUMS) for Texas.

23

No Children

50.9%

Married

Couple

29.7%

Single

Mother

14.7%

Single Father

4.3%

With

Children,

49.1%

Chart 4: Workers Who Benefit with

Children in the Home

Texas Average

0%

10%

20%

30%

40%

50%

60%

70%

Bexar

County

Cameron

County

Dallas

County

El Paso

County

Harris

County

Hidalgo

County

Tarrant

County

Travis

County

Chart 5: Regional Focus - Workers Who Benefit with Children in

the Home

No children With children (under 18)

Educational Attainment of Workers Who Benefit

Workers who benefit from a

minimum wage increase

represent every level of

educational attainment, including

graduate level degree holders.

However, a quarter did not

complete high school, and

another third stopped their

education after receiving their

diplomas or high school

equivalent.

Source: CPPP analysis of 1-year 2013 American Community Survey Public-Use Microdata Sample (PUMS) for Texas.

24

Less than high

school diploma,

25%

HS diploma or

equivalency,

32%

Some college,

28%

Associate's

degree, 5%

Bachelor's

degree, 8%

Beyond

bachelor's

degree, 2%

Chart 6: Educational Attainment of

Workers Who Benefit

Texas Average

0%

10%

20%

30%

40%

Bexar

County

Cameron &

Hidalgo

Counties

Dallas

County

El Paso

County

Harris

County

Tarrant

County

Travis

County

State

Average

Chart 7: Regional Focus - Educational Attainment of Workers

Who Benefit By County

Less than high school diploma HS diploma or equivalency

Some college Associate's Degree and Above

Race and Ethnicity of Workers Who Benefit

Raising the minimum wage to

$10.10 would benefit workers

across racial lines, though not

always in equal measure. Hispanic

and African Americans workers

represent a larger share of workers

who benefit than their share of the

for-profit and not-for-profit

sectors. Alternately, White and

Asian workers represent a smaller

share of workers who benefit than

their share of the private and not-

for-profit sector workforce.

Source: CPPP analysis of 1-year 2013 American Community Survey Public-Use Microdata Sample (PUMS) for Texas.

25

Table 2: Race and Ethnicity of Workers Who Benefit

Percent of

Workers Who

Benefit

Percent of For-Profit

and Not-for-Profit

Sector Workforce

Hispanic or Latino

51.5%

35.3%

Non-Hispanic

White Alone

32.4%

47.7%

Black or African

American

11.4%

10.7%

Asian Alone

3.2%

4.7%

Other

1.5%

1.5%

31.0%

3.9%

49.5%

8.3%

42.8%

4.4%

60.6%

51.3%

69.0%

96.1%

50.5%

91.7%

57.2%

95.6%

39.4%

48.7%

B E X A R

C O U N T Y

C A M E R O N

C O U N T Y

D A L L A S

C O U N T Y

E L P A S O

C O U N T Y

H A R R I S

C O U N T Y

H I D A L G O

C O U N T Y

T A R R A N T

C O U N T Y

T R A V I S

C O U N T Y

Chart 8: Regional Focus - Hispanic or Latino

Workers Who Benefit

Not Hispanic or Latino Hispanic or Latino

Male and Female Workers Who Benefit

While more Texas women than

men would benefit from an

increase in the minimum wage to

$10.10 per hour, the margin is

thin; 51.4 percent are female,

while 48.6 percent are male. It is

important to note that while there

is a near equal number of male

and female workers who benefit,

jobs that pay close or equal to the

minimum wage are more likely to

be dominated by women. The

Bureau of Labor Statistics reports

that, as of 2013, 63 percent of

Texans working at or below the

minimum wage were women.

26

Source: CPPP analysis of 1-year 2013 American Community Survey Public-Use Microdata Sample (PUMS) for Texas.

27

Male

48.6%

Female

51.4%

Chart 9: Male and Female Workers Who

Benefit Texas Average

46.2%

45.5%

51.1%

45.2%

52.3%

42.9%

48.1%

50.6%

53.8%

54.5%

48.9%

54.8%

47.7%

57.1%

51.9%

49.4%

B E X A R

C O U N T Y

C A M E R O N

C O U N T Y

D A L L A S

C O U N T Y

E L P A S O

C O U N T Y

H A R R I S

C O U N T Y

H I D A L G O

C O U N T Y

T A R R A N T

C O U N T Y

T R A V I S

C O U N T Y

CHART 10: REGIONAL FOCUS - MALE AND

FEMALE WORKERS WHO BENEFIT BY COUNTY

Male Female

Workers Who Benefit by Industry

Nearly half are concentrated in three industry sectors: the retail trades; accommodation and food

services; health care and social assistance industry. However, workers in nearly every industry would

benefit from an increase in the minimum wage.

Table 3: Workers Who Benefit by Industry

Number of Workers

Who Benefit

Percent of Total

Workers Who Benefit

Retail Trade

435,099

20.0%

Accommodation and Food Services

358,830

16.5%

Health Care and Social Assistance

269,067

12.4%

Manufacturing

175,908

8.1%

Construction

168,822

7.8%

Administrative and support and waste management

services

150,561

6.9%

Other Services, Except Public Administration

137,718

6.3%

Educational Services

77,059

3.5%

Transportation and Warehousing

74,733

3.4%

Finance and Insurance

59,427

2.7%

Wholesale Trade

52,801

2.4%

Professional, Scientific, and Technical Services

51,084

2.4%

Real Estate and Rental and Leasing

39,377

1.8%

Arts, Entertainment, and Recreation

34,107

1.6%

Agriculture, Forestry, Fishing, and Hunting

31,520

1.5%

Information

25,980

1.2%

Mining, Quarrying, and Oil and Gas Extraction

23,683

1.1%

Utilities

5,712

0.3%

Source: CPPP analysis of 1-year 2013 American Community Survey Public-Use Microdata Sample (PUMS) for

Texas.

28

Appendix B: Workers Who Benefit by County

Regional analyses were conducted by county. Cities have been listed as an additional point of reference.

Information is provided only for those counties with sufficient sample sizes to provide statistical significance.

County

Major City within the

County

Percent of Private and

Not-for-Profit

Workforce Affected by

Increase to $10.10

2016 Estimated

Number of Workers

Hidalgo County

McAllen

43.1

67,317

Cameron County

Brownsville

40.8

34,490

El Paso County

El Paso

40.2

77,819

Webb County

Laredo

38.9

24,027

Taylor County

Abilene

33.0

14,658

Brazos County

College Station

32.7

17,981

San Patricio, Bee, Refugio,

Aransas & Nueces

Corpus Christi

32.0

47,703

Lubbock County

Lubbock

31.8

30,292

Tom Green County

San Angelo

31.1

11,614

McLennan

Waco

29.0

23,415

Gregg County

Longview

28.9

16,485

Wichita County

Wichita Falls

28.4

12,333

Smith County

Tyler

27.2

20,308

Bexar County

San Antonio

26.8

167,441

Montgomery County

Conroe, The Woodlands

26.1

34,043

Potter & Randall

Amarillo

26.0

19,906

Jefferson County

Beaumont

24.8

23,653

Ector County

Odessa

24.4

12,427

Tarrant County

Fort Worth

22.4

155,617

Denton County

Denton, Flower Mound

22.3

40,186

Bell County

Temple, Belton, Killeen

22.0

18,314

Harris County

Houston

21.5

394,771

Williamson County

Round Rock, Georgetown

21.3

26,642

Collin County

Plano, McKinney

20.7

63,227

Dallas County

Dallas

19.9

232,754

Travis County

Austin

19.7

99,894

Midland County

Midland

18.7

12,945

Source: CPPP analysis of 1-year 2013 American Community Survey Public-Use Microdata Sample (PUMS) for Texas.

Data and Methods

The analysis used in this paper is modeled after the methodology of the Institute for Research on Labor

and Employment at the University of California at Berkeley found in Data and Methods for Estimating

the Impact of Proposed Local Minimum Wage Laws

29

, with guidance and input from researchers

Annette Bernhardt and Ian Perry.

Data source

The data source for the analysis is the 1-year 2013 American Community Survey Public-Use Microdata

Sample (PUMS) for Texas.

30

Sample definition

The sample consists of individuals at least 16 years old, working at least 14 weeks in the prior year, and

with positive earnings from wages or salaries. Individuals excluded from the analysis are the

unemployed, self-employed workers, unpaid family workers, and public-sector employees who would

not be affected by a state minimum wage law. Additionally, household-level characteristics such as

presence of children in the household and family type were included in the analysis.

Geography

The analysis uses data for residents of Texas. The level of analysis is at the state and the local level. We

base local-area analysis on place-of-work, not place-of-residence, as workers may not live in the areas

they work.

We define local areas using Place-of-Work Public Use Microdata Areas (POWPUMAs), statistical

geographic areas that contain at least 100,000 people and are built on counties. The Amarillo area is

comprised of two POWPUMAs that cover Potter and Randall counties. We combine Potter and Randall

counties to analyze the impact on Amarillo-area workers. The Corpus Christi area is comprised of two

POWPUMAs that cover Nueces, San Patricio, Bee, Refugio, and Aransas counties. We combine these

counties to analyze the impacts on Corpus Christi-area workers.

Estimating hourly wages

The American Community Survey asks individuals to report their income in the prior year, weeks worked

in the prior year, and usual hours worked per week. We compute an hourly wage variable using these

three variables. For example, if an individual reported earning $30,000 in the prior year, working 50

weeks, and 35 hours per week, we calculate the hourly wage as:

$30,000 / (50 weeks * 35 hours per week) = $17.14 per hour

Survey respondents report weeks worked in the prior year in intervals, such as 50-52 weeks or 40 to 47

weeks worked. We use the midpoint of each interval as the weeks worked value for each respondent.

To account for measurement error, we dropped data for respondents with a computed hourly wage of

$6.525 or less (90 percent or less of the current minimum wage). This dropped approximately 15.9

percent of the sample.

Using the computed hourly wage variable, we estimate that approximately 330,000 working Texans

were earning minimum wage or less in 2013. For comparison, the Bureau of Labor Statistics estimates

400,000 Texas workers earned minimum wage or less in 2013.

Estimating wage growth

Because any proposed minimum wage increase would not take effect until 2016, we needed to project

worker’s wages in 2016 to accurately estimate who would be affected by an increase. We used a two-

step process to project 2016 wages. First, because the ACS data were collected during 2013, we adjusted

estimated wage growth to the present year (2015) using the Consumer Price Index (CPI) in the Texas

Comptrollers’ Biennial Revenue Estimate between 2013 and 2015.

31

Second, we project wages from the

present year to 2016 using the CPI between 2015 and 2016. For example, see Table 1 below.

Table 1. Example of hourly wage adjustments

Computed hourly wage using 2013 ACS data

$8.00

Hourly wage adjusted to 2015

$8.40

Projected hourly wage in 2016

$8.78

State analysis of workers affected by minimum wage increase

Estimating percentages of workers affected by minimum wage increase

Using projected hourly wages in 2016, we calculate the percentage of workers in the sample whose

projected hourly wage would be less than $10.10. We calculate all percentages out of the sample

universe, which includes individuals at least 16 years old, working at least 14 weeks in the prior year in

the private or not-for-profit sectors, and with positive earnings from wages or salaries. We exclude

individuals who are unemployed, self-employed, unpaid family workers, and public-sector employees.

We include in our analysis workers earning slightly above the expected minimum wage increase to

$10.10 because employers typically increase the wages of workers slightly above newly mandated

minimum wages to maintain a hierarchy of wages. This group of workers are indirectly affected by the

minimum wage increase, and the effect on workers earning just above the minimum wage is referred to

as the “spillover” or “ripple” effect.

Estimates of the magnitude of “spillover” effects range within a relatively narrow band. The Institute for

Research on Labor and Employment (IRLE) at UC Berkeley used two scenarios. The first scenario

assumed a spillover effect on workers earning between 100 and 115 percent of the new minimum wage.

(In the case of a new minimum wage of $10.10, indirectly affected workers would be those earning

between $10.10 and $11.615 per hour). The second scenario assumed a slightly larger spillover effect on

workers earning up to the value of the new minimum wage plus the difference between the new and

old minimum wages. (In the case of a new minimum wage of $10.10, indirectly affected workers would

be those earning between $10.10 and$12.95 per hour.)

Jeannette Wicks-Lim from the Political Economy Research Institute at the University of Massachusetts

Amherst, used Current Population Survey (CPS) data from 1983-2002 to empirically estimate the

magnitude of the spillover effect from past minimum wage increases. She found minimum wage

increases indirectly affected workers earning up to 123 percent of the new minimum wage, but the

largest number of workers affected were those who earned 115 percent of the new minimum wage.

32

In

its most recent report, the Congressional Budget Office (CBO) estimates that workers earning up to

$11.50 per hour would be affected by a minimum wage increase to $10.10.

33

Using methods above, we considered the range of spillover effects on a minimum wage increase to

$10.10 to be between $11.50 and $12.95. With input from researchers at IRLE, we assume the spillover

effect goes up to workers earning 115 percent of the new minimum wage, or $11.615 per hour.

Table 2. Texas workers directly and indirectly affected by a minimum wage increase

Group of Workers

Definition

Directly affected

Earning less than $10.10/hr in 2016

Indirectly affected

(“spillover” or “ripple” effect)

Earning between $10.10 and $11.615 in 2016

Total affected

Earning less than $11.615/hr in 2016

Estimating numbers of minimum wage workers affected by minimum wage increase

In addition to calculating natural wage growth before estimating the impact of the minimum wage

increase, we also estimate the natural employment growth over the same period so that we can better

estimate the number of workers affected by a minimum wage change in 2016.

Similar to adjusting wages, we use a two-step process to adjust for employment growth. First, we adjust

the 2013 estimates to 2015 using the rate of employment growth between 2013 and 2015 as indicated

in the Comptroller’s Biennial Revenue Estimate. We then project estimates to 2016, the year of the

proposed minimum wage increase, using estimates of employment growth between 2015 and 2016.

We did not make adjustments for either positive or negative changes in employment growth prior to

implementation of a minimum wage increase. There has been much conflicting research on the

employment effects that occur after implementation of a minimum wage increase. (For more, see the

state report.) However, there is no evidence to suggest that employment growth would be affected

prior to implementation of a minimum wage increase.

Table 3. Employment growth adjustments to statewide estimates

Estimated number of workers affected by minimum wage increase to $10.10 based

on 2013 data

2,171,966

Adjustment for employment growth that occurred between 2013 and present year

(2015)

2,281,570

Adjustment for projected employment growth between 2015 and 2016 (year of

proposed minimum wage increase)

2,383,554

Demographic characteristics of workers affected by minimum wage increase

We analyze key demographic variables in the individual-level PUMS files: age, sex, race/ethnicity,

educational attainment, and veteran status. We also analyze the reported occupation and industry of

workers. Finally, we link the household-level PUMS file to the individual-level PUMS file to analyze two

household characteristics of individuals potentially affected by a minimum wage increase:

household/family type and household presence of children.

Local Area Analysis of Workers Affected by Minimum Wage Increase

We define local areas using Place-of-Work Public Use Microdata Areas (POWPUMAs), statistical

geographic areas that contain at least 100,000 people and are built on counties. The Amarillo area is

comprised of two POWPUMAs that cover Potter and Randall counties. We combine Potter and Randall

counties to analyze the impact on Amarillo-area workers. The Corpus Christi area is comprised of two

POWPUMAs that cover Nueces, San Patricio, Bee, Refugio, and Aransas counties. We combine these

counties to analyze the impacts on Corpus Christi-area workers.

Approximately 9.5 percent of the state sample is not included in the data for local-area analysis. This

occurs because survey respondents report place-of-work based on work during the week prior to taking

the survey. Approximately 9.5 percent of individuals who worked at least 14 weeks in the prior year (and

are thus considered “workers” in the state analysis) did not work the week prior to the survey.

Therefore, they did not report a place-of-work and are not included in the local-area analysis.

Estimating percentages and numbers of workers affected by minimum wage increase in local areas

Percentages and numbers of minimum wage workers affected in local areas used the same

methodology as state estimates. We assume employment growth in local areas is the same as

employment growth for the state.

Demographic characteristics of workers affected by minimum wage increase in local areas

We analyze key demographic variables in the individual-level PUMS files: age, sex, race/ethnicity, and

educational attainment. We link the household-level PUMS file to the individual-level PUMS file to

analyze two household characteristics of individuals potentially affected a minimum wage increase:

household/family type and household presence of children.

Because of the smaller sample sizes and differing demographics in local areas, we are able to report a

limited number of demographic characteristics for selected local areas. Furthermore, for each local area,

the demographic characteristics that we are able to report with confidence differ according to the

makeup of that area. For example, in Webb County, we are able to estimate the percent of workers

affected by a state minimum wage law who are Hispanic because of the county’s large Hispanic

population. However, because of the county’s relatively small population, we are not able to provide

estimates of the age distribution of those affected with the same level of confidence.

We calculate margins of error using generalized standard error formulas with design factors

34

and

present margins of error at 90 percent confidence intervals. We do not report local estimates with

moderately high levels of statistical inaccuracy due to small sample size (defined as estimates where the

coefficient of variation is higher than 10).

1

Working Poor Families Project Data, ACS 2013 release.

2

Workers who benefit include those currently earning less than the proposed minimum wage of $10.10 per hour and those

earning between $10.10 and $11.62 per hour. Workers earning between $10.10 and $11.62 per hour are considered

indirectly affected by a minimum wage increase because of ‘spillover’ effects because their wages would likely rise of the

minimum wage rose. The spillover band is defined as between 100 and 115 percent of the proposed minimum wage. The

sample consists of individuals at least 16 years old, working at least 14 weeks in the prior year, and with positive earnings

from wages or salaries. Individuals excluded from the analysis are the unemployed, self-employed workers, unpaid family

workers, and public-sector employees who would not be affected by a state minimum wage law.

3

CPPP analysis of 1-year 2013 American Community Survey Public-Use Microdata Sample (PUMS) for Texas. U.S. Census

Bureau. (2015). 2013 American Community Survey Public Use Microdata Sample [Data file]. Retrieved from

http://www2.census.gov/acs2013_1yr/

4

Additional information can be found in the appendix.

5

U.S. Census Bureau. (2015). 2013 American Community Survey Public Use Microdata Sample [Data file]. Retrieved from

http://www2.census.gov/acs2013_1yr/

6

LoPalo, M. & Orrenius, P. (2014). Texas Leads Nation in Creation of Jobs at All Pay Levels. Southwest Economy, Federal

Reserve Bank of Dallas. http://bit.ly/1MNtoAW

7

The Federal Fair Labor Standards Act sets the national minimum wage at $7.25 per hour. Workers that make below the

federal minimum wage may include tipped workers and small firms that are not subject to the Fair Labor Standards Act.

Governing Data. (2014). Minimum Wage Workers by State: Statistics, Totals. http://bit.ly/1ML3hc0

8

Working Poor Families Project Data, ACS 2013 release.

9

Raise the Minimum Wage. (2015). What’s the Minimum Wage in Your State? http://bit.ly/1MNudcX This data was confirmed

and analyzed by the Worker’s Defense Project in Austin, Texas

10

Center for Public Policy Priorities family budgets calculator. www.familybudgets.org

11

American Sustainable Business Council and Business for a Fair Minimum Wage. (2014). Opinion Poll: Small Business Owners

Favor Raising Federal Minimum Wage. http://bit.ly/1EG8Qtd

12

These numbers were calculated using the tool at familybudgets.org.

13

Card, D. and Krueger, A.B. (1994). Minimum Wage and Employment: A Case Study of the Fast-Food Industry in New Jersey

and Pennsylvania. American Economic Review. 84: 772-793. http://bit.ly/1Glb4vb

14

Card, D. and Krueger, A.B. (1995a). Time-series minimum-wage studies: A meta-analysis. American Economic Review. 85:

238-243. http://bit.ly/1BvkrUs

15

Doucouliagos, H. & Stanley, T.D. (2014) Publication Selection Bias in Minimum-Wage Research? A Meta-Regression Analysis.

Deakin University Economics Working Paper. http://bit.ly/1CqxmfL; Schmitt, J. (2013). Why Does the Minimum Wage Have

No Discernible Effect on Employment? The Center for Economic and Policy Research. http://bit.ly/1MHShOs

16

Meer, J. & West, J. (2015). Effects of the Minimum Wage on Employment Dynamics. Texas A&M University.

http://bit.ly/1wX2gvq

17

Congressional Budget Office. (2014). The Effects of a Minimum-Wage Increase on Employment and Family Income.

http://1.usa.gov/1EylIyC

18

Chicago Booth IGM Forum. (2013). Minimum Wage. http://bit.ly/1be6DZv

19

U.S. Department of Labor, Wage and Hour Division. (2014). Handy Reference Guide to the Fair Labor Standards Act.

http://1.usa.gov/1O9KXNm

20

Minnesota Department of Labor and Industry. (2014). Labor Standards –Minnesota’s minimum-wage law.

http://bit.ly/1AVlOfb

21

National Employment Law Project. (2014). City Minimum Wage Laws: Recent Trends and Economic Evidence on Local

Minimum Wages. http://bit.ly/18DVMXi

22

U.S. Census Bureau. (2015). 2013 American Community Survey Public Use Microdata Sample [Data file]. Retrieved from

http://www2.census.gov/acs2013_1yr/

23

U.S. Census Bureau. (2015). 2013 American Community Survey Public Use Microdata Sample [Data file]. Retrieved from

http://www2.census.gov/acs2013_1yr/

24

U.S. Census Bureau. (2015). 2013 American Community Survey Public Use Microdata Sample [Data file]. Retrieved from

http://www2.census.gov/acs2013_1yr/

25

U.S. Census Bureau. (2015). 2013 American Community Survey Public Use Microdata Sample [Data file]. Retrieved from

http://www2.census.gov/acs2013_1yr/

26

Bureau of Labor Statistics Southwest Information Office. (2014). Minimum Wage Workers in Texas-2013.

http://1.usa.gov/1EocIK3

27

U.S. Census Bureau. (2015). 2013 American Community Survey Public Use Microdata Sample [Data file]. Retrieved from

http://www2.census.gov/acs2013_1yr/

28

U.S. Census Bureau. (2015). 2013 American Community Survey Public Use Microdata Sample [Data file]. Retrieved from

http://www2.census.gov/acs2013_1yr/

29

Welsh-Loveman, J., Perry, I., & Bernhardt, A. (2014). Data and methods for estimating the impact of proposed local minimum

wage laws. Institute for Research on Labor and Employment: University of California at Berkeley.

http://www.irle.berkeley.edu/cwed/briefs/2014-01-data-and-methods.pdf

30

U.S. Census Bureau. (2015). 2013 American Community Survey Public Use Microdata Sample [Data file]. Retrieved from

http://www2.census.gov/acs2013_1yr/

31

Hegar, G. (2015). Biennial revenue estimate.

http://www.texastransparency.org/State_Finance/Budget_Finance/Reports/Biennial_Revenue_Estimate/2016_17/pdf/BRE_

2016-17.pdf.

32

Wicks-Lim, J. (2006). Mandated wage floors and the wage structure: New estimates of the ripple effects of minimum wage

laws. Political Economy Research Institute: University of Massachusetts Amherst.

http://www.peri.umass.edu/fileadmin/pdf/WP116.pdf.

33

http://www.cbo.gov/sites/default/files/cbofiles/attachments/44995-MinimumWage.pdf.

34

U.S. Census Bureau. (2015). PUMS accuracy of the data 2013.

http://www.census.gov/acs/www/Downloads/data_documentation/pums/Accuracy/2013AccuracyPUMS.pdf.

For more information or to request an interview, please contact Oliver Bernstein at [email protected] or

512.823.2875.

About CPPP

The Center for Public Policy Priorities is an independent public policy organization that uses research,

analysis and advocacy to promote solutions that enable Texans of all backgrounds to reach their full

potential. Learn more at CPPP.org.

Join us across the Web

Twitter: @CPPP_TX

Facebook: Facebook.com/bettertexas