TEXAS MUNICIPAL POWER V. THE BNSF RY. CO. 803

7 S. T. B.

STB DOCKET NO. 42056

TEXAS MUNICIPAL POWER AGENCY

v.

THE BURLINGTON NORTHERN AND SANTA FE RAILWAY

COMPANY

Decided September 24, 2004

Upon reconsideration, the Board modifies the rate prescription and

reparations award in this proceeding.

BY THE BOARD

In this proceeding, Texas Municipal Power Agency (TMPA) challenged

the reasonableness of the rate charged by The Burlington Northern and Santa

Fe Railway Company (BNSF) for transportation of coal in unit trains from

certain mine origins in the Powder River Basin (PRB) of Wyoming to

TMPA’s Gibbons Creek Steam Electric Station at Iola, TX. In Texas Mun.

Power Agency v. The Burlington N. & S. F. Ry. Co. 6 S.T.B. 573 (2003)

(TMPA 2003), the Board found that BNSF has market dominance over that

transportation and that the challenged rate was unreasonably high. Based

upon a stand-alone cost (SAC) analysis, the Board prescribed maximum

reasonable rates through the year 2011 and awarded reparations to TMPA.

TMPA and BNSF have each filed timely petitions for reconsideration of

various aspects of that decision. They ask the Board to reconsider various

substantive determinations made in TMPA 2003 and to correct several

asserted technical errors. The issues raised, which are discussed in turn below,

involve:

< whether BNSF should have been required to formally establish a rate

for transportation in shipper-supplied railcars and to use those cars in

place of its own railcars (Section I);

< the variable costs associated with maintenance-of-way, return on

road property and depreciation, and locomotive fuel expense

(Section II);

< those portions of the SAC analysis addressing rerouting of traffic,

revenue forecasts, locomotive fueling expense, general and

administrative expenses, bridges, utility relocation, road resurfacing,

at-grade crossings, and fencing (Section III);

< the asserted technical errors (Section IV); and

SURFACE TRANSPORTATION BOARD REPORTS804

7 S. T. B.

< the scope of the rate prescription (Section V).

Three industry associations—Western Coal Traffic League (WCTL),

National Industrial Transportation League (NITL), and North America Freight

Car Association (NAFCA) (collectively, the “associations”)—have filed

petitions to intervene in support of TMPA’s request for reconsideration with

respect to the first set of issues listed above. The associations will be allowed

to participate as amici, but not intervene as parties to this private rate dispute.

As amici, they may present their views on, and support of, issues raised by

TMPA in its petition for reconsideration. They will not, however, have

access to confidential information; nor will they be allowed to broaden the

issues in the proceeding. See Arizona Pub. Serv. Co. & Pacificorp v. The

Burlington N. & S. F. Ry. Co., 7 S.T.B. 71 (2003).

As discussed below, upon reconsideration we correct two technical errors

in the SAC computation and we revise the SAC analysis in one respect (a

modest increase in the level of executive salaries) to conform with the record

in this case. We revise the rate prescription and reparations accordingly, and

we clarify that the rate prescriptions extend to all mine origins in TMPA’s

complaint. The remaining reconsideration requests are denied.

DISCUSSION AND CONCLUSIONS

A party may seek to have the Board reconsider a decision by submitting a

timely petition that presents new evidence or changed circumstances that

would materially affect the case or that demonstrates material error in the

prior decision. 49 U.S.C. 722(c); 49 CFR 1115.3 (timely administrative

appeals). Where, as here, a petition is timely filed within 20 days after the

service date of the prior decision, the prior decision does not become

administratively final for purposes of seeking judicial review until the Board

has acted on the administrative appeal. See American Farm Lines v. Black

Ball, 397 U.S. 532, 541 (1970); ICC v. Brotherhood of Locomotive Engineers,

482 U.S. 270, 284-85 (1987).

The Board encourages parties to file timely administrative appeals where

they believe the Board has erred in some respect. The courts favor such

administrative reconsideration, as it is a more expeditious and efficient means

of achieving corrections or adjustments than resort to the federal courts in the

first instance. See Commonwealth of Pennsylvania v. ICC, 590 F.2d 1187,

1194 (D.C. Cir. 1978); B. J. Alan Co. v. ICC, 897 F.2d 561, 562-63 n.1 (D.C.

Cir. 1990). And even where judicial review is later sought, the reconsideration

process can assist the court’s review process by providing a further

exploration of the issues in advance. See American Farm Lines, 397 U.S. at

541; McCarty Farms, Inc. v. STB, 158 F.3d 1294, 1301 n.1 (D.C. Cir. 1998)

(further Board decision was “helpful to the court”).

On the other hand, the Board generally does not consider new issues

raised for the first time on reconsideration where those issues could have and

should have been presented in the earlier stages of the proceeding. Moreover,

the term “new evidence” refers to evidence that was not reasonably available

to the party when the record was developed, and not simply newly raised. See

TEXAS MUNICIPAL POWER V. THE BNSF RY. CO. 805

1

TMPA Open. WP. at 4121 (TMPA letter dated October 17, 2000).

2

TMPA Open. WP. at 4123 (BNSF letter dated November 1, 2000).

3

TMPA Open. WP. at 4126-7 (TMPA letter dated January 8, 2001).

4

TMPA Open. WP. at 4131 (TMPA letter dated February 27, 2001).

5

TMPA Open. WP. at 4132 (BNSF letter dated March 12, 2001).

6

Section 10702 provides that “[a] rail carrier providing transportation or service subject to the

jurisdiction of the Board under this part shall establish reasonable (1) rates * * * and (2) rules and

practices on matters related to that transportation or service.”

7 S. T. B.

Friends of Sierra R.R., Inc. v. ICC, 881 F.2d 663, 667 (9th Cir. 1989).

Nothing in the statute or the Board’s regulations obliges the agency to rethink

its decisions whenever a party wishes to try out a new theory or finds new

information at a late stage in the process. Connecticut Trust for Historic

Preservation v. ICC, 841 F.2d 479, 484 (2d Cir. 1988). And if a party were

free to reshape its case, so long as it did so within 20 days after a decision, the

administrative process might never end. The agency is not expected to

“behave like Penelope, unraveling each day’s work to start the web again the

next day.” Western Coal Traffic League v. ICC, 735 F.2d 1408, 1411 (D.C.

Cir. 1984).

I. Rate for Transportation in Shipper-Owned Cars

Historically, BNSF has served TMPA’s coal movements from the PRB to

the Gibbons Creek station in three train sets of BNSF-furnished railcars. In

2000, TMPA asked BNSF to establish a separate rate for movements in

shipper-supplied cars. TMPA advised BNSF that it was prepared to supply

the equipment “if the rate differential justified the acquisition costs.”

1

BNSF,

however, chose to establish a rate only in railroad-furnished cars, explaining

that it had the equipment available and had chosen to use that equipment for

this service.

2

Two months later, TMPA began objecting to a perceived drop-off in

BNSF’s service level. In a series of correspondence with BNSF, TMPA

complained that it was becoming critically short on its coal requirements due

to BNSF’s inability to provide an adequate number of train sets and crews to

meet TMPA’s needs. BNSF advised TMPA that the larger volumes of coal

coming out of the PRB required more trains and crew, but that congestion on

its network made adding a fourth train set for TMPA inadvisable. Instead,

BNSF instituted some “short-term plans” that, TMPA acknowledged, “seem

to be easing our inventory shortages.”

3

Nonetheless, in light of its past

inventory concerns, TMPA renewed its request for a rate in TMPA-supplied

cars.

4

BNSF again advised TMPA that it had sufficient equipment to fulfill

its common carrier obligations and that, if it should become necessary to use

TMPA-supplied cars, BNSF would accept them, applying the same rate it

used for movements in BNSF-supplied cars.

5

In its complaint challenging the BNSF rate for movements in railroad-

supplied cars, TMPA also charged that BNSF’s refusal to use TMPA-supplied

equipment and to formally establish a rate for shipments in shipper-supplied

cars constituted an unreasonable practice, in violation of 49 U.S.C. 10702.

6

TMPA argued that at least one trainset of shipper-supplied cars is needed to

SURFACE TRANSPORTATION BOARD REPORTS806

7

TMPA Open. Narr. at 34.

8

Id.

7 S. T. B.

supplement the BNSF fleet and satisfy TMPA’s service requirements.

7

TMPA further argued that using shipper-supplied cars for one or more

trainsets of its traffic would not cause the railroad’s cars to be idled, because

they could be shifted immediately to alternative productive uses elsewhere.

8

In TMPA 2003, 6 S.T.B. at 581-82, the Board declined to require BNSF

to accept TMPA-supplied cars. The Board explained that railroads have the

right to use their own railcars so long as they can meet their common carrier

obligations with those cars. See Atchison, Topeka & S. F. Ry. Co. v. United

States, 232 U.S. 199, 214-15 (1914) (Atchison); Shippers Comm., OT-5 v. Ann

Arbor R.R., 5 I.C.C.2d 856, 865 (1989) (SCOT-5), aff’d, Shippers Comm. OT-

5 v. ICC, 968 F.2d 75 (D.C. Cir. 1992). Examining the record in this case, the

Board concluded that TMPA had not shown that BNSF cannot meet its

common carrier obligations using its own railcars.

TMPA and the three amici have sought reconsideration, raising two

distinct issues: (A) whether the carrier can lawfully decline to accept TMPA-

supplied cars; and (B) even if the carrier is not required to accept shipper-

supplied railcars at this time, whether the railroad nonetheless should be

required to establish a rate for such movements. Although the parties often

merge these two issues, they present distinct concerns and will be discussed

separately.

A. Use of TMPA-Supplied Cars

In its petition for reconsideration, TMPA reiterates its complaints about

the inconsistency of BNSF’s service and its prediction that the railroad’s cars

would not be idled if TMPA cars were used. However, TMPA has failed to

demonstrate that BNSF has not met and cannot continue to meet its common

carrier obligations in railroad-furnished cars. Rather, the evidence

demonstrates that congestion on the rail lines was the cause of TMPA’s

inventory problems and that adding more trainsets to the already congested

network would not have alleviated that situation. The argument that BNSF

might find alternative uses for its railcars, even if correct, is irrelevant to this

inquiry. For absent evidence that BNSF does not have sufficient railcars

available to serve TMPA, BNSF has no common carrier obligation to use

shipper-supplied cars. And, given the lack of evidence that BNSF-supplied

railcars were unavailable, we cannot find that BNSF engaged in an

unreasonable practice, in violation of 49 U.S.C. 10702, by favoring the use of

its own railcars over railcars to be provided by TMPA.

WCTL argues that this analysis does not hold up for unit-train service.

WCTL cites Potomac Electric Power Co. v. Penn Central Transp. Co.,

356 I.C.C. 815 (1977) (PEPCO), aff’d in relevant part, Potomac Electric

Power Co. v. United States, 584 F.2d 1058 (D.C. Cir. 1978) for the

proposition that railroads do not have a common carrier obligation to provide

unit-train service in railroad-supplied cars. And because a carrier’s right to

TEXAS MUNICIPAL POWER V. THE BNSF RY. CO. 807

9

TMPA Open. Narr. at 34; see also id. at 117; TMPA Reply Narr. at 78; TMPA Br. at 29.

7 S. T. B.

favor the use of its own railcars derives from its obligation to provide cars for

that service, WCTL concludes that railroads may not refuse to accept shipper-

supplied cars for unit-train service.

In PEPCO, the shipper had asked the defendant railroad (Penn Central

Transportation Company) to establish a rate for “unit-train” service in

railroad-supplied cars. Instead, Penn Central established one tariff rate for

“train-load” service in railroad-supplied cars and another rate for unit-train

service in shipper-supplied cars. The train-load service Penn Central offered

in its own railcars was nearly identical to the unit-train service PEPCO

sought: both called for shipments of over 7,000 tons of coal per train from

eastern mines to PEPCO’s three electric generating plants in railroad-supplied

cars. But in unit-train service railcars and locomotives are joined for

uninterrupted, round trip, shuttle-type service, and Penn Central did not want

to commit its own railcars to the repeated movement of a single unit-train.

Penn Central preferred the greater operating flexibility of train-load service,

whereby it could use those railcars to serve other shippers if needed.

PEPCO challenged Penn Central’s refusal to dedicate the railroad’s cars

to unit-train service as an unreasonable practice. The Board’s predecessor,

the Interstate Commerce Commission (ICC), found no merit to PEPCO’s

claims, as the record clearly established that Penn Central was providing

comparable train-load service to PEPCO in railroad-supplied cars. PEPCO,

356 I.C.C. at 827 (1977). The court of appeals agreed. Potomac Elec. Power

Co., 584 F.2d at 1063 (“In these circumstances, the railroad’s refusal to hold

out a complete unit-train service did not violate the Interstate Commerce

Act.”).

Thus, PEPCO does not stand for the broad proposition that a carrier is

never required to provide service in unit trains. In PEPCO, the ICC made a

case-specific determination that it was reasonable for the carrier to offer

trainload service, instead of unit-train service, where that service applied from

the same origin at the same minimum weight as the unit-train service. See

PEPCO, 365 I.C.C. at 827. To the extent that PEPCO stands for a general

proposition, it is that how a railroad satisfies its common carrier obligation is

left to the railroad to decide in the first instance. So long as the railroad offers

service that satisfies its common carrier obligations (the critical inquiry), it

need not provide the particular service that the shipper would prefer.

In this case, the issue of whose equipment is to be used appears to be

more about rate levels than service. TMPA complains that, in insisting on

using the railroad’s cars, BNSF is “leveraging its monopoly over TMPA’s

coal transportation service to collect a guaranteed, 80% mark-up on its

variable railcar costs.”

9

Under 49 U.S.C. 10707(c)(1)(A), a railroad may

charge a captive shipper up to 180% of its variable cost of serving that shipper

without regulatory intervention, and the Board cannot prescribe a rate that

would yield revenues below that level. See West Texas Util. Co. v. Burlington

N. R.R., 1 S.T.B. 638, 677 (1996) (West Texas), aff’d sub nom. Burlington N.

SURFACE TRANSPORTATION BOARD REPORTS808

10

The term “OT-5” refers to procedures published at the time in the Official Railway

Equipment Register, OT-5, Circular E, for assigning reporting marks and handling private cars.

Under those procedures, a noncarrier would file an application with the Association of American

Railroads, which would forward it to the carrier on whose lines the cars were to be placed in service.

The originating carrier had the discretion to grant or deny OT-5 approval.

7 S. T. B.

R.R. v. STB, 114 F.3d 206 (D.C. Cir. 1997). Therefore, it may indeed be more

profitable for a railroad to use its own railcars to provide service to a captive

shipper, at least when a rate prescription is set at the regulatory floor.

But when Congress established the 180% revenue-to-variable (R/VC)

floor, it was well settled that railroads may use their own railcars in

preference to shipper-supplied cars. As far back as 1914, the law has been

clear that railroads have the right to use their own cars so long as they can

meet their common carrier obligations with those cars. Atchison, 232 U.S. at

214-15. Because Congress legislates against the backdrop of then-existing

law, one must presume that, in enacting 49 U.S.C. 10707(d)(1)(A), Congress

intended to permit railroads to charge captive shippers 180% of the variable

cost of supplying the railcars. See, e.g., United States v. Baxter Int’l, Inc.,

345 F.3d 866, 900 (11th Cir. 2003) (“We presume that Congress legislates

against the backdrop of established principles of state and federal common

law, and that when it wishes to deviate from deeply rooted principles, it will

say so.”).

Although TMPA may want a lower rate for transportation using its own

cars, the Supreme Court has held that a railroad is under no obligation to

provide a lower rate for service in shipper-supplied cars. As the Court has

explained, because railroads must stand ready as common carriers to provide

service in railroad-supplied cars (see 49 U.S.C. 11101, 11121) they “cannot

be compelled to accept [railcars] tendered by the shipper on condition that a

lower freight rate be charged.” Atchison, 232 U.S. at 214-15.

B. Rate for TMPA-Supplied Cars

NITL/NAFCA argue that the railroad should nonetheless be obliged to

provide a rate for transportation in shipper-supplied cars (TMPA 2003,

6 S.T.B. at 581-82) in light of the balance struck in SCOT-5. In that case, a

shipper group filed a complaint challenging the practices of most of the

nation’s railroads regarding the use and control of privately owned covered

hopper cars in grain transportation. The complainants alleged, among other

things, that the railroads had defaulted on their common carrier obligation by

not supplying a sufficient number of railcars when requested by shippers.

They also objected to the industry practice of sometimes denying “OT-5

approval” for assigning reporting marks to privately owned railcars—which is

required before private cars can be put onto the rail system—solely for

economic reasons.

10

The ICC concluded that it was an unreasonable practice for carriers to

deny such approvals for reasons other than safety, mechanical factors, or

inadequate track storage space. SCOT-5, 5 I.C.C.2d at 864 (1989). The ICC

explained that there should be no artificial impediment to the use of private

cars when carrier cars are unavailable. But the ICC also made clear that

TEXAS MUNICIPAL POWER V. THE BNSF RY. CO. 809

11

TMPA Open. WP. at 4132 (BNSF letter dated March 12, 2001).

12

See Procedures To Expedite Resolution of Rail Rate Challenges To Be Considered Under

the Stand-Alone Cost Methodology, 6 S.T.B. 805 (2003).

7 S. T. B.

“[a]llowing shippers freely to register private cars under the OT-5 process

does not, in itself, require the railroads to use private cars when the railroads

have cars of their own available.” Id. at 870.

Here, NITL/NAFCA argue that, just as the ICC found it unlawful for

carriers to routinely refuse OT-5 approval for cars that the owners were ready

to put into the rail system, the Board should find that a carrier must establish a

common carrier rate for transportation using those cars. Otherwise, the 10-

day period that railroads have for establishing a common carrier rate (see

49 CFR 1300.3) would create another artificial barrier to the use of privately

supplied railcars.

While there may be merit to that argument, we need not and do not

resolve that issue here, because the delay concerns expressed by

NITL/NAFCA do not apply in this case. The record indicates that BNSF has

already informed TMPA of the common carrier rate it would charge, at least

initially, for shipments in TMPA-supplied railcars should movements in

shipper-supplied cars become necessary

11

—a fact that the amici would not

have known, as the evidence in this case was filed prior to the Board’s

clarification of the requirement that parties file public versions of their

evidence in rate cases,

12

and a fact that was not reported in TMPA 2003. The

rate the carrier has quoted for movements in shipper-supplied cars is the same

as the rate for movements in railroad-supplied cars, but, as previously

discussed, BNSF cannot be compelled to accept shipper-supplied railcars on

the condition that a lower freight rate be charged. Atchison, 232 U.S. at

214-15.

II. Variable Cost Issues

The Board may consider the reasonableness of a challenged rate only if

the carrier has market dominance over the traffic involved. 49 U.S.C.

10701(d)(1), 10707(b). Market dominance is “an absence of effective

competition from other carriers or modes of transportation for the

transportation to which a rate applies.” 49 U.S.C. 10707(a). The statute

precludes a finding of market dominance, however, where the carrier shows

that the revenues produced by the movements at issue are less than 180% of

the carrier’s variable costs for providing that service. 49 U.S.C.

10707(d)(1)(A).

The variable costs associated with the traffic at issue also determine the

floor for regulatory rate relief, because the Board cannot prescribe a rate that

is below the 180% R/VC jurisdictional floor. See West Texas, 1 S.T.B. at 677

(1996). Therefore, the rate prescribed in this case was the higher of the rate

level produced by the SAC analysis or the regulatory floor (the 180% R/VC

rate level). See TMPA 2003, 6 S.T.B. at 608-11.

Under 49 U.S.C. 10707(d)(1)(B), a carrier’s variable costs are to be

determined using the Board’s Uniform Railroad Costing System (URCS),

SURFACE TRANSPORTATION BOARD REPORTS810

7 S. T. B.

with adjustment where appropriate. URCS is a general purpose costing model

used to determine the variable cost of a movement. The model determines,

for each Class I railroad, what portion of each category of costs shown in its

Annual Report to the Board (STB Form R-1) represents its system-average

variable unit cost for that cost category for that year. In considering whether

to allow adjustments to the system-average variable costs produced by URCS,

the Board evaluates whether the party proposing to use a different figure has

shown that its proposed figure would better reflect the variable costs of

serving the particular traffic at issue than the URCS system-average figure.

These adjustments are known as “movement-specific” adjustments.

In this case, each party proposed various movement-specific adjustments

to the URCS system-average figures. In TMPA 2003, the Board accepted

some of the adjustments proposed by the parties but not others. The Board

then concluded that the challenged rate produces revenues that exceed 180%

of the variable costs of providing service from the two mine origins for which

traffic data had been submitted. In their petitions for reconsideration, each

party objects to certain component parts of our variable cost analysis. Their

objections are discussed individually below.

A. Maintenance-of-Way Costs

To calculate the variable costs associated with maintenance-of-way

(MOW), the Board used system-average URCS rather than the “speed

factored gross ton” (SFGT) formula accepted in prior cases. The original

SFGT formula was developed in 1973 to allocate MOW costs between

passenger and freight traffic. It was based on research on track degradation

and MOW activities from 1950 to 1970, and the precise parameters of the

formula were estimated using those data and standard regression analysis.

See generally Nat’l R.R. Passenger Corp. & Consolidated Rail Corp.,

10 I.C.C.2d 863, 872-74 (1995) (Amtrak). The Board had accepted

adjustments based on the SFGT formula in prior SAC cases. But in this case,

the Board concluded that the SFGT formula is so outdated as to no longer be

reliable. TMPA 2003, 6 S.T.B. at 633.

TMPA objects to the departure from precedent. It argues that use of the

SFGT formula was well-settled and that the Board has previously rejected

arguments that the formula was out-of-date. TMPA also contends that the

record contained evidence demonstrating that the SFGT formula accurately

calculates average MOW costs because of adjustments that have been made

to the formula to reflect changes in maintenance practices, heavier wheel

loads, and traffic densities. To justify some movement-specific adjustments

for these high-density lines, TMPA pointed to evidence that BNSF’s system-

average MOW expense has fallen over time, allegedly showing that there

remain economies of density in the maintenance of rail lines.

It is undisputed that much has changed since the original SFGT formula

was derived. As BNSF had pointed out, in 1983 the ICC changed the

accounting system that is used by railroads from a retirement, replacement,

and betterment system to a depreciation accounting system, which treats a

significantly greater portion of maintenance as capital cost (as opposed to an

TEXAS MUNICIPAL POWER V. THE BNSF RY. CO. 811

13

See TMPA Open Narr. at 73.

7 S. T. B.

operating expense) than the prior accounting system had. Track materials

have become more durable. In 1978 the average rail line had 111-lb. rail,

only 6% of which was continuous welded rail (CWR); by 1999, the average

weight of rail was 125-lb., and 62% of that was CWR. And industry

maintenance practices have changed over the years, so that more of the

maintenance that is being performed is planned maintenance, which is

capitalized under depreciation accounting. TMPA 2003, 6 S.T.B. at 633 n.92.

Furthermore, the average densities of the railroads of the 1970’s bear no

relation to the average densities of the railroad today. The SFGT formula

reflected railroad lines with an average density of 10-15 million gross tons

(MGT), and densities of 25 MGT were relatively rare when that formula was

developed. See Amtrak, 10 I.C.C.2d at 877. In contrast, in 2000 the average

density along the route BNSF uses for TMPA’s traffic was approximately 60

MGT. In short, present-day railroad maintenance expenses and practices bear

little resemblance to those of 30 to 50 years ago.

The SFGT formula, however, has not been re-benchmarked to address

these changes. And scholars have long cautioned of the dangers of using a

regression analysis to extrapolate beyond the range of existing data. See, e.g.,

Rudolf Freud & William Wilson, Regression Analysis: Statistical Modeling of

a Response Variable (1998), at 65 n.53. See also Amtrak, 10 I.C.C.2d at 877

(“Applying [the SFGT] regression results to circumstances outside the

relevant range of data upon which the regression equations are based may not

produce valid results.”).

The fact that the formula has been modified by consultants does not

correct the problem. To the contrary, such changes could render the new

formula less reliable than the original formula. For example, the formula was

changed to add an “R-Factor”—an index purportedly designed to reflect

current maintenance practices, price levels, and departmental overheads.

13

The R-Factor was derived by comparing the SFGT formula with the system-

average MOW expenses of the carrier. For example, if the original SFGT

formula would yield a system-average MOW figure of $100 million for a

carrier, when in fact its MOW expense was $150 million, the R-Factor would

be 1.5. The formula would then be indexed by this percent markup (or

markdown as the case may be). In this case, TMPA applied an R-Factor of

0.86, indicating that the original SFGT formula overstates BNSF MOW

expenses by 14%. But the extent to which the adjustment yields reliable

results or simply masks the unreliableness of the old formula is impossible to

determine. In its circular fashion, the R-Factor does ensure that the SFGT

formula produces accurate system-average MOW expenses, but there is no

evidence that this adjustment ensures that the formula accurately models the

relationship between MOW expenses and density with respect to individual

lines.

In sum, there is no evidence that the SFGT formula produces MOW

expenses that are comparable to current actual MOW costs for any rail line.

Compare San Antonio v. Burlington N. R.R., STB Docket No. 36180 (ICC

served April 11, 1986) (SFGT-calculated MOW costs were shown to be

SURFACE TRANSPORTATION BOARD REPORTS812

7 S. T. B.

within 8% of BNSF’s actual 1978 MOW expenditures). Thus, although the

SFGT formula originally fit the data well, the passage of time and profound

changes in this industry have plainly rendered unreliable the continued use of

the SFGT formula. We need not use an outdated formula forever simply

because it was accepted in prior cases. See Atchison, T. & S. F. Ry. v. Wichita

Board of Trade, 412 U.S. 800, 808 (1973); JSG Trading Corp. v. USDA,

176 F.3d 536, 544 (D.C. Cir. 1999) (an agency is not strictly bound to follow

the test applied in prior cases, so long as it articulates a principled rationale

for departing from that test).

B. Return on Road Property and Depreciation Expense

In TMPA 2003, 6 S.T.B. at 635, the Board accepted, with one correction,

the movement-specific adjustments that TMPA had proposed for calculating

variable road property return-on-investment and depreciation expense. The

Board found that TMPA’s adjustments were reasonable and supported, and

that BNSF had failed to discredit them. On reconsideration, BNSF argues

that the Board should have followed the precedent in Wisconsin Power &

Light Co. v. Union Pacific R.R., STB Docket No. 42051 (STB served May 14,

2002) (WPL Recons.) at 4-6, where, to calculate the MOW component of

variable cost, the Board rejected a similar aggregate approach in favor of a

segment-by-segment approach. Although the determination in WPL Recons.

dealt with a different variable cost expense, BNSF contends that the same

type of analysis should be applied to road property expenses.

However, BNSF never proposed that the Board use a segment-by-

segment procedure when making movement-specific adjustments to the road

property expense item. Rather, it argued (unsuccessfully) that the Board

should not make any movement-specific adjustment to this expense item. (In

contrast, in the WPL Recons. case, the Union Pacific Railroad Company’s

initial case had included movement-specific adjustments to the MOW

expense item using a segment-by-segment weighted allocation procedure.) It

is inappropriate for BNSF to raise an issue in a petition for reconsideration

that it chose not to raise initially. Furthermore, the issue in WPL Recons. is

not identical to the issue sought to be presented here, as it related to a

different expense item. The Board did not have the benefit of a full record

and debate on whether a segment-by-segment approach would be appropriate

for road property expenses. As BNSF failed to challenge the particular

manner in which TMPA performed its movement-specific adjustment below,

its request for reconsideration of the calculation of variable road property

expenses is denied.

C. Locomotive Fuel Expense

TMPA seeks reconsideration of the Board’s determination with respect to

locomotive fueling expense, in TMPA 2003, 6 S.T.B. at 635-36. Before the

filing of evidence, the Board had ordered BNSF to let TMPA conduct a

TEXAS MUNICIPAL POWER V. THE BNSF RY. CO. 813

14

Texas Mun. Power Agency v. Burlington N. & S. F. Ry. Co., STB Docket No. 42056 (STB

served February 9, 2001) at 8.

15

TMPA Open. Narr. at 96-98; TMPA Reply Narr. at 71-72; TMPA Reb. Narr. at 96, 186.

16

TMPA Reply Narr. at 72 n.66; TMPA Reply e-WP. “Fuel Summary Reply.123”; TMPA

Reb. Narr. at 193.

17

TMPA Open. Narr. at 96-97.

7 S. T. B.

special study of locomotive fuel consumption.

14

The parties had negotiated

and agreed upon a study methodology, which was tested and validated by

TMPA’s witness. The special study examined a three-locomotive consist (the

number of locomotives used to move trains transporting TMPA’s traffic)

using an event recorder. This device documented the amount of time that a

locomotive consist operated at a particular throttle setting. Based on

manufacturer-specified fuel consumption levels at different throttle settings,

an estimate of the gallons of fuel consumed to serve TMPA was developed.

TMPA, however, was not satisfied with the results of this study, which

showed fuel consumption rates higher than BNSF’s system-average rates.

TMPA argued that the study results were too high because certain operating

characteristics of the study trains (number of locomotives in consist and cycle

time) did not accurately portray the characteristics of its traffic when

compared to train movements conducted in the ordinary course of business.

15

TMPA therefore proposed adjustments to the fuel consumption data based on

a three-locomotive consist and 2001 train cycle times.

16

Specifically, TMPA

increased the running time and decreased the idle time of the study

locomotives, and decreased the number of locomotives consuming fuel, based

on a presumption that fuel consumption varies directly with the number of

locomotives and cycle time.

17

The Board was not persuaded that TMPA’s adjustments produced a more

accurate picture of the variable locomotive fuel cost than did the unadjusted

study results (with exclusion of a few anomalous study observations).

Accordingly, the Board rejected TMPA’s adjustments and instead used the

results of the jointly conducted fuel study to determine the variable

locomotive fuel expense.

On reconsideration, TMPA again argues that discrepancies between the

operating characteristics of TMPA trains moving during the fuel study period

and those moving in the ordinary course of business required adjustments to

produce accurate variable cost results. TMPA contends that its proposed

adjustments were consistent with BNSF’s service in the period from April to

November 2001, relying on a chart comparing average running and idle times

extrapolated from train movement records during this post-contract period

with the running and cycle times of the shorter, encapsulated study period

(July to September 2001).

While there may have been differences in cycle times and the number of

locomotives in the consists during the study period as compared to other time

periods, TMPA’s proposed adjustments would not properly correct for any

such discrepancies. TMPA’s adjustments were based on the assumption that

fuel consumption is directly variable with cycle time. That is not the case,

however. It is the locomotive’s throttle position that determines the amount

of fuel consumed, not simply the aggregate time spent running as opposed to

SURFACE TRANSPORTATION BOARD REPORTS814

18

TMPA Reply Narr. at 77 (acknowledging that the fuel study measured fuel consumption as

the product of the rate of fuel consumption at a given throttle setting multiplied by the amount of

time the locomotive runs at that throttle setting).

19

BNSF Reb. V.S. Fisher at 50.

7 S. T. B.

idling.

18

The throttle position, in turn, is dependent on such factors as the

weight and makeup of the train, the grade and curvature over which the train

is moving, train spacing over the line, and weather and track conditions.

Indeed, BNSF submitted a scatter diagram showing the absence of a linear

relationship between locomotive running time and fuel consumption for the

fuel study trains.

19

TMPA alleges that its proposed adjustments were necessary because the

original study suggested the anomalous result of fuel consumption at levels

above system-average using BNSF’s most efficient locomotives. But in light

of the fact that TMPA’s trains are heavier than BNSF’s average trains, thus

requiring greater tractive effort for movement, it is not unreasonable for the

joint fuel study to have shown that fuel consumption was slightly above

system-average. Accordingly, TMPA has failed to show that it was improper

for the Board to use the results of the locomotive fuel expense study.

III. Stand-Alone Cost Issues

The Board’s finding that the challenged rate was unreasonable and its

determination of the maximum reasonable rate were based on a SAC analysis.

To make a SAC presentation, a shipper designs a stand-alone railroad

(“SARR”) specifically tailored to serve an identified traffic group, using the

optimum physical plant or rail system needed for that traffic. Based on the

traffic group, services to be provided, and terrain traversed, a detailed

operating plan must be developed to define further the physical plant that

would be needed for the SARR. It is assumed that investments normally

would be made prior to the start of service and that recovery of the

investments would occur over the economic life of the assets. A computerized

discounted cash flow (DCF) model simulates how the SARR would likely

recover its capital investments, taking into account inflation, Federal and state

tax liabilities, and a reasonable rate of return. The annual capital costs are

combined with the annual operating costs to calculate the total annual revenue

requirements of the SARR.

The defendant carrier’s rates are then judged against the revenue

requirements of the SARR. Traffic and rate level trends for the traffic group

are forecast into the future to determine the future revenue contributions from

that traffic. By comparing the total revenues generated by the traffic group

against the revenue requirements of the SARR, the Board determines whether

there would be over- or under-recovery of costs. Because the analysis period

is lengthy, a present value analysis is used that takes into account the time

value of money, netting annual over-recovery and under-recovery as of a

common point in time. If the revenues from the traffic group are determined

to be less than the revenue requirements of the SARR, then the challenged

rates are considered reasonable.

TEXAS MUNICIPAL POWER V. THE BNSF RY. CO. 815

7 S. T. B.

The parties seek reconsideration of several components of the SAC

analysis conducted in this case. Their objections are discussed below.

A. Rerouting of Traffic

To increase the amount of traffic that would flow over the hypothetical

SARR in this case, referred to as the Gibbons Creek Railroad (GCRR),

TMPA proposed an operating plan for the GCRR that would transport certain

non-issue traffic using a different route than the route BNSF uses for that

traffic. The rerouted traffic consisted of PRB coal destined to the Parrish,

Nelson, Fayette, and Big Brown utility plants. For these movements, BNSF

uses its Front Range route, which proceeds southwest along the Rocky

Mountains through Denver, CO, then southeast into Texas and Louisiana.

However, to achieve maximum traffic densities for its SARR, TMPA

hypothesized that the GCRR would haul that traffic over the somewhat

longer, but higher-density, Central Corridor route, which proceeds east from

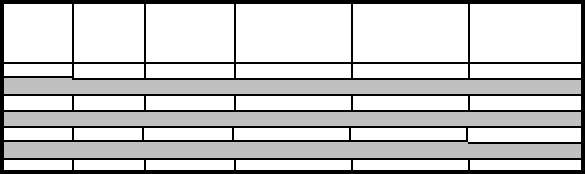

Northport through Kansas City, and then south into Oklahoma and Texas.

The map below, reproduced from TMPA 2003, 6 S.T.B. at 593, illustrates the

proposed rerouting.

SURFACE TRANSPORTATION BOARD REPORTS816

7 S. T. B.

Proposed Rerouting

This rerouting proposal presented an issue of first impression. The Board,

guided by the underlying purpose and objectives of the SAC test, see Coal

Rate Guidelines, Nationwide, 1 I.C.C.2d 520 (1985) (Guidelines), aff’d sub

nom. Consolidated Rail Corp. v. United States, 812 F.2d 1444 (3d Cir. 1987),

first set forth general principles relating to the rerouting of traffic. TMPA

2003, 6 S.T.B. at 594-98. The Board concluded that a SAC analysis may

reroute traffic that the SARR would handle entirely from origin to destination,

so long as the proposed route is reasonable and would meet the shipper’s

transportation needs. But to reroute cross-over traffic (i.e., traffic for which

the SARR would not replicate the full length of the defendant carrier’s current

move), the SAC analysis must fully account for the ramifications of assuming

that the residual carrier (i.e., the portion of the defendant carrier’s system that

would not be replaced by the SARR) would alter its handling of the traffic.

Applying these principles, the Board permitted the proposed rerouting of

the Big Brown traffic, which the GCRR would carry entirely from the origin

mines to the plant, because the evidence demonstrated that the GCRR would

provide the same or superior service as the shipper receives from BNSF.

However, because that traffic moves in shipper-supplied cars, the Board

reduced the revenues from the Big Brown movement to account for the

additional (per-mile) car maintenance costs that the utility would incur due to

the longer route.

The Board disallowed the proposed rerouting of the Fayette, Parish, and

Nelson traffic because TMPA’s evidence had failed to address and account

TEXAS MUNICIPAL POWER V. THE BNSF RY. CO. 817

7 S. T. B.

for the variety of off-SARR costs (both capital and operating costs) that could

be associated with rerouting this cross-over traffic. This deficiency was

highlighted by TMPA’s failure to address the concerns raised by BNSF

regarding the potentially serious operational problems associated with

rerouting this traffic through the Houston area. TMPA 2003, 6 S.T.B. at 596.

Moreover, TMPA had not demonstrated that the revenues from the rerouted

traffic would be sufficient to cover all costs for the entire movement over the

longer new route, including all off-SARR costs.

Although the Board did not permit this rerouting, it did not exclude the

traffic to these three utilities from the SAC analysis entirely, as BNSF had

proposed. Instead, the Board assumed that the GCRR would carry this traffic

up to the point at which the historical routing diverged from the BNSF lines

replicated by the GCRR (i.e., Northport), where it would be interchanged with

the residual BNSF. TMPA 2003, 6 S.T.B. at 597.

Both parties seek reconsideration of the Board’s treatment of rerouted

traffic. TMPA objects to the disallowance of the proposed rerouting of the

Fayette, Parish, and Nelson traffic, while BNSF objects to the acceptance of

the rerouting of the Big Brown traffic.

1. Overview

In evaluating TMPA’s arguments here on reconsideration, it is important

to consider them in light of the underlying principles of the SAC test, which is

to determine whether the carrier is being charged more for its service than a

hypothetical, efficient carrier would charge.

Here, TMPA has sought to reroute traffic onto its SARR that in actuality

travels out of the PRB south on another route on the BNSF system. And the

Board has allowed such so-called “rerouting” in circumstances where it is

demonstrated that such rerouting would not affect the service those shippers

expect or currently receive. However, in this instance TMPA has sought to

take that concept one step farther, and reroute traffic that traverses another

route onto its system for a long length, and then arbitrarily hand that traffic

back to the BNSF at a point of its choosing, without regard to whether such a

handoff is practical or feasible. In this instance, the handoff point happens to

be near Houston, TX, one of the nation’s most crowded rail terminals. TMPA

contends that BNSF could then carry unit trains of coal through Houston to

their destination at the power plants in question.

BNSF has contended that its existing lines through Houston do not have

the necessary infrastructure to handle this demanding type of traffic. For its

part, TMPA has not submitted evidence that either demonstrates that BNSF’s

Houston lines could handle such additional traffic, or how much it would cost

to upgrade those lines to handle this traffic. The Board has properly

disallowed these movements in this instance, because it found that TMPA had

neither determined nor included the additional infrastructure and operating

costs of moving this coal traffic through Houston.

Allowing re-routing of movements in the way proposed by TMPA would

distort the SAC test by permitting the complainant to artificially increase

SURFACE TRANSPORTATION BOARD REPORTS818

20

See TMPA Open. Narr. at 125-26.

21

BNSF Mot. to Dismiss at 18-19; see also BNSF Reply Narr. at I-13-17; BNSF Reply V.S.

Mueller at 30-32.

22

See Union Pac. Corp.--Control & Merger--Southern Pac. Rail Corp., 1 S.T.B. 233 (1996),

aff’d sub nom. Western Coal Traffic League v. STB, 169 F.3d 775 (D.C. Cir. 1999).

23

Joint Pet. for Service Order, 2 S.T.B. 725 (1997), modified and extended, 2 S.T.B. 744

(1997), further modified and extended, 3 S.T.B. 44 (1998), terminated, Joint Pet. for a Further

Service Order, 3 S.T.B. 612 (1998).

24

BNSF Mot. to Dismiss at 19.

7 S. T. B.

traffic on, and revenue allocated to, its SARR, all while passing on the

ramifications of such a rerouting (in this case, funneling 8,000- foot unit trains

of coal through the city of Houston) to BNSF. The Board properly disallowed

such a reroute unless the complainant shows that it has identified what these

additional infrastructure and operational costs would be and ensured that these

costs are fully accounted for.

2. Fayette, Parish, and Nelson

TMPA presents three arguments as to why the rerouting the Fayette,

Parish, and Nelson traffic should have been allowed. First, it maintains that

its rebuttal testimony incorporated all of the on-line and off-line costs that

BNSF had identified and that this should have been sufficient and accepted as

the best evidence of record. Second, TMPA argues that the Board should not

have applied new evidentiary requirements that had not been advocated by

either party without first giving TMPA an opportunity to address them.

Third, it argues that the Board should not have made findings about Houston

congestion without first affording parties an opportunity to address such

extra-record matters.

A cursory summary of the record in this case will put TMPA’s

evidentiary arguments into context. Notwithstanding the novelty of its

rerouting proposal, TMPA offered no evidence to support that proposal as

reasonable and consistent with the Guidelines; TMPA simply asserted that its

proposal should be accepted.

20

BNSF raised several objections to the proposal, including whether it was

proper to propose an operating plan that would impose additional costs on the

residual BNSF by changing the off-SARR routing of the cross-over traffic.

BNSF pointed out that TMPA’s proposal to route the three cross-over

movements through Iola, TX, would require BNSF to handle the traffic in a

new manner. To illustrate the problems such a rerouting might present, BNSF

noted that the ability to meet the cycle time commitments in the governing

contracts would be called into serious question, as the new routing of traffic

would be through Houston, a congested terminal area.

21

BNSF reminded the

Board of the traffic problems that have arisen after the “UP/SP” merger,

22

and

of the emergency service order issued to address those problems.

23

BNSF

asserted that, while those emergency conditions had abated, the effect of

rerouting coal trains through Houston would be “uncertain, at best.”

24

TEXAS MUNICIPAL POWER V. THE BNSF RY. CO. 819

25

TMPA Reply to Mot. to Dismiss at 5.

26

See TMPA Reb. Narr. at 44-45 (asserting that BNSF’s interchange preferences were

“irrelevant”).

27

See TMPA Reb. Narr. at 604.

7 S. T. B.

Despite TMPA’s statement that it would “respond with appropriate

rebuttal evidence further demonstrating the propriety of including these

movements in its stand-alone traffic group,”

25

TMPA’s rebuttal testimony

contained no such evidence. Instead, TMPA simply repeated its assertion

that, because a shipper may include cross-over traffic in its traffic group, it

can dictate where the cross-over interchange would occur—even if that would

impose off-SARR costs on the defendant carrier’s operations.

26

The only

concession TMPA made was to include some (but not all) of the off-SARR

road property investment that BNSF had claimed would need to be incurred

as a result of such a rerouting.

27

Given the record that was presented in this case, TMPA’s arguments for

reconsideration of this issue ring hollow. With respect to TMPA’s first

argument, it is true that TMPA’s rebuttal testimony accepted (for the most

part) the additional off-SARR investment costs that BNSF had quantified.

See TMPA 2003, 6 S.T.B. at 597. But BNSF had not purported to address all

of the costs associated with the off-SARR rerouting—it had not, for example,

sought to quantify the cost of rerouting these movements through the

congested Houston area—and BNSF had vigorously objected to the rerouting

even if the costs it did quantify were included in the SAC analysis. The first

issue with respect to rerouting was not whose evidence was the best evidence

of record, but whether TMPA’s rerouting assumptions were consistent with

the purpose and goal of the SAC test. Thus, TMPA’s concession that some

additional road property investment would be needed for the residual BNSF

to handle that traffic south of Iola, TX, was not by itself sufficient to justify

its rerouting proposal in light of the spectrum of concerns that BNSF had

raised.

As for TMPA’s second argument, the Board did not impose a

qualitatively different or undue burden on TMPA; the Board simply required

TMPA to support its case. See Guidelines, 1 I.C.C.2d at 544 (“A proponent

of a particular stand-alone model must identify, and be prepared to defend, the

assumptions and selections it has made.”). Here, TMPA had offered no

evidence of the off-SARR ramifications of its rerouting proposal.

Accordingly, it had failed to defend its traffic selection in the face of serious

objections raised by BNSF. As the Board stated in TMPA 2003, 6 S.T.B. at

597-98, TMPA cannot avoid the potential impact that might result from its

rerouting proposal by choosing to terminate the SARR before the point at

which those impacts would occur (e.g., Houston).

Turning to TMPA’s third argument, concerning the discussion of

potential congestion in Houston (which TMPA characterizes as extra-record),

BNSF had specifically raised the concern of rerouting heavy coal trains

through the congested Houston area as an illustrative example of the problems

SURFACE TRANSPORTATION BOARD REPORTS820

28

See BNSF Reply Narr. at I-14-17; BNSF Reply V.S. Mueller at 30-32; BNSF Mot. to

Dismiss at 4, 16-19.

7 S. T. B.

associated with the proposed rerouting.

28

It was, therefore, entirely

appropriate for the Board to address those operational considerations.

Moreover, an expert agency may draw on its general expertise and the Board

properly did so here with respect to rail service in Houston—an issue that had

been the subject of numerous Board decisions. See TMPA 2003, 6 S.T.B. at

596-97 & n.52.

TMPA’s final argument is that, even if it was proper to disallow the

particular rerouting that it had proposed, the Board should not have reverted

to using the historical routing of that traffic, under which the SARR would

need to interchange the traffic with the residual BNSF at Northport, NE.

Instead, TMPA now argues, the Board should have maximized the SARR’s

participation in the movement by assuming that this traffic would be rerouted

as far as Fort Worth, TX, where the GCRR could interchange the traffic with

BNSF, which in turn could transport the rerouted traffic to its respective

destinations without going through Houston. However, this was not how

TMPA had structured its SAC presentation and TMPA had not suggested any

alternative scenarios. Thus, no record had been presented as to whether such

an alternative rerouting would itself pose operational concerns or place

additional costs on the residual BNSF.

In sum, as the proponent of the novel rerouting proposal, it was TMPA’s

responsibility to support its proposal. It failed to do so here. Therefore the

Board properly disallowed the proposed rerouting of the Fayette, Parish, and

Nelson traffic through the Iola interchange.

3. Big Brown

BNSF argues that, because its rail transportation contract for the Big

Brown movement specifies the Front Range route, the Board was required to

give effect to that routing provision. BNSF relies on the Board’s statement in

West Texas, 1 S.T.B. at 658 n.41, that a SAC analysis assumes that a SARR

would replace the defendant railroad but does not assume that a governing

contract would be displaced or its terms changed.

The issue in West Texas was whether the SAC analysis could ignore the

contractual rights of a connecting railroad. In that case, the complainant had

proposed an operating plan that would have routed all of the traffic destined

for a particular utility plant via the SARR to Amarillo, TX, where it would

have been interchanged with a third-party carrier. This assumption

contravened a contract provision stating that 75% of the traffic would be

interchanged with a third-party carrier at Denver. The Board therefore

rejected the complainant’s effort to route all of the traffic through Amarillo.

The Board explained that the contract terms could not be ignored simply to

garner a greater proportion of the revenue from that traffic.

The ruling in West Texas reflects the broader principle that a complainant

may not assume an operating plan that would divert traffic away from other

railroads—see Arizona Elec. Power Coop., Inc. v. Burlington N. & S. F. Ry.

TEXAS MUNICIPAL POWER V. THE BNSF RY. CO. 821

7 S. T. B.

Co. et al., 6 S.T.B. 322, 327-28 (2002)—as the analysis of the reasonableness

of a defendant carrier’s rate should be based on the extent of the defendant

carrier’s participation in the movement. And the West Texas ruling reflects

the general SAC principle that the proponent of a SARR may not assume

a changed level of service to suit its proposed configuration unless it also

presents evidence showing that the affected shippers, connecting carriers, and

receivers would not object. See, e.g., McCarty Farms, Inc. v. Burlington N.,

Inc., 2 S.T.B. 460, 467 (1997).

Here, in contrast, it is BNSF itself that has the contract for the Big Brown

movement and handles that movement from origin to destination. With the

proposed rerouting, the SARR would merely step into the shoes of the BNSF.

The traffic would not be diverted from a third-party connecting carrier, as

there is no connecting carrier involved in that movement. Furthermore,

TMPA presented evidence showing why the affected shipper presumably

would not have any reason to object to the change in service. Thus, there is

no inconsistency with the objectives of the SAC test. See TMPA 2003,

6 S.T.B. at 591.

BNSF argues that the rerouting of the Big Brown traffic would not meet

the needs of the shipper because it would deny the shipper several enumerated

benefits of the routing provision that were placed in the contract at the

shipper’s request. BNSF seeks to support this claim with a newly presented

verified statement from its Vice President of Coal Marketing. But because

that evidence could have, and should have, been presented when the record

was developed on this issue, it is not timely now.

B. Revenue Forecasts

To forecast the revenues that would be generated after 2004 for traffic

not under contract, the Board used the most recent rate forecast from the

Department of Energy’s Energy Information Administration (EIA) as the best

evidence of record. This forecast—one of several forecasts advanced by

BNSF—was found to be preferable to the forecast proposed by TMPA for

two reasons. First, it was a recent forecast from an official and impartial

source. (The EIA, an independent statistical arm of the Department of

Energy, was created by Congress for the express purpose of providing policy-

neutral data and forecasts.) Second, use of EIA’s rate forecast was consistent

with the parties’ reliance on EIA’s tonnage forecast. TMPA 2003, 6 S.T.B. at

603.

TMPA argues that the Board should have accepted its rate forecasts,

which were based on specific contract information, rather than rely on a more

general, regional forecast. TMPA’s forecasts had differentiated between

traffic based on whether it would be captive or competitive traffic for the

GCRR. For captive traffic, TMPA’s forecasts escalated the rate at the end of

the contract period by the weighted average rate adjustment for captive

shippers remaining under contract. For competitive shippers, TMPA’s

forecasts estimated a new competitive market rate and, for subsequent years,

SURFACE TRANSPORTATION BOARD REPORTS822

7 S. T. B.

escalated that rate by the weighted average rate adjustment for competitive

shippers remaining under contract. Overall, TMPA forecast a 1.7% average

annual increase in rail coal transportation rates, in contrast with EIA’s

forecast of 1.4%.

Contrary to TMPA’s assertions, its forecast was not the best evidence of

record as to post-contract rate changes beyond 2004. As the Board explained,

TMPA 2003, 6 S.T.B. at 602, TMPA’s rate projections were more reflective

of past rate changes and were not the best evidence of what changes in rates

would reasonably be expected in the future. Moreover, the Board regards the

forecasts developed by EIA, a neutral governmental source, as more reliable

than forecasts developed by private parties for litigation, which are inherently

subject to manipulation. Indeed, TMPA itself acknowledged the

reasonableness of EIA forecasts when it used the EIA forecast for traffic

volumes to demonstrate the reasonableness of its own traffic volume

projection. Finally, having used the EIA forecast for tons, it was appropriate

to use EIA’s rate forecast as well. As explained in Duke Energy Corp v. CSX

Transp., Inc., 7 S.T.B. at 448-449, the forecasts of future transportation rates

cannot be divorced from the forecasts of future demand for coal transportation

(tonnages), as the two matters are interrelated. EIA’s coal demand forecasts

reflect EIA’s rate forecasts, and tonnage and rate forecasts should be

internally consistent where possible. Thus, where EIA tonnage forecasts are

used, it is preferable to use the matching EIA rate forecasts as well. This

provides a single, consistent, and independent source for both components of

the revenue forecast.

C. Locomotive Fueling

As previously discussed, the parties conducted a joint fuel study that was

used in the variable cost analysis to determine the fuel expenses associated

with handling the TMPA traffic alone. For the GCRR’s operating costs, the

Board again relied on this special study to estimate the fuel expense

associated with serving all of the traffic in the traffic group, an approach

advocated by BNSF. TMPA 2003, 6 S.T.B. at 663. TMPA seeks

reconsideration of this determination.

TMPA again asserts that adjustments to the results from the fuel study

are required to address differences between the trains studied and the traffic

group. In the variable cost analysis, it was the differences in cycle times that

TMPA sought to address. In the SAC analysis, it was differences in the route

that TMPA argued necessitated an adjustment, as the joint fuel study

examined movements that traveled over the Front Range route, while the

traffic group would travel over the Central Corridor route. TMPA contends

that coal shipments over the Central Corridor route should have a lower fuel

consumption rate because that route has less severe grades and curves than

the Front Range route.

TMPA’s proposed adjustment, however, bore no relationship to the

perceived problem, as TMPA sought to use the same adjustment it advocated

for the variable cost analysis. That adjustment addressed alleged discrepancies

TEXAS MUNICIPAL POWER V. THE BNSF RY. CO. 823

29

TMPA Open. Narr. at 96-98; TMPA Reply Narr. at 72; TMPA Reb. Narr. at 186-87.

30

TMPA Open. Narr. at 196; TMPA Reb. Narr. at 379-80.

7 S. T. B.

in cycle times and locomotive consists, not route characteristics.

29

Nowhere

in TMPA’s variable cost evidence on the proposed fuel study adjustments did

TMPA describe any adjustment based on differences in route characteristics.

And the Board could find no explanation in TMPA’s SAC evidence of any

proposed adjustment to fuel study results to account for differing route

characteristics. Rather, TMPA simply stated that it was submitting fuel costs

for the GCRR based on the consumption rate from the locomotive fuel study

results.

30

Accordingly, the fuel consumption estimates drawn from the joint

fuel study were the best evidence of record and were therefore properly used

in the SAC analysis.

D. General and Administrative Expenses

To determine the general and administrative (G&A) expenses that the

SARR would incur, the Board reviewed the record in detail to assess what a

least-cost, most efficient railroad would need to manage the company. That

inquiry ran the gambit, from the number of outside directors to the number of

purchasing agents. With a few exceptions, the Board accepted as feasible

TMPA’s evidence of the number of employees; the Board also accepted

TMPA’s proposed salary levels. Accordingly, the Board assumed that the

GCRR would be staffed by 63 G&A employees, at an annual expense of

$13.38 million. TMPA 2003, 6 S.T.B. at 675. BNSF seeks reconsideration,

arguing that the total G&A costs accepted in this case are exceedingly low

when compared with those of real-world railroads. But BNSF’s cost-

comparison data does not show what it would cost to run a specialized,

optimally efficient railroad. As explained in TMPA 2003, 6 S.T.B. at 659-60,

the structure of the GCRR would be substantially simpler than that of the

BNSF or any other large-scale, general commodity rail carrier. Under these

circumstances, the costs incurred by BNSF or other large carriers are not

necessarily a reliable indicator of the costs that would need to be incurred by

the GCRR.

BNSF argues that the Board’s analysis on this issue erroneously shifted

the burden of proof to BNSF to show that TMPA’s evidence was infeasible.

This is incorrect. The Board found that TMPA’s evidence was feasible and

supported. See TMPA 2003, 6 S.T.B. at 676-77 (finding that TMPA’s

operating department proposal would be reasonable and that BNSF’s

proposed additional layer of management would be unnecessary), 679

(agreeing with TMPA’s proposal to outsource marketing functions and

finding that TMPA’s customer service staffing were reasonable), 683 (finding

TMPA’s proposed law and administration department reasonable),

685 (finding TMPA’s arguments on legal staffing persuasive, its proposed

staffing level for safety and claims reasonable, and its human resources

staffing adequate), 686-87 (finding TMPA’s indexation of wages realistic and

verifiable), 687-88 (finding TMPA’s proposals on non-operating personnel

SURFACE TRANSPORTATION BOARD REPORTS824

31

See TMPA Reb. e-WP “Salaries” & BNSF Reply WP. 05194-051200.

32

See TMPA Open WP. at 5959.

7 S. T. B.

salaries supported). Thus, under SAC principles, it does not matter whether

BNSF’s higher-cost evidence may also have been feasible and supported, so

long as TMPA’s evidence—which represented the least cost for these

expenses—was feasible and supported. See Guidelines, 1 I.C.C.2d at 542.

Finally, BNSF asserts that TMPA’s executive salary assumptions were

unsupported. TMPA estimated the salary for the president, vice-president of

law and administration, and controller from public filings by Florida East

Coast Industries. The salary estimate for Vice President-Finance was drawn

from public filings by Wisconsin Central Transportation Corporation. TMPA

drew its remaining G&A salary estimates from BNSF’s 2000 Annual

Wage Forms A & B.

31

Upon reconsideration, BNSF is correct that TMPA’s workpapers do not

support TMPA’s salary estimates for the senior executives. For example, the

public filing by Florida East Coast Industries shows that in 2000, the

President of the Florida East Coast Railway (FEC) received total

compensation of $506,400, in the form of a salary of $300,000 and a bonus of

$206,400.

32

TMPA, however, used only the salary to develop its estimate.

Similarly, TMPA ignored non-salary compensation of $173,000, $86,000, and

$31,580 paid to the VP-Law and Administration, Controller, and VP-Finance

respectively. Accordingly, we will modify the SAC analysis with respect to

executive compensation.

BNSF maintains that the Board should use BNSF’s evidence of salaries

paid to executives of several regional and short-line railroads to calculate

salaries for the GCRR’s executives. However, with the exception of the VP-

Law position, including the non-salary compensation components paid by the

FEC produces lower total compensation figures than proposed by BNSF.

Therefore, our revised SAC analysis uses BNSF’s evidence only with respect

to the salary for VP-Law, where it is the least-cost evidence on record. For

the other executive positions, we will continue to rely on TMPA’s evidence,

but revised to include the total annual compensation paid to the FEC

executives (excluding stock options that we cannot value), and not just the

salary component. This will increase the total G&A operating expense

by $550,221 (from $13,380,139 to $13,930,360).

E. Road Property Investment

1. Barriers to Entry

The ultimate objective of the SAC constraint is to simulate a competitive

rate standard for non-competitive rail movements by determining the rate that

would be available to the shipper in a contestable market environment. As

explained in Guidelines, 1 I.C.C.2d at 529, the railroad industry is not

considered contestable due to its significant barriers to entry and exit. It is

only by excluding from the SAC analysis the costs and other limitations

TEXAS MUNICIPAL POWER V. THE BNSF RY. CO. 825

33

The statement in TMPA 2003 6 S.T.B. at 726 (2003), that TMPA only included 62 rail

bridges south of Bridger Junction was incorrect, as that was the number of bridges TMPA excluded.

7 S. T. B.

associated with entry and exit barriers that the Board can approximate the cost

structure of firms operating in a contestable market.

The SAC analysis treats as a barrier to entry any type of cost that a new

entrant would have to incur that was not actually incurred by the defendant

carrier. West Texas, 1 S.T.B. at 670 (1996). Thus, a defendant railroad is not

entitled to earn a return on investments it did not incur, but it can earn a

reasonable return on the current replacement costs of investments it made.

However, costs associated with modern construction practices are not treated

as barriers to entry, as such practices are merely a present-day substitute for

the procedures used when the original rail line was constructed. See FMC

Wyoming Corp. and FMC et al. v. Union Pac. R.R., 4 S.T.B. 699, 800-01

(2000).

It is often difficult to determine if a defendant railroad or its

predecessor(s) incurred a particular construction cost, given the passage of

time. We therefore rely on the Engineering Reports (“Engrg Rpts”), which

are a compendia of data collected by the ICC in the early part of the 20th

Century. They detail the material quantities required to build most rail lines

in place in the United States at the time. These reports included only those

items for which the ICC concluded a carrier had paid all or some part of the

cost. See Texas Midland R.R., 75 I.C.C. 1, 115-86 (1918). Therefore, if an

item appears in the Engrg Rpts, the Board includes in the SAC analysis some

cost to replicate that facility, albeit only a percentage of that cost if there is

reason to conclude that the defendant carrier (or its predecessor) did not bear

the full cost of that item.

Both parties object to how these barrier-to-entry principles were applied

in this case to four particular expenses: rail bridges, utility relocation, at-

grade crossings, and road resurfacing.

i. Bridges

South of Bridger Junction, TMPA had included the costs for only those

rail bridges needed to cross over natural barriers and other rail lines that

predated BNSF’s line. TMPA asserted that BNSF’s predecessors had not

incurred the cost to build the remaining 62 rail bridges now on the BNSF lines

that would be replicated by the GCRR.

33

BNSF responded by noting that the

excluded bridges all had construction dates within the last 20-30 years –

inferring that they had either paid to construct that bridge (after highways

became prevalent) or paid to replace bridges that had become obsolete. The

Board excluded any cost for constructing those rail bridges, explaining that, if

BNSF had replaced bridges as they became obsolete, those costs should be

considered a maintenance expense, rather than a capital investment expense.

BNSF seeks reconsideration of that decision. BNSF contends that, if it

had paid to replace those bridges, the SAC analysis should include the

replacement cost of those bridges. BNSF argues that, even if the SAC

SURFACE TRANSPORTATION BOARD REPORTS826

7 S. T. B.

analysis did not need to include the cost of initially constructing the bridges,

the SARR would need funds to replace the bridges as they age and that, by

excluding the capital for the construction, the Board wrongly omitted any

provision for the capital recovery needed for replacement of the bridges. This

is because the DCF model used by the Board automatically calculates the

amounts needed in future years to replace SARR assets, based on the amounts

included in the original construction costs, but does not calculate a

replacement cost for items excluded from the original investment base.

Finally, BNSF argues that the Board also erred by excluding all operating

costs associated with maintenance of the bridges.

Upon reconsideration, we agree that, where BNSF has paid to replace an

obsolete bridge, even if it did not pay for the original bridge, it should be

entitled to earn a return on that investment just as it would if it had paid for

the original bridge. Treating that capital outlay as a maintenance expense is

insufficient, as the result would be to include in the SAC analysis only enough

cost to cover future operating expenses to maintain that bridge. The SAC

analysis would not provide for a return on that investment.

Here, however, BNSF has failed to prove that it paid to construct or

replace the contested bridges. It simply asserted that it had, based on nothing

more than a bridge inventory list. If BNSF had paid to replace or construct

those bridges in the last 20-30 years, we would expect BNSF to have much

stronger evidence showing that financial outlay. Thus, on this record, it was

proper to exclude the cost to construct or replace the contested bridges. And,

as discussed in Section IV below, because the Board accepted BNSF’s

evidence regarding MOW expenses, which presumably included the annual

operating cost to maintain all of the bridges along the right-of-way (ROW),

no change to that expense is necessary.

ii. Utility Relocation

Where there was no evidence that BNSF or its predecessor paid to

relocate utility lines when it constructed its rail lines, the Board excluded that

cost as a barrier to entry. TMPA 2003, 6 S.T.B. at 705-06. BNSF seeks

reconsideration of that treatment. It argues that the costs of siting or

relocating utilities should be included regardless of whether the rail line

predated or postdated the utilities, as utilities are necessary to provide power

to a railroad and BNSF invested capital in the utilities’ poles and lines.

BNSF’s argument rests on the unsupported assertion that the GCRR

would benefit from the utility lines. But in this case, the inclusion of recent

technology (encoded track circuitry) would make pole lines unnecessary.

Therefore, it was appropriate to exclude those costs.

iii. Road Surfacing and At-Grade Crossings

In this case, the Board included the costs of at-grade crossings south of

Bridger Junction because the Engrg Rpts demonstrated that BNSF’s

predecessor had incurred crossing costs south of Bridger Junction. TMPA

2003, 6 S.T.B. at 741-42. But the Board excluded the cost to surface new

TEXAS MUNICIPAL POWER V. THE BNSF RY. CO. 827

7 S. T. B.

roads or resurface existing roads damaged during construction of that line,

because the lines predated the adjacent roads and there was no evidence that

BNSF had incurred the costs for surfacing (or resurfacing) such roads. Id. at

708.

Both parties seek reconsideration of the Board’s treatment of these two

costs. BNSF argues that, because the Engrg Rpts show that the railroad paid

for at-grade crossings, that means the road predated the railroad and that the

railroad therefore would have incurred costs for road resurfacing. TMPA

responds that BNSF’s position rests on the incorrect presumption that Engrg

Rpts provide evidence of who paid for an item, instead of just the existence of

an item. TMPA argues that Engrg Rpts, which were the basis for the Board’s

decision on this issue, catalog the existence of at-grade crossings, but do not

specify whether the incumbent, or some other party, paid for the crossings,

and that BNSF has provided no other evidence that it or its predecessor paid

for the crossings.

As explained above, we do not accept TMPA’s limiting characterization

of the Engrg Rpts. Rather, inclusion of an item in those reports generally

means that the railroad paid at least some portion of the expense for that item

and that expense is therefore properly included in the SAC analysis. Here,