Scene Connect Ltd

46A Constitution St

Edinburgh

EH6 6RS

Brampton 2 Zero

Low Carbon Options Appraisal

21

st

November 2022

2

Scene Document Reference: Brampton2Zero – Low Carbon Options Appraisal

Authors: Sandy Robinson, Dom Stephen, Alex Schlicke

Date: 18

th

November 2022

Document Revisions:

Version 1.0 Brampton2Zero – Interim Baseline Report (Draft for Comment)

Version 1.1 Brampton2Zero – Interim Baseline Report (Revised Draft for Comment)

Version 1.2 Brampton2Zero – Draft Final Report (Draft for Comment)

Version 1.21 Brampton2Zero – Draft Final Report (Final)

Scene Connect Ltd.

Address: 46A Constitution Street, Edinburgh, EH6 6RS, United Kingdom

Email: info@scene.community

Telephone: +44(0)131 603 8822

Website: www.scene.community

3

1. Introduction ...................................................................................................... 6

1.1. Brampton Context ................................................................................................................. 6

1.2. Organisations ......................................................................................................................... 7

2. Planning & Environmental Baseline .................................................................. 9

2.1. National Context.................................................................................................................... 9

2.2. Local Plan – Development within Carlisle District ............................................................... 11

2.3. Local Developments ............................................................................................................ 12

2.4. Natural & Cultural Heritage ................................................................................................. 12

2.5. Local Electricity Network ..................................................................................................... 14

3. Baseline Energy Assessment ........................................................................... 16

3.1. Methodology ....................................................................................................................... 16

3.2. Energy Demand Assessment ............................................................................................... 17

3.3. Climate Change & Action in Brampton ............................................................................... 20

4. Technical Appraisal ......................................................................................... 22

4.1. Solar Photovoltaics .............................................................................................................. 22

4.2. Solar Cooperative Engagement ........................................................................................... 22

4.3. Solar Capacity Assessment .................................................................................................. 23

4.4. Solar PV Energy Modelling .................................................................................................. 26

4.5. Electric Vehicle (EV) Car Club .............................................................................................. 30

5. Financial Appraisal .......................................................................................... 33

5.1. Solar Co-operative ............................................................................................................... 33

5.2. Domestic Properties ............................................................................................................ 35

5.3. EV Car Club .......................................................................................................................... 36

6. Commercial & Governance ............................................................................. 38

6.1. Energy Cooperatives ............................................................................................................ 38

6.2. EV Car Clubs ......................................................................................................................... 41

7. Funding & Finance .......................................................................................... 43

8. Conclusions ..................................................................................................... 46

8.1. Solar Cooperative ................................................................................................................ 46

4

8.2. EV Car Club .......................................................................................................................... 46

8.3. Project Roadmap ................................................................................................................. 47

Appendix A – Financial Details ................................................................................. 48

Appendix B – Technical Details ................................................................................. 50

Appendix C – Community Engagement .................................................................... 51

5

FIGURES

FIGURE 1.1 - MAP OF BRAMPTON PARISH AND THE BRAMPON CONSERVATION AREA. 7

FIGURE 2.1 - MAP OF CULTURAL HERITAGE DESIGNATIONS WITHIN AND NEARBY BRAMPTON. 13

FIGURE 2.2 - MAP OF NATURAL HERITAGE DESIGNATIONS WITH AND NEARBY BRAMPTON. 14

FIGURE 2.3 - LOCATION OF NEAREST PRIMARY SUBSTATION TO BRAMPTON. 15

FIGURE 3.1 – 25 NON-DOMESTIC BUILDINGS WITHIN AND AROUND BRAMPTON INCLUDED WITHIN THIS STUDY. 16

FIGURE 3.2 – ENERGY DATA HIERARCHY 17

FIGURE 3.3 – NON-DOMESTIC ELECTRICITY DEMAND IN BRAMPTON. 18

FIGURE 3.4 - ANNUAL ELECTRICITY DEMAND PROFILE FOR NON-DOMESTIC PROPERTIES IN BRAMPTON 18

FIGURE 3.5 – SURVEY RESPONDENT TYPES 20

FIGURE 3.6 – SURVEY RESPONDENTS’ VIEWS ON CLIMATE CHANGE 20

FIGURE 3.7 – RESPONDENTS' ACTIONS TO ADDRESS CLIMATE CHANGE 21

FIGURE 4.1 – LEVEL OF INTEREST IN A SOLAR PV COOPERATIVE IN BRAMPTON 23

FIGURE 4.2 - A 165.75 KW ARRAY SIMULATED ON THE ROOFTOPS OF THE BUILDING 17. 25

FIGURE 4.3 - A 30 KW ARRAY SIMULATED ON THE BUILDING 4 25

FIGURE 4.4 - A 2.25 KW ARRAY SIMULATED ON THE ROOFTOP OF THE BUILDING 1. 25

FIGURE 4.5 – AN EXAMPLE DOMESTIC ROOFTOP SOLAR PV ARRAY OF 3KW 29

FIGURE 4.6 – SURVEY RESPONDENTS' INTEREST IN A BRAMPTON EV CAR CLUB 30

FIGURE 4.7 – SURVEY RESPONDENTS' VIEWS ON HOW THEY WOULD USE AN EV CAR CLUB IN BRAMPTON 31

FIGURE 4.8 – MAP OF EV CAR CLUB INTEREST IN BRAMPTON 32

FIGURE 5.1 - CASHFLOW OUTCOMES FOR THE NON-DOMESTIC SOLAR PV COOPERATIVE. 33

FIGURE 5.2 - CASHFLOW OUTCOMES FOR THE NON-DOMESTIC SOLAR PV COOPERATIVE WITH BATTERY STORAGE. 34

FIGURE 5.3 – NET PRESENT VALUE FOR AN EV CAR CLUB OVER A 20-YEAR LIFETIME 37

FIGURE 7.1 – REASONS FOR COMMUNITY SHARE INVESTMENT (COOPERATIVES UK, 2020) 44

FIGURE 7.2 – SHARE / BOND OFFER JOURNEY 45

TABLES

TABLE 2.1 – RELEVANT POLICIES WITHIN THE CARLISLE DISTRICT LOCAL PLAN 2015 – 2030 ......................................... 11

TABLE 2.2 - EXISTING PLANNING APPLICATIONS RELEVANT TO THIS LOW CARBON STUDY. ........................................... 12

TABLE 2.3 – CULTURAL HERITAGE DESIGNATIONS WITHIN OR NEAR TO BRAMPTON. ................................................... 13

TABLE 3.1 - DOMESTIC ELECTRICITY DEMAND DATA FOR THE PROPERTIES WITHIN BRAMPTON. .................................. 19

TABLE 4.1 - LONGLIST OF 25 NON-DOMESTIC BUILDINGS WITHIN THE BRAMPTON STUDY ........................................... 24

TABLE 4.2 - UNIT COSTS ASSUMED FOR SOLAR COOPERATIVE CAPITAL COST ESTIMATIONS. ........................................ 26

TABLE 4.3 - OUTCOMES OF INITIAL SOLAR PV COOPERATIVE MODELLING, FOR EACH NON-DOMESTIC BUILDING. ...... 28

TABLE 4.4 - ANNUAL OUTCOMES OF SUPPLYING A TYPICAL DOMESTIC PROPERTY WITH ROOFTOP SOLAR PANELS. .... 29

TABLE 4.5 – EV CAR CLUB CHARACTERISTICS ................................................................................................................... 31

TABLE 5.1 - SOLAR VIABILITY FOR DOMESTIC PROPERTIES WITHIN BRAMPTON PARISH ................................................ 35

TABLE 5.2 – EV CAR CLUB DEMAND ASSESSMENT AND TARIFFING STRUCTURE ............................................................. 36

TABLE 5.3 – COMPARATIVE ASSESSMENT OF PROPOSED ANNUAL CAR CLUB COSTS AND CAR OWNERSHIP COSTS ..... 37

TABLE 7.1 - FUNDING OPPORTUNITIES FOR SOLAR PV AND EV INFRASTRUCTURE ......................................................... 44

TABLE 0.1 – SOLAR PV COOPERATIVE ASSUMPTIONS & VARIABLES ................................................................................ 48

TABLE 0.2 – EV CAR CLUB ASSUMPTIONS & VARIABLES .................................................................................................. 49

TABLE 0.1 - ESTIMATED ELECTRICITY CONSUMPTION AND CARBON EMISSIONS OF THE NON-DOMESTIC SITES ........... 50

TABLE 0.1 - OVERVIEW OF STAKEHOLDER TYPES AND ACTIONS ...................................................................................... 51

6

In 2022, Brampton 2 Zero (B2Z) secured funding through the UK Government Rural Community Energy Fund (RCEF)

to undertake a low carbon feasibility study in Brampton, Cumbria. This study explores local options for low carbon

energy generation and mobility in the town, focusing particularly on the development of a solar PV cooperative

across public and private rooftops, as well as EV charging and a community car club for residents and visitors.

This study forms part of B2Z’s ambitions to:

1) Create a solar energy co-operative, to reduce the town’s reliance on fossil fuels, reduce associated carbon

emissions, meet the electricity needs of multiple non-domestic rooftops, and integrate with battery

storage and electric vehicles (EVs) where appropriate;

2) Establish an EV car club in Brampton, via the installation of EV chargers in Brampton, to provide accessible

mobility services for local community use, and integrated with solar generation and battery storage;

3) Develop a low carbon business case, to reduce residents’ and local businesses’ energy bills and to

generate income for low carbon development.

This study was undertaken between June and September 2022, comprising a baseline energy and financial

assessment of energy use, costs and carbon emissions in the town, technical and commercial modelling to assess

energy generation and low carbon mobility opportunities, and a commercial roadmap to guide the development

of viable options beyond the feasibility stage.

Further information, including graphical outputs, mapping and data resources can be found in the report

appendices.

Brampton is a small market town of around 4,600 people (UK Census, 2011), located 9 miles east of Carlisle in

Cumbria, in north west England (Figure 1.1). It is situated within the City of Carlisle District of Cumbria. The town

sits at the edge of the Hadrian’s Wall world heritage site (WHS) and has several historical listed properties within

the town centre, particularly the octagonal Moot Hall, built in 1817, which now houses the town’s Tourist

Information Centre, and St Martin’s Church, the only Pre-Raphaelite church containing a famous series of stained-

glass windows which were executed in the William Morris studio.

There are 2,105 households within Brampton Parish, with the majority centred on the town itself. The area has a

relatively high average age, with around 51% of residents over the age of 65. Employment within Brampton is

generally focused on the retail, health and social care, and education sectors, with many residents commuting

elsewhere (e.g., Carlisle) for jobs. The housing stock within Brampton is varied, including historic (and listed)

properties within the town’s core and larger private housing towards the fringes of the settlement, as well as

newer housing estates and social housing located across the town.

Brampton is passed by the A69 road, and the Brampton railway station is located about a mile southeast of the

town, near the village of Milton. Services within the town include a Co-operative supermarket, medical practice,

Brampton community centre, hotel, and numerous other B&Bs, cafés, restaurants, and convenience shops. The

Townfoot Industrial Estate is located to the west of the town centre, comprising a large number of varying business

and industrial unit types. There are two schools in Brampton – Brampton Primary School and the William Howard

secondary school.

Brampton benefits from its location close to the well-connected and visited city of Carlisle to the west, which is

located on the M6 corridor and the east-west motorway which spans to the northeast of England and the

southwest of Scotland. Larger towns nearby to Brampton are also easily accessed via public transport, with the

most regular bus services running to and from Carlisle and Newcastle, as well as from the main train station.

Within the relevant Lower Layer Super Output Areas (LSOAs) for Brampton (Carlisle 002A, 002B, and 002C), UK

Government data recorded a total of 3,077 vehicles, comprising 2,486 cars, 144 motorcycles, and 447 listed as

‘other body types’, as of Q1 of 2022.

7

Between 18% of properties within the town are off gas grid, therefore using electricity or oil heating sources rather

than mains gas. This figure rises to 36% for properties outside of the town, in more rural areas. Fuel poverty rates

range between 8% (rural areas) to 11.5% (urban area), although these figures are expected to be much higher in

2022 due to increasing cost and volatility in electricity and heating fuel prices (Non-gas Map, 2022).

Brampton 2 Zero is one of several local environmental groups in Brampton: the Brampton and Beyond Community

Trust (BBCT) is a community-based development trust serving Brampton and the surrounding area. The

organisation has operated since 2010, working to develop local carbon energy schemes in the area, in particular

including a community-owned anaerobic digestion plant. BBCT aims to provide accessible, affordable, and

responsive services for local people and seeks to be self-financing. Furthermore, B2Z has a sister organisation,

Sustainable Brampton, which initiated the Brampton and Beyond Energy (BABE) group, which is planning a 500-

kW anaerobic biodigester in 2019 to support local heat, electricity, and fertiliser.

Parts of Brampton centre were designated a Conservation Area in 2003, described as "an area of special

architectural or historic interest the character or appearance of which it is desirable to preserve or enhance" and

which is included in Figure 1.1. This Area has implications for building regulations and planning permissions, among

others, for which additional scrutiny and considerations will be made before granting development proposals. Of

particular relevance to the ambitions of this project, permitted development rights for rooftop solar do not apply

within conservation areas.

Figure 1.1 - Map of Brampton Parish and the Brampon Conservation Area.

The following organisations are relevant to the study and have played a role in supporting and creating this report.

Brampton 2 Zero

Brampton 2 Zero is a Community Interest Company (CIC) set up to implement sustainable energy solutions and a

scheme for community land management in Brampton, Cumbria. Through their projects across community

woodland, home retrofits, solar panel installations, and electric vehicles, they aim to increase local biodiversity

8

and carbon sequestration and make Brampton a net carbon zero town. B2Z is working closely with local

educational institutions – including Brampton Primary School, Lanercost School, Irthington school, The William

Howard School, and Lancaster University – to develop interest and support for local low carbon projects

Rural Community Energy Fund

The Rural Community Energy Fund (RCEF) is a £10 million programme which supports rural communities in

England to develop renewable energy projects, which provide economic and social benefits to the community.

The RCEF is administrated by the North West Net Zero Hub and has provided funding for this heat network

feasibility study. The RCEF closed in April 2022 and is not expected to provide any further project funding to local

energy projects in 2022/23.

Scene

Scene Connect Ltd. (Scene) is a UK based social enterprise established in 2011 with the intention of furthering the

community energy sector. The organisation works with landowners, developers, and community groups to further

opportunities for a range of community developments, expanding from its initial focus on renewable energy,

through benefits packages, joint ventures, and wholly owned projects. Scene is the technical consultancy which

produced this feasibility study in partnership with B2Z.

9

A review of relevant environmental and planning policy and regulation in relation to low carbon development has

been carried out. The following reference sources are of relevance:

• The Climate Change Act 2008, (HM Government, 2008)

• Energy white paper: Powering our net zero future, (HM Government, 2020)

• Heat and Buildings Strategy, (HM Government, 2021)

• Carlisle District Local Plan (2015-2030)

• The Environmental Permitting (England and Wales) Regulations (2016)

There are a number of relevant UK Government policies and strategies which underpin the UK’s ambitions and

progress in relation to energy and carbon. Brampton’s low carbon ambitions fall within the aims of these policies,

meaning that any associated development proposals are expected to start with a presumption of support from a

planning policy point of view. Further information on the specifics of local planning is provided in Section 2.2.

Climate Change

The UK is a leading country in terms of climate change policy and action. It has made considerable progress,

reducing emissions by 48% on 1990 levels, including a reduction of 3% between 2018 – 2019 (CCC, 2019). This has

largely been driven by renewable power deployment and a large reduction in coal use. The UK also benefits from

a strong policy framework for climate commitments in the form of the Climate Change Act (2008).

Energy Policy

The Energy Security Strategy was published in April 2022 in the context of increasing climate change concern, the

UK cost of living crisis and Russian invasion of Ukraine. The policy reviews the UK Government’s energy strategy,

providing an approach to meeting low carbon targets whilst reducing reliance on international fossil fuel imports,

including oil and gas. The strategy sets out an ambition for 95% of the UK’s electricity to come from low carbon

sources by 2030, ahead of a complete decarbonisation target in 2035.

Zero emission vehicles

In November 2020, the UK government announced a commitment to end the sale of new internal petrol and diesel

vehicles by 2030, and that all new cars and vans will be required to be fully zero emission at the tailpipe by 2035.

More than 10% vehicles sold in 2020, and 25% in 2021 were zero or ultra-low emission vehicles. In 2019 the figure

was less than 2%. Although the expectation is that the majority of drivers will do most of their charging at home,

a public charge point infrastructure is required to support longer distance journeys and those without off-street

parking. By 2030, the Government expects "around 300,000 public charge points as a minimum in the UK, but

there could potentially be more than double that number"

1

.

National Planning Policy Framework (NPPF)

In respect to energy development, there are a number of important sections within the NPPF which are laid out

below. Whilst these sections provide the justification, guidance and policy base for energy planning, all sections

of the NPPF must be considered in respect to any planned development.

It addresses topics that are relevant to the economic, environmental, and social sustainability of development

proposals, including but not limited to:

• 2. Sustainable Development states that, ‘at the heart of the Framework is a presumption in favour of

sustainable development,’ meaning development plans should seek to promote development which meet

1

HM Government Electric Vehicle infrastructure strategy

https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/1065576/taking-

charge-the-electric-vehicle-infrastructure-strategy.pdf

10

the development needs of their area; align growth and infrastructure; improve the environment; mitigate

climate change; and adapt to its effects.

• 9. Promoting Sustainable Transport states that ‘the environmental impacts of traffic and transport

infrastructure should be identified, assessed and taken into account,’ in local planning. It highlights that

new development should be designed to enable charging of plug-in and other ultra-low emission vehicles

in safe, accessible, and convenient locations.

• 11. Making Effective Use of Land states that ‘Local planning authorities, and other plan-making bodies,

should take a proactive role in identifying and helping to bring forward land that may be suitable for

meeting development needs,’ which includes identifying opportunities for development, as considered

within this study.

• 12. Achieving well-designed places, highlights the need to remain sympathetic to local character and

history (including built environment and landscape setting), whilst optimising the scale and extents of

development. Where available, development must follow local design guides or the national design guide

and code in their absence.

Solar PV Array Development

Part 14 of The Town and Country Planning (General Permitted Development) (England) Order 2015 provides details

regarding the development constraints and conditions for the development of solar equipment. In general,

developments are assumed to be permitted on residential homes and blocks of flats, except when the proposed

solar array does not meet the requirements of size, spacing, and natural or cultural heritage constraints. The

document should be consulted thoroughly before a development application is considered.

Within the Brampton context there are few situations where solar PV would not be considered a permitted

development, in particular for listed properties and where rooftops are clearly visible from the nearby world

heritage site. There are also additional development constraints relevant to solar panel placement lie within the

Brampton Conservation Area, where solar panels should be situated in a way that reduces impact on the nature,

look and feel of the town. This often requires placement of panels facing away from roadways and public-facing

orientations.

This impacts particularly on domestic properties within the conservation area and several non-domestic properties

in this study.

EV Charging

Part 2 of The Town and Country Planning (General Permitted Development) (England) Order 2015 provides details

around the development conditions for installing both wall-mounted and upstanding electric vehicle charging

points. It states that planning permission is not required for the installation of either a wall mounted or upstanding

electrical outlet for recharging of electric vehicles as long as the area(s) is lawfully used for off–street parking. This

includes factors such as distance from a highway and parking space, dimensions of the charging unit, and relative

location to any scheduled monuments or listed buildings. The document should be consulted thoroughly before a

development application is considered.

11

Brampton is included within the City of Carlisle’s district ward and development jurisdiction, and therefore covered

by the policies and ambitions set forth in the Carlisle District Local Plan 2015-2030. The Local Plan outlines several

strategic objectives which themselves include multiple policy aims. Those most relevant to this low carbon study

in Brampton are outlined in Table 2.1, below.

Relevant

Strategic

Objectives

Relevant Policies

Relevant Sections

Spatial Strategy

and Strategic

Policies

SP1: Sustainable

Development

SP8: Green and

Blue Infrastructure

“To contribute to protecting and enhancing our natural, built and

historic environment (including improving biodiversity), using

natural resources prudently, minimising waste and pollution, and

mitigating and adapting to climate change including moving to a

low carbon economy.”

Infrastructure

IP 1: Delivering

Infrastructure

IP 2: Transport and

Development

“Developers will be encouraged to include sustainable vehicle

technology such as electric vehicle charging points within

proposals.”

Climate Change

and Flood Risk

CC 1: Renewable

Energy

CC 2: Energy from

Wind

CC 3: Energy

Conservation,

Efficiency and

Resilience

“Proposals for renewable energy development will be supported

where they can demonstrate, through identifying and thoroughly

appraising any potential individual and cumulative effects, that any

associated impacts are or can be made acceptable.”

“It should be noted that within Carlisle District there are a number

of additional landscape and functional constraints that may limit

renewable energy development in certain locations…”

Health,

Education and

Community

CM 3: Sustaining

Community

Facilities and

Services

CM 5:

Environmental and

Amenity Protection

“Planning has a social role to play in supporting strong, vibrant and

healthy communities, by ensuring there are accessible local

services that reflect the community’s needs and support its health,

social and cultural wellbeing”

Green

Infrastructure

GI 1: Landscapes

“The aim of the policy framework is to protect and enhance green

infrastructure assets and the functions they perform, ultimately

for the sake of their own natural value, but also through

recognition of the many wider social and economic benefits they

perform, including: the opportunities they present for positively

improving the health and wellbeing of the population; for

sustainable travel; for mitigating and adapting to climate change

and for their amenity value.”

Table 2.1 – Relevant policies within the Carlisle District Local Plan 2015 – 2030

12

Existing or planned local developments within or around Brampton may have an impact on the likelihood of future

energy developments securing planning permission. This may include future limitations on local infrastructure,

visual impact, among others, or may be an opportunity in terms of impact and cost reduction.

Relevant local planning applications and their status within Brampton, found through Carlisle City Council’s

Planning Portal are detailed in Table 2.2. There are no large applications currently in planning which affect possible

low carbon development within Brampton resulting from this study, but it is reasonable to expect that the EIA

Screening for the solar farm at Leaps Rigg will progress to a full application in due course.

Application title

Address

Application Ref No.

Decision/Status

Installation Of Solar Panels

to Southern Roof Elevation

Blacksmiths Barn,

Lanercost, Brampton,

CA8 2HG

21/0953

Grant Permission

Replacing Existing 15

Diesel Generators with

New Low Carbon Battery

Energy Storage System

Within Existing Fenced

Compound

Capon Generation

Compound, Capon Tree

Road, Brampton,

Carlisle, CA8 1QW

21/0626

Grant Permission

Request For an EIA

Screening Opinion for

Development of Solar

Farm (49,90 MW, 88.0 ha)

Leaps Rigg, Walton,

Brampton, CA8 2DZ

21/0004/ESO

Response – proposal

not likely to have

significant effects on

the environment.

Table 2.2 - Existing planning applications relevant to this low carbon study.

Natural and cultural heritage issues must be addressed to satisfy the local planning authority and to avoid or

minimise any negative impacts of low carbon implementation and installation on natural and cultural assets within

Brampton.

Cultural Heritage

A preliminary assessment of cultural heritage designations has been undertaken of locally and nationally

designated sites within and near to Brampton, presented in Table 2.3 and in Figure 2.1 . These designations may

have an impact on the development of renewable electricity assets (solar PV, wind turbine) or heat infrastructure,

including generation infrastructure, supply routes and internal works (e.g., energy efficiency measures).

Designation

Name/Description

World Heritage Site

Brampton is situated on the edge of the Hadrian’s Wall World Heritage Site (WHS),

which runs along the northern edge of the town.

Scheduled Monument

There is 1 Scheduled Monument in Brampton town centre, the Mote castle mound

and site of late medieval beacon.

13

Designation

Name/Description

Outside the western edge of Brampton’s centre, there are a further 5 scheduled

monuments.

Listed Buildings

There are 54 Listed Buildings within and around Brampton’s town centre.

Of these, 1 is Grade I listed (Church House), 52 are Grade II listed, and 1 is Grade II*

Listed (Moot Hall).

Conservation Area

Since 2003, parts of Brampton have been designated as a Conservation Area,

providing additional development and planning protection to buildings, trees, and

land within the Area.

Table 2.3 – Cultural heritage designations within or near to Brampton.

Figure 2.1 - Map of cultural heritage designations within and nearby Brampton.

Natural Heritage

Brampton is situated 2km away from a number of Sites of Special Scientific Interest (SSSI) – including the River

Eden and Tributaries (SSSI ID: 8540), the Unity Bog (SSSI ID: 4764), and the Gelt Woods (SSSI ID: 1900). The town

centre is not within or overlapping with any Green Belt, Nature Reserves, or Environmentally Protected Areas.

Figure 2.2 provides an overview of local designations.

Proposed developments in the north of the town, closer to the World Heritage Site, may be expected to be more

restricted than elsewhere.

As both Solar PV and EV charging infrastructure are permitted development (GDPO, 2015), it is unlikely that

problems would occur in relation to any of the designations noted above. The most likely constraint is expected

to be the positioning of solar PV panels to face away from, or be restricted in views from, the WHS. Due to the

14

fact that the WHS is to the north of the town and the preference for south facing solar PV panels, this is unlikely

to be an issue for the proposed development.

Figure 2.2 - Map of natural heritage designations with and nearby Brampton.

A review of the local electricity network is necessary to understand the renewable electricity generation and

connection potential within and around Brampton, which is serviced by the local Distribution Network Operator

(DNO), Electricity North West (ENW).

ENW’s network capacity heatmap shows that the closest primary substation for potential future connection is

around 1.4km from the centre of Brampton, just south of the Brampton Bypass (Figure 2.3). It is a 33 kV / 11 kV

substation, named ‘Capontree’ with significant headroom and connectivity potential for new sources of both

demand and generation (Figure 2.1Figure 2.3). A more detailed phone call with ENW’s Low Carbon Connections

Advisor noted that a grid connection assessment for solar PV and EV chargers would be required on a per-site

basis, to ensure that the expected voltage rise and transformer capacity are suitable to support such new

connections. ENW would fund the cost of additional connections required for domestic properties but not for

commercial sites.

Local use of energy is the preferred option in nearly all instances, as it offsets high energy costs on site. Export to

the national grid will be assessed in regard to larger scales of generation as well as excess generation after local

energy demand has been satisfied.

The expected cost of any new local grid connections will be provided by ENW following a grid connection

application for the project. Our discussions with ENW found that a single application comprising the multiple sites

would be acceptable, though likely requiring longer review time than timeframes specified for standard single-site

applications. Before submitting the application, a pre-application meeting can be arranged with ENW’s

engagement team to discuss the details of the application requirements, client expectations, and expected

turnaround time. Expected connection costs are not known until ENW’s technical assessment has been completed.

15

Figure 2.3 - Location of nearest primary substation to Brampton.

16

This chapter provides an overview of the current energy situation across key sites of interest within Brampton,

including both electricity and heating. This baseline energy information is a critical building block in understanding

the low carbon energy options available to Brampton and the associated economic, social, and environmental

impacts.

The electricity demand from the 25 sites listed below are those considered within this baseline assessment (Table

3.1), to be enable scaling of solar PV generation options and EV charging locations. Sites were selected based on

level of interest demonstrated by owners / tenants and suitability of buildings for solar PV generation.

Further to this, aggregate energy demand across all domestic properties has been highlighted in Table 3.1.

Individual solar PV assessments have not been conducted for any residential sites due to the high number of

properties.

Figure 3.1 – 25 non-domestic buildings within and around Brampton included within this study.

Energy data from these sites was collected through correspondence with relevant property owners, council

members, and other representatives of Brampton throughout July and August 2022 via email and online video

calls. This data included:

• Spatial and planning information, such as site maps, building plans, and planning proposals;

• Energy and technical data, such as energy consumption, fuel use, and building Energy Performance

Certificates (EPCs);

• Building and land use types;

• Times of use.

17

An initial site visit was conducted by Scene in June 2022.

A hierarchy of data sources was used to ensure the greatest level of detail and accuracy possible, whilst ensuring

the full coverage of relevant assets required to form an accurate energy baseline (Figure 3.2). Where real and

reliable data (smart metering, energy billing) was not available, prior EPC data has been used and applied to

standardised domestic and non-domestic energy demand profiles to generate demand profiles. Where EPCs are

unavailable or out of date, energy modelling based on building size, type, age, and use was used to generate

demand profiles. Due to the COVID-19 pandemic affecting typical energy profiles over 2020 – 2021, a preference

for 2019 (pre-pandemic) data was used in this study.

Figure 3.2 – Energy Data Hierarchy

Energy consumption data for the majority of the relevant buildings was provided in the form of monthly energy

bills per site between 2019 and 2022. To this monthly and annual energy demand dataset, a series of hour-by-

hour energy use profiles was able to be applied, suited to each building type and times of use. This process was

also supported by the client, who gave details on visitor and staff numbers, opening and closing times of the

various sites, and any relevant holidays, to inform a more accurate energy use profile of sites across the year.

Total baseline energy demand across the 25 sites amounts to 3,156 MWh per year, with an estimated further

8,951 MWh per year of electricity demand across domestic properties within Brampton.

Figure 3.3 provides an overview of non-domestic electricity demand across properties in Brampton. This

demonstrates that there are several properties with very high usage – including the William Howard School and

Make-Believe Ideas. Further to this, there is a concentration of high demand properties on the Townfoot Estate,

west of the town.

Figure 3.4 provides an overview of total energy electricity demand for the non-domestic properties in this study

within Brampton over a typical year. The profile demonstrates peak demand loads in the winter months and lower

demand throughout the summer and autumn months. This variance in heating energy demand is predominantly

due to use of electric sources of light and heating within those properties used more often during the winter

months, including electric heating systems and fireplaces, portable radiators, electric blankets, and evening lamps.

Metering and billing data was provided for 4 properties, with EPC and / or CIBSE benchmarking utilised to

understand electrical loads at wider non-domestic properties in Brampton. Understanding of exact electricity

demand, via energy metering or billing, is necessary to fully understand the case for a solar PV cooperative in

Brampton. Further detail on non-domestic property electricity demand and carbon emissions can be found in

Appendix B.

Smart metering

(Half Hourly)

Energy / Fuel

Billing (Annual)

Partial Energy /

Fuel Billing

(monthly)

Energy

Performance

Certificates

(EPC)

Energy Profiling

&

Benchmarking

18

Figure 3.3 – Non-domestic electricity demand in Brampton.

Figure 3.4 - Annual electricity demand profile for non-domestic properties in Brampton

19

Whilst non-domestic properties form the core of this study, both in terms of understanding demand and as

potential solar cooperative members, an understanding of local domestic demand may enable a greater number

of lower demand cooperative members.

In total, there are 2,296 properties in Brampton, therefore a full appraisal of electricity demand is not feasible

with real world data. Using average electricity demand values and profiles for the North West of the UK, it is

projected that domestic properties use ~8,908 MWh of electricity a year. This is significantly greater than the total

non-domestic demand in Brampton and demonstrates the scale of the opportunity for aggregating domestic

properties within a solar PV cooperative.

Based on an average solar PV installation size of 4kWp, these properties have a combined solar PV capacity

potential of 9.2 MW. In reality, only a moderate proportion of properties will be able to install solar PV: from

excluding those with existing solar PV arrays, unsuitable orientations, a lack of interest, siting within the Brampton

Conservation Area, or other development constraints. Further scenario analysis of potential domestic solar PV

capacity and generation is provided in Chapter 4.

Domestic Energy Demand and Emissions

Total number of households

2,296

Average annual domestic electricity

consumption

3,880 kWh

Total domestic electricity consumption,

per year

8,908,480 kWh

(8,908 MWh)

Total CO

2

e emissions, per home

76.7 tCO

2

e

Potential domestic solar PV array scale

9,184 kWp

Based on an average installed capacity of 4kW per household

Table 3.1 - Domestic electricity demand data for the properties within Brampton.

3.2.1. Carbon Emissions

Total annual carbon emissions resulting from electricity generation across all sites was calculated using an

electricity carbon factor of 0.19338 kg CO

2

e per kWh of grid electricity assumed, and a gas carbon factor of 0.180

kg CO

2

e per kWh of natural gas consumed. Both figures are provided by the UK Government’s Greenhouse gas

reporting: conversion factors data for 2022.

Using these assumptions, total carbon emissions from the 25 sites within the study amounts to 610 tCO

2

e per

year. Brampton’s 2,296 domestic properties contribute a further 1,731 tCO

2

e, bringing the total carbon emissions

throughout Brampton to 2,341 tCO

2

e.

Demand and emissions figures only account for electricity consumption across the properties. Heat consumption

within Brampton is primarily from the gas grid, with around 18% of households using alternative heating fuels

such as oil and wood logs, both of which have a significantly higher carbon emissions factor than gas.

20

Low carbon projects are often underpinned by

ambitions to address the ongoing climate

emergency, whether through reducing emissions

or adapting to future climatic conditions. Whilst

the financial case for low carbon projects is

essential, environmental metrics (e.g., carbon

emissions reduction) can provide a justification

even when the financial case is marginal.

Part of the Brampton community energy survey

focused on locals’ views in relation to climate

change and the actions undertaken by residents

to address the climate emergency. details

respondent types across the 180 surveys received,

with 95% of respondents Brampton residents and

/ or business owners.

Figure 3.5 – Survey respondent types

Figure 3.6 demonstrates a high level of concern in relation to the climate emergency in Brampton, with 94% of

respondents stating they are "concerned" about climate change, and 55% as "very concerned" within that number.

90% of respondents noted that they take action to tackle climate change, including:

• Reduce carbon impacts through dietary change, including consuming seasonal vegetables, less meat, and

less dairy products;

• Limit of single use plastic purchases;

• Use low carbon energy supplier and investing in home energy efficiency;

• Create greenspaces at home;

• Having fewer children;

• Buy second hand products, including clothes; or

• Limit driving and air travel.

95% of respondents also noted that they are willing to take one or more of the above actions to address climate

change in future. On average, 8% of respondents stated that they are unwilling to undertake the actions stated

above. The questions posed were aligned with a national YouGov poll issued in 2022, demonstrating that

Brampton residents have a greater awareness of, and are willing to undertake greater actions to address, climate

change.

Figure 3.6 – Survey respondents’ views on climate change

21

Figure 3.7 – Respondents' actions to address climate change

The above survey responses and analysis demonstrate that there is a large appetite for climate action in Brampton.

In particular, respondents noted an interest in activities which can be actioned at a local level – including

greenspace improvements, home energy efficiency, energy switching, and sustainable consumption. Community

energy organisations, such as Brampton2Zero, are particularly suited to supporting and enabling such activities. A

solar PV cooperative in Brampton would fulfil some of the demand for, and ambitions surrounding, low carbon

energy in Brampton. Similarly, an EV car club would help residents to address travel impacts and provide a simple

route for those interested in electric vehicles to reduce their own transport emissions.

It is important to note that surveys of this type may not be reflective of the entirety of the Brampton community.

Both respondent biases, where those with an interested in climate change and low carbon energy are more likely

to respond, and wider biases, such as time availability, internet access, and language, all play a role in defining

survey respondent types. Further information resulting from the survey can be found throughout this report and

in Appendix C.

22

This section presents the results from the technical, energy and environmental modelling of a simulated solar PV

cooperative across multiple buildings in Brampton. It details solar PV options, opportunities, and constraints for

non-domestic and domestic rooftop solar PV installations.

Solar PV (Solar Photovoltaics) is the generation of electricity using energy from the sun. Modern solar panels

produce electricity from daylight and do not require direct sunlight, although more electricity is produced on

bright, sunny days.

Enough sunlight falls onto the earth every hour to meet the

world’s power demands for an entire year, so harnessing and

using this free energy can help reduce our reliance on other

sources of energy and be beneficial to the environment as well.

By installing Solar PV panels, you can produce free, green

energy for your home or business. Solar PV panels are normally

mounted on the roof of your building although they can also be

placed on the ground when a suitable roof is not available. A

device called an inverter changes the DC electricity produced

by the panels into ‘useable’ electricity that can then be used to

power appliances in your home or can be fed back into the

National Grid. Solar PV panels contain no moving parts, are low

maintenance and roof mounted systems will typically be

adequately cleaned by rainfall.

In the UK energy market, domestic and non-domestic solar PV arrays are frequently installed across the country.

Demand for solar installations has increased dramatically in 2021 / 22 due to dramatic increases in electricity

prices. The cost of solar PV is generally on a decreasing trend, as panel performance increases and production

costs decrease. Supply chain issues resulting from the COVID-19 pandemic and increased demand has led to short

term increases in solar PV costs and material availability.

Within the Carlisle City Council area there are 341 domestic solar PV installations per 10,000 households, totalling

6.2 MWp of solar generation capacity, with a further 2.7 MW of non-domestic solar installations in the region.

Solar PV is by far the most dominant small-scale generation technology, comprising 59% of all small-scale

renewable energy generation.

Critical to the success of a solar cooperative model is the sign up of properties and locations to install solar panels

and arrays. This may be non-domestic or domestic rooftops or land where ground-mounted arrays may be

installed.

During the course of this feaisblity study, engagement with both non-domestic and domestic property owners has

demonstrated a keen interest in a solar cooperative approach in Brampton, as well as helping to identify a large

number of potential sites for devleopment. Figure 4.1 details responses from the community survey, showing that

over 100 residents were intersted in developing solar on their rooftop or land, with a further 40 respondents

unable to commit to solar PV installation but willing to invest in a local solar PV cooperative.

Qualitative responses to the survey demonstrated a wide range of reasons for a lack of interest, including:

• Respondents who did not feel solar PV was viable on their properties as they sit within the Brmapton

Conservation Zone;

• Respondents who are interested but unsure of the cooperative model and what the benefits to them

individually might be;

23

• Respondents with previous experience with solar PV rooftop leases concerned about negative impacts on

future property sales and mortgages;

• Respondents who felt that solar PV was not a suitable route forward for Brampton due to a preference

for wind energy, a lack of belief in renewable technologies, and a perception that the carbon emitted

during manufacture is greater than carbon saved through operation.

It is clear that there is a strong investor and participant interested in a solar cooperative in Brampton but further

engagement is required to detail the business model and benefits to local people.

Figure 4.1 – Level of interest in a Solar PV Cooperative in Brampton

An assessment of potential solar generation was carried out across non-domestic sites in Brampton and compared

against electricity demand profiles to explore possible cost and carbon savings for non-domestic sites and project

as a whole. Industry standard PV*SOL Premium 2021 software was used for the solar assessment, producing hourly

solar generation figures.

Assessment against energy demand profiles is an important process as it demonstrates how much electricity can

be used locally, therefore reducing high-cost energy bills (£0.28 – 0.40 / kWh). This is a preference to energy export

to the electricity grid, which offers comparatively low-income generation potential (£0.05 – 0.20 / kWh).

Throughout this study, energy bill savings through local energy use is preferred to grid export.

Table 4.1 below details the rooftops included within the solar assessment, and the potential solar capacity and

generation output of each site. Total estimated solar capacity is 1.31 MWp solar PV, producing 1,069 MWh of

solar generation per year.

Sites such as the Building 7, Building 10, Building 14, Building 17, among others, are considered as priority sites for

high potential solar generation, given their suitable rooftops and sufficient baseline demand to yield significant

cost and carbon savings.

Conversely, Unit 3 of the Townfoot Industrial Estate and Building 1 are considered particularly poor candidates for

solar generation. This is due either to the orientation and spatial characteristics of their rooftops or because their

baseline energy demand is unlikely to be great enough to derive significant cost or carbon savings.

24

Finally, the Stalker’s Transport Services building within the Industrial Estate already hosts a significant existing

solar array, and so was excluded from the study. Figure 4.2 - Figure 4.4 provide examples of rooftop solar arrays

as simulated within PV*SOL software.

#

Site Name

Solar Capacity

(kW)

PV Generation

(kWh/year)

1

Building 1

2.25

2,025

2

Building 2

13.5

12,394

3

Building 3

81.00

69,810

4

Building 4

30.00

27,726

5

Building 5

42.00

36,896

6

Building 6

11.25

9,429

7

Building 7

94.24

77,846

8

Building 8

43.5

33,620

9

Building 9

12.75

8,329

10

Building 10

249.75

181,199

11

Building 11

12

Building 12

6.38

16,310

13

Building 13

48.75

33,968

14

Building 14

97.88

85,288

15

Building 15

90.00

71,954

16

Building 16

65.63

50,656

17

Building 17

165.75

142,062

18

Building 18

31.5

27,911

19

Building 19

57

51,012

20

Building 20

40.13

32,728

21

Building 21

22.5

18,810

22

Building 22

31.5

28,383

23

Building 23

10.13

9,182

24

Building 24

22.5

9,182

25

Building 25

36.0

32,782

Totals

1.31 MW

1,069 MWh

Table 4.1 - Longlist of 25 non-domestic buildings within the Brampton study

25

Figure 4.2 - A 165.75 kW array simulated on the rooftops of the Building 17.

Figure 4.3 - A 30 kW array simulated on the Building 4

Figure 4.4 - A 2.25 kW array simulated on the rooftop of the Building 1.

26

To understand how each building’s solar PV capacity potential can provide energy and environmental benefits,

building-by-building energy modelling was undertaken to assess levels of local electricity use, export, and the

benefits of integrating electricity storage.

4.4.1. Modelling Assumptions

The potential solar cooperative comprises a total of up to 25 non-domestic buildings, including educational,

industrial, retail, and healthcare sites. A variable number of domestic residences within Brampton is also included

within the model, to simulate the possible inclusion and outcomes of residential homes within the cooperative

also. The model uses the properties’ electricity bills where available, and otherwise EPC and floor area

measurements, compared against simulated solar generation produced through the PV*SOL software described

in the previous chapter.

Electricity Prices & Tariffs

Where instantaneous electricity demand is met by solar generation, for each hour of a typical year, an electricity

cost saving is assumed, equivalent to the current unit cost of electricity at the particular site. An electricity tariff

of £0.40/kWh has been assumed across all properties in line with the 2022/23 energy price cap and through

conversations with property owners.

Where solar PV generation exceeds demand, excess electricity is modelled as exported to the electricity grid with

a typical Smart Export Guarantee (SEG) rate paid to the cooperative. While typical SEG rates are up to 0.12p / kWh

exported for individual properties, a solar cooperative comprising multiple sites could be able to negotiate a Power

Purchase Agreement (PPA) with a supplier. A PPA rate of £0.185 / kWh has been assumed within the model, based

on recent projects and rates secured by Scene.

Existing solar cooperative examples in the UK utilise lease agreements with building owners typically including a

PPA for the direct supply, where a price is agreed per kWh for use of electricity generated by the cooperative’s

solar PV array. Within all modelling it is assumed that building owners / tenants would pay a set £0.20 / kWh for

all electricity consumed from solar cooperative energy infrastructure (i.e., solar PV or battery storage). Given this

provides a substantial saving to energy bills, it is assumed there would be no cost paid to the building owner for

the rooftop rental. A different model could be required if the building owner and bill payer are different.

Carbon Emissions

Based on the UK Government’s latest Conversion factors for company reporting of greenhouse gas emissions, a

value of 0.193 kg CO2e (carbon dioxide emissions equivalent) per kWh used/avoided has been assumed.

Capital (CAPEX) and Operating (OPEX) Costs

Solar PV cost data from 2021/22 published by the UK Government (BEIS, 2021) has been used to model capital

costs for the solar arrays. These costs are provided for multiple scales of the solar installation (Table 4.2).

Further information on all assumptions made within this study can be found in Appendix A.

Battery Storage

Battery storage has been modelled to enable greater local use of electricity within the solar cooperative scenario.

Battery storage modelling assumes a 40% increase in local use of electricity, and therefore greater energy bills

savings.

Installation scale (kW)

Median £/kW installed

0-4

£1,618

4-10

£1,531

10-50

£1,016

Table 4.2 - Unit costs assumed for solar cooperative capital cost estimations.

27

4.4.2. Non-domestic Modelling

Table 4.3 below details the solar capacity, cost and carbon savings, and estimated capital costs for each of the

non-domestic properties included within the modelled cooperative.

Notable properties include the Building 5 / 6, Building 7, Building 12, and Building 13, meeting around 40% of their

annual electricity demand through solar generation. Building 1 and Building 18, on the other hand, have relatively

high demand compared to their low solar potential, and represent poor opportunities.

Particular consideration should be given to those sites within the Brampton Conservation Area (BCA in the table)

- namely, Building 1, Building 2, Building 3, Building 4, Building 20, and Building 21 - for which solar development

may be more difficult to gain approval.

Solar PV Technical and Financial Overview

Property

Solar PV

capacity

kW TIC

Demand met

by solar

(% of demand)

kWh/year

Electricity

cost

savings

£/year

Export

income

£/year

Carbon

savings

tCO

2

e/year

Estimated

cost

£

BCA

Building 1

2.3

2,025 (1%)

£810

£0

0.4

£3,641

Yes

Building 2

13.5

10,383 (18%)

£4,153

£372

2.0

£13,716

Yes

Building 3

81.0

23,640 (25%)

£9,456

£8,542

4.6

£82,296

Yes

Building 4

30.0

22,943 (19%)

£9,177

£885

4.4

£30,480

Yes

Building 5

42.0

8,102 (37%)

£3,241

£5,327

1.6

£42,672

No

Building 6

11.3

1,343 (39%)

£537

£1,496

0.3

£11,430

No

Building 7

43.5

19,365 (22%)

£7,746

£2,637

3.7

£44,196

No

Building 8

94.2

35,586 (41%)

£14,234

£7,818

6.9

£95,748

No

Building 9

12.8

5,099 (34%)

£2,039

£598

1.0

£12,954

No

Building 10

249.8

164,285 (23%)

£65,714

£3,129

31.7

£253,746

No

Building 11

6.4

9,243 (36%)

£3,697

£1,307

1.8

£9,768

No

Building 12

48.8

11,422 (36%)

£4,569

£4,171

2.2

£49,530

No

Building 13

97.9

34,130 (24%)

£13,652

£9,464

6.6

£99,446

No

Building 14

90.0

18,429 (28%)

£7,372

£9,902

3.6

£91,440

No

Building 15

32.8

4,300 (31%)

£1,720

£3,890

0.8

£33,340

No

Building 16

32.8

4,300 (31%)

£1,720

£3,890

0.8

£33,340

No

Building 17

165.8

58,341 (25%)

£23,336

£15,489

11.3

£168,402

No

28

Solar PV Technical and Financial Overview

Property

Solar PV

capacity

kW TIC

Demand met

by solar

(% of demand)

kWh/year

Electricity

cost

savings

£/year

Export

income

£/year

Carbon

savings

tCO

2

e/year

Estimated

cost

£

BCA

Building 18

31.5

27,557 (4%)

£11,023

£66

5.3

£32,004

No

Building 19

57.0

36,159 (16%)

£14,464

£2,748

7.0

£57,912

No

Building 20

40.1

25,178 (30%)

£10,071

£1,397

4.9

£40,772

Yes

Building 21

22.5

18,751 (16%)

£7,500

£11

3.6

£22,860

Yes

Building 22

31.5

14,252 (22%)

£5,701

£2,614

2.8

£32,004

No

Building 23

10.1

4,555 (22%)

£1,822

£856

0.9

£10,292

No

Building 24

22.5

9,422 (21%)

£3,769

£1,787

1.8

£22,860

No

Building 25

36.0

12,330 (25%)

£4,932

£3,784

2.4

£36,576

No

Totals

1,306

581,138 (18%)

£232,455

£92,182

112.2

£1,331,424

-

Table 4.3 - Outcomes of initial solar PV cooperative modelling, for each non-domestic building.

29

4.4.3. Domestic Modelling

According to UK Government data on domestic meter numbers within the relevant Lower Layer Super Output

Areas (LSOAs), there are 2,296 domestic properties in Brampton as of 2020. Domestic modelling assumes an

average electricity consumption of 3901.7 kWh per year, based on subnational electricity consumption statistics

data for 2020 and applies a typical domestic electricity use profile from Ofgem to plot this energy consumption

for every hour of a typical year.

A conservative estimate of 3 kW of rooftop solar was assumed for a typical household (Figure 4.5), comprising 8

modules of 375W solar PV panels. A system of this scale would generate a total of 2,717 kWh solar energy per

year in Brampton. As with the non-domestic properties, this was then compared with hourly energy demand to

estimate electricity cost saving, export income, and carbon savings (Table 4.4).

Due to a combination of rooftop size, orientation, shading, and the Brampton Conservation Area, not all the 2,296

houses will be viable for rooftop solar panels.

Further scenario analysis of the technical and financial viability of including domestic properties in a solar

cooperative can be found in Section 5.

Solar PV performance for an average domestic property in Brampton

Electricity demand (kWh/year)

3,902

Solar PV generation (kWh/year)

2,717

Demand met by solar (kWh/year) (%)

997 (26%)

Electricity cost savings (£/year)

£399

Export income (£/year)

£318

Carbon emissions savings (tCO

2

e/year)

0.2

Table 4.4 - Annual outcomes of supplying a typical domestic property with rooftop solar panels.

Figure 4.5 – An example domestic rooftop solar PV array of 3kW

30

This section provides a technical assessment of EV car club options and opportunities in Brampton. Understanding

the level of local demand for a car club, establishing potential locations for car club infrastructure (i.e., vehicles

and chargers), and optimising proposals to meet estimated levels of demand are important steps in developing an

EV car club.

There are two options presented:

1. An EV car club owned and operated by a community organisation in Brampton.

2. An EV car club operated by a commercial operator in Brampton.

All variables and assumptions used within this assessment are detailed in Appendix A.

4.5.1. Demand Assessment

The community survey conducted in June 2022 provided initial information on levels of interest in an EV car club

in Brampton. Of the 180 respondents, 110 showed some level of interest in participating in a car club.

Primary reasons for interest included those currently without access to vehicles and reliant on inconsistent public

transport, those interested in buying an EV but unable to afford one currently, and those looking to get rid of a

second car on both cost and environmental reasons.

Those uninterested stated a lack of understanding of the business model to be used, costs compared to ICE

vehicles, expected inability to use the car club due to distance from Brampton town centre, and a lack of

confidence in car club operation and EVs in general.

Figure 4.6 – Survey respondents' interest in a Brampton EV Car Club

Respondents stated how they were most likely to use an EV car club, with the greatest number of respondents

suggesting infrequent use – one to two times a month – was the most likely scenario for them. This data was input

into the demand assessment to provide a weighted annual distance assessment for typical user types (Figure 4.7).

Respondents were further asked their views on possible tariffing structures. In general, respondents requested a

daily tariff of <£10, highlighting the high costs of other car clubs (e.g., Enterprise, ZipCar) and lack of price parity

with ICE vehicle use.

31

Figure 4.7 – Survey respondents' views on how they would use an EV car club in Brampton

From survey responses and local data on transport use, a demand assessment was conducted. The proposed EV

car club has been scaled to meet local demand, ensuring there are a suitable number of vehicles and charging

points to deliver an accessible service for local people (Table 4.5).

It is important to note that this demand assessment underpins all technical and financial modelling. This is a

scenario that is supported by both local population and transport dynamics, as well as the survey responses

received. Increased demand scenarios would improve the financial viability of the scheme, though may require

greater levels of capital investment (e.g., vehicles and chargers). The opposite would be true in reduced demand

scenarios.

EV Car Club Characteristics

No.

Notes

Electric Vehicle

3

Renault Zoe (or similar)

EV Charger

3

22kW ‘fast’ charger

Number of users

110

-

Average miles per trip

20

-

Average miles per user per year

798

-

Table 4.5 – EV Car Club characteristics

4.5.2. Spatial & Technical Analysis

Spatial analysis was conducted to understanding the distribution of EV car club demand and to propose locations

for EV cars and charging infrastructure.

The community survey results suggest that the highest level of demand is in Central Brampton, as the most likely

area to have high car club demand due to having the highest population density in the area.

Figure 4.8 provides an overview of local car club demand as a heat map of the Brampton area. Access to the A6071

and A69 is a requirement, as the major trunk roads connecting Brampton to nearby settlements (e.g., Carlisle).

Several potential locations for EV cars and / or EV chargers are shown.

32

1. Townfoot Estate: position to enable access to those working on the estate and potentially make use of

solar cooperative electricity generation sites.

2. Brampton Community Centre: Positioned in the centre of Brampton with easy access to both the town

and A6071, as well as likelihood of support for any proposal.

3. William Howard School: providing access to the town and A6071, as well as providing a resource for

families and school users.

4. The White Rabbit Tearoom: providing easy access to the Brampton Bypass (A69) although limited

onwards transport into Brampton itself.

Figure 4.8 – Map of EV car club interest in Brampton

33

This section provides a financial appraisal of the options and opportunities considered within section 4. It provides

detailed financial forecasting and metrics and considers the feasibility of both solar cooperative and EV car club

projects in Brampton. Full detail on the financial variables and assumptions used within this section can be found

in Appendix A.

All financial modelling presented in this section assumes that initial financing is raised through a community share

offer with an annual return of 4%.

A 20-year financial model was developed for a solar cooperative based on the non-domestic properties included

within this study. Integrating domestic properties into the solar PV cooperate is expected to improve financial

viability, with greater generation potential and therefore larger income streams (Section 5.2).

Solar PV

Implementing solar PV across all non-domestic properties in the study is expected to cost £1,464,567, with an

annual running cost of £29,291, including maintenance, servicing, replacement, metering, and billing, and share

administration costs.

Income would be generated through PPAs with building owners / users (£116,228 / year), and export of electricity

(£92,182 / year). Alongside OPEX costs of £29,291, share interest of £58,583 is anticipated from year 2 onwards.

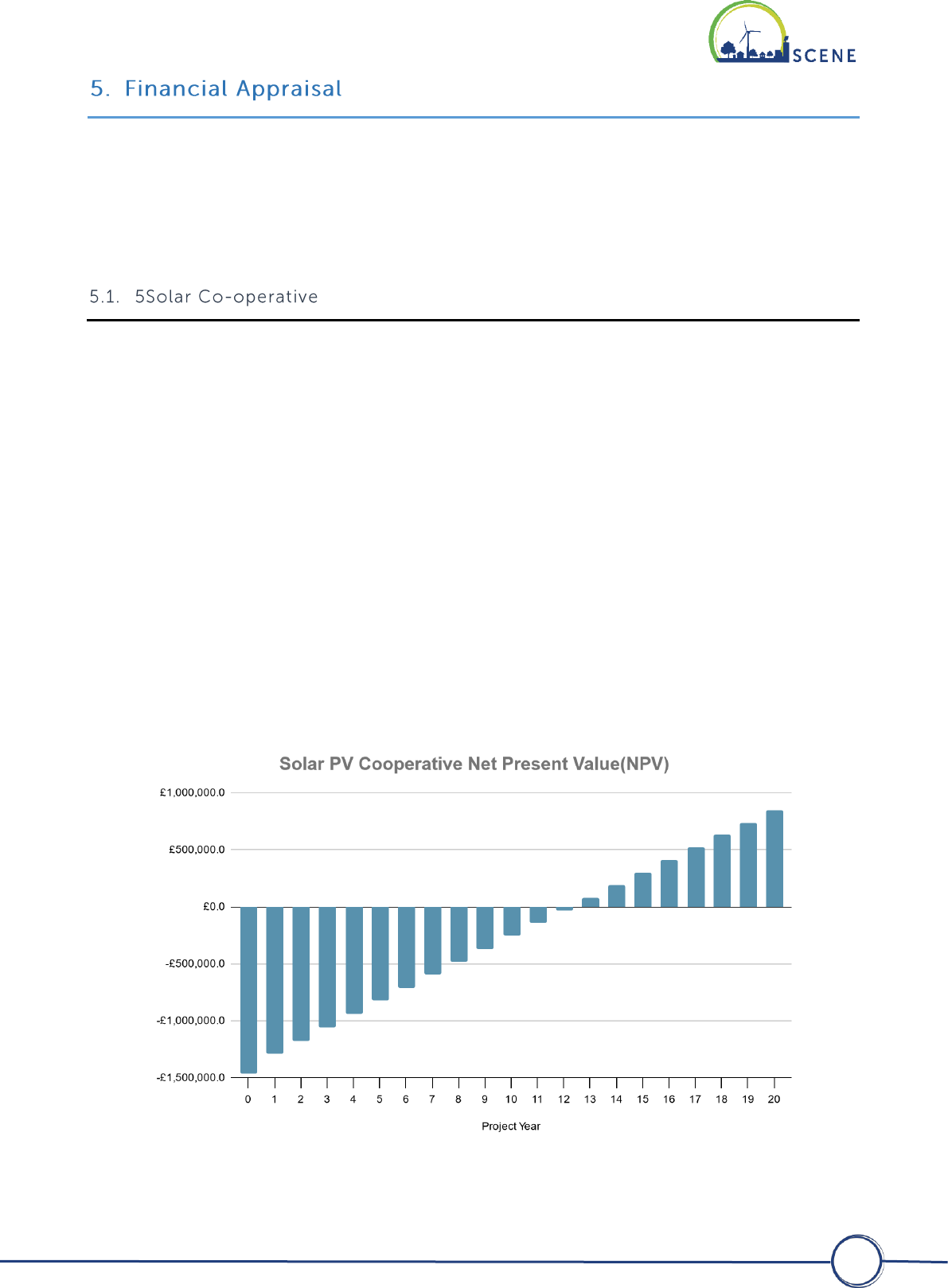

The 20-year net present value (NPV) is projected to be £847,224 with an internal rate of return (IRR) of 5%. The

project is expected to breakeven at year 13.

This is deemed to be a reasonable return over 20 years which balances several objectives:

1. Providing an income stream for the community solar cooperative to finance future system replacement costs

and / or develop further low carbon projects;

2. Providing building owners with energy bill reductions through access to solar energy via a PPA at £0.20 / kWh.

3. Providing shareholders with reasonable returns on their investment.

Figure 5.1 - Cashflow outcomes for the non-domestic solar PV cooperative.

34

Solar PV with Battery Storage

As detailed in Section 4, battery storage capacity has been modelled on a building-by-building basis. With greater

income resulting from local use over grid export, battery storage has the ability to improve the financial viability

of a solar cooperative, increase local energy use, reduce carbon emissions, and reduce cooperative members’

energy bills.

Implementing solar PV with battery storage across all non-domestic properties in the study is expected to cost

£1,927,775, with an annual running cost of £38,555, including maintenance, servicing, replacement, metering, and

billing, and share administration costs.

Income would be generated through PPAs with building owners / users (£348,683 / year), and export of electricity

(£30,727 / year). Alongside OPEX costs of £38,555, share interest of £77,111 is anticipated from year 2 onwards.

Replacement expenditure (REPEX) is included within this model for battery storage, with a cost of £347,406 at

year 10 include for the replacement of all cooperative-owned battery systems.

The 20-year net present value (NPV) is projected to be £2,808,995 with an internal rate of return (IRR) of 7%. The

project is expected to breakeven at year 8.

This shows that battery storage improves viability of the scheme, though detailed energy modelling is required on

a building-by-building basis to better understand system sizing and latent electricity use potential.

Figure 5.2 - Cashflow outcomes for the non-domestic solar PV cooperative with battery storage.

35

With a financially viable option to develop a solar cooperative with non-domestic properties in Brampton, it is

worthwhile considering the opportunities arising from involvement of domestic properties. A financial model was

created to understand the potential for solar PV development in Brampton, the costs of development and

potential benefits from the perspectives of the solar cooperative and potential members.

Table 5.1 demonstrates that 10% of domestic properties within the study (~230 properties) could support up to

0.69 MW of solar capacity. This would deliver £91,540 in aggregate cost savings to property owners / tenants, as

well as generating £118,831 in income for the solar cooperative, via export (£73,061) and building PPAs (£45,770).

Greater levels of ambition would result in capacities as high as 2.06 MW of solar installed, providing local benefits

of £274,621 and generating £356,494 for the solar cooperative per year.

The numbers detailed above have been provided as indicative scenarios and do not account for a number of

important variables, indulging:

• Size and scale of property;

• Local constraints, including cultural, environmental, and technical barriers;

• Property suitability for solar, including roof type, space, and orientation;

• Potential capital and operating costs for smaller scales of development, as would be implemented for

domestic properties.

Also, commercial rooftop lease and PPA agreements typically have a duration of 15-20 years, to provide long-term

security over the investment. These time periods may not be acceptable to many households, and consumer

protection issues may become relevant to domestic supply which are not factors for non-domestic supply.

Based on the above limitations, detailed cashflow modelling has not been conducted for domestic properties

within the solar cooperative. Further assessment should be conducted once specific properties have been

identified and owners engaged with to confirm interest and suitability for the solar cooperative proposal.

Domestic Properties Participation Level

30%

20%

10%

Number of Properties

689

459

230

Installed solar (MW)

2.06

1.38

0.69

Demand met by solar (MWh/year) (%)

26%

26%

26%

Electricity cost savings (£/year)

£274,621

£183,081

£91,540

Total income (£ / year)

£356,494

£237,662

£118,831

Export income (£/year)

£219,183

£146,122

£73,061

PPA Income (£/year)

£137,311

£91,540

£45,770

Carbon emissions savings (tCO

2

e/year)

132.5

88.3

44.2

Table 5.1 - Solar viability for domestic properties within Brampton Parish

36

This section provides an assessment of financial viability for an EV car club in Brampton. Full details on the financial

variables and assumptions used within this study can be found in Appendix A.

Demand data used within this assessment was collected through a community survey conducted in 2022. This

survey demonstrated that ~110 users were interested in an EV car club in Brampton, although with varying levels

of use type and regularity. The views of these respondents have been used to develop the below user demand

assessment and tariffing structure (Table 5.2). The proposed tariffing structure has been developed to support a

scheme which meets the required scale and use characteristics for Brampton.

Demand Assessment

Unit

Estimated number of users (annual)

110

Average number of trips / years

40

Average Trip Length

20 miles

Average annual user distance covered

796 miles

Proposed Tariffing Structure

Unit

Annual Membership Fee

£60

Fixed tariff (per journey)

£7

Variable tariff

£0.20 / mile

Table 5.2 – EV Car Club demand assessment and tariffing structure

Based on the tariffing structure, demand assessment and technical appraisal, a 20-year financial model has been

developed for an EV car club in Brampton (Figure 5.1). Implementation is expected to cost £100,500, with an

annual running cost of £29,291, including insurance, servicing, metering, and billing, software platform licences,

and administration costs.

Income would be generated through the annual membership fee (£6,600 / year), fixed tariffs for journeys (£30,646

/ year), and variable tariff payments (£17,512 / year). Alongside OPEX costs of £33,758, share interest of £865 is

anticipated from year 2 onwards. Replacement expenditure (REPEX) is included for EV and EV charger

replacement, with a cost of £54,000 at year 5, £43,200 at year 10, and £38,880 at years 15 and 20.

The 20-year net present value (NPV) of is projected to be £100,017 with an internal rate of return (IRR) of 7%. The

project is expected to breakeven at year 9.

Modelling assumes that all vehicle charging is conducted using grid supplied energy, and therefore subject to

electricity costs. If EV chargers were to be integrated with solar PV and / or battery storage to supply electricity,

then 20-year NPV is projected to be £326,387, with an IRR of 10%, breaking even in year 4.

An EV car club is therefore viable within Brampton, although it is unlikely to generate significant income due to

the high operating costs and requirements for frequent replacement cost investments. Further understanding of

local demand and acceptability of the proposed tariff structure is required to better understand the opportunity.

37

Figure 5.3 – Net Present Value for an EV Car Club over a 20-year lifetime

5.3.1. Individual User Costs

An assessment of EV car club costs to the users in comparison to ownership of a typical internal combustion engine

(ICE) vehicle is provided in Table 5.3. It demonstrates that, whilst per trip costs may be higher for EV car club users,