DEFINITIVE GUIDELINE

Fraud, Bribery and

Money Laundering

Oences

Definitive Guideline

For reference only.

Please refer to the guideline(s)

on the Sentencing Council website:

www.sentencingcouncil.org.uk

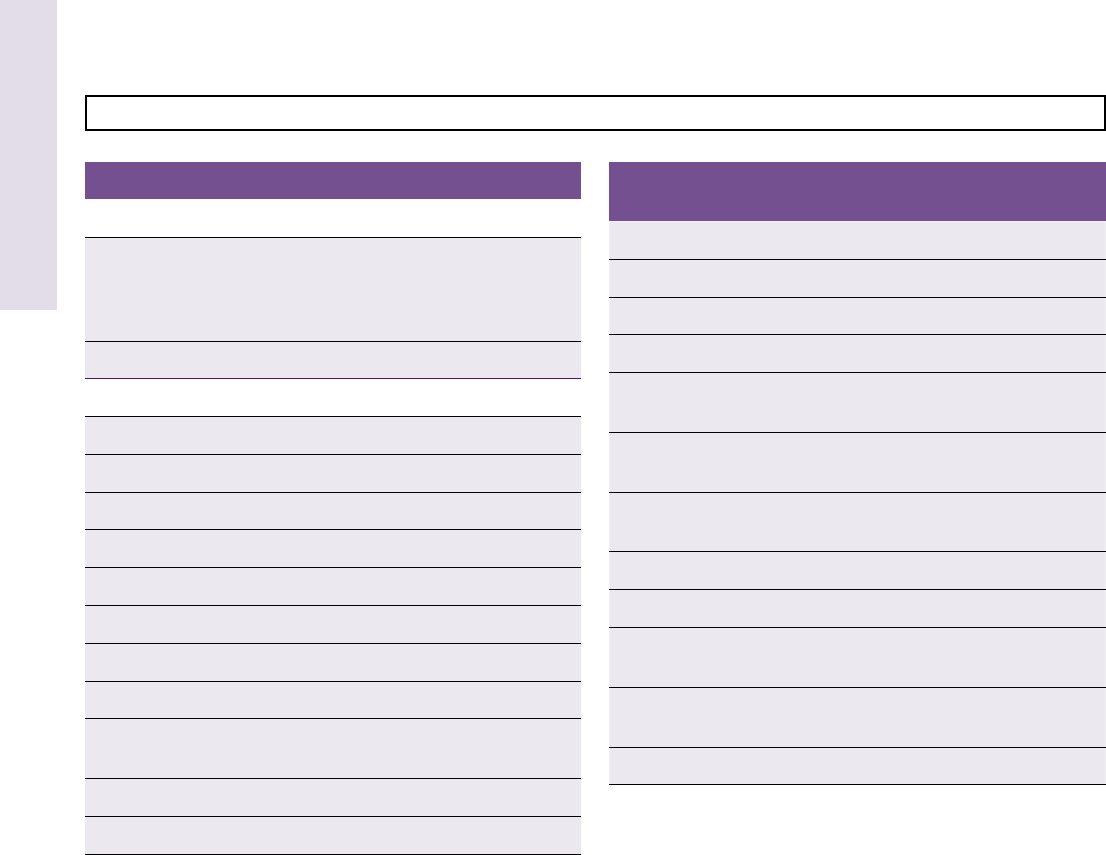

Contents

Applicability of guideline 4

Fraud 5

Fraud by false representation, fraud by failing to disclose

information, fraud by abuse of position

Fraud Act 2006 (section 1)

Conspiracy to defraud

Common law

False accounting

Theft Act 1968 (section 17)

Possessing, making or supplying articles for use in fraud

13

Possession of articles for use in frauds

Fraud Act 2006 (section 6)

Making or supplying articles for use in frauds

Fraud Act 2006 (section 7)

Revenue fraud

19

Fraud

Conspiracy to defraud (common law)

Fraud Act 2006 (section 1)

False accounting

Theft Act 1968 (section 17)

Fraudulent evasion of VAT; False statement for VAT purposes;

Conduct amounting to an oence

Value Added Tax Act 1994 (section 72)

Fraud, Bribery and Money Laundering Offences Definitive Guideline 1

Eective from 1 October 2014

For reference only.

Please refer to the guideline(s)

on the Sentencing Council website:

www.sentencingcouncil.org.uk

Fraudulent evasion of income tax

Taxes Management Act 1970 (section 106A)

Fraudulent evasion of excise duty; Improper importation of goods

Customs and Excise Management Act 1979

(sections 50, 170 and 170B)

Fraud

Cheat the public revenue (common law)

Benefit fraud

27

Dishonest representations for obtaining benefit etc

Social Security Administration Act 1992 (section 111A)

Tax Credit fraud

Tax Credits Act 2002 (section 35)

False accounting

Theft Act 1968 (section 17)

False representations for obtaining benefit etc

Social Security Administration Act 1992 (section 112)

Fraud by false representation, fraud by failing to disclose information,

fraud by abuse of position

Fraud Act 2006 (section 1)

Conspiracy to defraud

Common law

Money laundering

35

Concealing/disguising/converting/transferring/removing criminal

property from England & Wales

Proceeds of Crime Act 2002 (section 327)

Entering into arrangements concerning criminal property

Proceeds of Crime Act 2002 (section 328)

Acquisition, use and possession of criminal property

Proceeds of Crime Act 2002 (section 329)

2 Fraud, Bribery and Money Laundering Offences Definitive Guideline

Eective from 1 October 2014

For reference only.

Please refer to the guideline(s)

on the Sentencing Council website:

www.sentencingcouncil.org.uk

Bribery 41

Bribing another person

Bribery Act 2010 (section 1)

Being bribed

Bribery Act 2010 (section 2)

Bribery of foreign public ocials

Bribery Act 2010 (section 6)

Corporate Oenders

47

Fraud

Conspiracy to defraud (common law)

Cheat the public revenue (common law)

Fraud Act 2006 (sections 1, 6 and 7)

Theft Act 1968 (section 17)

Value Added Tax Act 1994 (section 72)

Customs and Excise Management Act 1979 (section 170)

Bribery

Bribery Act 2010 (sections 1, 2, 6 and 7)

Money laundering

Proceeds of Crime Act 2002 (sections 327, 328, 329)

Annex: Fine bands and community orders

54

© Crown copyright 2014

You may re-use this information (not including logos) free of charge in any format or medium, under the terms of the

Open Government Licence. To view this licence, visit www.nationalarchives.gov.uk/doc/open-government-licence/

or email: psi@nationalarchives.gsi.gov.uk

Fraud, Bribery and Money Laundering Offences Definitive Guideline 3

Eective from 1 October 2014

For reference only.

Please refer to the guideline(s)

on the Sentencing Council website:

www.sentencingcouncil.org.uk

4 Fraud, Bribery and Money Laundering Offences Definitive Guideline

Eective from 1 October 2014

I

n accordance with section 120 of the Coroners

and Justice Act 2009, the Sentencing Council

issues this denitive guideline. It applies to

all individual oenders aged 18 and older and

to organisations who are sentenced on or aer

1 October 2014, regardless of the date of the

oence.

Section 125(1) of the Coroners and Justice Act 2009

provides that when sentencing oences committed

aer 6 April 2010:

“Every court –

(a) must, in sentencing an oender, follow any

sentencing guideline which is relevant to the

oender’s case, and

(b) must, in exercising any other function relating

to the sentencing of oenders, follow any

sentencing guidelines which are relevant to the

exercise of the function,

unless the court is satised that it would be

contrary to the interests of justice to do so.”

This guideline applies only to individual oenders

aged 18 and older or organisations. General

principles to be considered in the sentencing of

youths are in the Sentencing Guidelines Council’s

denitive guideline, Overarching Principles –

Sentencing Youths.

Structure, ranges and starting points

For the purposes of section 125(3)–(4) Coroners

and Justice Act 2009, the guideline species

oence ranges – the range of sentences

appropriate for each type of oence. Within each

oence, the Council has specied a number

of categories which reflect varying degrees of

seriousness. The oence range is split into category

ranges – sentences appropriate for each level

of seriousness. The Council has also identied a

starting point within each category.

Starting points dene the position within a category

range from which to start calculating the provisional

sentence. The court should consider further

features of the oence or the oender that warrant

adjustment of the sentence within the range,

including the aggravating and mitigating factors set

out at step two.

1

Starting points and ranges apply to

all oenders, whether they have pleaded guilty or

been convicted aer trial. Credit for a guilty plea is

taken into consideration only aer the appropriate

sentence has been identied.

2

Information on community orders and ne

bands is set out in the annex at page 54.

Applicability of guideline

1 Aggravating and mitigating factors are at step four in the guideline for organisations. In the guideline for organisations, having identied a provisional

sentence within the range at step four, the court is required to consider a further set of factors that may require a nal adjustment to the sentence at step ve

2 In the guideline for organisations, guilty pleas are considered at step seven; in the guidelines for individuals, guilty pleas are considered at step four

For reference only.

Please refer to the guideline(s)

on the Sentencing Council website:

www.sentencingcouncil.org.uk

Fraud, Bribery and Money Laundering Offences Definitive Guideline 5

Eective from 1 October 2014

Fraud by false representation, fraud by failing to disclose information,

fraud by abuse of position

Fraud Act 2006 (section 1)

Triable either way

Conspiracy to defraud

Common law

Triable on indictment only

Maximum: 10 years’ custody

Oence range: Discharge – 8 years’ custody

False accounting

Theft Act 1968 (section 17)

Triable either way

Maximum: 7 years’ custody

Oence range: Discharge – 6 years and 6 months’ custody

FRAUD

Fraud

For reference only.

Please refer to the guideline(s)

on the Sentencing Council website:

www.sentencingcouncil.org.uk

6 Fraud, Bribery and Money Laundering Offences Definitive Guideline

Eective from 1 October 2014

STEP ONE

Determining the oence category

The court should determine the oence category with reference to the tables below. In order to determine

the category the court should assess culpability and harm.

The level of culpability is determined by weighing up all the factors of the case to determine the

oender’s role and the extent to which the oending was planned and the sophistication with which it

wascarried out.

Culpability demonstrated by one or more of the following:

A – High culpability

A leading role where oending is part of a group activity

Involvement of others through pressure, influence

Abuse of position of power or trust or responsibility

Sophisticated nature of oence/signicant planning

Fraudulent activity conducted over sustained period of time

Large number of victims

Deliberately targeting victim on basis of vulnerability

B – Medium culpability

Other cases where characteristics for categories A or C are not present

A signicant role where oending is part of a group activity

C – Lesser culpability

Involved through coercion, intimidation or exploitation

Not motivated by personal gain

Peripheral role in organised fraud

Opportunistic ‘one-o’ oence; very little or no planning

Limited awareness or understanding of the extent of fraudulent activity

Where there are characteristics present which fall under dierent levels of culpability, the court

should balance these characteristics to reach a fair assessment of the oender’s culpability.

FRAUD

For reference only.

Please refer to the guideline(s)

on the Sentencing Council website:

www.sentencingcouncil.org.uk

Fraud, Bribery and Money Laundering Offences Definitive Guideline 7

Eective from 1 October 2014

FRAUD

Harm is initially assessed by the actual, intended or risked loss as may arise from the oence.

The values in the table below are to be used for actual or intended loss only.

Intended loss relates to oences where circumstances prevent the actual loss that is intended to be

caused by the fraudulent activity.

Risk of loss (for instance in mortgage frauds) involves consideration of both the likelihood of harm

occurring and the extent of it if it does. Risk of loss is less serious than actual or intended loss. Where the

oence has caused risk of loss but no (or much less) actual loss the normal approach is to move down

to the corresponding point in the next category. This may not be appropriate if either the likelihood or

extent of risked loss is particularly high.

Harm A – Loss caused or intended

Category 1 £500,000 or more Starting point based on £1 million

Category 2 £100,000 – £500,000 or Risk or category 1 harm Starting point based on £300,000

Category 3 £20,000 – £100,000 or Risk of category 2 harm Starting point based on £50,000

Category 4 £5,000 – £20,000 or Risk of category 3 harm Starting point based on £12,500

Category 5 Less than £5,000 or Risk of category 4 harm Starting point based on £2,500

Risk of category 5 harm, move down the range within the category

Harm B – Victim impact demonstrated by one or more of the following:

The court should then take into account the level of harm caused to the victim(s) or others to determine

whether it warrants the sentence being moved up to the corresponding point in the next category or

further up the range of the initial category.

High impact – move up a category; if in category 1 move up the range

Serious detrimental eect on the victim whether nancial or otherwise, for example substantial damage to credit rating

Victim particularly vulnerable (due to factors including but not limited to their age, nancial circumstances, mental capacity)

Medium impact – move upwards within the category range

Considerable detrimental eect on the victim whether nancial or otherwise

Lesser impact – no adjustment

Some detrimental impact on victim, whether nancial or otherwise

For reference only.

Please refer to the guideline(s)

on the Sentencing Council website:

www.sentencingcouncil.org.uk

8 Fraud, Bribery and Money Laundering Offences Definitive Guideline

Eective from 1 October 2014

FRAUD

STEP TWO

Starting point and category range

Having determined the category at step one, the court should use the appropriate starting point (as

adjusted in accordance with step one above) to reach a sentence within the category range in the table

below. The starting point applies to all oenders irrespective of plea or previous convictions.

Where the value is larger or smaller than the amount on which the starting point is based, this should lead

to upward or downward adjustment as appropriate.

Where the value greatly exceeds the amount of the starting point in category 1, it may be

appropriate to move outside the identied range.

TABLE 1

Section 1 Fraud Act 2006

conspiracy to defraud

Maximum: 10 years’ custody

Culpability

Harm A B C

Category 1

£500,000 or more

Starting point based

on £1million

Starting point

7 years’ custody

Starting point

5 years’ custody

Starting point

3 years’ custody

Category range

5 – 8 years’ custody

Category range

3 – 6 years’ custody

Category range

18 months’ – 4 years’ custody

Category 2

£100,000–£500,000

Starting point based

on £300,000

Starting point

5 years’ custody

Starting point

3 years’ custody

Starting point

18 months’ custody

Category range

3 – 6 years’ custody

Category range

18 months’ – 4 years’ custody

Category range

26 weeks’ – 3 years’ custody

Category 3

£20,000 - £100,000

Starting point based

on £50,000

Starting point

3 years’ custody

Starting point

18 months’ custody

Starting point

26 weeks’ custody

Category range

18 months’ – 4 years’ custody

Category range

26 weeks’ – 3 years’ custody

Category range

Medium level community order

– 1 year’s custody

Category 4

£5,000- £20,000

Starting point based

on £12,500

Starting point

18 months’ custody

Starting point

26 weeks’ custody

Starting point

Medium level community order

Category range

26 weeks’ – 3 years’ custody

Category range

Medium level community order

– 1 year’s custody

Category range

Band B ne –

High level community order

Category 5

Less than £5,000

Starting point based

on £2,500

Starting point

36 weeks’ custody

Starting point

Medium level community order

Starting point

Band B ne

Category range

High level community order –

1 year’s custody

Category range

Band B ne – 26 weeks’

custody

Category range

Discharge – Medium level

community order

For reference only.

Please refer to the guideline(s)

on the Sentencing Council website:

www.sentencingcouncil.org.uk

Fraud, Bribery and Money Laundering Offences Definitive Guideline 9

Eective from 1 October 2014

FRAUD

TABLE 2

Section 17 The Act 1968: false accounting

Maximum: 7 years’ custody

Culpability

Harm A B C

Category 1

£500,000 or more

Starting point based

on £1million

Starting point

5 years 6 months’ custody

Starting point

4 years’ custody

Starting point

2 years 6 months’ custody

Category range

4 years’ –

6 years 6 months’ custody

Category range

2 years 6 months’ –

5 years’ custody

Category range

15 months’ –

3 years 6 months’ custody

Category 2

£100,000–£500,000

Starting point based

on £300,000

Starting point

4 years’ custody

Starting point

2 years 6 months’ custody

Starting point

15 months’ custody

Category range

2 years 6 months’ –

5 years’ custody

Category range

15 months’ –

3 years 6 months’ custody

Category range

26 weeks’ –

2 years 6 months’ custody

Category 3

£20,000–£100,000

Starting point based

on £50,000

Starting point

2 years 6 months’ custody

Starting point

15 months’ custody

Starting point

High level community order

Category range

15 months’ –

3 years 6 months’ custody

Category range

High level community order –

2 years 6 months’ custody

Category range

Low level community order –

36 weeks’ custody

Category 4

£5,000–£20,000

Starting point based

on £12,500

Starting point

15 months’ custody

Starting point

High level community order

Starting point

Low level community order

Category range

High level community order –

2 years 6 months’ custody

Category range

Low level community order –

36 weeks’ custody

Category range

Band B ne –

Medium level community order

Category 5

Less than £5,000

Starting point based

on £2,500

Starting point

26 weeks’ custody

Starting point

Low level community order

Starting point

Band B ne

Category range

Medium level community

order – 36 weeks’ custody

Category range

Band B ne –

Medium level community order

Category range

Discharge –

Low level community order

See page 10.

For reference only.

Please refer to the guideline(s)

on the Sentencing Council website:

www.sentencingcouncil.org.uk

10 Fraud, Bribery and Money Laundering Offences Definitive Guideline

Eective from 1 October 2014

The table below contains a non-exhaustive list of additional factual elements providing the context of the

oence and factors relating to the oender.

Identify whether any combination of these or other relevant factors should result in an upward or

downward adjustment from the sentence arrived at so far.

Consecutive sentences for multiple oences may be appropriate where large sums are involved.

Factors increasing seriousness

Statutory aggravating factors:

Previous convictions, having regard to a) the nature of the

oence to which the conviction relates and its relevance to

the current oence; and b) the time that has elapsed since

the conviction

Oence committed whilst on bail

Other aggravating factors:

Steps taken to prevent the victim reporting or obtaining

assistance and/or from assisting or supporting the

prosecution

Attempts to conceal/dispose of evidence

Established evidence of community/wider impact

Failure to comply with current court orders

Oence committed on licence

Oences taken into consideration

Failure to respond to warnings about behaviour

Oences committed across borders

Blame wrongly placed on others

Factors reducing seriousness or reflecting personal

mitigation

No previous convictions or no relevant/recent convictions

Remorse

Good character and/or exemplary conduct

Little or no prospect of success

Serious medical conditions requiring urgent, intensive or

long-term treatment

Age and/or lack of maturity where it aects the

responsibility of the oender

Lapse of time since apprehension where this does not arise

from the conduct of the oender

Mental disorder or learning disability

Sole or primary carer for dependent relatives

Oender co-operated with investigation, made early

admissions and/or voluntarily reported oending

Determination and/or demonstration of steps having been

taken to address addiction or oending behaviour

Activity originally legitimate

FRAUD

See page 11.

For reference only.

Please refer to the guideline(s)

on the Sentencing Council website:

www.sentencingcouncil.org.uk

Fraud, Bribery and Money Laundering Offences Definitive Guideline 11

Eective from 1 October 2014

STEP THREE

Consider any factors which indicate a reduction, such as assistance to the prosecution

The court should take into account sections 73 and 74 of the Serious Organised Crime and Police Act

2005 (assistance by defendants: reduction or review of sentence) and any other rule of law by virtue of

which an oender may receive a discounted sentence in consequence of assistance given (or oered) to

the prosecutor or investigator.

STEP FOUR

Reduction for guilty pleas

The court should take account of any potential reduction for a guilty plea in accordance with section 144

of the Criminal Justice Act 2003 and the Guilty Plea guideline.

STEP FIVE

Totality principle

If sentencing an oender for more than one oence, or where the oender is already serving a sentence,

consider whether the total sentence is just and proportionate to the overall oending behaviour.

STEP SIX

Confiscation, compensation and ancillary orders

The court must proceed with a view to making a conscation order if it is asked to do so by the prosecutor

or if the court believes it is appropriate for it to do so.

Where the oence has resulted in loss or damage the court must consider whether to make a

compensation order.

If the court makes both a conscation order and an order for compensation and the court believes

the oender will not have sucient means to satisfy both orders in full, the court must direct that the

compensation be paid out of sums recovered under the conscation order (section 13 of the Proceeds of

Crime Act 2002).

The court may also consider whether to make ancillary orders. These may include a deprivation order, a

nancial reporting order, a serious crime prevention order and disqualication from acting as a company

director.

STEP SEVEN

Reasons

Section 174 of the Criminal Justice Act 2003 imposes a duty to give reasons for, and explain the eect of,

the sentence.

STEP EIGHT

Consideration for time spent on bail

The court must consider whether to give credit for time spent on bail in accordance with section 240A of

the Criminal Justice Act 2003.

FRAUD

For reference only.

Please refer to the guideline(s)

on the Sentencing Council website:

www.sentencingcouncil.org.uk

12 Fraud, Bribery and Money Laundering Offences Definitive Guideline

Eective from 1 October 2014

FRAUD

Blank page

For reference only.

Please refer to the guideline(s)

on the Sentencing Council website:

www.sentencingcouncil.org.uk

Fraud, Bribery and Money Laundering Offences Definitive Guideline 13

Eective from 1 October 2014

Possession of articles for use in frauds

Fraud Act 2006 (section 6)

Triable either way

Maximum: 5 years’ custody

Oence range: Band A ne – 3 years’ custody

Making or supplying articles for use in frauds

Fraud Act 2006 (section 7)

Triable either way

Maximum: 10 years’ custody

Oence range: Band C ne – 7 years’ custody

POSSESSING, MAKING OR SUPPLYING ARTICLES FOR USE IN FRAUD

Possessing, making or supplying

articles for use in fraud

For reference only.

Please refer to the guideline(s)

on the Sentencing Council website:

www.sentencingcouncil.org.uk

14 Fraud, Bribery and Money Laundering Offences Definitive Guideline

Eective from 1 October 2014

POSSESSING, MAKING OR SUPPLYING ARTICLES FOR USE IN FRAUD

STEP ONE

Determining the oence category

The court should determine the oence category with reference to the tables below. In order to determine

the category the court should assess culpability and harm.

The level of culpability is determined by weighing up all the factors of the case to determine the

oender’s role and the extent to which the oending was planned and the sophistication with which it

wascarried out.

Culpability demonstrated by one or more of the following:

A – High culpability

A leading role where oending is part of a group activity

Involvement of others through pressure, influence

Abuse of position of power or trust or responsibility

Sophisticated nature of oence/signicant planning

Fraudulent activity conducted over sustained period of time

Articles deliberately designed to target victims on basis of vulnerability

B – Medium culpability

Other cases where characteristics for categories A or C are not present

A signicant role where oending is part of a group activity

C – Lesser culpability

Performed limited function under direction

Involved through coercion, intimidation or exploitation

Not motivated by personal gain

Opportunistic ‘one-o’ oence; very little or no planning

Limited awareness or understanding of extent of fraudulent activity

Where there are characteristics present which fall under dierent levels of culpability, the court

should balance these characteristics to reach a fair assessment of the oender’s culpability.

Harm

This guideline refers to preparatory oences where no substantive fraud has been committed. The level

of harm is determined by weighing up all the factors of the case to determine the harm that would be

caused if the article(s) were used to commit a substantive oence.

Greater harm

Large number of articles created/supplied/in possession

Article(s) have potential to facilitate fraudulent acts aecting large number of victims

Article(s) have potential to facilitate fraudulent acts involving signicant sums

Use of third party identities

Oender making considerable gain as result of the oence

Lesser harm

All other oences

Lesser harm

• All other oences

For reference only.

Please refer to the guideline(s)

on the Sentencing Council website:

www.sentencingcouncil.org.uk

Fraud, Bribery and Money Laundering Offences Definitive Guideline 15

Eective from 1 October 2014

POSSESSING, MAKING OR SUPPLYING ARTICLES FOR USE IN FRAUD

STEP TWO

Starting point and category range

Having determined the category at step one, the court should use the appropriate starting point to

reach a sentence within the category range in the table below. The starting point applies to all oenders

irrespective of plea or previous convictions.

Section 6 Fraud Act 2006: Possessing articles for use in fraud

Maximum: 5 years’ custody

Culpability

Harm A B C

Greater Starting point

18 months’ custody

Starting point

36 weeks’ custody

Starting point

High level community order

Category range

36 weeks’ custody –

3 years’ custody

Category range

High level community order –

2 years’ custody

Category range

Medium level community order

– 26 weeks’ custody

Lesser Starting point

26 weeks’ custody

Starting point

Medium level community order

Starting point

Band B ne

Category range

High level community order –

18 months’ custody

Category range

Low level community order –

26 weeks’ custody

Category range

Band A ne –

Medium level community order

Section 7 Fraud Act 2006: Making or adapting or supplying articles for use in fraud

Maximum: 10 years’ custody

Culpability

Harm A B C

Greater Starting point

4 years 6 months’ custody

Starting point

2 years 6 months’ custody

Starting point

1 year’s custody

Category range

3 – 7 years’ custody

Category range

18 months’ –

5 years’ custody

Category range

High level community order –

3 years’ custody

Lesser Starting point

2 years’ custody

Starting point

36 weeks’ custody

Starting point

Medium level community order

Category range

26 weeks’ –

4 years’ custody

Category range

Low level community order –

2 years’ custody

Category range

Band C ne –

26 weeks’ custody

For reference only.

Please refer to the guideline(s)

on the Sentencing Council website:

www.sentencingcouncil.org.uk

16 Fraud, Bribery and Money Laundering Offences Definitive Guideline

Eective from 1 October 2014

POSSESSING, MAKING OR SUPPLYING ARTICLES FOR USE IN FRAUD

The table below contains a non-exhaustive list of additional factual elements providing the context of the

oence and factors relating to the oender.

Identify whether any combination of these or other relevant factors should result in an upward or

downward adjustment from the starting point

Consecutive sentences for multiple oences may be appropriate where large sums are involved.

Factors increasing seriousness

Statutory aggravating factors:

Previous convictions, having regard to a) the nature of the

oence to which the conviction relates and its relevance to

the current oence; and b) the time that has elapsed since

the conviction

Oence committed whilst on bail

Other aggravating factors:

Steps taken to prevent the victim reporting or obtaining

assistance and/or from assisting or supporting the

prosecution

Attempts to conceal/dispose of evidence

Established evidence of community/wider impact

Failure to comply with current court orders

Oence committed on licence

Oences taken into consideration

Failure to respond to warnings about behaviour

Oences committed across borders

Blame wrongly placed on others

Factors reducing seriousness or reflecting personal

mitigation

No previous convictions or no relevant/recent convictions

Remorse

Good character and/or exemplary conduct

Little or no prospect of success

Serious medical conditions requiring urgent, intensive or

long-term treatment

Age and/or lack of maturity where it aects the

responsibility of the oender

Lapse of time since apprehension where this does not arise

from the conduct of the oender

Mental disorder or learning disability

Sole or primary carer for dependent relatives

Oender co-operated with investigation, made early

admissions and/or voluntarily reported oending

Determination and/or demonstration of steps having been

taken to address addiction or oending behaviour

Activity originally legitimate

See page 17.

For reference only.

Please refer to the guideline(s)

on the Sentencing Council website:

www.sentencingcouncil.org.uk

Fraud, Bribery and Money Laundering Offences Definitive Guideline 17

Eective from 1 October 2014

POSSESSING, MAKING OR SUPPLYING ARTICLES FOR USE IN FRAUD

STEP THREE

Consider any factors which indicate a reduction, such as assistance to the prosecution

The court should take into account sections 73 and 74 of the Serious Organised Crime and Police Act

2005 (assistance by defendants: reduction or review of sentence) and any other rule of law by virtue of

which an oender may receive a discounted sentence in consequence of assistance given (or oered) to

the prosecutor or investigator.

STEP FOUR

Reduction for guilty pleas

The court should take account of any potential reduction for a guilty plea in accordance with section 144

of the Criminal Justice Act 2003 and the Guilty Plea guideline.

STEP FIVE

Totality principle

If sentencing an oender for more than one oence, or where the oender is already serving a sentence,

consider whether the total sentence is just and proportionate to the overall oending behaviour.

STEP SIX

Confiscation, compensation and ancillary orders

The court must proceed with a view to making a conscation order if it is asked to do so by the prosecutor

or if the court believes it is appropriate for it to do so.

Where the oence has resulted in loss or damage the court must consider whether to make a

compensation order.

If the court makes both a conscation order and an order for compensation and the court believes

the oender will not have sucient means to satisfy both orders in full, the court must direct that the

compensation be paid out of sums recovered under the conscation order (section 13 of the Proceeds of

Crime Act 2002).

The court may also consider whether to make any ancillary orders.

STEP SEVEN

Reasons

Section 174 of the Criminal Justice Act 2003 imposes a duty to give reasons for, and explain the eect of,

the sentence.

STEP EIGHT

Consideration for time spent on bail

The court must consider whether to give credit for time spent on bail in accordance with section 240A of

the Criminal Justice Act 2003.

For reference only.

Please refer to the guideline(s)

on the Sentencing Council website:

www.sentencingcouncil.org.uk

18 Fraud, Bribery and Money Laundering Offences Definitive Guideline

Eective from 1 October 2014

POSSESSING, MAKING OR SUPPLYING ARTICLES FOR USE IN FRAUD

Blank page

For reference only.

Please refer to the guideline(s)

on the Sentencing Council website:

www.sentencingcouncil.org.uk

Fraud, Bribery and Money Laundering Offences Definitive Guideline 19

Eective from 1 October 2014

Fraud

Conspiracy to defraud (common law)

Triable on indictment only

Fraud Act 2006 (section 1)

Triable either way

Maximum: 10 years’ custody

Oence range: Low level community order – 8 years’ custody

False accounting

Theft Act 1968 (section 17)

Fraudulent evasion of VAT; False statement for VAT purposes; Conduct

amounting to an oence

Value Added Tax Act 1994 (section 72)

Fraudulent evasion of income tax

Taxes Management Act 1970 (section 106A)

Fraudulent evasion of excise duty; Improper importation of goods

Customs and Excise Management Act 1979 (sections 50, 170 and 170B)

Triable either way

Maximum: 7 years’ custody

Oence range: Band C ne – 6 years and 6 months’ custody

Fraud

Cheat the public revenue (common law)

Triable on indictment only

Maximum: Life imprisonment

Oence range: 3 – 17 years’ custody

REVENUE FRAUD

Revenue fraud

For reference only.

Please refer to the guideline(s)

on the Sentencing Council website:

www.sentencingcouncil.org.uk

20 Fraud, Bribery and Money Laundering Offences Definitive Guideline

Eective from 1 October 2014

STEP ONE

Determining the oence category

The court should determine the oence category with reference to the tables below. In order to determine

the category the court should assess culpability and harm.

Harm – Gain/intended gain to oender or loss/

intended loss to HMRC

Category 1

£50 million or more

Starting point based on £80 million

Category 2

£10 million–£50 million

Starting point based on £30 million

Category 3

£2 million–£10 million

Starting point based on £5 million

Category 4

£500,000–£2 million

Starting point based on £1 million

Category 5

£100,000–£500,000

Starting point based on £300,000

Category 6

£20,000–£100,000

Starting point based on £50,000

Category 7

Less than £20,000

Starting point based on £12,500

The level of culpability is determined by

weighing up all the factors of the case to

determine the oender’s role and the extent

to which the oending was planned and the

sophistication with which it wascarried out.

Culpability demonstrated by one or more of the

following:

A – High culpability

A leading role where oending is part of a group activity

Involvement of others through pressure/influence

Abuse of position of power or trust or responsibility

Sophisticated nature of oence/signicant planning

Fraudulent activity conducted over sustained period of time

B – Medium culpability

Other cases where characteristics for categories A or C are

not present

A signicant role where oending is part of a group activity

C – Lesser culpability

Involved through coercion, intimidation or exploitation

Not motivated by personal gain

Opportunistic ‘one-o’ oence; very little or no planning

Performed limited function under direction

Limited awareness or understanding of extent of fraudulent

activity

Where there are characteristics present which

fall under dierent levels of culpability, the

court should balance these characteristics

to reach a fair assessment of the oender’s

culpability.

REVENUE FRAUD

For reference only.

Please refer to the guideline(s)

on the Sentencing Council website:

www.sentencingcouncil.org.uk

Fraud, Bribery and Money Laundering Offences Definitive Guideline 21

Eective from 1 October 2014

STEP TWO

Starting point and category range

Having determined the category at step one, the court should use the appropriate starting point to

reach a sentence within the category range in the table below. The starting point applies to all oenders

irrespective of plea or previous convictions.

Where the value is larger or smaller than the amount on which the starting point is based, this should lead

to upward or downward adjustment as appropriate.

Where the value greatly exceeds the amount of the starting point in category 1, it may be

appropriate to move outside the identied range.

TABLE 1

Section 1 Fraud Act 2006

Conspiracy to defraud (common law)

Maximum: 10 years’ custody

For oences where the value of the fraud is over £2 million refer to the corresponding category in Table 3

subject to the maximum sentence of 10 years for this oence.

Culpability

Harm A B C

Category 4

£500,000–£2 million

Starting point based

on £1million

Starting point

7 years’ custody

Starting point

5 years’ custody

Starting point

3 years’ custody

Category range

5 – 8 years’ custody

Category range

3 – 6 years’ custody

Category range

18 months’ –

4 years’ custody

Category 5

£100,000–£500,000

Starting point based

on £300,000

Starting point

5 years’ custody

Starting point

3 years’ custody

Starting point

18 months’ custody

Category range

3 – 6 years’ custody

Category range

18 months’ –

4 years’ custody

Category range

26 weeks’ –

3 years’ custody

Category 6

£20,000–£100,000

Starting point based

on £50,000

Starting point

3 years’ custody

Starting point

18 months’ custody

Starting point

26 weeks’ custody

Category range

18 months’ –

4 years’ custody

Category range

26 weeks’ –

3 years’ custody

Category range

Medium level community order

– 1 year’s custody

Category 7

Less than £20,000

Starting point based

on £12,500

Starting point

18 months’ custody

Starting point

36 weeks’ custody

Starting point

Medium level community order

Category range

36 weeks’ –

3 years’ custody

Category range

Medium level community order

– 18 months’ custody

Category range

Low level community order –

High level community order

REVENUE FRAUD

For reference only.

Please refer to the guideline(s)

on the Sentencing Council website:

www.sentencingcouncil.org.uk

22 Fraud, Bribery and Money Laundering Offences Definitive Guideline

Eective from 1 October 2014

TABLE 2

Section 17 Theft Act 1968: False Accounting

Section 72(1) Value Added Tax Act 1994: Fraudulent evasion of VAT

Section 72(3) Valued Added Tax Act 1994: False statement for VAT purposes

Section 72(8) Value Added Tax Act 1994: Conduct amounting to an offence

Section 106(a) Taxes Management Act 1970: Fraudulent evasion of income tax

Section 170(1)(a)(i), (ii), (b), 170(2)(a), 170B Customs and Excise Management Act 1979: Fraudulent

evasion of excise duty

Section 50(1)(a), (2) Customs and Excise Management Act 1979: Improper importation of goods

Maximum: 7 years’ custody

Culpability

Harm A B C

Category 4

£500,000–£2 million

Starting point based

on £1million

Starting point

5 years 6 months’ custody

Starting point

4 years’ custody

Starting point

2 years 6 months’ custody

Category range

4 years’ –

6 years 6 months’ custody

Category range

2 years 6 months’ –

5 years’ custody

Category range

15 months’ –

3 years 6 months’ custody

Category 5

£100,000–£500,000

Starting point based

on £300,000

Starting point

4 years’ custody

Starting point

2 years 6 months’ custody

Starting point

15 months’ custody

Category range

2 years 6 months’ –

5 years’ custody

Category range

15 months’ –

3 years 6 months’ custody

Category range

26 weeks’ –

2 years 6 months’ custody

Category 6

£20,000–£100,000

Starting point based

on £50,000

Starting point

2 years 6 months’ custody

Starting point

15 months’ custody

Starting point

High level community order

Category range

15 months’ –

3 years 6 months’ custody

Category range

High level community order -

2 years 6 months’ custody

Category range

Low level community order –

36 weeks’ custody

Category 7

Less than £20,000

Starting point based

on £12,500

Starting point

15 months’ custody

Starting point

26 weeks’ custody

Starting point

Medium level community order

Category range

26 weeks’ –

2 years 6 months’ custody

Category range

Medium level community order

– 15 months’ custody

Category range

Band C ne –

High level community order

See page 23.

REVENUE FRAUD

For reference only.

Please refer to the guideline(s)

on the Sentencing Council website:

www.sentencingcouncil.org.uk

Fraud, Bribery and Money Laundering Offences Definitive Guideline 23

Eective from 1 October 2014

TABLE 3

Cheat the Revenue (common law)

Maximum: Life imprisonment

Where the oending is on the most serious scale, involving sums signicantly higher than the starting

point in category 1, sentences of 15 years and above may be appropriate depending on the role of the

oender. In cases involving sums below £2 million the court should refer to Table 1.

Culpability

Harm A B C

Category 1

£50 million or more

Starting point based on

£80 million

Starting point

12 years’ custody

Starting point

8 years’ custody

Starting point

6 years’ custody

Category range

10 – 17 years’ custody

Category range

7 – 12 years’ custody

Category range

4 – 8 years’ custody

Category 2

£10 million–£50 million

Starting point based on

£30 million

Starting point

10 years’ custody

Starting point

7 years’ custody

Starting point

5 years’ custody

Category range

8 – 13 years’ custody

Category range

5 – 9 years’ custody

Category range

3 – 6 years’ custody

Category 3

£2 million–£10 million

Starting point based on

£5 million

Starting point

8 years’ custody

Starting point

6 years’ custody

Starting point

4 years’ custody

Category range

6 – 10 years’ custody

Category range

4 – 7 years’ custody

Category range

3 – 5 years’ custody

See page 24.

REVENUE FRAUD

For reference only.

Please refer to the guideline(s)

on the Sentencing Council website:

www.sentencingcouncil.org.uk

24 Fraud, Bribery and Money Laundering Offences Definitive Guideline

Eective from 1 October 2014

The table below contains a non-exhaustive list of additional factual elements providing the context of the

oence and factors relating to the oender.

Identify whether any combination of these or other relevant factors should result in any further upward or

downward adjustment from the starting point.

Consecutive sentences for multiple oences may be appropriate where large sums are involved.

Factors increasing seriousness

Statutory aggravating factors:

Previous convictions, having regard to a) the nature of the

oence to which the conviction relates and its relevance to

the current oence; and b) the time that has elapsed since

the conviction

Oence committed whilst on bail

Other aggravating factors:

Involves multiple frauds

Number of false declarations

Attempts to conceal/dispose of evidence

Failure to comply with current court orders

Oence committed on licence

Oences taken into consideration

Failure to respond to warnings about behaviour

Blame wrongly placed on others

Damage to third party (for example as a result of identity

the)

Dealing with goods with an additional health risk

Disposing of goods to under age purchasers

Factors reducing seriousness or reflecting personal

mitigation

No previous convictions or no relevant/recent convictions

Remorse

Good character and/or exemplary conduct

Little or no prospect of success

Serious medical condition requiring urgent, intensive or

long term treatment

Age and/or lack of maturity where it aects the

responsibility of the oender

Lapse of time since apprehension where this does not arise

from the conduct of the oender

Mental disorder or learning disability

Sole or primary carer for dependent relatives

Oender co-operated with investigation, made early

admissions and/or voluntarily reported oending

Determination and/or demonstration of steps having been

taken to address addiction or oending behaviour

Activity originally legitimate

REVENUE FRAUD

See page 25.

For reference only.

Please refer to the guideline(s)

on the Sentencing Council website:

www.sentencingcouncil.org.uk

Fraud, Bribery and Money Laundering Offences Definitive Guideline 25

Eective from 1 October 2014

STEP THREE

Consider any factors which indicate a reduction, such as assistance to the prosecution

The court should take into account sections 73 and 74 of the Serious Organised Crime and Police Act

2005 (assistance by defendants: reduction or review of sentence) and any other rule of law by virtue of

which an oender may receive a discounted sentence in consequence of assistance given (or oered) to

the prosecutor or investigator.

STEP FOUR

Reduction for guilty pleas

The court should take account of any potential reduction for a guilty plea in accordance with section 144

of the Criminal Justice Act 2003 and the Guilty Plea guideline.

STEP FIVE

Totality principle

If sentencing an oender for more than one oence, or where the oender is already serving a sentence,

consider whether the total sentence is just and proportionate to the overall oending behaviour.

STEP SIX

Confiscation, compensation and ancillary orders

The court must proceed with a view to making a conscation order if it is asked to do so by the prosecutor

or if the court believes it is appropriate for it to do so.

Where the oence has resulted in loss or damage the court must consider whether to make a

compensation order.

If the court makes both a conscation order and an order for compensation and the court believes

the oender will not have sucient means to satisfy both orders in full, the court must direct that the

compensation be paid out of sums recovered under the conscation order (section 13 of the Proceeds of

Crime Act 2002).

The court may also consider whether to make ancillary orders. These may include a deprivation order, a

nancial reporting order, a serious crime prevention order and disqualication from acting as a company

director.

STEP SEVEN

Reasons

Section 174 of the Criminal Justice Act 2003 imposes a duty to give reasons for, and explain the eect of,

the sentence.

STEP EIGHT

Consideration for time spent on bail

The court must consider whether to give credit for time spent on bail in accordance with section 240A of

the Criminal Justice Act 2003.

REVENUE FRAUD

For reference only.

Please refer to the guideline(s)

on the Sentencing Council website:

www.sentencingcouncil.org.uk

26 Fraud, Bribery and Money Laundering Offences Definitive Guideline

Eective from 1 October 2014

Blank page

REVENUE FRAUD

For reference only.

Please refer to the guideline(s)

on the Sentencing Council website:

www.sentencingcouncil.org.uk

Fraud, Bribery and Money Laundering Offences Definitive Guideline 27

Eective from 1 October 2014

Dishonest representations for obtaining benefit etc

Social Security Administration Act 1992 (section 111A)

Tax Credit fraud

Tax Credits Act 2002 (section 35)

False accounting

Theft Act 1968 (section 17)

Triable either way

Maximum: 7 years’ custody

Oence range: Discharge – 6 years 6 months’ custody

False representations for obtaining benefit etc

Social Security Administration Act 1992 (section 112)

Triable summarily only

Maximum: Level 5 ne and/or 3 months’ custody

Oence range: Discharge – 12 weeks’ custody

Fraud by false representation, fraud by failing to disclose information,

fraud by abuse of position

Fraud Act 2006 (section 1)

Triable either way

Conspiracy to defraud

Common law

Triable on indictment only

Maximum: 10 years’ custody

Oence range: Discharge – 8 years’ custody

BENEFIT FRAUD

Benefit fraud

For reference only.

Please refer to the guideline(s)

on the Sentencing Council website:

www.sentencingcouncil.org.uk

28 Fraud, Bribery and Money Laundering Offences Definitive Guideline

Eective from 1 October 2014

BENEFIT FRAUD

STEP ONE

Determining the oence category

The court should determine the oence category with reference to the tables below. In order to determine

the category the court should assess culpability and harm.

Harm – Amount obtained or intended to be obtained

Category 1

£500,000–£2 million

Starting point based on £1 million

Category 2

£100,000–£500,000

Starting point based on £300,000

Category 3

£50,000–£100,000

Starting point based on £75,000

Category 4

£10,000–£50,000

Starting point based on £30,000

Category 5

£2,500–£10,000

Starting point based on £5,000

Category 6

Less than £2,500

Starting point based on £1,000

The level of culpability is determined by

weighing up all the factors of the case to

determine the oender’s role and the extent

to which the oending was planned and the

sophistication with which it wascarried out.

Culpability demonstrated by one or more of the

following:

A – High culpability

A leading role where oending is part of a group activity

Involvement of others through pressure/influence

Abuse of position of power or trust or responsibility

Sophisticated nature of oence/signicant planning

B – Medium culpability

Other cases where characteristics for categories A or C are

not present

Claim not fraudulent from the outset

A signicant role where oending is part of a group activity

C – Lesser culpability

Involved through coercion, intimidation or exploitation

Performed limited function under direction

Where there are characteristics present which

fall under dierent levels of culpability, the

court should balance these characteristics

to reach a fair assessment of the oender’s

culpability.

For reference only.

Please refer to the guideline(s)

on the Sentencing Council website:

www.sentencingcouncil.org.uk

Fraud, Bribery and Money Laundering Offences Definitive Guideline 29

Eective from 1 October 2014

BENEFIT FRAUD

STEP TWO

Starting point and category range

Having determined the category at step one, the court should use the appropriate starting point to

reach a sentence within the category range in the table below. The starting point applies to all oenders

irrespective of plea or previous convictions.

Where the value is larger or smaller than the amount on which the starting point is based, this should lead

to upward or downward adjustment as appropriate.

Where the value greatly exceeds the amount of the starting point in category 1, it may be

appropriate to move outside the identied range.

TABLE 1

Section 111A Social Security Administration Act 1992: Dishonest representations to obtain

benefit etc

Section 35 Tax Credits Act 2002: Tax Credit fraud

Section 17 Theft Act 1968: False accounting

Maximum: 7 years’ custody

Culpability

Harm A B C

Category 1

£500,000 or more

Starting point based

on £1million

Starting point

5 years 6 months’ custody

Starting point

4 years’ custody

Starting point

2 years 6 months’ custody

Category range

4 years’ –

6 years 6 months’ custody

Category range

2 years 6 months’ –

5 years’ custody

Category range

15 months’ –

3 years 6 months’ custody

Category 2

£100,000–£500,000

Starting point based

on £300,000

Starting point

4 years’ custody

Starting point

2 years 6 months’ custody

Starting point

1 year’s custody

Category range

2 years 6 months’ –

5 years’ custody

Category range

15 months’ –

3 years 6 months’ custody

Category range

26 weeks’ –

2 years 6 months’ custody

Category 3

£50,000–£100,000

Starting point based

on £75,000

Starting point

2 years 6 months’ custody

Starting point

1 year’s custody

Starting point

26 weeks’ custody

Category range

2 years’ –

3 years 6 months’ custody

Category range

26 weeks’ –

2 years 6 months’ custody

Category range

High level community order –

36 weeks’ custody

Category 4

£10,000–£50,000

Starting point based

on £30,000

Starting point

18 months’ custody

Starting point

36 weeks’ custody

Starting point

Medium level community order

Category range

36 weeks’ –

2 years 6 months’ custody

Category range

Medium level community order

– 21 months’ custody

Category range

Low level community order –

26 weeks’ custody

Category 5

£2,500–£10,000

Starting point based

on £5,000

Starting point

36 weeks’ custody

Starting point

Medium level community order

Starting point

Low level community order

Category range

Medium level community order

– 18 months’ custody

Category range

Low level community order –

26 weeks’ custody

Category range

Band B ne –

Medium level community order

Category 6

Less than £2,500

Starting point based

on £1,000

Starting point

Medium level community order

Starting point

Low level community order

Starting point

Band A ne

Category range

Low level community order –

26 weeks’ custody

Category range

Band A ne –

Medium level community order

Category range

Discharge –

Band B ne

For reference only.

Please refer to the guideline(s)

on the Sentencing Council website:

www.sentencingcouncil.org.uk

30 Fraud, Bribery and Money Laundering Offences Definitive Guideline

Eective from 1 October 2014

BENEFIT FRAUD

TABLE 2

Section 112 Social Security Administration Act 1992: False representations for obtaining benefit etc

Maximum: Level 5 ne and/or 3 months’ custody

Culpability

Harm A B C

Category 5

Above £2,500

Starting point based

on £5,000

Starting point

High level community order

Starting point

Medium level community order

Starting point

Low level community order

Category range

Medium level community order

– 12 weeks’ custody

Category range

Band B ne –

High level community order

Category range

Band A ne –

Medium level community order

Category 6

Less than £2,500

Starting point based

on £1,000

Starting point

Medium level community order

Starting point

Band B ne

Starting point

Band A ne

Category range

Low level community order –

High level community order

Category range

Band A ne –

Band C ne

Category range

Discharge –

Band B ne

See page 31.

For reference only.

Please refer to the guideline(s)

on the Sentencing Council website:

www.sentencingcouncil.org.uk

Fraud, Bribery and Money Laundering Offences Definitive Guideline 31

Eective from 1 October 2014

BENEFIT FRAUD

TABLE 3

Section 1 Fraud Act 2006

Conspiracy to defraud (common law)

Maximum: 10 years’ custody

Culpability

Harm A B C

Category 1

£500,000 or more

Starting point based

on £1million

Starting point

7 years’ custody

Starting point

5 years’ custody

Starting point

3 years’ custody

Category range

5 – 8 years’ custody

Category range

3 – 6 years’ custody

Category range

18 months’ –

4 years’ custody

Category 2

£100,000–£500,000

Starting point based

on £300,000

Starting point

5 years’ custody

Starting point

3 years’ custody

Starting point

15 months’ custody

Category range

3 – 6 years’ custody

Category range

18 months’ –

4 years’ custody

Category range

26 weeks’ –

3 years’ custody

Category 3

£50,000–£100,000

Starting point based

on £75,000

Starting point

3 years’ custody

Starting point

15 months’ custody

Starting point

36 weeks’ custody

Category range

2 years 6 months’ –

4 years’ custody

Category range

36 weeks’ –

3 years’ custody

Category range

26 weeks’ –

1 year’s custody

Category 4

£10,000–£50,000

Starting point based

on £30,000

Starting point

21 months’ custody

Starting point

1 year’s custody

Starting point

High level community order

Category range

1 year’s –

3 years’ custody

Category range

High level community order –

2 years’ custody

Category range

Low level community order –

26 weeks’ custody

Category 5

£2,500–£10,000

Starting point based

on £5,000

Starting point

1 year’s custody

Starting point

High level community order

Starting point

Medium level community order

Category range

High level community order –

2 years’ custody

Category range

Low level community order –

26 weeks’ custody

Category range

Band C ne –

High level community order

Category 6

Less than £2,500

Starting point based

on £1,000

Starting point

High level community order

Starting point

Low level community order

Starting point

Band B ne

Category range

Low level community order –

26 weeks’ custody

Category range

Band B ne –

Medium level community order

Category range

Discharge –

Band C ne

For reference only.

Please refer to the guideline(s)

on the Sentencing Council website:

www.sentencingcouncil.org.uk

32 Fraud, Bribery and Money Laundering Offences Definitive Guideline

Eective from 1 October 2014

BENEFIT FRAUD

The table below contains a non-exhaustive list of additional factual elements providing the context of the

oence and factors relating to the oender.

Identify whether any combination of these or other relevant factors should result in any further upward or

downward adjustment from the starting point.

Consecutive sentences for multiple oences may be appropriate where large sums are involved.

Factors increasing seriousness

Statutory aggravating factors:

Previous convictions, having regard to a) the nature of the

oence to which the conviction relates and its relevance to

the current oence; and b) the time that has elapsed since

the conviction

Oence committed whilst on bail

Other aggravating factors:

Claim fraudulent from the outset

Proceeds of fraud funded lavish lifestyle

Length of time over which the oending was committed

Number of false declarations

Attempts to conceal/dispose of evidence

Failure to comply with current court orders

Oence committed on licence

Oences taken into consideration

Failure to respond to warnings about behaviour

Blame wrongly placed on others

Damage to third party (for example as a result of identity

the)

Factors reducing seriousness or reflecting personal

mitigation

No previous convictions or no relevant/recent convictions

Remorse

Good character and/or exemplary conduct

Serious medical condition requiring urgent, intensive or

long term treatment

Legitimate entitlement to benets not claimed

Little or no prospect of success

Age and/or lack of maturity where it aects the

responsibility of the oender

Lapse of time since apprehension where this does not arise

from the conduct of the oender

Mental disorder or learning disability

Sole or primary carer for dependent relatives

Oender co-operated with investigation, made early

admissions and/or voluntarily reported oending

Determination and/or demonstration of steps having been

taken to address addiction or oending behaviour

Oender experiencing signicant nancial hardship or

pressure at time fraud was committed due to exceptional

circumstances

See page 33.

For reference only.

Please refer to the guideline(s)

on the Sentencing Council website:

www.sentencingcouncil.org.uk

Fraud, Bribery and Money Laundering Offences Definitive Guideline 33

Eective from 1 October 2014

BENEFIT FRAUD

STEP THREE

Consider any factors which indicate a reduction, such as assistance to the prosecution

The court should take into account sections 73 and 74 of the Serious Organised Crime and Police Act

2005 (assistance by defendants: reduction or review of sentence) and any other rule of law by virtue of

which an oender may receive a discounted sentence in consequence of assistance given (or oered) to

the prosecutor or investigator.

STEP FOUR

Reduction for guilty pleas

The court should take account of any potential reduction for a guilty plea in accordance with section 144

of the Criminal Justice Act 2003 and the Guilty Plea guideline.

STEP FIVE

Totality principle

If sentencing an oender for more than one oence, or where the oender is already serving a sentence,

consider whether the total sentence is just and proportionate to the overall oending behaviour.

STEP SIX

Confiscation, compensation and ancillary orders

The court must proceed with a view to making a conscation order if it is asked to do so by the prosecutor

or if the court believes it is appropriate for it to do so.

Where the oence has resulted in loss or damage the court must consider whether to make a

compensation order.

If the court makes both a conscation order and an order for compensation and the court believes

the oender will not have sucient means to satisfy both orders in full, the court must direct that the

compensation be paid out of sums recovered under the conscation order (section 13 of the Proceeds of

Crime Act 2002).

The court may also consider whether to make any ancillary orders.

STEP SEVEN

Reasons

Section 174 of the Criminal Justice Act 2003 imposes a duty to give reasons for, and explain the eect of,

the sentence.

STEP EIGHT

Consideration for time spent on bail

The court must consider whether to give credit for time spent on bail in accordance with section 240A of

the Criminal Justice Act 2003.

For reference only.

Please refer to the guideline(s)

on the Sentencing Council website:

www.sentencingcouncil.org.uk

34 Fraud, Bribery and Money Laundering Offences Definitive Guideline

Eective from 1 October 2014

BENEFIT FRAUD

Blank page

For reference only.

Please refer to the guideline(s)

on the Sentencing Council website:

www.sentencingcouncil.org.uk

Fraud, Bribery and Money Laundering Offences Definitive Guideline 35

Eective from 1 October 2014

Concealing/disguising/converting/transferring/removing criminal property

from England & Wales

Proceeds of Crime Act 2002 (section 327)

Entering into arrangements concerning criminal property

Proceeds of Crime Act 2002 (section 328)

Acquisition, use and possession of criminal property

Proceeds of Crime Act 2002 (section 329)

Triable either way

Maximum: 14 years’ custody

Oence range: Band B ne – 13 years’ imprisonment

MONEY LAUNDERING

Money laundering

For reference only.

Please refer to the guideline(s)

on the Sentencing Council website:

www.sentencingcouncil.org.uk

36 Fraud, Bribery and Money Laundering Offences Definitive Guideline

Eective from 1 October 2014

MONEY LAUNDERING

STEP ONE

Determining the oence category

The court should determine the oence category with reference to the tables below. In order to determine

the category the court should assess culpability and harm.

Harm A

Harm is initially assessed by the value of the

money laundered.

Category 1

£10 million or more

Starting point based on £30 million

Category 2

£2 million–£10 million

Starting point based on £5 million

Category 3

£500,000–£2 million

Starting point based on £1 million

Category 4

£100,000–£500,000

Starting point based on £300,000

Category 5

£10,000–£100,000

Starting point based on £50,000

Category 6

Less than £10,000

Starting point based on £5,000

Harm B

Money laundering is an integral component

of much serious criminality. To complete the

assessment of harm, the court should take

into account the level of harm associated

with the underlying oence to determine

whether it warrants upward adjustment of

the starting point within the range, or in

appropriate cases, outside the range.

Where it is possible to identify the underlying

oence, regard should be given to the relevant

sentencing levels for that oence.

The level of culpability is determined by

weighing up all the factors of the case to

determine the oender’s role and the extent

to which the oending was planned and the

sophistication with which it wascarried out.

Culpability demonstrated by one or more of the

following:

A – High culpability

A leading role where oending is part of a group activity

Involvement of others through pressure, influence

Abuse of position of power or trust or responsibility

Sophisticated nature of oence/signicant planning

Criminal activity conducted over sustained period of time

B – Medium culpability

Other cases where characteristics for categories A or C are

not present

A signicant role where oending is part of a group activity

C – Lesser culpability

Performed limited function under direction

Involved through coercion, intimidation or exploitation

Not motivated by personal gain

Opportunistic ‘one-o’ oence; very little or no planning

Limited awareness or understanding of extent of criminal

activity

Where there are characteristics present which

fall under dierent levels of culpability, the

court should balance these characteristics

to reach a fair assessment of the oender’s

culpability.

For reference only.

Please refer to the guideline(s)

on the Sentencing Council website:

www.sentencingcouncil.org.uk

Fraud, Bribery and Money Laundering Offences Definitive Guideline 37

Eective from 1 October 2014

MONEY LAUNDERING

STEP TWO

Starting point and category range

Having determined the category at step one, the court should use the appropriate starting point (as

adjusted in accordance with step one above) to reach a sentence within the category range in the

table below. The starting point applies to all oenders irrespective of plea or previous convictions.

Where the value is larger or smaller than the amount on which the starting point is based, this should

lead to upward or downward adjustment as appropriate.

Where the value greatly exceeds the amount of the starting point in category 1, it may be

appropriate to move outside the identied range.

Section 327 Proceeds of Crime Act 2002: Concealing/disguising/converting/transferring/removing

criminal property from England & Wales

Section 328 Proceeds of Crime Act 2002: Entering into arrangements concerning criminal property

Section 329 Proceeds of Crime Act 2002: Acquisition, use and possession of criminal property

Maximum: 14 years’ custody

Culpability

Harm A B C

Category 1

£10 million or more

Starting point based

on £30 million

Starting point

10 years’ custody

Starting point

7 years’ custody

Starting point

4 years’ custody

Category range

8 – 13 years’ custody

Category range

5 – 10 years’ custody

Category range

3 – 6 years’ custody

Category 2

£2 million–£10

million

Starting point based

on £5 million

Starting point

8 years’ custody

Starting point

6 years’ custody

Starting point

3 years 6 months’ custody

Category range

6 – 9 years’ custody

Category range

3 years 6 months’ –

7 years’ custody

Category range

2 – 5 years’ custody

Category 3

£500,000–£2 million

Starting point based

on £1 million

Starting point

7 years’ custody

Starting point

5 years’ custody

Starting point

3 years’ custody

Category range

5 – 8 years’ custody

Category range

3 – 6 years’ custody

Category range

18 months’ –

4 years’ custody

Category 4

£100,000–£500,000

Starting point based

on £300,000

Starting point

5 years’ custody

Starting point

3 years’ custody

Starting point

18 months’ custody

Category range

3 – 6 years’ custody

Category range

18 months’ –

4 years’ custody

Category range

26 weeks’ –

3 years’ custody

Category 5

£10,000–£100,000

Starting point based

on £50,000

Starting point

3 years’ custody

Starting point

18 months’ custody

Starting point

26 weeks’ custody

Category range

18 months’ –

4 years’ custody

Category range

26 weeks’ –

3 years’ custody

Category range

Medium level community

order – 1 year’s custody

Category 6

Less than £10,000

Starting point based

on £5,000

Starting point

1 year’s custody

Starting point

High level community order

Starting point

Low level community order

Category range

26 weeks’ –

2 years’ custody

Category range

Low level community order –

1 year’s custody

Category range

Band B ne –

Medium level community

order

For reference only.

Please refer to the guideline(s)

on the Sentencing Council website:

www.sentencingcouncil.org.uk

38 Fraud, Bribery and Money Laundering Offences Definitive Guideline

Eective from 1 October 2014

MONEY LAUNDERING

The table below contains a non-exhaustive list of additional factual elements providing the context of the

oence and factors relating to the oender.

Identify whether any combination of these or other relevant factors should result in an upward or

downward adjustment of the sentence arrived at thus far.

Consecutive sentences for multiple oences may be appropriate where large sums are involved.

Factors increasing seriousness

Statutory aggravating factors:

Previous convictions, having regard to a) the nature of the

oence to which the conviction relates and its relevance to

the current oence; and b) the time that has elapsed since

the conviction

Oence committed whilst on bail

Other aggravating factors:

Attempts to conceal/dispose of evidence

Established evidence of community/wider impact

Failure to comply with current court orders

Oence committed on licence

Oences taken into consideration

Failure to respond to warnings about behaviour

Oences committed across borders

Blame wrongly placed on others

Damage to third party for example loss of employment to

legitimate employees

Factors reducing seriousness or reflecting personal

mitigation

No previous convictions or no relevant/recent convictions

Remorse

Little or no prospect of success

Good character and/or exemplary conduct

Serious medical conditions requiring urgent, intensive or

long-term treatment

Age and/or lack of maturity where it aects the

responsibility of the oender

Lapse of time since apprehension where this does not arise

from the conduct of the oender

Mental disorder or learning disability

Sole or primary carer for dependent relatives

Oender co-operated with investigation, made early

admissions and/or voluntarily reported oending

Determination and/or demonstration of steps having been

taken to address addiction or oending behaviour

Activity originally legitimate

See page 39.

For reference only.

Please refer to the guideline(s)

on the Sentencing Council website:

www.sentencingcouncil.org.uk

Fraud, Bribery and Money Laundering Offences Definitive Guideline 39

Eective from 1 October 2014

MONEY LAUNDERING

STEP THREE

Consider any factors which indicate a reduction, such as assistance to the prosecution

The court should take into account sections 73 and 74 of the Serious Organised Crime and Police Act

2005 (assistance by defendants: reduction or review of sentence) and any other rule of law by virtue of

which an oender may receive a discounted sentence in consequence of assistance given (or oered) to

the prosecutor or investigator.

STEP FOUR

Reduction for guilty pleas

The court should take account of any potential reduction for a guilty plea in accordance with section 144

of the Criminal Justice Act 2003 and the Guilty Plea guideline.

STEP FIVE

Totality principle