Title:

Fraud Penalties and Sanctions

Lead department or agency:

Department for Work and Pensions

Other departments or agencies:

Her Majesty’s Revenue and Customs

Impact Assessment (IA)

IA No:

Date: 23 November 2011

Stage: Final

Source of intervention: Domestic

Type of measure: Primary

Legislation

Contact for enquiries:

Summary: Intervention and Options

What is the problem under consideration? Why is government intervention necessary?

The government is concerned that the existing provisions for imposing sanctions on benefit claimants where there is

benefit fraud are simply too lenient, do not have an appropriate level of consequence for offences and fail to deter

repeated benefit fraud adequately. This applies equally to high volumes of claimant error. The annual cost of welfare

benefit fraud and error (including Tax Credits) is assessed to be £5.3 billion. The intention is to reduce this monetary

loss and to discourage fraud and negligent behaviour within the benefit system.

What are the policy objectives and the intended effects?

The policy intention is to prevent, deter and increase the consequences of benefit fraud and reduce claimant error,

which costs taxpayers money and undermines public confidence in the welfare system. As part of this, the government

wants the ability to impose tougher penalties for benefit fraud. This will mean the introduction of a new minimum

administrative penalty of £350 for benefit fraud or 50% of the amount overpaid whichever is greater up to a maximum of

£2000; increase in the detection rate of attempted fraud; extension of the loss of benefit sanction for 1 to 3 strikes which

will mean a loss for 13 weeks, 26 weeks and 3 years and; immediate 3 year loss of benefit for serious organised benefit

fraud cases. Hardship payments at a reduced rate will be available for

vulnerable groups. Allied to this is the

introduction of a new civil penalty of £50 for claimants who are negligent in maintaining their benefit claim in order to

encoura

g

e and

p

romote

p

ersonal res

p

onsibilit

y

for such claims.

What policy options have been considered? Please justify preferred option (further details

in Evidence Base)

Do nothing approach – the current policy does not adequately address the problem, and the current sanction regime

needs reviewing and strengthening in light of claimant feedback.

Financial Penalties – Higher and lower amounts for the fraud penalty were considered, and the £350 rate was the

most appropriate as a middle point between existing administrative penalties of £15 minimum and £600 maximum. It

will be offered to claimants, not imposed, and there will be a 14 day cooling off period. If it is refused, the Department

may consider prosecution.

Attempted Fraud - The Department already has the necessary powers to prosecute claimants who attempt benefit

fraud; however, improved /quicker access to intelligence will increase the number of attempted frauds detected, and the

new administrative penalty of £350 will apply as an alternative to prosecution for such cases.

Loss of Benefit Extension - Longer and different combinations were considered as a way to increase the

consequences of fraud. The periods of 13 weeks, 26 weeks and 3 years were determined to be most appropriate to

achieve an appropriate strengthening of the sanction regime and consistency of approach with conditionality sanctions

under Universal Credit. In recognition of the serious nature of organised attacks a higher 5 year loss of benefit was

considered for such cases, but it was limited to 3 years to ensure proportionality and a consistent approach.

Civil Penalty – A new penalty will deter errors and place greater emphasis on personal responsibility for errors that

could have reasonably been prevented. Different amounts were considered, but a £50 flat rate was determined as an

appropriate starting point for benefit claimants to encourage better care of their claim. The option of increasing the civil

penalty to £300 to recognise higher value overpayments and mirror existing HMRC compliance penalties was

considered but rejected.

When will the policy be reviewed to establish its impact and the

extent to which the policy objectives have been achieved?

It will be reviewed within 3

to 5 years time

Are there arrangements in place that will allow a systematic

collection of monitoring information for future policy review?

Yes, see Annex 1

1

Summary: Analysis and Evidence

Net Benefit

(

Present Value

(

P

V

)

)

(

£m

)

Price Base

Year 11/12

PV Base

Year 11/12

Time Period

Years

4

Low: High: Best Estimate(NPV):

£42m

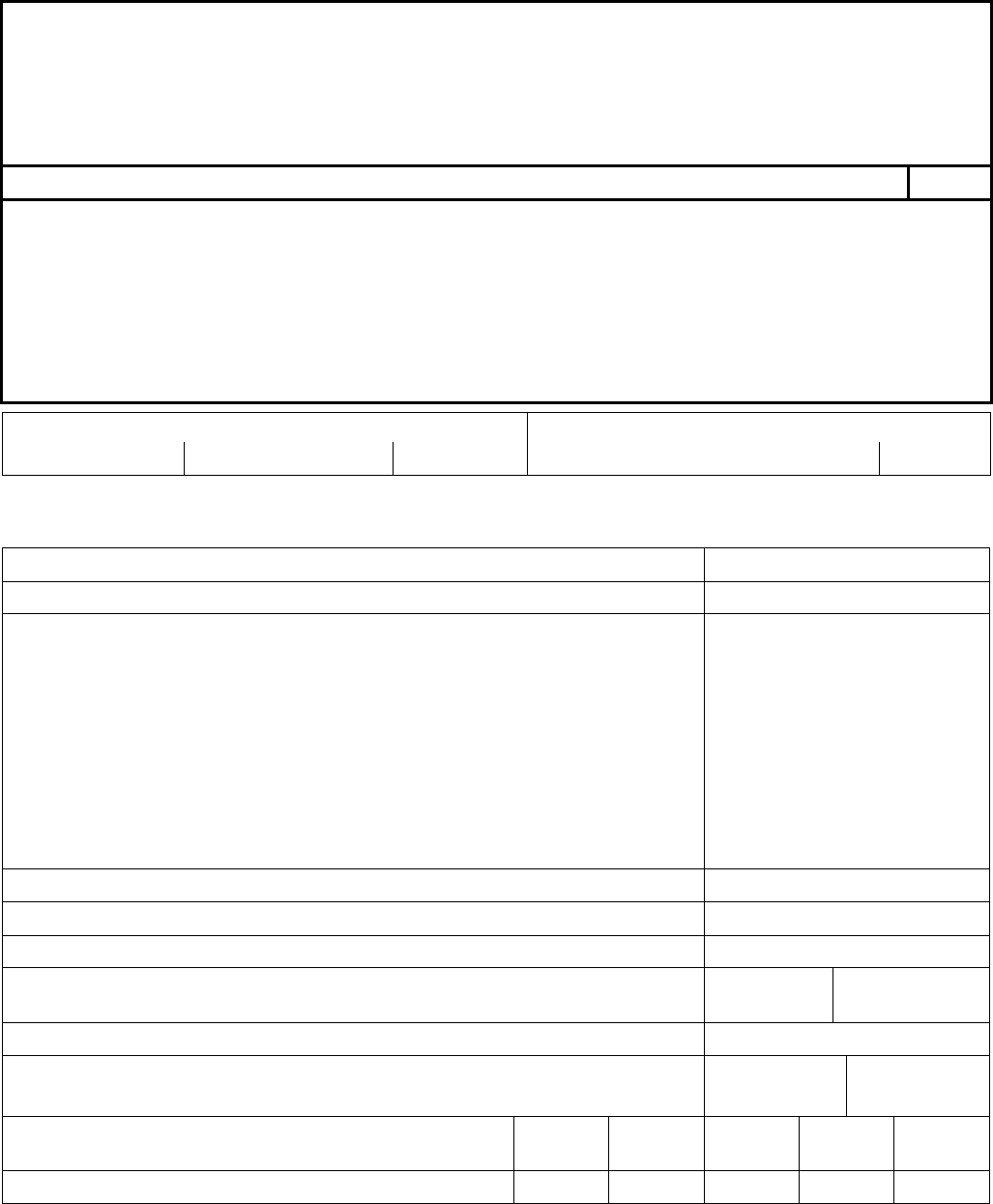

COSTS (£m) Total Transition

(Constant Price) Years

Average Annual

(excl. Transition) (Constant Price)

Total Cost

(Present Value)

Cost

£7.3m £8.4m £26m

– – –

Best Estimate

£7.3m

£8.4m £26m

Description and scale of key monetised costs by ‘main affected groups’

Exchequer costs = £27.7m over 4 years to 2014/15

Costs will include IT changes to include the £350 fine etc and the civil penalty fines as well as the

2/3 strikes to Jobseeker's Allowance Payment System (JSAPS), Income Support Computer

System (ISCS systems), Fraud Referral and Intervention Management System (FRAIMS) Debt

and Customer Information System (CIS).

Includes 11/12 – 13/14 staffing costs to implement the civil penalty.

Other key non-monetised costs by ‘main affected groups’

BENEFITS (£m) Total Transition

(Constant Price) Years

Average Annual

(excl. Transition) (Constant Price)

Total Benefit

(Present Value)

Benefit

£12m £30m £68m

– – –

Best Estimate

(NPV)

–

– £68m

Description and scale of key monetised benefits by ‘main affected groups’

(1) Claimants who commit a benefit fraud offence and are offered an alternative to prosecution will face a

higher financial penalty and will no longer be offered a caution as a method of disposal. Savings of £42m

will be realised over the three years to 2014/15.

(2) Claimants who commit a benefit fraud offence that results in a conviction will be subject to extended loss

of benefit sanctions. Savings of £11m will be realised over the three years to 2014/15.

(3) Claimants who commit serious organised fraud will now face a longer loss of benefit. Savings of £2m will

be realised over the three years to 2014/15.

(4) Claimants who fail to provide information or evidence or those who are negligent (but not fraudulent) with

their benefit claim resulting in an overpayment of £65 or more will now face a financial penalty for failing to

ensure the correctness of their claim as well as recovery of the overpaid benefit . Savings will be £19m over

the three years to 2014/15.

2

Other key non-monetised benefits by ‘main affected groups’

The Department expects these measures to create a deterrence factor, but is unable to quantify both on

fraud and error cases or those potential fraudsters. This will have an added knock on effect of lower

administration costs due to any reduction in the number of fraudulent or erroneous claims made for which

we are also unable to provide robust figures.

Ke

y

assum

p

tions/sensitivities/risks Discount rate

3.5%

Assumptions:

Delivery businesses administer the new rules correctly.

Overpayments will be recovered from claimants.

As the Civil penalty will be added to the overpayment decision this is unlikely to increase the overall number

of appeallable decisions issued.

The ratio of those who remain on a sanctionable benefit is comparable to present numbers.

A higher number of attempted fraud cases will be detected and increase in overall sanctions achieved.

Im

p

act on admin burden

(

AB

)

(

£m

)

: Im

p

act on

p

olic

y

cost savin

g

s In

New AB: AB savings: Net: Policy cost savings:

Enforcement, Implementation and Wider Impacts

What is the geographic coverage of the policy/option? [UK-actually no-only

From what date will the policy be implemented? 01/04/2012

Which organisation(s) will enforce the policy? Job Centre Plus

(JCP);Pensions Disability

Carers

Service(PDCS);Fraud

Investigation Service (FIS);

HM Revenue & Customs

(HMRC); Local Authorities

(LA); Service Pensions

And Veterans agency

(SPAV).

What is the annual change in enforcement cost (£m)? n/a

Does enforcement comply with Hampton principles? YES

Does implementation go beyond minimum EU requirements? NO

What is the CO

2

equivalent change in greenhouse gas emissions?

(Million tonnes CO

2

equivalent)

Traded:

N/a

Non-traded:

N/a

Does the proposal have an impact on competition? No

What proportion (%) of Total PV costs/benefits is directly attributable

to primary legislation, if applicable?

Costs:

100%

Benefits:

100%

Annual cost (£m) per organisation

(excl. Transition) (Constant Price)

Micro < 20 Small Mediu

m

Large

Are any of these organisations exempt?

n/a n/a n/a n/a n/a

3

4

Specific Impact Tests: Checklist

Set out in the table below where information on any SITs undertaken as part of the analysis of

the policy options can be found in the evidence base. For guidance on how to complete each

test, double-click on the link for the guidance provided by the relevant department.

Please note this checklist is not intended to list each and every statutory consideration that

departments should take into account when deciding which policy option to follow. It is the

responsibility of departments to make sure that their duties are complied with.

Does your policy option/proposal have an impact on…?

Impact Page ref

within IA

Statutory equality duties

1

YES Separate

Publication

Economic impacts

Competition NO n/a

Small firms NO n/a

Environmental impacts

Greenhouse gas assessment NO n/a

Wider environmental issues NO n/a

Social impacts

Health and well-being NO n/a

Human rights YES

Justice system NO n/a

Rural proofing NO n/a

Sustainable development NO n/a

1

Race, disability and gender Impact assessments are statutory requirements for relevant policies. Equality statutory requirements will be

expanded 2011, once the Equality Bill comes into force. Statutory equality duties part of the Equality Bill apply to GB only. The Toolkit provides

advice on statutory equality duties for public authorities with a remit in Northern Ireland.

Evidence Base (for summary sheets) – Notes

References

No. Legislation or publication

1 “ Tackling fraud and error in the benefit and tax credits systems” , published on 18

th

October

2010,

http://www.dwp.gov.uk/docs/tackling-fraud-and-error.pdf

2 Universal Credit command paper ( http://dwp.gov.uk/docs/universal-credit-full-

document.pdf )Universal Credit White Paper published on 11 November 2010 chapter 5 covers fraud

and error.

Evidence Base

Annual profile of monetised costs and benefits* - (£m) constant prices

2010/11 2011/12 2012/13 2013/14 2014/15

Transition costs

-

1.2 6.1 - -

Annual recurring cost

-

0.2 3.4 8.4 8.4

Total annual costs

-

1.4 9.5 8.4 8.4

Transition benefits

-

- - - -

Annual recurrin

g

-

- 12 29 32

Total annual benefits

-

- 12 29 32

* For non-monetised benefits please see summary pages and main evidence base section

5

Evidence Base

Policy Rationale

What is the current policy?

1. DWP has a comprehensive and successful strategy for tackling benefit

fraud based on preventing, detecting and deterring fraud.

2. DWP has an extensive criminal sanction regime to deter claimants from

committing benefit fraud. This includes recovery of fraud overpayments at

a higher rate from benefit, formal cautions

2

, administrative penalties

3

,

prosecution, restraint/confiscation of assets obtained from the proceeds of

crime and loss/reduction of certain benefits for a first offence (“one strike”)

and a second conviction for a benefit fraud offence (“two strikes”).

3. DWP has an existing error strategy and does correct claimant errors and

recover overpayments. However, there is no current provision allowing a

civil penalty to be imposed where the claimant has been negligent in their

dealings with the Department.

What is the change in policy?

4. The proposed policy change is to increase the consequences of benefit

fraud. This will mean an amended administrative fraud penalty regime that

will introduce a £350 minimum financial penalty for benefit fraud with a

maximum of £2,000; retaining the 4 week loss of benefit for such cases;

widening the penalties for attempted fraud; extending the current loss of

benefit sanction for 1 to 3 strikes to introduce a loss for 13 weeks, 26

weeks and 3 years, and; introducing an immediate 3 year loss of benefit

for serious organised benefit fraud cases. Cautions will no longer be part

of the DWP sanctions policy.

5. This would mean that in all cases where there is sufficient evidence that

benefit fraud had been committed to commence a prosecution there would

be:

• Recovery of the overpayment

• An offer of a fraud penalty (£350 or 50% up to £2000)

• A four week loss of benefit.

2

A formal caution is an administrative sanction that the Department in England and Wales is able to

offer as an alternative to a prosecution as long as specific criteria are met, and the case is one the

Department could take to court if the caution was refused.

In Scotland cautions are known as administrative cautions and cannot be cited in court, but may be

referred to in reports to the procurator fiscal for consideration of prosecution of any subsequent offence.

3

An administrative penalty is the offer to the claimant to agree to pay a financial penalty where the

claimant has caused benefit to be overpaid to them, by either an act or omission. The amount of the

penalty is currently stipulated at 30 per cent of the amount of the gross overpayment.

6

6. Where there is a conviction for benefit fraud there would be:

• Recovery of the overpayment

• A 13 week, 26 week or 3 year loss of benefit (the period applied will

depend on any previous benefit fraud offences). In the case of

serious organised fraud it will be an immediate 3 year loss of benefit

• Where appropriate recovery of assets under POCA.

Hardship payments at a reduced rate are available for vulnerable groups

7. For cases of claimant error where the claimant has negligently supplied

incorrect information or statements without taking reasonable steps to

correct the error or fails (other than fraudulently) to provide information or

evidence, resulting in an overpayment, there will be:

• Recovery of the overpayment

• A new civil penalty of £50

• A right of appeal against the civil penalty.

Reason for change in policy?

Policy Objective

8. The new policy is being introduced to strengthen the deterrents and to

increase the consequences of fraud compared with the current criminal

sanction. It introduces a new civil penalty for those who are negligent in

maintaining their benefit claim to increase the importance of personal

responsibility.

Rationale for Intervention

9. Current DWP fraud and error overpayments are estimated from national

statistics to be £3.3bn, (£5.3bn if Tax Credits included). DWP has a fiscal

responsibility to reduce this loss and cost to the tax payer and considers

that it is right that it consequences for who choose to steal from it should

be appropriately severe. The current policy is seen as too weak in its

impact on offenders who are sanctioned or convicted of benefit fraud. This

change will strengthen the penalties and sanctions available to deter the

opportunist and significantly increase consequences for more determined,

repeated or organised attempts.

10. Introduction of a minimum financial penalty for fraud cases ensures that all

benefit fraud offenders receive an appropriate level of financial punishment

as an alternative to prosecution.

11. Increasing the length of the periods of the loss of benefit is consistent with

the changes proposed under Universal Credit for conditionality sanctions.

It is important that benefit fraud sanctions continue to be equal to or

tougher than labour market sanctions.

7

12. For organised fraud cases a tougher loss of benefit sanction is considered

appropriate given the serious nature of the criminal behaviour involved.

13. DWP wants to reduce the financial loss from claimant error and achieve

greater claimant compliance. It is a claimant’s responsibility to make sure

that the information held by the Department is correct and up to date at all

times and what they tell us is truthful. Where a claimant has failed to do

this, DWP will impose a civil penalty, similar to the existing Tax Credits

Civil Penalty regime (and in readiness for the advent of Universal Credit

and transfer of tax credit claimants), for those who fail to comply.

Estimating Costs and Benefits

14. Table 1 below shows the Savings and Costs to the Exchequer for fraud

and error measures:

• 3 year loss of benefit for organised fraud,

• Longer 1-3 strike loss of benefit sanction,

• Financial Penalty: £350 minimum fine for existing administration

penalties or caution cases and 30% to 50% administration penalties,

• Increased sanction or prosecution for attempted fraud,

• £50 civil penalty in certain cases of claimant error.

Sources:

15. A combination of Fraud Investigation Service/Debt management statistics

were used to estimates volumes and values of administration penalties,

cautions & prosecutions and claimant error cases.

16. Assumptions:

• Information from Debt management and the Fraud and Error Strategy

Division were used to determine average amounts of penalties

imposed and values of overpayments.

• The application of the fraud sanctions on Local Authority benefits

would have the same impact as that on DWP benefits. The impact on

Tax Credits has not been included in these costings.

• New fines for claimants that, for example, fail to report changes and

transgress into overpayment have an additional penalty added onto

their benefit.

• A de minimis value of overpayment of £65 will be applied when

considering the imposition of the £50 civil penalty.

8

Table 1: Breakdown of Costs & Savings to the Exchequer from

individual fraud and error measures (constant prices)

2011/12 2012/13 2013/14 2014/15 Total

Costs £1.4m £9.5m £8.4m £8.4m £27.7m

Organised and Attempted

fraud

Savings

£m

£m £1m £1m £2m

Civil penalty £50 Savings

£m

£2m £8m £9m £19m

Longer 1-3 strike loss of

benefit sanction

Savings

£m

£2m £4m £5m £11m

Financial Penalty : £350

minimum fine for existing

administration penalties or

caution cases and 50%

administration penalties Savings

£m

£8m £16m £18m £42m

Grand savings total

Total

Savings £m £12m £29m £32m £73m

Net

Savings -£1m £3m £21m £24m £45m

17. The wider social benefits of the new regimes would include:

• Compliance with benefit conditions by encouraging personal

responsibility and deterring criminal behaviour

• Increased public perception that benefit fraud and error is taken

seriously by the Department.

9

10

Annex 1: Post Implementation Review (PIR) Plan

A PIR should be undertaken, usually three to five years after implementation

of the policy, but exceptionally a longer period may be more appropriate. A

PIR should examine the extent to which the implemented regulations have

achieved their objectives, assess their costs and benefits and identify whether

they are having any unintended consequences. Please set out the PIR Plan

as detailed below. If there is no plan to do a PIR please provide reasons

below.

Basis of the review:

The impact of the policy changes will be reviewed and monitored regularly. All

analysis in the review will be subject to the ongoing availability of the underlying

datasets for benefits administered by DWP.

Review objective:

To assess whether the policy changes to fraud sanctions and the new civil

penalty for claimant error meets the broad objectives set out in the Impact

Assessment, and also the scale of the potential knock on impacts e.g.

reductions in the level of fraud and error.

Review approach and rationale:

A mixture of approaches will be used including:

1) Analysis of internal administrative datasets such as FRAIMS which holds

information on detected overpayments.

2) Any management information collected and secondary analysis to

supplement this.

Baseline:

Projected trends in fraud sanctions; volumes of overpayments as a result of

claimant error, levels of expenditure as a result of loss of benefit.

Success criteria:

Criteria will include indicators such as benefit expenditure, trends on levels of

fraud and claimant error.

Monitoring information arrangements:

Where possible, Business operational units will be the main source of

information for the application of a fraud financial penalty; loss of benefit

sanction and the civil penalty.

Reasons for not planning a PIR:

Not applicable