Sustainable & Thematic Investing

Food Waste: Ripe for Change

We waste an unsustainable one third of the food

we produce globally, valued at $1 trillion pa and accounting

for 8% of GHG emissions. This report proposes that

the time is ripe to execute change through collaborative

action across the food value chain.

Emily Morrison

+44 (0)20 7773 9080

emily.morrison@barclays.com

Barclays, UK

Equity Research

4 March 2019

Hiral Patel

+44 (0)20 3134 1618

hiral.p[email protected]om

Barclays, UK

Anushka Challawala

+44 (0)20 3134 2326

anushka.challawala@barclays.com

Barclays, UK

Barclays Capital Inc. and/or one of its ailiates does and seeks to do business with companies

covered in its research reports. As a result, investors should be aware that the firm may have a

conflict of interest that could aect the objectivity of this report. Investors should consider this

report as only a single factor in making their investment decision.

This research report has been prepared in whole or in part by equity research analysts based

outside the US who are not registered/qualified as research analysts with FINRA.

Please see analyst certifications and important disclosures beginning on page 68.

SIGNATURE

Barclays | Sustainable & Thematic Investing

4 March 2019 2

CONTENTS

EXECUTIVE SUMMARY .................................................................................... 3

THE PROBLEM WITH FOOD WASTE ............................................................ 6

It's a global issue and it’s expected to grow ............................................................................................ 6

A greatly overlooked driver of climate change ....................................................................................... 9

WHY SHOULD INVESTORS FOCUS ON FOOD WASTE? ........................ 11

5 key factors to consider ........................................................................................................................... 11

WHAT CAN BE DONE ABOUT THE PROBLEM ......................................... 14

A collaborative approach is key ............................................................................................................... 14

Calls to action – Government, Consumers, Industry ......................................................................... 15

All players in the food value chain will need to take action ............................................................. 20

Emerging innovation can help accelerate change ............................................................................. 21

INVESTOR GUIDEBOOK – SECTOR IMPLICATIONS ................................ 25

Dissecting the food value chain .............................................................................................................. 25

Contributing Authors ................................................................................................................................. 27

Food Retail ..................................................................................................................................................... 28

Food Manufacturing ................................................................................................................................... 34

Agribusiness .................................................................................................................................................. 37

Leisure ............................................................................................................................................................ 41

Packaging ...................................................................................................................................................... 47

Energy ............................................................................................................................................................. 52

Chemicals ...................................................................................................................................................... 55

Food Delivery & Meal Kit Solutions ......................................................................................................... 58

Transport ....................................................................................................................................................... 59

APPENDIX 1 – EXPERT & START-UP INTERVIEWS ................................. 60

APPENDIX 2 – UK/US SUPERMARKET SCORECARDS ........................... 66

Barclays | Sustainable & Thematic Investing

4 March 2019 3

EXECUTIVE SUMMARY

We currently waste 1.3 billion tonnes of food per year, about one-third of all food produced for human consumption. This

represents a loss of around $1 trillion dollars annually, a figure estimated to hit $1.5 trillion by 2030. Such massive waste is

simply unsustainable in a world far off course from our two-degree climate change limit and one where an expanding

population is putting ever-increasing pressure on resources. We think food waste is a greatly overlooked driver of climate

change, accounting for as much as 8% of global greenhouse emissions, and an area ripe for transformation. The UN’s

Sustainable Development Goal 12.3 targets halving food waste by 2030, but without decisive action, the world risks failing

to meet this goal. Companies are starting to see food waste as an opportunity, rather than simply a by-product of doing

business, and this is particularly true in the developed world where most waste occurs at the consumption stage. We

question the current dynamics of the food value chain and see the need for collaboration across key stakeholders, with a

clear role for innovation to accelerate change.

Food waste is forecast to rise to 2.1 billion tonnes per year by 2030, at a yearly value of $1.5 trillion dollars, according to BCG

(Figure 1). Food waste per person is significantly higher in the developed world, where the majority occurs in the later stages

of the value chain with significant sources including restrictive appearance standards and over-reliance on expiry dates.

Whereas in the developing world, the majority of food waste occurs at earlier stages due to inadequate storage and

infrastructure. Similar to the current spotlight on plastics, we believe food waste will be a key focus in the coming years and

see awareness continuing to grow.

We believe that a collaborative approach is necessary with specific calls to action from key stakeholders: governments,

consumers and industry. We argue that change is necessary all along the food value chain and draw on numerous

discussions with futurist NGOs, disruptive start-ups and VC firms. Furthermore, we see the increasing use of emerging

innovation to tackle the problem of food waste (page 21) such as shelf life extension technology, AI, innovative packaging

and surplus food platforms.

Our Investor Guidebook (page 25) assesses the impacts of increasing food waste awareness on a wide variety of sectors,

following discussions with our sector analysts. We see Food Retail and Leisure as the sectors most at risk due to regulatory

change and consumer pressure. Whereas we see greatest opportunity in the Food Manufacturing and Agribusiness sectors

due to brand perception and cost opportunities, respectively. We think food waste also has implications for Packaging,

Energy, Chemicals, Food Delivery and Transport. Refer to Figure 2 for our sector overview and key company mentions. Our

current food system is synonymous with waste, but we think growing awareness has the long-run potential to redefine the

balance of power across the food value chain and hence promote the shift to a leaner society.

Why read this report?

Viewing companies through a sustainable lens, investors should ensure that food waste is firmly on their radar. If a company

does not take appropriate action on food waste, its relevance in an ethical and sustainable long-term portfolio may come

into question. We argue that increasing awareness around food waste highlights the risks of significant regulatory change

and consumer backlash. As such, investors should be putting pressure on companies to prioritise efforts to tackle this

problem.

In the wider discussion around the move to a lower-carbon world, this report adds to the series of Barclays research on the

topic (European Energy: Value in a lower-carbon world 21/11/18, European Mining: Decarbonisation - an opportunity not a

threat 17/1/19, Global Agriculture: Winds of change: the next environmental debate 11/2/19). Importantly, this report also

highlights food waste as an area of significant opportunity that we think is greatly overlooked when it comes to combatting

climate change – if food waste was a country, the FAO estimates it would be the third-largest contributor of GHG emissions.

Barclays | Sustainable & Thematic Investing

4 March 2019 5

FIGURE 2 Sector implications around growing food waste awareness

Source: Barclays Research

Sector Impact

Key company

mentions

Food

Manufacturing

Opportunity

• Create innovative product offerings

• Adapt existing products

• Develop sustainable brand image

• Re-engineer manufacturing processes

• Kellogg

• Mondelez

• Kraft Heinz

Emerging

innovation

• Shelf life extension

• Repurposed products

• Assortment

management system

Food Retail

• Review promotions strategy

• Increase flexibility of supplier contracts

• Optimise order forecasting

• Promote food waste awareness

• Tesco

• Walmart

• Kroger

• Sainsbury

• Carrefour

• Upcycled products

• Innovative packaging

• Ethical supermarkets

Agribusiness

• Benefit from more flexible supply contracts

• Invest in technology around yield, storage

and demand forecasting

• Tyson

• JBS and PPC

• BRF

• Hormel

• Supply management

• Repurposed products

• Land analysis

• Produce monitoring

Leisure

• Invest in waste analytics

• Increasing use of demand forecasting

• Embrace consumer waste initiatives

• Carnival

• Sodexo

• SSP

• JD Wetherspoon

•Greggs

• Data analytics

• Smart waste

management system

• Excess food platforms

Energy

• Increasing demand for renewable fuels

• Food waste as feedstock

• Neste

• Covanta

• Energy recovery

Chemicals

• Leverage agrochemical solutions

• Improve consistency of food production

• Facilitate transport and prolong shelf life

• BASF

• Croda

• Covestro

• Seed enhancements

• Biostimulants

• Shelf life extension

Food delivery &

Meal kit solutions

• Shift towards flexible eating

• Pre-portioning of ingredients

• HelloFresh• Demand analytics

• Intelligent logistics

• Modified atmosphere

packing

Transport

• Increasing demand for supply chain

management

• Demand for in-transit shipment monitoring

• DPDHL

• Kuehne + Nagel

• DSV

• Hapag-Lloyd

• Remote monitoring

• Spoilage reduction

Risk

Packaging

• Improve shelf life stability

• Reformulate to meet sustainability goals

• Enhance supply chain efficiencies

• Enable consumers to waste less through

portion control and re-sealability

• Sealed Air

• Bemis

• Sonoco

• Avery Dennison

• High barrier film

technology

• RFID and smart labels

• Atmospheric control

Barclays | Sustainable & Thematic Investing

4 March 2019 6

THE PROBLEM WITH FOOD WASTE

We already waste 1.3 billion tonnes of food each year and this is expected to increase

to 2.1 billion tonnes by 2030. Fresh produce presents the biggest problem, with almost

half of the world’s fruit and vegetables being thrown away each year. The scale of the

problem is also greatest in the developed world, where an over-reliance on expiry dates

and lack of understanding over the value of food means that consumers waste around

10 times more than in poorer regions. Food waste is not only a serious market

inefficiency, but also a major contributor to greenhouse gas emissions throughout

food production and disposal processes. We believe the developed world holds the

greatest potential in terms of tackling food waste in the medium term through

improved technology and awareness in the later stages of the value chain.

It's a global issue and it’s expected to grow

Each year roughly one-third of the food produced for human consumption globally is

wasted (FAO). This equates to around 1.3bn tonnes of wasted food and in monetary terms

represents around $1 trillion (c$680bn in developed countries and c$310bn in developing

countries). Food waste is expected to continue growing, and is forecast to reach 2.1 billion

tonnes by 2030, worth around $1.5 trillion (BCG).

Looking at the composition of food waste, fresh produce is the biggest contributor with

fruits, vegetables, roots and tubers having the highest rates of wastage (Figure 3).

FIGURE 3 Proportion of food wasted is highest in the fresh produce section

Source: FAO 2011

Food waste per capita is greater in the developed world

Per capita food wastage from all stages of the supply chain is generally higher in developed

countries – at 280-300kg per capita per year in Europe and North America compared with

120-170kg per capita per year in sub-Saharan Africa and South/Southeast Asia. The

proportion of food waste relative to total food production is, however, similar at 31-33% in

Europe and North America and 26-37% in sub-Saharan Africa and South/Southeast Asia.

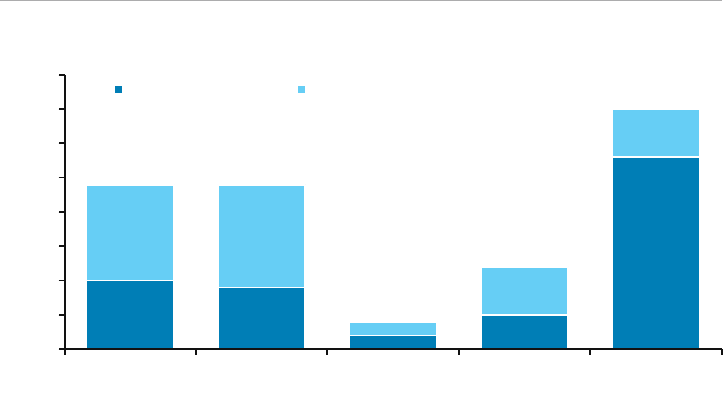

FIGURE 4 Food wastage per capita is higher in the developed world

Source: FAO 2011

0

50

100

150

200

250

300

350

Europe

North

America &

Oceania

Industrialized

Asia

Sub-Saharan

Africa

North Africa,

West &

Central Asia

South &

Southeast

Asia

Latin America

Per capita food losses and waste (kg/year)

Production to Retailing

Consumer

Barclays | Sustainable & Thematic Investing

4 March 2019 7

Consumer waste is more prevalent in developed countries

There is wastage all along the food supply chain, from the initial production stages all the

way through to final consumption. However, wastage at the final consumption stage

represents a greater proportion of the total in more developed countries – Figure 5. The

FAO estimates that per capita food waste by consumers in Europe and North America is 95-

115kg per year compared with only 6-11kg per year in sub-Saharan Africa and

South/Southeast Asia. In the UK, the Institute of Mechanical Engineers highlights that food

wastage by consumers costs the average household around £480 per year.

FIGURE 5

Food waste from later supply stages (and consumption) is higher in developed regions

Source: FAO 2011, WRI 2013. 100% = 1.5 quadrillion kcal.

Expiry dates, multi-buy promos and pack sizes

One factor likely driving this consumer waste is the developed world’s over-reliance on

expiry dates and best-before dates. The Institute of Mechanical Engineers finds that

between 30-50% of the produce that reaches the supermarket shelf is thrown away by the

consumer, “often at the direction of conservative ‘use by’ labelling.” This presents an

opportunity to reduce food waste through innovative packaging that enables consumers to

more accurately determine whether the food is safe to eat – we explore this later in the

report (see our Mimica interview, page 62). Another reason for food waste in the home is

due to grocery retailers’ prominent use of multi-buy promotions such as ‘buy-one-get-one-

free’, encouraging consumers to purchase more than is required. Consumers are also

constrained by pack sizes – i.e. it is often difficult for a consumer to purchase only the

quantity of food they need.

Some produce doesn’t even make it to the consumer

Other dominant sources of food waste in developed countries include the introduction of

appearance quality standards – i.e. grocery retailers have set strict produce specifications

that farmers and manufacturers need to meet. This is particularly prevalent in the fresh

produce space such as fruits and vegetables (which is also the commodity group with the

largest proportion of waste – Figure 3). The result is a significant amount of produce that

ends up being wasted because it is not accepted by the grocers. In the UK, the Soil

Association estimates that 20-40% of fresh produce doesn’t make it to the supermarket

shelf due to aesthetic reasons.

In contrast, in developing countries, food wastage generally occurs in earlier stages, with

difficulties in harvesting, storage, infrastructure, packaging and transport systems. Figure 5

shows that in developed nations, food waste in the distribution and consumption stages

10%

9%

2%

5%

28%

14%

15%

2%

7%

7%

24%

24%

4%

12%

35%

0%

5%

10%

15%

20%

25%

30%

35%

40%

Production

Handling and

Storage

Processing and

Packaging

Distribution and

Market

Consumption

Developed Countries

Developing Countries

Barclays | Sustainable & Thematic Investing

4 March 2019 8

makes up a greater proportion of the total than in developing nations where a greater

amount of waste comes from the production and handling stages.

Scope for change all along the food supply chain

There are a variety of factors influencing the food supply chain that can lead to food waste;

we outline some of the main reasons in Figure 6.

FIGURE 6 Factors contributing to food waste – a lack of awareness along the value chain

Source: Barclays Research

A focus on the developed world

We acknowledge that many families in developing nations rely more heavily on agriculture,

while also living closer to food insecurity, hence a reduction in food wastage could have

larger benefits for their standard of living. We see scope in the long-run for governments of

developing nations to improve infrastructure and for companies to embed suitable

technology to improve harvesting techniques and storage conditions.

However, in the medium term we see the largest opportunity to reduce food wastage in the

developed nations. This is due to the larger scale of the problem in developed nations per

person and the greater opportunities to improve technology and awareness in the later

stages of the value chain. Due to our focus on the developed world, we have included some

statistics for the scale of the problem in the US, Europe and the UK (Figure 7).

FIGURE 7 The problem of food waste in the developed world

Source: ReFed, NRDC, Fusions, WRAP

Agriculture Manufacturers Food Retailers Consumers

• Inadequate storage

• Lack of cooling facilities

• Harvesting difficulties

• Overproduction

• Inadequate storage

• Loss in transport

• Waste from product

processing

• Over precise product

specifications standards

• Packaging

• Stock rotation

• Over-ordering

• Inadequate forecasting

• Multi-buy promotions

• Confusion over

expiry dates

• Over-buying

• Undervaluing food

• Not knowing the

environmental cost

• Pack size constraints

Most prevalent in developing countries Most prevalent in developed countries

US

Europe UK

• 63mn tonnes of food wasted yearly

• Represents 40% of food in the US

and c$165bn in value

• 40% of food waste comes from

restaurants and grocery stores

• Reducing fruit and vegetable waste

is an $18bn opportunity for retailers

• A 15% decline in food waste could

feed 25million Americans yearly

• c88mn tonnes of food waste per

year, or 20% of the food produced

for human consumption

• The associated cost is cEUR143bn

• Food waste of around 2.5x the

average body weight for every

person, per year

• Households generate over 50% of

the food waste

• c10mn tonnes of food waste annually

• Represents c25% of the food

purchased in the UK

• Represents over £20bn in value

• 25mn tonnes of greenhouse gas

emissions are associated with

the waste

• c70% of food waste from

households and 18% from food

manufacturing

Barclays | Sustainable & Thematic Investing

4 March 2019 9

A greatly overlooked driver of climate change

It is clear that food waste is a serious market inefficiency – the $1 trillion value of global

annual food waste represents c1.2% of global GDP. But food waste also poses a significant

environmental challenge in terms of its carbon footprint as well as land and water use.

Food waste’s significant carbon footprint

The FAO estimates that if food waste was a country, it would be the 3

rd

biggest emitter of

greenhouse gases at 3.6 Gtonnes of CO

2

equivalents, behind only China and the USA

(Figure 8). This means that food waste contributes around 8% of global greenhouse gas

emissions, almost equivalent to global road transport emissions (IPCC). Producing the food

we waste causes GHG emissions all along the value chain from farm-to-fork and also leads

to emissions when it is sent to landfill, releasing methane when it decomposes

anaerobically. ReFED, a US coalition to reduce food waste, estimates that a 20% reduction

in US food waste over the next 10 years would avoid almost 18 million tonnes of

greenhouse gases annually, recover c1.8 billion meals per year and save over 1.6 trillion

gallons of water annually.

FIGURE 8 If food waste was a country, it would have the third-largest carbon footprint

Source: WRI's Climate Data Explorer 2011 data, FAO for 2011 food waste estimate

Wider environmental costs

A land mass larger than Canada and India combined is needed to grow the food that we

waste each year (FAO) and the water and energy used to produce this food are wasted as

well. Agriculture is the world’s largest user of fresh water and it is estimated that over 25%

of fresh water use in the US is accounted for by wasted food.

FIGURE 9 Food waste is a significant burden on the environment

Source: ReFed

Reducing food waste can help the shift to a lower-carbon world

Barclays has already published on the move to a lower-carbon world – see European Energy:

Value in a lower-carbon world (21/11/18), European Mining: Decarbonisation - an

opportunity not a threat 17/1/19, Global Agriculture: Winds of change: the next

environmental debate 11/2/19). However, we think food waste is an often over-looked, and

yet solvable, factor and presents an opportunity to dramatically improve the environmental

outlook. Project Drawdown’s researchers found that reducing food waste could lower

0

2

4

6

8

10

12

GHG emissions - Gtonnes CO2 eq

18%

of cropland

19%

of all fertiliser

21%

of landfill volume

In the US, food waste consumes:

Barclays | Sustainable & Thematic Investing

4 March 2019 10

emissions by 70 Gtonnes over the next 30 years and ranked reducing food waste as the

third most impactful action to targeting climate change, behind only refrigerant

management (90GT) and onshore wind turbines (85GT).

Consumer food waste presents largest opportunity for reducing carbon footprint

In terms of the food value chain, the highest carbon footprint is generated from the

consumption stage because of the cumulative effect from previous stages (Figure 10). As

an example, a single tomato wasted at the harvesting stage will have a much lower carbon

footprint than a consumer wasting tomato sauce because the harvesting, transportation

and processing accumulates additional greenhouse gas emissions. As most food waste

occurs at the consumer level, this suggests that reducing food waste in the consumption

stage is likely to have the biggest impact in terms of carbon footprint.

FIGURE 10 Consumption stage contributes most to carbon footprint

Source: BIO Intelligence Service, Presentation of the Footprint 2013, FAO 2011, WRI 2013. Note: Food waste by energy.

Animal products – low wastage rates but high carbon footprint

Animal products contribute significantly towards the global carbon footprint, much more so

than their contribution to food waste (Figure 11). This is because of the intensity of GHG

emissions to produce meat, specifically beef products. For further details see Global

Agriculture: Winds of change: the next environmental debate 11/2/19.

FIGURE 11 Animal products contribute more to carbon footprint than wastage

Source: BIO Intelligence Service, Presentation of the Footprint, 2013. Note: Contribution to food waste by volume.

As awareness around agriculture’s impact on the environment has grown, investor pressure

has also become more apparent. On 29 January 2019, over 80 investors supported a letter

sent to some of the largest global fast food companies including McDonald’s and Burger

King urging them to take swift action on climate change. We think similar investor pressure

could emerge as awareness around food waste continues to grow.

0%

5%

10%

15%

20%

25%

30%

35%

40%

Agricultural

production

Handling &

storage

Processing

Distribution

Consumption

Contribution of commodity to food waste and carbon footprint

Food waste

Carbon footprint

0%

5%

10%

15%

20%

25%

30%

35%

40%

Cereals

Vegetables

Starchy

roots

Fruits

Milk &

eggs

Meat

Oilcrops &

pulses

Fish &

Seafood

Contribution of commodity to food waste and carbon footprint

Food waste

Carbon footprint

Barclays | Sustainable & Thematic Investing

4 March 2019 11

WHY SHOULD INVESTORS FOCUS ON FOOD WASTE?

Tackling food waste should be seen as a significant investment opportunity that not

only champions long-term sustainable business practices but also offers a way to

develop additional consumer brand value. Over $125 million of private capital was

invested in food waste start-ups in 2018 and we believe that, with growing awareness

around the issue, companies that ignore their responsibilities on food waste could be

labelled ‘unethical’ and ‘uninvestable’ when viewed through a sustainable lens.

Whereas we think firms that are proactively tackling the problem through innovation

and collaboration are likely to be viewed more positively by both investors and

consumers. Similarly to how society is being dramatically reshaped by the plastic

movement, we argue that food waste should be firmly on the investor radar given the

growing risks attached to regulatory action and the potential for consumer backlash.

5 key factors to consider

We acknowledge that food waste fits within the much broader discussion on food

sustainability and climate change, and thus we have included sustainability factors within

our five key factors for focusing on food waste – Figure 12 – as we think food waste is a

powerful driver that is often overlooked. Consumer awareness continues to be a key

catalyst in addition to the UN’s Sustainable Development Goals, forcing companies and the

government to shift their viewpoint on food waste away from a by-product of doing

business to an opportunity to improve efficiency.

FIGURE 12 A summary of the 5 key factors to consider on food waste

Source: Barclays Research, ReFED, FAO 2011

Sustainability factors

Greatly overlooked driver of climate change

As discussed already on page 9, we think food waste is a greatly overlooked driver of

climate change contributing around 8% of global greenhouse gas emissions. Investors are

taking note of the carbon footprint of certain activities and we think this will be the case

with food waste also. The letter on 29 January 2018 from over 80 investors to some of the

largest global fast food companies (McDonalds, Burger King, Domino’s Pizza) about the

carbon footprint in their supply chain shows the growing awareness around sustainability

factors within investment decision making.

The UN’s Sustainable Development Goal 12.3 target to halve food waste

Food waste is emerging as a critical global issue with the UN including a specific target for

food waste as part of its 2015 Sustainable Development Goals. SDG 12: Responsible

Consumption and Production seeks to “ensure sustainable consumption and production

patterns” and the third target within this goal (SDG12.3) calls for “halving per capita global

food waste at the retail and consumer levels and reduce food losses along production and

supply chains, including post-harvest losses” by 2030. We think it is therefore important for

investors to be aware of the action needed to achieve this goal.

1. Sustainability

factors

5. Investment

opportunity

2. Policy

momentum

4. Private capital

investments

3. Consumer

awareness

• Climate change driver

• UN’s SDG 12.3 target

• Increasing population

• Misuse of resources

• Mandatory

measurement, taxes,

fines or incentives

• French-style regulation

• Consumer driven

campaigns

• Risk of consumer

backlash

• >$125 mn of private

capital invested

in 2018

• Larger funding rounds

• $1trn global annual

value

• $1.9bn per year

in business profit

Barclays | Sustainable & Thematic Investing

4 March 2019 12

Increasing population puts pressure on resources

In a world where the population is predicted to reach 9.8 billion by 2050 (UN 2017),

increasing pressure on resources requires urgent action to tackle the problem of food

waste. Interestingly, we are already growing enough food for 10bn people, according to the

Journal of Sustainable Agriculture, but the problem is that we are wasting a third of it.

Unsustainable food practices are creating hunger and inequality around the world.

Food waste highlights a misuse of resources

Even though we produce enough food to feed everyone, the World Food Programme

estimates that around 800 million people in the world are undernourished, representing

around one in nine people. If we can reduce food waste by even 25%, this would save

enough food to effectively end world hunger (also achieving SDG 2: Zero Hunger).

Policy momentum – risk of restrictive policy changes

Food waste is moving up the policy agenda. The EU and US have committed to the SDG

12.3 target and a group of around 40 CEOs, government officials and NGO leaders have

launched a coalition called Champions 12.3 to mobilise progress towards the SDG’s goal.

The Champions 12.3 have produced a 2018 Progress Report for the SDG target. The report

indicates some impressive progress made by the industry on food waste, with nearly two-

thirds of the world’s 50 largest food companies participating in programmes with a food

waste reduction target and more than a quarter measuring their waste. However, the report

indicates that there is still a way to go for government action on food waste. We explore the

government’s role in the solution to food waste in more detail in the next chapter.

We have seen some governments prioritising food waste, for example France’s law

prohibiting supermarkets from sending excess food to landfill, hence we see a risk of future

regulatory change whether in the form of mandatory measurement, taxes, fines or

incentives. We think voluntary, collaborative company action has the potential to shape

future regulation around food waste and is therefore a more positive outcome than waiting

and risking intrusive regulation.

Consumer awareness is growing

Consumer awareness around the issue of food waste is growing and we think this will

continue – Figure 13. There have been a growing number of consumer-driven campaigns

around food waste, for example Isabel Soares founded Fruta Feia (Ugly Fruit), a co-op in

Portugal that has rescued 300 tonnes of blemished produce, and Italian chef Massimo

Bottura set up a soup kitchen at the Rio Olympics using excess food from the Olympic

Village. Selina Juul is also a notable food activist who has driven significant change in the

food waste culture in Denmark through the Stop Wasting Food movement (see page 18).

FIGURE 13 The increase in interest over time for the term ‘food waste’

Source: Google Trends, Note: Numbers represent search interest relative to the highest point on the chart for the given region and time.

0

20

40

60

80

100

Feb-04 Feb-05 Feb-06 Feb-07 Feb-08 Feb-09 Feb-10 Feb-11 Feb-12 Feb-13 Feb-14 Feb-15 Feb-16 Feb-17 Feb-18 Feb-19

Barclays | Sustainable & Thematic Investing

4 March 2019 13

A survey conducted for Zero Waste Week in the UK found that over 75% were concerned

about food waste; in the US this figure was 89%, according to the American Frozen Food

Institute. WRAP also find that concerns around food waste increase with more information

that is given about food waste, so we think that as awareness grows the risk of consumers

putting significant pressure on companies will increase. There is also the risk of consumer

backlash on social media, for example, similarly to what we have seen with plastics.

VC and PE investment in food waste start-ups

In 2018, over $125 million of private capital was invested in food waste start-ups according

to ReFED. This includes Apeel Sciences ($70m), WISErg ($19m), Full Harvest ($9m),

FoodMaven ($9m), TeleSense ($7m) and Blue Cart ($5m) Jan-Sept 2018. With ever-

increasing funding rounds, we think investors should be paying close attention to the space.

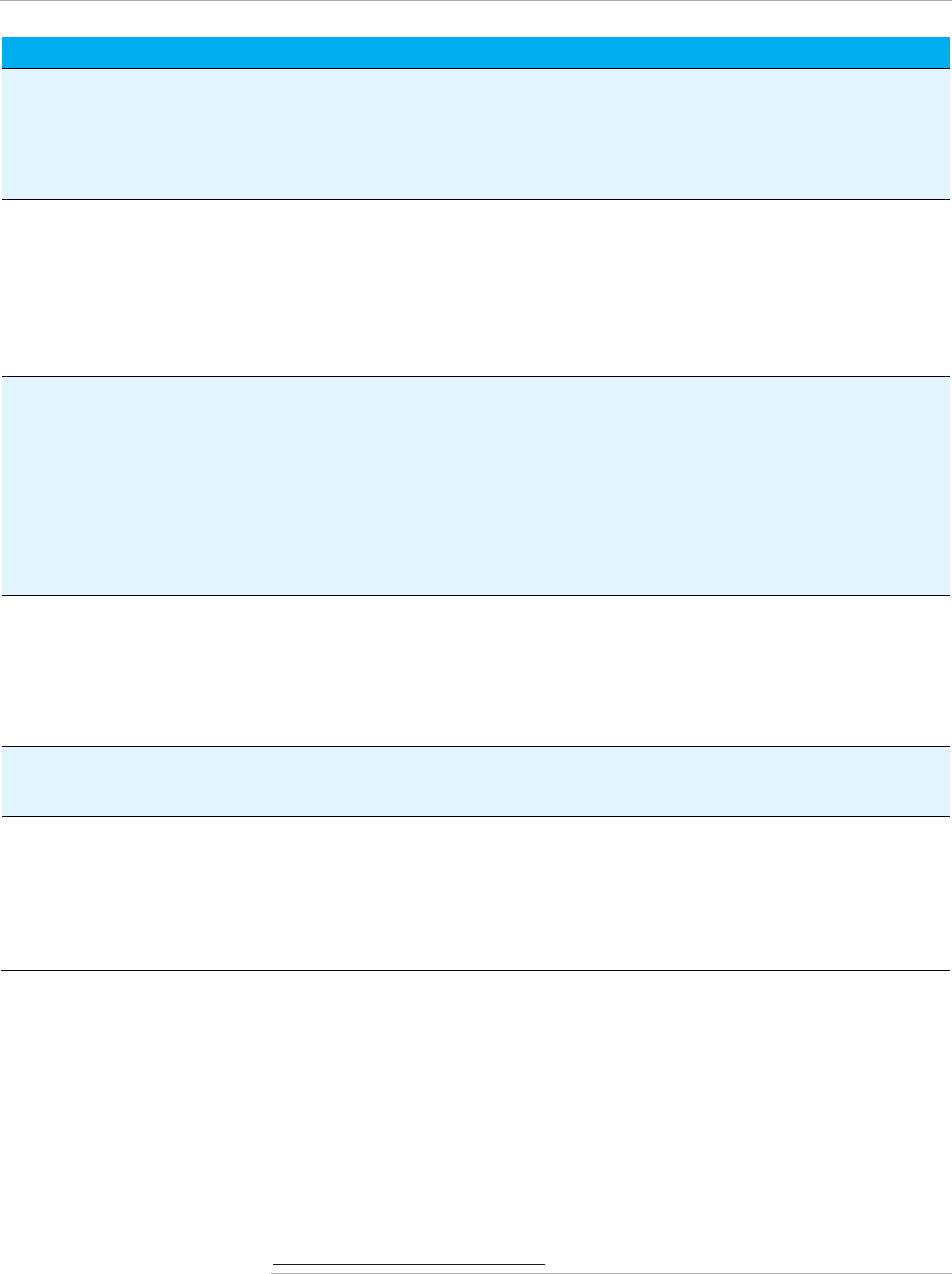

A significant investment opportunity

We also see significant value to be had from investing in companies tackling food waste.

Using the FAO’s estimate of the value of food waste per year of $680 billion in the

developed world and $310 billion in the developing world, we have broken down the value

by stage of the supply chain in Figure 14 (see page 25 for our detailed sector analysis). We

highlight that, although we do not see food waste falling to zero, as there will always be

some unavoidable waste, the values in Figure 14 indicate a significant opportunity from

even a small change in food waste.

FIGURE 14 Reducing food waste holds significant value

Source: Barclays Research, FAO 2011, WRI 2013

In the US alone, ReFED estimates that an $18 billion investment in its proposed 27 solutions

to reduce food waste by 20% over a decade has the potential to deliver an expected $100

billion in societal economic value. It is also estimated that the 20% reduction in food waste

could generate $1.9 billion in potential annual business profit as well as $5.6 billion in

potential annual consumer savings.

In the next chapter we look at the relevant stakeholders around the problem of food waste

and highlight what can be done to unlock some of this untapped value.

“In the same way that child labour used to be endemic in the fashion industry but is

now completely unacceptable, I believe the same is happening to food waste.”

Tessa Clarke, Co-founder of OLIO

~$126bn

~$113bn

~$25bn

~$63bn

~$353bn

~$96bn

~$103bn

~$14bn

~$48bn

~$48bn

~$222bn

~$217bn

~$39bn

~$111bn

~$401bn

$0bn

$50bn

$100bn

$150bn

$200bn

$250bn

$300bn

$350bn

$400bn

$450bn

Production

Handling and

Storage

Processing and

Packaging

Distribution and

Market

Consumption

Value of food waste along the value chain per year

Developed Countries

Developing Countries

Barclays | Sustainable & Thematic Investing

4 March 2019 14

WHAT CAN BE DONE ABOUT THE PROBLEM

We see increasing awareness as a first step towards collaborative action, followed by

improvements in the infrastructure and efficiency of the supply chain. We provide calls to

action from three key stakeholders: governments, consumers and industry. The recent

wave of newsflow in this space is encouraging, from countries introducing specific

regulation around food waste to companies making food waste pledges. We also see the

increasing use of emerging innovation to tackle the problem of food waste such as

artificial intelligence, shelf life extension, innovative packaging and surplus food

platforms.

A collaborative approach is key

In the long term, we think a collaborative approach across the value chain is key to tackling

the systemic problem of food waste. Businesses at each stage must realise that food waste

is a risk to the entire system and work together to implement solutions. We believe the

solutions put in place should prioritise prevention given this is likely to deliver long-term

sustainable change, followed by recycling, recovery and then finally disposal.

We acknowledge the current difficulties of full collaboration – it is a tall order to bring all the

relevant players into the same room. Management teams are under scrutiny to provide

shareholder value and hence investing in tackling food waste may not be a top priority.

However, as we have discussed (page 12), awareness around food waste is growing and

consumers and governments are putting increasing pressure on companies to take action.

Awareness is the first step, with the supply chain close behind

We therefore argue that improving awareness around food waste is crucial as a first step

towards collaborative action, highlighting the longer-term rewards of acting now. We spoke

with BCG, whose work estimates that improving awareness could save 190 million tons of

food waste per year by 2030, representing c$260 billion in yearly value (Figure 15). We also

think the supply chain is another key area in which collaborative action can reduce food

waste. BCG estimates that improving infrastructure could save 225 million tons of waste per

year and that improving supply chain efficiency could save 105 million tons per year.

FIGURE 15 Action needed across the value chain

Source: BCG Analysis

Barclays | Sustainable & Thematic Investing

4 March 2019 15

Calls to action – Government, Consumers, Industry

We see the problem of food waste as a collective responsibility and hence provide calls to

action from 3 groups: governments, consumers and industry.

FIGURE 16 Calls to action from three groups

Source: Barclays Research

1. Governments – enabling regulation is certainly helpful

Europe – France sets a good example

France has been recognised for its action against food waste through its number one

position in the Food Sustainability Index for both 2016 and 2017. In 2013, France launched

its National Pact against Food Waste target of halving food waste by 2025 and then in 2016

passed a law requiring grocery stores over a certain size to donate unsold food, with a fine

of €3750 for each violation. The law also made it simpler for food manufacturers to donate

excess products, requires restaurants to recycle excess food and offer ‘doggy bags’, bans

expiry dates on products like wine, baked goods and sweets and ensures food-waste

education starts at primary school.

Following France’s move, Italy created regulation in 2016 to incentivise restaurants and

grocers to donate excess food rather than waste it. The regulation enables retailers to

donate food past its sell by date and pay a lower amount of waste tax.

UK – moving in the right direction

The UK does not have any formal legislation to require retailers to stop wasting food;

instead it has focused on a voluntary agreement. The Courtault Commitment 2025 is a

voluntary agreement to bring together organisations across the food system to progress

towards more sustainable production and consumption of food and drink. However, we do

see some moves in the right direction:

• The Mayor of London has adopted the UN’s SDG to help cut food and associated

packaging waste by 50% by 2030.

• A £15 million pilot scheme set for 2019/20 to promote awareness and work towards

eliminating food waste sent to landfill by 2030 (as part of the 25 Year Environment

Plan).

• Publication of the Resources and Waste Strategy in December 2018, with key proposals

including the introduction of mandatory reporting of food waste statistics by businesses

and the potential for future food waste targets if progress should be “insufficient”.

US – some way to go

The US has attempted to tackle food waste through a set of bills called the Food Recovery

Act, introduced in 2015. The legislation establishes programmes to educate consumers

about food waste, aims to improve cooperation amongst the industry and help schools to

use food that would otherwise go to waste. The bill also expanded tax deductions that

could be made for the donation of food to charities as well as stipulating the language to be

used for ‘sell-by’ dates. Despite this, we see the US as lagging behind Europe in terms of

regulation on food waste. The US comes in 11

th

place in the November 2018 Food

Consumers

IndustryGovernments

Targets

Mandatory measurement

Penalties & Incentives

Education

Attitude

Embrace innovation

Aesthetic standards

Collaboration

C-suite support

1

2

3

Barclays | Sustainable & Thematic Investing

4 March 2019 16

Sustainability Index data when looking only at food loss and waste in high-income countries

(Figure 17).

FIGURE 17 France leads the way on food waste, US lags behind

Source: Food Sustainability Index by The Economist and BCFN, Nov 2018.

Actions to take:

− Targets: We think governments should primarily ensure an official target has been

set on the topic of food waste. A number of developed countries have decided to

adopt the UN’s SDG 12.3 target to halve food waste by 2030, but others have taken

less aggressive targets. From this first step, companies can then be asked to set their

own targets on food waste alongside proper measurement and data disclosure.

− Mandatory measurement: We think that mandating standardised measurement of

food waste could be one of the most important roles for governments in the

developed world. The UK’s Waste & Resources Action Programme (WRAP) has

produced guidelines for reporting and measurement as part of its Food Waste

Reduction Roadmap. Its core recommendations include measuring and quantifying

the tonnage of food sent to various destinations, separating out the food

redistributed to charity, sent to animal feed or bio-based materials.

− Penalties & Incentives: We think governments should be actively pursuing

comprehensive policies that change consumer attitudes towards food and dissuade

retailers from rejecting produce due to aesthetic conditions. We think France’s

approach of making it illegal for supermarkets to throw away food is a bold one,

which has significantly boosted its food waste credentials. We think fiscal penalties

for food waste are likely to have greater impact than incentives, which can be seen

from government policy around issues such as the sugar tax and plastic bag charge.

50

55

60

65

70

75

80

85

90

95

Food waste rankings - Top 20 high income countries

France sets an example

US lags behind Europe

Barclays | Sustainable & Thematic Investing

4 March 2019 17

2. Consumers – education required to raise awareness

Consumer power through social activism

We see consumers as an important driver of change as awareness around food waste

continues to grow. Consumers can pressure companies through their purchasing decisions

as well as through their ever-increasing social media influence (we refer to Generation Z as

social activists in our report Generation Z: Step aside Millennials, 28.6.18). We have seen

this phenomenon with plastic waste, with younger consumers using hashtags such as

#StrawsSuck and #SkiptheStraw on social media to highlight their commitment to limit

plastic use. A variety of foodservice, retail and leisure companies have since responded by

cutting their availability of plastic straws. Jacob Hansen at BCG agrees that “if consumers

put pressure on companies, the industry will become more conscious of the problem”,

adding that “similarly to what has happened in plastics, companies will try to differentiate

themselves on their food waste actions”.

Expectation of abundance and perfection

Consumers in the developed world have become detached from the process of producing

food and many now have the expectation of being able to buy anything they want, at all

times. This expectation of abundance puts a burden on supermarkets and restaurants to

over-order to ensure sufficient availability, in turn leading to food waste. The Institute of

Mechanical Engineers estimates that the catering industry wastes around one-third of its

food as restaurants frequently over-order. Although we see this problem reducing in the

future as forecasting systems become more accurate (we highlight innovative solutions

using big data/AI such as Tenzo and Winnow on page 24), we still see a need for

consumers to be more conscious about their expectations on availability.

There is also a tendency for consumers to expect perfect produce, which has led

supermarkets to impose strict aesthetic produce standards on farmers and contributed to

significant amounts of waste.

What about a sugar-style tax?

Although some may argue that a sugar-tax style tax on food would be an effective solution

to change consumer behaviour around food waste, we think this type of solution would be

difficult to apply globally and politically unpopular with lobby groups. Similarly to a GHG tax

to reduce the consumption of meat (discussed in Global Agriculture: Winds of change: the

next environmental debate 11/2/19), a tax of this nature would likely have a regressive

impact, hurting lower income families the most. This is particularly significant given that

most waste comes from fruit and vegetables and hence a tax to reduce food waste would

likely disincentivise the purchase of healthy produce, particularly problematic given growing

concerns around obesity. We think a more plausible policy would be to charge consumers

for the amount they waste. In South Korea the recycling rate of food waste rose from 2% in

1995 to 95% in 2009, driven by its ‘pay-as-you-throw’ solutions. Municipalities could

choose between 3 solutions: paid-for standard plastic bags, attaching paid-for stickers to

food waste bins, and bins that weigh food waste in order to calculate a household’s charge.

Shift to convenience shopping could be helpful for food waste

Modern lives are busy and likely to get even busier – the IGD estimates that 71% of 18-24

year olds believe their lives will be busier in 5-10 years’ time. This has meant that the food

retail market has seen consumer behaviour shift away from large weekly shops, towards

more frequent but smaller shopping trips. We discuss the growth in convenience grocery

shopping in our thematic note Future of Food Retail: Long Live Clicks and Mortar (12.10.18).

We argue that this shift to convenience-style shopping could help with the problem of food

waste as consumers buy their food as and when it is needed, reducing the chance that food

is forgotten about/goes off and is hence wasted. On the other hand, some may argue that

planning and scheduling meals in advance is the best way to reduce waste.

Barclays | Sustainable & Thematic Investing

4 March 2019 18

Case Study: Denmark’s change in attitude towards food waste

Denmark has reportedly cut its food waste by 25% in the past 5 years, according to the

Danish Agriculture and Food Council. This has been achieved in large part due to a

change in consumer attitudes towards food waste, driven by numerous waste

reduction initiatives and innovative start-ups. Denmark has a wide variety of awareness

campaigns around the topic whilst also hosting food waste supermarkets (e.g. We

Food) and cooking schools for food waste.

We think there are a number of factors influencing the rapid change in mindset: 1) the

small population size means it is easier to spread the message, 2) food is expensive

(Danes spend almost twice what Americans spend on food) a cultural expectation of

knowing how to cook (according to Rikke Bruntse Dahl at Copenhagen House of

Food).

Actions to take:

− Education: We think educating consumers around the scale of the food waste

problem, the impact this is having on the environment (and their wallet) as well as

informing them on practical solutions is important to help tackle the issue. Specific

programmes around food waste and the food production system in general could be

included in national curriculums rather than sporadically taught through charity

programmes. In the UK, for example, WRAP’s Love Food, Hate Waste campaign

contributed to a 21% reduction in food waste over five years.

− Attitude: Consumers should recognise the pressures they put onto supermarkets

through their expectations of abundance and perfect produce. Buying ‘wonky’

produce sends signals to retailers that these products are demanded and hence

should not be wasted. There is also an opportunity for consumers to impact the

restaurant and leisure industry – ask to take excess food home, ask for smaller

portions and hold to account those companies that waste food.

− Embrace innovation: Many options now exist for consumers to use technology in

order to reduce food waste – we explore some of these in our emerging innovation

section on page 21. Consumers can make use of excess food sharing platforms such

as OLIO and Too Good To Go, support ethical supermarkets such as HISBE and buy

items produced using excess food such as Snact’s fruit jerky.

Barclays | Sustainable & Thematic Investing

4 March 2019 19

3. Industry – revenue vs. responsibility or simply bad for business?

Although it may at first appear that tackling food waste represents a trade-off between

revenue and responsibility, growing awareness about the issue, as well as innovative

solutions (page 21), suggest that food waste is simply bad business. Food waste presents

opportunities for businesses on many levels including cost savings, enhancing their

reputation, boosting margins and improving staff retention.

Revenue opportunity

Tackling the issue of food waste presents numerous revenue opportunities for existing and

potential new businesses. Excess food that would otherwise have been wasted can be

turned into new products (see examples in our emerging innovation section on page 21) or

sold as ‘imperfect’ produce. We do acknowledge there is a risk to the industry if consumers

purchase less due to growing awareness of food waste. However, we think this is likely to

be partially offset through both product substitution by consumers and the use of emerging

innovation across the industry to protect profitability.

Margin opportunity

We see significant margin opportunity for companies tackling food waste. After analysing

data for 700 businesses across 17 countries, the WRI and WRAP found that for every $1

invested in reducing food waste, companies on average saved $14 or more. BCG also

estimates that companies that lead in reducing their environmental footprint tend to boast

margins 3.3pp higher than competitors.

Case Study: Apeel and Harps Food Stores – interview on page 61

We spoke with Head of Marketing at Apeel, Michelle Masek, about their work

extending the shelf life of avocados at Harps Food Stores using their plant-based

coating. “Harps have reduced their food waste in the Hass avocado category by over

50%”, this led to a “10% sales lift in avocados” and hence a “65pp increase in margin.”

Investor pressure

Alongside consumer pressure to tackle food waste, we think the issue will increasingly

appear on the investor radar as awareness continues to grow. We think food waste will

increasingly impact investment decisions and believe that companies ignoring their

responsibilities could fall short on certain sustainability measures. We spoke with Geraldine

Gilbert at Forum for the Future, who told us that investors are showing “more interest for

ethical and ambitious companies”, and that investor pressure “would likely help the issue”.

Actions to take:

− Aesthetic standards: In an attempt to combat strict aesthetic standards, ‘wonky’ veg

has been introduced by several of the mainstream food retailers. We see ‘wonky’

produce as still relatively niche but think this can help adjust consumer expectations

of perfect produce – particularly if they can buy the imperfect produce cheaper.

− Collaboration: We believe industry should increasingly engage in collaborative

initiatives with non-profits and industry organisations. We also see the need for

network and knowledge sharing along the supply chain – for example, the largest

grocers should be encouraging farmers to not waste produce by linking up farmers

with other industry players who could use the excess produce.

− C-suite support: We think senior support is significant when it comes to driving

change in the food waste agenda. Tesco’s CEO Dave Lewis chairs the Champions

12.3 group and we think this has been instrumental in Tesco becoming one of the

leading companies on food waste.

Barclays | Sustainable & Thematic Investing

4 March 2019 20

All players in the food value chain will need to take action

We argue that there is scope for action on food waste at all stages of the food value chain

and that significant progress towards SDG 12.3 will require all stakeholders to work

collaboratively towards the goal. We highlight the value chain in Figure 18 below and offer

potential actions that each stage could take in order to improve food waste. Some of the

actions available can be adopted immediately; however, in the next section we highlight

emerging innovation that could help each stage tackle the problem of food waste.

FIGURE 18 Possible approaches for reducing food waste across the food value chain…

Source: Barclays Research, Champions 12.3 2018 Progress Report

Barclays | Sustainable & Thematic Investing

4 March 2019 21

Emerging innovation can help accelerate change

There are many factors behind the problem of food waste and hence we do not believe

there is one solution. But it is clear that innovation can help improve awareness around the

issue as well as provide solutions to reduce food waste along the food value chain.

Following our discussion with the start-up community and specialised VCs, we highlight

examples of innovation and companies along each stage of the value chain in Figure 19-23.

Production – Farming & Agriculture

Within Farming & Agriculture, we believe there are five key areas of innovation: harvesting &

supply management, storage & transportation, alternative business models, product

innovation and repurposing waste – Figure 19. The increased use of AI and big data analysis

has led to a variety of smart imagery and crop management software, as well as the greater

use of autonomous robots for both data collection and field management.

For example, Trace Genomics (VC backed – $19m funding) uses machine learning to

analyse soil samples and can help farmers increase yield and see potential threats long

before they are visible in the field. Taranis (VC backed – $30m funding) is an international

precision AgTech start-up. Its AI platform combines high-resolution imagery and sensors to

derive real-time and historic insights with over 90% accuracy. Taranis is currently targeting

commodity crops (corn, cotton, sugarcane, soybean, wheat, and potatoes) and charges $5-

$20 per acre per season. It is claimed that Taranis’ suite can boost crop yields across-the-

board by as much as 7.5%. Pivot Bio is a synthetic biology company working on nitrogen-

producing microbes (VC backed – $87m funding). It will offer the first in-field solution to

biological nitrogen fixation available to farmers for 2019 planting in selected US states.

Within Barclays partnership with Unreasonable Impact, AeroFarms is a data-driven vertical

farming company on a mission to enable local production at scale. They propose an

alternative business model given that they enable local farming at commercial scale all-year

round, using 95% less water and with yields 390 times higher per square foot annually.

FIGURE 19 Emerging innovation in the production stage

Value chain

stage

Area of

innovation

Example Companies Description

Farming &

Agriculture

Harvesting &

supply

management

Farmers Edge

Trace Genomics

Vultus

Taranis

AgCode

EarthSense

Small Robot Company

Scott Technology

Smart imagery & VR: Monitoring crops and grid soil sampling

Disease prevention: Agronomic insights using soil DNA

Reduce fertilizer waste: Offers satellite based fertilizer prescriptions

Precision air-scouting: Aerial surveillance imagery to avert crop yield loss

Specialty crop management software: Harvest scheduling

Autonomous robots: Data collection and field management

Autonomous robots: To monitor, weed and plant

Automation and robotics: Used in meat cutting

Storage &

transportation

TeleSense

PICS

Wireless monitoring: Sensors collect data about grain/cold storage & transport

Hermetic storage: Low-cost crop storage bags that preserve food longer

Alternative

business

models

AeroFarms

Plenty

Local Roots

Vertical farming: Aeroponic technologies reducing environmental impact

Vertical farming: Hydroponic tech at farms just outside major urban centres

Modular farming solution: 24/7 sustainable crop production

Product

innovation

Inari

Rootility

Indigo

Pivot Bio

Plant breeding & seed foundry: Developing new crop varieties

Root-focused plant-breeding: Smart root technology to boost yields

Smart/precision farming: Coated seeds with yield-enhancing microbes

Crop nutrition specialists: Nitrogen-producing microbes

Repurposing

waste

Solum Gruppen Generating value from waste: Anaerobic digestion and in-vessel composing

Source: Barclays Research

Barclays | Sustainable & Thematic Investing

4 March 2019 22

Handling & Storage

Within Handling & Storage, we believe there are two key areas of innovation: storage &

transportation and excess produce management – Figure 20. The increased use of real-time

technology has led to the industry adopting various intelligent supply chain solutions. This

has effectively redefined the way transportation of food is planned and managed, in our

view, as well as promoting innovation focused on reducing spoilage.

For example, BT9 is an Israeli-based cold chain management solutions provider. It has a

suite of products tailored for the food industry, including BT9’s Xsense system which

minimises risks to fresh produce quality by providing real-time or offline monitoring

information to decision-makers at every segment of the cold chain. For produce storage,

Hazel Technologies is a USDA-supported AgTech company that develops biotechnology to

increase the shelf life of produce. Hazel's products are packaging inserts that release an

anti-fungal shelf life extending vapour. For apples, they have delivered 5x extended shelf, 2x

improved post-stage firmness and a 90% reduction in the incidence of scald.

FIGURE 20 Emerging innovation in the handling & storage stage

Value chain

stage

Area of

innovation

Example Companies Description

Handling &

Storage

Storage &

transportation

BT9

Hazel Technologies

Real-time cold chain technologies: Visibility for the entire cold chain

Spoilage reduction: Conditions the storage environment to slow spoilage rate

Excess

produce

management

Food Cowboy

Charity collection platform: Connects food transporters and wholesalers with

food charities, offering a waste hotline and running awareness campaigns

Source: Barclays Research

Processing & Packaging

Within Processing & Packaging, we believe there are three areas of innovation: shelf life

extension & unique packaging, repurposing surplus foods and innovative products – Figure

21. Consumer interest in sustainability and the environment has meant that up-cycled

products likes Snact, ChicP and Toast Ale have proved popular. We have even seen other

players within the value chain leverage this trend, including Tyson Foods which has started

to make crisps from up-cycled chicken breast. For food waste specifically, we believe shelf

life extension & unique packaging has garnered significant interest across the VC

community and industry bodies.

Within Barclays partnership with Unreasonable Impact, Mimica aims to reduce food waste

and improve food safety through its innovative food expiry labels. The Mimica Touch labels

allow customers to monitor the freshness of the product through simply feeling the texture

of the packaging. We spoke with the founder of Mimica who championed the value of

partnerships as the most mutually beneficial way to work. For example, for milk it is now

incorporating its label into the milk lid through a partnership with Coveris, which makes

80% of milk caps in the UK. (Refer to Appendix 1 for our full interview including information

on pricing/ROI and its global expansion plans).

We highlighted Apeel in our thematic note Future of Food Retail: Long Live Clicks and

Mortar (12/10/18), though we equally think this is relevant to our discussion on food

waste. Apeel develops invisible plant-based edible skin aimed at extending the shelf life of

fruits and vegetables by slowing down water loss and oxidation. Existing partnerships have

shown that Apeel-coated avocados have led to a 65pp increase in margin and 10% increase

in sales. (Refer to Appendix 1 for our full interview including trial feedback).

Barclays | Sustainable & Thematic Investing

4 March 2019 23

FIGURE 21 Emerging innovation in the processing & packaging stage

Value chain

stage

Area of

innovation

Example Companies Description

Processing &

Packaging

Shelf life

extension &

unique

packaging

BluWrap

Apeel Sciences

Mimica

Shelf life extension technology: Focusing on perishable protein

Shelf life extension: Edible coating to extend the shelf life of fruit and vegetables

Innovative packaging: Tactile label to indicate the spoilage of the product

Repurposing

surplus food

Snact

Rubies in the Rubble

ChicP

Foxhole Spirits

Toast Ale

Fruit jerky: Turning excess/ugly fruits into snacks

Condiments: Makes condiments from surplus produce

Hummus: Made from surplus fruit and vegetables

Gin: Made from unused resources in the English wine industry

Beer from bread: Beer brewed with surplus bread from sandwich manufacture

Innovative

products

Beyond Meat

Memphis Meats

MycoTechnology

Plant-based meat alternative: To reduce waste in supply chain

Cultured meat: Made in a lab, with less waste in production

Mushroom fermentation: To produce mycoproteins

Source: Barclays Research

Distribution & Market – Food Retail

Within Food Retail, we believe there are three areas of innovation: innovative retail formats,

excess produce management and repurposing surplus food. Within Barclays partnership

with Unreasonable Impact, HISBE is the most widely discussed innovative format within

food retail and is known as the “supermarket rebel.” Powered by local people and a social

enterprise business model, HISBE aims to reduce food waste by providing products loose

and products that are locally and ethically sourced. We spoke with co-founder Amy Anslow

who told us that their goal is to “hack the current supermarket model to make it fit and fair

for the 21

st

century”. (Refer to Appendix 1 for our full interview including information on the

business model and expansion plans).

Another growing area of focus is the idea of turning food waste into locally produced

fertiliser. For example, Vivid Life Sciences has partnered with ag-tech start-up WISErg to

produce the Lifeforce line of fertilisers, created from food waste from local grocery stores.

The “zero-waste process” reportedly retains 90% of the food nutrient value, providing a full

spectrum of nutrients and minerals to promote higher-quality crops, healthier soils and

increased ROI for growers.

FIGURE 22 Emerging innovation in the distribution & market stage

Value chain

stage

Area of

innovation

Example Companies Description

Food Retail

Innovative

formats

HISBE

Bulk Market

The Source Bulk Foods

WeFood

Flashfood

Ethical supermarket: Focusing on local suppliers and minimal waste

Bulk supermarket: Focus on minimizing waste

Buy-what-you-need: Minimal waste, bulk food grocery store

Excess food supermarket: Sells unwanted food products at a 30-50% discount

Excess food app: Sells foods near its best-before to customers via an app who

then pick up the produce in-store from a designated Flashfood area

Excess

produce

management

Spoiler Alert

412 Food Rescue

FoodCloud

Unsold inventory management: Mitigates unsold food and recovers value

Charity donation: Connects grocers with non-profits in Pittsburgh

Charity donation: Connects grocers with partner charities in Ireland and the UK

Repurposing

surplus food

Vivid Life Sciences

California Safe Soil

Repurposed fertilizer: Made from grocery food waste

Repurposed fertilizer: Aerobic, enzymatic digestion technology

Source: Barclays Research

Barclays | Sustainable & Thematic Investing

4 March 2019 24

Consumption – Foodservice and Households

Within Consumption, we believe innovation has either focused on foodservice (e.g.

restaurants) or the individual household.

For foodservice companies, this includes order forecasting, waste measurement, excess

food platforms, buying networks and repurposing. For example, Tenzo is a restaurant

management software solution that collates sales/labour/inventory data to provide

actionable insights. We spoke with the co-founder who mentioned how its offering can help

restaurants optimise labour and food – each of which account for c. 25-30% of a

restaurant’s cost line. (Refer to Appendix 1 for our full interview including Tenzo’s

partnership with Mitchell & Butlers).

For individual households, innovation has focused primarily on making the idea of food

sharing and meal planning more accessible. OLIO is a free app that connects neighbours

and local shops so that surplus food can be shared rather than wasted. It is another

member of the Barclays partnership with Unreasonable Impact and we spoke with the co-

founder who mentioned that, within the consumption stage of the value chain, there is very

little understanding of the environmental consequences attached to food production. (Refer

to Appendix 1 for our full interview including OLIO’s retail partners in the UK and how

awareness is set to grow).

FIGURE 23 Emerging innovation in the consumption stage

Value chain

stage

Area of

innovation

Example Companies Description

Foodservice

Order

forecasting

Tenzo

Restaurant demand forecasting: AI forecasting to optimize inventory levels

Waste

measurement

Winnow

Leanpath

Tracks and measures food waste: Through weighing and logging systems

Data analytics: To reduce food waste in kitchens

Excess food

platforms

Too Good to Go

Karma

Goodr

Surplus food marketplace: For restaurants

Surplus food marketplace: For grocery stores, cafes and restaurants

Blockchain food management system: Enables businesses to donate surplus

food, captures waste analytics and IRS tax savings data

New formats Instock Surplus food restaurant: Creates meals from supermarkets’ excess food

Buying

network

Bluecart Wholesale procurement: Platform to connect buyers and sellers of produce

Repurposing

surplus

FatHopes Energy Biofuel production: Used oil is piped directly from restaurants

Households

Food sharing OLIO Food sharing platform: Allows users to share food with the local community

Meal planning Innit Virtual chef: Helps consumers with meal planning, shopping and cooking

Source: Barclays Research

Barclays | Sustainable & Thematic Investing

4 March 2019 25

INVESTOR GUIDEBOOK – SECTOR IMPLICATIONS

Alongside our sector analysts, we assess the impacts of increasing food waste

awareness on a wide variety of sectors. We see Food Retail and Leisure as the sectors

most at risk, whereas we see greatest opportunity in the Food Manufacturing and

Agribusiness sectors (Figure 25).

A number of sectors fit neatly into the stages of the food value chain we have been

analysing (e.g. Agribusiness and Food Retail), whereas others sectors will be impacted

by changes across the entire value chain (e.g. Energy and Chemicals).

We analyse the risks and opportunities for each sector from increasing awareness

around food waste, highlight specific company actions that can reduce food waste and

assess relative company positioning within each sector.

Dissecting the food value chain

In Figure 24, we show the breakdown of the food value chain alongside the Barclays sectors

we believe to be both directly and indirectly impacted by growing food waste awareness. A

number of sectors fit neatly into the stages of the food value chain we have been analysing

(e.g. Agribusiness and Food Retail), whereas others sectors will be impacted by changes

across the entire value chain (e.g. Energy and Chemicals).

We have broken down the $ opportunity around food waste for each stage using the FAO’s

estimate of the value of food waste per year of $680 billion in the developed world and

$310 billion in the developing world. We highlight that, although we do not see food waste

falling to zero, as there will always be some unavoidable waste, the values in Figure 24

indicate a significant opportunity from even a small change in food waste.

FIGURE 24 Barclays sector analysis – potential opportunity across the food value chain

Source: Barclays Research, FAO 2011, WRI 2013

We see Food Retail and Leisure as the sectors most at risk from growing food waste

awareness, whereas we see greatest opportunity in the Food Manufacturing and

Agribusiness sectors (Figure 25).

~$126bn

~$113bn

~$25bn

~$63bn

~$353bn

~$96bn

~$103bn

~$14bn

~$48bn

~$48bn

~$222bn

~$217bn

~$39bn

~$111bn

~$401bn

Production Handling &

Storage

Processing &

Packaging

Distribution &

Market

Consumption

Barclays Sectors:

Agribusiness

Barclays Sectors:

Transport

Barclays Sectors:

Food Manufacturing

Packaging

Barclays Sectors:

Food Retail

Barclays Sectors:

Food Delivery

Leisure

Developing

Countries

Developed

Countries

Barclays Sectors:

Energy Chemicals

Barclays | Sustainable & Thematic Investing

4 March 2019 26

FIGURE 25 Sector implications around growing food waste awareness

Source: Barclays Research

Sector Impact

Key company

mentions

Food

Manufacturing

Opportunity

• Create innovative product offerings

• Adapt existing products

• Develop sustainable brand image

• Re-engineer manufacturing processes

• Kellogg

• Mondelez

• Kraft Heinz

Emerging

innovation

• Shelf life extension

• Repurposed products

• Assortment

management system

Food Retail

• Review promotions strategy

• Increase flexibility of supplier contracts

• Optimise order forecasting

• Promote food waste awareness

• Tesco

• Walmart

• Kroger

• Sainsbury

• Carrefour

• Upcycled products

• Innovative packaging

• Ethical supermarkets

Agribusiness

• Benefit from more flexible supply contracts

• Invest in technology around yield, storage

and demand forecasting

• Tyson

• JBS and PPC

• BRF

• Hormel

• Supply management

• Repurposed products

• Land analysis

• Produce monitoring

Leisure

• Invest in waste analytics

• Increasing use of demand forecasting

• Embrace consumer waste initiatives

• Carnival

• Sodexo

• SSP

• JD Wetherspoon

•Greggs

• Data analytics

• Smart waste

management system

• Excess food platforms

Energy

• Increasing demand for renewable fuels

• Food waste as feedstock

• Neste

• Covanta

• Energy recovery

Chemicals

• Leverage agrochemical solutions

• Improve consistency of food production

• Facilitate transport and prolong shelf life

• BASF

• Croda

• Covestro

• Seed enhancements

• Biostimulants

• Shelf life extension

Food delivery &

Meal kit solutions

• Shift towards flexible eating

• Pre-portioning of ingredients

• HelloFresh• Demand analytics

• Intelligent logistics

• Modified atmosphere

packing

Transport

• Increasing demand for supply chain

management

• Demand for in-transit shipment monitoring

• DPDHL

• Kuehne + Nagel

• DSV

• Hapag-Lloyd

• Remote monitoring

• Spoilage reduction

Risk

Packaging

• Improve shelf life stability

• Reformulate to meet sustainability goals

• Enhance supply chain efficiencies

• Enable consumers to waste less through

portion control and re-sealability

• Sealed Air

• Bemis

• Sonoco

• Avery Dennison

• High barrier film

technology

• RFID and smart labels

• Atmospheric control

Barclays | Sustainable & Thematic Investing

4 March 2019 27

Contributing Authors

European Food Retail

James Anstead

+44 (0)20 3134 6166

james.anstead@barclays.com