IRAS e-Tax Guide

GST: Reverse Charge

(Seventh Edition)

2

Published by

Inland Revenue Authority of Singapore

Published on 26 Jun 2024

First Edition on 4 Feb 2019

Second Edition on 22 Aug 2019

Third Edition on 11 Feb 2022

Fourth Edition on 3 Aug 2022

Fifth Edition on 1 Jan 2023

Sixth Edition on 1 Jan 2024

Disclaimers: IRAS shall not be responsible or held accountable in any way for any damage, loss or expense

whatsoever, arising directly or indirectly from any inaccuracy or incompleteness in the Contents of this e-Tax

Guide, or errors or omissions in the transmission of the Contents. IRAS shall not be responsible or held

accountable in any way for any decision made or action taken by you or any third party in reliance upon the

Contents in this e-Tax Guide. This information aims to provide a better general understanding of taxpayers’

tax obligations and is not intended to comprehensively address all possible tax issues that may arise. While

every effort has been made to ensure that this information is consistent with existing law and practice, should

there be any changes, IRAS reserves the right to vary its position accordingly.

© Inland Revenue Authority of Singapore

All rights reserved. No part of this publication may be reproduced or transmitted in any form or by any means,

including photocopying and recording without the written permission of the copyright holder, application for

which should be addressed to the publisher. Such written permission must also be obtained before any part

of this publication is stored in a retrieval system of any nature.

Table of Contents

1 Aim ................................................................................................................... 5

2 At a Glance ....................................................................................................... 5

3 Background....................................................................................................... 6

4 The Reverse Charge Mechanism ...................................................................... 7

4.1 Persons subject to reverse charge .................................................................... 7

(1) GST-registered persons ............................................................................. 7

(2) Non-GST registered persons ................................................................... 12

4.2 Scope of imported services ............................................................................. 13

4.3 Scope of LVG under reverse charge ............................................................... 14

4.4 Common scenarios on whether imported services or LVG will fall into the scope

of reverse charge ............................................................................................ 15

4.5 Election to apply reverse charge on all imported services and LVG ................ 16

4.6 Preventing double taxation on the supply of imported services and LVG ........ 17

5 Time of supply for imported services (made on/after 1 Jan 2020) and LVG (made

on/after 1 Jan 2023) ........................................................................................ 20

5.1 General time of supply rule ............................................................................. 20

5.2 RC Business that elected to apply reverse charge at the end of the longer

period.............................................................................................................. 21

5.3 GST was wrongly charged and refunded by supplier ...................................... 23

5.4 Situations where RC Businesses must track the time the imported services are

performed or when the LVG are delivered to Singapore ................................. 23

5.5 Accounting for GST on imported services and LVG based on posting date .... 26

5.6 Request for alternative time of supply ............................................................. 27

6 Value of supply ............................................................................................... 27

7 Intra-GST group and inter-branch transactions ............................................... 29

7.1 GST treatment under normal GST rules .......................................................... 29

7.2 GST treatment of imported services and LVG under reverse charge rules ...... 29

7.3 Value of intra-GST group and inter-branch transactions for imported services 30

8 Claiming of input tax ....................................................................................... 31

8.1 Rules for claiming input tax ............................................................................. 31

8.2 To obtain approval to support input tax claim with alternative documents ....... 32

9 Reverse charge and transfer pricing .............................................................. 32

9.1 Scope of reverse charge on payments to overseas related parties ................. 32

9.2 Transfer pricing adjustments ........................................................................... 34

10 Registration and Deregistration ....................................................................... 35

10.1 Registration rules ........................................................................................... 35

10.2 Exemption from GST registration ................................................................... 39

10.3 Voluntary GST registration ............................................................................. 40

4

10.4 Registration procedures ................................................................................. 40

10.5 De-registration ............................................................................................... 40

11 Reporting and record-keeping requirements ................................................... 41

11.1 General reporting requirements ..................................................................... 41

11.2 Adjustment for unpaid invoices ...................................................................... 41

11.3 Documentary evidence and record keeping ................................................... 44

12 Amendment to “Directly Benefit” Condition ..................................................... 45

13 Transactions Straddling Implementation Date of Reverse Charge for Imported

Services and LVG ........................................................................................... 46

14 Frequently Asked Questions ........................................................................... 52

15 Contact Information ......................................................................................... 61

16 Updates and Amendments .............................................................................. 62

Annex A – Whether you are subject to reverse charge ................................................... 65

Annex B – Services that fall within or outside the scope of reverse charge (“RC”) .......... 67

Annex C – Connected persons ....................................................................................... 80

Annex D – Checklist for applying tax on reverse charge transactions straddling 1 Jan 2020

....................................................................................................................... 82

Annex E – Step-by-step guide for reverse charge transactions straddling 1 Jan 2020 .... 84

Annex F – Checklist for the taxability of transactions straddling 1 Jan 2023 (after the

implementation of RC on LVG) ....................................................................... 86

1 Aim

1.1 The Minister for Finance announced in Budget 2018 that GST would be

applied on imported services in the context of business-to-business (“B2B”)

1

transactions by way of a reverse charge mechanism with effect from 1 Jan

2020.

2

1.2 With effect from 1 Jan 2023, GST will apply to imported low-value goods

(“LVG”) by way of extending the reverse charge and overseas vendor

registration (“OVR”) regimes. This will achieve parity in GST treatment for all

imported low-value goods consumed in Singapore regardless of whether

they are procured from overseas or locally.

1.3 This guide explains the features of the reverse charge mechanism and the

related registration and compliance rules. It also covers the amendments to

the zero-rating provisions and transitional rules for transactions spanning the

implementation date of 1 Jan 2020 for reverse charge on imported services

and 1 Jan 2023 for reverse charge on LVG.

1.4 This guide is applicable to:

(i) GST-registered persons who procure services from overseas suppliers,

import LVG, and are either not entitled to full input tax credit or belong to

GST groups that are not entitled to full input tax credit; and

(ii) Non-GST registered persons who procured or will procure services from

overseas suppliers and imported LVG exceeding S$1 million in a 12-

month period and would not be entitled to full input tax credit even if GST-

registered.

2 At a Glance

2.1 Under the reverse charge mechanism, when a supplier who belongs outside

Singapore

3

makes a B2B

4

supply of services

5

to a GST-registered person

who belongs in Singapore, the GST-registered recipient would be required to

account for GST on the value of his imported services as if he were the

supplier, to the extent the imported services fall within the scope of reverse

charge. With effect from 1 Jan 2023, the application of reverse charge would

be extended to the purchase of LVG. The requirement to perform reverse

1

Business-to-Business (“B2B”) supplies refer to supplies made to GST-registered persons, including

companies, partnerships and sole-proprietors.

2

An overseas vendor registration regime was also implemented on 1 Jan 2020 to tax business-to-consumer

(“B2C”) cross-border supplies of digital services. Refer to the e-Tax Guide “GST: Taxing imported services by

way of an Overseas Vendor Registration Regime” for information on the overseas vendor registration regime.

3

Refer to the e-Tax Guide “GST: Guidelines on Determining the Belonging Status of Supplier and Customer”

for the guidelines for determining the belonging status of the supplier.

4

Reverse charge also applies to services provided by individuals who belong overseas in his personal or

business capacity. Refer to Paragraph 4.4.1 for more information.

5

Reverse charge does not apply to imported goods which are not low-value goods (refer to paragraph 4.3).

Import of goods would be subject to GST at the point of importation into Singapore unless it qualifies for import

GST relief.

6

charge applies to all LVG and includes LVG purchased from local and

overseas suppliers, electronic marketplaces and redeliverers, regardless of

whether they are GST-registered or not. The GST-registered recipient would

be allowed to claim the corresponding GST as his input tax, subject to the

normal input tax recovery rules.

6

2.2 A non-GST registered recipient of supplies of imported services and LVG

may become liable for GST registration by virtue of the reverse charge rules.

Once registered, he would be required to apply reverse charge and account

for GST on his imported services and LVG just like any GST-registered

business who is subject to reverse charge.

2.3 For the purposes of reverse charge, inter-branch transactions (i.e.

transactions between a Singapore branch and its offshore head office, or

Singapore head office and its offshore branches) and intra-GST group

transactions

7

(i.e. transactions between a Singapore member and its offshore

members who are registered as a GST group under section 30 of the GST

Act) are not disregarded.

2.4 With the implementation of reverse charge, the “directly benefit” condition in

the zero-rating provisions would also be modified.

2.5 For imported services and LVG that span 1 Jan 2020 and 1 Jan 2023

respectively, there are transitional rules that ascertain whether and to what

extent the transactions are subject to tax and when the tax has to be

accounted.

3 Background

3.1 With the advent of technology, businesses in Singapore may increasingly

procure services from overseas that in the past could only be supplied by

local service providers. Prior to 1 Jan 2020, a supply of services (other than

an exempt supply) procured from a local GST-registered supplier is subject

to GST, while the same supply of services, if provided from an overseas

supplier (i.e. imported), is not subject to GST even if the services are

consumed in Singapore.

3.2 In addition, under the current rules, the importation of LVG is not subject to

import GST by Singapore Customs and neither does the supplier charge GST

on the supply of the LVG

8

.

3.3 Example 1 Scenario (a) illustrates the difference in the GST treatment prior

to 1 Jan 2020 between locally sourced services and imported services.

6

Where applicable, businesses may apply their prescribed fixed input tax recovery rates or special input tax

recovery formula to compute the input tax claimable on reverse charge transactions.

7

This does not refer to transactions between separate legal entities within the same corporate group (e.g.

transactions between an overseas holding company and a Singapore subsidiary).

8

This is on the assumption that the ownership of the goods were transferred to the RC Business while the

goods are still located outside Singapore and the goods belong to the RC Business at the point of importation

i.e. the RC Business is the “importer” on the import permit.

7

Example 1 Scenario (b) illustrated the difference in the current GST treatment

between locally sourced goods and imported LVG.

Example 1

Scenario (a)

Co. A engages a local advertising firm to provide media planning services. As the

local advertising firm is GST-registered, it charges GST on the fees billed to Co. A.

Co. A being a partially exempt business is not able to recover the GST as its input

tax in full. If Co. A engages an overseas advertising firm, the overseas advertising

firm does not charge GST and Co. A will not bear any GST, under the GST regime

prior to 1 Jan 2020.

Scenario (b)

Co. B purchased office supplies (e.g. stationary) from a local supplier where the

value of the goods is S$300. As the local supplier is GST-registered, it charges GST

on the sale of the goods to Co. B. Co. B being a partially exempt business is not

able to recover the GST as its input tax in full. If Co. B now purchases the same

goods from another supplier where the goods are imported via air, the goods would

qualify as LVG and would not be subject to import GST as the goods are non-

dutiable goods and the value does not exceed the import relief threshold of S$400.

As such, Co. B will not bear any GST under the current GST regime.

3.4 As shown in Example 1, all things being equal, the local suppliers may have

to lower its service fee/price of goods in order to be on par with the overseas

service provider / supplier of LVG. Hence, the absence of GST on imported

services and LVG results in an uneven playing field between the local

suppliers and the overseas service provider / supplier of LVG and puts local

suppliers at a disadvantage.

3.5 To level the GST treatment for services procured from overseas and those

procured locally so as to achieve parity in GST treatment for all services

consumed in Singapore, the reverse charge mechanism will be implemented

on 1 Jan 2020 with the intent of taxing imported services.

3.6 Similarly, to achieve parity in GST treatment for all LVG consumed in

Singapore regardless of whether they are procured from overseas or in

Singapore, the reverse charge mechanism will be extended to LVG on 1 Jan

2023.

4 The Reverse Charge Mechanism

4.1 Persons subject to reverse charge

4.1.1 In this e-Tax Guide, we refer to a person who is subject to reverse charge as

an “RC Business”.

(1) GST-registered persons

8

4.1.2 If you are a GST-registered person who procures services from overseas

suppliers

9

and LVG, you are an RC Business when:

(a) You are not entitled to full input tax credit; or

(b) You belong to a GST group that is not entitled to full input tax credit.

10

4.1.3 If you are an RC Business, you must account for GST on the value of your

imported services (with effect from 1 Jan 2020) and LVG (with effect from 1

Jan 2023) as if you were the supplier. You can claim the GST accounted for

on your imported services and LVG as your input tax.

Examples of RC Businesses:

• Taxable businesses that make substantial exempt supplies such as interest

from inter-company loans

• Partially exempt businesses such as developers of mixed-use properties,

banks and other financial institutions

• Fully taxable businesses that do not make any exempt supplies but are GST

group registered with partially exempt members

• Charities and Social Service Agencies that receive outright grants, donations

and sponsorships and provide free/ subsidised services

• Investment-holding companies that derive dividend income

To determine whether you are entitled to full input tax credit

4.1.4 You are not entitled to full input tax credit if you fall under either of the

following circumstances:

(a) You carry out non-business activities (i.e. provide free or subsidised

services)

11

; or

(b) You fail the De Minimis Rule under regulation 28 of the GST (General)

Regulations

12

at the end of any prescribed accounting period, unless

you meet the conditions in paragraph 4.1.5.

In either case, you would be an RC Business.

4.1.5 Even if you fail the De Minimis Rule, you may be entitled to full input tax

credit

13

(and hence not an RC Business), when you meet any of the following

conditions:

9

Refer to e-Tax Guide "GST: Guidelines on Determining the Belonging Status of Supplier and Customer" for

the guidelines for determining whether the supplier belongs in or outside Singapore.

10

Where a GST group has any member who is not entitled to full input tax credit, reverse charge will apply to

every member in the GST group.

11

An example would be charities and social service agencies that provide free/ subsidised activities and are

not entitled to full input tax credit. Refer to e-Tax Guide “GST: Guide For Charities And Non-Profit Organisations”

for the input tax recovery rules for charities, social service agencies and other non-profit organisations.

12

The De Minimis Rule is satisfied if the total value of all exempt supplies made does not exceed (a) an average

of S$40,000 a month; and (b) 5% of the total value of all taxable supplies and exempt supplies made in that

period. The value of taxable supplies in (b) shall exclude the value of imported services subject to reverse

charge, value of digital services supplied by an electronic marketplace operator on behalf of underlying suppliers

under the overseas vendor registration regime and value of relevant supplies received from your supplier that

are subject to customer accounting.

13

Input tax disallowed under regulations 26 and 27 of the GST (General) Regulations is still not claimable.

9

(a) You make only exempt supplies listed in regulation 33 of the GST

(General) Regulations (“regulation 33 exempt supplies”) and the nature

of your business is not one of those listed in regulation 34 of the GST

(General) Regulations (“regulation 34 business”);

Example 2

Co. B is a manufacturing company (i.e. not a regulation 34 business). At the end of

the prescribed accounting period 31 Mar 2020, Co. B determined that it does not

satisfy the De Minimis Rule. The nature of the exempt supplies made by Co. B are

realised foreign exchange differences and interest income received in respect of a

fixed deposit account placed with a local bank (i.e. regulation 33 exempt supplies).

Notwithstanding that Co. B does not satisfy the De Minimis Rule, the input tax for

the prescribed accounting period ending 31 Mar 2020 is claimable in full. Hence, Co.

B is not required to apply reverse charge.

(b) You are entitled to apply a provision in the GST legislation that grants

you the right to claim your input tax in full; or

Example 3

Co. C is an Approved Refiner under section 37B of the GST Act. Although Co. C

makes both taxable supplies and exempt supplies comprising local sales of

Investment Precious Metals, it is able to recover all its input tax incurred in the

course or furtherance of its business pursuant to regulation 46A(16) of the GST

(General) Regulations. Hence, Co. C is not required to apply reverse charge.

(c) Your non-regulation 33 exempt supplies do not exceed 5% of the total

value of your taxable and exempt supplies (i.e. you pass the Regulation

35 test), you do not incur expenses (including imported services that

are within the scope of reverse charge) that are directly attributable to

the making of non-regulation 33 exempt supplies, and your recoverable

residual input tax ratio is 100%.

GST-registered persons with fluctuating exempt supplies may elect to apply

reverse charge at the end of the longer period

4.1.6 GST-registered persons who are entitled to full input tax credit in some

accounting period(s) and not entitled to full input tax credit in other period(s)

within a particular tax year (referred to as “GST-registered persons with

fluctuating exempt supplies”) may be liable to apply reverse charge in one

accounting period but not so in the next accounting period.

For administrative ease, they may elect to apply reverse charge only at the

end of the longer period, instead of each accounting period.

14

There is no

need to write in for the Comptroller’s approval.

14

This option is not applicable to businesses that are accorded fixed input tax recovery rates as they are not

required to perform longer period adjustments. In addition, please note that this election is only applicable for

GST-registered person with fluctuating exempt supplies as defined in Paragraph 4.1.6. If the GST-registered

person is expected not to be entitled to full input tax credit for all of the accounting periods within a tax year, it

is not eligible for this election.

10

To make the election, the GST-registered person has to:

(1) Complete the “Declaration of Reverse Charge Election” form

15

and keep

it as part of his records. He may be asked to provide the form in the course

of an audit; and

(2) Proceed to only apply reverse charge at the end of the longer period, if

necessary.

Example 4

Co. D makes both taxable and exempt supplies comprising the supply of

management services and provision of inter-company loans respectively. The value

of its exempt supplies fluctuates from period to period depending on the prevailing

interest rate and amount of outstanding loans to related companies. This resulted in

Co. D being entitled to full input tax credit in some periods and not being entitled to

full input tax credits in other periods within a tax year. Co. D makes the election to

determine if it is subject to reverse charge at the end of the longer period. If Co. D

determines that it is entitled to full input tax credit for the longer period, it would not

be required to apply reverse charge on its imported services and LVG for the longer

period.

The election shall be made yearly, within one month from the end of the first

accounting period of the longer period in which the GST-registered person imports

services and LVG which are within the scope of reverse charge

16

. Once made, the

election will apply to the current and the subsequent accounting period(s) of the

longer period.

Example 5

Co. E’s prescribed accounting periods are Mar-May, Jun-Aug, Sep-Nov and Dec-

Feb.

Co. E procures services from overseas suppliers on a regular basis. It has

fluctuating exempt supplies and would like to elect to apply reverse charge at the

end of the longer period. For the tax year from 1 Jun 2019 to 31 May 2020, Co. E

would make the election by completing the “Declaration of Reverse Charge Election”

form by 31 Mar 2020 (i.e. within one month from the end of the first accounting

period of the longer period in which Co. E imports services which are within the

scope of reverse charge). The election will apply up to 31 May 2020.

Co. E will only assess whether it is required to apply reverse charge (i.e. whether it

is entitled to full input tax credit

17

) for the tax year when it files the GST return for the

prescribed accounting period ending 31 Aug 2020.

15

You can access the form on IRAS website at www.iras.gov.sg > Quick Links > Forms > GST > Self-review.

16

As imported services will only be subject to reverse charge from 1 Jan 2020, such election shall only be

made on/ after 1 Jan 2020.

17

Co. E shall use the value of supplies made in the tax year from 1 Jun 2019 to 31 May 2020 to perform the

De Minimis test and input tax apportionment computation.

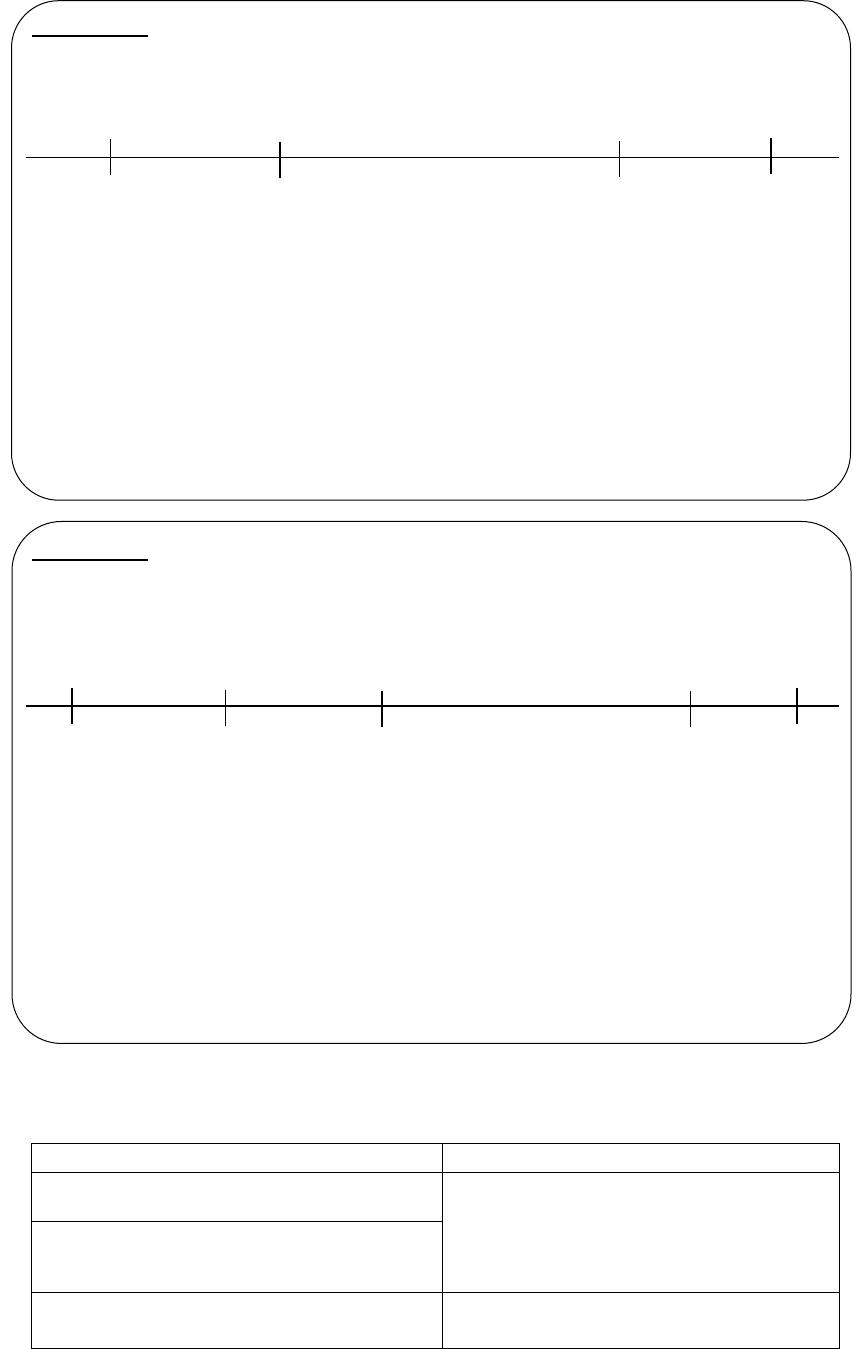

Implementation

date (01/01/20)

31/08/19

29/02/20

30/11/19

31/05/20

Tax year spanning

implementation date

01/06/19

11

Example 5 (continued)

For the subsequent tax year from 1 Jun 2020 to 31 May 2021, if Co. E would like to

continue to apply reverse charge at the end of the longer period, it would have to

make the election by completing the “Declaration of Reverse Charge Election” form

by 30 Sep 2020.

Example 6

Co. F’s prescribed accounting periods are Jan-Mar, Apr-Jun, Jul-Sep and Oct-Dec.

For the tax year from 1 Apr 2020 to 31 Mar 2021, Co. F received the first supply of

imported services from an overseas supplier on 15 Aug 2020.

Co. F has fluctuating exempt supplies and would like to elect to apply reverse charge

at the end of the longer period. Co. F will make the election by completing the

“Declaration of Reverse Charge Election” form by 31 Oct 2020 (i.e. within one month

from the end of the first accounting period of the longer period in which Co. F imports

services which are within the scope of reverse charge). The election will apply up to

31 Mar 2021.

Co. F will only assess whether it is required to apply reverse charge (i.e. whether it

is entitled to full input tax credit

18

) for the tax year from 1 Apr 2020 to 31 Mar 2021

when it files the GST return for the prescribed accounting period ending 30 Jun

2021.

GST-registered persons who are entitled to full input tax credit may elect to

apply reverse charge

4.1.7 Although you are not required to apply reverse charge, you may elect to do

so. There is no need to write in for the Comptroller’s approval.

To make the election, you have to:

(1) Complete the “Declaration of Reverse Charge Election” form

19

and keep

it as part of your records. You may be asked to provide the completed

form in the course of an audit; and

(2) Proceed to apply reverse charge on your imported services and LVG that

are within the scope of reverse charge

20

.

The election must be made yearly, within one month from the end of the first

accounting period from which you wish to apply reverse charge.

18

Co. F shall use the value of supplies made in the tax year from 1 Apr 2020 to 31 Mar 2021 to perform the

De Minimis test and input tax apportionment computation.

19

This form is posted on IRAS website at www.iras.gov.sg > Quick Links > Forms > GST > Self-review.

20

The scope of imported services and LVG which are subject to reverse charge is defined in paragraphs 4.2.1

and 4.3 respectively.

30/06/20

31/12/20

31/03/21

01/04/20

30/09/20

Import services

(15/08/20)

12

Once you make the election, you must consistently account for GST on your

imported services and LVG for one year. You will be subject to the same

rules and record keeping requirements that apply to RC Businesses.

Examples of GST-registered businesses that may wish to elect to apply reverse

charge:

• Businesses that make infrequent and irregular non-regulation 33 exempt

supplies. They may elect to apply reverse charge to avoid having to constantly

track if they meet the De Minimis Rule, to determine if they are required to

apply reverse charge.

• Fully taxable persons that belong to corporate groups (which consist of both

fully taxable persons and partially exempt persons) with centralised accounting

functions or share the same accounting system. Administratively, it might be

easier for all GST-registered persons in the corporate group to apply reverse

charge.

(2) Non-GST registered persons

4.1.8 If you are a non-GST registered person who procures services from overseas

suppliers or LVG, you would be liable for GST registration by virtue of the

reverse charge rules if you satisfy the following conditions:

(a) Your imported services and LVG which are within the scope of reverse

charge

21

exceed S$1 million in a 12-month period (under either the

retrospective or prospective basis)

22

; and

(b) You would not be entitled to full input tax credit if you were GST-

registered.

Once you are liable for GST registration by virtue of the reverse charge rules,

you would be an RC Business.

To determine whether you would be entitled to full input tax credit if you were

registered

4.1.9 You would not be entitled to full input tax credit even if you were registered,

if you fall within either of the circumstances under paragraph 4.1.4. To

determine if you fail the De Minimis Rule, you are required to apply the tests

under the De Minimis Rule using the same basis you have applied in

determining if your imported services and LVG exceed S$1 million. For

example, if the sum of your imported services and LVG exceed S$1 million

on a retrospective basis, you too are required to apply the tests under the De

Minimis Rule on a retrospective basis.

4.1.10 If a non-GST registered person becomes registered or liable for registration

by virtue of the reverse charge rules, he must comply with the responsibilities

21

The scope of imported services and LVG which are subject to reverse charge is defined in paragraphs 4.2.1

and 4.3 below.

22

The definition of retrospective basis and prospective basis is in paragraph 10.1.1 below.

13

and obligations of a GST-registered person

23

. Besides accounting for GST

on imported services and LVG, he would also be required to report his

supplies and account for GST on any standard-rated supplies made in the

course or furtherance of his business. At the same time, he would be entitled

to input tax claims, subject to the normal input tax recovery rules.

4.1.11 Annex A provides diagrammatic flowcharts for determining whether a person

would be subject to reverse charge.

4.2 Scope of imported services

4.2.1 RC Businesses must account for GST on all imported services other than:

(a) services that fall within the description of exempt supplies under the

Fourth Schedule to the GST Act;

(b) services that qualify for zero-rating under section 21(3) of the GST Act

had the services been made to them by a taxable person belonging in

Singapore;

(c) services provided by the government of a jurisdiction outside

Singapore, if the services are of a nature that fall within the description

of non-taxable government supplies under the Schedule to the GST

(Non-Taxable Government Supplies) Order of the GST Act; and

(d) services that are directly attributable to taxable supplies (this exclusion

is only applicable to RC Businesses that are not prescribed a fixed input

tax recovery rate or on special input tax recovery formula to be applied

on all input tax claims

24

).

Examples of (d):

• RC Business procures shared services (e.g. IT, legal, marketing services) from

overseas service providers and recovers a portion of the shared service fees

from his related entities. The recovery of the shared service fees constitutes

taxable supplies made by the RC Business. Hence, the portion of the shared

service fees which is recovered is considered directly attributable to his taxable

supplies and therefore not subject to reverse charge.

• RC Business procures overseas brokerage services in respect of his sale of

shares on an overseas exchange, which is zero-rated supplies. Hence, the

overseas brokerage services procured is not subject to reverse charge.

23

Refer to e-Tax Guide “GST: General Guide For Businesses” for details on the responsibilities and obligations

of a GST-registered person.

24

An RC Business that is required to directly attribute its input tax and is granted a special input tax recovery

formula that applies only on its residual input tax is entitled to exclude imported services which are directly

attributable to his taxable supplies from RC.

On the other hand, an RC Business that is accorded fixed input tax recovery rates or granted the use of a

special input tax recovery formula to be applied on all input tax claims is not entitled to this exclusion, unless it

reverts to the use of the standard input tax recovery formula as agreed with the Comptroller.

14

4.3 Scope of LVG under reverse charge

4.3.1 LVG

25

refer to goods which at the point of sale:

(i) are not dutiable goods, or are dutiable goods, but payment of the

customs duty or excise duty chargeable on the goods is waived under

section 11 of the Customs Act

26

;

(ii) are not exempt from GST;

(iii) are located outside Singapore and are to be delivered to Singapore

via air or post; and

(iv) each item of the goods has a value not exceeding the import relief

threshold of S$400.

In the above definition, ‘Point of sale’ refers to the time at which an order

confirmation is issued by the supplier or such other time as agreed with the

Comptroller, whilst ‘Singapore’ refers to customs territory.

4.3.2 From 1 Jan 2023, a GST-registered RC Business is required to perform

reverse charge on all supplies of LVG, unless the LVG is directly attributable

to its taxable supplies (this exclusion is only applicable to an RC Business

that is not prescribed a fixed input recovery rate or special input tax recovery

formula to be applied on all input tax claims).

4.3.3 The requirement to perform reverse charge applies to all supplies of LVG

(except those directly attributable to taxable supplies, where applicable) and

includes LVG supplied by local and overseas suppliers

27

, regardless of

whether the suppliers are GST-registered or not.

Determining whether the value of the goods exceed the import relief

threshold of S$400

4.3.4 An RC Business should use the value of each item of imported goods,

determined in accordance with Section 18 of the GST Act (“import value”), to

determine whether the value of each item of goods exceeds the import relief

threshold of S$400. Generally, the import value comprises the Cost,

Insurance and Freight (“CIF”) value, any customs duties payable,

commission and other incidental charges.

Determining whether the goods are located outside Singapore or to be

delivered to Singapore via air or post

4.3.5 Generally, the RC Business would usually know from the contract or sales

arrangement with the supplier whether the goods are located outside

Singapore at the point of sale and whether the goods are to be delivered to

Singapore via air or post.

25

LVG are referred to as ‘distantly taxable goods’ in the Singapore Goods and Services Tax Act 1993.

26

Intoxicating liquor and tobacco products do not fall within the scope of LVG.

27

This includes local or overseas electronic marketplace operators and redeliverers who are treated as the

supplier of the LVG.

15

4.3.6 For ease of compliance, if an RC Business is unable to verify the location of

the goods at the point of sale, or the mode of transport by which the goods

will be delivered to Singapore, the RC Business may rely on the best

available information to do so.

4.3.7 Examples of information which the RC Business may rely upon includes

information on the location and/or mode of transport of the goods stated on

the supplier’s website/mobile application or the supplier’s invoice,

confirmation on the location and/or mode of transport from the supplier, or

the import or shipping documents for the goods.

Example 7

Co. A is a GST-registered RC Business. It purchases two books, each with an import

value of S$300, for delivery to Singapore via air freight. As the import value of each

book does not exceed S$400, the supply of the books will be considered as supplies

of LVG. Co. A will be required to apply reverse charge on the supplies of LVG.

Example 8

Co. A purchases an office chair with an import value of S$700, for delivery to

Singapore via air freight. As the import value of the chair exceeds S$400, Co. A will

not be required to apply reverse charge on the supply.

At the Customs border, the existing import GST rules will continue to apply. That is,

GST will be levied by Singapore Customs on the importation of the chair since the

import value exceeds the import relief threshold of S$400.

4.4 Common scenarios on whether imported services or LVG will fall into

the scope of reverse charge

Supplies procured from individuals

4.4.1 When an RC Business procures imported services or LVG that fall within the

scope of reverse charge from a supplier who is an individual, reverse charge

would similarly apply regardless of whether the individual is carrying on a

business.

4.4.2 This is because the GST treatment of imported services and LVG should be

considered from the recipient’s perspective as the supplier. As the recipient

(i.e. the RC Business) is regarded as if it had itself supplied the goods or

services in the course or furtherance of its business, the goods or services

procured will be subject to reverse charge, regardless of whether the

supplies are made by the individual suppliers in their business or personal

capacity.

Purchases made by employees for business purposes

4.4.3 When the RC Business reimburses its employee for purchase of imported

services or LVG that the employee made on behalf of the business, the RC

16

Business needs to perform reverse charge unless the imported services or

LVG fall outside the scope of reverse charge.

4.4.4 Refer to Annex B for examples of imported services that fall in and out of the

scope of reverse charge.

4.5 Election to apply reverse charge on all imported services and LVG

4.5.1 You may elect to account for GST on all your imported services and LVG,

including services and LVG that are specifically excluded from the scope of

reverse charge (as listed in paragraphs 4.2.1 and 4.3.2 respectively). You

will be allowed to recover the corresponding input tax, subject to the normal

input tax recovery rules. There is no need to write in for the Comptroller’s

approval.

4.5.2 To make the election, you have to:

(1) Complete the “Declaration of Reverse Charge Election” form

28

and keep

it as part of your records. You may be asked to provide the completed

form in the course of an audit; and

(2) Proceed to apply reverse charge on all your imported services and LVG,

including services and LVG that are specifically excluded from the scope

of reverse charge

29

.

4.5.3 The election must be made yearly, within one month from the end of the first

accounting period in which you wish to start applying reverse charge on all

imported services and LVG.

4.5.4 Once you make the election, you must account for GST on all your imported

services and LVG consistently for one year, from the first day of the

accounting period for which you make the election.

Example 9

Co. G is a partially exempt business. Its prescribed accounting periods are Jan-Mar,

Apr-Jun, Jul-Sep and Oct-Dec.

For compliance ease, Co. G decides to make an election to subject all its imported

services to reverse charge, from the implementation of reverse charge on 1 Jan

2020.

As the first accounting period for which reverse charge will apply is from 1 Jan 2020

to 31 Mar 2020, Co. G can make the election by completing the “Declaration of

Reverse Charge Election” form any time from 1 Jan 2020 to 30 Apr 2020 (i.e. within

one month from the end of the first accounting period in which Co. G wishes to apply

reverse charge on all imported services).

28

This form will be posted on IRAS website at www.iras.gov.sg > Quick Links > Forms > GST > Self-review.

29

The scope of imported services and LVG which are subject to reverse charge is defined in paragraphs 4.2

and 4.3 respectively.

17

Example 9 (continued)

Once the election is made, Co. G will have to apply reverse charge on all its imported

services for one year, from 1 Jan 2020 (i.e. first day of the accounting period for

which Co. G makes the election) to 31 Dec 2020.

If Co. G would like to continue to apply reverse charge on all its imported services

after 2020, it will have to make a yearly election by completing the “Declaration of

Reverse Charge Election” form by 30 Apr each year.

4.6 Preventing double taxation on the supply of imported services and LVG

When the supply of imported services has been taxed before

4.6.1 Notwithstanding the rules set out in paragraph 4.2.1, when a supply of

imported services has been subject to Singapore GST previously, an RC

Business is not required to account for GST on the imported services to the

extent the supply has been taxed in Singapore. The RC Business is required

to maintain supporting documents (e.g. invoice on the first leg of transaction

showing that GST has been charged on the services) to substantiate that the

imported services have been subject to Singapore GST previously.

4.6.2 Example 10 illustrates a scenario where a supply of imported services was

subject to GST previously and the extent to which reverse charge does not

have to be applied on the imported services.

Example 10

Local Supplier A is engaged by Foreign Business B to provide valuation services in

respect of a commercial building in Singapore. As Local Supplier A is GST-

registered and the valuation services cannot qualify for zero-rating, it charges GST

on the valuation fees billed to Foreign Business B. Foreign Business B onward

supplies the same valuation services to Local Customer C. In this instance, Local

Customer C will not be required to account for GST on the supply of valuation

services by Foreign Business B to the extent the supply has been subject to GST in

Singapore.

(i) Supply from Local Supplier A to Foreign Business B:

- Valuation fee charged by Local Supplier A to Foreign Business B = S$10,000

- GST charged by Local Supplier A to Foreign Business B = S$10,000 x 9%

30

= S$900

(ii) Supply from Foreign Business B to Local Customer C:

- Valuation fee charged by Foreign Business B to Local Customer C =

S$12,000 (i.e. S$2,000 more than the fee charged by Local Supplier A to

Foreign Business B)

- GST charged by Foreign Business B to Local Customer C = Nil (Foreign

Business B is not GST-registered in Singapore)

30

The GST rate has been increased from 8% to 9% with effect from 1 Jan 2024. Please refer to the e-Tax

Guide “2024 GST Rate Change: A Guide for GST-registered Businesses” for more information on rate

change.

18

Example 10 (continued)

Local Customer C is required to account for GST on S$2,000 (i.e. S$12,000 –

S$10,000; the portion of the valuation fee charged by Foreign Business B that has

not been subject to GST).

Accordingly, Local Customer C must account for the imported valuation services as

follows:

Value of imported services = S$12,000 – S$10,000 = S$2,000

Value of GST on imported services = S$2,000 x 9% = S$180

When OVR suppliers had incorrectly charged GST or when GST on LVG

was paid to Singapore Customs

4.6.3 A GST-registered OVR supplier would charge GST on his supplies of digital

services/remote services

31

or LVG

32

if he regards the customer as a non-

GST registered person in Singapore. Hence, in the event an RC Business

procures digital services/remote services

29

or LVG

30

from an OVR supplier

but does not correctly represent to the supplier that he is GST-registered in

Singapore, he would be charged GST on his purchase of digital

services/remote services

29

or LVG

30

.

4.6.4 Where the RC Business has been wrongly charged GST by the OVR

suppliers, the RC Business should comply with the following:

(i) the RC Business should first contact the OVR supplier to obtain a refund

of the GST wrongly charged, instead of making an input tax claim on

the purchase; and

(ii) if the RC Business obtained a refund of the GST paid on the imported

services or LVG and no GST was paid to Singapore Customs at the

point of importation of the LVG, it is required to perform reverse charge

on the imported services or LVG (provided that the imported services

or LVG falls within the scope of reverse charge). Subject to the normal

input tax recovery rules, the RC business can claim the corresponding

input tax.

4.6.5 To prevent double-taxation, an RC Business need not perform reverse

charge on a supply of imported services or LVG with effect from 1 Jan 2023

if:

31

With effect from 1 Jan 2023, the Overseas Vendor Registration Regime will be extended to supplies of non-

digital services made to non-GST registered customers in Singapore. In other words, all supplies of services

procured from overseas suppliers by non-GST registered customers in Singapore, whether digital or non-digital,

which can be supplied and received remotely (i.e. known as “remote services”) will be taxed under the Overseas

Vendor Registration Regime.

32

With effect from 1 Jan 2023, imported LVG in respect of business-to-consumer (“B2C”) transaction will be

subject to GST by way of extending the Overseas Vendor Registration Regime. GST-registered OVR suppliers

must duly charge GST on their supplies of LVG, if their customer is not GST-registered. OVR suppliers should

not charge GST on supplies of LVG made to GST-registered customers that have provided their GST

registration numbers. Instead, the GST-registered customers (i.e. the RC Business) will perform reverse charge

on these overseas purchases if they fall within the scope of reverse charge.

19

(i) the RC Business did not obtain a refund of the GST that was wrongly

charged by the OVR supplier on that supply of imported services or

LVG and it has already paid the GST to the GST-registered OVR

supplier at the point of purchase.

However, the RC Business is also not allowed to claim the GST paid to

the OVR supplier as its input tax

33

.

(ii) the RC Business has already paid GST to Singapore Customs at the

point of importation of the LVG. As mentioned in Paragraph 4.6.6 below,

such input tax is claimable, subject to the normal input tax recovery

rules.

4.6.6 There could also be cases where the RC Business paid GST on the LVG to

Singapore Customs, which may occur if the CIF value of the goods exceeds

the import relief threshold of S$400 during importation (e.g. due to exchange

rate fluctuations from the point of sale to the point of importation), resulting

in Customs collecting GST on the import. In such cases where import GST

is correctly levied, the RC Business can claim the import GST paid on the

LVG, subject to the normal input tax recovery rules.

4.6.7 For clarity, notwithstanding paragraph 4.6.5, in determining whether a non-

GST registered business is liable for GST registration by virtue of the reverse

charge rules, the business must include the supplies of imported services

and LVG even where GST has been paid to the OVR suppliers or Singapore

Customs at the point of importation in computing its value of imported

services and LVG.

Example 11

Co. A is an RC Business who made a purchase of LVG from local GST-registered

electronic marketplace operator E. As Co. A provided its GST registration number

to marketplace operator E, marketplace operator E should not charge and account

for GST on the supply. Instead, Co. A is required to account for GST under the

reverse charge on the purchase of LVG.

Example 12

Co. A makes a purchase of remote services from an overseas GST-registered

electronic marketplace operator F. Co. A inadvertently omitted to provide its GST

registration number. Hence, electronic marketplace operator F charged and

accounted for GST on the supply to Co. A. Co. A did not seek a refund of the GST

from marketplace operator F.

With effect from 1 Jan 2023, since Co. A has paid GST on the imported services to

marketplace operator F at the time of purchasing the services, Co. A is not required

to account for GST under the reverse charge on the supply of imported services.

However, Co. A is not allowed to claim the GST paid to marketplace operator F as

its input tax.

33

As the scope of tax under the OVR regime only covers B2C sales of digital services/remote services and

LVG (i.e., sales to non-GST registered customers), any GST charged on a B2B sale would mean that GST

was incorrectly charged by the OVR Vendor. Accordingly, no input tax claims will be allowed to the customer.

20

Example 13

Co. B is an RC business who made a purchase of LVG from overseas supplier G.

The supply of LVG was made in foreign currency and had an import value of S$390

at the time of supply.

At the time of importation, the actual import value of the goods was S$420 due to

exchange rate fluctuations. As the import value of the goods exceeded the S$400

import relief threshold, GST was levied by Singapore Customs on the imported

goods.

Since Co. B has already paid GST on the LVG to Singapore Customs at the time of

importation, Co. B is not required to account for GST under the reverse charge on

the supply of LVG. Co. B is allowed to claim the GST paid to Singapore Customs

as its input tax, subject to the normal input recovery rules.

5 Time of supply for imported services (made on/after 1 Jan 2020) and

LVG (made on/after 1 Jan 2023)

34

5.1 General time of supply rule

5.1.1 The general time of supply rule for reverse charge is the earlier of the

following two events:

(a) When invoice in respect of the supply is issued; and

(b) When payment in respect of the supply is made.

RC Business

5.1.2 You are required to account for GST on your imported services and LVG

based on the date of the supplier’s invoice or the date you pay the supplier,

whichever is earlier.

Example 14

According to the general time of supply rule for reverse charge, the time of supply

shall be on 15 Jul 2020, i.e. the earlier of the date of the supplier’s invoice and the

date of payment. If your prescribed accounting periods are Jan-Mar, Apr-Jun, Jul-

Sep and Oct-Dec, you will account for GST on the imported services in the

prescribed accounting period ended 30 Sep 2020. The date the services are

performed does not trigger the time of supply for this reverse charge transaction.

34

Refer to paragraph 13 for the transitional time of supply rule for transactions straddling 1 Jan 2020 and 1

Jan 2023.

Supplier’s

invoice date

Payment

made

15/06/20

15/07/20

01/10/20

Services

performed

21

Example 15

According to the general time of supply rule for reverse charge, the time of supply

shall be on 30 Jun 2020, i.e. the earlier of the date of the supplier’s invoice and the

date of payment. If your prescribed accounting periods are Jan-Mar, Apr-Jun, Jul-

Sep and Oct-Dec, you shall account for GST on the imported services in the

prescribed accounting period ended 30 Jun 2020.

Non-GST registered business

5.1.3 If you are a non-GST registered business, you will apply the general time of

supply rule for reverse charge to determine when your imported services and

LVG exceed the S$1 million threshold. You will treat the date of the supplier’s

invoice or the date of payment to the supplier, whichever is earlier, as the

date the imported services and LVG are being supplied to you.

Example 16

You are a non-GST registered business who would not be entitled to full input tax

credit if you were GST-registered. You make a procurement of IT services from an

overseas supplier. You paid S$1.1 million for the imported IT services.

Based on the general time of supply rule for reverse charge, the supply of imported

IT services is considered as being made on 15 Dec 2020, i.e. the earlier of the date

of the supplier’s invoice and the date of payment. To the extent the IT services fall

within the scope of reverse charge, you will be liable for GST registration on 31 Dec

2020 (i.e. the end of the calendar year in which the total value of your imported

services exceed S$1 million).

5.2 RC Business that elected to apply reverse charge at the end of the

longer period

5.2.1 Notwithstanding the above, if you are a GST-registered RC Business that

elected to apply reverse charge at the end of the longer period (as mentioned

in paragraph 4.1.6), the time of supply of your imported services and LVG

shall be on the day immediately after the last day of the longer period, i.e. the

first day of the accounting period in which the longer period adjustment is

made. Hence, you will only be required to account for GST on your imported

services and LVG for the longer period in the GST return following the end of

the longer period.

LVG delivered to

the RC Business

Supplier’s invoice

date

Payment

made

31/10/20

31/01/21

Services

performed

15/12/20

20/06/20

Supplier’s

invoice date

Payment

made

30/06/20

01/07/20

22

Example 17

Your prescribed accounting periods are Jan-Mar, Apr-Jun, Jul-Sep and Oct-Dec and

you have elected to apply reverse charge at the end of the longer period.

According to the general time of supply rule for reverse charge, the time of supply

is 15 Jul 2020. However, as you have elected to apply reverse charge at the end of

the longer period, the time of supply for this imported service is 1 Apr 2021. At the

end of the tax year 1 Apr 2020 to 31 Mar 2021:

• if you establish that you are not entitled to full input tax credit, you will account

for GST on the imported services in the GST return for the prescribed accounting

period ended 30 Jun 2021.

• if you establish that you are entitled to full input tax credit, you are not required

to account for GST on the imported services.

Example 18

Your prescribed accounting periods are Jan-Mar, Apr-Jun, Jul-Sep and Oct-Dec,

you have elected to apply reverse charge at the end of the longer period. You started

making exempt supplies from 1 May 2020.

According to the general time of supply rule for reverse charge, the time of supply

is 3 May 2020. However, as you have elected to apply reverse charge at the end of

the longer period, the time of supply for this imported service is 1 Apr 2021. At the

end of the longer period 1 May 2020 to 31 Mar 2021:

• if you establish that you are not entitled to full input tax credit, you will account

for GST on the imported services in the GST return for the prescribed accounting

period ended 30 Jun 2021.

• if you establish that you are not subject to reverse charge, you are not required

to account for GST on the imported services.

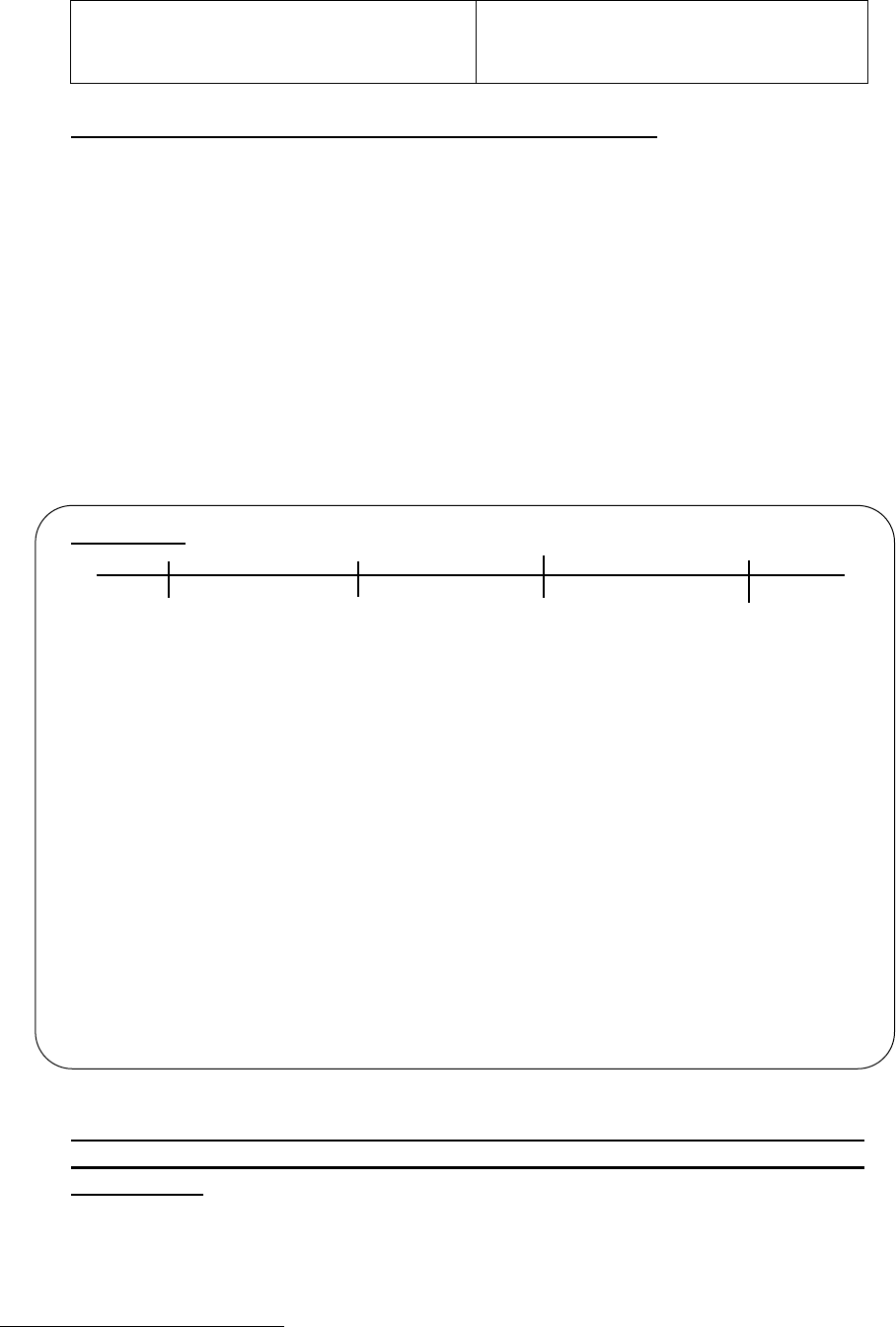

5.2.2 The table below summarises the general time of supply rules for reverse

charge:

Types of businesses

Time of supply

RC Business

Earlier of issuance of supplier’s

invoice or payment made

Non-GST registered business (to

determine GST registration liability)

RC Business that elected to

determine the application of reverse

Day immediately after the last day

of the longer period (i.e. first day of

Supplier’s invoice

date

20/06/20

01/10/20

Payment

made

Services

performed

15/07/20

Payment

made

End of tax

year

31/03/21

Supplier’s invoice

date

End of tax

year

02/05/20

31/03/21

Services

performed

03/05/20

30/09/20

Date of GST

registration

01/05/20

23

charge at the end of the longer

period

the accounting period in which the

longer period adjustment is made)

5.3 GST was wrongly charged and refunded by supplier

5.3.1 There are instances where the suppliers have wrongly charged GST on

supplies of imported services and LVG to an RC business

35

. Where the RC

business requests for a refund of the GST incorrectly charged on the

imported services and LVG from the supplier and correspondingly needs to

account for reverse charge on the imported services and LVG, it is required

to apply reverse charge on the imported services and LVG at the earlier of:

(i) when a revised invoice in respect of the supply of imported services

and/or LVG is issued or posted; and

(ii) when the refund of the amount wrongly charged as GST is received from

the supplier.

Example 19

Co. B is an RC business who made a purchase of LVG from GST-registered

electronic marketplace operator G. Co. B inadvertently omitted to provide its GST

registration number. Hence, electronic marketplace operator G charged GST on the

supply to Co. B and issued an invoice for the sale on 31 Mar 2023.

Co. B contacted marketplace operator G to seek a refund of the GST incorrectly

charged and provided its GST registration number to the marketplace. On 15 Apr

2023, a revised invoice was issued by the OVR Vendor to correct the GST wrongly

charged. The refund of the monies was received on 16 Apr 2023.

Based on the time of supply rules, the time of supply for the reverse charge

transaction is triggered on 15 Apr 2023, when the revised invoice was issued. Co.

B is therefore required to apply reverse charge on the LVG on 15 Apr 2023.

5.4 Situations where RC Businesses must track the time the imported

services are performed or when the LVG are delivered to RC

Businesses

5.4.1 The following are situations where RC Businesses must track the time the

imported services are performed or the LVG are delivered (i.e. the Basic Tax

Point):

35

Refer to Paragraph 4.6.5.

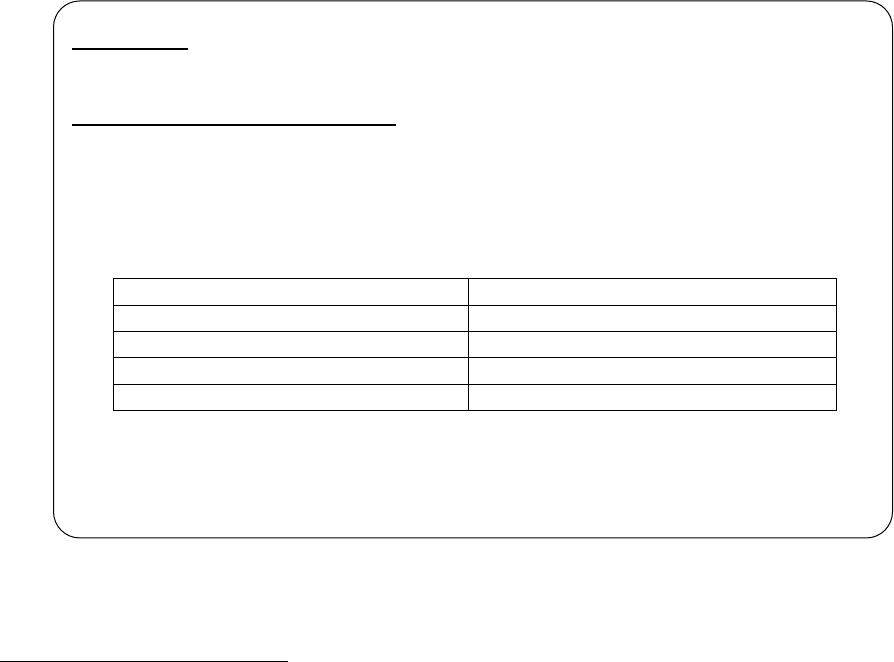

31 Mar 2023

Issuance of invoice

with GST

15 Apr 2023

Revised invoice

issued

16 Apr 2023

Refund of amount

wrongly charged

as GST received

5 Apr 2023

Request for

refund of GST

24

Example 20

The services that you procure from an overseas supplier is performed by 30 Apr 2020.

You maintain a service agreement to prove that the services are performed by 30 Apr

2020. You are GST-registered on 1 May 2020.

According to the general time of supply rule for reverse charge, the time of supply is

2 May 2020. However, as the transaction straddles the date of GST registration (i.e.

services performed before GST registration), you are allowed to treat the supply as

taking place on 30 Apr 2020 and hence, not apply reverse charge on the transaction.

Correspondingly, you are not entitled to claim any input tax in respect of the

transaction.

02/05/20

30/04/20

Supplier’s invoice

date

01/05/20

15/05/20

Date of GST

registration

Services

performed

(1) To determine whether an imported service or LVG that straddles

GST-registration date

36

is subject to reverse charge

Imported services or LVG received by a newly-registered RC Business

may straddle its GST registration date.

In such circumstances, if the supplier’s invoice is issued and payment is

made after the RC Business’ effective date of GST registration, the supply

of the imported services or LVG shall be treated as taking place after the

RC Business’ date of GST registration and hence, reverse charge shall

apply.

However, if the Basic Tax Point takes place before the RC Business

becomes GST-registered, the RC Business may rely on the Basic Tax

Point to determine when the supply is made and hence, not apply reverse

charge on the imported services which are performed or LVG which is

received before its GST registration. If the RC Business wishes to rely on

the Basic Tax Point to determine the time of supply, the RC Business

must maintain supporting documents (e.g. service contracts, delivery

note) to substantiate that the Basic Tax Point took place before its GST

registration.

(2) To determine whether an imported service or LVG that straddles de-

registration date

37

is subject to reverse charge

36

A transaction would be considered as straddling the GST-registration date if one or two of these three

events occur(s) before the RC Business’ effective date of GST registration: services performed, supplier’s

invoice issued, payment made.

37

A transaction would be considered as straddling the de-registration date if one or two of these three events

occur(s) before the RC Business’ effective date of de-registration: services performed, supplier’s invoice

issuance, payment made.

Payment

made

25

Example 21

You procure services from an overseas supplier on 15 May 2021 before de-registering

from 1 July 2021. The value of the supply of imported services is S$10,000.

You have to account for GST on the part payment of S$3,000 made on 15 Jun 2021.

As the Basic Tax Point (i.e. services performed) took place before you become de-

registered, notwithstanding that the time of supply for the remaining balance of

S$7,000 has not been triggered by the supplier’s invoice or payment before the de-

registration date, you are required to account for GST on the remaining balance of

S$7,000 on 30 Jun 2021 (i.e. the day immediately before you are de-registered), in

your final GST F8 return for the period ending 30 Jun 2021.

31/05/21

01/07/21

De-registered

from GST

15/06/21

25/07/21

Makes part

payment of S$3,000

Services

performed

15/07/21

Imported services or LVG received by an RC Business that has cancelled

its GST registration may straddle its GST de-registration date.

In such circumstances, when the Basic Tax Point takes place before the

RC Business becomes de-registered and full output tax on the imported

services or LVG has not been accounted for as at the date of de-

registration, the supply of imported services or LVG shall (to the extent

that it is not covered by any invoice issued or payment made) be treated

as taking place on the day immediately before it ceases to be registered

for GST.

In other words, RC Businesses are required to apply reverse charge on

imported services which are performed and LVG which is received prior

to its de-registration.

(3) To determine the time of supply for a supply of imported services

and LVG procured from a connected person, overseas branch or

head office or overseas member within the same GST group

38

A supply of imported services or LVG procured from a connected person,

overseas branch or head office (as mentioned in paragraph 7.2.1(a)

below), or overseas member within the same GST group (as mentioned

in paragraph 7.2.1(b) below) shall be treated as taking place at the earliest

of the following:

(a) when invoice is issued;

(b) when payment is made; and

(c) 12 months after the Basic Tax Point (i.e. when the LVG is delivered to

the RC Business and when the services are performed).

38

Refer to Annex C for the definition of connected persons.

Supplier’s

invoice date

Pays remaining

S$7,000

26

Example 22

You engaged your overseas subsidiary to provide accounting support services to

you for the period from 1 Jan 2020 to 31 Dec 2020.

If your overseas subsidiary does not issue any invoice to you and you do not

make any payment for the services before 31 Dec 2021, the time of supply of the

imported services shall be triggered on 31 Dec 2021 (i.e. 12 months after the

Basic Tax Point). Accordingly, you shall account for GST on the accounting

support services in your GST return for the period in which 31 Dec 2021 falls.

However, the 12-month rule does not apply to the following supplies of

imported services and LVG:

• a supply of imported services or LVG under a contract which provides

for the retention of any part of the consideration by one party pending

full and satisfactory performance of the contract, or any part of it, by

the other party

• a supply of imported services (including telecommunication services)

for a period for a consideration the whole of part of which is determined

or payable periodically or from time to time

• a supply of imported services comprising the right to use a benefit

where the whole of the consideration for the supply (being in the

nature of royalties or other similar payments) cannot be ascertained

at the time the services are performed but only subsequently by a

person other than the supplier of the services upon the use of the

benefit

• a supply of imported services or LVG in the course of the construction,

alteration, demolition, repair or maintenance of a building or of any

engineering work under a contract which provides for payments for

such supplies to be made periodically or from time to time

• a supply of LVG under an arrangement where:

(i) the supplier retains the property in the goods until the goods or a

part of them are appropriated under the agreement by the buyer;

and

(ii) the whole or part of the consideration is determined at the time

of that appropriation.

For the abovementioned supplies of imported services and LVG, GST is

to be accounted for based on the general time of supply rule for reverse

charge as stated in paragraph 5.1 above.

5.5 Accounting for GST on imported services and LVG based on posting

date

5.5.1 Notwithstanding paragraphs 5.1.1 and 5.1.2, GST-registered RC Businesses

are allowed to account for GST on their imported services and LVG based

on the posting date

39

of the imported services and LVG in their business

39

Refers to invoice posting date or journal posting date (in the absence of the supplier’s invoice).

27

accounts (instead of the supplier’s invoice date) if the method is consistently

applied for all GST returns.

5.5.2 However, a payment made to the overseas supplier before the posting date

will still trigger the time of supply.

Example 23

Your prescribed accounting periods are Jan-Mar, Apr-Jun, Jul-Sep and Oct-Dec.

Scenario (a)

According to the general time of supply rule for reverse charge, the time of supply

is 25 Mar 2020, i.e. when the supplier’s invoice is issued. However, if you

consistently account for GST on imported services based on the posting date of

suppliers’ invoices, you will account for GST on this supply of imported services on

1 Apr 2020 (i.e. earlier of invoice posting date and payment date), in your GST return

for the prescribed accounting period ending 30 Jun 2020.

Scenario (b)

According to the general time of supply rule for reverse charge, the time of supply

is 25 Mar 2020, i.e. when the supplier’s invoice is issued. If you consistently account

for GST on imported services based on the posting date of suppliers’ invoices, you

will account for GST on this supply of imported services on 27 Mar 2020 (i.e. earlier

of invoice posting date and payment date), in your GST return for the prescribed

accounting period ending 31 Mar 2020.

5.6 Request for alternative time of supply

5.6.1 In the event where you face difficulty in reporting the supplies that are subject

to reverse charge based on the earlier of when the supply is entered into your

books of account or when you pay the consideration for the supply, you may

write to the Comptroller to request for an alternative time of supply for

reporting your reverse charge transactions. However, the proposed

alternative time of supply must be earlier than the normal time of supply for

the reverse charge transaction.

6 Value of supply

6.1.1 GST is to be accounted for on the value of the imported services and LVG at

the time of supply.

25/03/20

Supplier’s invoice

posting date

01/04/20

Supplier’s invoice

date

Payment date

05/04/20

Payment date

Supplier’s invoice

date

Supplier’s invoice

posting date

25/03/20

27/03/20

01/04/20

28

6.1.2 Consideration paid wholly in money

If an RC Business pays the overseas supplier for the imported services

and/or LVG wholly in money, the value of imported services and/or LVG will

be the amount equal to the consideration paid for the services and/or LVG.

Accordingly, the GST to be accounted for shall be computed based on 9% of

the consideration paid for the imported services and/or LVG as follows:

Value of supply = Money consideration

GST = Money consideration x 9%

6.1.3 Consideration is not consisting or not wholly consisting of money

If an RC Business does not pay for the imported services and/or LVG wholly

in money, the value of the imported services and/or LVG will be its open

market value. Accordingly, the GST to be accounted for shall be computed

based on 9% of the open market value of the imported services and/or LVG

as follows:

Value of supply = Open market value

GST = Open market value x 9%

6.1.4 Services and LVG procured from a connected person

40

(including an

overseas member within the same GST group) or an overseas branch/ head

office

If an RC Business procures services and/or LVG from (i) an overseas related

party who is a “connected person” (including an overseas member within the

same GST group) or (ii) its overseas branch or head office, the value of the

imported services and/or LVG would be the open market value if the

consideration paid for the imported services and/or LVG is less than the open

market value of the supply.

If there is a cost allocation from an overseas member within the same GST

group or its overseas branch/ head office, the value of the imported service

41

may be reduced by the salaries, wages and interest cost components of the

imported service, including their proportionate mark-up in accordance with

transfer pricing policy (refer to paragraph 7.3.1 below for details).

6.1.5 Foreign currency denominated invoices

If an imported service and/or LVG is invoiced in a foreign currency, the RC

Business is required to convert the invoice amount using an acceptable

exchange rate

42

and account for GST on the reverse charge transaction

based on the Singapore dollar equivalent. To compute the Singapore dollar

equivalent of the corresponding input tax, the RC Business is required to

40

Refer to Annex C for the definition of connected persons.

41

This does not apply to LVG.

42

Refer to the e-Tax Guide “Exchange Rates for GST Purpose” for the definition of acceptable exchange rates.

29

apply the same exchange rate that is used to compute the SGD equivalent

of the output tax.

Subject to the conditions in the e-Tax Guide “GST: Exchange Rates for GST

Purpose”, an RC Business may use his in-house exchange rates to convert

the value of the imported services and LVG.

6.1.6 Reverse charge supplies subject to withholding tax

If a reverse charge supply comprising imported services and/or LVG is to be

subject to withholding tax, the value of the supply shall be the consideration

paid for the supply, without any deduction of withholding tax

43

.

6.1.7 Related services for supply of LVG

In addition, the value of supply of LVG should also include any amounts paid

by the RC Business for related services such as transportation and insurance

for the goods.

Example 24

Co. B is a GST-registered RC Business who purchased an office chair for S$350.

The supplier charged Co. B an additional S$30 for the transportation and insurance

costs to deliver the chair to Singapore.

The value of supply of the chair is the total monetary consideration of S$380.

7 Intra-GST group and inter-branch transactions

7.1 GST treatment under normal GST rules

7.1.1 Under normal GST rules, any supply made between members of the same

GST group are disregarded for GST purposes. Likewise, supplies made

between head office and its branches are disregarded for GST purposes, as

they are regarded as a single legal entity.

7.2 GST treatment of imported services and LVG under reverse charge

rules

7.2.1 However, reverse charge will apply in the following circumstances:

(a) A local branch or head office procuring services or LVG from an overseas

branch or head office.

(b) A local member of a GST group procuring services or LVG from an

overseas member within the same GST group.

43

If RC Business pays withholding tax (e.g. S$100) out of the consideration for the reverse charge supply

(e.g. S$1,000) and only pays the net amount of S$900 to the supplier, he should account for reverse charge

based on S$1,000. On the other hand, if the consideration for the supply is S$1,000 but the RC Business pays

an additional S$100 for withholding tax, he should still account for reverse charge on S$1,000.

30

7.3 Value of intra-GST group and inter-branch transactions for imported

services

7.3.1 If you are a local branch or head office procuring services from your overseas

branch or head office (i.e. supplies within the same legal entity), or a local

member of a GST group procuring services from an overseas member within

the same GST group

44

, you shall account for GST on the value of the inter-

branch or intra-GST group transaction which is subject to reverse charge,

which can be calculated as follows: