Insert Classification

Classification: Public

ANZ TRANSACTIVE – GLOBAL

FILE FORMATS

(WITH ANZ TRANSACTIVE – AU & NZ PAYMENTS

)

02|2018

1

Insert Classification

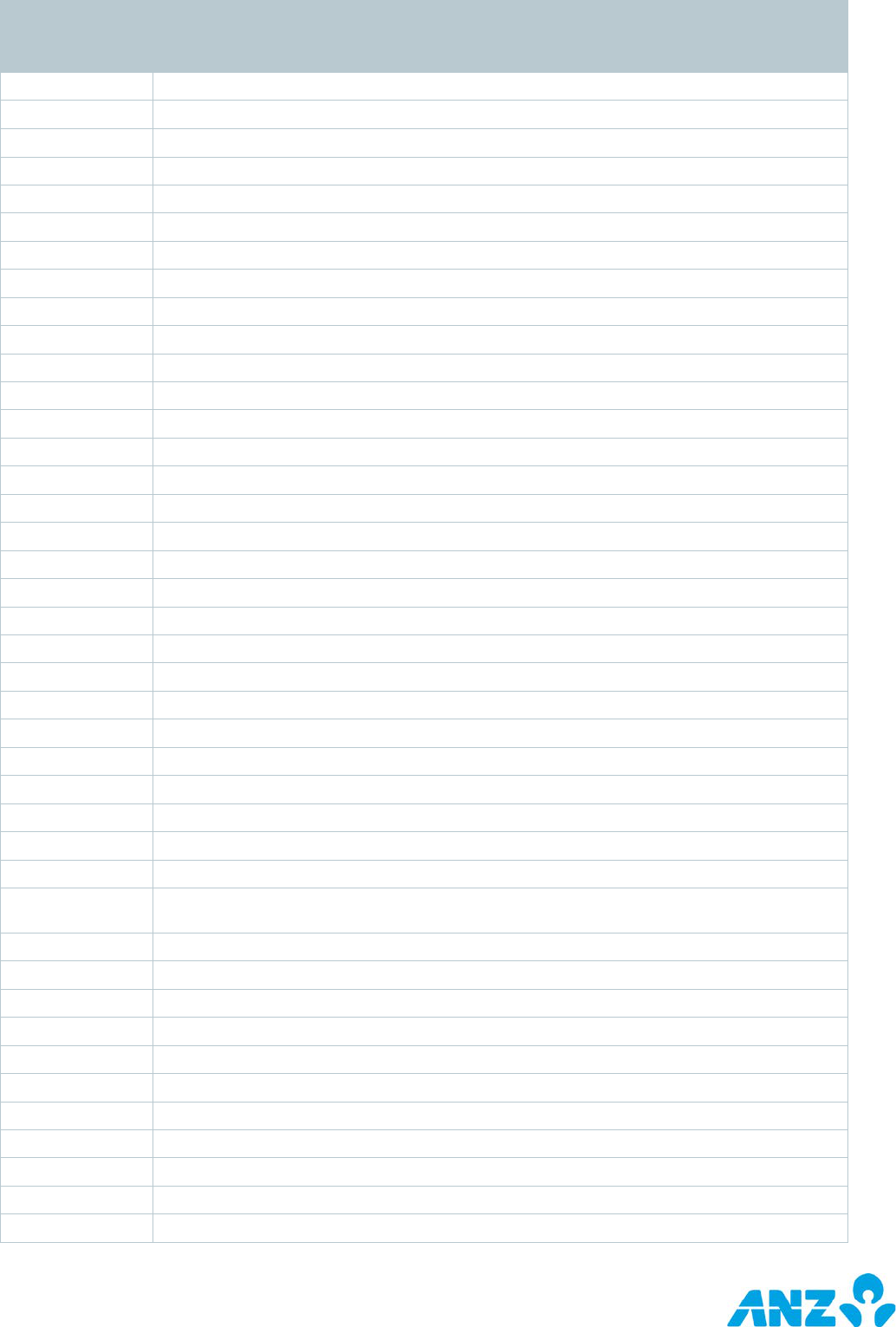

CONTENTS

1 INTRODUCTION .................................................................................................... 4

1.1 About this guide................................................................................................................................. 4

1.2 Scope ............................................................................................................................................... 4

1.3 Online Help ....................................................................................................................................... 4

1.4 Online Resources ............................................................................................................................... 4

1.5 Further Assistance.............................................................................................................................. 4

1.6 File Formats Overview (Payables) ........................................................................................................ 5

2 AU DOMESTIC PAYMENTS FILE FORMATS ................................................................. 6

2.1 ABA File Format ................................................................................................................................. 6

2.1.1 Import Methods ........................................................................................................................... 6

2.1.2 ABA File Layout and Character Set ................................................................................................. 6

2.1.3 Descriptive record (0) .................................................................................................................. 7

2.1.4 Detail record (1) .......................................................................................................................... 7

2.1.5 Batch Control Record (7) .............................................................................................................. 9

2.2 AU Domestic Payments CSV Detail Import ............................................................................................ 10

2.2.1 CSV File Layout and Character Set ................................................................................................ 10

2.2.2 Detail Record ............................................................................................................................. 10

3 NZ DOMESTIC PAYMENTS FILE FORMATS ............................................................... 11

3.1 NZ Domestic Payment CSV (Full File Import) ........................................................................................ 11

3.1.1 File Layout and Character Set ....................................................................................................... 11

3.1.2 Descriptive Record ...................................................................................................................... 11

3.1.3 Detail Record ............................................................................................................................. 12

3.1.4 Batch Control Record................................................................................................................... 13

3.2 NZ Domestic Payments CSV Detail Import (with Control Record) ............................................................ 14

3.2.1 File Layout and Character Set ....................................................................................................... 14

3.2.2 Descriptive Record ...................................................................................................................... 14

3.2.3 Detail Record ............................................................................................................................. 14

3.2.4 Batch Control Record................................................................................................................... 15

3.3 NZ Domestic Payments CSV Detail Import (without Control Record) ........................................................ 16

3.3.1 File Layout and Character Set ....................................................................................................... 16

3.3.2 Detail Record ............................................................................................................................. 16

4 SINGLE PAYMENTS FILE FORMATS ......................................................................... 17

4.1 MT101 File Format (Australia & New Zealand)....................................................................................... 17

4.1.1 File Naming Convention ............................................................................................................... 17

4.1.2 MT101 File Layout and Character Set ............................................................................................ 17

4.1.3 Character Set ............................................................................................................................. 17

4.1.4 Sequence A – General Information ................................................................................................ 18

4.1.5 Sequence B – Transaction Detail Record ........................................................................................ 19

4.1.6 Clearing System Codes ................................................................................................................ 21

4.2 WIRS file format (Australia only) ......................................................................................................... 22

4.2.1 File Naming Convention ............................................................................................................... 22

4.2.2 WIRS File Layout and Character Set .............................................................................................. 22

4.2.3 Character Set ............................................................................................................................. 22

4.2.4 Detail Record ............................................................................................................................. 23

4.2.5 Miscellaneous Field Format Specifications ...................................................................................... 24

4.2.6 Account with Institution Country ISO Code..................................................................................... 24

4.2.7 Conditional field rules: ................................................................................................................. 24

4.3 NZ International Payment CSV file format (New Zealand only) ................................................................ 25

4.3.1 File Naming Convention ............................................................................................................... 25

4.3.2 NZ International CSV File Layout and Character Set ........................................................................ 25

4.4 BPAY File format (Australia only) ......................................................................................................... 28

4.4.1 BPAY File Layout and Character Set .............................................................................................. 28

4.4.2 File Header Record ...................................................................................................................... 28

4.4.3 Payment Instruction Record ......................................................................................................... 29

4.4.4 File Trailer Record ....................................................................................................................... 30

5 BTR AND RETURNED ITEMS FILE FORMATS ............................................................ 31

5.1 BAI File ............................................................................................................................................ 31

5.1.1 Reserved Characters ................................................................................................................... 31

5.1.2 BAI File Layout ........................................................................................................................... 31

5.1.3 File Header Record ...................................................................................................................... 32

5.1.4 Group Header Record .................................................................................................................. 32

5.1.5 Account Identifier and Summary Status Record (03) ....................................................................... 33

5.1.6 Transaction Detail Record (16) ..................................................................................................... 34

5.1.7 Continuation Record (88) ............................................................................................................. 35

5.1.8 Account Trailer Record (49) ......................................................................................................... 35

5.1.9 Group Trailer Record (98) ............................................................................................................ 36

5.1.10 File Trailer Record (99) ............................................................................................................. 36

5.2 Statement Files................................................................................................................................. 37

5.2.1 Statement Balance File Format ..................................................................................................... 37

2

Insert Classification

5.2.2 Statement Transaction File Format ................................................................................................ 38

5.3 SAP/Multicash Files ........................................................................................................................... 40

5.3.1 SAP/Multicash Balance File Format ................................................................................................ 40

5.3.2 SAP/Multicash Transaction File Format .......................................................................................... 42

5.4 NZ Statement Files (New Zealand Domestic Accounts only) .................................................................... 44

5.4.1 NZ Statement File(s) – Balance File .............................................................................................. 44

5.4.2 NZ Statement File(s) – Transaction File ......................................................................................... 45

5.4.3 Transaction Record - Type 3 ......................................................................................................... 45

5.4.4 Opening Balance Record - Type 5 ................................................................................................. 46

5.4.5 Closing Balance Record - Type 6 ................................................................................................... 47

5.4.6 Total Debits/Credits Record - Type 8 ............................................................................................. 48

5.4.7 Grand Total Debits/Credits Record - Type 9.................................................................................... 49

5.5 MT940 ............................................................................................................................................. 50

5.5.1 Block 1 (Basic Header) ................................................................................................................ 50

5.5.2 Block 2 (Application Header) ........................................................................................................ 50

5.5.3 Block 4 (Message Body)............................................................................................................... 51

5.6 Returned Items Payments .................................................................................................................. 53

5.6.1 Header Record – Returned Direct Debits and Credits ....................................................................... 53

5.6.2 Detail Record – Returned Direct Debits and Credits ......................................................................... 53

5.6.3 Trailer Record – Returned Direct Credits and Debits ........................................................................ 54

5.6.4 Return Reason Codes – Returned Direct Debits/Credits.................................................................... 54

5.7 Returned Items Cheques .................................................................................................................... 55

5.7.1 Header Record – Returned Cheques .............................................................................................. 55

5.7.2 Details Record – Returned Cheques ............................................................................................... 55

5.7.3 Trailer Record – Returned Cheques ............................................................................................... 56

5.7.4 Return Reason Codes – Returned Cheques ..................................................................................... 56

5.8 CSV ................................................................................................................................................. 58

5.8.1 Account Summary CSV Report...................................................................................................... 58

5.8.2 Account Statement CSV Report .................................................................................................... 59

5.8.3 Balance Summary CSV Report ...................................................................................................... 60

5.8.4 Net Position View ........................................................................................................................ 60

5.8.5 Returned Items Cheques ............................................................................................................. 61

5.8.6 Returned Items Payments ............................................................................................................ 61

5.8.7 Transaction Details ..................................................................................................................... 62

5.9 ANZ Transactive – Global grid screen exports ....................................................................................... 62

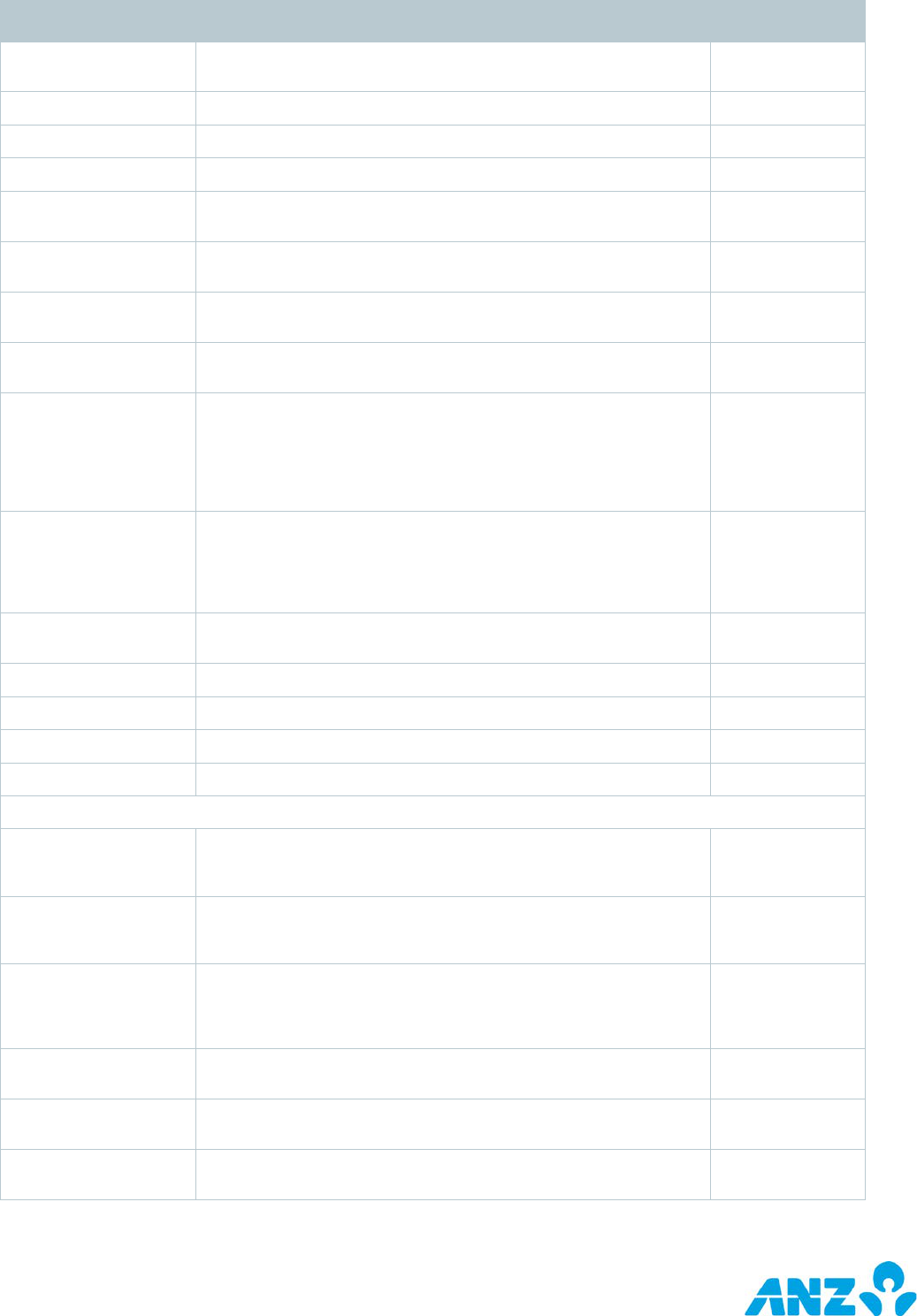

6 APPENDICES ....................................................................................................... 63

6.1 APPENDIX A – BAI/TRANSACTION CODES ............................................................................................ 63

6.1.1 BAI Status and Summary Level Items ........................................................................................... 63

6.1.2 Retail, Corporate/Institutional and V2 Plus accounts (CAP, CMM and V2P sources) .............................. 68

6.1.3 MANTEC accounts, MIDANZ accounts (local & offshore), other ANZ offshore accounts and other bank

accounts 83

6.1.4 New Zealand ANZ Bank (SYS account source) ................................................................................ 87

6.1.5 New Zealand Cross Bank accounts (Westpac & Bank of New Zealand) ............................................... 97

6.1.6 SWIFT MT950 Transaction Codes (Tag :61) .................................................................................... 99

6.1.7 SWIFT MT940 Transaction Codes (Tag :61) .................................................................................. 100

6.2 USE OF AUXDOM/Trancode .............................................................................................................. 102

3

Classification:Public

1 INTRODUCTION

1.1 About this guide

This document is designed to:

• Collate the various file formats for ANZ Transactive – Global and its underlying application ANZ

Transactive – AU & NZ

• This is intended to be a file format specification guide only, and as such does not include any training

on how to use the different file formats

This user guide will be updated when there is new and/or updated information. Please ensure you

regularly check the available version for the most up-to-date copy. We recommend that you read this

guide in conjunction with the applicable product terms and conditions.

1.2 Scope

This document contains the following:

1. ANZ Transactive – AU & NZ web solution file formats for Payments:

• Australia (AU) Domestic Payments import file formats:

o ABA

o CSV

• New Zealand (NZ) Domestic Payments import file formats:

o NZ Domestic Payment CSV (Full File Import)

o NZ Domestic Payment CSV Detail Import (with Control Record)

o NZ Domestic Payment CSV Detail Import (Without Control Record)

• Single Payments import file formats:

o MT101

o WIRS

o NZ International Payment CSV

o BPAY

2. ANZ Transactive – Global web solution file formats for balance and transaction reporting:

• BAI

• Statement Files

• SAP/Multicash

• NZ Statement Files

• MT940

• Returned Items export format

• CSV

• Onscreen exports

This document does NOT address:

• Host-to-Host file formats

• Instructions for importing/exporting files

• Examples of correctly formatted import/export files

• Payment file formats for ANZ Transactive – Global. If you have moved from payments in ANZ

Transactive AU & NZ to payments in ANZ Transactive - Global, please refer to the ANZ Transactive –

Global File Formats Guide on Online Resources.

1.3 Online Help

The online help in ANZ Transactive – Global allows you to access screen specific help and frequently

asked questions.

1.4 Online Resources

You can access the ANZ Transactive – Global Quick Reference Guides, User Guides and other information

from the Online Resources page. To access the page, click on the Help icon within the application and

then the Online Resources link.

1.5 Further Assistance

If you require further assistance, please contact your local Customer Service Centre. Details can be found

at anz.com/servicecentres

.

4

Classification:Public

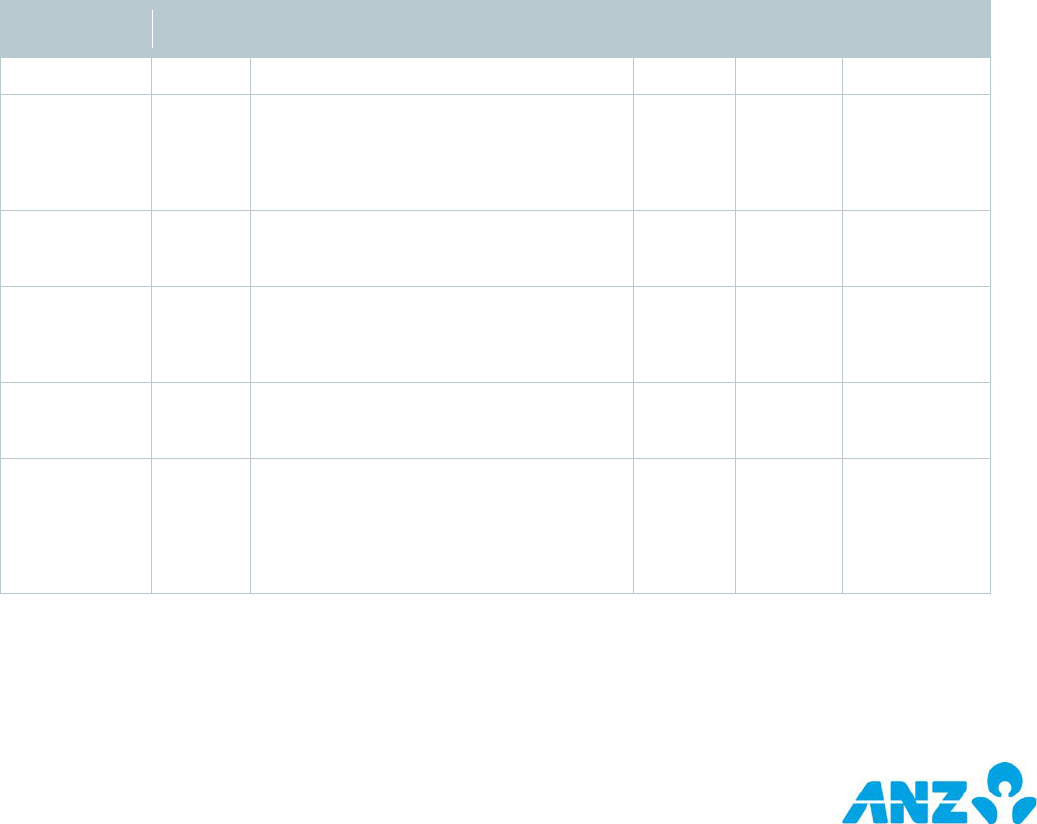

1.6 File Formats Overview (Payables)

The Table below is a summary of the Payable File Formats for Australian and New Zealand customers.

File Type

Australian

Customers

New Zealand

Customers

Single

Payments

BPAY

MT101

WIRS

NZ International Payment CSV

Domestic

Payments

ABA

AU Domestic Payments CSV

NZ Domestic Payments CSV

NZ ANZ Domestic Payments CSV

Note: File formats shown in italics are supported by Transactive – AU & NZ, but are not preferred file

formats.

5

Public

2 AU DOMESTIC PAYMENTS FILE FORMATS

This section details the types of Australian Domestic Payments import file formats available in ANZ

Transactive – AU & NZ.

2.1 ABA File Format

The ABA File format allows a user to import an ABA formatted file into ANZ Transactive – AU & NZ as one

or more batches of payment instructions.

Note: The ABA file conforms to the Australian Payments Clearing Associations (APCA) file specifications.

2.1.1 Import Methods

There are two methods for importing ABA files in ANZ Transactive – AU & NZ:

• Direct Entry ABA Detail Import method (Importing into an existing Batch or Template). This method

only allows one batch of payment instructions per ABA file.

• ABA File Import method (Importing creates batches). This method allows one or more batches of

payment instructions per ABA file.

2.1.2 ABA File Layout and Character Set

An ABA file can contain one or more batches of payment instructions. The records in the ABA file to be

imported must follow a defined order. Each batch must:

• Start with a Descriptive Record

• Contain one or more Details Record(s)

• End with a Batch Control Record

The format specifications for each of these record types are outlined in detail further in this document.

The following character set is allowed in an ABA file:

• Fields that are marked ‘Alpha’ (Alphanumeric) in the ‘Type’ column are limited to:

o Letters: A-Z, a-z

o Numbers: 0-9

o The following Characters: spaces ( ), ampersands (&), apostrophes (‘), commas (,), hyphens (-),

full stops (.), forward slashes (/), plus sign (+), dollar sign ($), exclamation mark (!), percentage

sign (%), left parenthesis ((), right parenthesis ()), asterisk (*), number sign (#), equal sign (=),

colon (:), question mark (?), left square bracket ([), right square bracket (]), underscore (_),

circumflex (^) and the at symbol (@)

o ‘Optional’ Alphanumeric fields must be filled with spaces if no data exists

• Fields that are marked ‘Numeric’ in the ‘Type’ column are limited to:

o Numbers: 0-9

o ‘Optional’ Numeric fields must be filled with zeros if no data exists

ANZ Transactive – AU & NZ requires ABA files to be prepared as 120 byte fixed length records and must

be separated by CRLF (carriage-return/line feed, Hex 0D0A) end of line characters. This must be

consistent for the whole file.

6

Public

2.1.3 Descriptive record (0)

The Descriptive Record contains Direct Entry payment batch header details.

Field

Description

Type Notes

Start

Position

End

Position

Length

Mandatory/

Optional

Record type

Numeric

Must be ‘0’

1

1

1

Mandatory

BSB

Alpha

Bank/State/Branch number of the

funds account with a hyphen in the

4th character position.

e.g. 013-999

2

8

7

Optional

Account

Alpha

Funds account number

9

17

9

Optional

Reserved

Alpha

Blank filled

18

18

1

Optional

Sequence

number

Alpha

Must be ‘01’

19

20

2

Mandatory

Name of User

Financial

Institution

Alpha

Must contain the bank mnemonic

that is associated with the BSB of the

funds account.

e.g. ‘ANZ’

21

23

3

Mandatory

Reserved

Alpha

Blank filled

24

30

7

Optional

Name of User

supplying File

Alpha

User Preferred Name as registered

with ANZ

31

56

26

Mandatory

User

Identification

number

Numeric

Direct Entry User ID.

Right-justified, zero-filled.

57

62

6

Mandatory

Description of

entries on File

Alpha

Description of payments in the file

(e.g. Payroll, Creditors etc.).

Can be used to match existing

domestic payments template.

63

74

12

Mandatory

Date to be

processed

Alpha

Date on which the payment is to be

processed.

DDMMYY (e.g. 010111)

75

80

6

Mandatory

Time

Alpha

Time on which the payment is to be

processed.

24 hour format - HHmm

81

84

4

Optional

2.1.4 Detail record (1)

Each Detail Record contains one Direct Entry payment instruction. One or more Detail Items can be

included in a single ABA file.

Field

Description

Type Notes

Start

Position

End

Position

Length

Mandatory/

Optional

Record type

Numeric

Must be ‘1’

1

1

1

Mandatory

BSB of account

to be CREDITED

or DEBITED

Alpha

Bank/State/Branch number with a

hyphen in the 4

th

character position.

e.g. 013-999

2

8

7

Mandatory

Account number

to be CREDITED

or DEBITED

Alpha

Numeric, alpha, hyphens & blanks

are valid. Right justified, blank

filled.

Leading zeros that are part of an

Account Number must be included.

9

17

9

Mandatory

Withholding Tax

Indicator

Alpha

One of the following values, if

applicable:

W – Dividend paid to a resident of a

country where a double tax

agreement is in force

X – Dividend paid to a resident of

any other country

18

18

1

Optional

7

Public

Field

Description

Type Notes

Start

Position

End

Position

Length

Mandatory/

Optional

Y – Interest paid to all non-

residence. The amount of

withholding tax is to appear in

the Amount of Withholding Tax

field.

Transaction

Code

Numeric

Select from the following options as

appropriate:

50 General Credit

53 Payroll

54 Pension

56 Dividend

57 Debenture Interest

13 General Debit

19

20

2

Mandatory

Amount to be

CREDITED or

DEBITED

Numeric

Right justified, zero filled, unsigned,

two decimal places are implied (e.g.

$10.21 is recorded as 0000001021).

21

30

10

Mandatory

Title of account

to be CREDITED

or DEBITED

Alpha

Preferred format is: Surname

followed by given names with one

blank between each name.

e.g. SMITH John Alan

Left justified, blank filled

31

62

32

Mandatory

Lodgement

Reference

Produced on the

recipient’s

Account

Statement.

Alpha

Payment reference indicating details

of the origin of the entry (e.g. payroll

number, policy number).

Left justified, blank filled.

63

80

18

Mandatory

Trace BSB

Number

Numeric

Bank/State/Branch number of the

trace account with a hyphen in the

4

th

character position.

e.g. 013-999

81

87

7

Mandatory

Trace Account

Number

Alpha

Numeric, alpha, hyphens & blanks

are valid. Right justified, blank

filled.

Leading zeros that are part of an

Account Number must be included.

88

96

9

Mandatory

Name of

Remitter

Produced on the

recipient’s

Account

Statement.

Alpha

Name of originator of the entry. This

may vary from Name of User.

Left justified, blank filled.

97

112

16

Mandatory

Withholding

amount

Numeric

Must be zero filled or contain a

withholding tax amount.

If it contains a withholding tax

amount, two decimal places are

implied (e.g. $10.21 is recorded as

0000001021).

113

120

8

Optional

8

Public

2.1.5 Batch Control Record (7)

The Batch Control Record contains details relating to the total number of items as well as debit/credit

totals for a batch within the ABA import file.

Field

Description

Type

Notes

Start

Position

End

Position

Length

Mandatory/

Optional

Record type

Numeric

Must be ‘7’

1

1

1

Mandatory

Reserved

Alpha

Must be ‘999-999’

2

8

7

Mandatory

Reserved

Alpha

Blank filled

9

20

12

Optional

Batch Net Total

Amount

Numeric

Batch Credit Total Amount minus

Batch Debit Total Amount.

Right justified, zero filled, unsigned,

two decimal places are implied (e.g.

$1001.21 is stored as

‘0000100121’).

21

30

10

Mandatory

Batch Credit

Total Amount

Numeric

Must be zero filled or contain the

total value of all Record Type 1

CREDIT transactions on the batch.

Right justified, zero filled, unsigned,

two decimal places are implied.

31

40

10

Optional

Batch Debit

Total Amount

Numeric

Must be zero filled or contain the

total value of all Record Type 1

DEBIT transactions on the batch.

Shown in cents without punctuation

(e.g. $1001.21 is stored as

‘0000100121’).

Right justified, zero filled, unsigned,

two decimal places are implied.

41

50

10

Optional

Reserved

Alpha

Blank filled

51

74

24

Optional

Batch Total Item

Count

Numeric

Total count of Type 1 records in the

batch.

Right justified, zero filled.

75

80

6

Mandatory

Reserved

Alpha

Blank filled

81

120

40

Optional

9

Public

2.2 AU Domestic Payments CSV Detail Import

The Direct Entry CSV Detail Import file format allows a user to import a CSV file containing payment

details into an existing Domestic Payments batch or template in ANZ Transactive AU & NZ.

2.2.1 CSV File Layout and Character Set

A valid CSV file consists of only one record type - Detail Record. Direct Entry detail items will be created

for each Detail Record in the CSV file.

The format specifications for the Detail Record is are outlined in detail further in this document.

The following character set is allowed in a CSV file:

• Fields that are marked ‘Alpha’ (Alphanumeric) in the ‘Type’ column are limited to:

o Letters: A-Z, a-z

o Numbers: 0-9

o The following Characters: spaces ( ), ampersands (&), apostrophes (‘), commas (,), hyphens (-),

full stops (.), forward slashes (/), plus sign (+), dollar sign ($), exclamation mark (!), percentage

sign (%), left parenthesis ((), right parenthesis ()), asterisk (*), number sign (#), equal sign (=),

colon (:), question mark (?), left square bracket ([), right square bracket (]), underscore (_),

circumflex (^) and the at symbol (@)

• Fields that are marked ‘Numeric’ in the ‘Type’ column are limited to:

o Numbers: 0-9

2.2.2 Detail Record

Each Detail Record contains information used to create one payment instruction (Detail Item).

There may be many Detail Records in one CSV file. Other required detail item fields are inherited from

the Batch/Template Header and can subsequently be changed.

All fields must be separated by a comma (,) and may be enclosed in double-quotes (“”) if required. Each

record will end with CRLF (carriage-return/line feed).

Field

Description

Type

Notes

Record

Position

Max

Length

Mandatory/

Optional

Reserved

Alpha

Not used by ANZ Transactive – AU & NZ

1

NA

Optional

Title of account

to be CREDITED

OR DEBITED

Alpha

Preferred format is: Surname followed by

given names with one blank between each

name.

e.g. SMITH John Alan.

2

32

Mandatory

BSB of account

to be CREDITED

or DEBITED

Numeric

Bank/State/Branch number of the payee

account.

e.g. 013999

3

6

Mandatory

Account number

to be CREDITED

or DEBITED

Alpha

Numeric, alpha, hyphens & blanks are valid.

Right justified, blank filled.

Leading zeros that are part of an Account

Number must be included.

4

9

Mandatory

Amount to be

CREDITED or

DEBITED

Numeric

Payment amount.

Decimal point optional and not implied.

5

11 (8 if no

decimal is

used)

Mandatory

Lodgement

Reference

Produced on the

recipient’s

Account

Statement.

Alpha

Payment reference indicating details of the

origin of the entry (e.g. payroll number,

policy number).

6

18

Mandatory

10

Public

3 NZ DOMESTIC PAYMENTS FILE FORMATS

This section details the 3 types of New Zealand Domestic Payments import file formats available in ANZ

Transactive – AU & NZ:

1. NZ Domestic Payment CSV (Full File Import)

2. NZ Domestic Payment CSV Detail Import (with Control Record)

3. NZ Domestic Payment CSV Detail Import (Without Control Record)

3.1 NZ Domestic Payment CSV (Full File Import)

The NZ Domestic Payments import file format allows a user to import a Domestic Payment file into ANZ

Transactive – AU & NZ as one or more batches of payment instructions.

3.1.1 File Layout and Character Set

An NZ Domestic Payments file can contain one or more batches of payment instructions. The records in

the file to be imported must follow a defined order. Each batch must:

• Start with a Descriptive Record

• Contain one or more Detail Record(s)

• End with a Batch Control Record

The format specifications for each of these record types are outlined in detail further in this document.

The following character set is allowed in an NZ Domestic Payment file:

• Character fields can contain both alpha and numeric values

• Numeric fields should only have digit values (0-9)

• The delimiter between fields is a comma, so text fields such as Other Party Name should not contain

commas. There may optionally be a comma after the final field.

3.1.2 Descriptive Record

The Descriptive Record contains Domestic Payment batch header details.

Field

Description

Type

Notes

Record

Position

Max

Length

Mandatory/

Optional

Record Type

Numeric

Must be "1"

1

1

Mandatory

Batch Type

Numeric

"D" = Debit Batch / "C" = Credit Batch

2

1

Mandatory

Payment Date

Numeric

In The Form YYYYMMDD (e.g. 20100130)

3

8

Mandatory

Payment Time

Numeric

HHMM (e.g. 1330 is 1.30pm)

4

4

Optional

Batch Creation

Date

Numeric

Value may be omitted or a YYYYMMDD

format value will be ignored by Transactive

5

8

Optional

Funds Account

Numeric

In Form BBbbbbAAAAAAASS (2, 4, 7, 2).

No hyphens

6

15

Mandatory

DD Code

Numeric

Mandatory for Debit Batches

7

7

Conditional

Reporting

Method

Numeric

"S" = Single / "M" = Multiple. The Multiple

Reporting Method has a threshold of 4999

transaction items. If the threshold is

exceeded Transactive will update the

Reporting Method to ‘Single’ upon validation

of the file. Customers will not be notified

via the front-end.

8

1

Mandatory

Dishonour

Account

Numeric

In Form BBbbbbAAAAAAASS (2, 4, 7, 2).

No hyphens

9

15

Mandatory

Batch Name

Alphanumeric

The name given to the batch being created.

Can be used to match an existing NZ

domestic payments template (including

Restricted Templates). This only applies to

payments requiring web authorisation.

10

12

Mandatory

11

Public

Field

Description

Type

Notes

Record

Position

Max

Length

Mandatory/

Optional

Originator

Particulars

Alphanumeric

Reference details which are captured by the

originator

11

12

Optional

Originator

Analysis Code

Alphanumeric

Reference details which are captured by the

originator

12

12

Optional

Originator

Reference

Alphanumeric

Reference details which are captured by the

originator

13

12

Optional

Reserved

-

Field reserved for future use

14

-

Optional

Reserved

-

Field reserved for future use

15

-

Optional

Reserved

-

Field reserved for future use

16

-

Optional

3.1.3 Detail Record

One or more Detail Items can be included in a single NZ Domestic Payment batch.

Field

Description

Type

Notes

Record

Position

Max

Length

Mandatory/Optional

Record Type

Numeric

Must be "2"

1

1

Mandatory

Account

Number to be

CREDITED or

DEBITED

Numeric

In Form BBbbbbAAAAAAASS (2, 4, 7,

2), BBbbbbAAAAAAASSS (2, 4, 7, 3)

or BBbbbbAAAAAAAASSS (2, 4, 8, 3).

No hyphens

2

17

Mandatory

Transaction

Code

Numeric

The transaction code for the item.

The following codes are available:

50 – Credit

52 - Credit

00 - Debit

3

2

Mandatory

Amount

Numeric

Amount must be less than or equal to

99999999.99

2 decimal places are implied (e.g.

$10.21 is recorded as 1021)

4

10

Mandatory

Other Party

Name

Alphanumeric

Party Receiving Payment

5

32

Mandatory

Other Party

Particulars

Alphanumeric

Other Party Statement Details

6

12

Optional

Other Party

Analysis Code

Alphanumeric

Other Party Statement Details

7

12

Optional

Other Party

Reference

Alphanumeric

Other Party Statement Details

8

12

Optional

Originator

Particulars

Alphanumeric

Only applicable if Reporting Method is

"M". If blank, will populate with

Originator Particulars in Batch Header.

9

12

Optional

Originator

Analysis Code

Alphanumeric

Only applicable if Reporting Method is

"M". If blank, will populate with

Originator Code in Batch Header.

10

12

Optional

Originator

Reference

Alphanumeric

Only applicable if Reporting Method is

"M". If blank, will populate with

Originator Reference in Batch Header.

11

12

Optional

Reserved

-

Field reserved for future use

12

-

Optional

Reserved

-

Field reserved for future use

13

-

Optional

12

Public

Field

Description

Type

Notes

Record

Position

Max

Length

Mandatory/Optional

Reserved

-

Field reserved for future use

14

-

Optional

3.1.4 Batch Control Record

The Control Record contains details relating to the Hash Total, the total number of items and the

debit/credit totals for a batch.

Field

Description

Type

Notes

Record

Position

Max

Length

Mandatory/

Optional

Record Type

Numeric

Must be "3"

1

1

Mandatory

Batch Debit

Total Amount

Numeric

Value of all Debit transactions in the batch. 2

decimal places are implied (e.g. $10.21 is

recorded as 1021)

2

10

Mandatory

Batch Credit

Total Amount

Numeric

Value of all Credit transactions in the batch.

2 decimal places are implied (e.g. $10.21 is

recorded as 1021)

3

10

Mandatory

Batch Total

Item Count

Numeric

Total number of Transactions in the batch

4

6

Mandatory

Hash Total

Numeric

Sum of Branch/Account Numbers

5

11

Optional

Reserved

-

Field reserved for future use

6

-

Optional

Reserved

-

Field reserved for future use

7

-

Optional

Reserved

-

Field reserved for future use

8

-

Optional

Note: The hash total is calculated using the branch and account numbers in each transaction record. The

bank number and account suffix are not used when calculating the hash total. If the account number is 8

digits then the left most digit is excluded from the calculations.

Example:

01 0123 0456789 00

06 0475 0123456 02

11 6100 1234567 040

03 0321 00987654 030

7019 2802466

The hash total is therefore 70192802466.

If the hash total is more than 11 characters, exclude the characters on the left.

13

Public

3.2 NZ Domestic Payments CSV Detail Import (with Control Record)

The NZ Domestic Payments CSV Detail Import (with Control Record) file format allows a user to import a

CSV file containing payment details into an existing Domestic Payments batch or template in ANZ

Transactive – AU & NZ.

3.2.1 File Layout and Character Set

A valid NZ Domestic Payments CSV file (with Control Record) consists of the following record types:

• A Descriptive Record

• One or more Detail Record(s)

• A Batch Control Record

The format specifications for each of these record types are outlined in detail further in this document.

The following character set is allowed in a CSV file:

• Character fields can contain both alpha and numeric values

• Numeric fields should only have digit values (0-9)

The delimiter between fields is a comma, so text fields such as Other Party Name should not contain

commas. There may optionally be a comma after the final field of each record

3.2.2 Descriptive Record

The Descriptive Record contains Domestic Payment batch header details.

Field Description

Type

Notes

Record

Position

Max

Length

Mandatory/

Optional

Record Type

Numeric

Must be ‘1’

1

1

Mandatory

Subscriber ID

Numeric

Contents will be ignored

2

16

Optional

Batch Number

Numeric

Contents will be ignored

3

2

Optional

Null

Numeric

Contents will be ignored

4

4

Optional

Subscriber’s Account Number

Numeric

Contents will be ignored

5

15

Optional

Batch Type

Numeric

Contents will be ignored

6

1

Optional

Batch Due Date

Numeric

Contents will be ignored

7

8

Optional

Batch Creation Date

Numeric

Contents will be ignored

8

8

Optional

3.2.3 Detail Record

Each Detail Record contains information used to create one payment instruction (Detail Item)

There may be many Detail Records in one CSV file. Other required detail item fields are inherited from

the Batch/Template Header and can subsequently be changed.

All fields must be separated by a comma (,) and each record will end with CRLF (carriage-return/line

feed).

Field Description

Type

Notes

Record

Position

Max

Length

Mandatory/

Optional

Record Type

Numeric

Must be ‘2’

1

1

Mandatory

Account Number

Numeric

In Form BBbbbbAAAAAAASS (2, 4, 7, 2),

or BBbbbbAAAAAAASSS (2, 4, 7, 3) or

BBbbbbAAAAAAAASSS (2, 4, 8, 3).

No hyphens.

2

17

Mandatory

Transaction Code

Numeric

The transaction code for the item.

The following codes are available:

50 – Credit

52 - Credit

00 - Debit

3

2

Mandatory

14

Public

Field Description

Type

Notes

Record

Position

Max

Length

Mandatory/

Optional

Amount

Numeric

The amount is in cents. No Dollar Signs,

Commas or Decimal Points.

4

10

Mandatory

Other Party Name

Alphanumeric

Party Receiving Payment

5

32

Mandatory

Other Party

Reference

Alphanumeric

Other Party Statement Details

6

12

Optional

Other Party

Analysis Code

Alphanumeric

Other Party Statement Details

7

12

Optional

Other Party Alpha

Reference

Alphanumeric

Not Used (but must be allowed for)

8

12

Optional

Other Party

Particulars

Alphanumeric

Other Party Statement Details

9

12

Optional

Originator Name

Alphanumeric

Name of Party Making Payment.

Contents will be ignored (since the

payer's name will be the 'Funds Account

Name' from the batch header details).

10

20

Optional

Originator Analysis

Code

Alphanumeric

Details on customer's Statement

11

12

Optional

Originator

Reference

Alphanumeric

Details on customer's Statement

12

12

Optional

Originator

Particulars

Alphanumeric

Details on customer's Statement

13

12

Optional

3.2.4 Batch Control Record

The Batch Control Record contains details relating to the total number of items, the Hash Total and debit

or credit totals.

Field Description

Type

Notes

Record

Position

Max

Length

Mandatory/

Optional

Record Type

Numeric

Must be ‘3’

1

1

Mandatory

Batch Total

Amount

Numeric

The amount is in cents. No dollar signs,

commas or decimal points

2

11

Mandatory

Number of

Transactions

Numeric

Total number of Transactions

3

5

Mandatory

Hash Total

Numeric

Sum of Branch / Account Numbers,

overflow Ignored.

4

11

Mandatory

Note: The hash total is calculated using the branch and account numbers in each transaction record. The

bank number and account suffix are not used when calculating the hash total. If the account number is 8

digits then the left most digit is excluded from the calculations.

Example:

01 0123 0456789 00

06 0475 0123456 02

11 6100 1234567 040

03 0321 00987654 030

7019 2802466

The hash total is therefore 70192802466.

If the hash total is more than 11 characters, exclude the additional characters on the left.

15

Public

3.3 NZ Domestic Payments CSV Detail Import (without Control Record)

The NZ Domestic Payments CSV Detail Import (without Control Record) file format allows a user to

import a CSV file containing payment details into an existing Domestic Payments batch or template.

3.3.1 File Layout and Character Set

A valid NZ Domestic Payments CSV file (without Control Record) consists of only one record type - Detail

Record. NZ Domestic Payment detail items will be created for each Detail Record in the CSV file.

The format specifications for the Detail Record are outlined in detail further in this document.

The following alphanumeric fields are supported in a CSV file:

• A..Z, 0..9, spaces and other keyboard characters (except commas which are treated as field

separators)

• Numeric fields should only have digit values (0-9)

3.3.2 Detail Record

Each Detail Record contains information used to create one payment instruction (Detail Item).

There may be many Detail Records in one CSV file. Other required detail item fields are inherited from

the Batch/Template Header and can subsequently be changed.

All fields must be separated by a comma (,) and each record will end with CRLF (carriage-return/line

feed).

Field

Description

Type

Notes

Record

Position

Max

Length

Mandatory

/Optional

Transaction

Amount

Numeric

The dollar amount of the transaction. This can be

expressed either in whole dollars or in dollars

and cents, e.g.

12 is read as 12.00

12. is read as 12.00

12.3 is read as 12.30

12.34 is read as 12.34

Commas cannot be used to separate '000s.

The maximum allowable value is

$99,999,999.99.

1

10 (or 11

if

decimal

point is

included)

Mandatory

Account

Number

Alphanumeric

The account number of the other party. The

account number must contain 17 digits, in the 2-

4-8-3 format with optional hyphens, e.g.

06-0501-00123456-000 or 06050100123456000

bank-branch-account base- account suffix

The base number and suffix portions should be

RIGHT JUSTIFIED (i.e. zero-filled to the left),

e.g.

06-0501-0123456-02 (in 2-4-7-2 format) must

be represented as 06-0501-00123456-002 (in 2-

4-8-3 format).

2

20

Mandatory

Other Party

Name

Alphanumeric

The name of the other party. Free format

alphanumeric text.

3

32

Mandatory

Originator

Reference

Alphanumeric

The Reference that will appear on the customer's

bank statement. Free format alphanumeric text.

4

12

Optional

Originator

Analysis Code

Alphanumeric

The Analysis Code that will appear on the

customer's bank statement. Free format

alphanumeric text.

5

12

Optional

Originator

Particulars

Alphanumeric

The Particulars that will appear on the

customer's bank statement. Free format

alphanumeric text.

6

12

Optional

Other Party

Reference

Alphanumeric

The Reference that will appear on the other

party's bank statement. Free format

alphanumeric text.

7

12

Optional

Other Party

Analysis Code

Alphanumeric

The Analysis Code that will appear on the other

party's bank statement. Free format

alphanumeric text.

8

12

Optional

Other Party

Particulars

Alphanumeric

The Particulars that will appear on the other

party's bank statement. Free format

alphanumeric text.

9

12

Optional

16

Public

4 SINGLE PAYMENTS FILE FORMATS

This section details the Single Payments import format available in ANZ Transactive – AU & NZ.

4.1 MT101 File Format (Australia & New Zealand)

The MT101 File Import allows a user to import an MT101 file into ANZ Transactive – AU & NZ as one or

more Single Payment instructions. The supported payment types include RTGS, International and Multi

Bank. The MT101 file format is the ANZ preferred file format for the aforementioned payment types.

4.1.1 File Naming Convention

Not applicable.

4.1.2 MT101 File Layout and Character Set

The MT101 message contains four (4) blocks of information. One or more transactions can be presented

in the file; each payment instruction will begin with a block 1 and end with a block 4. The file may

contain any of the supported Single Payments payment types.

Block

Title

Mandatory/

Optional

Comments

1

Sending financial

institution

Mandatory

Block 1 is mandatory and must begin with “{1: F01”

and end with “}”

Example for ANZ Australia: {1: F01 ANZBAU3MXXX}

2

Message

Type/Receiving

financial institution

Mandatory

Block 2 is mandatory and for International and RTGS payments must

contain the SWIFT BIC of the Bank that owns the funding account.

Example for ANZ Australia: {2: I 101 ANZBAU3MXXX}

Example for ANZ New Zealand: {2: I 101 ANZBNZ22XXX}

For Multibank payments, enter either the Australian or New Zealand ANZ

SWIFT BIC as per the examples above.

3

Additional Tag

Information

Optional

Block 3 is optional. If present must begin with “{3:” and end with “}”.

Not used by ANZ Transactive – AU & NZ

4

Sequence A and

Sequence B

Mandatory

Block 4 is mandatory and must begin with “{4:” and end with “-}”.

This block contains Sequence A and Sequence B – see below for further

details.

4.1.3 Character Set

The following character set is allowed in an MT101 import file:

• Fields that are marked ‘Alpha’ (Alphanumeric) in the ‘Type’ column are limited to:

o Letters: A-Z, a-z

o Numbers: 0-9

o The following Characters: spaces ( ) , ampersands (&), apostrophes (‘), commas (,) , hyphens (-

), full stops (.), forward slashes (/), plus sign (+), dollar sign ($), exclamation mark (!),

percentage sign (%), left parenthesis ((), right parenthesis ()), asterisk (*), number sign (#),

equal sign (=), colon (:), question mark (?), left square bracket ([), right square bracket (]),

underscore (_), circumflex (^) and the at symbol (@)

• Fields that are marked ‘Numeric’ in the ‘Type’ column are limited to:

o Numbers: 0-9

Note: Braces (‘{’ and ‘}’) are used to identify the beginning and end of each block as outlined previously,

but they cannot be used anywhere else in an MT101 file. As such they have not been included in the

character set above.

17

Public

4.1.4 Sequence A – General Information

Tag

Field Description

Type

Length

Notes

Mandatory

/ Optional

:20:

Sender’s Reference

Alpha

16

Reference number to link payment to

originating system.

Mandatory

:21R:

Customer reference

Alpha

16

The customer reference associated with the

payment. If 21R is not supplied then tag 21 in

sequence B will be used as the customer

reference.

Optional

:28D:

Message Index/Total

Numeric

5n/5n

Always ‘00001/00001’. ANZ supports a single

sequence B.

Mandatory

:50L:

Instructing Party

Alpha

35

Identifies the customer authorised by the

account owner to order the payment. Used for

Multibank payments only.

Must be provided in either sequence A or B (but

not in both) for Multibank payments.

Optional

:50H:

Ordering Customer

Alpha

34

Funding account preceded by ‘/’. BSB should be

included where applicable. Name and address

need not be entered.

Must be provided in either sequence A or B but

not in both.

Optional for BSB to be included in either tag

50H or 52A but mandatory to be provided in

either 50H or 52A.

Optional

:52A:

Account Servicing

Institution

Alpha

11

SWIFT code pertaining to the funding account of

the payment.

May be provided in either sequence A or B but

not in both.

Must be provided in either sequence A or B for

Multibank payments.

If populating then provide:

Optional national clearing system code preceded

by a double slash (‘//’). E.g., for Australia,

populate with “//AU” and the six number

funding account BSB.

Mandatory 11 character SWIFT code pertaining

to the funding account of the payment. If only 8

characters known then pad with trailing “XXX”,

e.g. “ANZBAU3MXXX”

Optional for BSB to be included in either tag

50H or 52A but mandatory to be provided in

either 50H or 52A.

Optional

:30:

Requested Execution

Date

Numeric

6

The payment date in format YYMMDD (e.g.

110101)

Mandatory

18

Public

4.1.5 Sequence B – Transaction Detail Record

Tag

Field

Description

Type

Length

Notes

Mandatory/

Optional

:21:

Transaction

Reference

Alphanumeric

16

Customer reference associated with the

payment

Mandatory

:21F:

F/X Deal

Reference

Alpha

16

Forward Exchange Contract or BID reference if

an international payment.

Applicable exchange reference if a Multibank

payment.

Mandatory if tag 36 is populated.

Optional

:23E:

Instruction Code

Alphanumeric

4 x 30

Specific instructions provided by the ordering

customer to the account servicing institution.

The system will only accept up to four

instruction codes.

For RTGS NZ the instruction code ‘OTHR’

followed by ‘/FAX’ or ‘/ATT’ can be provided to

enter the beneficiaries fax number and

Attention.

E.g.

:23E: OTHR/FAX/64-02-1234567

:23E: OTHR/ATT/Mr Smith

Note: Country Code, Area Code, and Phone

Number must be separated by a hyphen as

per example.

Conditional

:32B:

Currency and

Transaction

amount

Alphanumeric

3 –15

Payment currency and amount.

E.g. USD1234,56 (note ‘,’ convention)

Amount can be 0 if 33B is specified.

For payments in Currencies with no decimal

place, no values should be provided after the

decimal place (E.g. JPY100,)

Mandatory

:50L:

Instructing Party

Alphanumeric

35

Identifies the customer authorised by the

account owner to order the payment.

Used for Multibank payments only.

Must be provided in either sequence A or B

(but not in both) for Multibank payments.

Optional

:50H:

Ordering

Customer

Alpha

34

Funding account preceded by ‘/’. BSB should

be included where applicable. Name and

address need not be entered.

Must be provided in either sequence A or B but

not in both

Optional for BSB to be included in either tag

50H or 52A but mandatory to be provided in

either 50H or 52A.

Optional

:52A:

Account Servicing

Institution

Alpha

11

SWIFT code pertaining to the funding account

of the payment.

May be provided in either sequence A or B but

not in both.

If populating then provide:

Optional national clearing system code

preceded by a double slash (‘//’). E.g., for

Australia, populate with “//AU” and the six

number funding account BSB.

Mandatory 11 character SWIFT code

pertaining to the funding account of the

payment. If only 8 characters known then pad

with trailing “XXX”, e.g. “ANZBAU3MXXX”

Optional for BSB to be included in either tag

50H or 52A but mandatory to be provided in

either 50H or 52A.

Optional

:56A:

Intermediary

Institution

Alpha

11

Bank code of Intermediary bank. Can be one

of the following:

Optional

19

Public

Tag

Field

Description

Type

Length

Notes

Mandatory/

Optional

OR

SWIFT BIC

:56C:

OR

Intermediary

Institution

Alpha

15

Domestic Clearing Code of Intermediary bank,

// followed by a two letter clearing system

code and party identifier

E.g. //XXnn..nn

Where XX is the country Clearing System Code

– See the relevant section for valid Clearing

System Codes

:56D:

Intermediary

Institution

Alpha

5 x 35

Line 1: Bank code of Intermediary bank.

Can be one of the following:

▪ Clearing code (format //XXnnn…nn)

Line 2: Intermediary Bank name.

Line 3: Intermediary Bank address line 1.

Line 4: Intermediary Bank address line 2.

Line 5: Intermediary Bank country (must be

ISO compliant format).

Lines 1, 2, 3 and 5 are mandatory.

Note: Tag :56D: should only be used if bank

code of Intermediary Bank is unknown to ANZ

Transactive – AU & NZ.

:57A:

OR

Account With

Institution

Alpha

11

Bank code of beneficiary bank. Can be one of

the following:

SWIFT BIC

The following clearing codes are accepted in

57A, however it is preferable that they are

used in field 57C:

BSB for RTGS AU (format //AUnnnnnn)

BB for RTGS NZ (format //NZnnnnnn)

Mandatory

:57C:

OR

Alpha

15

Domestic Clearing Code of beneficiary bank, //

followed by a two letter clearing system code

and party identifier

E.g. //XXnn..nn

Where XX is the country Clearing System Code

– See the relevant section for valid Clearing

System Codes

:57D:

Alpha

5 x 35

Line 1: Bank code of beneficiary bank.

Can be one of the following:

BSB for RTGS AU (format //AUnnnnnn)

BB for RTGS NZ (format //NZnnnnnn)

Clearing code (format //XXnnn…nn)

Line 2: Beneficiary Bank name.

Line 3: Beneficiary Bank address line 1.

Line 4: Beneficiary Bank address line 2.

Line 5: Beneficiary Bank country (must be ISO

compliant format).

Lines 1, 2, 3 and 5 are mandatory.

Note: Tag :57D: should only be used if bank

code of Beneficiary Bank is unknown to ANZ

Transactive – AU & NZ.

:59:

Beneficiary

Alpha

5x35

Line 1: Account of the payment Beneficiary

preceded by a ‘/’.

Lines 2-5: Name and address of the payment

beneficiary.

Mandatory

:70:

Remittance

Information

Alpha

4x35

Details of payment.

Optional

:33B:

Funding currency

and amount

Alphanumeric

3 – 15

Funding currency and amount.

E.g. AUD1234,56 (note ‘,’ convention).

Currency should match that of funding

account.

Amount can be 0 if 32B is specified.

Optional

20

Public

Tag

Field

Description

Type

Length

Notes

Mandatory/

Optional

:71A:

Details of Charges

Alpha

3

Must be ‘SHA’ for RTGS payments.

Must be ’SHA’ or ‘OUR’ for International

payments.

Must be ‘SHA’, ‘OUR’ or ‘BEN’ for Multibank

payments.

Mandatory

:36:

Exchange Rate

Numeric

12

Forward Exchange Contract or BID rate if an

international payment. Applicable exchange

rate if a Multibank payment.

Must be populated if 21F is populated. If 33B

is present and 32B is non zero then this tag

must be present.

Optional

Note: Some standard SWIFT MT101 file format fields that are not used by ANZ Transactive – AU & NZ

have been omitted from this document.

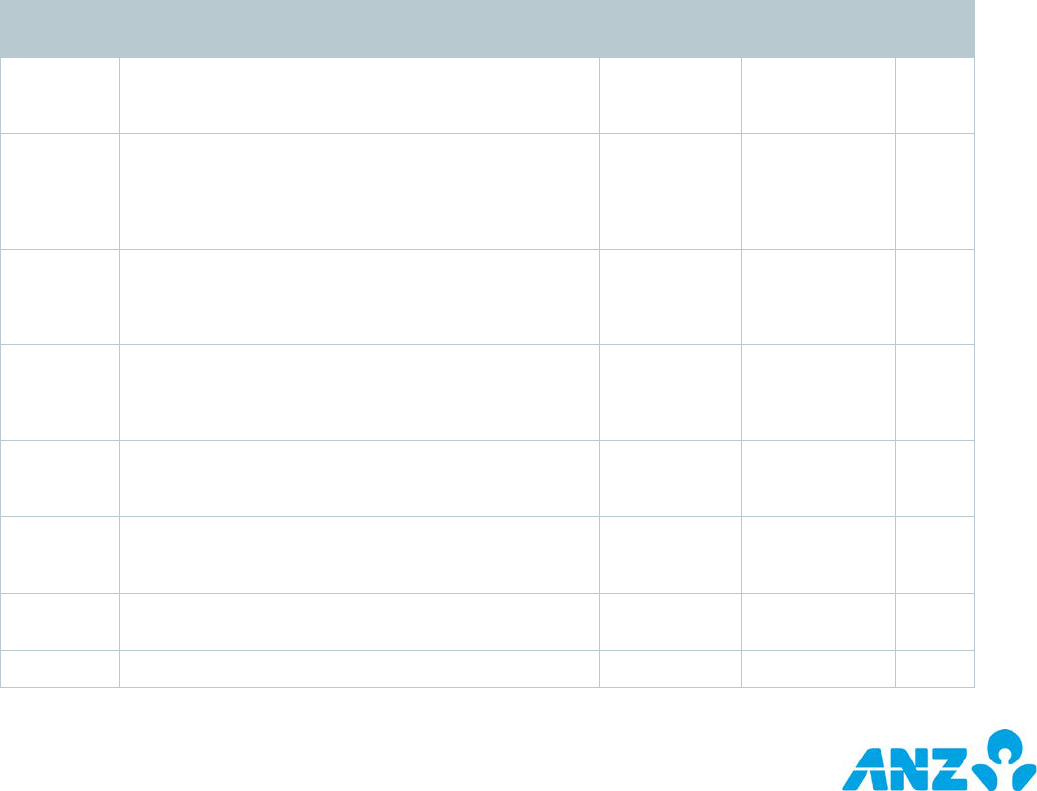

4.1.6 Clearing System Codes

Clearing System Code

Length

Comments

AT

5

Austrian Bankleitzahl

AU

6

Australian Bank State Branch (BSB) Code

BL

8

German Bankleitzahl

CC

9

Canadian Payments Association Payment Routing Number

CH

6

CHIPS Universal Identifier

CP

4

CHIPS Participant Identifier

ES

8 or 9

Spanish Domestic Interbanking Code

FW

9

Fedwire Routing Number

GR

7

HEBIC (Hellenic Bank Identification Code)

HK

3

Bank Code of Hong Kong

IE

6

Irish National Clearing Code (NSC)

IN

11

Indian Financial System Code (IFSC)

IT

10

Italian Domestic Identification Code

NZ

6

New Zealand National Clearing Code

PL

8

Polish National Clearing Code (KNR)

PT

8

Portuguese National Clearing Code

RU

9

Russian Central Bank Identification Code

SC

6

UK Domestic Sort Code

SW

3 or 5

Swiss Clearing Code (BC code)

SW

6

Swiss Clearing Code (SIC code)

ZA

6

South African National Clearing Code

21

Public

4.2 WIRS file format (Australia only)

The WIRS File Import allows a user to import a WIRS file into ANZ Transactive – AU & NZ as one or more

Single Payment instructions. The supported payment types include RTGS and International. Although

WIRS files are supported by ANZ Transactive – AU & NZ, MT101 files are the preferred file format for

these payment types. WIRS files can only be used for payments funded from ANZ Australian domiciled

accounts. The file format also does not allow users to specify an Intermediary Bank.

Note: Multibank Payments cannot be created using WIRS formatted files.

4.2.1 File Naming Convention

Not Applicable.

4.2.2 WIRS File Layout and Character Set

ANZ WIRS operates on a combination of an MT101 and MT103 message formats. The file consists of one

record - the Detail Record.

Each line of incoming data is to terminate with a Carriage Return, Line feed.

Multiple payment instructions can be included in a single WIRS formatted file. Each payment instruction

must be separated by a hyphen “-” followed by a Carriage Return, Line Feed.

4.2.3 Character Set

The following character set is allowed in a WIRS import file:

• Fields that are marked ‘Alpha’ (Alphanumeric) in the ‘Type’ column are limited to:

o Letters: A-Z, a-z

o Numbers: 0-9

o The following Characters: spaces ( ) , ampersands (&), apostrophes (‘), commas (,) , hyphens (-

), full stops (.), forward slashes (/), plus sign (+), dollar sign ($), exclamation mark (!),

percentage sign (%), left parenthesis ((), right parenthesis ()), asterisk (*), number sign (#),

equal sign (=), colon (:), question mark (?), left square bracket ([), right square bracket (]),

underscore (_), circumflex (^) and the at symbol (@)

• Fields that are marked ‘Numeric’ in the ‘Type’ column are limited to:

o Numbers: 0-9

22

Public

4.2.4 Detail Record

Tag

Field

Description

Type

Length

Notes

Mandatory/

Optional

:20:

Transaction

Reference Number

Alpha

16

This reference must be unique per payment

per day

Mandatory

:32A:

Value Date,

Currency Code,

Amount

Numeric

24

This field contains the Value Date (6

Characters) as YYMMDD, Currency Code (3

Characters) and Amount (15 Characters) with

comma separated decimal.

Mandatory

:50:

Ordering

Customer

Alpha

4 x 35

Company Identifier as agreed with ANZ

Implementation

Mandatory

:53B:

Sender’s

Correspondent

Alphanumeric

34

Must start with “/” followed by the BSB and

Account Number for Transaction funding

Optional

:57:

Account With

Institution

Country ISO

Alpha

2

Where field :57D: specified, it is mandatory to

provide the International Organization for

Standardization (ISO) Country code.

Optional

:57A:

OR

Account With

Institution

Alpha

11

Bank code of beneficiary bank. Can be one of

the following:

SWIFT BIC

BSB for RTGS (format //AUnnnnnn)

Mandatory

:57C:

OR

Alpha

15

Domestic Clearing Code of beneficiary bank, //

followed by a two letter clearing system code

and party identifier

E.g. //XXnn..nn

Where XX is the country Clearing System Code

:57D:

Alpha

5 x 35

Line 1: Bank code of beneficiary bank.

Can be one of the following:

▪ BSB for RTGS (format //AUnnnnnn)

▪ Clearing code (format //XXnnn…nn)

Line 2: Beneficiary Bank name.

Line 3: Beneficiary Bank address line 1.

Line 4: Beneficiary Bank address line 2.

Line 5: Beneficiary Bank country (must be ISO

compliant format).

Lines 1, 2, 3 and 5 are mandatory.

Note: Tag :57D: should only be used if bank

code of Beneficiary Bank is unknown to ANZ

Transactive – AU & NZ.

:59:

Beneficiary

Customer

Alpha

5 x 35

Line 1: Account of the payment Beneficiary

preceded by a ‘/’.

Lines 2-5: Name and address of the payment

beneficiary.

Mandatory

:70:

Details of

Payment

Alpha

4 x 35

Four lines of information

OR

First Line RFB maximum of 16 characters and

3 lines thereafter a maximum of 35 characters

each)

E.g. :70:/RFB/Invoice 123

Optional

:71A:

Details of Charges

Alpha

3

Must be ‘SHA’ for RTGS payments.

Must be ’SHA’ or ‘OUR’ for International

payments.

Optional

23

Public

4.2.5 Miscellaneous Field Format Specifications

Optional Fields from SWIFT Message Type 101 may be utilised when creating a payment.

Tag

Field

Description

Type

Length

Notes

Mandatory/

Optional

:21F:

F/X Deal

Reference

Alpha

16

Foreign exchange instrument reference

(Deal/Bid/FEC).

For example:

:21F:123456789

Optional

:33B:

Currency

Original/Ordered

Amount

Numeric

15

Used in conjunction with field :21F: this value

is the sell currency amount with comma

separated decimal

For example:

:33B:5438,10

Optional

:36:

Exchange Rate

Numeric

12

Used in conjunction with field :21F: this value

is the F/X rate supplied by ANZ with comma

separated decimal

For example:

:36:0,42

Optional

4.2.6 Account with Institution Country ISO Code

ANZ must be provided a Country ISO code within SWIFT field 57 whenever a “D” format option is utilised

at Field :57:

4.2.7 Conditional field rules:

Field: 57: Account With Institution Country ISO Code

Definition: International Standards Association country code for domicile of Beneficiary Bank.

Format: 2 alpha

Presence: Mandatory when field: 57D: is present

Non-standard SWIFT field for Bank Country ISO Code:

Tag

Field Description

Type

Length

Notes

Mandatory/

Optional

:57:

Account With Institution

Country ISO

Alpha

2

Where field :57D: specified, it is mandatory to

provide the International Organization for

Standardization (ISO) Country code.

Optional

24

Public

4.3 NZ International Payment CSV file format (New Zealand only)

The NZ International Payment CSV File format allows a user to import an International Payment into ANZ

Transactive – AU & NZ as one or more Single Payment instructions. ANZ NZ accounts and ANZ foreign

currency accounts located in New Zealand can be used to fund these payments

Although NZ International Payment CSV files are supported by ANZ Transactive – AU & NZ, MT101 files

are the preferred file format for International payments.

4.3.1 File Naming Convention

Not Applicable.

4.3.2 NZ International CSV File Layout and Character Set

The NZ International Payment CSV file format contains one record per transaction and can contain

multiple transactions in a single file.

A valid CSV file must adhere to the following rules:

• All specified fields of type ‘alphanumeric’ must be enclosed in inverted commas (“”). The Beneficiary

Account number / IBAN International Bank Account Number. This is required for international

transactions paid to parties in Europe. If a valid IBAN is not supplied, additional charges may be

incurred.

• There must be a minimum of 1 record and it is recommended the file does not exceed a maximum of

1250 records.

Tag

Field Description

Type

Length

Notes

Mandatory/

Optional

1

Payment Currency

(Code)

Characters A..Z

a..z

3

Currency in which the international payment

is being made.

Mandatory

2

Payment Amount

Characters 0..9

and decimal,

maximum 3

digits allowed

after decimal

14 +

decimal

This is the amount in the payment currency

that the beneficiary will receive. Decimal point

is optional.

Mandatory

3

Value Date

Characters 0..9

8

The Payment Date for the international

payment transaction.

Format: DDMMYYYY

Must be greater than or equal to the present

date.

Mandatory

4

Beneficiary Bank

Country (Code)

Characters A..Z

a..z

2

Country where the international payment is

being sent.

Mandatory

5

Debit Account

Number

Characters A..Z

a..z 0..9 –

20

The Account Number from which the

international payment is to be made.

Mandatory

6

Your Reference

Characters A..Z

a..z 0..9 () - +

16

The reference that is displayed on your

statement. If this is not provided, ANZ

Transactive – AU & NZ will default this to the

first 16 characters of the Beneficiary Account

Name (field 9).

Optional

7

Charges Account

Number

Characters A..Z

a..z 0..9 -

20

This field will be ignored since charges will be

applied to your nominated billing account.

Optional

8

Beneficiary

Account Number

or IBAN

Alphanumeric,

but no spaces

allowed

34

Account number that will receive the

international payment.

Optional

9

Beneficiary

Account Name

Alphanumeric

35

Account Name for the receiving end of the

international payment.

Mandatory

10

Beneficiary

Address 1

Alphanumeric

35

First line of the address of the person /

organization to whom the payment is being

sent. The address must not be a P.O. Box

address.

Mandatory

11

Beneficiary

Address 2

Alphanumeric

35

Second line of the address of the person /

organization to whom the payment is being

sent. The address must not be a P.O. Box

Optional

25

Public

Tag

Field Description

Type

Length

Notes

Mandatory/

Optional

address.

12

Beneficiary

Address 3

Alphanumeric

35

Third line of the address of the person /

organization to whom the payment is being

sent. The address must not be a P.O. Box

address.

Optional

13

Message to

Beneficiary 1

Alphanumeric

35

First line of any transaction related details

sent to the beneficiary.

Optional

14

Message to

Beneficiary 2

Alphanumeric

35

Second line of any transaction related details

sent to the beneficiary.

Optional

15

Message to

Beneficiary 3

Alphanumeric

35

Third line of any transaction related details

sent to the beneficiary.

Optional

16

Message to

Beneficiary 4

Alphanumeric

35

Fourth line of any transaction related details

sent to the beneficiary.

Optional

17

SWIFT / BIC

Alphanumeric

11

An international standard to uniquely identify

a financial institution. (also known as BIC -

Bank Identifier Code).

If the SWIFT / BIC is unknown to ANZ

Transactive – AU & NZ, this field should be

left blank, and beneficiary bank details should

instead be provided in fields 18 – 22. (An

unrecognised SWIFT / BIC cannot be imported

by Transactive.)

One of fields

17 or 22

must be

populated

18

Bank Name

Alphanumeric

35

Name of the bank to which the international

payment is being sent.

Optional

19

Bank Branch

Alphanumeric

35

Name of the bank branch to which the

international payment is being sent.

Optional

20

Bank Address 1

Alphanumeric

35

First line of the address of the bank to which

the international payment is being sent.

Optional

21

Bank Address 2

Alphanumeric

35