1

Classification: Public

Classification: Public

ANZ

HOST TO HOST

FILE FORMATS

JULY 2021

2

Classification: Public

Table of Contents

1 INTRODUCTION ............................................................................................ 7

1.1 Overview ....................................................................................................................................... 7

1.2 Scope ............................................................................................................................................ 7

2 AU DOMESTIC PAYMENTS FILE FORMATS ......................................................... 8

2.1 Introduction ................................................................................................................................... 8

2.2 Overview ....................................................................................................................................... 8

2.3 File Naming Convention ................................................................................................................... 8

2.4 ABA File Layout and Character Set .................................................................................................... 8

Descriptive Record ........................................................................................................................... 8

Detail Record .................................................................................................................................. 10

Batch Control Record ....................................................................................................................... 11

2.5 BPAY File format (Australia only) ..................................................................................................... 12

BPAY File Layout and Character Set ................................................................................................... 12

File Header Record .......................................................................................................................... 13

Payment instruction record............................................................................................................... 13

File Trailer Record ........................................................................................................................... 14

Error messages ............................................................................................................................... 15

3 NZ DOMESTIC PAYMENTS FILE FORMATS ....................................................... 17

3.1 Introduction .................................................................................................................................. 17

3.2 Overview ...................................................................................................................................... 17

3.3 Host-to-Host File Naming Convention ............................................................................................... 17

3.4 File Layout and Character Set .......................................................................................................... 17

Descriptive Record .......................................................................................................................... 17

Detail Record .................................................................................................................................. 18

Batch Control Record ....................................................................................................................... 19

4 AU AND NZ DOMESTIC PAYMENTS REPLY FILE FORMAT ................................... 21

4.1 Overview ...................................................................................................................................... 21

4.2 Standard File Naming Convention .................................................................................................... 21

4.3 Domestic Payments Reply File Layout ............................................................................................... 21

Data Header Record One .................................................................................................................. 21

Data Header Record Two.................................................................................................................. 22

Detail Record .................................................................................................................................. 23

4.4 Failure Codes and Reasons .............................................................................................................. 24

5 CHINA DOMESTIC PAYMENTS FILE FORMATS .................................................. 27

5.1 Fixed-Length Payment File .............................................................................................................. 28

Header Detail Record ....................................................................................................................... 28

Payment Detail Record .................................................................................................................... 30

Enrichment Detail Record ................................................................................................................. 33

Additional Details Record ................................................................................................................. 33

5.2 ISO XML Payment File .................................................................................................................... 36

Group Header ................................................................................................................................. 36

Payment Information ....................................................................................................................... 38

Supplementary Data........................................................................................................................ 45

Supplementary Data Record ............................................................................................................. 45

6 SINGLE PAYMENTS FILE FORMATS ................................................................ 48

6.1 Introduction .................................................................................................................................. 48

6.2 MT101 Non-Straight Through Processing (NSTP) File Format (Australia and New Zealand) ...................... 48

Overview ....................................................................................................................................... 48

Host-to-Host File Naming Convention ................................................................................................ 48

MT101 File Layout and Character Set................................................................................................. 48

Sequence A – General Information .................................................................................................... 50

Sequence B – Transaction Detail Record ............................................................................................ 51

Clearing System Codes .................................................................................................................... 56

6.3 MT101 Straight Through Processing (STP File) Format (Australia and New Zealand) ............................... 57

Overview ....................................................................................................................................... 57

Host-to-Host File Naming Convention ................................................................................................ 57

MT101 File Layout and Character Set................................................................................................. 57

Sequence A – General Information .................................................................................................... 60

Sequence B – Transaction Detail Record ............................................................................................ 62

Instruction Codes ............................................................................................................................ 73

Clearing System Codes – Option A .................................................................................................... 75

Clearing System Codes – Option C .................................................................................................... 75

6.4 Single Payments Reply File Format (Australia and New Zealand) .......................................................... 76

Overview ....................................................................................................................................... 76

Single Payments Reply File Layout .................................................................................................... 76

Single Payments Reply File Layout .................................................................................................... 76

Payment Header Record................................................................................................................... 77

3

Classification: Public

Payment Main Record ...................................................................................................................... 77

Payment Funding Record ................................................................................................................. 78

Payment Error Record...................................................................................................................... 79

File Trailer ...................................................................................................................................... 79

Failure Messages ............................................................................................................................. 80

7 BTR FILE FORMATS ..................................................................................... 81

7.1 Introduction .................................................................................................................................. 81

7.2 CSV Files (Australia and New Zealand) ............................................................................................. 81

Introduction ................................................................................................................................... 81

File Naming Convention ................................................................................................................... 81

Statement Balance File Format ......................................................................................................... 81

Statement Transaction File Format .................................................................................................... 83

7.3 SAP/Multi-cash Files (Australia and New Zealand) .............................................................................. 85

Introduction ................................................................................................................................... 85

File Naming Convention ................................................................................................................... 85

SAP/Multi-cash Balance File Format ................................................................................................... 85

7.4 BTR SingleFile (Australia only) ......................................................................................................... 91

Overview ....................................................................................................................................... 91

File Naming Convention ................................................................................................................... 91

File Layout ..................................................................................................................................... 91

File Header ..................................................................................................................................... 91

Account Header .............................................................................................................................. 92

Transaction Record.......................................................................................................................... 94

Account Trailer ............................................................................................................................... 95

File Trailer ...................................................................................................................................... 95

8 RETURNED ITEMS FILES (AUSTRALIA ONLY) .................................................. 96

8.1 Introduction .................................................................................................................................. 96

8.2 File Naming Convention .................................................................................................................. 96

8.3 Returned Items File Layout ............................................................................................................. 96

Header Record – Returned Direct Debits and Credits ........................................................................... 97

Detail Record – Returned Direct Debits and Credits ............................................................................. 97

Trailer Record – Returned Direct Credits and Debits ............................................................................ 98

Header Record – Retuned Cheques ................................................................................................... 99

Detail Record – Retuned Cheques ..................................................................................................... 99

Trailer Record – Returned Cheques ................................................................................................. 101

Return Reason Codes – Returned Direct Debits/Credits ...................................................................... 101

Return Reason Codes – Returned Cheques ....................................................................................... 102

9 BTR FILE FORMATS (ANZ TRANSACTIVE) ...................................................... 104

9.1 Introduction ................................................................................................................................ 104

9.2 CSV File Format ........................................................................................................................... 104

File Naming Convention ................................................................................................................. 104

File Layout ................................................................................................................................... 104

File Format – Balance Record ......................................................................................................... 104

File Format – Transaction Record .................................................................................................... 107

9.3 Multicash File Format – SAPGen ..................................................................................................... 108

File Naming Convention ................................................................................................................. 108

File Layout ................................................................................................................................... 108

Balance Record ............................................................................................................................. 108

Transaction Record........................................................................................................................ 110

9.4 BAI File....................................................................................................................................... 113

Introduction ................................................................................................................................. 113

Reserved Characters ..................................................................................................................... 113

File Layout ................................................................................................................................... 114

File Header Record ........................................................................................................................ 115

Group Header Record .................................................................................................................... 115

Account Identifier and Summary Status Record ................................................................................ 116

Transaction Detail Record .............................................................................................................. 117

Continuation Record ...................................................................................................................... 118

Account Trailer Record ................................................................................................................... 119

Group Trailer Record.................................................................................................................... 120

File Trailer Record ....................................................................................................................... 120

9.5 NZ Statement Files (New Zealand Domestic Accounts only) ............................................................... 121

Introduction ................................................................................................................................. 121

NZ Statement File(s) – Balance File ................................................................................................. 121

NZ Statement File(s) – Transaction File ....................................................................................... 122

Transaction Record - Type 3 ....................................................................................................... 122

Opening Balance Record - Type 5 ............................................................................................... 124

Closing Balance Record - Type 6 ................................................................................................. 125

Total Debits/Credits Record - Type 8 ........................................................................................... 126

Grand Total Debits/Credits Record - Type 9.................................................................................. 127

4

Classification: Public

10 ANZ SWIFT REPORTING .............................................................................. 128

10.1 Introduction ................................................................................................................................ 128

10.2 File Format - MT940 Statement file ................................................................................................ 128

10.3 File Format – MT941 Intra-Day Balance Statement File ..................................................................... 130

10.4 File Format - MT942 Interim Transaction Report File ........................................................................ 131

10.5 File Format – MT950 Current Day Statement File ............................................................................. 133

11 OFF-SYSTEM BSB (OS BSB) (AUSTRALIA ONLY) ............................................. 135

11.1 Introduction ................................................................................................................................ 135

File Naming Convention ............................................................................................................... 135

11.2 File Format - Paper Transaction File................................................................................................ 136

Record Identifiers ........................................................................................................................ 136

Header Record ............................................................................................................................ 137

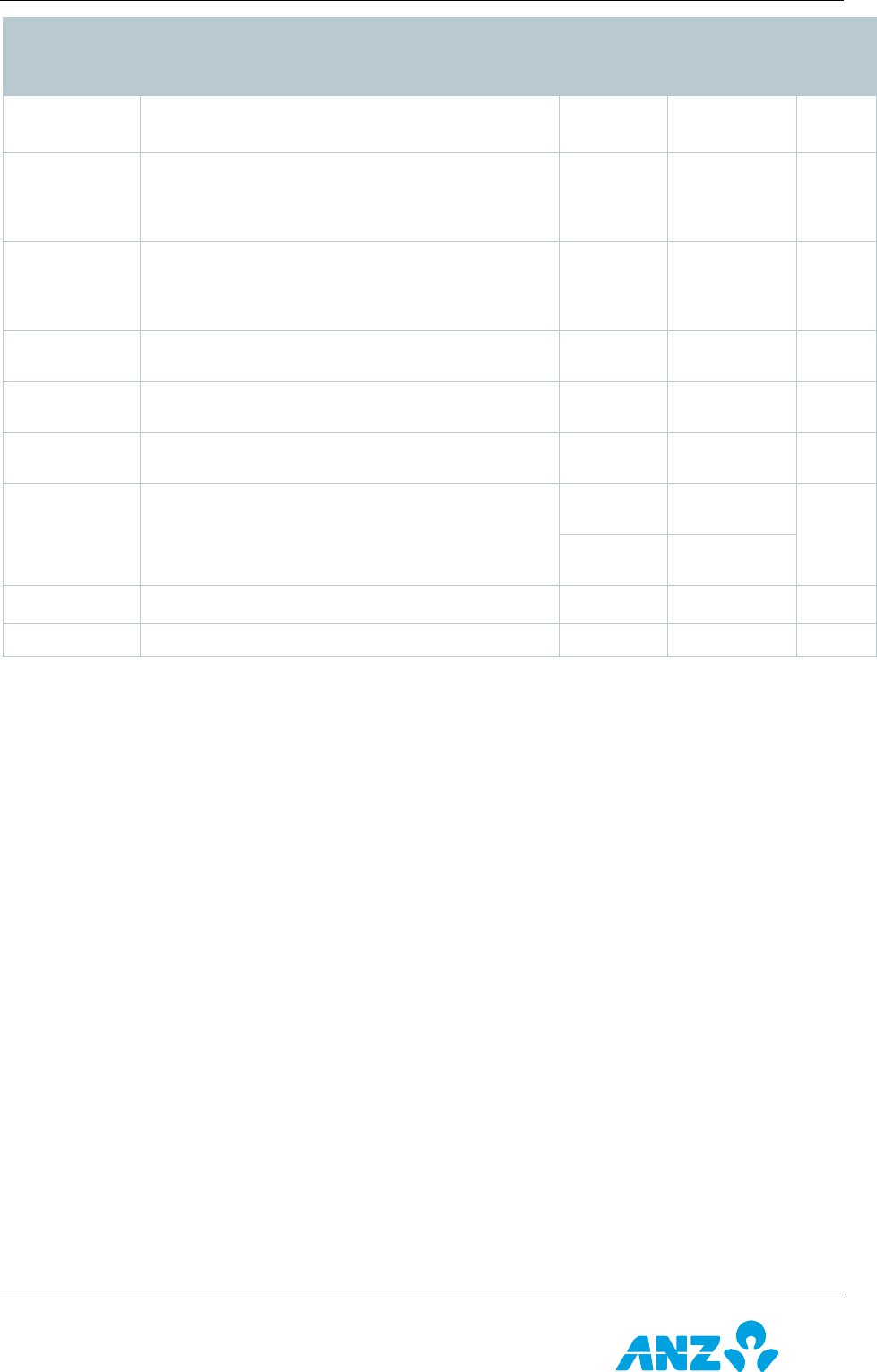

Transaction Records .................................................................................................................... 137

File Total Record ......................................................................................................................... 140

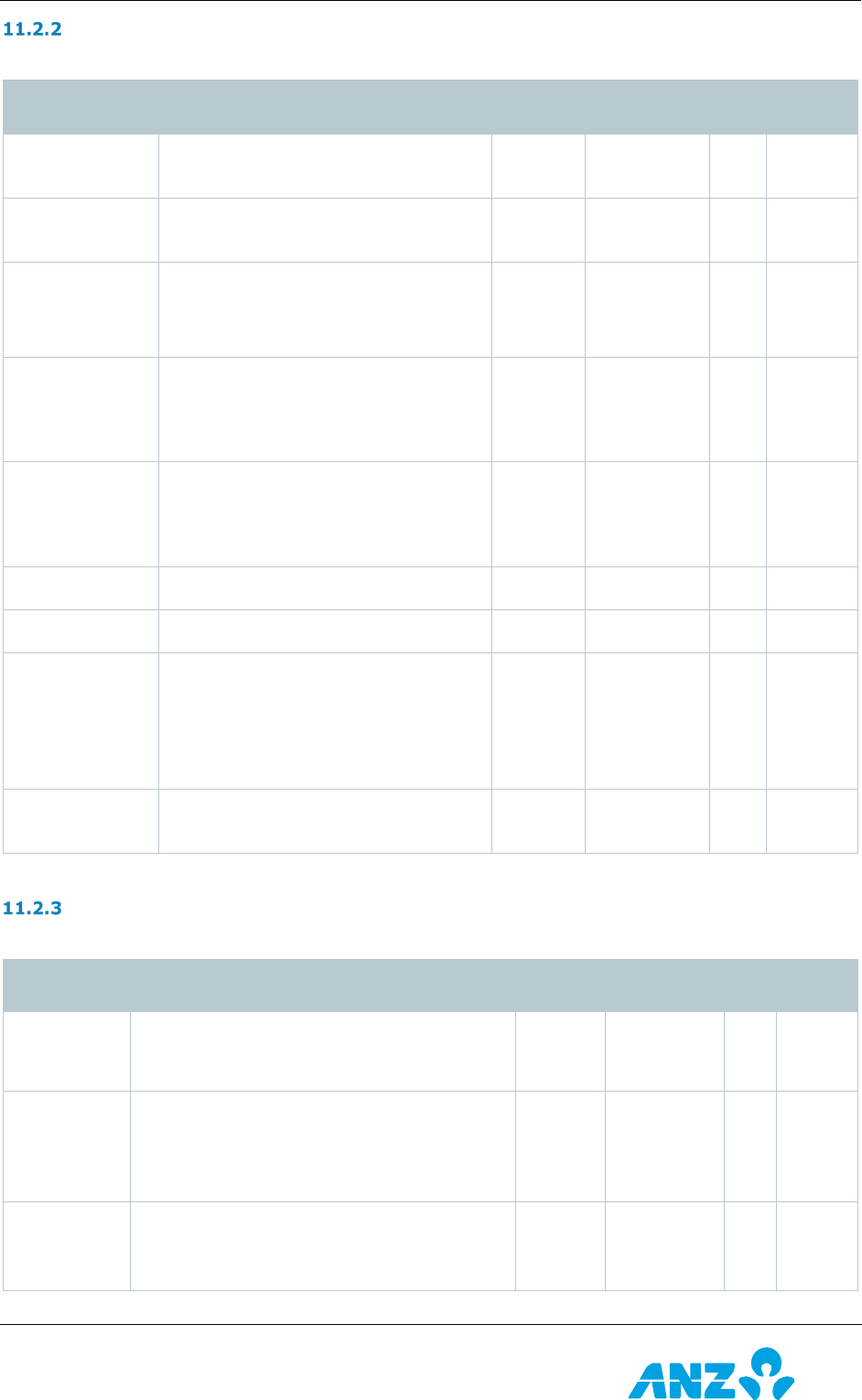

11.3 File Format - Direct Entry .............................................................................................................. 141

Direct Entry File Header Record..................................................................................................... 141

Direct Entry Exchange Record (Type 1) .......................................................................................... 142

Direct Entry File Total Record ........................................................................................................ 143

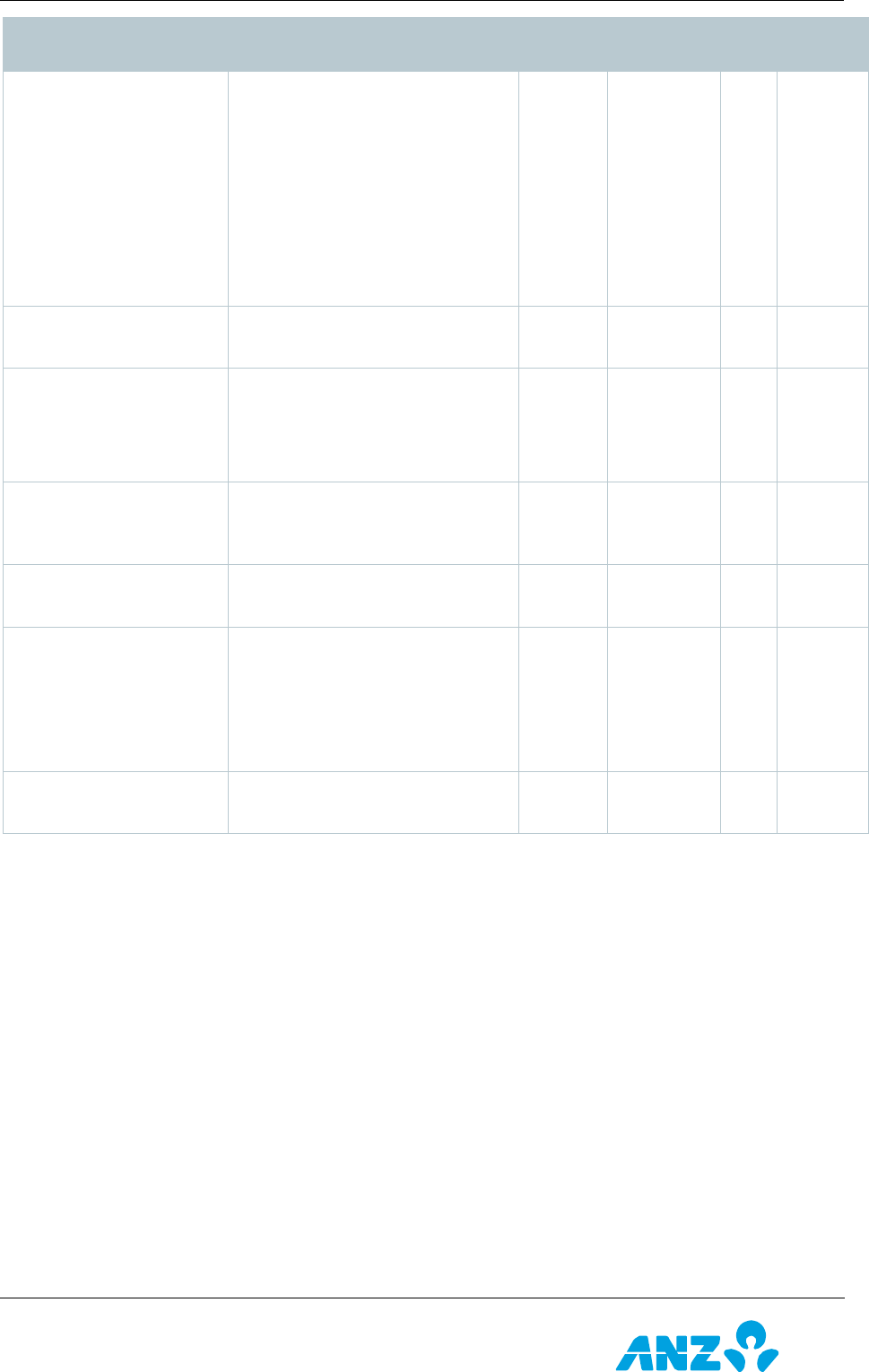

11.4 Return/Refusal File ....................................................................................................................... 143

Direct Entry & GDES File Header Record (Type 0) ............................................................................ 143

Direct Entry & GDES Rejected Record (Type 2) ............................................................................... 145

Direct Entry & GDES Refusal Record (Type 3) ................................................................................. 146

Summary Report ......................................................................................................................... 147

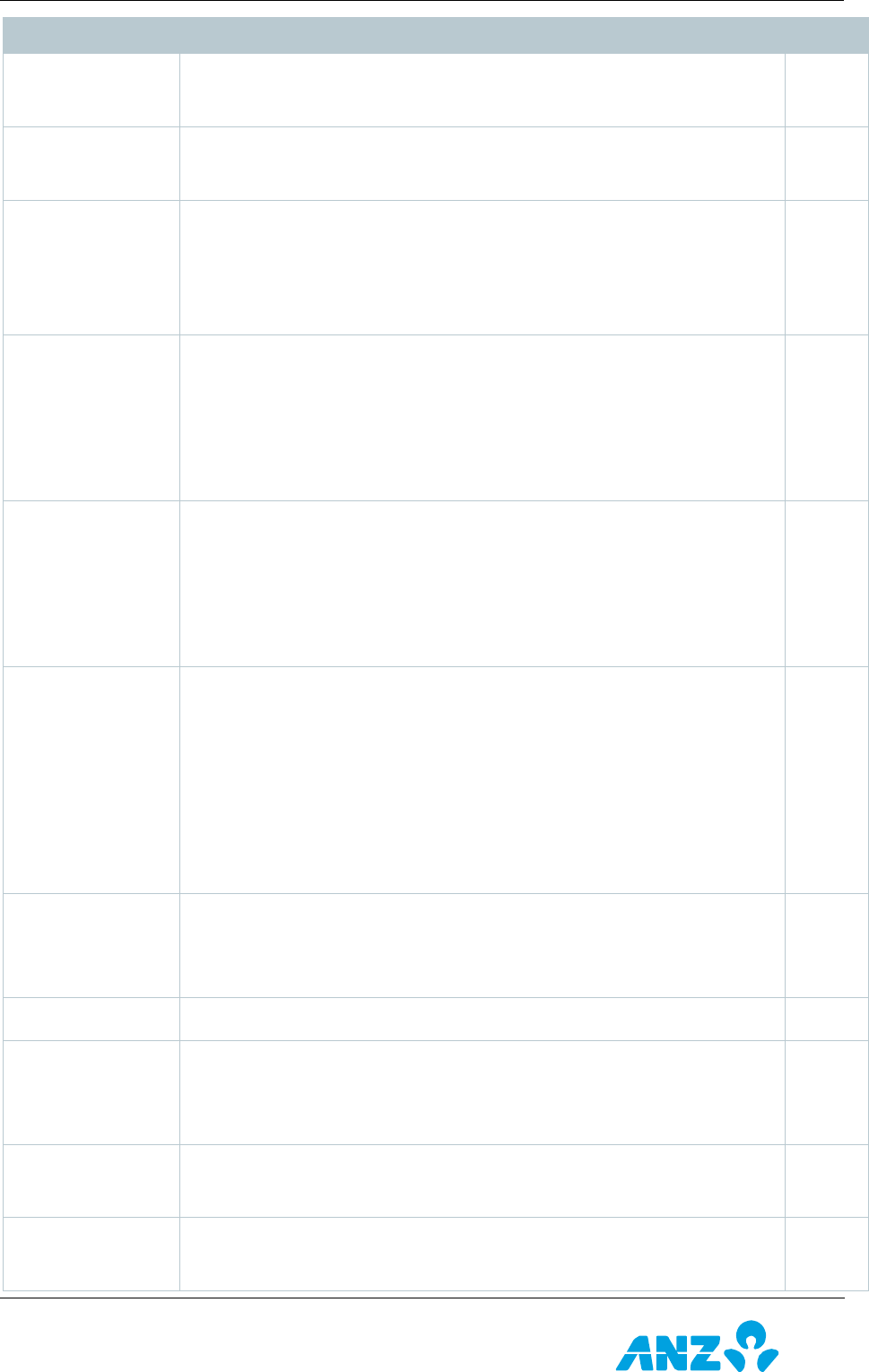

11.5 GDES File.................................................................................................................................... 147

GDES File Header Record ............................................................................................................. 147

GDES Exchange Record (Type 1) ................................................................................................... 148

GDES File Total Record ................................................................................................................ 149

12 ANZ RECEIVABLES MANAGEMENT ................................................................ 150

12.1 Introduction ................................................................................................................................ 150

Field Notations ............................................................................................................................ 150

Record Types .............................................................................................................................. 150

12.2 Open Items File Format ................................................................................................................ 151

Detail Record .............................................................................................................................. 151

12.3 Collection Detail File ..................................................................................................................... 152

File Structure .............................................................................................................................. 152

Header Record ............................................................................................................................ 152

Detail Record .............................................................................................................................. 152

Trailer Record ............................................................................................................................. 155

13 AGENCY CLEARING (AUSTRALIA ONLY) ......................................................... 157

13.1 Introduction ................................................................................................................................ 157

13.2 Standard File Naming Convention .................................................................................................. 157

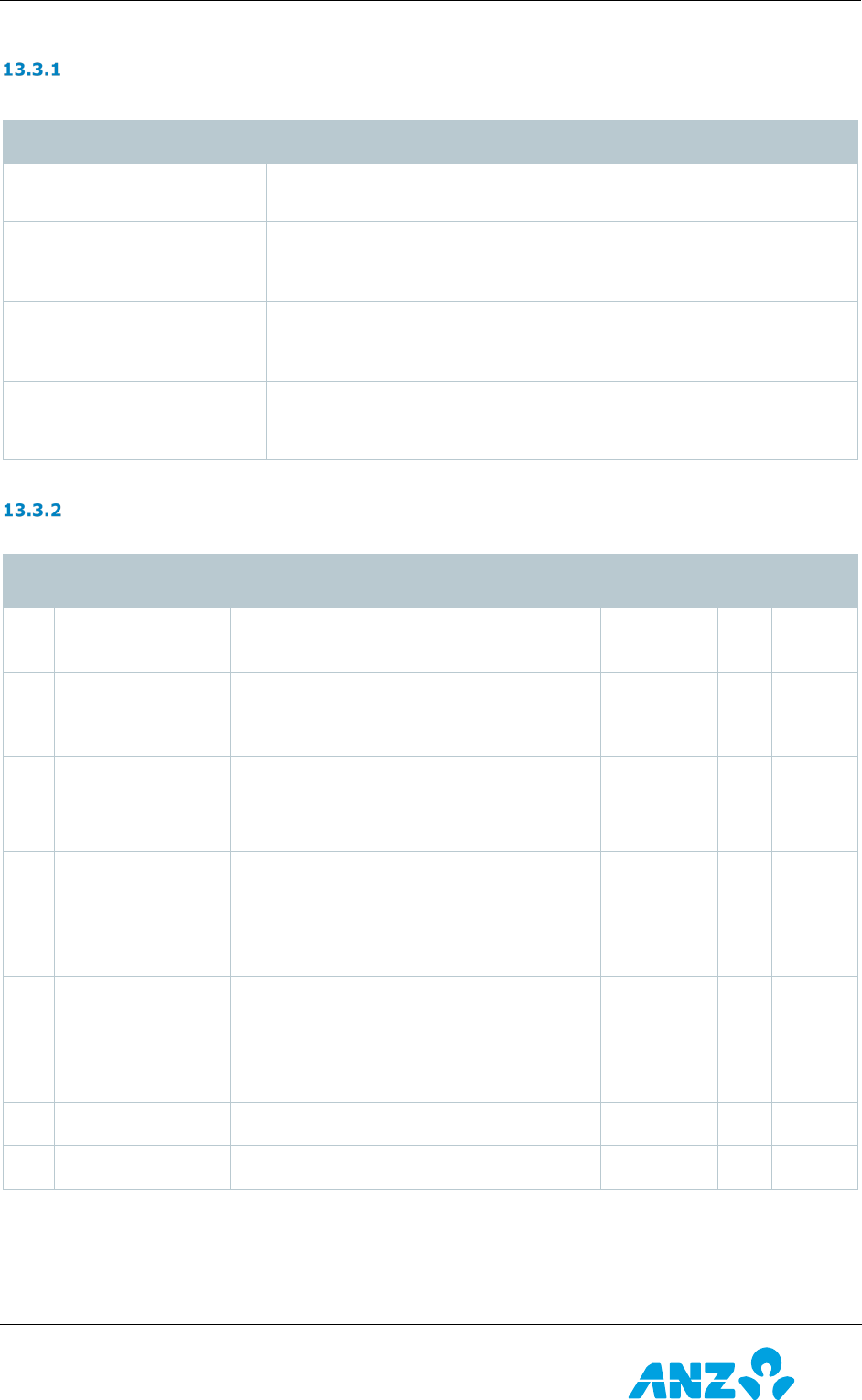

13.3 Electronic Presentment (Paper) File ................................................................................................ 158

Record Identifiers ........................................................................................................................ 158

Header record ............................................................................................................................. 158

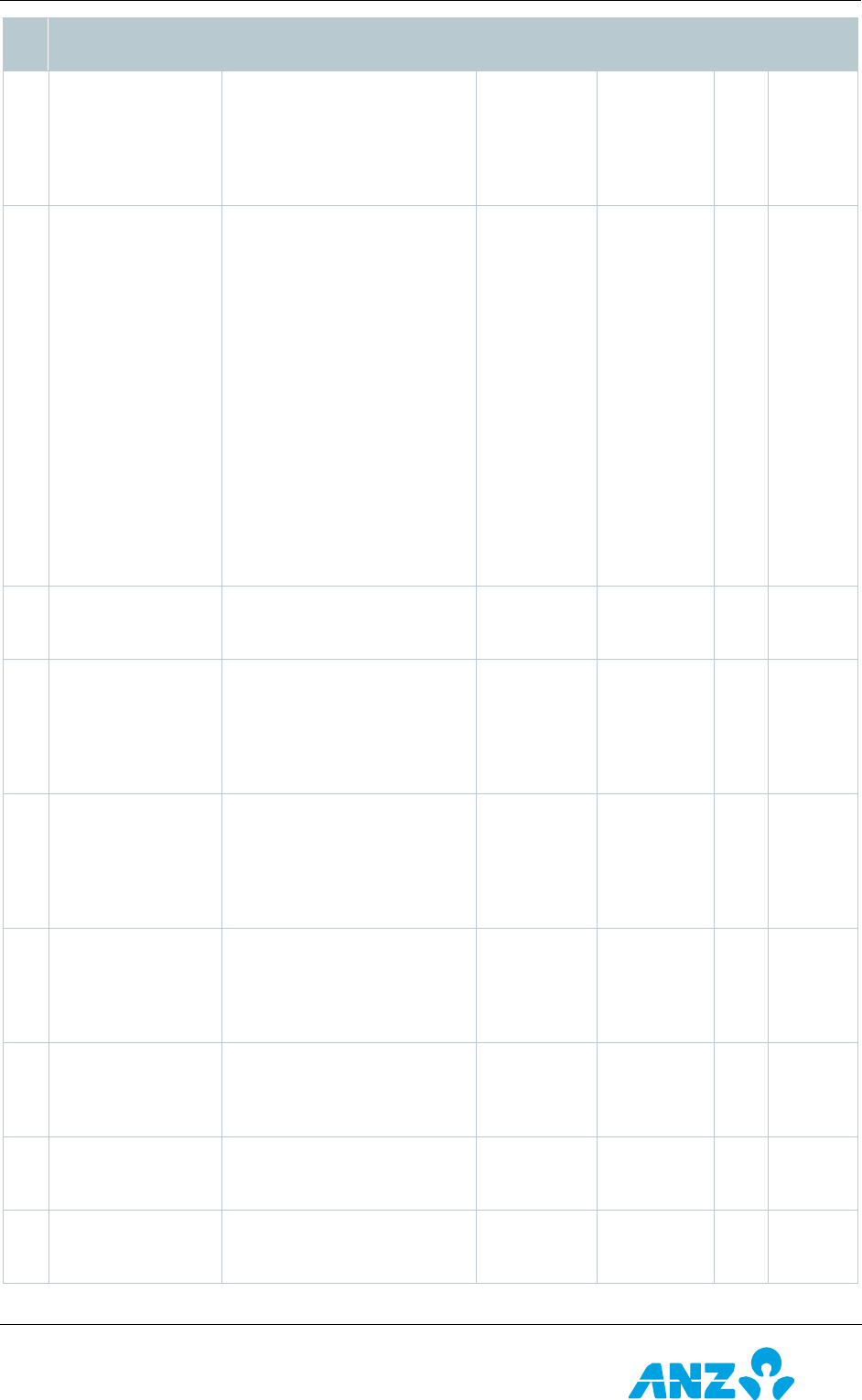

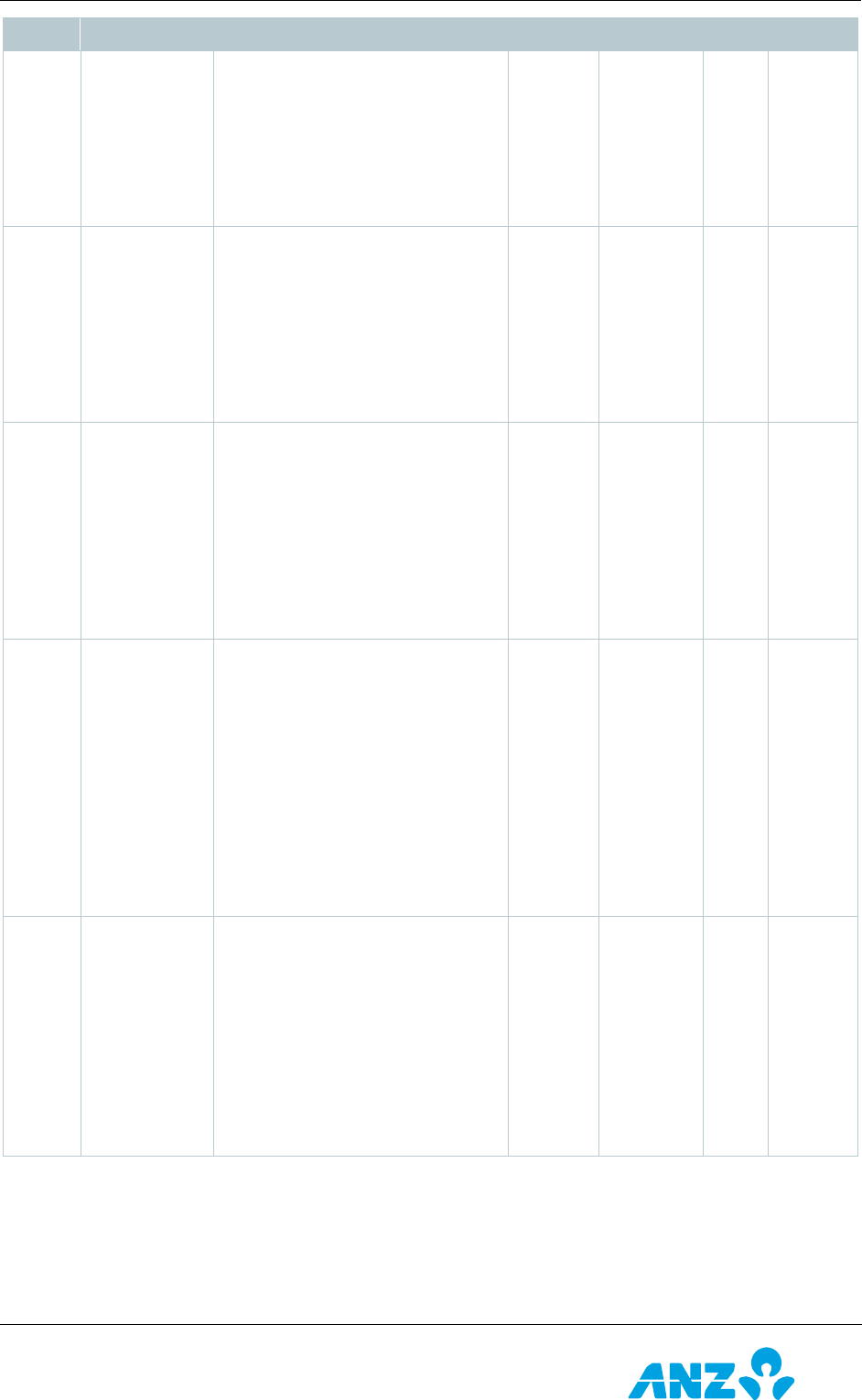

Transaction Records .................................................................................................................... 159

File Total Record ......................................................................................................................... 162

13.4 Inward Direct Entry File ................................................................................................................ 163

Direct Entry File Header Record..................................................................................................... 163

Direct Entry Exchange Record (Type 1) .......................................................................................... 165

Direct Entry File Total Record ........................................................................................................ 166

13.5 Outward Return/Refusal File .......................................................................................................... 166

Direct Entry & GDES File Header Record (Type 0) ............................................................................ 166

Direct Entry & GDES Rejected Record (Type 2) ............................................................................... 167

Direct Entry & GDES Refusal Record (Type 3) ................................................................................. 168

Direct Entry & GDES File Total Record (Type 7) ............................................................................... 169

13.6 Summary Report ......................................................................................................................... 170

Sample Daily Summary Report ..................................................................................................... 170

13.7 Inward GDES File ......................................................................................................................... 171

GDES File Header Record ............................................................................................................. 171

GDES Exchange Record (Type 1) ................................................................................................... 171

GDES File Total Record ................................................................................................................ 172

13.8 Cash and Cheque Deposit (Over the Counter) File ............................................................................ 173

Over the Counter File Header Record ............................................................................................. 173

Over the Counter File Detail Record ............................................................................................... 173

Over the Counter File Trailer Record .............................................................................................. 174

13.9 Outward Direct Entry File .............................................................................................................. 175

File Layout and Character Set ....................................................................................................... 175

Header Record ............................................................................................................................ 175

Detail Record .............................................................................................................................. 176

Batch Control Record ................................................................................................................... 178

13.10 Inward APCS Dishonour and Voucher Required File .......................................................................... 179

APCS Dishonour and Refusal File Layout ....................................................................................... 179

5

Classification: Public

Header Record – APCS 9000 for APCS 1011 .................................................................................. 179

Detail Record – APCS 1011 ......................................................................................................... 179

Trailer Record – APCS 9090 for APCS 1011 ................................................................................... 182

Header Record – APCS 9000 for APCS 1510 .................................................................................. 182

Detail Record – APCS 1510 ......................................................................................................... 183

Trailer Record – APCS 9090 for APCS 1510 ................................................................................... 185

13.11 Outward APCS Refusal File ............................................................................................................ 185

Outward APCS Refusal File Layout ............................................................................................... 185

Header Record – APCS 9000 for APCS 1012 .................................................................................. 185

Detail Record – APCS 1012 ......................................................................................................... 186

Trailer Record – APCS 9090 for APCS 1012 ................................................................................... 189

13.12 Inward BECS Return and Refusal Files ............................................................................................ 189

Header Record – BECS Type 0 .................................................................................................... 189

Detail Record – BECS Type 2 ...................................................................................................... 190

Detail Record – BECS Type 3 ...................................................................................................... 192

Trailer Record – BECS Type 7 ...................................................................................................... 193

13.13 Threshold Transaction Report ........................................................................................................ 193

Threshold Transaction Report File Layout ...................................................................................... 193

Threshold Transaction Report Header Record ................................................................................ 194

Threshold Transaction Report Detail Record .................................................................................. 194

Threshold Transaction Report Trailer Record ................................................................................. 201

13.14 Appointer Image File (AIF) XML File Format .................................................................................... 201

<HEADER> Record .................................................................................................................... 202

<ITEM> Record ......................................................................................................................... 202

<TRAILER> Record .................................................................................................................... 204

Image Quality Requirements ....................................................................................................... 204

File Requirements ...................................................................................................................... 205

File Validations .......................................................................................................................... 205

Hash File .................................................................................................................................. 205

ZIP File .................................................................................................................................... 206

13.15 Appointer Image File (AIF) Report Descriptions ................................................................................ 206

Full Processing Report ................................................................................................................ 206

Summary Report ....................................................................................................................... 206

14 BPAY+ (AUSTRALIA ONLY) .......................................................................... 208

14.1 Introduction ................................................................................................................................ 208

14.2 Standard File Naming Convention .................................................................................................. 208

14.3 File Layout .................................................................................................................................. 208

14.4 File Format - Standard Output File ................................................................................................. 209

Header Record ............................................................................................................................ 209

Detail Record .............................................................................................................................. 209

Trailer Record ............................................................................................................................. 212

14.5 Summary Report and Tax Invoice .................................................................................................. 213

Sample Daily Summary Report ..................................................................................................... 213

Sample Monthly Tax Invoice ......................................................................................................... 214

Detailed Transaction Report .......................................................................................................... 215

15 POINT-OF-SALE (POS) (AUSTRALIA ONLY) .................................................... 216

15.1 Introduction ................................................................................................................................ 216

15.2 Standard File Naming Convention .................................................................................................. 216

15.3 POS File Layout ........................................................................................................................... 216

15.4 POS File Format ........................................................................................................................... 216

Transaction Record ...................................................................................................................... 216

16 ANZ COMMERCIAL CARDS (VISA) (AUSTRALIA ONLY) .................................... 218

16.1 Overview .................................................................................................................................... 218

16.2 Standard File Naming Convention .................................................................................................. 218

16.3 File Layout .................................................................................................................................. 218

16.4 File Format .................................................................................................................................. 218

File Naming Convention Record ..................................................................................................... 218

Account Balances Record .............................................................................................................. 218

Card Account Record ................................................................................................................... 219

Cardholder Record ....................................................................................................................... 220

Company Record ......................................................................................................................... 221

Hierarchy Level Record ................................................................................................................ 221

Hierarchy Tree Record ................................................................................................................. 221

Hierarchy Record......................................................................................................................... 222

Period Record ............................................................................................................................. 222

Transaction Record .................................................................................................................... 224

17 ANZ LOCKBOX (AUSTRALIA ONLY) ............................................................... 226

17.1 Introduction ................................................................................................................................ 226

17.2 Standard File Naming Convention .................................................................................................. 226

17.3 File Layout .................................................................................................................................. 226

17.4 Detail Record Usage ..................................................................................................................... 227

6

Classification: Public

17.5 ANZ Lockbox File Format .............................................................................................................. 228

Header Record ............................................................................................................................ 228

Detail Record .............................................................................................................................. 228

Transaction Details - Remittance Details Record .............................................................................. 228

Transaction Details - Credit Card Details Record .............................................................................. 228

Transaction Details—Cheque Details Record ................................................................................... 229

Transaction Details—Trailer .......................................................................................................... 229

Field Definitions .......................................................................................................................... 229

18 ANZ LOCKBOX (NEW ZEALAND ONLY) .......................................................... 232

18.1 Introduction ................................................................................................................................ 232

Record File Format ...................................................................................................................... 232

Batch Summary Files Example ...................................................................................................... 233

19 BANK@POST CUSTOMER TRANSACTION DATA FILE & CUSTOMER TRANSACTION

REPORT 234

19.1 Introduction ................................................................................................................................ 234

Bank@Post Customer Transaction Data File .................................................................................... 234

Bank@PostCustomer Transaction Report ........................................................................................ 234

19.2 File Format .................................................................................................................................. 234

Bank@PostFile Header ................................................................................................................. 234

Bank@PostTransaction Record ...................................................................................................... 234

Bank@PostTrailer Details ............................................................................................................. 236

19.3 Sample Bank@PostCustomer Transaction Report ............................................................................. 237

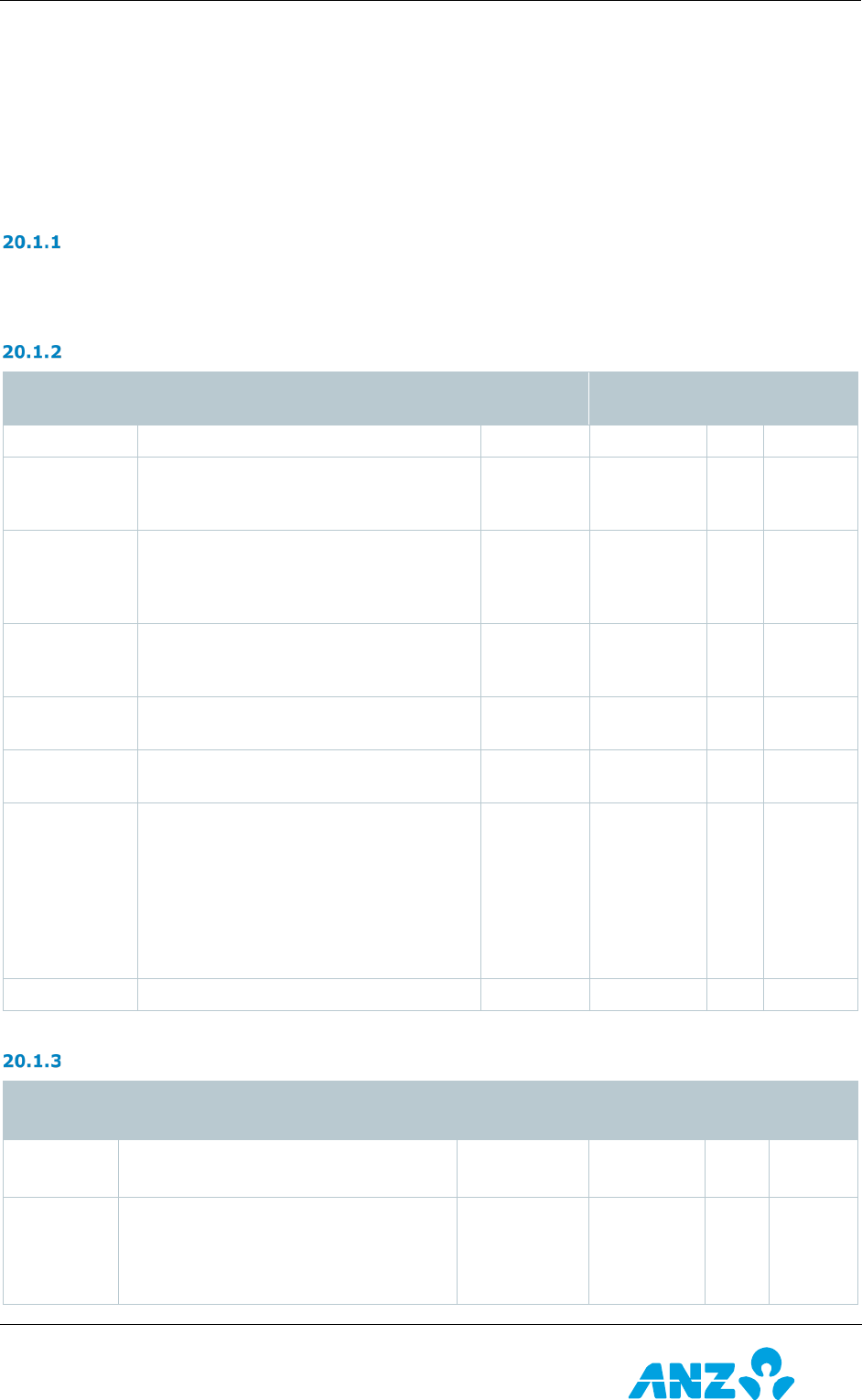

20 BPAY PIM/ AM ............................................................................................ 238

20.1 Introduction ................................................................................................................................ 238

Payer / Biller Details File ........................................................................................................................... 238

Payer/Biller Details File – File Layout ............................................................................................. 238

Payer/Biller Details File – Header Record ........................................................................................ 238

Payer/biller Details File – Payment Instruction Record ...................................................................... 238

Payer/biller Details File – Trailer Record ......................................................................................... 241

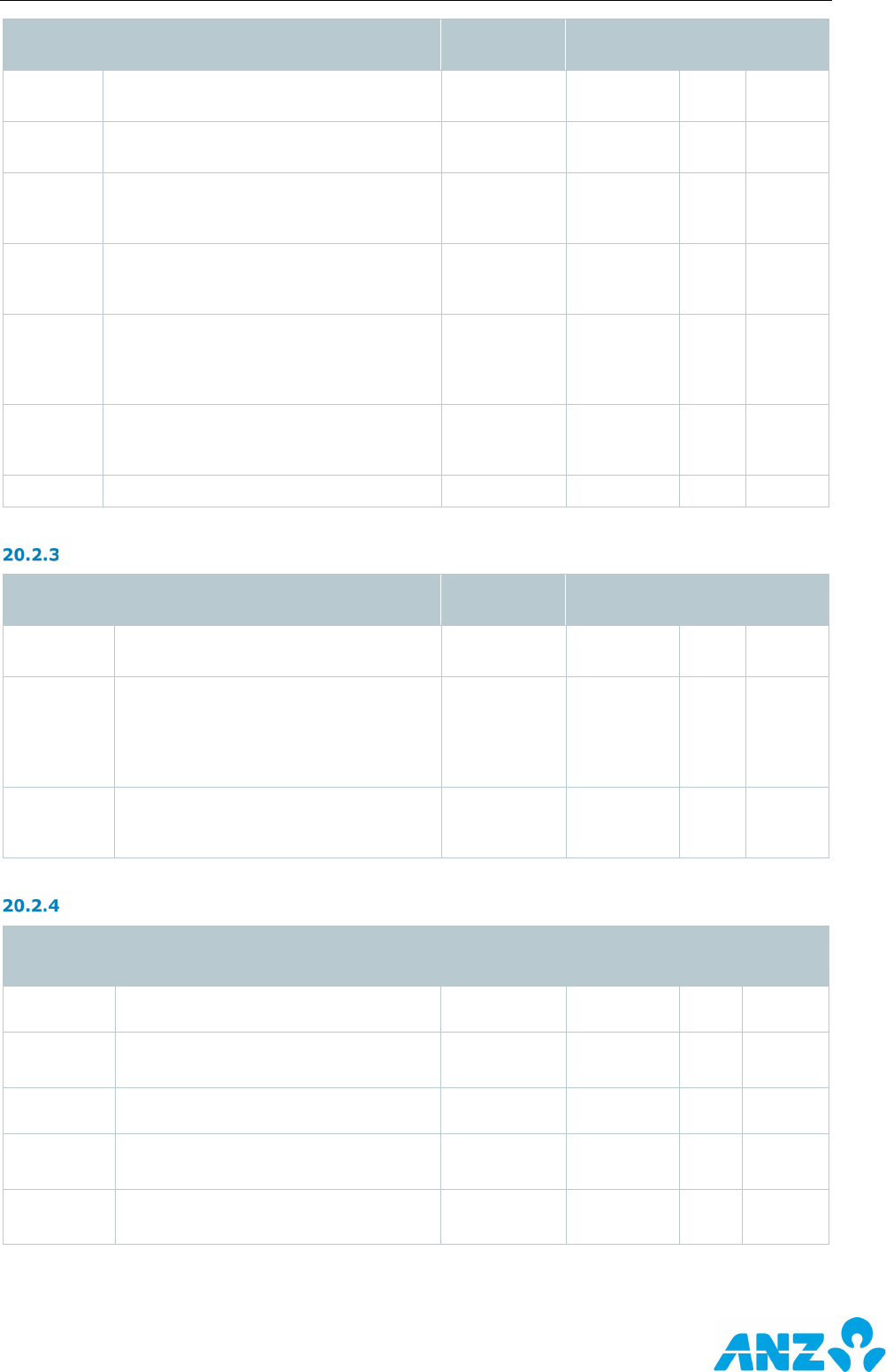

20.2 Payer Details Rejections File .......................................................................................................... 242

Payer Details Rejections File – File Layout ...................................................................................... 242

Payer Details Rejections File – Header Record ................................................................................. 242

Payer Details Rejections File - Rejection Record .............................................................................. 243

Payer Details Rejections File – Trailer Record .................................................................................. 243

Payer Details Rejections File – File Rejection Reasons ...................................................................... 244

Payer Details Rejections File – Record Rejection Reasons ................................................................. 245

21 APPENDICES.............................................................................................. 248

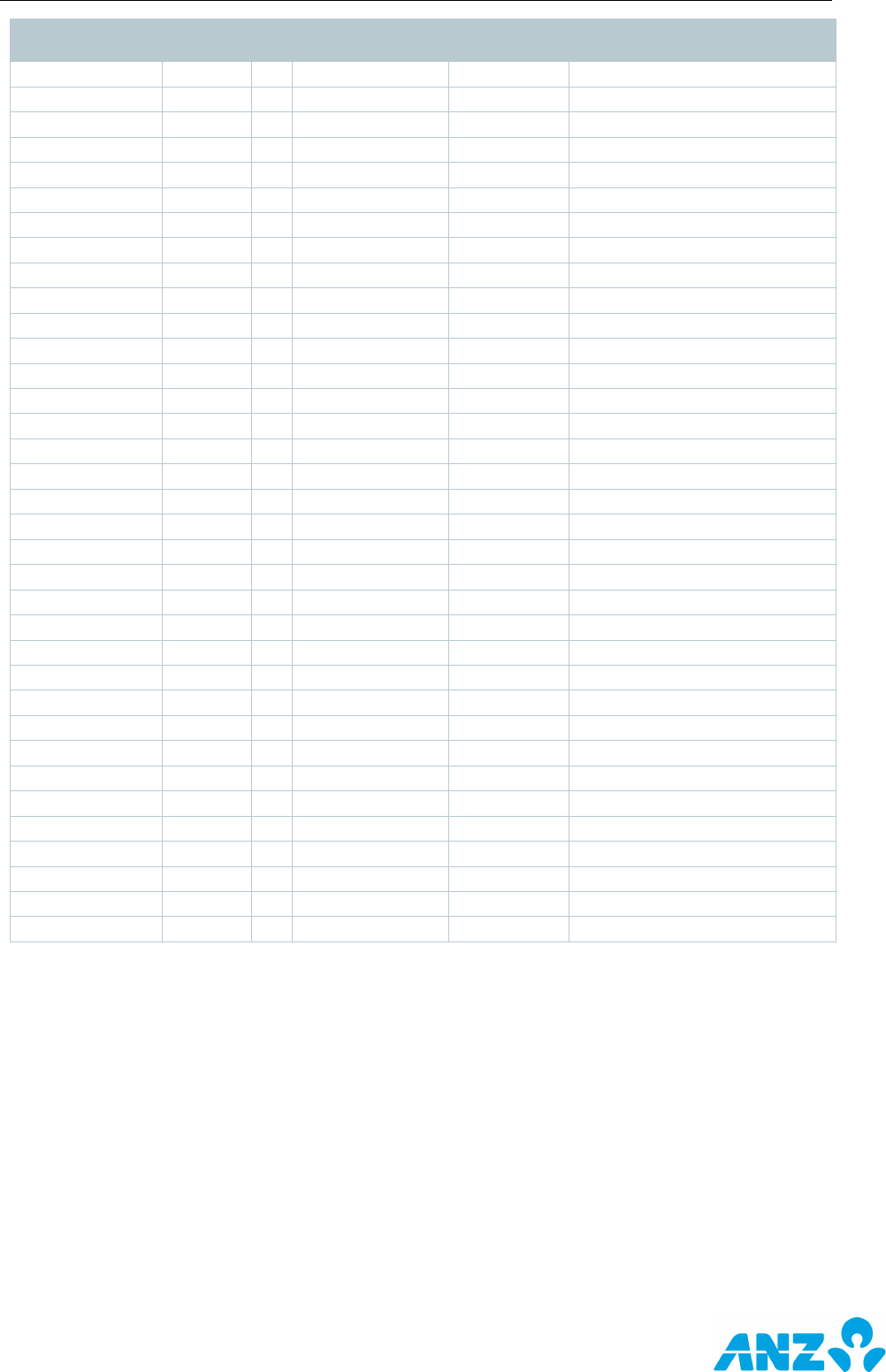

21.1 Appendix A – Transaction Codes (Tandem) ..................................................................................... 248

Transaction code descriptions - HFR Source. ................................................................................... 248

Transaction code descriptions - CMM Source ................................................................................... 255

Transaction Code to BAI Code Mapping .......................................................................................... 263

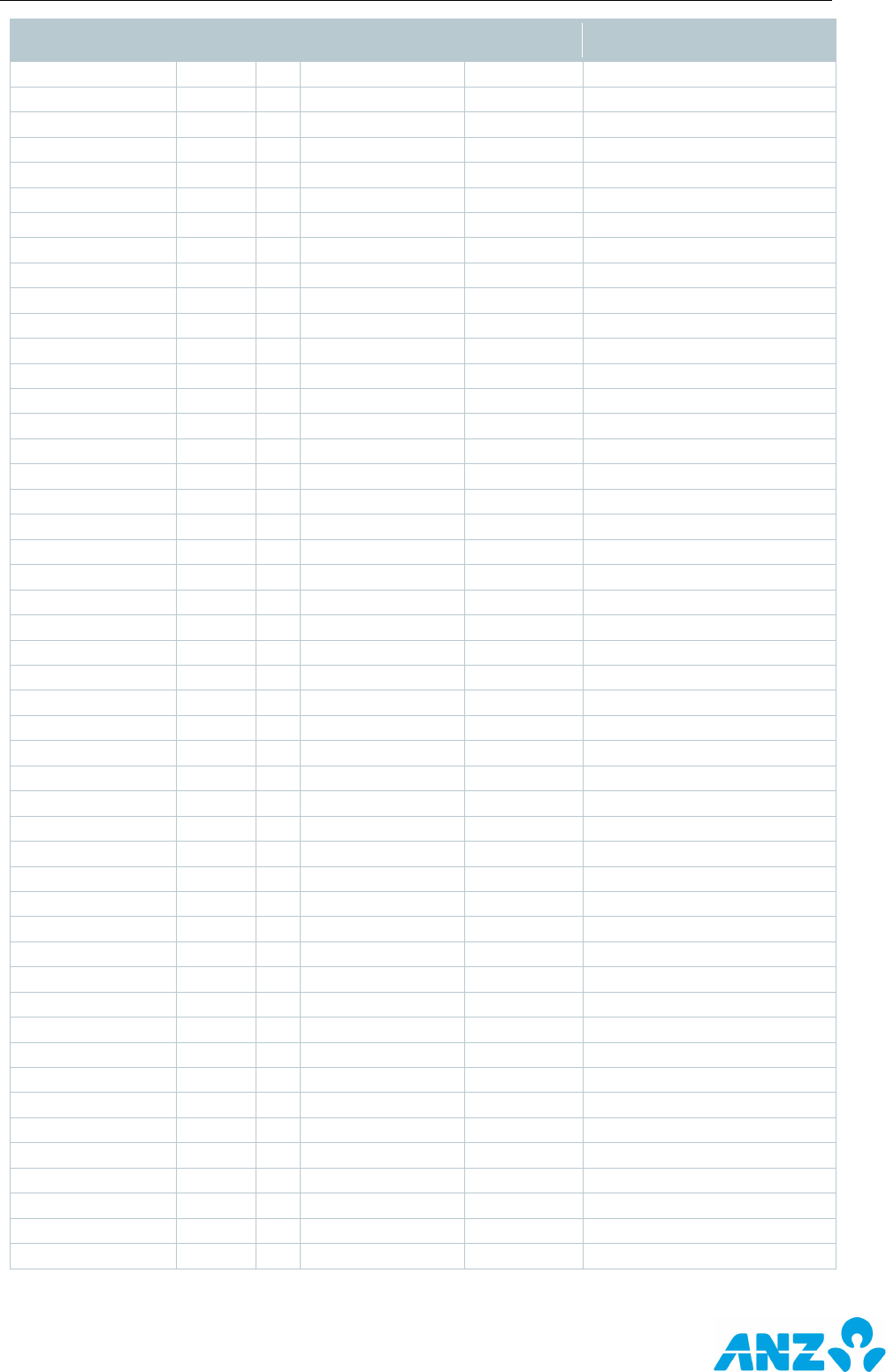

22 APPENDIX B – BAI/TRANSACTION CODES – (ANZ TRANSACTIVE) .................... 271

22.1 BAI Status and Summary Level Items ............................................................................................ 271

22.2 Transaction code descriptions – HFR / CMM / V2P Source.................................................................. 275

Transaction code descriptions – MANTEC / MIDANZ Source .............................................................. 293

Transaction code descriptions – SYS Source ................................................................................... 297

Transaction code descriptions –XBK Source .................................................................................... 307

23 APPENDIX C - USE OF AUXDOM/TRANCODE .................................................. 308

24 APPENDIX D - IMPROVED STATEMENT NARRATIVE ......................................... 310

24.1 Statement Narrative Rules for Returned Cheques ............................................................................. 310

Statement Narrative Rules for Returned Direct Entry Debits and Credits .......................................................... 311

Example ..................................................................................................................................... 311

25 APPENDIX E – MT940/MT950 CODES ............................................................ 312

26 APPENDIX F – CASH ACTIVE CONTROL TRANSACTION BATCH IMPORT ............. 313

27 APPENDIX G: CHINA PAYMENT CODES .......................................................... 314

27.1 BOP Codes .................................................................................................................................. 314

27.2 Purpose Codes ............................................................................................................................. 319

Page 7 of 321

1 INTRODUCTION

1.1 Overview

The purpose of this document is to collate the various file formats for ANZ Transaction Banking.

This document is intended to be a file format specification only, and as such does not include any

training in how to use the different file formats.

1.2 Scope

This document applies to:

The following standard file formats:

Domestic Payments import file formats:

o AU Domestic Payments ABA import file format.

o NZ Domestic Payments NZD import file format.

o AU and NZ Domestic Payments Reply File format.

Single Payments import file formats:

o MT101 file format (Australia and New Zealand)

o Single Payments Reply File format.

Balance & Transaction and Returned Items Reporting export file formats:

o CSV export format

o SAP/Multi-cash export format

o BAI2 export format

o New Zealand Statement export format

o Returned Items export format

o BTR Singlefile format

Other file formats included;

o Off System BSB (OS BSB) file format (Australia only)

o Agency Clearing file format (Australia only)

o BPAY file format (Australia only)

o BPAY+ file format (Australia only)

o Point-of-Sale (POS) file format (Australia only)

o ANZ Commercial Cards (Visa) file format (Australia only)

o ANZ LockBox file format (Australia and New Zealand)

o Enhanced Cheque Processing (Australia only)

o Bank@Post file format

o ANZ Receivables Management

o ANZ SWIFT Reporting

o AIF XML File Format

This document does NOT address:

Instructions for importing/exporting files.

Examples of correctly formatted import/export files.

Any possible customisations made to file naming conventions.

Page 8 of 321

2 AU DOMESTIC PAYMENTS FILE FORMATS

2.1 Introduction

This section details the types of AU Domestic Payments import file formats.

2.2 Overview

The ABA File format allows a user to import an ABA formatted file as one or more batches of payment

instructions.

Note:

The ABA file conforms to the Australian Payments Network (APN) file specifications.

ANZ recommends the use of ISO 20022 XML Corporate to Bank systems integration. Please contact

your ANZ representive for further details. This legacy format is provided for reference where it is

currently used by customers.

2.3 File Naming Convention

The length of the filename - inclusive of colons and file extensions – must be no more than 22

characters in order that the whole file name is included in the reply file.

2.4 ABA File Layout and Character Set

An ABA file can contain one or more batches of payment instructions. The records in the ABA file to be

imported must follow a defined order. Each batch must:

Start with a Descriptive Record.

Contain one or more Detail Record(s).

End with a Batch Control Record.

The format specifications for each of these record types are outlined in detail further in this document.

The following character set is allowed in an ABA file:

Fields that are marked ‘Alpha’ (Alphanumeric) in the ‘Type’ column are limited to:

o Letters: A-Z, a-z

o Numbers: 0-9

o The following Characters: spaces ( ) , ampersands (&), apostrophes (‘), commas (,) , hyphens

(-), full stops (.), forward slashes (/), plus sign (+), dollar sign ($), exclamation mark (!),

percentage sign (%), left parenthesis ((), right parenthesis ()), asterisk (*), number sign (#),

equal sign (=), colon (:), question mark (?), left square bracket ([), right square bracket (]),

underscore (_), circumflex (^) and the at symbol (@)

o ‘Optional’ Alphanumeric fields must be filled with spaces if no data exists.

Fields that are marked ‘Numeric’ in the ‘Type’ column are limited to:

o Numbers: 0-9.

o ‘Optional’ Numeric fields must be filled with zeros if no data exists.

ABA files are required to be prepared as 120 byte fixed length records and must be separated by CRLF

(carriage-return/line feed, Hex 0D0A). This must be consistent for the whole file.

Descriptive Record

The Descriptive Record contains AU Domestic Payment batch header details.

If using ANZ Fileactive in combination with ANZ Transactive – Global the payment funding account

can be specified using one of the following methods (in order of preference):

1. Provide a BSB and Account Number in the Descriptive Record

Page 9 of 321

2. Create a self-balancing file in your accounting software which will add an extra line in the file

to represent the total debit for the payment.

Note: if neither of these methods is used, the system will choose an account linked to the DE User ID.

If there is more than one account linked to the DE User ID, the batch will fall into a needs repair

status.

The following table describes the format of the Descriptive Record:

Field

Description

Type Notes

Start

Position

End

Position

Length

Mandatory/

Optional

Record type

Numeric

Must be ‘0’.

1

1

1

Mandatory

BSB

Alpha

Bank/State/Branch number of the

funds account with a hyphen in the

4th character position.

e.g. 013-999.

2

8

7

Mandatory

Account

Number

Alpha

Funds account number.

Note: the funding BSB and account

must match the BSB/accounts linked

to the User Identification Number

specified in position 57-62

9

17

9

Mandatory

Reserved

Alpha

Blank filled.

18

18

1

Optional

Sequence

number

Alpha

Must be ‘01’.

19

20

2

Mandatory

Name of User

Financial

Institution

Alpha

Must contain the bank mnemonic

that is associated with the BSB of the

funds account.

e.g. ‘ANZ’.

21

23

3

Mandatory

Reserved

Alpha

Blank filled.

24

30

7

Optional

Name of User

supplying File

Alpha

User Preferred Name as registered

with ANZ

31

56

26

Mandatory

User

Identification

number

Numeric

Direct Entry User ID.

Right-justified, zero-filled.

57

62

6

Mandatory

Description of

entries on File

Alpha

Description of payments in the file

(e.g. Payroll, Creditors etc.).

Can be used to match existing AU

domestic payments template

(including Restricted Templates). This

only applies to payments requiring

web authorisation.

63

74

12

Mandatory

Date to be

processed

Alpha

Date on which the payment is to be

processed.

DDMMYY (e.g. 010111).

75

80

6

Mandatory

Time

Alpha

Time on which the payment is to be

processed.

24 hour format - HHmm.

• If blank or spaces, process now.

• If the time is less than the

current time, process now

• If the time is after the final cut-

off time:

• The batch will be placed in a

‘warehoused’ status with a

release time of 00:00 on the

following day

Otherwise, process at time specified

81

84

4

Optional

Page 10 of 321

Field

Description

Type Notes

Start

Position

End

Position

Length

Mandatory/

Optional

Reserved

Alpha

Blank filled.

85

120

36

Optional

Detail Record

Each Detail Record contains one AU Domestic Payment instruction. One or more Detail Items can be

included in a single ABA batch.

The following table describes the format of the Detail Record:

Field

Description

Type Notes

Start

Position

End

Position

Length

Mandatory/

Optional

Record type

Numeric

Must be ‘1’.

1

1

1

Mandatory

BSB of account

to be CREDITED

or DEBITED

Alpha

Bank/State/Branch number with a

hyphen in the 4

th

character position.

e.g. 013-999.

2

8

7

Mandatory

Account number

to be CREDITED

or DEBITED

Alpha

Numeric, hyphens & blanks are valid.

Right justified, blank filled.

Leading zeros that are part of an

Account Number must be included.

9

17

9

Mandatory

Withholding Tax

Indicator

Alpha

One of the following values, if

applicable:

N – for New or varied BSB number or

name details

W – Dividend paid to a resident of a

country where a double tax

agreement is in force.

X – Dividend paid to a resident of any

other country.

Y – Interest paid to all non-

residence.

The amount of withholding tax is to

appear in the Amount of Withholding

Tax field.

18

18

1

Optional

Transaction

Code

Numeric

Select from the following options as

appropriate:

50 General Credit.

53 Payroll.

54 Pension.

56 Dividend.

57 Debenture Interest.

13 General Debit.

19

20

2

Mandatory

Amount to be

CREDITED or

DEBITED

Numeric

Right justified, zero filled, unsigned,

two decimal places are implied (e.g.

$10.21 is recorded as 0000001021).

21

30

10

Mandatory

Page 11 of 321

Field

Description

Type Notes

Start

Position

End

Position

Length

Mandatory/

Optional

Title of account

to be CREDITED

or DEBITED

Alpha

Preferred format is: Surname

followed by given names with one

blank between each name.

e.g. SMITH John Alan.

Numeric, hyphens, semicolons &

blanks are valid. Left justified, blank

filled.

31

62

32

Mandatory

Lodgement

Reference

Produced on the

recipient’s

Account

Statement.

Alpha

Payment reference indicating details

of the origin of the entry (e.g. payroll

number, policy number).

Left justified, blank filled.

63

80

18

Mandatory

Trace BSB

Number

Alpha

Bank/State/Branch number of the

trace account with a hyphen in the

4

th

character position.

e.g. 013-999

81

87

7

Mandatory

Trace Account

Number

Alpha

Numeric, alpha, hyphens & blanks

are valid. Right justified, blank filled.

Leading zeros that are part of an

Account Number must be included.

88

96

9

Mandatory

Name of

Remitter

Produced on the

recipient’s

Account

Statement.

Alpha

Name of originator of the entry. This

may vary from Name of User.

Left justified, blank filled.

97

112

16

Mandatory

Withholding

amount

Numeric

Must be zero filled or contain a

withholding tax amount.

If it contains a withholding tax

amount, two decimal placed are

implied (e.g. $10.21 is recorded as

0000001021).

113

120

8

Optional

Batch Control Record

The Batch Control Record contains details relating to the total number of items as well as debit/credit

totals for a batch within the ABA import file.

Field

Description

Type Notes

Start

Position

End

Position

Length

Mandatory/

Optional

Record type

Numeric

Must be ‘7’.

1

1

1

Mandatory

Reserved

Alpha

Must be ‘999-999’.

2

8

7

Mandatory

Reserved

Alpha

Blank filled.

9

20

12

Optional

Page 12 of 321

Field

Description

Type Notes

Start

Position

End

Position

Length

Mandatory/

Optional

Batch Net Total

Amount

Numeric

Batch Credit Total Amount minus

Batch Debit Total Amount.

Right justified, zero filled, unsigned,

two decimal places are implied (e.g.

$1001.21 is stored as ‘0000100121’).

21

30

10

Mandatory

Batch Credit

Total Amount

Numeric

Must be zero filled or contain the

total value of all Record Type 1

CREDIT transactions in the batch.

Right justified, zero filled, unsigned,

two decimal places are implied.

31

40

10

Mandatory

Batch Debit

Total Amount

Numeric

Must be zero filled or contain the

total value of all Record Type 1

DEBIT transactions in the batch.

Right justified, zero filled, unsigned,

two decimal places are implied.

(e.g. $1001.21 is stored as

‘0000100121’).

41

50

10

Mandatory

Reserved

Alpha

Blank filled.

51

74

24

Optional

Batch Total Item

Count

Numeric

Total count of Type 1 records in the

batch.

Right justified, zero filled.

75

80

6

Mandatory

Reserved

Alpha

Blank filled.

81

120

40

Optional

2.5 BPAY File format (Australia only)

The file format for importing BPAY payments is the Batch Entry Method (BEM) format. This format

allows a user to submit multiple BPAY payments to one or more billers in a single file. Each payment

instruction is processed as a single batch. Only Australian domiciled accounts can be used to fund

these payments.

BPAY File Layout and Character Set

A valid BPAY file consists of the following record types:

• A File Header Record

• Payment Instruction Record(s)

• A File Trailer Record

The following character set is allowed in a BPAY file:

• Fields that are marked ‘Alpha’ (Alphanumeric) in the ‘Type’ column are limited to:

o Letters: A-Z, a-z

o Numbers: 0-9

o The following Characters: spaces ( ) , ampersands (&), apostrophes (‘), commas (,) , hyphens

(-), full stops (.), forward slashes (/), plus sign (+), dollar sign ($), exclamation mark (!),

percentage sign (%), left parenthesis ((), right parenthesis ()), asterisk (*), number sign (#),

equal sign (=), colon (:), question mark (?), left square bracket ([), right square bracket (]),

underscore (_), circumflex (^) and the at symbol (@)

Page 13 of 321

o ‘Optional’ Alphanumeric fields must be filled with spaces if no data exists

• Fields that are marked ‘Numeric’ in the ‘Type’ column are limited to:

o Numbers: 0-9

o ‘Optional’ Numeric fields must be filled with zeros if no data exists

o Unless otherwise indicated, numeric fields should be right justified and blank filled

ANZ Transactive – Global requires BPAY Import files to be prepared as 201 byte fixed length records

and must be separated by CRLF (carriage-return/line feed, Hex 0D0A). This must be consistent for the

whole file.

File Header Record

The File Header Record contains BPAY Payment header details.

Field

Description

Type

Notes

Start

Postion

End

Position

Length

Mandatory/

Optional

Record Type

Numeric

A code ‘00’ indicating the

Header record

1

2

2

Mandatory

Payer

Institution Code

Alphanumeric

The Institution Code that is

to receive the file. For

example ANZ, 114, C02,

etc.

3

5

3

Mandatory

File Creation

Date

Numeric

Format YYYYMMDD. The

local date of file creation.

6

13

8

Mandatory

File Creation

Time

Numeric

Format HHMMSS. The

local time of file creation.

14

19

6

Mandatory

File Number

Numeric

The unique file number for

the file creation date

20

22

3

Mandatory

Filler

Alpha

Spaces

23

201

179

Mandatory

Payment instruction record

The Payment Instruction record contains information usded to create the BPay payment.

Field

Description

Type Notes

Start

Position

End

Position

Length

Mandatory/

Optional

Record Type

Numeric

A code ‘50’ indicating a Payment

Instruction record

1

2

2

Mandatory

Payer

Institution Code

Alphanumeric

The Code representing the Payer

Institution. For example ANZ, 114,

C02, etc.

3

5

3

Mandatory

Payment

Account Detail

Alphanumeric

The relevant account number of

the payer (BSB and account

number), left justified with trailing

spaces.

6

25

20

Mandatory

Country of

Payment

Alpha

The ISO alphabetic country code in

which the Payer’s Account resides.

This will be the code for Australia.

26

28

3

Optional

Page 14 of 321

Field

Description

Type Notes

Start

Position

End

Position

Length

Mandatory/

Optional

State of

Payment

Alpha

The alphanumeric state in which

the Payer’s account resides, if the

country has state codes.

29

31

3

Optional

Currency Code

of Payment

Alpha

The ISO alphabetic code denoting

the currency of Payment. This

should be the code for Australian

Dollars (AUD).

32

34

3

Mandatory

Biller Code

Numeric

The CIP assigned number denoting

the Biller

35

44

10

Mandatory

Service Code

Numeric

Reserved for future use. Currently

zero filled. e.g. “0000000”

45

51

7

Mandatory

Customer

Reference

Number

Alphanumeric

The number by which the Biller

identifies the account that is being

paid. Left Justified filled with

trailing spaces. The leading non-

space part must be all numeric. .

Include leading zeroes if advised by

Biller.

52

71

20

Mandatory

Amount

Numeric

The amount of the Payment, 2

digits of cents implied

72

83

12

Mandatory

BPAY

Settlement Date

Numeric

The date is used for forward dating

files, in YYYYMMDD format. If left

blank, the date will default to the

current business day.

84

91

8

Optional

Payer Name

Alphanumeric

The name of the Batch Payer

92

131

40

Optional

Additional

Reference Code

Alphanumeric

Not required

132

151

20

Optional

Discretionary

Data

Alphanumeric

Not required

152

201

50

Optional

File Trailer Record

Field

Description

Type

Notes

Start

Postion

End

Position

Length

Mandatory/

Optional

Record Type

Numeric

A code ‘99’ indicating the

Trailer record.

1

2

2

Mandatory

Payer

Institution

Code

Alphanumeric

Same value as Header record.

3

5

3

Mandatory

File Creation

Date

Numeric

Same value as Header record.

6

13

8

Mandatory

Page 15 of 321

File Creation

Time

Numeric

Same value as Header record.

14

19

6

Mandatory

File Number

Numeric

Same value as Header record.

20

22

3

Mandatory

Number of

Payments

Numeric

The total number of Payment

Instructions in the file.

23

31

9

Mandatory

Amount of

Payments

Numeric

The total amount of Payment

Instructions in the file, 2 digits

of cents implied.

32

46

15

Mandatory

Filler

Alpha

Spaces

47

201

155

Mandatory

NOTE: Bpay file upload format can have only single header and single footer.

Error messages

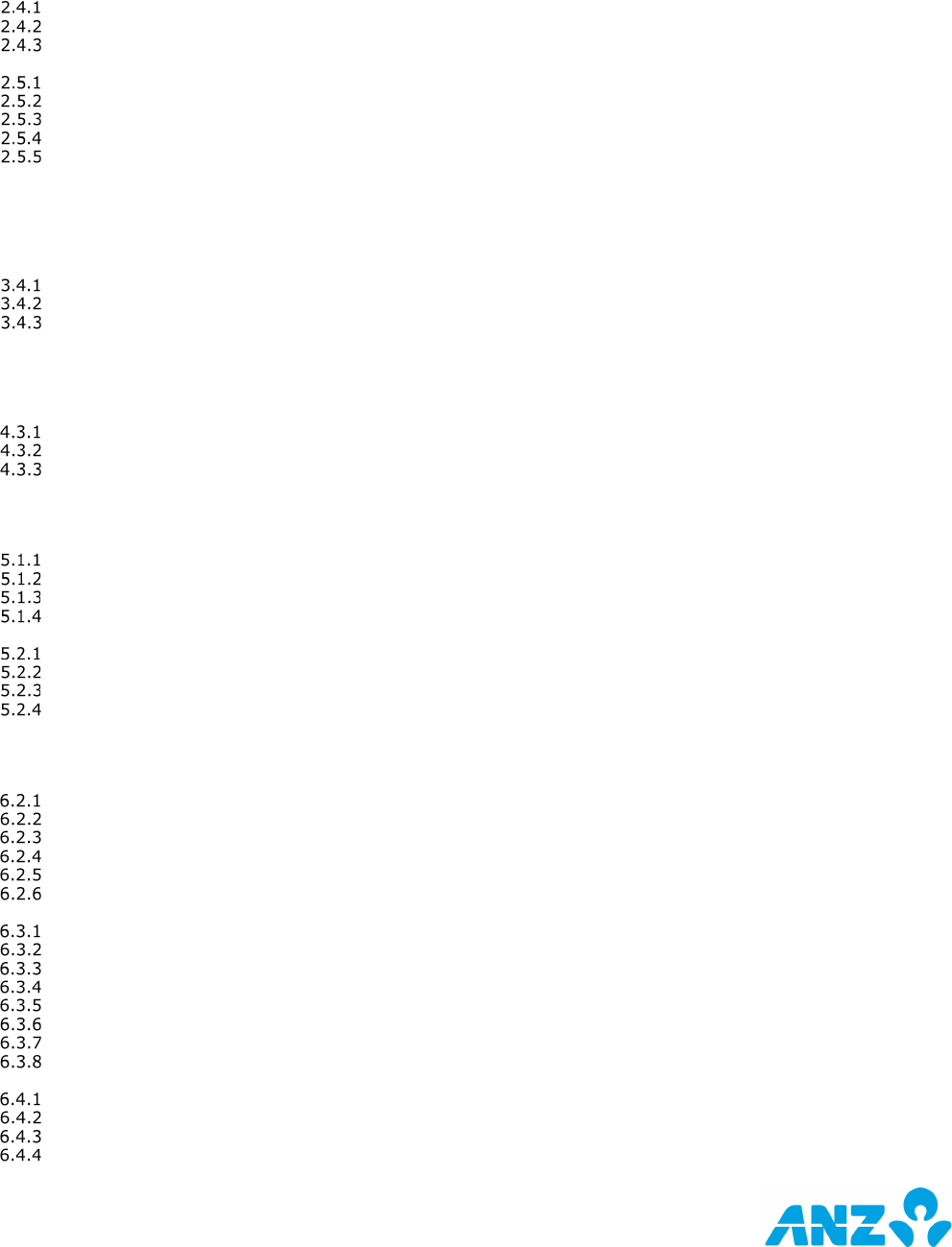

Type

Validation

Validation Description

Action

Error Code

File Level

Entire File

Invalid BPAY file, where the file is

not in the specified format

- Not as per the defined file

structure

Reject File

Invalid File Format.

- Empty File

There are no records in the file.

- Unable to read the data

Invalid File Format.

Validate

header record

The batch must start with a

header record

Batch must start with a header

record.

Validate

Control record

The batch must end with a

control record

Batch must end with a control

record.

Batch Level

Validate detail

items

The batch must contain at least

one (1) valid transaction Record.

Reject batch

There are no detail records in

the batch.

Validate batch

total

The batch total (count / amount)

must match with the total of

payment instructions

Invalid batch totals.

Debit Account

Number

Debit Account Number is not

available

<Field name> is mandatory.

Product

Entitlement

Product is not entitled for the

given division / debit account

number

Product is not entitled. Contact

the ANZ Customer Service

Centre.

Payment Date

Given payment date is not a valid

date or payment date is dated

beyond the defined threshold

Pay Date is not a valid date.

Mandatory

Field

Validation

Batch Level Mandatory field is

missing

<Field name> is mandatory.

Character

Validation

Character set validation in batch

level fields

Invalid characters in <Field

Name>.

Duplicate

Payment

Duplicate payment batch

The payment is a possible

duplicate.

Page 16 of 321

Field level

Payment

Amount

Payment Amount is not available

Reject

Instruction

<Field name> is mandatory.

Biller Code

Biller Code is not available

<Field name> is mandatory.

Biller Code is invalid / not found

<Field name> is invalid.

Customer

Reference

Number

Customer Reference Number is

not available

<Field name> is mandatory.

Customer Reference Number is

invalid

<Field name> is invalid.

The instructed payment amount

is not within the specified biller's

minimum and maximum

payment amount thresholds.

Payment Amount is not within

Biller’s Threshold.

Character

Validation

Character set validation in

transaction level fields

Invalid characters in <Field

Name>.

Processing

Insufficient

Funds

Payment failed due to insufficient

funds

Reject Batch

Insufficient funds.

Pending CAD

officer

approval

Payment is moved to LMS for

CAD officer approval as the limit

exceeded

Limit exceeded pending ANZ

approval

CAD officer

rejected

Limits approval is rejected by

CAD officer

Limit authorisation is rejected.

Bank user

stopped

Payment is stopped by bank user

Payment stopped at customer‘s

request.

Technical

errors

Technical error contact ANZ

helpdesk.

Page 17 of 321

3 NZ DOMESTIC PAYMENTS FILE FORMATS

3.1 Introduction

This section details the NZ Domestic Payments import file format.

ANZ recommends the use of ISO 20022 XML Corporate to Bank systems integration. Please contact

your ANZ representive for further details. This legacy format is provided for reference where it is

currently used by customers.

3.2 Overview

The NZ Domestic Payments import file format allows a user to import a Domestic Payment as one or

more batches of payment instructions.

3.3 Host-to-Host File Naming Convention

The length of the filename - inclusive of colons and file extensions – must be no more than

22 characters in order that the whole file name is included in the reply file.

3.4 File Layout and Character Set

An NZ Domestic Payments file can contain one or more batches of payment instructions. The records

in the file to be imported must follow a defined order. Each batch must:

Start with a Descriptive Record.

Contain one or more Detail Record(s).

End with a Batch Control Record.

The format specifications for each of these record types are outlined in detail further in this document.

The following character set is allowed in an NZ Domestic Payment file:

Character fields can contain both alpha and numeric values

Numeric fields should only have digit values (0-9)

The delimiter between fields is a comma, so text fields such as Other Party Name should not

contain commas. There may optionally be a comma after the final field.

Descriptive Record

The Descriptive Record contains Domestic Payment batch header details.

The following table describes the format of the Descriptive Record:

Field

Description

Type Notes

Record

Position

Max

Length

Mandatory/

Optional

Record Type

Numeric

Must be "1"

1

1

Mandatory

Batch Type

Numeric

"D" = Debit Batch / "C" = Credit Batch

2

1

Mandatory

Payment Date

Numeric

In The Form YYYYMMDD (e.g. 20100130)

3

8

Mandatory

Payment Time

Numeric

HHMM (e.g. 1330 is 1.30pm)

4

4

Optional

Batch Creation

Date

Numeric

Value may be omitted or a YYYYMMDD

format value will be ignored

5

8

Optional

Funds Account

Numeric

In Form BBbbbbAAAAAAASS (2, 4, 7, 2).

No hyphens

6

15

Mandatory

DD Code

Numeric

Mandatory for Debit Batches

7

7

Conditional

Reporting Method

Numeric

"S" = Single / "M" = Multiple. The Multiple

Reporting Method has a threshold of 4999

transaction items. If the threshold is

8

1

Mandatory

Page 18 of 321

Field

Description

Type Notes

Record

Position

Max

Length

Mandatory/

Optional

exceeded Reporting Method will be

updated to ‘Single’ upon validation of the

file. Customers will not be notified via the

front-end.

Dishonour

Account

Numeric

In Form BBbbbbAAAAAAASS (2, 4, 7, 2).

No hyphens

9

15

Mandatory

Batch Name

Alphanumeric

The name given to the batch being

created.

Can be used to match an existing NZ

domestic payments template (including

Restricted Templates). This only applies to

payments requiring web authorisation.

10

12

Mandatory

Originator

Particulars

Alphanumeric

Reference details which are captured by

the originator.

11

12

Optional

Originator

Analysis Code

Alphanumeric

Reference details which are captured by

the originator.

12

12

Optional

Originator

Reference

Alphanumeric

Reference details which are captured by

the originator.

13

12

Optional

Reserved

-

Field reserved for future use.

14

-

Optional

Reserved

-

Field reserved for future use.

15

-

Optional

Reserved

-

Field reserved for future use.

16

-

Optional

Detail Record

One or more Detail Items can be included in a single NZ Domestic Payment batch.

The following table describes the format of the Detail Record:

Field

Description

Type Notes

Record

Position

Max

Length

Mandatory/

Optional

Record Type

Numeric

Must be "2"

1

1

Mandatory

Account Number

to be CREDITED

or DEBITED

Numeric

In Form BBbbbbAAAAAAASS (2, 4, 7, 2),

BBbbbbAAAAAAASSS (2, 4, 7, 3) or

BBbbbbAAAAAAAASSS (2, 4, 8, 3). No

hyphens

2

17

Mandatory

Transaction Code

Numeric

The transaction code for the item.

The following codes are available:

50 – Credit

52 - Credit

00 - Debit

3

2

Mandatory

Amount

Numeric

Amount must be less than or equal to

99999999.99

2 decimal places are implied (e.g. $10.21

is recorded as 1021)

4

10

Mandatory

Page 19 of 321

Field

Description

Type Notes

Record

Position

Max

Length

Mandatory/

Optional

Other Party

Name

Alphanumeric

Party Receiving Payment

5

32

Mandatory

Other Party

Particulars

Alphanumeric

Other Party Statement Details

6

12

Optional

Other Party

Analysis Code

Alphanumeric

Other Party Statement Details

7

12

Optional

Other Party

Reference

Alphanumeric

Other Party Statement Details

8

12

Optional

Originator

Particulars

Alphanumeric

Only applicable if Reporting Method is "M".

If blank, will populate with Originator

Particulars in Batch Header.

9

12

Optional

Originator

Analysis Code

Alphanumeric

Only applicable if Reporting Method is "M".

If blank, will populate with Originator

Code in Batch Header.

10

12

Optional

Originator

Reference

Alphanumeric