1040 Instructions

Step 1 6

Step 2 7

Step 3 8

Step 4 9

Step 5 13

Step 6 47

Step 7 57

Step 8 59

Step 9 62

Other Information

New for 2023 3

Conformity with The Internal Revenue Code (IRC) 4

Who Must File? 5

IA 1040 Schedule 1 63

Contacts 78

Amending Tax Returns 78

Are You a Resident of Iowa for Tax Purposes? 78

Certified Tax Returns for Nonresidents 80

Confidentiality 80

Credits: Refundable or Nonrefundable - What's the Difference? 80

Do You Owe Tax? Here Are Your Payment Options 81

Estimated Payments 82

Extension Requests 83

Farmers and Commercial Fishers 83

Federal Bonus Depreciation / Section 179 84

How to Prorate 84

Injured Spouse 84

Iowa 2210 / 2210S General Information 85

Iowa and Illinois Reciprocal Agreement 88

Iowa Income Tax Responsibilities of Native Americans 89

Iowa Tax Responsibilities of Servicemembers and their Spouses 89

Iowans Paid in Foreign Currency 96

Mailing Address for Returns and Payments 96

Net Operating Losses 97

Nonresidents and Part-Year Residents 97

Nonresidents with Gambling Winnings 98

Record Keeping 98

Refunds May Be Used to Pay Debt 98

Supporting Documentation 98

Use Tax 98

What to Do If You Do Not Receive Your W-2 99

2

New for 2023

Note: Due to a number of legislative changes to Iowa income tax taking effect on January 1, 2023, the IA 1040

has been substantially revised. Read these instructions carefully.

All dollar amounts should be rounded to the nearest cent.

The starting point for taxation on the IA 1040 is now federal taxable income. You must complete the federal

1040 prior to completing the IA 1040. You may need to complete a federal 1040 even if you are below the

federal filing requirement.

● This means that Iowa will now incorporate the federal standard or itemized deduction and will no

longer allow an Iowa-specific standard or itemized deduction.

● Iowa will also now incorporate the federal net operating loss and will no longer allow an Iowa-specific

net operating loss. Taxpayers must use Schedule 1 to carry forward any pre-2023 Iowa net operating

loss and must use Schedule 1 to reduce federal taxable income by any pre-2023 federal net operating

loss carryforward. Taxpayers must use the new IA 124 to calculate pre-2023 federal net operating loss

carryforwards to add back and pre-2023 Iowa net operating loss carryforwards to deduct against

taxable income.

● Additionally, this change incorporates the federal qualified business income deduction and the

domestic production activities deduction, and those will no longer be deducted separately on the Iowa

return.

Step 2: All taxpayers are now required to use the same filing status on their Iowa return that they use on their

federal return. Married taxpayers no longer have the option to file separately on a combined return.

Line 5: The number of tax brackets has decreased as well as the rate for each bracket. These will continue to

decrease until 2026 when Iowa will have a single tax rate of 3.9%.

Iowa’s alternative minimum tax has been repealed. The alternative minimum tax credit carried forward from a

previous year may be applied to this return, but will be repealed on January 1, 2024 and cannot be carried

forward to a future tax year.

Line 27: Taxpayers claiming the Composite or Pass-Through Entity Tax (PTET) Credit should report the credit on

line 27. Include the IA Schedule CC with your return. See the Department's website for more information on

the PTET Credit.

Schedule 1: The IA 1040 now includes Schedule 1 (located on page 4 of the IA 1040) to enter any required

Iowa adjustments to federal taxable income. See instructions below for more information about Schedule 1.

Schedule 1, line 7: The retirement income exclusion has been increased to include all qualifying pension and

retirement income for qualifying taxpayers.

Schedule 1, line 15: The additional Iowa health insurance premiums deduction, previously allowed for all

taxpayers, will be limited to taxpayers age 65 or older with Iowa taxable income of less than $100,000. In order

to determine whether a taxpayer’s Iowa taxable income is less than $100,000 for purposes of this provision,

taxpayers are required to add back the following items:

● Iowa reportable Social Security

● Iowa pension or retirement income exclusion

● Federal standard or itemized deduction to the extent it does not exceed federal adjusted gross income

● Federal personal exemption deduction ($0 for 2023)

● Federal qualified business income deduction

3

Schedule 1, line 16: There have been significant changes to the Iowa capital gain deduction. Most of the

capital gain deductions have been repealed for transactions occurring after January 1, 2023. However,

installments from sales occurring prior to January 1, 2023 may still be deducted. Taxpayers may deduct the

capital gain from the sale of real property used in a farming business if they meet certain holding period and

material participation requirements. Additionally, retired farmers may elect to deduct the capital gain from

the sale of cattle, horses, or breeding livestock in certain circumstances. Also new for 2023 is an additional

deduction for the capital gain from the sale or exchange of employee-owned capital stock in a qualified Iowa

corporation. See the IA 100 forms and Iowa Administrative Code rules 701—302.41 and 302.87 for more

information about the Iowa capital gain deductions.

Schedule 1, line 19:

● A deduction is allowed for the amount of student loan repayments paid by an employer that result in

income. Payments on any qualified loan for this purpose include payments of principal or interest and

those made to either the taxpayer or to a lender. No deduction will be allowed to the extent the

taxpayer claimed deduction for federal purposes under section 221 of the IRC for interest on the same

qualified education loan.

● Retired farmers may elect to exclude income from a farm tenancy agreement covering real property if

certain holding period and material participation requirements are met. See Iowa Administrative Code

rule 701—302.88 for more information.

● To the extent included for federal purposes, the amount of education savings account payments used

for qualifying expenses.

Step 9: To allow another individual to discuss this tax return with the Department, complete the third-party

designee section on the IA 1040, Step 9.

IA 124: Taxpayers should use this form to calculate any pre-2023 federal NOL carryforward that must be added

back or any pre-2023 Iowa NOL that may be deducted. The IA 123 has been discontinued.

IA 125: Retired farmers may elect to exclude income from a farm tenancy agreement covering real property if

certain holding period and material participation requirements are met. See IA 125 and Iowa Administrative

Code rule 701—302.88 for more information.

Track Your Return: Use Where's My Refund to check the status of individual income tax returns and amended

individual income tax returns you've filed within the last year or over the phone at 515-281-3114 or

800-367-3388.

Conformity with the Internal Revenue Code (IRC)

For tax years beginning on or after January 1, 2020, Iowa has adopted rolling conformity, meaning the state will

automatically conform with any changes made to the Internal Revenue Code (IRC), except as specified by Iowa

law. The calculation of Iowa taxable income is the same as the calculation for federal taxable income. However,

the calculation of Iowa taxable income will be different from the federal taxable income calculation when it

comes to certain items described later in these instructions, such as depreciation for certain assets placed in

service before tax year 2021, section 179 special election deductions, and the business interest expense

limitation.

Disclaimer: Please be advised that this is an informational document. It should not be relied upon or otherwise

cited as precedent. This information is subject to change at any time. If a member of the public wishes to

request a binding decision, they must file a Petition for Declaratory Order pursuant to Iowa Administrative

Code rule 701—7.24.

4

Who Must File?

You must file an Iowa return if... you were a resident or part-year resident of Iowa in 2023 and meet any of the

following requirements. Nonresidents, see items f. and g.

In meeting the filing requirements below, you must add back to Iowa taxable income reported on IA 1040, line 4:

● any amount of itemized or standard deduction from federal form 1040, line 12 (only add back the

amount that does not exceed your federal adjusted gross income on federal form 1040, line 11)

● any amount of personal exemption deduction allowed for federal purposes ($0 for 2023)

● any amount of QBI deduction from federal form 1040, line 13

● any amount of lump sum distribution separately taxed on federal form 4972, and

● any Iowa net operating loss carryforward

Note to married couples:

Incomes of both spouses must be included when determining who must file.

a. You had Iowa taxable income including the additions above of more than $9,000 and your filing status

is single or married filing separately. ($24,000 if 65 or older on 12/31/23)

b. You had Iowa taxable income including the additions above of more than $13,500 and your filing status

is other than single or married filing separately. ($32,000 if you or your spouse is 65 or older on

12/31/23)

c. You were claimed as a dependent on another person’s Iowa return and had Iowa taxable income of

$5,000 or more.

d. You were in the military service with Iowa shown as your legal residence even though stationed outside

of Iowa unless you are below the income thresholds above. For information about military spouses, see

Tax Responsibilities of Military Personnel.

e. You were subject to Iowa lump-sum tax.

f. You were a nonresident or part-year resident and your Iowa-source net income IA 126, line 25, (pdf)

was $1,000 or more, unless below the income thresholds above. In the case of married nonresidents,

the spouses' combined income is used to determine if their income is high enough to require them to

file an Iowa return. To understand “Iowa-source income,” see the instructions for IA 126, lines 1

through 25. Common examples of Iowa-source income include:

■ Wages earned in Iowa

■ Income from Iowa property

■ Rental income

■ Capital gain on the sale of property

■ Farming income from Iowa farmland activities and land rent

■ Self-employment income earned while working in Iowa

■ Iowa unemployment benefits

■ Iowa gambling winnings

■ Income from an IA K-1 issued by pass-through entities, such as partnerships and S-corporations

g. You were a nonresident or part-year resident and subject to Iowa lump-sum tax (even if Iowa-source

net income is less than $1,000).

NOTE: If you do not meet any of the above requirements but you had Iowa tax withheld and you wish to

receive a refund, you must file an Iowa return.

5

Step 1

Before You Begin

Step: 1

Step Subject: Name and Address

Make sure you have received all W-2s, 1099s, and other tax documents needed to prepare your return.

Important: Enter your Social Security Number(s) in the appropriate boxes on the form. Otherwise, we may be

unable to process your return.

The Iowa Department of Revenue may require proof of any item listed on a return or schedule.

Filing Period

If your filing period is other than calendar year 2023, enter the beginning and ending dates of your fiscal tax

year on the line provided above the name and address boxes on the return.

Name and Mailing Address

Enter your name and current mailing address on the tax return. If using a foreign mailing address, in place of

the domestic city, state, ZIP, include the foreign city, country, and postal code.

Provide the Department with your updated address if you move after your return is filed. Send an email to

NOTE: The email address entered will NOT be used to request or provide confidential information without your

authorization.

County

Enter the number of the county you lived in as of December 31, 2023. If you do not know your county number,

view a list of districts by county and number.

● Nonresidents and part-year residents who moved out of Iowa before December 31, 2023, should enter

"00" as your county number.

● Part-year residents who moved into Iowa should enter the number of the Iowa county in which you

lived on December 31, 2023.

● Military personnel should enter the county number of their Iowa residence, even if the service member

is not physically present in Iowa on the last day of the tax year.

School District Number

Enter the district in which you lived on December 31, 2023. View a list of districts by county and number. This

is not necessarily the district where your children attended school. Even if you do not have children, you must

enter this number.

Other possible resources to identify your school district information include:

● Your voter registration card

● Search “school surtax” from the Iowa Tax Mapper

● Your county assessor’s website

Nonresidents, Part-Year Residents, and Military Personnel

● Nonresidents: Those who did not live in Iowa at all during 2023 should enter "0000" for the school

district number. You are not subject to school district surtax on line 19.

6

● Part-year residents who moved into Iowa should enter the Iowa school district in which you lived on

the last day of 2023. You may be subject to school district surtax on line 19.

● Part-year residents who moved out of Iowa before December 31, 2023, should enter "9999." You are

not subject to school district surtax on line 19.

● Military personnel should enter the school district number of their Iowa residence, even if the service

member is not physically present in Iowa on the last day of the tax year. You may be subject to school

district surtax on line 19.

Foreign Currency

Taxpayers who are paid in foreign currency must convert the currency to U.S. dollars as required for federal tax

purposes.

All Dollar Amounts Should be Rounded to the Nearest Cent

A new requirement beginning this year is for all dollar amounts to be rounded to the nearest cent. This is also

applicable to the calculation of the amount of tax due which is based upon the use of tax rate schedules. You

can round to whole dollars on the IA 1040 lines 1 and 2 as allowed for federal purposes, information on these

lines should match your federal return exactly.

Step 2

Filing Status

Step: 2

Step Subject: Filing Status

Your filing status on the Iowa return is the same filing status as on your federal return.

Status 1. Single

Check filing status 1 if you used the single filing status on your federal return. All single filers must answer the

question, "Were you claimed as a dependent on another person's Iowa return?"

If this question is not answered, you will be taxed as a dependent.

Status 2. Married Filing Jointly

Check filing status 2 if you used the married filing jointly status on your federal return.. Use the same filing

status as your federal return, even if only one spouse had income from Iowa sources. Both spouses must sign

the return.

Joint and several liability

Both spouses are jointly and severally liable for the total tax due on the return, except when one spouse is

eligible for relief from joint and several liability under criteria established pursuant to section 6015 of the

Internal Revenue Code.

Spouse with debts

If a spouse has outstanding debt that may be automatically paid (setoff) with your refund, be sure to read our

Refunds May Be Used to Pay Debt information.

7

Status 3. Married Filing Separately

Check filing status 3 if you and your spouse filed separate federal tax returns. Use the same filing status as your

federal return, even if only one spouse had income from Iowa sources. Write your spouse's name and Social

Security Number in the spaces provided at the top of the return in Step 1 and net income (as determined on

line 1g of the Alternate Tax Worksheet, 41-145) in the space provided at the top of the return in Step 2. The

processing of refunds, alternate tax calculations, and low-income exemptions will be delayed without this

information or supporting schedules.

Taxpayers using filing status 3 may have to prorate (divide) certain items between them on the return. This

information is included with instructions for each line of the return.

Married taxpayers using filing status 3 must use the combined income of both spouses in determining

eligibility for exemption from tax.

If either spouse has a net operating loss that is carried back or forward, then the other spouse cannot use the

low-income exemption. If the spouse with the net operating loss chooses not to carry the loss back or forward,

then the other can claim the low-income exemption. A statement must be attached to the return saying that

the spouse with the net operating loss will not carry it back or forward.

Status 4. Head of Household

Check filing status 4 if you are filing as head of household for federal income tax purposes. If you have a

qualifying person (as defined by the Internal Revenue Service) living with you who you did not claim as a

dependent on this return, enter the person's name and Social Security Number in Step 3.

Status 5. Qualifying Surviving Spouse

Check filing status 5 if you meet the federal filing requirements for qualifying surviving spouse. Enter the

dependent’s information in Step 3.

Step 3

Exemption Credits

Step: 3

Step Subject: Exemption Credits

a. Personal Credit

If you are filing single (status 1), married filing separately (status 3), or qualifying surviving spouse (status 5),

enter 1 in the Personal Credit space.

If you are filing married filing jointly (status 2) or head of household (status 4), you are eligible for an extra

credit and should enter 2 in the Personal Credit space.

Add the number of personal credits and multiply by $40. Enter this amount on the $ line.

Note to dependents filing their own returns:

You may claim a $40 personal exemption credit even if you are claimed as a dependent on another person's

Iowa return.

8

b. Additional Personal Credit: 65 or older or blind

If you were 65 or older on or before January 1, 2024, you may take an additional personal credit.

If your spouse was 65 or older on or before January 1, 2024, and you are filing a joint return (status 2), you

may take an additional personal credit for your spouse.

If you were blind on December 31, 2023, you may take an additional personal credit.

If your spouse was blind on December 31, 2023, and you are filing a joint return (status 2), you may take an

additional personal credit for your spouse.

Add the number of credits for 65 or older and blind and multiply by $20. Enter this amount on the $ line.

c. Dependents: Consult IRS Publication 17 to learn who qualifies as a dependent.

Enter the number of dependent children and other dependents you are claiming for federal income tax

purposes. Add the number of dependent credits and multiply by $40. Enter this amount on the $ line.

Federal tax law determines whether or not a person is a dependent. Consult IRS Publication 17 to learn who

qualifies as a dependent. The IRS has guidelines that also determine which parent/guardian can claim a

dependent when separate returns are filed (such as in the case of divorced parents). The Iowa tax law follows

federal guidelines.

d. Total

Add the dollar amounts and enter on Step 3, line d and on line 8.

Dependent(s)

Enter the first name, last name, social security number, and relationship to you for each dependent claimed on

the tax return. If you have more than three dependents, include a separate page listing any additional

dependents with this return.

Married Separate Filers:

You must report the same dependents you claimed on your federal income tax return.

Step 4

Reportable Social Security Benefits

Step: 4

Step Subject: Reportable Social Security Benefits

Iowa does not tax Social Security benefits. While Social Security benefits are excluded from income when

computing tax, some Social Security benefits are included as income in determining whether a taxpayer

qualifies for the health insurance deduction.

1. Enter the amount from Box 5 of form(s) SSA-1099. If you filed a joint federal return, enter

the totals for both spouses. Do not include Railroad Retirement benefits from form RRB-1099

here.

1.

2. Enter one-half of line 1 amount

2.

3. Add amounts from the federal form 1040 on lines 1z, 2b, 3b, 4b, 5b, 7 and 8

3.

9

4. Add one-half of Railroad Retirement Net Social Security Equivalent benefits from Box 5 of

RRB-1099*

4.

5. Add any depreciation and section 179 adjustment from IA 1040 Schedule 1, line 9 and all

other Iowa nonconformity adjustments to compute correct amount

5.

6. Enter the amount from your federal 1040, line 2a

6.

7. Add lines 2 through 6

7.

8. Enter total adjustments from federal form 1040, Schedule 1, lines 11 through 20, line 23,

plus the total other adjustments reported on line 25

8.

9. Subtract line 8 from line 7

9.

10. Enter one of the following amounts based on the federal filing status used on form 1040

● Single, head of household, qualifying surviving spouse: enter $25,000

● Married filing jointly: enter $32,000

● Married filing separately: enter -0- if you lived with your spouse at any time in 2023 or

$25,000 if you did not live with your spouse at any time in 2023

10.

11. Subtract line 10 from line 9. If zero or less, enter -0-

If line 11 is zero, stop here. None of the Social Security benefits are reportable.

If line 11 is more than zero, go to line 12

11.

12. Enter one-half of line 11

12.

13. Iowa Reportable Social Security benefits: Enter the smaller of line 2 or line 12

13.

* Notes: Depreciation / Section 179 / and All Other Iowa Taxable Income Nonconformity

with Federal Tax Rules

Iowa taxpayers who received Social Security benefits in 2023 and claimed depreciation / section 179 on their

federal returns or have other Iowa taxable income nonconformity may have to recompute their reportable

benefits on the worksheet. For other Iowa nonconformity adjustments see Schedule 1.

Those who need to recompute the reportable Social Security benefits should add the adjustment from line 5 of

Schedule IA 4562A and all other Iowa taxable income nonconformity to the other amounts shown on line 5 of

the Social Security Worksheet from the federal return and the RRB-1099. The rest of the form is then

completed with the amounts normally used to complete the worksheet from the federal 1040.

Include the following incomes or adjustments to income on line 5 if applicable.

(These were excluded from federal AGI):

● foreign-earned income

● income excluded by residents of Puerto Rico or American Samoa

● proceeds from Savings Bonds used for higher education and

● employer-provided adoption benefits.

Railroad Retirement Benefits

Although Railroad Retirement benefits are not taxable, one-half of the Net Social Security Equivalent Benefits

from Box 5 of the RRB-1099 received must be used to determine the amount of Social Security benefits that

are reportable to Iowa.

Interest from Federal Securities

For purposes of determining reportable Social Security benefits, you must also include interest from federal

securities.

10

Federal Total Income

Line: 1

Step: 4

Step Subject: Taxable Income

Enter federal total income as reported on federal 1040, line 9. This information may be needed for taxpayers

who claim the nonresident and part-year resident credit (IA 126) or the out-of-state tax credit (IA 130).

If you were not required to file a federal return you must enter on line 1 the amount that would have been

reported on federal 1040, line 9, if a return was required to be filed.

Federal Taxable Income

Line: 2

Step: 4

Step Subject: Taxable Income

Enter your federal taxable income as reported on Federal 1040, line 15.

If you were not required to file a federal return you must enter on line 2 the amount that would have been

reported on federal 1040, line 15, if a return was required to be filed.

Net Iowa Modifications

Line: 3

Step: 4

Step Subject: Taxable Income

Enter amount from IA 1040, Schedule 1, Line 22

Schedule 1

Schedule 1 is used to report Iowa adjustments to federal taxable income. Amounts should only be reported if

there is a difference between the federal and Iowa reportable amounts. Column A should be used to report

additions to federal taxable income and Column B should be used to report subtractions from federal taxable

income. Report all amounts as a positive number. Report all amounts on Lines 1-12 and 14-20 (Column A or B)

as a positive number. If Lines 13, 21, or 22 are negative, enter as negative on the IA 1040, Line 3.

Iowa Taxable Income

Line: 4

Step: 4

Step Subject: Taxable Income

Add lines 2 and 3.

Check the box if using low-income exemption, alternate tax, or tax reduction. When calculating income for the

low-income exemption, the following income must be included:

a. The incomes of both spouses must be combined to determine if you meet this exemption from tax.

b. The federal itemized or standard deduction from federal form 1040, line 12 (only include the amount

that does not exceed your federal adjusted gross income on federal form 1040, line 11).

c. Personal exemption deduction allowed for federal purposes ($0 for 2023).

11

d. Qualified business income deduction allowed for federal purposes.

e. Net operating loss carryover from IA 1040 Schedule 1, line 17b.

f. Any amount of lump-sum distribution separately taxed on federal form 4972.

Filing status 1, Single: If you are using filing status 1 (single), you are exempt from Iowa tax if you meet either

of the following conditions:

a. Your Iowa taxable income from all sources, IA 1040, line 4, is $9,000 or less and you are not claimed as

a dependent on another person’s Iowa tax return. ($24,000 if you are 65 or older on 12/31/23)

b. Your Iowa taxable income from all sources, IA 1040, line 4, is less than $5,000 and you are claimed as a

dependent on another person’s Iowa return. For purposes of this condition, none of the income listed

above is required to be added back to the Iowa taxable income.

Filing status 3, Married Filing Separately: If you are using filing status 3 (married filing separately), you are

exempt from Iowa tax if you meet all of the following conditions:

a. Your Iowa taxable income from all sources, IA 1040, line 4, with the additions above, is $9,000 or less.

b. You and your spouse’s combined Iowa taxable income from all sources, IA 1040, line 4, with the

additions above, is $13,500 or less.

c. You are not claimed as a dependent on another person’s Iowa return.

All other filing statuses: If you are married filing jointly, head of household, or qualifying surviving spouse, you

are exempt from Iowa tax if you meet both of the following conditions:

1. Your Iowa taxable income from all sources, IA 1040 line 4, is $13,500 or less ($32,000 if you or your

spouse was 65 or older on 12/31/23).

2. You are not claimed as a dependent on another person’s Iowa return.

Nonresidents and Part-Year Residents: In addition to the exemption provisions above, if you were a

nonresident or part-year resident and had Iowa source net income of less than $1,000 (see note below) you

are exempt from Iowa tax. For a description of “Iowa-source income”, see the instructions for the IA 126, lines

1 through 26. If you had Iowa taxes withheld and are requesting a refund, or choose to file an Iowa return even

though you aren’t required to do so, you must complete the entire IA 1040 and the entire IA 126.

Note: If you were a nonresident or part-year resident and subject to Iowa lump-sum tax (even if Iowa-source

income is less than $1,000), you are required to file an Iowa return reporting the lump-sum tax even if you

have no regular Iowa income tax liability.

Illinois Residents

See reciprocal agreement.

Military Spouses

See Tax Responsibilities of Servicemembers and their Spouses

Married Separate Filers:

Married taxpayers filing married filing separately must use the combined income of both spouses in

determining eligibility for exemption from tax.

If either spouse has a net operating loss that is carried forward, then the other spouse cannot use the low

income exemption. If the spouse with the net operating loss chooses not to carry the loss forward, then the

other can claim the low income exemption. A statement must be included with the return saying that the

spouse with the net operating loss will not carry it forward.

12

Step 5

Iowa Tax

Line: 5

Step: 5

Step Subject: Tax, Non-refundable Credits, and Check-off Contributions

Iowa tax from tax rate schedule or alternate tax

Tax from tax rate schedule: Use the Tax Calculation Worksheet (41-026) or the 2023 IA 1040 Tax Calculator.

Alternate tax calculation: You may owe less tax by completing the worksheet below. All filing statuses except

filing status 1, Single, may qualify for the Iowa alternate tax computation. Single taxpayers may be eligible for

the Iowa income tax reduction; see Iowa Income Tax Reduction Worksheet.

If you are using alternate tax calculation on IA 1040 in lieu of the tax rate calculation, check the box in IA 1040,

Step 5.

Special instructions for filing status 3, Married filing separately:

● The combined Iowa taxable incomes of both spouses must be used.

● The alternate tax between spouses must be prorated in the ratio of the Iowa taxable income of each

spouse to the combined Iowa taxable income of both spouses using lines 7-11.

● If you are married filing separately and one spouse has a net operating loss that will be carried forward,

then you cannot use the alternate tax computation. If the spouse with the net operating loss elects not

to carry the net operating loss forward, then you can use the alternate tax computation.

● If you do not provide the other spouse’s income on the IA 1040, Step 2, you will not be allowed to use

the alternate tax calculation.

1. Enter:

a. Iowa taxable income from IA 1040, line 4

b. Itemized/standard deduction from federal form 1040, line 12

c. Personal exemption deduction allowed for federal purposes ($0 for 2023)

d. QBI deduction from federal form 1040, line 13

e. Net operating loss carryover from IA 1040 Schedule 1, line 17, column B

f. Lump-Sum distributions of taxable income reported on federal form 4972, line 8

g. Add lines a through f

Total of line g, columns A and B

2. Enter $13,500 ($32,000 if you or your spouse was 65 or older on 12/31/23)

3. Income subject to alternate tax calculation. Subtract line 2 from line 1

4. Multiply line 3 by 6% (.06)

5. Using the tax tables, determine the tax on the taxable income from the IA 1040, line 5.

(Status 3 filers: Calculate tax separately and combine the amounts)

6. Compare the amounts on line 4 and line 5. Enter the smaller amount. If using filing statuses 2, 4, and 5,

also enter on IA 1040, line 5. If using filing status 3 and line 4 is less than line 5, continue to line 7. If

using status 3 and line 5 is less than line 4, then enter each spouse’s tax from the tax rate schedule on

IA 1040, line 5. 6

13

7. Taxable income of both spouses from line 1g above

8. Total adjusted Iowa taxable income, add lines 7a and 7b

9. Divide the amount on line 7a by the amount of line 8. Enter to the nearest tenth of a percent

10. Multiply line 6 by the percentage on line 9. Enter here and on IA 1040, line 5

11. Subtract line 10 from line 6. Enter here and on IA 1040, line 5 of your spouse’s return

Iowa Lump-Sum Tax

Line: 6

Step: 5

Step Subject: Tax, Non-refundable Credits, and Check-off Contributions

A lump-sum distribution occurs when, in one tax year, you receive the total balance from a pension or

profit-sharing plan of an employer due to termination of employment, termination of the plan, or death of the

employee.

Iowa lump-sum tax applies only if federal form 4972 was used to compute the federal tax on any portion of the

lump-sum distribution. If there is no federal lump-sum tax, then there is no Iowa lump-sum tax.

Iowa Residents:

Enter 25% of the federal tax from federal form 4972 on the IA 1040, line 6. Include federal form 4972.

Part-Year Residents:

If a lump-sum distribution reported on federal form 4972 was received while an Iowa resident, 25% of the

federal tax from form 4972 must be entered on line 6. Part-year residents who receive a lump-sum distribution

while not an Iowa resident are not subject to Iowa lump-sum tax on that distribution. A copy of the federal

form 4972 must be included.

Nonresidents:

Nonresidents receiving lump-sum distributions are not subject to Iowa lump-sum tax.

Married Separate Filers:

Lump-sum tax is reported by the spouse who received the distribution.

Total Tax

Line: 7

Step: 5

Step Subject: Tax, Non-refundable Credits, and Check-off Contributions

Add lines 5 and 6.

Taxpayers who had a distressed sale in 2023 and have included the gain in Iowa taxable income may be eligible

to limit their tax to their net worth immediately prior to the distressed sale. If you qualify, limit the amount on

line 7 to your net worth before the distressed sale and include an Iowa Income Tax Balance Sheet / Statement

of Net Worth (form IA 6251B).

14

Iowa’s alternative minimum tax has been repealed. The alternative minimum tax credit carried forward from a

previous year may be applied to this return, repealed on January 1, 2024 and cannot be carried forward to a

future tax year.

Total Exemption Credit

Line: 8

Step: 5

Step Subject: Tax, Non-refundable Credits, and Check-off Contributions

Enter the total exemption credit amount from IA 1040, Step 3, line d.

Tuition and Textbook Credit (K-12 Only)

Line: 9

Step: 5

Step Subject: Tax, Non-refundable Credits, and Check-off Contributions

Taxpayers who have one or more dependents receiving private instruction in Iowa, as defined in section 422.12

(also referred to as homeschooling), or attending kindergarten through 12th grade in an accredited Iowa

school (under section 256.11, not operated for a profit, and adheres to the provisions of the U.S. Civil Rights

Act of 1964) may take a credit for each dependent for amounts paid for tuition and textbooks.

Note: Purchases made from Students First Educational Savings Account (ESA) funds authorized under Iowa

Code section 257.11B are not eligible for the tuition and textbook credit.

The credit amount is 25% of the first $2,000 of qualifying expenses paid for each dependent’s tuition and

textbooks. In the case of divorced or separated parents, only the spouse claiming the dependent can claim the

amounts paid by that spouse for that dependent’s tuition and textbooks. Qualifying expenses paid with 529

account distributions may qualify for the tuition and textbook credit.

Calculating the Credit

Calculate the proper amount of expenses per dependent, not to exceed $2,000, and multiply the amount by

25% (.25).

Keep records of your calculation, showing the name of each dependent, school(s) attended or qualifications

for private instruction, and an itemized list of qualifying expenses.

Enter the total allowable credit on IA 1040, line 9.

Example: Students Karlee and Kurt have qualifying expenses of $2,400 and $1,700 respectively. Their parents

can take a credit of $500 (25% of $2,000 maximum) for Karlee and $425 (25% of $1,700) for Kurt, for a total

credit of $925.

Example: Student Stephen received Students First ESA funds of $7,635 in tax year 2023. Stephen’s parents paid

total tuition to an accredited private school in Iowa of $9,000 for the tax year. They cannot claim a credit for

the $7,635 in tuition expenses paid with ESA funds. They may claim a credit of $341.25 (25% of $1,365) for the

$1,365 in out-of-pocket tuition expenses.

Divorced or separated parents

Only the parent claiming the dependent can claim the amounts paid by that parent for that dependent’s

tuition and textbooks.

15

Married Separate Filers:

This credit must be taken by the spouse claiming the dependent. Any unused part of this credit cannot be used

by the other spouse.

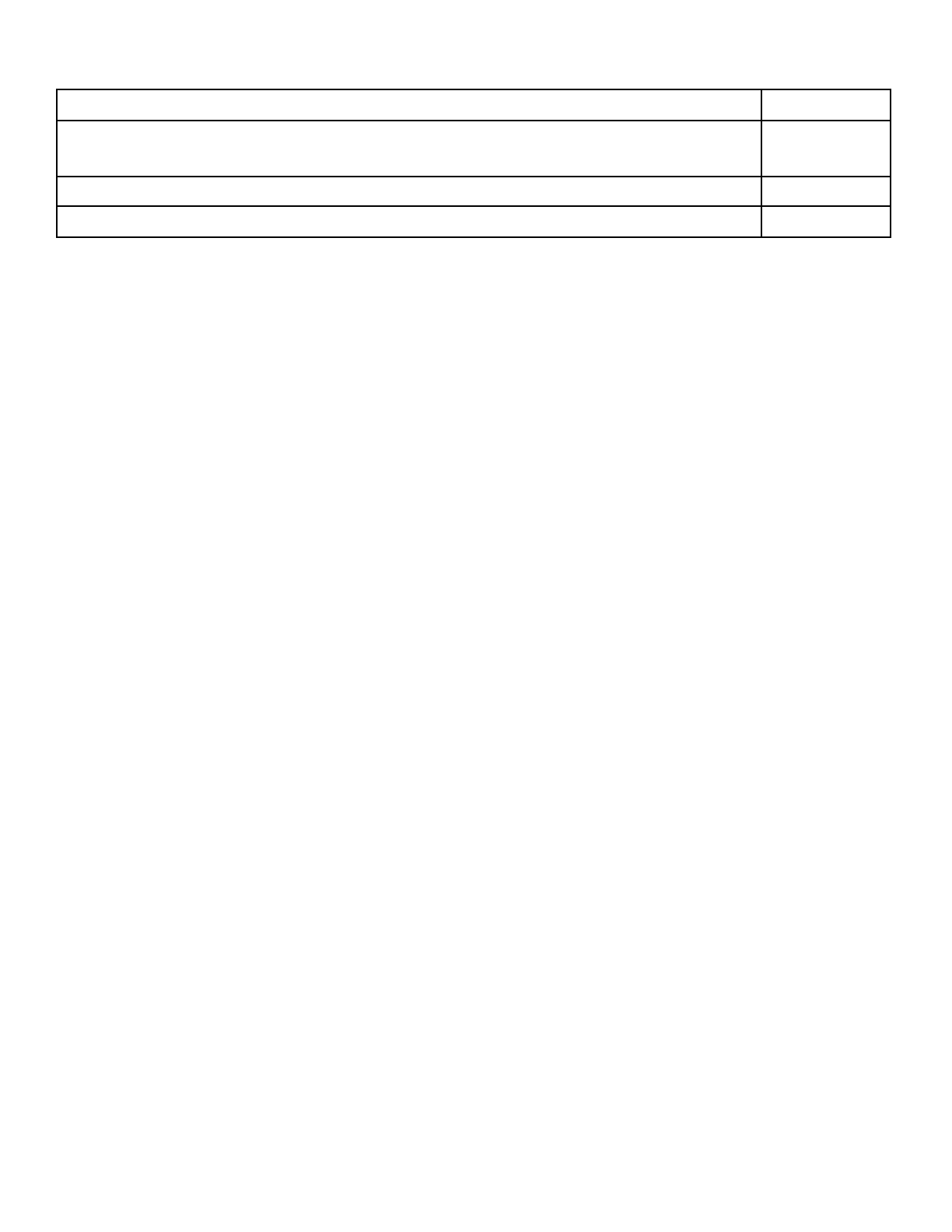

Eligible & Ineligible Expenditures for the Iowa Tuition and Textbook Tax Credit

Expense

Eligible Expenditures

Ineligible Expenditures

Tuition

Tuition for any K-12 school that is accredited or for

competent private instruction as defined in Iowa

Code section 299A.2.

Any amount for food, lodging, or clothing

or amounts paid relating to the teaching

of religious tenets, doctrines or worship;

amounts for tutoring not paid to a school

Textbooks and

Publications

Textbooks and other instructional materials used in

teaching subjects legally and commonly taught in

Iowa's public elementary and secondary schools,

including those needed for extracurricular activities

(including fees for required textbooks and supplies);

computers, if required

Yearbooks or annuals; textbook fines

Required Materials

and Supplies Other

Than Textbooks

Pocket folders, spiral notebooks, pens, pencils,

backpacks, rulers, calculators, flash drives and other

items on a required supply list issued by the

dependent’s school

Items on a supply list that are optional

Clothing

Rental or purchase of “non-street” costumes for a

play or special clothing for a concert not suitable for

everyday wear; rental of prom dresses and tuxedos

Clothes which can be used for street

wear, such as T-shirts for extracurricular

events; clothing for a play or concert that

is suitable for everyday wear; purchase of

prom dresses and tuxedos

Driver's Education

Fees paid for driver’s education

Dues, Fees and

Admissions

Annual school fees; fees or dues paid for

extracurricular activities; booster club dues (for

dependent only); fees for athletics; activity ticket or

admission for K-12 school or private

instruction-related athletic, academic, music, or

dramatic events and awards banquets or buffets;

fees for a physical education event such as roller

skating; advanced placement fees if paid to high

school or private instructor; fees for homecoming,

winter formal, prom, or similar events; fees required

to park at the school and paid to the school

Sports-related socials; special education

programs like career conferences; special

testing like SAT, PSAT, ACT and Iowa

talent search tests; fees paid to K-12

schools for college credit or special

programs at colleges and universities;

advanced placement fees if paid to a

college or a university; parking fines

Materials for

Extracurricular

Activities

Materials for extracurricular activities, such as

sporting events, speech activities, musical or

dramatic events, awards banquets, homecoming,

prom, and other school or private instruction-related

social events

Class rings

Music

Rental of musical instruments for school or private

instruction-related band; music / instrument lessons

at a school or as part of private instruction; sheet

music used in a school or as part of private

instruction; music books and materials used in

school or private instruction-related bands or

Purchase of musical instruments

(including rent-to-own contracts); sheet

music for private use

16

orchestras for maintenance of instruments, including

reeds, strings, picks, grease, and other consumables

Religion

--------------------

Amounts paid are not allowed if they

relate to teaching of religious tenets,

doctrines, or worship

Shoes

Football, soccer, and golf shoes; other shoes with

cleats or spikes not suitable for street wear for teams

associated with the school or private instruction

Basketball shoes and other shoes

suitable for everyday wear

Supplies for

Industrial Arts,

Home Economics or

Equivalent Classes

Cost of required basic materials for classes such as

shop class, mechanics class, agricultural class, home

economics class, or equivalent classes

Optional expenditures or materials used

for personal projects of the dependents

or for family benefit

Travel

Fees for transportation to and from school if paid to

the school or private instructor; fees for field trips if

the trip is during school hours

Travel expenses for overnight trips which

involve payment for meals and lodging

Uniforms

School or private instruction-associated band and

athletic uniforms

---------------

Volunteer Firefighter and Emergency Medical Services Personnel and Reserve

Peace Officer Tax Credit

Line: 10

Step: 5

Step Subject: Tax, Non-refundable Credits, and Check-off Contributions

The Volunteer Firefighter, Volunteer EMS Personnel, and Reserve Peace Officer Tax Credit is available for

volunteer firefighters, volunteer EMS personnel, and volunteer reserve peace officers. In order to qualify for

the credits, the taxpayer must meet the conditions listed below.

Qualifying Conditions

For Volunteer Firefighters:

● Must be an active member of an organized volunteer fire department in Iowa.

● Must meet the minimum training standards established by the Fire Service Training Bureau, a division

of the Iowa Department of Health and Human Services.

● A paid firefighter who volunteers for another fire department is eligible for the credit.

● A person who volunteers as a firefighter, for a fire department by which they are employed, is eligible

for the credit if they are employed in a capacity other than as a firefighter.

For Volunteer Emergency Medical Services Personnel:

● Must be trained to provide emergency medical care, certified as a first responder, and must have

received a certificate by the Iowa Department of Health and Human Services.

● A paid EMS personnel member who volunteers for another department is eligible for the credit.

● A person who volunteers as an EMS personnel member, for a department by which they are employed,

is eligible for the credit if they are employed in a capacity other than as an EMS personnel member.

For Reserve Peace Officers:

● Must be a volunteer, non-regular, sworn member of a law enforcement agency who serves with or

without compensation, has regular police powers while functioning as a law enforcement agency’s

17

representative, and participates on a regular basis in the law enforcement agency’s activities including

crime prevention and control, preservation of the peace, and enforcement of the law.

● Must have met the minimum training standards established by the Iowa Law Enforcement Academy.

● A person who volunteers as a reserve peace officer, for a department by which they are employed, is

eligible for the credit if they are employed in a capacity other than as a peace officer.

Amount of the Tax Credit

The tax credit equals $250 if the volunteer serves for the entire calendar year. If the volunteer does not serve

the entire year, the $250 credit will be prorated based on the number of months that the volunteer served,

rounded to the nearest dollar. If the volunteer served for a portion of a month, that will be considered as an

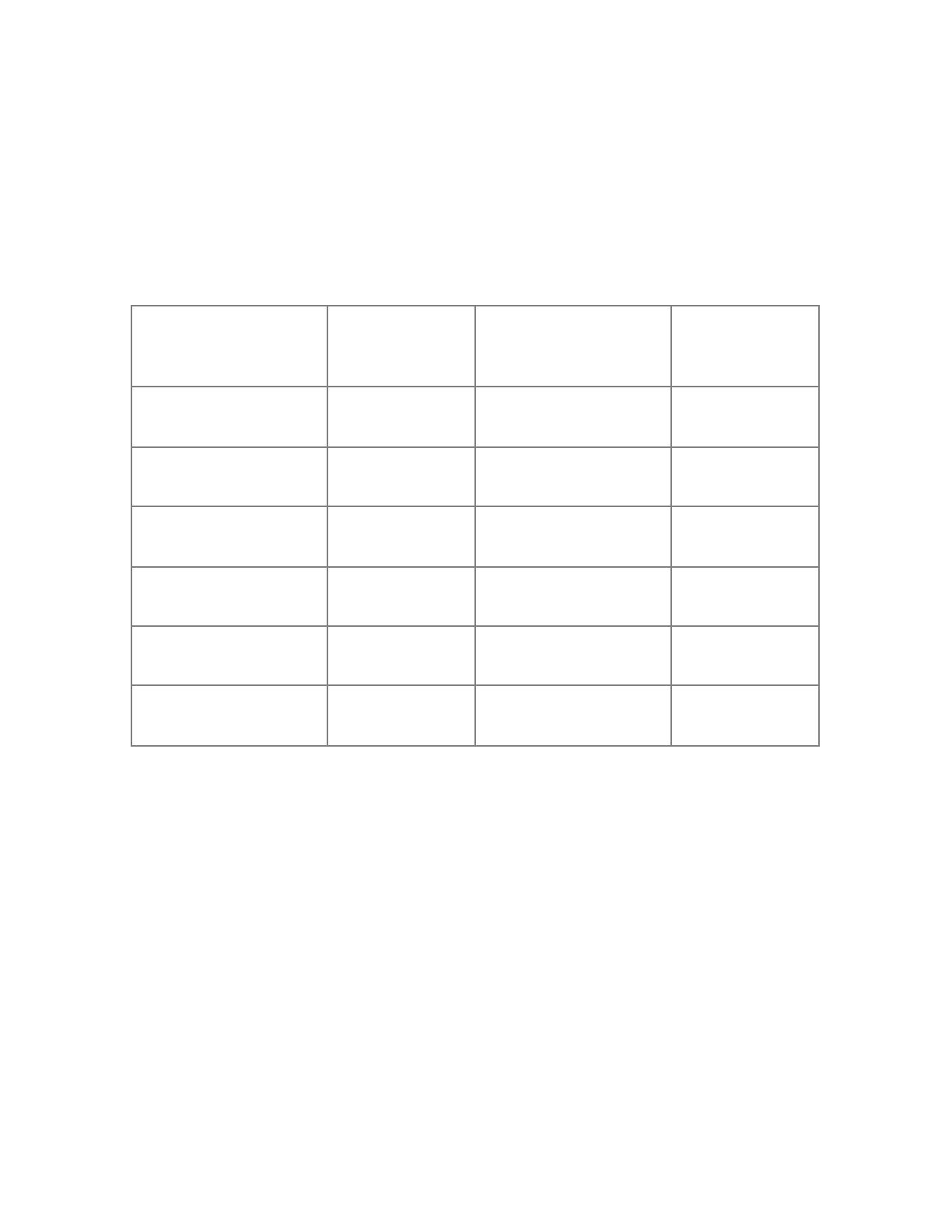

entire month. The table below provides the qualifying amount of tax credit by months of service for the year.

Number of Months

of Service

Amount of

Tax Credit

Number of Months

of Service

Amount of

Tax Credit

1

$21

7

$146

2

$42

8

$167

3

$63

9

$188

4

$83

10

$208

5

$104

11

$229

6

$125

12

$250

If an individual serves in more than one position at the same time as a volunteer firefighter, volunteer EMS

personnel, and/or reserve peace officer, the credit can only be claimed for one volunteer position.

Written Statement Requirements

Taxpayers claiming the tax credit are required to have a written statement from the fire chief, the chief of

police, sheriff, commissioner of public safety, or other appropriate supervisor verifying that the individual was

a volunteer for the number of months that are being claimed. These letters do not have to be included with a

filed return, but must be produced by the taxpayer upon request by the Iowa Department of Revenue. It is

recommended that the statement contain the following information: Volunteer Name, Fire Department or

EMS Service Name or Police Department, Number of Months of Service for the Year, Amount of Qualifying

Credit, and the Name, Title, and Signature of the official authorizing the credit.

Recordkeeping Recommendations

It is recommended that volunteer fire departments, EMS services, or police departments maintain a record of

the letters that are authorized in the event that the Department requests a list of authorized credit recipients.

It is recommended that these lists be kept for at least 10 years.

18

Married Separate Filers:

This credit must be taken by the spouse who qualifies. Any unused part of this credit cannot be used by the

other spouse.

Total Credits

Line: 11

Step: 5

Step Subject: Tax, Non-refundable Credits, and Check-off Contributions

Add lines 8, 9, and 10.

Balance

Line: 12

Step: 5

Step Subject: Tax, Non-refundable Credits, and Check-off Contributions

Subtract line 11 from line 7. If less than zero, enter zero.

Tax Reduction

Single taxpayers may be eligible for the Iowa income tax reduction; see Income Tax Reduction Worksheet (41-146).

Credit for Nonresident or Part-Year Resident

Line: 13

Step: 5

Step Subject: Tax, Non-refundable Credits, and Check-off Contributions

Nonresidents or Part-Year Residents:

A nonresident or part-year resident of Iowa must complete the IA 1040, lines 1 through 12 prior to completing

the IA 126. The nonresident or part-year resident then completes a Schedule IA 126. On the IA 126, only Iowa

income is reported and a percentage of Iowa income to total income is determined. The taxpayer receives a

credit against the initial tax liability based on the percentage of income from outside Iowa. Therefore, the

result of this credit is that only Iowa-source income is taxed.

NOTE: The Iowa income percentage is rounded to the nearest ten-thousandth of a percent in accordance with

Iowa Administrative Code rule 701—304.5. The final credit from this form is used to reduce the total tax on

your IA 1040.

Although non-Iowa income is used to calculate the initial tax liability at the appropriate tax rate, the non-Iowa

income itself is not subject to tax. By using this method, Iowa taxes the Iowa-source income of nonresidents

and part-year residents at the same rate it taxes Iowa residents. Iowa, like many states and the federal

government, uses a graduated tax rate system based on level of income

A nonresident of Iowa with all-source income of $250,000 and $10,000 of Iowa income, will use the same tax

rate as an Iowa resident with $250,000 of income to calculate their initial tax liability, rather than using the

same tax rate as an Iowa resident with $10,000 of total income.

Enter the amount of your nonresident or part-year resident tax credit from Schedule IA 126, line 32. A copy of

Schedule IA 126 and a copy of your federal return must be included.

19

General instructions for completing the IA 126:

Part-Year Iowa Residents:

Iowa-source net income includes all income received while living in Iowa plus any Iowa-source income received

while a nonresident.

Part-Year Resident Example: Michael lived and worked in Iowa the first six months of the tax year. In addition

to Michael’s wages, Michael received interest income from an Iowa bank. Michael then permanently moved to

Missouri, where Michael was employed for the rest of the year. Michael continued to receive interest income

from the Iowa bank.

Michael’s IA 1040, line 1, will report all of the income from both states as all-source income. On the IA 126,

Michael will report the wages and interest income earned while an Iowa resident as Iowa-source income. The

interest income earned the last half of the year is not considered Iowa-source income since Michael was no

longer an Iowa resident.

Nonresidents:

Iowa-source net income will include all income from Iowa sources. Complete IA 126, lines 1 through 13 using

only income from Iowa sources.

Nonresident Example 1: Nick is a resident of Nebraska and works in Iowa. Nick’s income includes wages

earned in Iowa and interest income from a Nebraska bank. Nick will report the wages and interest on the IA

1040 as all-source income. Nick will list only the Iowa wages on the IA 126 as Iowa-source income.

Iowa has a reciprocal agreement with Illinois, which means that wages and salaries are taxed by the

individual’s state of residence. All income received from other Iowa sources (gambling, unemployment, etc.) is

taxable to Iowa regardless of the person’s state of residence.

Nonresident Example 2: Tiana is a resident of Illinois. Tiana earned $25,000 in wages from Iowa and won

$5,000 at an Iowa casino. Tiana will report income from all sources on the IA 1040. Only the gambling winnings

will be reported on the IA 126 as Tiana’s Iowa-source income.

Full-Year Residents (married jointly filers check the corresponding box if one spouse is a full-year Iowa resident)

For married taxpayers, if one spouse is a full year Iowa resident, the full year Iowa resident must include all of

that spouse’s income from the IA 1040.

Married Separate Filers:

Divide your Iowa income between spouses using the instructions on each line of the IA 126 below for married

separate filers.

1. Wages, Salaries, Tips, Etc.

Part-year residents:

Include all W-2 income earned or received while an Iowa resident, even if it was earned in another state, and

any income for services performed in Iowa while a nonresident of the state. If it was earned in another state,

you may also need to fill out the IA 130 (pdf) if you pay tax to the other state or local jurisdiction in another

state. You will need to check with that state for their filing requirements.

Nonresidents:

Report only Iowa-source income. If the portion of employee compensation earned in Iowa by a nonresident is

not reported separately, allocate the compensation based upon the number of days worked in Iowa to total

work days.

20

Severance pay and vacation pay from Iowa employment are Iowa-source income even if the pay was received

after leaving Iowa.

Note to nonresident military taxpayer:

As a result of federal legislation, the nonresident military taxpayer does not include military pay on the IA 126,

line 1 (nor is it reported on the IA 1040). In general, this applies to active duty military and does not include

the National Guard or reserve personnel.

Military spouses, please see Iowa Tax Responsibilities of Servicemembers and Their Spouses.

Married Separate Filers:

W-2 income is reported by the spouse earning the income.

2. Taxable Interest Income

Part-year residents:

Report all interest shown on the IA 1040 that accrued while an Iowa resident and any interest received while a

nonresident which was derived from a trade, business, or profession carried on within Iowa. Interest earned

from an Iowa bank account is only considered Iowa-source income while the taxpayer is an Iowa resident.

Nonresidents:

Report only the interest derived from an Iowa trade, business, or profession.

Married Separate Filers:

Divide interest income based on ownership of the account or certificate.

● Jointly held: Divide equally between spouses.

● Held in the name of only one spouse: Allocate interest wholly to that spouse.

3. Dividend Income

Part-year residents:

Report all dividends received while an Iowa resident and any dividends derived from an Iowa trade, business,

or profession while a nonresident.

Nonresidents:

Report the dividends derived from an Iowa trade, business, or profession.

Married Separate Filers:

Divide dividends based on registered ownership of stock.

● Jointly held: Divide equally.

● Held in the name of only one spouse: Allocate dividends wholly to that spouse.

4. Alimony Received

Part-year residents:

Report all taxable alimony or separate maintenance payments received while an Iowa resident.

Nonresidents:

Do not enter anything on this line.

Married Separate Filers:

Reported by the spouse who received the alimony.

21

5. Business Income or Loss

Part-year residents:

From the total business income or loss shown on the federal Schedule 1, line 3, report the amount earned

while an Iowa resident, and report any portion of the total business income or loss earned while a nonresident

using the instructions for nonresidents given below.

Nonresidents:

Report the portion of business income or loss attributable to a trade, business, or profession carried on within

Iowa. Include a supporting schedule showing Iowa gross receipts divided by total gross receipts for each

business; multiply this ratio times the total net income from the corresponding business. A sale of goods is

considered an Iowa sale if goods are delivered or shipped to a point within the state regardless of Freight on

Board (F.O.B.) point. A sale of a service is considered an Iowa sale if the recipient of the service receives the

benefit of the service in Iowa.

Married Separate Filers:

Reported by the spouse deriving the income or loss.

6. Capital Gain or (Loss)

Part-year residents:

Include 100% of the capital gain or loss from assets sold while an Iowa resident. In addition, capital gain or loss

from assets sold while a nonresident of Iowa should be reported on the basis of the instructions for

nonresidents that follow.

Nonresidents:

Include in Iowa income 100% of capital gain or loss from the following:

a. Sales of real or tangible personal property if the property was located in Iowa at the time of the sale; or

b. Sales of intangible personal property if the taxpayer's commercial domicile is in Iowa.

NOTE: You may have a gain here even if you have a net loss on the federal return.

Married Separate Filers:

Taxpayers who filed separate federal returns should report capital gain or loss as reported for federal tax

purposes.

If a joint federal return was filed, each spouse must report capital gain on the basis of ownership of the

property sold or exchanged. The combined net capital gain or loss must be the same as reported on the joint

federal return.

If a joint federal return was filed and both spouses have capital losses, each spouse may claim up to a $1,500

capital loss plus any unused portion of their spouse's $1,500 loss limitation. If both spouses are reporting

capital losses, the sum of both spouses' losses may not exceed $3,000.

7. Other Gains or (Losses)

Part-year residents:

Report 100% of gains or losses from assets sold or exchanged while an Iowa resident and any gains or losses

from federal form 4797 while a nonresident if the property was located in Iowa at the time of sale or exchange.

Nonresidents:

Report any gains or losses from federal form 4797 if the property was located in Iowa.

NOTE: You may have a gain here even if you have a net loss on the federal return.

22

Married Separate Filers:

Divide gains or losses based on ownership of the asset sold or exchanged.

8. Rents, Royalties, Partnerships, Estates, Trusts, Etc.

Part-year residents:

Report all income shown on federal Schedule E that was earned or received while an Iowa resident. Also report

all rents and royalties from Iowa sources and all Iowa partnership or S corporation income earned or received

while a nonresident.

Nonresidents:

Report all rents and royalties from Iowa sources and all Iowa partnership or S corporation income. See

instructions for allocation of business income on line 5 of this section.

Married Separate Filers:

Divide income or loss from Schedule E based upon ownership of the assets or business interest producing the

income or loss, or the individual named as beneficiary.

9. Farm Income or (Loss)

Part-year residents:

Report all net farm income earned or received while an Iowa resident. Also report all net income from Iowa

farm activities while a nonresident using the instructions for nonresidents given below.

Nonresidents:

Report the total net income from the Iowa farm activities. If farm activities were conducted both within and

without Iowa, provide a separate schedule showing allocation of the income and expenses to Iowa.

Married Separate Filers:

Farm income must be reported by the spouse who claims it for self-employment tax purposes on the federal

Schedule SE.

If the other spouse claims a share of the farm income, then that spouse must attach a worksheet showing how

that share was determined based on capital contribution, management and control, and services rendered.

10. Unemployment Compensation

Part-year residents:

Report all unemployment benefits received while an Iowa resident and those benefits received the rest of the

year that relate to past employment in Iowa.

Nonresidents:

Report the unemployment benefits that relate to employment in Iowa. If the unemployment benefits relate to

employment in Iowa and employment in another state, report the benefits to Iowa on the basis of the Iowa

salaries and wages to the total salary and wages.

Married Separate Filers:

If both spouses received unemployment benefits, each of the spouses should report the benefits received as

shown on the 1099-G(s) for each spouse.

23

11. Gambling Winnings

Part-year residents:

Report any gambling winnings that were received while an Iowa resident or winnings from Iowa sources while

a nonresident.

Nonresidents:

Report any gambling winnings that were received from Iowa sources.

Married Separate Filers:

The spouse to whom the income was paid must report that income.

12. Other Income

Part-year residents:

Report any income on the IA 1040, Schedule 1, line 11 which was received while an Iowa resident or income

from Iowa sources while a nonresident. This includes any federal nonconformity adjustments including the

depreciation/section 179 adjustment from the IA 4562A. This also includes non-exempt pension, annuity, and

IRA income received while an Iowa resident.

Nonresidents:

Report all other income from Iowa sources. This includes the Bonus Depreciation and Section 179 Adjustment

attributable to Iowa from the IA 4562A. Where this other income or adjustment relates to income allocated to

Iowa on another line of this form, include such other income or adjustments in the same ratio as the income to

which it relates was allocated to Iowa.

Married Separate Filers:

The spouse to whom the income was paid must report that income.

Modifications to partnership and S corporation income are allocated between spouses in the same manner as

that income was divided on IA 1040, line 10.

13. Iowa source gross income

Add lines 1-12

14. Federal total income from IA 1040, line 1

Enter federal total income from IA 1040, line 1

15. Iowa modifications to federal total income from IA 1040 Schedule 1, line 13

Enter Iowa modifications to federal total income from IA 1040 Schedule 1, line 13

16. Total

Add lines 14 and 15.

17. Payments to an Individual Retirement Account (IRA), Keogh, or Simplified Employment

Plan (SEP)

Part-year residents:

Deduct the payments made to an IRA, Keogh, or SEP plan while an Iowa resident. Only enter the Iowa

apportioned amount claimed on your federal tax return for payments made to your IRA, Keogh, SEP, SIMPLE,

or other qualified plans. Payments made to a Roth IRA are not deductible.

Nonresidents:

Deduct the payments made to an IRA, Keogh, or SEP plan. Only enter the Iowa apportioned amount claimed

on your federal tax return for payments made to your IRA, Keogh Plan, SEP, SIMPLE, or Qualified Plans in the

ratio of Iowa earned income to total earned income. Payments made to a Roth IRA are not deductible.

24

1. Married Separate Filers:

If only one spouse has earned income, that individual can contribute up to $6,000 per year ($7,000 if

50 or older) to an IRA account of the nonworking spouse and up to $6,000 per year ($7,000 if 50 or

older) to an IRA account of the individual.

2. When claiming the deduction between spouses, the working spouse will usually claim all of the

deduction, not to exceed the federal limits for both spouses. However, if the nonworking spouse has

any earned income, then the nonworking spouse must claim the deduction to the extent of their

earned income. The working spouse will then claim the balance of the IRA contribution of both

spouses.

3. If both spouses earned income and made contributions to an IRA account, each spouse must claim

their own contribution, not to exceed $6,000 per spouse ($7,000 if 50 or older).

4. If both spouses made contributions to an IRA but only a portion of the contribution is deductible on the

federal return, the amount of the IRA deduction that is allowed for federal income tax purposes must

be allocated between the spouses in the ratio of the IRA contribution made by each spouse to the total

IRA contribution made by both spouses. (Example of how to prorate)

5. For Keogh Plans, SEPs, SIMPLE, or Qualified Plans, each spouse must claim their individual

contributions.

18. Deductible Part of Self-employment Tax

Part-year residents:

Deduct the portion of the self-employment tax allowed on your federal return that is attributable to the

self-employment income earned while an Iowa resident.

Nonresidents:

Deduct the portion of the amount allowed on your federal return in the ratio of your Iowa self-employment

income to your total self-employment income.

Married Separate Filers:

The deduction is allocated in the ratio of self-employment tax paid by each spouse to the total

self-employment tax paid. (Examples of how to prorate)

19. Health Insurance Deduction for Over 65 Years Old

Note: This deduction is only available for taxpayers who are 65 years of age or older and whose Iowa taxable

income is less than $100,000.

Part-year residents:

Self-employed: Enter the health insurance premiums reported on the Iowa 1040, Schedule 1, line 15, paid by a

self-employed individual while an Iowa resident.

Deducted through wages: Enter the health insurance premiums reported on the Iowa 1040, Schedule 1, line

15, that were not withheld from your wages on a pretax basis while an Iowa resident.

Paid directly by the taxpayer: Enter the health insurance premiums reported on the Iowa 1040, Schedule 1,

line 15, that you paid while an Iowa resident.

Excess advance premium tax credit repayment: Enter the amount from the federal 1040, Schedule 2, line 2

multiplied by your 2022 Iowa income percentage. If you filed a 2022 IA 126, your 2022 Iowa income

percentage is shown on the 2022 IA 126, line 28. If you did not file a 2022 IA 126 because you were a resident

of Iowa in 2022, your 2022 Iowa income percentage is 100%. If you did not file a 2022 IA 126 because you

were a part-year resident or nonresident with no Iowa-source income in 2022, your 2022 Iowa income

percentage is 0%.

25

Nonresidents:

Self-employed: Enter the health insurance premiums reported on the Iowa 1040, Schedule 1, line 15, paid by a

self-employed individual multiplied by the ratio of Iowa self-employment income to total self-employment

income.

Deducted through wages: Enter the health insurance premiums reported on the Iowa 1040, Schedule 1, line

15, that were not withheld from your wages on a pretax basis multiplied by the ratio of Iowa wages to total

wages.

Paid directly by the taxpayer: Multiply the health insurance premiums reported on the Iowa 1040, Schedule 1,

line 15, that you paid by the ratio of your Iowa-source net income on the IA 126, line 25 to total net income on

the IA 1040, line 4. For this net income calculation, do not include line 19, the health insurance deduction in

the above-referenced net income amounts.

Excess advance premium tax credit repayment: Enter the amount from the federal 1040, Schedule 2, line 2

multiplied by your 2022 Iowa income percentage. If you filed a 2022 IA 126, your 2022 Iowa income

percentage is shown on the 2022 IA 126, line 28. If you did not file a 2022 IA 126 because you were a resident

of Iowa in 2022, your 2022 Iowa income percentage is 100%. If you did not file a 2022 IA 126 because you were

a part-year resident or nonresident with no Iowa-source income in 2022, your 2022 Iowa income percentage is

0%.

Married Separate Filers:

If one spouse is employed and has health or dental insurance premiums paid through their wages post tax,

that spouse will claim the entire deduction. If both spouses pay health or dental insurance premiums through

their wages post tax, each spouse will claim what that individual paid.

If both spouses have self-employment income, the deduction for self-employed health or dental insurance

must be allocated between the spouses in the ratio of each spouse's self-employment income to the total

self-employment income of both spouses.

For taxpayers who are not self-employed, if health or dental insurance premiums are paid directly by one

spouse, that spouse will claim the entire deduction. If both spouses paid through a joint checking account, the

deduction will be allocated between the spouses in the ratio of each spouse's Iowa-source net income to the

total Iowa-source net income of both spouses. For this calculation, do not include line 19, the health or dental

insurance deduction. (Examples of how to prorate)

20. Penalty on Early Withdrawal of Savings

Part-year residents:

Deduct the amount of any penalty you were charged because you withdrew funds from your time savings

deposit before its maturity while an Iowa resident. Also report any penalty you were charged while a

nonresident using the instructions for nonresidents given below.

Nonresidents:

Deduct the amount of any penalty you were charged because you withdrew funds from your time savings

deposit, derived from an Iowa trade, business, or profession, before its maturity.

Married Separate Filers:

Divide the penalty amount between spouses based upon registered ownership of the time deposit.

● Jointly held: Divide the penalty equally between spouses.

● Held in the name of only one spouse: Allocate the entire penalty to that spouse.

26

21. Alimony Paid

Part-year residents:

Deduct the amount of alimony allowed for federal purposes while an Iowa resident.

Nonresidents:

Deduct the amount of alimony allowed for federal purposes in the ratio of Iowa gross income to total gross

income.

Married Separate Filers:

Only the spouse liable for these payments can deduct the amount of alimony allowed for federal purposes.

22. Iowa Capital Gain Deduction

Enter 100% of the qualifying capital gain deduction that is attributable to Iowa sources. See the applicable IA

100 for instructions.

Married Separate Filers:

Divide the capital gain deduction based on ownership of the asset.

● Jointly held: Divide equally between spouses.

● If other than jointly held: Divide between spouses based on percentage of ownership.

23. Other Adjustments

Deduct miscellaneous adjustments to income in the same ratio as the income to which the adjustment relates

was allocated to Iowa.

Married Separate Filers:

When the adjustment is attributable to a specific spouse, it is taken on IA126 for that spouse.

When the adjustment is not attributable to any one spouse, it must be prorated on IA 126 for each spouse

based on the Iowa-source net income amounts on line 25. Calculate through line 25 as if the adjustment in

question were excluded.

If the adjustment is attributable to a dependent, such as the student loan interest deduction, it is prorated

based on the Iowa-source net income before the adjustment in question. (Examples of how to prorate)

24. Total Adjustments

Add lines 17-23

25. Iowa-Source Net Income

Subtract line 24 from line 13 and enter the difference on this line. If line 25 is $1,000 or more or you are

subject to Iowa lump-sum tax, complete lines 26 through 32. If line 25 is less than $1,000 and you are not

subject to Iowa lump sum tax, you are not required to file an Iowa income tax return. Married taxpayers must

combine their Iowa income amounts for purposes of the $1,000 filing threshold. However, if you had Iowa tax

withheld and are requesting a refund, or if you choose to file an Iowa return even if you are not required to do

so, enter 100% on line 28, complete the remainder of the schedule, and enter the credit amount on IA 1040,

line 13.

26. All Source Net Income

Subtract line 24, column A from line 16.

27. Iowa Income Percentage

Divide line 25 by line 26. Enter percentage rounded to the nearest ten-thousandth of a percent (e.g.

12.3456%).This can be no more than 100.0% and no less than 0.0%

27

28. Nonresident or Part-year resident credit percentage

Subtract the percentage on line 27 from 100.0%.

Enter percentage rounded to nearest ten-thousandth of a percent (e.g. 12.3456%).

29. Iowa tax on total income from IA 1040

Enter the amount from IA 1040, line 5.

30. Total Credits from IA 1040

Enter the amount from IA 1040, line 11.

31. Tax After Credits

Subtract line 30 from line 29.

Single taxpayers (filing status 1) who used the Tax Reduction Worksheet to calculate the amount on IA 1040,

line 12 should enter the amount from IA 1040, line 12 on the IA 126, line 31.

32. Nonresident or part-year resident credit.

Multiply line 31 by the percentage on line 28. Enter this amount on IA 1040, line 13

Balance

Line: 14

Step: 5

Step Subject: Tax, Non-refundable Credits, and Check-off Contributions

Subtract line 13 from line 12.

Out-of-State Tax Credit

Line: 15

Step: 5

Step Subject: Tax, Non-refundable Credits, and Check-off Contributions

For additional information on the Iowa out-of-state tax credit, see Iowa Administrative Code rule 701—304.6.

Who May Use the IA 130?

Only Iowa residents or part-year residents with an income tax liability in another state, local jurisdiction

outside of Iowa, or foreign country may reduce their Iowa tax liability by claiming an Iowa Out-of-State Tax

Credit.

Part-year residents of Iowa may claim this credit only if any income earned while an Iowa resident was also

taxed by another state, local jurisdiction outside of Iowa, or foreign country. Only income included on the IA

126, and taxed by another state, local jurisdiction outside of Iowa, or foreign country, may qualify for this

credit. Nonresidents of Iowa may NOT claim this credit.

Caution: Shareholders of S corporations who have income from the corporation that was apportioned outside

Iowa through a claim to the IA 134 S Corporation Apportionment Tax Credit may NOT claim an out-of-state

credit on this S corporation income.

Filing Requirements

Complete a separate IA 130 for each state, local jurisdiction outside of Iowa, or foreign country. Separate IA

130s are not required for foreign taxes paid by mutual funds or other regulated investment companies. The

28

credit or portion of the credit must not exceed the amount of the Iowa tax imposed on the same income that

was taxed by the other state, local jurisdiction outside of Iowa, or foreign country.

When filing your IA 1040, include all IA 130 schedules, the income tax return you filed with the other state,

local jurisdiction outside of Iowa, or foreign country, the supplemental schedule that was provided by your

pass-through entity if you are claiming income taxes paid by your pass-through entity, and federal form 1116,

Foreign Tax Credit, if you are claiming income taxes paid to a foreign country and it is required with your

federal return.

Married Filing Separate Filers

If a taxpayer is married filing separately in Iowa but married filing jointly in another state, only the taxpayer’s

portion of the income taxed by the other state may be used in calculating the out-of-state tax credit. The

spouse’s income should be excluded from any amount of income reported on IA 130.

Lump-Sum Distribution Tax

Do not include any lump-sum distribution tax when computing this credit for regular income tax paid. You

must compute this credit separately for regular income tax and special lump-sum distribution tax. For more

information, see the special instructions for lump-sum distribution tax at the end of these instructions.

Line Instructions for IA 130

Part 1: Iowa Source Income Taxed by Another State or Jurisdiction

1. Wages, Salaries, Tips, Etc.

Include all W-2 income earned or received while an Iowa resident and taxed in another state, local jurisdiction

outside of Iowa, or foreign country. For Iowa residents with W-2 income from Illinois, see Iowa - Illinois

Reciprocal Agreement.

Married Separate Filers:

W-2 income is reported by the spouse earning the income.

2. Taxable Interest Income

Report all interest shown on the IA 1040 that accrued while an Iowa resident which was derived from a trade,

business, or profession carried on outside of Iowa and taxed in another state, local jurisdiction outside of Iowa,

or foreign country.

Married Separate Filers:

Divide interest income based on ownership of the account or certificate.

● Jointly held: Divide equally between spouses.

● Held in the name of only one spouse: Allocate interest wholly to that spouse.

3. Dividend Income

Report all dividends received while an Iowa resident that was taxed in another state, local jurisdiction outside

of Iowa, or foreign country.

4. Alimony Received

Report all taxable alimony or separate maintenance payments received while an Iowa resident that was taxed

in another state, local jurisdiction outside of Iowa, or foreign country.

Married Separate Filers:

Reported by the spouse who received the alimony.