Cathay Pacic Airways Limited

Annual Report 2016

Stock Code: 293

6 Financial and Operating Highlights

8 Chairman’s Letter

10 2016 in Review

18 Review of Operations

23 2016 Sustainable Development Review

28 Financial Review

34 Directors and Officers

36 Directors’ Report

44 Corporate Governance Report

57 Independent Auditor’s Report

62 Consolidated Statement of Profit or

Loss and Other Comprehensive Income

63 Consolidated Statement of

Financial Position

64 Consolidated Statement of

Cash Flows

65 Consolidated Statement of

Changes in Equity

66 Notes to the Financial Statements

103 Principal Subsidiaries and

Associates

105 Principal Accounting Policies

110 Statistics

115 Glossary

116 Corporate and Shareholder Information

Contents

Cathay Pacific is an international airline registered and based in Hong Kong, offering

scheduled passenger and cargo services to 181 destinations in 43 countries and territories.

The airline was founded in Hong Kong in 1946 and celebrated its 70th anniversary on 24th

September 2016. It has been deeply committed to its home base over the last seven decades,

making substantial investments to develop Hong Kong as one of the world’s leading international

aviation centres.

The Cathay Pacific Group operated 202 aircraft at 31st December 2016. Cathay Pacific itself had

146 aircraft at that date. Its other investments include catering and ground-handling companies

and its corporate headquarters and cargo terminal at Hong Kong International Airport. Cathay

Pacific continues to invest heavily in its home city. At 31st December 2016 it had 59 new aircraft

due for delivery up to 2024.

Hong Kong

Cathay Pacific

Cathay Pacific Freighter

Cathay Dragon

Air Hong Kong

Hong Kong Dragon Airlines Limited (“Cathay Dragon”), a regional airline registered and based in

Hong Kong, is a wholly owned subsidiary of Cathay Pacific operating 43 aircraft on scheduled

services to 53 destinations in Mainland China and elsewhere in Asia. Cathay Pacific owns 18.13%

of Air China Limited (“Air China”), the national flag carrier and a leading provider of passenger,

cargo and other airline-related services in Mainland China. Cathay Pacific is the majority

shareholder in AHK Air Hong Kong Limited (“Air Hong Kong”), an all-cargo carrier providing

scheduled services in Asia.

Cathay Pacific and its subsidiaries employ more than 33,800 people worldwide, of whom around

26,200 are employed in Hong Kong. Cathay Pacific is listed on The Stock Exchange of Hong Kong

Limited, as are its substantial shareholders Swire Pacific Limited (“Swire Pacific”) and Air China.

Cathay Pacific is a founding member of the oneworld global alliance, whose combined network

serves more than 1,000 destinations worldwide. Cathay Dragon is an affiliate member of oneworld.

A Chinese

translation of this

Annual Report is

available upon

request from the

Company’s

Registrars.

本年報中文譯本,

於本公司之股份

登記處備索。

The Cathay Dragon rebranding has brought the award-winning

regional airline closer to Cathay Pacic, providing customers

with a more seamless, unied customer experience across

their respective global and regional networks.

Seamless

connectivity

6

Cathay Pacific Airways Limited

Financial and Operating Highlights

Group Financial Statistics

2016 2015 Change

Results

Revenue HK$ million 92,751 102,342 -9.4%

(Loss)/profit attributable to the shareholders of Cathay Pacific HK$ million (575) 6,000 -109.6%

(Loss)/earnings per share HK cents (14.6) 152.5 -109.6%

Dividend per share HK$ 0.05 0.53 -90.6%

(Loss)/profit margin % (0.6) 5.9 -6.5%pt

Financial position

Funds attributable to the shareholders of Cathay Pacific HK$ million 55,365 47,927 +15.5%

Net borrowings HK$ million 49,879 42,458 +17.5%

Shareholders’ funds per share HK$ 14.1 12.2 +15.6%

Net debt/equity ratio Times 0.90 0.89 +0.01 times

Operating Statistics – Cathay Pacific and Cathay Dragon

2016 2015 Change

Available tonne kilometres (“ATK”) Million 30,462 30,048 +1.4%

Available seat kilometres (“ASK”) Million 146,086 142,680 +2.4%

Revenue passengers carried ‘000 34,323 34,065 +0.8%

Passenger load factor % 84.5 85.7 -1.2%pt

Passenger yield HK cents 54.1 59.6 -9.2%

Cargo and mail carried ‘000 tonnes 1,854 1,798 +3.1%

Cargo and mail load factor % 64.4 64.2 +0.2%pt

Cargo and mail yield HK$ 1.59 1.90 -16.3%

Cost per ATK (with fuel) HK$ 3.02 3.14 -3.8%

Cost per ATK (without fuel) HK$ 2.12 2.06 +2.9%

Aircraft utilisation Hours per day 12.2 12.2 –

On-time performance % 72.1 64.7 +7.4%pt

Average age of fleet Years 9.0 9.1 -1.1%

GHG emissions Million tonnes of CO

2

e 17.2 17.1 +0.6%

GHG emissions per ATK Grammes of CO

2

e 565 569 -0.7%

Lost time injury rate

Number of injuries per

100 full-time equivalent

employees

3.12 2.95 +5.8%

6

Financial and Operating Highlights

2017 Target

12 Airbus A350-900

Fleet

Cathay Dragon Rebranding

2016 Took delivery

10 Airbus A350-900

1 Boeing 747-8F

The Pier Business

Class lounge in

Hong Kong

reopened in

June 2016

New lounge

in Vancouver

opened in

May 2016

Lounges

Best First Class

Airline Lounge in the

Skytrax World Airline

Awards 2016

First and business

class lounges at

London Heathrow

reopened in

December 2016

SafetyNetwork

2015

2016

Zurich

Boston

Tokyo

Haneda

Düsseldorf

London

Gatwick

Madrid

January

2016

Cathay Pacic Cathay Dragon

December

2016

2016 Average:

72.1%

On-time Performance

Leading airline

in the 2016 JACDEC airline

safety rankings

Cathay Pacific Cathay Dragon

8

Cathay Pacific Airways Limited

Chairman’s Letter

The Cathay Pacific Group reported an attributable loss of HK$575 million for 2016. This

compares to a profit of HK$6,000 million in 2015. The loss per share was HK14.6 cents

compared to earnings per share of HK152.5 cents in the previous year.

The operating environment for our airlines was difficult in

2016, with a number of factors adversely affecting their

performance. Intense and increasing competition with other

airlines was the most important. Other airlines significantly

increased capacity. There were more direct flights between

Mainland China and international destinations. Competition

from low cost carriers increased. Overcapacity in the market

was a particular competitive problem for our cargo business.

Three economic factors were also important, the reduced

rate of economic growth in Mainland China, a reduction in

the number of visitors to Hong Kong and the strength of the

Hong Kong dollar. Hong Kong dollar strength made Hong

Kong an expensive destination and caused revenues earned

in other currencies to be reduced on conversion into Hong

Kong dollars. All these factors put severe competitive

pressure on yields. We benefited from low fuel prices, but

the benefit was reduced by fuel hedging losses, largely

incurred on hedges put in place when the fuel price was

much higher than today. The contribution from subsidiary

and associated companies was satisfactory.

The Group’s passenger revenue in 2016 was HK$66,926

million, a decrease of 8.4% from 2015. Capacity increased

by 2.4%, reflecting the introduction of new routes and

increased frequencies on other routes. The load factor

decreased by 1.2 percentage points, to 84.5%. Yield, which

was under intense pressure throughout the year, fell by

9.2% to HK54.1 cents, reflecting overcapacity in the

market, a decline in premium class demand and weak

foreign currencies.

The Group’s cargo revenue in 2016 was HK$20,063 million,

a decrease of 13.2% compared to the previous year. The

cargo capacity of Cathay Pacific and Cathay Dragon

increased by 0.6%. The load factor increased by 0.2

percentage points, to 64.4%. Tonnage carried increased by

3.1%. The market was very weak in the first quarter. Tonnage

recovered from the second quarter, becoming seasonally

strong in the fourth quarter. Yield fell by 16.3% to HK$1.59,

reflecting strong competition, overcapacity and the

suspension of Hong Kong fuel surcharges. Demand on

European routes was weak. Demand on transpacific routes

grew slightly in the second half of the year. Freighter

services to Portland and Brisbane West Wellcamp were

introduced. We managed freighter capacity in line with

demand and carried a higher proportion of cargo in the

bellies of our passenger aircraft.

Total fuel costs for Cathay Pacific and Cathay Dragon (before

the effect of fuel hedging) decreased by HK$4,906 million (or

20.4%) compared with 2015. Fuel is still the Group’s most

significant cost, accounting for 29.6% of our total operating

costs in 2016 (compared to 34.0% in 2015). Fuel hedging

losses reduced the benefit of low fuel costs. After taking

hedging losses into account, the Group’s fuel costs

decreased by HK$5,015 million (or 15.2%) compared to 2015.

There was a 2.9% increase in non-fuel costs per available

tonne kilometre. Staff costs, landing and parking fees,

and aircraft maintenance costs increased at a faster rate

than capacity.

Congestion at Hong Kong International Airport and air traffic

control constraints in the Greater China region continued to

impose costs on the Group. We are doing more to improve

the reliability of our operations. This was reflected in a 7.4

percentage points improvement in on-time performance.

In response to weak revenues, we have undertaken a critical

review of our business. In the short term, we are

implementing measures designed to improve revenues and

reduce costs. The longer term strategy which is being

developed in response to the review is designed to improve

performance over a three year period.

In 2016, Cathay Pacific introduced passenger services to

Madrid (in June) and London Gatwick (in September). Both

services have been well received. We will increase the

frequency of our Gatwick and Manchester services in June

2017. Frequencies on some other routes were increased in

2016. Cathay Pacific will introduce services to Tel Aviv in

March 2017, to Barcelona in July 2017 and to Christchurch in

December 2017. Cathay Pacific stopped flying to Doha in

February 2016, but still offers codeshare services with Qatar

Airways on this route. Cathay Dragon increased frequencies

on its Phnom Penh, Wenzhou and Wuhan routes and reduced

frequencies on its Clark and Kota Kinabalu routes. Cathay

Dragon stopped flying to Hiroshima and stopped the tagged

flight between Kathmandu and Dhaka, providing direct

services to both destinations instead.

8 9

Annual Report 2016

Chairman’s Letter

In 2016, we took delivery of 10 Airbus A350-900 aircraft.

These fuel efficient and technologically advanced long-haul

aircraft are being used on our Auckland, Düsseldorf, London

Gatwick, Paris and Rome routes. We retired our last three

Boeing 747-400 passenger aircraft and three Airbus A340-

300 aircraft during the year. One Airbus A340-300 aircraft

was retired in January 2017 and the remaining three such

aircraft will be retired later in 2017. We took delivery of our

final Boeing 747-8F freighter in August.

The new Airbus A350-900 aircraft have our latest cabins,

seats and entertainment systems and inflight connectivity

for passengers’ mobile devices. We opened a new lounge in

Vancouver in May 2016, reopened the business class

lounge at The Pier in Hong Kong in June 2016, and

reopened our first and business class lounges at London

Heathrow in December 2016. The G16 lounge in Hong Kong

closed for renovations in July 2016 and will reopen in the

second quarter of 2017.

In November 2016, Dragonair was rebranded as Cathay

Dragon, bringing the brands of our two airlines into closer

alignment. The first aircraft featuring the Cathay Dragon

livery went into service in April 2016.

Prospects

We expect the operating environment in 2017 to remain

challenging. Strong competition from other airlines and the

adverse effect of the strength of the Hong Kong dollar are

expected to continue to put pressure on yield. The cargo

market got off to a good start, but overcapacity is expected

to persist.

We expect to continue to benefit in 2017 from the fact that

fuel prices are much lower than their previous high levels,

but to a lesser extent (because of some increase in oil

prices in recent months) than in 2016. We also expect to

incur further fuel hedging losses in 2017, but these should

be less than in 2016. Our subsidiaries and associates are

expected to continue to perform satisfactorily.

Despite the challenges with which we are faced, we still

expect our business to grow in the long-term. Air traffic to,

from and within the Asia-Pacific region is expected to grow

strongly. We intend to benefit from this growth by increasing

our passenger capacity by 4-5% per annum, at least until

the third runway at Hong Kong International Airport is open.

We will continue to introduce new destinations and to

increase frequencies on our most popular routes. We are

buying new and more fuel efficient aircraft. This will increase

productivity and reduce costs.

We are starting on a three year programme of corporate

transformation with the intention of achieving returns above

the cost of capital. The goal is to become a more agile and

competitive organisation in order to take advantage of

changing market trends and customer preferences.

We will continue to make investments designed to

strengthen our brand and what we offer to our customers.

We aim to deliver better services and to do so more

effectively through the use of data analytics and mobile

technology. Doing this will increase operational efficiency

and help us to meet our customers’ needs better. We are

reviewing our revenue management, distribution and pricing

practices. We intend to increase ancillary revenue.

Just as important as improving revenues is reducing costs.

We are working on operational changes intended to

improve the reliability of our schedules. This will reduce the

costs of disruption and will also enable us to use our assets

more efficiently and to improve our on-time performance.

Our organisation will become leaner. This will improve

productivity and reduce costs and will also enable us to

make decisions more quickly. Our aim is to reduce our unit

costs excluding fuel over the next three years.

The objective of the Cathay Pacific Group is to provide

sustainable growth in shareholder value over the long term.

We are confident of longer-term success. We celebrated

our 70th anniversary in 2016 and our commitment to Hong

Kong and its people remains unwavering.

John Slosar

Chairman

Hong Kong, 15th March 2017

10

Cathay Pacific Airways Limited

The Group’s performance in 2016 did not match that of 2015. The operating environment

for our airlines was difficult in 2016, with a number of factors adversely affecting their

performance. Intense and increasing competition with other airlines was the most

important. Other airlines significantly increased capacity. There were more direct flights

between Mainland China and international destinations. Competition from low cost carriers

increased. Overcapacity in the market was a particular competitive problem for our cargo

business. Three economic factors were also important, the reduced rate of economic

growth in Mainland China, a reduction in the number of visitors to Hong Kong and the

strength of the Hong Kong dollar. Hong Kong dollar strength made Hong Kong an expensive

destination and caused revenues earned in other currencies to be reduced on conversion

into Hong Kong dollars. All these factors put severe competitive pressure on yields. We

benefited from low fuel prices, but the benefit was reduced by fuel hedging losses, largely

incurred on hedges put in place when the fuel price was much higher than today. The

contribution from subsidiary and associated companies was satisfactory.

Despite the challenges with which we are faced, we still expect our business to grow in the

long-term. Air traffic to, from and within the Asia-Pacific region is expected to grow

strongly. We intend to benefit from this growth by increasing our passenger capacity by

4-5% per annum, at least until the third runway at Hong Kong International Airport is open.

We will continue to introduce new destinations and to increase frequencies on our most

popular routes. We are buying new and more fuel efficient aircraft. This will increase

productivity and reduce costs.

We are starting on a three year programme of corporate transformation with the intention

of achieving returns above the cost of capital. The goal is to become a more agile and

competitive organisation in order to take advantage of changing market trends and

customer preferences.

We will continue to make investments designed to strengthen our brand and what we offer

to our customers. We aim to deliver better services and to do so more effectively through

the use of data analytics and mobile technology. Doing this will increase operational

efficiency and help us to meet our customers’ needs better. We are reviewing our revenue

management, distribution and pricing practices. We intend to increase ancillary revenue.

Just as important as improving revenues is reducing costs. We are working on operational

changes intended to improve the reliability of our schedules. This will reduce the costs of

disruption and will also enable us to use our assets more efficiently and to improve our on-

time performance. Our organisation will become leaner. This will improve productivity and

reduce costs and will also enable us to make decisions more quickly. Our aim is to reduce

our unit costs excluding fuel over the next three years.

2016 in Review

10 11

Annual Report 2016

2016 in Review

Award-winning products and services

• We took delivery of our first Airbus A350-900 aircraft in

May, and took delivery of a further nine aircraft of this type

before the end of 2016. We expect to have 22 aircraft of

this type in service by the end of 2017. They have our

latest cabins, seats and entertainment systems and

inflight connectivity for passengers’ mobile devices.

• The Airbus A350 aircraft are fuel efficient and have the

right range, capacity and operating economics for our

requirements.

• The business class seats in the Airbus A350-900 have

better beds, more storage space, larger televisions and

simpler seat controls than the business class seats in our

other aircraft types.

• The premium economy class seats in the Airbus A350-900

have better storage space and leg rests and larger tables

than the premium class seats in our other aircraft types.

They have personal reading lights and tablet holders.

• The economy class seats in the Airbus A350-900 have

new headrests and tablet holders, and have larger

televisions than the economy class seats in our other

aircraft types.

• We opened a new lounge in Vancouver in May 2016.

The design follows that of our lounges in Bangkok, Tokyo

Haneda, Manila and Taipei.

• In June 2016, we reopened our business class lounge at

The Pier in Hong Kong after refurbishment. This is our

largest lounge. It can accommodate 550 passengers.

• In December 2016, we reopened our first and business

class lounge at London Heathrow following a refurbishment.

It is Cathay Pacific’s only lounge outside Hong Kong that

has separate first and business class areas.

• The G16 lounge at Hong Kong International Airport closed

for renovations in July 2016. It is scheduled to reopen in

the second quarter of 2017.

• Cathay Pacific was ranked first in 2016 among the world’s

largest airlines by the Jet Airliner Crash Data Evaluation

Centre in terms of safety.

• Cathay Pacific was voted Best North Asian Airline at the

27th Annual TTG Travel Awards in 2016.

• At the 2016 Business Traveller Asia-Pacific Awards,

Cathay Pacific won Best Airline Premium Economy Class,

Best Frequent Flyer Programme and Best Airline Lounge in

Asia-Pacific awards.

• In 2016, the first class lounge at The Pier in Hong Kong

was named Best First Class Airline Lounge in the Skytrax

World Airline Awards. Cathay Pacific also won the award

for World’s Best Airline Cabin Cleanliness.

• The business class lounge at The Pier in Hong Kong was

named Best Airport Lounge at the Monocle Travel Top

50 Awards.

• Cathay Pacific service teams and individual staff members

won honours at the Inflight Sales Person of the Year

Awards and the Customer Service Excellence Awards

organised by the Hong Kong Association for Customer

Service Excellence.

• In 2016, Cathay Pacific won Best Presented First Class

Wine List at the Business Traveller Cellars in the Sky 2015

Awards.

Hub development

• In 2016, Cathay Pacific celebrated its 70th anniversary as

the home carrier of Hong Kong. We remain deeply

committed to the long-term development of Hong Kong

International Airport as a premier international centre for

passenger and cargo traffic.

• We fully support the construction of the third runway at

Hong Kong International Airport. We believe its

construction is critical to addressing the airport’s

shortage of capacity, and to maintaining Hong Kong’s

long-term competitiveness as a premier aviation centre.

• The development of our networks is a priority. We manage

capacity in line with passenger and cargo demand. In

2016, we cancelled flights for commercial and operational

reasons, without affecting the integrity of our networks.

• The passenger capacity of Cathay Pacific and Cathay

Dragon increased by 2.4% in 2016 compared to 2015. This

reflected the introduction of new routes and increased

frequencies on other routes. Cathay Pacific’s passenger

capacity increased by 2.8%. Cathay Dragon’s passenger

capacity decreased by 0.4%.

• In 2016, Cathay Pacific introduced passenger services to

Madrid (in June) and to London Gatwick (in September). In

June 2017, we will increase the frequency of the Gatwick

service from four flights per week to daily and the

Manchester service from four to five flights per week. In

December 2017, a sixth weekly flight will be added to the

Manchester route. In October 2017, the service on the

Madrid route will increase from four to five flights per week.

In December 2017, an 11th weekly flight to Paris will be

restored. We will introduce a four-times-weekly passenger

service to Tel Aviv in March 2017 and a four-times-weekly

passenger service to Barcelona between July and

October 2017.

12

Cathay Pacific Airways Limited

2016 in Review

• We will introduce a three-times-weekly passenger service

to Christchurch between December 2017 and February

2018. From October 2017 to March 2018, we will replace

the current tagged service between Cairns and Brisbane

by providing direct flights to both destinations. The

service to Brisbane will have 11 flights per week and the

service to Cairns will have three flights per week.

• To meet high summer demand, two flights were added per

week on the Toronto route between July and August 2016.

We will operate a twice daily service on this route between

June and September 2017. In April 2017, we will increase

the number of flights to Vancouver from 14 to 17 per week.

A fifth weekly flight was added on the Boston route

between May and August 2016. Daily flights will start on

this route at the end of March 2017. In October 2017, four

flights will be added per week to San Francisco, so that

this service will become three-times-daily.

• In July and August 2016, we increased our services to

Sapporo from five times per week to daily.

• Three of our 10 times per week flights to Paris and all of

our flights to Düsseldorf are now operated by Airbus

A350-900 aircraft. From October 2016 to May 2017, four

flights per week to Rome were operated by Airbus A350-

900 aircraft.

• In October 2016, we started to use Airbus A350-900

aircraft on the Auckland route. One of the flights on this

route was operated by larger Boeing 777-300ER aircraft.

• Cathay Pacific stopped flying to Doha in February 2016,

but still offers codeshare services with Qatar Airways on

this route.

• In November 2016, Cathay Dragon stopped flying to

Hiroshima and Kathmandu via Dhaka. Cathay Dragon now

provides direct services to both Kathmandu and Dhaka.

• From October 2016 to March 2017, Cathay Pacific reduced

flights to Bangkok from 63 to 56 per week.

• In May 2016, Cathay Dragon increased the frequency of its

Wenzhou service from seven to 10 flights per week. From

May to October 2016, it increased the frequency of its

Wuhan service from 11 to 12 flights per week and used

bigger aircraft on the Xi’an route.

• From September 2016, Cathay Dragon increased the

frequency of its Phnom Penh service from 12 to 14 flights

per week. It reduced the frequency of its services to Kota

Kinabalu from seven to five flights per week from May

2016 and of its Clark service from four to three flights per

week from March 2016. In October 2016, the fourth weekly

Clark flight was restored.

• In November 2016, Cathay Pacific introduced a twice-

weekly cargo service to Portland, Oregon and a weekly

cargo service to Brisbane West Wellcamp.

Fleet development

• At 31st December 2016, Cathay Pacific operated 146 aircraft,

Cathay Dragon operated 43 aircraft and Air Hong Kong

operated 13 aircraft (a total of 202 aircraft for the Group). There

are 59 new aircraft on order for delivery up to 2024.

• We took delivery of our first Airbus A350-900 aircraft in

May, and took delivery of a further nine aircraft of this type

before the end of 2016. We expect to have 22 aircraft of

this type in service by the end of 2017. They have our

latest cabins, seats and entertainment systems and

inflight connectivity for passengers’ mobile devices.

• We will start to take delivery of Airbus A350-1000 aircraft

(which have a longer range and more capacity than Airbus

A350-900 aircraft) in 2018 and expect to have 26 aircraft

of this type in service by the end of 2020.

• We retired our last three Boeing 747-400 passenger

aircraft and three Airbus A340-300 aircraft during 2016.

One Airbus A340-300 was retired in January 2017 and our

remaining three Airbus A340-300 aircraft will be retired

later in 2017.

• We delivered four Boeing 747-400F freighters to Boeing

during 2016.

• We took delivery of our final Boeing 747-8F freighter in

August 2016.

• One of Cathay Pacific’s regional Airbus A330-300 aircraft

was transferred to Cathay Dragon in December 2016.

Three Airbus A330-300 aircraft were transferred to

Cathay Dragon in 2017, two in February 2017 and one

March 2017. One more such aircraft will be transferred

later in 2017.

Advances in technology

• During 2016, self-service bag drop facilities were

introduced in Hong Kong and Amsterdam and kiosk bag

tagging facilities were introduced in Auckland, Bengaluru,

Hangzhou, London Gatwick, London Heathrow, Los

Angeles, Paris, San Francisco, Singapore, Toronto,

Vancouver and Xiamen. These facilities will be introduced

in other airports in 2017.

• In August 2016, we introduced a new cargo booking system.

• The Marco Polo Club introduced benefits for some of its

members using electronic vouchers. The benefits provide

the eligible members with additional lounge access,

bookable upgrades and companion cards.

12 13

Annual Report 2016

2016 in Review

Partnerships

• Cathay Pacific stopped flying to Doha in February 2016,

but still offers codeshare services with Qatar Airways on

this route.

• In April 2016, Cathay Pacific ended its frequent flyer

relationship with China Eastern Airlines.

• In August 2016, Cathay Pacific and Cathay Dragon entered

into an air plus rail arrangement with SNCB Railway in

Belgium on train services between Amsterdam and

Brussels, and between Amsterdam and Antwerp.

• In October 2016, Cathay Pacific entered into a codeshare

agreement with LATAM Airlines Brasil. The CX code will be

placed on all LATAM Airlines Brasil flights between London

and Paris (on the one hand) and Sao Paulo (on the other

hand) and between New York (on the one hand) and Sao

Paulo and Rio de Janeiro (on the other hand). The LATAM

Airlines Brasil JJ code will be placed on all Cathay Pacific

flights between New York and Hong Kong.

• In May 2016, Cathay Pacific signed a joint business

agreement with Lufthansa Cargo AG in relation to cargo

routes between Hong Kong and Europe. The agreement

came into effect in the first quarter of 2017.

• In January 2017, Cathay Pacific entered into a codeshare

and frequent flyer programme agreement with Air

Canada. The CX code will be placed on some domestic

Air Canada flights. Air Canada’s AC code will be placed

on some Cathay Pacific and Cathay Dragon flights to

Southeast Asia.

Fleet profile*

Number at

31st December 2016

Leased Firm orders Expiry of operating leases

Aircraft

type Owned Finance Operating Total ‘17 ‘18

‘19 and

beyond Total ‘17 ‘18 ‘19 ‘20 ‘21

‘22 and

beyond Options

Aircraft operated by Cathay Pacific:

A330-300 23 12 6 41 3 1 2

A340-300 4 4

(a)

A350-900 5 3 2 10 12

(b)

12 2

A350-1000 8 18 26

747-400BCF 1 1 1

747-400ERF 6 6

747-8F 3 11 14

777-200 5 5

777-200F 3

(c)

777-300 12 12 2 3 5

(d)

777-300ER 19 11 23 53 1 2 5 15

777-9X 21 21

Total 71 43 32 146 12 10 42 64 5 3 2 5 17 3

Aircraft operated by Cathay Dragon:

A320-200 5 10 15 2 1 1 3 3

A321-200 2 6 8 1 2 3

A330-300 10 10

(e)

20 6 2 2

Total 17 26 43 6 2 3 2 7 6

Aircraft operated by Air Hong Kong:

A300-600F 4 4 2 10 2

747-400BCF 3

(e)

3 3

Total 4 4 5 13 3 2

Grand total 92 47 63

(e)

202 12 10 42 64

(d)

6 10 8 4 12 23 3

*

Includes parked aircraft. The table does not reflect aircraft movements after 31st December 2016.

(a) Cathay Pacific is accelerating the retirement of its Airbus A340-300 aircraft. Three of these aircraft were retired in 2016. One Airbus A340-300 was

retired in January 2017. The remaining three such aircraft will be retired before the end of 2017.

(b) Two of these Airbus A350-900 aircraft were delivered after 31st December 2016, one in February 2017, the other in March 2017.

(c) Purchase options for aircraft to be delivered by 2019.

(d) Five Boeing 777-300 used aircraft will be delivered from 2018.

(e) 57 of the 63 aircraft which are subject to operating leases are leased from third parties. The remaining six of such aircraft (three Boeing 747-400BCFs

and three Airbus A330-300s) are leased within the Group.

14

Cathay Pacific Airways Limited

2016 in Review

Review of other subsidiaries and associates

The share of profits from other subsidiaries and associates

in 2016 increased by 14.8% to HK$2,788 million from

HK$2,428 million. This mainly reflected a strong

performance from our associate, Air China, whose results

benefited from low fuel prices and strong passenger

demand, offset in part by the adverse effect of the

devaluation of the Renminbi. Below is a review of the

performance and operations of subsidiaries and associates.

AHK Air Hong Kong Limited (“Air Hong Kong”)

• Air Hong Kong is the only all-cargo airline in Hong Kong.

It is 60.0% owned by Cathay Pacific. It operates express

cargo services for DHL Express.

• Air Hong Kong operates eight owned Airbus A300-600F

freighters, two dry leased Airbus A300-600F freighters

and three Boeing 747-400BCF converted freighters dry

leased from Cathay Pacific.

• During 2016, Air Hong Kong operated six flights per week

services to Bangkok, Ho Chi Minh City, Osaka, Penang

(via Ho Chi Minh City), Seoul, Shanghai, Singapore, Taipei

and Tokyo and five flights per week services to Beijing,

Manila and Nagoya.

• On-time performance was 86% within 15 minutes.

• Compared with 2015, capacity increased by 0.1% to 777

million available tonne kilometres. The load factor

decreased by 1.2 percentage points to 65.3%. Revenue

tonne kilometres decreased by 1.6% to 508 million.

• Air Hong Kong recorded a marginal increase in profit for

2016 compared with 2015.

Asia Miles Limited (“AML”)

• AML, a wholly owned subsidiary, manages the Cathay

Pacific Group’s reward programme. It has nearly nine

million members.

• In 2016, AML recorded an increase in profit compared

with 2015, due to an increase in business volume.

Cathay Pacific Catering Services (H.K.) Limited

(“CPCS”) and kitchens outside Hong Kong

• CPCS, a wholly owned subsidiary, operates the principal

flight kitchen in Hong Kong.

• CPCS provides flight catering services to 45

international airlines in Hong Kong. It produced 30.2

million meals and handled 73,000 flights in 2016

(representing a daily average of 83,000 meals and 200

flights and an increase of 2.5% and 2.0% respectively

over 2015). CPCS had a 66.6% share of the flight catering

market in Hong Kong in 2016.

• Increased business volume resulted in higher revenue.

This was offset by increases in direct labour and

overhead costs, which led to a decrease in profit in 2016.

• An expanded facility with 40% additional capacity

commenced operations in the first quarter of 2017.

• Outside Hong Kong, profits decreased.

Cathay Pacific Services Limited (“CPSL”)

• CPSL, a wholly owned subsidiary, operates the Group’s

cargo terminal at Hong Kong International Airport. The

terminal’s annual handling capacity is 2.6 million tonnes.

• At the end of 2016, CPSL provided cargo handling

services to 15 airlines. Seven airlines became new

customers in 2016.

• CPSL handled 1.8 million tonnes of cargo in 2016, 51.3%

of which were transshipments. Export and import

shipments accounted for 31.1% and 17.6% respectively

of the total.

• The financial results in 2016 improved compared with

2015. This was due to an increase in the number of

customers and effective management of operating

costs.

14 15

Annual Report 2016

2016 in Review

Hong Kong Airport Services Limited (“HAS”)

• HAS, a wholly owned subsidiary, provides ramp and

passenger handling services at Hong Kong International

Airport. It provides ground services to 22 airlines,

including Cathay Pacific and Cathay Dragon.

• In 2016, HAS had 44% and 20% market shares in ramp

and passenger handling businesses respectively at

Hong Kong International Airport.

• In 2016, the number of customers for passenger

handling was 20 and the number of customers for ramp

handling was 20. Passenger handling flights increased by

1.2% in 2016. Ramp handling flights decreased by 0.3%.

• The 2016 financial results were worse than the 2015

results. HAS stopped providing services to some airlines.

This was necessary in order to maintain services to the

remaining airlines in a period of labour shortage.

• With fewer customers, HAS improved the quality of its

services and operations. There were year on year

reductions of over 30% in delays to aircraft and in the

staff injury rate.

Air China Limited (“Air China”)

• Air China, in which Cathay Pacific had a 20.13% interest

at 31st December 2016, is the national flag carrier and

leading provider of passenger, cargo and other airline-

related services in Mainland China. On 10th March 2017,

the procedures for Air China’s registration of the new A

shares were completed. As a consequence, Cathay

Pacific’s shareholding in Air China has been diluted from

20.13% to 18.13% .

• At 31st December 2016, Air China operated 262

domestic and 116 international (including regional) routes

to 41 countries and regions, including 64 overseas cities,

three regional cities and 109 domestic cities.

• We are represented on the Board of Directors of

AirChinaandequityaccountforourshareofAirChina’s

results.

• Our share of Air China’s results is based on its financial

statements drawn up three months in arrear.

Consequently, our 2016 results include Air China’s

results for the 12 months ended 30th September 2016,

adjusted for any significant events or transactions in the

period from 1st October 2016 to 31st December 2016.

• For the 12 months ended 30th September 2016, Air

China’s results improved, principally as a result of low fuel

prices and strong passenger demand, partly offset by

the adverse effect of the devaluation of the Renminbi.

Air China Cargo Co., Ltd. (“Air China Cargo”)

• Air China Cargo, in which Cathay Pacific owns an equity

and an economic interest, is the leading provider of air

cargo services in Mainland China. It has its headquarters

in Beijing. Its main operating base is in Shanghai Pudong.

• At 31st December 2016, Air China Cargo operated 15

freighters. It flies to 10 cities in Mainland China and 11

cities outside Mainland China. Taking into account its

rights to carry cargo in the bellies of Air China’s

passenger aircraft, Air China Cargo has connections to

more than 170 destinations.

• Air China Cargo’s 2016 financial results were better than

those of 2015. Savings from lower fuel prices were

partially offset by unrealised exchange losses on loans

denominated in United States dollars and lower yield in

the highly competitive air cargo market.

We care about our passengers’

experience at every stage of their

journey with us, from the moment they

plan their travel through to arriving at

their destination in better shape.

Life Well

Travelled

%

40

50

60

70

80

90

%

0

20

40

60

80

100

20

30

40

50

60

70

2012 2013 2014 2015 2016

2012 2013 2014 2015 2016

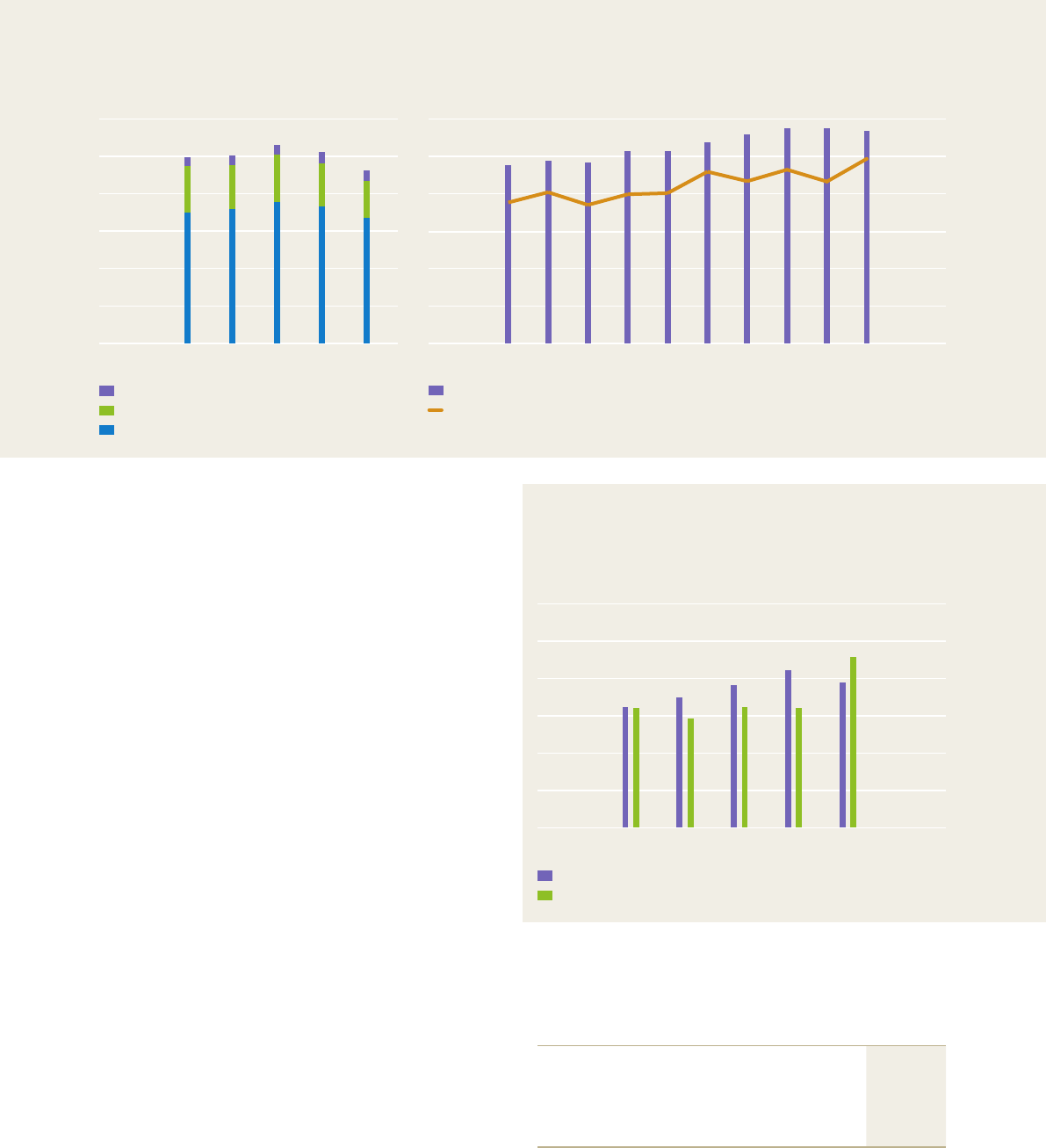

Load factor by region

North Asia

Southwest

Pacic and

South Africa

Southeast

Asia

Europe

North

America

India, Middle East,

Pakistan and

Sri Lanka

HK cents

Passenger load factor and yield

YieldPassenger load factor

18

Cathay Pacific Airways Limited

Cathay Pacific and Cathay Dragon carried 34.3 million passengers in 2016, an increase of

0.8% compared to 2015. Revenue decreased by 8.4% to HK$66,926 million. The load factor

decreased by 1.2 percentage points to 84.5%. Capacity increased by 2.4%, reflecting the

introduction of new routes (to Madrid and London Gatwick) and increased frequencies on

some other routes. Yield decreased by 9.2%, to HK54.1 cents. The operating environment for

our passenger business was difficult in 2016, with a number of factors adversely affecting its

performance. Intense and increasing competition with other airlines was the most important.

Other airlines significantly increased capacity. There were more direct flights between

Mainland China and international destinations. Competition from low cost carriers increased.

Three economic factors were also important, the reduced rate of economic growth in

Mainland China, a reduction in the number of visitors to Hong Kong and the strength of the

Hong Kong dollar. Hong Kong dollar strength made Hong Kong an expensive destination and

caused revenues earned in other currencies to be reduced on conversion into Hong Kong

dollars. All these factors put severe competitive pressure on yields. We benefited from low

fuel prices, but the benefit was reduced by fuel hedging losses, largely incurred on hedges

put in place when the fuel price was much higher than today. Corporate demand for premium

class travel weakened considerably, especially on long-haul routes. Economy class demand

was stable, but yield was under pressure.

Review of Operations Passenger Services

18 19

Annual Report 2016

Review of Operations Passenger Services

Available seat kilometres (“ASK”), load factor and yield by region for

Cathay Pacific and Cathay Dragon passenger services for 2016 were as follows:

ASK (million) Load factor (%) Yield

2016 2015 Change 2016 2015 Change Change

India, Middle East and Sri Lanka 9,172 10,127 -9.4% 79.3 82.9 -3.6%pt -6.8%

Southwest Pacific and South Africa 19,702 19,350 +1.8% 87.8 89.3 -1.5%pt -12.0%

Southeast Asia 21,151 20,641 +2.5% 84.2 83.2 +1.0%pt -8.0%

Europe 25,958 23,969 +8.3% 86.6 88.5 -1.9%pt -12.8%

North Asia 30,802 30,267 +1.8% 79.5 80.6 -1.1%pt -7.4%

North America 39,301 38,326 +2.5% 86.8 88.4 -1.6%pt -8.9%

Overall 146,086 142,680 +2.4% 84.5 85.7 -1.2%pt -9.2%

Home market – Hong Kong and Pearl River

Delta

• Passenger volume grew slightly, but at the expense of yield.

Promotional pricing benefited the premium class load factor.

• Fewer Hong Kong passengers travelled to Japan in 2016

than in 2015, due to the strength of the yen. More

passengers travelled to Korea in 2016 than in 2015, when

demand was adversely affected by concerns over middle

east respiratory syndrome.

• In February 2016, the suspension of Hong Kong fuel

surcharges adversely affected yield. In September, we

re-imposed fuel surcharges on tickets booked outside

Hong Kong and the Philippines. Yield was also adversely

affected by strong competition and overcapacity in Asia.

• Corporate travel originating in Hong Kong was below

expectations, particularly to London and New York. The

number of corporate travellers declined for the first time

since 2009, when business was affected by the global

financial crisis. The decline prompted us to sell premium

class tickets on a promotional basis to leisure travellers.

• Transit traffic between Japan and the Pearl River Delta

was adversely affected by the introduction of direct

services. Transit traffic between North America (on the

one hand) and Southeast Asia and the Pearl River Delta

(on the other hand) grew.

India, Middle East and Sri Lanka

• The performance of our India routes was reasonable in

2016. However, increased competition adversely affected

demand for travel between North America and North Asia

(on the one hand) and India (on the other hand).

• Low oil prices adversely affected Middle Eastern economies.

• Cathay Pacific stopped flying to Doha in February 2016, but

still offers codeshare services with Qatar Airways on this route.

• Demand on the Colombo route was strong.

Southwest Pacific and South Africa

• There was a slight increase in passenger numbers on

Southwest Pacific routes. Yield was adversely affected by

the weakness of the Australian dollar and by overcapacity

in the market.

• Transit traffic between Mainland China and Australia was

adversely affected by the availability of additional cheap

direct flights.

• In October 2016, we started to use Airbus A350-900

aircraft on the Auckland route. One of the flights on this

route was operated by larger Boeing 777-300ER aircraft.

• From October 2017 to March 2018, we will replace the

current tagged service between Cairns and Brisbane by

providing direct flights to both destinations. The service to

Brisbane will have 11 flights per week and the service to

Cairns will have three flights per week.

• Cathay Pacific will introduce a three-times-weekly

passenger service to Christchurch between December

2017 and February 2018.

• The strategic agreement between Cathay Pacific and Air

New Zealand in relation to the Auckland route has been

extended until 31st October 2019.

• Demand for travel between Johannesburg (on the one

hand) and Japan and Mainland China (on the other hand)

remained strong.

Southeast Asia

• The performance of our Southeast Asian routes was

satisfactory. We carried more passengers despite strong

competition and the depreciation of local currencies.

Yield on these routes was affected by overcapacity and

intense competition.

• From October 2016 to March 2017, Cathay Pacific

reduced flights to Bangkok from 63 to 56 per week.

20

Cathay Pacific Airways Limited

Review of Operations Passenger Services

• From September 2016, Cathay Dragon increased the

frequency of its Phnom Penh service from 12 to 14

flights per week. It reduced the frequency of its services

to Kota Kinabalu from seven to five flights per week from

May 2016 and of its Clark service from four to three

flights per week from March 2016. In October 2016 a

fourth weekly Clark flight was restored.

• In November 2016, Cathay Dragon stopped the tagged

flight between Kathmandu and Dhaka, providing direct

services to both destinations instead.

• Cathay Pacific will stop flying to Kuala Lumpur in May

2017. Cathay Dragon will operate this four-times-daily

service instead.

Europe

• We increased capacity to Europe in 2016. This reflected the

introduction of new routes (Madrid and London Gatwick).

The use of A350 aircraft reduced capacity on some routes.

• Our London and Manchester routes were adversely

affected by the weakness of sterling and strong

competition. Passenger volumes numbers were maintained.

• There was some recovery in demand for travel to Europe

in 2016. Premium class demand from leisure travellers

benefited from promotions. But demand for corporate

travel weakened.

• Increases in capacity by Middle Eastern carriers on routes

between Mainland China and Europe affected yield.

• In 2016, Cathay Pacific introduced passenger services

to Madrid (in June) and London Gatwick (in September).

Both services have been well received. In June 2017, we

will increase the frequency of the Gatwick service from

four flights per week to daily and the Manchester service

from four to five flights per week. In December 2017, a

sixth weekly flight will be added to the Manchester route.

• In October 2017, the service on the Madrid route will

increase from four to five flights per week.

• In December 2017, an 11th weekly service to Paris

will be restored.

• Cathay Pacific will introduce a four-times-weekly

passenger service to Tel Aviv in March 2017.

• Cathay Pacific will introduce a four-times-weekly

passenger service to Barcelona between July and

October 2017.

North Asia

• Demand for travel between Mainland China and Taiwan

fell sharply in the second half of 2016. Demand for travel

between Taiwan (on the one hand) and Japan and Korea

(on the other hand) also fell. Yield was under pressure

due to increased capacity.

• Demand for travel to Japan was adversely affected by

the strength of the Japanese yen. Transit traffic between

Japan and Mainland China (including the Pearl River

Delta) was adversely affected by the introduction of

direct services. In July and August 2016, we increased

our services to Sapporo from five times per week to daily.

In November 2016, we stopped our service to Hiroshima.

• More passengers went to Korea in 2016 than in 2015,

when demand was adversely affected by concerns over

middle east respiratory syndrome. Strong competition

put pressure on yield.

• In May 2016, Cathay Dragon increased the frequency of

its Wenzhou service from seven to 10 flights per week.

From May to October 2016, it increased the frequency of

its Wuhan service from 11 to 12 flights per week and

used bigger aircraft on the Xi’an route.

North America

• Revenue from United States routes declined in 2016.

Passenger numbers did not increase as much as capacity.

A reduction in corporate travel affected premium class

revenue, especially on the New York route.

• Competition intensified as Mainland China carriers

operated more direct flights to the United States, which

put pressure on yield.

• Our Boston service has been doing well since its

introduction in 2015. From May to August 2016 we

increased the number of flights per week from four to

five. Daily flights will start at the end of March 2017.

• Demand on our Canada routes was stable. To meet high

summer demand, two flights were added per week on the

Toronto route between July and August 2016. We will

operate a twice daily service on this route between June

and September 2017. In April 2017, we will increase the

number of flights to Vancouver from 14 to 17 per week.

• In October 2017, four flights will be added per week to

San Francisco, so that this service will become three-

times-daily. The service will be operated by Airbus

A350-900 aircraft.

• In October 2017, the number of flights on the Los

Angeles route will be reduced from 28 to 21 per week.

0

10,000

5,000

15,000

20,000

25,000

30,000

2012 2013 2014 2015 2016

0

4,000

8,000

12,000

20,000

16,000

2012 2013 2014 2015 2016

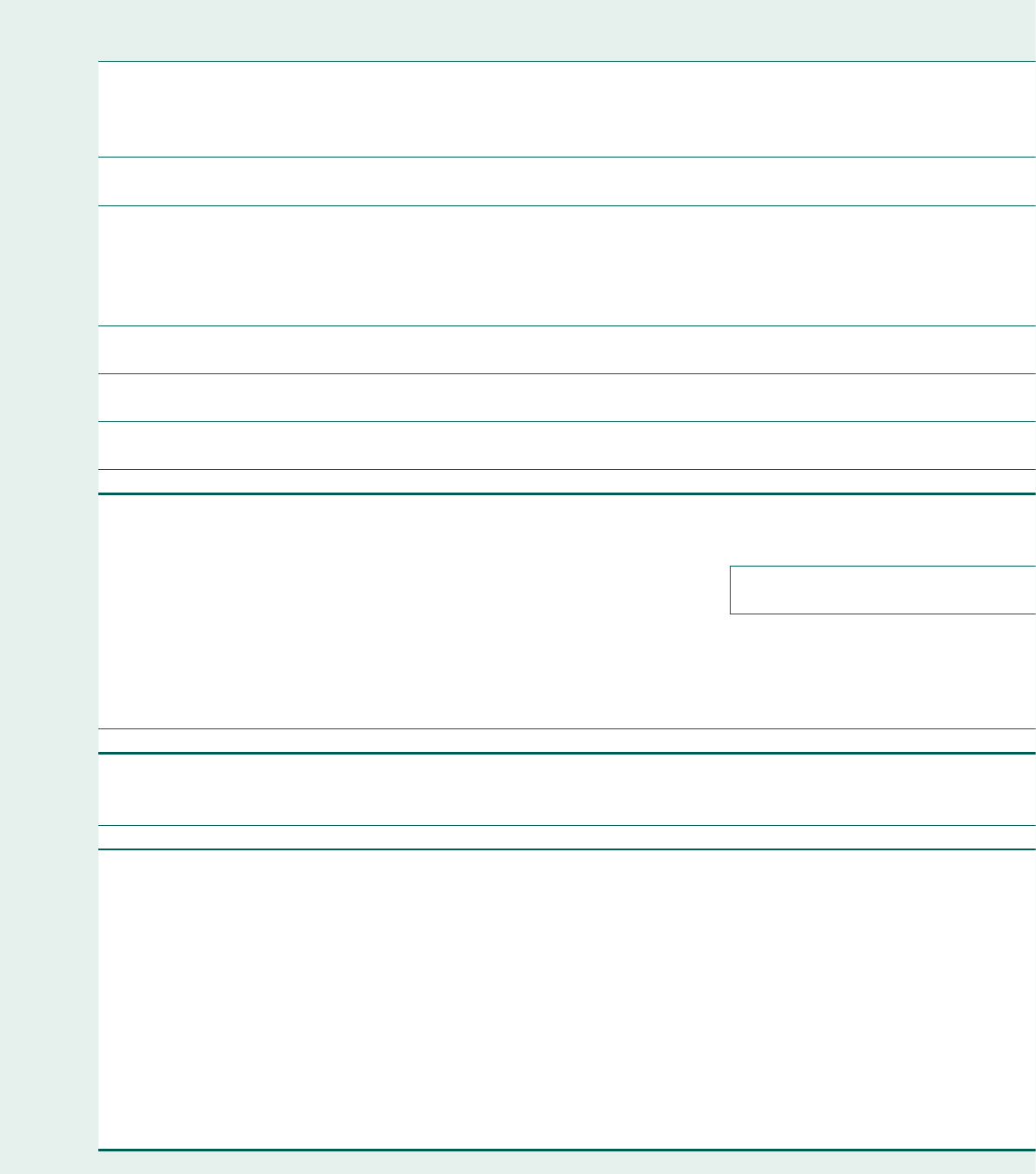

Capacity – cargo and mail ATK

HK$ million

Revenue

Million tonne

kilometres

20 21

Annual Report 2016

Cathay Pacific and Cathay Dragon carried 1.9 million tonnes of cargo and mail in 2016, an

increase of 3.1% compared to 2015. The cargo revenue of Cathay Pacific and Cathay

Dragon was HK$17,024 million, a decrease of 15.2% compared to the previous year. This

mainly reflected the suspension of Hong Kong fuel surcharges. Capacity for Cathay Pacific

and Cathay Dragon increased by 0.6%. The load factor increased by 0.2 percentage points.

Strong competition, overcapacity and the suspension of Hong Kong fuel surcharges put

significant pressure on yield, which decreased by 16.3% to HK$1.59. The market was very

weak in the first quarter. Tonnage recovered from the second quarter, becoming seasonally

strong in the fourth quarter. We managed freighter capacity in line with demand and carried

a higher proportion of cargo in the bellies of our passenger aircraft.

Review of Operations Cargo Services • Loyalty and Reward Programmes

Available tonne kilometres (“ATK”), load factor and yield for Cathay Pacific and

Cathay Dragon cargo services for 2016 were as follows:

ATK (million) Load factor (%) Yield

2016 2015 Change 2016 2015 Change Change

Cathay Pacific and Cathay Dragon 16,572 16,481 +0.6% 64.4 64.2 +0.2%pt -16.3%

• Strong competition, overcapacity and the suspension of

Hong Kong fuel surcharges put significant pressure on

yield. The market was very weak in the first quarter.

Tonnage recovered from the second quarter, becoming

seasonally strong in the fourth quarter.

• Shipments of pharmaceutical products and mail, the

yield on which is above average, increased by 11% and

8% respectively in 2016.

• Exports from Hong Kong and Mainland China increased

in the second half of the year, resulting in high load

factors on North American routes. However, the

weakness of the Renminbi adversely affected the yield

from exports from Mainland China.

• Northeast Asia exports of electronics, machinery and

perishable goods were steady. Other shipments within

Asia grew.

22

Cathay Pacific Airways Limited

• In November 2016, we introduced a twice-weekly service

to Portland, Oregon, our 18th cargo destination in the

Americas. The service was introduced to cater for

growing demand to move goods from the Pacific

Northwest to Asia.

• In November 2016, we introduced a weekly service to

Brisbane West Wellcamp, principally to carry agricultural

products grown in one of Australia’s most productive

regions.

• In April 2016, we started to operate additional services to

the Indian sub-continent in response to strong demand.

However, yield was under pressure. Airport congestion at

Dhaka limited shipments in and out of the city at some

points in the year.

• Shipments of perishable products from the Americas to

Asia grew strongly.

• In the last week of September 2016, before the long

national holiday in Mainland China, we shipped a record

weekly tonnage of cargo. We maximised the number of

flights in the last quarter of the year to meet peak

seasonal demand, but yield was down.

• In May 2016, we signed a joint business agreement with

Lufthansa Cargo AG in relation to cargo routes between

Hong Kong and Europe. The agreement came into effect

in the first quarter of 2017.

• Four Boeing 747-400F freighter aircraft were delivered to

Boeing in 2016.

• We took delivery of our 14th and final Boeing 747-8F

freighter in August 2016.

Loyalty and reward programmes

The Marco Polo Club

• The Marco Polo Club loyalty programme provides

benefits and services to the frequent flyers of Cathay

Pacific and Cathay Dragon. It has approximately one

million members.

• Members of the Club contribute to almost a quarter of

the revenues of Cathay Pacific and Cathay Dragon.

• In April 2016, the basis on which club points are earned

by club members was changed. Cabin class, fare class

and distance travelled are now taken into consideration.

The new basis is in line with that used by other loyalty

programmes. It reflects better the contributions which

our passengers make to the revenues of our airlines.

• The new basis for earning points does not change the

benefits available to qualifying members of the club.

Silver members (and above) continue to have unlimited

access to lounges when flying on Cathay Pacific or

Cathay Dragon and all members are entitled to priority

boarding and check-in.

Asia Miles

• Asia Miles is a leading travel and lifestyle rewards

programme in Asia. It has nearly nine million members

and over 700 partners worldwide, including 25 airlines,

more than 150 hotel brands and restaurants and

retail shops.

• There was a 7% increase in redemptions by Asia Miles

members on Cathay Pacific and Cathay Dragon flights

in 2016.

• Marco Polo Club members are also members of

Asia Miles.

Antitrust proceedings

Cathay Pacific remains the subject of antitrust proceedings

in various jurisdictions. The outcomes are subject to

uncertainties. Cathay Pacific is not in a position to assess

the full potential liabilities but makes provisions based on

relevant facts and circumstances in line with accounting

policy 20 set out on page 109.

Review of Operations Cargo Services • Loyalty and Reward Programmes

22 23

Annual Report 2016

Sustainable development

We apply sustainable development principles when doing

business. We take environmental and social considerations

into account when making business decisions. It is our

policy to comply with environmental and social regulations

and to educate our employees, engage with others and set

targets in relation to environmental and social matters. We

encourage our staff to mitigate or reduce the environmental

and social impact of the decisions which they make.

We operate an environmental management system which is

based on ISO14001 certification. The system is audited

once a year externally and twice a year internally.

2016 Sustainable Development Review

Opportunities for improvement are identified during these

audits.

We engage with the communities in which we operate and

involve our employees in doing so. We prioritise our

community activities but maintain flexibility in order to

respond to specific local needs.

Our people are one of our greatest assets. We are proud of

the high-quality service which they give and are committed

to providing them with the best possible working and career

environment. This enables us to attract, develop and retain

the best people.

Performance updates

2016 2015 Change

Environment

GHG emissions Million tonnes of CO

2

e 17.2 17.1 +0.6%

GHG emissions per ATK Grammes of CO

2

e 565 569 -0.7%

Electricity consumption MWh 42,001 42,490 -1.2%

Paper consumption Tonnes 2,355 2,270 +3.7%

Paper recycled (office and inflight) Tonnes 1,931 1,888 +2.3%

Metal recycled (office and inflight) Kg 42,326 38,415 +10.2%

Plastic recycled (office and inflight) Kg 44,800 41,706 +7.4%

People

Totalworkforce Number 26,674 26,824 -0.6%

By location

HongKong % 71.5 71.1 +0.4%pt

Outport % 28.5 28.9 -0.4%pt

By employment type

Flightcrew % 14.6 14.2 +0.4%pt

Cabincrew % 45.8 46.3 -0.5%pt

Groundstaff % 39.6 39.5 +0.1%pt

By gender

Female % 61.3 61.8 -0.5%pt

Male % 38.7 38.2 +0.5%pt

Data for Cathay Pacific and Cathay Dragon is presented. Full indicator tables will be provided in Cathay Pacific’s Sustainable

Development Report at www.cathaypacific.com/sdreport.

Awards and Recognitions in 2016

• Cathay Pacific is a constituent of the FTSE4Good

Index and the Hang Seng Corporate Sustainability

Index.

• Cathay Pacific has received the Caring Company Logo

from the Hong Kong Council of Social Service every year

since 2003 in recognition of its good corporate

citizenship. Cathay Dragon has received the same

recognition every year since 2005.

24

Cathay Pacific Airways Limited

2016 Sustainable Development Review

2016 Highlights

Environment

• In October 2016, an agreement to implement a carbon

offset and reduction scheme for international aviation

was reached by states attending the International Civil

Aviation Organization (ICAO)’s 39th assembly. Cathay

Pacific has been involved in discussions about the

scheme since 2008. We participate in an ICAO task force

which leads the aviation industry’s work in developing

proposals for a fair, equitable and effective global

agreement on emissions.

• Cathay Pacific engages with regulators and groups (the

IATA Environment Committee, the Airlines Advisory

Group on Global Market-Based Measures, the

Sustainable Aviation Fuel Users Group, the Roundtable

on Sustainable Biomaterials and the Association of Asia

Pacific Airlines) involved in shaping climate change and

aviation policy as part of its climate change strategy. The

aim is to increase awareness of climate change and to

develop appropriate solutions for the aviation industry.

• In compliance with the European Union’s Emissions

Trading Scheme, our 2016 emissions data from intra-EU

flights were reported on by an external auditor in January

2017 and our emissions report was submitted to the UK

Environment Agency in February 2017. Cathay Pacific’s

overall greenhouse gas emissions data for 2016 were

reported on by an external auditor.

• All our Airbus A350-900 aircraft are being flown on their

delivery flights from Toulouse using fuel containing 10%

biofuel. 10 Airbus A350-900 aircraft were delivered in

2016 and 12 more aircraft are scheduled to be delivered

by the end of 2017. Biofuel reduces carbon emissions

from aircraft by 60-80% when compared to fossil fuel.

• We have started to use Sedex (the Supplier Ethical Data

Exchange) in order to obtain information about our

suppliers.

• Unopened food items from inbound Cathay Pacific

flights to Hong Kong have been collected by Feeding

Hong Kong, a non-profit organisation which provides

surplus food to Hong Kong charities for distribution to

people in need. More than 195 tonnes of surplus food

were donated during 2016.

• We donated 2,445 kilograms of surplus food from our

canteens at Cathay City in 2016 to Food Angel. Food

Angel makes surplus food into hot meals for

underprivileged families in Hong Kong.

• In March 2016, Cathay Pacific participated in WWF’s

annual Earth Hour activity. We switched off all

nonessential lighting in our buildings and on billboards

outside Cathay City.

• A staff photo competition called “Our Planet, Our Future”

was held in June 2016. Staff were encouraged to submit

photos celebrating the environment on World

Environment Day.

• Our retiring Airbus A340 aircraft are being dealt with

under PAMELA (Airbus’ Process for Advanced

Management of End-of-Life Aircraft). This enables old

aircraft to be dismantled (and disposed of or recycled) in

a sustainable manner.

• Our online Sustainable Development Report 2015,

entitled “Together for Tomorrow” was published

in September 2016 and is available at

www.cathaypacific.com/sdreport. The Sustainable

Development Report 2016 is scheduled to be published

in July 2017.

• In June 2016, Cathay Pacific signed the United for

Wildlife Transport Taskforce Buckingham Palace

Declaration. The Declaration aims to reduce the illegal

trafficking of wildlife with the support of aviation and

shipping industry companies and organisations.

• In June 2016, Cathay Pacific decided not to carry

shark fins.

Contribution to the community

• In January 2016, Hong Kong SAR Chief Executive CY

Leung was the guest of honour on a community flight

organised by Cathay Pacific. The 90-minute flight on a

Boeing 777-300 aircraft was a special treat for 250

residents from less-advantaged families in Hong Kong.

Most of the participants had never flown before.

• Starting in March 2016, 300 young people took part in

the 2016 three month “I Can Fly” programme. They

received training in aviation matters and participated in

social service projects. The top 100 participants visited

aviation facilities in Singapore and Adelaide. Over 3,700

students have participated in this programme since it

started in 2003.

24 25

Annual Report 2016

2016 Sustainable Development Review

• We held a 24 hour Hackathon in October 2016 for the

local youth. It demonstrated our efforts to foster

innovation and to generate ideas to improve services to

passengers.

• Cathay Pacific supports UNICEF through its “Change for

Good” inflight fundraising programme. Our passengers

contributed HK$13.9 million in 2015 to help improve the

lives of vulnerable children. Since its introduction in 1991,

more than HK$165 million has been raised through the

programme.

• A percentage of the “Change for Good” donations are

passed to the Cathay Pacific Wheelchair Bank, which

raises funds to provide specially adapted wheelchairs for

children with neuromuscular diseases. Since its

formation, the bank has raised more than HK$16 million,

benefiting more than 490 children.

• In July 2016, 11 Cathay Pacific staff went to Birgunj and

Kathmandu in Nepal and in December 2016, 14 staff

visited Chongqing in Mainland China, to see how

“Change for Good” donations were being applied.

• The Cathay Pacific Volunteers, made up of around 1,400

Cathay Pacific staff, help the local community in Hong

Kong. Their “English on Air” programme has helped more

than 2,400 students to improve their conversational

English skills. They sort unopened and shelf stable food

from inflight meal carts to be given to families in need. In

2016, Cathay Pacific Volunteers contributed more than

1,300 hours of voluntary service to support the local

community.

• In October 2016, 300 Cathay Pacific staff flew on our last

Boeing 747-400 passenger flight, over Hong Kong

harbour. Each of them contributed a minimum of HK$747

in order to do so. HK$200,000 was raised for the Hong

Kong Breast Cancer Foundation.

• We organised tours of our headquarters at Hong Kong

International Airport for around 10,000 visitors in 2016.

• In April 2016, Cathay Dragon organised an aviation

career workshop for 200 young people.

• The Cathay Dragon aviation certificate programme is

organised with the Hong Kong Air Cadet Corps and the

Scout Association of Hong Kong. Participants gain first

hand knowledge of the Hong Kong aviation industry and

are mentored by Cathay Dragon pilots. In 2016, Cathay

Dragon pilots mentored 40 participants over nine

months. To date, over 200 participants have graduated

from the programme. Almost half of the graduates have

started aviation-related careers.

• In December 2016, Cathay Pacific donated

approximately 6,000 used blankets to the Society for the

Prevention of Cruelty to Animals to help animals stay

warm over the winter.

Commitment to staff

• At 31st December 2016, the Cathay Pacific Group

employed more than 33,800 people worldwide. Around

26,200 of these people are based in Hong Kong. Cathay

Dragon employs more than 3,300 people.

• In 2016, Cathay Pacific recruited more than 1,000 staff,

including around 320 cabin crew and around 230 pilots.

Cathay Dragon recruited around 110 cabin crew and 10

pilots.

• In 2016, 74 cadets graduated from the Cathay Pacific

cadet pilot programme and 11 cadets graduated from

the Cathay Dragon cadet pilot programme.

• In 2016, 10 graduates (out of more than 400 applicants)

were selected to join our IT graduate trainee programme.

• In 2016, we introduced a careers website. It enables

those inside and outside the Group to register interest

and to search and apply for jobs.

• We regularly review our human resources and

remuneration policies in the light of legislation, industry

practice, market conditions and the performance of

individuals and the Group.

• We are reviewing productivity and expenditure.

• In May 2016, Cathay Pacific introduced “Work Well Done”,

which encourages recognition of the contributions

which our people make to our business.

• Our annual Betsy awards are given to frontline staff who

display exceptional customer service. We have

introduced Niki awards, for staff who have made

exceptional contributions behind the scenes.

We continually invest in our products and services,

both on the ground and in the air, enabling our

customers to enjoy a Life Well Travelled.

Inspiring

journey

28

Cathay Pacific Airways Limited

The Cathay Pacific Group reported an attributable loss of HK$575 million in 2016 compared

with a profit of HK$6,000 million in 2015.

The operating environment for our airlines was difficult in 2016, with a number of factors

adversely affecting their performance. Intense and increasing competition with other

airlines was the most important. Other airlines significantly increased capacity. There were

more direct flights between Mainland China and international destinations. Competition

from low cost carriers increased. Overcapacity in the market was a particular competitive

problem for our cargo business. Three economic factors were also important, the reduced

rate of economic growth in Mainland China, a reduction in the number of visitors to Hong

Kong and the strength of the Hong Kong dollar. Hong Kong dollar strength made Hong Kong

an expensive destination and caused revenues earned in other currencies to be reduced

on conversion into Hong Kong dollars. All these factors put severe competitive pressure

on yields. We benefited from low fuel prices, but the benefit was reduced by fuel hedging

losses, largely incurred on hedges put in place when the fuel price was much higher

than today.

The contribution from the Group’s subsidiary and associated companies was satisfactory.

Financial Review

Revenue

Group

Cathay Pacific and

Cathay Dragon

2016

HK$M

2015

HK$M

2016

HK$M

2015

HK$M

Passenger services 66,926 73,047 66,926 73,047

Cargo services 20,063 23,122 17,024 20,079

Catering, recoveries and other services 5,762 6,173 5,067 5,590

Total revenue 92,751 102,342 89,017 98,716

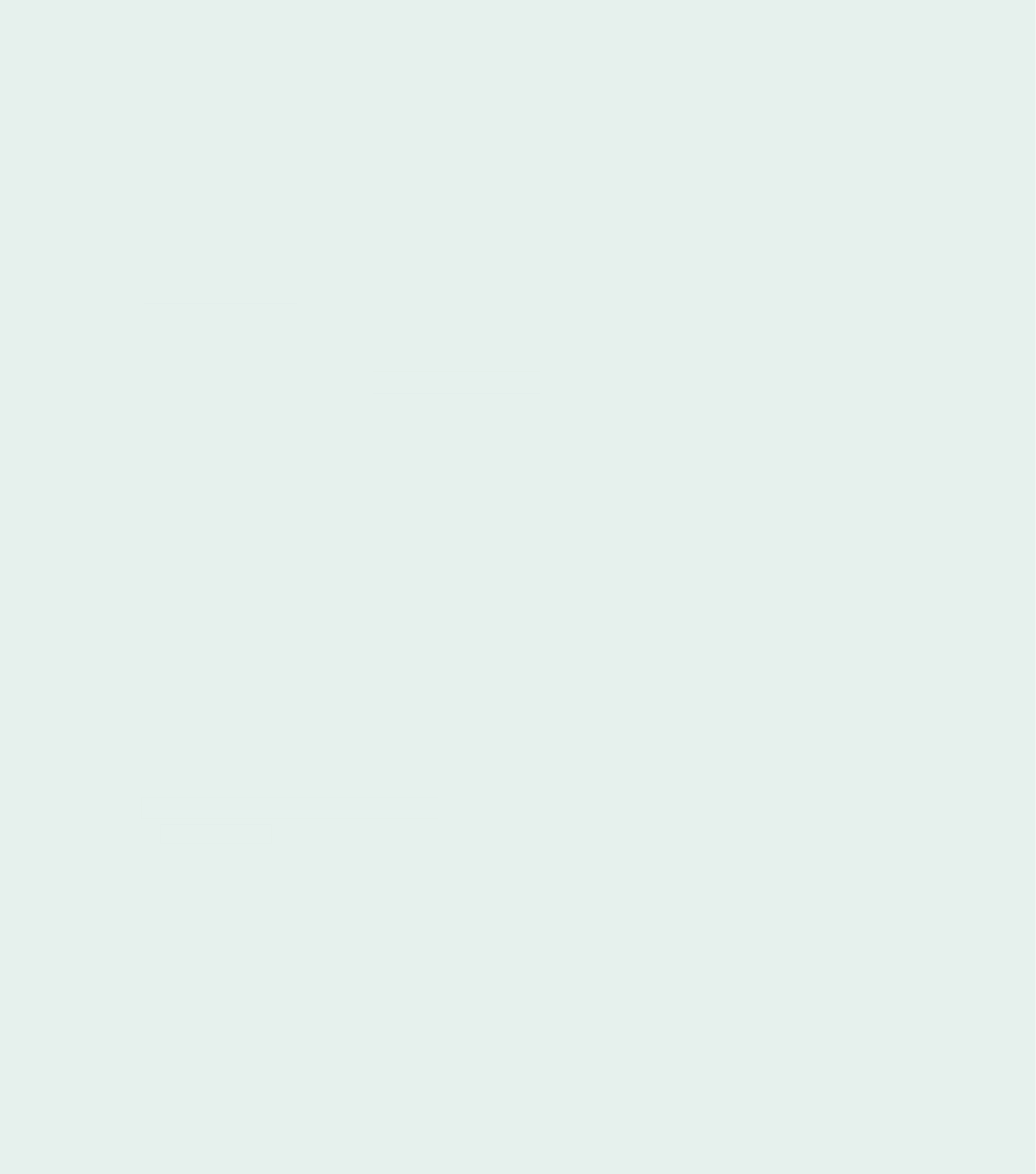

%

60

65

70

75

80

85

90

2012 2013 2014 2015 2016

Revenue load factor

Breakeven load factor

Cathay Pacic and Cathay Dragon:

revenue and breakeven load factor

0

20,000

40,000

60,000

80,000

100,000

120,000

0

3,000

9,000

6,000

12,000

15,000

18,000

0

200

400

600

1,000

800

1,200

2012 2013 2014 2015 2016

HK$ million

Revenue

Passengers in ‘000

Cargo in ‘000 tonnes

Cathay Pacic and Cathay Dragon:

passengers and cargo carried

Cargo and mail carried

Passengers carried

Catering, recoveries and other services

Cargo services

Passenger services

1H12 2H12 1H13 2H13 1H14 2H14 1H15 2H15 1H16 2H16

28 29

Annual Report 2016

Financial Review

• Group revenue decreased by 9.4% in 2016 compared

with 2015.

Cathay Pacific and Cathay Dragon

• Passenger revenue decreased by 8.4% to HK$66,926

million. The number of revenue passengers carried

increased by 0.8% to 34.3 million. Revenue passenger

kilometres increased by 0.9%.

• The passenger load factor decreased by 1.2 percentage

points to 84.5%. Available seat kilometres increased by

2.4%.

• Passenger yield decreased by 9.2% to HK¢54.1.

• First and business class revenues decreased by 6.6%

and the load factor increased from 71.8% to 73.2%.

• Premium economy and economy class revenues

decreased by 9.2% and the load factor decreased from

88.3% to 86.5%.

• Cargo revenue decreased by 15.2% to HK$17,024 million.

There was a 0.6% increase in capacity.

• The cargo load factor increased by 0.2 percentage

points. Cargo yield decreased by 16.3% to HK$1.59.

• The revenue load factor decreased by 1.6 percentage

points to 79.5%. The breakeven load factor was 82.9%.

• The annualised effect on revenue of changes in yield and

load factor is set out in the table below:

HK$M

+ 1 percentage point in passenger load factor 790

+ 1 percentage point in cargo and mail load factor 264

+ HK¢1 in passenger yield 1,235

+ HK¢1 in cargo and mail yield 107

Fuel, including

hedging

losses

Net nance

charges

Commissions

Others

Sta

Inight service and

passenger expenses

Landing,

parking

and route

expenses

9%

Aircraft

maintenance

Depreciation,

amortisation

and operating

leases

Total operating expenses

14%

1%

1%

3%

21%

5%

16%

30%

40

60

80

120

140

160

0

10

20

40

50

60

100 30

2012 2013 2014 2015 2016

US$ per barrel

(jet fuel)

Barrels

in million

Fuel price and consumption

Into wing price – before hedging

Into wing price – after hedging

Uplifted volume

30

Cathay Pacific Airways Limited

Financial Review

Operating expenses

Group Cathay Pacific and Cathay Dragon

2016

HK$M

2015

HK$M Change

2016

HK$M

2015

HK$M Change

Staff 19,770 18,990 +4.1% 17,607 17,028 +3.4%

Inflight service and passenger expenses 4,734 4,713 +0.4% 4,734 4,713 +0.4%

Landing, parking and route expenses 14,985 14,675 +2.1% 14,704 14,406 +2.1%

Fuel, including hedging losses 27,953 32,968 -15.2% 27,551 32,475 -15.2%

Aircraft maintenance 8,856 7,504 +18.0% 8,453 7,168 +17.9%

Aircraft depreciation and operating leases 10,551 10,883 -3.1% 10,406 10,724 -3.0%

Other depreciation, amortisation and operating

leases 2,457 2,310 +6.4% 1,841 1,712 +7.5%

Commissions 700 798 -12.3% 700 798 -12.3%

Others 3,270 2,837 +15.3% 4,941 4,222 +17.0%

Operating expenses 93,276 95,678 -2.5% 90,937 93,246 -2.5%

Net finance charges 1,301 1,164 +11.8% 1,125 1,007 +11.7%

Total operating expenses 94,577 96,842 -2.3% 92,062 94,253 -2.3%

• The Group’s total operating expenses decreased by

2.3% to HK$94,577 million.

• The combined cost per ATK (with fuel) of Cathay Pacific

and Cathay Dragon decreased from HK$3.14 to HK$3.02.

30 31

Annual Report 2016

Financial Review

Cathay Pacific and Cathay Dragon operating results analysis

2016

HK$M

2015

HK$M

Airlines’ (loss)/profit before taxation (3,045) 4,463

Taxation (318) (891)

Airlines’ (loss)/profit after taxation (3,363) 3,572

Share of profits from subsidiaries and associates 2,788 2,428

(Loss)/profit attributable to the shareholders of Cathay Pacific (575) 6,000

The changes in the airlines’ (loss)/profit before taxation can be analysed as follows:

HK$M

2015 airlines’ profit before taxation 4,463

Decrease of revenue (9,699) – Passenger revenue decreased due to a 9.2% decrease in yield and

a 1.2% points decrease in load factor, offset in part by a 0.8%

increase in passengers carried.

– Cargo revenue decreased due to a 16.3% decrease in yield, offset

in part by a 0.2% points increase in load factor and a 3.1% increase

in cargo and mail tonnage carried.

Decrease/(increase) of costs:

– Fuel, including hedging losses 4,924 – Fuel costs decreased due to a 21.1% decrease in the average

into-plane fuel price, offset in part by a 0.8% increase in

consumption.

– Aircraft maintenance (1,285) – Increased mainly due to an increase in operational capacity, higher

engine maintenance charge rates, fleet retirement costs and more

programmes to improve aircraft availability.

– Depreciation, amortisation and

operating leases

189 – Decreased mainly due to the retirement of aircraft.

– Staff (579) – Increased mainly due to increases in headcount and salaries.

– All other operating expenses, including

inflight service, landing and parking,