ANNUAL REPORT 2019

Cathay Pacic Airways Limited

Stock Code: 293

Management Discussion and Analysis

4 Financial and Operational Highlights

6 Chairman’s Statement

9 Review of Operations

26 Financial Review

33 Sustainable Development Review

Corporate Governance

36 Directors and Officers

38 Directors’ Report

45 Corporate Governance Report

Financial Statements

63 Independent Auditor’s Report

69 Consolidated Statement of Profit or

Loss and Other Comprehensive Income

70 Consolidated Statement of

Financial Position

71 Consolidated Statement of

Cash Flows

72 Consolidated Statement of

Changes in Equity

73 Notes to the Financial Statements

121 Principal Subsidiaries and

Associates

123 Principal Accounting Policies

138 Statistics

143 Glossary

144 Corporate and Shareholder Information

144 Disclaimer

CONTENTS

A Chinese translation of this Annual Report is available

upon request from the Company’s Registrars.

本年報的中文譯本於本公司的股份登記處備索。

Cathay Pacific Airways Limited (“Cathay Pacific”),

withitssubsidiaries Hong Kong Dragon Airlines Limited

(“Cathay Dragon”), Hong Kong Express Airways Limited

(“HKExpress”) and AHK Air Hong Kong Limited

(“AirHongKong”), operated 236 aircraft at the end of 2019,

directly connecting Hong Kong to 119 destinations in

35countries worldwide (255 and 54 respectively with

codeshare agreements), including 26 destinations in

Mainland China. The Cathay Pacific Group is the world’s

eighth-largest carrier of international passengers, and the

third-largest carrier of international air cargo.

Cathay Pacific was founded in Hong Kong in 1946. It has

been deeply committed to its home base over the past

seven decades and remains so, making substantial

investments to develop Hong Kong as one of the world’s

leading international aviation centres.

Cathay Pacific itself operated 155 passenger and cargo

aircraft at 31st December 2019. The Group’s other

investments include its catering, ground-handling and

cargo terminal companies, and corporate headquarters at

Hong Kong International Airport.

Hong Kong

Cathay Dragon, a regional full-service airline registered and

based in Hong Kong, is a wholly owned subsidiary of Cathay

Pacific operating 48 aircraft at 31st December 2019.

HKExpress, a low-cost airline based in Hong Kong offering

scheduled services within Asia, is a wholly owned subsidiary

of Cathay Pacific operating 24 aircraft at 31st December

2019. Air Hong Kong, an express all-cargo carrier offering

scheduled services in Asia, is a wholly owned subsidiary of

Cathay Pacific operating nine aircraft at 31st December

2019. Cathay Pacific owns 18.13% of Air China Limited

(“AirChina”), the national flag carrier and a leading provider

of passenger, cargo and other airline-related services in

Mainland China. The Group continues to invest heavily in its

home city. At 31st December 2019 it had 70 new aircraft due

for delivery up to 2024.

At 31st December 2019, Cathay Pacific and its subsidiaries

employed more than 34,200 people worldwide, of whom

around 28,200 are employed in Hong Kong. Shares of Cathay

Pacific are listed on The Stock Exchange of Hong Kong

Limited, as are the shares of its substantial shareholders Swire

Pacific Limited (“Swire Pacific”) and Air China.

Cathay Pacific is a founding member of the oneworld global

alliance, whose combined network serves more than 1,000

destinations worldwide. Cathay Dragon is an affiliate member

of oneworld.

Cathay Pacific

Cathay Pacific Freighter

Cathay Dragon

HK Express

Air Hong Kong

Cathay Pacific Airways Limited

4

GROUP FINANCIAL STATISTICS

2019 2018 Change

Results

Revenue HK$ million 106,973 111,060 -3.7%

Profit attributable to the shareholders of Cathay Pacific HK$ million 1,691 2,345 -27.9%

Earnings per share HK cents 43.0 59.6 -27.9%

Dividend per share HK$ 0.18 0.30 -40.0%

Profit margin % 1.6 2.1 -0.5%pt

Financial position*

Funds attributable to the shareholders of Cathay Pacific* HK$ million 62,773 63,936 -1.8%

Net borrowings* HK$ million 82,396 58,581 +40.7%

Shareholders’ funds per share* HK$ 16.0 16.3 -1.8%

Net debt/equity ratio* Times 1.31 0.92 +0.39 times

OPERATING STATISTICS – CATHAY PACIFIC AND CATHAY DRAGON

2019 2018 Change

Available tonne kilometres (“ATK”)

Million

33,077 32,387 +2.1%

Available seat kilometres (“ASK”)

Million

163,244 155,362 +5.1%

Available cargo tonne kilometres (“AFTK”)**

Million

17,558 17,616 -0.3%

Revenue tonne kilometres (“RTK”)

Million

24,090 24,543 -1.8%

Passenger revenue per ASK

HK cents

44.2 47.1 -6.2%

Revenue passenger kilometres (“RPK”)

Million

134,397 130,630 +2.9%

Revenue passengers carried

‘000

35,233 35,468 -0.7%

Passenger load factor

%

82.3 84.1 -1.8%pt

Passenger yield

HK cents

53.6 55.8 -3.9%

Cargo revenue per AFTK**

HK$

1.20 1.40 -14.3%

Cargo revenue tonne kilometres (“RFTK”)**

Million

11,311 12,122 -6.7%

Cargo carried**

‘000 tonnes

2,022 2,152 -6.0%

Cargo load factor**

%

64.4 68.8 -4.4%pt

Cargo yield**

HK$

1.87 2.03 -7.9%

Cost per ATK (with fuel)

HK$

3.06 3.27 -6.4%

Fuel consumption per million RTK

Barrels

1,867 1,830 +2.0%

Fuel consumption per million ATK

Barrels

1,360 1,387 -1.9%

Cost per ATK (without fuel)

HK$

2.19 2.25 -2.7%

Underlying***cost per ATK (without fuel)

HK$

2.22 2.24 -0.9%

ATK per HK$’000 staff cost

Unit

1,879 1,801 +4.3%

ATK per staff

‘000

1,256 1,217 +3.2%

Aircraft utilisation

Hours per day

11.9 12.3 -3.3%

On-time performance

%

76.3 72.7 +3.6%pt

Average age of fleet

Years

10.3 9.9 +0.4 years

GHG emissions

Million tonnes of CO

2

e

18.0 18.0 –

GHG emissions per ATK

Grammes of CO

2

e

545 556 -2.0%

Lost time injury rate

Number of injuries per 100

full-time equivalent employees

5.33 4.55 +17.1%

*

Shareholders’ funds, net borrowings and net debt/equity ratio at 31st December 2019 are arrived at after taking account of the effect of HKFRS 16.

Disregarding the effect of adopting HKFRS 16, the net debt/equity ratio increased from 0.92 times to 0.96 times. Further details can be found in

accounting policy 1.

**

Including mail. Mail is no longer referred to separately but mail services continue to be accounted for under cargo services.

***

Underlying costs exclude exceptional items, non-recurring item for 2019 and 2018, and are adjusted for the effect of foreign currency movements, as

well as the adoption of HKFRS 16 for the year ended 31st December 2019.

FINANCIAL AND

OPERATIONALHIGHLIGHTS

5

Annual Report 2019

FLEET

HK EXPRESS

CATHAY PACIFIC / CATHAY DRAGON

2020 Target –

3 Airbus A350-1000

4 Airbus A350-900

6 Airbus A321-200neo

2019 Took delivery –

4 Airbus A350-1000

2 Airbus A350-900

3 Boeing 777-300

OPERATING HIGHLIGHTS

CUSTOMER PROPOSITIONNETWORK

2015 2016 2017 2018 2019

Cathay Pacic Cathay Dragon

Average 2019:

76.3%

Average 2018:

72.7%

ON-TIME PERFORMANCE

2019

Seattle Komatsu

Niigata

Average 2019*:

90.4%

2020 Target –

4 Airbus A320-200neo

4x more

Inflight

Entertainment

Hong Kong

5

Annual Report 2019

*

Period from 20th July 2019 to 31st December 2019

New food

and beverage

offerings

New

products for

customers

7 destinations

unique to the Group

Cathay Pacific Cathay Dragon

Cathay Pacific Airways Limited

6

OVERVIEW

2019 was a turbulent year for the Cathay Pacific Group. With

our three-year transformation programme starting to bear

fruit we delivered a positive performance in the first half of

2019 notwithstanding a difficult environment brought about

by geopolitical and trade tensions. However, with social

unrest in Hong Kong intensifying over the second half of

theyear and mounting US-China trade tensions, we

experienced a sharp drop in both inbound and outbound

passenger traffic. We were faced with an incredibly

challenging environment to operate as the Hong Kong

economy slipped into recession. As a result, our second-

half results – traditionally stronger compared to first-half

results – fell well below what we would have hoped for.

The Cathay Pacific Group reported an attributable profit of

HK$1,691 million for 2019. This compares with a HK$2,345

million profit for 2018. The earnings per share was HK43.0

cents in 2019 compared to an earnings per share of HK59.6

cents in 2018. The Cathay Pacific Group reported an

attributable profit of HK$344 million in the second half of

2019, compared to an attributable profit of HK$1,347 million

in the first half of 2019 and an attributable profit of

HK$2,608 million in the second half of 2018. Cathay Pacific

and Cathay Dragon reported an attributable loss of HK$434

million in the second half of 2019, compared to an

attributable profit of HK$675 million in the first half of 2019

and an attributable profit of HK$1,253 million in the second

half of 2018.

Overall, passenger and cargo yields were under intense

pressure in 2019 and both were below those seen in 2018.

Events in Hong Kong in the second half of the year

significantly reduced load factors, forward bookings and

the number of passengers we carried. Inbound traffic was

hit hard, particularly on short-haul and Mainland China

routes, while outbound traffic also decreased. Demand for

premium travel was weak and we became increasingly

reliant on lower-yielding transit traffic. We carried 0.7%

fewer passengers in 2019 than in 2018.

CHAIRMAN’S STATEMENT

Cargo demand was depressed all year as a result of US-

China trade tensions and was noticeably below that of 2018.

However, it did pick up later in 2019 during the traditional

high season, reflecting new consumer product, specialist

airfreight shipments and restocking ahead of holiday

periods. Exports from Mainland China and Hong Kong to

trans-Pacific and European markets were more

encouraging later in the year. Nevertheless, the cargo

business performed significantly below expectations

in2019.

To boost the competitiveness of Hong Kong International

Airport as a global cargo hub, the Group together with the

Airport Authority of Hong Kong announced in December it

would introduce a new Terminal Charge concession

effective 1st April 2020. The reduction ranges from 18% to

more than 20% compared with the current charge levels

and is applicable to shipments from Hong Kong on all four of

the Group’s airlines.

We benefited from lower fuel prices for most of the year, but

were adversely affected by a strong US dollar. There was a

2.7% decrease in non-fuel costs per available tonne

kilometre (ATK), reflecting our focus on productivity and

efficiency as part of our successful transformation

programme.

In July 2019, we completed the acquisition of low-cost

carrier HK Express, now a wholly owned subsidiary of

Cathay Pacific. In November, we announced that the airline

would begin taking delivery of half of our new narrow-body

Airbus A321-200neo fleet (16 of 32 new aircraft) from 2022

as part of the Group’s efforts to optimise the deployment of

the passenger fleets of its airlines.

In May 2019 we built on our commitment to our customers

with the launch of our new brand direction, ‘Move Beyond’,

expressing our drive to always exceed their expectations.

Despite the challenges of the second half of the year, this

period saw some of our most extensive enhancements to

the customer experience proposition in recent years. These

included a major expansion to our inflight entertainment

7

Annual Report 2019

content library; new bedding, amenities and culinary

options in our First and Business Class cabins; an elevated

Economy Class dining experience on our long-haul services

departing Hong Kong; and the reopening of our newly

renovated Shanghai Pudong lounge. All are designed to

give our customers more reasons to fly with us.

BUSINESS PERFORMANCE OF CATHAY

PACIFIC AND CATHAY DRAGON

Passenger revenue in 2019 was HK$72,168 million, a

decrease of 1.3% compared to 2018. RPK traffic increased

by 2.9%, while ASK capacity increased by 5.1%, albeit this

was less than originally expected. Consequently the load

factor decreased by 1.8 percentage points, to 82.3%. Yield

decreased by 3.9% to HK53.6 cents, reflecting a strong US

dollar, intense competition and reduced travel in the second

half of 2019 as a result of the social unrest in Hong Kong.

Inbound and outbound traffic, particularly on short-haul

Mainland China routes, substantially reduced from August

to December. We became increasingly reliant on low-

yielding transit traffic, which was relatively less affected.

Premium class travel was also weak during this period.

To mitigate these challenges, in October we introduced a

number of short-term tactical measures, including

frequency cuts on more than a dozen routes during the

winter season and suspending our service to Medan

indefinitely. We examined expenditure to focus on increased

productivity and cost saving, along with implementing a

hiring freeze, prioritising projects and deferring or

cancelling non-critical expenditure.

Cargo revenue in 2019 was HK$21,154 million, a decrease of

14.2% compared to 2018. RFTK traffic decreased by 6.7%,

whilst AFTK capacity decreased by 0.3%. Consequently the

load factor decreased by 4.4 percentage points, to 64.4%.

Yield decreased by 7.9% to HK$1.87, reflecting a strong

USdollar and weakened cargo demand resulting from

intensified US-China trade tensions.

Total fuel costs (before the effect of fuel hedging)

decreased by HK$3,110 million (or 9.8%) compared with

2018. Prices decreased but we flew more. After taking

hedging losses into account, fuel costs decreased by

HK$4,454 million or 13.4% compared to 2018. The net cost

of fuel is the Airlines’ most significant cost, accounting for

28.4% of operating costs in 2019 (compared to 31.4%

in2018).

Non-fuel costs per available tonne kilometre decreased

slightly, reflecting our focus on productivity and efficiency.

We continued to take delivery of new and more fuel-

efficient aircraft, including six Airbus A350 aircraft. We now

have 24 Airbus A350-900 and 12 Airbus A350-1000 aircraft

in our fleet. We also took delivery of three used Boeing

777-300 aircraft during the year. At the same time we retired

three Boeing 777-200 aircraft, and returned four Airbus

A330-300 and one Boeing 777-300ER leased aircraft to

their lessors.

BUSINESS PERFORMANCE OF OTHER

SUBSIDIARIES AND ASSOCIATES

HK Express reported a post-acquisition loss for 2019,

against expectations of a small profit. The airline suffered

from reduced demand to and from Asia as a result of the

Hong Kong social unrest.

Air Hong Kong’s results attributable to the shareholders of

Cathay Pacific improved year on year. In 2019 we owned

100% of the airline compared with 60% in 2018. On a 100%

like-for-like basis there was a decrease in profit. This was in

part due to gains on disposal of certain aircraft in 2018, and

in part due to a new block space agreement and an

underlying decrease in capacity and cargo uplift in 2019.

Our airline services subsidiaries generally performed worse

than 2018 due to reduced activity and rising cost pressures.

Whilst our share of Air China’s results (accounted for three

months in arrears) marginally improved, Air China Cargo

suffered a significant decline in results as trade tensions

escalated, negatively impacting air traffic and yield, and

reducing throughput tonnage for its cargo terminals.

Cathay Pacific Airways Limited

8

CHAIRMAN’S STATEMENT

PROSPECTS

Following the impact of social unrest in Hong Kong in the

latter half of 2019, the first half of 2020 was expected to be

extremely challenging financially, with an already reduced

winter season capacity. This has been exacerbated by the

significant negative impact of COVID-19, (see note 36 of the

Accounts). It is difficult to predict when these conditions will

improve. Travel demand has dropped substantially and we

have taken a series of short-term measures in response.

These have included a sharp reduction of capacity in our

passenger network. Despite these measures we expect to

incur a substantial loss for the first half of 2020.

We expect our passenger business to be under severe

pressure this year and that our cargo business will continue

to face headwinds. However, we are cautiously optimistic

about cargo following the recent reduction in US-China

trade tensions and we have maintained our cargo capacity

intact. The US dollar is expected to remain strong in 2020,

and intense competition, especially in long-haul economy

class, will continue to place significant pressure on yields.

Although there is much uncertainty, we have an incredible

brand with a reputation and track record of premium service

and commitment to our customers that differentiates us

from our competitors. These qualities and values remain at

the heart of everything we do and are what will help us

through the current challenges.

Our three-year transformation programme has left the

business leaner and more resilient, and we move forward

with a culture of continuous improvement. Investment in our

products, customers and fleet is ongoing. We will continue

to take delivery of new aircraft in 2020 and, with the hope

that the environment will improve, we will retain the flexibility

to add capacity back to the market as soon as we are able

to. Our plan to take delivery of 70 new and more fuel-

efficient aircraft by 2024 remains unchanged.

The hard work and determination of our teams of

professionals over the past year, and in the current

COVID-19 crisis, has been outstanding. I would like to thank

them for the dedication they have shown during these

exceptionally challenging times in ensuring our ability to

maintain our operations as smoothly and efficiently as

possible. As a Group, we remain unwavering in our

commitment to our customers, our people and our home

hub, which we have proudly served for more than seven

decades. We will continue to invest significantly in

delivering an industry-leading experience for our customers

and in strengthening Hong Kong’s position as a world-class

global aviation hub.

Patrick Healy

Chairman

Hong Kong, 11th March 2020

9

Annual Report 2019

2019 was a turbulent year for the Cathay Pacific Group. With our three-year transformation

programme starting to bear fruit we delivered a positive performance in the first half of 2019

notwithstanding a difficult environment brought about by geopolitical and trade tensions.

However, with social unrest in Hong Kong intensifying over the second half of the year and

mounting US-China trade tensions, we experienced a sharp drop in both inbound and outbound

passenger traffic. We were faced with an incredibly challenging environment to operate as the

Hong Kong economy slipped into recession. As a result, our second-half results – traditionally

stronger compared to first-half results – fell well below what we would have hoped for.

Overall, passenger and cargo yields were under intense

pressure in 2019 and both were below those seen in 2018.

Events in Hong Kong in the second half of the year

significantly reduced load factors, forward bookings and

the number of passengers we carried. Inbound traffic was

hit hard, particularly on short-haul and Mainland China

routes, while outbound traffic also decreased. Demand for

premium travel was weak and we became increasingly

reliant on lower-yielding transit traffic. We carried 0.7%

fewer passengers in 2019 than in 2018.

Cargo demand was depressed all year as a result of US-

China trade tensions and was noticeably below that of 2018.

However, it did pick up later in 2019 during the traditional

high season, reflecting new consumer product, specialist

airfreight shipments and restocking ahead of holiday

periods. Exports from Mainland China and Hong Kong to

trans-Pacific and European markets were more

encouraging later in the year. Nevertheless, the cargo

business performed significantly below expectations

in2019.

REVIEW OF OPERATIONS

TRANSFORMATION

In 2017, we laid the foundations. We put in place a more

efficient head office organisation and reduced our Hong

Kong headcount. We formed a central Digital team to

improve our use of technology and analyse data, a Lean

team which focuses on business process improvement and

a Global Business Services team which focuses on shared

efficiency.

In 2018, we started restructuring our operations outside

Hong Kong, benefited from productivity improvements,

increased our digital capabilities and concentrated on

developing a shared service capability. We improved inflight

dining, passenger comfort, the way we contact passengers

and our loyalty programmes. We extended our network at a

record rate and improved our service delivery training. We

also increased our ancillary sources of revenue.

CUSTOMER

CENTRIC

We place great importance in listening

to our customers and are continually

enhancing our products and services,

both on the ground and in the air, to

provide a Life Well Travelled.

11

Annual Report 2019

In 2019, we focused on continuous improvement in our

airlines’ core activities, which have been broken down

intonine processes as part of an effort to obtain stronger

cooperation across business functions. Business units

proposed over 1,100 transformation initiatives, many of

which provided financial or other benefits in 2019. These

initiatives included improvements to sourcing, increasing

maintenance productivity and the development of new

sources of revenue. We have projects focusing on

improving our global contact centres and our integrated

operations control units. Our SAP system is improving our

financial analysis and our ability to control spending. Our

crew management programme is improving productivity.

We are also investing more in digital and analytical

capability, and in process automation. Our Global Business

Services team has taken on tasks resulting from the

redesign and relocation of some business processes. For

our customers we have introduced new seats, installed

Wi-Fi across our long-haul fleet of aircraft, enhanced food

and beverage offerings in all classes and upgraded our

digital platform to give customers more control of their

journey – with the promise of more to come.

While the primary goal of the transformation programme is

to ensure our business returns to sustainable financial

health, the intentions are of course broader and deeper.

How we build a winning team and how we create a business

that can compete and win beyond 2019 is dependent on the

success with which we anticipate and react to changing

customer expectations, as well as providing a proposition

toour customers that makes us more attractive than

competitive alternatives. To that end in the first half of 2019,

we commenced a new brand journey, which has the

REVIEW OF OPERATIONS

Passenger services • Loyalty and reward programmes

purpose of moving people forward in life, through our ability

to connect them to meaningful people, places and

experiences. ‘Move Beyond’ reflects our determination to

challenge what is considered standard; to move beyond and

be the very best we can be. We are moving beyond for our

customers by bringing personal recognition and a sense of

care and reliability to the whole travel experience. Living up

to this aspiration will enable Cathay Pacific to reach levels of

service and customer experience that place us amongst

the world’s greatest service brands.

CATHAY PACIFIC AND CATHAY DRAGON

PASSENGER SERVICES

Cathay Pacific and Cathay Dragon carried 35.2 million

passengers in 2019, a decrease of 0.7% compared to 2018.

Revenue decreased by 1.3% to HK$72,168 million. RPK

traffic increased by 2.9%, while ASK capacity increased

by5.1%, albeit this was less than originally expected.

Consequently the load factor decreased by 1.8 percentage

points, to 82.3%. Yield decreased by 3.9% to HK53.6 cents,

reflecting a strong US dollar, intense competition and

reduced travel in the second half of 2019 as a result of the

social unrest in Hong Kong. Inbound and outbound traffic,

particularly on short-haul Mainland China routes,

substantially reduced from August to December. We

became increasingly reliant on low-yielding transit traffic,

which was relatively less affected. Premium class travel was

also weak during this period. To mitigate these challenges,

in October we introduced a number of short-term tactical

measures, including frequency cuts on more than a dozen

routes during the winter season and suspending our service

to Medan indefinitely.

Cathay Pacific Airways Limited

12

INNOVATION

• We launched an elevated First Class experience with new

soft products and amenities from UK brand Bamford, new

tableware and wellness-themed dining options.

• We also introduced enhanced bedding and amenities

from UK brand Bamford in our Business Class cabins,

including a plusher pillow and the addition of a mattress

and slippers – both highly requested by customers. Our

new Business Class dining experience has now been

rolled out across all long-haul routes since July 2019.

AVAILABLE SEAT KILOMETRES (“ASK”), LOAD FACTOR AND YIELD CHANGE BY REGION

FOR 2019 WERE AS FOLLOWS:

ASK (million) Load factor (%) Yield

2019 2018 Change 2019 2018 Change Change

Americas 43,555 40,308 +8.1% 82.9 86.5 -3.6%pt -5.0%

Europe 34,677 32,090 +8.1% 86.0 86.2 -0.2%pt -5.9%

North Asia 31,914 31,533 +1.2% 76.6 80.7 -4.1%pt -1.9%

Southeast Asia 21,483 20,919 +2.7% 81.3 83.2 -1.9%pt -1.7%

Southwest Pacific 18,799 18,494 +1.6% 85.4 83.2 +2.2%pt -3.0%

South Asia, Middle East and Africa 12,816 12,018 +6.6% 82.2 82.3 -0.1%pt +0.2%

Overall 163,244 155,362 +5.1% 82.3 84.1 -1.8%pt -3.9%

REVIEW OF OPERATIONS

Passenger services • Loyalty and reward programmes

• In November 2019, we launched a new partnership

collaboration with Michelin-starred Hong Kong dining

group, Black Sheep Restaurants, featuring restaurant-

inspired meals in Economy Class on all long-haul routes

departing Hong Kong.

• We reopened our newly renovated Shanghai Pudong

Cathay Pacific Lounge in July 2019 – the first of our

lounges in Mainland China and 11th globally to feature our

signature, awards-winning airport lounge design.

• We opened The Sanctuary, a dedicated yoga and

wellness area inside The Pier Business Class Lounge at

Hong Kong International Airport in January 2019, in

collaboration with The Pure Group.

15,000

20,000

25,000

30,000

35,000

40,000

10,000 51.0

52.0

53.0

54.0

55.0

56.0

57.0

0

20,000

40,000

100,000

80,000

60,000

40.0

42.0

44.0

46.0

50.0

48.0

HK$ million

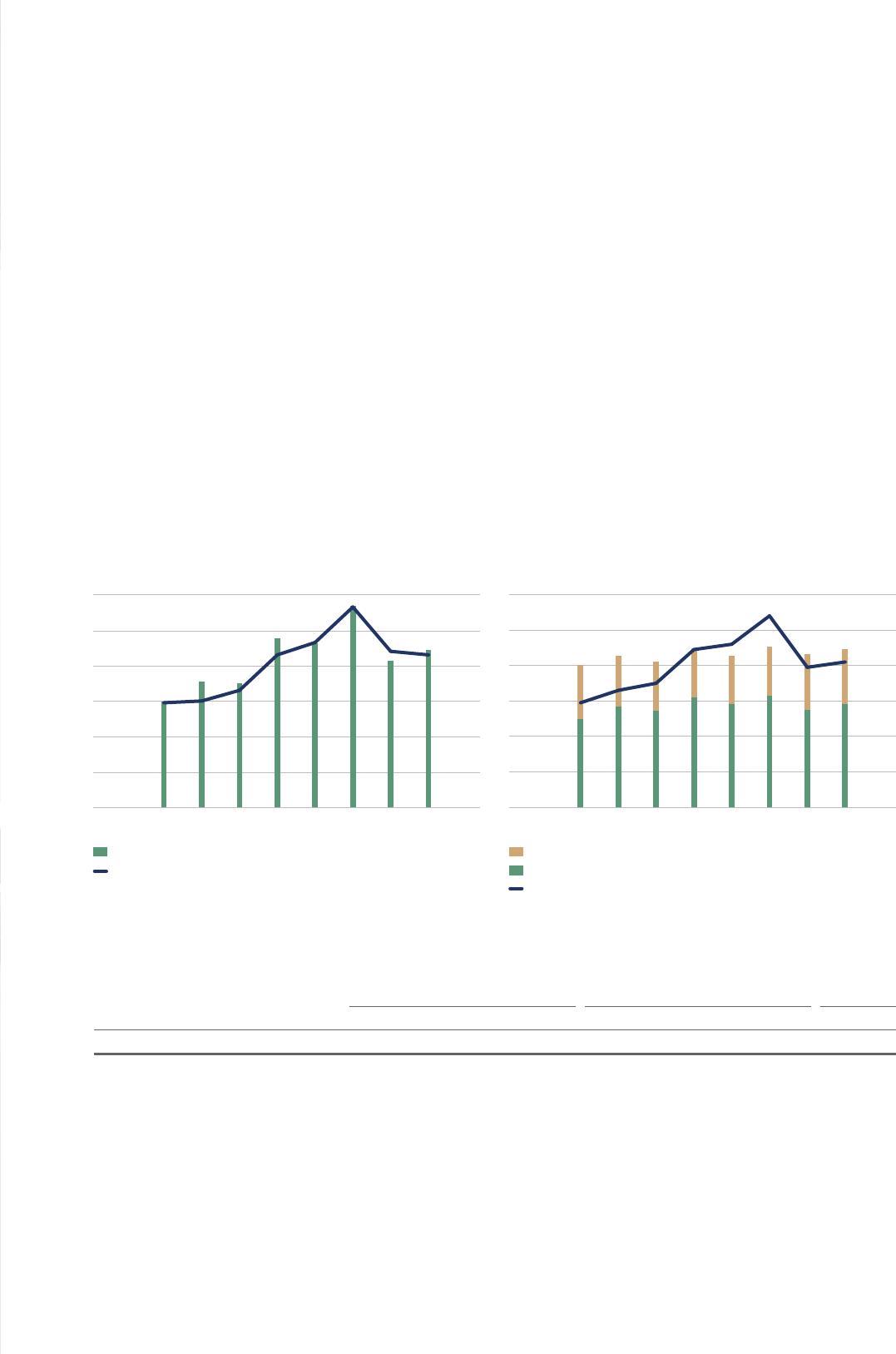

Passenger capacity, load factor and eciency

HK cents

Passenger revenue and yield trend

Million HK cents

Available seat kilometres (ASK)

Load factor (as a proportion of ASK)

Passenger revenue

Passenger yield

Passenger revenue per ASK

1H16 2H16 1H17 2H17 1H18 2H18 1H19 2H19 1H16 2H16 1H17 2H17 1H18 2H18 1H19 2H19

13

Annual Report 2019

• In September 2019, Cathay Pacific won the Best Inflight

Service Award at the TTG Travel Awards 2019.

• In September 2019, Cathay Pacific received a Gold award

for Excellence in HR Structure Transformation at the HR

Distinction Awards 2019 Hong Kong.

• In November 2019, Cathay Pacific was ranked within

thetop five of the World’s Top 20 Airlines on

AirlineRatings.com.

• In November 2019, Cathay Dragon won Best Airline

Economy Class at the Business Traveller China Awards.

At the same awards, the Cathay Pacific Group’s Marco

Polo Club programme won Best Frequent Flyer

Programme.

• In December 2019, Cathay Pacific won Best Airline in Asia

at the Best in Business Travel Awards by Business

Traveler (US) magazine.

HOME MARKET – HONG KONG AND

PEARL RIVER DELTA

• Our weekly “fanfares” promotions in Hong Kong continue

to demonstrate our commitment to offering good-value

fares in our home market. There was a “super fanfare”

promotion in April.

• Demand during the 2019 Chinese New Year and Easter

holiday period was strong, particularly on short-haul

routes from Hong Kong.

• Premium class demand was strong at the beginning of

the year, particularly on long-haul routes, but tapered off

in the second-half of the year placing pressure on yield.

• In November, we launched our annual senior citizen

discount for Hong Kong and Macau residents aged 65

and above, and accompanying adults.

• From January 2019, we have progressively been rolling

out a series of new “Hong Kong Flavours” dishes featuring

locally inspired cuisine across all cabins on long-haul

flights departing Hong Kong.

• We greatly expanded our inflight entertainment library,

quadrupling the number of movies, adding more

complete boxsets and introducing a live sports channel

on our Airbus A350 flights.

• The installation of Wi-Fi across our long-haul fleet of

aircraft continued. By the end of the first quarter of 2021,

all our long-haul aircraft will have Wi-Fi.

• We relaunched our locally brewed craft beer, Betsy Beer,

and made it available to passengers in all cabins on all

long-haul flights, as well as in our lounges in Hong Kong

International Airport.

• We revamped our cathaypacific.com homepage,

upgraded our online booking platform and added live chat

function on key pages (booking creation and

management, online check-in) to offer easier and faster

transactions.

• We continued to take delivery of new and more modern

aircraft, including six Airbus A350 aircraft.

AWARDS

• In February 2019, Cathay Pacific was awarded Best First

Class Sparkling and Best Business Class Red at the

Cellars in the Sky 2018 awards by Business Traveller

magazine.

• In June 2019, Cathay Pacific featured in the World’s Top

10 Airlines of 2019 category at the Skytrax World Airline

Awards. At the same awards, Cathay Dragon was runner-

up in The World’s Best Regional Airlines 2019 category.

• In September 2019, Cathay Pacific won Best Airport

Lounge for The Pier First Class Lounge in Hong Kong at

the 2019 Business Traveller Asia-Pacific Awards.

Cathay Pacific Airways Limited

14

AMERICAS

• Demand on our routes to the Americas fell short of

increases in capacity throughout 2019, though this was

especially felt in the second half of the year.

• Cathay Pacific introduced a four-times-weekly service to

Seattle in March, using Airbus A350-900 aircraft. The

service became daily in July.

• In response to reduced demand resulting from social

unrest in Hong Kong, in October 2019 Cathay Pacific

reduced the frequency of its services to Washington D.C.,

New York (JFK) and Vancouver for the winter season.

• In October 2019, Cathay Pacific started to use an

additional Airbus A350-900 aircraft on its San Francisco

route for the winter season.

EUROPE

• Demand was strong for Europe throughout 2019 where

our passenger traffic almost caught up with the capacity

increase.

• Europe was well supported by strong transit traffic

fromAustralia throughout 2019 where additional travel

volume offset a yield decrease as a result of a weaker

Australian dollar.

• Demand was also good for leisure travel from Taiwan

toEurope.

• Cathay Pacific increased the frequency of its services to

Madrid from five flights per week to daily between June

and October 2019.

• In response to reduced demand resulting from social

unrest in Hong Kong, in October 2019 Cathay Pacific

reduced the frequency of its service to Paris and

suspended its service to Dublin for the winter season.

• Cathay Pacific expanded its codeshare agreement with

the Lufthansa group so as to include three more routes to

Europe. Cathay Pacific now places its code on

Lufthansa’s flights between Hong Kong and Frankfurt and

Munich, and on Swiss International Air Lines’ flights

between Hong Kong and Zurich.

NORTH ASIA

• Demand for business and leisure travel to and from

NorthAsia was firm in the first half of the year with

strongdemand on Taiwan routes, but weakened in the

second half.

• Cathay Pacific introduced a two-times-weekly seasonal

service to Komatsu from April to October 2019.

• Inbound passenger traffic from Mainland China dropped

significantly in the second half of the year as travel

sentiment weakened due to social unrest in Hong Kong. In

2019, revenue passenger kilometres to and from

Mainland China were down 10.9% compared with 2018.

• Our Japan routes performed very well in October with the

Rugby World Cup generating good demand, especially

from England and South Africa when both teams

advanced to the final.

• Cathay Dragon reduced the frequency of its service to

Shanghai (Pudong) from 105 to 84 flights per week for the

winter season. Among those cancellations, 14 were

effective only from November 2019.

• In response to reduced demand resulting from social

unrest in Hong Kong, in October 2019 Cathay Pacific and

Cathay Dragon reduced the frequency of their services to

Beijing, Taipei, Seoul and Osaka, while Cathay Dragon

suspended its service to Tokyo (Haneda) for the winter

season.

SOUTHEAST ASIA

• Demand for travel to Southeast Asia destinations was

robust in the first half of 2019 – load factors were strong,

but there was pressure on yield. Bookings dropped

significantly in the second half of the year as sentiment

for travel weakened due to social unrest in Hong Kong.

• In response to reduced demand resulting from social

unrest in Hong Kong, in October 2019 Cathay Pacific

reduced the frequency of its service to Bangkok, while

Cathay Dragon suspended its service to Denpasar (Bali)

for the winter season and suspended its service to Medan

indefinitely.

REVIEW OF OPERATIONS

Passenger services • Loyalty and reward programmes

15

Annual Report 2019

SOUTHWEST PACIFIC

• Traffic on Southwest Pacific routes performed well

throughout the year, helped by capacity reductions by

other airlines and strong demand for travel to Europe.

This was partially offset by a lower yield on transit revenue

and a weaker Australian dollar.

• In October 2019, Cathay Pacific suspended its service

toCairns.

SOUTH ASIA, MIDDLE EAST AND AFRICA

• Traffic on Indian routes benefited from capacity

reductions by Indian carriers in the first half of the year.

• Demand for travel to Colombo was negatively affected by

the bombings in April 2019. Frequencies were reduced.

• From June 2019, Cathay Pacific increased the frequency

of its services to Hyderabad from four to five times

weekly.

• From July 2019, Cathay Dragon increased the frequency

of its services to Dhaka from four to five times weekly.

• Our South Asia routes performed positively throughout

2019, buoyed by strong demand for travel between India

and North America.

• In response to reduced demand resulting from social

unrest in Hong Kong, in October 2019 Cathay Pacific

reduced the frequency of its service to Colombo for the

winter season.

• Yield pressure remained severe on our South Africa route.

LOYALTY AND REWARD PROGRAMMES

MARCO POLO CLUB

• The Marco Polo Club loyalty programme provides

benefits and services to the frequent flyers of Cathay

Pacific and Cathay Dragon.

• Marco Polo Club members contribute to about a quarter

of the revenues of Cathay Pacific and Cathay Dragon.

• Club points are earned by reference to airline, cabin, fare

class and distance travelled.

• Silver members (and above) have unlimited access to

lounges when flying on Cathay Pacific or Cathay Dragon.

All members are entitled to priority boarding and

check-in.

ASIA MILES

• Asia Miles is a leading travel and lifestyle rewards

programme in Asia. It has more than 12 million members

and over 800 partners worldwide, including 26 airlines,

more than 150 hotel brands and over 400 dining partners

and shops.

• There was a 30% increase in redemptions by Asia Miles

members on Cathay Pacific and Cathay Dragon flights

compared to last year.

• A new arrangement for mileage expiry was launched, with

new miles credited on or after 1st January 2020 being

under an activity-based rule. As long as members earn or

redeem any of their miles at least once in an 18 month

period, the balance of the new miles will remain active.

• Marco Polo Club members are also members of

AsiaMiles.

OPERATIONAL

EXCELLENCE

Our ecient, environmentally-friendly

eet of aircraft enables us to expand our

network, boost our connectivity and provide

our customers with more travel choices.

17

Annual Report 2019

CATHAY PACIFIC AND CATHAY DRAGON

CARGO SERVICES

Cargo revenue in 2019 was HK$21,154 million, a decrease of

14.2% compared to 2018. RFTK traffic decreased by 6.7%,

REVIEW OF OPERATIONS

Cargo services • Fleet

whilst AFTK capacity decreased by 0.3%. Consequently the

load factor decreased by 4.4 percentage points, to 64.4%.

Yield decreased by 7.9% to HK$1.87, reflecting a strong US

dollar and weakened cargo demand resulting from

intensified US-China trade tensions.

0

4,000

2,000

6,000

8,000

10,000

12,000

0.4

0.8

0.6

1.0

1.2

1.4

1.6

1.0

1.4

1.2

1.6

1.8

2.0

2.2

2,000

4,000

6,000

8,000

14,000

10,000

12,000

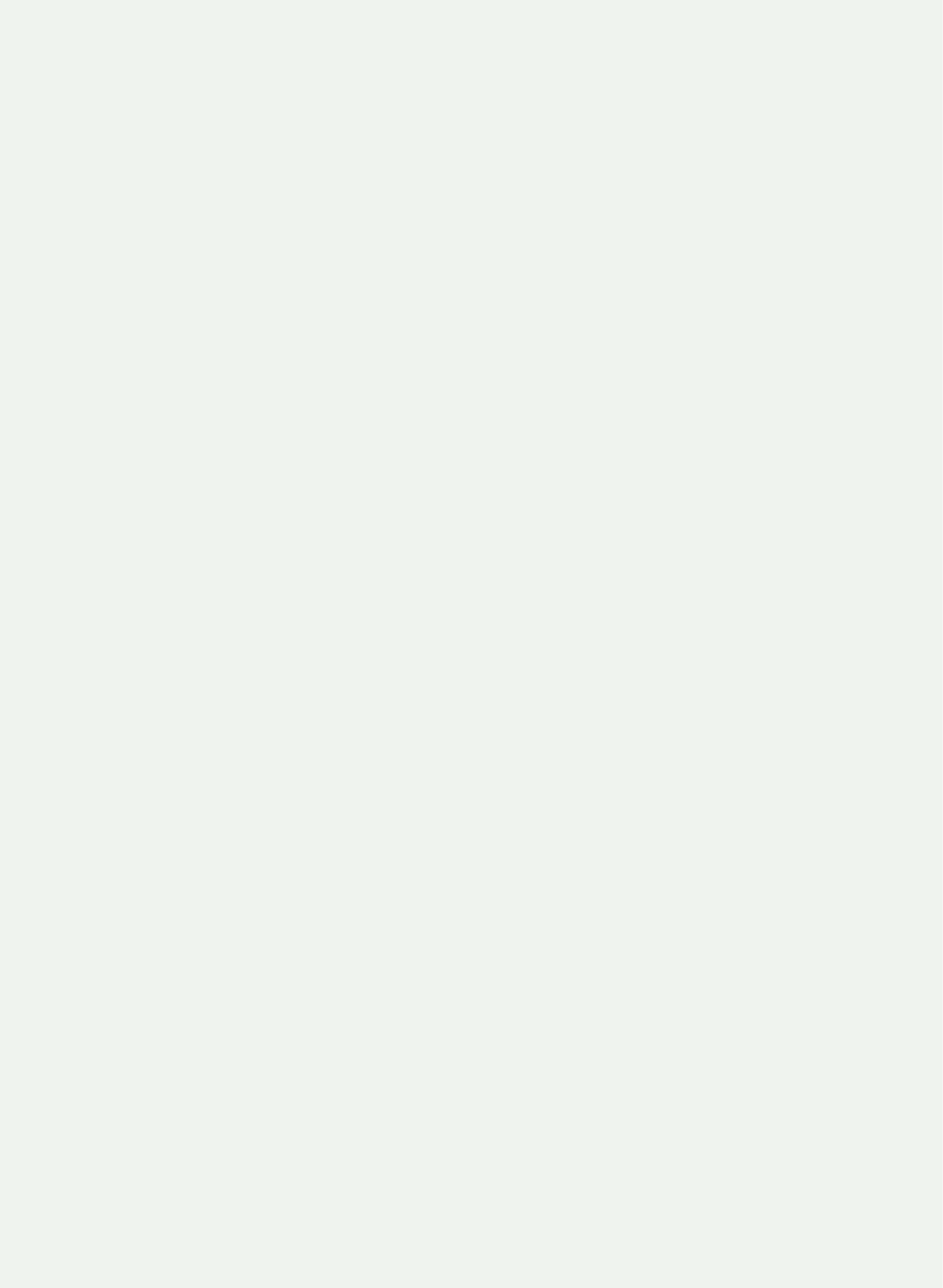

Cargo capacity, load factor and eciency

Million

Cargo revenue and yield trend

HK$ million HK$HK$

Cargo revenue

Cargo yield

Available cargo tonne kilometres (AFTK)

Load factor

Cargo revenue per AFTK

1H16 2H16 1H17 2H17 1H18 2H18 1H19 2H19 1H16 2H16 1H17 2H17 1H18 2H18 1H19 2H19

AVAILABLE CARGO TONNE KILOMETRES (“AFTK”), LOAD FACTOR AND YIELD CHANGE

FOR 2019 WERE AS FOLLOWS:

AFTK (million) Load factor (%) Yield

2019 2018 Change 2019 2018 Change Change

Cathay Pacific and Cathay Dragon 17,558 17,616 -0.3% 64.4 68.8 -4.4%pt -7.9%

Cathay Pacific Airways Limited

18

• Cargo demand was depressed throughout 2019,

reflecting weaker global trade brought about by ongoing

US-China trade tensions and a weaker global economy.

Overall load factor for 2019 was down compared to the

previous year.

• Cargo demand picked up in the latter part of 2019 during

the traditional high season, reflecting new consumer

product, specialist airfreight shipments and restocking

ahead of holiday periods. Exports from Mainland China

and Hong Kong to trans-Pacific and European markets

were more encouraging later in the year. Nevertheless,

the cargo business performed significantly below

expectations in 2019.

• In April 2019, we expanded our joint-business agreement

with Lufthansa Cargo, so as to start eastbound joint

shipments from Europe to Hong Kong.

• In April 2019, Cathay Pacific became the first airline to be

awarded CEIV Fresh, IATA’s accreditation for perishable

cargo handling, reflecting our commitment to provide

specialised cargo solutions.

• In July 2019, we introduced a fire containment bag

solution that allows for the safe carriage of standalone

lithium-ion batteries on our freighter aircraft.

• While we still experienced an increase in demand in the

last quarter of the year – the traditional high season –

from new consumer products and the e-commerce

sector, overall volumes and yields were significantly down

in comparison with a record year in 2018.

• We adjusted our freighter services across our network.

• We took our one Boeing 747-400BCF freighter aircraft out

of service in September 2019 in preparation for

retirement in 2020.

• As of 1st September, Cathay Pacific Cargo is the General

Sales and Service Agent (GSSA) for all HK Express cargo

activities.

FLEET DEVELOPMENT

• At 31st December 2019, Cathay Pacific operated 155

aircraft, Cathay Dragon operated 48 aircraft, HK Express

operated 24 aircraft and Air Hong Kong operated nine

aircraft (a total of 236 aircraft). There are 70 new aircraft

on order for delivery up to 2024.

• We took delivery of two Airbus A350-900 and four Airbus

A350-1000 aircraft in 2019 and now have a total of 24

Airbus A350-900 and 12 Airbus A350-1000 in our fleet.

We expect to have 28 Airbus A350-900 in service by the

end of 2020 and 20 Airbus A350-1000 aircraft in service

by the end of 2021.

• We took delivery of three used Boeing 777-300 aircraft in

2019. Three Boeing 777-200 aircraft were retired and four

Airbus A330-300s and one Boeing 777-300ER were

returned to their lessors.

• We expect to take delivery of 17 aircraft in 2020, including

four Airbus A350-900, three Airbus A350-1000, six

Airbus A321-200neo and four Airbus A320-200neo

aircraft.

REVIEW OF OPERATIONS

Cargo services • Fleet

19

Annual Report 2019

FLEET PROFILE*

Number at

31st December 2019

Leased** Firm orders Expiry of operating leases**

Aircraft

type Owned Finance Operating Total

Average

age ‘20 ‘21

‘22 and

beyond Total ‘20 ‘21 ‘22 ‘23 ‘24

‘25 and

beyond

Aircraft operated by Cathay Pacific:

A330-300 17 10 2 29 12.4 1 1

A350-900 18 4 2 24 2.6 4 4 2

A350-1000 9 3 12 1.1 3 5 8

747-400BCF 1 1 28.5

747-400ERF 6 6 11.0

747-8F 3 11 14 6.9

777-200 1 1 23.5

777-300 17 17 18.2

777-300ER 22 8 21 51 7.8 6 4 2 3 6

777-9 6 15 21

Total 88 42 25 155 8.7 7 11 15 33 1 6 4 2 3 9

Aircraft operated by Cathay Dragon:

A320-200 5 10 15 14.5 4

(a)

3 3

A321-200 2 6 8 17.1 1 2 2 1

A321-200neo 6 8 2 16

A330-300 21

(b)

4 25 15.2 1 3

Total 28 20 48 15.3 6 8 2 16 6 5 5 1 3

Aircraft operated by HK Express:

A320-200 8 8 10.2 3 1 4

A321-200 11 11 2.2 11

A320-200neo 5 5 2.5 4 1 5

(c)

5

A321-200neo 16

(d)

16

Total 24 24 4.9 4 1 16 21 3 1 4 16

Aircraft operated by Air Hong Kong:

A300-600F*** 9 9 15.6 1 5 3

Total 9 9 15.6 1 5 3

Grand total 116 42 78 236 9.9 17 20 33 70 8 14 14 7 7 28

*

The table includes two aircraft parked in preparation for retirement (one Boeing 777-200 aircraft and one Boeing 747-400BCF freighter) and does not

reflect aircraft movements after 31st December 2019. The two parked aircraft were deregistered in February 2020.

**

With effect from 1st January 2019, leases previously classified as operating leases are accounted for in a similar manner to finance leases as a result of

an accounting standard change (HKFRS 16; see accounting policy 1). The majority of operating leases captured in the above table are within the scope

of HKFRS 16.

***

Under the new block space agreement Air Hong Kong entered into with DHL International which commenced on 1st January 2019, the nine Airbus

A300-600F freighters are considered operated by Air Hong Kong, even though the arrangement does not constitute a lease in accordance with

HKFRS16.

(a) The operating lease of one Airbus A320-200 aircraft expired in February 2020. The aircraft was returned to its lessor.

(b) 11 of these aircraft are owned by Cathay Pacific and leased by Cathay Dragon.

(c) These aircraft are operating leased.

(d) These aircraft, ordered by Cathay Dragon, will be operated by HK Express from 2022.

BUILDING THE

HONG KONG HUB

A modern eet with value fare proposition enables

HK Express to leverage new opportunities within

the region and help strengthen Hong Kong’s

position as Asia’s leading international aviation hub.

21

Annual Report 2019

REVIEW OF OTHER SUBSIDIARIES

AND ASSOCIATES

The share of profits from other subsidiaries and associates

in 2019 decreased by 26.1% to HK$1,450 million from

HK$1,961 million. The decline was mainly attributable to

losses in HK Express since acquisition, lower cargo tonnage

handled through our cargo terminal and a reduced share of

profits from Air China Cargo. Set out below is a review of the

performance and operations of principal subsidiaries and

associates.

HONG KONG EXPRESS AIRWAYS LIMITED

(“HK EXPRESS”)

• On 19th July 2019, Cathay Pacific completed the

acquisition of 100% of the share capital of Hong Kong

Express Airways Limited.

• HK Express is Hong Kong’s only low-cost carrier, focusing

on serving leisure travel destinations.

• At the end of 2019, HK Express operated an all Airbus

narrow-body fleet of 24 aircraft, including eight Airbus

A320-200 aircraft, 11 Airbus A321-200 aircraft and five

Airbus A320-200neo aircraft. The young fleet had an

average age of just below five years. It is expected to take

delivery of five more Airbus A320-200neo aircraft by

early2021.

• HK Express will receive an order previously made by

Cathay Dragon for the delivery of 16 Airbus A321-200neo

aircraft from 2022, which is the most fuel efficient of its

type. Such a modern fleet enables HK Express to

REVIEW OF OPERATIONS

Review of other subsidiaries and associates

leverage new opportunities within the region and help

strengthen Hong Kong’s position as Asia’s leading

international aviation hub.

• HK Express operates flights to 24 destinations including

Bangkok, Da Nang, Fukuoka, Nagoya, Ningbo, Osaka,

Phuket, Saipan, Seoul, Taichung and Tokyo.

• After the acquisition, HK Express launched the Hong

Kong-Okinawa service and suspended the Hong Kong-

Chiang Rai service.

• On-time performance was 90.4% within 15 minutes

during the post-acquisition period.

• For the period from 20th July to 31st December 2019,

capacity amounted to 4,583 million available seat

kilometres. The average load factor was 91.5% during

theperiod.

• HK Express recorded an after tax loss during the post-

acquisition period of HK$246 million, against

expectations of a small profit. The airline suffered from

reduced demand to and from Asia as a result of the Hong

Kong social unrest.

• Ancillary revenue penetration as a percentage of total

revenue was 21.7% during the period. This included

non-flight scheduled revenue which arises from the sale

of baggage, priority boarding, allocated seats and

administration fees, all directly attributable to the low-fare

business of HK Express.

• Acquisition details are further detailed in note 26 to the

financial statements.

Cathay Pacific Airways Limited

22

HK Express

Period from 20th July 2019

to 31st December 2019

HK$M

Revenue

Passenger services* 1,817

Cargo services 23

Other services and recoveries* 53

Total revenue 1,893

Expenses

Staff (307)

Inflight service and passenger expenses (23)

Landing, parking and route expenses (476)

Fuel cost (459)

Aircraft maintenance (244)

Aircraft depreciation and rentals (386)

Other depreciation, amortisation and rentals (17)

Commissions (7)

Others (170)

Operating expenses (2,089)

Net finance charges (112)

Total operating expenses (2,201)

Loss before taxation (308)

Taxation 62

Loss after taxation (246)

*

A portion of ancillary revenue used to calculate ancillary penetration for HK Express is captured under “Passenger services revenue” in alignment with

the Group’s treatment of revenue in accordance with HKFRS 15.

HK Express

Period from 20th July 2019

to 31st December 2019

Operating Statistics

Available seat kilometres (“ASK”) Million 4,583

Passenger revenue per ASK HK cents 40.8

Revenue passenger kilometres (“RPK”) Million 4,195

Revenue passengers carried ‘000 1,888

Passenger load factor % 91.5

Passenger yield HK cents 44.6

Cost per ASK (with fuel) HK cents 46.0

Fuel consumption per million ASK Barrels 150

Fuel consumption per million RPK Barrels 164

Cost per ASK (without fuel) HK cents 36.0

ASK per HK$’000 staff cost Unit 14,932

ASK per staff ‘000 4,287

Aircraft utilisation Hours per day 8.9

On-time performance % 90.4

Average age of fleet Years 4.9

REVIEW OF OPERATIONS

Review of other subsidiaries and associates

23

Annual Report 2019

AHK AIR HONG KONG LIMITED

(“AIRHONG KONG”)

• Air Hong Kong principally operates express cargo

services for DHL Express.

• At the end of 2019, Air Hong Kong operated nine dry

leased Airbus A300-600F freighters, one wet leased

Airbus A300-622RF freighter, one wet leased A330-243F

freighter and two wet leased A330-300 passenger-to-

freighter converted freighters.

• Air Hong Kong operates six flights per week services to

Bangkok, Ho Chi Minh City, Osaka, Penang (via Ho Chi

Minh City), Seoul, Shanghai, Singapore, Taipei and Tokyo

and five flights per week services to Beijing, Cebu (via

Manila) and Nagoya.

• On-time performance was 87% within 15 minutes.

• Compared with 2018, capacity decreased by 3.7% to 703

million available tonne kilometres. The load factor

increased by 2.5 percentage points to 68.6%. Revenue

tonne kilometres decreased by 0.2% to 482 million.

• At the end of 2018, Air Hong Kong became a wholly

owned subsidiary of Cathay Pacific, having been

previously 60% owned by Cathay Pacific. Air Hong Kong

continues to operate an agreed freighter network to

destinations in Asia for DHL International. It does so under

a new block space agreement with DHL International for a

15-year term, which commenced on 1st January 2019.

• Air Hong Kong’s results attributable to the shareholders

of Cathay Pacific improved year on year. On a 100%

like-for-like basis there was a decrease in profit. This was

in part due to gains on disposal of certain aircraft in 2018,

and in part due to the new block space agreement and

the underlying decrease in capacity and cargo uplift

in2019.

PRINCIPAL AIRLINE SERVICES

SUBSIDIARIES

CATHAY PACIFIC CATERING SERVICES

(H.K.) LIMITED (“CPCS”) AND KITCHENS

OUTSIDE HONG KONG

• CPCS, a wholly owned subsidiary, operates the principal

flight kitchen in Hong Kong.

• CPCS provides flight catering services to 51 international

airlines in Hong Kong. It produced 29.6 million meals and

handled 70,520 flights in 2019 (representing a daily

average of 81,000 meals and 193 flights, a decrease of

1.3% and 4.0% respectively from 2018).

• Profits fell in 2019. Revenue decreased because of a

decrease in business volume. Labour and overhead costs

were higher.

• The profits of the flight kitchens outside Hong Kong

decreased compared to the previous year.

CATHAY PACIFIC SERVICES LIMITED

(“CPSL”)

• CPSL, a wholly owned subsidiary, owns and operates the

Group’s cargo terminal at Hong Kong International

Airport. The terminal’s annual handling capacity is 2.6

million tonnes. At the end of 2019, CPSL provided cargo

handling services to 14 airlines.

• CPSL handled 1.9 million tonnes of cargo in 2019, 53%

ofwhich were trans-shipments. Export and import

shipments accounted for 31% and 16% respectively of

the total.

• The financial results in 2019 declined compared with

those of 2018. This was mainly due to lower tonnage

handled.

HONG KONG AIRPORT SERVICES

L I M I T E D ( “ H A S ”)

• HAS, a wholly owned subsidiary, provides ramp and

passenger handling services at Hong Kong International

Airport. At the end of 2019, it provided ground handling

services to 21 airlines, including Cathay Pacific and

Cathay Dragon.

• In 2019, HAS had 44% and 5% market shares in ramp and

passenger handling businesses respectively at Hong

Kong International Airport. The number of flights handled

under ramp handling business increased by 0.3% in 2019.

The number of flights handled under passenger handling

business decreased by 42% against last year. The

reduction in passenger handling business followed the

transfer of Cathay Dragon’s passenger handling business

to Cathay Pacific in March 2018.

Cathay Pacific Airways Limited

24

• The financial results in 2019 were worse than those in

2018. This reflected the loss of the Cathay Dragon

passenger handling business and the reduction of

customers’ flight frequencies in the second half of

theyear.

VOGUE LAUNDRY SERVICE LIMITED

(“VOGUE LAUNDRY”)

• Vogue Laundry, a wholly owned subsidiary, provides a

comprehensive range of services in laundry and dry

cleaning of commercial linen, uniform and guest garment.

• It operates a commercial laundry plant in Yuen Long

Industrial Park and runs 13 valet shops in Hong Kong

serving retail customers at the end of 2019.

• Vogue Laundry processed 102 million pieces of laundry

items in 2019 comparing to 107 million pieces in 2018.

The financial results of 2019 declined compared with that

of 2018 mainly due to lower volume of laundry items being

handled.

PRINCIPAL ASSOCIATES

AIR CHINA LIMITED (“AIR CHINA”)

• Air China, in which Cathay Pacific had a 18.13% interest at

31st December 2019, is the national flag carrier and

leading provider of passenger, cargo and other airline-

related services in Mainland China.

• At 31st December 2019, Air China operated 327 domestic

and 124 international (including regional) routes to 43

countries and regions, including 65 overseas cities, three

regional cities and 119 domestic cities.

• We are represented on the Board of Directors of Air China

and equity account for our share of Air China’s results.

• Our share of Air China’s results is based on its financial

statements drawn up three months in arrear.

Consequently, our 2019 results include Air China’s results

for the 12 months ended 30th September 2019, adjusted

for any significant events or transactions in the period

from 1st October 2019 to 31st December 2019.

• For the 12 months ended 30th September 2019, Air

China’s financial results improved compared to those for

the 12 months ended 30th September 2018.

AIR CHINA CARGO CO., LTD.

(“AIRCHINA CARGO”)

• Air China Cargo is the leading provider of air cargo

services in Mainland China. It has its headquarters in

Beijing. Its main operating base is in Shanghai Pudong.

• In October 2019, the Cathay Pacific Group’s equity and

economic interest in Air China Cargo of 49.00% was

reduced to 34.78%, when the China National Aviation

Holding Company group, as part of a mixed ownership

reform to transform the business from an airport-to-

airport service provider into a total logistics solution

provider, injected certain equity interests and cash. A gain

of HK$114 million was recorded on this deemed partial

disposal.

• At 31st December 2019, Air China Cargo operated 15

freighters. It flies to nine cities in Mainland China and 11

cities outside Mainland China. Taking into account its

rights to carry cargo in the bellies of Air China’s

passenger aircraft, Air China Cargo has connections to

more than 200 destinations.

• In 2019, Air China Cargo’s financial results declined from

2018 due to slowing air cargo market.

DATA SECURITY INCIDENT

In October 2018, Cathay Pacific announced that it had

discovered unauthorised access to passenger data and

notified privacy regulators in affected jurisdictions,

including the Hong Kong Privacy Commissioner for

Personal Data. In June 2019, the Hong Kong Privacy

Commissioner published a report on the data incident.

Investigations by privacy regulators in Singapore, Turkey,

Taiwan and the United Kingdom have been closed. Cathay

Pacific continues to respond to the investigations and

enquiries of other privacy regulators.

ANTITRUST PROCEEDINGS

Cathay Pacific remains the subject of antitrust proceedings

in various jurisdictions. The outcomes are subject to

uncertainties. Cathay Pacific is not in a position to assess

the full potential liabilities, but makes provisions based on

relevant facts and circumstances in line with accounting

policy 19 set out on page 137.

REVIEW OF OPERATIONS

Review of other subsidiaries and associates

PRODUCTIVITY &

VALUE FOCUSED

By leaning our work processes and

being more agile in our decision making,

we are focusing in areas which our

customers value most.

Cathay Pacific Airways Limited

26

FINANCIAL REVIEW

The Cathay Pacific Group reported an attributable profit of HK$1,691 million for 2019. This

compares with a HK$2,345 million profit for 2018. The earnings per share was HK43.0 cents in

2019 compared to an earnings per share of HK59.6 cents in 2018. The Cathay Pacific Group

reported an attributable profit of HK$344 million in the second half of 2019, compared to an

attributable profit of HK$1,347 million in the first half of 2019 and an attributable profit of

HK$2,608 million in the second half of 2018. Cathay Pacific and Cathay Dragon reported an

attributable loss of HK$434 million in the second half of 2019, compared to an attributable

profit of HK$675 million in the first half of 2019 and an attributable profit of HK$1,253 million in

the second half of 2018.

CATHAY PACIFIC AND CATHAY DRAGON

• Passenger revenue decreased by 1.3% to HK$72,168

million. The number of revenue passengers carried

decreased by 0.7% to 35.2 million. Revenue passenger

kilometres increased by 2.9%.

• The passenger load factor decreased by 1.8 percentage

points to 82.3%. Available seat kilometres increased by

5.1%.

• Passenger yield decreased by 3.9% to HK53.6 cents.

• First and business class revenues decreased by 3.4% and

the load factor decreased from 76.1% to 75.7%.

• Premium economy and economy class revenues

decreased by 0.2% and the load factor decreased from

85.5% to 83.4%.

• Cargo revenue decreased by 14.2% to HK$21,154 million.

There was a 0.3% decrease in capacity.

• The cargo load factor decreased by 4.4 percentage

points. Cargo yield decreased by 7.9% to HK$1.87.

REVENUE

Group Cathay Pacific and Cathay Dragon

2019

HK$M

2018

HK$M Change

2019

HK$M

2018

HK$M Change

Passenger services 73,985 73,119 +1.2% 72,168 73,119 -1.3%

Cargo services 23,810 28,316 -15.9% 21,154 24,663 -14.2%

Other services and recoveries 9,178 9,625 -4.6% 8,284 8,730 -5.1%

Total revenue 106,973 111,060 -3.7% 101,606 106,512 -4.6%

27

Annual Report 2019

0

20,000

40,000

60,000

80,000

100,000

120,000

0

3,000

9,000

6,000

12,000

15,000

21,000

18,000

0

200

400

600

1,000

800

1,400

1,200

2015 2016 2017 2018 2019

HK$ million

Revenue

Passengers in ‘000

Cargo in ‘000 tonnes

Cathay Pacic and Cathay Dragon:

passengers and cargo carried

Cargo carried

Passengers carried

Other services and recoveries

Cargo services

Passenger services

1H15 2H15 1H16 2H16 1H17 2H17 1H18 2H18 1H19 2H19

• The overall revenue load factor decreased by 2.2

percentage points to 77.4%. The breakeven load factor

was 77.2%.

• The annualised effect on revenue of changes in yield and

load factor is set out below:

HK$M

+ 1 percentage point in passenger load factor 874

+ 1 percentage point in cargo load factor 328

+ HK¢1 in passenger yield 1,344

+ HK¢1 in cargo yield 113

%

60

65

70

75

80

85

90

2015 2016 2017 2018 2019

Revenue load factor

Breakeven load factor

Cathay Pacic and Cathay Dragon:

revenue and breakeven load factor

Cathay Pacific Airways Limited

28

FINANCIAL REVIEW

OPERATING EXPENSES

Group Cathay Pacific and Cathay Dragon

2019

HK$M

2018

HK$M Change

2019

HK$M

2018

HK$M Change

Staff 20,125 20,211 -0.4% 17,604 17,987 -2.1%

Inflight service and passenger expenses 5,306 5,292 +0.3% 5,284 5,292 -0.2%

Landing, parking and route expenses 17,758 17,486 +1.6% 16,900 17,115 -1.3%

Fuel, including hedging losses 29,812 33,869 -12.0% 28,778 33,232 -13.4%

Aircraft maintenance 9,858 9,401 +4.9% 9,231 8,965 +3.0%

Aircraft depreciation and rentals* 12,022 12,743 -5.7% 11,640 12,414 -6.2%

Other depreciation, amortisation and rentals* 2,991 2,851 +4.9% 2,132 2,091 +2.0%

Commissions 927 862 +7.5% 920 862 +6.7%

Others 4,847 4,750 +2.0% 6,280 6,164 +1.9%

Operating expenses 103,646 107,465 -3.6% 98,769 104,122 -5.1%

Net finance charges* 2,939 2,114 +39.0% 2,446 1,853 +32.0%

Total operating expenses 106,585 109,579 -2.7% 101,215 105,975 -4.5%

*

The adoption of HKFRS 16 has resulted in increased depreciation and finance charges, offset by a reduction in lease charges.

• The Group’s total operating expenses decreased by 2.7%

(with the combined Cathay Pacific and Cathay Dragon

operating expenses decreasing by 4.5%).

• The cost per ATK (with fuel) of Cathay Pacific and Cathay

Dragon decreased from HK$3.27 to HK$3.06.

• The cost per ATK (without fuel) of Cathay Pacific and

Cathay Dragon decreased from HK$2.25 to HK$2.19.

• The underlying cost per ATK (without fuel), which

excludes exceptional items, non-recurring item and

adjusts for the effect of foreign currency movements and

the adoption of HKFRS 16, decreased from HK$2.24 to

HK$2.22, a decrease of 0.9%.

Net nance

charges

Commissions

Others

Sta

9%

Aircraft

maintenance

Depreciation,

amortisation

and rentals

14%

3%

1%

4%

19%

Fuel, including

hedging

losses

Inight service and

passenger expenses

Landing,

parking

and route

expenses

Group total operating expenses

5%

17%

28%

0

20

40

80

100

0

10

20

40

50

60 30

2015 2016 2017 2018 2019

US$ per barrel

(jet fuel)

Barrels

in million

Group fuel price and consumption

Into wing price – before hedging

Into wing price – after hedging

Uplifted volume

29

Annual Report 2019

OPERATING RESULTS ANALYSIS

1st half

2019

HK$M

2nd half

2019

HK$M

Full year

2019

HK$M

1st half

2018

HK$M

2nd half

2018

HK$M

Full year

2018

HK$M

Cathay Pacific and Cathay Dragon’s

profit/(loss) before exceptional items,

non-recurring item and taxation 966 (455) 511 (844) 1,539 695

Exceptional items* (59) (61) (120) 101 (259) (158)

Non-recurring item** – 114 114 – – –

Taxation (232) (32) (264) (126) (27) (153)

Cathay Pacific and Cathay Dragon’s

profit/(loss) after exceptional items,

non-recurring item and taxation 675 (434) 241 (869) 1,253 384

Share of profits from subsidiaries and associates 672 778 1,450 606 1,355 1,961

Profit/(loss) attributable to the shareholders

of Cathay Pacific 1,347 344 1,691 (263) 2,608 2,345

*

Exceptional items in 2019 included additional redundancy costs of HK$8 million in connection with the reorganisation of our outports, data security

costs of HK$41 million and costs of HK$71 million associated with the acquisition of HK Express (2018: a HK$101 million gain on the disposal of CO2

emissions credits, redundancy costs of HK$201 million incurred in connection with the reorganisation of our outports and data security costs of

HK$58million).

**

Non-recurring item in 2019 included a HK$114 million gain on deemed partial disposal of Air China Cargo.

The movement in Cathay Pacific and Cathay Dragon’s profit before exceptional items, non-recurring item and taxation

(isolating the effect of the adoption of HKFRS 16 and foreign currency movements) can be analysed as follows:

Reported

HK$M

HKFRS 16

adoption

HK$M

Currency

movement

HK$M

Adjusted

HK$M

ATK unit *

% change Note

2018 Cathay Pacific and Cathay Dragon’s

profit before tax 695 695

Changes:

– Passenger and Cargo revenue (4,460) 1,213 (3,247) -5.3% 1

– Other services and recoveries (446) 28 (418) -6.8% 2

– Staff 182 (31) (108) 43 -2.3% 3

– Inflight service and passenger expenses 8 (51) (43) -1.3% 4

– Landing, parking and route expenses 215 (81) (261) (127) -1.4% 5

– Fuel, including hedging losses 4,454 (8) 4,446 -15.2% 6

– Aircraft maintenance (266) (95) (9) (370) +2.0% 7

– Owning the assets** 140 182 (14) 308 -3.9% 8

– Other items (including commissions) (11) (85) (476) (572) +5.8% 9

2019 Cathay Pacific and Cathay Dragon’s

profit before tax 511 (110) 314 715

*

ATK unit % change represents the adjusted revenue or cost component change per ATK.

**

includes aircraft and other depreciation, rentals and net finance charges.

Notes:

1) As per Review of Operations section for passenger and cargo services.

2) Lower cargo ancillary contribution from Atlas operations and lower aircraft lease income and related recoveries from Air Hong Kong. Lower inflight sales

recoveries; offset by a 17% increase in Asia Miles revenues.

3) Reduction in unit staff costs following the reorganisation of our outports and capped discretionary bonuses for 2019.

4) Lower inflight cost of sales in line with reduction in inflight sales recoveries.

5) Reduction in cargo handling costs resulting from decrease in cargo activities.

6) 10% fall in the average into-plane fuel price and a decrease in fuel hedging losses.

7) Increase in engine overhaul and component overhaul costs, partially offset by lower lease return and stock provisions.

8) Decreased aircraft leasing costs on the cessation of the Atlas contract.

9) Increased marketing costs associated with ‘Move Beyond’ and increased activity levels in Asia Miles.

Cathay Pacific Airways Limited

30

FINANCIAL REVIEW

FUEL EXPENDITURE AND HEDGING

A breakdown of the Group’s fuel cost is shown below:

2019

HK$M

2018

HK$M

Gross fuel cost 29,711 32,424

Fuel hedging losses 101 1,445

Fuel cost 29,812 33,869

0

10

20

30

50

40

56

58

60

62

66

64

40%

40%

40%

38%

35%

30%

20%

10%

64.96

65.36

63.58

61.27

59.84

58.33

57.12

57.24

% US$

Fuel hedging cover

Hedge Cover Average Strike Price

1Q20 2Q20 3Q20 4Q20 1Q21 2Q21 3Q21 4Q21

• The Group’s policy is to reduce exposure to fuel price risk

by hedging a percentage of its expected fuel

consumption. The Group uses fuel derivatives which are

economically equivalent to forward contracts to achieve

its desired hedging position. The chart above indicates

the estimated percentage of projected consumption by

year covered by hedging transactions at various Brent

strike prices. The projected consumption in 1Q20 and

2Q20 is currently being impacted by the capacity

reductions associated with COVID-19; as such the

percentage covered during this period will increase.

• The Group does not speculate on oil prices but uses

hedging to manage the risk of changes in oil prices and

therefore its fuel costs. Hedging is not risk free.

TAXATION

• The tax charge decreased by HK$12 million to HK$454

million, principally due to the reduced year on year result.

DIVIDENDS

• Dividends paid for the year were HK$708 million. No

second interim dividend is proposed.

• The dividend per share decreased to HK$0.18 for 2019

(2018: HK$0.30).

ASSETS

• Total assets at 31st December 2019 were HK$214,516

million.

• As a result of the adoption of HKFRS 16 (which changed the

required accounting for operating leases to recognise

right-of-use assets), right-of-use assets of HK$17,350

million were brought onto the consolidated statement of

financial position at 1st January 2019.

• During the year, additions to property, plant and equipment

were HK$13,270 million, comprising HK$12,381 million in

respect of aircraft and related equipment, HK$589 million

in respect of land and buildings and HK$300 million in

respect of other equipment.

Total assets

Buildings

and other

equipment

Intangible

assets

Aircraft and

related

equipment

Current

assets

Long-term

investments

and others

57%

7%

8%

13%

15%

Fuel consumption in 2019 was 46.6 million barrels (2018:

45.8 million barrels), an increase of 1.7% compared with an

increase in capacity of 2.0%.

• The Group’s fuel hedging cover at 31st December 2019 is

set out in the chart below.

31

Annual Report 2019

BORROWINGS AND CAPITAL

• Borrowings (which reflect the adoption of HKFRS 16)

increased by 31.7% to HK$97,260 million. These are

mainly denominated in United States dollars, Hong Kong

dollars and Japanese yen, and are fully repayable by

2033, with 52.8% currently at fixed rates of interest after

taking into account derivative transactions. HKFRS 16

did not make a major change to the currency profile of

borrowings. Excluding lease liabilities previously

classified as operating leases, borrowings increased by

4.6% to HK$77,293 million, which are fully repayable by

2031, with 44.2% at fixed rates of interest.

• Available unrestricted liquidity at 31st December 2019

totalled HK$20,011 million, comprising liquid funds of

HK$14,864 million (79.9% of which are denominated in

United States dollars) and committed undrawn facilities of

HK$5,289 million, less pledged funds of HK$142 million.

• Net borrowings (reflecting the adoption of HKFRS 16 and

after taking liquid funds and bank overdrafts into account)

increased by 40.7% to HK$82,396 million. Disregarding

the effect of adopting HKFRS 16, net borrowings

increased by 6.6% to HK$62,429 million.

• Funds attributable to the shareholders of Cathay Pacific

decreased by 1.8% to HK$62,773 million. This was due to

retained net profits and other comprehensive income,

0

40,000

80,000

60,000

20,000

Borrowings in key currencies

HK$ million

HKD JPY USD Others

Others include EUR and SGD.

0

20,000

60,000

80,000

100,000

0.4

0.6

1.0

1.2

1.4

40,000 0.8

2015 2016 2017 2018 2019

HK$ million

Net debt and equity

Funds attributable to the shareholders of Cathay Pacic

Net borrowings

Net debt/equity ratio (see Borrowing and capital below)

Times

%

0

20

40

60

80

100

2015 2016 2017 2018 2019

Interest rate prole: borrowings (after derivatives)

Fixed

Floating

less the dividend distribution, being more than offset by

the impact to opening reserves on the initial application

of HKFRS 16.

• Disregarding the effect of adopting HKFRS 16, the net

debt/equity ratio increased from 0.92 times to 0.96 times

(against borrowing covenants of 2.0). Taking into account

the effect of adopting HKFRS 16, the net debt/equity ratio

was 1.31 and 1.25 times at 31st December 2019 and 1st

January 2019 respectively.

HIGH

PERFORMANCE

CULTURE

Our exceptionally well-trained and

service-orientated people are equipped

with the knowledge and skills to enrich the

travel experience of customers at every

stage of their journey with us.

33

Annual Report 2019

SUSTAINABLE

DEVELOPMENT REVIEW

SUSTAINABLE DEVELOPMENT

We apply sustainable development principles when doing

business. We take environmental and social considerations

into account when making business decisions. It is our

policy to comply with environmental and social regulations

and to educate our employees, engage with others and set

targets in relation to environmental and social matters.

Weencourage our people to mitigate or reduce the

environmental and social impact of the decisions which

they make.

We operate an environmental management system which is

based on ISO14001:2015 certification. The system is

audited once a year externally and internally. Opportunities

for improvement are identified during these audits.

We engage with the communities in which we operate and

involve our employees in doing so. We prioritise our

community activities but maintain flexibility in order to

respond to specific local needs.